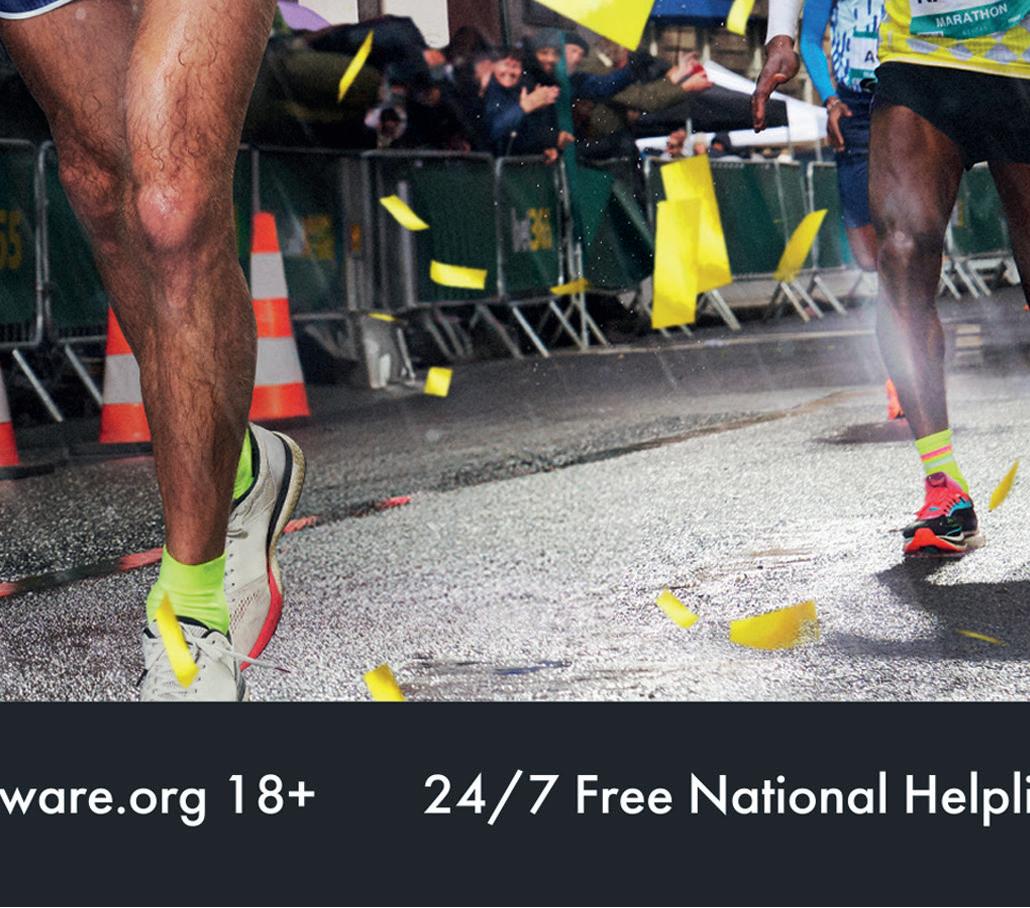

Within the ethical complexities of gambling, where does the onus fall for ensuring responsibility? Gambling Insider explores the moral, practical and legal aspects

WINNERS REVEALED: A full rundown of the Global Gaming Awards EMEA

CONTRIBUTORS:

Gustaf Hoffstedt, Paul Sculpher and ICE panellists

What’s the latest from live casino gaming suppliers?

Julian Perry, COO, Editor-in-Chief

ambling.

COO, EDITOR IN CHIEF

Julian Perry

EDITOR

Tim Poole

Tim.Poole@gamblinginsider.com

SENIOR STAFF WRITER

Beth Turner

STAFF WRITERS

Will Underwood, Ciaran McLoughlin

CONTENT WRITER

Megan Elswyth

LEAD DESIGNER

Claudia Astorino

DESIGNERS

Olesya Adamska, Callum Flett, Gabriela Baleva

JUNIOR DESIGNER

Tim Poole, Editor

It's a word that has so many different perceptions and connotations, depending on who you ask.

Within our industry, gambling is the lifeblood and livelihood. Customer lifetime value and portion of entertainment budget spend quickly turn into monthly gross gaming revenue reports, and quarterly financial presentations for multi-billion-dollar public companies.

For a CEO, Product Owner or Sales Manager, gambling is business, gambling is numbers, gambling is what they travel to trade shows around the world for.

But, unlike so many other perceived 'safe' sectors – finance, insurance or IT, the word 'gambling' can elicit so many negative reactions around the world.

For some, it is a sin, for others an 'evil' industry. Even in my personal experience, taxi drivers have proceeded to spend a whole journey explaining why the sector is the devil's work, not necessarily registering that I would know infinitely more than them about this very sector. People close to me, meanwhile, may still say 'be careful placing that bet, you'll be addicted in no time.'

And, of course, I know none of that is true. I know placing a £10 ($12.65) bet on Liverpool to a win a match will not lose me my mortgage, even though some claim that's where every bettor will automatically end up one day.

The product, though, and the nature of gambling, is intrinsically linked with addiction issues and can end in tragic circumstances for problem gamblers that are not looked after.

We who work in the industry know both of the above ends of the spectrum to be true: that casual betting can be carried out on a huge scale and enjoyed by millions across the globe (hence such growth for the industry), but that gambling issues can have destructive consequences for individuals. So, in this issue of Gambling Insider magazine, we ask in our cover feature: how do we find the line? If a gambler deposits £1,000 and loses it overnight, whose responsibility, ultimately, is this?

There is no one single answer but there are so many factors to consider: how much is down to the player and personal choice? How much is down to the operator to intervene? And how much is down to the regulator or legislator to ensure both of the former enter into a more protected environment?

As those who have truly thought about the conundrum of gambling will know, you cannot simply 'ban' the activity – one conducted by humans for millennia. Banning anything, as the Prohibition era showed so aptly around a century ago, will not discourage the activity; it will simply send it underground, where protections are weaker and the stakes, literally, so much higher. In today's society, regulated gambling markets are the only forward – but, morally, practically and in legal terms, where does the responsibility for safer gambling truly lie within these environments?

Elsewhere in our March/April edition, we review the winners of the Global Gaming Awards EMEA – during the first-ever ceremony to have taken place in Barcelona. Soft2Bet was a three-time winner, while, on theme with the topic of safer gambling, Betsson claimed victory in the Social Responsibility of the Year category once again.

We also review panels from ICE Barcelona, explore updates from Brazil, Sweden, the UK, US sweepstakes and more.

Another jam-packed issue, then, with plenty of food for thought as ever in gambling. A word that has so many different perceptions and connotations, depending on who you ask...

TP, Editor

Medina Mammadkhanova

ILLUSTRATOR

Judith Chan

MARKETING & EVENTS MANAGER

Mariya Savova

FINANCE & ADMINISTRATION ASSISTANT

Dhruvika Patel

PUBLISHING ASSISTANT

Abi Ockenden

IT MANAGER

Tom Powling

COMMERCIAL DIRECTOR

Deepak Malkani

Deepak.Malkani@gamblinginsider.com

Tel: +44 (0)20 7729 6279

ACCOUNT DIRECTOR

Michael Juqula

Michael.Juqula@gamblinginsider.com

Tel: +44 (0)20 3487 0498

SENIOR ACCOUNT MANAGER

William Aderele

William.Aderele@gamblinginsider.com

Tel: +44 (0)20 7739 2062

BUSINESS DEVELOPMENT MANAGER - U.S. Casey Halloran

Casey.Halloran@playerspublishing.com

Tel: +1 702 850 8503

ACCOUNT MANAGERS Irina Litvinova

Irina.Litvinova@gamblinginsider.com

Tel: +44 (0)207 613 5863

Serena Kwong

Serena.Kwong@gamblinginsider.com

Tel: +44 (0)203 435 5628

Tracey Frost

Tracey.Frost@gamblinginsider.com

Tel: +44 (0) 203 882 9693

AWARDS SPONSORSHIP MANAGER

Michelle Pugh

Michelle.Pugh@globalgamingawards.com

Tel: +44 (0)207 360 7590

CREDIT MANAGER

Rachel Voit

WITH THANKS TO:

Šimon Vincze, Tracy Parker, Daniela Johansson, Duncan Garvie, Sally Gainsbury, Paul Sculpher, Gavin Isaacs, Ismail Vali, Laura McAllister Cox, Rhea Loney, Jason Clairmont, David Rebuck, Vicente Fox Quesada, Gustaf Ho stedt, Kirsi Lagus, Chris Shaban, John Hagan, David Crawford, Florian Diederichsen, Kirsty Caldwell, Leon Sucharov, Sam Douglas, Kevin Kilminster, Emily Asava, Hakob Manukyan, Edvardas Sadovskis, Edgar Davtyan, Ashley Lang, Anton Chumel, David Natroshvili, Vigen Safaryan and Edmond Ghulyan.

