Digital platforms are giving broadcasters more space to expand their coverage and fully connect with the community

REVVING UP NEXTGEN TV IN THE MOTOR CITY CAN LOCAL TV STAY IN THE PRO SPORTS GAME?

POLITICAL WINDS TO YIELD WINDFALL FOR STATIONS

RULESSYNDICATION’SOLD NOLONGERAPPLY VOLUME 154 • NUMBER 3 APRIL 2024 • $6.95

WWW.BROADCASTINGCABLE.COM

WWW.MULTICHANNEL.COM

FOLLOW US

On X: x.com/BCBeat or x.com/MultiNews

On Facebook: facebook.com/BroadcastingandCable or facebook.com/MultichannelNewsMagazine

CONTENT

Content Director Kent Gibbons, kent.gibbons@futurenet.com

Content Manager Michael Demenchuk, michael.demenchuk@futurenet.com

Senior Content Producer - Technology

Daniel Frankel, daniel.frankel@futurenet.com

Senior Content Producer - Business

Jon Lafayette, jon.lafayette@futurenet.com

Senior Content Producer - Programming Michael Malone, michael.malone@futurenet.com

Senior Content Producer - Programming R. Thomas Umstead, thomas.umstead@futurenet.com

Contributor Paige Albiniak

Production Manager Heather Tatrow

Art Directors Steven Mumby, Cliff Newman

ADVERTISING SALES

Managing VP, Sales Dena G. Malouf, dena.malouf@futurenet.com

SUBSCRIBER CUSTOMER SERVICE

To subscribe, change your address, or check on your current account status, go to www.broadcastingcable.com and click on About Us, email futureplc@computerfulfillment.com, call 888-266-5828, or write P.O. Box 8688, Lowell, MA 01853.

LICENSING/REPRINTS/PERMISSIONS

Broadcasting+Cable is available for licensing. Contact the Licensing team to discuss partnership opportunities.

Head of Print Licensing Rachel Shaw licensing@futurenet.com

MANAGEMENT

SVP, MD, B2B Amanda Darman-Allen

VP, Global Head of Content, B2B Carmel King

VP, Global Head of Sales, B2B John Sellazzo

Managing VP of Sales, Media Entertainment Dena G. Malouf

VP, Global Head of Strategy & Ops, B2B Allison Markert

VP, Product & Marketing, B2B Scott Lowe

Head of Production U.S. & U.K. Mark Constance

Head of Design, B2B Nicole Cobban

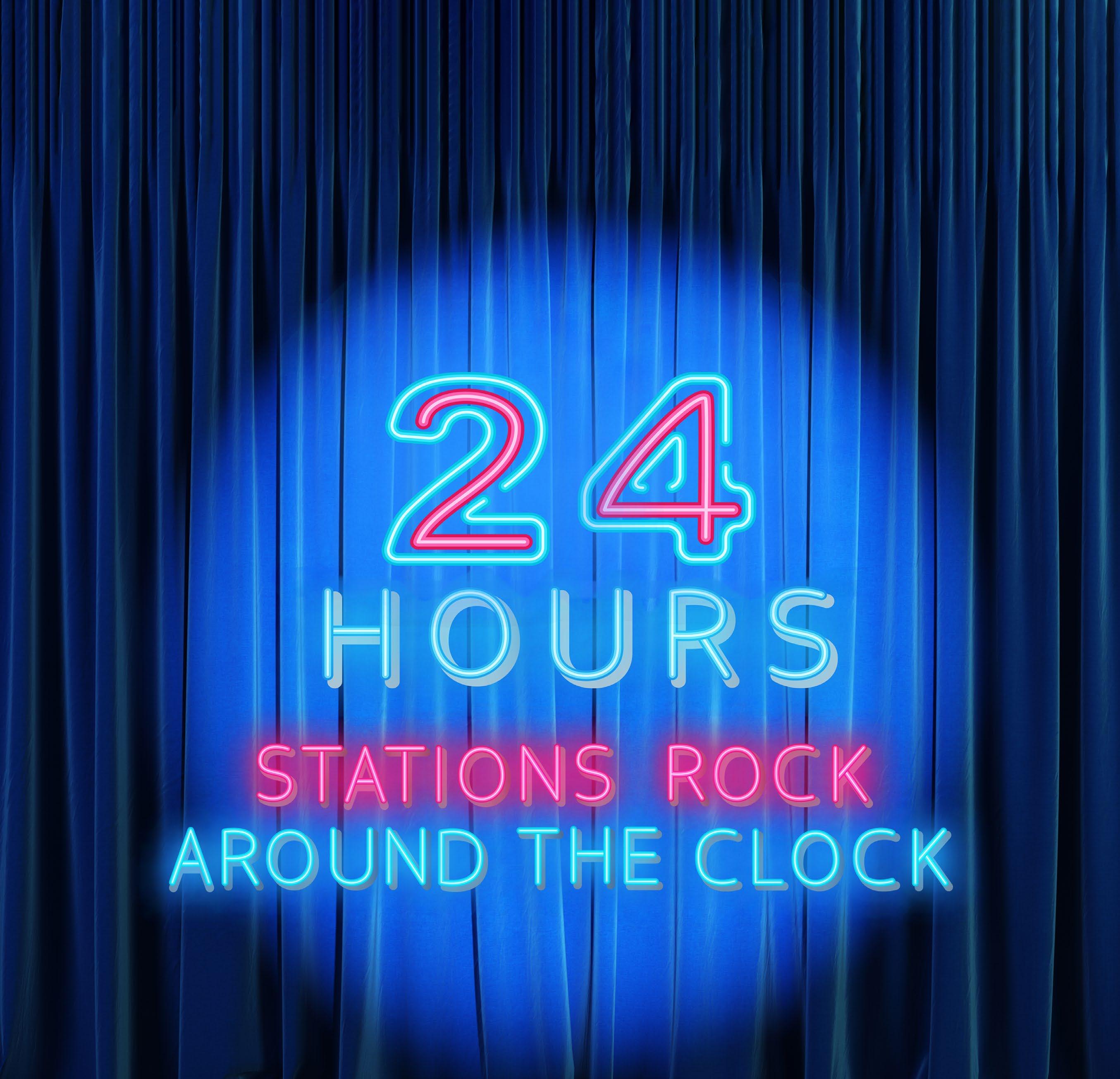

8 COVER STORY

FEATURES

8 COVER STORY

FAST channels and apps are providing the shelf space for stations to ramp up efforts to superserve viewers with around-the-clock news and expanded local content.

By Michael Malone

4 LEAD-IN

This year’s presidential election cycle is shaping up for a “massive spend” up and down the ballot, one that could see media rake in more than $11 billion in ad revenue.

By Stuart Miller

14 PROGRAMMING

16 LOCAL NEWS

18 SYNDICATION

20 CURRENCY

22 FATES & FORTUNES

24 FREEZE FRAME

30 DATA MINE

33 VIEWPOINT

34 THE FIVE SPOT

or updates to them. This magazine is fully independent and not affiliated in any way with the companies mentioned herein.

If you submit material to us, you warrant that you own the material and/or have the necessary rights/ permissions to supply the material and you automatically grant Future and its licensees a licence to publish your submission in whole or in part in any/all issues and/or editions of publications, in any format published worldwide and on associated websites, social media channels and associated products. Any material you submit is sent at your own risk and, although every care is taken, neither Future nor its employees, agents, subcontractors or licensees shall be liable for loss or damage. We assume all unsolicited material is for publication unless otherwise stated, and reserve the right to edit, amend, adapt all submissions.

We are committed to only using magazine paper which is derived from responsibly managed, certified forestry and chlorine-free manufacture. The paper in this magazine was sourced and produced from sustainable managed forests, conforming to strict environmental and socioeconomic standards.

Chief

10 LEAD-IN Detroit has become something of a test track for NextGen TV’s technical bells and whistles, with stations taking features like Start Over and datacasting out for a spin.

By Jon Lafayette

Multichannel.com Broadcastingcable.com 3

DEPARTMENTS

VOLUME 154 • ISSUE 3 • APRIL 2024 Future plc is a public company quoted on the London Stock Exchange (symbol: FUTR) www.futureplc.com

executive officer Jon Steinberg, Non-executive chairman Richard Huntingford and Chief financial and strategy officer Penny Ladkin-Brand Tel +44 (0)1225 442 244 All contents ©2024 Future US, Inc. or published under licence. All rights reserved. No part of this magazine may be used, stored, transmitted or reproduced in any way without the prior written permission of the publisher. Future Publishing Limited (company number 2008885) is registered in England and Wales. Registered office: Quay House, The Ambury, Bath BA1 1UA. All information contained in this publication is for information only and is, as far as we are aware, correct at the time of going to press. Future cannot accept any responsibility for errors or inaccuracies in such information. You are advised to contact manufacturers and retailers directly with regard to the price of products/ services referred to in this publication. Apps and websites mentioned in this publication are not under our control. We are not responsible for their contents or any other changes

FUTURE US, INC. 130 W. 42nd St., 7th Floor, New York, NY 10036-8002 Vol. 154 • No. 3 • April 2024 • B&C Broadcasting & Cable (1068-1627) is published 7 times per year (Feb, March, April, June, Sept, Oct, Dec) by Future US, Inc., 130 W. 42nd St., 7th Floor, New York, NY 10036. Periodicals postage rates are paid at New York, NY, and additional mailing offices. POSTMASTER: Send address changes to Broadcasting & Cable, PO Box 848, Lowell, MA 01853. Printed in U.S.A. © 2024 Future US, Inc. All Rights Reserved. 20 CURRENCY 14 PROGRAMMING

