OUTSIDE THE BOX

Psychiatrist Brian Dixon wants to take treatment outdoors

FERTILE SOIL

Susser Bank in full bloom in Arlington

Psychiatrist Brian Dixon wants to take treatment outdoors

Susser Bank in full bloom in Arlington

These 20 distinguished entrepreneurs excel in a climate of uncertainty through preparation and persistence.

Our trusted advisors understand and value the courage of taking on a new beginning. We offer direction through each business decision, driving your vision towards success. Think big and start by visiting whitleypenn.com.

36 Mission: Possible What do 20 entrepreneurs spanning industries from consumer and durable goods to real estate and hospitality have in common? Persistence. This year’s class of Entrepreneurs of Excellence share their stories of setback and success, dealing with change — oh, and that five-letter C-word whose repercussions continue to pose challenges.

6 Publisher’s Note

Bizz Buzz

9 Bizz Buzz: Arlington-based Susser Bank is in growth mode as branches stretch across major markets throughout the state.

12 Face Time: A retired cop takes to the bricks of Camp Bowie for a drastic career change — owning a vintage clothing shop.

Executive Life & Style

15 Office Space: Cafés and coffee shops serve as inspiration for Agency Habitat’s modern, minimalist office design.

24 Health and Fitness: A new boutique fitness studio on Hulen Street plays up the experience factor with more than mere flashy lights and loud music.

26 Wine and Dine: Marketing guru Beth Hutson switches to her alter ego as a mocktail mixologist and shares a recipe for a zero proof holiday cocktail.

28 Distinctive Style: Offbeat hairstyles are in at the office. Here are a few tips for balancing both a trendy and professional look.

32 Off the Clock: Off-grid meets out of the ordinary at these two vacation homes designed for comfort and style.

60 Business Management/Info Tech: Why Facebook’s recent outage serves as a warning for potential cyberattacks.

62 EO Spotlight: A Fort Worth psychiatrist talks the business of being a doctor, the meaning of mindfulness, and what he’s learned from EO.

64 Analyze This/Wealth: The Employee Retention Credit is emerging as the new “superstar” of the federal CARES Act, our columnist writes. Here’s how you can take advantage.

66 Analyze This/Economic Development: The real estate market is looking good in Fort Worth with industrial leading the way.

68 Analyze This/FW Chamber Report: The Fort Worth Chamber enters a New Frontier, offering members more ways to connect.

70 Analyze This/Real Estate: Fort Worth still falls short in areas like diversity and public transportation, according to our columnist.

72 Day in the Life: After leading the financing for the sale of Burnett Plaza, the charter president for Pinnacle Bank, Texas looks toward more deals, both big and small.

Afew years ago,

I was speaking with an entrepreneur who is now a business coach about the importance of making a profit and managing your cash flow. During our conversation he said, “When you run out of money, you close the doors and go look for a job.” This statement resonated with me because of its simplicity. It is something that most every entrepreneur has thought about.

Unless you run a publicly traded company that can fail to turn a profit and still stay in business (like Uber, which lost $8.5 billion in 2019, or Airbnb that posted $4.6 billion in net losses in 2020), earning a profit and having enough cash flow to operate is imperative to a company’s survival. This applies to startups and mature companies. Most every entrepreneur at one time or another has experienced the fear of running out of money. It can be one of the drivers for success or failure.

Walt Monk, who owns Pollmakers, is one of this year’s Entrepreneur of Excellence award winners. A tech company, Pollmakers’ primary business is surveys, polling, and political fundraising via text and phone calls. Monk is a serial entrepreneur, starting his first business, a convenience store, when he was 21 years old. He added two more stores and sold the business two years later. Over the next 24 years, Monk ventured into several other industries before converting one of his failing companies, a dating service, into Pollmakers in 1999.

Since starting Pollmakers, Monk reinvented the business many times to

conform with the changing laws that affect his industry. In mid-2019 sales were trending down over the previous year, and Monk was running out of money. He had two choices: Begin laying off personnel and rethinking the business or spend money to innovate and risk bigger losses. Monk decided to innovate and added peer-to-peer texting to his services.

By the end of 2019, Pollmakers’ revenues were down 38% over the previous year, and it posted a six-figure loss. In Q1 of 2020, the peer-to-peer texting began to pay off. Not only did Monk not go out of business, 2020 turned into the best year in Pollmakers’ history with more than $14 million in sales, three times more than the company’s previous record year, with profit being greater than the previous eight years combined.

Thomas Edison once said, “Many of life’s failures are people who did not realize how close they were to success when they gave up.” Do you remember that guy who gave up? Neither does anyone else. The one thing that all 20 of this year’s 2021 Entrepreneur of Excellence award winners have in common is that they never gave up. I hope you are inspired by their stories.

Hal A. Brown owner/publisher

Susser Bank, whose operations hub is in Arlington, continues its push into every major Texas market.

BY SCOTT NISHIMURA |

CCarl Cravens has witnessed plenty of growth as a fifth-generation resident of Arlington.

As chief lending officer for the fast-growing Susser Bank, which changed its name from Affiliated Bank to reflect the namesake of its entrepreneur CEO Sam Susser, Cravens is in the middle of more growth.

The Dallas bank, whose operations base is in Arlington, opened the year with branches in Fort Worth, Arlington, Bedford, Garland, and Round Rock. It’s opened since then in Dallas and San Antonio and is opening this fall in Austin and Houston. Susser, who bought the bank in 2018, set a goal of being in all of Texas’ major markets within five years.

“We’re really two years ahead of where we thought we would be,” says Cravens, who came aboard the bank three years ago.

Cravens’ great-great-grandfather established Carlisle Military Academy, now the site of the University of Texas at Arlington. Cravens’ grandfather donated the land for the popular 86-acre Cravens Park, with baseball fields, tennis, volleyball, basketball courts, playgrounds, and hiking trails, in south Arlington.

Cravens’ father, Tom, is a retired longtime Arlington banker and businessman who worked his way from teller to CEO and chairman at First National Bank and has served as an officer at several local banking institutions.

Carl Cravens has spent 25 years in banking, with his career beginning

in 1994, starting as a credit analyst. Growing up the son of a banker, Cravens says, “My stream of consciousness came in the S&L crisis. I do remember his friends. I thought, this doesn’t seem so fun.”

Today, he notes, “Banking’s a little more different. Much more regulated. Much more scrutinized. What the really good [bankers] do is make connections to people. That’s where they really add value.”

We’re really two years ahead of where we thought we would be.

– Carl Cravens

The bank’s history dates to 1959 when it opened as Affiliated Federal Credit Union. Today, Susser Bank has $1.3 billion in assets, including $500 million in Fort Worth. When Cravens joined, the bank had $650 million in assets.

The bank likes commercial real estate lending, including office, manufacturing, and industrial. “People we’ve banked a long time,” Cravens says. “Owner-occupied office, we like.”

The bank isn’t too worried about the pandemic and its impact on the office market, Cravens says. “I don’t think everybody’s going to go home and work. I think people need to be around work.”

Rents have been stable. But even if they were to soften, “I’d rather be here and worry about that problem than in another state,” he says.

The bank likes the strength of residential homebuilding. “That is going to continue with the influx of people moving into Texas and the short supply,” he says.

The bank also likes Class B multifamily properties. “People move into it when they do better, and move out of it when they do better, and move back when they do worse,” Cravens says.

Susser is putting together a team to focus on technology lending, looking for opportunities in software and software as a service. “The world’s changing. Technology is evolving.”

The bank is “very careful” on lending to the retail sector, Cravens says, and it’s avoided oil and gas. “Oil and gas is not something we’ve chosen to do. If we ever do go public, which I believe we will, the discount we get from any piece of the [oil and gas] world is too much.”

The bank today has 200 employees and is Arlington’s ninth-largest employer. It had 15 bankers at the beginning of the year and has hired another 15 since then. “That’ll round us out for the year,” Cravens says.

Them, There’s Bank of

Helping Fort Worth Grow. We are proud to stand behind our Fort Worth customers to make their business growth possible. As a top 30 U.S-based bank*, we have the strength and stability to accomplish projects of any scale. And, with dedicated local expertise and a commitment to the community, we build long-term relationships focused on the smallest details. See what heights your business can reach with a true financial partner at bankoftexas.com.

BY SCOTT NISHIMURA / PHOTO BY OLAF GROWALD

Talk about a career change.

Laura Simmons, a 25-year police officer, retired two years ago and spent a year working in her husband’s jewelry store, Simmons Estate Jewelers, in Fort Worth. Then in January, Simmons, who’d dabbled in vintage for years as a photographer, opened her own vintage shop on the bricks at 4908 Camp Bowie Blvd., near the jewelry store.

Simmons has filled the store with finds she gets at estate sales and in private sales, coming up with pieces, for one, formerly owned by Priscilla Davis. Leon Bridges — Simmons messaged him on Instagram and he dropped by — and Armond Vance, the Fort Worth musician, have become customers.

“I’m an old soul,” says Simmons, who started in photography 10 years ago, styling her subjects in vintage pieces and shooting an array of magazine covers.

Simmons has built the purchasing side of the business on relationships with operators of estate sales. “There’s a handful that will let me preview their sales. I’m always first in line at these sales.” She also advertises that she buys vintage.

And not that Simmons is the only one chasing these finds. “The competition is getting stronger and stronger.”

Simmons’ customers are a blend. “I really didn’t know what to expect. It’s a very good mix of young and old and male and female. I’m really surprised at the

number of men looking for vintage now. Younger men want to look different.”

Bridges came in soon after Simmons sent him a direct message. “He never messaged me back. I went a few days, and he walked in the door.” Simmons doesn’t sell online. “I want to keep it all here for my locals.”

Why Camp Bowie? “I looked all over the place for a building to lease. This was during COVID. And I was scared to death whether I was doing the right thing or not. I did put a lease offer on the South Side, and it didn’t work out. They chose another client.”

The small 2,400-square-foot space is in a strip center with an Olivella’s Neo Pizza Napoletana restaurant, Gunter TV & Appliance, Hale House Fort Worth gift shop, and across the street from Kincaid’s burger restaurant.

“I just have to maximize my space because I don’t want to leave,” she says. She washes every piece she buys. “I obsess over the tiniest spot. If it has a blemish, it doesn’t go in my store.”

Simmons likes to buy items from the ’50s through the ’80s, in men’s, women’s, and children’s. “As long as it’s in mint condition. All of this has a story.”

Vintage prices have risen, she says. “Even the estate sales have figured out how popular it is.”

Office Space / Health & Fitness / Wine & Dine / Distinctive Style / Off the Clock

Designed with a minimalist, café-esque aesthetic, marketing firm Agency Habitat moves to a stylish new space conceived to foster collaboration and creativity.

BY SAMANTHA CALIMBAHIN / PHOTOGRAPHY BY OLAF GROWALD

The kicker about Agency Habitat’s stylish new office just north of West Seventh Street — no one actually has an office.

The 30,000-square-foot warehouse at 2733 Cullen St. — designed with a minimalist, coffee shop-esque aesthetic — has all the makings of a creative workspace. There are lounge areas, conference rooms, and open-concept desks, plus a few elevated amenities like an upstairs loft and restaurant-size bar equipped with a kegerator and cold-brew coffee on a tap. Another perk is the adjacent Lowtown Studios, a separate enterprise run by the marketing firm’s president and CEO Neil Foster, offering four sound stages and other audio/video production capabilities.

And every space is open for anyone to use, whether C-level executive or entry-level employee.

“What I have understood is, you have managers that are getting promoted because they’re doing a good job, and the next thing you know, they get an office, close their door, and they’re not accessible to any of the employees that they manage. It never made sense,” Foster says. “This way, I think overall, it’s a better way for people to communicate, know what’s going on, and meet people from other teams.”

Executive creative director Lauren Coleman personally handled the interior design, partnering with Dallas-based Coeval Studios to finalize the overall look. The new space correlates with the company’s rebranding. (Agency Habitat was formerly GCG Marketing, officing on West Seventh Street.) The move and the rebrand took place in 2020.

“A big part of our business is creative inspiration,” Coleman says. “We’re big believers that the spaces around you inform how you think. By sitting in the same place every day, with the same people every day, you’re having one perspective every day … each space was concepted to make sure there were different ways for people to work.”

“In every airport there is a lounge waiting to be discovered. Let Escape Lounges be your next discovery.”

• Boutique Service on a Grand Scale

• Fort Worth based

• Serving 12 locations in 7 domestic U.S. airports

Gideon Toal Management Services . . . A Heart for hospitality and a Spirit for Service

The adjacent Lowtown Studios is a full-service audio/video production facility, complete with four sound stages, a recording booth, hair/makeup stations, and a shooting kitchen.

Our goal is simple. Be the best personal injury law firm in the state of Texas. We are honored that Fort Worth Inc. magazine has recognized Travis’ vision, creativity and integrity, which allow us to push closer to that goal every day.

pattersonpersonalinjury.com

From traditional conference rooms to homey lounge areas, plenty of spaces allow for collaboration.

