FWinc.

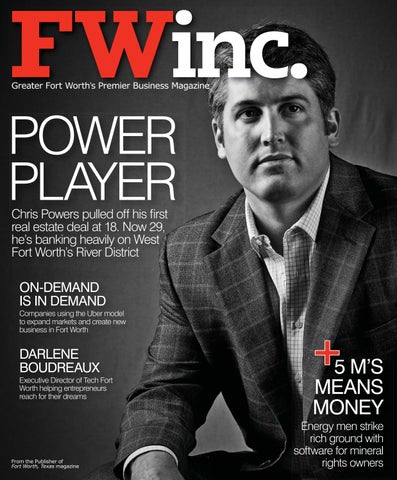

Chris Powers pulled off his first real estate deal at 18. Now 29, he’s banking heavily on West Fort Worth’s River District

Companies using the Uber model to expand markets and create new business in Fort Worth

DARLENE BOUDREAUX

Executive Director of Tech Fort Worth helping entrepreneurs reach for their dreams

5 M’S MEANS MONEY

Energy men strike rich ground with software for mineral rights owners

Amy & Jay Novacek Texas Land Owners

After a week full of deadlines, meetings and rush hour traffic, welcome to a quiet country morning. It’s just one of the rewards that comes with owning your own piece of rural Texas property. If you’re looking to buy land in Texas, Heritage Land Bank is the lender that can help make it happen. Ready to buy? Talk to a Heritage lender today.

D&M Leasing has been based in Tarrant County for 34 years and is excited to open the new Fort Worth Location, conveniently located at I-30 and Summit.

D&M Leasing is the largest leasing company in America and was recently awarded the 2015 Leasing Company of the Year award by Dealer Rater for Texas and the entire U.S.

With D&M Leasing you can save up to 50% each month over buying a vehicle, and the entire transaction can take place right over the phone.

Best of all, your new or pre-leased vehicle will be delivered to next vehicle can be.

Kelly Strausser President D&M Leasing Fort Worth

50 Powers’ Trip: Chris Powers pulled off his first real estate deal at age 18. Now 29, he’s helping redevelop a forgotten part of West Fort Worth.

42 Uberization of Business: Companies using on-demand technology to expand markets and create new ones.

58 Darlene’s Kids: After 30 years of breaking glass ceilings and launching an Inc. 500 pharma manufacturer, Fort Worth’s Darlene Boudreaux is comfortable helping other entrepreneurs reach for their dreams.

66 5 M’s Means More Money: Fort Worth startup strikes rich ground with software for mineral rights owners.

( BIZZ BUZZ )

11 Bootstrapping a Bootlegger: Entrepreneurs convert their retail store into a wine and beer bar on West Magnolia Avenue.

12 South Main Redo: A developer is changing another piece of the South Main corridor.

12 Comings and Goings: Game On gets ready to open second location in West Fort Worth.

14 Reviving Hemphill: Developers get ready to launch a restoration of a historic apartment building.

16 Face Time: Jodi Tommerdahl, entrepreneur and UT Arlington prof who’s trying to convert her love of language into an app that helps language learners and stroke victims.

18 Staying Informed: Fort Worth’s best places to work for women.

20 Around Town: Images from around Fort Worth.

( EXECUTIVE LIFE & STYLE )

24 Distinctive Style: BFFs Kacey Cargile and Alyson Johnson step out and launch Esther Penn.

26 Off the Clock: Adirondacks provide the backdrop for luxurious getaways.

28 Gadgets: Toys for the desktop.

30 Wine & Dine: Local restaurants increasingly use technology to increase consumer and employee satisfaction.

34 Health & Fitness: Schedulefriendly classes in Fort Worth for perfect work-life balance.

36 Office Space: Enilon, a digital marketing agency, opted for a custom-designed workspace when it moved offices.

( COLUMNS / DEPARTMENTS )

72 EO Spotlight: Entrepreneur and saleswoman Kim Booker moves from telecom, to insurance, restaurants, Tshirts and training.

74 Running Toward the Roar: Failing at business? Either you’re not cut out for it, or you’re due for a win.

78 Analyze This: FW Chamber report. Fort Worth Chamber of Commerce Quarterly Report. Private investment bolsters economic success.

82 Analyze This: Legal and Tax. Employers move to contain costs from government’s updated overtime rules.

84 Analyze This: Commercial real estate. Commercial Real Estate Council reaches out to millennials with mentoring and professional development.

86 Analyze This: Wealth. Twenty million more people have insurance under Obamacare, but the economic impact on individuals, companies, and the marketplace is still taking shape.

88 Analyze This: Insurance. Blue Zones gains momentum with well-being initiative.

90 Management Tips and Best Practices: How best to inspire a shared vision in your workplace?

92 Exceptional Entrepreneurship: Four potential solutions to the problem of getting people on board with your goals.

94 Day in the Life: There’s no way to tell what’s in store when Johnny Campbell, president of Sundance Square, shows up for work. But his day always begins with Scripture.

In the mid ‘90s, we were publishing a home improvement magazine called Builder’s Square Home Image. It was not doing great, and Builder’s Square (at that time the third largest home improvement store in the country behind Lowe’s and Home Depot) was having financial issues, so we mutually decided to sever our licensing agreement.

In our final issue, we focused on kitchens and baths and sold three times as many copies on the newsstands. Instead of closing it down, we decided to retain it and changed the name to Signature Kitchens and Baths.

Competitive magazines at the time like behemoths Better Homes and Gardens and House Beautiful sold on the newsstand for $2.95 and contained long editorials (lots of words) with minimal photography.

We flipped that traditional model, incorporated lots of pictures with minimal copy, and increased the price to $4.95. We then threw the dice and printed 100,000 copies (that’s two 18-wheelers filled from top to bottom) and hoped they would sell.

The gamble paid off. We increased the price on the next issue to $6.95 and continued to raise the price, before topping out at $14.99, the same price it is today, 20 years later.

Interestingly, publishing giants Hearst and Meredith now have vertical kitchen and bath magazines priced at $14.95, all because two Fort Worth guys were too naïve to know any better, and were willing to take a very expensive calculated risk.

In our cover story this issue, Chris

Powers, founder and CEO of Fort Capital, talks about risk and says, “some of the best ideas were started by people who were super-naive.”

Many businesses have not seen success because the owner was scared of failure. Scared of being or looking foolish, or scared of taking a risk. Often, the smartest people in the room know that they sometimes have to act on ideas that others might initially perceive as reckless. Chris is one of those people.

I first met Chris in 2010 to discuss his company building our 2011 Fort Worth, Texas magazine Dream Home. He and his former partner, who had primarily been working on smaller projects in the TCU area, had just moved into the high-end spec-home market.

I remember from this first meeting thinking that this guy was so much more business savvy than a kid two years out of college should be.

We awarded the Dream Home build to them, and they sold the house before the touring was complete. Two years later, he built our 2013 Dream Home. Talking to Chris the other day, he told me getting the Dream Home was a “big deal” and that he thought he’d “hit the pinnacle of his career.” If only he could have seen his future at that time.

Since our first meeting, he and his company have become a legitimate big deal, doing $78 million in projects, with $55-$60 million in assets under management.

What most excites the 29-year old Curtis today is his play in the River District, where Fort Capital owns 40 acres, half commercial, half residential and could invest $150 million-$200 million in the next five years. If it works the way he thinks it will, he believes it will change the lifestyles of the west side of Fort Worth. I wouldn’t bet against Powers.

Hal A. Brown owner/publisher

All rights reserved. No part of this publication may be reproduced without written permission from the publisher. how to contact us For questions or comments, contact Scott Nishimura, executive editor, at 817.560.6178 or via email at snishimura@fwtexas.com.

At Gus Bates Insurance, our clients rely on us to help guide them through the complex world of insurance and investments. But b before

Tommy and Tammy Brown’s first shot at making a go on West Magnolia didn’t work, so they switched to selling wine and beer instead of home furnishings and gifts.

BY SCOTT NISHIMURA

There were a few signs that 44 Bootlegger should have been born a bar instead of a specialty retailer of gifts and goods for the home, owners Tommy and Tammy Brown say. One was sales that didn’t take off. Another was that most people who walked in thought it was a bar.

The Browns closed the store on Fort Worth’s West Magnolia Avenue the day after Christmas last year and re-opened as a wine and beer bar during the Near Southside’s Open Streets festival late this spring.