Facing facts

URI POLIAVICH RHEA LONEY

How are gaming trends in Nevada differing to Macau? Gambling Insider investigates...

Taking stock

Gambling Insider tracks operator and supplier share prices

18 Winners revealed!

Congratulations to the winners of the first Global Gaming Awards EMEA to be held in Barcelona. We review who won what and how they reacted

36 Where is the line?

Who is responsible for responsible gambling – operators, regulators or players? With insights from across the industry, Gambling Insider explores

44 Where’s the limit?

Regular contributor Paul Sculpher discusses the law and prevalence of limiting sports bettors in the modern market

46 Breaking the ICE

Gambling Insider highlights some of the biggest panels from ICE Barcelona 2025, from speakers including former Entain CEO Gavin Isaacs

52 Teamwork makes the dream work

Gambling Insider regular contributor Gustaf Hoffstedt breaks down how regulators and suppliers can work together to combat illegal operators

54 An eInstant success

Why have eInstant games gained such popularity in recent years?

Gambling Insider spoke with Fennica Gaming and Aristocrat Interactive to find out more

56 David vs Goliath

Sweepstakes casinos in the US have not only surged in popularity but they have polarised opinion. This is best summed up by the AGA's recent verbal sparring with the SPGA

58 Legislation in the UK

Gambling Insider speaks with John Hagan about the latest developments within UK gambling legislation, including the statutory levy, advertising and more 60 Regulating to innovate? Technology leaders from The Hippodrome Casino, Playtech and more came together in February for a session titled ‘Responsibility in gaming and gambling technology’ 62 Roundtable: Live dealer

Industry experts answer Gambling Insider ’s burning questions on all things live casino

70 Edgar Davtyan Lynon

Ashley Lang Pragmatic Solutions

Anton Chumel Champion

David Natroshvili Spribe

Vigen Safaryan Galaxsys

76 What's new?

Gambling Insider delves into the latest products on offer

82 Edmond Ghulyan Relum

How is the Nevada gaming market faring against Macau? Gambling Insider investigates trends across both, plus online data from additional US states

Source: Gaming Inspection and Coordination Bureau of Macau (DICJ)

In both 2023 and 2024, October was the highest earning month in Macau, making MOP 19.5bn ($2.41bn) in 2023 and MOP 20.8bn ($2.57bn) in 2024 – the latter being the only time in two years that revenue exceeded MOP 20bn. This spike has been put down to local festivities that annually increase tourism levels to Macau.

December 2024 marks the first time in two years that monthly gross gaming revenue (GGR) in Macau declined year-on-year, down 2% to MOP 18.2bn.

Indeed, the second half of the year saw yearon-year growth slow down compared to early in the year. From June onwards, growth did not exceed 20%, while in January and February, GGR was up over 60%. This suggests a market that may now be settling following explosive post-Covid recovery – but not reaching postCovid levels.

Macau vs Nevada monthly revenue change (%), 2023 v 2024

Source: DICJ & Nevada Gaming Control Board (NGCB)

Aside from an instance in October, Macau’s year-on-year revenue growth in the second half of the year remained around the 15% mark. Nevada, meanwhile, experienced both increases and decreases in year-on-year revenue, peaking at growth of 3.3% and declining as much as 6.9% in July.

Interestingly, in October, Macau made $2.57bn, on account of the month hosting the Mid-Autumn Festival, making it popular among tourists. Yet this month saw minimal growth compared to others in the sample, suggesting consistency in earnings unlike other months.

July was the second-highest earning month for Nevada in the sample, just behind September. However, it faced the sharpest decline of the months in the sample. This suggests a Nevada that is struggling in peak months – a potential concern for the US gambling capital.

December marks not only the first time in two years that Macau's gaming revenue has declined, but the first time during the six-month period that Vegas has outperformed Macau in terms of growth.

Source: NGCB

Using June and November as a sample, we can see a general trend in the revenue generated by gaming in Nevada month-on-month. Pre-Covid, revenue was just shy of $1bn, reaching $967.2m in November 2019. However, some pre-Covid months saw revenue exceed $1bn, including October 2018 and December 2019, when both hit revenue of $1.06bn. Post-Covid recovery was immediate in Nevada –unlike Macau, which is still yet to see revenue levels reach those recorded pre-Covid – with both June and November recording revenue of over $1bn. November 2024’s revenue was $4.6m lower than 2021, making $1.32bn. However, June revenue from the same period was up 7.8%, totalling $1.29bn. As this graph shows, the last four years have shown continuous inconsistency, with year-on-year growth on a monthly basis hard to predict.

Source: NGCB

Trends across the past four years show interesting statistics about growth and declines in monthly revenue. While some months show linear growth, such as September, and others show slight increases and decreases monthly, such as June and October, other months have seen more drastic jumps in revenue year-on-year, including July and November. November 2023 saw the introduction of the Las Vegas Grand Prix, which coincides with the highest November revenue in the four-year sample and, indeed, the highest November revenue on record, at $1.37bn. Despite this, December 2023 revenue outperformed November, reaching $1.43bn. Despite fluctuations year-on-year, there are clear trends month-on-month. Revenue seems to peak in July and November – the peak of summer and just before Christmas – while August, directly after a peak month like July, faces on average the lowest revenue of the sample.

Macau vs Nevada monthly gaming revenue ($bn)

Source: DICJ & NGCB

*Conversions from MOP may vary from time of writing

On average, between June – November 2024, Macau earned $1.04bn more per month than Nevada.

In October, Macau revenue almost doubled that of Nevada, making $2.57bn to Nevada’s $1.29bn. This is on account of the month being a particularly lucrative one for the territory, while being an average earning month for the Silver State.

Between September and October 2024, Macau’s monthly GGR rose 20.1%. Meanwhile, the largest month-on-month increase in the six-month period in Nevada was between August and September, with revenue up 12.9%.

Source: Regulator sites

New York proves itself to be the leading state in terms of online sports betting, outperforming both Pennsylvania and Michigan in terms of handle. Indeed, even when combined, these two states’ sports betting handle would not reach that reported by New York.

Interestingly, New York also shows less volatility in month-on-month revenue on a percentile level, despite the higher value difference between months. There is a 45.6% decrease between the highest-earning (October) and lowest-earning (July) months, while for Pennsylvania and Michigan, this difference is 55.8% and 61.5% respectively.

However, all three show the same trend, with a lull in wagers during the summer months and a spike between August and September. Interestingly, while New York’s peak sports wagering month is October, it is November for Pennsylvania and Michigan.

Source: Regulator sites

While New York outperformed both New Jersey and Ohio month-on-month, all three show similar inclines and declines in monthly revenue. These results include both online revenue and retail revenue where applicable.

November is the month of the NBA, Breeders’ Cup and Las Vegas Grand Prix, making it a particularly high wagering month. September also shows a spike in revenue across the board, likely due to the NFL, Italian Grand Prix and other popular sporting events.

October shows an instance of Ohio outperforming New Jersey, making $81.1m to New Jersey’s $77.5m. The two seem to be performing at relatively close levels across the sample, particularly in the fourth quarter of the year.