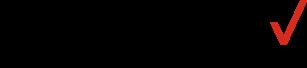

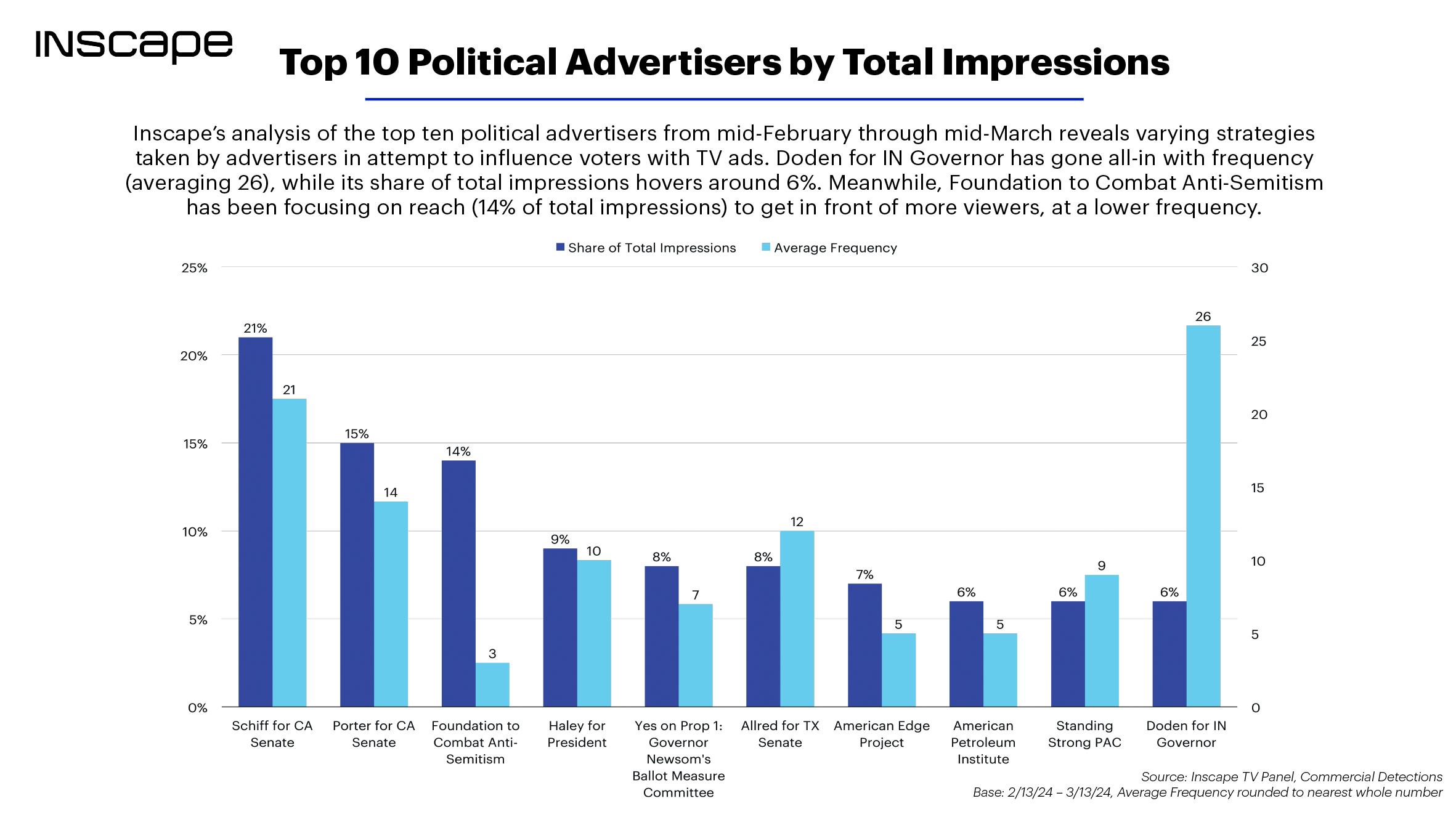

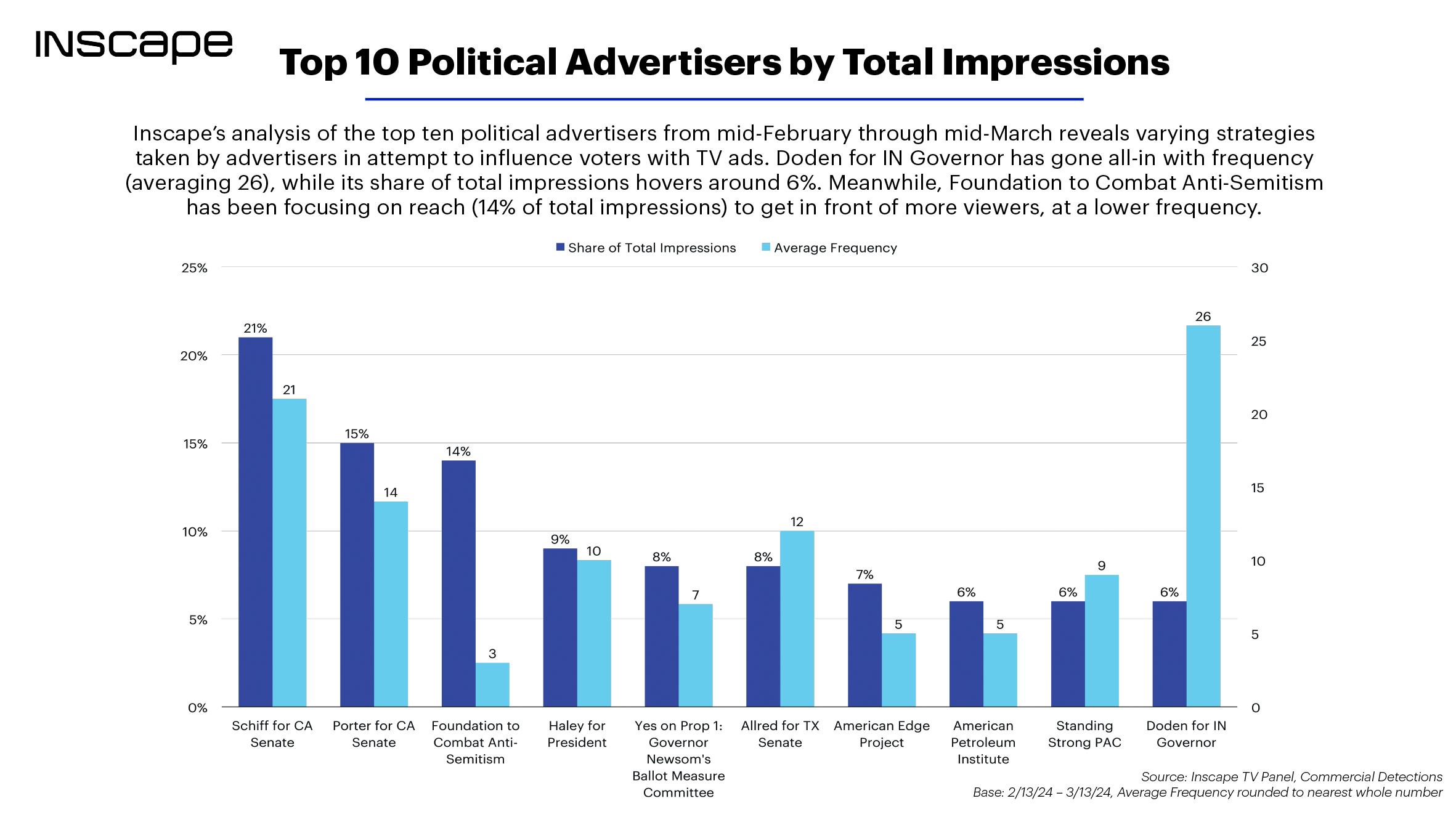

Political Winds Could Yield A Windfall for Stations

‘Massive spend’ in a contentious presidential election year could exceed $11 billion

By Stuart Miller smiller@journalist.com @sfmsfm5186

By Stuart Miller smiller@journalist.com @sfmsfm5186

The state of the union is hopelessly divided and nearly paralyzed by rancor and bitterness. But as this is an election year, the state of spending on political advertising — even in a media world that is increasingly fragmented — has gone from robust to record-shattering.

Perry Sook, chairman and CEO of Nexstar Media Group, projected “a record level of political spending” on a fourth-quarter earnings call. Fox Television Stations has created a political unit in its advertising sales division to meet the rising demand.

Steve Lanzano, president and CEO of the Television Bureau of Advertising (TVB), the broadcast industry trade association, projected political campaigns would deliver a $10.2 billion infusion into the media economy, more than 10% higher than the last presidential cycle.

Mitchell West, director of CMAG (Campaign Media Analysis Group) at the ad-intelligence platform Vivvix, predicted the cycle’s “massive spend” would reach $11.6 billion.

BIA Advisory Services put out the most recent forecast, calling for $11.1 billion in political ad spending this year, up $2.2 billion (24%) over 2022 and up $1.5 billion (15.5%) over 2020, the last presidential year. Broadcast TV again is the biggest spending category with $4.6 billion, per BIA.

The primary season in 2024 was modest, with both major candidates locked in from the beginning, but the presidential grudge match started early. President Joe

Biden recently launched a $30 million ad spend in battleground states.

West said campaigns typically spend 60 cents of every dollar raised on advertising, but Biden might up that spend to 65-70 cents. Plus, outside groups have pledged to spend more than $1 billion in ad support.

Former President Donald Trump loves campaigning, but Lanzano said he’ll need to spend more since his earned media has declined since 2016, not counting the focus on his multiple criminal trials.

(From l.): TVB president and CEO Steve Lanzano; Vivvix director of Campaign Media Analysis Group Mitchell West

“They’re going to have to balance out that message on the airwaves,” West agreed.

While the pie is growing, it is changing, too. “There’s more and more spending but the media landscape and viewership are evolving,” Madhive senior VP, sales Kristin Wnuk said. “Local broadcast television is still the powerhouse, but CTV is absolutely taking a larger share.”

West said that while broadcast stations’ share will climb, reaching $5 billion, its share of money spent will dip as connected TV soars well beyond $1 billion from “almost nothing” a few cycles ago.

Madhive’s data analysis lets politicians use CTV to target ads more efficiently than an old-fashioned broadcast TV ad, Wnuk said, aiming at just, say, Democrats or Republicans or independents, or voters within specific ZIP codes. “It’s a different buying model and there are different levels you can pull,” she said.

For now, most CTV ads are just broadcast TV ads, achieving reach but not using the more precise targeting possible with OTT. “When that gets embraced by politicians, it will become a really huge tool for them,” he said.

The shift is slow also because voters, like broadcast viewers, tend to be older, Sook noted. That favors broadcast and with its local viewership share, it remains “the medium of choice for campaigns and PACs.”

PARSING POLITICAL SPEND

Political advertising this year is expected to rake in $11.6 billion, per Vivvix CMAG, with the biggest share going to TV stations. Here are the top political-ad spending categories.

$5 Billion: Broadcast Local/Network TV

$1.8 Billion: Connected TV Platforms

$1.6 Billion: Google/ Facebook

$1.5 Billion: Cable Local/ Network

$400 Million: Radio

SOURCE: Vivvix CMAG, a MediaRadar Company

Big Down-Ballot Spending

This year’s battles for control of both the Senate and House will fuel extra spending, Lanzano said. That growth is now fueled by an inversion of Tip O’Neill’s adage that “all politics is local.”

“Politics has become kind of almost like the national sport — campaigns openly solicit money by advertising out of their state and then money flies all over the country,” West said.