“A guy came in here early on (when the business was a retail store) and said people are going to tell you what you are and who you are,” Tommy Brown, 45, says.

The Browns – Tommy Brown is a longtime shoe rep for Ugg boot and shoe line – had their eye on West Magnolia for a store when they spotted a vacancy in a little strip shopping center with its own parking lot fronting Magnolia – an oddity for the street. “There’s no retail on the street,” Brown says of the couple’s rationale.

Moreover, an independent movie theater was in the rumor mill for the large neighboring lot (that idea faded, and a developer has since purchased the lot and is moving ahead with plans for a mixeduse development).

The available space was a dark, non-air-conditioned, 1,250-square-foot storage unit in a 30-year-old building whose other tenant is Jim’s Lock & Safe.

The Browns moved on it, investing savings of $150,000 to con-

vert the space into a retailer selling his-and-her home furnishings, décor, fine gifts, apparel, accessories, and strong footwear brands like Ugg. They chose the name because Tommy Brown’s mother sold beer and whiskey in the Texas Panhandle, and Tommy was in the boot business. “The 44 gave the store a little bit of mystery,” he says. Maybe too much mystery. The store opened in January 2014, but sales never took off.

During the Arts Goggle festival in 2015, West Magnolia was clogged with patrons. “Half the people opening the door thought we were a bar,” Tommy Brown says. So the couple decided then to convert the store to a bar.

The Browns invested another $60,000, including wine and beer, to convert to a bar. They added plumbing in the kitchen and a refrigerator. The menu features 44 wines and 44 beers, including more than 25 bottles available by the glass. On a street teeming with bars, the response so far has been good, the couple said. “It’s been phenomenal,” Tommy Brown said. “These first few weeks were tricky. We had a $3 day one day.” Says Tammy, 44: “When you walk in a bar, you’re going to order something.”

In October, they plan to add a charcuterie and cheese menu. The bar will call out for food orders today. A favorite nearby restaurant for 44 Bootleggers is Nonna Tata. “A lot of Favor deliveries happen in here,” Tommy Brown says.

They’re also thinking of adding a patio in the parking lot, which would mean subtracting one parking space. “That’s definitely in the plans,” Tommy Brown says. They’ve even thought of adding a rooftop deck, which would cost about $50,000, he estimates.

The Browns, who live in the Eagle Mountain Lake area, still fantasize about retail on West Magnolia, which continues to have a dearth of it. “If we’d been in Uptown Dallas with the brands we had, I think it might have worked,” says Tommy Brown, who’s sold shoes since he was 16, first at Finish Line, then at Luke’s and Larry’s, where he was a buyer. In the ‘90s, he worked as a cook at a restaurant on West Magnolia. “In a thriving retail environment, there’s no reason why it wouldn’t have survived,” Tammy Brown says.

Another piece of the South Main Street corridor in Fort Worth is changing.

BY SCOTT NISHIMURA

Developer Dak Hatfield is redeveloping the site at the southeast corner of South Main and Dashwood, a block north of Rosedale Street, taking down one building and planning to build a total 9,500 square feet. His plans call for a firstfloor restaurant, with a patio. “Hopefully, it’s something we haven’t seen before on the Near Southside,” he said. The second floor plan calls for office space.

Hatfield began demolition in August. Crimson Building Co. is the general contractor. “We are looking at being finished in spring 2017 if not before,” he said.

Real estate activity in the South Main corridor, south of downtown, continues to pick up steam as the city nears completion of a reconstruction of the street. “Ev-

erybody’s starting to get excited about the street now that it’s being completed,” Hatfield said.

Activity farther north of the site, including ongoing construction of the University of Texas Southwestern Monty and Tex Moncrief Medical Center at Fort Worth at Pennsylvania Avenue and South Main, and a major multifamily project under construction at that intersection, shows the appeal of South Main, Hatfield said. Development interests have been following the success of eating and drinking places like the Shipping and Receiving bar and venue east of South Main near Vickery Boulevard, Hatfield said. “It just shows we have a lot of demand for business in this area,” he said.

Hatfield’s other projects include teaming with partners to remake the Supreme Golf warehouse – its tenants include Shipping and Receiving - and Magnolia-May mixed-use spaces on the Near Southside. He has a few other projects going on around the one at South Main and Dashwood. One block to the east, he recently completed the renovation and conversion of a building at 1001 Bryan Ave., leasing it to the Pouring Glory Growler Fill Station and Grill.

At 916 Bryan, he and partner Andrew Blake have been bringing back a 1945-vintage building, putting office tenants on the first floor and nearing completion later this year on the second floor.

Game On for Sports Complex

Game On, the new West Side multisport complex, will open its second facility, Sept. 24, at 2600 Alemeda Drive.

On Oct. 8,

Media personality

Scott Murray and Fort Worth City Councilman Zim Zimmerman will headline a 1 p.m.-2 p.m. ribbon-cutting ceremony. Following that, Game On will host a Sports & Wellness Fair with its partners, including Active Spine & Sport Therapy, PRISM, and Rally Time Wellness, and top volleyball and basketball clubs from the area.

The center will include 12 indoor regulation volleyball courts, which are convertible to six full-size basketball courts; eight outdoors regulation sand volleyball courts; seven pitching and batting cages; a healthoriented dining facility; two event rooms; outdoor performance stage; full-service sporting goods store; wellness center; and an 11,000-square-foot

APEC performance training space that will have a 75-yard track and 25-by-40 artificial turf field.

The new Game On is in the path of projected high growth for Fort Worth and Parker County. Its owners expect to host a number of volleyball and basketball leagues and regional tournaments. It will employ 50 people, the owners said.

“This new development is the fulfillment of a longterm vision for us to offer athletes of all ages the opportunity to reach their full potential,” said Trevor Armstrong, partner and general manager. “We’re able to provide the infrastructure and resources for all sports enthusiasts.”

Game On’s partnerships include APEC, a sports performance training company based in Tyler.

Game On in 2012 opened its first sports complex, a 48,000-square-foot indoor center at 251 Settlement Plaza Drive in west Fort Worth.

— FW Inc. staff

Justin J. Sisemore has been recognized by his peers as a 2016 “Rising Star” in Texas Monthly and Super Lawyers Magazines, as a “Top Attorney” in Fort Worth, Texas Magazine for the last eight years, and has been a guest speaker for the Tarrant County Family Law Bar Association and various law firms throughout Fort Worth. Samantha M. Wommack has been recognized by her peers as a “Top Attorney” in Fort Worth, Texas Magazine for the last three years. Zoe Meigs, of counsel, is an AV Preeminent Rated attorney and has been recognized for the second time as a “Top Attorney” in Fort Worth, Texas Magazine. We are proud to welcome Jerold H. Mitchell, Chris B. Norris and Pamela L. Wilder to the Sisemore Family Law Firm. Jerold H. Mitchell and Pamela L. Wilder have also been recognized by their peers as “Top Attorneys” in Fort Worth, Texas Magazine. With a combined 40 years of experience in complex civil and family law trials and appeals, our firm provides an extensive range of family law services: all aspects of divorce, cases with complex property divisions, and custody disputes. While we represent clients throughout Texas, we regularly serve Tarrant, Dallas, Collin, Parker, Johnson, Denton, Hood and Wise counties. The Sisemore Law Firm works diligently to provide highly competent and efficient service to each and every client. Our firm also works with various civil litigation firms throughout the DFW Metroplex to assist their clients in family law matters. Visit our website at www.thetxattorneys.com to view our client testimonials.”

Developers Terri and Gary West get ready to launch restoration of the historic Hamilton Apartments in Fort Worth’s Hemphill corridor.

BY SCOTT NISHIMURA

Terri and Gary West have redone four homes in Ryan Place on Fort Worth’s Near Southside. Their next project may be a little more ambitious.

They’re taking the 10,000-square-foot, 12-unit Hamilton Apartments building at 2837 Hemphill St., which they bought last year, and planning to bring it back. It’s the latest project to come off the drawing board on Hemphill, a huge canvas stretching from south of downtown to Interstate 20.

“We’re working towards an eight-plex,” with units of 800 to 1,000 square feet, compared to the former 480-650-square-foot units,” Terri West said, giving a tour of the boarded-up building in late August.

