RENTAL GROWTH RAMPING UP DESPITE UPTICK IN BANKRUPTCIES

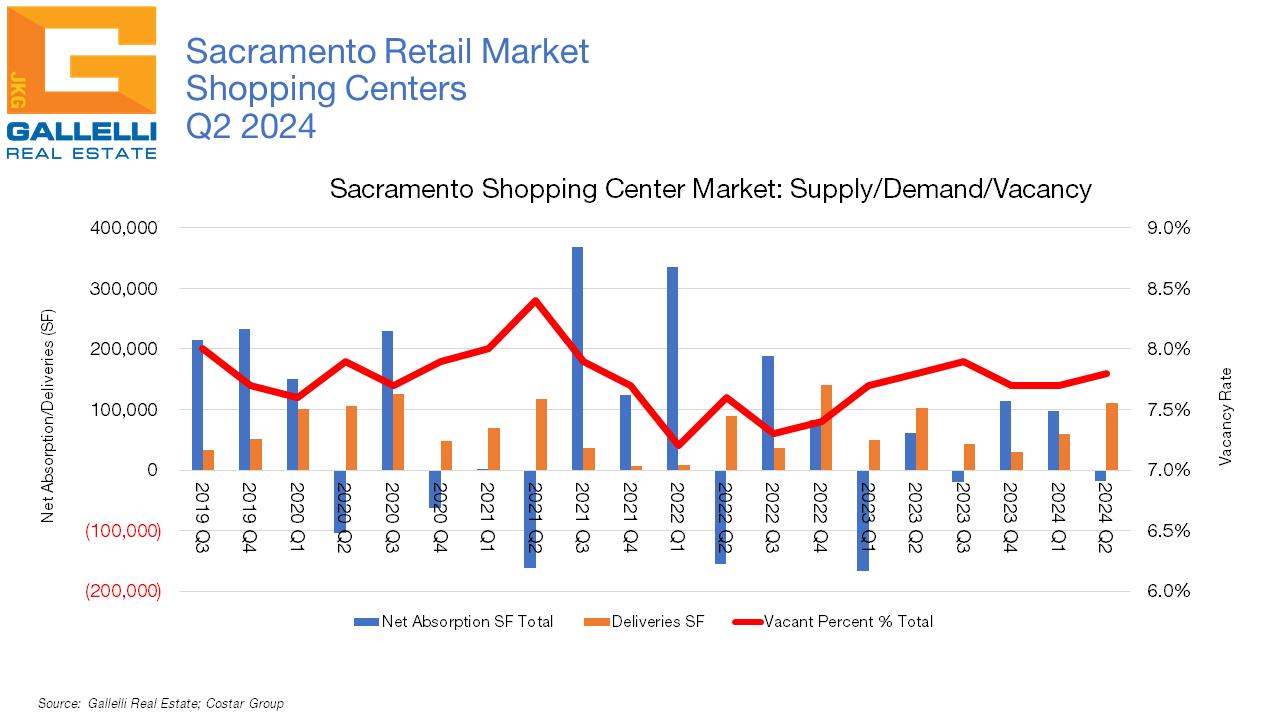

As of the close of Q2 2024, overall shopping center vacancy in the Sacramento region stood at 7.8%, up slightly from the 7.7% rate where it had hovered for two consecutive quarters. The market recorded modest negative net absorption of just -19,000 square feet (SF) in Q2. Against a total shopping center inventory of just over 66.1 million square feet (MSF), this equates to a flat quarter. However, these numbers mask some more substantial shifts that have occurred, depending on shopping center type. Power and lifestyle/outlet centers combined for over 159,000 SF of growth in Q2. However, those gains were outpaced by occupancy declines within malls, strip, and community/neighborhood centers to the tune of -188,000 SF.

DOLLAR AND DRUG STORE PAIN HITS NEIGHBORHOOD CENTERS

Community/neighborhood shopping centers, which are typically anchored by grocery or drug stores, were the big losers in Q2. This is the largest segment of the shopping center market, accounting for 38.4 MSF, or 58.1% of the Sacramento region’s total inventory. Over the past 20 years, community/neighborhood centers have been the strongest performers across the retail world. With tenant mixes that overwhelmingly favor grocery, food, services, and personal needs retail, it has been the shopping center type most immune to eCommerce disruption. But contraction from both drug and dollar store chains sent occupancy growth sideways in Q2.

Community/neighborhood shopping center vacancy climbed from 6.4% to 6.9% as the market recorded over -169,000 SF of negative net absorption this quarter. In April, the bankruptcy

and liquidation of 99 Cents Only resulted in the closure of 371 stores across the Western United States (they had a presence in California, Arizona, Nevada, and Texas), with 11 Sacramento region stores. 99 Cent Only stores range between 10,000 and 18,000 SF: with local occupancy loss alone at 154,000 SF.

Meanwhile, all three major national drug store chains in the United States are in contraction mode and this trend will primarily impact community/neighborhood centers going forward. The challenges come from multiple fronts; increased competition from online pharmacies may be getting much of the blame, but there are some significant other factors including heightened from grocers, convenience stores and discount beauty concepts. Lastly, over the past two years, all three of these chains have been burdened with multi-billion-dollar opioid settlements that have further accelerated cash crunches.

• Rite Aid has been working through Chapter 11 proceedings since Q4 2023 and should emerge from bankruptcy sometime in July. When filing for bankruptcy protection in October of last year, Rite Aid had just over 2,150 stores nationally and was initially looking to reject about 150 leases. That closure

list has since ballooned to over 570 closures in multiple waves. Eight local stores had been shuttered before Q2, but the chain closed two more units over the past three months (South Sacramento and Elk Grove) returning 32.000 SF more space to market.

