Kari Crowe Seher says her Melt Ice Creams has caught up to its growth and is set for years

Four Fort Worth women executives and their paths to business success

DON’T BE AN APRIL FOOL Office pranks that may not get you fired

How to recognize and steer clear of what’s in your way

Whitley Penn is proud to have more than 50 women serving in management roles across the firm. We are proud to have a strong women’s initiative in place called WP ENGAGE that was created to foster an environment to attract, retain, develop and encourage the leadership of talented women within Whitley Penn and the community.

March / April 2019

With an ice-cream cone and a bright shade of yellow paint, Kari Crowe Seher has become one of the driving forces of the Near Southside. Now, her sights are set on growth, taking business to Dallas and on the road.

34 Hammering the Glass Ceiling From breaking barriers to becoming girl boss, six local business leaders share their stories.

44 Five Utterly Hilarious and (Hopefully) Harmless Office Pranks Beware the first of April.

48 Top Realtors 2019 The city’s top names in real estate, chosen by readers and industry professionals.

At Whitebox, we maintain complete transparency throughout the process, so you always know where you stand and what to expect next. The result is the best deal for you and your needs.

9 Bizz Buzz: The bank backing Fort Worth Inc.’s Dream Office has a firm footprint in Fort Worth.

12 Face Time: On to the next product with biotech entrepreneur Art Clapp.

14 Stay Informed: How to get on “Shark Tank.”

18 Distinctive Style: Casual-Friday and Friday-night looks, built entirely from local shops.

20 Wine and Dine: The city’s brewers know a thing or two about supermarket survival.

22 Off the Clock: Bet you didn’t know these local business leaders were musicians.

26 Office Space: An office that’s one-part Near Southside, one-part Africa.

30 Tech: How to do business in an Airstream.

32 Health and Fitness: When employees can’t make the gym, bring the gym to them.

52 EO Spotlight: Juan Rodriguez is the chef who doesn’t want a restaurant.

54 Running Toward the Roar: When John Steinmetz left a big corporation for a familyowned bank, there was nowhere to go but up.

56 Analyze This/Real Estate: Yes, it’s been raining a lot in Fort Worth. And it’s affecting real estate.

58 Analyze This/Legal and Tax: Hiring an intern? Great. But don’t skip over these legal rules.

60 Analyze This/Wealth: Wanted: more accountants.

62 Business Leadership/Successful Entrepreneurship: Clearing the obstacles holding back your business.

64 Day in the Life: A locally developed logistics app could be facing its biggest year yet.

Melt Ice Creams owner Kari Crowe Seher finally catches up to her company’s growth, five years in.

Kari Crowe Seher’s Melt Ice Creams has finally caught up to its growth, five years after the company opened its first store on Fort Worth’s Near Southside. The concoction of the 35-year-old Crowe Seher, among a number of budding entrepreneurs whom Fort Worth is touting as exemplifying the kinds of creatives the city wants to recruit, nurture and retain, is set up for potential growth into a multi-store chain. “We think we can be DFW’s ice-cream brand,” Crowe Seher, whose Melt has become one of Fort Worth’s most popular restaurants, told us for our cover story in this issue.

Crowe Seher opened Melt in 2014 on West Rosedale Street to long lines, thanks to friends and savvy social media posts during the runup to the opening, including the numerous pizza-and-paint parties Crowe Seher hosted, where friends helped her get the store open. Melt quickly outgrew its capacity from Day One to produce enough ice cream to satisfy demand from the throngs, forcing it to at least find a new production kitchen. Two years later, Melt found a new home — for both its flagship restaurant and the kitchen — on West Magnolia Avenue in a building newly purchased by developers Will Churchill and Corrie Watson. Churchill and Watson helped set West Magnolia down the path to its latest renewal, buying buildings for cash and setting out to recruit tenants they wanted.

To Crowe Seher’s surprise, the new production kitchen almost immediately outgrew its capacity to produce the ice cream that Melt’s fans — who formed lines out the door, instantly and dramatically elevating activity on West Magnolia — were clamoring for. Crowe Seher moved the kitchen

a third time, last year, to the historic O.B. Macaroni building on the Near Southside. This kitchen, she believes, will last the company for years and be able to handle as many as six to nine stores.

Crowe Seher’s story, told by executive editor Scott Nishimura, isn’t the only one about Fort Worth’s growing number of entrepreneurs who are women in this issue of the magazine.

In another story, freelancer Teresa McUsic tells the stories of four Fort Worth executives and their different paths to success. Elyse Dickerson, one of Fort Worth’s growing number of biotech entrepreneurs, and partner Joe Griffin quickly went to market with their company Eosera and its launch product, Earwax MD, for compacted earwax. Marie Holliday has carved out a spot for decades in the demanding Sundance Square downtown as a dentist and owner of a spa and florist. Darlene Boudreaux, who recently retired as executive director of the TechFW incubator and has nurtured numerous life sciences startups in Fort Worth, drawing on her own career as the owner of a successful contract pharma manufacturer, is now a coach for TechFW. And Lisa Cobb, chief financial officer for Precise Energy Products, went into business with her husband after a long corporate accounting career.

Their stories highlight numerous different challenges each of these entrepreneurs faced, along with important lessons for future entrepreneurs.

Hal A. Brown owner/publisher

Send address changes to Fort Worth Magazine, 6777 Camp Bowie Blvd, Suite 130, Fort Worth, TX 76116. Volume 5, Number 2, March/ April 2019. Basic Subscription price: $19.95 per year. Single copy price: $6.99 ©2019 Panther City Media Group.

At Gus Bates Insurance, our clients rely on us to help guide them through the complex world of insurance and investments. But t before

Amegy Bank’s backing of our Dream Office project represents the latest push into Fort Worth by the community bank, which has financed $200 million in several key projects in the city.

BY SCOTT NISHIMURA

Fort Worth Inc.’s Dream Office project — under construction in Fort Capital’s West Side River District — represents a continued push into the city by Amegy Bank, which has financed the building and more than $80 million in the development.

Amegy opened its first Fort Worth branch in October in downtown’s Sundance Square and has since opened a second office on South Hulen Street at the entry to the Clearfork development.

The Fort Worth leadership is stacked with executives who have long ties to the city.

The Houston-based bank, however, isn’t

new to the market, estimating it’s served Fort Worth for 17 years and provided $200 million in financing to several key projects: Texas and Pacific Lofts, Whiskey Ranch, Elan West 7th Luxury Apartments, Elan River District Apartments and Elan Crockett Row Apartments. The bank expects to add several

branches in the market over the next five years, Sarah Mayer Jackson, senior vice president and commercial real estate manager for Amegy in Fort Worth, said. “We’re going to be really strategic about how we do that,” she said.

The Dream Office is a three-story, 22,000-square-foot building underway at White Settlement Road and Nursery Lane in The River District, a mixed-use development of Fort Capital, led by CEO Chris Powers. PRIM Construction is the general contractor; The Beck Group is architect; Royer Commercial is designing the common areas. The building, the second office building that Fort Capital is putting up in The River District, is expected to be completed later this year.

Amegy and Powers were introduced in 2013, after Powers assembled a large portion of the Linwood neighborhood west of Montgomery Plaza and sold it to Elan developer Greystar, Amegy’s client. Amegy later refinanced the loan on the first office building that Powers built in The River District and provided the financing for Greystar’s recently completed Elan apartment community in the district.

A lot of folks have done this on the Near Southside, but not to the scale.

– Brandon Bledsoe, Fort Worth market president, Amegy Bank

Of The River District, “a lot of folks have done this on the Near Southside, but not to the scale” of The River District, Brandon Bledsoe, Amegy’s Fort Worth market president, says. The River District financing falls within the realm of the “catalyst projects” Amegy has financed in Fort Worth, and it typifies the kind of urban infill project that Amegy has been financing across the state. “We do well with that project across Texas,” Mayer Jackson said. “We understand that space.” Said Bledsoe: “We’re blending the past with the opportunities of the future.”

Amegy has provided about $200 million in construction financing for several Fort Worth projects:

Texas and Pacific Lofts: Renovation and conversion of historic downtown Texas & Pacific Terminal building into residential lofts, developed by Wood Partners and completed in 2007.

Firestone & Robertson Distilling Co.’s Whiskey Ranch: 85,000-squarefoot distillery and entertainment venue and redevelopment of the former Glen Garden Country Club. Developed by F&R, makers of TX Whiskey, and completed in November 2017.

Elan West 7th Luxury Apartments: 375-unit project at Azalea Avenue and Carroll Street, developed by Greystar and completed in 2015.

Elan River District Apartments: 325-unit project at White Settlement and Athenia in the River District. Land assembled by Fort Capital and developed by Greystar, apartments completed in June 2018.

Elan Crockett Row Apartments: New 380-unit project at Crockett and University in West Seventh Street-area corridor, developed by Greystar.

