THE BEST Build

BRAG

Our flour, sauce and signature three cheeses make our product distinctly Marco’s. Our dough is prepared in-store daily and keeps customers coming back.

1,200+ locations and key territories available in the U.S. and international markets.

Business support, enterpriselevel systems and an experienced corporate leadership team make Marco’s a scalable investment for multiunit entrepreneurs.

OPEN TERRITORIES AVAILABLE

Main Street to Capitol

This information is not intended as an offer to sell a franchise. We will not offer you a franchise until we have complied with disclosure and registration requirements in your jurisdiction. Contact Auntie Anne’s Franchisor SPV LLC, Carvel Franchisor SPV LLC, Cinnabon Franchisor SPV LLC, Jamba Juice Franchisor SPV LLC, McAlister’s Franchisor SPV LLC, Moe’s Franchisor SPV LLC, or Schlotzsky’s Franchisor SPV LLC, located at 5620 Glenridge Drive, NE, Atlanta, GA 30342, to request a copy of their FDD. RESIDENTS OF NEW YORK: This advertisement is not an offering. An offering can only be made by a prospectus filed first with the Department of Law of the State of New York. Such filing does not constitute approval by the New York Department of Law. RESIDENTS OF MINNESOTA: MN Franchise Registration Numbers: Auntie Anne’s Franchisor SPV LLC: F-8191, Carvel Franchisor SPV LLC: F-8199, Cinnabon Franchisor SPV LLC: F-8190, Jamba Juice Franchisor SPV LLC: F- 6111, McAlister’s Franchisor SPV LLC: F-8196,