Gambling Insider tracks online casino operator and supplier prices. Stock prices are taken across a six-month period (September 2024 to February 2025) – and from the close of the first available date of the month

• Six-month high – February (18.22 USD)

• Six-month low – September (17.13 USD)

• Market capitalisation – US$739.32m (as of February 3 2025)

• Six-month high – February (8.35 USD)

• Six-month low – September (3.41 USD)

• Market capitalisation – US$4.06bn (as of February 3 2025)

• Six-month high – February (69.70 GBp)

• Six-month low – January (60.45 GBp)

• Market capitalisation – US$378.32m (as of February 3 2025)

• Six-month high – February (150.96 SEK)

• Six-month low – October (125.00 SEK)

• Market capitalisation – US$1.83bn (as of February 3 2025)

• Six-month high – February (5.20 USD)

• Six-month low – December (3.20 USD)

• Market capitalisation – US$125.08m (as of February 3 2025)

• Six-month

–

• Six-month high – September (108.70 USD)

• Six-month low – February (85.34 USD)

• Market capitalisation – US$7.76bn (as of February 3 2025)

• Six-month high – October (745.00 GBp)

• Six-month low – September (640.00 GBp)

–

(as of February 3 2025)

Gambling Insider reviews the big winners at the Global Gaming Awards EMEA 2025, as the industry gathered for the first-ever ceremony in Barcelona

Sponsored by

Sponsored

LEAD PARTNER

CATEGORY SPONSORS

Within the ethical complexities of gambling, how much onus falls on the operator, the regulator and the player to ensure a responsible environment?

Gambling Insider explores the moral, practical and legal aspects involved

In an industry as vast as gaming, it is rare that you will find a common, unanimously agreedupon theme across all verticals and sectors. Rare and unlikely, indeed, but not impossible. Player protection isn’t the hottest phrase in the industry right now. Compliance, AI, Brazil, microbetting, sweepstakes, personalisation all yield a weightier respective presence among the discourse. Yet something we can all agree on is that, without the players, there is no industry.

– such as deposit and loss limits – which are particularly effective and highly enforced across the European market for this younger demographic, often ranging from 18-24 years of age. However, on the side of the players not included in this bracket, they remain responsible for exercising their own cautious gambling practices to protect themselves from any harmful outcomes.

It is common to hear professionals in gambling eulogise about the many wonderful people that work within the industry. Indeed, this is certainly not untrue and, if any one of those individuals were posed a question on the importance of player protection, they would all but unanimously agree it is paramount. Despite this, it can be argued that many of the players that fund our industry, quite simply, aren’t protected.

But where does the responsibility for that protection lie? Well, at the root of things, gambling products filter through a lifecycle that contains three major groups of stakeholders; those who consume the products – the players – those who provide the products – which can be referred to as the operators – and those who regulate the products –governments, regulatory bodies and such.

All three of these parties are responsible for – and benefit from – ensuring safe gambling practices. In the same vein, all three parties bare their own unique conflict of responsibility.

Taking responsibility for one’s own actions is a key life-lesson that transcends geographical boundaries – and one reinforced from an early age. Consumers that engage with gambling products will, by the time they’re in their mid-twenties, most likely be fully aware of the potential risks affiliated with the practice of gambling. Of course, this does not account for younger players that can in many countries engage with gambling from the age of 18.

There are enhanced protection measures

Sustainable & Safer Gambling Lead at Casino Guru, Šimon Vincze, touches on the unique conflict of responsible gambling from the player’s side. He tells Gambling Insider: “Players cannot meaningfully manage their play without understanding fundamental gambling principles. This can be referred to as gambling literacy, and it is vital for having fun with gambling in the long run. For example, understanding that a big win is just chance that cannot be easily repeated can have a profound impact. That said,” he continues, “industry stakeholders must actively support players in embracing it as their responsibility rather than passively informing them about the addictive nature of gambling.”

This point is further backed up by Tracy Parker – Vice President, Policy, Standards and Accreditation, Responsible Gambling Council. She tells us: “Players have a responsibility to be aware of their own, personal limits regarding the frequency and amount of time and money spent gambling. It is also important for players to be mindful of their gambling and the impact it’s having on their lives. It is not always easy to do this, so being aware and using the available resources, such as self-assessments and play history, is important for players to gain valuable insights into gambling patterns. Educating themselves about gambling – such as understanding that winning is largely based on randomness, not luck or skill – can help players view gambling more as a form of entertainment and less as a way to earn.”

As evidenced here, players must therefore utilise their knowledge to exercise selfcontrol via limiting spending to what they can afford, alongside setting time limits, not chasing losses, remaining aware of their

feelings/reactions, taking regular breaks and – crucially – being honest about the nature of the habit with those closest to them. They are likely to see something as a problem long before an individual sees a problem themself.

Daniela Johansson, Paf Deputy CEO & Chief Regulatory Officer, clarifies the importance of recognising the signs and taking the first steps towards addressing compulsive behaviour to Gambling Insider: “We know from experience that it is difficult to encourage players to seek help for problem gambling. The first step is to help them recognise that they have a problem; for example, through interventions and easy-to-use reality checks. Once a player acknowledges their problem, there is often a critical window where they are more likely to follow advice and seek help, especially if the process is simple and not too complicated.”

Examining one’s own ethical position before stepping onto the casino floor is paramount for players looking to ensure their own safety. Even within a nation such as the US, which yields extremely relaxed gambling advertising restrictions – almost every single gambling product or advertisement will come complete with a warning message that seeks

to encourage safer play. Therefore, a player that is fully cognizant of the risks cannot expect to be protected by any external source, as they have been alerted to the potential dangers of their engagement.

However, none of these aspects account for the vicious hereditary, psychological and physiological nature of addictive compulsion. Unfortunately, addiction –despite being accepted in all medical, psychological, physiological and public health fields, alongside having widespread cultural acceptance – cannot be used as a legal defence.

Herein lies the player’s key conflict of responsibility. Some players can be trusted to protect themselves and others, through no fault of their own, simply cannot. Vincze explains: “Problem gambling is a spectrum, and the worst-case scenario is a person who gets to the addiction end of that spectrum with zero understanding of how gambling works, the kind of reactions it causes in the brain, or how to manage gambling behaviour. Such players would subsequently be seeking help after there is considerable damage already having been done.”

Duncan Garvie, Founder & Trustee of self-exclusion RG service BetBlocker, explains to Gambling Insider why protection from the player’s side needs to be enforced as a ‘second nature’ response: “I would suggest that our biggest challenge is with language. When you climb into your car, do you consider buckling your seatbelt a ‘responsibility?’ Or is it just something you do without ever really thinking about it?

a healthy pastime, frequent habit and debilitating addiction can, at times, make for a difficult ethical conundrum around player responsibility.

Laws pertaining to responsible gambling and player protection vary across global jurisdictions. This makes it more difficult to determine what the law stipulates with regard to the responsibility of responsible play – and whose shoulders it rests on. A region that is recognised across the gambling industry for being at the front of the battle for responsible practices is the UK. Taking a look at the law here, then, provides a valuable insight into how the legal land may lie on a more global scale as responsible initiatives continue to progress in the future.

“The problem here is that the language we’re using is creating an undesirable response before we even start. ‘Responsibility’ implies a burden we take on. We don’t want players to see the tools and support that are available to them this way. There will always be players who are not capable of managing their own engagement. Operators need to step in to help these players. But for everyone else, we need to embed in the public consciousness a view that this is just something you do when gambling. Without thinking about it. Without it feeling like a responsibility.”

Evidently, the blurred lines between

Of course, unpicking the full UK Gambling Act 2005 would be a little – shall we say, dry? Cherry picking a handful of key stipulations, though, presents an interesting picture of the framework that, bear in mind, is one of the strictest in the world when it comes to ensuring player protection.

Vulnerability: Caution when preparing campaigns must be exercised by operators. The protection of children, which are defined clearly into age groups, is specified alongside ‘vulnerable persons.’ However, the latter remains undefined, presenting a grey area for protection initiatives. The law also advises that men aged 18-34 are more likely to experience problems with compulsive gambling, but does not specify any requirements not to target this demographic.

Misrepresentations: Advertising must not glorify or misrepresent gambling as an activity without risk, as an activity based on skill, as a way to be part of a community, or any other means of creating an unrealistic perception as to the outcomes of the practice.