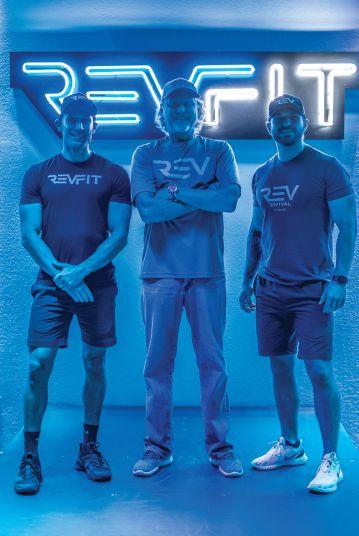

RevFit plays up the experience factor at its newly opened studio on Hulen Street.

BY SAMANTHA CALIMBAHIN / PHOTO BY OLAF GROWALD

There’s nothing particularly flashy about the exterior of RevFit, the newly opened boutique fitness studio situated next to a Smoothie King in an innocuous Hulen Street strip center.

Inside, however, is a different story. Clients walk into a clean, modern entry space, waiting among their peers until the next door opens to reveal a spacious dark room, where neon-colored lights bounce off the

walls and up-tempo music pulses through the speakers.

Compare it to a rave, but owner and managing partner Gary D. Simpson calls it the “Disneyland of it all.”

“You’re stepping into an environment just one notch up instead of going through a door, grabbing weights, or jumping on a spin cycle,” he says. “The door opens, the room is ready for you, and the music starts. You just feel like something is happening.”

The experience factor — which many businesses (particularly retailers) have been tapping into in an effort to appeal to younger consumers — is a big deal at RevFit. Since opening in May, Simpson says the studio has consciously worked to build up the “fireworks” around each workout — and not just through flashy lights and sounds.

The basic structure of each class has clients rotating among five stations, alternating between two different workouts within a designated space. You’ll do everything from lifting kettlebells to working a rowing machine before taking a break and moving onto the next station, all during a 50-minute session.

The point of keeping the room dark and everyone separated, aside from social distancing because of COVID-19, is to allow clients to focus on themselves rather than worrying about the person next to them, operating partner Kevin Forbes says.

“There are a lot of studios out there that are bright. When you have that brightness, you can sometimes feel that insecurity of people watching you,” Forbes says. “When you’re in a dark room, there are no mirrors; it is literally [just] you. You can now push yourself based on you. You’re not competing with everyone else; you’re competing against yourself.”

RevFit’s concept was years in the making, originating, of all places, in Orange County, California, where Simpson and his family were living at the time. While there, Simpson (through his son, Nathan) met Forbes and future business partner Reid Warner, who both had experience in personal training and opening fitness studios. Forbes says the trio planned to come to Fort Worth a couple of years ago with a different concept. Then the pandemic arrived, and “everything flipped,” forcing them to go back to the drawing board.

“Can we, one, create the experience but also, two, create a safe space that people

feel comfortable with, especially based off the last year where we’re 6 feet apart from everyone?” Forbes says. “We’re alone, we’re on an island, but we want to bridge that island to community back.”

Beyond the workout itself, another big part of the experience is a purposeful effort to get to know clients on a personal level. Instructors learn your name, will come by your station, and guide you through movements. And if you haven’t been in the studio in a while, they’ll send you a text to make sure you’re OK.

“All these little things are ingrained in the experience,” Warner says. “You have all the big moments, but you also feel like there’s somebody there who cares about you.”

The Hulen studio is currently RevFit’s only location. Only months into the business, Simpson says some folks have already expressed interest in franchising, but he’d like to refine the flagship product before making moves to expand.

“We can do something to move the paradigm of athletics into a world where you can engage socially; get strong; get healthy — mind, body, and soul; and don’t even realize it because you’re having fun,” Simpson says. “That’s what we dream.”

1. Stretch beforehand. If you don’t, prepare for major soreness afterward. Stretching can also prevent injury.

2. Follow the screens. Screens on both walls of the room demonstrate the workout you should be doing at your station.

3. Wipe down your equipment. RevFit provides sanitizing wipes so you can disinfect your equipment before moving on to the next station. Considering COVID-19, be courteous to other classmates and be sure to wipe down your area thoroughly.

Beth Hutson shares an alcohol-free alternative for your next holiday party.

BY SAMANTHA CALIMBAHIN

Beth Hutson is a video producer and publicity guru by day, but by night — or any time, really — she’s a mocktail mixologist through her zero proof lifestyle brand, The Elevated Elixir. It’s a division of Elevated Content Co., the creative branding agency she runs with her husband, Brian. The Hutsons “broke up” with alcohol

a few years ago. Brian, a former wine buyer, has been going zero proof for eight years straight, Beth says. Struggling to find quality nonalcoholic beverages, Beth decided to launch her own — and The Elevated Elixir was born.

“Alcohol is something that was always around us in our careers and social lives. We loved the flavors and fellowship but

not the way it made us feel,” she says. “I wanted to make zero proof cocktails more accessible, fun, and without stigma.”

Here’s a recipe for one of Beth’s alcoholfree concoctions. Find The Elevated Elixir on Instagram (@theelevatedelixir).

Pomegranate Pear Fizz

Ingredients

2 ounces Looza pear juice

2 ounces pomegranate nectar

1 ounce Lyre’s Classico zero proof sparkling wine

1/2 cup pellet ice

Directions

1. Combine pear juice, pomegranate nectar, and pellet ice in a shaker and shake gently.

2. Strain into glass.

3. Top with Lyre’s Classico and enjoy.

With workplace hairstyles trending away from the clean and basic, two local stylists offer tips on how to go nontraditional — without looking unprofessional.

BY SAMANTHA CALIMBAHIN

If you want to be certain you are maximizing your return on investment, then contact TMS today for a complimentary Power Study!

The COVID-19 pandemic changed a lot about business — and we’re not just talking about, well, business.

Workplace fashion is changing, too. Months of working from home and phased reentry back to the office have made some companies more accepting of relaxed looks, easing the rules when it comes to employee self-expression in exchange for better productivity.

“Bring your full self to the workplace.” That sort of thing.

That doesn’t just go for clothing but also for hair. Boardroom Salon for Men head stylist Vicky Pena and Salon Dexterity stylist Michaela Manuel say they’ve both seen corporate clients embrace offbeat looks, particularly when it comes to texture and color, but there’s a way to go nontraditional without looking unprofessional.

Here, Pena talks men's hair, and Manuel, women’s hair, sounding off on what’s trendy — and acceptable — for the office.

Inc: What are some overall trends you’ve been seeing when it comes to workappropriate hairstyles?

MM: Fashion color, vivids, naturally curly hair — along with textured, shag, or asymmetrical cuts — are trendy and can be an expression of personality and confidence.

While many professionals are limited by rules of wearing “natural” hair colors only, there are many ways to style these looks and be professional.

VP: During the pandemic, a lot of men changed up their look to a more casual, low-maintenance style, including their hairstyle. Now, despite returning to the office, many men are not in a rush to go back to their old ways.

Casual Fridays are a thing of the past, as business professionals are adopting a more low-maintenance style every day of the week. Men have traded their pressed suits, shiny leather shoes, and cleanshaven faces for longer, textured hair, jeans, and beards. We cater to all styles at Boardroom Salon for Men — whether traditional or trendy. Our mission is to ensure our clientele leave our salons looking good and feeling confident.

Inc: What specific styles should folks try to go for?

VP: Since quarantine, we are now seeing men keeping their longer hair for easier maintenance and a trendier look. However, long hair does not mean that you can just let it grow and leave it alone. Longer hair needs some pampering, including regular trims and deep conditioning treatments. We encourage all men to get into a styling regimen to maintain their locks as they return to the office.

We are also seeing men feel more comfortable with curls and a more textured look that provides movement. This is different from a lot of the razor cuts men have been used to for decades. The key to this look is to pay attention to your specific hair type — whether curly, thin, stick-straight, or anything in between — and apply products catered to your type of hair.

MM: Although various styles are becoming more professionally accepted, many are concerned about loss of respect in their workplaces and decide against their personal hair dreams. The way you carry yourself should determine your professionalism — not your hairstyle. Stylists are creative artists who can help you achieve a “new do” and give you tips for confident presentation.

MM: For women — peekaboos, which are pops of color hidden beneath the top layer of hair, are one creative way to incorporate fashion colors and not be too flashy. Other options are to add highlights or blend the vivid color into a naturalcolored root. Another alternative is adding violet to red which results in a deep wine color with purple reflection. Seek out a professional in fashion colors, who will not only give you a fun change but share knowledge on how to meet the workplace criteria as well.

Inc.: What are your tips for everyday styling and maintenance? Any products you recommend?

VP: For longer men’s hair, we recommend Bumble and Bumble’s Creme de Coco shampoo and conditioner or any moisturizing shampoo and conditioner that will start your look off with a great foundation of moisture. Next, you should incorporate a leave-in product, such as Bumble and Bumble's Grooming Creme that tames any flyaways and will leave you with that intentional look at work.

For men’s curly hair, we recommend Bumble and Bumble’s Curl shampoo and conditioner that help create a foundation of moisture. Next, we suggest Bumble and Bumble’s Curl Defining Cream that tames and adds a lightweight control that most often textured hair needs. If you have the texture but are working with less density, we recommend using Bumble and Bumble's Thickening Contour Creme to add fullness and polish that texture.

MM: Curly-haired women often feel the need to smooth their locks rather than embrace the volume and texture. Flat irons and hot tools can lead to damaged ends, which are more difficult to control. Frizz is caused when the outer layer of your hair strand — that is, the cuticle — opens up. Oftentimes, this is a result of your hair seeking moisture in the air — humidity — or being roughed up with a regular towel. Drying with a microfiber towel or cotton T-shirt and using hydrating creams, such as Kérastase Crème De Jour Fondamentale or Keratine Thermique, is a great start to minimize frizz and define natural curls. When it comes to a shaggy or asymmetrical cut, add some loose, wavy curls to soften your look. Remember to always use a heat protectant and workable hairspray, such as Kérastase Discipline Oil and Kérastase Laque Couture. Some asymmetrical cuts can be symmetrical when parted in the middle and styled with a side part for a more edgy appearance. Also, try clipping the longer section or side up or back to hide the disconnected look in the office. Remember, your stylist has knowledge to share and expertise with different products and hair textures.

FACT: 100% OF THE NETWORKS MICHAEL MOORE FACT: 100% OF THE NETWORKS MICHAEL MOORE AUDITS HAVE MAJOR CYBER ISSUES AUDITS HAVE MAJOR CYBER ISSUES

FACT: ONE OF THE MAJOR WEAKNESSES IN CYBERSECURITY

FACT: ONE OF THE MAJOR WEAKNESSES IN CYBERSECURITY OCCURS WHEN A COMPANY PLACES CYBER AS AN “EXTRA” OCCURS WHEN A COMPANY PLACES CYBER AS AN “EXTRA” RESPONSIBILITY UNDER A NON-EXPERT RESPONSIBILITY UNDER A NON- EXPERT BECAUSE IT’S CHEAPER THIS WAY BECAUSE IT’S CHEAPER THIS WAY

FACT: FACT:

Go off-grid and out of the ordinary at these modern, stylish vacation homes.

BY SAMANTHA CALIMBAHIN

Glamping — an amalgamation of the words “glamour” and “camping,” for those unfamiliar with the term — has been the choice alternative for those wishing to be immersed among woodland creatures without having to sacrifice creature comforts. If sleeping in a tent and cooking over a campfire don’t sound palatable, luxurious cabins decked out with modern finishes and full bathrooms are just an Airbnb search away.

But then, there are other accommodations that take glamping a step further. Two destinations in particular — Lilla Norr and Getaway — have drawn social media fame for their eye-catching architectural designs and Instagrammable interiors. These spaces also get nods for offering truly offgrid and solitary experiences completely surrounded by wildlife and trees — and not another human for miles.

Should you decide to take a holiday from your office in the middle of the city, here’s

a little more info on these two cabins available for your glamping pleasure.

Lilla Norr

Where: Brook Park, Minnesota

More info: lillanorr.com

Run by the same folks who own Twin Cities-based vintage shop Arlee Park, Lilla Norr (that is, “Little North” in Swedish) is a restored 1978 A-frame cabin located on 5 acres of woods along the Snake River.

It’s a picturesque piece of architecture, with a black exterior and neutral color palette indoors, decorated with vintage furniture, including a 1970s Morsø stove and 1986 modular sectional by Carson’s of High Point.

Among the amenities are a walk-in shower; full kitchen with a GE refrigerator, electric stove, stainless steel oven, and cooking tools; AC, heating, and a woodburning fireplace; and, yes, there’s Wi-Fi.

An HDTV includes Netflix and Amazon Prime; there’s also a record player and

Samsung Bluetooth sound system.

But, if you care for more unplugged forms of entertainment, the cabin comes stocked with books and board games. Roast marshmallows over the fire pit outside, nap in the hammock, or take in your surroundings atop the private balcony.

According to Lilla Norr, the property is meant to be enjoyed as is, and hiking and boating areas are a decent drive out from the cabin. Nonetheless, Lilla Norr sits in proximity to Banning State Park, Knife Lake, and the Vasaloppet Nordic Center, a great spot for skiing.