. KLZ travels the world to find the most beautiful stone. Your home is very precious, and with that in mind, we search far and wide to make sure that everyone in our family will help and serve your family. Take the time and stop by and be amazed at our selections and friendly faces. After all, you really can’t afford not to.

Fort Worth biotech entrepreneur Art Clapp looks to his next product — a turmeric-based pain reliever — after taking the startup’s treatment for psoriasis to market last year.

BY SCOTT NISHIMURA

Ayear after launching Prosoria Nuvothera, a topical treatment for psoriasis, Fort Worth biotech entrepreneur Art Clapp is busy “gathering more social proof, proving our product is working for everyone,” against a backdrop of skepticism among patients about the effectiveness of treatments.

over-the-counter Prosoria on its website and at Amazon. “Probably a year, year and a half, we’ll start looking to get distribution at a drugstore,” Clapp says. “And after that, start to look at international.”

A 30-day supply of Prosoria is for sale at Amazon for $75.95. Prosoria is meant to be a daily maintenance medication, with a three-step kit that includes a conditioner; treatment gel that penetrates and relieves redness, scaling, flaking, itching and irritation; and conditioner. The chronic nature of psoriasis-related inflammation makes treatment difficult.

“You can ask people

with psoriasis

Social proof includes encouraging testimonials and product reviews. “We’re getting tremendous response from the community that the product is working well,” Clapp says. “People are sending us pictures of themselves with testimonials.”

what's been effective for you, and they'll say nothing.”

- Art Clapp

Psoriasis sufferers have long complained about the sustained effectiveness of other treatments they’ve used, and even safety, he notes. “Data shows that almost 90 percent of people are dissatisfied with the products that are out there,” Clapp, an ex-Galderma executive, says. “You can ask people with psoriasis what’s been effective for you, and they’ll say nothing. We knew we could make a product that’s extremely safe.”

Clapp’s Nuvothera, whose offices are based in the TechFW incubator, sells the

“That’s why it takes so long to get under control,” Clapp says. “The inflammation has been going on for a while.” But once under control, users can take a lower maintenance dose, he says.

Clapp is now readying the launch of his second product — Nuvothera Super-Micronized Turmeric Curcumin — a dietary supplement and pain reliever based on the anti-inflammatory qualities of turmeric, a spice. Nuvothera super-micronizes turmeric root into small particles to make it more easily absorbed into the body. Curcumin is an active ingredient in turmeric, which also is a component of Prosoria.

The OTC capsules will be available for sale on Nuvothera’s site beginning in March, and at Amazon. “It’s a really potent product and highly safe,” Clapp says.

Behind the scenes of Mitchell Allen's nine minutes of fame.

BY SAMANTHA CALIMBAHIN

Mitchell Allen’s first pitch competition was “Shark Tank.”

The self-proclaimed “head elf” at Hire Santa — a Southlake-based Santa hiring service that helps customers book Santa gigs for events — had always been a fan of the hit ABC show but never experienced a business competition before. So, he took the leap, brought 20 Santas to the “Shark Tank” set and came out with a deal with Barbara Corcoran. Here, he shares how he got into the tank — and survived.

Allen says his edge was having a product that was visual. He wouldn’t have pitched his internet advertising company, LeadRival: “That’s just not a company you

see on ‘Shark Tank.’”

“You have to really cater toward the producers and casting agents ... their job is to make the show entertaining,” he says.

Allen’s first open audition took place during a small-business expo in Dallas, where he waited in line for a full day to give a one-minute pitch to the casting crew. The prospective companies varied,

from people with full-fledged businesses to folks who just had an idea.

What impressed the showrunners, he says, was the fact that his company had revenue, a fun service and an interesting story. They told him to not expect to get called back — he got a callback in less than a week.

The next step was to create an audition tape that not only explained the company but showcased his energy. Allen’s 10-minute video got him another callback in less than a month. He was then assigned to producers whom he spoke with over the phone each week. They went over his pitch, made sure financials were in order, signed contracts, then started working on how the show would be filmed.

Allen says he overprepared: He DVRed reruns, watched almost every episode several times and took notes on the types of questions sharks raised on the show. He also did four “dress rehearsals” with members of EO.

“It’s not shown, but whenever I was on the air, there were 25 minutes of negotiating … I had multiple scenarios about how to negotiate, so when I walked into it, I was ready to get it over with,” Allen says. “Because of all the preparation, I didn’t have the nerves that I would have otherwise had.”

Once filming ended, Allen says the show has a psychiatrist talk with the contestants to make sure they’re OK — he was. He was then assigned to one of Corcoran’s staff that manages her portfolio of companies. From there, Allen and Corcoran began a due diligence process standard to buying or a selling a company. As of press time, Allen was still in the middle of due diligence, but he says the exposure from the show has already increased business.

“It is entirely live. [The sharks] don’t know you; you don’t know them. You walk in, and once you hit your mark, you have to stand there for several seconds, wait for them to get the cameras all set, then they say, ‘Begin.’ You start. There’s no stopping, no do-overs. It is live. You get a deal or not; then you walk out. Generally, whether you make a deal or not, you don’t get to talk with [the sharks] at all afterwards … but because of all the Santas and how visual it was, after we made a deal, all the Santas got to go back into the set and do pictures, do some promos. We actually got to do something that we hadn’t heard anybody else do, which was go back into the set and interact with the sharks.” -Mitchell Allen

Craig Rogers President & CEO

Join us as we honor the finalists and unveil the winners for our annual event focused on entrepreneurs whose vision, creativity and integrity have made Fort Worth the premier place to do business. All finalists will be featured in the May issue of Fort Worth Inc.

To purchase tickets, go to fwtx.com/fwinc/eoe today!

Industry categories:

• Construction, commercial

• Construction, residential

EOE Awards Gala Thursday, May 9

6:00 pm - 9:00 pm Cendera Center

Thank you to our event sponsors:

• Media/Communications/PR

• Professional Services

• Tech and Ecommerce

• Transportation, Logistics and Distribution

*PLUS, a winner in the special Supporter of Entrepreneurship category will be awarded during the evening.

Presenting Sponsor:Platinum Sponsor: Gold Sponsors:

Distinctive Style / Wine and Dine / Tech / Health and Fitness / Office Space / Off the Clock

Six-string CEO. Get in tune with these local executives on page 22.

Whitney Howell is in the business of small businesses — the owner of Shop

Small Fort Worth has spent the last three years providing opportunities for

BY MARIANA RIVAS

ness saw growth — Shop Small expanded to the building next door and now holds six large studio spaces, an approximately 700-square-foot storefront area and five other build-to-suit spaces. While the finish-

own small busiout offic

her personal wardrobe. A lot of brands she partners with sell fashion pieces that align with her taste. Here, she puts together both casual-Friday and Friday-night looks — entirely from local brands she’s partnered with for Shop Small’s recently launched discount card program, which gives shoppers discounts for showing the card at participating local retailers. w tive.

The go, so s

The mom of two says she’s always on the go, so she looks for ease and flexibility in

FRIDAY NIGHT

Paris Sleeveless Dress, Keeping Up with the Joneses, $345

ABLE Joselyne Lavender Suede Slingbacks, Winton & Waits, $138

Susan Standeffer Designs Feather Earrings, Keeping Up with the Joneses, $125

CASUAL FRIDAY

Adera Paper Bead Long Necklace, Winton & Waits, $32

Fort Worth Skyline Necklace, Cowtown Made, $48

Envelope Clutch - Natural Leather, Tribe Alive, $98

Flowy Fort Worth Tee, Cowtown Made, $36

Dress Pants - Navy, Keeping Up with the Joneses, $142

Luxe Brass Handle Handbag - Sage Suede, Tribe Alive, $168

Figure Earrings, Tribe Alive, $88

Recycled Ammunition Bracelet Set, Winton & Waits, $32

Acrylic Cuff, Winton & Waits, $14

Bead Bracelet – Seafoam, Winton & Waits, $18

How does a product find success on grocery store shelves? Ask the folks in the beer department. BY MARIANA RIVAS

Getting a product to the grocery store is tricky, but perhaps there’s one industry in Fort Worth that knows how to navigate the process best — local breweries. Rahr & Sons Brewing Company and Martin House Brewing Company are two brewers whose products get prominent display at grocery stores like Central Market and Tom Thumb. How did they get their product to the store in an increasingly saturated market? Here’s their advice.

(1) Time is of the essence. Don’t wait to start thinking about retail. Once you have the idea, the sooner the product is available to customers, the better. “It’s always the right time,” Rahr & Sons co-founder Erin Rahr says. She says that from the moment they knew they were bottling, they had to start making connections with distributors. Shugg Cole, director of marketing at Martin House, also recommends getting a head start, as each retailer has different systems

for selling products. “The earlier you can iron out the details, the better,” he says.

(2) It’s all about real estate. Saving your spot is a big part of staying competitive in the brewing industry. “It’s important to make sure your product is seen on shelves,” Cole says. For Martin House, that means emphasizing branding and art so that products visually stand out from the rest. For Rahr & Sons, that means keeping an eye on quality — shelf space is limited in the grocery store, so “consistency is key” to make sure retailers still want to work with you, Rahr says.

