SUMMER 2024

OWNEROCCUPIED RENTALS PURCHASING PROPERTY IN FLORIDA

PORSCHE EXPERIENCE CENTRE

SUMMER 2024

OWNEROCCUPIED RENTALS PURCHASING PROPERTY IN FLORIDA

PORSCHE EXPERIENCE CENTRE

Dear Valued Readers,

With immense joy and pride, we are thrilled to present to you the second edition of Fund Magazine. The response to our inaugural edition at the end of 2023 was extraordinary, and we can't wait to share our journey and successes with you.

First and foremost, we want to express our sincere gratitude to you—our readers, content contributors, distribution partners, and referral partners. Your support has been the driving force behind the reach and impact of Fund Magazine. We are proud to donate significant pages to local businesses, charitable organizations, and referral partners that we want to highlight. By doing so, we all benefit by providing solid content to potential clients and referral partners, expanding our brand awareness through the power of collaboration and shared networks.

As you explore the pages of this edition, you'll discover that our scope extends well beyond mortgages. While we continue to provide insightful financial information, we are dedicated to offering you a holistic experience that includes luxury and lifestyle content. Our goal remains to inspire and guide you towards intelligent financial decisions while enjoying the process.

In the wake of our first edition, we've witnessed flourishing connections among our magazine partners. Referrals have flowed organically between businesses, and we’ve received wonderful feedback from readers like you. With an average read time surpassing industry norms, it’s clear that genuine engagement and interest are at the heart of what we do.

The success of our first edition has reinforced our commitment to delivering the most up-to-date and relevant information. Our team of experts is ready to share valuable insights, practical advice, and real-life stories that simplify the often-overwhelming world of mortgages and real estate.

At Fund Magazine, we believe in the transformative power of education for making informed financial decisions. Through our pages, we aim to empower you to take control of your financial future. Together, we are building a community that is not only educated and informed but also financially savvy, supporting and uplifting one another.

We extend our deepest thanks to everyone who has contributed to making Fund Magazine a reality. We eagerly anticipate even more engagement in this second edition, with additional distribution partners joining our community.

Here's to a future marked by informed choices, financial prosperity, and the joys of home ownership. Don't forget to share your thoughts with us; we love hearing from you!

Best Regards,

Heike Hientzsch

Scott Westlake

For advertising inquiries, please email Scott Westlake at scott@fund-mag.com

Striking design and timeless craftsmanship combine to create exquisite exterior spaces. Our seamless process from design to build ensures clients enjoy a high-quality outdoor space that is tailored to their unique needs.

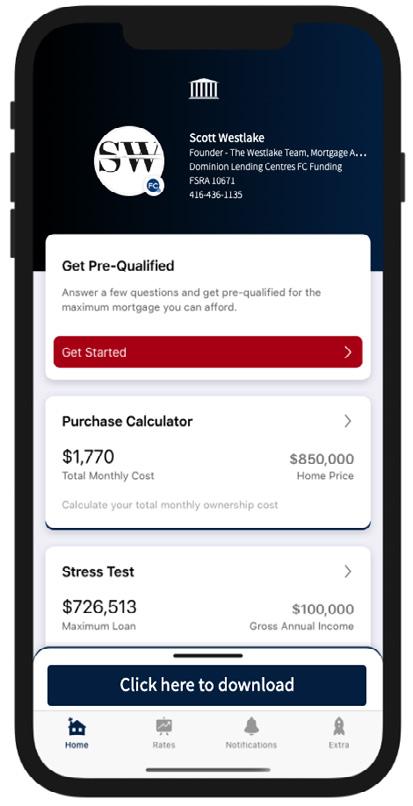

• Calculate your total cost of owning a home

• Estimate the minimum down payment you need

• Calculate Land transfer taxes and the available rebates

• Calculate the maximum loan you can borrow

• Stress test your mortgage

• Estimate your Closing costs

• Compare your options side by side

• Search for the best mortgage rates

• Email Summary reports (PDF)

• Use my app in English, French, Spanish, Hindi and Chinese

SCOTT WESTLAKE

Mortgage

Agent,

Dominion

Lending Centres FC Funding

FSRA 10671

In the ever-evolving landscape of business operations, accessing cutting-edge equipment and technology stands as a cornerstone for success. However, acquiring such assets outright can pose significant financial challenges. That's where equipment leasing steps in, offering a smart, strategic approach that empowers businesses to thrive without the burden of hefty initial investments.

Leasing is a viable alternative for various types of businesses, irrespective of their structure or industry focus. It extends far beyond merely acquiring hardware or software; it encompasses the entire spectrum of operational necessities, from installation to consultation. A staggering 8 out of 10 businesses opt for leasing over cash or bank loan equipment purchases. Why? Because businesses thrive by utilizing equipment, not by owning it outright.

Unlike the sluggish pace often associated with traditional financing sources, leasing aligns with the agility and adaptive nature of modern businesses. Online applications get swift approvals within minutes, bypassing the tedious wait a nd providing the flexibility needed for fast-paced operations. Moreover, a lease line of credit brings added advantages, offering predetermined rates tailored to the volume of the line, ensuring a lower interest rate compared to individual leases.

Technology evolves rapidly, rendering once-cutting-edge equipment obsolete. Leasing comes with a built-in termination date that aligns with the equipment's productive life. This allows businesses to leverage the latest technology cost-effectively until it no longer meets their needs, enabling easy upgrades without the hassle of dealing with outdated assets.

Businesses across various sectors benefit from equipment leasing. From restaurant equipment to vehicle fleets, medical tools in doctors' offices, industrial buildings, and construction sites, leasing facilitates

access to crucial assets. Furthermore, leasing can simply serve as an avenue to upgrade existing or older equipment, ensuring businesses stay competitive in their respective fields.

Easylease offers lease financing for leasehold improvements and infrastructure development, catering to remodeling and expansion in retail chain stores, franchise updates, plant and office expansion, among other qualifying applications.

In the equipment leasing process, specific qualifiers streamline transactions:

• Transaction Qualifiers for Established Businesses:

• 2 years plus in business

• Generating revenue

• Registered Canadian business (Incorporated, Sole Proprietor, Partnership, etc.)

• Equipment need within 60 days

• Transactions exceeding $80k require financial statements (2 years and interim)

• Transaction Qualifiers for Newer Businesses (2 Years or Less):

• Transaction size not exceeding $70k

• Personal guarantee requirement

• Submission of personal net worth statement and business plan

• 3 months' business bank statements if available

In essence, equipment leasing presents a strategic pathway for businesses to thrive, providing access to essential assets without the upfront financial strain. Whether it's keeping up with technological advancements, upgrading existing infrastructure, or efficiently managing operational costs, leasing emerges as a dynamic solution empowering businesses to soar towards success.

To apply now or connect with us further:

1. Elite Customer Service: Every customer gets a dedicated local leasing representative, ensuring personalized, knowledgeable, and attentive service.

2. Optimal Rates and Terms: Through strategic partnerships with over 30 funding partners, we secure preferred rates and terms, passing on the best deals to our customers.

3. High Approval Ratio: Our experts craft credit packages and present them to a select group of funding partners, boasting a 95% approval ratio for all credit submissions.

