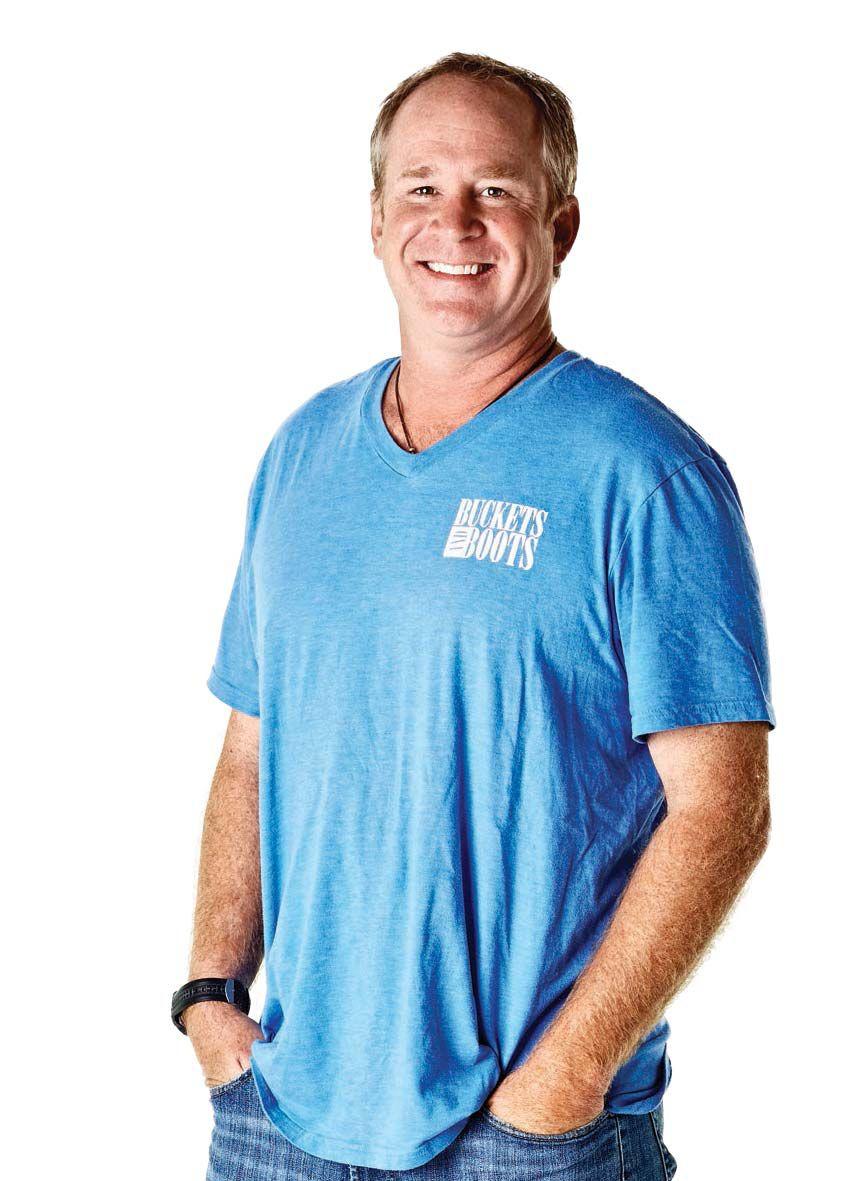

The country star sounds off on family, his ventures in music, The Rustic in Dallas, real estate and oil and gas

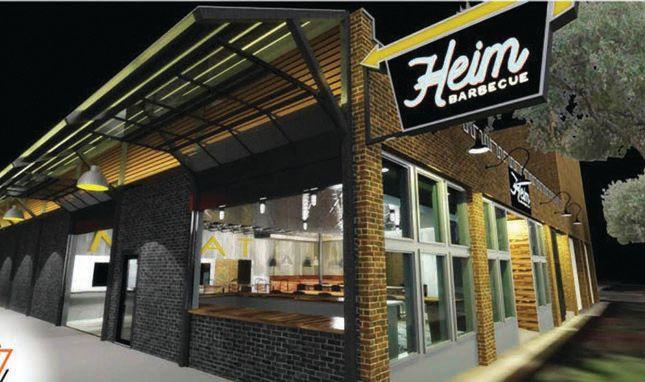

Is Hemphill Next?

Redevelopment moving ahead on Fort Worth's gritty Southside thoroughfare

Cary Moon, entrepreneur and poker player, on building his real estate and entertainment portfolio

Three Fort Worth companies contain healthcare costs

How Scouting helped Glenn Adams sell his company for a half-billion dollars

At Gus Bates Insurance, our clients rely on us to help guide them through the complex world of insurance and investments. But b before

Chase Kennemer General Manager D&M Leasing Fort Worth

D&M Leasing has been based in Tarrant County for 34 years and is excited to open the new Fort Worth Location, conveniently located at I-30 and Summit.

D&M Leasing is the largest leasing company in America and was recently awarded the 2015 Leasing Company of the Year award by Dealer Rater for Texas and the entire U.S.

With D&M Leasing you can save up to 50% each month over buying a vehicle, and the entire transaction can take place right over the phone.

Best of all, your new or pre-leased vehicle will be delivered to next vehicle can be.

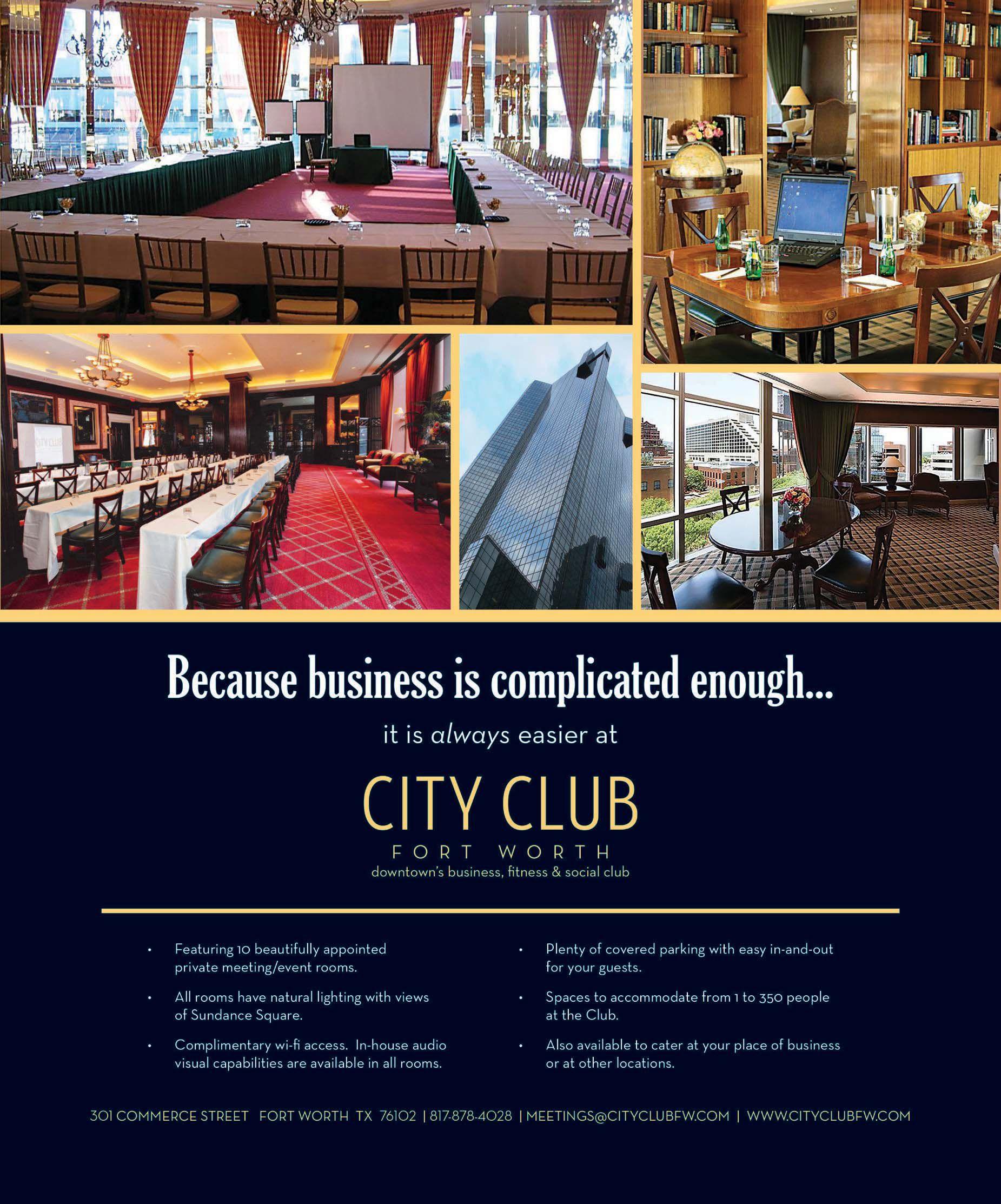

56 The Business of Being Pat Green: Fort Worth’s own Texas country legend has grossed $77.5 million in the music business, owns a minority ownership in The Rustic in Dallas, helped build and sell a $10 million real estate fund, has dipped his toes in oil and gas, and is just getting started.

64 Is Hemphill Next? Yes, Southsiders say, but road ahead for redevelopment is a complicated one.

70 Moon’s River: Cary Moon, entrepreneur and one-time poker player, on building his real estate and entertainment portfolio and how he underestimated the amount of time he would need to spend fulfilling his duties as a new city councilman.

76 When Flatlining Is Good: Companies put clamps on healthcare claims, driving down insurance premiums.

80 Kentrifying Near Southside: Will Churchill and Corrie Watson park the profits from the sale of their Frank Kent Honda dealership and downtown tract on West Magnolia, Hemphill and South Main.

