FWinc.

OUT OF GAS?

How fast will development adjust to energy disruption and a future of fewer cars?

VIRTUALLY REAL

TCU student turns memories of hospital stays into virtual reality startup.

How fast will development adjust to energy disruption and a future of fewer cars?

TCU student turns memories of hospital stays into virtual reality startup.

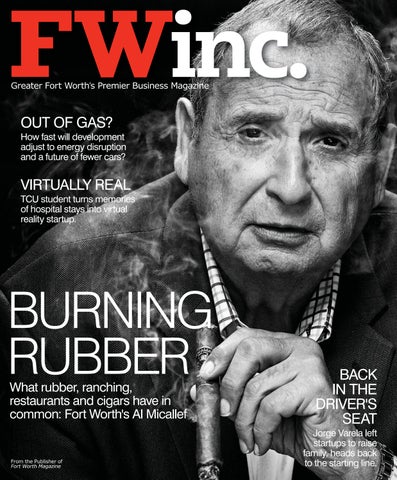

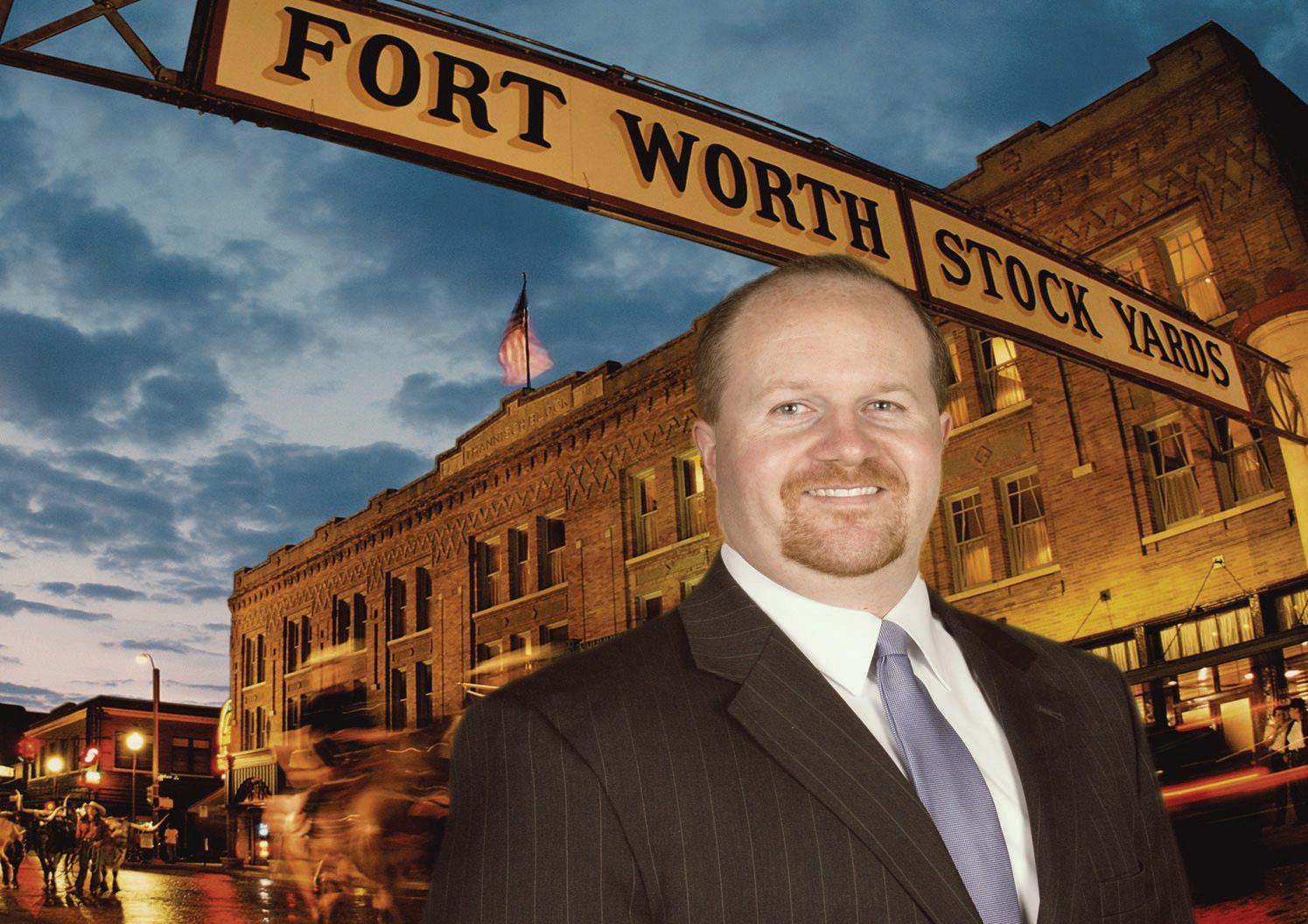

What rubber, ranching, restaurants and cigars have in common: Fort Worth's Al Micallef

Jorge Varela left startups to raise family, heads back to the starting line.

Breadth of knowledge and depth of experience are essential in an ever-changing energy industry. Whitley Penn understands the energy industry including its unique accounting and tax challenges as well as opportunities. We work directly with companies to help them achieve their business objectives and goals.

46 Burning Rubber: Fort Worth knows him as the owner of Reata, but there’s more to Al Micallef than a good chicken-fried steak.

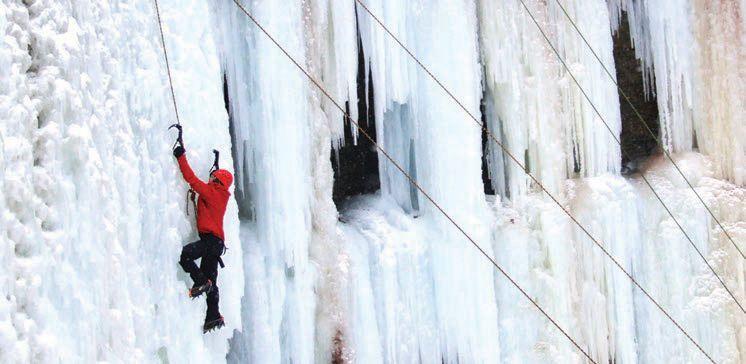

54 Out of Gas?: Cars may become a thing of the past – at least, according to one futurist author.

62 Ventures With Values: A TCU student turns her hospital experience into a business venture.

68 Back in the Driver’s Seat: After taking a break from the startup world to raise his children, Jorge Varela returns with new ideas and a new outlook.

9 Consolidated Care: Texas Oncology breaks ground on a new facility.

12 Fit to Scale: Local alternative delivery companies PICKUP and Gozova are scaling up.

14 Comings and Goings: From relocations to new openings, businesses make moves.

16 Face Time: Lauren DoerenBarnett shifts her focus from advertising to helping the homeless.

18 Stay Informed: Five tips to become a better networker.

20 Around Cowtown: Chamber gatherings, banquets and more photos from Fort Worth’s top business events.

( EXECUTIVE LIFE & STYLE )

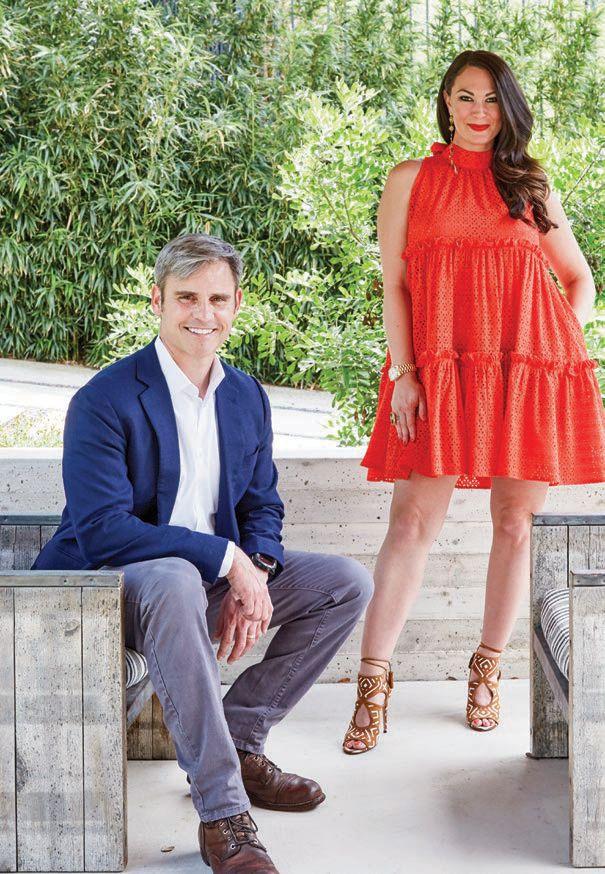

24 Distinctive Style: Design is life for Fort Worth couple Lauren and Andrew Blake.

28 Off the Clock: Skip the hotel ballroom. These resorts take conference venues from the beach to Broadway.

32 Wine & Dine: Vivo 53 moves out; Mercury Chop House moves in. Mercury Chop House moves out; Waters moves in. What’s next?

34 Gadgets: Four ways to make an app.

36 Health & Fitness: A recipe for an easy, tasty office snack for the days when you feel off-balance.

38 Office Space: An old auto body shop transforms into a hip coworking space.

( COLUMNS / DEPARTMENTS )

74 EO Spotlight: The leader of the Entrepreneurs’ Organization’s Fort Worth Chapter almost became a jazz musician. Then he changed his mind.