The Swedish inspiration comes from Mora, Minnesota — a sister city to Mora, Sweden — located about 18 minutes from Lilla Norr. The city has a distinctly Scandinavian flair with photo-friendly landmarks, including the Mora Klocka (or clock) and bell tower. Mora is also home to a theater, breweries, shops, and local restaurants.

Price per night at Lilla Norr is about

$200. Keep an eye on the cabin’s website or Airbnb page, as owners release booking dates one to two months in advance.

Getaway Piney Woods

Where: LaRue, Texas

More info: getaway.house/dallas

Cabin rental company Getaway has several campsites across the country — the closest to Fort Worth is Getaway Piney Woods in LaRue, Texas, which sits roughly two hours from here and 90 minutes from Dallas.

Engulfed amid towering pine trees, Getaway’s 40 cabins in LaRue are spread out across 99 acres and decidedly minimalist, offering single queen beds or queen bunks in one box-shaped space. There’s AC and heat, a shower and toilet, and a kitchen equipped with a stove and mini fridge.

Granted, there is no Wi-Fi — Getaway encourages disconnection, and each cabin includes a “Cellphone Lockbox” so guests can keep electronics out of reach.

But that’s the point, right? While you dis-

connect, enjoy a trek through the Wolfpen Hike and Bike Trail, take a canoe out to Cedar Creek Lake, fish Lake Palestine, or wander Beaver Slide Nature Park, all located about 40 minutes or less from Getaway Piney Woods. End each day making s’mores over a campfire just beside your cabin, and after taking an actual shower, curl up under the covers next to a large bedside window that makes one feel as though they’re nestled in the middle of nature.

Price per night at Getaway Piney Woods ranges from around $99 – $199 depending on number of beds and duration of stay. Something else to feel good about — for every cabin booked, Getaway will donate a tree to One Tree Planted. According to Getaway, about 15,000 trees have been planted so far.

If you need to escape a little further than LaRue, Getaway also has campsites in the Hill Country; Mount Vernon, Washington; the Catskills in New York, and others. Check the website for more details.

Align your investment portfolio with your values.

UMB Investment Management is at the forefront of building innovative impact investing solutions based on your objectives. Aligning your social and ethical values with your investment strategy is both an emphasis and a specialty of UMB’s team. We have experience constructing socially responsible solutions for our clients without sacrificing returns.

While others may focus exclusively in large-cap stocks, we deliver a total ESG (environmental, social, governance) portfolio inclusive of domestic largecap, mid-and, small-cap stocks, international and emerging markets stocks, as well as fixed income. We’re pioneering investment trends to connect with your passion and performance expectations.

PSK LLP is a full-service CPA, consulting and advisory firm providing services to national and local clients. Opening for business in 1964, PSK is now one of the largest firms in Arlington. From accounting, auditing, tax and business consulting through estate planning, corporate tax planning and preparation, fraud risk consulting, succession planning and guidance on payroll and personal taxes, PSK’s level of service to clients is unparalleled.

Working with large and medium-size organizations in transportation, construction, real estate, manufacturing, professional services, healthcare and insurance sectors, PSK also serves churches and nonprofits, family-owned businesses and investor groups. PSK provides expert advice that gets financial tasks accomplished and accounting systems in order.

The firm‘s “relationship-first” mentality provides top-notch personalized financial solutions that include assistance with recent COVID-related legislation and the impact to your business. Caring deeply about each client it serves, PSK gives you peace of mind that your business is being handled properly by a firm you can trust.

Fort Worth Inc.’s annual entrepreneur class is in, and it’s laden with stories of persistence and can-do in uncertain times.

BY SCOTT NISHIMURA AND JOSEPH RICHARDSON PHOTOGRAPHY BY OLAF GROWALD

Fort Worth Inc.’s 2021 Entrepreneur of Excellence class is chock-full of stories of persistence.

These 20 entrepreneurs are in commercial and residential construction, consumer and durable goods, health care, hospitality, professional services, real estate, and tech and e-commerce.

This is Fort Worth Inc.’s fifth annual Entrepreneur of Excellence edition. As in past years, applications were judged independently of the ownership and staff of the magazine. The judges — business leaders from across the region — reviewed each application confidentially, based on sales and profit growth, best practices, ethical business practices, innovation, perseverance

and community involvement. The judges made their decisions this summer, choosing finalists and winners in each of eight categories. Financial performance data in the applications is confidential and not made available to the magazine staff for use in the biographies in this issue.

The category winners’ identities were kept secret until they were revealed Nov. 11 at a gala dinner at the Fort Worth Club. There was no cost associated with applying for, or being considered for, this award.

Eligibility criteria included ownership or lead of a business in the Greater Fort Worth area, at least two years in business, and $1.5 million in annual sales.