)

13 On the Go: Fort Worth’s personal concierge industry steps out.

14 Branching Out: A Near Southside developer takes on Dickson-Jenkins, Branch-Smith buildings.

14 Polished Gem: After 50 years, Southlake jeweler Pieter Andries still hunts for new opportunities.

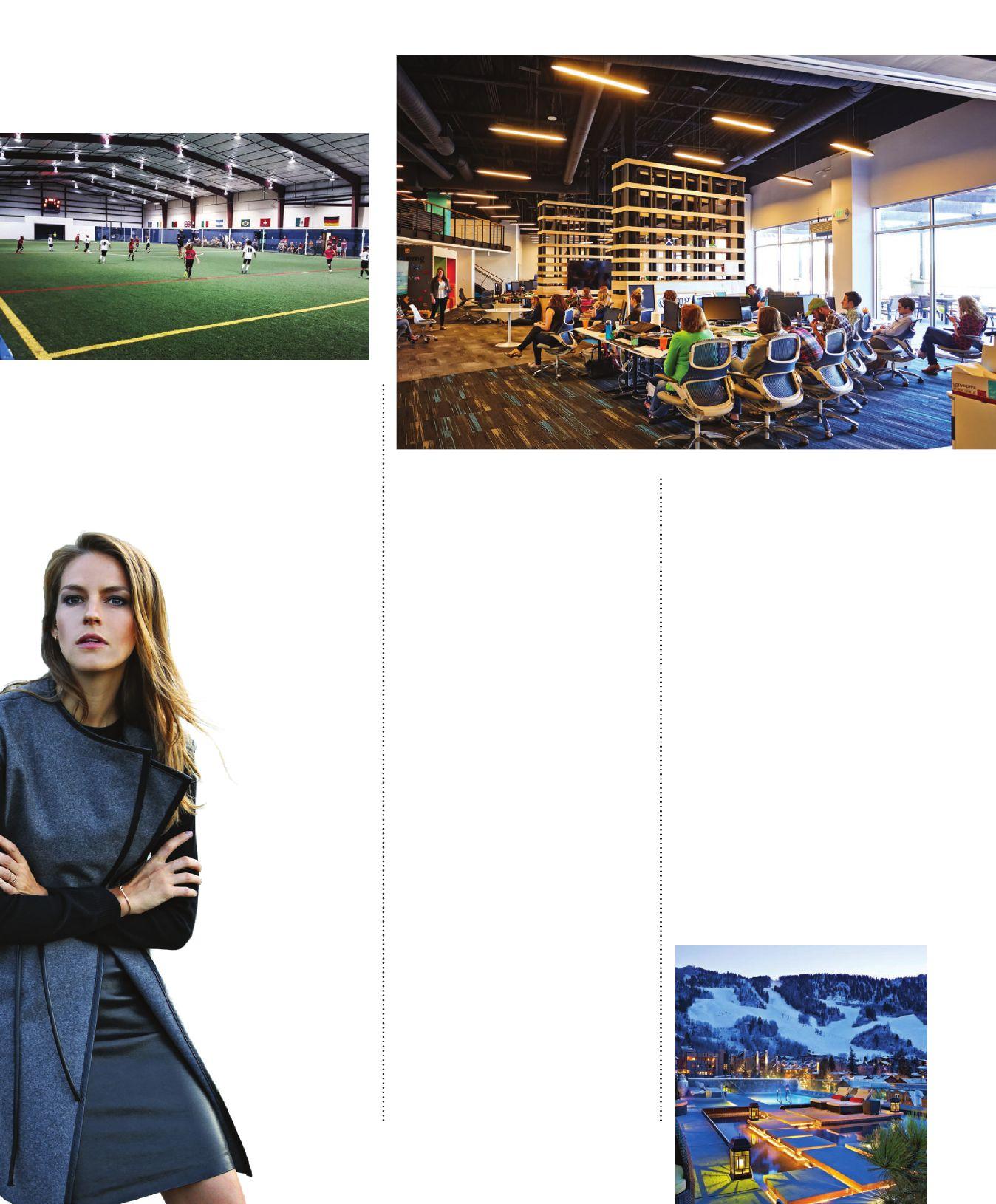

16 It’s Game On: West Side arena owners plan a second facility, on the All Saints school campus.

18 Looking for Light: Lighthouse for the Blind looks for new revenue streams.

18 Comings and Goings: What’s new in Fort Worth?

19 Going Strong:

Velvet Box owner says upcoming holiday season looks good.

20 Face Time: Businessman Lance Byrd and partners launch The Mopac, a new venue near TCU.

22 Stay Informed: On the go? These mobile apps save executives time and money.

( EXECUTIVE LIFE & STYLE )

28 A Coat Above: Work rarely freezes, even if winter weather does. Try on a new overcoat.

32 Off the Clock: There’s no business like snow business. Ski resort lodges that cater to corporate retreats.

36 Gadgets: Flapit is a social media metrics counter that connects to all major platforms.

40 Wine & Dine: Firebird Restaurant Group spreads its wings with El Fenix and other restaurants.

46 Health & Fitness: Employers are realizing the importance of strong wellness programs to maximize productivity and contain insurance costs.

48 Office Space: Fort Worth’s fastgrowing PMG Worldwide is into its third expansion, matches office space to the company’s collaborative culture.

( COLUMNS / DEPARTMENTS )

84 EO Spotlight: Lab owner Hillary Strasner, at $20 million in annual sales, looks to diversify and expand her business.

86 Business Strategy: Eagle Scout CEO and entrepreneur Glenn Adams goes from burning camp breakfast to making millions in oil and gas.

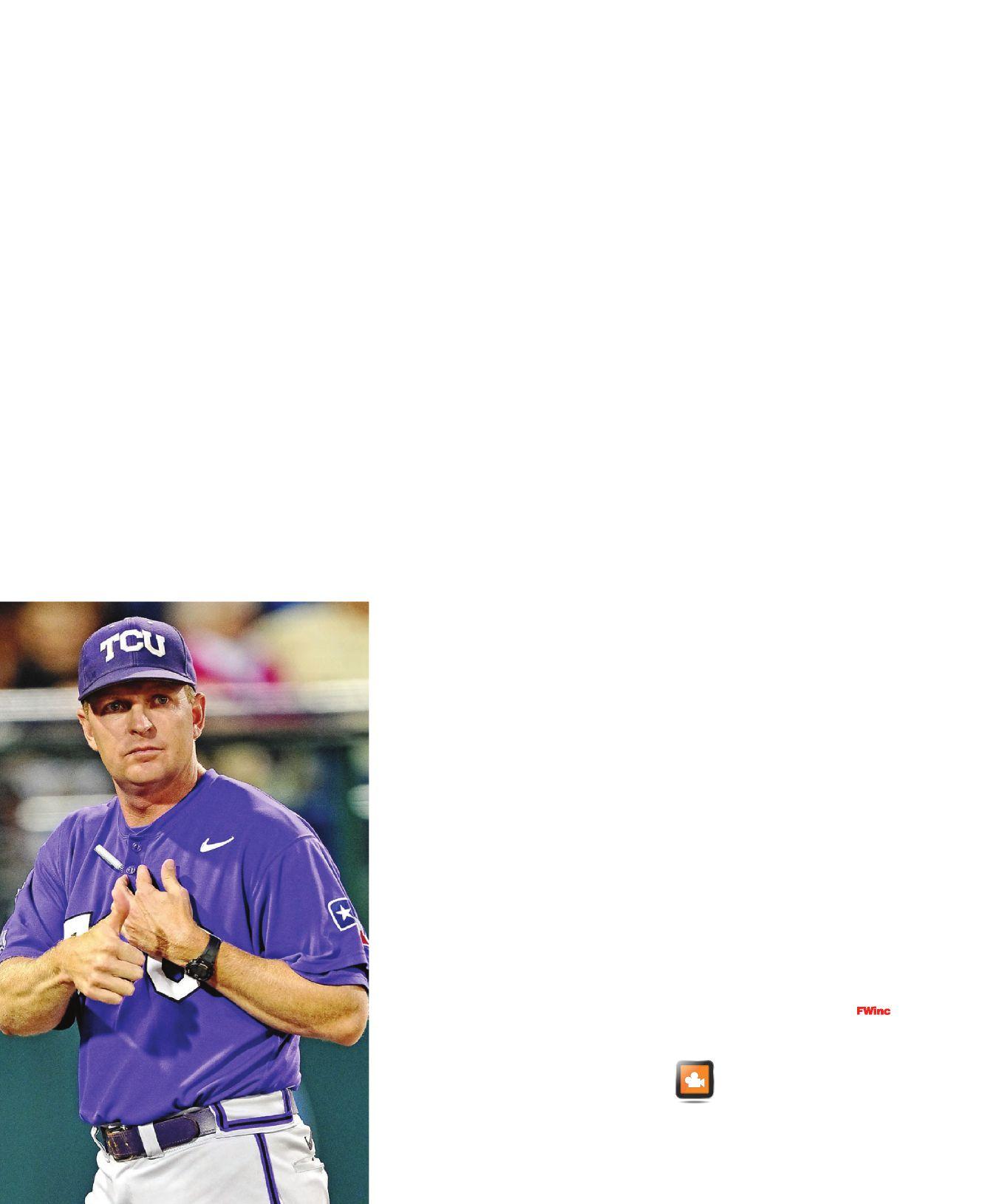

92 Business Leadership: TCU Baseball Coach Jim Schlossnagle can teach executives a lot about management and communicating.

94 Analyze This: Fort Worth Chamber of Commerce quarterly report.

96 Analyze This: Fort Worth quarterly commercial real estate report card.

98 Analyze This: Three Ds of Open Carry laws for Texas businesses.

100 Analyze This: IRS looks at curtailing valuation discounts in wealth transfers.

102 Day in the Life: Briggs Freeman CEO Robbie Briggs on juggling a growing firm, family, and the need to recharge.

ihave long been an admirer of the late Dee Kelly, founding partner in the law firm of Kelly Hart & Hallman who passed away in October. I respected Mr. Kelly not only for his business success, but for his love and commitment to the City of Fort Worth. Mr. Kelly was one of Fort Worth’s and Texas’ best-known attorneys and a political power broker who took his civic responsibility seriously. He made it one of his life missions to promote the city where he lived and worked, which was inspirational for me.