76 Business Strategy/Running Toward the Roar: A boy grows up at the Lena Pope Home...and becomes a state district judge.

80 Analyze This/FW Chamber Report: Fort Worth’s transportation

industry is going places.

82 Analyze This/Commercial Real Estate Report: Get to know the 2017 Real Estate Council award winners.

84 Analyze This/Wealth: Financial forecasting and why it’s good for you.

86 Analyze This/Legal and Tax: Is a SAFE startup investment right for you?

88 Analyze This/Insurance: How Trump’s new health secretary may impact home care.

90 Business Leadership/ Successful Entrepreneurship: Seven ways to boost company tenacity.

92 Business Leadership/ Startups: Michael Sherrod talks life as TCU’s entrepreneur in residence.

94 Business Leadership/ Management Tips and Best Practices: How to craft an effective performance appraisal.

96 Day in the Life: Walk through the busy day of Gloria Starling, managing partner at The Capital Grille.

Novacek

If you’ve found your piece of Texas, talk to a Heritage lender today.

Six months ago, I was smoking a $42 Micallef Reserva cigar with Al Micallef at a corner table on the rooftop of his Reata Restaurant, where he shared the story of his newest entrepreneurial venture into cigars. I was there for a guys’ night out party where Rolls-Royce Motor Cars Dallas, a Park Place dealership, was introducing the new Rolls-Royce bespoke limited series edition, with a Stetson Hat Company interior package. Why would a Dallas dealership throw an unveiling in Fort Worth? While many out-of-staters may consider Dallas to be the city that best represents Old West Texas heritage, those from around here know Fort Worth is where the West was won and Dallas is where the East peters out. And where better to announce a Stetson Rolls-Royce partnership than Reata, named after the classic Western “Giant” with Rock Hudson and James Dean.

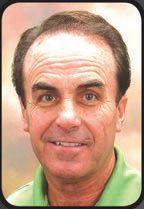

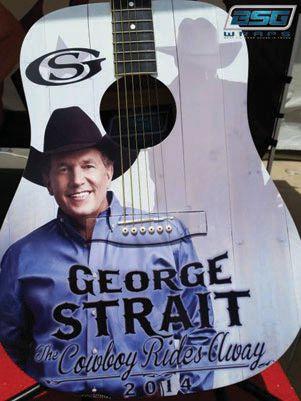

At 6’1”, the Stetson and Justin-wearing, cigar-smoking, 74-year-old Al Micallef is a poster child for what people think real Texans should look like. If you Google “Old West Texan images,” Micallef’s face might just show up. Micallef grew up in Detroit, but thought he lived in Texas as a child, because the only radio station he could get on his old crystal set was from Del Rio. Micallef arrived in Texas in the early ‘70s when he moved his rubber company Jamak, Inc. to Weatherford. Over the last almost four decades, his businesses have included silicone rubber products, ranching, ranch real estate, development, horses, restaurants and, lately, cigars. (Our feature on Al Micallef begins on page 46.)

Like many entrepreneurs, Micallef is an out-of-the-box thinker. As a kid, he had trouble in school and was a teenager before he taught himself to read. He was never diagnosed, but says he might be dyslexic. Because of his learning disability, he has had to think outside the box his whole life.

When launching his new venture, Micallef Cigars, he could not get his cigars rated. So like any brilliant marketing mind, he gathered 12 friends who had no stake and created the Royal Academy of Cigar Connoisseurs.

These 12 individuals, with various cigarsmoking experiences, including many at the Silver Leaf Cigar Lounge in Fort Worth, rated the Micallefs. The Reserva received a 98 rating. With that, Micallef had Royal Academy of Cigar Connoisseurs rating cards produced and hand-delivered them to the stores carrying Micallef Cigars. The rating changed the trajectory of the cigars, and, according to the Micallef Cigars website, Micallef Cigars are now being sold in eight states, in 41 retail locations.

Not only did the Royal Academy of Cigar Connoisseurs help Micallef get his cigars into more stores, they are now being rated by the big boys.

Micallef thinks his cigar business could do $20 million in sales in the next five years. In a 2012 Fort Worth Magazine interview, Micallef gave this advice: “Love what you’re doing, not what it gives you. Rewards will come if you love what you’re doing and love being the best.” I know Al Micallef loves being the best at what he does, and I suspect because he loves cigars like he does, the rewards will follow.

Hal A. Brown owner/publisher

Inc. is

Group, 6777 Camp Bowie Blvd,

by

Fort Worth, TX 76116. Periodicals Postage Paid at Fort Worth, Texas. POSTMASTER: Send address changes to Fort Worth, Texas, 6777 Camp Bowie Blvd, Suite 130, Fort Worth, TX 76116. Volume 3, Number 3, May/June 2017. Basic Subscription price: $19.95 per

or via email at scott.nishimura@fwtx.com.

Is your company one of the best places to work for in Fort

FW Inc. and Fort Worth Magazine are pleased to present the Best Companies to Work for in Fort Worth awards. Our program uses a two-part assessment process taking into account the employer’s policies, practices, benefits and demographics, as well as the company’s employees and their engagement and satisfaction. After all, employees know best if their company is a great company to work for or not. The combined employer and employee components assessment produces both quantitative and qualitative data that will be analyzed to determine the final rankings. The winning companies will be recognized in FW Inc. and Fort Worth Magazine and honored at an awards event.

To register your company for participation and award consideration, please visit: www.BestCompaniesFW.com. PARTICIPATION IN THE SURVEY IS FREE

Comfortable design, improved patient flow among features of new Texas Oncology facility.

BY SAMANTHA CALIMBAHIN

Construction is underway for Texas Oncology’s new cancer center, a consolidation of the organization’s Eighth Avenue, 12th Avenue and Klabzuba facilities. The new facility, located at 500 Henderson St., is expected to open in spring 2018. Texas Oncology will occupy three of the four stories in the 100,000-squarefoot building, with the fourth story used as physician office space. Dallas-based Cambridge Holdings, Inc. is developing the project, which also includes a parking garage.

With a new cancer care facility comes the opportunity to purchase updated equipment, as well as design spaces that are more accommodating and comfortable for patients.

“Sometimes we underestimate just how important it is to simply have a peaceful environment for patients to enjoy,” said Jerry Barker, a radiation oncologist with Texas Oncology. “This transition with a new facility has given us the opportunity to really design with that in mind and try to create an environment that is a healing environment.”

The infusion room on the third floor, for example, will feature “inviting” decor and “homey” lighting, practice director Marta Hansard said. Some treatment areas will be designed to mimic a living room or communal space, while other areas will be more individualized and personal.

“Different patients react differently to treatments,” Hansard said.

“[Some patients] want to be in a more community setting, or they’d like to be in a more private setting, so we have multiple options.”

The new facility also offers potential for growth, with room to add physicians and bring in additional service providers to the medical oncology floor, Hansard said.

Moving also presents the opportunity to purchase updated equipment for radiation and imaging, Barker said.

But perhaps one of the best benefits of the consolidated cancer center, Hansard says, is the ability to easily move patients between treatments.

Barker said it’s not uncommon for cancer patients to move from one facility to another for chemotherapy and radiation treatment, an ordeal that affects not just Texas Oncology patients, but cancer patients everywhere.

“Patients with cancer these days have very complicated diseases that require very complicated care and a multiplicity of specialists,” Barker said. “This can be a lot of different tests, procedures, treatments or therapies, inside and outside our practice. Really, our goal is to take some of this ever-increasing complexity and

simplify it as much as we can.”

In the new facility, patient appointments can be scheduled consecutively, allowing the patient to simply move between rooms and floors in one building, as opposed to traveling among two or three different buildings about half a mile apart from one another.

Texas Oncology facilities are typically consolidated, but Fort Worth was the exception, Barker said. The Fort Worth cancer center was built over time as practices joined and real estate was acquired.

But the organization always had interest in bringing the campuses together, Barker said. So three years ago, Texas Oncology’s physician team, which included Barker, decided to sit down and make plans for a new facility.

“Despite the challenges associated with designing, constructing and moving into a new facility, we really felt like this was so much better for our patients,” Barker said. “They really deserved this.”

The hardest part was finding a location, Hansard said. Texas Oncology was determined to stay in the Medical District, close to partners like Texas Health Harris Methodist and Cancer Care Services of North Texas. Late last year, Texas Oncology secured its spot on Henderson Street.

“It is just south of Interstate 30 in downtown Fort Worth, so very easily accessible for patients who have to travel into Fort Worth from any outlying communities, as well as folks who live right here,” Barker said.

Ground broke for the project in April.

“We are excited about elements of design with the building that really bring a sense of hope and a sense of peace to patients who are struggling with complicated diseases and complicated treatments,” Barker said.

Texas Oncology was founded in 1986. The organization as a whole treats more than 50,000 patients each year.

Texas Oncology currently offers the following treatments, all of which will be consolidated at its Henderson location. The new facility will also include an in-house research laboratory and pharmacy, along with nutrition and social services.

Texas Oncology | Fort Worth 8th Ave.

Radiation oncology

Texas Oncology | Fort Worth 12th Ave.

Chemotherapy and infusion

Genitourinary oncology (treatment of cancers affecting male reproductive organs, as well as male and female urinary systems)

Gynecologic oncology

Immunotherapy

Medical oncology

Texas Oncology | Fort Worth Klabzuba

Medical oncology

Radiation oncology

Local app-based delivery services PICKUP and Gozova move out of the startup phase and look toward growth.