(3) Be nice. Being personable goes a long way when interacting with retailers and customers, Cole says, and meeting their needs is just as important as fulfilling yours. Rahr & Sons works with distributors on a daily basis to hit their goals. “It’s like a marriage,” Rahr says.

(4) Stay original. Like everything else in business, staying on the shelf comes down to one thing: having a good product. Cole says Martin House’s niche is the ability to incorporate unique tastes to its brew, like The Salty Lady, which combines salt and coriander. For Rahr, it’s all about quality, spending time in the lab testing and finding ways to maintain shelf-life stability.

(5) Keep it growing. Growth shouldn’t stop once you’ve made it to one grocery store. Cole says the quest for more retailers never ends: “We are constantly searching for accounts where we think our brand would sell well.”

Three Fort Worth business leaders and their not-so-secret lives as musicians.

BY SAMANTHA CALIMBAHIN / PHOTOGRAPHY BY OLAF GROWALD

Touring the globe. Making big money. Living the rock ‘n’ roll lifestyle. While that destiny lands on the laps of some musicians, others opt to keep their talents at home, gigging on the side of a day job. Sometimes, that day job turns out to be a success all on its own.

If you’ve hung around long enough in Fort Worth’s business community, chances are you’ve shaken hands with Michael Bennett — the architect behind downtown landmarks like Sundance Square and Frost Tower. Or Andra Bennett (no relation to Michael) — the PR maven of the Fort Worth Chamber of Commerce. Or Matthew Avila — CEO of the construction company behind projects like Texas Wesleyan’s Martin University Center and the renovation of the Sinclair Building.

While they’re oft-seen at business luncheons and community board meetings, not many know about what they do out of office — that is, their not-so-secret life as gigging musicians.

And, so we’ve come to discover, they’re really, really good.

Michael Bennett, Bass Day Job: Principal/CEO, Bennett Benner Partners

Michael Bennett’s schedule is generally

booked end to end, but on select Thursday nights, you can catch him on the bass at Lili’s Bistro, accompanying guitarist Chip Christ. The duo will play everything from jazz standards to Weezer, depending on who’s in the crowd that evening.

Bennett’s background was in music, having studied music theory and composition at TCU before deciding to switch gears and pursue architecture. While his playlist today includes rock bands like Radiohead and The Beatles, he also loves the intellectual challenge of classical music, particularly Romantic-era composers like Clara Schumann and Johannes Brahms.

“There’s a relationship, in my mind, of music and architecture,” Bennett says. “In both of them, you have the aspect of rhythm; that rhythm might be windows or columns on a façade … Musical pieces usually have some sort of form that they follow; the same thing in architecture. You may have ABA form; that also applies to music. In my mind, they start morphing into the same creative pursuit.”

So, don’t ask Bennett if he’s ever had wishful thoughts of the music career that could have been.

“I really love what I do in my day job,” he says. “I can’t ever imagine anything competing with that.”

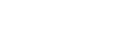

Andra Bennett, Singer

Day Job: Vice President of Communications, Fort Worth Chamber of Commerce Andra Bennett never took voice lessons; instead, she grew up singing in church and attempting to mimic the techniques of contralto vocalists like Karen Carpenter and Sarah Vaughan. As she pursued a career in communications, she would find herself working for General Dynamics (now Lockheed Martin) and playing trumpet in the company jazz band, The Dynamic Swing Machine.

But the band didn’t have a singer — so Bennett, knowing the words to all the songs they played, volunteered to be vocalist. The gig stuck, and Bennett’s dynamic alto range and commanding belt eventually landed her in three different jazz ensembles: The Dynamic Swing Machine, Buddy’s Big Band in the Near Southside and the Southlake Swing Band. Three bands became a lot to juggle, so she dropped two but continues to sing for the Southlake Swing Band. She can scat, too, and does a mean impression of Patsy Cline’s “Crazy.”

“I’m an audience pleaser,” she says. “They like to hear it the way they expect to hear it.”

She also sings in the choir at Good Shepherd Catholic Community in Colleyville.

In June, they will be performing Johannes Brahms’ “Schicksalslied (‘Song of Fate’)” and Mark Hayes’ “Te Deum” at Carnegie Hall. Bennett’s personal playlist lists the classics: Julie London. Ella Fitzgerald. And, of course, Sarah Vaughan and Karen Carpenter. She says she doesn’t listen to a lot of new music but loves the soundtrack to “A Star Is Born.”

While her busy schedule doesn’t allow her to sing as often as she’d like, she is open to doing more in music. “[My husband’s cousin] does his own recordings; he does country gospel. He’s like, ‘Come sing with me. Let’s record. Let’s do an album.’ I might just do that someday.”

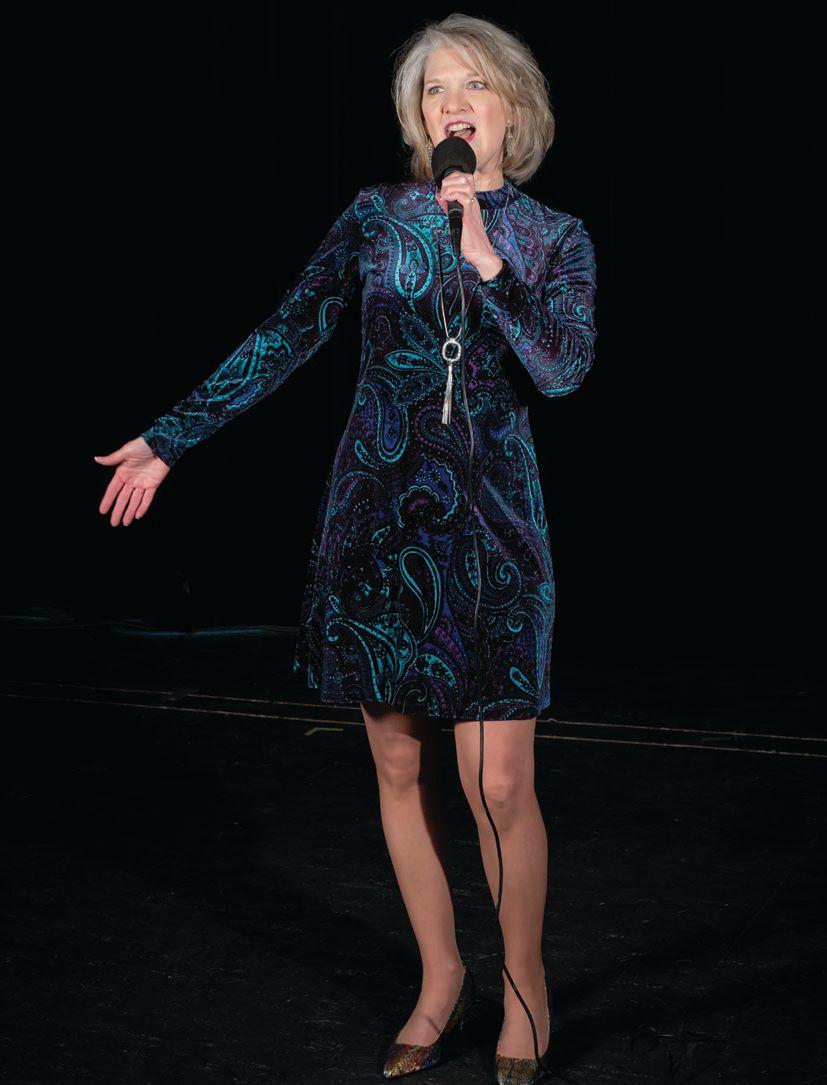

Matthew Avila, Guitar

Day Job: CEO, Byrne Construction Services Matthew Avila grew up wanting to be the next Eddie Van Halen — and for a while,

Hear Them Play Check out the online version of this story on fwtx.com/fwinc to watch Andra, Michael and Matthew take the stage at Ridglea Theater for exclusive solo performances.

he was serious about it. He delayed college to pursue a music career, playing in a rock band that opened for acts like Tripping Daisy and The Nixons.

But the grind took a toll. “[I] was the responsible one. I was the one that had a car that worked, who knew how to keep the books and book the dates and make sure we ended up in the right city on the right day. I was the one who kept the money and kept them out of trouble. I was like the band manager and mom … I basically got burned out and said, ‘You know, I think I’m going to go to college.’”

He didn’t play in a band again until about two years ago when he joined KYSER — an alternative rock group mostly comprised of, ironically, business executives: Drummer Andrew Harris is CEO of Gladiator Fence, bass player Sol Kanthack is president of Left Dial Entrepreneurial Solutions and An-

drews Tool Company and frontman Robby Kyser is chief digital officer and digital director at Fort Worth Magazine.

“The only one who’s not a [businessman] is our keyboard player and backup vocalist [Antonio Thomas]; he’s our starving artist,” Avila says. “You’ve got to have one.”