4. Swift Approvals: Credit approvals within minutes for amounts under $50,000, and responses within one business day for larger amounts.

5. Effortless Process: Advanced e-commerce tools enable instant online tracking, credit scoring, and customized lease calculators for easy and quick financing.

6. Comprehensive Asset Management: Access online asset tracking and tailored reports, ensuring streamlined lease management throughout the term.

7. New Business Support: Specialized funding partners cater to new businesses, facilitating credit approval for companies under a year old.

8. Scalable Support: Years of experience supporting businesses of all sizes, from small enterprises to large corporations, ensuring tailored financial assistance.

9. Vendor Leasing Programs: Custom-designed vendor programs and innovative tools for equipment vendors, enhancing business rowth opportunities.

In essence, our commitment lies in providing tailored, hassle-free, and efficient leasing solutions that empower businesses to thrive, irrespective of their size or tenure.

Summer brings with it the perfect excuse to relax and unwind with a refreshing cocktail in hand. This season, elevate your mixology game with these trendy summertime concoctions that are sure to tantalize your taste buds and keep you cool under the sun.

Embrace the light and fruity flavours of summer with a Rosé Spritz. This effervescent cocktail is perfect for warm evenings and outdoor gatherings.

INGREDIENTS:

• 3 oz. chilled rosé wine

• 2 oz. soda water

• Fresh berries (for garnish)

• Ice

INSTRUCTIONS:

1. Fill a glass with ice.

2. Pour in the rosé wine and soda water.

3. Stir gently to combine.

4. Garnish with fresh berries for a pop of colour.

The Spicy Margarita has been gaining popularity for its unique blend of heat and zesty citrus flavours that truly pack a punch.

INGREDIENTS:

• 2 oz. tequila

• 1 oz. fresh lime juice

• 0.5 oz. agave nectar

• 3-4 slices of jalapeño

• Ice

INSTRUCTIONS:

1. Muddle the jalapeño slices

For a refreshing and herbaceous option, look no further than the Cucumber Basil Smash. This cocktail is a delightful mix of crisp cucumber, fragrant basil, and a hint of sweetness.

INGREDIENTS:

• 2 oz. gin

• 1 oz. fresh lemon juice

• 0.5 oz. simple syrup

INSTRUCTIONS:

• 4-5 slices of cucumber

• 3-4 fresh basil leaves

• Ice

1. In a shaker, muddle the cucumber and basil leaves.

2. Add gin, lemon juice, simple syrup, and ice to the shaker.

3. Shake vigorously and strain into a glass filled with ice.

4. Garnish with a cucumber slice and a basil leaf.

When it comes to reverse mortgages, opinions are often sharply divided, ranging from skepticism to endorsement. The experience one has had with the product or the information they've gathered can shape their perspective. Personally, I've had positive experiences with reverse mortgages, which guide my perspective on this unique financial tool.

By Scott Westlake

qualify for a mortgage, a line of credit

may be a suitable choice, providing cash flow flexibility. But it comes with regular payments and qualification requirements, which can be challenging due to stringent lending standards. If you do not qualify for a mortgage or line of credit, or you wish to avoid regular payments, drawing on investments becomes the only alternative. Yet, this may have tax implications and affect long-term cash flow. Beyond investments, there's the option of private lending, which, like a reverse mortgage, allows qualification based on home equity and provides leverage. It can even capitalize interest-only payments. The advantage here is that private mortgages can be obtained at any age, offering flexibility for those under 55.

However, private mortgages come with fees, which can make the cost of capital more expensive than expected. Private mortgages typically offer one-year terms, while reverse mortgages provide various term options, including fiveyear terms. Private mortgages have setup and renewal fees, which reverse mortgages do not, making reverse mortgages a more cost-effective option. Reverse mortgages usually offer lower interest rates and are designed to be conservative in terms of loanto-value ratios, helping to safeguard equity. Private mortgages can erode equity if over-leveraged and left on the balance sheet for too long.

It's essential to clarify some common misconceptions about reverse mortgages. Firstly, you continue to own your home and retain full control over it. The lender cannot force you to sell, and you can live in your home for as long as you wish. You are responsible for property taxes and general maintenance, but that's the extent of your obligations. Most Canadians maintain over 50% equity in their homes, and some reverse mortgage products

offer guarantees to ensure you always have equity. While the mainstream reverse mortgage products typically require an applicant to be at least 55, private lending can provide similar solutions to those under 55. The age factor mainly influences the mortgage leverage you can apply, which is logical for securing equity in your home and avoiding over-leverage.

In the end, whether a reverse mortgage makes sense depends on your specific circumstances and financial goals. Working with a knowledgeable and reputable broker, banker, or financial

professional who understands the product and its alternatives is crucial. Debt can be a valuable financial tool when used wisely and managed effectively, but it's not suitable for everyone. Access to a wide range of products and services is a tremendous value for the mortgage broker channel, but, as with all financial instruments, careful handling is essential.

In summary, reverse mortgages provide a unique and flexible solution to address the financial needs of a specific demographic. Understanding the product and working with an experienced advisor are key factors in making the most of this financial tool.

Power Yoga, a dynamic and invigorating form of yoga, blends strength, flexibility, and mindfulness. It's a fastpaced practice that challenges both body and mind. Here's what you need to know about it:

Power Yoga is a modern style developed in the late 20th century, and draws from traditional yoga but with a more vigorous approach. It focuses on flowing sequences of postures to build strength, increase flexibility, and improve overall fitness.

Benefits include improved physical fitness, increased heart rate, calorie burn, muscle building, weight loss, enhanced stamina, and cardiovascular health. It also promotes mental well-being by reducing stress, enhancing focus, and improving mental clarity. It's effective for managing anxiety, depression, and other mental health conditions.

Compared to traditional yoga, Power Yoga is fasterpaced, with dynamic sequences emphasizing strength and endurance over flexibility and relaxation.

For weight loss, it combines cardiovascular exercise and strength training, leading to increased calorie burn and improved metabolism.

It's highly effective for building strength and endurance, engaging multiple muscle groups, improving muscle tone, balance, and physical performance.

Power Yoga aids stress relief and mental clarity through physical movement, breathwork, and mindfulness, promoting inner peace and relaxation.

When choosing a class, consider your experience level, fitness goals, and preferences. Look for experienced instructors who provide modifications for beginners and challenges for advanced practitioners.

For beginners, start slowly, listen to your body, take breaks as needed, use props for support, and focus on proper alignment to prevent injuries.

Power Yoga is not just physical but also a journey of

self-discovery and personal growth, fostering selfconfidence, resilience, and empowerment.

It offers numerous physical and mental benefits, making it a transformative practice for those seeking improved fitness, stress management, and inner strength.

Ready to experience Power Yoga? Find a class that suits your goals and preferences to unleash your inner strength and embark on a journey of self-discovery and empowerment.

Visit poweryogacanada.com for more information.

A

the epitome of luxury condominium living in Toronto. This extraordinary 6,000 sq. ft. unit offers the trifecta of a perfect location, a world-class building, and a one-of-a-kind residence for your unparalleled urban lifestyle.