FEATURES

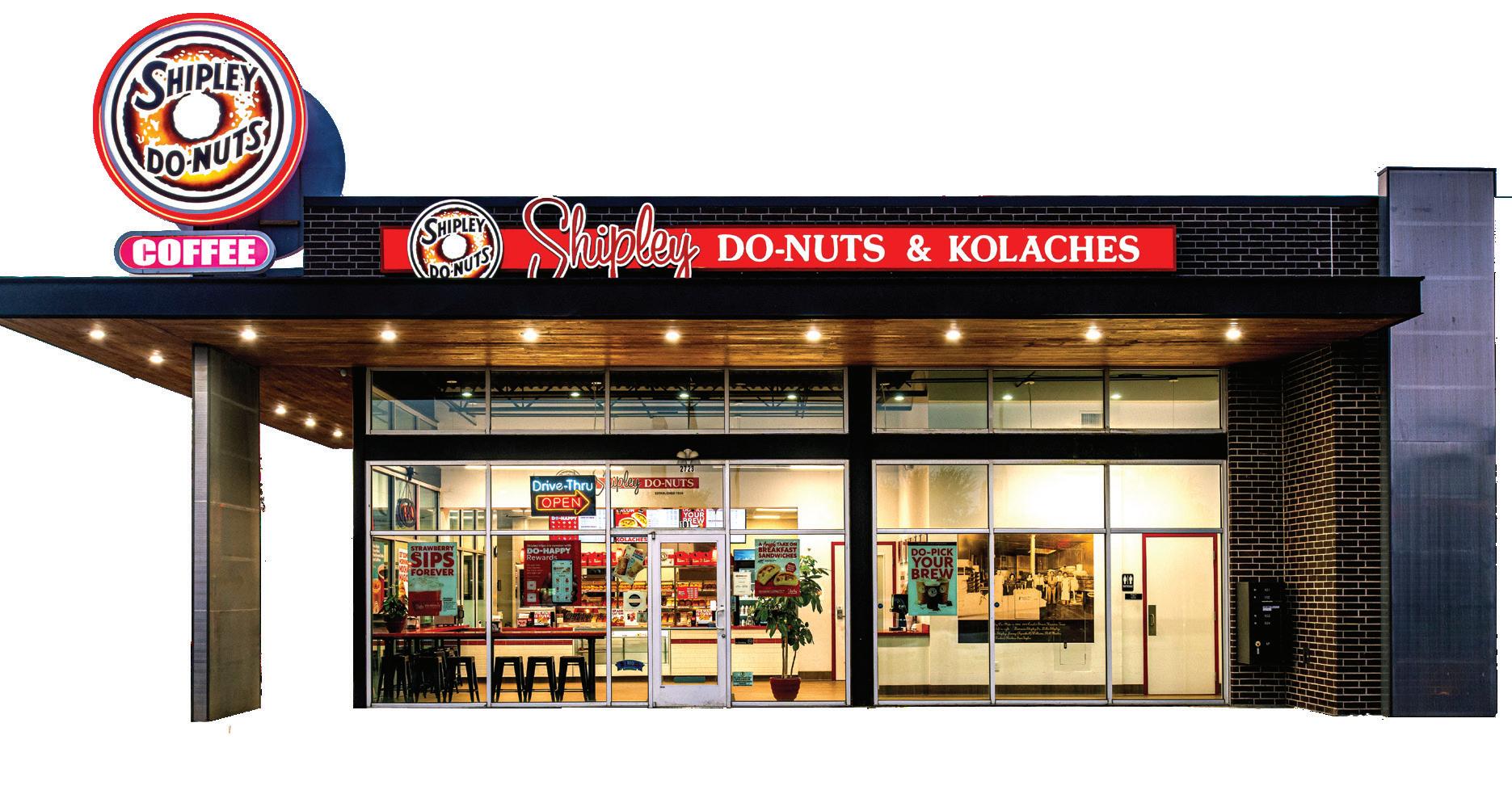

46 From Main Street to Capitol Hill

Franchise leaders tell their stories to Congress at IFA’s 2025 Advocacy Summit 52 Revive and Refresh

How remodels can drive revenue for franchisees

58 One Umbrella, Many Brands

Multi-unit franchisees link their fortunes to multibrand platform companies

COLUMNS

64 Customers Count

Why customer service feels colder than ever

Our Team

CO-FOUNDER

Gary Gardner

CO-FOUNDER

Therese Thilgen

VP, EVENT OPERATIONS

Sue Logan

VP, MARKETING AND CONTENT

Diane Phibbs

VP, BUSINESS DEVELOPMENT

Barbara Yelmene

DIRECTOR, BUSINESS DEVELOPMENT SALES

Krystal Acre Hope Alteri

Jeff Katis

DIRECTOR, EXECUTIVE EDITOR

Kerry Pipes

Drawing distinct lines between the duties of franchisees and franchisors

IFA Report

The American Franchise Act is a landmark step for franchise independence

Is your accounting method limiting your expansion potential? 72 Business Law

System change without buy-in is a recipe for resistance 74 Market Trends

The franchise financing ecosystem is changing fast

76 Exit Strategies

Explore the opportunities and risks of multi-brand franchising

MANAGER, EDITOR

M. Scott Morris

MANAGER, EDITOR

Kevin Behan

DIRECTOR, CREATIVE

Cindy Cruz

DIRECTOR, TECHNOLOGY

Benjamin Foley

SENIOR MANAGER, WEB DEVELOPER

Matt Wing

MANAGER, WEB DEVELOPER

Don Rush

COORDINATOR, DIGITAL

Juliana Foley

DIRECTOR, EVENT OPERATIONS

Katy Coutts

REGISTRATION NOW OPEN!

MANAGER, EVENT OPERATIONS

Sharon Wilkinson

COORDINATOR, EVENT OPERATIONS

Leticia Pascal

MANAGER, GRAPHIC DESIGN

Michael Llantin

DIRECTOR, CUSTOMER EXPERIENCE

Chelsea Weitzman

MANAGER, MARKETING

Taylor Williams

COORDINATOR, SPONSORSHIP BENEFITS

Alison Shelton

Heather Stoner

CONTRIBUTING WRITER

Colleen McMillar

CONTRIBUTING EDITORS

Carty Davis John DiJulius

Matt Haller

Nichole Holles

Larry Layton Paul Santomauro

Brian Schnell

ARTICLE INQUIRIES

editorial@franchiseupdate.com

SUBSCRIPTIONS subscriptions@franchising.com 408-402-5681

If You Have Multi-Unit Challenges, You Need the MUFC

I was reflecting on how I first found out about the Multi-Unit Franchising Conference (MUFC). I remember talking with a franchisee who had attended the MUFC and served on the conference advisory board. He was someone I trusted, and we spoke about franchising all the time.

He told me how the MUFC was made for franchisees. He explained how the agenda was built by an advisory board made up entirely of franchisees. These were franchise operators who wanted to tackle the kinds of issues that keep franchisees up at night. They wanted to provide tactics and strategies to help solve some of those challenges.