Encouragement via trivialisation: In the UK, advertising must not encourage repetitive or frequent participation, play down the potential risks through the use of humour, encourage people to spend more than they can afford, or present unrealistic portrayals of winning.

As previously mentioned, a deep dive

Duncan Garvie

into responsible gambling law is perhaps for another day. The legislation included above, though, acts as a demonstrative tool for where the bar has been raised to for player protection, particularly within the EU market – and particularly regarding advertising restrictions. It is evident, then, that federal and local governments do yield a power in authorising responsible practices when it comes to gambling. Further, they also yield their own responsibility to motivate change via legislation. While it is true that many operators will pursue change without regulatory impetus, it is equally true that many simply will not. This, therefore, places both the successes and failures of governmental enforcement when it comes to player protection under the microscope.

“Speak to anyone who’s held a decision-maker level role around player protection in the industry and you’ll quickly become familiar with the dichotomy that exists within businesses between profitability and protection” – Duncan Garvie

In an industry often dressed up in glitz and glamour, the player protection sector could almost be referred to as an area where the ‘dirty work’ gets done. Essential? Yes. Glamorous? Not so much.

This is where a government steps in to do the heavy lifting. However, its own conflict of responsibility is one that is akin to that of an operator, as gambling is an industry that generates billions for economies across the globe every year. This money then gets pumped back into economical and infrastructural development, education, welfare and industry. It could be going towards protecting the most vulnerable sectors of a given society.

On the other side of the coin, much of this tax revenue generated by the industry will, indisputably, be generated by compulsive problem gamblers. Some may shy away from this fact and, while it almost certainly doesn’t even come close to making up a majority of

another 4-10% experience severe harms, which again varies between products.

gambling profits, it is a reasonable assumption that it will account for financial figures in the tens of millions. This, by the standards of 99% of the population, is a lot of money.

Sally Gainsbury, Director at Gambling Treatment & Research Clinic & Professor of Psychology, University of Sydney, pulls back the veil on the prevalence of problem gambling – explaining to Gambling Insider where the regulatory responsibility lies: “A notable proportion of gambling customers experience negative consequences and harms from their gambling ranging from mild to severe. This is not 1%, which is a figure based on population prevalence and includes many who do not gamble at all. The actual proportion of regular gambling customers who experience moderate harms is closer to 6-16% depending on the product and around

“Regulators have a responsibility to ensure that the product and environment is not harmful, does not encourage gambling beyond what is affordable, and does not encourage irrational or erroneous beliefs about the likelihood of winning or other product characteristics. Unfortunately, there are many instances where the operators and regulators fail in their responsibilities, which makes it difficult for more vulnerable consumers to control their gambling and essentially resist the potentially manipulative strategies used against them.”

One solution to tackling the conflicting ideologies of tax generation and harm minimisation is through non-monetary restrictions, such as implementing time limits, self-assessment tests, self-exclusion & enforcing requirements that demand operators carry out enhanced data collection and player observation techniques. Further, ensuring that operators report their RG initiatives and player protection techniques, providing statistics that display

continuous progression, remains potentially game changing.

Critics from the operator side will argue that these can be hard to measure – and even harder to then report back to the government. This, however, should be beginning to change with the ever-increasing sophistication of AI and player monitoring techniques. Technological advancements within gaming seem to be changing the way we approach almost everything year-uponyear. Now, with the rise of AI, new player acquisition and retention techniques have exploded. Concepts like personalisation or microbetting have such powerful applications for keeping players betting, so there must be a way to utilise this kind of technology for protection. The impetus, though, remains on global governments to introduce regulatory measures that can curb the potentially destructive powers of these techniques. The manner in which they introduce these regulatory measures still remains up for debate.

Johansson: “In general, I don’t believe every new gambling innovation should go through a rigid RG vetting process before

being released. Overregulating through excessive administrative hurdles and added complexity could stifle innovation within the industry. A dynamic and competitive market requires room for technological advancements and product evolution.

regulators keep pace with emerging trends,

“That being said, it is essential that regulators keep pace with emerging trends, and ensure that regulatory frameworks remain relevant and effective. Instead of a pre-approval process, a better approach could be continuous monitoring and adaptation – where both operators and regulators collaborate to assess potential risks and make data-driven adjustments when necessary. Ultimately, player protection should always be a priority, but it is crucial to strike a balance between responsible gambling measures and

protection should always be a priority, but fostering innovation.”

There is mounting evidence that financial behaviours while gambling can be clear indicators of risk or harm. The way to traditionally associated with RG, including powerful new channels for player protection.”

Parker suggests that governmentally affiliated stakeholders, such as financial institutions, could have a role to play in improving RG approaches: “For me the most important, untapped point of leveraging RG opportunities is with financial institutions. There is mounting evidence that financial behaviours while gambling can be clear indicators of risk or harm. The way to tackle this issue is with stakeholders not traditionally associated with RG, including financial institutions who are potentially powerful new channels for player protection.”

the responsible gambling sector, like the wider

challenge that lies before international lawmakers in the industry. This point is accentuated when one observes the sheer financial power of some of the largest conglomerates in the industry. Examining whether some organisations are too deeply entrenched in government interest is, though, another

There is no doubt that the responsible gambling sector, like the wider industry itself, is changing. Those who have been in the field since it first began to be taken seriously around 20 years ago will tell you just how much attitudes have indeed changed in that time. This is clearly represented by the American Gaming Association’s recent report which recorded that $472m is now invested in RG annually, up 72% from figures reported in 2017.

Whether or not this antithesis in outcomes represent a shift in wider attitudes toward recognising player protection is subjective. However, the latter of the two underlines the growing power modern-day operators now yield via the vast amount of data they have on their players – a theme explored by Gainsbury: “Operators have a wealth of information about customers that is highly disproportionate. That is to say, they have information on a customer they do not share with the customer. This information is often used for marketing purposes, including to send personalised promotional offers.

be taken seriously around have indeed changed in that time. This is clearly represented by the American which recorded that $472m is now invested in RG annually, up 72% from figures

have on their players – a theme explored by Gainsbury: “Operators have a wealth of information about customers that is highly disproportionate. That is to say, they have information on a customer they do not share with the customer. This information is often used for marketing purposes, including to send personalised promotional offers.

Providing protection in a rapidly changing online landscape, where compulsive gambling is at times seemingly encouraged –one only has to look as far as microbetting for an example of this – is now a monumental industry. This point is accentuated in the industry. Examining whether some subject entirely.

Moreover, the swinging pendulum of shifting attitudes is well represented by two juxtaposing

Johansson continues: “For me, the most pressing concern is the rising prevalence of problem gambling among young players. It is well established that younger individuals are a high-risk group for gambling-related harm. Today, we see an entire generation

Johansson continues: “For me, the most problem gambling among young players. It

harm. Today, we see an entire generation growing up with gaming experiences that include gambling-like features, such as loot boxes and skin gambling. This trend is deeply concerning, as it blurs the lines between gaming and gambling from an early age.

“As operators, we must take this issue seriously and implement safeguards to protect young players. However, regulators also have a significant responsibility –

particularly in proactively addressing and regulating the largely unregulated gaming industry to prevent harm before it occurs.”

Weighing up wellbeing and wealthgenerated welfare is a tricky line to walk, yet it is the job of any good government to examine its own moral imperative before every single decision it makes.

former patron Arelia Tavares unsuccessfully chase a $20m racketeering lawsuit in federal court

swinging pendulum of shifting attitudes is well represented by two juxtaposing legal cases, one of which saw former patron Arelia Tavares unsuccessfully chase a $20m racketeering lawsuit in federal court against six Atlantic City casinos in the mid-2000s. Tavares claimed that the casinos neglected their duty of care,

“If operators are going to use a customer’s personal information as a way to incentivise and encourage further gambling spend and activity, I believe they have a

“If operators are going to use a customer’s personal information as a way to incentivise and encourage further gambling spend and activity, I believe they have a responsibility to ensure they are not creating any harm through encouraging excessive gambling. Individuals may be trying to control their gambling, take a break or reduce their spend and individuals experiencing problems, by definition, have reduced ability to control their gambling. These are the individuals who will find it difficult to control their responses to promotional offers. If operators are going to personalise any approaches, they have a responsibility to ensure they are not targeting people who are vulnerable to experiencing

creating any harm through encouraging excessive gambling. Individuals may be trying to control their gambling, take a break or reduce their spend and individuals experiencing problems, by definition, have reduced ability to control their gambling. These are the individuals who will find it difficult to control their responses to to personalise any approaches, they have a responsibility to ensure they are not targeting people who are vulnerable to experiencing gambling harms.”

that the casinos neglected their duty of care, failing to notice her compulsive behaviour as she accumulated nearly $1m in total losses.