William F. Hamilton, a prominent real estate investor and mayor of the city of Polytechnic for four years until it was annexed by the city of Fort Worth in 1924, built the Colonial Revival Hamilton Apartments in the late 1920s.

Hamilton sold the property to the prominent Fort Worth contractors Charles Butcher and Robert Sweeney. Sweeney sold the property in late 1939 to Robert Stuart, a former state senator and Tarrant County district attorney, for less than two-thirds of the

1928 purchase price, with prices still depressed by the Great Depression.

The building has sat vacant and deteriorating for 20 years, becoming the residence of squatters. The real estate developer Fran McCarthy, the most recent owner, sold it to the Wests after starting the application process for historic tax credits. The building was listed on the National Register in 2015.

The Wests are working with development consultant Jim Johnson, architect Brandon Allen and builder Matt Awbrey. Southwest Bank is their lender.

They’re negotiating with the Texas Historical Commission and National Parks Service on requirements for their state and federal tax credit applications. The potential state tax credit, which they would likely sell at a discount to monetize it faster, is 25 percent of qualifying expenses. The potential federal credit is 20 percent. The project will also qualify for a 10-year freeze on the property’s valuation for city taxes and for a city Neighborhood Empowerment Zone waiver of permit fees. The Wests decline to say what they expect to invest in the project.

To qualify for the credits, the Wests will have to meet negotiated requirements for preservation. Because the originally laid out apartments are small, they’re negotiating to go to larger units and reduce their number to eight.

That would allow amenities such as larger kitchens and more closets, Allen, the architect, says. The dilapidated interiors will be “essentially gutted,” Allen said. “We’ll have to do it selectively,” to meet the historic preservation requirements.

The Wests plan to replace the roof with clay tile, which was originally on the building, and repair or replace all of the windows. Part of the foundation will require work. They plan to bring in separately metered electric service and water service that will likely be on a single meter, but divided among the tenants.

The Wests plan to demolish a non-historic garage and apartment and other outbuildings and build parking. They also plan to build a duplex in the back of the property and preserve the lawn defined by an old rock wall on the south side of the apartments.

The Wests plan to market the apartments at professionals. They’re not certain yet what rents they’ll seek. Terri West compared it to the nearby Bastion, a complex of apartments built around a restaurant and event center redeveloped by Chandra and Richard Riccetti. “They’re the bravest of all souls,” West said.

How the UT Arlington prof is trying to parlay a childhood love into a mobile app that helps people learn languages or regain their ability to speak after a stroke.

BY SCOTT NISHIMURA

Jodi Tommerdahl says she’s always been interested in languages. It started with Norwegian as a child when her grandmother would teach her bits. When she was 12, Tommerdahl, who grew up in Minnesota, began attending summer Norwegian camps in the state. When she was in her 20s, Tommerdahl learned French.

“I have a huge American accent because I learned it in my ‘20s,” she says. In the back of her mind for years: “Why is there no computer game or software that would show me the difference between these two sounds” – the correct and incorrect pronunciations?

“There’s language learning products, but there’s nothing for your accent, nothing with feedback,” Tommerdahl says.

Tommerdahl, who earned her bachelor’s degree from the University of Minnesota, lived in Europe for 18 years in Norway, France and England. She earned her master’s degree from the University of London and Ph.D. in neurolinguistics from the Sorbonne in Paris. She was a professor at the University of Birmingham in England when she learned the University of Texas at Arlington was searching for a professor in mind, brain and education for a new program in the College of Education.

Once at UTA, Tommerdahl – associate professor of neurolinguistics - was introduced to an associate professor of electrical engineering, Samir Iqbal. The two, with Motasim Bellah, a Ph.D. in Samir’s lab and an app developer, have teamed up on a mobile app that people learning languages or stroke patients learning to speak again can

use to perfect their speech. Using the app, still in development, users repeat words until a dot on the screen moves into the center, verifying correct pronunciation. The team has collected “hundreds of thousands” of language samples that it’s using to build the app, Tommerdahl says.

“We’re swimming in data,” Tommerdahl says. “It’s not just about building the app. It’s about building the science behind the app.”

The company, VisioSound, has joined the Tech Fort Worth incubator and thinks it can bring the app, called the Visual Accent Trainer, to market in six months.

“There’s a big push now on the technical side,” Tommerdahl says. “What we’re doing with the app is we’re going back to how babies learn language. The babble. They’re listening to themselves, and they’re setting up this feedback loop.”

The company is talking to language learning companies about potential licensing deals. “Whether it’s available straight from us (in the app store) or from a third party remains to be seen,” Tommerdahl says.

Even if the company licenses its technology, it would likely retain rights for medical applications, Tommerdahl says.

UTA has been backing the group, paying for its patent application, patent attorneys, and university attorneys. Engineering students have been volunteering for the project, Tommerdahl says. The university owns the intellectual property, but VisioSound recently signed an option to lease it back for a fee.

The partners think there’s a huge potential market. “There are literally billions of people studying foreign language,” Tommerdahl says. “It’s just tinder waiting to be lit.”

What’s it take? These winners offer a big mix that ranges from compensation and leave, to training and flexibility.

BY SCOTT NISHIMURA

Half of the members of the leadership team at the Balcom Agency, the Fort Worth brand marketing firm, are women. That says a lot about the company’s drive to recruit and retain women.

The agency joined the Girl Scouts of Texas Oklahoma Plains and Naval Air Station Fort Worth Joint Reserve Base as the winners of the Fort Worth Chamber of Commerce’s 2016 Best Workplaces for Women competition, in the small, medium, and large employer categories.

Judges reviewed the 26 applicants and 12 finalists on compensation and leave, ethics, work flexibility, training and mentoring, facilities, community involvement and wellness initiatives. The Chamber developed the award with help from Texas Woman’s University, which brought its research and results from focus groups and an online survey to bear.

Established: 1993

Employees locally: 38, including 24 women

Benefits: Health insurance, cafeteria plan, 401k, vacation time, sick time, personal time, flexible work schedule. Also leadership, computer, and skillset training. Merit and holiday bonus, reimbursement for certification training, industry organization membership, paid attendance at industry conferences. Flex time for children’s school activities, discount at Zyn22 spin studios, employee recognition programs, maternity leave, flex time and resources for elder care, and telecommuting. Health premium fully paid for employees. Fulltime

employees eligible for 401(k). Employees 100 percent vested from enrollment. Balcom matches first 3 percent of employee contributions, then 50 percent for up to 5 percent of their contribution. New moms receive six weeks of paid maternity leave. Comp time available to employees who work outside normal hours. Agency offers discounted rates to nonprofits and pro bono services to certain organizations. Balcom touts its “creative and fun space” and is developing plans for expansion. Flexibility: “As long as employees log at least eight hours of billable time each day and make it to any scheduled meetings, the agency knows flexible schedules make us all more productive.”

“Four-Legged Fridays,” early shutdowns one day a month for work anniversaries and birthdays, active outdoor meetings, company on path to certification as a Blue Zones workplace.

Established: 1912

Employees locally: 57, including 54 women

Benefits: Health insurance, dental insurance, life insurance, disability insurance, 401(k), vacation, sick time, personal leave, flexible work schedule, employee assistance program, paid time off for bereavement. Also leadership, computer, skillset, diversity and sensitivity, and customer relations training, paid membership dues

for job-related associations, flex time for children’s school activities, employee recognition programs, flexible time and resources for elder care. Vacation: 15 days in first year, 20 days after five years. Ten sick days per year, one floating holiday such as a United Way day off. Sixteen paid holidays. Three days bereavement leave. Half days on Fridays. Flexible or modified work schedules available. Scouts use Welbe, a corporate fitness platform that levers wearable devices like FitBit to track wellbeing, organize challenges, set goals, and offer rewards.

Established: 1994

Employees locally: 10,000, including 2,900 women

Benefits: Health insurance, dental insurance, life insurance, disability insurance, cafeteria plan, 401(k), vacation time, sick times, personal time, flexible work schedule, employee assistance program, company car. Also leadership, computer, skillset, diversity and

sensitivity, and customer relations training. Team bonus, loans for continuing education, reimbursement for certification training, tuition reimbursement, free family classes and counseling. On-site day care, time off for community service, child care referral service, flex time for children’s school activities, lactation room for new moms, employee recognition programs, maternity leave. Tricare health insurance at no additional cost for all military members. Civilian employees offered several health insurance options, with reduced costs and co-pays. Complete coverage of breast pumps and supplies. Twelve weeks paid maternity leave. Opportunity to freeze eggs to provide greater flexibility in starting a family. All NAS members are assigned a mentor. Formal career transition programs and staff. Paid tuition for college courses or classes at technical institutes. NAS provides nursing room, with kitchen, bed, TV, and multiple outlets for pumping. School Age Program allows students in local schools to be picked up and dropped off at NAS. Onsite gym, pool, track, playing courts. Womenonly locker room and cardio center. Thirty days annual leave.

