INSIDE

Betby sports data: Australian Open tennis review Features: X Games, greyhounds & social media Company profiles: Who’s who of sports betting

INSIDE

Betby sports data: Australian Open tennis review Features: X Games, greyhounds & social media Company profiles: Who’s who of sports betting

With contributions from across sports betting, Gambling Insider takes a deep dive into – literally – the market’s fastest-growing vertical

In our last Sports Betting Focus magazine (H2 2024), we looked closely at the betbuilder trend sweeping the industry. The abundance of data available to sportsbook providers, combined with player demand for greater control over their betting experience, has seen betbuilders permeate across the sector.

Overall, though, the total percentage of wagers that betbuilders account for is not yet dominant, despite strong growth. Many sports fanatics still bet ‘the old way,’ while there is in fact another growing trend that heads in the opposite direction.

Indeed, in-play betting is king across a number of sports and, certainly, high-profile sports betting events (like the Super Bowl in early February). And that aforementioned abundance of data has, equally, allowed in-play betting to thrive in new forms – chiefly that of microbetting. Microbetting ensures speed is of the essence: the next shot, the next throw-in, the next ace.

Take tennis, for example: we’re no longer talking about the outcome of a match, set or even game. It’s the next point that matters. The differences between microbetting and betbuilding could not be starker. Control over the betting experience goes out of the window, while strategy and patience become alien concepts. There is more gut feel, less analysis and a greater emphasis on instant gratification.

This satisfies a huge portion of bettors – and creates healthy margins for sportsbooks. But there are immediate considerations: will bettors simply get tired sooner of wagering once every few moments? Will bettors use up their entertainment budget quicker and come back less often after a negative gaming experience? Most importantly, how can operators ensure microbetting is carried out responsibly – and how can regulators keep up with this fast-paced activity when setting guidelines for what determines acceptable levels of necessary intervention?

COO, EDITOR IN CHIEF

Julian Perry

EDITOR

Tim Poole

Tim.Poole@gamblinginsider.com

SENIOR STAFF WRITER

Beth Turner

STAFF WRITERS

Will Underwood, Ciaran McLoughlin

CONTENT WRITER

Megan Elswyth

LEAD DESIGNER Olesya Adamska DESIGNERS

Claudia Astorino, Callum Flett, Gabriela Baleva

JUNIOR DESIGNER Medina Mammadkhanova

ILLUSTRATOR

MARKETING & EVENTS MANAGER

Tel: +44 (0)20 7729 6279

ACCOUNT DIRECTOR

Michael Juqula

Michael.Juqula@gamblinginsider.com

Tel: +44 (0)20 3487 0498

SENIOR ACCOUNT MANAGER William Aderele

William.Aderele@gamblinginsider.com

Just like the growth of betbuilders, this is another phenomenon that won’t be going away anytime soon. But what does that mean for the sector and how can suppliers capitalise - in the right way? As always at , we don’t shy away from these big questions in our cover feature, speaking to sportsbook suppliers and analysts as we apply a microscopic lens to microbetting.

Gambling Insider

Elsewhere, Betby provides us with exclusive data once again, this time on the recently concluded Australian Open, while we also speak with the CEO of new sports betting sector arrival X Games. Are sportsbooks getting more social? And how will greyhound racing fare around the world after the announcement it will be banned in New Zealand from 2026?

We look into these issues and more, while again bringing you a who’s who of sports betting companies via an array of company profiles, as well as a preview of April’s SiGMA Americas Summit in Brazil. So, if you work in sports betting, what more do you need to hear? Get reading –this is the publication for you.

April’s SiGMA Americas Summit in Brazil. So, if you work in sports betting, what

TP, Editor

Casey.Halloran@playerspublishing.com +44 +44 Kaufman, Iain Hutchison, Abios, Data.Bet, Stephen Crystal,

Irina.Litvinova@gamblinginsider.com

Tel: +44 (0)207 613 5863

Serena Kwong

Serena.Kwong@gamblinginsider.com

Tel: +44 (0)203 435 5628

Tracey Frost

Tracey.Frost@gamblinginsider.com

Tel: +44 (0) 203 882 9693

AWARDS SPONSORSHIP MANAGER

Michelle Pugh

Michelle.Pugh@globalgamingawards.com

Tel: +44 (0)207 360 7590

CREDIT MANAGER

Rachel Voit

WITH THANKS TO: Betby, Digitain, DS Virtual Gaming, Jeremy Bloom, GR8 Tech, Karl Danzer, Igor Kaufman, Iain Hutchison, Abios, Data.Bet, Stephen Crystal, Emmanouil Mountalas, Alison Vaughan and Mark Bird.

06 DATA: AUSTRALIAN OPEN

Sports betting supplier

Betby provides Gambling Insider with exclusive data on the recent Australian Open

18 BETTER SKATE THAN NEVER Gambling Insider speaks with X Games CEO Jeremy Bloom about its arrival onto the sports betting scene

20 CYCLES OF HISTORY

Gambling Insider investigates trends of the past to predict trends of the future

26 A ZOOM-IN ON MICROBETTING

With insights from several sportsbook suppliers, Gambling Insider puts microbetting under the microscope

36 SIGMA AMERICAS PREVIEW

With speakers including the Wolf of Wall Street himself, Gambling Insider gives the lowdown on what to expect in Brazil

40 EMBRACING CHALLENGES AS OPPORTUNITIES

Digitain CRO Iain Hutchinson reflects on 2024 lessons, staying ahead of the curve and more

42 A SOCIAL SPORTSBOOK NETWORK

Gambling Insider investigates the trend of social media feature integration in sportsbooks, and whether it is effective

46 THE DOG DAYS ARE OVER What can the racing industry learn following the shutdown of greyhound racing in New Zealand?

Sports betting supplier Betby provides Gambling Insider with exclusive data once more, this time focusing on the recent Australian Open, won by Jannik Sinner on the men’s side and Madison Keys on the women’s side