When I registered for my first conference, I didn’t know what to expect. The first event was a franchisee-only meet and greet. I was so impressed to be welcomed by so many multi-unit and multibrand franchisees of all sizes.

This was the beginning of my love affair with the MUFC. The rest of the conference was filled with great keynote speakers, sessions, and information to help me successfully grow my network. Each day was packed with timely topics, great speakers, and panel discussions led by multi-unit franchisees.

The networking was amazing and allowed me to meet some of the most successful franchisees in the industry.

We all talk about investing in our businesses the way we should. Getting to scale is always a goal for franchisees who want to build wealth for themselves and their families. Do you ever think about investing in yourself to continue to gain knowledge and learn best practices from some of our industry’s elite?

The MUFC is the best investment I have made. I have not only educated myself more on this great business, but also gained new friends who are now part of my franchisee family.

If you have never been to the Multi-Unit Franchising Conference, I strongly suggest you make the investment to attend.

I look forward to seeing you in Las Vegas, March 24–27.

Mitch Cohen

MITCH COHEN MUFC 2026 Chair

Christopher Aslam

“My dad taught me to always dream big, stay positive, and that money isn’t the only thing.”

Bold Moves

Youngest franchisee in Jack in the Box history capitalizes on risk

Written by KEVIN BEHAN

CHRISTOPHER ASLAM

CEO & Principal

Company: Rock Strategies and various entities

No. of units: 59 Jack in the Box, 5 Golden Chick, 5 Hawaiian Bros Island Grill

Age: 44

Family: Wife Natalie and 3 children, Beckham, 11, Finnley, 9, and Cruz, 2 Years in franchising: 29

Years in current position: 20

At first glance, Christopher Aslam might look like another second-generation franchisee, following his father’s lead with Jack in the Box. Dig a little deeper, and their entrepreneurial journeys reveal anything but a typical legacy story.

In the 1970s, Aslam’s father arrived in the U.S. from Pakistan with little more than ambition and a college dream. He landed a graveyard shift at a Jack in the Box in Dallas, where his first night tested him: The cook fell asleep, leaving him to juggle both the grill and the front counter. What felt like one of the hardest nights of his life sparked a 14-year career with the brand. Along the way, he met his future wife at the drive-thru window. In 1988, he opened the first of the five restaurants he owns today.

Aslam grew up in the family business, starting as a teenager behind the counter at Jack in the

Box. That early job sparked a genuine love for the restaurant world. A few years later, when one of his father’s restaurants burned down, Aslam left college to take charge of the rebuild and essentially acted as a general contractor. The success of that project gave him the confidence to chase something bigger: his own franchise. He flooded Jack in the Box officials with emails about opening a store. Skeptical about his age and his plan to start small, the company hesitated. Aslam persisted and secured financing. At 23, he became the youngest franchisee in Jack in the Box history.

His boldness didn’t stop there. While most operators gravitated toward established neighborhoods, Aslam studied a population density map of Dallas and spotted a different kind of opportunity: a struggling part of the city with cheap real estate, one McDonald’s, and no other major chains. Where others saw risk, he saw untapped demand. With his business partner, Edith Diaz, who maxed out her credit cards to help fund the project, Aslam built his first restaurant in 2007. His emotions swung from excitement to terror and back again on the night before the grand opening.

“It was the most thrilling and scariest part of my life,” Aslam says. “A TV reporter walked around the property and asked me if I was worried about whether we would be successful in that location, and that question caught me off guard. I thought either this would not go well and I would work the drive-thru and just keep the place open, or I would build a bunch more restaurants and be very successful. Thank God the latter happened.”

Despite his age and inexperience, the planned locations of his restaurants, and the economic recession that was hitting the country at the time, Aslam was undeterred by risk. During a time of limited growth, his restaurant succeeded, encouraging him to build more units. Today, he operates 59 Jack in the Box locations and serves as chairman of the Texas Restaurant Association.

A few years back, Aslam decided to diversify beyond Jack in the Box. It was a difficult decision given his deep history and loyalty to the brand. With prime markets already tapped, he began searching for complementary QSR concepts that could strengthen his portfolio. In 2016, he opened his first Golden Chick, strategically placing it in the same parking lot as his original Jack in the Box. The gamble paid off: Sales for both restaurants climbed. Two years ago, he added Hawaiian Bros Island Grill to the mix, further expanding his reach. Today, Aslam operates 69 restaurants across three brands, and he’s not slowing down. His next target? Steady expansion toward 150 units over the next decade.