For nearly a century, the mere mention of the name Ritz-Carlton has been synonymous with a lavish, high-end hospitality experience. If you're seeking an elevated level of pampering and personalized attention, there's no other destination that quite compares. Whether your day involves a sumptuous mid-afternoon hot stone massage or a two a.m. room service cheeseburger, every whim is satisfied here.

The Ritz-Carlton Toronto represents true luxury living and has redefined the standard for the downtown Toronto area. Designed by Kohn Pedersen Fox Associates, this 52-story marvel on Wellington Street West is also home to more than 150 exclusive private residences, the finest of which is inarguably Cielo Alba.

This is your chance to make permanent habitancy and daily bliss at The Residences of the Ritz-Carlton Toronto your reality, and experience superlative living every day. Owners reside atop the hotel itself, with private entrance and elevator access, but also retain full usage rights to all wellness amenities—such as state-of-the-art fully-equipped fitness center, tranquil saltwater pool, double Bali beds, hot tub and steam room—plus the Ritz’s wide variety of exquisite dining, as well as valet parking, dedicated concierge, and 24-hour room service. This unique

unit within the Ritz-Carlton Residences, Toronto is your opportunity to enjoy the world-class shopping, dining and entertainment of downtown along with the unparalleled amenities that RitzCarlton owners cherish.

The Ritz-Carlton Toronto is positioned in the center of the action in Toronto's entertainment district, directly across the street from David Pecaut Square, where you'll find the Toronto Fashion Week and Roy Thompson Hall, and just a stone's throw away from a number of worldrenowned theaters such as the Royal Alexandra Theatre and The Princess of Wales Theatre. You'll also be a short walk away from TIFF Bell Lightbox, the headquarters and main venue for The Toronto International Film Festival.

ANDY TAYLOR, Broker

As you step inside Cielo Alba, the north-facing living room offers breathtaking views of the city lights. Imagined and executed by renowned Crayon Design, this singular residence was created through the merger of two units. The result is a condominium of remarkable creativity and space. It already feels like home as you take in the grandeur of its rooms. With ample natural light and generous living areas, this condominium is a blank canvas ready for your art and furniture.

The elevator on the north side opens to the office and living room, making it an exceptional residential office situation for those who need to work from home.

C: 416-994-2118 | O: 416-960-9995 andytaylor@sothebysrealty.ca

JODI ALLEN, Sales Representative C: 416-456-6075 | O: 416-960-9995 jallen@sothebysrealty.ca

So brilliant. So perfect. So unique. This luxury condominium is an exceptional opportunity to live among the clouds in one of Toronto's most desirable locations. Capitalize on this unique chance to experience the best that urban living has to offer.

Nestled on a highly sought-after street, this exceptional home boasts an amazing location that truly sets it apart. Located on a quiet street within a topranking school district and walking distance to downtown Oakville, this property offers a perfect blend of tranquility and convenience.

The primary suite features a luxurious soaker tub and heated floors for ultimate comfort and relaxation. In addition to two spacious bedrooms and a charming bathroom, the basement includes a versatile “plus one” bedroom, expanding options for family or guests.

Custom hardwood floors flow throughout the living spaces, accentuating the designer kitchen equipped with top-end stainless steel appliances. A brand new stunning Muskoka room with sliding screen windows adds a contemporary touch to indoor-outdoor living.

The home is designed for entertainment, boasting a state-of-the-art movie theatre, custom wine feature, and a professionally landscaped backyard with a putting green, hot tub, saltwater pool, sauna, outdoors fireable and a pergola – creating an ideal setting for both relaxation and gatherings. The private backyard backs onto a park, offering a peaceful retreat amidst nature for families.

This Oakville gem presents a rare opportunity, combining luxurious features, an unbeatable location, and the potential for further customization with permits for a brand new primary enclave and garage expansion. Whether you seek a comfortable family home or a stunning space for entertaining, this property has it all. Dont miss the change to make this dream home your own.

EXQUISITE CUSTOM HOME IN LORNE PARK

Set on an expansive 125' x 270' lot, adorned with majestic, mature trees, this private oasis offers a serene backyard retreat reminiscent of the beauty found in Muskoka. Indulge in the lavishness of this residence, boasting four generously proportioned bedrooms, each accompanied by its own luxurious ensuite and walk-in closet. Immerse yourself in the splendour of this remarkable property and embrace a lifestyle of unparalleled sophistication and refinement.

elcome to this custom-built luxury estate in South East Oakville. Featuring meticulous landscaping, a grand entrance, cedar-ceiling front patio, and American Cherry hardwood floors, the home boasts a chef's kitchen, serene Muskoka room, junior primary bedroom, and spa-like primary suite. Enjoy a stone patio, sauna, BBQ, saltwater pool, and gardens. Close to top schools and amenities, this is luxury living at its finest.

The Canadian mortgage landscape is evolving, and for the self-employed, securing a mortgage demands a unique approach. Unlike traditional employment, self-employment often brings variable income streams and diverse documentation requirements, presenting challenges in obtaining standard mortgages.

Business-for-Self (BFS) mortgages cater to the selfemployed, allowing them to access mortgage solutions tailored to their financial structure. These mortgages stand distinct due to the flexibility they offer in income verification and documentation, recognizing the unconventional income patterns of self-employed individuals.

Self-employed applicants encounter specific documentation needs, including income verification, business financial statements, and tax returns. Lenders keenly analyze income stability, emphasizing credit scores and financial history as crucial indicators of financial responsibility.

Verifying income for self-employed individuals often involves innovative approaches. Methods like stated income programs, bank statements, or Notice of Assessments (NOAs) are commonly used, providing lenders with insights into applicants' financial standings and income trends.

Knowing the available programs is key to maximizing mortgage opportunities. Some programs allow a gross up of a 2-year average income by 15%, while others permit the addition of a portion of the Net Income After Taxes (NIAT) from corporate financials to be combined with personal income. Additionally, certain programs consider 6 to 12 months of bank statements where income is stated or declared, backed by financial records that include recurring expenses.

Self-employed individuals face distinct hurdles, from irregular income patterns to the impact of business expenses on net income. To counter these, maintaining a robust credit history, meticulous financial records, and seeking professional advice prove invaluable.

Programs offering extended amortizations, up to 50 years in some cases, alleviate debt servicing strains and improve cash flow. Some mortgage products use the contract rate over the stress test for debt servicing evaluations. Moreover, certain programs provide debt servicing extensions, setting higher thresholds for easier approval.

Mortgage brokers specializing in BFS mortgages play a pivotal role. Their expertise in navigating complexities, identifying suitable lenders, and guiding applicants through the intricate application process offers immense value to self-employed individuals.

In summary, securing a mortgage as a selfemployed individual demands meticulous planning, understanding lender requirements, and seeking professional guidance. The landscape may seem complex, but with preparation and expert assistance, navigating the mortgage journey becomes smoother.

by becoming a Golf Canada Foundation Trustee

Learn more by visiting Golf Canada Foundation’s Trustee Program to get exclusive access to top players and events.

Nick Taylor tosses his putter in celebration after sinking a 72-foot eagle putt on the fourth playoff hole to defeat Tommy Fleetwood and win the 2023 RBC Canadian Open.