Your smile is more than just a response; it’s the symbol of your personality and the centerpiece to your overall look. As a pioneer in the field of cosmetic dentistry, Dr. Mitch Conditt combines technical skill with artistic vision to create a smile that will represent who you are and fit your lifestyle and aspirations.

An instructor to thousands of dentists from all over the world, Dr. Conditt takes a great deal of pride in having built a practice where patients—like you—feel rejuvenated simply because of the amount of care and experience that has been invested in their personal smile needs.

Contact Dr. Conditt’s practice today to schedule your smile consultation. We are ready to help you start the journey to a smile that is unlike any other.

BY NICOLE CRITES

Kacey Cargile and Alyson

Johnson were just two best friends working together when they decided to step out on their own and become entrepreneurs in 2014. The duo opened Esther Penn, which went on to become one of Fort Worth’s most popular and fashion-forward boutiques, on West Seventh Street. In April, the store expanded to Dallas.

The co-owners were not exactly in the market for a new location when they were

driving in Dallas during the holidays, but an open space along Henderson Avenue caught their eyes.

“We pulled up and were like ‘Oh my gosh! This is what we always dreamed it would look like,’” Johnson said, “just a little white stand-alone building. So we just saw it and had to have it.”

Johnson and Cargile said they mainly chose Dallas as the location for their second store because of its proximity to Fort Worth. It is a good place for the two to go

back and forth and be in both places while continuing to expand.

“I think another reason we were drawn to Dallas was so we could still work together,” Cargile said. “That’s kind of why we did this in the first place because we are best friends and want to work together as much as we can. That’s why it’s fun.”

Like with their store in Fort Worth, Johnson and Cargile plan to put their relationship with Dallas customers as a top priority.

“In Fort Worth, our customers are our friends. We have gotten to know these people and their kids and their cousins and when they got married. And, we are here for them for all of these events in their lives because we have been open two years and have a regular customer base,” Cargile said. “And in Dallas, we are still working on that. We are working on finally getting repeat customers, which is awesome, and learning more about them and what they like.”

The two said that one difference of being a business owner in Dallas now is how much more competitive it is. And, while competition is good, it is also hard trying to figure out where their store fits in.

“The market is pretty saturated right now,” Cargile said. “I feel like there are stores opening up every day and, you know, how do you stay fresh? How do you stay cool? What are you offering that is different? So it’s hard and it’s a constant process.”

One thing that remains the same between the locations is how supportive other local businesses have been.

“In Fort Worth, other small businesses really rallied behind us when we opened…” Cargile said. “[And] I mean, the people on Henderson have been so nice to us, the other stores and their customers down here, because we are different and we offer different things. So we have had a lot of support.”

The Adirondacks provide the backdrop for unique, rustic and luxurious getaways.

BY KENDALL LOUIS

Prominent New York families in the early 1900s needed a way to get away from it all just as busy executives do today. But, rather than escape for a weekend to a tropical getaway, the wellequipped vacationers opted to build their own wooded retreats. So, families like the Vanderbilts, Astors, Rockefellers and Guggenheims escaped to the Adirondack Mountains to create what was perhaps the first form of “glamping.” The families would make the trip in the early summer to relax among glistening lakes and towering fir trees.

Dubbed “Great Camps,” many of these camps, situated in the largest protected wilderness in the continental United States, host curious visitors throughout the year. But, often, the hardest part is getting an invite. Luckily, one of the most luxurious Great Camp options,

The Point, can be booked for public use. Built by William Avery Rockefeller in the 1930s as his family’s private home, The Point sits on a 75-acre peninsula stretching into Upper Saranac Lake. The resort, filled with antiques inside grandiose log cabins, was designated the first Relais & Châteaux property in North America – and still exists as one of only 50 today. Eleven guest rooms are spread among four log buildings, each one with lake views, hand-built beds, oil paintings, private baths and a fireplace. The most popular guest room, The Boathouse, is a vast open room above the boats with beamed ceilings and a canopied bed anchoring the center of the room. The room has panoramic views of Upper Saranac Lake and the distant mountains. Perhaps the most historic room on the property is the Mohawk, the Rockefeller’s former master bedroom, with a private corridor, outdoor sitting area and striking bath. True to the time of its conception, meals at The Point are a lavish event. Executive Chef Loic Leperlier, with a resume full of Michelin-star restaurants and five-star resorts, cooks with seasonal produce from nearby farms. Black tie attire is suggested for dinner on Wednesdays and Saturdays, per the tradition of Great Camps. Meals, rooms and cocktail hours are enough to keep guests entertained and satisfied for days, but in case a bout of boredom sets in, various

activities are available throughout the year. Lake swimming, water sports, hiking, croquet, canoes, mahogany electric boats and golf dominate activities in the summer and fall. The winter still allows for outdoor activities like cross-country skiing, ice-skating, curling and “snow barbecues” – yes, a Texas-style barbecue in the middle of the snow.

There are various ways to reach The Point from the metroplex, but the easiest is a flight from DFW to Boston Logan International Airport, where you can catch one of several daily flights to Adirondack Regional Airport on Cape Air. The Point is also a scenic 5-hour drive from New York City and Boston and just a 2 – 2.5-hour drive from Montreal, Albany, New York, and Burlington, Vermont. thepointsaranac.com. All-inclusive 2016 rates start at $1,600 per room. The entire property can be reserved for $25,650 for private family or corporate gatherings.

The former vacation home of the Vanderbilt family, this 27-building National Historic Landmark has played host to celebrities and world leaders. Now the Raquette Lake retreat hosts families and groups at the resort. A more rustic Great Camp option, guests share bathrooms and are encouraged to spend time outdoors taking in nature in true Adirondack style. greatcampsagamore.org. Call for prices.

Originally built in 1923 by the Post family, this Great Camp is now owned by Dallas real estate tycoon Harlan Crow. The property sits on the Upper St. Regis Lake and is an invite-only getaway for the Crow family and guests.

Located on Osgood Pond, White Pine Camp was built by prominent New York Banker Archibald S. White and his wife Olive. Later, under new ownership, it served as the summer White House for President Calvin Coolidge. Thirteen cabins and cottages with hand-built Adirondackstyle furniture flank the 35-acre property. The two most popular cabins, Mrs. Coolidge’s Cabin and the President’s Cabin, where the subjects actually slept, book fast. whitepinecamp. com. Rates vary.

BY KENDALL LOUIS

You work there, you eat there, and as much as you hate to admit it, sometimes you even sleep there. So, why not make your office as comfortable and functional as possible? These four gadgets make life just a little bit easier, or at least a lot prettier, while you’re working the week away.

(A) PhoneSoap

Smartphone Sanitizer

The perfect gadget for germaphobes, this smartphone sanitizer kills germs with an ultra-violet light. From your lunch meeting, to your desk, to (admit it) the restroom, to your pocket, your phone is a breeding ground for bacteria and viruses. And where does the phone ultimately end up? Your face. Zap the problem away with this sleek device. Place your phone inside, attach the charging cable, and close the lid. Once closed, a pair of specialized, ultra-violet lights clean the phone while simultaneously charging it. Exterior lights let you know when the phone is clean and charged. Large enough to accommodate most smartphones, it comes with a micro USB charging cable that can be easily switched out for your phone. The case even has built-in acoustic amplifiers that allow you to continue listening to music or use your phone’s alarm while it’s getting its treatment. Uncommongoods.com, $59.95

(B) Amazon Echo First books, then shipping, then TV, now Amazon is in the personal assistant business. Amazon Echo is a digital personal assistant that responds to your voice and gets to know you better each day. Connect it to your lights, your thermostat, your music; all you have to do is ask and Amazon will answer. Or, use its “skills” or connected apps to order an Uber, have Domino’s delivered or reorder paper towels. Just ask Alexa, Amazon or Echo – you decide its name too. Amazon.com, $179.99

(C) Petcube Check in on your furry best friend while you’re stuck at the office. Whether it’s meant for your pet's peace of mind, or your own, this device can make the whole family a little happier while you’re stuck at the office. Check in on your dog or cat, or even better, entertain them from your desk while watching their every move on the HD video. Petcube connects to your smartphone so you can watch, talk to and

play with your cat or dog from anywhere. A built-in, two-way microphone allows you to whisper sweet nothings to your lonely pet while you’re at work and even listen to him or her respond. You can also control a laser from your smartphone to keep them entertained and stimulated. Brookstone. com, $149

(D) Perpetual Calendars

Perhaps more form than function, this calendar can be used year after year. Created for the Museum of Modern Art, two magnetic balls mark the date and month. Mount it on your wall or place it on your desk for a calendar that won’t expire or go out of style. Uncommongoods. com, $45

Local restaurants use technology to increase consumer and employee satisfaction while encouraging personto-person interaction.

