Gaming America shares insight as to how Interblock Gaming went from a small company meant for developing security systems into one of the global leaders of gaming.

INTERNET VIKINGS: Examining how gaming firms can plan for the Trump tariffs

IGA REVIEW: We look back at interviews from Tribal gaming's biggest show of 2025

LATIN AMERICA: A brand new section focuses on LatAm and, in particular, Brazil

POWERED BY

COO, EDITOR IN CHIEF

Julian Perry

CONTRIBUTING EDITOR

Tim Poole

SENIOR STAFF WRITER

Beth Turner

STAFF WRITERS

Kirk Geller, Laura Mack, Will Underwood

LEAD DESIGNER

Claudia Astorino

DESIGNERS

Olesya Adamska, Callum Flett, Gabriela Baleva

JUNIOR DESIGNER

Medina Mammadkhanova

ILLUSTRATOR

Judith Chan

MARKETING & EVENTS MANAGER

Mariya Savova

FINANCE & ADMINISTRATION ASSISTANT

Dhruvika Patel

PUBLISHING ASSISTANT

Abi Ockenden

IT MANAGER

Tom Powling

COMMERCIAL DIRECTOR

Deepak Malkani

Deepak@playerspublishing.com

Tel: +44 (0)207 729 6279

ACCOUNT DIRECTOR

Michael Juqula

Michael.Juqula@gamblinginsider.com Tel: +44 (0)203 487 0498

SENIOR ACCOUNT MANAGER

William Aderele

William.Aderele@gamblinginsider.com Tel: +44 (0)207 739 2062

BUSINESS DEVELOPMENT MANAGER - U.S. Casey Halloran

Casey.Halloran@playerspublishing.com Tel: +1 702 850 8503

ACCOUNT MANAGERS

Irina Litvinova

Irina.Litvinova@gamblinginsider.com Tel: +44 (0)207 613 5863

Serena Kwong

Serena.Kwong@gamblinginsider.com Tel: +44 (0)203 435 5628

AWARDS SPONSORSHIP MANAGER

Michelle Pugh

Michelle.Pugh@globalgamingawards.com Tel: +44 (0)207 360 7590

CREDIT MANAGER Rachel Voit

WITH THANKS TO: Kevin Nephew, Elizabeth Deegan, Brian Parrish, Joe Maloney, Elliott Rapaport, Rickard Vikström, Kristo er Ottosson, Rita Garry, Rick Arpin, Oliver Lovat, Kimberly Haigh, Joan Botts, Emma Ford, John Connelly, Neil Montgomery, Ana Bárbara Costa Teixeira, Elvis Lourenço, Stephen Crystal, Mauricio Lima, Paulina Hovar, Abhinay Bhagavatula, Tom Light, Andre Gel , Interblock, FabiCash and IGT

2632-766X

The Interblock story is quite a story.

As we sat down with Global CEO John Connelly at IGA 2025, industry-defining trends were rolling off his tongue, notably the creation of new gaming categories – most famously, Electronic Table Games.

That is exactly why Connelly, and Interblock, form the cover feature of this May/June edition of Gaming America magazine. His journey is fascinating, but Interblock's goes even deeper considering how different its original roots were to where it stands today.

Speaking of IGA, it was a fantastic show to attend again this year. The show floor is smaller than G2E's, allowing you to pretty much get from one side of the hall to the other in the space of just a couple of minutes. At the same time, however, everyone who needs to be there is in attendance.

You basically get a less crowded, more personal show – but it is arguably no less productive. As for the conference panels, I've always said IGA does them better than any other show... 2025 proved no different.

As such, we provide write-ups of some of our IGA-based interviews with Tribal leaders in this issue – but it is worth noting that an overarching theme from across the week was the threats Tribes face from new forms of gaming: sweepstakes, daily fantasy 2.0 and, most of all, predictions markets.

As sweepstakes and predictions markets continue to dominate the headlines, our daily news coverage on the Gaming America website is either showing influential figures join an operator (Sara Slane going to Kalshi) or a state outlawing a sweepstakes operator completely (VGW in Delaware, for instance).

Back to this magazine, though, and I am yet to even mention a huge new feature this issue: a dedicated section of Gaming America focusing purely on Latin America.

With the incredible growth of LatAm gaming in recent years, we will now be dedicating specific coverage to the area every issue. And we start this edition with a map outlining some of this year's highest-profile partnerships across Latin America, while we also have expert contributions from Neil Montgomery, Ana Bárbara Costa Teixeira and Elvis Lourenço on Brazil. Our regular viewpoints feature looks at LatAm, too, as suppliers and operators give their outlook on the rest of 2025.

Across our magazine, we have some pioneering female contributors, with three senior female executives featuring from Paragon Casino Resort alone (it's a fascinating property, which has its own alligator atrium!).

But one high-profile female executive who stood atop the industry will sadly no longer be with us. Indeed, on the day of writing this letter, Elaine Wynn has passed away and, to close, Gaming America would like to pay its respects to an important figure in gaming history.

JULIAN PERRY, COO, Editor-in-Chief

8

Gaming America takes a peek behind the curtain of the upcoming Asia-Pacific and Americas Awards.

Providing a detailed look at the daily fantasy sports (DFS) market, Gaming America goes statewide to see where it is, and is not, a stand-alone option for players.

Gaming America spoke with several Tribal industry leaders at IGA 2025.

16

American Gaming Association SVP of Strategic Communications Joe Maloney discusses responsible gaming messaging and the association's Play Smart from the Start campaign.

18

Birches Health Founder & CEO Elliott Rapaport explains the facts of problem gambling and need for the industry to create aid, tools and treatment.

20

Internet Vikings’ CEO and COO discuss remaining stable in a continuously moving market.

Howard & Howard Attorneys’ Rita Garry explores the importance of monitoring, measuring and assessing data policies.

24

Rick Arpin of KPMG US looks into exchange betting and prediction markets.

Regular contributor Oliver Lovat breaks down the state of the Las Vegas Strip, and asks: How can it keep up with the times?

32

We speak with three female leaders at the Paragon Casino Resort in Louisiana, a property where they even have an alligator sanctuary...

36 THE INTERBLOCK STORY

Gaming America looks back on the history of one of the industry’s leading suppliers. 46 A DEAL'S A DEAL

Gaming America provides a detailed look at partnerships undertaken by gaming companies across regulated LatAm markets.

48 ONE DOWN, THREE TO GO

Gaming America regular contributor Neil Montgomery reflects on the first quarter of a regulated online gaming market in Brazil.

50 AN INFLUENCED MARKET

Brazilian lawyer and AMIG Founding Member Ana Bárbara Costa Teixeira discusses the impact of influencer marketing on Brazil’s gaming industry.

54 OPERATOR POV

Aposta Ganha Chief Product Officer Elvis Lourenço looks back at Brazil’s year so far, and what may come in the future.

56 VIEWPOINTS

Executives from across the industry provide insight on the latest developments from the LatAm market.