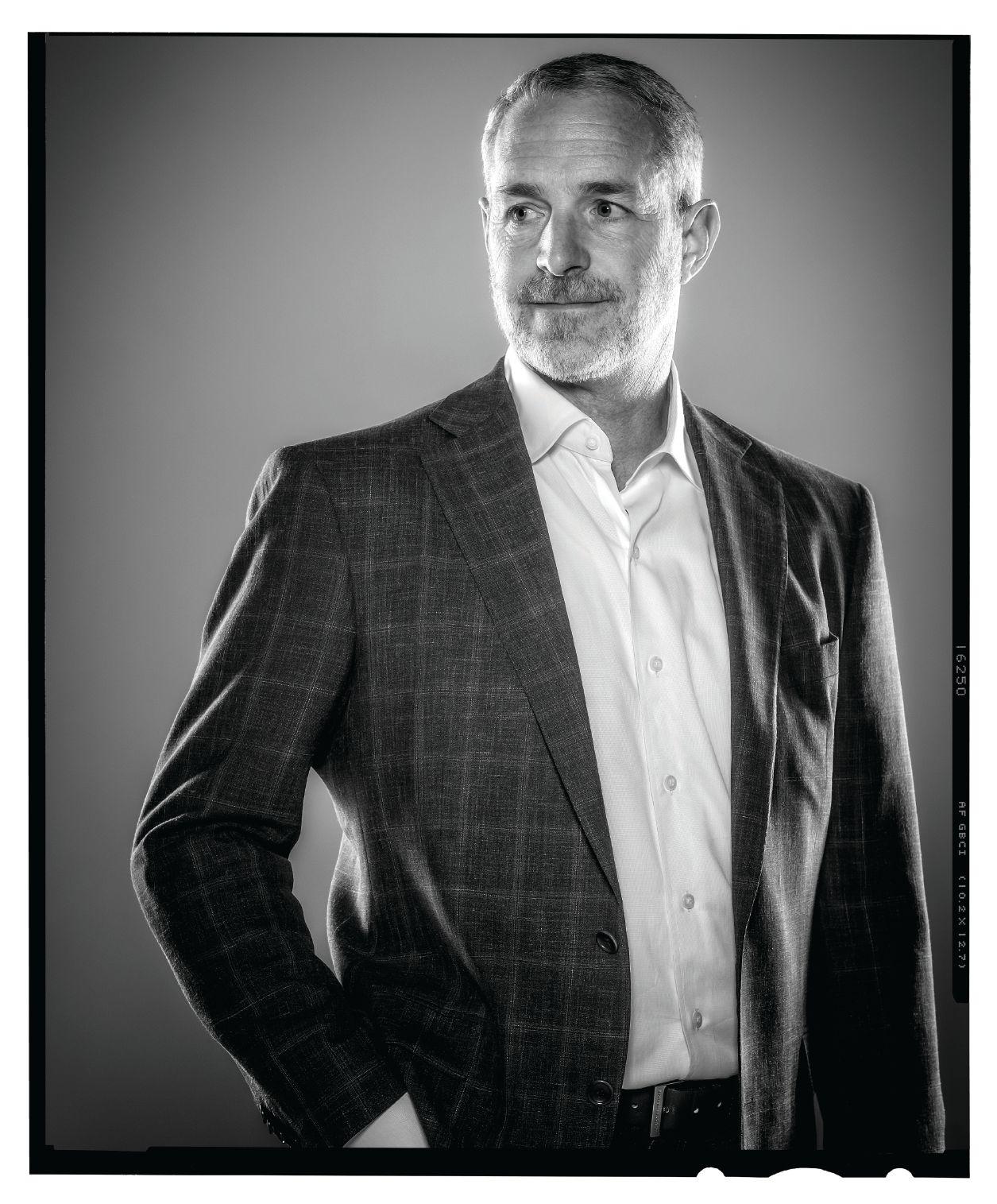

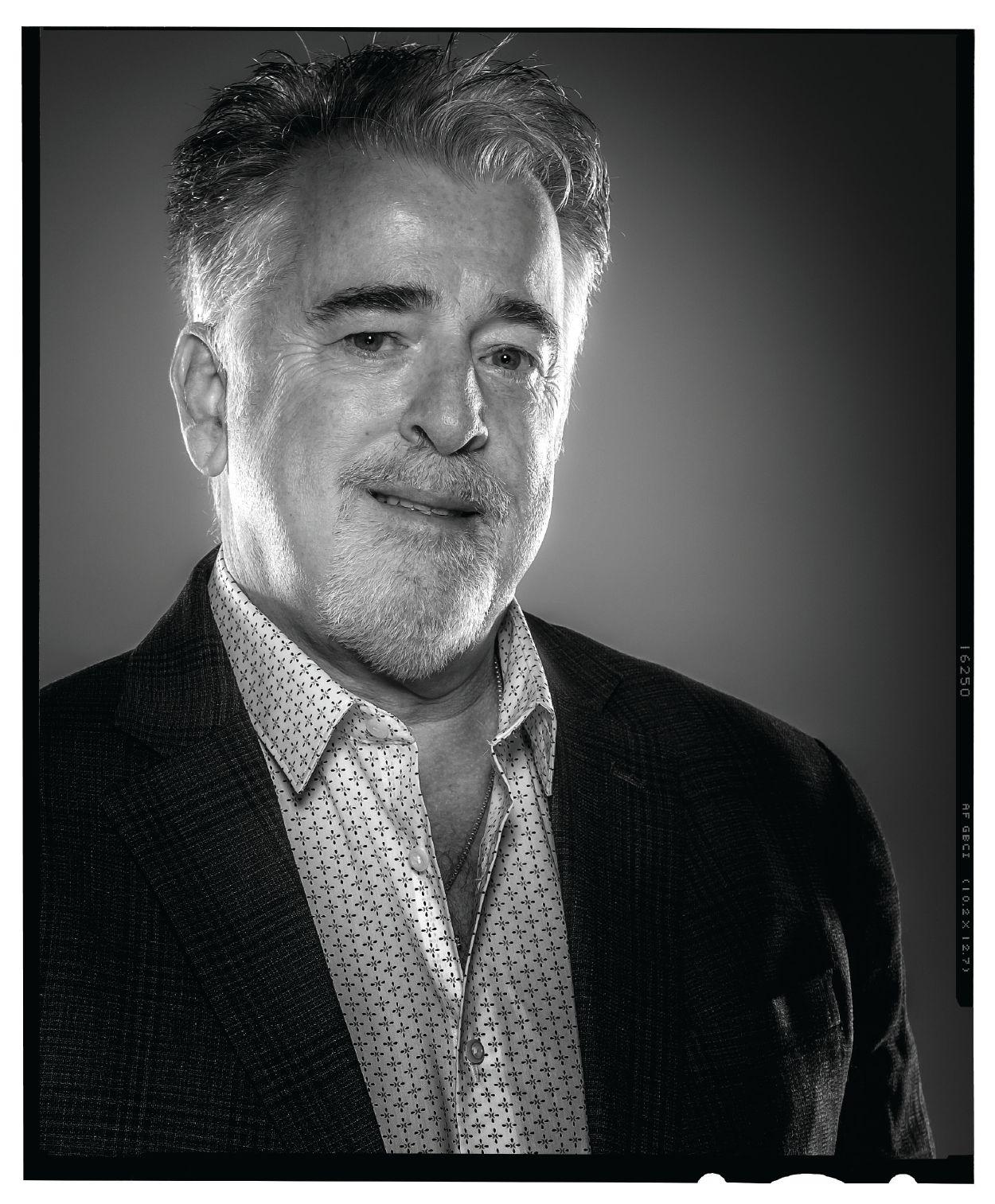

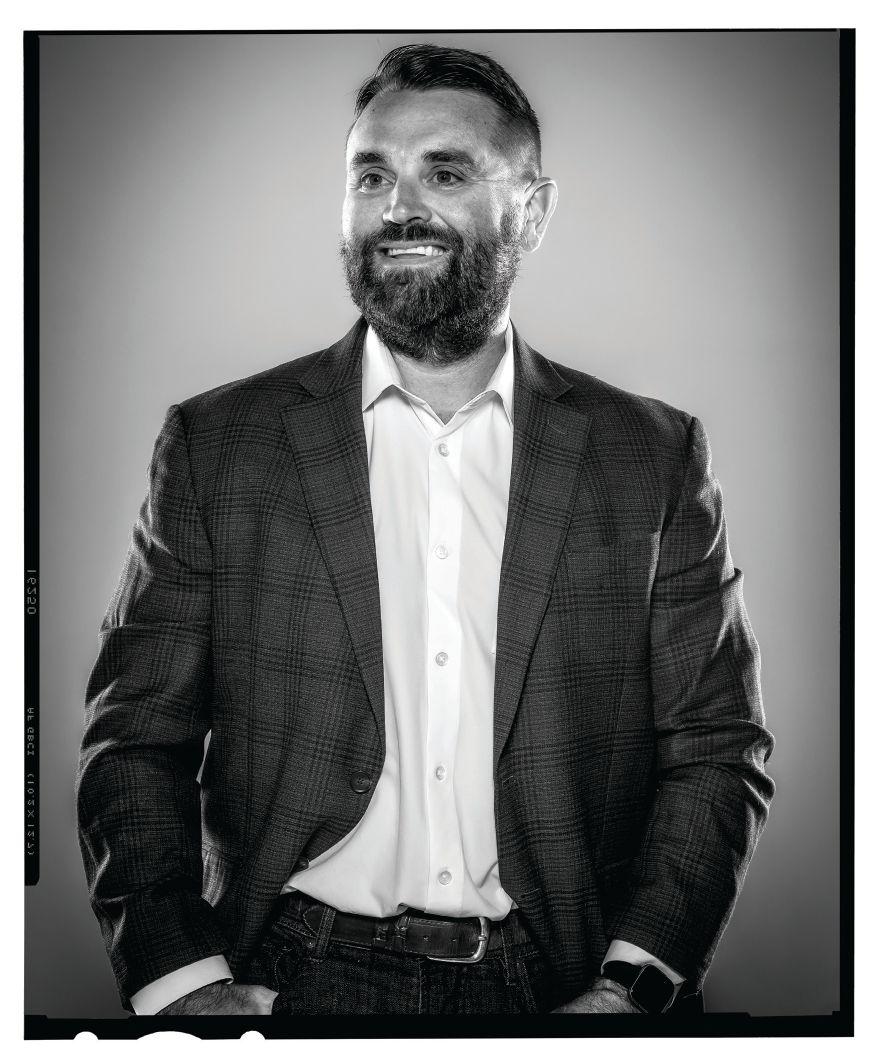

category winner

Michael Freeman Steele & Freeman

Michael Freeman joined his father’s construction company, Steele & Freeman, in 1992 after graduation from Texas A&M. In 2005, his father retired, and Freeman, at 35, bought the company. With $34.2 million in sales in 1999, the company grew to $175.3 million in 2020 and is on track this year for more than $250 million in revenue, according to the company. Over the years, the Fort Worth firm has changed its model to construction management and long-term partnerships with clients, rather than pursuing traditional bid work. Much of its work is from repeat clients. The firm implemented 23 “Fundamentals” that comprise the “Steele

& Freeman Way.” One of Freeman’s favorite fundamentals: “Ride for the Brand. We are successful because of people like you who have been dedicated to our work. You are an ambassador of the Steele & Freeman family. Continue our legacy and enhance our reputation.”

Steele & Freeman has been recognized by Inc. Magazine as one of America’s 5,000 fastest-growing companies. It has also received the Aggie 100 award five times as one of the 100 fastest-growing Aggie-owned or -led businesses in the world.

category finalist

Brandon Flowers

WeatherShield Roofing & Sheet Metal

Business has nearly tripled in three years at WeatherShield, a company based in Aledo. Sales reached more than $30 million in 2020,

according to the company. “We set a goal this year to become a $100 million-a-year roofing company in three to five years,” says Brandon Flowers, the company’s owner. “With the people, equipment, and tools we have invested in, I’m confident we will obtain our goal.”

Flowers attributes the fast scaling to key hires. “We have hired some people that have really let us expand on our capabilities,” he

says. “I’ve always known how to put on a roof; I just didn’t always know the kind of support I need to be able to do it on a bigger and bigger scale.” Like others, the company faces numerous nearterm challenges as it concerns the supply chain. “We have had to be very creative and proactive in procuring materials to meet project deadlines. We started bulk buying roofing materials back in

the spring as soon as word got out that shortages were coming. That, combined with a lot of material prices almost doubling in the past eight to 10 months, has created a very challenging time in our industry. The work is there, we have the people to do it, we just can’t get material when our customers need it all the time.”

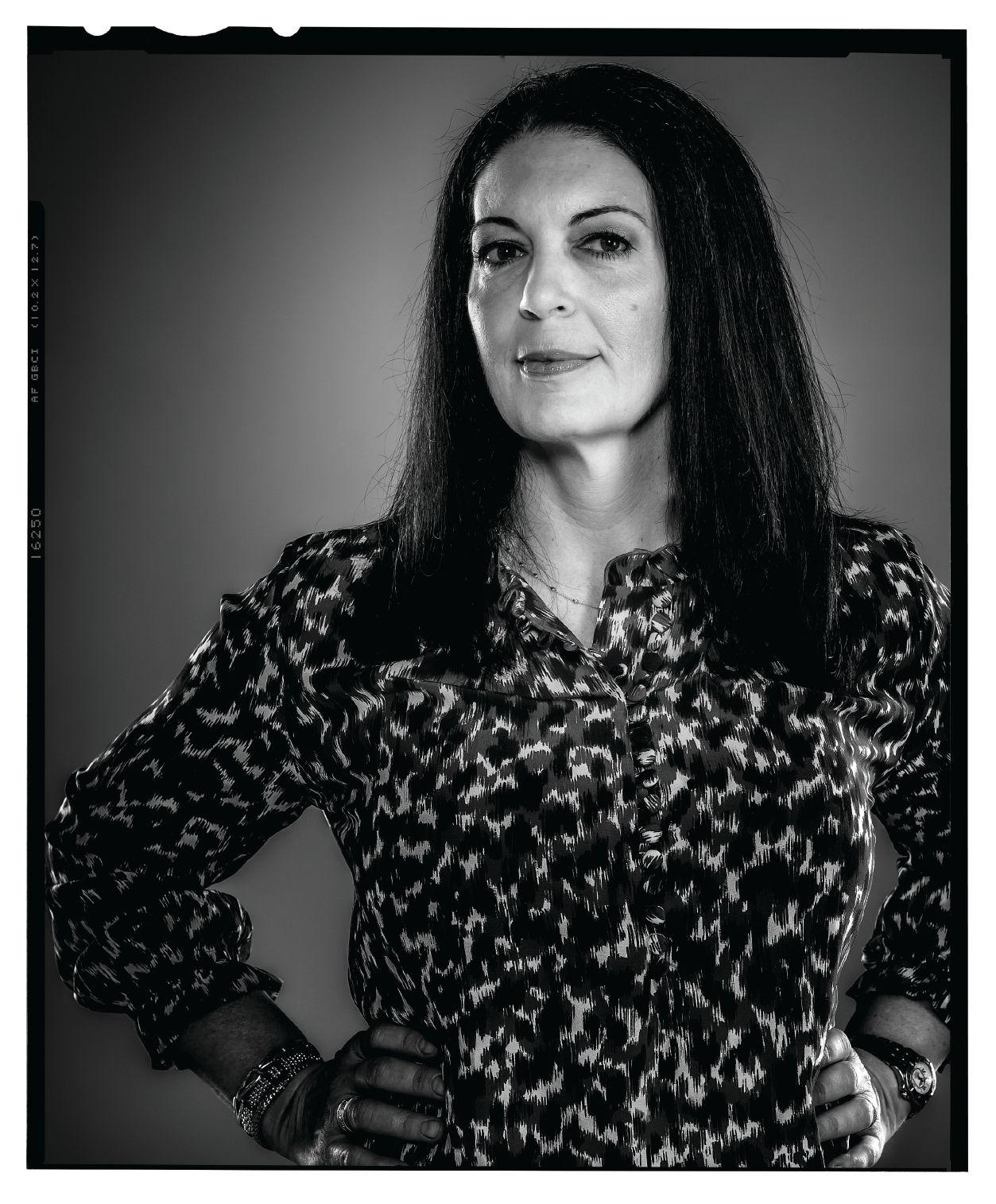

Marcelle LeBlanc

The Velvet Box

Marcelle LeBlanc majored in ornamental horticulture at California Polytechnic State University, San Luis Obispo, but quickly decided that wasn’t a career for her. She got a job as a buyer of adult DVDs out of school. That “gave me the opportunity to travel all over the U.S. and Europe, which allowed me to see successful retail operations of all kinds.” LeBlanc watched as adult products reached new levels in design and appeal and went mainstream in stores like Brookstone and Spencer’s Gifts. “I asked myself, ‘Why not curate a beautiful store in an upscale location with highly trained people that can answer anyone’s questions?’ I wanted to take on the stigma of seedy 18-and-up pornographic stores and create a luxury, comfortable shopping experience that would change the lives of the people who need it the most, helping people connect with themselves and their partners.” In 2009, LeBlanc founded The Velvet Box in Fort Worth. A legal dispute with her first landlord impeded growth early. Today, the company has five boutiques in North Texas. “We have shown consistent year-overyear growth for all five locations, ranging from 14% to 38%,” LeBlanc says. “The focus on maintaining and growing profitability during expansion of additional stores is proven by the increase from 6% to 15% profitability.” Velvet Box closed 2020 with 1.3% growth, “even though we were shut down for an entire month.” LeBlanc’s growth goals: Expand to 10 stores over the next five years; hone the staff training program, Velvet Box University; and multiply customers’ viewership of its popular online courses by five times.

Evin Sisemore

Texas Motive Solutions, LLC

Since graduating LSU in 2007, Evin Sisemore’s career has been about forklift batteries. Her first job was for a forklift battery firm. “I didn’t even know what a forklift

was,” she recalls. That led her to a post at Interstate Batteries. And when Interstate decided to sell its unit that sold premium Hawker forklift batteries, Sisemore, who had foreseen the sale and already indicated her interest, took out a loan to start Texas Motive Solutions in 2018 in Fort Worth as a Hawker distributor. Her vision: “Over the last several years, the motive power industry has been

relatively stagnant, with little to no changes or improvements. My vision was to truly shake up the industry by providing great improvements in service offerings, industry expertise, account management, and product quality.” In 2019, Motive maintained its target profit margins while increasing sales to nearly $18 million, eclipsing its initial year’s $7.5 million, Sisemore says. The company

saw a slight sales increase in 2020 “while also achieving our profitability goals. 2021 has been a great year, where we have already exceeded last year’s performance only eight months into the year, and we are on target to exceed our 2021 revenue goals.” Texas Motive has also grown to more than 40 full-time employees from 18.