In 1999, not long after my partner and I launched Fort Worth, Texas magazine, I received a handwritten note from Mr. Kelly complimenting the magazine and wishing me luck. I kept that note and in June of this year, 16 years later, mailed it back to him along with an invitation to our FW Inc. launch party. Mr. Kelly did not have to attend our unveiling, but he did. He was a man who understood the importance of working hard, of doing, even when it was not convenient. He understood the adage that, “Eighty percent of success is showing up,” and at the age of 86, Mr. Kelly showed up every day. It’s something he passed on to others verbally and by example.

One of Kelly’s early lessons about working hard came in the late 1940s during an interview with legendary U.S. Rep. and House Speaker Sam Rayburn, when Kelly

was a columnist for Bonham High School’s student newspaper. Rayburn told Kelly that people were not too dissimilar in talent, but what really divides successful men and women from those who are not successful is hard work. Working hard was one of the secrets to his success.

Dee Kelly was not born and raised here in Fort Worth, but once he got here, he became one of the city’s biggest supporters and lived his life paying it forward and celebrating Fort Worth. He left a legacy that his family, his firm and all who love Fort Worth should attempt to emulate.

Someone else who is pretty well-known in Texas and throughout the country is the subject of this issue’s cover story. Like Kelly, Pat Green was not born or raised here in Fort Worth, but 10 years ago chose to move here and raise his family. When I had the idea to feature Pat in this issue, my thought was to focus on the business side of his music career.

We spent a half day with Pat at The Rustic Kitchen and Bar in Dallas, where he is a minority owner. What we found out is that he is not only a gifted musician, but a pretty savvy entrepreneur who has been involved in various investments over the years. One of his recent entrepreneurial investments was with a small group who built a $10 million real estate fund, leveraged it to over $30 million in assets and then sold it.

In our interview he also talks about a lesson learned in oil and gas, where he lost his investment. “Business at the highest level is not a respecter of friendship or anything else,” Green said. “Nor should it be. It’s just business.”

The mission of FW Inc. is to deliver inspirational, educational and entertaining coverage through shared experiences, lessons learned and best practices to help busy executives run their companies better and have fun doing it. In this, our second issue, I think we have all of these items covered. Enjoy.

Hal A. Brown owner/publisher

Divorce can lead to some ugly vows. But, like any other important business dealing, your due diligence can protect you throughout the process. Knowing the complexities of prenuptial agreements, separate and community property and ensuring a positive relationship with your children – these are the essentials we bring to the transaction. The lawyers at Nunneley Family Law will represent you with business acumen and insight so you can vow to reach the result that’s fair to everyone, and plan for what comes next.

nunneleyfamilylaw.com

817.577.2332 • Hurst, Texas

Nunneley is a

“Origin” is the point or place where something begins or is created, the source or cause of something. Formerly known as Community Trust Bank, Origin Bank is our new name, but not a new take on how we do business. Our more-than-a-century old, $3.8 billion financial institution will continue to provide a wide range of superior banking services within our 41 banking centers throughout Louisiana, Mississippi and Texas, including the centers in and around the Fort Worth area.

Throughout our history, our bank has continued to evolve to better represent our customers’ changing financial needs. Our name change to Origin Bank is not the result of being sold or merging with another institution. It is a strategic decision to differentiate our brand, and to set a new standard for unmatched customer service and relationship banking. Origin is a name we can trademark and distinctly call our own.

As the bank transitions to our new name, all account numbers, PINs, routing numbers and other account information will remain exactly the same for existing customers. In addition, ATM cards, debit cards, credit cards and checks will continue to function normally as we make every effort to sustain, and even improve, the bank’s normal business operations.

Under the leadership of Origin Bank Tarrant County Regional President Grant James, our team is excited to continue our tradition of being trusted advisors to our customers and partners to our community. Rest assured, our core promise remains the same: to make every customer feel like the only customer, every time. WELCOME TO ORIGIN BANK.

Locally

Backed

By Scott NiShimura

the personal concierge market in Fort Worth just took a step up in visibility. Longtime concierges Rendee Bullard and Kellye Garrett, who have teamed up to form the Go Cowtown service underneath Bullard’s Go Go Me mantle, in September opened their first Fort Worth brick-and-mortar beachhead at 2501 Forest Park Blvd. Vendors joining Go Cowtown in the building include Turquoise Video Productions, Mariel and Joey photographers, and stylist Renn Traylor.

“We’re going to be able to cross-pollinate all of it,” Traylor says.

Go Cowtown brought together Bullard, whose global concierge service includes clients such as LeAnn Rimes, and Cowtown Concierge owner Kellye Garrett, who launched her personal concierge service 10 years ago in Fort Worth. Bullard will continue to retain two high net worth clients outside the partnership, and Garrett will continue to retain a number of clients she serves.

Go Cowtown has a network of oncall concierges it uses to serve clients, including 10 in the DFW area, four in Austin, six in Nashville, Tenn., eight in Los Angeles, two in New York, three in Northern California, and seven over-

seas. Bullard plans to launch “Go U-go university” next year that will certify concierges. Once that happens, Bullard hopes to bring them on as staff members.

“I’m ready to be a full-time booking agent,” says Bullard, 41, who still travels extensively to Los Angeles and Nashville on business, but now delegates travel generated by the two high net worth clients she retains personally to her two personal assistants.

Go Cowtown, which bills itself as “your exclusive lifestyle managers,” divides its services under five categories called Go Home, Go Nerd, Go Event, Go Beauty, and Go You.

It offers nearly 60 services, ranging from arranging housekeeping, to

preparing meals, moving services, party planning, network assistance, travel management, on-location beauty services, housesitting, and airport pickup and dropoff.

The partnership comes six years after Bullard gave the Go Go Me name to the services she was offering. She estimates she’s worked 20 years for high-net worth and high-profile clients.

“I’ve never not worked 24/7,” she says. “I’m figuring out what that means and finding other people like me.”

Near Southside developer takes on Dickson-Jenkins, Branch-Smith complex next.

By Scott NiShimura

After 50 years, Southlake jeweler Pieter Andries still hunts for new opportunity.

By Scott NiShimura

Fort Worth developer Eddie Vanston — whose credits include restorations of the Supreme Golf Warehouse, Markeen Apartments, Leuda-May Apartments, and LaSalle Apartments on the Near Southside — have purchased a historic property on the Near Southside and plans to renovate it into residential and commercial lofts and condos.

Vanston confirmed he and longtime business partner Tom Reynolds have closed on the property at 120 St. Louis Ave. that includes the three-story, 44,550-squarefoot Dickson-Jenkins Building and 12,756-square-foot Branch-Smith Building that was part of the original Branch-Smith printing plant. The property is commonly known as Branch-Smith, which bought the Dickson-Jenkins building in 1983, but Vanston and Reynolds plan to name the property the Dickson-Jenkins Lofts.

They plan commercial condos on the ground floor of the DicksonJenkins Building and in the Branch-Smith warehouse. They plan residential lofts on the top two floors of the Dickson-Jenkins Building.

“Given the mess of apartments coming online here (on the Near Southside), there’s very little that’s going to be for sale,” Vanston said.

There will be about 20 residential lofts and 24,000 square feet of commercial, 12,000 each in both buildings, Vanston said.

There will be about 20, 900-1,500-square-foot residential lofts, priced at $199-$229 per square foot, Vanston said. He and Reynolds will have a 50-50 mix of commercial space for lease and sale, with rent rates of $18-$19 per square foot, and white box commercial condos for sale at about $150 per square foot.

The Dickson-Jenkins was constructed as a two-story factory in 1927, with the third floor added in 1929. The building is recognizable for its large window openings.

At 67, after 50 years in the business as a jeweler, Pieter Andries Hye is still on the hunt for ways to grow the business.

Next year, Hye will add 10,000 square feet onto his Pieter Andries jewelry store, 2525 E. Southlake Blvd., bringing in a Rolex boutique (the store already sells Rolex), adding more showroom space, and augmenting the workshop where his employees create one-ofa-kind pieces to order, the Pieter Andries specialty.

Hye, who has 22 employees, is also looking for six more and says he expects to get to about 40 within the next two years. Hye says he’s looking into opening stores in other cities, but he’s concerned he wouldn’t be able to sustain the highest standards with multiple locations.

“Part of maturity is to accept that no one can be everything to anyone, including me,” Hye says.

Hye, a Belgian whose grandfather was a jeweler and father ran a coffee plantation and built bridges and sold lumber, became a goldsmith 50 years ago. In 1982, after a career as a goldsmith, designer, and buyer, he moved to the United States to start his own business, first to Los Angeles, where he spent a year as a designer and buyer. Later, selling to Zale Corp., he settled in North Texas and opened his original store in 1997 at Solana, then built his own in 2000 and moved to Southlake. It took seven years to pay off the bank debt from opening his own business, Hye says, declining to discuss his numbers.

Hye buys all of his stones from mines and diamond cutters, and buys his gold from refineries. In 2011, he earned the title Certified Gemologist Appraiser from the American Gem Society, the industry’s highest achievement held by 400 people in North America. The society dedicates itself to ethics, gemological knowledge, and consumer protection.

“We are all in business to make a sale,” says Hye, who shuns markdowns and instead stands by the value of his work. “But we want to make a sale that leads to other sales.”

USMD Hospital at Fort Worth is home to 11 of the area’s foremost orthopedic, neuro and spine surgeons – people passionate about getting you back to the activities you love.

By Scott NiShimura

Game On Arena Sports’ owners have been looking to expand close to their popular indoor soccer and flag football facility in far West Fort Worth off of Loop 820. They’ve got the site, having signed a long-term ground lease on an 8.5-acre site on the campus of the All Saints Episcopal School at Interstate 30 and Loop 820.

“This is the fulfillment of a long-term dream,” Trevor Armstrong, one of the partners in Game On Arena, told FW Inc.

The new facility, to be called Game On Sports Complex, will cater to baseball, volleyball, basketball, football, softball and indoor soccer teams and leagues.