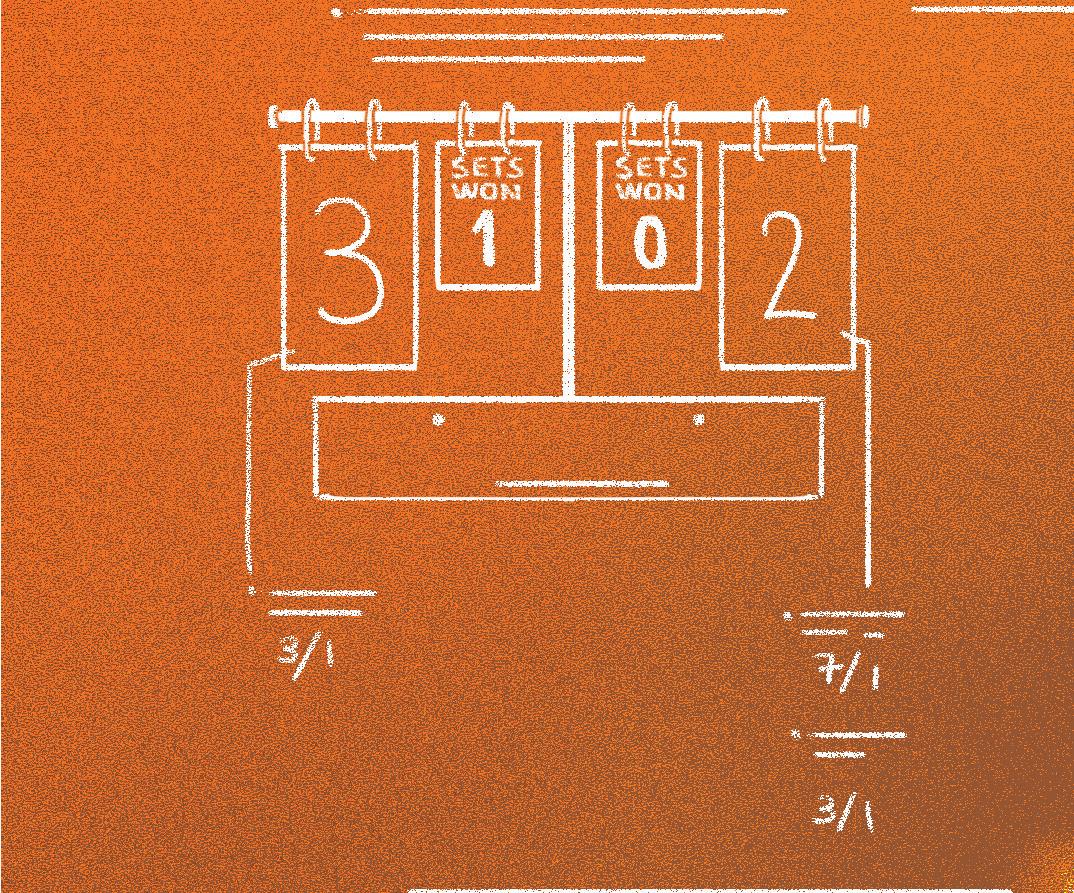

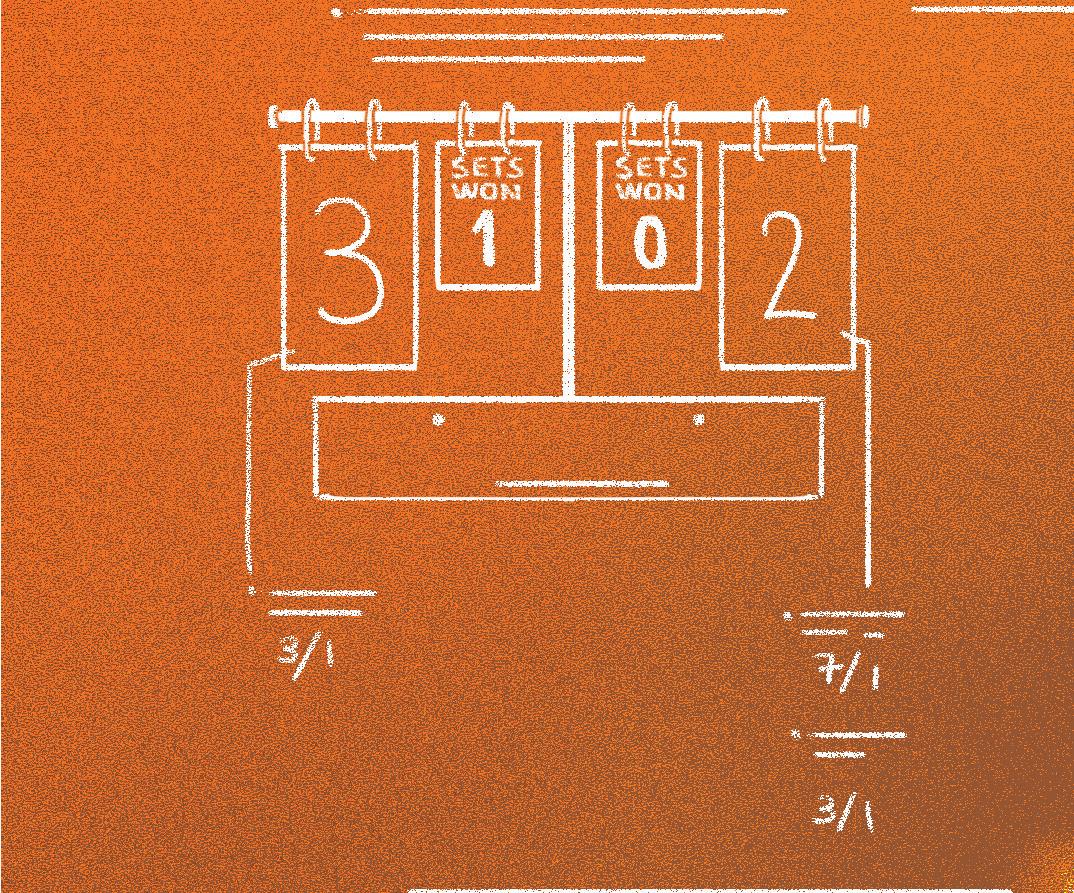

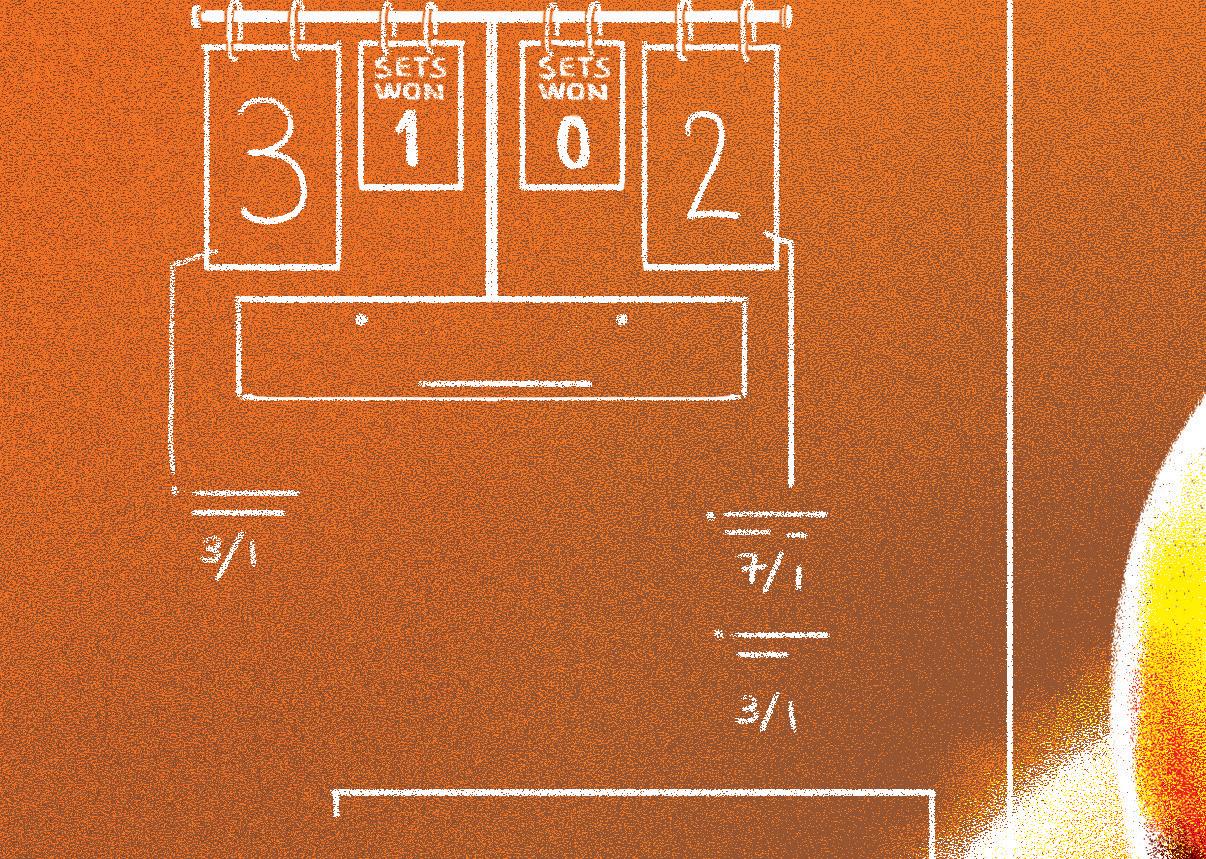

The first set of data from Betby’s operator network is interesting to note, as it potentially bucks a wider trend of granular focus and microbetting. At the Australian

Open, the bulk of turnover – and certainly the bulk of bets – leaned towards the more traditional categories, such as match winner and, to a lesser extent, set winner.

Betting on the total number of sets or games, or the winner of a certain set or game, was far less popular; over 40% of bets and over 50% of turnover came from the match winner market.

- In our second chart, we can see a very equal split in terms of pre-match or in-play wagers. More bets were placed in-play, which is par for the course for a sport like tennis where the action is ever-changing.

- Notably, though, bettors were less confident with their money in terms of turnover. A greater amount was placed across Betby’s operater network pre-match, when players had more time to assess all available data and information.

- So, while more wagers were placed in-play at the Australian Open, turnover was far greater for pre-match wagering.

Djokovic, Novak - Alcaraz, Carlos

round: Tien, Learner - Medvedev, Daniil

round: Draper, Jack - Vukic, Aleksandar

Quarter-final: Sinner, Jannik - de Minaur, Alex

10.10% of turnover during the tournament went towards eventual champion Jannik Sinner

- Player betting across Betby’s operator network was fascinating. The greatest share of bets went towards Novak Djokovic, statistically the greatest tennis player of all time, who was booed off after pulling out injured in his semi-final against Alexander Zverev.

- Zverev himself, alongside 22-year-old losing semi-finalist Ben Shelton, also captured the betting public’s imagination in turns of percentage of bets.

- However, eventual winner Sinner saw the “smart money” bet on him. It is very intriguing to note that the Italian took over 10% of total turnover, despite being wagered on less overall than Zverev, Shelton and Djokovic in terms of total bets.

- A look into the most bet-on events of the Australian Open throws up another potential surprise. While it makes sense that the quarter-finals are a popular betting round due to there being more action than the semi-finals and final, with more potential “value” in picking a tournament winner, it is still noteworthy that the final is only the second-most bet-on event.

- Both in terms of turnover and number of total bets, Novak Djokovic’s quarter-final victory over Carlos Alcaraz ranked number one. Neither of these players went on to win the tournament. A potential second-round upset also saw Daniil Medvedev’s win over Learner Tien make the top three.

64% of total bets during the Australian Open were placed pre-match, although 59% of turnover was on in-play

Betby’s data shows that the men’s singles final followed the same trend as the wider tournament. The percentage of both bets and turnover was far higher for the straightforward winner’s market, followed after some

distance by the set winner market, then total sets.

Turnover was, in fact, higher for total games in a set than for total sets, while there was also a small percentage of overall bets on the set/game winner.

- When it comes to pre-match versus in-play wagers, the Australian Open nal showed a slightly di erent trend to the overall tournament.

- Indeed, pre-match bets accounting for over 60% of the market was consistent across both the number of bets and the amount of turnover.

- The straightforward nature of the final probably played into this, with Jannik Sinner ultimately triumphing over perennial runner-up Alexander Zverev in straight sets. Was there, truly, ever any doubt?

Sports betting supplier Betby provides Gambling Insider with exclusive data once more; this time, we focus on the women’s singles...

went towards the match winner markets, rather than anything more broken down in terms of sets or games. No. 19 seed Madison Keys stunned the Rod Laver Arena with a three-set

victory over Aryna Sabalaneka, the no.1 seed who was expected to claim her third Australian Open title in a row. As we’ll see later, the final made for a positive result for operators.

- There was a signi cant di erence when it comes to the women’s singles and men’s singles in bet types. Indeed, while the majority of bets and turnover were placed pre-match in the men’s draw, the women’s singles saw far greater action in-play.

- In total, 55% of bets and an overwhelming 69% of turnover were in-play on the women’s side of the Australian Open. This suggests a greater level of upsets and momentum shifts, which is often common in women’s matches. It is perhaps best demonstrated by the nal, which saw a signi cant upset.

Keys, Madison - Swiatek, Iga

Semi-final: Sabalenka, Aryna - Badosa, Paula

round: Navarro, Emma - Kasatkina, Daria

Gauff, Coco - Badosa, Paula

Quarter-final: Sabalenka, Aryna - Pavlyuchenkova, Anastasia

Quarter-final: Keys, Madison - Svitolina, Elina

Fourth round: Rybakina, Elena - Keys, Madison

Fourth round: Gauff, Coco - Bencic, Belinda

Fourth round: Sabalenka, Aryna - Andreeva, Mirra

11.9% of turnover went on losing finalist Aryna Sabalenka during the Australian Open

In terms of total bets and turnover, unsurprisingly, defending champion Aryna Sabalenka took the lioness’ share. Eventual winner Madison Keys was second in the running, although no. 2 seed Iga Swiatek took the second-most in terms of turnover. She was also defeated by Keys in a semi-final epic that went all the way to 10-8 in a final-set tiebreak.