BY SAMANTHA CALIMBAHIN

Uber-style businesses are everywhere these days, reaching into industries like food and hospitality. The model is also making its way to delivery services through local companies like PICKUP and Gozova, both of which have launched and are looking to grow their Fort Worth footprints.

PICKUP and Gozova work similarly, using an app to connect customers with drivers who could pick up and move items like heavy furniture and appliances. PICKUP launched about two years ago, while Gozova launched its iPhone app last October and Android app in March.

PICKUP, an Addison-based company that serves Dallas, Fort Worth, Houston and Austin, is currently “recruiting heavily in Fort Worth,” said Brenda Stoner, PICKUP’s “Chief Good Guy,” as the company’s employees are called. Though PICKUP will not disclose its exact number of drivers in Fort Worth, the company estimates “dozens” and is trying to triple its current number.

“We don’t have enough guys there right now,” Stoner said.

According to PICKUP, business in Fort Worth is expected to quadruple in 2017 over 2016. The app currently has 10,000 active users in all cities it serves.

PICKUP hires “good guys,” Stoner says, as employees go through extensive background checks that cover criteria like truck type, driver insurance, temperament and vehicle safety inspections,

and only 10-15 percent of applicants get hired. Drivers are hired full time or part time and paid between $35-$50 an hour.

While the company focuses on hiring people like firefighters, veterans or first responders, anyone is welcome to apply – like Fort Worth driver Steven Lopez, who joined the company last year. When he’s not working his day job as an internal auditor for coffee company Farmers Brothers, he’s working in business development at PICKUP, as well as making deliveries in his 2013 Chevrolet Silverado.

He says the company does deliveries for several retail partners like Pier 1 Imports, Pottery Barn and Big Lots.

“We have so many opportunities in front of us,” Lopez said. “We just want to actually be a part of this thing because it will continue to grow.”

Gozova, too, is looking toward growth in Fort Worth. The company currently has 35 full-time drivers serving Fort Worth, as well as parts of Arlington and Keller. Many of its Fort Worth customers come from TCU-area apartments like Edge 55 and Century Colonial Park, as well as businesses like Costco.

“We’re having a chicken and egg problem right now,” Gozova founder and CEO Goran Krndija said. “Sometimes we have a lot of demand but not enough drivers. Sometimes we have a lot of drivers and not enough demand.”

That’s why Gozova, though capable of doing instant delivery, has been honing its focus on scheduled deliveries. The company was also recently accredited by the Better Business Bureau and is looking to join the Fort Worth Chamber.

Krndija said he’s fascinated by how the Uber business model has spread.

“How many cars does Uber own? Zero. How many hotels or rooms does Airbnb own? Zero. That’s the interesting part about that,” Krndija said. “You’ve got all these hotels and taxis that people actually own. Then you’ve got companies like us. We own the business [for] people who have trucks.”

And technology isn’t just impacting the delivery service industry, Stoner said.

“People are not going to be willing to wait anymore – technology is disrupting that entire space,” she said. “We are smack in the middle of what’s happening in the world, not only in our industry. We’re using technology to change the way things have been done. The status quo will not work anymore.”

A few Fort Worth businesses are relocating, while new ones are moving in.

BY MOLLY JENKINS

The Shops at Clearfork continues to grow, with numerous tenants recently announced. Five new restaurants are set to move in: Malai Kitchen (a modern Southeast Asian restaurant that offers vegan, vegetarian, and gluten-free options), Luna Grill (a fast, casual Mediterranean joint), Mesero (an upscale Tex-Mex restaurant), B&B Butchers and Restaurant (a Houston-based steakhouse opening its second location in Fort Worth), and Fixe (a progressive Southern eatery known for its biscuits). There will also be plenty of entertain-

ment options, with both AMC Theaters and bowling center Pinstripes set to open late 2017. Additionally, custom clothing shops Double R and Q Clothier are among retailers that will join the already-open Neiman Marcus. Home stores Mitchell Gold + Bob Williams, Z Gallerie and Arhaus are also expected to open in the fall.

Coworking space-meets-coffee shop Craftwork Coffee Co. opened its second Fort Worth location at 1121 West Magnolia Ave. on April 26. The 1,850-square-foot space features 14 desks, a conference room and a 36seat coffee shop, among other amenities. The space is also open to members at Craftwork’s first location at 4731 Camp Bowie Blvd.

Keller Williams now has an office in West Fort Worth. The local realty firm relocated its 7755 Bellaire Drive South office to 6333 Camp Bowie Blvd. and celebrated its grand opening in March (although it had moved in September 2016). The branch offers full real estate services in residential, rental, farm and

ranch, and commercial divisions. According to Kim Tarver, Keller Williams’ director of business development, the company had been looking to open a space on Camp Bowie for a while to better serve West Fort Worth. Owner Inga Dow also purchased land by Montserrat and plans to build a location there in the next few years.

The building that will become Pinnacle Bank’s future home at 250 West Lancaster Ave. celebrated its grand opening March 10. At press time, construction of the bank itself was expected to wrap up by the end of April. The bank will span 8,500 square feet, while the rest of the building totals 160,000 square feet with 130 residential units, of which 30 percent are occupied.

Law firm Dorsett Johnson & Swift has moved out of the Knights of Pythias Building in Sundance Square and into the Cassidy Building, a few blocks away at 407 Throckmorton St. The 4,000-square-foot location is double the size of its previous location, featuring seven offices, three conference rooms, a parlor and lounge.

Lauren Doeren-Barnett moves from working in advertising and marketing to building a nonprofit aimed at bringing homeless people to self-sufficiency.

BY SCOTT NISHIMURA

Lauren Doeren-Barnett was working in development for a Fort Worth architecture firm when she took her daughter in 2014 to volunteer at Beautiful Feet Ministries, a nonprofit benefitting homeless men.

“I quickly realized how wrong I was about the homeless population,” says Doeren-Barnett, who continued to volunteer for Beautiful Feet and began to put out feelers for a job in nonprofits.

Coincidence intervened. Doeren-Barnett teamed up with businessman Bob McCarthy, whom she’d met while working at an ad agency on a campaign for the Entrepreneurs’ Organization, which McCarthy belongs to. McCarthy was moving his businesses to a building he bought in the heart of East Lancaster Street and was hiring homeless people in exchange for an incentive from the city.

“Bob hired the first five people and realized they needed more than just a job,” says Doeren-Barnett, who came to work for McCarthy in October 2014 and began working on putting together a nonprofit.

The Leg Up Program was soon born, with Doeren-Barnett, 34, as its executive director. The goal: to help bring the homeless to self-sufficiency through a rigorous program that starts with self-assessment and moves through courses and workshops in soft and professional skills; personal, professional and financial “visioning”; working with mentors; building resumes and interview skills; and getting jobs.

Leg Up worked with 60 people in both 2015 and 2016, placing 27 of 60 in the first year, and 30 of 60 in the second year. So far this year, Leg Up is working with two groups of 10 people in each and is starting a cohort with the nonprofit Samaritan House.

Leg Up recently won a $600,000, threeyear grant that will cover payroll and taxes for Doeren-Barnett and three new employees. Leg Up wants to move to serving 250-300 clients per year.

The organization has hired one social worker and an administrative assistant and is seeking another social worker.

Leg Up doesn’t work with sex offenders, and its clients must stay on their prescribed medications. Social service agencies and one apartment complex screen potential clients for Leg Up.

The growing mentorship piece of the program launched in March last year – Leg Up has 14 volunteer mentors, and DoerenBarnett is looking for more – helps Leg Up keep track of its clients.

At its graduation ceremonies, Leg Up clients receive a “key” to the program’s job bank, updated daily. “They have a job log where they wrote each position they applied for,” Doeren-Barnett says. “I’ll call and advocate for that person.”

Looking forward, Leg Up plans to launch a fundraising campaign after it’s done with its new hires, Doeren-Barnett says. It’s also planning an eventual move next door to another of McCarthy’s properties, a strip center at 1110 E. Lancaster. Leg Up will be looking for donors to help renovate the 3,500-square-foot building. “We’ll put your name on a plaque,” she says.

BY LAURA BELPEDIO

Happy hours, after-hour mixers and social events are old school. Networking has become a different game, and in today’s world, a more beneficial way to connect and build relationships may be through volunteering or getting involved in a community program in which your interests align with those you’re with, according to Staci Kirpach, founder of EMIT Strategies & Solutions and previous member of the SteerFW board of directors.

“I think that getting involved in some of the community groups and organizations or philanthropic efforts are always a great way to go about networking,” she said. “I think that provides a little bit more of a substantial avenue than events like an after-hours mixer.”

Here are a few networking tips from Kirpach and Harriet Harral, executive director of Leadership Fort Worth.

1. FIND SOMETHING YOU LIKE. “I think the best kind of networking comes when you’re connected, and you have the opportunity to get connected to people who share an interest,” Harral said. “Volunteering is a great way to achieve this. If you are involved in or working for some organization with a group of people doing something worthwhile, you’re going to find other people that share that kind of passion, and it connects you at a deeper level than just handing somebody a business card.”

2. DO YOUR HOMEWORK.

“Do research so that you know something about the people, individual, or group that are in an industry, a career, a community, or a structure that you’re interested in so that you have something to talk about with them,” Harral said.