Lanzano and West both said the spending spigots should remain open in future elections, allowing broadcast stations to build those dollars into their budgets at a time when overall TV ad spending is not doing that well. ●

4 Broadcastingcable.com Multichannel.com

LEAD-IN

THE WATCHMAN

Senior content producer Michael Malone’s look at the programming scene

By Michael Malone michael.malone@futurenet.com

@BCMikeMalone

By Michael Malone michael.malone@futurenet.com

@BCMikeMalone

Ben Franklin: Inventor, Statesman, Secret Agent

Apple TV Plus debuts Franklin, about Benjamin Franklin venturing to France to get help for the United States in the Revolutionary War, on April 12. Ben was 70 when he made the secret mission, staying a step ahead of British spies, French informers and hostile colleagues.

Michael Douglas plays Franklin.

Tim Van Patten, showrunner and executive producer, said the U.S. probably does not win the war if Franklin never makes the trip. “If we did not have the French jumping in, we were done,” he said. “It was really desperate. This whole notion of a republic designed by founding fathers would’ve been sunk.”

The series is based on the Stacy Schiff book A Great Improvisation: Franklin, France and the Birth of America. Van Patten enjoyed the research. “The more you learn about Franklin, he’s probably the only one of the founding fathers who could’ve pulled this off,” he said. “You could not send John Adams to do this. He would’ve bollixed this up.”

The series was shot in France. Van Patten admitted he had a pretty basic knowledge

of Franklin when producer Richard Plepler mentioned the idea. “I want to take myself someplace I’ve never been, and I also want to take the audience,” he said. “This presented itself as a story I didn’t know, a world I’ve never photographed.”

He added, “I really fell in love with the world, and the material and the man.”

What a Road Trip With Dulé Hill Might Look Like

The Express Way With Dulé Hill, which sees Hill trek across America to “explore the transformative power of the arts,” according to PBS, debuts April 23. The four-part series sees him in California, Appalachia, Chicago and Texas, as he connects with activists and changemakers putting their artistic passions to work.

Speaking at the TCA Winter Press Tour, Danny Lee, executive producer and director, said the series’ mission is to show how art fixes society’s issues. “We all know that we’re living during extremely challenging times — a lot of noise and a lot of clutter,” he said. “We wanted to craft a show that just addresses how art can be the antidote to a lot of these ills.”

As the producers kicked around the locales, they focused on what the problem was in a specific community, and how art is part of the solution.

Hill’s credits include The West Wing, Psych and Suits. He said The Express Way is the kind of show that never runs out of good stories to tell. “This is a vast country and it’s filled with so many diverse stories,” Hill said. “You can throw a stone and find a million stories to be able to be told. We all have a unique story.” ●

WATCH THIS …

Patti Stanger: The Matchmaker debuts on The CW April 11. Love guru Stanger helps people find love and Nick Viall, formerly of The Bachelor, pitches in. Just when you thought you’d never hear from Dora the Explorer again, Paramount Plus premieres Dora April 12. Diana Zermeño voices Dora and Asher Colton Spence voices Boots.

The 100th: Billy Joel at Madison Square Garden

Staying animated, Bluey special The Sign debuts April 14 on Disney Plus, Disney Junior and Disney Channel. The blue heeler dog finds a fresh set of adventures in Bluey’s first special. How about a little piano, man?

CBS has The 100th: Billy Joel at Madison Square Garden — The Greatest Arena Run of All Time on April 14. It was shot at the No. 100 concert of Joel’s MSG residency. And season three of Welcome to Wrexham is on FX April 18, as Rob McElhenney and Ryan Reynolds run their soccer team in Wales — and visit America on a summer tour.

Welcome To Wrexham

6 Broadcastingcable.com Multichannel.com

Dora

Ben Franklin, Apple TV Plus The Express Way With Dulé Hill: Larkin Donley/Joe Bressler/CALICO; Dora : Nickelodeon; Billy Joel Sonja Flemming/CBS; Welcome to Wrexham FX

LEAD-IN

Franklin

The Express Way With Dulé Hill

Local Outlets Increase Output

Digital platforms allow local broadcasters to thoroughly connect with community

By Michael Malone michael.malone@futurenet.com @BCMikeMalone

By Michael Malone michael.malone@futurenet.com @BCMikeMalone

Stations may never get to be true 24/7 local news outlets, but there are many out there that have that model in mind as they crank out more and more local programming — both on linear TV and on their digital platforms. Netflix and Hulu might do great entertainment, the thinking goes, but they hardly produce content targeting viewers in a specific market.

So, stations load up on content — news, talk, true crime, documentaries — that speaks directly to viewers in their community and that those audiences might not get anywhere else.

KTLA Los Angeles, for one, puts out a stunning 112 hours a week of local programming, including weekday news

from 4 a.m. to 2 p.m., then a talk show featuring station talent and then local news again from 3 to 7 p.m. After The CW primetime airs from 8 to 10 p.m., it’s another 90 minutes of weeknight news on the Nexstar Media Group station.

“Controlling our own destiny is really important — that’s what we are working very hard to do,” KTLA VP and general manager Janene Drafs said. “We may not be 24/7, but the more control we have of our content, the better suited we are to the changes that are happening so rapidly.”

Stations are adding more local fare on traditional TV, such as the sevenhour weekday morning behemoth that launched on KCAL Los Angeles last year, and on streaming, such as WNBC New York’s Today in New York 7 a.m. program that premiered on FAST channel NBC New York News in January. When WWJ Detroit launched local news last year,

KTLA Los Angeles is heavy on locally produced programming, including earlyafternoon talker Off the Clock with Chris Schauble (l.), Megan Henderson and Henry DiCarlo.

the newsroom, built for the modern era, touted a streaming-first mentality.

“The cord-cutting audience is larger and larger and larger, and some do not consume news on linear,” CBS Stations president Jennifer Mitchell said. “This is something we absolutely need to do to meet the audience where they are.”

Growing FAST

With their linear schedules typically carved up by network and syndicated commitments, stations are seeing the most room to grow on their secondary platforms. Besides its 45 hours a week of local linear programming, WTVF Nashville offers viewers another 17 hours of original local fare on its NewsChannel 5 Plus subchannel. That includes MorningLine, from 8 to 9 a.m. four days a week, and SportsLine, from 8 to 9 p.m. three nights a week. Both see viewers call in to ask questions and share their thoughts.

Capitol Broadcasting’s WRAL Raleigh streams 24/7, and acquired a religious station in the market then converted it to a news channel.

In the NBC group, WMAQ Chicago recently launched a 7 a.m. newscast on its FAST channel, and KNBC Los Angeles offers a FAST newscast at 9 a.m. “Most of our markets have launched a FAST-only newscast of some kind,” NBCUniversal Local director of streaming news channels Angela Grande said.

WTTG Washington has 88½ hours of news a week on linear and debuted a two-hour weekday show, Fox 5 Live Zone, in late January on the Fox Local app. Radio personality Guy Lambert hosts the current-affairs talker. “We’re live all the time anyway,” WTTG VP of news Paul McGonagle said. “It just gives us another platform.”

Streaming offers a different model than linear. Multiple newsroom chiefs spoke of a “conversational” vibe to their live, local programming on streaming. “We can have a conversation with the viewer about what they’re seeing,

8 Broadcastingcable.com Multichannel.com COVER STORY KTLA

instead of the 1:30 package and move on,” said McGonagle. “It gives us the time to tell great stories.”

A nonlinear newscast at NBCU might run for a quick 13 minutes, said Meredith McGinn, executive VP, NBCU Local Media, multicast networks and original programming. Besides original reporting, a station might take a block of news that was produced earlier, take out some elements that are less relevant as the day goes on, such as traffic, and update other timely items, such as weather.

“We’re experimenting with formats, in addition to length,” McGinn said.

Users watching digital platforms might not expect the traditional news setup on those platforms. WTVF, part of E.W. Scripps, has a weekly show in the works that is centered around positive stories that run in its newscasts. WTTG Washington, part of Fox Television Stations, has a couple of shows in development. McGonagle described them as “live but not talking-head live.”

Crime Pays

Several stations are finding those channels to be a good place for true crime and other documentary-style programs. In the NBCU group, WMAQ Chicago has Scene of the Crime and WCAU Philadelphia has Somebody Knows Something.

WTTG’s McGonagle said true crime has done “extremely well for us” on the Fox Local app. In mid-March, a new special about a D.C.-area doctor killed in a carjacking, The District of Carjacking, premiered. “We spend a lot of time going deeper into those issues,” he said.

There is also local growth on the linear side. After a split from The CW, eight CBSowned stations went independent last fall, and several launched primetime news. Also in the CBS group, KCAL’s 4-11 a.m. weekday block

Above: CBSowned stations like KCNC Denver are now set up to go live via FAST channels whenever news breaks.

Below: (From l.):

WNBC New York meteorologist Maria LaRosa, anchors Darlene Rodriguez and Michael Garguilo and traffic reporter Adelle Caballero do a 7 a.m. hour of Today in New York on the NBC New York News FAST channel.

launched in January 2023. “It’s been very good growth for that station,” Mitchell said, noting a 78% uptick in the 6-7 a.m. hour, compared to what was on before the newscast.

Live and Local

Station managers said viewer and user demand for live programming remains unfulfilled. KMGH Denver is live from 9 a.m. until noon weekdays on Denver 7 Plus. Brian Joyce, VP and general manager, mentioned “more indepth coverage around stories” on the OTT platform.

WPRI Providence added a Spanishlanguage newscast, 12 Informa, online last year.

The CBS-owned stations are now set up so an anchor, reporter and producer are available at most times of the day and are ready to go live if and when news breaks. “We have the ability to stand up and deliver live breaking news at a moment’s notice,” Mitchell said. “It’s now in the DNA. We are no longer resource-challenged in that area.”

Many stations aren’t in a position to increase headcount while adding local content. Everyone in the KMGH newsroom contributes to Denver 7 Plus, but dedicated staff was hired before launch. “We did not want to spread our journalists so thin that they can’t get to it,” said Joyce. Drafs mentioned KTLA adding eight to 10 hours of content over the

last half-dozen years. Headcount has increased at a more modest rate. The station’s 2 p.m. Off the Clock program is an example of how KTLA cranks out more with a mostly level number of people. The early-morning anchor and producer teams finish their duties at 7 a.m., then head off to tape Off the Clock.

“We’re constantly examining workflow that works and can serve all of those needs without burning out the staff,” said Erica Hill-Rodriguez, KTLA news director. She said she’s heard complaints about increased workloads in the newsroom her entire career.

“That’s been going on in news forever,” she said. “It’s a difficult job.”

Not every station will see the merit of adding original news to a secondary platform. A station that’s No. 4 in their market in the news derby can’t expect to draw enough of a crowd to an original online newscast to justify the cost. “A weak station where they don’t have strong news, they’re gonna have a tough time,” Bill Hague, executive VP at consultancy Magid, said. “Strong news stations with a strong brand are going to have an easier time.”