“I’ve been so blessed to have so many good people with me throughout my career: business partners, family, friends, and long-time employees,” Aslam says. “My dad taught me to always dream big, stay positive, and that money isn’t the only thing. I have everything that I want, and that is the blessing in my life. Quite honestly, this is fun. That’s what drives me, and we as a team will eventually reach our goals.”

PERSONAL

First job: As a Jack in the Box cashier when I was 15. My parents owned a couple of restaurants, and I helped out as a kid.

Formative influences/events: My parents were immigrants and instilled family values, like an unrelenting work ethic. I learned business from a young age through both wins and painful lessons. One of the biggest wins for our family was when my parents made generational progress by going from employees to becoming franchisees. It showed me firsthand the power of entrepreneurship, risk-taking, and the freedom that comes with building something of your own. On the other side, we unfortunately discovered that a CPA we trusted had been embezzling from us at the same time one of our restaurants, which was uninsured, caught fire. That double blow taught me two things: the absolute importance of controls and accountability in business, even with people you think you can trust, and the need to be resilient.

Key accomplishments: Successfully navigating high-stakes litigation and regulatory challenges and drafting laws that would influence our industry. I am also the chairman of the Texas Restaurant Association.

Biggest current challenge: Balancing growth and complexity while navigating economic, legal, regulatory, and labor headwinds is tough because each factor pulls you in a different direction. Growth brings opportunity, but it also magnifies complexity with more units, more people, and more risk. Legal and regulatory shifts mean the rules can change mid-game, and labor pressures add cost and limit flexibility. It forces you to stay agile, make fast but sound decisions, and build systems that scale without losing culture.

Next big goal: Lifting our organization and people to create a $1 billion enterprise over the next 15 years with an eye on the quality of assets rather than quantity.

First turning point in your career: My family’s support and the Jack in the Box brand taking a chance by allowing me to become a franchisee. I became the youngest franchise owner in the system at age 23 in 2005.

Best business decision: Risking everything to build our first Jack in the Box restaurant when others thought the chance of success was low.

Hardest lesson learned: Even when you do everything right, you can still sometimes fail. I opened a store that I thought was perfect in every

respect. When it opened, it did not do well. The truth is that even after the failure and my analysis of it, I would have made the same mistake again, which shows you can sometimes fail even when you think you have everything correct.

Work week: I don’t track hours; I work until I get tired. But because I enjoy it so much, it rarely feels like work.

Exercise/workout: An exhausting 45 minutes three times a week with fast-paced cardio and core strength work.

Best advice you ever got: You just need to get more decisions right than you get wrong. That is something my CPA, Gary Vick, told me years ago.

What’s your passion in business? I love building new restaurants because it allows my team to create opportunities for growth for our people.

How do you balance life and work? I don’t think entrepreneurs can really balance. We juggle. At work, I ask myself if I really need to be in a meeting. At home, I ask myself if I can afford to miss any family moment.

Guilty pleasure: Solo trips to recharge.

Favorite book: Atlas Shrugged by Ayn Rand. It was a life-changing book that I was lucky enough to find when I was a teenager.

Favorite movie: “Forrest Gump.”

What do most people not know about you? I love the art of design and innovation.

Pet peeve: People and institutions without a passion or care for what they do.

What did you want to be when you grew up? I always knew I wanted to go into business. I would play a video game called Aerobiz, where you are the CEO of an airline.

Last vacation: Terlingua in the West Texas high desert in May.

Person you’d most like to have lunch with: The founding leaders of the three major religions. I’d love to hear their vision firsthand and ask how they’d see the world today.

MANAGEMENT

Business philosophy: Grow smart and strong, and do it with people you like. It’s all about the journey.

Management method or style: I try to ask lots of questions. It helps those I manage to think through the entire picture.

Greatest challenge: Managing the unexpected. This applies to everything in life and is important to work through. In the restaurant industry, specifically, it can be the equipment fails during a lunch rush, a supplier runs short, or a storm knocks out power. Managing the unexpected means you keep a calm head, make quick calls, and train your people to problem-solve rather than freeze.

How do others describe you? Strategic, relentless, and creative.