At the end of March, Avila will take some time off work to travel with KYSER to Dripping Springs, Texas, where they’ll record their second five-song LP — something grittier, less polished and more rock ‘n’ roll.

“I love music; it’s very satisfying,” Avila says. “It doesn’t bother me that I’m not a guitar phenom.”

We’d have to disagree.

As a business owner, when you think about the future of your company, what comes to mind? Increasing revenues...launching new products...building partnerships. But what about planning for an exit strategy? Having a succession plan in place is key to protecting what you’ve built for future generations.

At Bank of Texas Private Wealth, we can help you identify the tools and resources necessary to help formulate a succession strategy that meets your objectives. After all, just because you’ll eventually retire, doesn’t mean your legacy should too.

Let us help you plan for the future.

The more time you have to plan your succession, the smoother the transition.

Involve Your Family

Your plans will affect your beneficiaries; include them in the process to ease potential discord.

Identify a Successor

Whether a family member or a trusted employee, grooming for leadership takes time.

Know

Your company’s financial standing plays an integral role in your planning process.

A local nonprofit turns an old Near Southside building into a space that’s one-part Fairmount, one-part Africa. BY

Local nonprofit Arise Africa hardly thought about design when it was searching for a new office space. The organization, which sponsors children in Zambia, at the very least needed a storage area and garage door to easily store and move supplies — and it needed more space than it had in its first office on Bailey Avenue, just a few blocks from the “intersection of death” between Camp Bowie Boulevard and West Seventh Street.

Then, Arise Africa’s Realtor happened upon an early 1900s building smack in the middle of the Fairmount neighborhood. While listed as a house on Zillow, the

building actually had many past lives — a photography studio, recording studio and a grocery store among others — but with the help of private donors, Arise Africa transformed the space into one that met its needs. Later in the game, interior designer Anna Harris of Annah Interiors stepped in to turn the space into one that she describes as “comfortable, energetic and, most importantly, reflects Arise Africa.”

“Each section of the space reflects the kids and their mission,” she says.

With a mix of African décor and funky finishes that pay homage to the organization’s work and the Near Southside neighborhood it calls home, it’s an office that’s

one-part Africa, one-part Fort Worth.

“We didn’t care what it looked like; we just needed functionality for the ministry,” executive director Alissa Rosebrough says.

“I don’t think we ever even thought we’d get a building in Fairmount, such a great place. That really was a God thing.”

Arise Africa bought the building in 2017 and renovated and moved in that same year — according to Rosebrough, the building is paid off, thanks to donors. The space is 3,500 square feet, defined by wood, exposed brick, bright colors and African décor, as well as vintage elements like the building’s original ceiling and, notably, the old Boswell’s Milk sign, which once hung

on a pole outside during its heyday. The office itself has an open floor layout with a living room and kitchen on the bottom floor. A former walk-in cooler from the building’s days as a grocery store is now a phone room, furnished with midcentury modern seating and vintage maps of Africa on the wall.

Among the most eye-catching pieces in the room is the chandelier in the center, made from colorful, handmade baskets purchased in Africa. Rosebrough says it was Harris’ idea to turn the baskets into a chandelier; a good friend, Bill Smith, assembled the bulbs and wiring.

Other touches of Africa are found

throughout the space, from stools upholstered with African fabric (a design known as “chitenge”) to a shelf in the living room displaying cars that African children made from scrap wire, flip-flops and bottlecaps. The side tables in the living room come from Africa as well.

“Anna did a great job of mixing both and working with what we had,” Rosebrough says. “It’s kind of funny to be like, ‘We have all this random stuff from Africa. Make it work.’ And she really did.”

The office has two unfinished areas: the upstairs loft, which offers a nice view of the bottom floor and has opportunity to become more office space in the future, and

the 1,000-square-foot storage area, which stores boxes of supplies going to Africa.

But the heart of the organization is on the living room wall, on which photos of Zambia’s landscape, Arise Africa staff and the children with whom they work are on display. Another wall nearby is overlaid with patterned wallpaper, a spot that acts as a pinboard with thank-you notes and letters from both volunteers and those the organization has helped.

“We know how blessed we are to be in the space that we are [in],” Rosebrough says. “There’s not a day that goes by that I don’t pull up to this building and think, ‘Wow, this is where I get to work.’”

Grow Plant Shop

1250 W. Magnolia Ave. growplantshop.com

Hippie Alice

Location varies. Check Facebook or Instagram (@hippie. alice) for updates. hippiealice.com

Brix Barbecue

Opening April or May.

See Facebook or Instagram (@brixbarbecue) for updates. brixbarbecue.com

completely gutted when the Lynges purchased it, forcing them to start from scratch, Bobby says. They did everything from repainting the walls to building the bathroom — laying the floors being the hardest part.

A 1930s travel trend is making a comeback as restaurant and retail businesses ditch brick-and-mortar for a more retro-inspired venue. BY REBECCA WILLIAMS

From shipping containers to renovated houses, some Fort Worth entrepreneurs are setting up shop outside the box of a traditional building. Now there’s another trendy place to do business: the Airstream.

Airstream, a brand of travel trailer initially popularized in the 1930s, is making a resurgence as some retail and restaurant businesses are ditching the brick-and-mortar for a funkier, alternative venue. Magnolia Avenue’s Grow Plant Shop and Decatur-based clothing retailer Hippie Alice are among those on the forefront. Arcadia Coffee added to the mix when it opened in February on South Main Street. Joining them soon will be

Brix Barbecue, coming late April or early May. Here, Fort Worth Airstreamers — Grow owners Bobby and Emily Lynge, Hippie Alice owner Bridget Meyer and Brix Barbecue owner Trevor Sales — share their tips and tricks for making the Airstream dream a reality.

Finding an Airstream To find an Airstream, searching online is the best bet. The Lynges found theirs on Craigslist, but Airstream also sells them directly, ranging anywhere from about $40,000 to upwards of $150,000, depending on the size.

Renovating the Airstream The Airstream that would become Grow was almost

“In theory, [this task] is simple,” Bobby says. “But there are only a few feet in the Airstream that are truly parallel” due to its shape, which complicated the project. Sales, like the Lynges, started his project from the “bare bones,” redoing the floors, the water tanks and the wiring. “What people forget is they didn’t build things for as big of people back then as they do now. The ceilings are low, and the doors are very tight,” he says. Sales eventually plans to add appliances and cut out the window through which he will serve food, finishing the final build-out. Meyer’s Airstream, on the other hand, was not completely gutted when she purchased it. She says she attempted to keep the original character of the Airstream intact; while she did remove the table, bunkbeds and bathroom, the Airstream still contains the original clock, gauges and cabinets.

Beware the elements. Emily Lynge warns that “the elements definitely play a part” in operating out of an Airstream. Due to the original insulation, there is heat and cold transfer depending upon the weather. Good is new. Emily also advises those interested in pursuing their own renovation to make sure everything is up to date from the onset to prevent being “set back by a random surprise.” Bobby recommends checking the plumbing in particular. Research, research, research. Besides researching logistics like Airstream size and what you’re going to pull it with, Meyer recommends evaluating your potential business market to confirm that an Airstream will fit your niche.

REBECCA WILLIAMS

When employees can’t make it to the gym, bring the gym to them.

These local fitness studios offer on-site workouts for the office, providing relief from workweek woes and giving co-workers an opportunity for community bonding. Whether you’re in marathon-ready shape or your idea of exercise has been couch surfing for the last 10 years, these classes accommodate all levels of ability. So, take a break from your crippling office chair and glaring computer screen — and put on

your tennis shoes. It’s time to get moving.

PILATES:

YOGA:

Indra’s Grace For workplaces that need a little more Zen, Indra’s Grace offers onsite, one-hour yoga. The studio offers a few corporate-friendly sessions, including breathing exercises for stress reduction, chair yoga for at-the-desk relaxation and regular yoga for overall well-being. Schedule classes as a one-time event or on an ongoing basis, once or twice per week. What you’ll need: Comfortable attire, water bottle, mat (if owned; can be provided if not)

GYM:

SCHEDULE AN OFFICE WORKOUT SESH:

D Method 817.810.9850 dmethod.com

ENDURALAB Strength, conditioning and endurance gym ENDURALAB can turn your conference room into a private gym, utilizing select equipment, including dumbbells and kettlebells to create the ideal office workout. Beyond physical exercise, ENDURALAB also leads goal-planning sessions and nutrition challenges to encourage health in all aspects of life.

Indra’s Grace 682.803.0727 indrasgrace@gmail.com indrasgrace.com

ENDURALAB

817.405.9LAB enduralab.com

Smart Barre Cityview cityview@smartbarrebody.com smartbarrebody.com

D Method D-Method’s signature Mat Pilates, a blend of strength and flexibility training, uses a contemporary approach to whip you into shape. These 45- to 50-minute classes include a full-body workout with emphasis on abs and posture, leaving students reenergized and renewed. What you’ll need: Mat or towel (something to lie on the floor with)

What you’ll need: Exercise attire, tennis shoes, water bottle, sweat towel

BARRE/DANCE: Smart Barre Cityview If you’ve been waiting to see your co-workers bust a move, here’s your chance. Smart Barre’s Open Level Barre class, adapted for your space, combines strengthening and stretching exercises that target major muscle groups and focus on correct postural alignment and abdominal work. The studio also holds general dance fitness classes. Classes are based on instructor availability.