The Revolution Will Be Televised

Most stations plan to keep on increasing their local output. Sure, it’s more stress for staffers, but a deeper programming portfolio gives them more room to chase down passion projects.

“It’s another revolution in our industry,” McGonagle said. “It’s scary and exciting at the same time.”

One might think KTLA’s local schedule is maxed out, but that’s not the case. The station has a few new shows in the works, and is running them on the KTLA Plus app to see if they draw an audience. “We’ll spend some time with it and grow it, and if we think it has a place on linear, we’ll move it to linear,” Drafs said. “We have high hopes that one or two, or all three, will be successful and can take the place of syndication.” ●

COVER STORY Multichannel.com Broadcastingcable.com 9 WNBC; KCNC

Detroit Stations Launch Start Over, Datacasting To Boost NextGen TV

Stations try out consumer apps to build momentum for ATSC 3.0 in local markets

By Jon Lafayette jon.lafayette@futurenet.com @jlafayette

By Jon Lafayette jon.lafayette@futurenet.com @jlafayette

NextGen TV has been on the air in Detroit for more than three years. At this point, not too many people are tuning in, but broadcasters there are using the market as a laboratory, testing features and getting ready for when more viewers are paying attention.

“There’s a bit of a chicken-and-egg phenomenon going on,” Michael Newman, director of transformation at Graham Media Group, owner of WDIV Detroit, told B+C Multichannel News. “We need to demonstrate the value of this nextgeneration television broadcast system.”

“We continue to search for the killer app that will be the motivating factor,” said Kerry Oslund, VP of strategy and business development at E.W. Scripps, which owns WXYZ-WMYD Detroit.

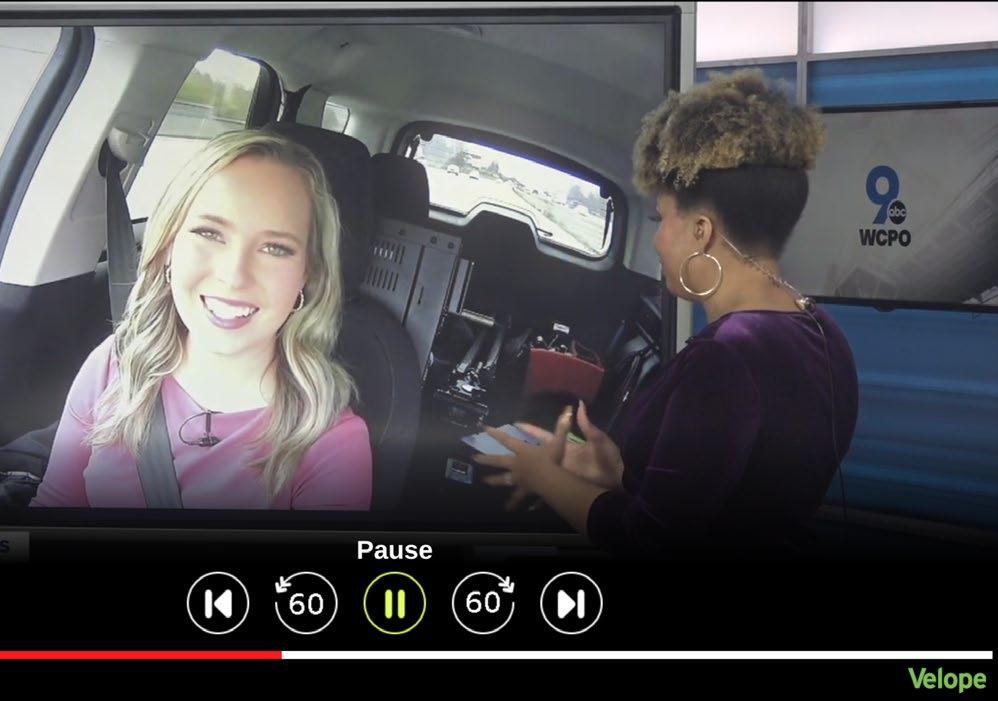

During the next quarter, the Scripps stations in Detroit plan to enable “start over” and “pause” functionality, giving over-the-air viewers a feature that cable viewers and streamers take for granted. The features also create new advertising inventory for the stations to sell.

Detroit is also the hub for OTA Wireless, Scripps’s joint venture with Nexstar Media Group, which is datacasting there and in Indianapolis, Kansas City and Denver, covering about 6% of the country. Another station is expected to be added, bringing coverage to 12%.

Datacasting could be used to update signage on a highway or menus in McDonald’s throughout the station’s coverage area, for example.

Business development people for OTA Wireless are beating the bushes to sign up clients and start to generate revenue

More Than Pretty Pictures

The Federal Communications Commission in 2017 approved the use of ATSC 3.0 broadcast technology, which was designed to offer viewers a sharper picture with better color, improved sound, mobile reception and access to internet-based programming over the air.

For broadcasters, the new format could support additional channels, pay services enabled by conditional access

Detroit’s TV stations have been broadcasting in ATSC 3.0 — and testing its new capabilities — for the past three years.

and enhanced GPS. One estimate had those services delivering a potential $15 billion in annual incremental revenue for the industry at a time when it is losing viewers and advertising revenue to streaming.

Detroit was an early market to begin the shift to NextGen TV — a brand name for ATSC 3.0 — with Scripps’s WMYD firing up a transmitter in December 2020.

WMYD, an affiliate of The CW, is the market’s “lighthouse” station, which means it is broadcasting ATSC 3.0 signals carrying its own programming, as well as programming for its in-market “guests,” Scripps’s ABC affiliate, WXYZ; Graham Media’s CBS affiliate, WDIV; Fox-owned WJBK; and CBS’s WWJ.

Originally, Scripps used Phoenix as its NextGen test market.

“We do a lot of things with our partners and our network partners in Phoenix,” Oslund said.

10 Broadcastingcable.com Multichannel.com LEAD-IN

But Detroit is where Scripps turns for its own projects because of the auto industry, which could be a big customer for mobile datacasting, enhanced GPS and other businesses.

“We want to be right under their nose, which we have been,” Oslund said.

To Oslund, the story of Detroit is two stories. One is about the viewer and advertiser experience with NextGen TV. The other is about mobile wireless data, “and we’ve made huge progress on that,” he said.

There are about 30,000 TV sets using NextGen over-the-air in the market, Oslund estimated.

The NextGen technology enables stations to see who is watching, if they’re using an over-the-air antenna, if the TV is connected to the internet and if the set owner has opted into sharing data.

In March, Oslund was able to track 65,000 devices in 59,000 homes nationwide that have tuned into a NextGen signal. They’ve tuned in 31 million times.

In Detroit, stations track 7,700 devices in 6,500 households. Those devices tuned in 2.2 million times.

That data could be valuable. The stations did their first data sharing deal, which gives them a dashboard that tells them how they’re doing with ATSC 3.0 viewers.

The stations, along with Pearl TV, a coalition coordinating the NextGen rollout, are discussing putting that data into a unified platform and licensing it to measurement companies, which don’t have another good way to measure overthe-air viewing.

Scripps introduced the start over and pause functions at last year’s NAB Show and have rolled them out in Las Vegas. Detroit will have it soon and “it seems like a no-brainer for us everywhere else,” Oslund said.

“I wouldn’t say we’re slingshotting ahead of the SVOD guys,” he added. “I think we’re catching up in a lot of ways and that’s okay. We need to.”

New Vehicles for Ads

When an over-the-air viewer pushes

the start-over button on the remote control, the set shifts from over the air to a virtual streaming channel. A pre-roll commercial or promo appears before the show restarts. “So we’re creating new kinds of inventory with new kinds of functionality,” Oslund said.

The new technology will also help compete with streamers for advertising.

“As a local TV station, it’s really important that we’re able to compete with Netflix, Disney and Paramount for ad dollars,” Newman said.

At this point NextGen ads are experimental. Stations will be able to see exactly where specific opted-in sets are located and tell advertisers precisely which households were exposed to commercials, making them more attractive to increasingly data-driven marketers.

“If you can do it on the internet we can do it on TV,” Oslund said.

In terms of programming, Oslund said he hasn’t seen any shows viewers like better on NextGen sets. Because so many stations are riding on a single signal, there isn’t enough spectrum for 4K pictures. But rolling out high-dynamic range (HDR) video for key sporting events is a priority.

Scripps

Cincinnati by rolling out “start over” via ATSC 3.0.

Eventually other features consumers will value will be available via ATSC 3.0, including interactivity, personalization, commerce, betting and up-to-date electronic program guides.

Fox station WJBK is keeping its powder dry. The station hasn’t done any

special programming using its ATSC 3.0 channel, according to general manager Greg Easterly.

“We’re just looking at it long term to see what’s going to be the best strategy and trying to determine what’s best for our viewers,” Easterly said.

But at WDIV, Graham Media is leaning into the new standard, Newman said.

“We really wanted to demonstrate what was different about this signal,” he said. “I think the Next-Gen stuff is hand and fist above what digital can do.”

Run3 TV App Launched

Four or five weeks after ATSC 3.0 started airing, WDIV launched the Run3 TV sidecar application.

“When you are tuned to our television station, you get a little call-to-action prompt that’s noticeable but not very disruptive,” Newman said. “With your remote control, you can open up the menu and navigate to all kinds of additional content” normally found on a station’s website.

One feed available on the sidecar app is a channel following the trial of the parents of the 17-year-old who was found guilty of the 2021 mass shooting at Oxford High School in Pontiac, Michigan.

Newscasts are available on-demand through the app, as is an airport cam. Viewers can create personalized feeds and bookmark stories during the workday and come home and watch them on their televisions.

The app provides a tangible benefit for buying a NextGen set, Newman said. “We have thousands of users in Detroit who actively have NextGen TV that are using our applications at the same time, and that’s every single day,” he said. “The Run3 has allowed us to dive in with two feet.”

Every once in a while, a set maker will update software and knock the sidecar offline, and calls come in from viewers who were watching.

“We get 10 to 30 complaints every time it happens,” Newman said. “I think that’s a really cool testament that people are looking for it and they’re using it regularly.” ●

Multichannel.com Broadcastingcable.com 11 LEAD-IN

station WXYZ is following the lead of sister station WCPO

Above, Kerry Oslund VP of strategy and business, E.W. Scripps. Below, Michael Newman, director of transformation, Graham Media Group.

Will Broadcast’s Local Sports Comeback Stand Up?

Stations have snapped up pro-sports rights from struggling RSNs, but could find themselves edged out by direct-to-consumer streamers

By R. Thomas Umstead thomas.umstead@futurenet.com @rtumstead30

By R. Thomas Umstead thomas.umstead@futurenet.com @rtumstead30

The implosion of the regional sports network business has allowed local broadcasters to step into the breach with live local pro-sports telecasts. The question now is: Can stations keep and even grow their sports stature, or will they get stuck on the bench once direct-toconsumer operations hit their stride?