Have you ever been in a mentor-mentee relationship? What did you learn? I’ve been in a mentor-mentee relationship with all my people. Sometimes, I learn from them, and sometimes, they learn from me. I’ve learned the value of perspective and patience, seeing challenges through someone else’s eyes and realizing that growth takes time. In most cases, it’s about guiding them to find the answers on their own.

One thing you’re looking to do better: Delegation by trusting my team and protecting time for staring out the window. As a leader, you can get so caught up in keeping the engine running that you forget to look out the window to guide the direction in which you are traveling.

How you give your team room to innovate and experiment: Encourage pilots, celebrate results, and don’t punish smart failures.

How close are you to operations? My role isn’t to run every detail of operations; it’s to make sure the teams have the tools, resources, and clarity they need. I stay close enough to understand the challenges, but my job is to set the direction and remove barriers so that the operations can succeed.

What are the two most important things you rely on from your franchisor? Brand protection and transparent and fair economics.

What you need from vendors: A partnership mindset.

Have you changed your marketing strategy in response to the economy? How? Yes, by adjusting to a more digitally focused approach. To stay relevant, you must navigate the third-party delivery system by finding the right balance of levers to pull, such as sponsored ads, pricing, and promotions. It adds an entirely new layer of analytics to our business.

How is social media affecting your business? It’s reputation management in real time, and it can make you or break you in an instant. No matter how many positive reviews you get, it only takes one negative video to go viral to hurt the entire brand. A lot of times, customers don’t even come to you to help solve the issue, and you find out about it at the same time as the rest of the world.

In what ways are you using technology (like AI) to manage your business? To help brainstorm and build out strategic decisions and implementation. Using AI to help run different scenarios for your business, including cost savings options, menu pricing, or break-even analysis, has become simple. Describing the problem in your own words and seeing thoughtful responses to complicated questions is a game changer.

How do you hire and fire? We hire based on our values and fire when it affects our culture. We hire for our ROCKS values: Right thing, Ownership, Can-do attitude, Kindness, and Striving for growth. If someone consistently goes against those values, it affects our culture, and that’s when we have to part ways. It’s rarely a single mistake. It’s

consistent opposition, which indicates it’s not a right fit.

How do you train and retain? By having clear systems, growth pathways, recognition, and profit sharing for our management teams.

How do you deal with problem employees? I approach the situation with direct conversations, coaching, and encouraging accountability.

Fastest way into your doghouse: Not caring.

BOTTOM LINE

Goals over the next year: Further development of each brand and acquisition. Continue a slow and steady new store development plan and keep our eyes out for great existing opportunities for acquisitions.

Growth meter: How do you measure your growth? Solid EBITDA growth, low leverage, and culture retention.

Vision meter: Where do you want to be in five years? 10 years? Within the next decade, we hope to achieve 150 units and a $1 billion valuation.

Do you have brands in different segments? Why/why not? Yes. Diversification hedges risk, allows for more opportunities in real estate and people growth, and creates learning across concepts. How is the economy in your region(s) affecting you, your employees, your customers? Broader immigration concerns have influenced consumer confidence and spending patterns among certain customer groups, creating ripple effects across the industry.

Are you experiencing economic growth in your market? Sales growth has been challenging this year, and labor costs, inflation, and regulatory pressure are real. However, the Texas, Nevada, and Utah markets have a lot to offer in the form of new development and a business-friendly environment. How do changes in the economy affect the way you do business? Changes always bring opportunity if you are looking at them correctly. For example, it can refocus attention to your P&Ls, which allows you to renegotiate with vendors and cut out nonessential expenses. It gives you an opportunity to reset expectations with your teams. One

of my favorite quotes is, “You become a millionaire during the good times and a billionaire during the bad times.”

How do you forecast for your business? A combination of R365 data, brand metrics, and real estate analysis. R365 gives us real-time financial and operational data so that we can see how each restaurant is performing day-to-day. Things like average unit volumes, customer traffic, and menu mix help us measure performance against the broader system and spot trends. Real estate analysis helps us understand the potential of a location, trade area growth, traffic patterns, and demographics. Putting those together gives us both a short and long-term view, so we can plan growth and manage risk with confidence.

What are the best sources for capital expansion? A mix of retained earnings and our lending partners, both local and national.

Experience with private equity, local banks, national banks, other institutions? Why/ why not? Local for the newer concepts and national for the established brands is the most efficient.

