Forestry Report

We Can’t Get No Satisfaction

By Marshall Thomas, President of F&W Forestry Services, Inc.

In a year that was supposed to bring a long-awaited recovery in timber prices, tree growers across our U.S. operating regions instead saw prices either continue their downward trend or remain flat over the last quarter. There are always exceptions, but they tend to be isolated to one region and temporary. Hence, the title of this article: We haven’t had any “satisfaction” in our sector since 2006.

Mortgage rates are often cited as a reason, but when looking at past housing booms (the 1990s, early 2000s, mid-2000s), the current rates aren’t too different from then. The big difference appears to be construction costs. We’re all familiar with the inflation that hit various commodities after COVID. Lower interest rates will help, but we also need improvements in wages and broader economic confidence before housing demand strengthens.

In the last Forestry Report, I discussed the Renewable Fuel Standard (RFS) and the exclusion of commercially grown, pulpwood-sized trees from the feedstock definition for renewable fuels (see page 6 for EPA ongoing review and forestry groups’ comments). Those opposed include AF&PA, the lobbying group of the pulp and paper companies. It’s not a good look for our business partners, given that their mill closures are creating large areas where there is little to no demand for the very trees they claim to need.

We’ve expanded our footprint into Maine with the acquisition of Two Trees Forestry (see below).

The Farm Bill, which used to enjoy bipartisan support, has become partisan and is going through the same legislative cycles as other partisan legislation —failure to agree on a new bill, a temporary continuation, rinse and repeat (see page 2).

Last December, Congress appropriated $21 billion

F&W Expands In Maine

F&W Forestry is strengthening its New England presence through the acquisition of Two Trees Forestry, a well-respected firm based in Winthrop, Maine. This strategic move broadens F&W’s footprint in the Northeast while ensuring landowners across the region continue to receive local, client-centered forestry services.

Founded in 1984, Two Trees has earned a strong reputation for providing comprehensive forest management services to private landowners and municipalities throughout central and southern Maine. Harold Burnett, who has owned and operated the business since 1999, will continue to oversee operations under the Two Trees name from the Winthrop office.

INSIDE THIS ISSUE

(continued on page 7) PAGE 6

(continued on page 11)

Farm Bill Extension Nears Expiration

For the third year in a row, Congress faces a looming deadline on the Farm Bill, the sweeping legislation that governs everything from agricultural commodity programs and crop insurance, forestry and conservation initiatives, and nutrition assistance for low-income families.

After the Farm Bill expired in the fall of 2023, lawmakers approved two short-term extensions to keep programs running. The current extension is set to expire on Sept. 30, meaning Congress must act before the end of this year to avoid a lapse in authorization and prevent major disruptions to programs.

The conservation and forestry programs within the Farm Bill represent the largest single source of federal funding available to private forestland owners. These programs

provide technical and cost-share assistance for a wide range of sustainable forest management and conservation practices.

While the Farm Bill has traditionally enjoyed bipartisan support, growing political divides are complicating negotiations.

The One Big Beautiful Bill Act, passed by Congress and signed by President Trump in July, provided stopgap funding for many Farm Bill programs. But it also cut support for nutrition programs, a change that is expected to spark fierce partisan debate when negotiations resume.

Since returning from the August recess, House Agriculture Committee Chairman Glenn Thompson (R-Penn.) has signaled interest in releasing a “skinny” Farm Bill draft as an opening

bid. Timing remains uncertain, but observers expect it to closely mirror the version the House Agriculture Committee advanced last year, largely along party lines.

Meanwhile, on the other side of the Capitol, Senate Agriculture Committee staff are quietly drafting their own proposal, though they have not announced when it might be considered.

To avoid major disruptions, Congress must act before the year’s end to either pass a new Farm Bill or extend the current law, buying lawmakers more time to resolve their differences. With competing priorities and a compressed legislative calendar, the coming months could prove pivotal in shaping the next generation of U.S. farm and food policy.

Disaster Aid Coming For Timber Losses

Forestry Report

For further information on material in this report or to discuss your forestry needs, contact the nearest F&W office or the Albany headquarters at:

PO Box 3610, Albany, GA 31706-3610

229.883.0505 / fax 229.883.0515 www.fwforestry.com

Marshall Thomas, President

Jeff Jordan, Chief Operating Officer

Jody Strickland, Chief Business Officer

Sonya Farmer, Chief Financial Officer

Stephen Logan, Chief Information Officer

Brent Williamson, Forest Operations

The F&W Forestry Report is produced by: Bates Associates 770.451.0370 batespr@bellsouth.net

©2025 F&W Forestry Services, Inc.

Last December, Congress approved $21 billion in disaster recovery funding for agriculture and timber producers affected by catastrophic weather in 2023 and 2024. A major driver of this relief is Hurricane Helene, which struck the Southeast in September 2024 and caused nearly $79 billion in damages, including $1.9 billion in timber losses across Florida, Georgia, the Carolinas, Tennessee, and Virginia.

The U.S. Department of Agriculture (USDA) is working with states to create block grant programs tailored to their specific recovery needs. These grants will help cover timber, crop, livestock, and infrastructure losses not addressed by other USDA programs. Once finalized, agreements will open the door for landowners and producers to apply for funding relief through their state departments of agriculture.