The bankruptcy plight of Diamond Sports Group and its lineup of Bally Sports-branded regional sports networks — as well as Warner Bros. Discovery’s 2023 decision to walk away from its regional sports networks in Denver, Houston, Pittsburgh and Seattle — opened the door for several majormarket stations to distribute games over

the air that for decades had been available only to pay TV subscribers.

Yet as the RSN business shakes out and streaming becomes a more viable revenue-generating distribution platform, it’s unclear if the current momentum for over-the-air local sports telecasts is sustainable or short-lived.

“Broadcast right now is a near-term solution for the teams, but eventually sports will follow the money and play on the most lucrative platforms,” television analyst John Mansell said.

Lineup Shifts

In the past year, several pro sports teams have moved their in-market games from regional sports networks to broadcast stations, providing a wide and broad television audience for valuable live sports programming. Much of that was due to the March 2023 Diamond

The New Orleans Pelicans and Dallas Mavericks are two of several NBA teams making a fast break to local broadcast due to struggles in the regional sports network business and the Diamond Sports Group bankruptcy.

Sports Group bankruptcy filing, which allowed Sinclair-owned RSN subsidiary to renegotiate some rights deals in an effort to salvage a viable business model. The most recent movement has come from NBA teams taking advantage of the Diamond Sports Group bankruptcy filing by purchasing games on the back end of the 2023-24 NBA regular-season schedule:

• The Milwaukee Bucks in February teamed with Tegna and Weigel Broadcasting to air 10 games on a group of stations including WMLW Milwaukee and WISC Madison. “Over-the-air is an easy and affordable way for Bucks fans to watch our games, and we’re excited to work with Weigel and broadcasters like Tegna to make them widely available,” Milwaukee Bucks president Peter Feigin said in a statement.

• Tegna in January also partnered with the Dallas Mavericks to air 10 games on WFAA in March and April. “Providing access to games has always been our top priority,” Dallas Mavericks CEO Cynt Marshall said at the time of the deal. “We are thrilled to work with WFAA.”

• Gray Television-owned WVUE in New Orleans, along with 10 other Gray stations in Alabama, Louisiana and Mississippi, is currently airing 10 New Orleans Pelicans games under a distribution deal reached in January. “The Pelicans welcome the opportunity to partner with Gray Television in this 10-game deal that will provide over-the-air viewing access to Pelicans games for more than 3 million households and over seven million people across the Gulf South region,” New Orleans Pelicans president Dennis Lauscha said in a statement.

12 Broadcastingcable.com Multichannel.com Richard Rodriguez/Getty Images LEAD-IN

• Gray TV also teamed with the Cleveland Cavaliers to air five games on local station WUAB. Cavaliers CEO Nic Barlage told NBA.com at the time of the deal that the partnership allowed the team to “test out a new model of distribution” that could reach more fans across its local footprint.

Those teams joined the Phoenix Suns and the Utah Jazz, which have been using broadcast stations as their primary local TV outlets since the season began.

The Suns and the WNBA’s Phoenix Mercury reached distribution deals with Gray Television in mid-2023 after an agreement with Bally Sports Arizona expired. The Utah Jazz began airing games on Sinclair-owned KJZZ Salt Lake City in October, after the team’s deal with the now-shuttered RSN AT&T SportsNet Rocky Mountain expired. There’s also a Jazz Plus streaming service that offers access to every game for $125 per year.

It’s not just NBA teams moving to local broadcast. The Vegas Golden Knights of the NHL last summer inked a deal with E.W. Scripps to air games on KMCC Las Vegas and other stations in its TV territory during 2023-24. The Golden Knights also had a local TV deal with AT&T SportsNet Rocky Mountain.

Sports analyst Lee Berke said he believes the regional sports network business will continue to melt down.

“The traditional [regional sports network] model is failing — companies are in bankruptcy, and the rest are facing a substantial drop off in pay TV penetration from 8% to 12% a year,” he said. “When you have a network model that’s dependent in large part on affiliate fees, then these networks are suffering. As a result you’re going to see more reduced RSNs and shutdowns in the offering.”

Even as Diamond fights its way out of bankruptcy, Berke said RSNs will increasingly be pushed onto pay tiers as MVPDs look to generate more revenue for high-priced sports channels from fewer subscribers. He

Above, Jack Eichel and the defending Stanley Cup champion Vegas Golden Knights skated away to Scripps station KMCC after AT&T SportsNet Rocky Mountain shuttered.

Below, the Colorado Rockies and Major League Baseball will join forces to make the team’s games available locally on a direct-toconsumer basis.

pointed to two recent moves by Comcast — it moved MASN, local TV home of baseball’s Baltimore Orioles and Washington Nationals, and SportsNet Pittsburgh, local rightsholder for MLB’s Pirates and the NHL’s Penguins, from basic to premium tiers.

Such moves leave broadcast as an attractive option for teams looking to maximize their television reach.

“There are two main categories that still generate substantial audiences and substantial profitability [on broadcast stations], and that is news and sports,” Berke said. “News is certainly maxing out, so I think you’re seeing more sports on broadcast right now, and I think those trends are going to continue.”

But not all industry observers are betting on a resurgence of local pro sports on broadcast TV. While some teams have turned to over-the-air for a select number of games, Mansell doesn’t see a mass migration of local rights back to stations, especially given the continued movement of viewers from linear television to streaming services.

company and the leagues,” he said.

“When you look at how much money the Googles, Amazons and Facebooks have compared to any given cable operator or station owner, it pales in comparison. Sports rights are going to go where the money is.”

Baseball’s DTC Play

Indeed, Major League Baseball will offer local-market games of the San Diego Padres, Colorado Rockies and Arizona Diamondbacks on a subscription direct-to-consumer streaming basis in 2024 as it looks to create a league-owned in-market DTC platform in 2025. Baseball already offers such a product to out-ofmarket viewers in MLB.tv.

MLB commissioner Rob Manfred said in February during team owner meetings in Orlando, Florida, that he needs more than half of the MLB’s 30 clubs to make the service work.

And Amazon will invest $115 million in Diamond Sports Group’s financial restructuring in an effort to set itself up to potentially gain streaming rights to live games in local markets.

Mansell also pointed to the flexibility that the digital platforms can provide, including alternative feeds, player cameras and sports betting-themed feeds that would complement the telecasts.

Mansell, a former senior analyst at Paul Kagan Associates, added that the lure of offering fans a subscription streaming service in local markets would be difficult to turn down as viewership continues to migrate from linear to digital

“I think the more likely scenario is a streaming venture, potentially

Berke acknowledged the revenue potential of streaming services, but believes teams will want to combine local telecasts with streaming options to give fans the ability to view the games on multiple platforms. Teams such as the Phoenix Suns offer both local game broadcasts for free as well as via the Suns Live direct-to-consumer streaming platform for $14.99 per month, he noted.

“It’s a revamped approach to how these games are being distributed — you have increased viewership and increased value for your ad inventory with the [broadcast] business model,” Berke said. “Then you add streaming in to maintain your revenue growth and the value of the franchise going forward.” ●

Multichannel.com Broadcastingcable.com 13

LEAD-IN

David Becker/NHLIGetty Images; Matthew Stockman/Getty Images

Multicam Comedy ‘Renaissance’ Stays on Track

Laugh tracks may seem like a blast from TV’s

past, but several

new shows feature them

thing one should be ashamed of.”

By Michael Malone michael.malone@futurenet.com @BCMikeMalone

By Michael Malone michael.malone@futurenet.com @BCMikeMalone

The laugh track, which fell out of favor when hipper single-camera comedies such as The Office and Brooklyn Nine-Nine drew substantial audiences and buzz, may be experiencing a rebirth. Among the series using them are Frasier, which recently received a second-season renewal on Paramount Plus, and a pair of NBC offerings, reboot Night Court, in season two, and rookie sitcom Extended Family. Viewers don’t care how many cameras are involved, producers on those shows said, as long as the show is funny, and actors said they feed off the studio audience.

Night Court star John Larroquette addressed the topic of comedies shot with multiple cameras (more like a stage play) versus a single camera (like a movie) during a Television Critics Association Winter Press Tour session on the Warner Bros. lot. “If you look at the landscape of four-camera, I don’t watch a whole lot of television, but it seems to me that it’s having a bit of a renaissance,” he said.

Single-Cam in Scranton

Some trace the single-cam trend to Malcolm In the Middle, which was on Fox from 2000 to 2007. Modern Family and 30 Rock were other popular single-cams with long runs that helped change the dynamic. “It taught [viewers] a new way to watch TV comedy,” Pittsburgh Tribune-Review TV critic Rob Owen said. “Viewers were taught to go without a laugh track, and it became easier to slam the laugh track as some-

Current comedies with laugh tracks — audio with audience laughter — include The Conners on ABC, Bob Hearts Abishola and The Neighborhood on CBS and The Upshaws on Netflix.

For some, hearing canned laughter brings them back to watching TV in a different era, and not necessarily in a good way. A review of Night Court’s season two on The Daily Beast said, “The braying, instructive laugh track creates a halting rhythm of setups and punchlines closer to the person-toperson energy of the theater than the rapid-fire density of jokes flourishing over the past couple decades of standard-setting comedies.”

TCA president Jacqueline Cutler called laugh tracks “annoying.”

“I feel like it’s telling me how to feel when I know how to feel,” she said.

Extended Energy

Yet some multicam actors said it’s easier to be funny in front of an audience. At the TCA tour, Donald Faison, who plays Trey in Extended Family, shared that the studio audience gives actors “so much energy.”

The rebooted Night Court on NBC, starring Melissa Rauch and John Larroquette, is one of several new multicam sitcoms fueling the laugh track comeback.

He talked about shooting in front of the crew, and then of the joy of welcoming an audience into the studio. “You want to make every one of those people laugh just as much as you made the crew laugh,” Faison said.

Cutler said she’s heard from a number of comedy actors, particularly those with a stage background, about how they feed off the crowd. “They talk about needing that energy from the audience and how much they get from it,” she said.

Larroquette mentioned coming up with jokes while waiting for the audience to stop howling. “Some of the best comedy that’s ever come out of my world, out of my brain, was waiting for you to stop laughing,” he said. “Because if you’re shooting, you can’t just wait. You’ve got to stay alive.”

Multiple Multicams

Time will tell if multicam comedies retain their place in television. CBS has ordered a multicam spinoff of Young Sheldon, while ABC ordered a Tim Allen multicam called Shifting Gears

Larroquette, for one, thinks the multicam will stick around. “The intimacy of four cameras and an audience sitting, watching it, and people at home know that it’s sort of like a little play that’s going on,” he said. “I have a feeling that that’s something that will always be desired.”