The facility will have 12 indoor regulation competition volleyball courts, convertible to six full-size basketball courts; eight outdoor regulation sand volleyball courts, seven pitching/batting cages, a healthoriented dining facility, two party rooms, outdoor performance stage, 6,000 square feet of retail space aimed at users such as rehab providers, and an 11,000-square-foot performance training space that will include a 75-yard track and a 25-by-40yard artificial turf field, Game On said. The total complex will have 140,000 square feet under roof and 50,000 square feet of outdoor facilities.

The development will break ground by Nov. 30 and is scheduled to be complete in August next

year, Armstrong said. Halbach•Dietz Architects of Fort Worth is the architect, Fort Construction will be contractor, and Pinnacle Bank is financing the project. Through the agreement with All Saints, Game On Sports will have access to as many as 24 total acres for future expansion, Armstrong said. The partnership declined to say how much it expects to invest in building the facility.

Armstrong, who with his partners bought Game On Arena four years ago, said Game On Sports Complex’s competitors on the west side of the Metroplex are mostly high schools and church venues. With the fast growth of the West Side, including the oncoming development of the Walsh Ranch, they view the location as ideal.

“There’s going to be great expansion in West Fort Worth,” Armstrong said. Expansion of the new facility past the first phase is years off, as is any expansion beyond the two sites they control today, he said.

“We want to make sure we do it right,” Armstrong said. “We’re putting 100 percent of our energy behind it right now.”

The ones in your marketing plan aren’t.

A marketing plan is a huge undertaking. With so many digital tactics and channels to consider and so much pressure put on marketers to get it right, it can be tough to see what’s missing. And one missing piece in your digital mix—too little integration here, too much focus there— can derail success.

So we’ve built a simple-to-use online tool that will assess your current marketing plan in about four minutes. You’ll receive a Digital Performance Score along with key insights to help you view your plan more holistically and put you on a stronger path to success.

By Scott NiShimura

The Lighthouse for the Blind of Fort Worth, whose employees produce an array of consumer, commercial, industrial, and other products from the nonprofit’s quarters on the Near Southside, continues its hunt for new revenue.

Sales of those items create jobs at the Lighthouse, which employs about 75 people in its industrial division, including 37 blind and 38 sighted. Sales of inventory were $13.3 million in 2014, off from $19.4 million in 2012 and driven down largely by the loss of a major federal government contract for pads used to protect goods in airdrops.

Platt Allen, the Lighthouse’s CEO, says the agency’s sales goal is $30 million in three years and $60 million in eight years.

“None of us thinks that’s too far-fetched,” Allen, a TCU MBA who arrived at the Lighthouse eight years ago after a lengthy business career, says.

Lighthouse employees assemble flashlights, copy paper, cleaning products, shipping boxes, flares, wrist restraints, cable ties, ball point pens, and other products. Two years ago, Lighthouse bought a machine shop on the South Side and a paper tube company. Finally, Lighthouse also has added drug test kits to its product lineup.

The machine shop has struggled, but has a new sales manager. It has four blind machinists and four sighted who set up the machines. “It’s repetitive work,” Allen said. “Whether you’re sighted or blind doesn’t affect the way you do the work.” The paper tube business, which generates tubes

GDC Technics, which earlier this year took out a 25-year lease for the former American Airlines hangar at Fort Worth’s Alliance Airport, expects to ramp up to 650 jobs there “within the next year,” a company executive says.

The company has 100 employees at Alliance now. It will be seeking employees across a broad range, including accounting, finance, engineering, machining, mechanics, information technology, warehouse, human resources, sales and maintenance, Kriss Parikakis, GDC’s chief financial officer, told the Fort Worth Chamber of Commerce’s Job Links Excelerator group this summer.

The company, in announcing its Alliance move in February, said then it expected to put 600 jobs in Fort Worth over several years.

for use in textiles and tracking and for applications such as packing posters, has been a “good piece of business,” Allen said.

Lighthouse continues to diversify away from government business; the loss of the federal contract cost 33 jobs in 2013. Today, 22 percent of sales are to federal clients, 61 percent state, and 17 percent commercial.

Lighthouse has a newly constructed sales team, Allen says. All new in the last three years: national sales manager for tubes, sales manager for the machine shop, two sales managers for State of Texas business, and one for order entry and telemarketing.

The Lighthouse is also poking around other new potential opportunities, including a commercial bakery, Allen said. “We’ve had some very cursory discussions,” Allen said. “We have so many boutique restaurants in the market right now.”

Higher sales help fund Lighthouse’s rehab services, which are on pace to serve 3,500-4,000 people this year, up from 1,300 eight years ago, Allen said.

And Tarrant County has more people who could be employed by the Lighthouse. An estimated 37,000 people in Tarrant County are blind or visually impaired. Of those, 5,000 want to be employed, Allen said. It would be “easy to employ” 250 or 350, he said. “I’m disappointed I have 37.”

Other COmings and gOings, as repOrted first On fwtx.COm:

Pate Ranch under contract:

The 471-acre A.M. Pate Ranch, in the heart of the Chisholm Trail corridor south of Altamesa Boulevard, has a new suitor. Provident Realty Advisors has the site under contract, its president, Leon Backes, confirmed.

UT Southwestern expanding on Near Southside: The University of Texas Southwestern Medical Center is building a major new multidisciplinary outpatient clinic on Fort Worth’s Near Southside. Victory Medical was under construction on a hospital at the 6.3-acre site at the northwest corner of Pennsylvania Avenue and South Main Street when it ran into problems and left the project in February.

Gus’s World Famous Fried Chicken: The Memphis, Tenn., institution has leased a 3,720-square-foot spot in a former office building at 1065 W. Magnolia Ave. Gus’s will open in spring 2016. - Scott Nishimura

Velvet Box owner says upcoming holiday retail season looks good.

The holidays are around the corner for retailers, and Marcelle LeBlanc, owner of the fourstore Velvet Box company, says the sales trends look good from where she sits.

“You can get a good feel for how people are spending,” LeBlanc, who celebrated her sixth year in business in September, said. “The holiday feels good.”

Sales at the Fort Worth company, which sells a wellcurated selection of lingerie, books, games, adult toys, massage oils, lubricants, condoms, and bath items out of four polished boutiques in the West 7th corridor, Northeast Tarrant Parkway near Alliance, Cityview in southwest Fort Worth, and a new one LeBlanc and her business partner opened in August in Lewisville, are up 13 percent so far this year, LeBlanc says.

Sales at the Lewisville store are going better than she expected, LeBlanc said. “It typically takes a year before they’re consistently in the black,” LeBlanc says.

The Velvet Box is one year removed from three years of litigation over whether its first store, at Alliance Town Center, was operating illegally as a sexually oriented business. A state district judge ruled in 2013 that The

Velvet Box was operating in violation of its lease covenants as a sexually oriented business, even though Fort Worth Police had run vice officers to the store and declared it wasn’t violating the city’s SOB ordinance.

The company was able to open the Lewisville store on all cash - her business partner had helped finance the previous openings, LeBlanc said. It takes about $300,000 to finish out a store, not including inventory, she said.

She and consultant Beth Boatman, a certified sex educator and therapist and doctoral candidate at Texas

Woman’s University, are also looking into expanding a popular series of classes they began developing at The Velvet Box three years ago.

LeBlanc and Boatman, who have run more than 3,000 people through the classes since 2012, are interested in launching a series for people who have cancer or are chronically ill, working with physicians and other health care professionals to reach patients.

“There’s a need, so hopefully we can begin to open some doors,” Boatman said.

Businessman Lance Byrd and partners launch event venue near TCU, Colonial.

BY SCOTT NISHIMURA

Several of the partners who put up Pop’s Garage - a private recreation center in South Fort Worth they use to support youth in Fort Worth - are back at it with another project, this time the transformation of an old warehouse into an event venue called The Mopac near Colonial Country Club and the Trinity River.

The Mopac, 1615 Rogers Road, opened in October to an open-to-the-public performance by the Bellamy Brothers and a private party headlined by Kenny Loggins.

Fort Worth businessmen Lance Byrd, Jared Shope, Gus Bates Jr., Ricky Stuart, Kyle Poulson and Walter Kinzie are partners in the project. All but Kinzie are partners in Pop’s Garage.

talent buyer Gary Osier, who will help book concerts, and Kinzie.

The partners’ offices are in a small office complex they renovated and expanded three years ago, next door to the Mopac.

“We get together on Saturdays and watch football,” Byrd says.

The low-slung, 6,814-square-foot, 1954-vintage Mopac building, on a 0.8-acre site, is about as unassuming as Pop’s from the exterior.

The partners converted the old storage space and bar area and added a stage, wood floors, sound system and lights, restrooms, and a fence and turf lawn.

The venue is already starting to book events, with word of mouth spreading from people who attended the early events.

The building has capacity inside for 250 seated, with tables. Spilling through three garage doors onto the exterior patio, capacity can run as high as 700, Byrd said.

Rental fee for a Saturday night is $5,000, and, for Friday night, $4,000.

“There’s a real need for this in Fort Worth, just a small venue” for weddings and events like meetings and fundraisers, Byrd said. Shope: “We’re trying to put something near TCU, Colonial, for the people right here.”

“We’ll mix in a few of the concerts,” but the business model isn’t focused on them, Byrd said.

Byrd and Shope are running the venue. The partners will lever some of their other businesses to help run The Mopac. Byrd is 25 percent owner in Encore Live, an event planning business that’s next door to The Mopac. Other Encore Live partners include

“It ticks down during the week,” Byrd said.

The entry foyer of Rogers Road can be rented for meetings. Amenities such as the stage and lights add value, Byrd said. “You save money” by not having to rent those, he said.

The venue is already starting to book events, with word of mouth spreading from people who attended the early events, Byrd said. “Fort Worth is a small town, so a lot of people talk,” he said.

A group of friends and investors launch a new event venue. Please see our video interview at fwtx.com/fwinc/videos.