Recent grant allocation announcements include:

• Florida – $675.9 million for citrus, timber, and infrastructure losses

• Georgia: $531.2 million for infrastructure, timber, and future economic losses

• North Carolina – $221.2 million for timber, infrastructure, and projected revenue losses in future years

• Virginia – $60.9 million for timber, infrastructure, and market losses

• South Carolina: $38.3 million for infrastructure, timber, and projected economic and market losses

An agreement with Tennessee has not yet been announced.

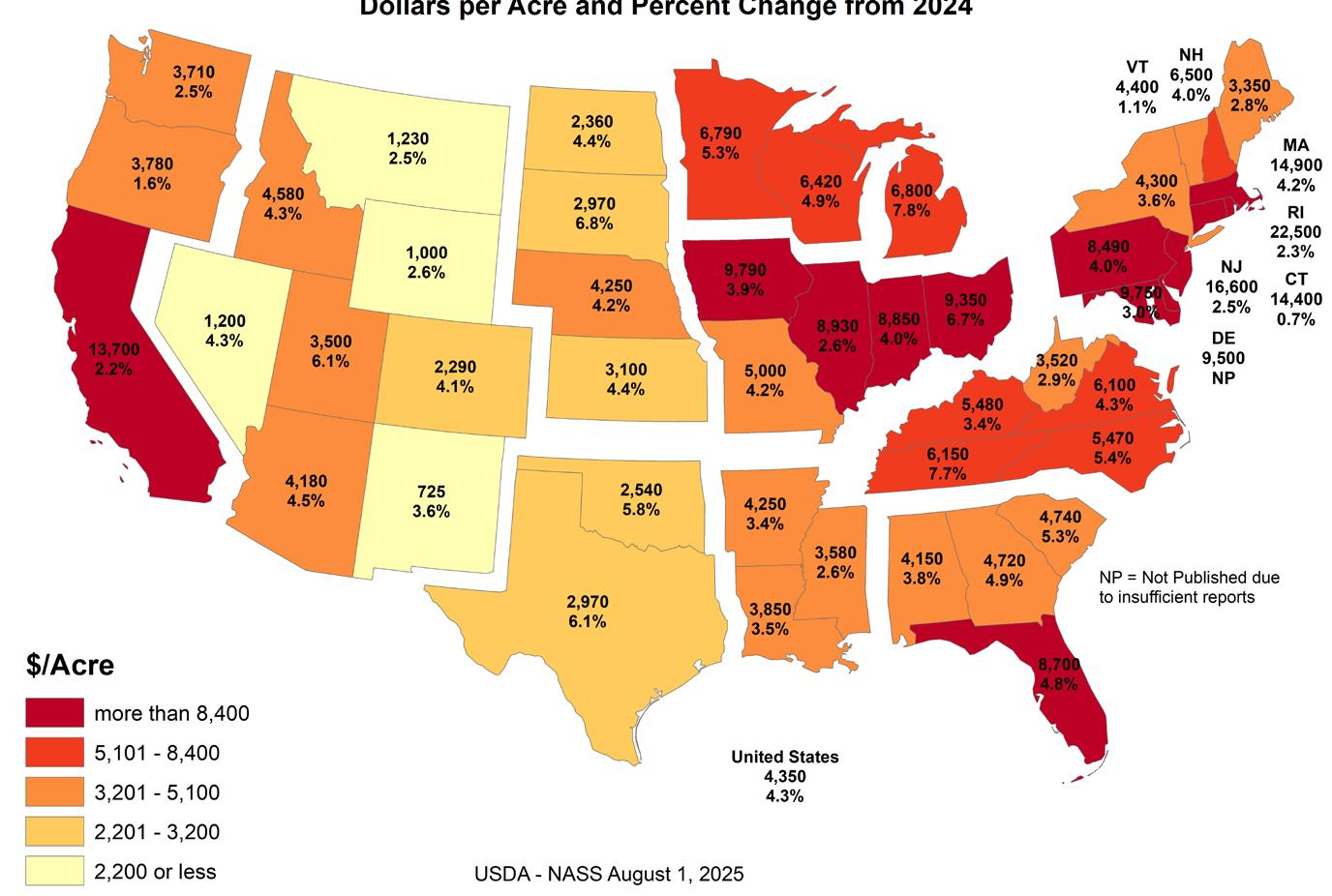

Ag Land Values Climb In 2025, But Growth Continues To Slow

The value of U.S. farm real estate, which includes all farm land and buildings, rose again in 2025, reaching a record high average of $4,350 per acre, according to the U.S. Department of Agriculture’s (USDA) National Agricultural Statistics Service. That represents an increase of $180 per acre, or 4.3 percent, from 2024.

This marks the fifth consecutive year of growth in land values. But while prices remain strong, the pace of appreciation continues to moderate compared to earlier years. The latest increase follows a $200 per acre (5 percent) gain in 2024 and a much sharper 12 percent jump in 2022, when surging commodity prices and high farm incomes drove rapid appreciation. Over the last five years, the average national farm real estate value has climbed 30.6 percent, up from $3,330 per acre in 2021.