Owen noted that TV trends cycle in and out. “I do not think multicams will completely go away,” he said. “With television, there are always ebbs and flows for formats and styles.”

Speaking at the Warner Bros. lot during press tour, Chuck Lorre, whose shows have included multicams The Big Bang Theory, Bob Hearts Abishola and Two and a Half Men, called it “a wonderful form of storytelling.”

The audience, he said, does not care if a show is a single cam or multicam, as long as it is funny and they dig the characters. “Some of the greatest shows in the history of television have been in front of an audience,” Lorre said. “Why would that not be true now?” ●

14 Broadcastingcable.com Multichannel.com PROGRAMMING Nicole Weingart/NBC

Fun, Sun and New Arrivals In West Palm Beach

Florida market plays larger than No. 39 in terms of news, thanks in part to Trump home base

By Michael Malone michael.malone@futurenet.com @BCMikeMalone

By Michael Malone michael.malone@futurenet.com @BCMikeMalone

West Palm Beach, Florida, saw a hearty influx of residents during the pandemic and the new arrivals just keep coming. Out-of-state driver’s licenses exchanged for ones in the southeastern Florida counties of MiamiDade, Broward, Palm Beach and Martin were 12.7% higher than they were in 2019, according to Miami Realtors, with former residents of New York, New Jersey and California leading the way. Stations are eager to get the Florida newbies to watch their programming. “It’s a huge opportunity for us,” Caroline Taplett, president and general manager of WPBF, said. “It’s also a great opportunity for sales folks — new people, new housing, new construction.”

A decade ago, Scripps-owned WPTV was the ratings beast in West Palm Beach-Fort Pierce. These days, it’s Hearst Television’s WPBF. Taplett mentioned winning weather (Cris Martinez is chief meteorologist), long-term anchors and a dedicated sports department as things that set the station apart. She also mentioned the long-running “Live, Local, Late-Breaking” brand and “an urgent and aggressive” approach to news.

WPBF is an ABC affiliate and WPTV is aligned with NBC. Sinclair has CBS outlet WPEC, along with The CW affiliate WVTX and MyNetworkTV station WTCN. Gray Television owns the Fox station WFLX. Univision owns WLTV.

West Palm Beach’s main pay TV operator is Comcast.

WPTV won the 6 a.m. household race in January, according to Nielsen numbers from a West Palm Beach source, and WPBF won in viewers 25-54. WPBF took the 5 and 6 p.m. contests,

with WPTV in second. At 11 p.m., WPBF had a 2.5 household rating, ahead of WPTV’s 2.0 and WPEC’s 1.6, while WFLX scored a 1.4 at 10 p.m. In the late news demo, WPBF and WPEC both had a 0.5, WPEC with the advantage in impressions, while WPTV had a 0.4, as did WFLX at 10.

WPTV produces news for WFLX. Bill Siegel came on board as WPTV VP and general manager two years ago. He did not return calls for comment.

In January, Diana Wilkin was named VP and general manager of WPEC-WVTXWTCN; she previously ran Sinclair’s West Palm stations in 2007-2008. She did not speak for this story due to just starting as GM.

Jaime Kawaja was named VP and general manager of WFLX in December 2022; she’s also the general sales manager. In September, the station launched the noon weekday show South Florida Daily. Megan Hayes and Kate Monahan host. “They do what’s to love and eat and see in West Palm Beach,” Kawaja said.

which went down February 29-March 3. South Florida Daily has some paid inserts. Station management is considering extending the show to an hour.

WPBF had a busy September, too, launching a 10 p.m. newscast on MeTV, expanding the noon newscast to an hour, and debuting public-affairs program On the Record. A 4 p.m. weekday newscast debuted in 2022.

Taplett said West Palm Beach has more news than its market size might suggest. There is weather, and the new arrivals, and whatever might be happening over at Mar-a-Lago. “This market has a plethora of breaking news,” she said.

The other West Palm stations feature sports stories in the body of a newscast, Taplett said, not as their own segment, while WPBF is the only one with a dedicated sports department. She also touted a dedicated traffic anchor.

Speaking of sports in West Palm, drama series Apples Never Fall, featuring Annette Bening and Sam Neill as a couple who ran a giant tennis academy in the area, debuted on Peacock March 14. The novel that inspired it was set in Australia, but the show was shifted to West Palm Beach, as it is home to many major tennis training facilities.

Boom Town

West Palm Beach is about 90 minutes north of Miami. The market is in strong economic shape. Downtown West Palm has a lively financial scene and tourism is hot.

“The economy is really good, it’s booming,” Kawaja said. “Automotive has come back. We’re not seeing any hiccups.”

A recent episode saw Hayes and Monahan at the PGA National Resort in Palm Beach Gardens, talking up the Cognizant Classic golf event,

Stations keep trying to connect with the new viewers. WFLX recently grabbed equestrian network Equus for its dot-two. Kawaja said polo and other horse activities are big in the market.

WPBF had nine specials in 2023, most airing in prime, their focus ranging from Black History Month to hurricanes to the Florida Atlantic men’s basketball team earning a spot in March Madness. (They went all the way to the Final Four.)

Taplett said the West Palm Beach stations play like Top 20 outlets. “The market has very good competitors,” she said. “It’s so competitive every single day. Everybody brings it.” ●

LOCAL NEWS 16 Broadcastingcable.com Multichannel.com WPBF; WFLX

Felicia Rodriguez (l.) and Tiffany Kenney deliver the noon and 5 p.m. news for Hearst Television’s pace-setting WPBF West Palm Beach.

Kate Monahan (l.) and Megan Hayes hang out with a seal on WFLX’s South Florida Daily

ISyndication’s Old Rules No Longer Apply

Anything goes as station groups forge their own content fiefdoms

By Paige Albiniak palbiniak@gmail.com @PaigeA

By Paige Albiniak palbiniak@gmail.com @PaigeA

n an environment where content is available everywhere and all the time, station groups are picking up shows from places and platforms that were previously considered off-limits. Rules such as number of episodes, national clearance and exclusivity are no longer in play. Instead, groups are looking at factors such as economics and versatility, as well as what they can produce themselves when it comes to programming.

Producers have been placing first-run shows on streaming channels for several years to create secondary revenue streams. But it’s been only recently that TV stations have begun to acquire shows off of streamers. That’s largely because streaming channels had not aired the types of day-and-date programs that stations need, but with the arrival of FAST (free ad-supported television) channels, that is changing. The proliferation of platforms has also rendered exclusivity almost moot.

“There’s very little duplication of audiences between streaming and broadcast,” Stephen Brown, executive VP, programming and development, Fox Television Stations and Fox First Run, said. “It’s OK when you are trying to aggregate an audience to have it on multiple platforms. That’s the reality of our business and I think that broadcasters are beginning to understand that.”

For example, Judge Judy ended original production in 2021, but daytime viewers scarcely know that. CBS Media Ventures (CMV) sold the show’s library

episodes — also known as repeats — to stations for much-lower license fees.

Judge Judy continues to average around a 4.0 household rating, according to Nielsen, ranking it fourth in overall syndication, behind only the top-rated game shows. In February, the CBS- and Fox-owned station groups both renewed Judge Judy for three more years, and Gray Television and Hearst Television also picked up the veteran court show in multiyear deals.

In the meantime, Judge Judy Sheindlin herself moved on to Amazon Studios, where she stars in Judy Justice and produces panel court series Tribunal Justice for free streamer Freevee. In the first example of a show coming to syndication from a streamer, Scott Koondel and his Sox Productions have cleared Judy Justice in all-barter multiyear deals in 99% of the country on such groups as Nexstar Media Group, Sunbeam Television, Cox Media Group, Weigel Broadcasting and Mission Broadcasting, Koondel said. Two seasons of Judy Justice have aired on Freevee and a third is in the works.

Above, Sony Pictures Television is offering stations two new hours of NFL Network morning show Good Morning Football. Below, the off-Freevee Judy Justice has been sold in 99% of the country.

Koondel has agreements in place for stations to take Tribunal Justice starting with the 2026-27 season, giving those stations Judy-centric court blocks. He is also offering stations that did not renew Judge Judy in this cycle two more episodes of Judy Justice each day.

Station executives argue that the deal is not so groundbreaking, since Judy Justice is essentially a new version of Judge Judy. But the key difference is that Amazon already paid for the show to be produced, so stations can now acquire it without cash changing hands.

‘Football’ All Year Round

Another example of a show that’s tweaking the typical business model is Sony Pictures Television’s Good Morning Football. The football-focused talk show has aired on NFL Network since 2016. Now, NFL Network is moving the show from New York to Los Angeles’s SoFi Stadium and expanding it by two hours. Those two new hours are being packaged and sold to TV stations, and possibly other platforms, to run five days a week in any time period a station prefers. The expansion hours will be produced 42 to 48 weeks a year, giving stations year-round programming.

Good Morning Football is poised to break the mold in a few ways — one of which is that TV stations generally haven’t aired sports programming in syndication. But nothing on broadcast TV is as marketable or appealing as the NFL, so it makes sense TV stations would want to offer pro football-focused programming to their local audiences.

In a similar vein, broadcast networks

18 Broadcastingcable.com Multichannel.com SYNDICATION

Good Morning Football: NFL Media ; Judy Justice Amazon Freevee

are also starting to toy with the model of letting other platforms pay for the privilege of getting a show’s first run. Amazon MGM Studios is producing a U.S. remake of hit British game show 1% Club, with Patton Oswalt as host. Eight days after each episode debuts on Prime Video, it will run on Fox.

“Deals like this make broadcast sustainable when it was increasingly becoming not,” Frank Cicha, executive VP, programming, Fox TV Stations and MyNetworkTV, said. “This is what needs to happen.”

NBCUniversal is currently in the market floating the idea of bringing Suits to TV stations, sources said, after the off-basic cable show became a streaming sensation on Netflix. Suits — starring Duchess of Sussex Meghan Markle, Gabriel Macht and Patrick J. Adams — originally aired on USA Network from 2011 to 2019. It was previously available on Prime Video, but Netflix snapped up the rights to seasons one through eight when they became available and started streaming the show in June. (Season nine, by which time Markle and Adams had departed, is only available on Peacock.) All of a sudden, a show that had been off the air for four years was dominating the streaming charts for weeks on end.

Should TV stations decide to pick up an off-network run of Suits, it will mark the first time a series has started on cable, moved to streaming and then headed to TV stations — riding a resurgence years after its original cable run.

Similarly, Amazon MGM is considering bringing procedural Bosch to TV stations. Bosch , starring Titus Welliver, aired for seven seasons on Prime Video and its sequel, Bosch: Legacy , also starring Welliver, has aired for two seasons on Amazon Freevee with season three on the way. Stations would have plenty of episodes to work with even with the shorter seasons that streamers typically order.