Justin J. Sisemore has been recognized by his peers as a ‘Rising Star’ in Texas Monthly Magazine, recognized as a ‘Top Attorney’ in Fort Worth, Texas Magazine for the last seven years, and has been a guest speaker for the Tarrant County Family Law Bar Association. Samantha M. Wommack has been recognized by her peers as a ‘Top Attorney’ in Fort Worth, Texas Magazine. We are proud to welcome Zoe Meigs to the Sisemore Law Firm. Zoe Meigs has an AV Preeminent Rating and has over 25 years of legal experience. Our firm provides an extensive range of family law services, which includes all aspects of divorce; including property divisions, and custody disputes. While we represent clients throughout Texas, we regularly service Tarrant, Dallas, Parker, Johnson, Denton, Hood and Wise counties. The Sisemore Law Firm works diligently to provide highly competent and efficient service to each and every client. Our firm also works with various civil litigation firms throughout the DFW metroplex to assist their clients in family law matters. Visit our website at www.thetxattorneys.com to view our client testimonials.

These six mobile apps save executives time and money.

These mobile apps will help you save more of boTh.

evernoTe. Among the most popular apps, Evernote works with all devices, allowing users to organize notes, photos, lists, and more in one location. The photo feature shoots perfect pictures of documents, business cards, and images, allowing users to email or text them.

skysCanner. Looking to jump a plane at the last minute? Try this app, which allows you to search and book fares to your destination by date, class of service, and one-way or roundtrip. The app also has an easily navigable feature that shows you what the cheapest fares are by date from your desired airport of departure.

Chefsfeed. On the go in a city where you’re not familiar with the restaurants? ChefsFeed collects restaurant reviews from chefs. If you’re dropping into the Bay Area and want to see who’s recommending what, pop in San Francisco, push the button, click on a restaurant and see what the chefs’ feedback is.

feedly. Not what it sounds like, this app allows you to aggregate your favorite digital media sources, by category and name. Love VentureBeat? Open it up in the app, and its posts populate in easy-tonavigate form.

favor. Busy at the office and want to order in food? Try this app, which has just recently busted onto the Fort Worth scene. Order from its selected restaurants, by featured promotions or what else is on the menu. Order something the restaurant is out of, and you’ll get a text from your eager Favor driver, offering to find you something else. Can’t find the restaurant or store you want? “Order anything,” the app says, and your Favor driver will find it. A seemingly open-ended feature of the app is “Essentials,” which has Walgreens and a few other offerings now, but in the future bears watching to see what pops up. Open an account with your credit card, and pay your bill, including service charge and tip. Entrees On-Trays, a Fort Worth delivery favorite, also has its own mobile app.FW Inc. staff

Stayful. Dropping into a city and need a hotel room? Load your city, budget (budget, mid-priced, and premium), and dates of stay into this app, click “I’m Ready,” and it displays what's available along with “best online rate,” from cheapest to most expensive.

You could be pocketing a 50 dollar bill for every light in your building.

Most businesses realize a return on investment through energy savings on lighting within two years! We will calculate your ROI before getting started on any of the services below:

Turn Key Solutions

Custom LED lighting

Commercial air conditioning controls

UV protection tint/film

Solar installation & maintenance

Energy rate negotiations

Financing

13995 Diplomat Drive, Suite 300

Farmers Branch, Texas 817-475-9394

tyrrell.hearn@millssystems.com

www.millssystems.com

BY KENDALL LOUIS

Every winter we learn that even when the weather freezes, work rarely does. Which means that exiting your home and facing the cold are an inevitable beginning to your workday. Solace can usually be found in the fact that, around here, weather can change with the drop of a felt hat. From lightweight to camel colored to sleeveless, these overcoats and trench coats might just be versatile enough to keep up with your busy schedule and finicky Fort Worth temperatures.

HUGO BOSS STAND-COLLAR WOOL OVERCOAT Neiman Marcus, neimanmarcus.com

The Executive Medicine of Texas concierge health memberships are designed to be the ultimate answer to personalized healthcare. Our comprehensive packages ensure that your current health is intensively assessed and a proactive plan for your future is developed. At Executive Medicine of Texas, we value a lasting relationship with patients and we are honored to partner with clients year after year to achieve the best health possible.

Primary Care

- Same Day/Next Day Office Visits

- Online Virtual Physician Consultations

- Routine Lab Work

- Routine Vaccinations

24/7 Physician Access

- Via phone, email, text messaging or online virtual meeting at the physicians discretion

Coordination of Care

- Care will be coordinated with other health care providers.

Air Medical Transfer

- Hospital of choice air medical transfer within your home country during domestic and international travel.

Gold Preventative Exam

- Half-day Executive Physical Exam

- Complete laboratory panel (Over 100 Values)

Primary Care

24/7 Physician Access

Coordination of Care

Air Medical Transfer

Gold Preventative Exam

- Half-day Executive Physical Exam

Primary Care

24/7 Physician Access

Coordination of Care

Air Medical Transfer

Gold, Gold Plus or Platinum Preventative Exam

- All testing as included in our Gold Plus or Platinum exams

- Hormone Evaluation

- Comprehensive health history

- Cardiovascular Stress Test

- Follow up visit with executive health report

PLUS

Bioidentical Hormone Replacement Therapy

For the full year of membership, BioTE Bioidentical Hormone Replacement Therapy, regardless of your personalized dosage or your personal therapy frequency, is included at no additional cost.

Personal Pharmaceutical-Grade Supplement Regimen

Your Executive Medicine of Texas physician will create a personalized supplementation program specific to your unique needs. All physician-recommended supplements will be included for the full year of membership at no additional cost.

- Complete laboratory panel (Over 100 Values)

- Hormone Evaluation

- Comprehensive health history

- Cardiovascular Stress Test

- Follow up visit with executive health report

Imaging

- CTs of the chest, abdomen, pelvis, coronary arteries with calcium score

- CT Reconstructive Colonography

- Carotid Doppler

- X-Rays, EKGs, MRI Scans

CHAMBERS CAMEL VEST

Esther Penn, estherpenn.com

Photo courtesy of Amanda Marie Portraits

WOOL BELTED VEST Cuyana, cuyana.com

WOOL COAT Cuyana, cuyana.com

BOYFRIEND COAT

Esther Penn, estherpenn.com

Photo courtesy of Alana Mendel

WE’RE JUST WARMING UP.

Visit the FWTX.com blog to see more winterworthy men’s and women’s coats. Learn where to find a capsule coat collection from a Hollywood costume designer and how bloggers are styling outerwear this season.

Conducting an annual review of your retirement goals and strategy is an ideal way to check that your plans for your financial future remain realistic and on track. With that in mind, taking the three easy steps outlined below will help you conduct your retirement tune-up.

Your first step should be to review your retirement savings goals and assess whether anything significant has occurred during the past year that might affect either your outlook for retirement or your current strategies to prepare for it. For example, have you decided to change the date when you’ll retire? Or have you experienced any new milestones such as getting married, divorced, or having a child? Any of these events may affect how much you will want to save to fund the retirement you envision.

Your portfolio’s specific mix of stocks, bonds, and cash, known as your asset allocation, should complement your financial goals, risk tolerance, and time horizon.1 If you haven’t taken a fresh look at your investments in a while, don’t assume that your old asset allocation is still appropriate for your current needs. Even if your personal outlook hasn’t changed, keep in mind that uneven returns provided by different investments may have caused your portfolio to shift from your intended asset allocation. If your asset allocation needs to be rebalanced, now may be the time for action.

None of us know what the future may hold. A good way to improve the odds that you have saved enough for retirement is to save more, no matter how prepared you may already be. If you have not already done so, consider funding an IRA. For the 2015 tax year, you can contribute a maximum of $5,500 and those aged 50 and older can make an additional catch-up contribution of $1,000. These limits are set annually by the IRS. More information can be obtained at www.irs.gov Conducting a retirement tune-up is always a great idea but don’t forget to consult with your financial advisor to discuss what else you can do to help plan for a confident retirement.

Contact one of our advisors today for a no obligation review.

by Kyle WhiTecoTTon

The greatest justification for a corporate getaway is the belief that the best way to do business is to feel like you’re not doing business at all. That’s why corporate retreats should be less about agendas and more about finding inspiration, cultivating relationships and broadening minds. And no place provides all of this better than a snow-covered mountain. So when the snow falls in the mountains and you’re itching to leave the office far behind, shake things up with your colleagues and clients at one of these well-appointed resort lodges.

The Peaks at Telluride—Telluride, Colo. Besides world-class Colorado skiing, The Peaks at Telluride is your headquarters for group adventures like snowmobiling, dogsledding, snowshoeing, winter horseback riding and heli-skiing. Your guests will enjoy mountain views from every room along with the comfort and convenience of a true ski-in/ski-out resort. Amenities include full ski valet, live music during après ski, and Colorado’s largest spa—The Spa at the Peaks. The Peaks also offers over 10,000 square feet of meeting space, including 9,000 square feet of outdoor decks and terraces. The Crystal Ballroom, surrounded by a 300-degree Rocky Mountain panorama, is the most popular of the 12 event space options.

The Little Nell—Aspen, Colo. In the heart of downtown Aspen, The Little Nell is just steps away from Aspen Mountain’s Silver Queen Gondola and a lavish collection of shops and eateries. Guests enjoy first tracks privileges before the resort opens, exclusive fresh powder via The Little Nell Powder Cat, and ski-in/ski-out convenience topped off by an

appetizing après ski at the chic Chair 9 and silver service cuisine at Element 47. Corporate venues at The Little Nell include the 1,800-square-foot Grand Salon, the luxurious Aspen Mountain Club with views of the Elk Mountains, or the Sundeck, which sits at 11,212 feet and overlooks the Continental Divide.

Fairmont Banff Springs—Banff, Alberta, Canada In addition to more than 8,000 skiable acres across three world-class mountains—Lake Louise, Mount Norquay and Sunshine Village—the Canadian Rockies landscape around Banff boasts group outings like canyon ice walks, dogsledding, ice fishing and sleigh rides. And guests of the Scottish baronial-style castle that is Fairmont Banff Springs Resort have exclusive access to it all, including the European-style Willow Stream Spa, a wide

Flying privately to a snowy location provides a level of ease that can only be matched by a close and convenient airport. These public airstrips with fixed-base operators service private planes and sit just a short drive away from our list of luxury hotels and resorts.