USDA’s long-running survey does not track forestland values, but general trends in the agriculture sector are likely to apply, to some degree, to land devoted to growing trees. The survey breaks out values for cropland and pastureland, categories that show similarities to the bare land value of forestland and can easily be converted to forests. Both categories posted strong gains in 2025, with cropland up 4.7 percent to an average value of $5,830 per acre and pastureland rising 4.9 percent to $1,920 per acre.

Rural land values vary significantly throughout the nation, with the highest values concentrated in regions where there is a large volume of high-value crops and in areas where urban and suburban sprawl is encroaching on less developed rural properties, putting upward pressure on land prices. Within F&W’s operating footprint,

several regions experienced strong increases in 2025, including the Southern Plains states of Oklahoma and Texas, which saw a 5.9 percent increase to an average of $2,880 per acre. In the Southeastern states of Alabama, Florida, Georgia, and South Carolina, values were up an average of 4.7 percent to $5,750 per acre. The Appalachian region—Kentucky, North Carolina, Tennessee, Virginia, and West Virginia—recorded an average

Connecticut ($14,400), and California ($13,700), rounding out the top five.

Competing land uses, including urban expansion, solar and energy development, lifestyle-driven demand fueled by telework, and investor interest are contributing to upward pressure on land prices, according to Daniel Munch, an economist with the American Farm Bureau Federation. He also said the Conservation Reserve Program (CRP), which pays landowners to

increase of 5.1 percent to $5,590 per acre.

In contrast, the Pacific region, which includes California, Oregon, and Washington, reported an average value of $8,210 per acre, only a 2.1 percent increase from the previous year. The Northeast region, encompassing states from Maryland to Maine, saw a modest 3.3 percent rise, with an average value of $7,300 per acre. But states in these regions also recorded the highest farm real estate values in the U.S., with Rhode Island ($22,500), New Jersey ($16,600), Massachusetts ($14,900),

retire environmentally sensitive acres, has reduced the supply of actively farmed land, tightening land markets.

While the U.S. farm real estate market remains resilient, the slowing pace of growth signals a transition from the rapid appreciation of the early 2020s toward a more stable, long-term trajectory. For landowners, this means rural real estate remains a valuable long-term asset, but future gains are likely to be steadier, shaped by a balance of profitability, development pressure, and policy decisions.

2025 FARM REAL ESTATE VALUE BY STATE

Mill Closures, Drop In Lumber Prices Reshape Timber Markets

The shift of the timber and forest products industry from the Pacific Northwest to the U.S. South more than four decades ago created new opportunities for private landowners, who collectively own 90 percent of the region’s forest base. The South became the woodbasket for the nation, with the strong markets for forest products encouraging sustainable forestry practices, supplying local mills, sustaining jobs, and supporting rural economies.