- In terms of which women’s singles event topped the charts for bets and turnover, the final between Aryna Sabalenka and Madison Keys generated the most turnover by a distance and the most bets by a small margin.

- Second in the running was, once again, the epic semi-final between Keys and Iga Swiatek. Sabalenka’s semi-final victory over no.11 seed Paula Badosa came third in the running, completing the line-up as would be expected.

69% of turnover for the women’s singles came from in-play betting, as did 55% of total bets

Unfortunately, there are no huge surprises in the above graph from Betby’s operator network. The trend of most players betting on the match winner was consistent throughout both the men’s singles and

women’s singles, as well as the men’s singles and women’s singles nals. Here, the percentage of turnover that went on the match winner was even more emphatic.

- Finally, as we look at bet types for the Australian Open women’s singles, we can see that a greater amount of money was placed pre-match (64% of turnover), although a greater amount of bets were placed in-play (59%). Again, the shifts in momentum most likely played a part here, with the nal going to a deciding set.

- Bettors may have also gone against their initial pre-match predictions, as Madison Keys caused an upset against favourite Aryna Sabalenka.

Digitain is a global leader in iGaming technology. We are ‘’BUILT TO LEAD’’ and renowned for our GLI-certified and award-winning sports betting and gaming solutions. With over two decades of expertise, Digitain empowers more than 180 partners worldwide by delivering cutting-edge turnkey and API solutions, enabling them to thrive in the dynamic and competitive iGaming industry. At the forefront of Digitain’s portfolio is its state-of-the-art Sportsbook Solution, a comprehensive platform designed to enhance sports betting operations and deliver exceptional results for partners worldwide.

The Sportsbook Solution is Digitain’s agship o ering, built to cater to the unique demands of online and retail sports betting operators. Combining advanced technology with unparalleled flexibility, our Centrivo Platform is designed to optimise player engagement, enhance user experiences, and support sustainable growth across all channels –whether online, mobile, tablet or retail. With a fully integrated approach, Centrivo merges sportsbook and casino functionalities into a single, cohesive platform. It offers native mobile applications for both iOS and Android, featuring intuitive UI/UX designs to ensure a seamless and engaging user experience. With essential components such as an integrated payment gateway and an advanced bonus engine, our Centrivo CRM system is the ultimate option for any iGaming business looking to simplify player management, acquisition and retention; an in-house Centrivo Affiliate solution, the affiliate management software that will take your affiliate marketing campaigns to a whole new level within our multi-brand, multi-currency and multilingual system; Centrivo Connect offers casino and business operators an innovative agent system management platform with unparalleled payment

flexibility complemented by fully customisable modules. Centrivo Retail offers the latest technology-driven all-inone retail solution designed explicitly for land-based betting operations. Aimed at creating high-performance business, we provide everything you need to stay ahead with our streamlined cashier operations, self-served terminal and portable POS management, diverse betting options and versatile franchise capabilities.

Centrivo strongly emphasises operational e ciency and player satisfaction. Operators can e ortlessly manage all channels and devices through a unified account and wallet system. Comprehensive reporting tools provide partners invaluable insights into player behaviour, game history and transactional data, empowering data-driven decision-making to fine-tune strategies for maximum impact.

The Sportsbook offers an advanced content management system (CMS) that grants operators unparalleled control over their platform’s front-end presentation. This dynamic feature ensures maximum flexibility, allowing operators to implement market-specific localisation and create a di erentiated brand experience to deliver tailored international views of the sportsbook to visitors from Europe, Asia, Latin American target audiences.

The sportsbook content is among the industry’s most extensive, featuring:

• Coverage of over 100 sports and 15,000+ leagues

• Access to 4,000+ betting markets

• Monthly delivery of 130,000+ live events and 80,000+ pre-match events.

• A robust virtual sports segment o ering a wide variety of daily events. Innovative features such as Autobet , In-House Betbuilder, Sport Jackpots,

Instant Cashback and Push Noti cations elevate the betting experience. The interactive Sportchat feature also fosters user community, promoting engagement and retention.

Complementing its sportsbook solution, Digitain introduces Paydrom, a centralised payment management system designed to simplify and enhance transaction work ows. With the integration of over 60 payment providers and more than 655 payment options across 30+ countries, Paydrom ensures seamless payment operations for partners and their players. The platform’s user-friendly interface allows operators to securely configure and manage multiple merchant accounts while supporting diverse transaction traffic for greater flexibility. Paydrom integrates seamlessly with leading payment providers, offering a comprehensive, efficient and secure payment solution that strengthens operational efficiency and player trust.

At Digitain, Innovation is the cornerstone of success. With our Sportsbook, Centrivo and Paydrom, Digitain continues to set new standards in the iGaming industry, empowering operators to deliver unmatched experiences to their players while driving sustainable growth and profitability. Our commitment to excellence and adaptability ensures we remain at the forefront of iGaming advancements, providing partners with the tools and insights needed to succeed in today’s competitive landscape.

Experience the power of Centrivo and explore Digitain’s comprehensive ‘’BUILT TO LEAD.’’ suite of solutions by visiting www.digitain.com.

For two decades, DS Virtual Gaming has been at the forefront of innovation, bringing cutting-edge technology, ethical values and a pioneering spirit to the gaming industry. Since its inception, the company has been committed to o ering only the highest quality, pre-recorded content from renowned racetracks and sporting events across the globe. This unique approach has established DS Virtual Gaming as a leading force in virtual gaming and betting, with a reputation for excellence that has only strengthened over time.

From day one, DS Virtual Gaming made the bold decision to operate exclusively with pre-recorded content. This approach not only ensures players experience the best possible gameplay but also guarantees the highest standards of quality. The company specialises in providing broadcasted content from famous racetracks, using only HD-quality videos. This commitment to high-quality content remains one of DS Virtual Gaming’s core principles, and the company has nurtured longstanding partnerships with prestigious racetracks such as Towcester Racecourse in Northamptonshire, UK and Kincsem Park in Budapest, Hungary.

As of today, DS Virtual Gaming boasts an impressive library of over 15,000 videos featuring greyhounds and 5,000 videos with horses. The company continuously expands its collection, adding thousands of new videos each year to keep its offerings fresh and engaging. In 2025, DS Virtual Gaming marked another milestone with the acquisition of new content in horseracing, reaffirming its dedication to maintaining a cutting-edge catalogue of virtual sports and entertainment.

DS Virtual Gaming’s commitment to providing high-quality and secure gaming experiences is reflected in its strict adherence to the standards of regulated markets. The company currently holds licences from leading regulatory bodies in several jurisdictions, including the UK, Malta, Italy, Panama, Peru, Colombia and Puerto Rico. Additionally, DS Virtual Gaming is certified with GLI-19 and GLI33, two highly regarded certifications that ensure the company’s products meet the highest standards of fairness, transparency and security. These licences

and certifications not only confirm the company’s legal standing but also underscore its commitment to providing a safe, responsible gaming environment for players worldwide.

Despite its longstanding presence in the industry, DS Virtual Gaming remains acutely aware that only technological innovation can maintain its leadership position. The company has earned a reputation for the stability of its transmission, which is crucial for both players and operators. The live broadcast plays a vital role in the betting experience, as it determines the outcome of bets.

Bets on DS Virtual Gaming’s virtual events are accepted up to three milliseconds before the start of the transmission, allowing su cient time for cashiers and players to process previous bets. The nal 30 seconds before an event begins are the most critical for both players and cashiers, as this is when the highest volume of bets is placed. To make this process even more e cient, DS Virtual Gaming offers a ticket ordering solution, allowing players to create and manage their own tickets, via mobile devices or computers, before submitting them at the cashier.

One of DS Virtual Gaming’s most exciting innovations is its Total Gaming Concept, which unifies all its gaming solutions, regardless of platform. This includes web retail, POS systems, terminals and online interfaces. With this approach, players, whether they

are at a physical location or betting online, are offered the same events, bonuses and a single unified jackpot. This seamless integration ensures that all players, regardless of how they access the games, have equal opportunities to win, enhancing the overall player experience and fostering a sense of community within the DS Virtual Gaming ecosystem. This groundbreaking approach to crossplatform connectivity allows DS Virtual Gaming to bring players together in a way that has never been done before in the industry, bridging the gap between traditional and digital gaming.

2025 is a monumental year for DS Virtual Gaming, as it marks the company’s 20th anniversary. As part of its ongoing commitment to innovation, DS Virtual Gaming is preparing to launch a series of new games that will set new benchmarks in the industry. With the successful growth trajectory from the previous year, the company plans to expand into new markets, further solidifying its position as a global leader in the virtual gaming space.

The company’s achievements, combined with its forward-thinking approach to technology and regulatory compliance, have ensured its continued success. DS Virtual Gaming remains poised to conquer new horizons in 2025 and beyond, constantly striving to o er the best in virtual gaming entertainment.

Gambling Insider’s Megan Elswyth speaks to X Games CEO Jeremy Bloom about the journey of launching sports betting for the iconic brand

They say you can’t teach an old skier new tricks, but as X Games prepares to celebrate its 30th anniversary this summer, it’s also taking its rst steps into the world of sports betting. Boasting disciplines such as skateboarding, BMX and freestyle motocross, it might not seem like the rst choice for traditional betting. But, as the X Games will continue to prove, unconventional is ‘in’ with Gen Z and Millennials more than ever.

launch sports betting now?

As Gambling Insider sat down with Jeremy Bloom, X Games CEO since December, the question of “why now?” is obvious, but there’s a little more to the story. The rst season of X Games was in 1995 and, while it’s remained true to itself this entire time, it’s also undergone several changes and evolutions along the way. Just as Tony Hawk kept pushing himself until he landed his iconic 900 at the 1999 X Games,

the event itself has always looked for new ways to innovate.

place a diverse range of traditional bets and prop wagers at licensed sportsbooks for the first time. “Our 30th anniversary is a celebration of X Games’ legacy of innovation and redefining action sports.”

How does this support the vision of engaging Millennial and Gen Z audiences?