In comparison, a case from January 2025 saw almost the exact same occurrence from an unnamed patron wagering with Sky Betting & Gaming, mostly placing bets on football online.

In this case, it was revealed that, despite numerous attempts from the player at self-exclusion, the operator still targeted them with advertisements and labelled them as a ‘high-value’ customer.

In this instance, though, Sky Betting and Gaming lost the case but is currently in the process of appealing the decision.

The question, then, is do operators prioritise their bottom line over the safety of their players? Here, Garvie gives his two cents...

“Yes. And no. As a corporate body considered as a single entity, it’s reasonable to say that commercial concerns can and do trump safer gambling considerations at times. I know many of the people who occupy the Head of Safer Gambling-type roles across the sector and it’s fair to say the conflict between commercial considerations and player safety is a common friction point that reduces their job satisfaction.

The question, then, is do operators prioritise their bottom line over the safety of their players? Here, Garvie gives his two cents... “Yes. And no. As a corporate body considered as a single entity, it’s reasonable to say that commercial concerns can and do trump safer gambling considerations at times. I know many of the people who occupy the Head of Safer Gambling-type roles across the sector and it’s fair to say the conflict between commercial considerations and player safety is a common friction point that reduces their job satisfaction.

“But these organisations in practice aren’t single entities, they’re an amalgamation of people. Therefore, if you have a strong or weak Head of Safer Gambling, that makes a difference. If you’ve got an entrenched, commercially exclusionary leadership team, or a team with more

progressive attitudes, that alters the landscape. The approach an operator will take is a reflection of the personalities that make up their team.”

Despite unanimously promoting safe practices through advertising and agreeing that players with addiction issues need to be protected, operators can and will utilise mass amounts of data to target their highest rollers who, in many cases, bet thousands a week with them – regardless of whether or not they are aware of these players’ backgrounds or financial situations.

Some of these players may be in a financial position strong enough to afford to lose significant amounts of money day-in day-out. However, many will not be in that position and encouraging those already sliding down the rabbit hole to take the first step towards additional ‘responsibility’ is something of a catch 22 at best.

The struggle and subsequent failure of admitting there is a problem is one that is frequently noted by recovering gambling addicts, exemplifying the crucial requirement for operators to always be willing to take the first step.

Parker underscores the importance of the operator’s first step: “It is fundamental, not only to take action when gambling harm is suspected, but also to actively monitor player behaviours for warning signs and markers of harm. With access to player data, operators can detect early signs of risky play patterns and intervene promptly to ideally prevent harm from occurring. Although players, regulators and operators all play a role in fostering a safe gambling environment, operators are in a unique position of having access to player information, and the ability to engage with players

directly and in a timely manner. Operators first need to educate themselves and their staff on the variety of help and support available to players and their communities. Making this information highly visible and easily accessible, as well as removing barriers for those seeking help, is essential.”

In many countries, these kind of initial protection incentives are becoming more commonplace and even federally enforced. This, of course, depends on exactly how you define a ‘first step.’ As stipulated in UK law, and clarified by the Gambling Commission, managing customer relationships falls under the umbrella of an operator’s commitment to social responsibility. Therefore, by this definition, encouragement to interact with gambling tools via including responsible gambling products in gambling advertisements could be counted as a first-step initiative.

Garvie explains: “There are clear times and places where operators both can and should be intervening to protect a player that has become a risk to themselves. There’s no excuse for not doing so. At times, I see appalling practices in the unregulated and weakly regulated markets. Operators who aren’t simply failing to intervene at the appropriate times but are actively encouraging and exaggerating harm. We have to do more to combat this.”

Indeed, as the industry advances, operators must look further than simply ‘first steps,’ a point that is rigorously emphasised by Garvie: “We don’t need to encourage players to seek help. We’ve a decade of messaging about the risk of gambling and the support services that are available. Though, admittedly, the industry could improve their signposting. We need to do better to encourage players who do not identify as impacted by gambling harm to engage with tools and strategies to help them stay within their affordability bracket.

“I was speaking with Professor Sally Gainsbury at ICE Barcelona, and she blew my mind by suggesting that Deposit Limits should be in the banking section of a player’s account, not the responsible gambling section. We want players to view these limits as just a normal part of gambling, not as something for people who have a problem. Common-sense genius.

“Despite all this, the overriding truth is that if we also get better at empowering players to play safely, there will be less need

Parker

for operators to intervene. This is a doubleedged conversation, and all stakeholders are responsible for behaving reasonably to minimise the harms associated with gambling.”

While both enhanced monetary and nonmonetary protection measures – such as time limits, self-exclusion lists or enhanced deposit limits – are a step in the right direction, it would appear that major operators in the modern industry have access to world-class data analysis and AI implementation tools, which they utilise for player acquisition and retention 24 hours a day. How, then, can this kind of technology make a difference when it comes to player protection?

Vincze tells us: “AI has proven to be very helpful in analysing and evaluating player behaviour, as it can handle many data points at once. Furthermore, AI can learn from this data and apply it to future decision-making, which is very promising for reducing errors down the line. Nevertheless, we are entering an era of AI assistants where communication with robots will become standard. I see significant advantages in such communication with players, as it can be automated through behaviour triggers. Moreover, when it comes to problem gambling, people might be less reluctant to talk to robots than humans.”

This point is further emphasised by

“Players, regulators and operators all play a role in fostering a safe gambling environment” – Tracy Parker

Parker, who continues: “The opportunities for highly targeted player interactions before harm occurs, or is exacerbated, are more accessible than ever before due to AI’s ability to collect, monitor and analyse data. One of the more exciting RG applications is real-time risk monitoring paired with personalised messaging based on patterns of play. In addition, AI has the potential to capture those players who might be showing early signs of gambling harm so

that early interventions and nudges can be provided to prevent harm from actually occurring.”

as horseracing that are still very much

Fear of driving players to the unregulated and potentially dangerous black market is one argument that is always on the table when it comes to discussions around more stringent player protection measures. Indeed, this fear has been voiced by many in response to affordability and credit checks for online players, which have been trialled in the UK and suggested to help curb the debilitating slot addiction crisis in Australia. Further, fears of an affected bottom line for industries such financially recovering from the Covid-19 pandemic have also been voiced.

While some of these initiatives do have the potential to affect profit growth, many will argue that a long-term view of a healthier industry, with happier and protected players, breeds a much more productive space within which operators can also thrive.

there are almost unlimited operators, products and abilities to pay. It is up to operators and regulators to decide whether they want to adopt a ‘churn and burn’ approach and attempt to monetise all players, or whether they want to establish a sustainable, responsible industry that is trusted and valued by consumers.

“I believe that respecting and valuing customers is an enormous opportunity and point of differentiation for gambling

and point of differentiation for gambling operators. Research demonstrates that consumer protection measures enhance customer loyalty and lifetime retention and value of customers. By putting players first, encouraging them to spend only what is affordable to them, operators can develop a loyal customer base who they can retain over time.”

Gainsbury adds: “Consumers have ultimate choice;

There are also examples of success stories where an increase in revenue has been evidenced following the introduction of more stringent player protection measures. An example of this includes Norsk Tipping’s mandatory pre-commitment loss limit introduced in 2014 – as part of a full suite of RG measures including time limits and selfexclusion options.

without inhibiting the experience of

exclusion options.

Evidently, if these kinds of initiatives are not implemented on a broad-scale trial basis, a definitive conclusion will never be reached. The impetus for achieving this, alongside consistently making the first steps towards protecting players and utilising AI for these purposes, falls indisputably under the operator’s umbrella of responsibility.