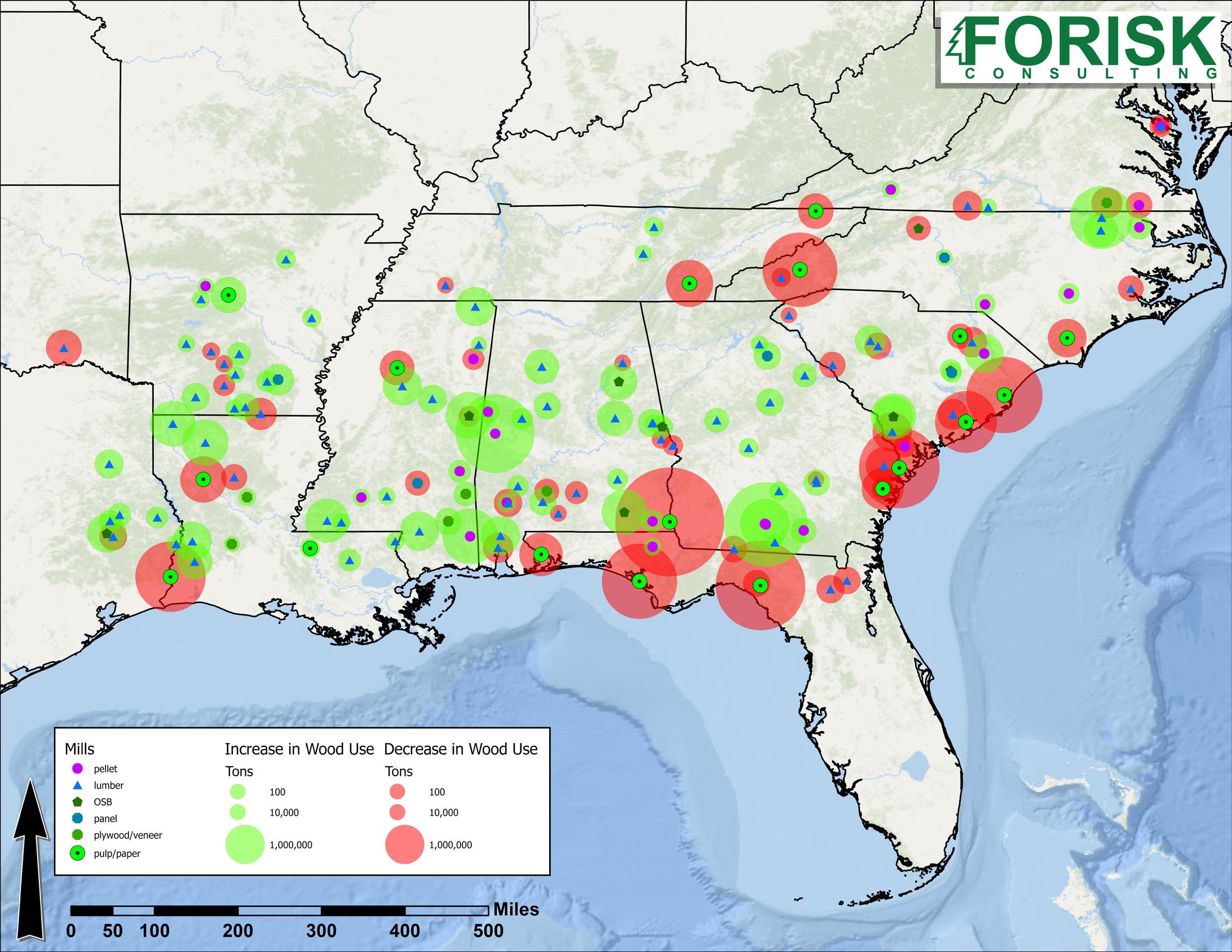

Today, however, those markets are under mounting pressure. Landowners and others dependent on the forestry sector face a growing list of challenges: persistently low timber prices, reduced wood demand from mill closures, catastrophic storms, urban development pressures, and shifting government policies. Two forces in particular—the widespread closure of pulp and paper mills and falling lumber prices—are reshaping timber markets and creating uncertainty for landowners across the region.

LOSS OF P&P MILLS

For landowners, perhaps the most concerning trend is the closure of pulp and paper mills. These facilities have long provided reliable markets for forest thinnings—a mainstay in responsible management. Without these outlets, landowners are left with fewer options for selling their small-diameter trees, which can make thinning and harvest operations costlier or even uneconomical. Over time, this not only reduces income from forest ownership but can also lead to overstocked stands, greater risks of pests, disease, and wildfire, and increased uncertainty for families and businesses that rely on timber revenue.

According to Athens, Ga.-based Forisk Consulting, 11 pulp mills have closed across the South since 2022. These shutdowns represent 8.2 million tons of lost pulp production capacity and 25 million tons of lost wood use—

equal to a 16 percent decline in pulp capacity across the region.

IP CLOSURES SEND JOLT

The most recent closure announcement came in August, when International Paper (IP), the world’s largest paper products company, said it would permanently close its Savannah and Riceboro, Ga., mills and two related facilities—eliminating about 1,100 jobs and removing 4.6 million tons of annual wood use from the region. The closures follow other recent IP shutdowns in Campti, La., and Georgetown, S.C., which together had 1.1 million tons of capacity.

For landowners in Southeast Georgia, this represents a major shift, as mills that once consumed millions of tons of wood each year are no longer an outlet for timber sales.

In the same announcement of the closures, IP said it will invest $250 million to convert a machine at its Selma, Ala., mill to produce containerboard. IP classified the moves as strategic and part of its ongoing transformation journey.

Earlier this year, IP completed the acquisition of DS Smith, a UK-based paper manufacturer that specializes in containerboard, similar to what the Savannah mill produces. That deal added between 500,000 and 600,000 tons of containerboard capacity to IP.

The ripple effects extend far beyond Georgia. In 2025 alone, other pulp and paper closures have included GeorgiaPacific’s Cedar Springs, Ga., mill; Greif Packaging’s Los Angeles, Calif., mill; Cascades’ Niagara Falls, N.Y., facility; and Pixelle’s Chillicothe, Ohio, mill— each removing vital wood demand and weakening the economic foundation of rural communities.

LUMBER PRICES SLIDE

While much of the recent attention has focused on pulp and paper mill closures, the lumber sector is also under significant strain. High mortgage

interest rates, a lethargic housing market, and uncertainty over trade and tariffs are pushing down lumber prices, forcing many manufacturers to curtail or close operations.

Lumber futures in early September fell by about 22 percent since the end of July and trading around $545 per thousand board feet (MBF)—well below recent highs of $696/MBF in July. Spot prices have also declined, with the Random Lengths Framing Lumber Composite Index dropping below $400/MBF in September for the first time in 2025.

Analysts note that lumber prices are often a leading indicator for the housing market and broader economy. During the pandemic, 2x4 lumber prices nearly tripled, foreshadowing inflation and supply chain disruptions. Now, falling prices reflect sluggish housing starts, a buildup of unsold inventory, and weak construction demand.

PRODUCERS SCALE BACK

Major lumber manufacturers are responding with cutbacks. Interfor, North America’s third-largest lumber producer, announced it will reduce output by 12 percent across its sawmills in the U.S. South, Pacific Northwest, and Canada—removing about 145 million board feet of production through year-end. Domtar is also scaling back, taking downtime at its Glenwood, Ark., mill, indefinitely idling its Maniwaki, Quebec, operation, and cutting a shift at its Côte-Nord, Quebec, facility.

PERMANENTLY CLOSED

Canfor cited persistently weak market conditions and sustained financial losses for the permanent closure of its Estill and Darlington sawmills in South Carolina in August. The closure reduces U.S. production capacity by 350 million board feet annually. Analysts expect more closures and curtailments to follow as mills attempt to balance supply with waning demand.