3. WORK CONNECTIONS YOU ALREADY HAVE. “I know networking is about meeting new people, but if you start with who’s in your existing network and find out what they’re doing and how you can better support

them and the group that they’re involved in, or what their interests are, then you’re more likely to land at places that are a natural fit with your goal and interests,” Kirpach said.

4. BE GENUINELY INTERESTED IN OTHERS. “I really think that a misconception of networking is that it’s superficial or selfserving,” Kirpach said. “I think you need to go into a networking opportunity with the mindset of getting to know the other people in your community and wanting to genuinely get to know and learn more about who they are, what they do, and how they’re making the city a better place for their community, and then taking the opportunity to share with them what you do. It becomes a much more intentional use of time.”

5. KEEP SHOWING UP. “Rome wasn’t built in a day, and relationships aren’t built in one afterhour mixer,” Kirpach said. “You have to continue to be consistent and find a few groups that feel natural to you and then continue to work with them over a period of time.”

The Fort Worth Metropolitan Black Chamber of Commerce and Fort Worth Convention & Visitors Bureau together hosted its annual Bring Meetings Home Luncheon on Feb. 23. Rev. Sultan Cole (right) and Revealed World Ministry Choir.

The Cultural District Alliance’s Annual Meeting, moderated by FW Inc. executive editor Scott Nishimura, took place Feb. 15. The event examined how the Cultural District impacts the future of Fort Worth.

Left to right: Stephanie Perryman, Rodney Niemuth, Mayor Betsy Price. Photo by Brian Luenser.

The Fort Worth Hispanic Chamber hosted its Women in Leadership Breakfast on April 13. The event highlighted four women who shared their experiences as community leaders and candidly discussed the risks and rewards associated with their experiences.

Left to right: Ish Arebalos, Jennifer Treviño, Rachel Vogel Marker, Ashley Paz, John Hernandez, Ann Zadeh, and Pilar CandiaJuarez.

The Near Southside Inc. annual banquet was held on March 4 at the Omni Hotel. The topic of the night was autonomous vehicles.

Left to right: Judy Jones, Leila Peeples, Tina Smith, Sam Shafeeq, Carole Ann Fleming, Cathy Lewis. Photo by Laura Belpedio. 1 23 4 5

Left to right: Hayden Blackburn, Brad Nelsen, Tony Seba, and Dr. Christopher Poe. Photo by Tina Howard.

(5)

The Fort Worth Chamber of Commerce held its Business After Hours event March 10 at the Fort Worth Magazine offices. Guests dined on hors d’oeuvres by Z’s Café while listening to live music by Bryan Lucas.

Located in the heart of Fort Worth’s lively West 7th Street Cultural District—close to great shopping, live music, theater and fine dining— The Stayton at Museum Way is everything you love about senior living. In the center of a vibrant cultural hub, The Stayton has become Fort Worth’s most distinctive retirement destination for people with the zest and taste for the best in life.

The Stayton has become a vital cultural cornerstone of the sophisticated West 7th district. Attend a concert at the Bass Performance Hall, take in a Broadway-style show at the Community Arts Center or visit the funky shops and fashionable boutiques in Sundance Square.

We also enrich the lives of our residents and thousands of members of our Fort Worth community through our cultural and educational events, such as our renowned Red Carpet Series, and our unique partnership with the Cliburn.

2501 Museum Way | Fort Worth, Texas 76107

Call to schedule your tour today 817.632.3601.

How Lauren and Andrew Blake weave design into their marriage and their busy professional lives.

BY SAMANTHA CALIMBAHIN / PHOTOGRAPHY BY ALEX LEPE

Lauren and Andrew Blake are looking for a shade of blue. Not just any shade of blue. A bright, neon aqua sort of blue. They’ve only seen it in places like Morocco or Mexico. They’ve taken pictures of it. But when they try to

replicate it back home in the states, they just can’t seem to get it exactly how they saw it.

“We think it has to do with the sunlight,” Lauren said.

It’s been about six or seven years since they first saw that blue, and until today,

they’re still looking for it, and they still talk about it. Design is how the Fort Worth couple finds common ground, and it translates to their professional lives. Andrew is a real estate developer, the founder and managing partner of Fort Worth-based firm Presidio Interests. Lauren is a freelance digital designer, running her own company that specializes in branding and graphic design.

“I’m fascinated with urban design, how cities function, and how the buildings and the blocks are designed,” Andrew said. “Her fascination extends to not only the exterior of the buildings, but the interior of the buildings, and into graphics and those kinds of things.”

Lauren admits, as evidenced by their ongoing search for the shade of blue, she and her husband often get “nerdy” about design. The topic is, after all, what brought the couple together in the first place.

Lauren and Andrew met in 2006 at a holiday party inside what was then a newly built penthouse in The Tower downtown. Eager to check out the new space, Andrew attended the party and met Lauren, who was working with Fort Worth real estate agency The Westover Group at the time. A conversation sparked between the two about how the space should be finished out. Lauren wanted modern – something “slick and cool” for a downtown penthouse.

Andrew not only agreed, but was also impressed.

“She was very candid about her opinion about it,” he said. “I thought, ‘Boy, she’s just calling it like she sees it, and she’s exactly right.’ ”

Lauren’s first impression of Andrew?

“I thought he was really handsome,” she said.

They married in 2009, the same year Lauren left real estate to start her own design company.

For the Blakes, design doesn’t stay at work. They both have a penchant for house

My style can be described as… “Automatic.”

My favorite shops are... D. Jones Clothiers, J. Crew, Service Menswear in Austin, Friend in New Orleans Style advice? “It’s better to own one suit that fits really well rather than five that don’t fit at all.”

My style can be described as… “I like bright colors – like, solid bright colors. I like to keep it simple and throw in something unexpected.”

My favorite shops are… Esther Penn, Neiman Marcus, Canary in Dallas Style advice? “I shop when I’m on vacation. It’s one of the joys when you’re on vacation to get to do a little shopping and bring back something that you can’t find here.”

flipping, renovating three homes together within 10 years – whether it needed renovation or not. Lauren describes their house today as “modern with leanings toward mid-century,” with neutral textures and “masculine” furniture for a “Mad Meninspired vibe” in the living room.

“We just cannot help ourselves,” she said. “We move into something and eventually do something to it.”

Their eye for design reflects in what they wear as well. For Andrew, style is a straightforward deal – he did away with his tendency to impulsively buy ill-fitting clothes just because they were on sale and now takes more care in finding a wellfitting suit. Sometimes, he likes to throw in something fun, like Kermit the Frog socks.

“Anything to get a smile out of our two boys,” Andrew said. The couple has two sons, ages 6 and 3.

Lauren describes her style as “all or nothing,” either “very casual” or “very dressed up.” She says she likes to keep her clothing simple, opting to go for something more dramatic in shoes or jewelry.

A lot of times, how the Blakes dress depends on whom they’re meeting with.

For Lauren, being in the creative industry sometimes requires her to show personal style, but since many of her clients come from word of mouth, she says she doesn’t necessarily need to dress up for a meeting.

“I don’t feel the pressure to put on a pantsuit before I meet a client, and I don’t think I’m expected to either,” she said.

Andrew says Fort Worth, as a city, lends itself to more casual dress.

“In Los Angeles, it’s OK for 50-year-old men to wear baseball caps and tennis shoes in a professional setting,” he said. “It’s part what industry you’re in, it’s part who you’re meeting with, but also the city you’re in, so it varies widely. I feel like Fort Worth’s in the middle. It’s casual, but it’s a really unpretentious city.”

They’re big fans of local boutiques, citing shops like Esther Penn and Pax & Parker as favorites. They also like shopping when they travel, finding pieces at shops that can’t be found anywhere else.

Or colors that can’t be found anywhere else – like that one pesky shade of blue.

“Every time we try to replicate it in paint, it’s never the same,” Lauren said. “Whenever we’re traveling somewhere, and [Andrew] sees that blue, he’s like ‘There’s the blue!’ And I’ll take a picture of it. It’s funny how after all these years, we’re still talking about that shade of blue.”

Unlimited Telephone and Help Desk Support, Remote Access Support with Timely & Responsive On-Site Support.

One-Flat-Rate All Services and Support at a Flat, Reliable, Monthly Rate that Fits Your Budget Needs.

Consulting Services and Planning on All Business Network & Project Issues on an as Needed Basis.

Customize Your Business Support Solution to Include Off-site Backups, 24/7 Monitoring, Anti-virus & More.

Six resorts that offer conference venues that move away from the ordinary ballroom

BY OLIVIA HEINEN

Executives don’t have to be counting down the hours until dismissal while attending a business meeting at a luxurious hotel. The venue can make all the difference. Fort Worth Convention and Visitors Bureau CEO Bob Jameson says three features make a great conference venue – access, functionality and food product. But an atmosphere with an interesting design, decor or personality can even further up the ante. From the Texas Hill Country to Times Square, here are a few resorts that do just that.

HILTON SANDESTIN BEACH GOLF

RESORT & SPA – Miramar Beach, Florida hiltonsandestinbeach.com A trip to a beach is more fun than a trip to

a conference. Hilton Sandestin combines the two, allowing meetings to take place on the South Walton beach itself. If the sound of crashing waves is too loud, there are four other outdoor venues to choose from. Sunset Deck, Sunrise Deck and Barefoot’s Deck overlook the beach, while the Emerald Pool Courtyard overlooks the resort’s main pool deck.