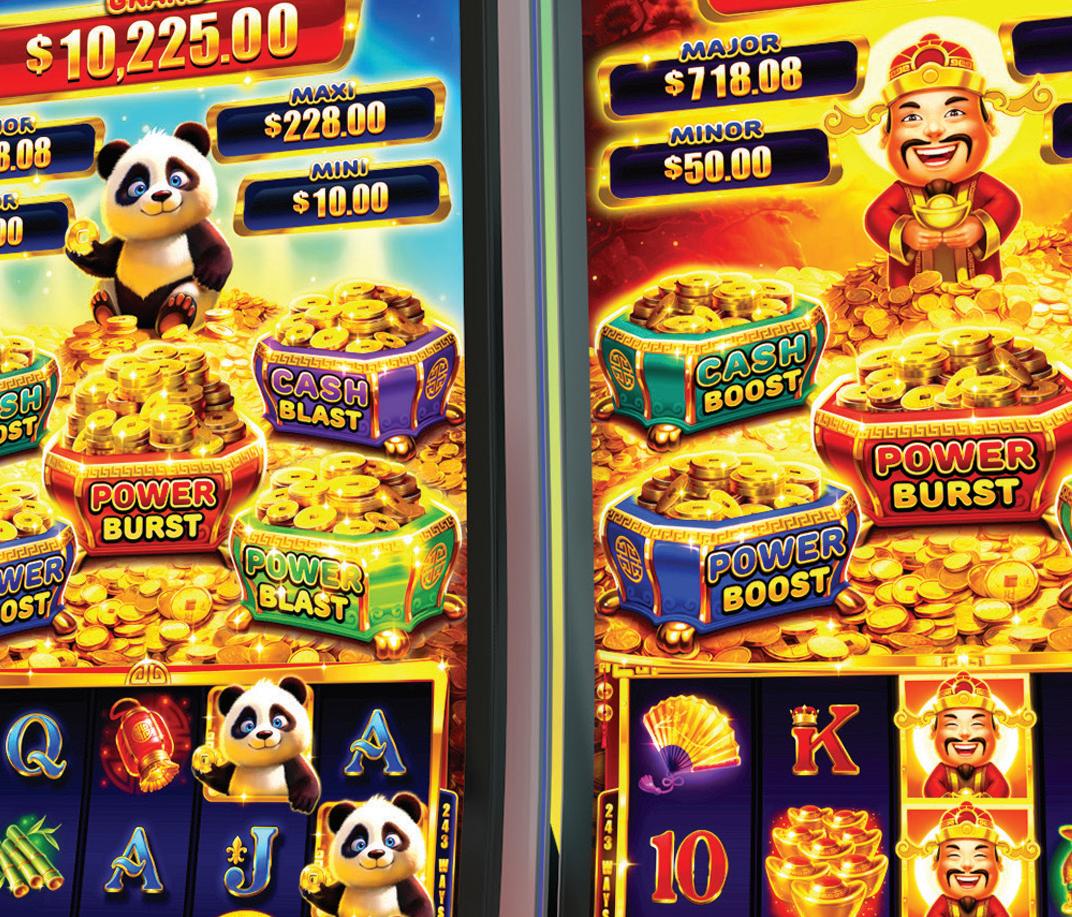

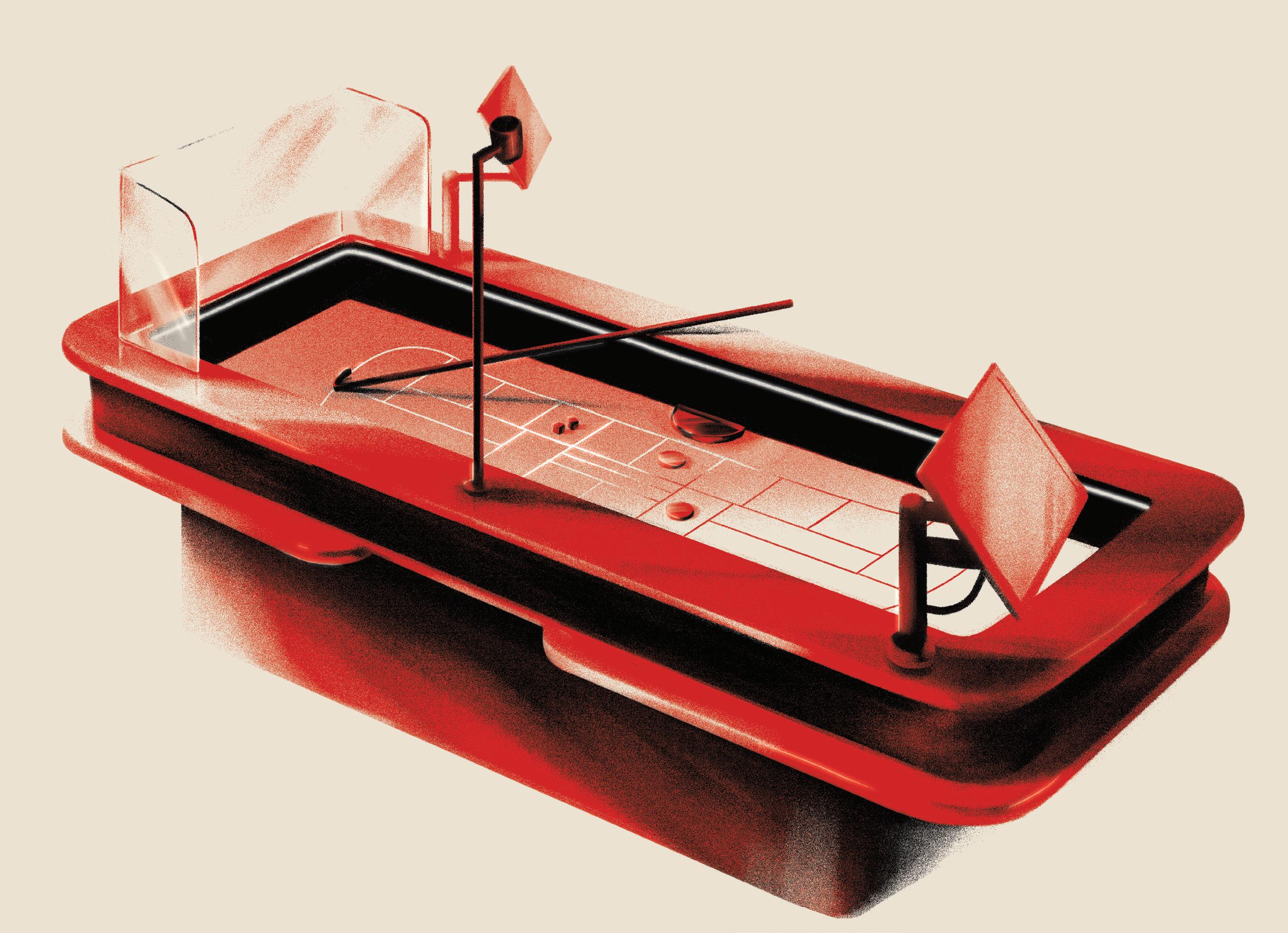

62 PRODUCT REVIEWS

Gaming America surveys the latest gaming innovations, including those from companies such as FABICash, IGT and Interblock.

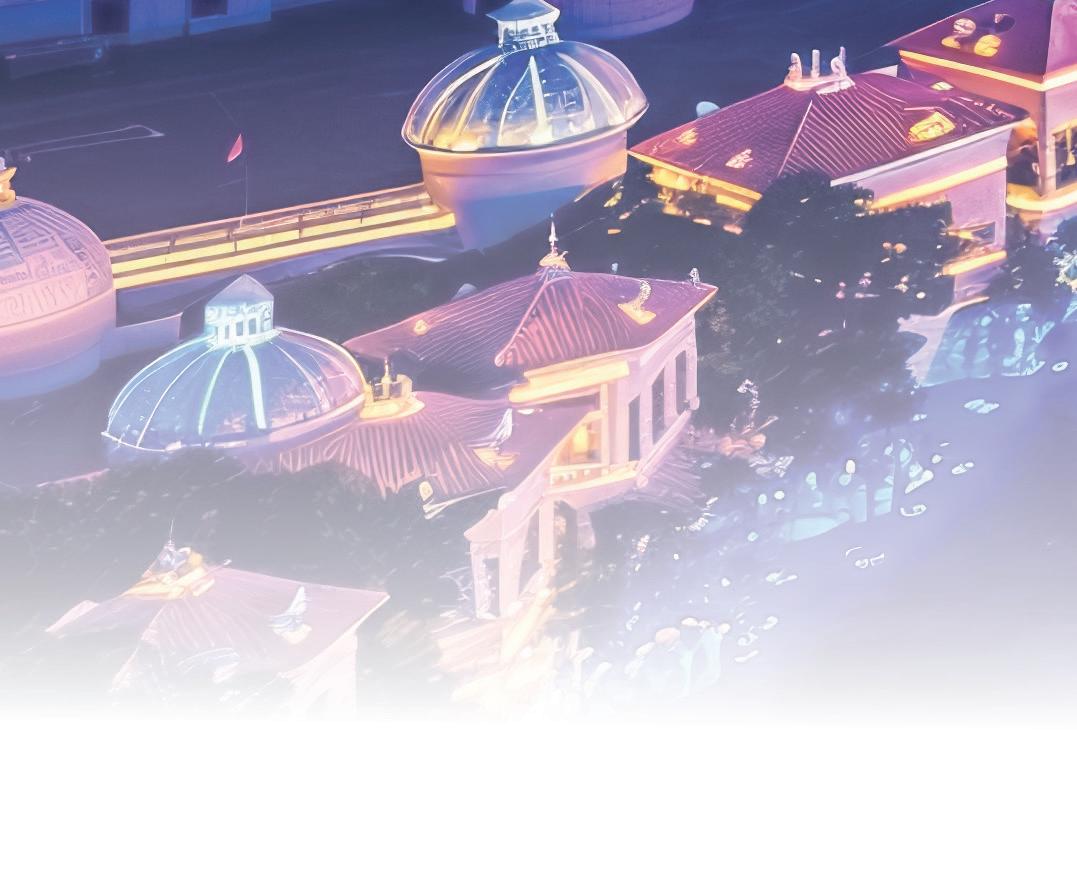

Gaming America previews the Global Gaming Awards Asia-Pacific 2025 while looking ahead to the Americas presentation in Las Vegas set to be held in October.

On March 17 2025, the nominations window for the Global Gaming Awards Americas 2025 officially opened, with the industry’s most prestigious Awards returning to Las Vegas for a 12th consecutive year. The event will be held at the Venetian Resort Las Vegas during the Global Gaming Expo (G2E) conference in October.

However, prior to this celebration, the Global Gaming Awards Asia-Pacific is set to be held on June 3 in Manila. The Global Gaming Awards Asia-Pacific will recognize and reward the strongest performers from the Asia-Pacific gaming industry across the previous 12 months. The event is powered by Gambling Insider and the voting process is independently adjudicated by KPMG in the Crown Dependencies.

driven by record performance from MGM China. MGM China continued to outperform industry recovery in the past 12 months, with property visitation growing by 54% year-overyear and reaching 163% of 2019 levels.

Throughout 2024, Wynn Resorts also drove a healthy market share in Macau, led by strength in both premium mass and VIP, earning a spot

Global Gaming Awards Asia-Pacific for Casino Operator of the Year, having increased its market share and outpaced industry growth during Q4 2024. The group continued to ramp up the newly opened Phase Three at Galaxy Macau while currently making progress with Phase Four.