What you’ll need: Exercise clothes, mat (flexible, if your office is carpeted), water bottle, tennis shoes (only if your office space requires your session to take place outside)

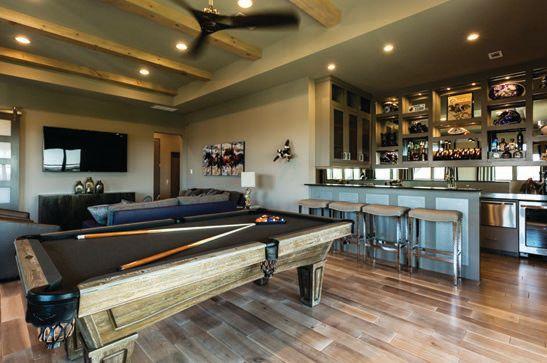

Completed in October of 2017, this 5,900 square foot, rustic, modern home is located on a hilltop in the luxurious gated community of La Cantera at Team Ranch with views of downtown. With four bedrooms, four bathrooms and 22.6-foot ceilings and glass that bring the outside in.

Four Fort Worth executives — in biotech, dentistry, accounting and finance — take different paths to business success.

BY TERESA MCUSIC / PHOTOGRAPHY BY OLAF GROWALD

TThe statistics are startling. Fifty-eight percent of the U.S. workforce is female, yet there are just 26 women among the Fortune 500 CEOs. Likewise, just 12 percent of last year’s Inc. 5000 were led by women — a low point for female founders in the modern history of the list. There are a few local bright spots: Jill Soltau at JCPenney was just named the first female CEO in the company’s 116-year history. In December, Cheryl Bachelder was named interim CEO of Pier 1.

But those running the show are still largely an older, white-male boys club. So where do ambitious women in Fort Worth end up? Here are four women who have taken different paths to reach business success.

Kicking the Corporate Can Elyse Dickerson had an abrupt end to her 13-year corporate life as a global senior director, managing a $1.7 billion portfolio of products, for the Fort Worth-based Alcon. In 2015, she suddenly was terminated while on sick leave. She filed a sexual discrimination lawsuit against the company and its parent Novartis for $10 million that was later followed with a $100 million suit that included 14 other women in a class action, citing gender-based pay discrimination, denied career opportunities and firing in retaliation of complaints. Five years earlier, Novartis was ordered to pay more than $253 million in a class action suit over gender discrimination (the largest monetary award ever made by a jury in a gender discrimination case). Both suits were settled, Dickerson’s for an undisclosed amount in 2017.

“I thought I would retire there,” Dickerson says of her Alcon career. “For me, every action I took was about trying to make a positive change.” These days, the 44-year-old Dickerson is making such changes as CEO of her own fast-growing ear-care products company, Eosera, co-founded with former Alcon colleague Joe Griffin. Its first product, Earwax

MD, for impacted earwax, launched in 2017. Eosera now has a suite of ear-care products in CVS, Target and Rite Aid stores and on Amazon. Revenue doubled in 2018 from 2017, she said, and is expected to double again in 2019. Dickerson raised more than $2 million in capital and last year took her manufacturing in-house with 15 employees in a building just west of downtown. Thirteen employees are women, including her team leader Gabby Barrientos. “It wasn’t necessarily intentional to have mostly women,” Dickerson said. “We certainly wanted a diverse workforce. We wanted to be an inclusive environment. We interviewed both men and women, but the women just rose to the top.”

Is there still a glass ceiling in corporate America? “One-hundred percent,” she said. “It’s not going to change until boards change, and boards are still primarily white men.

I don’t know how you solve it; that’s why I decided to go around the system and start my own business. I did as much as I could internally to make changes in big corporate America. Then you get let go or fired or whatever because people don’t want to hear the truth.”

Now Dickerson has what she calls a happy work environment, a priority for her and Griffin when establishing the company. “I don’t want to discourage young women from seeking big jobs and big positions, but then there’s that reality there that they need to understand,” she said. “I was less aware of it. I couldn’t fathom that a man would get paid more in the same job. But the reality is, it still happens. I think if we can educate this next generation to say you have to push and ask all these questions and make sure you’re starting out at the right salary. Now

I wouldn’t trade it. But I’m not sure I would have done it on my own.”

The Solo Professional Being a woman dentist in the 1970s was a barrier to break through in and of itself, but Dr. Marie Holliday had a second major hurdle — she’s also African-American. An established dentist for 42 years, 26 in Sundance Square, Holliday was named Dentist of the Year by the Fort Worth Academy of General Dentistry in 2017. It turns out the 66-year-old Holliday was ahead of her time: In the next decade, dentistry is expected to be a female-dominated profession in the U.S.

“I wouldn’t say it was hard, but it was interesting being a female and then also being African-American and being part of a male profession,” she said of starting her practice back in 1976 in her hometown of Fort Worth after going to Tufts University School of Medical Dentistry in Boston. Holliday said she always wanted to be in private practice because it would be more compatible to raising a family. “Dentistry affords the woman of child-bearing age to set their own hours so that when their children are in school, they can set their hours to their children’s schedule,” said the mother of two sons and three stepsons. “Dentistry is very conducive if you want to be that kind of participatory parent, which most women do.”

In 1991, Holliday got the entrepreneurial bug and started Parfumerie Marie Antoinette retail shop and spa, now located in Sundance Square. In 2005, she started Flowers to Go, now the only floral shop in Sundance Square.

“My passion for things has gotten me in a lot of interesting situations,” she said with a laugh.

“It’s was very challenging, especially the first few years. I’ve gone from a product that lasts forever if you don’t break the seal to one that dies in a few days.” Like many women-owned businesses, Holliday mostly hires women.

Darlene Boudreaux, pharma entrepreneur, who's nurtured numerous startups as executive director of TechFW

“I never could have just gone into being an entrepreneur in the beginning. I needed to build skills in the corporate world, not just business skills but standing up and talking to people.”

– Darlene Boudreaux

She has 12 female employees in the three businesses and one male driver.

Her advice to the next generation of wom-

en? “They should look at what their goals are both personally and professionally. In looking at that, they need to look at the different job or position opportunities that are available that will allow them to fulfill themselves in both ways. There’s only a certain period of time when women can bear children, and the joy of having children is impacted by the amount of time that you can spend with them and be involved with them. So they should not feel that they can’t do it all.”

Holliday isn’t finished growing. Starting March 1, she is subleasing space downtown from Metroplex Medical Group at First and Commerce streets. Metro-

plex Medical is an integrated medical clinic with lab and pharmacy, physicians and nurse practitioners. Holliday will offer exams and cleanings at that location and at her other dental office on Second Street.

Back to the Family Darlene Boudreaux had a heck of a corporate ride. Starting as an accountant in 1976 with the giant accounting firm Arthur Andersen, just two years after it began hiring women as accountants, Boudreaux climbed the ladder quickly, becoming the first female partner west of the Mississippi by 1987, one year after the first female partners in the company were named. In 1990, she was the first female Andersen partner to have a baby.

“They didn’t quite know what to with me,” she recalled with a laugh. “As a partner, there was no leave of absence.” Boudreaux negotiated her time off and with it insisted on a private room to lactate — another first in the

company that later won them top ranking for best place to work by a woman’s magazine. Boudreaux was pumping breast milk while handling multi-million-dollar real estate transactions with Japanese and Korean clients out of the Los Angeles office, including a deal that included Pebble Beach that was at the time the largest real estate transaction ever done.

But Los Angeles traffic and smog got to the new mother, so when a chance to move to the San Diego office came a year later, she jumped on it — and met her first significant road block: “One of the audit partners didn’t think women should be partners. I’d get a message I was being removed from a client because they didn’t like me on their job. I was taken off the account of a Korean company because a partner there said he didn’t think it would be appropriate. Things were being thrown in my face.”

In 1993, she left a $650,000-a-year job to go work as CFO for her dad’s small pharmaceutical manufacturer in Fort Worth for $40,000. “I wanted more time with my kid. A better quality of life,” she said, also realizing she would never make managing partner at Andersen. “It never crossed my mind,” she said. “I had hit my own personal ceiling. I had broken through enough glass ceilings by then.”

hiding. Boudreaux said she walked away from running a company of 300 employees with $30 million in sales. “I finally realized I wasn’t superwoman,” she said. She stepped away, only to be recruited as executive director of TechFW, an incubator firm from which she recently retired. At TechFW, Boudreaux founded the Cowtown Angels investing group and nurtured numerous startups, including Dickerson’s Eosera and a biotech company called Encore Vision, which sold recently for $465 million to Novartis. Today, Boudreaux teaches a course in family business at TCU and serves as a coach to TechFW members.