BY NICOLE CRITES

While dining at the upscale French restaurant Saint-Emilion, when you ask about its wine list, which exceeds 300 different wines, you may be surprised when the waiter pulls out an iPad rather than a large leather-bound binder.

It’s a sign that restaurateurs are finding themselves in the technology business along with the food business. More than one-third of consumers are more likely to use technology options at a restaurant, according to the National Restaurant Association’s 2014 innovation report.

Whether it is reading a wine list on an iPad, receiving a text when your table is ready at Brewed, ordering your meal on a tablet at Panera Bread or using a smartphone to pay for Starbucks, today you can find technology integrated into almost every restaurant in some way.

Saint-Emilion was one of the first restaurants in Fort Worth to use the electronic wine list when the highly acclaimed Cultural District spot rolled it out nearly five years ago, but now, they are hardly alone. According to Statista, a survey of professional chefs concluded that utilizing tablet computers for wine lists and order-

ing was the leading technology trend in restaurants in 2015.

“There’s a small percentage that find it confusing, but most people think it’s really good,” Saint-Emilion’s manager Joel Graham said. “It opens people’s eyes and doesn’t make them as intimidated because they are able to read about a bunch of different wines very clearly without any pressure from anybody.”

The restaurant even goes a step further with an option for customers to receive emails about their favorite wines.

“If you had a nice bottle of wine that you really liked at the restaurant, then we can

can pull it up and choose a mail option,” Graham said, “where you can put in your email address, and everything that we have found on the wine, like the price point and ratings, will go into your inbox.”

Downtown’s Capital Grille is another local advocator for electronic wine lists. The swanky steakhouse also uses tablets to present its dessert menu and even has an app that allows patrons who have wine lockers in the restaurant to manage their wine purchases and gift wine to other people.

In Statista’s survey, other leading trends in the restaurant industry were smartphone or tablet apps for consumers (e.g., ordering, menus, reservations), apps for chefs and restaurateurs (e.g., recipes, table management, point-of-sale tracking) and mobile or wireless payment options.

Starbucks is one of the first chains to implement an app with a system that allows customers to add their credit card and pay directly from their phone. While it may be one of the only businesses with that system, there are surely more to follow. Thirty-nine percent of smartphone users said they would pay restaurant and bar tabs via smartphone apps if offered, according to the National Restaurant Association’s 2016 report.

While paying for tabs on smartphone apps may be in our future, other restau-

rants are doing away with the traditional cash register system and opting for something more technologically advanced. For instance, Local Foods Kitchen, located off of South Hulen Street and Hartwood Drive, instead of registers, uses Square, a mobile point-of-sale system that connects a card reader to a smartphone or tablet.

“It has made life pretty easy when we have to-go orders or deliveries,” sous-chef Charlie Atkinson said.

Making life easier for the staff as well as the customer appears to be the leading incentive for restaurateurs to implement some type of technology. According to the National Restaurant Association, 72 percent of consumers say restaurant technology increases convenience.

Apparently, technology might also increase the amount of drinks you have in a single night at the Flying Saucer. The bar, that opened up downtown more than 20 years ago, has a program for avid beerdrinkers called the UFO Club, where if you drink 200 different beers from its list, you get your own “flying saucer” (a plate with your name displayed on the wall).

However, the trick is keeping track of what beers UFO members have already tried. It does this by giving each member

a card that they can swipe at an electronic kiosk. You choose your drink from its touchscreen list of beers and print out a ticket with a scanning code on it.

“We call them chips, and it’s going to say the name of the beer, what kind of style, a description of it, and then we scan it in and keep track of it for you,” manager Heather Rosemand said.

While technology is obviously involved in this process, the UFO Club tends to bring people together socially more than anything.

“The main people that start doing this are those who don’t know a lot about beer and are new to the area...,” Rosemand said, “so it’s a way for people to meet other people and actually just come around and learn about beer.”

Technology tends to get a bad rap for minimizing person-to-person contact, but even with this surge of technological advances, there are those who still value the social aspect of dining out. According to the National Restaurant Association’s 2014 report, most people who said they do not use smartphones for restaurant purposes or information give the same reason: they prefer to deal with people.

Located in the heart of Fort Worth’s lively West 7th Street Cultural District—close to great shopping, live music, theater and fine dining— The Stayton at Museum Way is everything you love about senior living. In the center of a vibrant cultural hub, The Stayton has become Fort Worth’s most distinctive retirement destination for people with the zest and taste for the best in life.

The Stayton has become a vital cultural cornerstone of the sophisticated West 7th district. Attend a concert at the Bass Performance Hall, take in a Broadway-style show at the Community Arts Center or visit the funky shops and fashionable boutiques in Sundance Square.

We also enrich the lives of our residents and thousands of members of our Fort Worth community through our cultural and educational events, such as our renowned Red Carpet Series, and our unique partnership with the Cliburn.

2501 Museum Way | Fort Worth, Texas 76107

Call to schedule your tour today 817.632.3601.

BY FW INC. STAFF

Thirty minutes or less. It used to be the promise at the end of a pizza order. But, now that lifestyles are speeding up, and workdays are getting longer, it’s a necessary time frame for almost any activity. Unfortunately, while your health should be a top priority, the length of many fitness classes leave you forced to prioritize between work and health. But, there is good news. The Center for Disease Control suggests just 2.5 hours of moderate exercise throughout the week to meet health recommendations. “We know that 150 minutes each week sounds like a lot of time, but it’s not. [That’s] about

the same amount of time you might spend watching a movie. The good news is you can spread your activity throughout the week, so you don’t have to do it all at once,” stated the CDC. You know what that math comes down to? Less than 30 minutes per day. We rounded up the schedule-friendly classes in town for the perfect work/workout life balance.

Kickboxing & Boxing 30 Class, TITLE Boxing Club: When there isn’t time to dedicate to the Power Hour, TITLE Boxing Club offers a convenient solution. Whether it is a kickboxing class or a boxing class, the shortened high-intensity workouts offer just the right amount of cardio to satisfy a daily exercise demand. 400 W. Seventh St., downtown-fortworth.titleboxingclub.com

Smart Barre Express & Smart Cardio Express, Smart Barre Studios: Perfect to squeeze into a hectic day, the benefits from an express barre or cardio class make the 30-minute workouts totally worth it. Barre Express aids in strengthening muscles, increasing flexibility, and burning fat. Cardio Express, while still a barre class, focuses on increased heart rates and utilization of the whole body. Three Fort Worth locations, smartbarrebody.com

Kickboxing, 9Round Fitness: No set class time or schedules here. During business hours, members can walk in whenever they please and almost immediately start their 30-minute exercise with a trainer. Workouts start every 3 minutes and change daily. Each full-body workout session can burn up to 500 calories. 3049 Greene Ave., 9round.com

10 [30 Minute] Private Sessions, Abundio’s Studios: Since

Abundio’s Studios plans to relocate to the River District, group classes are on hiatus. But to fill the void, Abundio’s trainers still offer packages of ten 30-minute personal training sessions that focus on a variety of strength and endurance exercises such as weight training, cycling, kickboxing, and TRX. Perfect for those without a lot of time and with specific health goals in mind. 2927 Shamrock Ave., abundiosstudios.com

Express Jazzercise, Jazzercise Fort Worth Fitness Center: If a quick, preweekend workout is what you’re looking for, Jazzercise Fort Worth Fitness Center is here to help. A 30-minute, get-pumped-up for the weekend and dance-the-stress-away class for all those leaving the office Friday afternoon awaits. This cardio-heavy class makes the heart pump and calories burn in half the normal time. 2924 Cleburne Road, jazzercise.com

Meditation Class, Indigo Yoga: Hectic work hours and busy lifestyles don’t leave much time for focusing on mental health. If you want to cut down stress and get over the middle-of-the-week hump, Indigo Yoga offers an early morning meditation class. Meditating even for 30 minutes regularly can help with concentration and attention, slow down the aging process of the brain, and reduce anxiety or depression. 5111 Pershing Ave., indigoyoga.net FWinc

ALL YOU NEED IS 30 MINUTES OF MODERATE-INTENSITY EXERCISE, FIVE DAYS A WEEK TO:

• Lose weight. Studies show that 30 minutes a day versus an hour is enough for weight loss.