Nick spent five years on Team Canada, four years on the Amateur Squad from 2008-2010, and one year on the Junior team in 2006.

Are you tired of the Canadian winter freeze? Perhaps it’s time to consider the sunny allure of Florida and invest in property there to fulfill your American dream.

Absolutely, Canadians can purchase houses in Florida without any restrictions. The process involves obtaining a tax identification number, opening a US bank account, and addressing associated fees and taxes. While purchasing property in Florida as a Canadian, it's vital to note that local property rules may vary from Canadian province regulations.

Various expenses need consideration when buying property in Florida. Alongside the down payment, account for real estate commission, legal fees, and closing costs, typically amounting to around 2% of the house's original cost. Ensure thorough research of the area’s safety and investment potential while also consulting with your mortgage company regarding financing options.

Defining your criteria before purchasing property in Florida is essential. Clarify the property’s intended use – vacation home or rental property? Consider your desired lifestyle and location preferences, like proximity to beaches, mountains, or theme parks, and align them with your budget. With Florida's 67 counties, factors like crime rates, climate, amenities, and attractions become critical, making it beneficial to scout properties with licensed local realtors.

The appeal of purchasing property in Florida as a Canadian extends beyond its sunny weather:

1. Climate: Florida's subtropical climate with mild winters and abundant sunshine is a major attraction.

2. Diverse Real Estate Market: From beachfront houses to condos and golf communities, Florida offers varied property types at different price points.

3. Cost of Living: Relatively lower compared to states like Hawaii, California, and New York.

4. Investment Opportunity: Steady property value appreciation with no state income tax adds to its investment potential.

5. Canadian-Friendly Lifestyle: Canadians seeking a second home find a warm welcome, diverse amenities, cultural exposure, and numerous events.

1. Miami Beach: Vibrant city life with stunning beaches and endless entertainment options.

2. Naples: A serene beach town offering a relaxed lifestyle and great dining experiences.

3. Orlando: Theme parks, resorts, and diverse entertainment options for everyone.

4. Boca Raton: Ultimate lifestyle destination with beaches, art galleries, and exceptional golf courses.

5. Tampa: An ideal blend of restaurants, arts, and outdoor activities for property owners.

To initiate the property purchase process in Florida, ensure you have the following documents in order:

• Valid passport and driver's license

• Proof of nationality and residency

• NEXUS card (if applicable)

• Financial stability evidence: letter, bank statement, credit profile

1. Define Your Needs: Identify essential property attributes.

2. Market Research: Analyze local real estate markets, taxes, and educational opportunities.

3. Real Estate Agent: Engage a knowledgeable agent for guidance and property search.

4. Making an Offer: Negotiate terms and make an offer through your agent.

5. Closing the Deal: Finalize paperwork, secure homeowner's insurance, and pay closing costs.

By Designer Jessica Cinnamon

The kitchen is truly the heart of homes today. It’s where we dine daily, gather with friends and loved ones, and retreat for quiet moments of reflection. It’s the mostused and most-scrutinized room in the home, and I’d argue that it’s also the most valuable. This spills into renovation budgets, too. If you’re planning a project, chances are that the kitchen will eat up a good chunk of your dough.

With that said, not all kitchen upgrades are created equal. Here are some that are worth a second thought.

REMOVING WALLS: The allure of an open-concept floor plan has captivated many homeowners, but before knocking out your walls, consider the challenges of reduced privacy, noise control and structural integrity. Additionally, removing loadbearing walls requires professional assessment and reinforcement, adding to the project's complexity and cost. Partial walls, glass partitions or strategic openings might strike the right balance between openness and function.

MATERIAL SELECTIONS: I know from experience that selecting the right materials for a project is critical, and can be a daunting task. Carefully weigh your priorities, such as budget, lifestyle and environmental impact. For example, when choosing countertop materials for kitchens, marble or natural quartzite boast natural beauty, but a hefty price tag and high maintenance. Meanwhile, quartz offers a comparable aesthetic, but is lower on upkeep and cost.

BUILT-INS: As a designer, I appreciate the functional and aesthetic benefits of custom built-ins. They provide tailored storage solutions and streamline organization, but they're not always the most cost-effective option. Builtins are inherently permanent, limiting flexibility in furniture arrangement. And if budget is a concern, freestanding furniture pieces offer versatility and mobility while allowing for easy reconfiguration as needs evolve.

PRIORITIZING BEAUTY OVER FUNCTION: A visually stunning kitchen has its obvious appeal, but you’ll quickly discover that you need more. Features and upgrades that look great but lack comfort or ergonomics, impractical layouts that impede daily routines, or decorative accents that hinder usability can detract from the overall liveability of a home. Striking a balance between form and function ensures that your renovation not only looks great but enhances your daily experience.

Avoid costly mistakes and maximize long-term satisfaction by giving careful consideration to your renovation. Evaluate every decision through a lens of aesthetics, practicality and budget, with an eye toward the future. Taking this thoughtful approach ensures that your home reflects your vision while maintaining its enduring appeal.

company that has become known for creating stylish and well curated interiors. They provide complete bespoke residential design services throughout Toronto Ontario, the GTA, Cottage Country, Chicago, and Los Angeles. @Jessica_Cinnamon_Design

By Heike Hientzsch

The worldwide Porsche Experience Centres offer a fully rounded experience, from the curves of the demanding routes to the diverse world of brand experiences and tailor-made training courses.

One melody, one scent and the mental images start pouring in. Memories, associations and dreams are like pages from very personal adventure stories. On rare occasions, even a single word is enough to awaken powerful feelings and aspirations. A word like Porsche.

“Porsche is more than just a car. Porsche is a promise of a unique brand and product experience,” affirms Detlev von Platen, Board Member for Sales and Marketing at Porsche AG. “And since we opened at Silverstone in 2008, our Porsche Experience Centres have been delivering on that promise in the best way possible.”

“Porsche is more than just a car. Porsche is a promise of a unique brand and product experience. And since we opened at Silverstone in 2008, our Porsche Experience Centres have been delivering on that promise in the best way possible.”

The tenth experience centre of this kind is now being built. Its opening is scheduled for 2024 in Toronto, the fastest growing city in North America with its everincreasing community of sports car fans from Zuffenhausen. PECs turn dreams into real world experiences for all of the senses. The soul of the Porsche brand can be experienced here, whether they own a car with the crest or not (yet).

The PEC world is diverse and one-ofa-kind in the automotive industry. Every centre is different, uniquely integrated into the specific culture and landscape of the location, and yet still carries the same genes. Toronto will be the first city version, located just 30 minutes by car from the downtown area in a very urban environment. Driving is part of the experience here, too. Porsche is building a two-kilometre track that, like all PECs, can offer year-round driving and instructor-led training. The building was designed by HOK, the global architecture, engineering and planning firm. It is known for projects such as the Apple campus in Cupertino, the Dali Museum in Florida

The

PEC world is diverse and one-of-a-kind

in the automotive industry. Every centre is different, uniquely integrated into the specific culture and landscape of he location, and yet still carries the same genes. Toronto will be the first city version.

and the headquarter of Porsche Cars North America in Atlanta. This PEC is also geared towards sustainability through the use of innovative technologies.