All of this gives TV stations more options and flexibility as they consider their programming options.

NBCUniversal is considering shopping Suits, the surprise off-cable streaming hit starring Gabriel Macht (l.) and Patrick J. Adams, to stations.

“A lot of the shows we’re doing now, we’re acquiring on a nonexclusive basis,” E.W. Scripps head of programming, national networks Tom Zappala said. “With declining ratings on the traditional side, you need more avenues to monetize the shows.”

Scripps, which now owns Court TV, is looking at how it can turn a true-crime show like Someone They Knew into a program it can run on its TV stations. Scripps also owns such FAST networks as Bounce, Grit and Laff, acquired from Katz Media Group in 2017. Scripps purchased Ion Media’s networks and TV stations in 2017 and offers national news service, Scripps News, formerly Newsy, which streams over OTT platforms. Many Scripps stations offer an hour of Scripps News each day.

“There are fewer syndicated options, but we are creating our own opportunities with the content we create and with our recent foray into sports,” Zappala said.

Groups Churn Out Content Hubs

Scripps is a good example of what many television station groups — including Nexstar, Sinclair and Gray — are doing, which is making themselves into local, regional and, in some cases, national content hubs. Groups are producing local content and news and offering that content over TV stations, FAST channels, diginets and apps.

Gray has Investigate TV Plus, which it produces and runs on its owned TV

stations in 113 markets, Matt Jaquint, senior managing VP and chief revenue officer at the station group, said. Gray is considering taking Investigate TV Plus out to the rest of the country. Gray also has FAST channel Local News Live, produced from its Washington, D.C., bureau. A version of LNL already airs as a linear show on Gray’s NBC and The CW affiliate WIS in Columbia, South Carolina, and Gray could add LNL to its other owned stations.

Station groups selling their programming to other broadcasters is something that is always discussed but rarely works. As traditional providers pull back, though, stations need to produce for themselves.

“I think that will be looked at more and more as we look at synergies and costs, because these things aren’t cheap to make,” Jaquint said. “I think as station groups consider what we can do together that makes sense, that’s how the industry changes.”

By taking advantage of all of these options, stations can be less reliant on expensive shows produced by Hollywood studios, although buyers say there’s still room in a mix for a few of those.

“We are definitely still willing to pay for premium syndication,” Zappala said. “Wheel of Fortune and Jeopardy! are perfect examples; we have those in 53 of our markets. There’s a reason we still pay for syndication, but the cost has to fit the model and daytime is a tougher place to make that work.”

While the local TV-station business has gotten tougher than ever, as recent station-group earnings reports demonstrate, groups are now freed up to find programming in whatever ways work for them.

“We’re willing to look at content wherever it is coming from,” Zappala said. “Our main feature is local news and information. Our job is to get great information and deliver it to people across all those different ways of distribution. That’s why I see more optimism in our future.” ●

Multichannel.com Broadcastingcable.com 19 SYNDICATION

Suits: Shane Mahood/USA Network/NBCU Photo Bank/NBCUniversal via Getty Images

Want a Live Audience? Trilith Studios Says Come on Down

Atlanta-area complex is opening two new stages with seats for 750

By Jon Lafayette jon.lafayette@futurenet.com @jlafayette

By Jon Lafayette jon.lafayette@futurenet.com @jlafayette

Atlanta, already a hub for television and movie production, is getting new studios designed to fill a perceived scarcity in facilities for programs with live studio audiences.

Live programming is a genre that appears to be growing even as streaming services and traditional networks cut back from the “peak TV” era of scripted shows.

Trilith Studios in Fayetteville, Georgia, already the state’s largest film studio, plans to open the doors in May on two new 25,000-square-feet sound stages, each able to host a live studio audience of 750.

“This facility was specifically designed for audiences and there really isn’t an offering that exists in this market,” Dawn Simonton, VP of sales, marketing and production, told Broadcasting+Cable.

Simonton was hired by Trilith to bring in productions. She previously worked at NEP Group and spent 20 years at Turner Broadcasting System and WarnerMedia, where she headed production operations, bringing in shows like the SAG Awards, NBA All-Star Weekend and March Madness.

“Our goal with our new live stages is to fill a void in Atlanta by providing a purpose-built alternative for live production and build the best facility available — one that’s designed with both the production and the audience in mind,” Craig Heyl, chief operating officer and executive in charge of production at Trilith Studios, said.

“Dawn’s deep experience in the

evolving technology needs of today’s live productions in entertainment and sports is a huge asset as we expand our live production business,” he said. “I’m excited to see us make this move.”

Known as Pinewood Atlanta Studios until its British owners sold the U.S. operation to local investors, including the founders of Chick-fil-A, Trilith has already produced shows with live audiences, including the syndicated Family Feud and VH1 series Nick Cannon Presents: Wild ’N Out, and expects to grow that business when the new stages open.

“We feel like we’re really diving into an emerging part of the business,” Simonton said.

The stages were designed to make both the production teams and the audience comfortable.

The studios are plug-and-play, with direct fiber connectivity and a bay where TV trucks can jack into the system, executives said. There is an abundance of space for workshops for scenery and costumes, large production offices that are near the stages and VIP space for talent. Each studio also has an insert stage, where one-onone interviews can be conducted.

There is a new hotel where production staffers can stay with high-end restaurants, wellness centers and other facilities designed to foster creativity.

The live stages will be located outside the main movie studio space so audience members won’t have to go through the security gates. Waiting areas will be comfortable and air-conditioned.

“We really do try and bend over backwards as far as guest services,” Simonton said. “When the audience members are enjoying their experience it makes the production that much better. We really provide state-of-the-art facilities that you just can find in a warehouse setup.”

Simonton said she’s reaching out to production companies and casting companies, as well as technology partners, to start to fill up the new studios.

“We’ve talked to a couple of really strong candidates who are looking at the space and hopefully [once the word gets out] we’ll start to talk to even more,” she said. “Hey, they’re going to be knocking down my door.”

A Peachy Production Hub

Tax benefits have helped make Georgia and Atlanta popular places to produce movies and TV shows.

Trilith Studios’ new facility near Atlanta, including two 25,000-squarefoot soundstages, will be designed to cater to live studio audiences.

The Georgia Department of Economic Development said the film industry has brought as much as $4 billion a year to the Georgia economy and lists 39 TV shows and films in production, ranging from game shows like Family Feud to network series like Will Trent and streaming programs including Amazon Prime Video’s The Bondsman.

Trilith, which has more than 1.5 million square feet of production facilities with 34 sound stages and an extensive 400-acre backlot, isn’t the only outfit building studio space. Last year, Gray Television had the grand opening of its Assembly Studios complex on the former home of a General Motors plant. NBCUniversal Media is a big tenant.

On the other hand, Tyler Perry has put on hold plans for an $800 million expansion of his studios in Atlanta because of concerns over how artificial intelligence will impact video production. ●

20 Broadcastingcable.com Multichannel.com CURRENCY

People

Notable executives on the move

AXS TV

Andy Schuon was named president of Anthem Sports & Entertainmentowned networks AXS TV and HDNet Movies. Schuon is the former president of Revolt Media and has managed such music brands as Viacom’s MTV Networks, Warner Bros. Records and CBS Radio.

NETFLIX

Jeff Gaspin has joined Netflix as VP of unscripted series, charged with bolstering its roster of unscripted shows. The former NBCUniversal Television Entertainment chair ran Gaspin Media, the studio that made The Tinder Swindler and Rhythm & Flow.

BBC STUDIOS

Rachel Bendavid was named executive VP, scripted programming at BBC Studios Los Angeles Productions. She had been head of scripted programming for the co-production partnership between Lions gate and BBC Studios that launched the CBS series Ghosts.

NIELSEN

Nielsen has named Nicolina Marzicola as chief people officer, leading the audience measurement firm’s global human resources function. She comes from HP, where she had been global head of HR, commercial head and global head of HR operations.

BBC STUDIOS

Angie Stephenson was elevated to executive VP, scripted programming at BBC Studios Los Angeles, working jointly with Rachel Bendavid. She had been senior VP of scripted development at BBC Studios and was its executive producer for Ghosts.

PARAMOUNT

Lee Sears was appointed as president of international market advertising sales at Paramount Global, a new post that unifies pay TV, streaming and broadcast ad sales teams. He had been executive VP, head of international sales and integrated marketing.

FREMANTLE

Jimmy Fox has joined Fremantle as executive VP of unscripted development and sales for its U.S. operations. The three-time Emmy winner comes from Religion of Sports (ROS) and will continue to serve as an executive producer on Main Event Media’s slate of ROS events.

SCRIPPS

The E.W. Scripps Co. has named Kate O’Brian as president of news, a new post overseeing the company’s local and national news operations. O’Brian had been in charge of the company’s national news outlets, Scripps News and Court TV.

NEP

NEP Group has named Lise Heidal president, NEP Europe, for NEP Broadcast Services, based in Norway and responsible for nine countries in Northern, Central and Southern Europe. She had been VP, of production, at TV2, Norway’s largest commercial broadcaster.

SHOWSEEKER

ShowSeeker, creator of the cloud-based Pilot advertising order-management system, has named Joni Claerbout as VP of sales and client engagement. She comes from Cox Media Group, where she was director of sales for Florida, Georgia and Alabama.

22 Broadcastingcable.com Multichannel.com

FATES & FORTUNES

SINCLAIR

Sinclair named Jim Doty VP and general manager of its stations in the Tri-Cities region of Tennessee and Virginia, NBC-The CW affiliate WCYB and ABC affiliate WEMT. He had been VP and GM of Tegnaowned KERO Bakersfield, California.

TUBI

Fox-owned ad-supported streaming service Tubi has tapped Jeff Lucas as chief revenue officer. Most recently chief revenue officer of video commerce platform Firework, Lucas was formerly head of North American sales and global client solutions at Verizon Media.

TEGNA

Tegna has elevated Tom Cox to chief growth officer, a new post at the station group reporting to president and CEO Dave Lougee. Cox had been president of the Premion over-the-top advertising unit as well as senior VP, business development at Tegna.

UP

UP Entertainment has added Ryan Randall as creative director, responsible for leading the creative direction across all of the company’s brands. He comes from The Walt Disney Co., where he was creative director for Freeform.

TEGNA

Daniel Spinosa has been elevated to president of Tegna’s Premion, succeeding Tom Cox. The 20-year media and finance veteran had been Premion’s chief financial officer, following finance, product and digital leadership roles at Comcast and a senior finance role at AOL.

WABC

WABC New York has added Joelle Garguilo as an entertainment reporter. She comes from WNBC New York, where she was an entertainment and feature reporter for New York Live, an E! News correspondent and a contributor to NBC’s Today With Hoda & Jenna.