There’s been a major refocus on the younger half of sports betting audiences in recent years, primarily those under the age of 30. Some sportsbooks create promotions aimed at markets they’ve been found to lean towards, while others have created their entire business models around them. In the same way that esports found a natural footing in the sports betting world, X Games comes with a natural advantage in that it has been popular with these age groups for decades already.

“X Games stands apart by being deeply ingrained in the culture of Millennials and Gen Z. Unlike traditional sports, action sports have a unique energy and authenticity that resonate with these audiences,” Bloom points out. “By integrating our odds into top platforms

When ESPN sold the event to MSP Sports Capital in 2022, the new owner explained that it would use its McLaren Racing team and the wider F1 world as a model to transform the X Games and introduce more commercial opportunities. These included multi-discipline teams, more global events and partnerships – and, for the first time, regulating sports betting on the events.

“Launching sports betting now allows us to continue that tradition by offering fans an entirely new way to connect with their favourite athletes and events,”

Bloom says. “It’s the perfect milestone to showcase our commitment to evolving how fans engage with the X Games.”

As the athletes took to Buttermilk Mountain in Aspen Snowmass at the end of January, fans were able to

like DraftKings, bet365 and Caesars, we’re bridging this cultural connection with the thrill of sports betting, making X Games a compelling partner for sportsbooks and brands looking to reach these influential demographics.”

As for why these demographics are so important for engagement with less traditional sports events, “Millennials and Gen Z are drawn to personalised, immersive experiences and sports betting is a powerful tool for deepening their connection to the X Games,” Bloom explains. “It transforms fans from spectators into participants, giving them an active role in the action.

“By offering a platform where they can leverage their knowledge of our athletes and competitions, we’re creating opportunities for deeper engagement, all while fostering a sense of community and excitement around the X Games.”

How will sports betting support audience growth and new commercial opportunities?

X Games has experienced a 113% increase in streaming audiences and 2.4 million new social followers in the past 12 months, and its new owners have emphasised its new capabilities for commercial growth. X Games was never limited to a local in-person audience, as it was always shown on ESPN, but thanks to its integration on YouTube, fans from all around the world can catch the action live as it happens.

“Sports betting is a natural extension of our mission to redefine the fan experience,” Bloom continues, as we discuss how important it is to ‘connect’ the audience to the event. “It not only keeps our current audience engaged but also invites a new segment of fans into the X Games community. This increased engagement drives our momentum in streaming and social growth, making us an even more attractive platform for commercial partners.”

It’s not just the fans who are finding new opportunities with this addition to the games. “With betting integrated seamlessly into the fan experience, we’re building new opportunities for sponsorships and partnerships that align with our vision for the future of X Games.”

Were there any unique challenges for X Games?

The process of entering a new sports market is never easy, especially when the sports in question haven’t been featured on this scale before. Sure, people might be used to seeing skiing on sportsbooks, but what about skateboarding and the various motorsports?

“Our partnership with Alt Sports Data was key to overcoming these hurdles,” Bloom says. “With their expertise in alternative sports and a deep understanding of the action sports ecosystem, we were able to ensure a smooth and successful launch.

“Launching regulated sports betting for action sports came with unique challenges, from creating accurate odds for dynamic competitions to navigating the regulatory landscape.”

Of course, Bloom would know all about this. He doesn’t come from the stereotypical business school background; instead, he made a name for himself on the slopes. Bloom is a

one-time world champion, two-time Olympian and 10-time World Cup gold medalist. He’s even in the National Ski Hall of Fame.

Bloom was also selected by the Philadelphia Eagles in the 2006 NFL draft before moving over to the Pittsburgh Steelers. He then co-founded a marketing software company and later became a sports television analyst for ESPN, Fox, NBC and the Pac-12 Network.

What has the reaction been within the X Games community and athletes?

As an athlete himself, Bloom knows how important the ecosystem is within a competition like X Games. The smallest change can have major knock-on e ects, whether it’s a huge competition like the Olympics or a local tournament. Every new development has to be meticulously weighed against the possible outcomes.

“The response from the X Games community, including fans and athletes, has been overwhelmingly positive,” Bloom reassures. “Sports betting represents a new way to amplify excitement and competition around the events. What excites us most is how it not only strengthens connections with existing fans but also attracts new ones who might not have engaged with X Games before.”

“X Games stands apart by being deeply ingrained in the culture of Millennials and Gen Z. Unlike traditional sports, action sports have a unique energy and authenticity that resonate with these audiences”

Modern sportsbooks produce new products each season, but does the cyclical nature of sports betting innovation simply mean reinventing the wheel?

Microbetting, chat functionality, copying betting slips from friends, personalised viewing experiences, behind-the-scenes content… and so on. These are the latest products trending in modern sportsbooks, but don’t they feel familiar? They say history doesn’t repeat itself, but it does rhyme. If we look back at where these trends originate from – and why they dissipated – we might be able to predict where sportsbooks will go in the coming years.

It is a truth universally acknowledged that a group of individuals in the audience of an event will find something to bet on. Whether it’s from the IFEMA Madrid VIP suites at the newest F1 circuit or the

Colosseum in Ancient Rome, people have always found a way to wager. If you’ve ever watched something with your friend, you’ve no doubt said to them at some point: “There’s no way he makes that; if he does, the next drink is on me” – the purest form of microbetting... If there are sports betting records as far back as the Ancient Greek Olympics, then is it fair to say this casual form of microbetting has existed since 776 BC? That’s purely speculative, of course, but the first written records we could find date back to 1813 when British aristocracy would bet on whose servants could complete certain chores the quickest – but with additional markets such as ‘Will he cut that corner to gain an advantage?’ or ‘He’s

losing the race, I bet another shilling he’ll break into a run’. This quickly grew from wagering on whose servant would lift both their feet off the floor when delivering a letter first (which would disqualify them from the ‘race,’ by the way) to organised Pedestrianism races, at which point any further examples of microbetting are lost among records of ‘gambling’ in general. While it is inconvenient that bookmakers from the Roman Colosseums never made written records on anyone betting whether Tigris Maximus would break a nail during the fight rather than just outright winning, if we trust in our own experiences of ‘microbetting’ between friends, we can assume it’s been around for as long as sports betting itself.

Somewhere down the line, things had to change. Once the Betting and Gaming Act legalised o -course betting in 1960, high-street betting shops exploded in popularity – and forever created a divide between live events and betting. This meant you could run down to the bookmakers on your lunch break on the Monday, place a bet on your favourite team, then watch the game several days later with your friends on the Saturday. Betting was transformed from being in the moment and at the event, to being something you did on your own ahead of time. Like separating eggyolk from the whites, betting was removed from the social aspect of watching sports with friends and set aside to be reintroduced at a later point in the process.

This mindset remained for many years. Even when online sportsbooks were becoming more mainstream, there was something very distant about them. Only recently has the idea of ‘social betting’ begun to reemerge, including features such as chatting with others, sharing betting strategies, watching streams of the game or copying someone’s betting slip. As Flutter puts it, social betting is, “at its simplest, sharing in the fun with fellow players,” but isn’t this blend of betting and socialising in real time what we were doing before the rise of high-street bookies? Is any of this really ‘new’, or are companies finally understanding

what made sports betting fun in the first place? Are we inventing the wheel, or have we simply reinvented it into a Wheel of Fortune?

The act of reinventing something can be just as revolutionary as creating it the rst time around. With every iteration comes the opportunity to improve a product or experience and, thanks to advancements in technology, each product launch is accompanied by more accessibility features than ever. Watching a game and betting in person is no longer restricted to your local friends, but you can now experience the beautiful game alongside international friends through in-app streaming and chat features. Rather than waiting out in the cold to catch a glimpse of the teams either arriving or leaving, you can access behind-the-scenes content at any time from the comfort of your home.

But what else is missing from the stands yet to be included in modern online sports betting spaces? We have our friends in the sportsbooks, but can you buy your friend a conciliatory drink when their acca fails right at the end? There are already some promotions serving as the foundation for this, such as Caesars offering Uber Eats gift cards, but could we see the day when this is integrated into the experience itself? The technology already exists; it’s just a

case of ensuring it passes regulation and would be beneficial to everyone involved. Speaking of accas, another thing sportsbooks are yet to capitalise on is the natural competitiveness between friends. If you’ve ever bet casually with friends, you’ve probably nudged your mate whose bet came in big and said “The first round’s on you!” If fantasy football has shown us anything, it’s that friends love to compete with one another over longer periods to ‘prove’ who is the best between them. With more peer-to-peer regulations passing each year, it’s more viable than ever to have a small side-pot in a closed tournament between friends, which could pay out for a full range of conditions. Sure, this can be found in a handful of dedicated apps such as Betmate, but we’re yet to see it properly integrated into some of the bigger operators. If modern sportsbooks are looking to reinvent the magic of watching the beautiful game with friends and waving that paper slip in your hands as the final goal is scored, they’ve certainly got their work cut out for them. But, as each ‘new’ product is released and that magic is offered to more people than ever across the globe, perhaps the biggest advantage of social betting is never having to separate your friends, the sport or the betting from one another in the first place. The experience is once again defined by all three being in the moment, rather than having to leave each other behind.

Platform provider GR8 Tech

Sports betting is the fastest-growing sector in iGaming, with a reported annual growth rate of 11.65%. The surge in popularity is driven by innovations like real-time odds, in-play betting and AI-powered personalisation, which have transformed the betting experience into something more dynamic and engaging than ever before. As players increasingly seek immersive betting opportunities, sportsbooks have become a cornerstone of any successful iGaming operation.

A sportsbook powered by GR8 Tech adds a profitable and dynamic edge to any platform, driving revenue not just through diverse betting markets but through a suite of advanced features designed to maximise operator success. GR8 Tech’s margin management capabilities allow operators to dynamically adjust odds and margins in real time, balancing player appeal with optimal pro tability. On average, clients report a 15% pro t increase – with some achieving over 30% growth without additional investment. GR8 Tech boosts player engagement with interactive features like live betting, realtime stats, and the integration of virtual and fantasy sports – bridging betting and other forms of entertainment. These features keep players immersed longer than traditional casino games, driving higher platform activity. Well-promoted sports events can also capture the attention of casino players, especially when paired with a high-performance CRM strategy. By offering personalised recommendations, operators can effectively encourage sports enthusiasts to explore casino games as well. This creates

new opportunities for revenue growth and strengthens the overall ecosystem by connecting sports betting with other gaming products.