The Peaks aT Telluride

Telluride regional airport

airport distance: 6.77 miles

runway length: 7,111 feet

The liTTle Nell

aspen/Pitkin County airport

airport distance: 4.83 miles

runway length: 8,006 feet

FairmoNT BaNFF sPriNgs

Calgary international airport

airport distance: 90 miles

runway length: 8,000 – 12,000 feet

sTeiN eriksoN lodge deer Valley

south Valley regional airport

airport distance: 42.6 miles

runway length: 5,862 feet

suN Valley lodge

Friedman memorial airport

airport distance: 14.4 miles

runway length: 6,952 feet

ToPNoTCh resorT

morrisville-stowe state airport

airport distance: 10.4 miles

runway length: 3,697

WhiTeFaCe lodge

lake Placid airport

airport distance: 4.1 miles

runway length: 4,196 ft

range of restaurants and rooms with unparalleled views. Over 76,000 square feet of event space includes the elegant Alhambra Ballroom, the Cascade Ballroom and Conservatory with hardwood floors and crystal chandeliers, and the baronial splendor of Mt. Stephen Hall.

Stein Eriksen Lodge Deer Valley—Park City, Utah Named after the Norwegian Olympic Gold Medal Skier, the Stein Eriksen Lodge is a ski-in/ski-out European retreat in Park City perched mid-mountain at Deer Valley Resort. From cozy private rooms to the 14-guest Mountain Lodge grand suites, unique style and architecture abound. The Stein Eriksen boasts Utah’s only Forbes Five Star spa as well as a diverse wine collection with more than 10,000 bottles complimenting luxury dining and group wine seminars. Old World charm extends to over 26,000 square feet of event venues including the Stein and Viking Boardrooms, the Odin and Valhalla Private Dining Rooms and Park City’s largest luxury ballroom.

Sun Valley Lodge—Sun Valley, Idaho In 1936, Sun Valley Lodge became America’s first destination ski lodge and a favorite among Hollywood stars and global leaders. Set amid the quaint mountain village of Sun Valley, Idaho, the lodge is a blend of charm, history and modern comforts. Even after a recent yearlong renovation, the lodge’s 94 guest rooms maintain a vintage charm that extends throughout the resort including the 20,000-square-foot spa, world-class fitness and yoga studio, and indoor-outdoor pool and pool café. Such appeal also extends to the meeting facilities, conference center and event service team offerings, which include everything from customizable menus to group horse drawn sleigh rides.

Topnotch Resort—Stowe, Vermont

Topnotch Resort sits on a private 120-acre wooded expanse of New England countryside just minutes from the picturesque village of Stowe and the slopes of Stowe Mountain Resort. Topnotch offers 68 guest rooms and more than

20 private resort homes. The grounds include a world-class spa, award-winning indoor/outdoor tennis center, Nordic Barn adventure center for group outings, indoor and outdoor pools and an equestrian center. Culinary offerings include the local farm-to-table fare of The Roost and the resort’s signature bistro/terrace Flannel. The resort’s 6,000 square feet of indoor meeting facilities offer both spacious and more intimate options, while all outdoor accommodations embrace panoramic views of the Green Mountains.

Placid, New York The three peaks and 86 trails of Whiteface Mountain, near the Olympic Village of Lake Placid, offer the greatest vertical drop east of the Rockies, while nearby Whiteface Lodge offers the most distinguished rustic setting for corporate gatherings. The Adirondacks influence every detail of the property from rustic guestroom furnishings to distinctive event spaces like Mountain View Terrace with scenic panoramas and a massive fieldstone fireplace or the Whispering Pines Room with space for 200 guests. In addition to a 54-seat movie theater, an award-winning spa and a three-season ice rink, the lodge also offers orienteering and skill-building clinics as well as on site team building with Grand Dynamics International.

2

West 7TH offers private and semi-private restaurant dining options to celebrate your company holiday luncheons & parties. The only distraction you will have is…the delicious food!

Whether your luncheon consists of 8 people or 60, West 7TH has room for everyone. With 8 different restaurants ready to serve, you will surely please everyone’s appetite. For more information, please visit: West-7TH.com/holiday-party

by brianna KESSLEr

Earned media, such as customer reviews and fan pages, has proven to be one of the most successful free marketing and advertising tools available to businesses. Big businesses and major brands have applied this through social media for years, making it an essential customer relations branding tool. But, the world of social media is continually evolving, and as soon as you think you’ve conquered social media marketing, it changes again.

It’s now possible to expand social media engagement from online to offline with Flapit, the first social media counter made for an offline environment. This powerful, interactive marketing tool will allow small businesses and corporations to increase customer relationships and successfully build reputations by displaying social stats in the companies’ physical surroundings.

“Social media is more important for businesses than ever before, driving increased engagement and two-way customer interaction online,” says CEO and founder Christophe Avignon. “With Flapit, we wanted to create an object which takes social offline and into the shop floors, stores, hotels, restaurants and offices, but in a designconscious way.”

What it is: Flapit is a ’60s-themed analog clock and a physical social metrics counter that connects to all the major social media platforms such as Facebook, Twitter, Google Plus & Analytics, YouTube, Weibo, Instagram, VKontakt, Yelp, Swarm and QZone. It shares your online popularity offline.

How it works: Flapit can be displayed anywhere. Just plug it in, connect to the Flapit network and go to flapit.com/flapmenow. Start showing off your social media achievements on the spot. The Wi-Fi-enabled device allows you to customize what is displayed from your social media sites. Display ratings, reviews, likes, promotional prices and discounts.

Why you should have one: Marketing research shows that the majority of customers are more likely to trust businesses and brands with a strong social media presence. Customers look to social media for information about your product and are more likely to try and recommend your brand based upon customer feedback. The success of your company depends upon a strong two-way communication between business and consumer with active engagement.

There are more than 30 million businesses on Facebook and 80,000 on Yelp, with more than 61 million consumer reviews. Yet 92 percent of retail transactions still take place offline. By displaying your company’s social media stats, your business can gain customer trust, expand social media presence offline, build relationships and keep customers informed and engaged.

Order your FlapIt at flapit.com. Shipping takes up to six weeks.

CosT: $299

The Naveen Jindal School of Management offers students:

• A full-time MBA program ranked No. 14 (tied) among public university programs and No. 33 (tied) overall by U.S. News & World Report (2016)

• 12 master’s degree programs and five MBA program options including joint degree, executive, flexible and online formats

• Jindal School’s own Career Management Center

• Networking with alumni and corporate mentors and recruiters

John R. Cochran President

ClubDesign Associates focuses on Interior Design, Purchasing, Project Management and Construction of Country Clubs, Golf Clubs and Hospitality Interior Design Projects based all over the United States. ClubDesign has been recognized and received awards and recognitions for its work from Fort Worth Star-Telegram; Golf Inc. Magazine; Club & Resort Business Magazine; Avid Golfer Magazine. Professional Memberships and Affiliations that ClubDesign is a member of includes IIDA (International Interior Design Association) and TBAE (Texas Board of Architectural Examiners). We’ve been fortunate to work on more than 200 clubs and resorts all over the United States: Lajitas Golf Resort & Spa, Fiddlesticks Country Club, Naples Grande Golf Club & Aliso Viejo Country Club, Colonial Country Club, Barton Creek Resort, La Quinta Resort, PGA West, Ridglea Country Club, Sun City Palm Desert, and Gainey Ranch Country Club. “Service your client to the best of your ability” is our business philosophy and mission. Member-owned clubs should select knowledgeable members to sit on house committees; if not, they’re setting themselves up for problems and bad decisions. With the large spaces that we work with, scale is important. Small furniture, accessories, artwork, etc. will look like you cut corners, and the membership is educated enough to know the difference.

Mike Karns, president and owner of Firebird Restaurant Group, talks about his company's ambitious growth plan.

BY BRIANNA KESSLER

El Fenix Mexican Restaurant celebrates its 97th anniversary this year, and Mike Karns is in major expansion mode at the moment. El Fenix, which was bought by Firebird Restaurant Group in 2008, runs and operates four major restaurants including El Fenix, Snuffer’s Restaurant and Bar, Meso Maya and Taqueria La Ventana. It also operates a supply company, Sunrise Mexican Foods.

Karns started his successful career in commercial real estate in 1987, and in 2008 his interest in property attracted him to the legendary EL Fenix restaurant chain. Since his purchase, Firebird Restaurant Group has expanded El Fenix from 15 restaurants generating $33 million to 22 restaurants generating $50 million and has established a total of 35 locations across four brands throughout Texas and Oklahoma.

Karns recently purchased the historic Kress Building in downtown Fort Worth, where Firebird Restaurant Group will open the city's first location of their popular Meso Maya restaurant.

Why did you purchase El Fenix? What about it appealed to you as an entrepreneur? As a heritage brand, I wanted El Fenix to maintain its legacy, history and authenticity. The goal with the purchase of El Fenix in 2008, a family-owned company with 15 locations, was to become the steward of the company. There had not been any changes to the restaurant in 10 years, but I saw a future for the brand. I would describe the relaunch of El Fenix, which had been in existence through five generations of the renowned Martinez family and close to 100 years old, not exactly as a rebranding but as restoring and repackaging of an iconic brand for the next generation of diners. My past experience in restaurant expansion and real estate development provided me with the knowledge to develop an expansion plan for El Fenix, a brand that I have always been personally fond of. I am an entrepreneur and very involved in both real estate and the restaurant side of the business.

Firebird Restaurant Group has 35 locations throughout Texas and Oklahoma and is still expanding. What are your long-term goals for the business and brands? When we acquired El Fenix, there were 15 locations. My team and I carefully reviewed the restaurants and selected a few of the best, being careful not to disrupt the guest experience or the guest base. We then built a restored and repackaged El Fenix at those sites while, at the same time, continuing to refine the “new” restaurant model. Along the way, we also developed

a new independent concept, which would complement the El Fenix brand but stand apart. Meso Maya is a true authentic Mexican restaurant with a menu inspired by natural ingredients from Mexico with scratch moles, adobos, salsas and handground tortillas. Firebird is on a careful but aggressive expansion mode with our four existing brands, along with additional innovative and exciting concepts rapidly taking shape. There is no end number of restaurants in mind, but we are looking at a 25 percent growth rate per year over the next five years, which would take us to 120 restaurants. Growth equals opportunity for everyone involved with our restaurants. Profits result in growth, and growth results in opportunities for our employees and our guests. We are very focused on increasing guest count by 8 percent, year over year.