WHOSE RESPONSIBILITY IS IT, ANYWAY?

enhanced monitoring techniques and

Conclusively, findings would suggest that all three parties are implicated. The players stand to benefit the most from responsible practices, as simple credit check regulation, enhanced monitoring techniques and financial restrictions could massively curb the issue of compulsive betting

‘high roller’ customers display habits of compulsion which any kind of stringent restrictions are likely to flag – and their

without inhibiting the experience of the recreational bettor. The operators, however, benefit the least; as many ‘high roller’ customers display habits of compulsion which any kind of stringent restrictions are likely to flag – and their bottom line will likely suffer. These factors make it that bit harder for either of these two groups to remain objective.

two groups to remain objective.

Yes, there is a duty of care on the operator’s

gambler to walk away from a slot machine, you cannot trust major corporations to walk away from advancing their revenue streams.

caveat of risking a rise in black-market activity, although, on balance, those in government bear the smallest conflict of responsibility of our three stakeholders.

for player protection falls largely on governmental and regulators’ shoulders as, put simply, it’s their job.

Yes, there is a duty of care on the operator’s side and, indeed, the player’s, too. However, as much as you cannot trust a compulsive gambler to walk away from a slot machine, you cannot trust major corporations to walk away from advancing their revenue streams. Enforcing regulation does come with the caveat of risking a rise in black-market activity, although, on balance, those in government bear the smallest conflict of responsibility of our three stakeholders. This could therefore suggest the impetus for player protection falls largely on governmental and regulators’ shoulders as, put simply, it’s their job.

present an opposing argument to this

any one party as more responsible for protecting vulnerable players. There have certainly been failings within the industry. Speak to anyone who’s held a decisionmaker level role around player protection in the industry and you’ll quickly become

However, Garvie’s parting thoughts present an opposing argument to this conclusion, as he states, “I don’t view any one party as more responsible for protecting vulnerable players. There have certainly been failings within the industry. Speak to anyone who’s held a decisionmaker level role around player protection in the industry and you’ll quickly become familiar with the dichotomy that exists within businesses between profitability and protection. But regulators have failed too, turning a blind eye to problems and deploying ineffective policy for political reasons. And the ‘third’ sector has not always engaged a supportive or collaborative approach.

within businesses between profitability and protection. But regulators have failed too, turning a blind eye to problems and deploying ineffective policy for political always engaged a supportive or collaborative approach.

“There’s more than enough blame to go

“There’s more than enough blame to go around. We all need to do better.”

Paul Sculpher, Director of GRS Recruitment and regular Gambling Insider contributor, and Melanie Ellis of Northridge Law LLP, discuss the prevalence, legality and fairness of account limitations within the modern UK gambling market

THE CASINO VIEW PAUL SCULPHER

These days, there’s a lot of talk about bettors having their accounts limited as to how much they can stake because, in theory, they’re winning too much. The truth is a little more complex, and different people would tell you different things from different sides. Some will say it’s an outrage, an infringement of rights – others will say it’s a necessary evil to keep sportsbooks running. There’s a subset who’ll even talk about the laughably neverexistent days of honest Queensbury rules of combat between gentleman bookmakers and gentleman punters to see who came out on top.

Firstly, what’s actually happening in the UK? Well, for one, it’s clear that it’s not just winning that gets accounts limited, but also what you actually bet on. The best example I’ve heard was a proposed stake, on a brand-new account with – well, an alliteratively named major operator – of £20 ($24.88) on a 150/1 shot. The odds were trimmed to 66/1 pre-accepting the bet,

with a max stake of £4, and that was the last bet the punter was able to get on that account. Oh, and the bet lost.

That’s an extreme example, but you don’t have to show too much knowledge to get chopped. Even I, with betting prowess essentially limited to player props on the New England Patriots NFL team, plus tips from friends, have lost the ability to use my accounts with a number of the main operators.

There’s even a solid market for losers’ accounts to be used second hand, with years of losses likely to mask a change of “owner” and give some runway for profitable betting. However, there are also legal issues at play here. A notable case in Northern Ireland, for example, was one where a student placed £25,000 of bets and bet365 refused to pay out. The operator suspected (or, if you prefer, it was blatantly obvious) that someone else staked the bet, perhaps to get around staking limits on their own account. They refused to pay and the court case from the punter was discontinued. The bookies

won. But what’s fair, and what’s ethical?

Many of the challenges in this debate stem from the explosion of side markets for sports betting. In a world where online bookies offer 200+ bets per NFL game, it’s an old adage that the bookie has to get them all correctly priced, while the sharp punter only needs to spot one wrong price and stake accordingly. That’s certainly true. However, with that in mind, if stakes were unlimited, that would be the end of a lot of operators. Or, at least, a massive contraction in either odds or markets offered. Neither of those outcomes is good for the industry.

Personally, I view the betting market as the same as a market for any other goods or services. What are you buying? Well, essentially, you’re buying the right to win £1 on a sporting event, and the odds just determine the price of that £1 of winnings. A company like Tesco wouldn’t be duty bound to accept an offer for a banana that cost less than they could source that banana for. Therefore, I don’t think it’s

outrageous that bookies should be able to choose their customers. At least, as Alun Bowden of EKG Gaming points out, brands are getting, and will continue to get, more precise on their limiting as tech improves.

This issue has been brought into focus in Great Britain by the Gambling Commission’s CEO, Andrew Rhodes. In a recent briefing

to gambling industry CEOs, he stated that the regulator would shortly be “asking for data on account restrictions and the reasons.” The rationale for this request was a desire to understand “what the actual reality is for accounts being factored, restricted, closed, or put onto zero stakes.”

To avoid panic and assumptions that this data-gathering exercise will form the backdrop to the regulator assessing options for restricting bookmakers’ ability to limit sports bettors, Rhodes was careful to point out that this was not the intention. He indicated that such requirements would need to be introduced through legislation, outside of the Gambling Commission’s powers to impose licence conditions. It should be noted, though, that the Commission has a statutory role to advise the Government on gambling regulation and could recommend areas for legislative intervention. At the moment, the regulator’s concern appears to centre on transparency and ensuring that customers understand what has happened and why. Still, by now we all know to be wary of roads paved with good intentions.

The concept of a ‘right to bet’ or ‘minimum bet law’ is not new. Notably, rules have been introduced in many Australian states. However, rather than being mandated by national legislation, these limits form part of the licence granted to bookmakers by racing authorities. Licence conditions prevent the operator from refusing a bet or taking other action, such as closing the customer’s account, as long as the potential winnings are under a specified amount for that type of race. So far, these limits have only been applied to certain horse and greyhound races, rather than more widely to sports betting.

The Massachusetts Gaming Commission has also opened discussions with operators on this topic. Although the majority declined in attend an initial meeting, a seemingly more productive discussion took place in September. As appears to be the case with the British Gambling Commission, consumer protection was also central to the Massachusetts regulator’s interest. For this regulator, as with the Gambling Commission, collecting operator data on bet limits is the next step.

As Paul points out, the idea of forcing a company to accept someone’s business seems to counter well-established principles of contract law in the UK. By advertising goods at a certain price, a shop is not bound to sell them to anyone who agrees to buy at that price – the shop is merely making an ‘invitation to treat.’ The reasons behind this concept are sound: in the seminal case dating from 1953, Boots displayed certain

products on its shelves that contained regulated poisons, making it necessary for a pharmacist to approve the sale. A sale was not deemed completed until the customer’s offer to buy the goods had been accepted by the pharmacist, who had to be entitled to refuse the sale if the customer did not pass scrutiny.

Likewise, it would not be appropriate for a bookmaker to be deemed to be making a legally binding offer, simply by publishing odds for sporting events. Otherwise, any person walking into a betting shop could accept the offer and form a binding contract, before appropriate age, identity, safer gambling and money laundering checks had been carried out. However, this does not rule out the possibility of mandating acceptance of certain bets in circumstances where the customer has passed this scrutiny, as is the case in the various Australian states.

In addition to concerns relating to consumer protection and transparency, another relevant factor for gambling regulators to consider is that many bettors who have been limited by licensed operators will turn to the black market. Not only does this reduce tax revenues for the Government, it places those customers at risk of losing their deposits or not having winnings paid out. In upcoming conversations with the Gambling Commission, it will be important for operators to demonstrate that customer accounts being limited is the exception rather than the rule, that limits are not being applied arbitrarily, and that they are being transparent with customers about the reasons for these measures.