To fully capitalise on these opportunities, operators must carefully select a sportsbook solution that aligns with their business goals, resources and growth strategies. GR8 Tech simpli es this decision with two tailored options – Hyper Turnkey and Turbo iFrame – each engineered to deliver high performance, maximise pro tability and boost player engagement.

The Hyper Turnkey is a fully customisable sportsbook solution designed for operators who want to build a complete and scalable iGaming platform. It offers powerful features like an advanced bonus engine, AI-driven tools for payments and global operations, and a built-in CRM to enhance player engagement. With margin optimisation software, region-specific line displays and localisation options, operators can maximise revenue while adapting to local market needs. For operators ready to manage every detail and scale without limits, Hyper Turnkey is the top choice.

The Turbo iFrame is a lightweight, streamlined solution designed for operators looking to quickly add sportsbook capabilities to their existing platforms. Easy to integrate, it offers the same features as a full sportsbook, including extensive content: over 50 sports, 25,000 daily events and 2,000+ betting markets. With an AI-powered personalisation engine to enhance user engagement and robust risk management to ensure security and profitability, the Turbo

iFrame delivers both performance and peace of mind. Its mobile-first, responsive design and flexible pricing make it an accessible, practical choice for operators aiming to expand without the complexity of a full platform upgrade.

Both GR8 Tech’s sportsbook solutions set a new standard in iGaming by offering unmatched performance, cutting-edge features, and proven scalability. With over 20 years of operational expertise, support from a team of over 500 in-house engineers, and a track record of more than 50 brand launches across 15 markets, GR8 Tech stands as a trusted partner for operators seeking to elevate their platforms.

What truly sets Hyper Turnkey and Turbo iFrame apart is their ability to boost profitability while maintaining peak performance. Operators can see significant profit boosts with margin personalisation, a standout feature that allows precise control over profitability by tailoring margins for specific user segments, sports or tournaments. GR8 Tech’s platforms process up to one million transactions daily and handle 30,000 bets per second, all while maintaining 99.96% uptime to ensure smooth and reliable operations, even during peak events.

Whether you’re looking for the all-in-one control of the Hyper Turnkey or the speed and simplicity of the Turbo iFrame, both solutions provide operators with the tools to succeed. With GR8 Tech’s expertise and advanced technology, you can confidently choose a sportsbook solution tailored to your platform’s needs and future ambitions.

There are a lot of positives that operators are receiving from the seemingly unstoppable upward trajectory that the sports betting industry is experiencing. The increase in popularity when it comes to mobile betting, the commercialisation and hence greater coverage of sporting events, and the rise of new and emerging markets such as the new Brazilian reality, are among some of the factors driving this growth. However, opportunities do not automatically translate into an easy win, even when it comes to the larger, more established Tier 1 operators.

Operators know they need to have a technological partner capable of putting at their disposal a cutting-edge sportsbook solution, a broad event and market offering, a solid trading team to offer a broader event coverage and margin flexibility, a very capable risk management team… and the latest AI-powered sportsbook tools.

Nowadays we are already seeing innovative bookmakers leveraging AI to their advantage on a daily basis. Advanced AI models are revolutionising sportsbook operations, being a driving factor for bookmakers in the running of their business and changing the dynamics for all the players in the market.

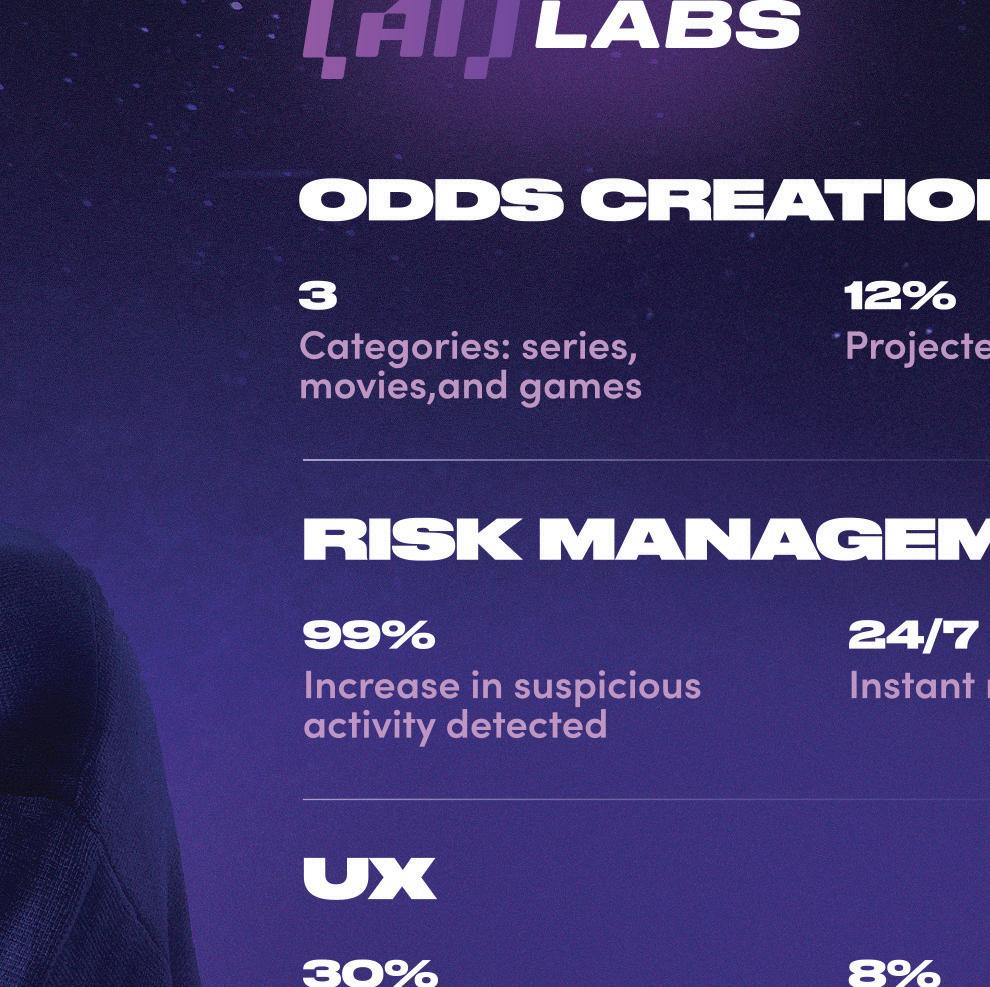

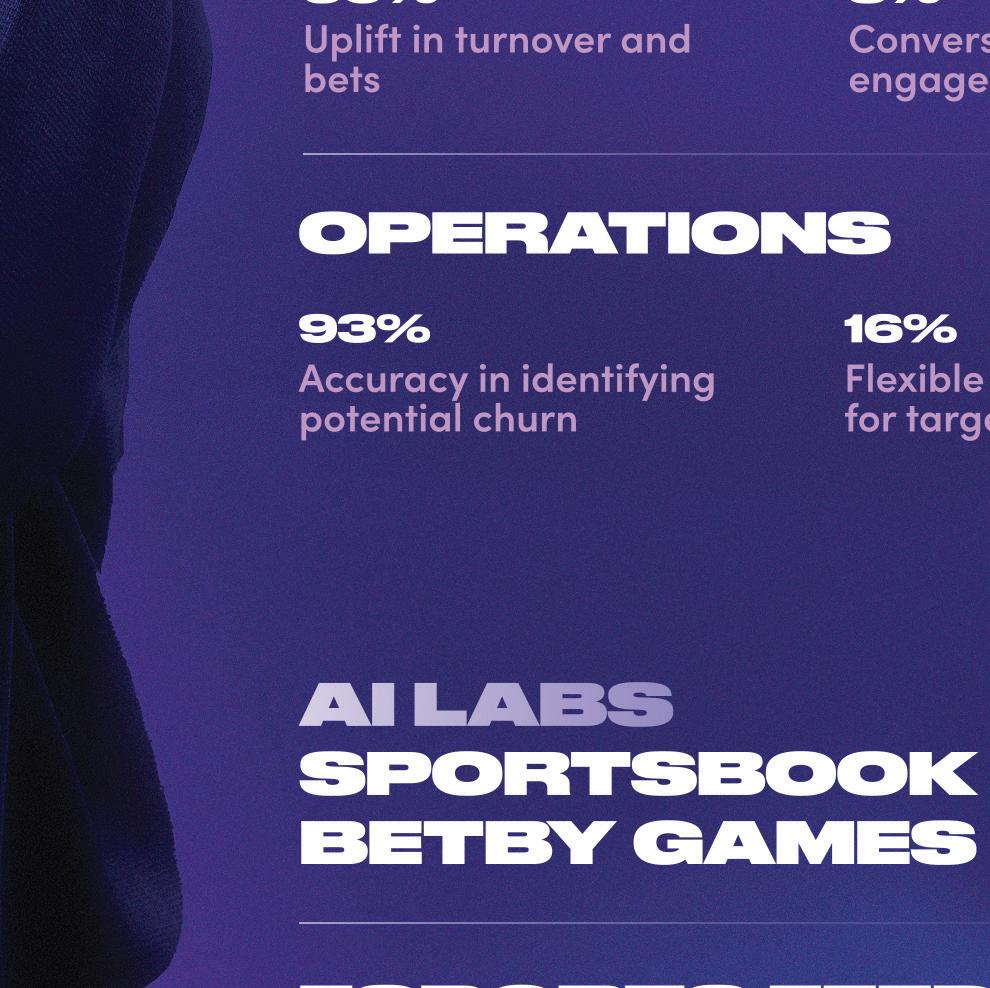

At Betby, with our proprietary AI Labs sportsbook technologies, we are witnessing this firsthand across four main pillars:

• UX

• Risk management

• Odds creation

• Operations

UX

While bookmakers have been doing marketing or CRM since the very start of their operations, not much has been done when it comes to personalisation. In comparison, this

is what we are delivering with our advanced models – taking the guesswork out of personalisation by analysing and identifying player betting behaviour through di erent data points – whether it’s sport, league, bet type, channel, time of activity etc – and o ering players the most appealing sport, league, event and market which best be ts their past behaviour. This is particularly important when it comes to seeing the positive impact this has in terms of boosted numbers of bets placed and increased turnover, by showing players the content that really appeals, matching their interests. Furthermore, having the possibility to tap into the volumes of individual player data that on an almost real-time basis allows bookmakers to target their players with the right content, bonuses and messages at the right time.