(continued on page 5)

Mill Closures

Trade policy is also adding to the volatility. Canadian softwood lumber accounts for about a quarter of U.S. consumption, and long-running disputes over duties have intensified. In August, antidumping and countervailing duties on Canadian lumber imports were raised from 15 percent to roughly 35 percent for most producers (see article on page 8).

WEAK HOUSING MARKET

Underlying the drop in lumber prices is continued weakness in home construction. High mortgage rates, elevated home prices, and rising construction costs have eroded affordability for buyers and dampened

from page 4)

demand for new homes. Builders are responding cautiously as residential building permits and housing starts fall to multi-year lows, while inventories of unsold homes grow.

Residential building permits in August were at a seasonally adjusted annual rate of 1.307 million units, down 8.5 percent from July and 6 percent from a year earlier. Total private residential construction spending in July was down 5.3 percent from a year ago. With fewer homes being built and remodeling slowing, lumber demand is struggling to recover.

There may be some relief ahead if interest rates come down and mortgage

costs fall, which could stimulate homebuilding—the single largest source of lumber demand. However, for now, mills are scaling back, markets are oversupplied, and landowners face a more uncertain timber market.

For landowners, the message is clear: mill closures and falling lumber prices are reshaping timber markets and directly affecting the ability to generate returns from well-managed forests. These changes highlight the importance of diversifying outlets for wood, supporting new investment in forest products, and advocating for policies that keep working forests working.

While mill closures often receive more attention than new investments, Forisk Consulting created the map above to show mill activity across the U.S. South from 2022 and 2025. Since 2022, 11 pulp mills in the region have closed, representing about 8.2 million tons of lost pulp production capacity and 25 million tons of wood use—a 16 percent decline in Southern pulp capacity. Source: Forisk Consulting

Forestry Groups Urge Expansion Of Woody Biomass Eligibility

The Environmental Protection Agency (EPA) recently sought public input on potential enhancements to the federal Renewable Fuel Standard (RFS) aimed at increasing the use of qualifying woody biomass to produce renewable transportation fuel.

The RFS requires that transportation fuel sold in the U.S. contain a minimum volume of renewable fuels. Established to reduce greenhouse gas emissions, strengthen the nation’s renewable fuels sector, and lessen reliance on imported oil, the program initially allowed commercially grown trees to be used for renewable energy— much like corn is used for ethanol. However, when Congress expanded the RFS in 2007, EPA narrowed the rules, effectively excluding whole trees and limiting eligible wood feedstocks to forest residuals and mill by-products.

PUSH FOR NEW MARKETS

With pulp and paper mill closures accelerating across the country, many in the forestry community argue that expanding the RFS to include more types of wood would create critical new markets for small-diameter trees. Treating commercially grown woodbased fuels on par with agriculture crops like corn could drive muchneeded investment in forests, mills, and biofuel infrastructure across rural, heavily forested regions.

HUNDREDS WEIGH IN

More than 330 organizations submitted comments to EPA, including the National Association of State Foresters (NASF), the Forest Landowners Association (FLA), the National Alliance of Forest Owners (NAFO), the American Wood Council (AWC), the Society of American Foresters (SAF), the American Forest Foundation (AFF), the American Forest & Paper Association (AF&PA), and many others. Most of these

organizations expressed strong support for expanding eligibility for forest-derived biomass under the RFS, emphasizing benefits for rural jobs, forest health, wildfire risk reduction, and U.S. energy security, while providing new markets for lowvalue wood, slash, and mill residues.

The push reflects a rare level of alignment across the forestry sector. Landowners, foresters, loggers, biomass producers, and state forestry agencies emphasized that new markets for small-diameter wood are critical to sustaining working forests and supporting rural economies.

POLICY FIXES PROPOSED

Commenters urged EPA to modernize outdated statutory and regulatory definitions that currently restrict qualifying woody biomass. Specific proposals included:

• Broadening the definition of “slash,” “pre-commercial thinnings,” “planted trees,” and “tree residues” to reflect modern silvicultural practices and include naturally regenerated trees within plantations, potentially unlocking new woody biomass markets for commercially grown, pulpwoodsize trees.

• Explicitly including mill and manufacturing residues (such as sawdust, bark, chips, pulp byproducts) as eligible feedstocks if sourced from compliant forests.

• Clarifying that salvaged wood and storm debris can qualify as eligible biomass, as they are low-value materials that need viable markets.

UNTAPPED FOREST POTENTIAL

A comment from Washington State University-Pacific Northwest National Laboratory Bioproducts Institute described the current RFS situation this way:

“There are ~328 million acres of cropland in the U.S. producing

feed, food, fiber, and various coproducts—a large fraction of which are used for fuel production applicable to the RFS. There are ~765 million acres of forest land in the U.S., but nearly none of that is yet to be used for production of fuels that would benefit from the RFS, due to multiple challenges.”

POWER FROM WOOD WASTE

Several commenters also called on EPA to activate and expand the renewable electricity pathway in the RFS to allow electricity generated from woody biomass to earn renewable identification numbers (RINs), which could create immediate demand for small-diameter wood and mill residuals.