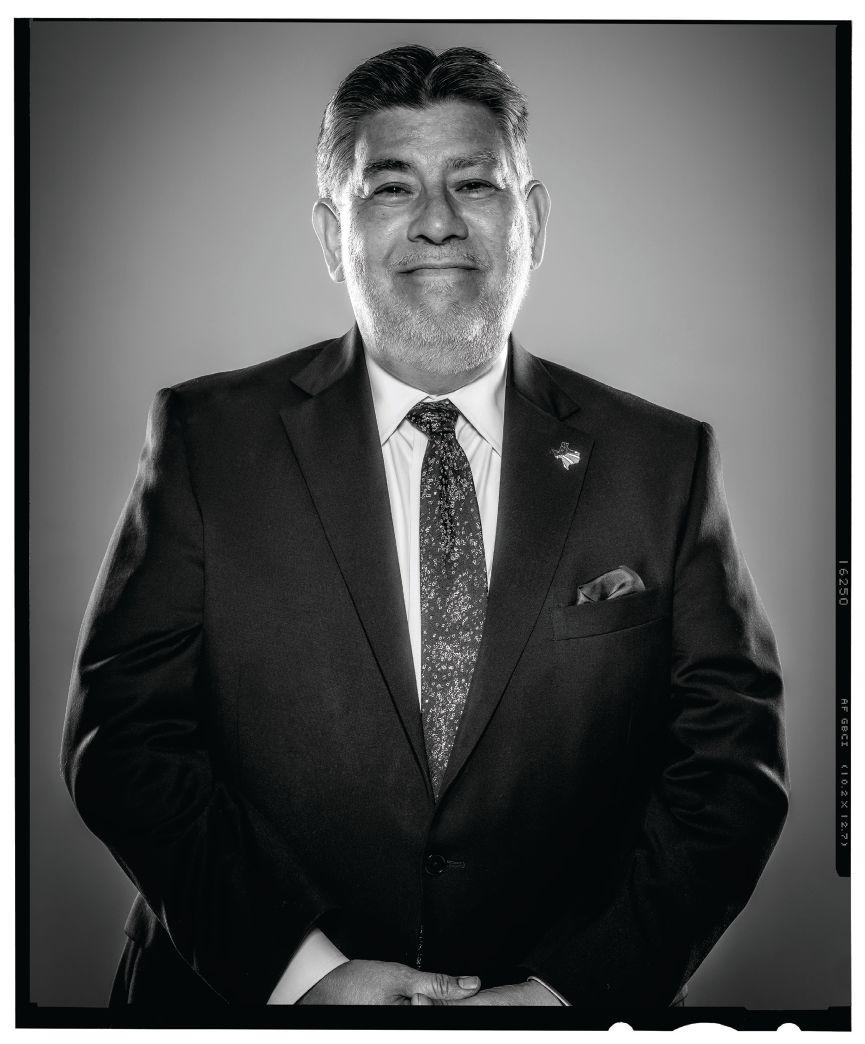

category finalist

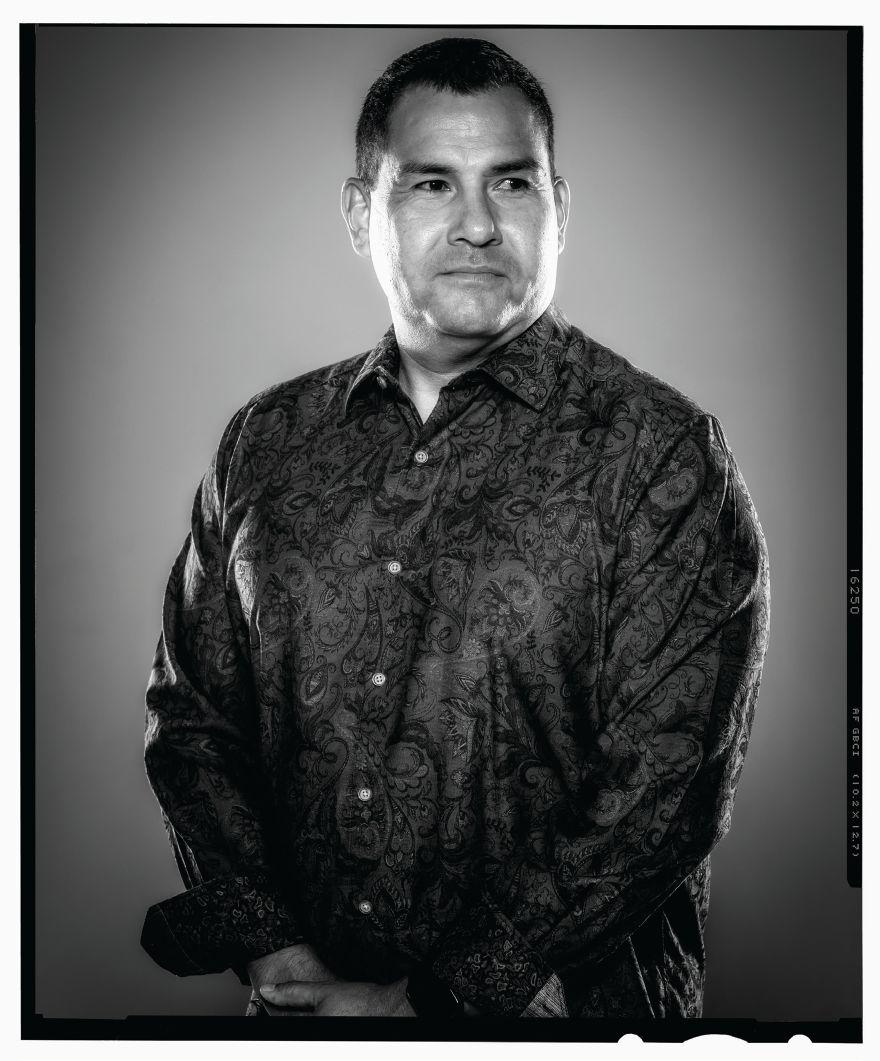

Vince Puente Sr.

The typewriter has gone the way of the Dodo bird (that is, extinct), but Southwest Office Systems Inc., which began as a two-person typewriter repair operation

in 1964, is alive and well and flourishing despite the hardships of recent times. That is largely due to the innovation and adaptability of leaders such as Vince Puente Sr., who in 1972 joined the company his father founded and eventually became co-owner and president of marketing and sales. Since 2001, SOS has operated debt-free, according to Puente, nothing less than a godsend for

any company living through a pandemic. While 2020 was supposed to be the peak of what has become a typical four-year revenue cycle, it became the low point. “The Lord continues to bless us. Even though business life is challenging, even though revenues are down. On the flip side, we’re comfortable in profit,” he says. “We’ve got tons of cash available, and we’ve got, I think for the most part, a happy

staff. The one thing that has not changed at all is our level of service to our clients.” The most significant challenge facing SOS now is staffing. Puente, a proud product of the Fort Worth school district, reached beyond the world of document imaging in 2016, being appointed by Gov. Greg Abbott to the Finance Commission of Texas and reappointed in 2018, a term that is set to run through 2024.

category winner

Elyse Dickerson Eosera

Elyse Dickerson’s Eosera, a fast-growing Fort Worth biotech firm, has watched revenue grow 657% over the last three years, she says. The company was ranked 753rd on the 2021 Inc. 5000 list of America’s fastestgrowing private companies. Dickerson and partner Joe Griffin started Eosera after losing their jobs at Alcon. The two spent nine months formulating their first product, EARWAX MD, for compacted earwax. Six years later, Eosera has more than 10 products in drugstores nationally that help consumers care for their ears. Supply chain disruptions during COVID caused problems for Eosera. But COVID and the resulting boom

of Zoom meetings have boosted sales, Dickerson says, “because everyone is wearing earbuds for work meetings and school. Sticking devices in their ear causes the ear to produce more wax.” A voluntary recall last year related to expiration dates was a hit but reinforced the company’s commitment to safety, Dickerson says. “I knew it was the right thing to do.” Biggest challenges today: widening distribution amid COVID, navigating changing dates for retailers’ annual “resets,” and finding and hiring talent. Eosera is working to get its products into every major retailer and is investing in a bigger, better marketing plan to include more digital and targeting.

category finalist

ExelHealth dba iReliev & PlayMakar Inc.

Mike Williams is a 25-year veteran of medical-device distribution. He launched ExcelHealth, dba iReliev, in 2014 with a single Transcutaneous Electrical Nerve Stimulation

pain relief system. iReliev now sells more than 30 doctor-recommended and FDA-approved muscle stimulators, hot and cold therapies, massage devices, and topical analgesics directly to consumers worldwide. Williams says the company had grown exponentially, bringing in $6 million in revenue each year since 2018, and he projected revenue to surpass 2020’s sales by $2 million. Consistent growth is the

objective for Williams. “I have a strong desire for both my team and me to accomplish meaningful tasks every day. It is what fuels me. I make a point to recalibrate daily based on the activities that contribute to our companies’ sales growth,” he says. “I do my best to always balance the day-to-day operational activities and redirect my activities that are tied to both immediate and more longterm growth.” In 2017, Williams

launched a second company, PlayMakar, focusing on movement optimization to help athletes reach their fitness and performance goals. Because the pandemic kept more people at home, the company adapted its supply orders to refocus on products adapted to customers spending more time at home. Ultimately, iReliev’s goal is to become the household name for pain relief and relaxation products.

The RM Restaurant Group

Brent Johnson realized that for him there was more to life than military life. He only discovered his true calling after returning home from the United States Military Academy at West Point and taking a job in the food service industry. “I immediately became attracted to every aspect of the industry. Competitiveness, business strategy, team building, training, development, and creativity,” Johnson says. He eventually became disillusioned with the business-first mentality of the industry and developed a people-first business philosophy. “The fact that I could pay someone to wash dishes for $6 per hour did not mean that I should, no more than charging someone $10 for a margarita when everyone still wins by charging $7.50,” he says. “I wanted to create a company where relationships mattered. First, last, and always.” To pursue his unique business philosophy, Johnson in 2001 opened Rio Mambo, which has become a Tex-Mex restaurant staple. When the pandemic shut down restaurants, Johnson adapted quickly, converting his restaurants to a to-go format by adding drive-thru lanes, online order lanes, and pickup parking spaces. Coming out of the pandemic, RM Restaurant Group experienced a 25% sales increase across its four Rio Mambo locations, including a 60% increase at the Burleson store and more employees than they have ever had. Moving forward, RM Restaurant Group has finished the design phase for a new Rio Mambo at the Hard Rock Casino and Resort in Tulsa, Oklahoma, which has a targeted opening date of spring 2022.

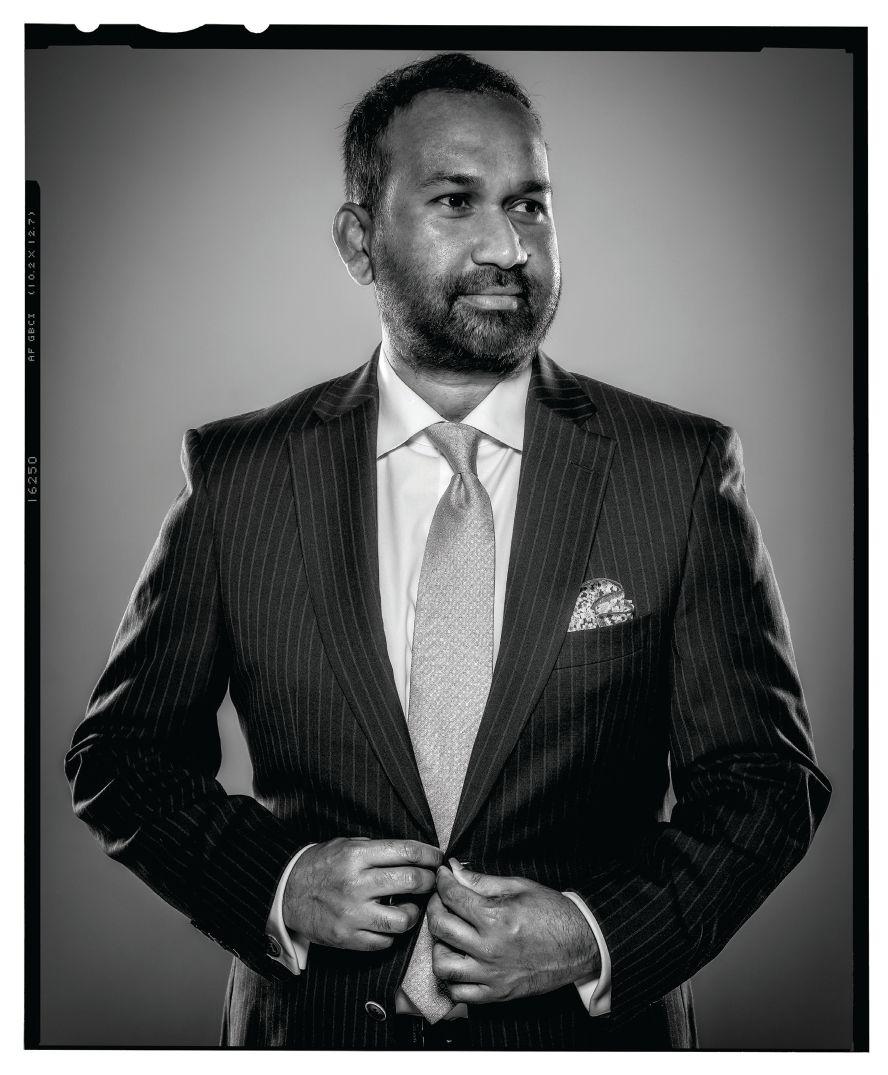

category finalist

Nafees Alam started young, trading and selling sports cards with his pals while growing up. This entrepreneurial spirit only continued to grow as he went through high school and college, studying computer science

and technology. But he was hungry — pun intended — for something more. Alam’s entrepreneurialism met up with a love of food and a “fascination with what makes something especially delicious and enjoyable to a growing market,” he says. Alam’s career started at Nokia, but when an opportunity to step into the hospitality and culinary field presented itself, he took it, a leadership position with Waffle House. While working at

Waffle House, he and his business partner Mike Hoque founded DRG Concepts, a “successful and dynamic family of restaurant concepts across diverse cuisines and experiences — all with excellence,” Alam says. DRG Concepts was on track to have its most successful year in 2020, and as the pandemic wanes (we hope), DRG will reopen carefully as the market and business climate allow. Alam says he is grateful his business can withstand

the pandemic, and DRG Concepts has built back slowly. “Given the current immediate dynamics and business travel not being quite at the expected levels, we will be timing our next openings over the next six months with careful discernment,” he says. Alam’s immediate goal is to rebuild the team and business to pre-pandemic levels and continue the tradition of bringing fresh and innovative ideas to Dallas and Fort Worth.

The Wealth Planner

John Loyd, a firstgeneration college student in his family, remembers asking his father at age 12 what it meant that the “Dow Jones went up or down?” For his 13th birthday, Loyd requested and received a subscription to a money management newsletter. Loyd learned the value of goals when, as a teen, he started a lawncare business and motivated himself with handmade messages such as “Work your,” ahem, tail, “off!” that he posted in his bedroom. At 18, Loyd walked into a Dean Witter (now Morgan Stanley) office and opened an investment account. And when he was in college, he wrote to Warren Buffett, asking for copies of his annual report, including a $5 McDonald’s gift certificate (a Buffett fave) and two $1 bills to cover

postage. Buffett signed one of the bills and returned it, “which I have hanging on my office wall.” After college, Loyd, who went on to earn an MBA from Purdue University, was working for a major financial services firm. In 2004, he went out on his own. Loyd recalls attending a meeting in the 1990s when the presenter asked the participants to state why they entered the investment business. “I was shocked to hear many participants say, ‘to make money.’ I started in this business over 20 years ago to help people, and that has never changed. Before I started my own wealth management firm, the company I worked for out of college had sales quotas. I always felt that was a conflict of interest, and it’s one of the reasons I branched off on my own.”