In the Corporate Social Responsibility of the Year category, Sands received a nomination after organizing 74 community events throughout 2024, impacting more than 49,800 beneficiaries while its team members contributed more than 13,000 volunteer hours. The company established 2021-2025 ambitions to invest $200m in workforce development, contribute 250,000 volunteer hours to its communities and reduce carbon emissions by 17.5%.

With the official Shortlist having been revealed on May 5, there are a number of contenders with US backgrounds that certainly stand out less than a month before the Awards are to be distributed.

the Awards are to be distributed.

For Casino Operator of the Year, MGM Resorts received a shortlist entry following the best full-year consolidated net revenues

Under the Casino Product of the Year category, International Game Technology (IGT) has been nominated for its Rising Rockets progressive slot, including two base games Emperor and Empress. With over 200 installations across Asia, Rising Rockets has consistently outperformed expectations, according to IGT.

in the history of the company for 2024, on the Global Gaming Awards Asia-Pacific Shortlist. In FY24, Wynn Macau’s adjusted property EBITDAR rose to $1.17bn, a significant increase from the $954m reported during FY23.

Galaxy Entertainment Group will be looking to defend its victory from the 2024

IGT has been nominated alongside Aristocrat Gaming, which took home the win last year at the Global Gaming Awards Asia-Pacific 2024. Aristocrat’s Big Fu Cash Bats will be up for nomination during the 2025 Awards show, having launched in the Philippines in 2024 and recently debuting in Singapore, where its

first-to-market gameplay mechanic is driving player interest and delivering strong performance.

Not only will Aristocrat be looking to win consecutive Casino Product of the Year Awards, the supplier will also be hoping to claim victory in the Casino Supplier Category for a second straight year as well. In 2024, Aristocrat Gaming partnered with Macau’s Studio City to launch the Dragon Zone in celebration of Golden Week, a first-of-its-kind immersive player experience.

The Global Gaming Awards Americas consistently recognize and reward the gaming industry’s strongest performers across the previous 12 months. These are the most prestigious and trusted Awards in the industry and have gained respect among industry heavyweights, due to the strict rules and procedures put in place.

with the nomination window running through May 8. These achievements can be from the land-based or digital verticals, but must be related to the US, Canada and/or LatAm markets.

Golden Week, a first-of-its-kind immersive

Fellow suppliers such as Light & Wonder, IGT and Interblock will also hope to crowned the Casino Supplier of the Year on June 3. In February, Light & Wonder officially opened its new Philippines office and showroom in Clark, while Interblock installed over 1,000 electronic table games (ETGs) across Singapore, Macau, Malaysia, the Philippines and Vietnam throughout 2024. IGT continuously offers a regionally attuned portfolio of gaming solutions that are designed to maximize player engagement and drive strong performance results for operators across the Asia-Pacific.

Global Gaming Awards Americas at the Venetian Resort in Las Vegas, the Awards will once again be returning to the gaming capital of the world during G2E on October 6.

the most prestigious and

industry heavyweights, due to put

The Global Gaming Awards Americas will now honor the Casino Services Supplier of the Year, handed to the company which outperforms even the highest of expectations over the previous 12 months. Also, the well-known Land-based Supplier of the Year category has been split into both Class II and Class III awards, ensuring all levels of the land-based gaming industry are honored each year.

Those that are Shortlisted will be contacted in August for a supporting statement, detailing why each should be recognized during the ceremony in Las Vegas. The full Shortlist, including an explanation as to why each company and/or individual has been Shortlisted, will be released publicly in September after being finalized on August 8. A panel of over 100 C-level executives from the industry decides the winners, with KPMG in the Crown Dependencies independently adjudicating the voting process to ensure full transparency and fairness.

With new Awards set to honor the vast expansion seen across gaming in recent times, there is no measuring the amount of anticipation already building for the Global Gaming Awards Americas

2025.

Land-based Operator of the Year Award for

With the growth seen in the LatAm region as well, the Global Gaming Awards Americas will now be presenting not only a Land-based Operator of the Year Award for LatAm companies, but an Online Operator of the Year also.

When submitting nominations, Gaming America

When submitting nominations, kindly asks companies

Gaming America to write a short (480 characters

to write a short (480 characters max) statement highlighting achievements from the previous 12 months,

previous 12 months,

Insider consistently offer the most prestigious Awards in the entire sector, looking toward a 12th consecutive year of presenting the honors from Las Vegas.

While nearly every state across the US has accepted the introduction of daily fantasy sports (DFS), only a few continue to o er the sports betting vertical as a stand-alone option for residents.

While a regulated sports betting market is unlikely to ever be offered in Utah due to the state’s deep ties with the Mormon faith, DFS platforms such as DraftKings, FanDuel and Underdog Fantasy operate legally as games of skill rather than gambling. Outside of gambling that is also considered skill-based, Utah is one of only two US states, the other being Hawaii, that does not offer any form of legal wagering. With neighboring states including Arizona and Nevada offering in-person and online forms of sports wagering, Utah lawmakers remain steadfast in their reluctance to construct a regulated market for residents.

While retail and online sports betting are still currently unavailable in Alaska, Representative David Nelson introduced House Bill 145 on March 21, which aims to authorize and regulate mobile sports wagering across the state. If enacted, HB 145 would provide online sports wagering in Alaska by January 1, 2026, as well as set an adjusted gross revenue tax rate of 20% for operators granted a license. The measure, which does not include language for DFS, underwent its fi rst reading and has been referred to the House Labor & Commerce and Finance Committees.

DFS operators have been able to conduct business throughout California for many years due to state laws failing to properly address the offering. California law prohibits most forms of sports betting under the California Penal Code, only including verticals such as lottery, horseracing and certain card games. In 2022, FanDuel and DraftKings backed Proposition 27, which would have formed a regulated online sports betting market for residents, only to watch as 70% of voters rejected the legislation as part of the midterm elections that year.

Despite Minnesota having taken a conservative approach to gambling laws, often classifying uncertain activities as gambling, the state’s Attorney General’s office has not issued a definitive opinion on DFS. During February 2025, even with public support from professional sports teams and key stakeholders within the state, Minnesota lawmakers voted to a tie on legislation that would have legalized both in-person and online forms of sports gambling. Originally introduced by Senator Matt Klein, the bill failed to pass through its first test of the Minnesota Senate, creating a roadblock to authorization before the conclusion of 2025.

On March 6, 2025, efforts to send a constitutional amendment that would have legalized sports betting in Georgia failed to come to a vote in the state’s House of Representatives, delaying hopes of a regulated market until at least 2026. Like many states, however, Georgia has neither legalized nor outlawed fantasy sports, leaving DFS operators to conduct business in what is seen as a legal grey area. PrizePicks is currently headquartered in Atlanta, while FanDuel opened a technology campus in the city with over 900 employees during May 2021.

With DFS available in the state due to unspecified gambling laws, South Carolina seems to be turning its attention toward legalized forms of sports betting with recent efforts made during 2025. Senator Tom Davis introduced SB 444 on March 12, which would legalize online sports betting throughout South Carolina and allow for up to eight operators to obtain official licenses. The bill would establish a South Carolina Sports Wagering Commission to oversee the market and will only allow operators which are already established in at least five other states to apply for a sports betting license.

In 2019, the Texas House of Representatives passed a bill defining fantasy sports as legal games of skill, marking a signifi cant step in clarifying the legal status of DFS platforms within the state. Senator Carol Alvarado filed Senate Joint Resolution 16 in March 2025, which proposes legalized sports wagering and gambling at casinos and other destination resorts. If passed, it would also create the Texas Gaming Commission, a new organization that would regulate gambling for the Lone Star State.

Over three years after Alabama’s Attorney General ruled that DFS operations would be seen as illegal, Governor Kay Ivey signed HB 361 during June 2019, allowing operators such as FanDuel and DraftKings to re-enter the state. In early 2024, the Alabama House of Representatives passed HB 151 and HB 152, aiming to legalize sports betting and casinos while also establishing a state lottery. However, both bills failed to pass through the Senate, and no such legislation has been brought forth during 2025.

Similar to many states included in this piece, Oklahoma law does not currently regulate DFS, leaving the door open for operators to conduct business in the state without fear of ramifications. On February 24, 2025, the office of Oklahoma Governor Kevin Stitt released its official plan to legalize sports betting throughout the state. Stitt ’s plan is seen as a nonstarter for organizations such as the Oklahoma Indian Gaming Association; however, as it would reportedly cost over $200m a year in exclusivity fees paid by the Tribes to help support Oklahoma’s education budget.

As the first Seneca Nation member to lead the corporation, do you feel an added responsibility to ensure Tribal sovereignty remains at the forefront for guests and players?

Absolutely. It’s interesting you say that. I think every enrolled Seneca member feels that sense of sovereignty. I think being that first Seneca as President and CEO, it’s not just the responsibility, it’s an honour to be able to do that.

With iGaming in New York described as a ‘when not if’ by certain lawmakers, how would that present a challenge or opportunity to Seneca in the future?

It’s interesting

Following the panel 'Future-Proofing Tribal Gaming: Strategies to Compete in an Evolving Market,' which drew so many heads listeners had to be turned away, Gaming America’s Kirk Geller spoke with Seneca Gaming Corporation President & CEO Kevin Nephew at IGA.

with iGaming. It’s out there, but nobody knows yet where iGaming is going to be. So, we’re monitoring that situation as we go forward. One of those situations is, we see iGaming, we’re monitoring where it’s going overall in the gaming industry; but part of it will be, how is it constructed from a governance standpoint?