AI models are very handy for bookmakers to improve their operational performance. This is particularly true when it comes to risk management, where without leveraging AI technologies, player pro ling is a manual process liable to result in errors. The direct consequences from this process mean that without proper player behaviour analysis, bookmakers cannot make correct determinations in terms of the risks associated with each bettor. Thus, resulting in the unwanted scenario where operational risk is increasing which can lead to a turnover downfall.

In contrast, when comparing our risk management solution, which works in sync with the AI Labs player profiling tools, we have seen a 99% increase in the detection of activities associated with increased risk.

At the end of the day a more robust risk management system means higher profits for businesses, and ensuring healthier operational risk exposure by limiting players in accordance to their behaviour.

AI also allows those operators who seek to scale and diversify their o erings without compromising quality. And all this can be achieved by reducing the need for manual intervention from trading teams. Through our freshly unveiled AI entertainment content feed – which is the first step that Betby is doing in the direction of content creation by leveraging its latest AI technologies –Betby is able to cover unlimited, unique and localised content, ensuring all player bases are consistently engaged with fresh, relevant and exciting betting opportunities, turning sports betting from a transactional activity into a captivating experience.

The advent of AI and Machine Learning technologies have perhaps their biggest impact from an operational point of view, allowing bookmakers to instantaneously analyse thousands of players and their behaviour, and determine on an almost realtime basis outcomes related to churn, LTV, and the overall value index of any player. These deep-learning algorithms generate several valuable insights that bookmakers can use to optimise their retention strategies, allowing for a more effective use of the marketing budget by targeting the right players with the right campaigns.

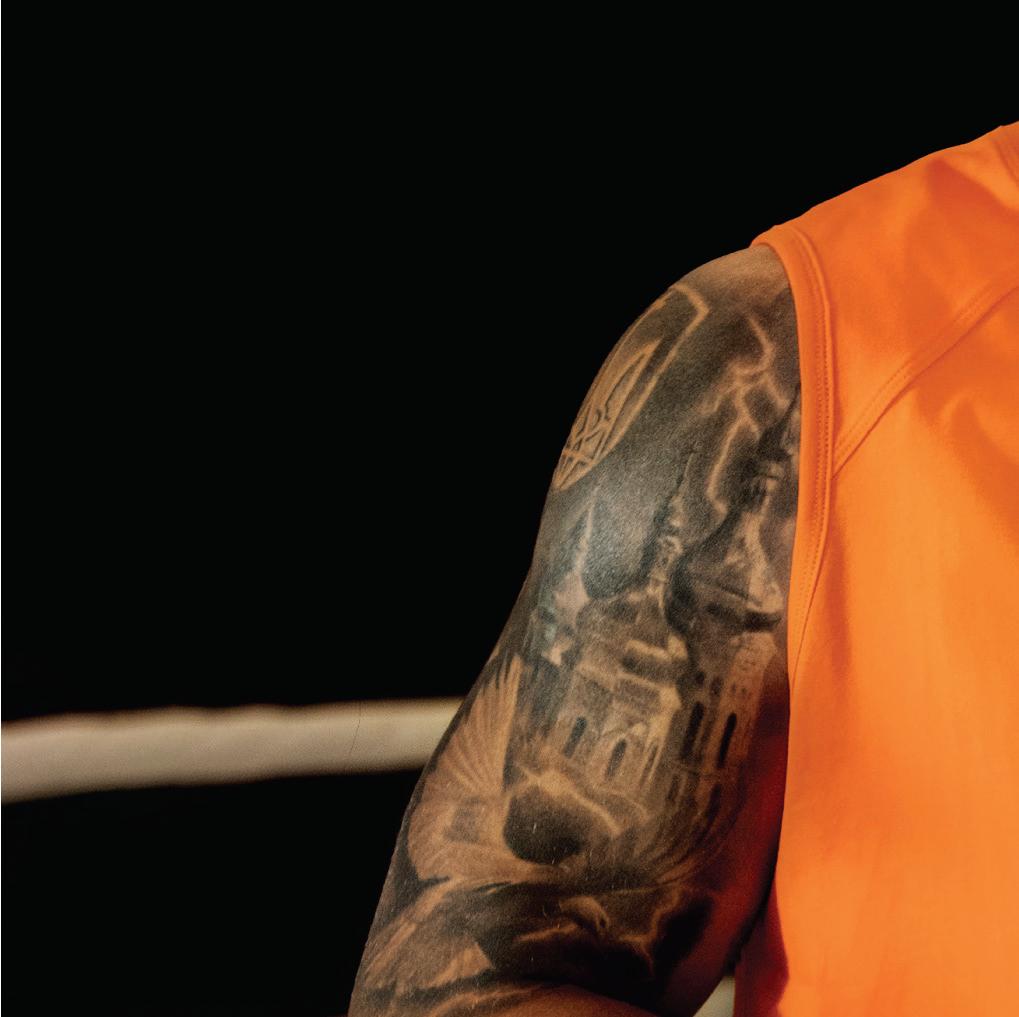

With contributions from across sports betting, Gambling Insider takes a deep dive into – literally – the market’s fastest-growing vertical – exploring the technology that makes it possible, the regions and sports within which it can thrive, alongside the potential ramifications from an RG perspective

Emerging from a stormy winter, the global sports betting landscape takes shape as we settle into another year.

The microbetting market has grown within the sports betting industry in a lightning flash, ushered in by operators and suppliers from across the global landscape looking to capitalise on a new trend that is, by all appearances, here to stay.

Anyone who is anyone in sports betting will understand what microbetting offers players in the modern industry. To underline it briefly for everyone else, microbetting is a form of in-game wagering that offers betting on markets that were not available before the game started – drawing on data gathered from the game as it plays out. However, a key variable of microbetting is that it also involves offering wagerers the chance to bet on specific markets that will be settled quickly, hence – a microbet.

As explained to Gambling Insider by Digitain’s Chief Revenue Officer Iain Hutchison, a number of factors have contributed to microbetting’s recent explosion in popularity: “Microbetting has quickly become popular in the sports betting industry due to the growing demand for fast, dynamic and more immersive betting experiences. Based on our observations, the sports that are most suitable for microbetting are those with continuous in-game/ in-play action and frequent stoppages, which allow bettors to engage in realtime events.”

It’s easy, then, to see why microbetting has become (and will likely remain) the fastest growing in-play vertical in the sports betting industry across 2024/25. It plays to the quick-fix, instant gratification aspect of sports wagering that circumvents the painstaking wait for the end of a game to find out whether a bet has come through. Further, it allows bettors to get both more creative and more involved with how they place their bets, as it can offer hyperfocused in-play markets that are highly reactive to the events happening in a game as they unfold.

Within the wider context of the gambling industry, microbetting is indeed a fledgling phenomenon, with its first occurrences being attributed by many to Cantor Gaming’s eDeck back in 2010. Players could access the sportsbook via a tablet device, to engage with in-play wagering options generated by Cantor’s solution.

Of course, at this time, the legal US sports betting market was limited entirely to the state of Nevada. Everything changed with the overturning of PASPA in 2018, however, as Delaware became the first state to pounce on the nationwide de-criminalisation of sports betting in the US, closely followed by New Jersey and, in the following years, the rest of the country.

It would seem, then, that the rise of microbetting in recent times has come

hand-in-hand with the sports betting explosion currently igniting the US market. However, the phenomenon is certainly not just limited to North America.

Microbetting is sweeping through the global industry, with the increasing worldwide regulation around sports betting pairing with a technological revolution that has seen the rise of AI technologies create the perfect storm for a microbetting takeover.

Indeed, the expansion of microbetting is a global phenomenon. With the recent regulation of the online gambling and sports betting markets in Brazil, LatAm is on everybody’s lips right now. But what is the potential of microbetting in Latin America in 2025 and beyond?

Across the region, it is fair to say that land-based wagering has largely dominated the landscape for the majority of the 21st century so far. The recent explosion in online betting in the region’s two largest markets of Brazil and Mexico has, though, coincided neatly with the rise of microbetting across the planet.

The recent regulation in Brazil has introduced an aspect of stability to what was a previously fraught legal landscape. That being said, operators will have to tread lightly and remain particularly alert to regulatory changes that may affect in-game wagering practices such as microbetting in Latin America.

This is because, despite Brazil now being regulated, there is still much legal contention around issues such as state vs federal licensing and promotional wagering, not to mention the necessary adjustment for PIX payments. These issues are also compounded further when considering the negative publicity currently befalling gambling in Brazil at the moment, following reports that recipients of the Bolsa Familia programme –which offers financial support to the nation’s poorest communities – had been spending excessively on betting on sport.

Elsewhere, legal contention in Mexico has been a pressure point in the nation’s gambling industry in recent years, with the lack of a centralised national regulator independent of the Federal Government causing confusion. This confusion has once again been compounded by a number of major regulatory backtracks – most notably the withdrawal of the nation’s recent slot ban.

Compliance will be a key hurdle for microbetting in the LatAm region.

However, with engagement figures for online gambling growing at breakneck speed across the continent, largely attributed to a fast-improving infrastructure and growing middle class, the upward potential for the practice is huge. A rising interest in online gaming, paired with a shared football fanaticism across the whole of LatAm, could make for some seriously impressive engagement figures as both microbetting and the Brazilian market continue to mature in the coming years.

Exploring the potential of microbetting in the LatAm region, Hutchison agrees that potential is sky high: “Microbetting represents more than a fleeting trend; it’s a transformative shift in how sports betting is experienced. Given Latin America’s deeprooted passion for sports, rapid mobile uptake and progressive regulatory changes, microbetting is set to become a pivotal growth driver for regional operators, just as it has in the US.