It has been a decade and a half since Porsche opened its first PEC on the Silverstone Grand Prix circuit. “Home of British Motor Racing” is written above the entrance to the circuit where the first official Formula 1 World Championship race ever took place in 1950. The presence of racing history and historic vehicles is one of the elements that characterises all of the PECs. In thrilling exhibitions, with films, literature and simulated experiences –for example at the wheel of the brand's successful race cars. The current models of the present are derived from the past. The entire range can be experienced on the on-site tracks, from all-electric to hybrid or combustion engine sports cars. Challenging handling courses, wet or dry skid pads, low-friction handling courses and offroad courses.

Virtually any driving situation can be represented in the PECs.

On the one hand to improve your own vehicle control, on the other to safely experience the performance of these sports cars and to better understand vehicles and technology. Highly qualified instructors are always responsive to the exact needs of their guests and accompany them on their journey toward achieving their personal goals. The focus is on the person as the decisive element in every cockpit. That's why drivers in Silverstone and other locations can also undergo health checks or relaxing massages in the integrated Porsche Human Performance facilities.

The simulator training in the state-ofthe-art SimLabs includes features that range from fun laps on international racetracks to a serious runninggear setup including virtual reality technology. Fine cuisine and bookable event locations are an invitation to exchange ideas at every location. At

the opening ceremony in England in 2008, no one could really have known that the idea of translating a brand into an approachable cosmos of experiences would actually become a worldwide success model. But the idea was already being planned at the turn of the millennium as part of the design of the Porsche factory in Leipzig. The location, which opened in 2002, now welcomes more than 40,000 guests from all over the world each year and has also officially been called a Porsche Experience Centre since May 2021. In 2019, Porsche's home country received its second PEC at the Hockenheimring.

Just like in Hockenheim and Silverstone, the PECs in Le Mans (opened in 2015) and Shanghai (2018) are also ideal for visiting the nearby racetracks. In the USA, Porsche created its first PEC overseas with the centre at the headquarters of Porsche Cars North America in 2015. Just one year later, the second opened in Los Angeles in light of the particularly large Californian community.

The uniqueness of the two properties quickly made them popular venues for corporate parties, galas and fundraising events as well as backdrops for television shows and films. Imagination knows no limits. The first dynamic wedding took place in Atlanta in 2018 – a couple tied the knot at a speed of 110 km/h in the back of a Cayenne.

Porsche created new architectural highlights in 2021 with its PECs in

Franciacorta in northern Italy and in Chiba Prefecture near Tokyo. Franciacorta is a futuristic statement with a striking arched structure, nestled in the vineyards of Lombardy and easily accessible from Milan, Bergamo and Verona airports. At the gates of Tokyo, on the other hand, in the area surrounding the largest city in the world, the inspiration for the architecture has local roots.

The exterior design is inspired by Edo Kiriko, a traditional Japanese craft. A pattern of diagonal lines, called yaraimon, characterises and protects the facade of the main building. The detailed interior features Japanese stucco and gardens. Highly qualified instructors are always responsive to the exact needs of their guests and accompany them on their journey toward achieving their personal goals.

Wherever and however people plan to visit a Porsche Experience Centre – when they leave, they are left with memories to reminisce over. Maybe it's the smell of a leather interior, the tactile experience of a steering wheel, the visual delight of the iconic lines, the encounter with moving history or the gut feeling at high lateral acceleration. Every second, their brains will take in vast amounts of stimuli and translate them into emotions. They can revel in these sensory experiences like a page right out of their own adventure story. That's a promise.

In a world where time is of the essence and convenience is paramount, Modern Concierge stands out as a beacon of luxury service, ensuring the seemingly impossible becomes reality. With their unparalleled dedication to client satisfaction, Modern Concierge has become synonymous with excellence in the concierge industry.

Here are five remarkable instances where Modern Concierge saved the day with their bespoke services:

Last-Minute Private Jet Charter: When a high-profile client needed to attend an urgent business meeting overseas, Modern Concierge swiftly arranged a private jet charter, complete with personalized amenities and seamless travel logistics. The client arrived refreshed and ready for success, all thanks to Modern Concierge's impeccable attention to detail.

Exclusive VIP Event Access: Securing coveted tickets to exclusive events can be a daunting task, but not for Modern Concierge. When a VIP client desired front-row seats to a sold-out fashion show, Modern Concierge pulled strings behind the scenes to make it happen, granting unforgettable access and creating lasting memories.

We free you from the small worries so you can live one big life.

Bespoke Luxury Shopping Experience:

For those with discerning tastes, Modern Concierge offers a tailored shopping experience like no other. From securing limitededition designer pieces to arranging private shopping consultations, Modern Concierge ensures that every client's unique style preferences are met with elegance and flair.

Personalized Wellness Retreat: In today's fast-paced world, self-care is more important than ever. Modern Concierge excels in curating bespoke wellness retreats that cater to individual preferences, from rejuvenating spa treatments to exclusive fitness classes led by top instructors. Clients emerge feeling refreshed, revitalized, and ready to take on the world.

Exceptional Home and Car Services: Modern Concierge takes care of your personal space and vehicles with the same meticulous attention to detail. Whether arranging professional home maintenance, luxury car detailing, or even sourcing rare car parts, they ensure that your assets are in pristine condition, allowing you to focus on what truly matters.

With Modern Concierge at the helm, no request is too extravagant, no detail too small. Their commitment to excellence and passion for exceeding expectations set them apart as the premier concierge service for the modern elite. When luxury meets unparalleled service, the result is nothing short of extraordinary. Trust Modern Concierge to elevate your lifestyle and make every moment truly unforgettable.

In today's real estate market, with the cost of capital becoming increasingly expensive, many potential homebuyers are finding it challenging to qualify for a mortgage. However, there is a unique opportunity that might help you overcome these obstacles while enjoying the benefits of homeownership. This opportunity involves purchasing a property that you plan to both occupy and rent out. In this article, we'll explore why this approach can be advantageous and provide essential information about financing such properties.

Purchasing a property that you intend to both live in and rent out offers several advantages, making it an appealing option in the current real estate landscape:

Buying an owner-occupied rental property allows you to use the rental income to help with debt servicing. This can make it easier to qualify for a mortgage, potentially enabling you to purchase a more valuable property.

When you live in one of the units, you can often take advantage of lower down payment requirements typically associated with primary residences.

Supports Your Mortgage: The rental income not only helps you qualify for a mortgage but also contributes to your monthly mortgage payments, reducing your financial burden.

In today's real estate landscape, exploring different pathways to homeownership is essential, especially when affordability seems out of reach.

UNDERSTANDING OWNER-OCCUPIED RENTAL PROPERTIES

When considering owner-occupied rental properties, it's essential to be well-informed and compliant with all legal and financial requirements:

1) Residential Mortgages: Residential mortgages are typically used to finance these properties. Ensure that you inform your lender about your intention to rent out a portion of the property.

2) Legal Requirements: Familiarize yourself with the Residential Tenancies Act, which outlines the rights and responsibilities of both landlords and tenants. Being aware of your obligations as a landlord is crucial.