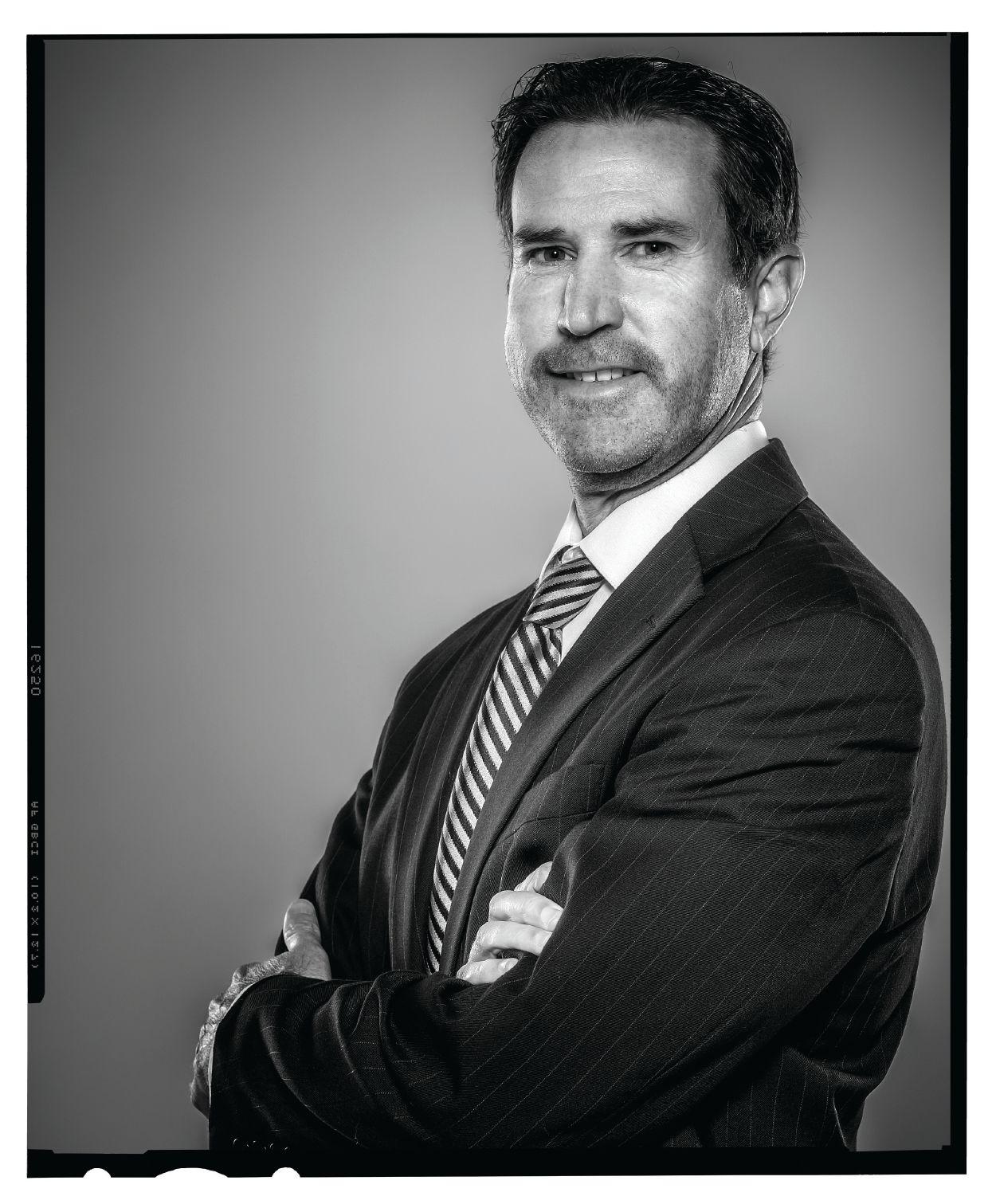

category finalist

Travis Patterson Patterson Law Group

Travis Patterson has had some role models for his journey through the law. His father was a lawyer, specializing in real estate but

also with a personal injury pre-litigation practice, helping clients resolve cases without filing lawsuits. “I always knew I wanted to be a lawyer like Dad, but I wanted to go to court,” Patterson says. “And that’s what I did.” After graduating law school in 2012 from UT Austin, he worked for firms in Dallas and Fort Worth, which gave him a “crash course” in Texas litigation. “But I wasn’t happy.

I wanted to help people, not corporations.” That’s when he, his father, and wife Anna, also a lawyer, decided to go in on a one-stop-shop personal injury firm, representing clients who’ve been injured through “no fault of their own.” “We’ve enjoyed steady growth for a while now. Not just revenue growth, but growth in happiness, fulfillment, capabilities, reach, talent, technology, clients.”

category finalist

Edward Crawford Coltala Holdings

Edward Crawford and partner Ralph Manning launched Coltala in 2017 and set up its headquarters in Fort Worth. Coltala Holdings is a holding company focused on acquiring majority ownership in

stable U.S. businesses in health care, manufacturing, and business services. Its Trüdela Partners is a DFW-based company specializing in home-service repairs and maintenance. Its Choice Health at Home is a leading regional provider of health care services, including home health, hospice, rehabilitation therapy, and chart-coding services. And Coltala’s Revere Packaging is a provider of single-use aluminum and plastic packaging solutions to food

service. Crawford holds a bachelor’s degree in English from TCU and two master’s degrees, including an MBA from MIT. Crawford’s mother was an entrepreneur who built a Suzuki violin school from scratch. “She was very mission-oriented in her approach.” Crawford’s grandfather was an Austrian Jew who immigrated to the U.S. after escaping the Holocaust. “I started my first profitable business venture in high school, then started a success-

ful coffee business in Dominican Republic while in the Peace Corps. I also built a business internally at Goldman Sachs and helped build a real estate company in Florida and Texas.” He and Manning “believe in improving the lives of others through business. Our mission and margin approach at Coltala help us both live our mission through building sustainable companies that make a difference in the world.”

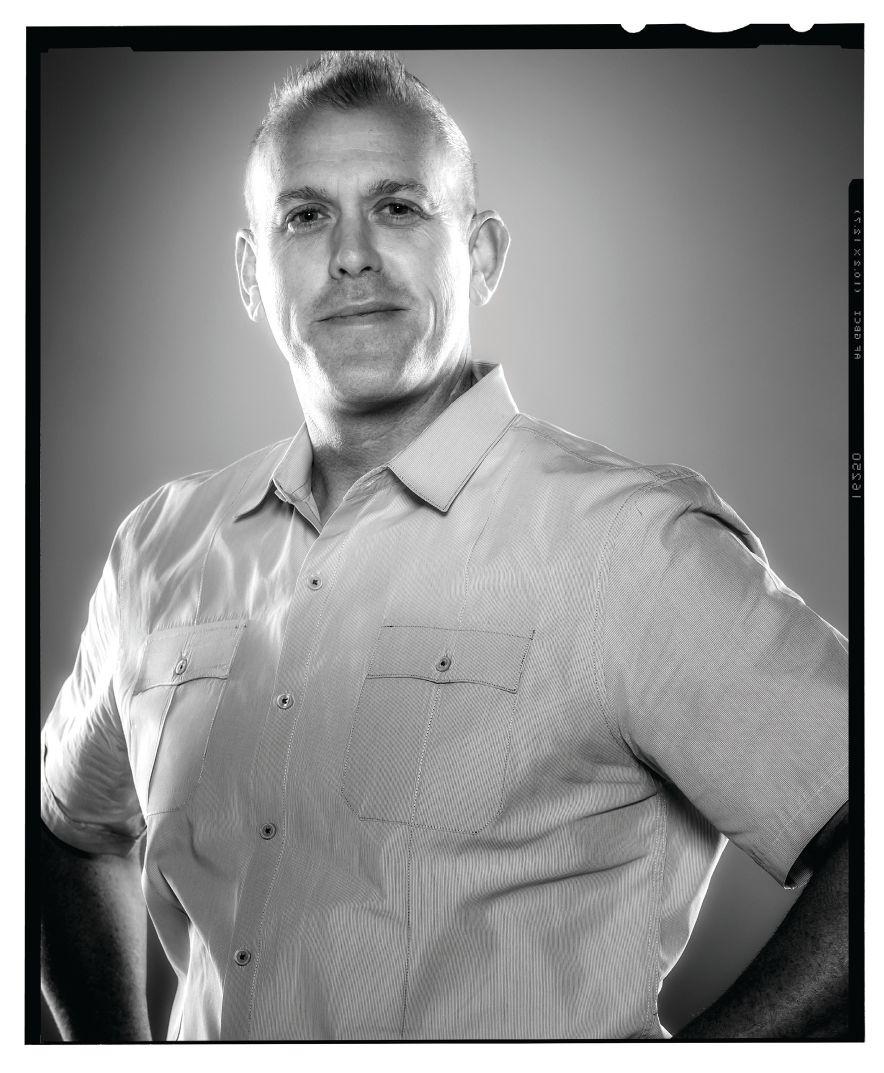

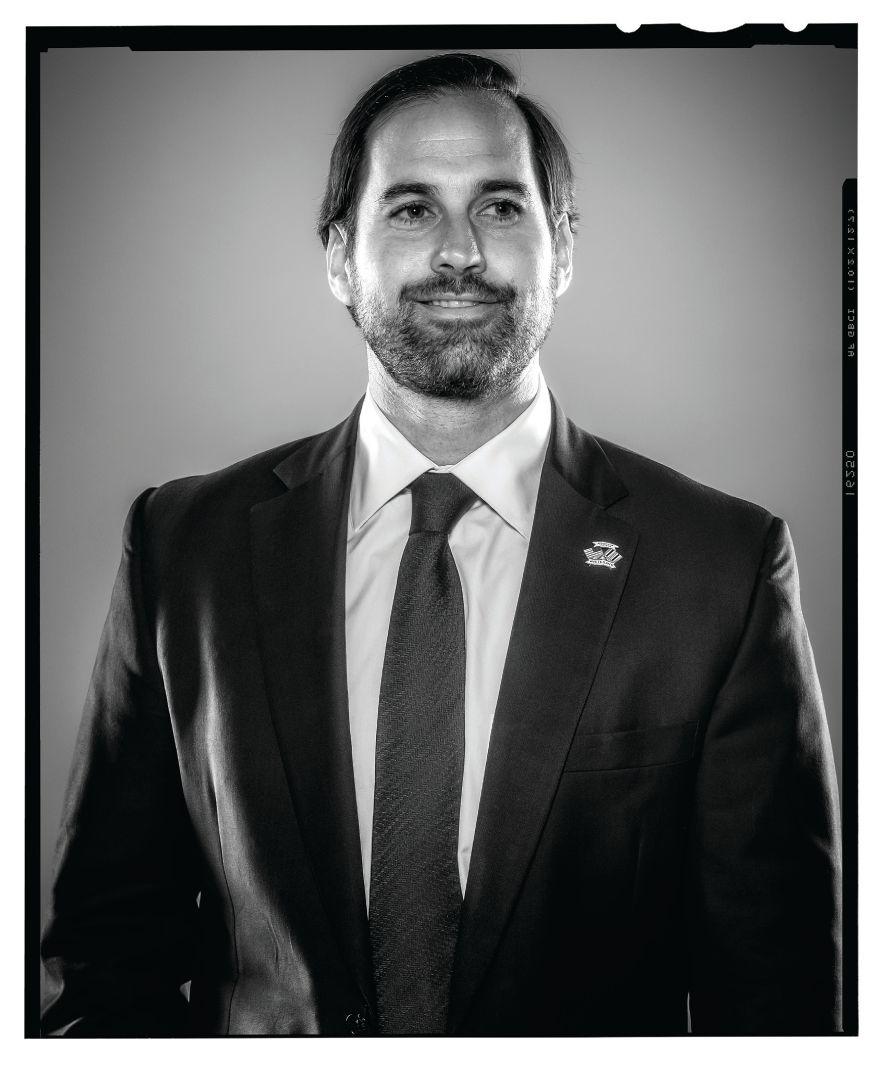

category winner Branson Blackburn

Trinity Real Estate Investment Services

Branson Blackburn started chasing the entrepreneurial dream in high school, selling discounted snacks from his locker and cruising around town on a moped, selling Cutco knives. Ultimately, real estate offered the perfect career path and competitive challenge for the business-minded young man. The first five years in real estate were challenging until Blackburn refocused from multifamily investment properties to the triple net lease sector, taking an interest in the large buyer pool of the dollar store market. Fort Worth-based Trinity

Real Estate Investment Services has grown over 50% in revenue each year for the past three years, earning $3.5 million in 2018 and being on track to pull in $11 million for 2021. Trinity has also grown from a team of 12 to 35. The company had its challenges through the pandemic, but business increased. “The majority of the single-tenant net lease properties we sell were designated as ‘essential businesses’ during the pandemic, so activity increased dramatically,” Blackburn says. “Businesses like dollar stores are especially recession-proof and generally fare better during economic crises like the one the pandemic created.” Moving forward, Trinity wants to continue its growth and expansion with a “nationwide footprint” and offices in the key investment regions. “Our goal is to increase our revenue by 50% every year and continue to expand the team. Currently, 3,300 square feet of the space we’ve leased is empty, but we intend to fill that space with new folks by the end of 2023,” Blackburn says. “Committing to Proof [new company headquarters] in this way has been a great reminder for us of the importance of investing in growth opportunities.”