Speaking on your panel at IGA, which was actually so full they were turning people away, how can sports betting and online gaming be incorporated by Tribes all around that are involved with IGA?

One of the things is, it isn’t so much just the product – a lot of it is the experience. What we’re finding now with all our gaming is it’s about the experience. One of the things we look at is technology. More technology comes into people’s households – they’re using their phones when they game – so, what’s going to differentiate us to get them on property?

One of the big things is to look at service. What we do there is monitor what our service standards are; customer service is critical. Then two, how do we encourage repeat visits? And, if they’re going to come in and experience, say, sports betting, how do you make that a true experience? What better place to meet friends and

KEVIN NEPHEW President & CEO Seneca Gaming Corporation

enjoy, say, the Final Four of March Madness and have that repeat customer come back?

Do you see those verticals, whether it be sports betting or iGaming, as a necessity for Tribes if they’re going to compete in an evolving market?

I think it’s a necessity. I think it’s like anything; you look at a portfolio of the products you provide and ask, how do you get into that market? It’ll be interesting what the future holds.

How does an event such as IGA help Fortune Bay Casino find new innovations in gaming for your guests?

I feel like IGA is probably one of the best resources to bring back for Tribal properties, because they know what’s going on in the industry, what’s coming in the industry. You've got to bring groups from your property out here to look, because there are so many different learning opportunities here, whether it’s digital marketing, online gaming, sports betting. Having a team that we bring out, to be able to bring back all that learning to the property, so that we’re ready when things are approved in our jurisdictions... we can just go and be ready for it.

With Minnesota lawmakers recently introducing legislation that could bring sports betting to the state, would Fortune Bay ever consider partnering with operators to bring a sportsbook to the property?

We have been in talks for the past few years, because there’s a back-and-forth between ‘it’s going to go, it’s not going to go.’ We’re making sure we’re ready, being a proactive property instead of a reactive property. So, we’ve definitely been searching and talking to some companies on partnering.

I attended your IGA 2025 panel where you spoke about female leadership in Tribal gaming. You said Fortune Bay has gotten away from the Tribal element and that, when guests step in, they might not feel as if they’re

Gaming America’s Kirk Geller spoke with Fortune Bay Casino GM Elizabeth Deegan at IGA 2025, discussing Tribal culture at Fortune Bay Casino and empowering women to lead in the future.

stepping into an Indian casino. How do you plan on changing that aspect and reintroducing Tribal elements to your property?

My number one goal is to make sure people feel that culture when they come in. So, just implementing little things where we’re opening up a new market on our property. We’re going to have market items, 12 packs of pop, etc in the property. Starting with the Anishinaabe language as a room, it’s the Giizhik Market, which means cedar in our culture, and using that. Even just placing the Anishinaabe language under signs so that our guests know when they come in that they are at a Tribal property.

How do you find that Fortune Bay continues to remain prominent in the area, especially in Minnesota where there are up to 20 tribal casinos that guests could attend?

As a female leader, do you feel extra motivation to help repair for future generations, specifically with possible females that could lead the property?

Most definitely. Right now I have a really strong team, and we recently promoted three women into executive positions, myself being General Manager. We promoted a young band member as our Human Resources Director; we have a young band member as our Marketing Director and we’re continuing to grow those ladies into better leaders for what they’re doing.

We have a band member mentorship programme for our Tribal members so they feel like they have the opportunity to move up or be in a job they didn’t think they could get. But giving them the tools they need to succeed in those positions is really another one of my goals.

We pride ourselves on the natural beauty of where we are located in the state. We have beautiful Lake Vermilion, we have a beautiful golf course, a beautiful RV park. We’re a destination property. In the wintertime we have snowmobile trails, so we are definitely making sure that we are staying competitive in the market, reaching down in the Minneapolis metro area to try bringing those people up, letting them know what we offer. We are a four-seasons destination. Canadians are a huge part of our industry too, so we’re definitely trying to have some promotions that will bring them down as well.

At IGA 2025, Brian Parrish, COO of the Osage Nation Gaming Enterprise, found time to speak with Gaming America about the importance of weaving customer experience in with business optimization.

You’ve been in the industry for over 30 years; I’m sure you’ve learned a lot! What would your biggest takeaway points or advice be?

I could spend all day talking about some of those things but for me, personally, it’s very gratifying to work in Indian Country because you can see who your shareholders are. You can see that the revenue you’re generating is going to build homes and provide education, food security, water security and things like that for communities, and it’s vitally important. The Osage Nation has well over a thousand years of documented history in the Oklahoma, Missouri and Kansas regions. So that, of course, predates the US by a long ways.

own way. I think an important message and takeaway, at least from my experience, is that my family is Irish on both sides and so I’m not Native American, but my wife is. I know that I’m a guest in these communities and so it’s important and incumbent upon me, when I come into a Tribal environment, to earn trust, show that I’m here for the right reasons: to help them make good decisions that make sense to further the quality of life for their membership and create security and stability. I have to earn trust.

over time, and they’ve become my best friends over the years. While I enjoyed commercial gaming, there is a tendency not to be able to forge those relationships because the focus is so different.

That’s consistent with what we’ve heard from people who worked in both and it’s a very humble perspective that you take. Can you tell us what you discussed at your first IGA panel this year?

But I’ve worked for four different Tribes and been CEO or COO for all of them. The lessons are all very similar: that sovereignty and self-determination are vitally important, and if it wasn’t for gaming and the Indian Gaming Regulatory Act that was signed into law by the late President Reagan back in 1988, the Tribes wouldn’t have these capabilities to be more economically interdependent and have the ability to improve quality of life for their membership; so it’s very gratifying.

I think it goes without saying that Tribal gaming, or gaming in general, has changed in the time since you entered the industry... but what are the most notable ways in which it has changed?

You know, every Tribe is different. They have different histories, different objectives, different cultures and tolerances for things, and it takes time for all of them to find their

Just because I have a title or a position, that doesn’t give me the authority to venture outside what my job duties and responsibilities are. I’m a guest in the community and I have to show respect for that. By taking that approach, I’ve built long-lasting, quality relationships with Tribal leaders and Tribal employees

BRIAN PARRISH COO Osage Nation Gaming Enterprise

Cashless gaming is evolving. I think at some point in the future, it will be a significant part of the gaming experience that everybody has right now. There are only eight to 10 states in the US that have approved cashless gaming. There are a lot of issues with technology and things like that. It’s also an education issue. Everybody has to understand how it works and why money handling in gaming, whether it’s credit or a cashless type of gaming, is very much about security and convenience. But people have to trust in the processes and how it works.

You know, we were laughing on the panel yesterday, talking about how there’s some of us like me that I still hold on to my chequebook, right? I enjoy handwriting checks because I’m touching the paper; I feel it. I see it and it’s the same thing with counting currency. Right now, the operators can go and pull a can out of a machine, they can take it to a soft count and they count it down and see the dollars; they record it and it runs through a counter, you can touch it and you know exactly what’s happening with your business. So then you get in the cashless

environment and everything is automated: you lose that comfort and that touch. So much about this is getting comfortable with the technology, understanding that you’re not going to have that kind of physical reassurance with some of it and that it’s not going to be for everybody. Nonetheless, the technology has to be seamlessly integrated, it has to work well and it has to be auditable.

That gives people comfort. So, overall and in time, I think it’s going to take root in younger people that are more technology savvy, who are much quicker to accept changes; but as time goes on, we think it will become an important part of how Class III gaming works across the US.

Sure, and then a word on the panel you had later in the week? So the next panel we’re talking about is improving guest experience – how do you do that through data collection and gathering information, and how do you measure it? Some of the thoughts I’ve been sharing and putting together questions on is the concept that our customers, our players, are not created equal, right? It’s interesting in the gaming environment, as it’s really based on value, worth and contribution. So just like you have to prioritize your players, you have to prioritize the feedback you get. You want to be proactive and responsive to the feedback you’re collecting and using it to make improvements. While most players will give you feedback, some won’t, and in that case your employees are the best source of that information, so take time to stop and listen, break that information down, communicate it back but prioritize it and then make good on the suggestions, and the feedback they’re giving you.

But when you’re surveying people one on one, you get a more specific look at what their perceptions are, you can still use that and measure it. It’s still good to have the social media side of things, but understand the value that it brings, as well as some of the potential limitations with it. Nevertheless, it’s critical to listen to your guest and then be responsive to what they’re telling you.

Data is still very relevant to this next question... in your Tribe, you’ve got an upcoming digital optimization strategy. Can you tell us a little bit about that and just how important it is for Tribes to stay ahead of digital trends? This is a really important issue for us and we’re hoping it is for all of the Tribes in Native American gaming. Our digital optimization strategy is about sitting down and developing a master specification in terms of how all the automated touchpoints, systems and services that you provide all interact in one ecosystem. But they also have to have all the data sovereignty, data security, controls and things in place that really safeguard the information properly, all while still providing frictionless, seamless services. If it’s convenient and easy and it inspires trust, people will use it, and that’s why it’s so

We’ve got a lot more data we can share on that. There are a lot of interesting biases when people get information. How has it been influenced? Social media is certainly an issue, but it’s just like focus groups, right? You get into a focus group and you can have one very vocal person that ends up artificially steering the dialogue, and it changes some of the data you’re going to collect – it’s the same thing with social media.

important to stop and develop that digital optimisation strategy or specification. Once that spec is in place, you just keep going back to it and make sure at every stage of your development and your implementation of these resources, it matches up.