“With a focus on effective localisation, strict regulatory adherence and advanced technological enhancements, Latin America is on the brink of becoming a leading hub for microbetting innovation. This is an opportunity that operators cannot afford to miss.”

Brazil aside, the (other) buzzword of the moment, AI, is changing the way most major businesses, across a multitude of industries worldwide, are thinking about running their operations. This

Karl Danzer, SVP Odds Services, Sportradar

technological revolution is also changing the way both operators and suppliers, alike, are thinking about sports betting.

The development of in-play wagering options, spurred on by AI-driven player acquisition and retention techniques, has led to a variety of ways that bettors can engage with betting on a game as the action unfolds. Therefore, it is important to first distinguish where microbetting, itself, fits into the fold.

Now, while microbetting is in fact a sub-section of live betting – and while both occur in-play, there is a key difference that separates the two.

Sportradar’s SVP of Odds Services, Karl Danzer, provides us with an insight into just how revolutionary AI technologies have become for new sports betting innovations: “If you look at the first batch of micro markets that were made available, there wasn’t much on offer beyond ‘who scores next’ betting. Now, AI enables the creation of a diverse range of betting markets that operators can use to engage customers more deeply with popular sports. Take Sportradar’s partnership with Tennis Data Innovations (TDI) as an example. By combining deep ATP data with our sophisticated AI-driven odds models, we’re able to engineer a unique range of micro markets that allow customers to bet on the nuances of a tennis match. The granularity of the markets available, which include ‘point outcome,’ ‘who will serve the next ace’ and ‘total shots in a point,’ drives deeper engagement with customers, stretching their betting preferences while increasing their understanding and appreciation of the sport.”

As alluded to here by Danzer, a traditional live bet will likely be placed on verticals such as total goals/points, goal scorers, or final results. Further,

these bets will typically be resolved by the end of a quarter, a half or an entire game – depending on the sport. However, microbets tend to be placed on events that are both immediate and specific – leading to near instantaneous resolutions of wagers within minutes, or sometimes seconds.

This kind of wagering experience is enabled entirely by rapid and highly reliable data feeds that provide real-time insights and immediate updates on constantly fluctuating game situations, as they occur on screen. In fact, it is now becoming common practice for sportsbooks to include live streams that allow players to visually track the games they have chosen to bet on.

What this contributes to the player’s side of things is a near-endless selection of potential, statistically driven short-term markets and live odds, coupled with fast payouts – playing to an ‘instant gratification’ wagering experience.

Further, Hutchison agrees that much of this technology may not have been possible without AI: “Recent advancements in AI have significantly fuelled the growth of microbetting, enhancing speed, accuracy and personalisation in in-play betting markets. AI makes microbetting scalable and engaging, while helping operators manage risk effectively.

“AI enables sportsbooks to instantly process large volumes of real-time data, creating dynamic microbetting markets for every play and event. Algorithms adjust odds within milliseconds, ensuring fair pricing and minimising betting delays.

“With high frequency microbetting, AI tools are crucial for detecting anomalies and preventing fraud. Machine-learning models analyse betting patterns in real time, flagging suspicious activities and adjusting limits accordingly. AI can also be used to personalise microbetting options based on player behaviour, recommending bets tailored to individual preferences. Real-time push notifications enhance engagement by suggesting in-game wagers at key moments.”

Evidently, the development of AI technology – more specifically machine learning – has made it far easier for sportsbooks to leverage such a wealth of data in real-time. However, it is also essential that this technology be integrated with an advanced platform capable of handling such a wealth of data activity and, crucially, a server that is able to handle major spikes in activity during substantial sporting events.

While this may sound like a caveat, it actually has the potential to breed a wealth of new opportunities for both data activity and, crucially, a server that it actually has the potential to breed a

data suppliers and the industry itself, as is explained by Igor Kaufman, Head of Sport Business Unit at GR8 Tech. Kaufman tells Gambling Insider: “In microbetting, official data suppliers are in a much stronger position compared to other sports betting markets, where operators often have alternative data sources.

“For microbetting, having high-quality, low-latency data is essential. That’s actually good news for official data suppliers, as it creates opportunities for them to collaborate with companies that generate microbetting odds and content, increasing their exposure among operators. In the long term, this reliance is unlikely to change; operators will always need fast and accurate data for microbetting to function effectively.”

Once players start to dig past the more basic wagering markets, such as betting on the outcome of a game, the type of wagering opportunities available to them begin to vary based on the sport they are watching.

“Yes and, in particular, the start-stop characteristics of, say, American football and baseball, lend themselves to microbetting,” adds Danzer, “there are plenty of in-game events that have so far been overlooked from a betting perspective. The introduction of micro markets provides operators with a number of new, previously untapped bet-able moments.”

Statistically driven sports thrive in the microbetting space. American football, for example, offers a fantastic playing field for microbetting to take place. Players can access a diverse tapestry of microbets such as field goal outcomes, the result of the next play or the next drive and the outcome of a field goal kick. Further, if players want to get even more specific, they can explore wagering options related to what will happen during the next drive – will the team turn over the ball, punt or score?

“Latin America is on the brink of becoming a leading hub for microbetting innovation. This is an opportunity that operators cannot afford to miss” - Iain Hutchison

The sport’s medium-tempo enables additional time for players to observe trends within the game – allowing for more strategic wagering options. Individualised betting markets such as individual-at-bats or the result of the next pitch will fluctuate and require close attention and quick action from players. Further, players can analyse the rich array of statistics generated by each pitch – and can bet on number of runs in a specific innings alongside combined runs.

“If you look at the marketplace, it’s the US that is really driving the growth of

as operators seek to grow their betting

“If you look at the marketplace, it’s the US that is really driving the growth of microbetting. In the past 12 months, we’ve seen basic micro markets introduced for American football, baseball and basketball as operators seek to grow their betting content portfolio,” states Danzer.

Similarly to baseball, football’s tempo allows bettors to observe trends within the game to predict where the next foul might come from and whether that foul might result in a card. Players can analyse a given team’s style of play to predict whether the next goal could come from a set-piece or open play. Players can bet on the number of corners, number of fouls or even number or throw-ins within a specific timeframe –with the vast variety of competition and league types across Europe alone offering near endless possibilities.

Basketball is a little different – and this is where tailoring microbetting to a player’s specific taste comes into play. The fastpaced nature of basketball makes it slightly more difficult to exercise microbetting as small betting opportunities will come and

For the Moneyball fans out there, perhaps the most famous story of statistical analysis in sports comes from the Oakland Athletics’ iconic 2002 run, enabled by innovative player analysis. Baseball and statistics have always gone hand-in-hand, which is why it is a match made in heaven for microbetting.

is why it is a match made in

go in the blink of an eye. However, this does lean even further into the instant gratification aspect, as if a player is sharp enough, knows the game and is willing to watch along intently, betting on whether the next basket will be a two/three-pointer – an option that can offer enticing payouts – is certainly possible.

Indeed, Danzer agrees that basketball offers an intriguing microbetting prospect: “From a Sportradar perspective, the best example I can provide is with NBA and basketball. Our operator clients can offer their customers a more diverse range of betting markets such as ‘the next basket type’ or ‘the next possession outcome.’ This provides customers with a more immersive betting experience as they engage with granular aspects of the sport.”

On the other end of the scale, golf offers an interesting prospect as it offers plenty of time for players to observe, analyse and place their microbets – thanks to the oftenlong intervals between shots. Players could opt to bet on the winner of a given hole while the hole is in play – for example.

However, microbetting is not by any means simply limited to just the sports mentioned above, as alluded to by Hutchison, who says: “Recently, there has been a growing interest in microbetting for cricket, especially in T20 and franchise leagues. Bettors can place wagers on outcomes like runs scored on the next ball, falls of wickets, or boundaries hit. Additionally, esports are emerging as an exciting new area for microbetting, particularly in live-streamed games, where players can bet on in-game events such as the first kill, the next objective captured or round winners.

“As technology continues to advance,

Iain Hutchison, Chief Revenue Officer, Digitain

AI-driven odds, real-time data feeds and instant settlement solutions are enhancing the microbetting experience even further, making it one of the most exciting growth areas in sports betting product vertical. At Digitain, we are committed to refining and expanding our sportsbook microbetting capabilities, to ensure operators can take full advantage of this high-engagement betting trend.”

experience is to make it more interactive – not just offering microbetting markets but also curating the experience in real time based on what’s happening in the game. This approach moves away from simply listing multiple options and instead suggests the most relevant market at any given moment. There are claims that this approach can lead to around 4% of turnover and 8% in margin for operators in football, though I can’t verify these numbers firsthand.”

It would be possible to sit here and simply list the upsides of microbetting, but as the practice is still very much in its teething phase, there are a plethora of pitfalls for both the players and sportsbooks.

For some, however, microbetting isn’t limited to any particular group of sports at all. Kaufman explains that the secret sauce of microbetting’s success comes from the interactivity of the wagering experience, itself – a point that blows its potential applications wide open. “Football, basketball, baseball, cricket and American football appear to be among the stronger sports for microbetting – however, for me, its popularity isn’t about specific sports but the overall experience.

“Since microbetting thrives on engagement, the best way to enhance the

Initially focusing on the latter, sportsbooks looking to offer microbetting markets must ensure that they meet a variety of self-imposed standards to ensure a positive product experience, as well as navigating the regulatory complexities of an emerging landscape.

Hutchison states: “Microbetting relies completely on real-time data, presenting both short-term and long-term challenges for operators and suppliers in latency, data accuracy and risk management. Some short-term challenges are around latency and data integrity. Instant data processing is crucial; even a one-second delay can create market inefficiencies. Operators must invest in low-latency data feeds and advanced algorithms for fair odds.

“Regarding long-term challenges, the reliance on third-party data providers may shift towards first-party data collection, with sportsbooks directly partnering with leagues for exclusive data feeds.”

Regarding the technological side, microbetting’s reliance on real-time data analytics churns up many potential problems for both operators and suppliers. The first hurdle – and this one is essential – is ensuring pinpoint accuracy within a near-zero latency window.