category finalist

Dr. Thomas Black, reviewing the past two decades, asserts that his “greatest attributes have arisen from my greatest failures.” An admitted bad high school student, he enlisted in the U.S. Navy after

graduating. “My Navy experience awoke in me a sense of responsibility in my future — it was up to me.” He ended up going to college on a full scholarship and then to medical school at the University of Texas Medical Branch at Galveston. While in his medical residency program, Black began reading about finance and real estate. After becoming a board-certified emergency physician and being married with children, he began

rethinking his future and started buying rent houses as an investment. “After obtaining a portfolio of 10 or so homes, I decided to develop a small 20-unit apartment community, which only served to accelerate participation requests from colleagues and further drive my passion and knowledge.” From this, he founded Napali Capital, resigned from a private physician group, and moved to the DFW area to build Napali. “The guiding

principles of the platform were to educate other doctors on private equity investing and to provide investment opportunities in various real estate assets.” In the past six years, the firm has acquired $500 billion in assets under management, he says. “We have grown to over 2,000 investors in 40 states with a stellar track record of returns having raised over $100 million in equity.”

category finalist

The last three years for League Real Estate, broker and partner Matt Lewis says, “have been quite a ride.” At the start of 2019, the Fort

Worth firm had just moved to new 2,200-square-foot offices on the West Side from a small co-working space. In January 2022, League will make another move, this time into a 6,000-square-foot home on Interstate 30. They have also added two satellite offices in Johnson and Parker counties to, in the words of Lewis, “better serve our clients and agents in that market.” The

Johnson County office has tripled in size in the last six months, Lewis says. In 2019, League had three staff members. League now has 10 staff supporting its 80-plus agents. In 2019, it had 40 agents. League is now the seventh-highest producing brokerage in Fort Worth, Lewis says. “One of our bedrocks was being Fort Worth first, and the city has accepted us and put their trust

in us.” Growing up in Midland, Lewis remembers accompanying his dad in checking on the family’s rental properties on Saturdays. Lewis was a double major at Baylor, earning degrees in 2002 in real estate and finance. He quickly obtained his real estate and broker’s licenses and dove into buying investment property.

Susan Semmelmann

Susan Semmelmann Interiors Inc.

Susan Semmelmann has spent a career designing and building homes. Nearly three years ago, she launched her own design brand. “I followed God’s lead to go out and give to the world. The freedom to breathe in all life has to offer is where the overwhelming blessing has arisen. I started with just wanting to do what I love to do with my clients, share and give to others. It quickly escalated into a full-blown business that has grown exponentially tenfold.” She started with a design client referred by a friend, “and it quickly turned into 11 jobs within three months, and now we are servicing over 60 projects, full turnkey homes, with 10 awaiting to construction plans.”

Semmelmann started with five employees and now has 15 and is “hiring as we speak.” Semmelmann is building a design center on Fort Worth’s West Side that will house her firm, a retail space called the Fort Worth Design Studio (“this will allow the public to come in and use all of our resources, along with being able to have help from one of our designers”), and her Fort Worth Drapery store. “We are also going to be servicing other designers. We carry more lines worldwide than ever before and truly have endless possibilities.”

category finalist

Jason Webber

JWC General Contractors

JWC General Contractors, founded by Jason Webber in Southlake in 2018, has turned into a perennial bloom. The firm

“has seen tremendous growth year after year,” Webber says. “From a small little executive office with a couple people to a large office with warehouses and more than 30 employees.” Last year, Webber started ADH Disaster Restoration. He and wife Jamie own Webber Family Investments, a company they started in order to buy multifamily property. In its first year, JWC had a $3 million-$4 million

backlog. For 2021, “our goal is to hit $14 million,” Webber says. “Shoot for the moon and land on the stars.” Materials shortages have been a challenge.

“We are still on track to move from a seven-figure company to an eight-figure company. Really, the only thing that has been challenging is the material shortage and never knowing what next week looks like with timelines.”

category finalist

Paul Ramon

Ramon Roofing

Paul Ramon learned how to run his own business by watching his father. Following in his footsteps, Ramon started his own roofing business as a 24-year-old in 1995 with $5,000 in capital he earned by

working for other roofing companies. Ramon Roofing is now a full-service company specializing in metal, tile, and slate roofs. They even have a sheet metal shop for customizing copper and metalwork. Ramon says the company experienced steady growth over the past three years, and while the pandemic took a bite out of his business, Ramon Roofing weathered the downturn with a rainy-day fund and a Paycheck

Protection Program loan. “One of the most import business decisions I have ever made was keeping a just-in-case fund. With the PPP loans and our backup fund, we handled COVID very well,” Ramon says. “From March of this year, we have been getting busier and busier.” The pandemic isn’t the only challenge facing Ramon Roofing and the industry at large. Staff shortage, material availability, cost increases,

and the dreaded Winter Storm Uri, aka, “snowmageddon,” in February hit the industry hard.

“While most people understand the reason for all the price increases and shortage of materials, some don’t,” Ramon says.

“We are very fortunate that 90% of our clients like to work with us on figuring a solution. We are hopeful that things will get back to normal by next year.”

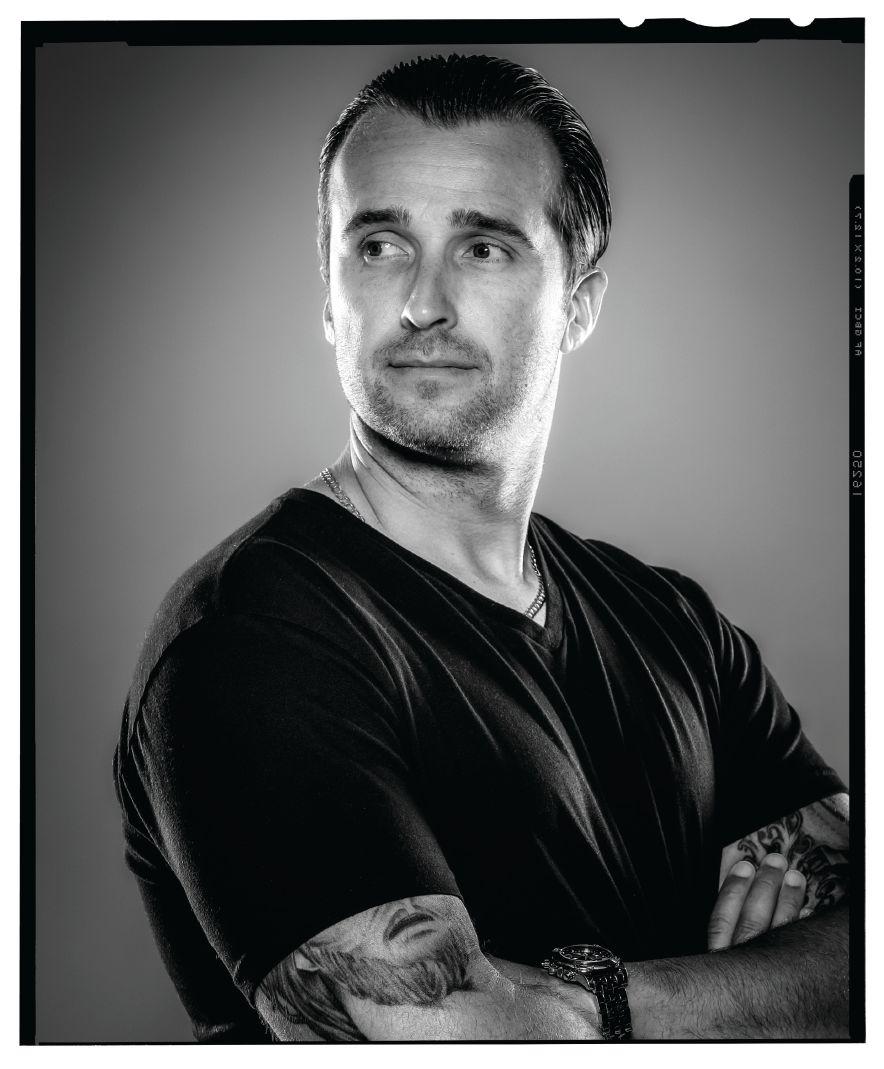

Walter Monk

Pollmakers

Walter Monk has dabbled in businesses: gas stations, lobster (although he says he never caught one), bars, dating services, advertising, and another 18 ideas that failed. “It was pretty discouraging, but I had no choice but to keep trying.” A defunct dating service spawned a firm with offerings for the political, nonprofit, and marketing research industries, generally doing mass communications “on behalf of clients’ clients that are running for office.” In the fall of 2020, for one, Monk’s firm was sending millions of text messages and phone calls for both the Trump and Biden campaigns. “And we were sending messages and phone calls on thousands of smaller races throughout the U.S. and Canada. However, even though we have many clients, we never forget that every race matters a lot to the people in it.” In 2020, the firm did $14.6 million in sales, three times its previous record. Its profit was greater than the previous eight years combined. In 2020, the Arlington firm upgraded its server room and now has more than 500 servers running in that location. “In 2021, which is a year without many elections, we are on track to do $8-plus million in sales. And 2022 looks like it will be absolutely amazing.”

category finalist

Dennis Hoang

Patturn

Dennis Hoang and his brothers Davis and Douglas came from different directions to create a solution for the reverse logistics, excess inventory, and returns

management industry. In 2019 as a New Year’s Resolution, the brothers created an end-to-end platform called Patturn that enables brands and retailers to recover profits from their returns and excess inventory. “Our solution determines the best steps of finding a new home for inventory. It helps manage, track, and control every single aspect of their returns, repairs, and after-sales care to ensure that it’s reduced their

operational cost and increasing their bottom line,” Dennis Hoang says. Since launching Patturn, the company doubled revenue in 2019-20. “We’re on track to doubling our revenue once again for 2020-21. We hired an additional eight employees to support our growth, and we’re looking to hire an additional 10 as well. We are also expanding into a new facility/warehouse here at the beginning of Q4 2021.”

Fort Worth Inc. is read by an influential range of successful businessmen and businesswomen around the Metroplex. The magazine is targeted to business owners and C-level management across a broad range of businesses.

Founded in 2000, True North Advisors is an independent Registered Investment Advisor (RIA) with $2.7 billion* in assets under management, serving as a fiduciary to high-net-worth families throughout the state. Without inherent conflicts of interest or internal products to sell, we craft truly customized solutions for each of our clients. Additionally, we have developed robust platforms for alternative investments and wealth planning that distinguish our firm in the marketplace. We are proud to serve local families, business owners and entrepreneurs

and look forward to propelling the city of Fort Worth forward.

Chris Pate leads the Fort Worth office of True North Advisors and serves on True North’s Management Committee with the firm’s two founders. Chris serves on the Investment Committee as a voting member and spends time sourcing/evaluating private investment opportunities for clients of the firm. Prior to True North, Chris spent 8 years managing both the public and private investments for Western Commerce Group’s asset management practice. Before Western, Chris spent 11 years at Q Investments, a Fort Worth based multi-strategy hedge fund and family office.

Chris graduated Cum Laude from Texas Wesleyan University with a Bachelor of Business Administration in Finance and Economics. He lives in Fort Worth, spends his free time with his wife and three teen-

agers, and is an active member of Young Presidents’ Organization.

Mark Davidovich is a Senior Advisor with True North advising families and individuals on tailored solutions for investment management and wealth planning. Prior to True North, Mark worked as an advisor at JP Morgan and Goldman Sachs. Previously, Mark held roles with a family office, a publicly traded Oil and Gas firm, and political positions with President George W. Bush and Senator John McCain.

Mark graduated with honors from Southern Methodist University and earned an MBA from the University of Texas. Mark lives in Fort Worth with his wife Marianne. He serves on the Fort Worth Country Day Alumni Council and is a member of St. Patrick’s Cathedral and Cliburn 180

BY MICHAEL MOORE

The recent Facebook/ Instagram/WhatsApp outage provided each of us with a very real potential concern.

What if hackers implemented cyberattacks that simultaneously and completely shut down the backbone of our entire communications system?

While it appears that the stoppage was due to an internal Facebook error, the question persists: Could hackers successfully attack the most sophisticated platforms on the planet, from Facebook/Instagram/WhatsApp to Google and Twitter?

They already have. Consider that hackers:

• Stole the personal data of 533 million Facebook users early this year

• Hacked Twitter last year when 130 highprofile users and corporate accounts such as Apple and Uber were compromised

• Invaded more than 30,000 Microsoft accounts

According to reports, hackers currently deploy millions of daily attempts at these targets, any one of which would be considered “the holy grail” to disable. With so much focus on highprofile targets, why should you and I be concerned?

The answer is simple: Because you and I are the “low-hanging fruit” that is easy to pick.

Oh, sure, a hacker or hacking network will earn incredible notoriety by taking down a social media giant, but that will take an inordinate amount of time with minimal likelihood of success.