SANCTUARY ON CAMELBACK MOUNTAIN

RESORT AND SPA –Paradise Valley, Arizona sanctuaryoncamelback. com

Sanctuary offers an indoor/ outdoor ballroom and boardrooms with a view of

Paradise Valley’s desert and mountains. The resort also offers eight private homes that can be used for corporate retreats, with amenities including game rooms and secluded patios. Just note that cacti are not take-home souvenirs.

THE GANT – Aspen, Colorado destinationhotels.com/hotels-andresorts/the-gant

The Molly Campbell Conference Center at The Gant offers a panoramic view of the Rocky Mountains. Its 1,500-squarefoot rooftop terrace is at the base of Aspen Mountain and surrounded by the Elk Mountains. The conference center also includes a specialty café. Feel free to explore the mountains during breaks, as the hotel has its own ski clubs, but steer clear of any approaching blizzards.

CREEK LODGE & RE-

SORT – Glen Rose, Texas roughcreek.com

“A critical component is to make sure that you have the highest or most current technology available,” Jameson said. One hotel he recommends is located just south of Dallas-Fort Worth – the Rough Creek Lodge & Resort, which has six meeting areas with high-speed wireless internet, drop-down screens, lavalier microphones and other technology features. The indoor conference rooms come in various configurations, from theater to U-shape. The resort boasts outdoor facilities as well – the Outdoor Terrace overlooks Mallard Lake, while The Pavilion can be open air or enclosed.

NEW YORK MARRIOTT MARQUIS

– New York City, New York marriott. com/hotels/travel/nycmq-new-york-

New York City is home to Broadway, Broadway is home to the Marriott Marquis, and the Marriott Marquis is home to Broadway Lounge. In addition to serving as a meeting space, the lounge is a 6,000-square-foot observation area of Times Square. For smaller and more private meetings, there is the 1,977-squarefoot Liberty Ballroom on the eighth floor, which overlooks the famous Shubert Alley. Nestled inside the Marriott Marquis is the Marquis Theatre, where Broadway shows play regularly.

hotelzaza.com/houston

Hotel ZaZa is just four hours away from Fort Worth and has 14 conference venues with different personalities. The Grapevine, Imagination and Room with a View allow its occupants to see the Houston skyline. Poolside at ZaZa – well, the location is explained there. The Conspiracy Room is designed as a speakeasy from the Prohibition Era, so it is fitting that there is a wine collection in the Vault Room next door. The Hemingway room pays tribute to Ernest Hemingway’s hunting and adventure travels, noted with animal

print carpet and hunting trophies on the fireplace mantel. The other conference rooms include the Déjà Vu, Fishbowl, Fountain Room, Gallery, and Phantom Ballroom, each with its own distinct features.

SHELBY BRUHN President

When one restaurant leaves, another opens. Here are two restaurateurs who did it right.

BY SAMANTHA CALIMBAHIN

Fort Worth restaurants like Mercury Chop House and Waters have been riding on a carousel of sorts.

When Vivo 53 closed its location in The Tower last year, Mercury Chop House moved in, picking up from its previous location at 301 Main St., where it had been for more than 15 years. Then Waters moved to Mercury Chop House’s old space, leaving the seafood restaurant’s former location in the West 7th development up for grabs.

Whoever occupies Waters’ former space is yet to be seen, but nonetheless, the trend of restaurants moving around in Fort Worth doesn’t make the process any easier. It’s a big deal, with many factors and logistics to consider, not to mention the money and employees that can be lost in the process.

That is, unless you do it right.

Take Mercury Chop House, for example. Owner Zack Moutaouakil first opened his steakhouse at 301 Main St. in 2000. But in the course of 15 years, he

says, things like the air conditioning and plumbing in the space had aged, making it difficult to stay.

“It was time,” Moutaouakil said. He figured that the best way to keep customers was to not move too far. Since Mercury Chop House had become somewhat of a downtown institution over the years, Moutaouakil said, he was determined to keep the restaurant downtown. Fortunately, Vivo 53 left a vacancy in The Tower, just a six-minute walk away.

Getting paperwork done quickly was another important factor, Moutaouakil said. He began applying for a liquor license and other permits early – even before the lease was finalized. It was a gamble, Moutaouakil said, but it saved a lot of time during the moving process. He said the move happened in “record timing” – Mercury Chop House closed in August 2016, got the lease in November, and reopened to the public in December,

just in time for the holiday rush.

The new location turned out to be a perfect fit, Moutaouakil said. No longer would Mercury Chop House have to rely on The Worthington Renaissance Fort Worth Hotel to bring in customers; the restaurant now serves a more consistent customer base with The Tower’s residents.

“People live there,” said Moutaouakil, who is currently planning a second Mercury Chop House location for Arlington. “These are wellto-do customers that every restaurant wants.”

And in turn, the space left behind by Mercury Chop House eventually became Waters’ new home.

Sundance Square had approached Chef Jon Bonnell about the possibility of moving his restaurant from West 7th to downtown, almost serendipitously, as Waters’ lease was almost up at West 7th.

“West 7th was a great spot. We really enjoyed our time down there,” Bonnell said. “But when we got an offer to go to Sundance Square, it was just too hard to pass up the amount of foot traffic, the amount of office space down there, the hotels, the plaza, the convention business – it just adds up to one of the most high foot-traffic areas in the city.”

The downtown audience seemed like a better fit for Waters too, Bonnell said.

“[In West 7th], a slightly more casual, baroriented place might do a little better because it’s become an extremely young, hip and trendy area,” he said. “We typically shoot more for the fine dining crowd.”

So Waters closed its West 7th location in August 2016. The move wasn’t without its struggles, though. Since Mercury Chop House’s former space was an older building (it was built in the early 1900s), the project faced delays due to construction. Eventually, Waters was able to reopen downtown and celebrate its grand opening April 10.

Bonnell’s advice for moving? “Make sure the move is worth it.”

“It’s very similar to closing and starting over,” Bonnell said. “To move a restaurant really takes more than most people would probably believe, financially and physically. It’s a whole ‘nother opening. A whole new set of problem-solving.”

Waters’ Jon Bonnell and Mercury Chop House’s Zack Moutaouakil offer their tips for moving a restaurant.

Be transparent with your staff. Moving a restaurant often means being closed for several months, and being closed means employees will be out of work for the same amount of time, which poses the risk of losing them to other jobs during the moving process.

Moutaouakil says openly communicating with your employees about the move, as well as offering additional benefits, builds their trust and encourages them to stay when the restaurant reopens. “The good thing that happened to me was, I have all my staff,” he said. “Even though I was closed for four months, they all got jobs somewhere else, but they all came back. Every single one of them.”

Start your paperwork early, if possible. Paperwork for things like permits and liquor licenses can be time-consuming.

Moutaouakil took a risk by filing the paperwork before

finalizing the lease, but it paid off. “If you don’t get [the lease], you’re going to lose money. Well, that’s a chance we take,” he said. “But if I get it, I’ve gained three or four weeks. For me, a week was a lot of time.”

the cost.

Moving also means leaving behind money spent on things like kitchen equipment and the finish out of the previous space, Bonnell said. “If it’s a spatula or a pan, and I can pick it up, I can take it with me,” he said. “But the walk-in refrigerator and freezer, which are very expensive and have to be installed and engineered into the building, you don’t take those with you, but you’re going to need a new one at the other place. You leave some money on the table when you decide to leave a spot.”

These days it seems there is an app for everything. Despite popular belief, acquiring one for your business isn’t as hard as it may seem.

BY MOLLY JENKINS

With every big technology update, there is a shift in the business world.

Many companies are jumping on the bandwagon, evolving their businesses digitally through mobile applications, or apps.

Fort Worth’s own Righteous Foods, for example, recently developed an app that allows customers to order their food in advance. The app will also eventually incorporate a delivery service.

Chef and owner Lanny Lancarte said he often investigates what innovative ideas are working in larger markets in order to “stay ahead of the curve.” For Lancarte, the decision to create an app was beyond convenience or following a trend – it was purely a practical move.

“I think people are connected to their phones 24 hours a day,” he said. “The easier you can make people’s lives, which are already busy, the better.”

Creating an app is relatively simple, Lancarte said. Here are four ways to create an app that can advance your business and aid your customers.

Use a customizable, predeveloped app platform. Third-party companies with customizable, pre-developed app platforms are

one of the routes businesses can take when developing an app. In Righteous Foods’ case, the restaurant partnered with thirdparty company ChowNow, which uses pre-developed app software that can be easily customized and turned into a platform unique to the company using it. Righteous Foods’ app features the restaurant’s own logo, content and design.

Not all pre-developed apps emphasize the company’s individual brand, however. For example, MINDBODY Inc. (used by Fort Worth’s own CycleBar) can help cre-

ate apps that make the company’s brand highly visible, similar in style to Righteous Foods’ app. But businesses can also join the MINDBODY network, making them visible to customers searching for fitness centers via the MINDBODY app. The company’s brand is less visible, but the app still works nonetheless.

Hire an outside developer. Businesses can also create a personalized app by turning to a freelance developer or app development firm. For this route, it is important to have a solid idea of the app’s purpose and lay out a plan that can be discussed with the developer.

Develop the app in-house. If a company is lucky enough to have someone skilled in app development, then an app can be made in-house.

For Booster Fuels, a Seattle startup that now has a branch in North Texas, an app is essential to its business – customers use the app to tell Booster Fuels what gas they want, where they want it and when. Then the company delivers the gas right to the customers’ cars.