Indeed, the quality of data that is fed towards players is paramount, as it is the sole informant for a player’s decision of where, when and how to wager. A lack in data quality can cause a domino effect that can spiral out of control quickly, affecting the entire pipeline of information that gets fed back to players. One piece of incorrect data can cause misinformation across an entire spread of statistical analysis.

Such is the fast-paced nature of microbetting, once a piece of ‘bad’ data pushes through the mould, it won’t be long before the observant player realises something is very wrong. The challenge, then, of ensuring accurate data at breakneck speed is of the utmost importance when it comes to player retention.

“When it comes to microbetting, it’s impossible to rely on people because the markets move too fast, and humans are too slow,” explains Kaufman; “some sort of automation is necessary and traditional mathematical models often fail since this market depends on many real-time factors, and those models aren’t designed to ingest that amount of data.”

The next thing to acknowledge is that a consistent flow of real-time data is not always guaranteed. In other words, data flow may fluctuate, presenting a unique troubleshooting challenge, especially when compared to how one would handle batch data. Unforeseen errors may not always be revealed by standard testing and, since

“Microbetting has quickly become popular in the sports betting industry due to the growing demand for fast, dynamic and more immersive betting experiences” - Iain Hutchison

real-time data flows constantly, one small discrepancy can again create a domino effect on the results.

“There is, as you have underlined, a lot at play at any given time. The question isn’t exactly how to build a model that can handle this kind of data – because the approaches already exist – but rather where to get the data for those models in real time. In the longer term, the only way to calculate microbetting odds is by utilising machine learning or AI – there’s no other option.”

“Another key point is that the markets relevant at a given moment should ideally be recommended to the user based on their preferences, and all of this is impossible without AI. GR8 Tech’s AI-based recommendation engine, for example, analyses user behaviour in real time to suggest the most relevant sports, events, and other betting options–such as parlays, tournaments and betbuilders.

“By making the experience more personalised and engaging, it increases user engagement by a third on average, which leads to higher betting activity

and retention. This directly extrapolates to microbetting – the more relevant the suggestions, the bigger the impact. This is something that will push microbetting to new heights.”

Unfortunately for data suppliers, the challenge of implementing strict data monitoring is one that must also be balanced with the issue of security. Platforms will require complex encryption, real-time monitoring and access control tools to protect data integrity, and guarantee regulatory compliance.

Discussing the key issues of microbetting compliance, Kaufman weighs in: “ The key compliance challenges mainly involve official data and responsible gambling. Ensuring access to official sports betting content is one issue, as some companies trade odds through unofficial channels, which doesn’t work well for microbetting. However, if microbetting grows, it could make official data more accessible.”

As with any emerging landscape, sports betting executives will need to keep their finger on the pulse as regulatory changes are both frequent and inevitable across a

developing global marketplace.

Hutchison discusses security challenges from Digitain’s side: “Fraud prevention and security are paramount. The risk of betting fraud increases, especially among in-stadium bettors exploiting broadcast delays. Advanced risk detection systems are vital. Furthermore, scalability and infrastructure are the lynchpin. A robust backend is needed to manage large volumes of microbetting transactions, ensuring quick updates and settlements for a seamless player experience.”

While all this may seem like something of an insurmountable endeavour, it is achievable. Evidently, this fine balance has already been mastered by a number of companies that have made microbetting the sports betting industry’s fastest vertical.

The catch? It is, quite simply, not cheap.

“The reality is that an effective and engaging microbetting offering requires super-fast and super-deep data – it’s impossible to deliver the product without those components.” says Danzer, who continues, “as microbetting

grows in popularity operators are going to prioritise fast and accurate data to ensure they’re delivering the best possible user experience. While super-fast, real-time data is, of course, important for the creation of micro markets, advanced artificial intelligence is required to process and contextualise millions of data points, and collect and transform them into a highly engaging betting offering. Many operators don’t have the necessary resources in-house to develop the AI capabilities for micro markets.”

The streamlined way of explaining business innovation is enhancing the user experience. Gambling is no di erent. Modern innovation in the gambling industry, be it personalisation for iGaming, slot development for land-based, or microbetting for sports wagering – all share this common goal. Further, these are all shining examples of innovations that are designed to enhance the player’s enjoyment and overall experience, thus keeping them engaged. Or, in other words, keeping them betting.

This, then, begs a different question –how much is too much? As the industry advances, it is the job of its participants to with it advance the responsible practices that protect the players it serves.

Breaking down the responsible perspective, it is important to understand initially what it is that makes microbetting so appealing to players. Not for the first time, the phrase ‘instant gratification’ comes to mind.

When it comes to microbetting, a successful bet could potentially have a life cycle of mere minutes – offering a straight dopamine hit that is then followed by another near-instantaneous opportunity to bet again.

GR8 Tech’s Kaufman explains to Gambling Insider how, on a basic level, the quickfire nature of microbetting could present problems in this area: “Microbetting to traditional betting is the same as short videos are to movies: a much quicker, more engaging format, increasingly popular with modern audiences. However, it doesn’t yet have the addictive scroll-based mechanics that rule mainstream entertainment. That being said, the potential dangers are clear, especially as user engagement grows.

People are spending more and more time on these faster, more interactive formats because they’re simply more engaging than traditional betting markets.”

The swift, pop-up nature of

microbetting poses clear problems for compulsive gamblers, as it plays on that compulsive aspect in ways not too dissimilar to slot machines. In fact, many have drawn comparisons between the quick-fix nature of microbetting to that of what a player may experience on a land-based slot.

On this topic, there has been a lot of industry agreement that a full disclosure to the potential risks around microbetting should be offered to players prior to their engagement with the practice. However, it could be argued that this is simply a bare minimum requirement – and that platform providers must go further to protect their players.

This a point strongly backed up by Kaufman, who further explains: “ While disclosing potential risks to players can help raise awareness, it’s not enough on its own to provide tangible protection. The key to effectively mitigating risks lies in giving players and operators the right tools to proactively manage and reduce those risks.

“Risk-management tools like exclusion programs, AI-based behaviour analysis, and robust KYC systems all play an essential role in identifying and intervening with at-risk users before problems escalate. Just as with other betting markets, microbetting must be equipped with these risk-management measures to ensure players are protected actively and in real time.”

Indeed, Hutchison also underlines the requirement for a proactive approach on the industry’s side to help broach this potential problem area, stating: “As microbetting grows in popularity, maintaining a focus on responsible gaming is essential for operators and suppliers. While its fast-paced nature enhances engagement, it also poses risks for impulsive betting behaviour. At Digitain, we emphasise that innovation in microbetting must go hand-in-hand with advanced RG safeguards.

“Ongoing dialogue and proactive measures are essential to ensure microbetting remains safe and enjoyable. Operators must adapt to evolving RG standards as regulators scrutinise highfrequency betting models. At Digitain, we work with partners to integrate effective RG tools while innovating in microbetting. By balancing an exciting betting experience with responsible safeguards, microbetting can become a safe and engaging format in the sports betting industry.”

Indeed, this sentiment is echoed by Sportradar’s Danzer, who suggests that AI may be at the forefront of this battle moving forwards: “The industry, Sportradar included, is working to improve measures, protect customers on both fronts and AI

Igor Kaufman, Head of Sport Business Unit, GR8 Tech

is helping this. Increased use of artificial intelligence is enabling the industry to effectively and efficiently analyse betting activity on a larger scale than ever before, helping to identify irregularities in customer betting patterns more quickly, which can then be addressed as appropriate. “

Considering slot machines, which are one of the most established forms of gambling, the industry has amassed decades worth of experience in learning how to protect players from the instantaneous and, at times, addictive nature of instantgratification wagering. What’s more, as the online industry has developed in recent decades, gambling companies across the globe have begun to implement highly technologically sophisticated protection measures that are able to identify and flag behaviour indicative of a compulsive or problem gambler, subsequently blocking them from a given site.

Therefore, perhaps a two-pronged approach that draws on a combination of protection measures for slot machines, combined with technological measures developed for online gambling, is the best way to tackle any potential harms that could arise from microbetting.

Hutchison, however, states that there could be some difficulties that arise from adopting this approach: “It is true that microbetting and slot machines share

traits like quick engagement and instant gratification, but they differ significantly in responsible gaming considerations. It’s essential to recognise these differences in player behaviour and engagement patterns.

“Microbetting is data-driven, influenced by real-time sports events, while slot machines rely solely on random outcomes. Bettors assess game or match statistics and player performance rather than just relying on luck. Slot machines encourage continuous play without external factors, whereas microbetting is tied to real-world events, leading to more regulated betting behaviour. As microbetting grows, regulatory scrutiny will increase, similar to past evaluations of slot machines. Therefore, in my opinion, the industry must implement responsible gaming measures to avoid past issues.”

The expectation of a fast-growing regulatory pressure on the microbetting sector is, again, one that is echoed by Kaufman, who says: “People are increasingly drawn to these new mechanics because they’re more immersive and engaging than traditional betting formats. However, it’s important to remember that betting is far more regulated than mainstream media. For example, in the US, lawmakers are already introducing – or at least planning – regulations aimed at limiting this kind of ‘scroll gambling.’ The fact that these laws are already in development highlights how regulators are anticipating potential risks. They recognise the level of engagement these fast, interactive formats can create and they’re prepared to address those risks to protect consumers.

“While we don’t yet see these advanced, scroll-based betting systems in play, the industry is likely headed in that direction. As regulators anticipate the challenges these new dynamics could bring, we may see a more controlled yet highly engaging microbetting ecosystem in the near future.”

On the other side of the responsible coin, 2024 was a year rife with long-term bans for athletes found to be in breach of match xing regulations related to gambling, both in the US and across the world.

“When it comes to microbetting, it’s impossible to rely on people because the markets move too fast, and humans are too slow”

- Igor Kaufman

Athlete wagering is a glaring issue at present, as evidenced by the high-profile case of Jontay Porter – who received a lifetime ban from the NBA last year. Now, questions have been raised about whether microbetting, if not carefully safeguarded, has the potential to compound the issue by leading athletes to believe they can more easily disguise match-fixing within the often-niche verticals offered in microbets.