“I don’t want to discourage young women from seeking big jobs and big positions, but then there’s that reality there that they need to understand.”

– Elyse Dickerson, CEO, Eosera

“I never could have just gone into being an entrepreneur in the beginning,” Boudreaux, 64, said. “I needed to build skills in the corporate world, not just business skills but standing up and talking to people. I don’t know if I would have been ready 20 years earlier or the world would have been ready. What surprises me today is that we women aren’t further along in these corporate careers. Not as far along as I would have thought. Why aren’t there more following in my footsteps?”

that company failed, and after 25 years in corporate America, Cobb found herself suddenly unemployed in 2010. Almost immediately, she and her husband decided to start an oil and gas parts assembler. “I went from a big corner office in Los Colinas, managing 60 or 70 people, to a small company working from home,” she said. She found her years of experience in accounting, payroll, health and contracts fit her new duties of an entrepreneur CFO wearing multiple hats.

Precise Energy Products took off, and sales quickly rose from $40,000 to $1.2 million, and it moved to offices in the Exchange Building of the Stockyards. By 2014, the company was named Small Business Exporter of the Year for DFW and a seven-state region. Today the company has $4 million in sales with 15 employees. “The cool thing is the flexibility in running our own company,” Cobb said. “We have a picnic table in our offices for the grandkids and will take them out to see The Herd.” Cobb is also chairwoman of Women Influencing Business, a networking branch of the Fort Worth Chamber of Commerce. Among their programs are Dine & Discuss, where a table of women discuss a single topic they sign up for, such as time management or negotiating salaries. “It enables them to take a deeper dive into the topic and helps their networking because they’ve spent time with a small group,” Cobb said. WIN is also focusing on more programs for women entrepreneurs.

A year later, Boudreaux and her brother started PharmaFab, another Fort Worth pharmaceutical manufacturer, this time of prescription tablets, capsules and liquids of cough and cold medications. She recalls going to Barnes & Noble for a book on how to incorporate. The company grew quickly — by 2001 it made Inc.’s then 500 list, then again in 2002 and 2003. “At that time, only 9 percent on that list had ever had women CEOs; only 30 percent ever repeated; only 3 percent were in manufacturing.”

But she hit a personal roadblock in 2003: Her son needed a heart operation, and her husband was diagnosed with a rare neurodegenerative disease with behavior so violent that she and her son had to go into

Trying a Startup Lisa Cobb had a different experience in corporate America after college at the University of Houston in Clearlake. She started off in tax department of Ernst and Whinney (now Ernst and Young) in 1985. Three years later, when she told her boss she was pregnant, his response was, “At least it’s not during tax season,” she said. To prove herself, she worked more billable hours than anyone else in the department. After a short maternity leave, she returned, only to hear the partner in charge of the tax department say, “I didn’t think you were going to come back.”

Cobb had two more children and worked for a handful of companies that eventually brought her to DFW, where she eventually headed the accounting office of a large, multi-state health care claims company. But

She encourages women to speak out more. “We have a tendency to believe that if we do our work, we will get noticed,” she said. “But we have to be outworking colleagues at such a level, it’s ridiculous.” Cobb suggests there are other paths to visibility. “You’ve got to get out of the office.”

While Cobb, 56, said her corporate life brought her personal and technical skills that lead her to be able to run her own successful company, entrepreneurship is a solid path out and up for many women today. “I believe that corporate America is changing; some companies are better than others; some departments are better than others,” she said. “But what women are doing on their own is amazing by not going through corporate America. They’re jumping ship and working their own way.”

Two flagship stores and three kitchens later, Kari Crowe Seher says her Melt Ice Creams has caught up to its growth and is set for the next several years. Next up: store No. 2 in Dallas and a new food truck.

Melt Ice Creams likes to call its new headquarters and kitchens — opened last year in the historic O.B. Macaroni pasta factory building on Fort Worth’s Near Southside — the “Joy Factory, where the magic happens.” Getting to the Joy Factory, the company’s third kitchen since founder Kari Crowe Seher opened Melt in April 2014, came after a string of unexpectedly robust sales gains that led her to move Melt’s flagship store two years after it opened.

Melt outgrew the 89-square-foot kitchen from Day One at its original Near Southside store on West Rosedale Avenue; then it quickly outgrew the 350-square-foot kitchen in its new West Magnolia Avenue shop after Crowe Seher moved Melt’s flagship store there in July 2016. The store, with other new restaurant tenants added by developers Will Churchill and Corrie Watson, helped dramatically increase activity on West Magnolia, with lines out the door a common sight, particularly during the summer. The 3,000-square-foot Joy Factory, which Melt moved its operations into in March 2018, should serve the company for several years and set it up to serve several more stores, Crowe Seher says.

“We think we can be DFW’s ice-cream brand,” Crowe Seher says, comparing the growth possibilities to the popular Amy’s Ice Creams chain, which has 15 locations, mostly in Austin. Melt is opening its second store in March in South Dallas’ Bishop Arts District. The company also is outfitting a food truck that it’ll launch this spring, significantly expanding its ability to handle catering, which it added after a year in business. Melt, which had two employees at its start, has 20 during the offseason and “upwards of 40” during the warmer months, Crowe Seher says.

With the infrastructure for growth in place, Crowe Seher, whom Fort Worth visitor and economic development organizations tout as exemplifying the raft of emerging entrepreneurs that make the city an attractive place to grow a business, has also been spending time honing the company’s culture.

“Our goal is to be a best place to work,” she says. Smiling faces are everywhere at Melt, known for its bright yellow West Magnolia

shop. “We want to be the place of happiness,” thus, the nickname Joy Factory. “Ice cream can melt away people’s problems. Sometimes, [customers] walk in the door, and they’ve got the whole weight of the world on their shoulders.”

Many of her employees are students. Melt’s “team leads run a business.” Crowe Seher hosts a book club for company leaders. And the company chooses a charity each year that it contributes a portion of profits to, and volunteers at. Previous years have been The Gladney Center for Adoption and The Net, addressing poverty. This year’s: The Center for Transforming Lives, also addressing poverty among women and children. “It’s a real privilege to have high school students” as employees, Crowe Seher says. “Part of that is to show them how a business can be impactful in the community.”

“We

tor program for entrepreneurs who haven’t yet hit their first $1 million in sales. She left that last year to participate in the prestigious week-long James Beard fellowship for food entrepreneurs at Babson College in Massachusetts, where she learned alongside entrepreneurs including the pastry chef Kelly Fields, owner of the Willa Jean restaurant in New Orleans, and Emily Blount, owner of the Saint Leo restaurant in Oxford, Mississippi.

thought we would have enough space in that to go another four to five years. We had to immediately start looking for off-site kitchen space.”

Road trip: Before she launched her own shop, Crowe Seher hit the road for two weeks, visiting independent ice cream shops in Arkansas, Tennessee, Alabama, Florida and Georgia.

“My husband rented me a car because he didn’t think my car would make it. I would just drop in. I really wasn’t thinking of it from the business perspective. I couldn’t tell if they were successful or not. My goal was to see what their experience was like.”

Crowe Seher, 35, joined the Entrepreneurs’ Organization Fort Worth Chapter’s Accelera-

Interning for a week in the kitchen of an Ohio couple relatively new to the business “Nobody who’d been around with any

longevity would let me come.”

Her original idea “Ice-cream cart and catering events. That was the industry I knew. But it really capped us out at our potential.”

Opening on West Rosedale, apart from the budding West Magnolia. “There was a coffee shop closing, and they were looking for someone to come in. The numbers made sense, but nobody in Fort Worth would loan me money. I think I went to five or six business banks. [Husband Mark Seher, who left his job and came on board full time two years after the business launch] had done the financial analysis. We had a really hefty business plan. Nobody would give us a loan. One particular banker told me she thought it was a bad idea, and that it would never work on West Rosedale.”

Starting up, Crowe Seher estimates it might have cost $100,000-$300,000. She did it for somewhat less “We probably started for less than $20,000. We didn’t even have a cash register. We had a cash box and Square. I did trades with people. I traded a photography session. I watched YouTube videos on how to patch sheetrock. We did pizza [and paint] parties. We didn’t do anything we couldn’t afford. As we made money, we put everything back in the business.”

The launch “We had a line out the door the day it opened. We had two employees at the start. We went to seven to nine more within two weeks. There were nights when we ran out of ice cream. We would have to close our doors. The kitchen [was so small], you could touch the sink, the freezer, the icecream maker and the prep area. We had five parking spaces. We were losing customers because they didn’t feel safe parking on West Rosedale.”

Moving to West Magnolia “We were approached [in 2015 by Churchill and Watson] to move to West Magnolia. I was very opposed to it. My husband was very for it. I was terrified. I just didn’t think a business needed to move its flagship. We knew we had to do something. Our kitchen was too small. We were trying to figure out what to do next. We weren’t going to leave the Southside. The Southside is home.”