Booster Fuels had the in-house expertise of Diego Netto, an app developer and software engineer.

Netto developed a fully functioning app in around 90 days, said John Parker, head of operations and growth at Booster Fuels.

“In a very quick time, we went from nothing to having an app on the App Store,” he said.

Use a simplified app program. Simplified programs like AppMakr, iBuildApp and GoodBarber help nonsoftware-oriented users make an app on their own. These programs don’t require the high cost or skillset of an app developer. However, the money saved may reflect in the quality of the app, as the app will likely not include as many features or advanced design aspects.

BY KENDALL LOUIS

On a particularly busy Wednesday morning, in the throes of managing the combination of an overloaded work day with a sick child and an unavailable nanny, a cookbook

made its way across my desk entitled “Life in Balance.” While the book and its title, by popular Australian home cook and author Donna Hay, reference a balanced diet without the need for an actual diet, its contents provide a solution for both life and nutrition,

particularly a section on power snacks. Items like Cocoa, Banana, Date and Cashew Bars; Peach and Coconut Chia Snacks; and Seed and Date bars provide the perfect make-at-home, grab-and-go snack options.

But the recipe for Apricot, Quinoa and Almond Bars particularly stood out for its use of spelt, an ancient grain that’s high in protein and easy to digest. Make these bars and keep them in the kitchen, or bring them to work for days that feel particularly off-balance.

Apricot, Quinoa and Almond Bars

• ½ cup quinoa flakes

• ½ cup flaked almonds

• ¼ cup pepitas (pumpkin seeds)

• ½ cup rolled oats

• 1¼ cups chopped dried apricots

• ½ cup desiccated coconut

• ½ cup wholemeal spelt flour

• ½ cup vegetable or nut oil

• ¾ cup maple syrup

• 1 teaspoon ground cinnamon

1. Preheat oven to 320 F. Line a 7-by-11inch tin with nonstick baking paper and set aside.

2. Place the quinoa flakes, almonds, pepitas and oats on a baking tray, toss to combine and bake for 10 minutes or until lightly toasted. Place in a large bowl, add the apricot, coconut, flour, oil, maple syrup and cinnamon and mix well to combine. Press the mixture firmly into the prepared tin, and bake for 40–45 minutes or until the slice is golden and firm to touch. Allow to cool in the tin for 10 minutes before turning out onto a wire rack to cool completely. Slice into bars to serve. Store bars in an airtight container for up to one week.

MAKES 16

Adjusting and Consulting Services Exclusively for the Policyholder

Our mission is clear - to help people who are devastated by loss, to see hope in a hopeless situation, and to make sure that you, the insured, receive all the compensation you rightly deserve.

SERVICES

Hail Damage

Business Loss & Claims

Documents & Damage Evaluation

Structural Damage

Rejection of a Claim Appraisals

A former auto body shop is now a favored Fort Worth coworking space for small business owners and entrepreneurs.

BY MOLLY JENKINS / PHOTOGRAPHY BY ALEX LEPE

Working from home has its perks, but it doesn’t have the same vibe of a big community. coLAB combines the perks of personal space with the energy of a community to create the ideal work environment.

coLAB coworking space sits at 262 Carroll St. – near an area busy with car dealerships and auto body shops – so it isn’t too surprising that the 9,000-square-foot building was once an auto body shop itself.

Blake Panzino, an entrepreneur, founded coLAB in August 2013. He and his wife Meggan arrived from Chicago ready to raise a new family. He was in need of a workspace outside of his home.

“I wanted a cool office space, but I also wanted people to be around,” he said.

Panzino found himself bored with every office space he saw, when he came across the old auto body shop. An avid fan of older buildings with unreplicable design, he wanted to save the aged industrial vibe of the building.

So the Panzinos got to work designing the coLAB space themselves. Blake credits Meggan with helping him add feminine touches to balance the gritty, masculine vibe.

The result is a chic-meets-industrial aesthetic found throughout the building. Brick walls make up the majority of the building’s exterior, and the inside is a mixture of concrete flooring, wood finishes, and bright pops of energy from decadent chandeliers and colorful detailing.

“I didn’t want to tear something down, and I found an auto body shop that was slated to be torn down,” he said. “We kept the garage doors to keep it functional, while at the same time, a nod to the past.”

The garage doors now function as large windows inside the common area, which includes communal workspace and a kitchen. Additionally, there are countertop seats placed on the garage doors for anyone who prefers a view outside the office while working.

“That building had a very rare, rough past as far as design,” Panzino said. “We wanted to retain that kind of grittiness, that warehouse feel, but at the same time make it suitable to be class A office space.”

A short walk down a ramp just off the left of the main entryway leads tenants into the spacious yet cozy communal area. The kitchen stays stocked with free coffee from local roasters. The common area

adds a dose of modern to the industrial space with dainty white and grey wallpaper and a sputnik chandelier. A dark navy rug anchors the room with a rustic wood coffee table paired with camel brown leather couches. A large colorful world map is hung in the center of the main wall, which consists entirely of wood paneling. A black chalkboard sits above a row of deep chocolate-brown leather booths and dark wood tables on the opposite wall. Exposed pipes and cement floors add to the industrial vibe.

An adjacent conference room, up for grabs to any tenant, buzzes with energy – a result of the bright orange dry-erase board, white walls, and another elegant chandelier. White swivel desk chairs, a TV for presentations, and a long wooden conference table complete the room.

The common space and bathrooms are strategically placed in the center of the building to promote “spontaneous bump-ins” and create “forced serendipity” between tenants, Panzino said.

A funky lobby greets guests. A moose head sits dead center on the wall behind the desk, juxtaposed against the same dainty wallpaper found in the common area. Above the desk are the brightly lit bold letters, W-O-R-K, and across from the desk is another orange dryerase board covered in various events and notes.

Against the wall across from the main doors are three bright-red phone booths that practically beg for someone to step inside and phone a friend. Adjacent to the phone booths is the largest private suite, which is 1,000 square feet.

At coLAB each company furnishes and designs its own space. The tenants’ design elements vary from classic wooden office spaces to hipster chic. One office, with a bike inside, hints at the tenant’s preferred method of transport.

“We want people to be proud that they work at coLAB but not feel like they work for coLAB,” said Panzino. “We want each of their spaces to feel like their own unique space.”

Two main hallways are lined with office suites, and white walls have bold and motivational sayings written in black script. One script reads, “Failure is only the opportunity to begin again, only this time more wisely.”

But the building’s design is not the only motivating element at coLAB – the people help too.

“People are inviting and engaging,” Panzino said, adding that there’s good energy at coLAB, as tenants are overall friendly and like to help each other.

“It depends what day it is, but there is typically a good buzz of creation going on,” he said.

Businesses have already grown out of coLAB, and the common area space provides a great area for people to meet and realize their skills combine well, which can lead to a new business venture itself, Panzino said.

“It’s geared toward people who just miss those interactions of being in an office space but who also want something that reflects their personality,” he said.

Another coLAB location, with new design elements and a new crop of tenants, is set to open in Dallas in a few months.

As a Tarleton student, Dr. Karla Dick majored in pre-med and played basketball for the TexAnns. She credits her college student-athlete experience with teaching her the time management skills and self-discipline necessary to graduate in the Top 10 of her medical school class and earn a spot in the prestigious John Peter Smith residency program.

Her career in family medicine allows her to diagnose and treat ailments that affect young and old, as well as incorporating education and all-important prevention strategies into her patient care.

Deciding to divorce is one of the most important decisions a person can face so it makes sense to know your options.

“

One option is traditional court room litigation. Another option is collaborative law divorce.”

Although attorney Stephanie Foster Gilbert is prepared to be the warrior in your court room battle as she has been in thousands of Tarrant County divorce cases over the past 25 years, her preference is to be peacemaker in your interest–based negotiations through the dignified, private, child–protecting process known as collaborative law divorce which involves no court.

Stephanie Foster Gilbert is confident that the collaborative law process is a powerful way to generate creative solutions in family law disputes while minimizing financial and emotional damage to the couple and their children all the while promoting post–divorce psychological and financial health of the restructured family.

As a family law mediator and one of the first Tarrant County attorneys trained in collaborative law, attorney Stephanie Foster Gilbert will help you navigate through your divorce options and zealously represent you through the process of your choice.

Al Micallef parlays a lifelong rubber products play into ranching, horses, restaurants, and, lately, cigars. It’s put 250 children of his employees through college. And he's not done yet.

BY SCOTT NISHIMURA / PHOTOGRAPHY BY ALEX LEPE

ALPINE – It’s dinnertime on a Thursday at the original Reata restaurant in downtown Alpine overlooking Texas’ Davis Mountains, the place is crowded, and owner Al Micallef is at the bar, having his usual Coke Zero. This is a roundabout spot for a kid who grew up in Detroit; hated school and founded five businesses before he graduated 12th grade; went to work for a rubber products company in his early 20s and ended up owning it; moved to escape Michigan’s high wages; chose Texas because the only radio station he raised on his old crystal set was Wolfman Jack’s; wound up in Weatherford because he stopped at the city’s

DQ while en route to see a site in Mineral Wells and the guy in line behind him was Weatherford’s city manager; bought a ranch because he always wanted a ranch; opened Reata because he tired of Alpine's Pizza Hut; and went into horse racing and polo because they were big adventures. And one thing: Al Micallef loves to turn his adventures into businesses.