AF&PA

URGES CAUTION

While most forestry groups support expansion, one major outlier was AF&PA, which took a more cautious stance. They warned that expanding woody biomass eligibility could distort fiber markets and undermine U.S. pulp and paper manufacturing. The association stressed that pulp and paper mills depend on sustainably managed private forests, and fiber is their largest cost input. New RFS incentives for woody biomass, they argued, could raise fiber costs, divert wood from existing markets, and displace U.S. manufacturing and jobs to foreign competitors with weaker environmental standards.

AF&PA also supports removing renewable electricity from the RFS entirely, arguing that electricity is not classified as a “fuel” under the statute and cannot displace fossil fuel in engines

Where Are Pulp Mills Being Built?

The last greenfield pulp and paper mill built in the U.S. was the Marlboro Paper Mill in Bennettsville, S.C. Opened by Willamette Industries in 1990, acquired by Weyerhaeuser in 2002, and later absorbed by Domtar in 2007, the facility produces about 274,000 short tons of paper and 320,000 metric tons of market pulp annually.

No new greenfield pulp mills have been built in the U.S. since then— and it’s not for lack of wood. The barriers are formidable. A modern greenfield mill—meaning a facility built from scratch rather than on an existing site—can cost $2 to $4 billion to build and take more than a decade to permit. Complex federal and state environmental reviews, local opposition, and the risk of litigation all contribute to long timelines and high upfront costs. Meanwhile, aging U.S. mills can be upgraded at a lower cost, so companies have chosen to modernize or repurpose certain existing facilities—while shuttering

Marshall

old and inefficient ones—instead of building entirely new plants.

One attempt to buck the trend came in 2016, when China’s Shandong Sun Paper announced plans to build a $1 billion fluff pulp mill near Arkadelphia, Ark. The project was later expanded to $1.8 billion and hailed as one of the largest industrial investments in the state’s history, expected to consume 400 truckloads of timber a day and generate $28 million in annual stumpage income for local landowners. However, after years of delays tied to permitting challenges, shifting product plans, trade uncertainty, and then the onset of the COVID-19 pandemic, Sun Paper ultimately canceled the project in March 2020.

In the meantime, competition from lower-cost regions has shifted new pulp and paper investment overseas.

Since 2020, eight new greenfield pulp mills have started up or been announced worldwide: one in Europe, two in Asia, and five in

Thomas (continued from page 1)

in disaster relief funding for ag and timber producers to offset losses caused by Hurricane Helene (see page 2). Payments to landowners for timber losses after Hurricane Michael sure eased the sting—hopefully that is about to happen for those hurt by Helene.

Timberland values have long been linked to agricultural land prices, so we include the annual USDA ag land values in the newsletter. Ag land values continue to rise, but at a slowing pace (see page 3).

For Georgia landowners, the biggest recent news is International Paper’s announcement of two pulp mill closures in Southeast Georgia—

following closely on the heels of the company’s closures in coastal South Carolina and Georgia-Pacific’s mill at Cedar Springs. What was once the hottest pulpwood market in the U.S. has just become average or worse. As discussed previously, the human toll of these closures is catastrophic (see page 4).

In Alabama, landowners prevailed in court against the U.S. Fish and Wildlife Service after the agency overstepped in restricting timber management activities to protect the Black Pinesnake. This ruling is significant for landowners because it emphasizes sound science and consideration of economic impacts

South America—with combined capacity expected to reach 17 million tons per year by 2028. These mills benefit from cheaper labor and fewer regulatory hurdles, giving them a cost edge over U.S. producers.

One of the most prominent of the “new” facilities is Metsä Group’s bioproduct mill in Kemi, Finland. While often described as a greenfield facility, it was built on the site of an older mill, leveraging existing infrastructure and permitting. Nevertheless, it stands out for its scale and design— producing 1.5 million tons of pulp annually, operating without fossil fuels, generating surplus renewable electricity, and converting nearly all by-products into marketable bioproducts.

For now, the U.S. pulp industry’s future appears rooted in conversions, modernizations, and closures rather than new greenfield mills—while global competitors keep building from the ground up.

when deciding how far an agency can go to protect species (see page 8).

Canadian lumber duties tripled in August, which should benefit U.S. sawmills, but only higher domestic demand will help landowners (see page 8).

Finally, more than 400 forestry associations, businesses, and landowners sent a letter to the president, citing a lack of “satisfaction” in our sector, and some actions that could help (see page 9).

You can’t say the forestry community isn’t trying. But I think it is going to take a continued effort before we get any satisfaction.

Court Restores Landowner Rights In Black Pinesnake Case

Private forest landowners secured a major victory for property rights when the U.S. District Court for the Southern District of Alabama struck down the federal government’s attempt to designate more than 35,000 acres of private timberland as “critical habitat” for the black pinesnake.

WHAT HAPPENED

In 2020, the U.S. Fish and Wildlife Service (FWS) labeled large portions of privately managed timberland in Clarke County, Ala., including familyowned tracts sustainably managed for generations, as “occupied critical habitat” for the threatened black pinesnake. The designation was based on only a handful of sightings, none on the properties in question. Nevertheless, the designation imposed restrictions that reduced land values and restricted the ability of landowners to manage their forests.