El Fenix opened a restaurant at WinStar World Casino a few years ago. Do you see the restaurant expanding into any other casinos? WinStar World Casino is one of the largest casinos in the United States based on gaming floor space, and it was a very good fit for us because it was geographically close

to our planned expansion area. In addition, the guest demographic was a match as so many Texans drive there. We see growth into other non-traditional sites as expansion opportunities for all our brands, as well as new concepts under development. We look at each opportunity to determine if it’s the right decision for the stage of the brand’s development.

What is the key to your success? I’ve always invested in myself from a growth and learning standpoint and focused on my strengths. I have always been a creative, driven, calculated risk taker. Through the growth of my companies, I’ve been able to build a platform and support team that I can give back to providing opportunities for others to grow individually and professionally, focusing on their strengths. We are a very people-focused company and have built a strong corporation. We are a very creative and opportunistic company.

How will you stay involved in the DFW community as your businesses expand into other states? Firebird Restaurant Group’s legacy brands and our new concepts are all products of North Texas. We may expand beyond Texas, but we are absolutely a “product of Texas.” Passion, pride, and performance profits growth and opportunity, which helps us provide for others in the community. Profits also allow us to support and grow our charity outreach.

Which companies do you admire? Why? I always admired the great combination of creativity and teambuilding that is personified by Phil Romano, Norman Brinker and Sir Richard Branson. No one was better than Norman Brinker at identifying talent and building a team. Phil Romano was and is a visionary. His concept creativity and aesthetics

are legendary. He executes the details so flawlessly to give his diners a true sense of place. Sir Richard Branson has taken a brand and successfully and creatively magnified its impact and services exponentially.

What are the annual sales for each segment? We look to break $100 million in sales by the end of 2016.

In March, Triton Commercial Real Estate, an associate of Firebird Restaurant Group, financed the newly purchased Kress Building in downtown Fort Worth for $5.4 million. Can you tell us a little bit more about this purchase? Why did you decide Meso Maya should occupy the space? We felt like it was the best fit for downtown Fort Worth and the historic building. We also have another open space on Houston Street.

Corporations are realizing the importance of strong wellness programs to maximize employees’ productivity, creativity and ability to meet their full potential.

By JEnnifEr caSSEday-BL air

Employers know healthy employees are happier and more productive - and less of a strain on insurance claims. Here are some area organizations that are trying to help their people get and stay healthy.

Alcon Alcon believes employees are the foundation of a successful company. That's why it offers personalized wellness programs through the Be Healthy initiative. Alcon helps its associates maintain and improve health, fitness and diet by focusing on four pillars: Move (exercise), Choose (healthy eating), Know (health education) and Manage (support programs).

Senior Training and Development Specialist Jaedeanne Shaver has worked at Alcon for three and a half years.

“When I first started working at Alcon, I signed up for one of the 5K running classes,” she says. “Since that time, with the support of the fitness center, I have run countless 5Ks and 10Ks, five half marathons, one full marathon, several sprint triathlons and one IRONMAN 70.3.”

The Be Healthy program kicks off each year with a celebration week, including five days of healthy activities such as healthy food offerings and free health checks.

Alcon has an incentive program that rewards its employees with points for reaching certain health goals. The points are redeemable for prizes such as gift certificates, live events and electronics.

Associates also have access to the Live and Work Well Program that helps with everything from the demands of everyday stress to major life events. Employees are offered information, consultation and referrals for legal assistance, financial services, child/parent support services, adult/ elder support services, chronic condition support services and life learning education support services.

In addition to having access to Alcon’s indoor fitness facilities and locker rooms, employees can take group classes or use the outdoor fitness areas for activities such as volleyball, kickball, soccer and other sports.

Alcon also provides a behavior-based program to help participants quit tobacco.

Capital One Financial In addition to the typical medical, dental and vision coverage, Capital One provides prescription drug benefits through CVS Caremark.

Many Capital One locations offer on-site fitness centers for employees and their family members in addition to giving discounts to area gym facilities. Through the healthcare insurance offered to its associates, Capital One promotes individual health goals by creating a personalized Health Report and Action Plan. It is possible for Capital One employees to earn incentives.

The Capital One Employee Assistance Program provides round-the-clock support and advice.

Texas Christian University TCU faculty, staff, retirees and their spouses/ partners are eligible to participate in the WellnessGold program. Once enrolled, the initial six-week program includes “wellness tasks” related to multiple areas of overall fitness and are assessed at the beginning and end of the program. This assessment includes body weight, waist circumference, hip circumference, resting heart rate, resting blood pressure, stress profile questionnaire, nutrition knowledge questionnaire and strength level.

Using the educational institution’s wealth of knowledge, the WellnessGold program partners with on-campus faculty, staff and students from Nursing, Nutrition, Information Technology, Center for Instructional Services, Office of Religious and Spiritual Affairs, Religion, Office of Communications and Campus Recreation.

Baylor All Saints Committed to improving the health of those they serve, Baylor All Saints asks its employees to model the same behaviors it promotes to its patients. Beginning in 2012, Baylor no longer hires individuals who use nicotine products. Baylor’s wellness program allows employees to take advantage of fitness center discounts and a wide variety of free, wellness-related services. An interactive website featuring health trackers, exercise plans, nutrition tips and customized articles is an excellent wellness resource. In addition to health screenings, seminars and competitions, Baylor provides telephone health coaching and disease management coaching for employees who qualify.

Becky Hall, vice president of health and wellness, has worked at Baylor All Saints for 14 years. She takes advantage of Baylor’s monthly challenges and walking groups. Hall says, “I also participated in the Naturally Slim weight management program four years ago. I lost more than 30 pounds and have been able to maintain that.” Baylor also offers financial incentives for staying fit. “We can earn up to $780 of premium credits and $325 of prizes and rewards throughout the year for participation and results,” Hall says.

Fast-growing Fort Worth digital media firm, into its third expansion, matches wide-open spaces to collaborative culture.

By Scott NiShimura / PhotograPhy By alex lePe

PMG Worldwide started modestly - and, perhaps, without foretelling its future success as a digital advertising and marketing agency that would make the Inc. 5000 ranking of the nation’s fastest-growing companies - in a little 900-square-foot office in Fort Worth’s West 7th development.

Three expansions later, including a 7,000-square-foot expansion that PMG and founder George Popstefanov cut the ribbon on this summer, the Fort Worth company is sitting in a 13,000-square-foot space in the same building, One West 7th.

“We have another 18,000 square feet behind us that is available,” Popstefanov says, and he expects to need that soon.

“Nine months to a year, maybe less,” he said in an interview this summer.

PMG continues its rapid growth. The company, a full-service digital agency that does everything from social media to search engine optimization for clients like Apple, J. Crew, Travelocity and OpenTable, made the 2014 Inc. 5000 at $5.8 million in sales for the previous year, up 5,000 percent over three years.

Popstefanov, 33, a Macedonian who emigrated to the United States as a high school exchange student in Wisconsin and then later made his way to college in Oklahoma City and, finally, TCU, where he earned a degree in e-business and marketing in 2005, projects $15$20 million in revenue this year. PMG has more than 70 employees today, and “the pace we’re on, it could be 100” next year, he said.

The company recently opened offices in New York and Los Angeles to be closer to clients and provide opportunities for employees who wanted to work in those cities and is considering other satellite offices, Popstefanov said.

PMG, working with VLK Architects, has developed a wide-open office space that - together with the various pieces of the company’s culture - fosters entrepreneurial collaboration, Popstefanov said.

A bar in the center of the room is typically covered with snacks. Whiteboard walls, lounges, couches and what Popstefanov calls “funky chairs” foster teamwork and idea generation, he says. A loft allows employees to move off by themselves. The latest expansion allowed PMG to take over the second-floor sky deck facing West 7th that belonged to Lucky Strikes, a bowling alley that closed in the building this year. It’s also dotted by cozy vignettes.

“We’ve seen a lot more cooperation; we see results for clients,” Popstefanov said.

PMG allows liberal opportunities for employees to attend conferences (“everybody can go to a conference,” Popstefanov says) and offers incentives for innovation, running an employee contest this year seeking best mobile idea for any of the company’s clients. Teams present their ideas after the holidays, and the winning team gets an all-expenses-paid, seven-day trip to a conference in Barcelona.

The company sponsors a running club; pays for employee fitness memberships; and offers weekly yoga and monthly massages, Happy Hour, and movie outings to the Movie Tavern in the West 7th development. In a nod to their philanthropic aspirations, employees are allowed to spend 10-15 hours per week “on something else” that isn’t work-related, Popstefanov says, although they often spend that time around the office.

And then there are those Beer Fridays.

“At 2 or 3 o’clock (on Friday afternoons), we get up, have a beer, and talk about the week, then we go home,” Popstefanov says.

The company’s health benefits include 12 weeks paid maternity leave - half of employees are women - and two weeks off for new dads.

Popstefanov, who started his career working for another agency before going off on his own, says he’d like to see Fort Worth turn into a technology center and idea incubator.

“I don’t necessarily have to be a pioneer, but if I end up helping Fort Worth to become that, I would like that,” says Popstefanov, who lives in Southlake and whose wife is a physician.

Noting Facebook’s recent announcement that it will build a data center in the Alliance Corridor, Popstefanov says he’d like to see something like that move closer into the city,

When he was in college, “we were debating whether people were going to buy food or shoes online,” he says. “So things have changed.”

Fort Worth's own Texas country legend has grossed $77.5 million in the music business, owns a minority share in The Rustic in Dallas, helped build and sell a $10 million real estate fund, dipped his toes in oil and gas, and is just getting started.