• Meanwhile, the 7,800-unit segment leader CVS is closing 300 stores nationally this year, though none that we are aware of in Q2 (they closed a unit in the Arden/Howe/Watt submarket in January).

• Walgreens, the nation’s second largest drug store chain with 8,600 stores entered 2024 with plans to also streamline their footprint by 300 units nationally. While they closed a few local stores in late 2023, we are only aware of one closure so far this year and none in Q2. However, this is about to change. In late June, their CEO announced that a full 25% of their store locations were underperforming and that the company was about to launch a multiyear rightsizing campaign with many closures. There have been no other details shared since, but industry speculation is that Walgreens may be closing as many as 2,100 stores through 2027 or 2028.

Challenges from drug store contraction are likely to increasingly create headwinds for community/neighborhood center landlords for the next few years—even though this product type typically drives the greatest amount of occupancy growth and even though retail is still currently in growth mode. Here is why: we meticulously track the growth and contraction plans of major chains via our sister publication, The Brown Book, and find the

tenant pool for space availability in the 5,000 SF and under range to be robust, as well as in the 20,000 to 35,000 SF range. But we see weak demand levels for retail in the 10,000 to 20,000 SF range and for larger spaces above 35,000 SF. That could easily change—for example, in late June, the Family Dollar (which typically uses space in the 6,000 SF to 10,000 SF range) bought 170 leases for former 99 Cents Only locations (including two in the Sacramento region) which they intend to open the stores under their Dollar Tree banner. Family Dollar had entered the year with plans to close 600 units of its namesake banner and 30 Dollar Tree stores, but this puts Dollar Tree back into growth mode.

While drug store contraction is across the board and remains a concern, contraction in the dollar store category has been limited to the 99 Cents Only (which had been struggling financially for years) and Family Dollar/Dollar Tree (which had been growing aggressively for the better part of the last decade and needed to prune some of its underperformers. Sector leader, Dollar General with 19,200 stores is still expanding and says they will open 670 units nationally in 2024. Likewise, elevated dollar store concepts like Five Below (+230 stores), Dollar General banner p0pshelf (+230 stores), Chinese dollar concept Miniso (+70 new stores), Japanese dollar concept Daiso (35 new stores) are all in growth mode. Going forward we anticipate slower growth from US players that have been saturating the market for years, but stronger growth from elevated and international dollar concepts.

Despite the challenges posed by drug store contraction, we don’t necessarily expect the community/neighborhood center to end 2024 with higher vacancy levels. Closures will create headwinds

to be sure, but in terms of overall leasing this is still the asset class that commands the most tenant demand with grocery stores, restaurants, gyms/health clubs, and most of the service categories remaining active in the marketplace. Q2’s occupancy decline of -169,000 SF follows five consecutive quarters of growth that expanded local occupancy by 433,000 SF. Over the past decade, community/neighborhood centers have recorded negative net absorption in only 10 of 40 quarters.

The current average asking rent for community/neighborhood centers is $2.05 per square foot (PSF), on a monthly triple net basis. This metric has increased by 2.5% over the past year. The Arden/Howe/Watt (5.9%, Auburn/Lincoln/Loomis (6.8%), Davis/ Woodland (5.9%, El Dorado Hills (6.2%), Elk Grove (2.3%), Folsom (3.2%), Natomas (3.2%), and Rio Linda/North Highlands (6.8%) submarkets all currently have vacancy levels below the 7.0% mark. Meanwhile, the Carmichael/Citrus Heights/ Orangevale (9.9%), Downtown/East Sacramento (7.8%), Highway 50 (10.8%), Roseville/Rocklin (7.6%), South Sacramento (7.8%) and West Sacramento (8.5%) trade areas all currently have vacancy levels above the 7.0% mark.

POWER, LIFESTYLE AND OUTLET CENTERS RECORD POSITIVE QUARTER

Local region’s lifestyle/outlet centers currently have a vacancy rate of 6.0%, down from las quarter’s 6.8%, but still elevated from the 5.4% reading of exactly one year ago. This product type recorded 119,000 SF of positive net absorption in Q2—the most this small sector of the market has posted in over a decade. Move ins from Nordstrom Rack and LA Fitness at Elk Grove’s The Ridge project (where 100,000 SF of new product came online in Q2, Tommy Bahama at the Fountains in Roseville and multiple new tenants at Folsom’s Palladio helped to propel these numbers. The current average asking rent for lifestyle/outlet center space in the Sacramento region is $2.90 PSF, on a monthly net lease basis. This metric has increased 1.8% over the past twelve months.

Despite the challenges faced by some community/neighborhood center landlords in Q2, combined occupancy growth from the power center and lifestyle/outlet centers nearly brought overall net absorption for the region into the black.

The current vacancy level for power centers is 5.8%, down from last quarter’s 6.2% reading and from the 6.4% rate. Power center occupancy expanded by 50,000 SF in Q2. This asset type has seen flat occupancy growth in the last couple of quarters. Part of this is because this is where the least amount of space is available. Of the 11.2 MSF power center, 649,000 SF was vacant as of the midyear 2024 mark. One third of that is attributable to just one shopping center, County Club Plaza in the Arden/Howe/ Watt submarket.

Currently the Auburn/Lincoln/Loomis (1.1%), Davis/Woodland (0.0%, Elk Grove (3.7%), Natomas (3.0%), Roseville/Rocklin (2.1%) and West Sacramento (1.0%) submarkets are experiencing incredibly tight availability with vacancy levels below 4.0%. At the other end of the spectrum is the Arden/Howe/Watt (32.7%), Carmichael/Citrus Heights/Orangevale (8.1%), and South Sacramento (15.9%) submarkets. The current average asking rent for power center space in the Sacramento region is $2.30 PSF, on a monthly triple net basis. This metric has increased by 2.2% over the past year.