What are you doing to take care of your employees? Offering benefits and increasing culture, recognition, and upward mobility. Every year, we have continued to improve the benefits we provide for our employees. With new store growth, there is always room for personal growth, caring about the employees’ personal lives, and supporting them when they have personal issues.

How are you handling rising employee costs (payroll, minimum wage, healthcare, etc.)? Making the job more efficient and enjoyable through tech and streamlining. Any software that simplifies tedious tasks, such as inventory or scheduling, helps. That includes simple things, like automated safes to reduce the time and accuracy of counting cash. Installing automated equipment, such as beverage dispensers, allows employees to have a simplified experience while helping keep costs down.

What laws and regulations are affecting your business, and how are you dealing with them? We deal with a wide range of labor, tax, and compliance regulations that vary from one jurisdiction to another, which can make uniform compliance difficult. My focus is on working with industry groups and policymakers to help shape laws toward fair, balanced solutions that work for businesses, employees, and guests.

How do you reward/recognize top-performing employees? Bonuses, recognition programs, and growth opportunities.

What kind of exit strategy do you have in place? I know they say start with the end in mind. I honestly have been in this for the journey and don’t know where or when the road will end.

POWER MOVE IN YOUR FRANCHISE PLAYBOOK

“Trust is the highest form of human motivation. It brings out the very best in people.”

Beyond the Clippers

Building a business, a legacy, and a lifelong partnership with Sport Clips

Written by KEVIN BEHAN

VManaging Member

Company: Lee Hill Companies

No. of units: 67 Sport Clips Haircuts, 1 Woof Gang Bakery & Grooming Age: 57

Family: Wife Stacey, 5 children, Derek, 32, Tyler, 30, Nicole, 28, Brandon, 24, and Breezy, 23, and 7 grandchildren

Years in franchising: 20

Years in current position: 20

al Hill had built a thriving career in construction contracting and supply chain management when a conversation with his longtime friend Jared Lee changed everything. The two had known each other since their days at Brigham Young University and often kicked around the idea of owning a business together. In 2005, Lee finally pushed: “Are we just going to keep talking about this, or are we going to do it?”

“I looked at a few franchise options, but when I came across Sport Clips, it resonated with me,” Hill says. “It is a really cool concept. At the time, there wasn’t anything like it that catered to men and boys. I mentioned it to Jared, and he hadn’t heard of it. He thought it was something involving sports highlight videos. When I explained it and my interest, he said, ‘Two dudes in the hair business?’ We went to a local salon and tried it, and we said, ‘This is pretty awesome.’”

By the end of 2005, they had purchased three licenses and taken over an existing salon. Hill kept his demanding job at Intel, juggling both careers as the Sport Clips footprint grew. But as the business expanded to 13 locations, the balancing act became impossible. Hill made the leap, leaving corporate life to focus fully on franchising. That decision paid off: Today, he and Lee run 67 Sport Clips salons across Arizona, Utah, Washington, and Oregon.

Hill and Lee thrived through their first 15 years in business, but Covid threatened to upend their operation. Salons shut down temporarily, and the real challenges came when doors reopened. Cushioned by stimulus checks and concerned for their health and safety, many employees throughout the hair salon industry did not return. Beauty schools, which had always supplied a pool of talent in a high-turnover field, closed for a year and did not produce graduates at a normal rate for about two years. Consumer behavior also changed with less emphasis on a professional appearance amid the shift to remote work. Others chose to cut their hair at home.

Calling that time “the hardest thing we’ve ever gone through,” Hill said that he and his partner doubled down on taking care of the more than 300 existing staff members across their 32 stores. They decided not to lay off any employees and continued to pay them, including their regular wages and the tips they would have earned. Hill says they weathered the initial storm better than many others in the industry, and they continue to provide employees with generous salaries and benefits to attract the best talent.

With the damage of the pandemic behind them, Hill and Lee recently decided to expand their franchise portfolio by opening their first Woof Gang Bakery & Grooming location earlier this year. They wanted another franchise in the service industry and knew the dog grooming and bakery concept had a proven business model that had been successful in several states. The partners plan to add about 10 Woof Gang locations in Arizona over the coming years while also continuing to grow their Sport Clips business.

Hill isn’t planning to retire anytime soon, but he can see the day when he and Lee step back and pass the business to his two of his sons who have been working alongside them for years. He said he would like to structure the company so that Tyler and Brandon become “the Val and Jared of the company.” Hill also takes pride in the lasting friendship and strong partnership he’s built with Lee throughout their journey.