These hackers are sending out thousands — even tens of thousands — of attacks simultaneously with a single keystroke. There are two massive, easy-to-attack targets: you and me as individuals and the companies that we work for or own.

Consider this statistic from dataprot. net: 57% of people who have already been scammed in phishing attacks still haven’t changed their passwords.

You and I as individuals are at risk because we don’t personally employ IT/cyber experts. Using our laptop, desktop, tablet, or smartphone leaves us vulnerable because we most likely get lazy with easy-to-remember passwords, such as the name of our first pet, maiden name, birthday, favorite vacation destination, or children’s names.

If you operate a company that conducts business online, know that 33% of account-compromise victims

have stopped doing business with companies and websites that leaked their credentials.

All it takes is just one employee — even a temp worker — to open an email and click a damaging link. To protect yourself and your company, here is what to look for:

• An email or text from a friend who normally sends a message but, for some strange reason this time, sends only a clickable link — maybe even a joke

• A clickable link with an address that makes no sense to you (I prefer links that begin with “https” to show they are secure sites and for the link to reference at least something I’m familiar with — espn.com, bbq.com, etc.)

• The email address is not quite the same as the address you normally hear from (instead of joe@heatingac.com, the address is joe@heatngac.com)

We as individuals and businesses are at risk if we do not employ a thirdparty password service that allows us to create a multitude of different passwords and remember just the one for logging into that service. The more complex our password is with numbers, letters, and symbols, the more effective that password will be.

With the average person having 80-100 passwords, developing a protocol or structure is essential. Anything less leaves you and your company wide open to hacking and to more hassles than you can ever imagine in straightening out your life and your business.

In medical terms: You are in critical condition. Act like it.

Michael Moore established M3 Networks in 2008 with the $1,000 that he and his wife Stephanie had saved. He grew M3 Networks to offices in Southlake and Fort Worth and serves clients throughout Texas.

Submitted by Justin Holt, Tarrant County Market Leader, Regional Executive Vice President for Origin Bank

In today’s environment of acquisitions and consolidations, the banking marketplace is rapidly changing. This can leave customers feeling unsettled, not knowing where to turn for the service and stability they deserve from a financial institution.

That’s why it’s so important to know what to look for when you’re choosing your relationship

banker, so you’ve always got a trusted advisor to guide you through your financial needs. One size does not fit all when it comes to banking, so look for a bank that’s big enough to offer a full portfolio of products, but small enough to provide personal, responsive service. Your banker should be nimble, with the ability to make quick decisions on loan requests and

the knowledge to guide you through financial transactions, no matter how small or large. Your go-to bank should offer advanced technology, with apps and online features to help you bank with ease no matter where you are in the world, 24/7. But they should also embody a culture that values personal relationships and commitment to community, demonstrating that while technology is a valuable and convenient resource, it should not replace human interactions.

Local matters, especially when it comes to banking. At Origin Bank, our relationship bankers are just a phone call away, and our leadership teams are embedded in the communities they serve. We’re proud to offer a community bank feel with personalized services to suit consumer, small business and commercial banking needs.

Contact me directly at 682-286-1902, visit us at Origin.bank or call us any time at 888-292-4037 to learn more.

In today’s banking landscape, technology is the rule – human interaction and genuine relationships are the exception. Origin Bank delivers on both. Our trusted advisors are there for our clients every step of the way and have worked together to help our communities grow for more than 100 years.

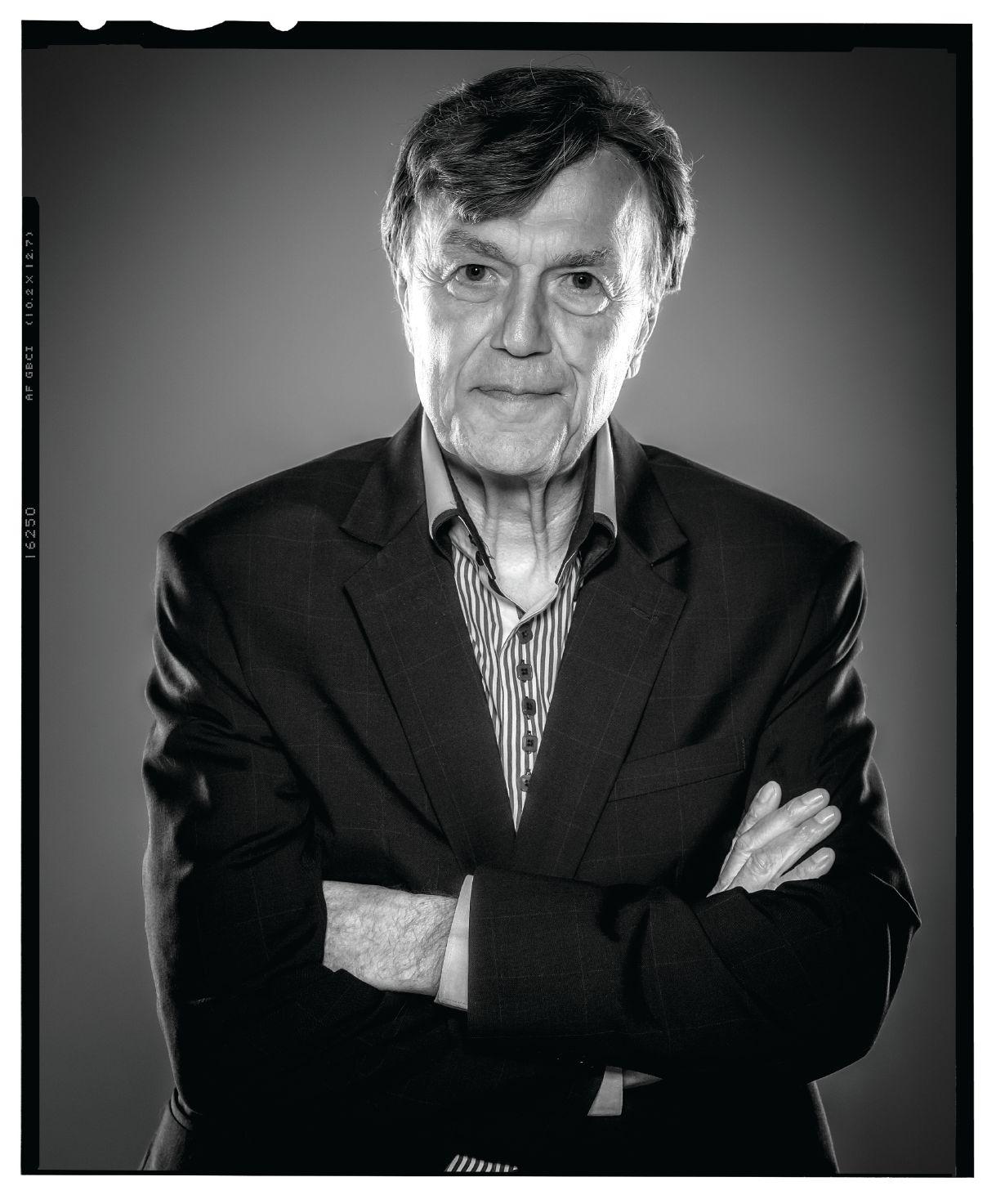

Worth psychiatrist, on mental health, entrepreneurship, and taking the next step

BY SCOTT NISHIMURA / PHOTOGRAPHY BY OLAF GROWALD

Dr. Brian Dixon’s early inspirations for becoming a physician: “I grew up watching Doogie Howser and Beverly Crusher on ‘Star Trek.’” Dixon didn’t know he wanted to be a psychiatrist until he did his clinical rotation in psychiatry while in medical school. “You get more time to sit with people and figure things out,” he says. “I enjoy kids and working with families.” Dixon went out on his own after his second job, at Cook Children’s in Fort Worth. Vocal of mental health as an aspect of social justice and critical to a holistic health care approach, Dixon argues mental health gets the short shrift. He doesn’t accept insurance. “Insurance keeps me from doing my job. Lots of insurance companies don’t pay for therapy being done by a psychiatrist.” He’s working on an unusual idea that’s raised his profile: developing a mental health medical office complex, abutting the city’s Glenwood Park in the Southeast Fort Worth neighborhood

of Historic Southside, where he lives. In 2019, Dixon joined the Entrepreneurs’ Organization Fort Worth Accelerator; the Accelerator is designed to help guide members to their first $1 million in annual revenue.

Finding office space as a mental health pro Because of patient privacy, “we have to have places designed that minimize the risk of information getting out there. Soundproofing, secure Wi-Fi. We can’t book 40 patients, and we want our patients to feel this is a safe space to be. It makes finding space really hard.”

Managing through COVID19 “We’ve never had a year of losses. 2020 was a year of levelling off. We switched to online. We bought a Zoom health care account for $200 a month. Patients love it, especially our established patients. New patients are a lot harder. As soon as we could go back to the office, we switched to inperson. Now it’s about 50/50.”

Why Mindful? “There’s a movement called Mindfulness, where you accept the moment as it is and don’t pass judgment on the moment.”

The park idea “We need to have a physical representation of our commitment. There’s more research coming out, about [the benefit of] getting into nature. We want people getting out, walking in nature. We’re in a ZIP code [76104] that has the lowest life expectancy in Texas.”

Job: CHILD PSYCHIATRIST, FORT WORTH

Hung out own shingle: 2014

department. The last answer I got from parks was trying to preserve parks space. It won’t work anywhere else. To have protected space beside the development is very important. I want it to be a boon and benefit to that neighborhood.”

Practice name: MINDFUL Employees: 9

Grew up: EAST TEXAS

Siblings: YOUNGEST OF FIVE

Undergrad: BAYLOR

Med school: TEXAS A&M

The developer “We found a developer in Alabama who does medical office buildings and inpatient behavioral hospitals. We priced this out somewhere between $20 million and $25 million to do the full concept.”

Talks with the city “The last answer was talk to the parks

HEALTH SCIENCE CENTER

What he’s learned in the EO Accelerator “I didn’t have a grasp of how to manage people or how to build really transparent processes. I need any coaching I can find. We have nine employees — four other psychiatrists and four other administrative staff. This year, we took those administrative staff and spun them off into a separate company. The goal is there are lots of therapists who would love to have a private practice. What we can offer is turnkey service. If you want to truly scale, that’s the model you need to use.”

The federal Employee Retention Credit is the new superstar of the stimulus package. But be wary of complexities and changing rules.

BY STEPHANIE BUDUHAN

When I think back to the beginning of the pandemic in March 2020, I’m reminded of the frenetic pace at which everyone was trying to figure out the various relief options of the federal CARES Act. Very quickly, the Paycheck Protection Program emerged as the superstar of the stimulus package. For the next several months, my colleagues and I were inundated with questions about the PPP.

And although, at the time, I was somewhat familiar with the Employee Retention Credit, a tax credit that came out of the CARES Act, it was not until January 2021 when the ERC slowly began to gain more attention. Congress passed the Consolidated Appropriations Act of 2021 at the end of December 2020, and it dramatically changed ERC rules.

Prior to the passage of the CAA, a business had to choose between participating in the PPP or claiming the ERC. But under the CAA, Congress removed the “eitheror” limitation. Now, businesses that had already taken a PPP loan could go back and also claim the ERC for 2020, provided they were not claiming PPP and ERC funds to cover the same payroll costs. On top of that, there were additional changes to the rules for the ERC: The credit would extend into 2021 rather than expire at the end of 2020; it would be easier for businesses to be eligible for the 2021 credit; and the credit would be larger in 2021.

The ERC is now becoming the new superstar of the CARES Act.

I Claim the ERC? There are many complexities when it comes to the details of the ERC. You should consult with your CPA or payroll provider if you are thinking about claiming the credit. Here’s basic information to get you started, but it’s not everything you should consider.

Qualifying for the ERC Your business has to pass one of two tests to claim the ERC.

• Receipts test: Your business needs to have experienced a certain level of decline in revenues. For 2020, that would be a 50% decline when comparing each quarter to the same quarter in 2019. For 2021, that would be a 20% decline when comparing each quarter to the same quarter in 2019.

• Orders test: Your business needs to have experienced more than a nominal impact in operations caused by a federal, state, local, or regulatory order. Full or partial shutdown, limited capacity, or shutdowns of your supply chain vendors could qualify you.

Calculating the ERC To calculate the amount of the credit, you’ll need to look at the size of your company, then calculate the amount of the credit separately for 2020 and 2021, as there are different rules in place for each year.

• For the 2020 credit, for employers who averaged fewer than 100 full-time equivalents during 2019, the credit is available for all employees. For employers who averaged more than

100 FTEs during 2019, the credit is only available for those employees who were paid but were not working due the company’s decline in revenues and/or impact in operations.

• For the 2021 credit, for employers who averaged fewer than 500 FTEs during 2019, the credit is available for all employees. For employers who averaged more than 500 FTEs during 2019, the credit is only available for those employees who were paid but were not working due to the company’s decline in revenues and/or impact in operations.

• Amount of the credit:

• The 2020 credit is equal to 50% of the first $10,000 of wages paid to each employee for whom the credit is available. Max credit is $5,000 per employee.

• The 2020 credit is available for wages paid from March 12, 2020, through Dec. 31, 2020.