3) Property Type: The type of property you intend to purchase may affect your financing options. Multi-unit properties like duplexes or triplexes might require a different mortgage structure, often referred to as an investment property mortgage, designed to accommodate rental income.

4) Down Payment: Down payment requirements for owner-occupied rental properties typically range from 5% to 20%, depending on the purchase price and property type. Multi-unit properties might require larger down payments.

5) Rental Income: Lenders often take into account the potential rental income when evaluating your mortgage application, which can enhance your mortgage eligibility.

6) Mortgage Rates: Interest rates for owner-occupied rental properties may differ from those for primary residences. When you can insure the mortgage, you can benefit from lower rates, but when you cannot, you may be subject to a rental premium.

7) Insurance: Landlord or rental property insurance is necessary and differs from standard homeowner's insurance. It provides protection in cases of damage, liability claims, or the loss of rental income.

8) Legal Agreements: Ensure that you have legally sound lease agreements in place with your tenants, following specific regulations governing lease agreements.

9) Tax Implications: Consult a tax professional to understand the tax implications of owning and renting a property. Rental income is taxable, and you may be eligible for deductions related to property expenses.

arrangements. They can help you find the most suitable financing options based on your unique situation.

In today's real estate landscape, exploring different pathways to homeownership is essential, especially when affordability seems out of reach. Whether you are looking to get prequalified for your first property, be it a primary residence or an owneroccupied investment property, there are distinct advantages to consider.

With discussions about cohabitating, purchasing with friends or family, and a growing need for parents to assist

rental income, helping you qualify for a mortgage and possibly enabling you to afford a more valuable property.

This versatile approach can be the key to your first investment property and may open the door to many more opportunities in the real estate market. As the real estate landscape evolves, owner-occupied rentals can offer the financial flexibility you need while fostering new possibilities for property ownership. It's an option worth exploring, given its potential to help you achieve both your homeownership and investment goals.

Purchasing an owneroccupied rental property allows you to benefit from rental income, helping you qualify for a mortgage and possibly enabling you to afford a more valuable property.

If you're considering buying a home, you've probably heard about traditional mortgage options. But what if we told you that there's a new approach to lending that looks beyond your income and credit score? It's called "net worth lending," and it might be the key to helping you achieve your homeownership goals.

Here's a simplified breakdown:

1. BORROWER QUALIFICATIONS: To qualify, you need to be a Canadian resident. Usually, a minimum of around $250,000 in liquid assets is required. If you're buying a property with someone else, but they're not on the mortgage application, a portion of your shared assets can be used.

2. ASSET REQUIREMENTS: You must have a minimum of $250,000 in liquid assets. For every dollar you need in a mortgage above what's typically qualified for, you must have a dollar in verified liquid assets. Your assets must not be pledged as security for other loans. Foreign income and assets aren't considered, except for specific eligible assets.

3. ELIGIBLE ASSETS: The good news is, many types of assets are eligible, including savings accounts, stocks, certain retirement accounts, and more. Pledged assets are an exception. They don't count, but that usually doesn't apply in this case.

DOCUMENTATION & DOWN PAYMENT:

Standard income and documentation policies apply. You'll need to show evidence of your average liquid assets over a 90-day history. This might include investment statements or bank records. Down payment requirements are in addition to the liquid asset requirement. You'll need a minimum down payment of 20%, with at least 10% coming from your own resources.

So, what's the bottom line? Net worth lending is a new way to explore mortgage opportunities. It focuses on your overall financial health and the assets you've accumulated. If you have substantial liquid assets and a strong credit score, this innovative approach could be your path to homeownership.

Remember, this lending approach is still evolving, and not all lenders offer it. But as it gains popularity, more options may become available. It's always a good idea to talk to a financial advisor or mortgage specialist to see if net worth lending is the right fit for you.

Healthcare in Ontario is in the midst of an unprecedented transformation to adapt to new technologies and rapidly increasing health needs. Now, thanks to a landmark $30 million collective gift, Oakville Trafalgar Memorial Hospital can accelerate the future of advanced patient care in the province’s fastest growing communities.

Recognized as the inaugural Flagship Families, the following donors each contributed $3 million or more to meet the hospital’s current and ongoing priority needs: Bob and Marilyn Beamish, David, Marc, Reid, and Scott Campbell, June and Ian Cockwell and family, Craig and Eleanor Mellish, Oakville Hospital Volunteer Association, David Pakrul and Sandra Onufryk, and the Shorey family. In addition, there was an anonymous Flagship Families contribution made in honour of Oakville Trafalgar Memorial Hospital frontline workers.

The donation is a game-changer for philanthropy in the region and will be used to transform care at Oakville Trafalgar Memorial Hospital. United in their commitment to make an extraordinary impact, these donors are supporting the Oakville Hospital Foundation in its goal of raising $150 million in philanthropic support over the next decade.

With sincere gratitude, we thank our inaugural Flagship Families for their historic contribution and philanthropic leadership; the benefits will be felt for generations to come in our community.

Paralympic Athlete Turned Entrepreneur

4XParalympicGamesMedalist.1Gold,2Silver,1Bronze

Q Can you start by sharing your journey into Ice Sledge Hockey? How did you discover the sport and what drew you to it?

A I grew up at rinks watching my brother play and developed a love for the game. I watched it every night and played every form of hockey I could – Ice hockey, road hockey, mini sticks, video games. I have always loved the speed of the game, the physicality, and that it is a team sport.

Q For our audience unfamiliar with Para Ice Hockey, could you briefly describe what it is and its unique aspects?

APara Ice Hockey is the Paralympic version of Hockey. It is an adaptive version meant for people with a disability. We sit down in a sled and have two sticks instead of one with big metal picks at the end of it that dig into the ice to help propel us on the ice. The rules of the game remain the same, as do the dimensions of the rink.

Q Reflecting on your athletic career, what do you consider your greatest achievement in Para Ice Hockey?

A The growth of the game is something I am tremendously proud of. I came in at the perfect time. The Paralympics were starting to get some traction, and I said yes to everything that was asked of me on the promotional side. To see the amount of kids playing the sport now and the opportunities that they have is something that warms my heart.

Q Can you share a memorable moment or accomplishment that stands out for you?

AWinning Canada’s first-ever gold medal at the Paralympics in 2006. Scoring the winning goal with 9.3 seconds left at the 2008 World Championships and being named the best forward of the 2013 World Championships. All championships are special, but impacting winning at those events meant a lot to me.

All championships are special, but impacting winning at those events meant a lot to me.

QAthletes often face challenges. Can you recall a specific moment that knocked you down, and how did you pick yourself up and move forward?

AFor all the highs in my playing career, there have certainly been lots of lows. We didn’t medal on home ice in Vancouver 2010; we lost in overtime in 2018 at the Paralympics. Coming back from injuries is certainly hard as well. The big lesson for me was to ask for help. It’s okay to have hard moments – we all have them! But reaching out to the staff that cared about me, my teammates, family, and friends can be crucial in taking steps to heal and be your best self again.

Q What lessons did you learn from overcoming challenges in your athletic career that you apply to your life now?

A

Resiliency. The importance of feeling the highs, feeling the lows and finding a way to work through them. Keep fighting, keep pushing until you get what you want.