• Lower cholesterol

• Lessen risk of stroke and cardiovascular diseases

• Lower blood pressure

• Increase mood, energy, and stamina

• Increase libido

• Maintain mental well-being

• Improve circulation and digestion

• Strengthen the immune system

• Improve overall health and fitness

BY KENDALL LOUIS / PHOTOGRAPHY BY ALEX LEPE

The Enilon team didn’t move far when they left their office space of five years last March. But they did move smart, saying goodbye to their 4,400-square-foot office facing Foch Street on the east end of the West 7th development and opting for a new custom-designed one in the building next door.

Co-founder Jeff Ireland, TCU grad, calls it an upgrade. It’s an upgrade in the form of 7,000 square feet. Enilon, a digital marketing agency founded in 2005, enlisted VLK Architects to configure the formerly bland medical office space into an engaging and contemporary office. Project designer Niki Schoessow was first tasked with granting most of the office access to natural light, so they took down various walls and installed a storefront to allow it to flow throughout. One of the biggest transitions came with the ceiling. VLK, along with contractor Jensen Commercial (now Cooper-Jensen Contractors) removed tiles to reveal an exposed concrete ceiling that added a loft-like vibe along with height.

“The space reflects the personality of Enilon as the digital agency we have grown to become, and I could not be happier with the way it turned out,” says Ireland.

On the top of Enilon’s list with the expansion? “More collaborative workspaces,“ says Claire Brunner, partner and executive vice president

of client services. “Our old office only had one conference room, and it was constantly booked.” Problem solved. Enilon’s new office has four different conference spaces: one built-in table just when you enter, another “war room” for top-secret meetings, and a small conference room with a wall of windows. The fourth and largest conference room sits behind two formidable sliding barn doors built by Mansfield artists Mary and Eddie Phillips. While the doors are rustic, everything behind them is modern and tech savvy. Three screens flank one wall while another larger wall is covered by a Clarus glassboard. The local company, one of Enilon’s clients, creates modern-style whiteboards made from tempered safety glass that can withstand permanent markers, dry erase markers and even spray paint. The one in the Enilon office, in a shade of black, resembles a modern chalkboard with strategic planning notes written in neon colors on a dark glass board.

“In order to deliver dynamic 360 digital programs, we must constantly change the way we work, think and use the space around us,” says Justin Rives, partner and executive vice president of delivery. “In our new space, we wanted an environment that encouraged multiple working styles, from rowdy brainstorms with big teams to a room made for one – anything is possible in our new office.”

If an employee has had enough collaborating for one day and just needs time for concentration, he or she can retire to one of three “phone booths” with a door and some pint-sized privacy. While cubes, collaboration and concentration fulfill the function the

space was meant for, a large-scale piece of art as you enter anchors the design of the office. The industrial-looking art wraps around a curved wall. One might take a glance and assume the art was made to fit the wall. But, instead, the wall was created specifically for the art. Its curved presence directs the flow of traffic in two directions. One leads you to a room filled with open-air workstations. The other leads to executive offices. Both directions will lead a visitor to similar art. It’s all designed by the husband-and-wife Mansfield team. The fun and practical office is a nod to the kind of work that happens inside the Enilon walls. The digital marketing agency describes itself as “a grown-up digital agency for serious marketers.”

“Everything that we do is focused in the digital space,” says Brunner. “We focus on providing 360-degree holistic digital services. Digital is highly measurable. We take data very seriously and use that from the very beginning to help map out our clients’ plans.”

Ireland says Enilon has more than 100 open projects at any given time but names local players like Texas Health Resources, Flexjet, D&M Auto Leasing and Bell Helicopter as some of the clients that keep them the busiest.

But, the Enilon partners try not to overwork employees, keeping a close eye to ensure staffers don’t regularly put in more than 40 hours a week and offering a few bonuses around the office. Catered lunches are brought in for the team on Fridays. Employees are welcome to bring their pet dogs in any time they please. The fridge is always stocked with alcoholic and non-alcoholic beverages, and the kitchen will soon be home to a kegerator so beer is always available on tap.

This larger office space also made it possible for Enilon to have a “Family Room.” The cozy room, furnished with couches and a TV, allows employees to bring their kids into work when their normal caretaking situation falls through. “Too many times people feel stress when something from their personal life bleeds over into work,” said Rives. “Simple solution: We created a room for ‘life to happen.’ A family room that allows employees to handle life from work without stress.” With board games and photos of the employees and their families throughout the space, it’s a practical acknowledgement that employees

have a full life outside the office walls.

And, there is plenty to do right outside the office walls. Since Enilon moved into Foch Street, both in this office and its previous space, it has watched the area grow and develop – in the form of bars and restaurants moving in and more businesses. “There are a lot of agencies around here so it’s kind of nice,” says Rives. “It’s definitely an innovative area within Fort Worth.”

The team also says it’s nice to have so many walkable places for lunch, coffee and happy hour. “We call Chimy’s ‘the cafeteria,’” Ireland adds. They find themselves enjoying both work and play at nearby spots like Avoca Coffee, Reservoir and Cork & Pig.

Ireland says he has also watched the digital space transform. “Ten years ago ‘digital’ was all about websites,” Ireland says. “Now that’s just one component of it,” he continues. “In order to survive, you have to be constantly changing. We worked hard to find the place that’s unique, that provides the value that clients are looking for and we are good at it. Now we have a model that’s very expandable, and we are seeing that right now.”

It’s because of this successful model that Enilon is now concentrated on growth. Ireland adds, “If things go as planned, we will outgrow this space in three years.”

From food delivery, to hauling stuff, and filling up your gas tank, entrepreneurs roll out apps to capitalize on the gig economy.

BY SCOTT NISHIMURA

From delivering food and gasoline, to carrying things around and just executing daily tasks, businesses are rapidly ripping off the Uber model and using ondemand technology to expand markets and create new businesses

“Entrepreneurs are going to be one-upping each other at an incredibly fast rate,” Michael Sherrod, a serial media entrepreneur and the William M. Dickey Entrepreneur in Residence at TCU’s Neeley Entrepreneurship Center, says. What’s plausible: “just about anything you can think of that’s something you would like to have on a moment’s notice that you don’t have access to.”

Food Fight! The Fort Worth food delivery segment, already crowded with the national GrubHub and Favor services and the longtime locally owned delivery service Entrees On-Trays, added the national Door Dash in May and – at the end of August –UberEats.

The services have some differences in the way their fees are structured; some allow tipping for their independent contractor drivers, and some have minimum charges while others don’t. But “it’s virtually the same thing,”

Sam Kalil, owner of Entrees On-Trays, says. “You’re going to order food, and you’re going to get it delivered to you.”

UberEats will lever its existing driver network by letting them deliver food as well. The service could also expand the driver network, because UberEats will allow drivers to use vehicles that don’t meet the company’s criteria for passenger service.

those restaurants.

Heileman said Favor is confident that its “Order Anything” option is a significant differentiator. Don’t see what you want among its list of partners? Click the “Order Anything” button, fill in the blank with what you want from anywhere, and Favor will handle the rest. CVS, Walgreens, Central Market, Target, Apple, RadioShack, and TCU Florist are Favor’s retail partners in Fort Worth. “With Favor, you can request for a Runner to pick up your dry-cleaning, dog food, really anything except alcohol,” Heileman says.