Dinner’s done and the ribeyes are gone from the gazebo at the rear of the Reata patio, and Micallef’s enjoying a cigar. It’s a $42 premium Micallef Reserva. Last year, Micallef was enjoying another cigar at his downtown Fort Worth hangout, the Silver Leaf Cigar Lounge, when two guys from the Gomez Sanchez family, Nicaraguan cigar makers since 1934, pulled up and broke down outside. They had cigars on them. They met Al. A partnership was born.

It’s hard to imagine that Micallef didn’t grow up in Texas, even though his accent is unmistakably Midwestern. At breakfast on his 20,000-acre CF Ranch the next morning, Micallef runs into an employee's son who’s about to graduate from high school.

“Where are you going to school?” Micallef inquires. “Probably Angelo,” the boy replies. If so, he’ll become one of the more than 250 children of employees who Micallef has put through public college and vocational schools, something he started doing after he began receiving community requests for donations.

“I thought, I love to help people, but why don’t I help the people that help me?” Micallef says later. Even if things have tightened up at some of Micallef’s businesses due to recession, supplier pressure, Obamacare and the like, this is a benefit Micallef has always

retained, and it might say something about the loyalty he's built among employees, some of whom have been with him for decades.

Later in the morning, Micallef is ranging across the ranch in a Jeep Wrangler Sport, no doors, no roof, no windshield, to watch a calf castration and branding operation underway. (Queue the Rock Hudson long shot, cloud of dust.) “Yeah,” Micallef, 74, says. “The thing about not having a windshield is sometimes you get to chew on some cow shit.”

First Business: Sand and Ajax Micallef grew up in what he characterizes as a “lower middle-class” family in Michigan. His dad was a parts picker for Ford Motor Co., meaning he picked, packaged, and sent parts to dealers. His mom made custom drapes.

Al Micallef wanted more. “He has an incredibly intense mind,” says Amanda Micallef, 40, one of the three children of Al and Jane Micallef, in business in Los Angeles, having co-founded a digital magazine called Arsenic that has 1.1 million Instagram followers. “He doesn’t just buy a restaurant and pay somebody to run it. When he bought the ranch, he wanted to understand everything about the ranch, even welding the gate.”

Micallef demonstrated as much when he flew to Los Angeles for a tutorial on social media at Arsenic and ended up investing in it. “At the end of the day, he said, ‘What do you need?’” Amanda Micallef says. “We gave him a number. He said, ‘Well, I’ll give you three times that.’ He became our first investor.”

Micallef’s first business was selling a homemade mix of sand and Ajax he marketed as rust cleaner, going door to door with it in his red wagon. “My bike fenders were a little rusty,” he says. “I couldn’t have been more than 6 or 7.”

He launched his next business when his uncle gave him an 8-millimeter movie projector. Micallef had three movies, including a Hopalong Cassidy classic, and he threw parties at his home where kids could throw darts at balloons. “After about four weekends, the mothers of the neighborhood called my mother and said I was taking their kids’ allowances, so I had to get out of that business,” he says.

Because he was in Catholic school, Micallef got out of school for the summer two weeks ahead of the public school kids. So he set up lemonade stands in the neighborhood and hired other kids to work for him.

Then later in high school, while working at a grocery store, Micallef came up with an idea to set up a dance club in a vacant space next door for friends. He and a partner sold cokes and potato chips and charged

50 cents cover on weekends, bringing in a D.J.

and I d leased it d from t them,” m he says. e

tner,” Micallef says.

“I had a financial kind of guy who was a partner,” Micallef says. “He was what you would call a geek today.”

Micallef even f figurred n out d how to w make money y a g number of roundtrips. Emptying his g tr

,000 a t year. ecalling his g father e that kind of

Micallef recalls he and his partner made $30,000 profit a year. “My father took me to a priest,” Micallef says, recalling his father never made more than $5,000 in a year. “I made that kind of money; he thought I was in a racket.”

Next, Micallef ran a Christmas tree lot, using the grocer’s parking lot. After a while, the puzzled store owner asked Micallef how he was pricing the trees. “I said, ‘By the price of the car,’” Micallef recalls. “If it’s a guy in a Cadillac, it’s a $15-$20 tree. If it’s a little family in a Ford, it would be a $3 tree.”

Micallef even figured out how to make money on the move, making a number of roundtrips. Emptying his truck in Weatherford, Micallef reloaded with watermelons and sold them in Detroit.

Micallef reloaded with watermelons h and sol d

“It’s all in the gut,” Mike Micallef, 42, another of the Micallef children – all grew up in Fort Worth – and an ex-hedge fund manager who returned to the city to help run Reata and the family’s other businesses, says of his dad. “I’m more of a numbers guy, but to him, it’s a gut feeling. You really do see how a couple of products

“It’s all in l the gutt,” , e Mike Mic i allef, 42, 2 ano n ther o r children – n all grew l up in Fort Worth – h and an d exager who r returrneed to the e city to run Reata n an a other businessees, sayys of his dad a “I’m more m of a n to himm, it’s a gut t You u do see how e a w c with t margi g n h can a cha h ngge n your profitability.”

Micallef says he viewed opportunities differently, not knowing how to read until he was a teenager, when he taught himself. “I go to see the Marfa Lights; I think, why no popcorn and lemonade?” he says. “That’s my immediate thought process when I see something.”

g the e asked Micallef d how the f car,’” e Micallef tree If it’s f a little ently, not g t ught himself “I go to and lemonade?” d he hen I see something.” e

One Word: Rubber Once out of high school, Micallef kept looking for ways to make money. When construction picked up in his neighborhood, he made deals with builders to lock up their houses at day's end and used that to start a heavy cleaning business.

l, Micallef kept look-on up in his lock up their houusses r ning business.

ck. “Not even t closese,” ch Managemennt h ity. His best frriieend’s t ne nd

Micallef tried college classes, but it didn’t stick. “Not even close,” he says, although he later attended TCU’s Ranch Management program and a mini-MBA at Harvard University. His best friend’s parents owned a company called Detroit Silicone Rubber Co. that was in trouble, Micallef says, and they recruited him at age 25. “I started running a department,” he says. “It didn’t take very long; I ended up taking the whole plant over.”

The “people side was easy,” he says. “The tendency was to treat workers like slaves. That’s not how I’d like to be treated.” With managers leaving, “my first duty was to walk around and ask everybody who was the smartest. Then I’d turn around and say to that person, ‘You’re the supervisor.’ I did that in every department.”

In 1971, three years later, K&M Plastics bought Detroit Silicone. The company was renamed Jamak, Inc., and the new owners promoted him to vice president and G.M. and offered 20 percent of the company for $5,000. “I can’t imagine I had it,” Micallef says. “But somehow, I got it.”

The partners set out to move the company from Michigan. Micallef focused on Texas. “When I was a little kid, I built a crystal set, and the only station I could get was Del Rio, Texas. I always thought I lived in Texas.”

A few years after its move to Weatherford, Jamak was ready to expand. But the city declined Jamak’s proposal, Al Micallef says. So to make a point, “the next payroll, I paid it in $2 bills. I covered the city in $2 bills. The next council meeting, they approved it.”

Micallef soon came to own 100 percent of the company, first buying one of three partners out. Two others died, but the partners had put in place buy-sell agreements that protected them from being in business with a partner’s heirs in event of a death. Micallef

A few w years after itts r mov o e to Wea e therford, Jam expand But the t city e declineed Jam a ak ’s proposal, A to o makke a point n , “thhe next pay a roll, I it d in t $2 b ciity y in $2 bilills s The h next e council meeting, l they ap Mi M c calleef soon f camme to own 100 percent of t the c e bu b y ying one g of e thr h ee e partners out. Two others died haad put in t place n buy u -sell e agreements l that protecte beinng in businnes e s with a partner’s heirs in event o t bought thoose s t stakes. e

Fixing Jam a ak had k $3 d million in n annual s l

“Professional managers in many cases cannot manage costs in a downturn. It’s not their money. It’s easier not to face the reality of what has to be done. When things are good, everybody’s a hero.”

Serendipity intervened. En route to Mineral Wells to look at a site, he stopped at the Dairy Queen in Weatherford and struck up a conversation with the man behind him, who turned out to be Weatherford’s city manager. “Weatherford built the plant for me,

Jamak had $3 million in annual sales when Micallef came to work for it, he recalls. Today, the company, which specializes in silicone rubber solutions with products like gaskets, seals, and tubing, does about $20 million in sales from continuing operations, down from a peak $30 million, Micallef said. Those figures don't count sales from one operation the company sold, Micallef said.

Micallef f came to work for k it, r he recalls. e the in silicone rubber e solutions r with produ h seals, and d does about $20 t million in n sales operations, down from n a m k callef said. f Those e don't t h l

Jamak has been buffeted by big changes in its industry and outside. “Margins shrank from pressure, dramatically, from suppliers,” one reason gross sales are off their peak, he says. And impact from Obamacare raised health premium.

Micallef had retired from day-to-day management before returning fulltime in 2012 after being away more than 10 years. He started to become more active in 2008 after recession hit.

“When I came back, I had excess inventory, too many managed disciplines that were unnecessary,” he says. “Professional managers in many cases cannot manage costs in a downturn. It’s not their money. It’s easier not to face the reality of what has to be done. When things are good, everybody’s a hero.”