Former Entain CEO Gavin Isaacs took to the stage as ICE Barcelona 2025’s first keynote speaker on Monday 20 February, where he discussed ‘turbocharging’ businesses and his philosophy for success. We now look back on this as the last public speech of his short Entain tenure...

Introduced by the day’s host on Monday 20 January as a “seasoned leader” with “experience built through previous roles at Games Global, DraftKings, Scientific Games and Bally Technologies” among others, Gavin Isaacs, then CEO of Entain, took to the stage as the first keynote speaker of ICE Barcelona 2025.

Giving us an introduction into his experience, Isaacs launched into a segment regarding Entain, a company in the FTSE 100; or, at least was in the FTSE 100 last time he checked, making a rather tongue-incheek reference to that morning’s Financial Reporting Council (FRC) investigation launched into Entain’s 2022 account audit by KPMG.

Entain was the latest business Isaacs was brought in to following a challenging time in operations – for the industry giant, this has included a fine of £585m ($737.2m) following bribery investigations in November 2023, M&A criticism from shareholders and the exit of former CEO Jette Nygaard-Andersen in December 2023. But what did Isaacs intend to do with Entain? This is where his concept of ‘turbocharging’ the business was supposed to come in, based on his past experiences managing organisations.

“I’m going to come back to what we’re going to do with Entain, because the topic was turbocharging change. So how do you

do that?” he said. “I’ve had the pleasure of working with some great teams. One of the biggest things in common with those teams and companies is that they’ve lost their way. A lot of it had to do with tech. When you don’t invest in your tech and you don’t invest for the right reasons in your tech, you end up losing your way and other people overpass you or you make mistakes. Often, it’s because you try and do the right things for too many people; you don’t focus.”

As CEO, Isaacs believed in starting from the beginning, looking for a clear vision and mission for the business and making it something where everyone can understand

what is trying to be done. He spoke of his strategic pillars, those being customer, product, operational efficiency and innovation. He also spoke of his 10 guiding principles, which were:

1. Always focus on your customer

2. If you say you are going to do something, do it – keep your commitments

3. Always look for better ways to do things

– continuously improve

• Empower your people to make decisions and take accountability

• Breakdown silos and build internal networks

• Laser-focus on tech execution

• Continuous improvement

• Be driven by data

4. We are ONE TEAM – respect each other – discuss different views but unite behind the decision

5. Meetings – participate, have an agenda, start on time and kill the useless meetings

6. Be passionate about what you do –if you are passionate, you will do well

7. Never, never, never lie

8. Set clear goals for yourself and your team, and be accountable

9. Money – be responsible and spend the company’s money as if it was your own 10. Have FUN!

Isaacs walked audience members through his career and examples of previous businesses he has ‘turbo-charged,’ including Aristocrat, which he took from a share price of sub-$2 to $20+, to Bally and Shuffle Master. He also made a particularly poignant comment regarding M&A activity, stating “there’s no such thing as a merger.” If a business pays for a company, it’s their company – and if staff cannot adapt to being a part of a new team, they can choose to leave.

Rounding out the talk were Isaacs’ keys for transformation, focusing on the pillars mentioned earlier. In talent and culture, his keys to transformation were:

• Align the team around unified objectives

• Share in each other’s success

• Set specific goals and measure performance

• Provide teams with the tools they need

• Sweat the small stuff

• Deliver brilliant basics

• Continuously develop and improve your product offer and experience

• Put the customer experience at the heart of all decisions

• Everyone has a customer-focus on delivering for them

• Challenge the status quo

• Provide teams with the tools they need

• Protect the customer at all costs

The panel wrapped with opportunities for audience members to present Isaacs with questions. Gambling Insider Editor Tim Poole was quick to take the mic, asking: “The majority of your experience is B2B. How have you found this – it’s the same industry, but a relatively new world, B2C,” to which Isaacs responded:

• Make every brand experience a positive one

“First of all, loving it. I miss having my direct customers; it’s a great fun part of the B2B role, the fact you have your customers that you interact with and build relationships with. You can see the benefits of what you do in their businesses. But I’m finding that fundamentally the business is a business, and that the same principles apply. They are tech businesses and, in the instances of what we’ve got now, we’ve got some tech issues on some of our platforms. So, from my role, it’s about building teams, giving them guidance, setting goals and

- Former Entain CEO Gavin Isaacs

“ When you don’t invest in your tech and you don’t invest for the right reasons, you end up losing your way ”

letting them get on with it. So, in that respect it’s the same, but put it this way; G2E was my first trade show ever that I went to and wasn’t selling something. This is my first ICE show [I’m not selling something] – and I think the first ICE I went to was 1999 at Earl’s Court... There are lots of similarities, but I’m learning a lot more again.”

It is a particular shame for anyone taking inspiration from this panel that Isaacs has since resigned from his role as CEO, on 11 February, “with immediate effect.” However, upon reflection, the panel provided simple and efficient tools that many industry professionals could take on in their career; a 101 to management success, as it were. Taking on these principles, crafted through decades of hands-on experience with some of the industry’s largest players, will certainly not negatively impact one’s career path.

Moderated

Chief Compliance Officer

Chief

Compliance Officer at BetMGM, came together with other panellists for a fireside chat on data protection, usage and more

With the perpetual growth of online gaming, especially in markets like the US, data and data protection are becoming all the more crucial for operators. In a fireside chat on day one of ICE Barcelona 2025, Rush Street Interactive (RSI) Chief Compliance Officer Laura McAllister Cox moderated a panel with Jason Clairmont, Principal Evangelist, Betting & Gaming at Amazon Web Services (AWS), David Rebuck, former Director at the New Jersey Division of Gaming Enforcement (NJDGE), and Rhea Loney, Chief Compliance Officer at BetMGM, to discuss just that. Speakers began by introducing themselves and what they do. Cox is notable for having “been in this industry since 1980,” stating “I’ve been in this industry so long there was no internet and here I am, Chief Compliance Officer of a gaming technology company. It’s been a fun ride.” Loney, meanwhile, has been involved in gaming her whole life, having been involved in horseracing since she “was knee-high.”

Cox continued, contemplating what kept her up at night. Her answer: Data. “In the online world, we have a tremendous amount of it,” she said. “Now we’re required to do a lot with it.” She then asked Loney: “In what ways are you seeing advancements in usage of technology in your operations?”

Data use goes above and beyond regulatory requirements at BetMGM, according to Loney, “particularly in the area of RG.” A lot

“Consumers don’t understand when they go to regulated legal sportsbooks that those are the regulated ones”

- BetMGM Chief Compliance Officer Rhea Loney

of operators have prevention models that utilise data, though BetMGM has introduced a system designed specifically to give players access to assessments and counselors, alongside other safer gambling measures. “We’re probably only scratching the surface of what is going to be available and ultimately what’s going to be used in our industry,” she concluded.

Indeed, in today’s market, every aspect of an operator’s business “comes back to data,” according to Cox. This is not just how it is used, but how it is protected. She asked Clairmont: “What might we be seeing next?”

According to him, AWS brings “the ability to participate in the current data economy you all experience in your personal lives.” That experience, especially in the US, has been limited, so what AWS has done is create an infrastructure that is unique compared to what we traditionally think of as the Cloud.” The system, described as a “purpose-built infrastructure in jurisdictions that require it,” extends Amazon’s Cloud services to locations that may previously have not employed it, like rural Tribal casinos. However, Clairmont also noted that, with big operators like RSI and BetMGM, there are large amounts of data in play. “They’re going to put their data in a cloud environment which, using the technology, the smarts that big tech has developed, we can process that data so cheaply and effectively that you’re able to leverage the data in the way that you want to,” something previously unviable due a lack of cost-effectiveness. “From a big tech perspective, it’s a new muscle for us to flex, to be working with industry,” Clairmont continued. “We talk internally that we’re surprised at how regulated this space is. We say for a fact, and educate our internal stakeholders, that this is more regulated than healthcare, more regulated than government.” Of course, this is for good reason, though it has seemingly required some adjustment from big tech.