BY SCOTT NISHIMURA

still recalls the conversation. His country band had selfreleased “Carry On” - the third of its first three albums - and sold 250,000 records and was packing fans into its concerts when the head of label for Universal Records dropped by a show in Washington, D.C. “Please don’t tell me you’re here to make me rich and famous,” Green told the exec. “I want longevity.” Green, 43, might have hit the trifecta. December marks the 20year anniversary of his first album, “Dancehall Dreamer,” which he churned out with his band while studying at Texas Tech. And 10 studio albums, two live albums, and more than 2.5 million record sales later, including a hot streak where he toured with Kenny Chesney, Keith Urban, Willie Nelson and the Dave Matthews Band, Green’s certainly had a long career. And rich?

“He’s always had financial goals,” Craven Green, Green’s dad and a longtime wealth manager who manages his son’s money, says. “He’s been derailed from time to time, but the numbers are still running around in his head. He still makes projections: ‘At 55 or 60, I ought to have x dollars, the house’ll be paid for, the kids are off, and (wife) Kori and I ought to be able to do what we want to do. He hasn’t hit those numbers yet. But he is very comfortable with where he is right now.”

Some of what Green estimates have been his band’s numbers over two decades: $22.5 million in revenue from record sales, including the Universal Records release “Wave on Wave” album in 2003, which went Gold. And $55 million in revenue from ticket sales, T-shirts and other merchandise, endorsements, and the like. Except for one year where he bought a second touring bus and its accoutrements, Green says the band has been consistently profitable, shooting for a 22-27 percent profit margin each year.

After five studio albums between 2001 and 2009, Green came back in 2012 with the “Songs We Wish We’d Written” on the independent Sugar Hill Records label. Then, burned out, he took a lengthy break, coming back only this year with the self-released “Home,” in which he writes, “I finally found my way home.” In short: Green’s happy to have dialed it down.

“I call it ‘making records by committee,’ ” Green, who moved to Fort Worth

near TCU 10 years ago from Austin, says of the demands of working under a major label. “There’s 15 guys in the studio telling me what to do with my songs that I wrote.”

During his break, Green teamed up a group of partners, including Free Range Concepts of Dallas, to open The Rustic, a restaurant, bar and live music venue at North Central Expressway and Uptown Station in Dallas. Green, with a minority ownership, is the Rustic’s public face and occasional performer. With the Rustic’s alcoholic beverage sales running at $9 million per year, making it Dallas’ top alcoholselling restaurant and bar, the partnership is drawing close to nailing down plans for Rustics in Frisco, San Antonio and Houston. All three could open simultaneously within 18 months of the announcements, Kyle Noonan, one of the Free Range partners, says. Green “has a name that carries a lot of weight here in Texas,” Noonan says. Most importantly, Green’s way back home has meant more time at home with his wife Kori, a Fort Worth lawyer, and their two children, Kellis, 11, and Rainey, 9. Where Green estimates he was on the road 240 days a year between 1999 and 2009, now he does 80-100 shows a year.

“I get to be home almost every day of the week,” he says. He’ll tour Fridays and Saturdays with the band, “then I’m home Sunday most of the time.” The time at home has also given Green more time to work with his Pat Green Foundation, which raises money through golf tournaments to benefit The Gladney Center for Adoption in Fort Worth and Ben Hogan Foundation’s initiatives, including the First Tee youth program.

Green’s ambivalence about spending so much time on the road is reflective of the sacrifices and tradeoffs of anybody building a business. “I missed the first few years of both my children’s lives,” he says. “It’s the biggest regret I have. It’s also the reason my children can go to college without a loan.”

“Business at the highest level is not a respecter of friendship or anything else. Nor should it be. It’s just business.”

- Pat Green

And, he adds, “There was also a part of me that felt a certain responsibility for continuing to grow a very good business.” Green has always had an eye on the numbers behind the business, but he says he’d never have gotten into it but for breaking his arm in 17 places during a pickup basketball game during his freshman year at Texas Tech. “I always thought I was going to be a baseball player,” Green says. “I was never good enough to be a pro baseball player. And I was never going to be a college ball player.”

While recovering from the fracture, Green picked up guitar. His mom had forced him to take piano as a child. “That was miserable,” says Green, who grew up in Waco. And he played drums in the high school band. “Also at a very low level,” he says.

Why guitar? “It was the only thing I could do,” he says. “I used the guitar to

prop up my arm. I was bored. And medicated.” Green became music leader for an all-Greek Bible study, which meant “beer after and playing guitar at somebody’s apartment.”

Green and his band made “Dancehall Dreamer” at a Lubbock studio in 1995 for $12,000, borrowed from family and friends; “Wave on Wave,” by contrast, cost as much as $250,000 to make later under the Universal Records label. The band then produced “George’s Bar” in 1998, plus two live albums. And it produced “Carry On” in 2000.

Green, who graduated from Tech in 1997, got a final push into music about one year later by his stepfather, Jack Burgess. Green had gone to work after graduation for a wholesale company owned by Burgess, while doing gigs on the weekends. “I got to have my beer on Sunday night, while everybody else was recovering,” Green jokes.

Then one Monday, one of the band members brought the money bag from the weekend’s work to Green’s office. The gross: $20,000. The band’s net: $10,000$12,000, including its 80 percent share of the door, plus the T-shirts, hats, and koozies it was selling to juice the profits. Burgess walked by. “Is that my money or your money?” he asked. He and Green took the bag into another office, where Burgess counted it.

“If you can do this one weekend, you can do it every weekend,” Green recalls Burgess saying. “He politely said, ‘It’s time to go.’ ” And Green says he was ready: “I just realized music was what I wanted more than anything.”

If Green needed the push, it wasn’t for any substantial doubts about the risk, his dad says. “I don’t think Pat ever had any doubts about his ability as an entertainer,” Craven Green says. “I don’t think it ever crossed his mind.”

Craven Green, who made Bank Investment magazine’s 2012 Top 50 Bank

Advisors ranking, says he’s given his two sons minimal financial advice over the years: “Your personal and business world is going to be fairly simple; it’s adding and subtracting.” And, “There are times when what you want to do is not what you can do.”

“Pat’s always been able to recognize a potential value and assess it fairly accurately,” his dad says. He’s not surprised his son has had such a long career. “He’s always been a show kid,” Craven Green says. Early on, he recalls attending one of his son’s concerts. “The crowds were mixed, from junior high school girls to 50- and 60-year-olds,” he says. From the start, “he’s got very broad appeal.”

After the band self-released “Carry On” in 2000, things took off. It packed thousands into its shows, including one in Bedford. “It just started exploding about that time,” Green says. The band had sold 250,000 records before it signed

with Universal. Green and the band did three albums for Universal between 2001 and 2004, including “Wave on Wave,” which peaked on the U.S. country charts at No. 2 and sent Green off touring with Chesney. The band later switched to BNA Records, an imprint of RCA, and produced “Cannonball” and “What I’m For” in 2006 and 2009. Those records cost $200,000-$250,000 to make.

The major label deals also brought big advances, including $750,000 for “Wave on Wave,” and endorsement deals such as a two-year agreement with Miller Lite for $500,000 a year, under which Green appeared on billboards, sang in the beer’s advertising jingle, and played golf seven times a year with Miller distributors.

“Songs We Wish We’d Written,” in 2012, peaked at 15 on the country chart. Green released "Home" on Aug. 14 this summer.

What’s led to such a long career for

Green? “His music has changed,” Craven Green said. “He was truly a honkytonk hero. The themes of his songs are much more mature now. As tastes have changed, so has his music changed.”

Pat Green attributes his longevity to linking up with strong management and having a good touring schedule and visibility, which he views as key components to any band’s life. “We’ve got a pretty good plan,” he says. At every turn, Green says he’s sought to associate himself with “the biggest guy in town.”

Green’s team on the music side includes 888 Management, the William Morris Entertainment agency, a business manager in Nashville, and a tour manager in Fort Worth. Typically in the industry, 30 percent of the gross goes to those people, including 15 percent

to management, 10 percent to the agency, and 5 percent to the business manager. Of his business manager, “I would admit I’m his most challenging client,” Green says. “I make a lot of decisions with my heart.” The Green team also includes Green’s wife. “She goes into that last comment,” Green says, adding, “She gives me an allowance.” And of Green’s money manager dad: “He doesn’t even charge me a fee. He better not; he’s my dad.”

“Most musicians don’t know what to do with the business side of it, but Pat loves the business side of it,” says Brad Ewert, who joined Green in 2001 as the band’s T-shirt manager and is now the tour manager and head of the Pat Green Foundation. “He still OKs everything.”

That doesn’t mean Green is pinching pennies on tour. The band has two potential configurations - a six-member band including Green, and one that includes Green and two band members. “He just wants the guys to be happy,” says Ewert, who manages all logistics of every

tour, including travel, hotels, meals, media interviews and Green’s “Meet & Greet” functions. “He wants the most we can afford; that’s why we don’t have big turnover.” On the road in big cities, that means hotel stays at places like Westin, and, in smaller towns, Hampton Inns and Holiday Inns, Ewert said.

Green’s dabbled in various investments in recent years, with what he says have been mixed levels of success. He and two partners built a $10 million dollar real estate fund, leveraged it to $30-$40 million in assets, and then sold off. “Everybody got what they wanted out of it,” he says. He was also in on an oil and gas venture that required continued investment. Unwilling to keep putting money in, he left and lost his investment. “It requires a certain level of ‘fundification,’ and I didn’t have the money to play,” Green says. “Now it’s making money - good for them.”

His biggest lesson learned from oil and gas, which he calls his “biggest mistake”: “Business at the highest level is not a respecter of friendship or anything else. Nor should it be. It’s just business.”

Green says he doesn’t dwell on the oil and gas investment. “I think a man who has no mistakes probably doesn’t have a mirror in the house.”

Making decisions with the heart has

been Craven Green’s one worry for his son. “Pat has such a big heart,” he says. “You’ll rarely meet someone more generous than he.” His son agrees: “My biggest mistakes are probably decisions based on people” instead of a solid business concept, he said.

Music is still Green’s principal paycheck. “Touring pays the bills for my family,” he says. The Rustic, apart from that, is where he’s hanging his business hat. “My going concerns are here and the music,” Green said recently, during a visit to The Rustic.