There’s a lot of pressure on operators to generate more revenue and keep up with the Joneses, and ‘everybody else is doing this so we should too;’ but that’s not always the right pressure to succumb to. You really need to stop, think through it: “Hey, we’re going be a little more disciplined. We’re not going to be first to market with it, but we will be the best once we execute it and people will migrate to us;” because if the technology doesn’t work and all the other components don’t fit well together the way they need to, customers aren’t going to use it anyway – and you’re not going to get the return on investment. Instead, you’re going to be spinning your wheels and frustrating your team and guests in the process. So I think it’s a great discipline to have. It means you slow things down a little bit, but in the end, you’ll accelerate to a better result.

Returning contributor, the American Gaming Association, writes all about responsible gaming messaging. Joining Gaming America this time is Joe Maloney, SVP of Strategic Communications.

Play smart from the start: Shaping the future of responsible gaming messaging

While responsible gaming has always been a priority for the legal gaming industry, it was clear we needed to evolve our approach to reflect how today’s consumers think, feel and engage with gaming. That’s why the American Gaming Association (AGA) recently unveiled Responsible Gaming: Play Smart from the Start – a new approach to RG messaging designed to resonate with today’s players.

What sets this platform apart isn’t just the message – it’s the method of how we got here. Over the last several months, the AGA conducted extensive research with focus groups that captured a broad range of player motivations and perceptions. The takeaway was clear: consumers want to bet responsibly, but current messaging doesn’t always speak to them. Our research uncovered a few key insights:

1. Players believe there is a “right” way to bet. We have an opportunity to reinforce the mindset that responsible betting is the “right” way to wager.

2. Today’s messaging often mixes responsible gaming with problem gambling, leading to player confusion. Our research suggests that effective responsible gaming communication is proactive and empowers players to make

informed choices. Meanwhile, messaging about problem gambling should be for those who need professional help.

3. Positive messaging is far more impactful than negative warnings. Our research reveals that consumers are more driven by the desire to enjoy positive experiences, like fun and entertainment, than by the need to avoid negative consequences. Encouraging smart decisions enhances their overall enjoyment.

Using these findings, Play Smart from

the Start reinforces the idea that gaming should be fun and enjoyed responsibly through three principles:

1. Start every game with the right mindset – be present and know your limits.

2. Act intentionally by setting limits – set a budget, take breaks and stay in control whether you win or lose.

3. Understand the rules and odds of the game – know the rules, understand the odds and bet with intention.

JOE MALONEY SVP of Strategic Communications American Gaming Association

What comes next? As we continue to roll out Play Smart from the Start, the AGA will collaborate closely with industry stakeholders to integrate this messaging across all marketing and communications. This will reinforce a unified, consistent voice wherever and however players are engaging with legal gaming.

This effort is about more than raising awareness – it’s also about trust. When players see a consistent, clear message across platforms and brands, it signals that the industry is in this together – strengthening consumer trust and benefiting the long-term health of the industry.

Our Play Smart from the Start messaging platform emphasizes that gaming should be a fun and responsible activity. And when consumers have the right tools to play responsibly, everyone benefits. The legal gaming industry can continue to serve as a trusted, enjoyable source of entertainment.

Birches Health Founder & CEO, Elliott Rapaport, discusses problem gambling in the US and why treatment access should be a wider gaming industry focus.

Problem Gambling Awareness Month (PGAM) reminds us that behind gambling lies a serious public health issue the industry must play a part in tackling. A January 2025 American Psychiatric Association national survey revealed that more than a quarter of Americans may gamble online daily. That means nearly 100 million people in the US are likely to pull out their mobile phones, find a quiet place to open a computer, and/ or generally find a way to place a bet online every single day.

The majority of these almost 100 million Americans who bet online daily may not ever need to seek out care for Gambling Disorder (the clinical designation for gambling addiction). However, for many that are in that minority and desperately need specialized treatment, the journey to find the necessary support for themselves, their families and their loved ones can be incredibly difficult.

The Lancet Commission on gambling estimated that 15.8% of adults and 26.4% of adolescents who gamble on online casino or slot products could be affected by Gambling Disorder. With sports betting products, they suggested 8.9% of adults and 16.3% of adolescents could be affected. Support for this population of individuals affected by Gambling Disorder is our central focus at Birches Health. Specialized clinical treatment is available across the US. Individuals struggling with their sports betting or gambling in general can receive care from the comfort of home from licensed, specially certified clinicians –with costs covered by insurance and state funding in select states. Demand for these services is increasing and more needs to be done through partnerships with state

governments, the sports industry and all stakeholders in gaming.

Birches Health’s goal as a company and a goal of the industry is two-fold: to increase access to specialized Gambling Disorder resources for those at risk, but ultimately to decrease gamblingrelated harms to reduce the number of individuals who ever reach a point of crisis.

Additional proactive collaboration between governments, healthcare providers and the gaming industry is needed to make sure those who need care can access it as quickly as possible.

Historically, Gambling Disorder was not a benefit covered by private and public insurance companies and, therefore, was not an option for members across the

ELLIOTT RAPAPORT Founder & CEO Birches Health

US. With Gambling Disorder’s inclusion into the Diagnostic and Statistical Manual of Mental Disorders, Fifth Edition (DSM5) in 2013, this began to change. Over the past few years, we have seen coverage accelerate – now even with many state Medicaid plans and organizations under a Medicaid Managed Care system beginning to reimburse for the diagnosis in different markets.

As the healthcare industry has augmented coverage for Gambling Disorder for those individuals who need care, the gaming industry must integrate direct treatment access into different facets of the bettor’s experience, within onboarding/ signup experiences, and throughout their playing journey with always-on messaging and features.

In the wake of Problem Gambling Awareness Month (PGAM), held every March, preventing problem gambling must remain a crucial focus for an industry that has both the resources and the responsibility to ensure that, if someone reaches the point of needing help, they can access specialized solutions.

Research shows that over 20% of Americans may struggle with behavioral health disorders like anxiety and depression. Gambling Disorder will most likely never reach that kind of prevalence. However, across the US today there are countless individuals and their families who are dealing with a never-ending barrage of questions; and a maze of unspecialized providers as they struggle to find access to high-quality clinical treatment for Gambling Disorder in a financially sustainable way. Today, as well as any other day, is the right time to focus on changing that.

Amid potential delays, price hikes and regulatory risks, Internet Vikings’ Founder & CEO, Rickard Vikström , and COO, Kristoffer Ottosson , speak to Tim Poole and discuss the steps taken to maintain stability for customers.

We’re used to discussing industry topics but, from time to time, what’s in the mainstream news has a big impact on gaming. How could potential trade wars affect the sector?

Rickard Vikström: When trade wars become a reality, we can’t ignore them, especially when it comes to supply-chain disruptions. They can delay hardware shipments, increase costs and create uncertainty. For the industry, this means slower deployment, higher operational expenses and potentially losing ground to competitors who are better prepared. It’s not just about the hardware; it’s about the ripple effect on service delivery.

Kristoffer Ottosson: Trade wars also create unpredictability in pricing and

RICKARD VIKSTRÖM Founder & CEO Internet Vikings

availability. For operators relying on international hardware, this can mean scrambling to find alternatives or paying a premium to meet deadlines. It’s a logistical nightmare that can derail even the best-laid plans.

How costly could any delays or disruptions be to gaming operators?

RV: Think about it: if you’re launching a new platform or scaling up for a big event, even a few days of downtime can cost millions and damage your brand reputation. Operators also face penalties for failing to meet regulatory deadlines or service-level agreements.

KO: From a technical perspective, delays don’t just hit the bottom line, they strain

your entire infrastructure. If you’re forced to rush deployments because of delays, you risk compromising on quality, security or performance.

Internet Vikings is billing its localized hardware as something that can mitigate these potential effects. Tell us how.

KO : We’ve always believed in being proactive rather than reactive. By acquiring hardware ahead of time, we eliminate the risks associated with international supply chains. Our localized infrastructure means we’re not waiting for shipments stuck in customs. We overprovision our hardware, and this approach allows us to deliver no matter what’s happening globally.

How do you ensure quick deployment and scalability? And how confident can you truly be of delivering on that aim, given that these disruptions could be on a wide scale?

RV: As for confidence –’ll be direct: we’ve stress-tested our systems and planned for worst-case scenarios. Trade wars or supply chain disruptions don’t just affect one company; they’re widespread. But because we’ve localized our operations and overprovisioned, we’re insulated from those shocks. Our track record speaks for itself – we’ve consistently delivered for our clients, even during global crises.

COO

Internet Vikings

What would you say to an operator that might prefer to avoid the cost of a trade-warproof strategy, in the belief that the impact may not be too high?

RV : I’d say this: hope for the best, but plan for the worst. The cost of being unprepared far outweighs the investment in a future-proof strategy. Trade wars, supply chain issues and geopolitical tensions aren’t hypothetical – they’re happening right now. If you wait until the disruption hits, it’s already too late.

KO: I couldn’t agree more. Cutting corners on infrastructure is a false economy. The upfront cost of a strategy might seem high, but it’s nothing compared to the cost of downtime. Think of it as insurance; you might not need it every day, but when you do, it’s invaluable.