Did you have a sports idol or someone who inspired you in your athletic journey? How did they influence your approach to sports and life?

My teammates over the years. From a young age, I was in a change room with cancer survivors, military veterans, and teammates who have gone through a tremendous amount of adversity and came out the other side wanting to be high-performance athletes, role models, and leaders. This has had a profound impact on my life.

Are there specific qualities in your sports idol that you aimed to emulate in your career?

I have always admired people that are passionate competitors, yet personable and kind away from the field

I have always admired people that are passionate competitors, yet personable and kind away from the field.

Which charity or cause do you closely align yourself with, and why is it significant to you?

Matt Cook Foundation, Matt was a teammate of mine who passed away from cancer. His family now raises money to support young people battling cancer and make their stays at the hospital more bearable.

Holland Bloorview – I get my legs made at this hospital and often meet with young amputees and their families to support their next steps and journey through life.

How do you actively support or contribute to this cause, both during your athletic career and now in your entrepreneurial pursuits?

For the Matt Cook foundation, I have been able to help raise funds for their cause. For Holland Bloorview, I live close enough I am able to be hands-on and meet with the young amputees. I also made a feature for Holland Bloorview and the work they do with the Pascal Siakam foundation that was featured on a TV show.

At the end of the day, people with disabilities deserve the same experiences in life as able-bodied people.

QWhat advice do you have for parents with kids who have disabilities and may be interested in sports or other activities?

A GO for it!!! Every day the world is becoming more accessible and more accepting. I tried some sports not knowing how it would turn out for me and my physical limitations. Some failed, and some I was great at, but I learned many life lessons along the way.

Q Are there key principles or experiences from your own journey that you believe parents can find valuable?

A Not treating your child any differently. Of course, you will always have their best interests in mind, but at the end of the day, people with disabilities deserve the same experiences in life as ablebodied people.

QMoving into your entrepreneurial journey, how did you navigate the transition from being a Paralympic athlete to becoming a businessperson?

AIt certainly wasn’t easy. Transitioning from something you love so deeply is a hard transition. I love entrepreneurship because it reminds me of being an athlete; your success is in your own hands and depends on your dedication and commitment to your brand.

Q

Could you share more about your current business and what it specializes in?

A Business-wise, I have a production company – Evergreen Productions We do broadcast television, corporate videos, post-production, podcasting/ social media, and we have a licensed drone that shoots at 4K for high-quality

Although I am used to traveling, I am not used to leaving a family behind. I miss them when I am away and am learning ways to be supportive and successful.

I also have gotten into coaching lately and have really enjoyed being back at the rink and working with the next generation of athletes that are up and

How does your business reflect your values and experiences, both as an athlete and a person with a disability?

We are committed to accessibility. Other production companies use us to make their work accessible. That means we do their closed captioning, described video, and integrated described video.

Q

Being both a businessman and a family man, how do you balance the demands of your professional and personal life?

AIt is hard! Especially because when I am filming or coaching it requires me to travel. Although I am used to traveling, I am not used to leaving a family behind. I miss them when I am away and am learning ways to be supportive and successful.

Q

Are there specific strategies or lessons from your sports career that you apply to maintain this balance?

AOne thing lots of sports psychologists have reminded me is the importance of being present. Whether at work or doing activities with my family, I try to be 100% present and commit to living in the moment I am in.

QNow that you’re retired from hockey, what are your revised goals as a businessman and family man?

AAs a family man, just try to enjoy and make the most of every day. I have a young son, and I am enjoying that I don’t have to travel as much I used to for hockey and am able to be here and watch him grow!

With regards to business, I hope to bring as much passion and enthusiasm as I did with sport to create a quality lifestyle for my family & colleagues.

I try to be 100% present and commit to living in the moment I am in.

QBeyond your athletic achievements, what legacy do you aspire to create through your current professional endeavors?

AI love supporting the underdog. I want to give publicity and notoriety to people that don’t always get the attention that they deserve. Through my broadcast storytelling and coaching, I hope to continue to be on the cutting edge of diversity, equity, and inclusion.

QCan you share any specific projects or initiatives within your business that reflect your commitment to making a positive impact?

A

We have a syndicated tv show called Level Playing Field, that is going into its fifth season. Level Playing Field is Canada’s only sports news magazine series that showcases and celebrates the power of Para Sport. Each 22-minute episode features stories of people, organizations, and communities using the power of sport to connect, evolve, and succeed both in competition and life.

QHow do you actively engage with the disability community through your business activities?

AWe don’t only do high-performance sport, we make sure to take time and make features on charities and organizations that are making a difference in the community. Last year we were able to help Holland Bloorview Kids Rehabilitation Hospital, Pascal Siakam’s P43 Foundation, and a project by Jays Care Foundation called Challenger Baseball.

Q

Are there specific initiatives or projects aimed at empowering individuals with disabilities that you’re currently involved in?

ACurrently, we work very closely with the Canadian Paralympic committee to do a weekly recap show that celebrates and promotes parasport.

I also work closely with the Hockey Canada Foundation to ensure kids from all walks of life get the chance to play the sport that has had such a positive impact on my life.

1976.

Sportswear, tailoring & styling.

Share your looks using #BurrowsStyle and tag us on instagram @burrowsclothiers

In the realm of corporate insurance planning, one key strategy that businesses utilize to secure their financial future is corporate whole life insurance. This type of policy offers numerous tax benefits, an investment component, and lifelong coverage.

Corporately-owned whole life insurance policies provide significant tax advantages to your corporation, helping you transfer assets out of your corporation tax-efficiently and tax-free. Most importantly, you can enjoy many of these benefits while you are alive.

A standout feature of corporate whole life insurance is the investment component, known as the cash value. The cash value within a whole life policy is guaranteed to grow year-over-year without the burden of annual taxes. This means you will never experience a negative return, nor will you be subject to the 66% capital gains tax or the 50.17% passive income tax on annual growth. This compounding interest allows you to accumulate significant funds within your policy, which can be used taxefficiently for personal or business needs. It’s a conservative approach to wealth accumulation while providing substantial tax benefits.

You can leverage your whole life insurance policy to fund your next property purchase or investment. For instance, the cash value can be used as a down payment to buy real estate and earn rental income. Additionally, if you need to renovate a current property, the cash value from your insurance policy can cover the costs. You have the flexibility to decide how to utilize your cash value, and it’s quite common to use it for investments.

Whole life policies can provide you with tax-free and tax-efficient retirement income. You can utilize the cash value

to ensure a steady stream of income during your retirement, providing a comfortable and secure lifestyle. For example, you could use your policy as collateral with the bank to take out a loan (e.g., a line of credit) to supplement your income. If you leverage your cash value to receive a $1,000,000 tax-free line of credit and use this to live off, the death benefit will cover the outstanding debt when you pass away. If the death benefit is $5,000,000, $4,000,000 will be paid to your beneficiary after accounting for the $1,000,000 line of credit balance. A whole life policy is flexible and adaptable to life’s everchanging circumstances.

Whole life policies provide permanent life insurance that will pay your

family, estate, or company a tax-free payout when you pass away. This tax-free payout can address estate tax obligations, equalize inheritances, and facilitate smooth wealth transfer— making it a crucial tool for preserving wealth and ensuring business continuity.