– Al Micallef

Micallef pared personnel. Today, Jamak has 240-250 employees, down from 300. He also moved some production offshore, to places like China with a partner there. Jamak does about 70 percent of manufacturing in the United States today, compared to 100 percent when Obama took office, he says. “Obama forced me to automate,” Micallef says.

Micallef also decided to get rid of the $18 million in debt he

had accumulated from his enterprises, including expanding manufacturing, investing in ranches since the early-1990s, and “doing all the things” like playing polo and indulging other hobbies, Micallef says.

A big chunk of the debt came from a $6-$8 million haircut Jamak took in resolving claims that resulted from a faulty part provided by a supplier. The supplier was unable to participate in paying the claims, so Jamak shouldered them. “It would have been much easier for me to bankrupt the company than to pay off the obligations,” Micallef says. “We paid off the obligations.”

Micallef, who began buying ranchland in the mid-1990s and built to 156,000 acres, started selling in 2009 to cash in on high prices and eliminate the debt.

Today, Micallef has a remaining 20,000 acres, all around Alpine, and he estimates he had a $5 million basis in the $18 million worth of ranchland he sold. “I wrote a check, and I hunkered down and rode out the recession,” says Micallef, who today remains debt-free.

Where Rubber Meats the Rode If Micallef says he remained away from Jamak for too long, it was because he was making money at his other enterprises.

Micallef opened the Alpine Reata in 1995 in an old house. A year later, he was talked into opening a second Reata at the top of the Bank One Tower in downtown Fort Worth, after a bank executive visited Micallef at the ranch to talk him into it. “I said, ‘I’m not in the restaurant business; I just wanted a place to eat,’” Micallef says.

Al Micallef begins work as manufacturing manager at Detroit Silicone Rubber Co.

K&M Plastics buys Detroit Silicone, and Jamak Fabrication is formed. Micallef becomes vice president and general manager and buys a 20 percent ownership stake.

Micallef moves Jamak to Weatherford.

Micallef buys CF Ranch in Alpine with an initial purchase of 10,000 acres, and eventually owns 156,000 acres of ranchland.

Reata Restaurants: Micallef opens first Reata, in Alpine. Reata opens at the top of the Bank One Tower in Fort Worth but is forced out after a tornado. In March 2002, Reata

But he invited the executive, a friend, to stay at the ranch and eat at Reata for a week. The executive stayed; Micallef relented. “We got a really good deal,” Micallef says, declining to specify terms. The restaurant was almost immediately profitable.

Reata opened two restaurants in Southern California that didn’t survive. Its Fort Worth restaurant was destroyed when a tornado hit the building in 2000, but Reata reopened in 2002 in the former Caravan of Dreams downtown, launching a lucrative catering business in the interim, in part, to keep his people

reopens its downtown restaurant in the former Caravan of Dreams. Two other Reatas in Southern California open and later close.

ia open and er r

on. “He didn’t want to lay anybody off,” Amanda Micallef says. Al Micallef estimates the Reata Fort Worth operation does about $12 million in annual sales today, one quarter from catering. The restaurant is considering opening a second location in Fort Worth.

009

llef starts f ranchland prices and $18 million 8 He pares e to 000 acres 0 he oday around y and is debtallef f 11,000 -acre a a ll cres sale r

Micallef starts selling ranchland to take advantage of high prices and pay off $18 million in debt. He pares to the 20,000 acres he owns today around Alpine and is debtfree. Micallef is dividing CF’s 11,000-acre Sierra La Rana ranch into small ranches of 10-150 acres for sale.

AL MICALLEF’S BUSINESSES – silicone rubber products, ranching, development, restaurants, and cigars – gross $50-$55 million in annual sales today and employ 800-1,000 depending on season, he estimates. g pg d Fort Worth. Micallef ’ s first major t foray r into y ranching occurred g when d he and partners d ranches t and 20,000 d head of d in Utah and Wyoming d morre g than 25 years ago. “We had genettics d in ouur boars r that would t throw d w every timme, ” y Micallef says. f The probllem: “A lot of t the we d noot d t d raiisse d three babies. The we had diis- d We sold off every th t i ingg.” f A short time t Miccalle l f threw in w this time buy ying 100,00 0 0 acrres s in a base thaat grrew to 156 5 ,000 00 accres The remaining g raanch properrt ty is branded CF d Rannchh. it’s runnniing g about 500 t head of d , off the h f 14,0000 15,000 peak from k 15 yeears r ago, beffoore Micallef downsizzed d f the e operation n duriinng a sustained d in prices Cattle priice c s are more than double what theey t weere 10 years ago. “We could be d extreeme m ly y proofittable if we f had as d many head y as we did d ” ,” he says.

ing occurred when he and partners bought ranches and 20,000 head of sheep in Utah and Wyoming more than 25 years ago. “We had genetics in our boars that would throw triplets every time,” Micallef says. The problem: “A lot of the breeds we had could not feed and raise three babies. The advantage we had disappeared. We sold off everything.” A short time later, Micallef threw in again, this time buying 10,000 acres in Alpine, a base that grew to 156,000 acres.

012

ef returns f ve e le in e Jamak out a t

Micallef returns to active leadership role in Jamak after about a decade away.

branded CF Ranch. Today, it’s running about 500 head of cattle, off the 14,00015,000 peak from 15 years ago, before Micallef downsized the operation during a sustained drop in prices. Cattle prices are more than double what they were 10 years ago. “We could be extremely profitable if we had as many head as we did,” he says.

016

ef ef goes f into ership with mez z to ket t igars.

Micallef Cigars. Micallef goes into partnership with the Gomez Sanchez family to produce and market premium cigars.

the potential revenue streams from the ranches. It’s dividing CF’s 11,000-acre Sierra La Rana ranch in Alpine into small ranches of 10-150 acres. Of the original 108 lots, 49 are left. “I paid $2 million for it,” Micallef says. “Over 30 years, it could be a $150 million asset for my family.”

Micallef has f worked to explo l it mosst t of the potenntial rev e ennue u l strreams m from the ranchees. It’t’s dividin i g CF’s 11,000-acre e Sierra La a Rana rannch in Alpinne inntto sma m ll ranches of 100-150 acrrees s Of the e orrigginnal 108 lots, 49 are left. t “I $2 millioon for r it,” Micallleef sayys. “Over 30 r yea e rs, it cou uld be a $150 mill lioon ass s et for o my r

underground aquifers, runs hunts and photo safaris, rents the property for film, TV, and print work, and special events like weddings, and raises and sells koi and desert plants. The property, which has populations of elk, mule deer, Barbary Sheep, antelope, javelina, feral pigs, and one reluctant buffalo that’s eluded hunters for years, has a modest amount of for-rent lodging. Micallef won't drill on the property, nestled among the Davis ranges. “I’m against exploration,” Micallef says. “There’s limestone and oil and gas for sure. But there’s this overburden of igneous rock that inhibits the 3D seismic. When you’re drilling, you’re purely wildcatting.”

CF Ranch h als l o sel e l ls water e frrom r its underground aquuiffers, , runns hunts and safariss, renntts the h proope p rty for film, r TV, and prinnt d work, k t and d spe p cial eventts l ddings, and raises d and sells d kooi and i desert d pla l nts. The ty, which has of elk, f mule deeerr, y e, feral pigs, l and one d relucta t nt buffalo l t th hat’s hunters for years, r has a modest amoount t of forr-rrent lodgingg. allef won't f drill t on l the property, nes e tled d among the h g Dav vis i “I’m against t Micallef says. f “TThere’ ’ s lim i ee nd oil d and l gas d for sure. r But there’s t this overbburdeen of ignne- f k that inhibits t the 3D seismic. When you ’ re drillling, g you ’ re wildcatting.”

If the family’s busithe youngest of the what’s connected the businesses and passions.

If I the h f business s por o tffolio seems s like a mish-mash, Mike e Micallef sayys the bus u ineesse s s bear similalari r ties s “If f youu’re maki k ng n a g par a t or a r recipe, it’s all the l samme thhing,” he says. “The brea eake k ven on cattle or a reccipe, it’s the same thhinngg. ” Sarah Micall lef, th t e youunggeest of the Micallef f chi h lddren at 38 and representaativve d of the f cigar bussin i esss r in Southwest Texass, t says “innovation o and new product” is part of t what’s connected the d businesses and passions. d

as a business to use the ranch more effectively. He bought and sold yearlings and raced horses, winning the industry’s NATC annual race considered the Kentucky Derby for two-year-olds. “I lost a substantial amount of money in that business,” Micallef says. “I left about $5 million in that area. It wasn’t as bad as it sounds.” Correcting himself, he adds, “well, that’s not true. That’s not true.”

If polo was a money-suck, Micallef says he covered that by going into farms at the same time. “We made a lot of money buying and selling farms,” he says. “I covered the costs of polo.”

Staying Young Micallef thinks his unexpected cigar business can surge. Micallef, who lives in Southwest Fort Worth with his wife, a few steps from their son's home, starts the day in Weatherford but is usually at Silver Leaf by midafternoon.

“I’m 74,” he says. “It’s not a smart thing to start a business of this magnitude at this point in your life. This is a 10-year project to do it right.”

“I with d school; he comes up with prob intuitively,” she says.

“I struggled with school; he comes up with problem-solving

An employee he recruited to help run the business is in Nicaragua, learning from the Gomez Sanchez operation. Micallef has two-thirds of the business. “Staying active mentally and physically creates longevity,” Micallef says. “I think this could be a $20 million cigar business in the next five to eight years.”