The Forest Landowners Association (FLA) and affected owners—including longtime landowner and FLA board

member Gray Skipper—challenged the designation in court. On Aug. 21, the judge overturned the designation for Units 7 and 8, citing a lack of scientific evidence, flawed economic analysis, and failure to properly weigh impacts on landowners.

Notably, the court found:

• No Proof of Occupancy: The agency claimed the areas were occupied by the species, yet the record showed only a handful of sightings decades ago, none on the disputed property. The Court deemed the designation arbitrary and unsupported by science.

• Economic Harm Ignored: FWS dismissed landowners’ concerns about decreased property values and regulatory burdens. The Court ruled the economic study unlawful for failing to account for stigma, diminished land values, and realworld financial impacts.

• Failure to Balance Costs and Benefits: The Court found FWS

U.S. Triples Duties On Canadian Lumber

The U.S. Department of Commerce has finalized steep hikes in countervailing (CVD) and antidumping (AD) duties on Canadian softwood lumber imports, intensifying a decades-old trade battle.

Effective mid-August, the combined duty rate for most Canadian softwood lumber imports jumped to 35.16 percent, up from 14.4 percent.

Commerce assessed individual CVD rates of 16.82 percent for West Fraser and 12.12 percent for Canfor, with a weighted average of 14.63 percent for all others. A recent AD increase lifted the weighted average to 20.53 percent, up from 7.66 percent, bringing Canfor’s total AD/CVD rate to 47.59 percent and West Fraser’s to 26.47 percent.

The rate climbed again after President Trump announced a new 10 percent tariff on imported timber and wood products—on top of the Commerce Department’s 35 percent rate for Canadian lumber. The additional tariff took effect on Oct. 15.

Countervailing duties are a mechanism for seeking relief when one country believes another country’s product is unfairly subsidized. Similarly, antidumping duties are intended to provide relief from the market-distorting effects caused by the harmful dumping of imports.

The U.S. Lumber Coalition, an alliance representing producers nationwide, contend that the Canadian

failed to weigh economic harm against potential conservation benefits, as required under the Endangered Species Act.

WHY IT MATTERS

By vacating the designation, the Court lifted unnecessary restrictions and restored the ability of landowners to manage their forests without unjustified federal interference.

It also sets an important precedent: federal agencies must use sound science and fully consider the economic impact before imposing burdens on private property.

THE BIG PICTURE

“This ruling is a clear rebuke of federal overreach and a major victory for private property rights,” said FLA CEO Scott Jones.

For landowners, the decision underscores that stewardship should not be punished with unjustified regulation

government, which owns the majority of timberlands in that country, provides trees to producers at prices far below market value and that Canadian lumber is being sold in the U.S. for less than fair market value.

In response to the duty escalation, Canadian Prime Minister Mark Carney announced a $1.2 billion federal support package for the lumber industry. The move signals Canada’s intent to mitigate short-term economic fallout while pursuing longer-term competitiveness strategies.

The U.S.-Canadian softwood lumber dispute is one of the most enduring trade disputes between the two nations.

Forestry Groups Urge Action On National Crisis

A national coalition of more than 400 associations, businesses, and landowners has sent a letter to President Trump urging immediate action to address challenges facing America’s private forests.

The coalition—led by the Forest Landowners Association (FLA), the American Biomass Energy Association, and the American Loggers Council—warn that mill closures, destructive natural disasters, and unfair trade practices are placing the U.S. timber supply chain, jobs, and energy security at risk.

The urgent appeal follows the President’s March 1 Executive Order directing federal agencies to expand domestic timber production.

According to the coalition, without decisive action, the nation risks losing vital private forestland, critical markets, and millions of jobs linked to forestry.

The letter outlines four key actions the Administration should advance:

• Support the Disaster Reforestation Act: Help landowners recover after catastrophic events and ensure replanting of America’s forests.

• Expand woody biomass in the Renewable Fuel Standard (RFS): Create new renewable energy markets for low-value wood.

• Promote biomass electricity: Reduce wildfire risk, expand renewable power, and create new rural jobs.

INLAND NORTHWEST TIMBER PRICES

• Back the Loggers Economic Assistance Act: Deliver direct relief to logging contractors and stabilize a critical workforce.

“By advancing these measures, the Trump Administration can provide certainty for landowners, loggers, and mills, while strengthening domestic manufacturing, renewable energy, and rural livelihoods,” said Scott Jones of FLA.

The coalition underscores that America’s 3.9 million forestrysupported jobs—along with the nation’s housing supply, infrastructure, consumer products, and energy independence—depend on strong working forests and healthy forest markets.