Finally, are there any planned updates for this kind of product for the rest of 2025?

RV: Absolutely. We’re always working on growing and improving Internet Vikings. In 2025, we plan to expand our localized hardware footprint even further, adding more data centers and increasing our internal overprovisioning capabilities.

KO: In the end, it’s about trust. We take pride in delivering on our promises, no matter what’s happening in the world. That’s how we help our clients and put them at the center of everything. By eliminating reliance on international shipments and investing in proactive infrastructure solutions, you can ensure uninterrupted service, scalability and future-proof performance. Whether trade wars escalate or not, being prepared is what sets industry leaders apart.

breaks down how data governance can be navigated from different sources, and how operators can measure and reassess data policies

The universe of privacy and data governance laws, regulations and frameworks is vast. Over 80% of the world’s population is covered by some form of privacy law. Often, the array of regulatory regimes conflict, overlap and change rapidly. There are laws and policies on data protection, privacy, cybersecurity, consumer protection, content moderation, online safety, artificial intelligence (AI) and intellectual property creating a complex digital regulatory environment. The gaming industry’s verticals are equally as vast. Covering, to name a few, casino play on and offline, console PC, and cloud gaming, sports betting, esports, streaming, mobile and iGaming, reaching overall revenues of $283bn in 2024 with expected growth at more than 8% per year. The glaring difference is the gaming industry is innovating faster than privacy and data governance legal frameworks can react. Gaming is deploying new technologies like virtual reality (VR), augmented reality (AR), AI and blockchain, adding to the complexities

of data governance and protecting player privacy, data management, advertising practices and monetization strategies.

The centerpiece of privacy laws is the idea of data protection and individuals’ rights

RITA W. GARRY Attorney and Counselor Howard & Howard

to control their personal information is fundamental. These laws are extraterritorial, protecting citizens’ personal information no matter where in the world they are, impacting the entire gaming ecosystem worldwide in correlation to their international user base. In 2022, Epic Games settled with the US Federal Trade Commission over violation of the Children’s Online Privacy Protection Act (COPPA) paying $520m related to the Fortnite video game. Online gaming companies fare no better in Europe as in March 2025, the Swedish company Star Stable Entertainment is being investigated by a consortium of EU national authorities for harmful marketing practices directed at children.

On the flip side, gaming owners and operators using multiple interaction channels are uniquely positioned to collect vast amounts of player information and must balance their desire to monetize such data to enhance player experiences with privacy laws, responsible and ethical data usage, and their

legal and ethical manner. This is a tall and, some may say, overwhelming order which can lead to “digital entropy.”

consumers’ trust. This is the privacy and security compliance balance beam gaming companies must walk to grow player engagement but also mitigate the risks of regulatory and civil actions, the operational and reputational harms caused by poor data governance, and growing consumer awareness of and appreciation for their privacy rights. With advanced technologies like AI, VR and AR, the amount of personal data expands to include biometric, geolocational and other forms of sensitive personal information that create both opportunities and challenges. So, in an already heavily regulated industry, gaming companies must also be personal data stewards ensuring transparency, fairness, focus on player wellbeing, and doing it all in a fully

Entropy is a measure of decay, disorder and randomness and, as technologies advance and data caches grow unmanaged or unchecked, organizational data governance can seem to fall into a state of disorder and uncertainty causing digital entropy. Rather than succumb to digital chaos, the gaming industry can leverage its familiarity with regulatory environments and the business imperative to enhance player engagement, to make data governance the centerpiece for both. To begin this process, apply the data matrix elements across each business domain to identify gaps in the organization’s data governance practices.

By surveying each business domain to identify relevant data repositories, classifying data types (personal information, confidential, intellectual property), accessors/users thereof and storage location, the risk areas and control weakness will identify themselves. This knowledge can then lead to reassessment or enactment of appropriate policies, and practices to safeguard against unauthorized access and grow privacy compliance confidence.

In the end, these activities will only yield real benefits with the support of executive level enthusiasm, budgets and regularly repeated reviews and assessments will achieve organizational data governance with skill and not by chance.

Rick Arpin, KPMG US Gaming Industry Leader, looks into exchange betting and prediction markets: Navigating the regulatory and industry implications.

The rapid expansion of exchange betting and prediction markets into sports-based event contracts has sparked significant interest and regulatory attention. These innovative financial products are raising discussions around jurisdiction, legal risk, taxation and industry alignment. I participated in recent panel alongside experts including DJ Hennes (KPMG Risk,

Regulatory & Compliance Advisory), Bob Stoddard (KPMG US Gaming Tax Leader), Alex Costello (VP of Government Relations at the American Gaming Association), and Reade Jacob (Counsel at WilmerHale), on these emerging dynamics and what they could mean for the future of prediction markets in the US.

At the heart of the current debate is the divide between federal and state regulation. The Commodity Futures Trading Commission (CFTC) allows new financial products, including event contracts, to be self-certified and launched quickly – an approach that prioritizes innovation. However, this

about how prediction markets could impact their legal frameworks and economies. Maintaining the integrity of these markets is another high priority. Concerns about transparency, manipulation and consumer protection are pushing regulators to consider stricter oversight mechanisms. The CFTC is evaluating potential enhancements such as disclosure rules and real-time surveillance to prevent fraud. State regulators are also exploring shared enforcement models to strengthen oversight and bolster public confidence.

or future reclassification. The CFTC’s ultimate stance could shape the economic viability of the entire sector, influencing how and where these platforms are deployed.

Maintaining the integrity of these markets is another high priority. Concerns about transparency, manipulation, and consumer protection are pushing regulators to consider stricter oversight mechanisms.

Stakeholder engagement is increasing in response. The American Gaming Association (AGA), for example, has been adamantly opposed to the introduction of federally regulated sports-based event contracts. In its letter to the CFTC, AGA commented that, “By circumventing the important regulatory protections implemented by states, these platforms also raise the prospect of considerable consumer and marketplace harms.”

has raised alarms among state gaming regulators where established sports betting frameworks may be at odds with the CFTC’s interpretations. Some states have argued that these products resemble traditional sports wagers and should fall under their oversight.

Meanwhile, the CFTC exercised its authority to review sports-based event contracts to determine their permissibility under the Commodity Exchange Act (CEA), the federal statute for the derivatives and futures markets. As part of this process, the CFTC requested industry comment and scheduled a public roundtable, after which it will determine whether such contracts (i) constitute “gaming” and (ii) are “contrary to the public interest.”11] Until the CFTC completes its review process, a definitive resolution remains elusive.

Beyond regulatory boundaries, legal concerns are also at play. States that have not legalized sports betting are particularly concerned

The tax implications of these markets are equally complex. If classified as sports betting, operators could face both federal excise taxes and state-level gross gaming revenue (GGR) taxes. From the user side, tax treatment hinges on whether a participant is categorized as a trader or investor. Traders may deduct losses and treat gains as ordinary income, while investors may face more limited deductions and higher capital gains rates.

This uncertainty is causing hesitation across the industry. Operators are wary of launching products that could be subject to unpredictable tax burdens

Upcoming CFTC roundtables will offer an additional opportunity for industry voices to weigh in. While no immediate decisions are expected, the discussions will help shape the regulatory roadmap and inform future rulemaking.

The future of prediction markets and exchange betting is still being written. Regulatory clarity, especially from the CFTC, state agencies and potentially Congress, will be crucial in determining the direction of the market. Operators, investors and regulators must all prepare for a range of outcomes, including potential legal challenges and evolving tax frameworks.

RICK ARPIN

US Gaming Industry Leader KPMG

Industry participants are encouraged to stay actively engaged. The decisions made in the coming months will have a lasting impact on how and where prediction markets grow. These markets could offer new tools for engagement, investment and economic activity. But without a coordinated regulatory approach, they risk becoming mired in legal and jurisdictional disputes.

It depends on who you talk to, or what day of the week it is, or what social media you follow; Las Vegas is either done, or things have never been better. One thing is true, something has changed in recent years, but there is nothing new in that.

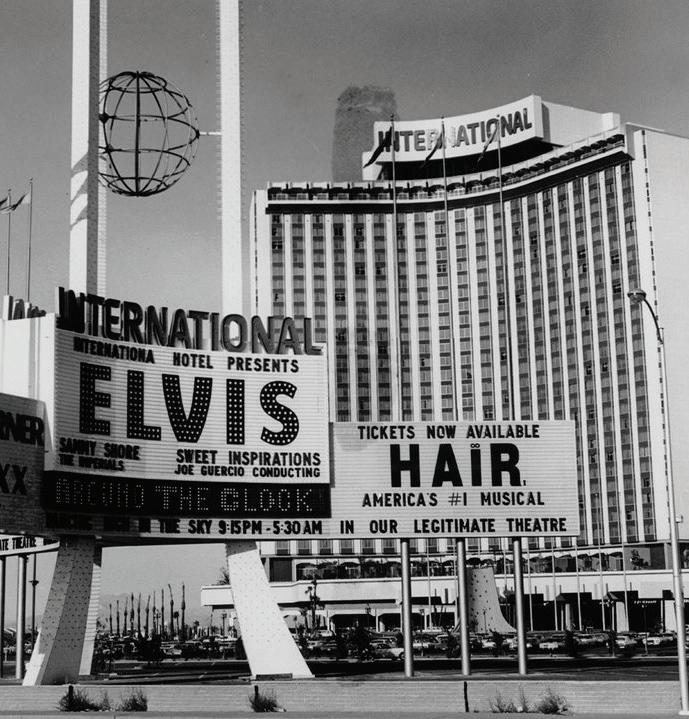

On July 31, 1969, Elvis Presley first took to the stage at the showroom of The International. Kirk Kerkorian’s Las Vegas casino resort was the largest in the world, and one fit for a king. Not even “old blue eyes” could put on a show like Elvis, who

... Or have we never had it so good? Gaming America regular contributor and Denstone Group CEO Oliver Lovat investigates how to transition Vegas for the next generation.

introduced a new generation of visitors to Las Vegas.