GrubHub, which entered the DFW market in 2011, connects restaurants to consumers, and most restaurants handle their own delivery. In the DFW market, as in some others, GrubHub also offers its own delivery. “We are able to leverage our national scale to provide delivery for restaurants at a lower average cost,” Lindsey Ruthen, a spokeswoman, said. GrubHub charges a $2.99 delivery fee in DFW. In 2015, companywide revenue rose to $361.8 million from $253.8 million the prior year, while net profit rose to $38 million from $24.2 million. What the company calls “active diners” rose 24 percent to 7.35 million.

“UberEats driver partners can deliver meals using two-door vehicles, which currently would not qualify for uberX” passenger service, Debbee Hancock, an Uber spokeswoman, said.

UberEats is trying to undercut competitors’ prices, charging a $3.99 flat delivery fee that will be “free for a limited time.” Favor, by contrast, charges a $5 delivery fee. Favor’s mobile app also allows tipping, where Uber’s does not.

“We are testing $3 delivery fees in some of our other markets (and) will eventually test it out in Fort Worth as well,” Tina Heileman, a Favor spokeswoman, told FW Inc. “But for now, we’re sticking with our flat $5 fee.”

Favor this summer teamed with eight restaurants in the West 7th area and offered free delivery for five weeks. “The promotion resulted in over 650 new customers for us and a 260 percent increase in take-out orders for those restaurants,” Heileman says. Over those five weeks, Favor completed 1,000 deliveries from

At Entrees On-Trays, a 30-year-old company Kalil bought in 2000, Kalil –whose family has been in the catering business in Fort Worth for years – has been trying to determine the impact on business from the new competitors.

Sales were off 12 percent two months ago but are now back to normal, Kalil says. “I attributed (the drop) to the new people coming to town, but I’m not sure whether some of that was (due to) the summer or not.”

Still, the June numbers were a “wake-up

call,” he says. The company emphasized to its drivers, who, like those of the other services are independent contractors, the importance of on-time delivery. It also kept up its schedule of email blasts to customers and fliers with coupons.

Entrees On-Trays is different from the services in that customers can order via the web, phone, or mobile app, which Kalil put into place at the first of this year, using his web program to set up the app. Seventythree percent of business today is coming from the web, 20 percent by phone, and 7 percent from the app, Kalil says. The company eschews small-ticket orders, requiring a $15 minimum and has an $80 average dinner ticket, he says.

That means Entrees On-Trays may be losing millennials to the other services, Kalil says. But he says he expects a shakeout among the various services within the next year and half or two years, and says Entrees On-Trays will still be around.

child. “I did not want her driving to the gas station,” says Mycroft, who at the time was running strategy and business for a company called Planetary Resources, which refuels spacecraft. “It wasn’t safe.”

Perot is an investor in Planetary Resources. “He was willing and happy and able to take the meeting,” Mycroft says. “He said, ‘As a property manager, I’m always looking for ways to amenitize my property.’”

"It's not rocket science to pump gas into a car. I get to say that because I used to be a rocket scientist."

– Frank Mycroft, Booster Fuels

“We’re family owned and operated; we can cut back when we need to cut back; we can expand when we need to expand,” he says. “We have 30 years of customers who continue to use us.”

Kalil also said Entrees On-Trays has a reliable network of drivers who transport food in insulated containers, which he views as a differentiator. He also questioned whether the other services have enough drivers. He pointed to Favor’s notice to customers late this summer that lasted for a short period, warning of double delivery charges to entice more drivers on to the road. That’s akin to Uber’s “surge” fees that occur during peak demand or when there are few drivers on the road.

Heileman, however, said such an occasional extra charge is not unusual. “We will turn on PrimeTime, usually for a short period of time, if a particular market is busy,” she said. “We have been using this feature for over a year.”

Haulin’ Gas The Fort Worth area now has at least two on-demand gasoline refueling services.

Booster Fuels, a Seattle startup that’s raised $9 million from backers like Ross Perot Jr. and Microsoft co-founder Paul Allen, is focusing on North Texas and Silicon Valley. In Alliance, it has partnerships with developer Hillwood, Galderma Labs, and DynCorp to fill up cars on the corporate campuses.

CEO and co-founder Frank Mycroft came up with the idea two years ago when his wife was expecting their first

Booster Fuels is now into the “double digits” on its number of vehicles in North Texas, Mycroft says. The vehicles carry 800 gallons of regular unleaded and 400 gallons of premium. On pricing, “we strive to be the same or better as the closest three gas stations,” he says. “The beauty of our model is we don’t have expensive real estate costs and costs of a gas station, we use mobile technology, and we buy the highest-quality fuels in wholesale.”

He adds, “It’s not rocket science to pump gas into a car. I get to say that because I used to be a rocket scientist.”

The small new entrant into the market is Gas Cab, which launched in Fort Worth, June 24, with one truck. Co-owner Clint Bookover, one of two partners, is a former landscape company owner.

Gas Cab is targeting firms like landscapers and construction companies that have vehicle fleets and either bring fuel transfer trucks onto their properties or have all drivers take their vehicles to the gas station each morning. “You’ll have one guy with a credit card,” Bookover says. “You’re losing a ton of money and labor.”

The first vehicle is a GMC 3500 flatbed that carries 440 gallons total and that Bookover and his partner outfitted for $70,000. They’re building a second truck, Bookover said.

Gas Cab charges the cost of the fuel it’s pumping, plus an extra charge ($2.25 for unleaded, $2.75 for premium, or $2.25 per diesel), and a $20 annual membership fee to cover its cost of fuel for the trip. The total fuel tab is “about average,” he said. “It’s not the highest. It’s not the lowest.”

Gas Cab will roll out a mobile app in September that will cost the company about $30,000. The company has been receiving calls about interest in franchises from other markets. “We would like to start franchising,” he said. He and his partner want to focus on the Dallas-Fort Worth market first; ideally, it would be corporate-owned, not franchised, he said. “We want to take over DFW,” which would take 10-15 trucks, he said. He and his partner also want to buy a distributorship to serve their trucks. The company has one investor besides the two founding partners, he said.

Demand has been strong since inception, Bookover said. Commercial will probably make up 60 percent of sales, while in-

dividual fill-ups account for 40, he said. A Nissan dealership in Fort Worth hired Gas Cab to put five gallons in each car on the lot over two days. “They don’t have gas on site,” Bookover said.

“It’s a really cool business if you know how to market it.”

Carry On On-demand delivery and hauling service is creeping out across North Texas.

Pickup Now operates in the Dallas-Fort Worth area. Its independent drivers are off-duty firemen and military and veterans who put their pickups into service. Minimum charge is $45. The drivers, which Pickup calls “Good Guys,” will help with loading and unloading. But if the item to be hauled is too large or heavy,

the customer must either have his own help or hire an extra Good Guy. Pickup Now insures its items at a maximum $20,000; it won’t carry anything that’s worth more than that.

Taskrabbit, another national company, operates in Dallas, which the company considers a small market. Taskrabbit, which offers delivery, handyman, moving, and cleaning service through its network of independent contractors, does not offer its services in Tarrant County. A company spokeswoman declined a request for an interview for this story.

Gozova, a Fort Worth startup founded by three entrepreneurs, is launching Sept. 25, with pickup available in the 76126, 76116, 76132, and 76133 zip codes in southwest Fort Worth and Ridglea. “We just really want to learn from these zip codes” before expanding, Goran Krndija, the CEO, says. Krndija, a Bosnian whose family came to the United States in 1998 as refugees, has gone into partnership with software engineer James Staud, to whom he was introduced through the Tech Fort Worth incubator, and engineer Cameron Moreau to launch the company and mobile app. Their app, which they plan to launch Sept. 25, will link customers to people with pickups. Drivers will pick up items and drop them off but not participate in the loading and unloading. That’s because the company doesn’t want the extra liability, Krndija says.

Customers will set up their pickup location via the mobile app and shoot and send pictures of the item through the app, which will calculate a price based on distance, time and the gasoline mileage of the driver’s truck. The app will also allow tipping. The driver will get 70 percent of the delivery fee, plus 100 percent of the tip, Krndija said.

Gozova wants to recruit 30-50 drivers for consistency. While competing services are trying to go national, Gozova wants to stay local, the partners say. “Companies that have completely covered one market, I think that’s where companies are going to succeed,” Staud said.

Sherrod says conventional delivery services blew the opportunity that’s now being taken over by these new entrants. “Delivery companies should have figured this out a long time ago, and they didn’t,” Sherrod says. “They were already in this business.”