Outgrowing the West Magnolia kitchen “We thought we would have enough space in that kitchen to go another four to five years. Right off the bat, we outgrew that production space. We had to immediately start looking for off-site kitchen space. The new [O.B. Macaroni] kitchen allows us to bake more. We knew we wanted to offer an ice cream sandwich and ice cream cakes.”

Filling out management as the company’s grown “We’ve added a delivery driver, shop manager, shift leaders, kitchen manager. Mark built all the inventory systems from scratch.”

Finding store No. 2 in south Dallas’ Bishop Arts District “As a single location, there’s not a lot of upward growth. We wanted to find a community-driven place. We wanted to find a community and neighborhood where people care about each other. Locations matter. We wanted a walkable street. Mark and I had spent a lot of time going on dates” in the Bishop Arts District. “Bishop Arts didn’t have an ice cream shop.”

Learning from the James Beard and EO programs “The importance of growing strategically. I learned a lot about building the financial side and building confidence. At

the end of the day, most people struggle with the same things. The James Beard exposed us to tell our story really well. It was almost like a mini-MBA in a week: P&L, pitching to investors, culture and thinking bigger than ourselves, what we need to do with resources, strategic relationships, next steps.”

Those next steps “The next five years, we hope to look at six to nine locations, depending on size.”

Whether she still scoops ice cream “I wish I could. We’re very hands-on, in the shop multiple times a week. My role has evolved in the last few years for sure. We’ve built a really good team.”

The paycheck: Founder and CEO, Melt Ice Creams

Years young: 35

Grew up: Georgia

Entrepreneurial journey began with: Uncle and aunt. “Incredible business acumen.”

Memorable summer job: Landscape crew for uncle and aunt, who founded the business in Florida after they retired. “They kind of had a bet to see how long I’d last on the landscaping crew.”

Graduated: Dallas Baptist University, 2006, where she played soccer two years and studied studio art and photojournalism.

Early career: Freelance photography for a Mansfield hospital, wedding photography, volunteering for Fort Worth Foodie. “They started assigning me stories.”

Ice cream idea: “I wanted to get out of weddings. I’ve always been creative in the kitchen. I had made ice creams. I thought ice cream was a big missing piece in Fort Worth.”

Latest accomplishments: 2018 James Beard Foundation Women’s Entrepreneurship Leadership, group of 20 fellows in the food industry. An accomplished runner, Crowe Seher completed Colorado’s Leadville 100 Trail Run, a 100-mile race, in 29 hours, 53 minutes and 21 seconds in 2018.

BY SAMANTHA CALIMBAHIN / ILLUSTRATIONS BY CHARLIE MARSH

Don’t be the office that takes itself too seriously. With tactful execution, playing a prank or two on your co-workers can be good for company culture. So says Justin Dorsey, the senior human resources manager at Ben E. Keith Company: “A laughter meter is better than any employee survey you can take.”

Now, we could get into how pranking can lighten the mood and build camaraderie, but let’s not ruin the fun with superfluous pleasantries.

Let the shenanigans begin.

What you’ll need:

• An old or unused computer keyboard (not your employee’s actual keyboard, please)

• Chia pet or grass seeds

• Potting soil

• Spray bottle with water

1. Pick a co-worker who’s going out of town for a few days.

2. Take an old or unused computer keyboard that looks identical to that co-worker’s keyboard.

3. Evenly sprinkle seeds and soil between the keys.

4. Spray the keyboard with water.

spray the keyboard with water over the next few days.

6. Watch as grass sprouts all over the keyboard.

7. Swap the co-worker’s keyboard with this one and watch their face as they discover their “welcome back” present: a brandnew desk plant.

THE “GOOD LUCK” BOX

What you’ll need:

• Cardboard box

• Sharpie

5. Place the keyboard by a window where it can get a lot of sunlight. Continue to

1. Choose an employee to pick on.

2. When that employee is out, take a card-

board box and have other employees sign it with messages like “good luck,” “wishing you the best on your next endeavor,” “we’ll miss you,” etc.

3.Leave the box on the employee’s desk.

4.Watch the reaction when the employee returns to their desk. (After a few minutes, kindly explain to them that they’re not actually getting fired.)

What you’ll need:

•Just a computer and good ‘ol Microsoft Word

On PC:

1.Get on your co-worker’s computer.

2.Open Microsoft Word.

3.Go to File > Options > Proofing > AutoCorrect Options.

4.Fill out the “Replace” and “With” boxes with the word you want to replace. (Maybe your co-worker’s name is “Charles,” and you replace his name with “Chicken.”)

5.Click “Add,” then “OK.”

6.Watch your co-worker open up Word and laugh as their name autocorrects to a new one.

On Mac:

1.Repeat Steps 1-2 above.

2.Go to Word > Preferences > Authoring and Proofing Tools > AutoCorrect

3.Select the “Plain Text” option.

4.Fill out the “Replace” and “With” boxes with the word you want to replace.

5.Click the “Add” button.

6.See Step 6 above.

What you’ll need:

•A co-worker with a wired keyboard and Bluetooth-capable computer

•A Bluetooth keyboard

1.Find a co-worker with a wired keyboard that’s connected to a computer with Bluetooth capability.

2.Get a Bluetooth keyboard, and when your co-worker steps away from their desk, pair the keyboard with that co-worker’s computer.

3.Sit at a distance with the Bluetooth keyboard and wait for your co-worker to return.

4.When they open an email or document, use the Bluetooth keyboard to remotely type messages on their computer.

5.Watch them stare in terror as their computer seems to type all by itself.

you take the screenshot, pull up a web browser window and Google search “frozen Mac desktop.” Leave the window up, then screenshot the whole screen. Proceed as normal.

3.Click the Finder. In Documents, create a new folder and title it “Desktop.”

4.Grab all the files on your co-worker’s desktop and put them in the “Desktop” folder you just created. This ensures that your co-worker’s files are all saved.

5.Right-click your co-worker’s desktop and select Change Desktop Background.

6.From there, go to Folders, then click the “+” sign and find the “Desktop” folder you just created.

7.In the Desktop folder, find the screenshot you took earlier. Click Choose.

8.Back on the Desktop and Screensaver window, select the screenshot image. This will change the desktop background to the image of your screenshot. You may then close the Desktop and Screensaver window.

What you’ll need:

•Just a co-worker’s computer to pull the prank on (works best on a Mac)

1.Get on a co-worker’s computer.

2.Press Command + Shift + 3 to take a full-screen screenshot. The screenshot will save to your desktop. Tip: If you’d really like to be a knucklehead, before

9.Navigate to System Preferences > Dock and change the Size to “Small” and Position to “Left.” Then check the box that reads “Automatically hide and show the Dock.” This hides all of the desktop’s icons.

10.Voila! When your co-worker sits back at their desk, they will frantically click all over their screen — now just a background photo — unable to open anything on their desktop.

11.Not to worry — the Finder bar at the top of the screen still works, so after getting a good laugh, you can set everything back to normal.

We asked our 2019 Best Companies to Work For in Fort Worth about what sorts of mischief have taken place in their offices. Turns out things got pretty serious.

“In order to help with financial requirements, we have a company-wide policy to lock your computer’s screen any time you leave your desk. Most people forgot, and we didn’t want to discipline them for just forgetting, so our CEO made a rule that if you see someone’s screen unlocked, you can change their desktop background to anything you want for the rest of the day. So, after a few people got ugly pictures, weird animals and their sport rivals’ logos on their background for a day, people started actually locking their screens. We’ve kept this up for almost a decade at this point and still share funny backgrounds around the office when it happens.

“One co-worker always remembered to lock his screen, so I could never change his desktop background. So, one day, I printed an image of his monitor, stole his monitor and taped the image on the wall behind his desk.” -Aaron McWilliams, senior director of marketing, Qualbe

“[On April Fools’ Day] we had a cookie cake made, but instead of icing, we had the bakery use mayonnaise. Of course, it tasted gross. The next April Fools, we called a doughnut shop and asked for a dozen cream-filled donuts, only without any cream in them. Yes, we filled them with mayonnaise.” -Greg Morse, CEO,Worthington National Bank

• Put a toy snake or spider in someone’s cubicle.

• Put a sticker or tape a silly note at the bottom of a person’s mouse to prevent it from moving.

• Tape an airhorn under someone’s chair so it goes off when they sit down.

• Cover an entire cubicle with foil, balloons, Post-it notes, etc.

• Hide photos of a celebrity — or someone else obnoxious — all over someone’s desk area. See if they can find them all.

“Early one morning in October 2016, pranking payback was on the mind of account executive Julie Ornelas as she took 2,200 Post-it notes (orange, pink and yellow) and strategically covered fellow AE Aeron Lopez’s Honda Accord. Julie stealthily went into the parking garage shortly after Aeron arrived and diligently decked out Aeron’s Honda ... by the time Aeron headed out to lunch, she discovered the colorful piece of paper art her car had become.” -Mario Tarradell, bilingual communications specialist, Apex Capital Corp.