Those familiar with the resorts of the 1950s weren’t convinced. The property was too big, customers too young and the dress code too casual. The personal touch had gone. It just wasn’t Las Vegas anymore.

In 2016, I authored the paper, ‘Elvis Who? A strategic approach to understanding, attracting and retaining the next generation of Las Vegas customers.’ This wasn’t to diminish Elvis’ legacy, it was to underline that if you had been 21 at Elvis’ final Vegas show, by 2020 you would be most likely collecting your pension – but with some great stories to tell your grandchildren!

Armed with this data and strong hypothesis, I approached the subject of developing programming for Millennial and Gen Z demographics with a (nowdeparted) senior casino executive. Based on customer lifetime value and loyalty drivers, we could develop engagement and begin the relationship. I was rebuked, with the

memorable response that “young people don’t gamble.”

The 2024 LVCVA visitor profile makes for interesting reading. Gen Z (aged 21-27) make up 7% of visitors and Millennials (aged 28-43) are 46%. These two (once dismissed) demographics now comprise a majority of Las Vegas’ visitors. Among those that gambled, Gen Z had an average gaming spend of $575 and Millennials $767. In 2017 only 20% of all visitors gambled over $600. Gen Z spent $541 per person and Millennials spent $636 on food and beverage compared to the average of $376 in 2017. Millennials paid on average $191 per night for accommodation, compared to the average of $114 only seven years prior.

Gen X (aged 44-59) – and all still too young to have seen Elvis – comprise of 38% of visitors, gaming spend was at $873 and $616 per person on F+B. 91% were return visitors. 84% paid for their rooms. Not only have the properties that have actively programmed for the next generation of customers succeeded in attracting them, but they have also been the beneficiaries of these trends. Moreover, the spending behaviors – and expectations – of this next generation of customer are different from their parents. There are less comps demanded and are prepared for pricing to be comparable to other major experiential destination markets, if not that of Las Vegas a generation ago.

My former colleague Ed Burrows, who runs Hotel Analytica, undertook a detailed analysis of Las Vegas operator performance. Of the three publicly listed gaming operators on the Strip, MGM, Caesars and Wynn, there are some interesting findings.

In 2024, MGM’s Las Vegas (gaming and non-gaming) properties generated $8.82bn. Its portfolio stretches across all segments and demographics from the budgetfriendly Excalibur to Cosmopolitan and Bellagio. Across the portfolio, casino generated 22%, rooms 33%, F+B 27% and 15% other. The overall EBITDAR margin was 35.2%.

By comparison, Caesars' portfolio produced revenues of $4.27bn, 23% from casino, 33% from rooms, 27% from F+B and 14% other. Its EBITDAR margin was 44.6%.

Wynn and Encore’s performance was $2.75bn, with 23% from casino, 33% from rooms, 30% F+B and 14% from other.

The Strip properties differ significantly from other listed gaming companies; Red Rock and Boyd, both of whom operate off-Strip and, in locals markets, generated 66% and 71% of their revenues from the casino, respectively.

Extrapolating data (where available) Burrows notes that, across the portfolio, MGM achieved a citywide ADR of $260 and Wynn $555, compared to the market average of $206 (data unavailable for Caesars) with REVPAR of $245 at MGM and $494 at Wynn, both of which are record levels. The market average REVPAR was $178. In 2017 REVPAR was $124.

illustrates the global range of visitors

50% of under 40s that have been to Las

to 67% of international visitors, with 48% of domestic primarily coming for vacation/pleasure and 79% of international for the same purpose. This illustrates the global range of visitors and highlights the evolving rationale of visitation. In 2016 we noted that nearly 50% of under 40s that have been to Las Vegas have done so over eight times.

In total, 89% of Las Vegas’ domestic visitors are repeat customers, compared

events, all of which build a compelling case

inflection point, where the customer, the

For those of us that monitor the evolution of the market, we note the layering of Las Vegas, cumulatively adding to the gambling destination with entertainment spectacle, Sin City, convention destination, luxury resorts, sports, experiences and global events, all of which build a compelling case for repeat visitation. In recent years, I commented that Las Vegas was at an inflection point, where the customer, the programming and business model required

review, because of the aging boomer demographic, proliferation of regional gaming and wider economic change. In November 2020, in this magazine, I cautioned the industry on making the mistakes of the 1980s which turned to discounting to keep visitor and occupation levels high.

The pandemic catalyzed the change. The inflationary confluence of rising labor rates, increased pricing for goods and services, and the sharp spike in energy, significantly increased operating costs for Las Vegas operators. Like many businesses, to remain profitable, these costs were passed on to the customers and attempts to discount were short-lived.

The first is segmentation, seen in the

In managing a business in challenging times, there are several strategic approaches. The first is segmentation, seen in the luxury resorts with high service standards, elevated experiences and market-leading pricing. These attract either aspirational or genuinely wealthy patrons. As such, the

pricing is aligned to expectations and, as seen above, the performance and EBITDAR margins realized are consistent.

For the value-driven strategy in an inflationary period, to deliver the same margins across the portfolio, a cost-leadership approach is required. This may be found in reduced service levels, lower human to human contact (fewer table games to slot ratios) and a cost focus throughout the business.

The other practical tactic employed to increase profitability is to reduce costs while raising prices. This may achieve increased operating margins but risks customer dissatisfaction, unless the value proposition remains apparent. In the case of ever-increasing parking and resort fees –where there is no additional benefit or value gained – for some customers it seems that this is eroding trust and the entire proposition.

It remains true that better, profitable gaming customers still receive benefits gaming customers still receive benefits

and perks; these have been reduced for more moderate players (save those that are offered discounted room product to meet slack inventory).

Those that remember the ‘old’ Las Vegas are somewhat shocked by this alteration to the business model. For them, visitation to Las Vegas is less frequent and changes to past behaviors are evident.

On November 18, 2022, Adele Atkins first took to the stage at the Colosseum at Ceasars Palace. Jay Sarno’s first Las Vegas casino resort was the most famous in the world, and the showroom built for Celine Dion is famed for legendary performers, identifiable by their first name alone. Not even Celine could generate the excitement of the best-selling artist of the 21 st century

welcoming a new generation of visitors to Las Vegas.

Adele, like Elvis, was aged 34 at the time of commencing her engagement. However, where Elvis’ tickets ranged from $12-$27 in price, Adele’s commanded sums from hundreds to tens of thousands of dollars. The commercial reality and spending power of the next generation of Las Vegas visitors had become apparent. Millennial and Gen Z visitors do not have the same expectations as older customers.

“Las Vegas… acts as an 'escape' from their normal routine for short and regular periods. The geography and the infrastructure of Las Vegas lends itself to accessibility; it is close by car or air travel to many of the key markets that this customer reside. Repeat visitation is uniquely high and is across all relationship demographics and especially high as a group activity. (This) group are

not opposed to gaming. Indeed, it remains an aspirational activity and as budgets and

an aspirational activity and as budgets and visitation increase, the next generation of visitors are more likely to gamble… Over 75% indicate that they are prepared to spend more on food and beverage when in Las Vegas… This customer is not motivated by transactional (loyalty) methods, (player’s cards and incremental benefits). However, other aspects of functional loyalty, such as environment and community may indeed be the best method of retention. We find that customers that visit more often both spend more on both gaming and on non-gaming and are the most loyal.” - Lovat, 2016

Using data from 2017, combining total spend, frequency of visit and taking a 10-year period, the value of an average single repeat customer was approximately $26,000. The same customer based on the 2024 data is valued at over $51,000.

and experience hungry customers, has been good business and in many cases, Las Vegas casino resorts have successfully repositioned, by replacing one customer profile with another.

My late father-in-law regularly observed that anyone can walk into The Ritz, but not everyone can stay there. Las Vegas casino operators are under no requirement to ensure that their businesses are open or affordable to everyone, rather their obligations are to ensure that their stakeholders (customers, employees and shareholders) are best served.

Casino resorts, like any business, have no right to be successful. Their sustainability is assured by identifying a customer and meeting their needs. The market is big enough for multiple operators and strategies. As a customer, if your needs are not being

OLIVER LOVAT CEO Denstone Group

a business that does.

met, you do have the right to migrate to a business that does.

Times change. Customers change. Properties change. Or they close.

Many resorts have closed in the past, more will close in the future, but in 2024, Las Vegas did pretty well. Not only was financial performance strong, the market transitioned to the next generation of customer and will continue to attract younger visitors, who will begin their own journeys and make memories, and in many ways, this group are better customers than previously.

What’s next? I am not certain, but Las Vegas is not as it was.