Corporate whole life insurance offers businesses and individuals a well-rounded solution for enhancing financial security, asset protection, and wealth transfer. Should you have other investments as well? Absolutely, but incorporating this versatile insurance product into your financial strategy can help pave the way for sustained success and long-term prosperity.

$1,000,000,000

With 16 years of dedicated experience in the mortgage lending industry, I have a proven track record in leveraging mortgage planning as a strategic tool for wealth creation and real estate acquisition. My services include, but are not limited to, comprehensive mortgage planning such as purchases, refinances, renewals, and resolving issues for applications that don’t fit into the big bank underwriting platform, all tailored to meet the unique needs of each client.

I specialize in high net worth lending, catering to clients with complex financial needs. My team and I are equipped to accommodate their unique requirements, having successfully assisted many executives, athletes, and entertainers in achieving their financial objectives. For self-employed professionals, we work closely with accountants and have a deep understanding of both personal and business financials, enabling us to navigate niche programs that facilitate qualification. In construction

lending, we bring expertise across all phases, from land acquisition through construction and into a well-planned take-out strategy.

As a key member of one of Canada’s leading mortgage lending teams, I have been personally responsible for originating billions in personal mortgage transactions. Equally important is my commitment to helping my partners grow, demonstrated by referring out thousands of opportunities to my referral partners—this dedication sets me apart from competitors and highlights the uniqueness of partnering with me. This track record speaks to my commitment to excellence and my deep understanding of the mortgage landscape.

If you want the best solutions, work with and surround yourself with the best people. Let’s connect and explore how I can support your mortgage needs with precision and insight.

As someone deeply invested in ensuring the best outcomes for my clients, I recently found myself reflecting on the traditional model of how mortgage brokers and bankers monitor their clients mortgages and felt compelled to innovate.

In today’s evolving market landscape, the importance of actively monitoring mortgages cannot be overstated. From fluctuating interest rates to changing financial goals, staying informed is crucial. That’s why I’m thrilled to introduce Mortgage Tracker.

This program is designed to keep a watchful eye on not just our clients’ mortgages, but anyone’s. With just a few key details - name, email, estimated mortgage balance, current rate, and type of mortgage - we can leverage our advanced tool to compare terms across a vast network of 143 lenders.

The insights provided by our program are invaluable. From identifying opportunities to switch between fixed and variable rates to pinpointing optimal times for refinancing, our proactive approach ensures

you’re always ahead of the curve. We can even begin preparations for renewal up to 13 months in advance.

Best of all, our service is entirely complimentary. Consider it our way of providing soft touches and keeping you informed about opportunities you may not be actively monitoring.

Having spent 16 years in the mortgage industry, I understand firsthand the challenges of providing timely and efficient advice. With Mortgage Tracker, we’re changing that narrative.

Please feel free to share this opportunity with your family, friends, and colleagues. Together, we can empower more individuals to make informed mortgage decisions.

If you’re interested in enrolling or have any questions, simply reply to this email, and we’ll take care of the rest.

Thank you for entrusting us with your mortgage journey. I look forward to continuing to serve you with excellence.

SCOTT WESTLAKE

Mortgage Agent, Dominion Lending Centres FC Funding, FSRA 10671

CLICK HERE TO HAVE YOUR MORTGAGE TRACKED FOR FREE!

33Seven Wealth Creation Boutique 33seven.ca

Albrecht Tamindzic Barristers & Solicitors at-lawyers.com

Axess Law Real Estate Law Firm axesslaw.com

Burrows Clothiers

Luxury Menswear in Downtown Oakville burrowsclothiers.com

Deeded Virtual Real Estate & Mortgage Closing Platform deeded.ca

Drake Law Law Firm drakelaw.ca

Dutra Wealth Management Financial Consulting & Wealth Management Firm dutrawealth.com

Evans Investment Council - Wilton Chan Wealth Counsellor & Client Relationship Manager evansinvestmentcounsel.com

Evergreen Productions

FC Funding

Video Production Company evergreenproductions.ca

Holistic Support for Mortgage Professionals fcfunding.ca

Forest Hill Real Estate Inc. Brokerage Real Estate Team foresthill.com

Four Point Financial - Matthew Farley Investment Advisory Firm fourpointfinancial.ca

FranChoice - Joe White

Golf Canada Foundation

Hali MacDonald Interiors

Franchise Professional Consultant franchoice.com

Advancing Golf in Canada Since 1979 golfcanadafoundation.com

Full-Service Design Boutique halimacdonald.com

Harvey McCreery Real Estate Real Estate Team harveymccreery.com

HummingbirdHill Homes + Construction Inc.

Luxury Home Builder hummingbirdhillhomes.com

Invidiata Team - Christopher Invidiata Real Estate Team invidiata.com

Jayne's Cottages

Jessica Cinnamon Design

Knar Jewellery

McKean Construction

MNP - Matt MacDonald

Modern Concierge

Nacora Insurance Brokers

Oakville Chamber of Commerce

Oakville Club

Oakville Hospital Foundation

Ontario Racquet Club

Phinney Real Estate

Policaro Group

Porsche Centre Oakville

Power Yoga Canada

ProScape Land Design Inc.

Sotheby’s International Realty CanadaAndy Taylor & Jodi Allen

Luxury Rentals & Concierge Services jaynescottages.com

Full-Service Interior Design jessicacinnamondesign.com

Fine Jewellery, Watches & Accessories by Top Brands knar.com

Custom Home Builder mckeanconstruction.ca

Business Advisor, Assurance & Accounting mnp.ca

Concierge Home Services & Event Experiences modernconcierge.com

Independent Commercial Insurance Broker nacora.ca

Fostering a Thriving Business Environment in Oakville oakvillechamber.com

Family-Friendly Recreational Club in Oakville oakvilleclub.com

Connecting Generosity to World-Class Healthcare at OTMH oakvillehospitalfoundation.com

Canada's Premier Private Family Sports Club Since 1975 ontarioracquetclub.com

Real Estate Team phinneyrealestate.com

Leading Automotive Retail Excellence in the GTA policaro.ca

New & Used Porsche Dealer in Oakville porschecentreoakville.com

Yoga For All Levels for Peace of Mind poweryogacanada.com

Landscape Design & Construction proscape.net

Real Estate Team

torontoluxuryhome.ca

The CB Group - The Agency Oakville Real Estate Team cbgrouprealty.com

The Westlake Team - Scott Westlake

Velocity Investment Partners

Vetere Team - Mark & Jeff Vetere

Licensed Mortgage Broker with 40 + Mortgage Agents thewestlaketeam.com

Wealth Management & Financial Planning

velocityinvestmentpartners.ca

Real Estate Team vetereteam.ca

GET THE SUPPORT YOU NEED TO THRIVE IN THE MORTGAGE INDUSTRY

Unlock your potential as an Agent or Broker with top-tier training, industry-leading tools and unbeatable income opportunities.

From training to branding, we have you covered.

Maximize your earnings with our attractive income opportunities.

Connect, share, and grow with like-minded professionals.

READY TO EXPLORE YOUR FUTURE WITH FC?