LAFAYETTE, AL

ORANGE PARK, FL

MARIANNA, FL

ALBANY, GA

MACON, GA

STATESBORO, GA

FOUNTAIN INN, SC

CLINTON, TN

PARIS, TN

EL DORADO, AR

CORINTH, MS

ANTLERS, OK

HUNTSVILLE, TX

CHARLOTTESVILLE, VA

GA MACON, GA

STATESBORO, GA

FOUNTAIN INN, SC

CLINTON, TN PARIS, TN

EL DORADO, AR

CORINTH, MS

ANTLERS, OK HUNTSVILLE, TX CHARLOTTESVILLE, VA

FL

ALBANY, GA

MACON, GA

STATESBORO, GA

FOUNTAIN INN, SC

CLINTON, TN

PARIS, TN

EL DORADO, AR

CORINTH, MS

ANTLERS, OK

HUNTSVILLE, TX

CHARLOTTESVILLE, VA

PINE SMALL SAWTIMBER

Stumpage

PINE LARGE SAWTIMBER

SOUTHERN TIMBER PRICES (continued)

ORANGE PARK, FL

MARIANNA, FL

ALBANY, GA

MACON, GA

STATESBORO, GA

FOUNTAIN INN, SC

CLINTON, TN

PARIS, TN

EL DORADO, AR

CORINTH, MS

ANTLERS, OK

HUNTSVILLE, TX

CHARLOTTESVILLE, VA

GA

TN

GA

INN, SC

TN

AR

MS ANTLERS, OK

TX

CHARLOTTESVILLE, VA

All prices based on sales handled by or reported to F&W offices. If no sales occurred, prior quarter ’s sales and other data are used to compile price range. Price ranges are due to proximity to mills, timber quality, logging conditions, type of harvest, and other local market conditions (i.e. weather, mill downtime, fuel cost, etc.).

F&W Expands in Maine (continued

from page 1)

“As I began planning for retirement, it was important to find a partner that shares our environmental ethics, professional standards, and dedication to client service,” Burnett said. “F&W aligns perfectly with our values, and I believe our clients will experience a seamless transition.”

Other Two Trees team members joining F&W are Jon Doty, who serves landowners in central Maine

from Madison, and Ian Adelman, who supports landowners closer to Portland. Their continued involvement ensures clients across the state will benefit from familiar expertise, backed by F&W’s extensive resources.

F&W President Marshall Thomas added: “From our very first meeting, it was clear that Harold and his team exemplify the professionalism

and client commitment that define our approach. We are excited to welcome Two Trees to the F&W family.”

With more than 40,000 acres of privately owned forestland already under management in Maine, the addition of Two Trees reflects F&W’s commitment to delivering local expertise and high-quality forest management services.

Timber Stumpage Price Averages By Region RED OAK (MBF)

NEW ENGLAND ADIRONDACKS, NY HERKIMER, NY NEW OXFORD, PA BLUEFIELD, WV

$700

WINTHROP, ME

MONTPELIER, VT

ADIRONDACKS, NY

HERKIMER NY

Herkimer, NY

New Oxford, PA Blue eld, WV $600

NEW OXFORD, PA

New England Adirondacks, NY

$200

Timber Stumpage Price Averages By Region

ADIRONDACKS, NY HERKIMER, NY NEW OXFORD, PA BLUEFIELD, WV

BLUEFIELD, WV

Third Quarter Price Range

WINTHROP, ME

MONTPELIER, VT

ADIRONDACKS, NY

HERKIMER NY

NEW OXFORD, PA

BLUEFIELD, WV

Timber Stumpage Price Averages By Region

NEW ENGLAND ADIRONDACKS, NY HERKIMER, NY NEW OXFORD, PA BLUEFIELD, WV

WINTHROP, ME

MONTPELIER, VT

ADIRONDACKS, NY NEW OXFORD, PA

BLUEFIELD, WV

WV

MAPLE (MBF)

NORTHERN TIMBER PRICES

NEW ENGLAND ADIRONDACKS, NY HERKIMER, NY

WINTHROP, ME

MONTPELIER, VT

ADIRONDACKS, NY

HERKIMER NY

PA

WV

NEW ENGLAND ADIRONDACKS, NY HERKIMER, NY NEW OXFORD, PA BLUEFIELD, WV

ME MONTPELIER, VT ADIRONDACKS, NY

PA BLUEFIELD, WV

IN MILLIONS OF UNITS (2025 AVERAGE THROUGH AUGUST )

Source: US Department of Commerce IN MILLIONS OF UNITS; TOTAL HOUSING STARTS WITH MULTIFAMILY STARTS REDUCED TO 40 PERCENT TO BETTER REFLECT LUMBER USAGE (2025 AVERAGE THROUGH AUGUST )

Source: US Census and F&W Forestry Services F&W’S LUMBER-USE ADJUSTED HOUSING STARTS IN MILLIONS OF DOLLARS (2025 AVERAGE THROUGH JULY)

Source: US Department of Commerce HOUSING PERMITS HOUSING STARTS

Source: Freddie Mac SOUTHERN PINE–$/MBF

Source: Random Lengths Southern Pine Composite Index

DOLLAR VALUE AGAINST 26 MAJOR TRADING PARTNERS

Source: Federal Reserve

F&W Forestry Services proudly serves a broad client base with comprehensive forest management solutions. Our team takes the time to get to know you, your land, and your goals to create a personalized plan for success.

OUR MISSION

F&W’s mission is to help clients maximize the value and enjoyment of their land and forest resources according to their individual objectives, needs, and desires – whether economic, aesthetic, environmental, or recreational.

OUR SERVICES

Timber Sales

Property Management

Field Support Services

Forest Inventory & Mapping

Forestland Accounting

Technical & Analytical

Real Estate

Natural Capital