Oliver Lovat is the CEO of The Denstone Group, that offers strategic consultancy in resort development. His research topics are Las Vegas Customer Behavior and Strategic Positioning of Casino Resorts.

Gaming America is joined by leaders of Paragon Casino Resort to discuss diversity within the property’s executive team and how it stands out across an expanding Louisiana market.

Having recently celebrated the launch of a new Dragon Link Den on April 11, Paragon Casino Resort VP of Hospitality Emma Ford, VP of Marketing Joan Botts and VP of Human Resources & Guest Services Kimberly Haigh spoke with Gaming America to share insight on the property’s leadership and initiatives.

What does it mean to represent a property that has been so progressive in both diversity and equality across its leadership team?

Kimberly Haigh: It is very exciting. at this property we pride ourselves on diversity and on our hiring practices to support inclusion for any hire.

Joan Botts: The other thing interesting to note is that the Tunica-Biloxi Tribe of Louisiana, which oversees our property, is

KIMBERLY HAIGH VP of Human Resources & Guest Services

Paragon Casino Resort

actually a multi-racial tribe. So it’s not just Native American; they actually have many different races across all of its members.

Having spoken on the Tribe, how do you work with Tribal leaders to ensure that not only the best interests of the property remain at the forefront, but Tribal sovereignty as well?

JB: Our General Manager, Marshall R. Sampson Jr, is also a Tribal member, citizen, leader and Vice Chairman of the Tunica-Biloxi Council. He’s worked at this property for many, many years and in the grand scheme of how Tribes work with casinos, I would say the biggest advantage for Paragon is that we are very autonomous, ironically.

We don’t have Tribal councils dictating our

strategies, but we also know to always place our top priority on their principles and the vision for their Tribal citizens – and then how that flows and manifests itself for our own associates, many of whom are not Tribal citizens. The Tribe’s headquarters is next door to our property as well, so we do a lot of things together. But when it comes to setting the direction for the property, that really comes from the executive team here at Paragon.

Emma, as the first African-American to be appointed a VP at Paragon, could you take me through your journey with the property and what it means to now hold an executive role?

Emma Ford: It’s an honor. I started off in the medical field actually, I was in nursing with three semesters left during my first clinical fundamentals at the time, but I started working for Paragon in 1996 and I haven’t left since. It’s the hospitality; it’s like a family here, it’s family oriented and I fell in love with the business side of it, to the point where I didn’t want to do the medical field anymore because I’m just an overall people’s person.

When I started working here, I just fell in love with the environment, the people and how everyone here just looked out

for each other. It’s really an honor to be the first African-American VP; it’s exciting to see others come along right after me because it is a fair environment here and it’s been very rewarding for almost 30 years.

Of course, you mentioned the family atmosphere and that is something that’s common across Tribal properties especially, and for those who have gone the corporate route previously.

EF: I can tell you this is definitely the better place to be. Corporate is tough, it has its good points and bad points, but I think for me, this will probably be the property where I retire.

Like Joan said, the Tribe gives us an opportunity to make decisions, take care of our employees and what’s in their best interest. This means a lot because, if there’s something you want to do, you’re not waiting two months for some corporate committee to say, ‘hey, you’re good to do that or no we can’t do that.’ Being able to make decisions for our associates is huge for us and very, very rewarding.

Paragon Casino Resort recently became the largest supplier of Dragon Link slot games for casino patrons of any property in Louisiana; what went into that partnership with Aristocrat?

we’re confident it’ll help continue to keep Paragon top of mind and relevant with Louisiana gamers.

What other elements of the property help it remain prominent in Louisiana, especially as the gaming industry continues to develop throughout the state?

JB: Louisiana is easily one of the more competitive environments with so many casinos. Our location is smack dab in the middle of the Louisiana. We are surrounded by casinos within 45 minutes to two hours away from us in every direction and what I am most proud of for Paragon in its 31st year of operation is we, hands down, have more resort amenities than any other gaming property in the state. Whether it’s the resort side with the spa, the hotel, convention and meeting services, supervised childcare, arcade, movie theatre. I can also assure you that no other casino, probably in the world, has a live alligator habitat, which is featured in our Bayouthemed atrium. We actually do a show with those alligators once a month, but they’re out there every day for people to see.

We have a lot of unique elements about our property and we were the first landbased casino in the state, so a lot of things for us to hang our hat on for sure.

JOAN BOTTS VP of Marketing Paragon Casino Resort

JB: We know Dragon Link games are one of the most popular slot games really across the country, but definitely in Louisiana, and the Dragon Link Den is the first-of-its-kind in the state. We now have the most Dragon Link games of any other casino in Louisiana, which includes over 20 properties, and we have 64 games across the casino with 46 of those inside the Dragon Link Den.

We did a soft opening recently and, already, the room is full. The guests love it, they’ve been hitting jackpots left and right. It was really a no-brainer for us to build some real estate space and dedicate assets to this game – because we know it performs. We’re excited about the Aristocrat partnership and

EMMA FORD VP of Hospitality Paragon Casino Resort

Coming off Women’s History Month, how have each of you seen female leadership become more recognizable throughout the gaming industry?

KH: Speaking from experience, I’ve been in the casino business for 25 years and it’s been a great thing to see women who are not only CEOs, but VPs of Finance and Systems and different things that are typically male-dominated roles.

I think we’ve come such a long way in this. I worked from the bottom to where I am now and it was tough. It was tough because men didn’t necessarily respect women in the early days. But it’s great to see how far things have progressed, to sit here with these women and be in the roles we’re in now; it just makes my heart very proud.

JB: My first gaming job was in 1995 in Tunica, Mississippi. I’ve worked for many

different companies, many different gaming markets and I know I’ve seen, firsthand, a definite evolution with the number of females taking senior management positions. I think that’s great to still be in an industry where we have witnessed that kind of change over time.

It’s almost cliché, I think, to talk about Women’s History Month and how far women have come. All the different achievements and accomplishments in every industry, not just gaming. It’s very prevalent even outside of Paragon in this market, and then even for Emma who’s been here the whole time, I’m sure you’ve seen that too.

EF: To Joan’s point, back in 1996, you didn’t see many VPs that were women. You probably didn’t have managers that were women either. Maybe one VP from 20 years ago that was in the hospitality field or on the gaming side, so we have come a long way.

Kimberly, what sort of responsibility do you feel in helping mentor the next generation of female leadership that could be coming through the gaming industry?

KH: I think succession, probably not just for women but in general, is tough. It’s very tough. When these ladies and I first started, I wouldn’t say we were the silent generation, but we were more of ‘your boss said do this, and we did it.’ In trying to help other females or other employees succeed, you have to learn to adjust to the generational thing,

what’s important to them and ensuring our associates have training that’s available to them in pretty much whatever field they’re interested in.

Our property is unique in that the executives here are very accessible. So, if any of our associates want to talk to them and say, ‘hey, how do I, how do I succeed here? what do I do?’ they’re very happy to share their knowledge and their experience with them. That’s why we’re fortunate here that we have those executives and a Tribe that does an excellent job as far as the resources they offer their members.

What would you all say is the most critical element to leading a casino resort?

JB: It’s super important to be really aware of the competitive landscape. Being able to leverage all your own property’s strengths and figuring out the best way to create a culture and an environment for your associates, so that they can create an experience for the guests that obviously keeps them coming back.

That’s probably every casino, hotel, restaurant, hospitality venue in the world, but having that knowledge and understanding about everything around you, especially from a marketing standpoint. Also having a real good understanding of your competitors, and then figuring out the best way to profitably

and strategically leverage those things for your own casino.

EF: For me, what’s critical in the hospitality department is making sure my associates and the guests feel like they are important and creating that environment for them. They used to say ‘if mama’s not happy, nobody’s happy.’ If your associate is not happy or dislikes what they are doing, then marketing could do all these things to bring customers here, but they won’t have a good experience. It’s maintaining and making sure

“I CAN ASSURE YOU NO OTHER CASINO, PROBABLY IN THE WORLD, HAS A LIVE ALLIGATOR HABITAT, WHICH IS FEATURED IN OUR BAYOUTHEMED ATRIUM. WE ACTUALLY DO A SHOW WITH THOSE ALLIGATORS ONCE A MONTH, BUT THEY’RE OUT THERE EVERY DAY FOR PEOPLE TO SEE.”JOAN BOTTS

my staff is happy, enjoying what they do, meeting the people of course and putting a real focus on guest service.

KH: This is my favorite part and to piggyback on what Joan and Emma said, engaging with our associates and maintaining an understanding of our competition is huge for us. We’re in a state that is so highly competitive, everybody has slot machines, we’re all brick-and-mortar, we all have the same sort of things. Now, we obviously have better amenities, but at the same time we’re all feeling that competitive nature as well.

Joan feels it from the gaming side, Emma from the hotel side, we feel it from the hiring side. We need to make sure we do what we’re known for, which is to provide that Southern hospitality because I think that’s a real thing. It’s a real, living breathing thing, and unless you’ve been here and been immersed in it, you just don’t get it.

What is that little extra we can do to make sure our guests leave here wanting to come back because they can go anywhere for the machines and the table games, but they come here for the experience that our associates provide to them. We try to keep the associates happy and engaged, we keep it fun and that is probably the best part of my job. That’s the easy part.

Gaming America shares insight as to how Interblock Gaming went from a small company meant for developing security systems into one of the global leaders of gaming.