“One of our attorneys once lost a case when he was at a different firm. One of his fellow attorneys printed hundreds of pictures of the victorious attorney and hid them all over his office. It took him months to find them all.” -Travis Patterson, attorney, Patterson Law Group

“While one of our regular pranksters was out on vacation, the team decided it was time for payback. We carefully removed all items from the lead prankster’s very messy desk so we could place them back in the same messy order. Our desks are very large and made of wood, so it took at least three or four people to move the desk into the bathroom. We then placed the mess back exactly where we found it — but this time on top of a porcelain throne. Needless to say, when she returned to the office on Monday morning, we were all mentally preparing for revenge.” -Sara Hull, executive vice president of account strategy and client development, Schaefer Advertising

“This started with a customer (and good friend) pulling a small prank on me. So, I retaliated by taking an ad out in the Star-Telegram for an estate sale at his house ... People that frequent estate sales are a different breed and will not take no for an answer. He woke up to strange noises at 5 a.m. When he went to investigate, there were about 20 people in his garage rummaging through his belongings. Once he determined what had taken place and told these people there was no estate sale, they still wouldn’t leave. He ultimately placed a sign in the yard explaining there was no sale, and that didn’t help. He and the family had to get a hotel room for the weekend. Maybe next time he won’t draw first blood, and I doubt he’s ever left his garage door open again.” -Troy Moncrief, president,The Baker Firm PLLC-Fidelity National Title

Not all human resource departments frown on pranking. HR professionals Mike Coffey, president of background screening service Imperative Information Group, and Justin Dorsey, senior human resources manager at Ben E. Keith Company, certainly don’t. But it would be remiss to play a prank without thinking through the possibility of negative repercussions. While much of this is common sense, Coffey and Dorsey have a few caveats before you try these at work.

1. Avoid pranks that target race, gender or religion. “Harmless is in the eye of the beholder,” Coffey says, so make sure your prank isn’t one that will come across as a personal attack.

2. Know your target. You never know what could be happening below the surface, so make sure you know your prank victim well before you execute. “What may work for one person may offend another,” Dorsey says. “You’ve really got to know your audience.”

3. Make sure the prank doesn’t interfere with someone’s job, threaten safety or damage company property. Coffey does have a warning about putting your co-worker's office supplies in Jell-O, as popularized in NBC's "The Office" “[It] sounds very funny, but that’s company property. A lot of employers frown on that.”

4. Don’t prank a subordinate. Unless you know them well, picking on a new employee or intern isn’t always a good idea, Coffey says. “If they are offended, they might feel like they can’t object or they can’t reciprocate.”

We draw our Top Realtor list from nominations by thousands of homeowners and industry professionals. This helpful resource unlocks some of Greater Tarrant County’s best agents who can help you find the perfect space for you and yours.

Chelsea Albright Williams Trew

Gaylene Anders Ebby Halliday Realtors

Brenda Anderson Williams Trew

Joel Arredondo Ebby Halliday Realtors

Wendy Bailey eXp Realty

Deborah Bailey Giordano, Wegman, Walsh and Associates

Debra Barrett Virginia Cook Realtors

Blake Barry Williams Trew

Andra Beatty Andra Beatty Real Estate

Emily Beck Briggs Freeman Sotheby’s International Realty

Hannah Behrens Briggs Freeman Sotheby’s International Realty

Joseph Berkes Williams Trew

Claire Berkes Williams Trew

Steve Berry Williams Trew

Earl Bilbrey Keller Williams Realty

Brady Bridges Chisholm Realtors

Jennifer Brown Ebby Halliday Realtors

Lindsay Bruns Charitable Realty

Suzanne Burt Burt Ladner Real Estate

Rachel Canafax RE/MAX Trinity

Tracey Chamberlain Ebby Halliday Realtors

Alexander Chandler Alexander Chandler Realty

Onofre Chapa Ebby Halliday Realtors

David Chicotsky Briggs Freeman Sotheby’s International Realty

Michaela Chicotsky

Briggs Freeman

Sotheby’s International Realty

Ruby ClaiborneLozano JP & Associates REALTORS

Jeff Clarkson Clarkson Realty Team

Kimberly Coatney Ebby Halliday Realtors

Micah and Robyn Coffey Briggs Freeman Sotheby’s International Realty

Jennifer Cohn Burt Ladner Real Estate

Rusty Collins Alexander Chandler Realty

Susan Cook Williams Trew

Sandy Cotton Ebby Halliday Realtors

Michael Crain

Briggs Freeman Sotheby’s International Realty

Tamara Crain

Century 21 Judge Fite Company

Hallie Cranford

Century 21 Judge Fite Company

Sharon Crockett

Compass

Allen Crumley Williams Trew

Becca Davis Ebby Halliday Realtors

Mary Margaret Davis

Mary Margaret Davis Real Estate Team

Melinda Deckert Burt Ladner Real Estate

Jennifer Demel Burt Ladner Real Estate

Sam Demel Burt Ladner Real Estate

Therese Deptula Ebby Halliday Realtors

TK Dorsey Virginia Cook Realtors

Sara Drehobl LEAGUE Real Estate

Virginia Durham Briggs Freeman Sotheby’s International Realty

Ida Duwe-Olsen Williams Trew

Nanette EcklundLuker

Allie Beth Allman & Associates

Tami Ellis Alexander Chandler Realty

Richard Farrelly Coldwell Banker

Danny Force DFW Legacy Real Estate Group

Lori Fowler Charitable Realty

Emma Gardner

Briggs Freeman Sotheby’s International Realty

Melissa Gaspari JP & Associates REALTORS

Mary Carolyn Gatzke Briggs Freeman Sotheby’s International Realty

Roslyn Gauntt Century 21 Judge Fite Company

Matt Gauntt Century 21 Judge Fite Company

John Giordano Giordano, Wegman, Walsh and Associates

Kay Goldthwaite Williams Trew

Tony Green The Tony Green Team

Sha Hair Century 21 Judge Fite Company

Andrea Halbach Burt Ladner Real Estate

Chase Hall Chase Realty DFW

Laura Hamilton Burt Ladner Real Estate

Ashley Hanson Coldwell Banker

Jennifer Harman Keller Williams Realty

Gwen Harper Briggs Freeman Sotheby’s International Realty

Allison Hayden Briggs Freeman Sotheby’s International Realty

Mark Hewitt Jr. Keller Williams Realty

Stefani Hill Williams Trew

Christa Holbert LEAGUE Real Estate

Karen Holcomb Northern Realty Group

Adrianne Holland Briggs Freeman Sotheby’s International Realty

Amy Hooper Trott Briggs Freeman Sotheby’s International Realty

Corrine Hyman Quast Williams Trew

Mary Ann Izzarelli Ebby Halliday Realtors

Claudia Jimenez Briggs Freeman Sotheby’s International Realty

Shannon Johnson eXp Realty

The most expensive ZIP code in Fort Worth in 2018.

SOURCE: GREATER FORT WORTH ASSOCIATION OF REALTORS

Allison Price Jones Williams Trew

Pedro Juarez RJ Williams & Company LLC

Josiah Keas LEAGUE Real Estate

Sara Keleher Ebby Halliday Realtors

Amanda Kenvin Giordano, Wegman, Walsh and Associates

Scott Killian Scott Real Estate, Inc

Shelby Kimball Kimball Real Estate

Kendall Kostohryz Williams Trew

Laura Ladner Burt Ladner Real Estate

Jayne Landers Burt Ladner Real Estate

Michelle Lanford Century 21 Judge Fite Company

Cyndi Lawson Ebby Halliday Realtors

Mitzi Lemons Coldwell Banker

Melissa Little Chase Realty DFW

37 The average number of days homes spent on the market in 2018 (three days more than 2017).

SOURCE: GREATER FORT WORTH ASSOCIATION OF REALTORS

Bob and Nancy Lohman Williams Trew

Darla Lorenson RE/MAX Trinity

Sarah Lyons Century 21 Judge Fite Company

Kandy Maberry Giordano, Wegman, Walsh and Associates

Shila Manley JP & Associates REALTORS

Kristen Martin Williams Trew

Amanda Massingill Williams Trew

Margaret McDermott Coulborn

Giordano, Wegman, Walsh and Associates

Lori McElyea Century 21 Alliance Properties

Donna McFarland Charitable Realty

Kelly McLean Williams Trew

Janice Miller Century 21 Judge Fite Company

Aileen Milton Burt Ladner Real Estate

Matthew Minor Burt Ladner Real Estate

Carley J. Moore

Briggs Freeman Sotheby’s International Realty

Ashley Mooring Briggs Freeman Sotheby’s International Realty

Michelle Moran Charitable Realty

Ann Motheral Coldwell Banker

Michelle Myers Rogers Healy and Associates Real Estate

Kelly Nelson Williams Trew

Keely Nezworski Pineapple Properties

Lela Nichols United Real Estate DFW Properties

Malorie Nielsen Burt Ladner Real Estate

Bobby Norris