Honey-Do Handymen Paintzen, an on-demand home and office painting service, is launching in the Dallas-Fort Worth area, Sept 15. The full-service online platform will allow customers to book, customize, and pay for paint jobs. The company now oper-

ates in San Francisco, New York, Chicago, Boston, and Washington, D.C. “The company will be providing on-demand painting services in a more convenient manner than before,” Jocelyn Kahn said.

In Flight Entertainment Even helicopter service has gone the way of ondemand technology. In Fort Worth, Epic Helicopters has teamed with UberChopper to provide charter service to as many as five major events since the National Basketball Association All-Star Game at AT&T Stadium in Arlington.

Game-goers fly from various airports in the area to the event at about $400 per head and receive an Uber credit for their ride home.

Some events, such as the All- Star Game, have been a success, Brian Dunaway, CEO of Epic, based at Fort Worth’s Meacham Airport, says. Others, such as WrestleMania, have been a dud. “To us, we’re not out anything” in those cases, Dunaway says. “It’s worth losing a little bit of money. The impact of messaging is beyond anything you could pay for.”

What’s Up Next Sherrod, the TCU Entrepreneur in Residence, sees numerous ways entrepreneurs can take advantage of the on-demand economy. “Companies that connect you with your neighbors to borrow tools, toys, etc.,” he says. “You could literally put together a bunch of people who had extra couches or extra TVs and put together an Uber business.”

Barriers to entry: “If there’s an incumbent, it’s going to take a lot of cash,” Sherrod says. “You’ve got to have great developers, and they’re in short supply.”

If there’s no incumbent, software and developers are the chief barriers, he says. “Scaling is the hard part,” Sherrod says. “When you’re doing that kind of sophisticated stuff, and your business depends on them, they have to be employees.”

Investors hunting for opportunities seek companies with strong technology teams first, he said. “If you don’t have the technology people, you’re dead.” .

Fort Worth’s Epic Helicopters, born out of founder’s boredom, looks at potentially “gamechanging” deeper move into training.

BY SCOTT NISHIMURA

BRIAN DUNAWAY, A HELICOPTER PILOT SINCE AGE 18, WAS IN MARKETING AT A SMALL AD AGENCY AFTER COLLEGE WHEN HE STARTED WRITING THE BUSINESS PLAN FOR A HELICOPTER COMPANY THAT WOULD SPECIALIZE IN AERIAL PHOTOGRAPHY.

One thing led to the next, and Dunaway launched his Epic Helicopters 10 years ago in Fort Worth. His first helicopter was a two-seater Robinson R22 he bought in Wisconsin on a loan and flew with a buddy back to Fort Worth, landing it in an Oklahoma field ahead of a storm, pushing it into a shed, and knocking on a family’s door to ask for use of their Internet connection.

The business has changed substantially since those days. Aerial photography, while fun, makes up only about 10 percent of sales today, and Dunaway quickly shifted to training and charters and tours, which comprise two roughly equal parts of the business.

“The business just wasn’t there,” Dunaway, 36, says of photography. “The phone wasn’t ringing on that. But the phone was ringing on training. People wanted to learn how to fly.”

Dunaway, who grew up in Fort Worth and graduated from Elon University in North Carolina with a business degree, learned some entrepreneurial chops early on, watching his father, Jim Dunaway, build the Dunaway

Associates civil engineering he founded in Fort Worth. On weekends, Dunaway - at the urging of his son - would open the firm’s parking lot near Mayfest and charge $5 or $10. In college, Brian Dunaway bought a townhome his freshman year, helped by a loan his father helped him obtain.

Today, Epic, based at Fort Worth’s Meacham Airport, has six helicopters – all Robinsons – and 12 employees, including seven pilots. It’s pushing further into international training, already regularly hosting students from China, Brazil and Mexico. “You sign up one customer, the volume of hours is there,” Dunaway says. “Most customers are going to need at least 50 hours of training.”

Epic trains three kinds of students: Ones who are paying out of their

pocket or are sponsored to be trained for careers in commercial, charters, tours, aerial photography, oil and gas, medical, or heavy lift; ones who are buying a Robinson helicopter from Epic and training in it; and international. Epic has recently rewritten its training content.

In the meantime, Dunaway says he’s working on strategic partnerships that could significantly change the company by the end of next year.

Earlier this summer, Epic celebrated the grand opening of a 30,000-squarefoot headquarters and training center at Meacham, having been forced out of the airport’s main terminal because of the city’s ongoing renovation plan there.

“We are much more of an educational institution than ever before,” Dunaway says.

The ARTEC Group, Inc. specializes in Interior Design and Remodeling services in the DFW Metroplex. Debbie Chirillo and her staff provide unparalleled interior design services for residential and commercial interiors. Work ranges from new construction selections to remodels and the creative use of existing spaces. One of the greatest personal achievement is that The ARTEC Group was featured in Beautiful Homes of Texas, an exclusive collection of the finest designers of Texas. The ARTEC Group combines great design, comfort, function and balance into an aesthetically pleasing environment. We believe it is essential that our client’s personality be reflected in the design whether the look is traditional, transitional or contemporary. As one of Fort Worth’s leading interior design firms, we provide outstanding designs for every client. Please visit us on Houzz.

Chris Powers pulled off his first real estate deal at age 18. Now 29, he’s helping redevelop a forgotten part of West Fort Worth.

BY SCOTT NISHIMURA / PHOTOGRAPHY BY ALEX LEPE

It was, as Chris Powers acknowledges, “the epitome of what was wrong with the economy.” Only, “I didn’t know it back then.”

A freshman at TCU interested in business, Powers befriended Adam Blake, a TCU student who was already buying houses around the university and later hit the headlines when he bought the Electric Building downtown as a 24-year-old.

The strategy Powers learned from Blake during that era of loose money: “You could go downtown to Countrywide Financial and get a loan with 3 percent down and 6 percent cash back at closing.” Buy the home, lease it to a tenant, take the deal back to the bank for a refi. “Now I can start borrowing against that,” Powers recalls.

By the time Powers graduated early from TCU at age 21, using that strategy, he owned eight single-family homes around TCU. And he’d launched a real estate management business with a web site, running 40-50 units and earning bonuses if he got higher rents than the property owners had been making.

From there, Powers quickly moved on bigger real estate deals. Today, he’s taken the lead among several developers in rebranding 275 acres overlooking the Trinity River off of White Settlement Road in west Fort Worth, with a goal of redeveloping it into a luxury mixed-use hub for residents of Westover Hills, Westworth Village, and Arlington Heights. Powers, who does business today under his Fort Capital banner, says the firm has done $78 million in projects in six years and has $55$60 million in assets under management. That’s a long resume and expansive portfolio for a 29-year-old.

“You only live one life, and you ought to spend it pursuing something you're passionate about,” Powers likes to say, quoting his dad, who died in 2012 from injuries suffered in a cycling accident.

“Tell the truth and be nice, and you’ll be surprised how many doors continue to open to you.”

– Chris Powers

Mentor The seeds of entrepreneurship were sown early for Powers, who found a mentor in the El Paso developer Meyer Marcus, whose Mimco Inc. today holds an estimated 7.5 million square feet of space in 320 projects in Texas and New Mexico and has more than 1,600 tenants. The Powers and Marcus families have been friends for several decades, and Powers is close friends of, and plays golf with, Marcus’ son. Powers worked as an intern for Marcus. As teenagers, the boys would convene regularly for all-night parties at the Marcus home, Marcus recalled in an interview. “Then, Chris would wake up at 6 in the morning and come with me” to look at real estate projects, Marcus says.

It wasn’t difficult then for Powers to figure out that

Marcus knew real estate. “You drive around El Paso, you see his signs everywhere,” Powers says. “I knew he owns every great building in El Paso.”

Marcus says Powers’ dad “was always so grateful” that his son had a business mentor at such a young age. “It was not my intention to teach Chris everything I know, but it was his intention to grab onto everything I know,” Marcus says. “It’s just very rare to see a guy like that.”

Today, Marcus and Powers invest in each others’ deals. Marcus, in an interview, said he couldn’t immediately recall the details of his investments in Powers’ deals. “I’ll be honest with you,” Marcus, 63, says. “I don’t even know what they are. But the fact that it’s Chris Powers, I’m not investing in a project, I’m investing with him.”