TELEMUNDO

Gemma Garcia was named executive VP of Noticias Telemundo, with oversight of the network’s news programming, editorial units, digital news properties, newsgathering and bureaus in the United States and Latin America. She was head of news at Spanish OTT platform RTVE Play.

WBNS

Tegna-owned WBNS Columbus, Ohio, has elevated Angela An to co-anchor of 10TV News at Four and 10TV News at Five-Thirty. With the CBS affiliate since 2000, she most recently was a co-anchor on early morning newscast Wake Up CBUS.

BRIEFLY NOTED

Other industry execs making moves

Brian Hurley, chief regulatory counsel at ACA Connects, was named to the Federal Communications Commission’s Consumer Advisory Committee. … Chanley Painter has joined Fox News Channel as an overnight anchor. She had been a legal correspondent and field anchor for Court TV. … Liberty Latin America has named Eduardo Diaz Corona as senior VP, general manager, Liberty Puerto Rico and U.S. Virgin Islands. Also, Rocio Lorenzo was elevated to senior VP and general manager, Cable and Wireless Panama. She had been senior VP, chief customer officer. … Dr. Lakeisha MaddreyLashley was named to the Maryland Public Broadcasting Commission, Maryland Public Television’s 11member governing body. She is the principal of Fairland Elementary School in Montgomery County, Maryland.

For more personnel news from the TV, video and connectivity business, go to nexttv.com/ fates-and-fortunes.

Multichannel.com Broadcastingcable.com 23

FATES & FORTUNES

24 Broadcastingcable.com Multichannel.com FREEZE FRAME

On stage at the March 21 Multichannel News Wonder Women of New York event at Manhattan’s Ziegfeld Ballroom (From l.): Kate Morgan, Gina Reduto, Tina Thornton, Stephanie Dorman, Ingrid Ciprián-Matthews, Woman of Influence Sarah Kate Ellis, Adriana Waterston, Adrienne Roark, Lucilla D’Agostino, Barbara Maushard, Kim Granito, Lindsey Woodland, Kavita Vazirani, co-host Victoria Arlen of ESPN, Laura Palumbo Johnson, Noga Rosenthal and Sheereen Miller-Russell

Honorees Ingrid Ciprián-Matthews, president, CBS News, and Adrienne Roark, president, content development and integration, CBS News and Stations and CBS Media Ventures.

Barbara Maushard, senior VP, news, Hearst Television, on stage at the Ziegfeld Ballroom.

Event host Natasha Verma (l.), anchor at WNYW New York, with Sheereen Miller-Russell, executive VP, ad sales, client partnerships & inclusive solutions, Warner Bros. Discovery.

Credit: Mark Reinertson

FREEZE FRAME Multichannel.com Broadcastingcable.com 25

Sarah Kate Ellis, president and CEO, GLAAD accepts the Woman of Influence award.

Reality TV was represented at Wonder Women of New York by Lucilla D’Agostino (l.), head of Evolution Media and Big Fish Entertainment, Amazon/MGM, and Laura Palumbo Johnson, co-founder and executive producer, Magilla Entertainment.

Wonder Women honoree Adriana Waterston, EVP and Insights & Strategy Lead, Horowitz Research division, MARC Research.

Co-host Victoria Arlen (l.), event host and reporter, ESPN, with honoree Tina Thornton, executive VP, creative studio and marketing, ESPN.

Noga Rosenthal, general counsel and chief privacy officer, Ampersand, on the Ziegfeld Ballroom stage.

Dominique Batiste, global head, market research at Eventbrite and VP and programming co-chair of The WICT Network: New York, co-sponsor of the Wonder Women luncheon.

Comcast and TV One awarded $10,000 to Hartford, Connecticut, organization Hart Lift during a Black History Month watch party for TV One’s Urban One Honors (l. to r.): Camille Thelemaque-Bearden, TV One; Adrienne Cochrane, CEO, YWCA Hartford

Sen.

26 Broadcastingcable.com Multichannel.com FREEZE FRAME

TV One; BOFA (2); Scott Kirkland/Fox; Dimitrios Kambouris/Getty Images

Region; Connecticut

Douglas McCrory; Carolyne Hannah, Comcast; LaTanya Butler, TV One; David Griggs, MetroHartford Alliance; Toi Thornton, anchor, NBC Connecticut; and Marcus Cook, TV One.

At the 2024 Broadcasters Foundation of America fundraising gala at The Plaza in New York (l. to r.): Scott Herman, chairman, BFOA; Hearst EVP and COO Jordan Wertlieb, the 2024 Golden Mic Award winner; and Tim McCarthy, president, BFOA.

Next Level Chef judge Nyesha Arrington arrives at Fox’s Spring Press Event on the Fox lot in Hollywood.

(From l.): Director Peter Farrelly and cast members Andrew Santino, Jermaine Fowler, Lex Scott Davis and John Cena at the New York premiere of Prime Video original movie Ricky Stanicky

(From l.): Broadcasters Foundation of America chair Scott Herman and board member Deborah Roberts, co-anchor of 20/20 on ABC; Deborah Norville, winner of the Edward F. McLaughlin Lifetime Achievement Award; and BFOA president Tim McCarthy at the group’s gala fundraiser in New York.

FREEZE FRAME Multichannel.com Broadcastingcable.com 27

Nathan Penrod/ACA Connects (2); Media+Tech Collective. Mat Hayward/Getty Images for Prime Video; Charley Gallay/Getty Images for Netflix

(From l.): ACA Connects president and CEO Grant Spellmeyer; FCC commissioner Anna Gomez; and Boycom president/CEO and co-founder Patricia Jo Boyers, the ACA chair, at the ACA Connects Summit in Washington, D.C.

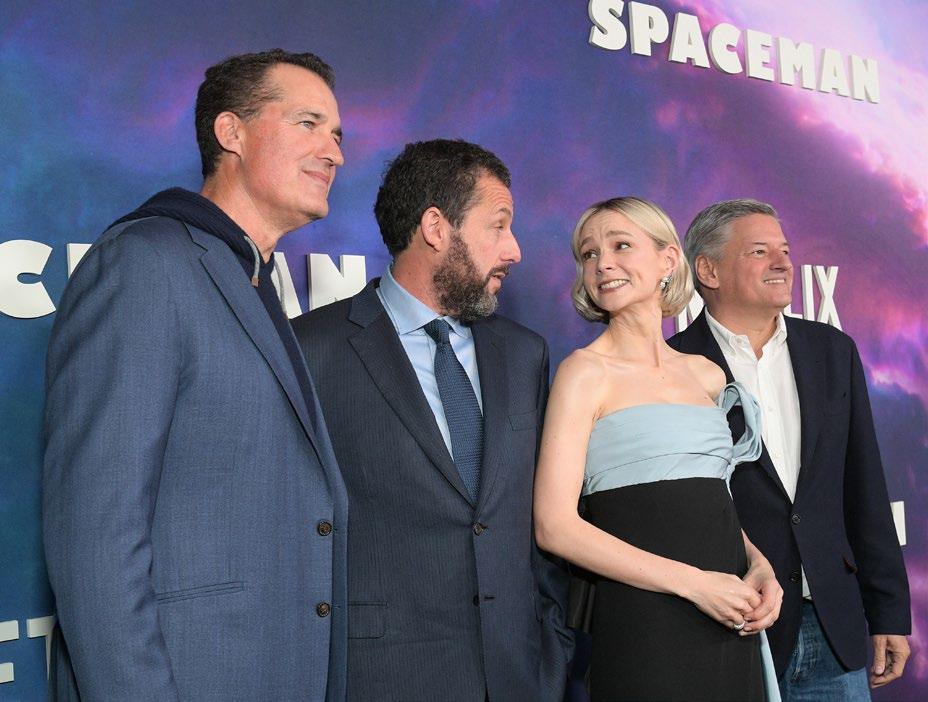

(From l.): Scott Stuber, former chairman, Netflix Film; Adam Sandler; Carey Mulligan; and Ted Sarandos, co-CEO, Netflix at the special screening of Spaceman at the Egyptian Theatre in Hollywood.

Executive producer Jonathan Nolan (l.) and Amazon Studios head of marketing Sue Kroll at the SXSW party for Prime Video’s Fallout

Team “Parabellum Group” from the University of Denver celebrate their win at the 17th annual Media+Tech Collective of the Rockies Innovation Challenge competition. (From l.): judge Mark Bridges of CableLabs, winner Lis McLaughlin, judge David Sedlock of Zayo, winner Benjamin Shorb and judge Brooke Puter of Comcast.

Frank Luntz, Luntz Global communications adviser and pollster, speaks at the ACA Connects Summit at the Grand Hyatt Washington in Washington, D.C.

Data provided by

Ad Meter

Who’s

spending what where Q1 2024 TV ADVERTISING RECAP

The most-seen brands and industries on TV, and more

Impressions Spotlight

Highlighted below are top programs and networks ranked by household TV ad impressions delivered from Jan. 1-Mar. 15.

Total household TV ad impressions: 1.56 trillion ( - 1.69% YoY)

Big 4 (ABC, CBS, Fox and NBC) TV ad impressions: 308.5 billion (+ 5.20% YoY)

Key takeaway: While overall television ad impressions are slightly off of last year’s pace halfway through March, this year is also dealing with the repercussions of 2023’s entertainment work stoppages, and a later start to the NCAA Men’s Basketball Tournament. Just the same, the Big 4 networks actually delivered more ad impressions year-over-year, partly due to airing more ads.

TOP 5 PROGRAMMING, JAN. 1-MAR. 15

By share of household TV ad impressions

1. NFL

Share of impressions: 3.70%

Top advertiser: Verizon (1.95%)

2. Men’s College Basketball

Share of impressions: 1.74%

Top advertiser: Lexus (1.76%)

3. NBA

Share of impressions: 1.54%

Top advertiser: State Farm (2.21%)

4. Law & Order: SVU

Share of impressions: 1.33%

Top advertiser: Domino’s (1.69%)

5. NCIS

Share of impressions: 0.88%

Top advertiser: Dominio’s (1.58%)

TOP ADVERTISERS

By share of household TV ad impressions (Jan. 1-Mar. 15)

1

Share of impressions: 0.93%

Top network: CBS (11.98%)

Top program: NFL (6.85%)

2

Share of impressions: 0.71%

Top network: ION (7.40%)

Top program: Law & Order: SVU (2.77%)

3

Share of impressions: 0.57%

Top network: ABC (11.53%)

Top program: NFL (11.59%)

4

Share of impressions: 0.56%

Top network: CBS (0.83%)

Top program: NFL (7.83%)

5

Share of impressions: 0.51%

Top network: CBS (7.65%)