Indeed, the gaming industry’s relationship with data has changed drastically, especially in the last decade. Cox explained that, when the New Jersey model led the way in the US in 2013, the concept was hard servers for data at the casinos in Atlantic City. There were limited locations housing the hardware. But,

as she learned, hardware becomes obsolete and data becomes uncontrollable. Risks come from physical data and Cloud hosting provides a solution. From here, Rebuck took the reins.

“10 years is light years in the technology field,” he said. When you’re just starting, you make decisions from assurances that it wouldn’t lead to fraud or unknown problems. At the time, it was just impossible to know. But “the one thing you have to do as a government, when you’re dealing with technology, is trust the B2B companies that are working for you, because you really don’t have the institutional skills and staffing to do the things you need to at a very high level.” Still, even then, the amount of data being worked with was “unbelievable,” according to Rebuck. Being so early to the online gambling market, players could not be anonymous under NJ regulation. The data is kept on player accounts for 10 years, including deposits, outcomes, etc. That’s a lot of data.

As such, the panel went on to discuss AI vs data in the gaming industry, with one key point being that, with so much data already available, just how useful really is AI?

Towards the end of the panel, Cox swung her earlier thought of “what keeps me up at night” to Loney. To her, the issue is expansive, covering not only big tech and the illegal market, but marketing and press too. “Consumers don’t understand when they go to regulated legal sportsbooks that those are the regulated ones versus the ones that are illegal. There’s not enough of a differentiator to say this is your legal lane and this is your illegal lane. I think that’s a real challenge.”

RG across jurisdictions was also noted as a pain point, particularly in the US. Every state has different requirements and while a one-size-fitsall model is not the answer, in Loney’s opinion, a system that can be adjusted to broadly fit local requirements would be ideal. Moreover, states list all those on self-exclusion registers differently, making it challenging to enforce across state lines. “I want it to be easier for the list to be consumed and put back out in all the different jurisdictions,” she said.

Following the panel, we spoke with Loney to gain more insights on her answers in an ICE-exclusive edition of The Huddle. This can be found on the Gambling Insider website.

According to Yield Sec Founder and CEO Ismail Vali, there is no such thing as a black or white online gaming market. Instead, he opts to use an analogy of an iceberg – in his ICE presentation, Vali wrote: ‘There is only one marketplace: the total marketplace. Only Yield Sec knows the total marketplace.’ According to Vali, there are just two segments of that total marketplace; one legal, one illegal. “I get death threats every month,” said Vali, because he points out that operators aren’t grey market and aren’t licensed. In Vali’s eyes, such businesses are thieves: “You do not have the licence to take money from that jurisdiction,” he stated.

Breaking down recent trends in the ‘illegal’ market, he noted how streaming is beginning to eclipse affiliates as a preferred method of getting eyes on illegal gambling sites. According to his statistics, there were 20 million illegal streams of the Jake Paul vs Mike Tyson professional boxing match in November 2024. For those streaming

illegally, there were an average of 16 ads that viewers needed to close throughout the broadcast – all of them from illegal operators. “What we thought was just an affiliate problem is an industry problem,” he added.

Ismail Vali , Founder and CEO of Yield Sec, pulled no punches on the ICE Barcelona 2025 stage, providing statistics on the illegal gaming market

cross-selling of certain verticals, while illegal operators face no such issue. Finally, a wholly legal and licensed market is a market of bricks.

Further Yield Sec statistics continue to paint a picture of the size and scale of the illegal market’s operations. In 2023, $5.1trn was wagered in illegal online gambling, rising to $5.7trn in 2024 due to growth from the Euros, Olympics and the predictors market, with illegal sports betting, horseracing, casinos, poker and crypto casinos noted as just some of the markets where such illegal play proliferates. Indeed, 73% of gambling is illegal, according to Vali – but why? Simply put: It looks too good to be true, and how can customers tell the difference?

Illegal gambling can advertise without restraints, because they lie, said Vali. After one month, when account monitoring ends, they can begin pushing illegal products. Moreover, as these operators do not pay for regulatory oversight in the form of taxes, they can give ‘better’ deals to players. Plus, by being online, these sites can operate anywhere, providing a global opportunity to generate revenue.

Vali went on to use the analogy of the three little pigs and their homes as metaphors for the different regulatory set-ups and their vulnerability to illegal operations. A nation with no legal market builds its market of straw, with illegal operators able to access players with ease. When some aspects of the market are legal and licensed, but not all, you have a market of sticks. “You’ve taken the legal industry and made it the whipping boy for the illegal sector,” Vali said, noting how such markets punish legal operators by limiting

Vali went on to use a further analogy of a Jenga Tower to describe regulation. He explained that, while regulation is required and necessary, regulation works best in a contained marketplace where crime has been actively identified and removed. Meaning, if you take away legal options, your legal market will collapse.

Towards the end of his panel, Vali made it clear that, to tackle the illegal market, all businesses within the gaming industry must play their part. There is a chain of enforcement escalation that can be implemented to call out illegal players. Failing to deal with illegal gambling because the illegal operator is ‘offshore’ misses the point: “There is no magic bullet to defeat crime,” Vali said. “It’s your marketplace – and you are being stolen from,” he concluded. A big statement to conclude – and one that will likely ruffle a few feathers.

- Yield Sec Founder and CEO Ismail Vali “ There is no magic bullet to defeat crime. It’s your marketplace – and you are being stolen from ”

Vicente Fox, the 62nd President of Mexico, addressed the attentive crowd at ICE Barcelona 2025 to discuss both Mexico and the wider LatAm region within the context of the gaming industry.

“THE SHORTCUT TO HAPPINESS IS DOING THINGS FOR OTHERS, DOING THINGS FOR THE WORLD”

Mexico’s 62nd President Vicente Fox Quesada touched down at ICE Barcelona to highlight the status quo within the Mexican political landscape – and how it could a ect gambling

When Vincente Fox stepped into office at the turn of the millennia, interest rates in Mexico were at 180% and inflation at 100%. These are statistics Fox listed at the beginning of his ICE address as he reflected on the challenge of taking on the 62nd Presidency of Mexico, which broke the one-party dictatorial rule of over 70 years.

During his six-year term, Fox’s primary imperative was poverty – an area in which he experienced success, as he brought 35% of Mexican households out of poverty as President. However, he also endeavoured to update Mexico’s gambling laws for the first time since 1947 – making Mexico one of the first nations worldwide to introduce a legislation that included online gambling measures. Prior to his Presidency, Fox was also President & CEO of Coca-Cola Mexico – so, it would be fair to say he knows a thing or two about business, as well as politics. It is no surprise, then, that his Presidency was business-friendly – and one that was friendly to the gambling business, in particular. Indeed, many of Mexico’s current gaming licences were granted during Fox’s tenure, with then head of the SEGOB Santiago Creel granting a staggering 763 gaming parlour licences all over the country prior to leaving office in 2005.

The action of Fox’s Government to mobilise the gambling industry in Mexico made it one of the first regulated nations in the Latin American landscape. However, despite the head start, the landscape remains –in places – spotty and uncoordinated due to a number of internal and external factors.

For one, the lack of a centralised regulator

– independent of the government – has created mass confusion within the market. As it stands, federal regulation is done inhouse by the Government, which has proved problematic, to say the least. The approval of a slot ban, which was eventually called off after being deemed unconstitutional in court, is perhaps the best example to highlight the state of affairs within Mexico’s regulation. And yet, the market still continues to thrive.

In fact, prior to Brazil’s regulation, it was the largest regulated LatAm market by a mile. Fox highlights a number of areas in which he anticipates gaming growth in the region, citing that he believes the growing middle-class population will attribute to a huge boom in pleasure industries such as gambling. Further, he underscores that Mexico is currently on a 1:1 trading basis with the US & Canada – further shining light on plans to open more gambling arenas, space for additional licences and the potential for utilising Mexican football stadiums as conference venues.

“Nine crimes per 100,000 tripled to 35 per 100,000 as soon as the army was brought in to tackle the cartels back in 2006”

- Vicente Fox, 62nd President of Mexico