“When people ask how a partnership works for that long, I say our business is significantly better

with both of us than it would be with one of us,” Hill says. “We don’t worry about keeping score. We both have confidence that the other person is doing their part. There is a huge amount of trust. He is incredibly generous and open to the idea of my sons coming into the business. It has definitely been a blessing for both of us.”

PERSONAL

First job: I spent my summers working in my grandfather’s furnace cleaning business when I was a teenager, starting in seventh grade. It was great because I got to work with my grandpa, dad, and uncles.

Formative influences/events: There were two. The first was working in our family business when I was growing up. We worked six days a week, and it was a dirty job, but I look back on it with pride because that is where I learned how to work hard. The other was when I served a two-year church mission at age 19. I learned the importance of my faith and how to serve others without worrying too much about myself.

Key accomplishments: My family is my biggest accomplishment. On the business side, we were a three-time winner of Store of the Year (The Logan Trophy) for Sport Clips, a two-time Team Leader (Franchisee) of the Year, an IFA Franchisee of the Year, and CNBC’s Top Franchisees in America in 2016. Biggest current challenge: Growing our client count back to pre-Covid levels.

Next big goal: The past five years have brought a lot of changes and upheaval into our business. It has felt like we’ve gone from one challenge to the next. My goal is to stabilize and strengthen the business so that we’re able to grow our client count, strengthen our margins, and continue to be the workplace of choice for our team members.

First turning point in your career: One of my close friends from business school, Jared Lee, and I had always talked about someday owning our own business. He always said, “You can’t win if you don’t play the game.” So, in 2005, we started looking, and I found Sport Clips. We investigated it and decided to jump in and become Sport Clips franchisees. By 2014, we had 13 Sport Clips stores when my business partner and I decided to focus on Sport Clips full-time. I had a good corporate job, and my wife was a little bit nervous about leaving the stock options and benefits behind. Fortunately, it worked out, and we never looked back.

Best business decision: After initially buying three Sport Clips licenses, we purchased an existing salon, which helped us hit the ground running and allowed us to open our next store, knowing the key elements of the business.

Hardest lesson learned: Be ready to change and adapt. When Covid hit, our business was devastated. With a lot of difficult decisions and hard work, we got rolling again and thought we were in good shape. Then the staffing crisis hit. Beauty schools

had shut down, so no new stylists were coming into the industry for well over a year. We struggled to keep the doors open for full hours. We made some missteps, but we learned, and fortunately, we have a resilient organization that has weathered these storms and is back in growth mode. The quote, “Success isn’t permanent, and failure isn’t fatal,” is a good one.

Work week: This year, I cut back my office days to Monday, Tuesday, and Wednesday. I work from home or visit stores on Thursday, and I try to reserve Fridays for family or personal time.

Exercise/workout: I try to play golf a couple of times a month, and I have a weekly pickleball game with some buddies. I also enjoy anything outdoors, but I’m hit or miss at the gym.

Best advice you ever got: I love this quote by Stephen Covey: “Trust is the highest form of human motivation. It brings out the very best in people.” I’ve worked for leaders in my career who were great examples of this, and it’s something I’ve tried to emulate within our own organization.

What’s your passion in business? I love making a difference for other people, such as providing a space where our people can create great careers for themselves. I enjoy seeing them buy their first home or first car. I also love seeing the difference that our team members make in the lives of our clients. The personal connections that can be made in our industry make the world a better place.

How do you balance life and work? I have great people at the top of our organization who make sure things run smoothly. We have the very best operations and area leaders who oversee eight to 10 stores, and they do a great job. We trust them to keep things on track, which allows me to get away when needed.

Guilty pleasure: Flying. I have a Piper Archer airplane that I love to fly whenever I can.

Favorite book: I have a lot of favorite books, but Shoe Dog is probably at the top. It’s about Phil Knight and how he built Nike. I really love to learn how entrepreneurs build a business. Business bios and sports bios are my favorites.

Favorite movie: “Gladiator” and “Miracle” are my two favorites. I also love the movie “Moneyball.” What do most people not know about you? I really enjoy cooking, especially outdoor cooking, like smoking meats.

Pet peeve: Not doing what you say you will do. What did you want to be when you grew up? I wanted to be a pro basketball player.

Last vacation: My last vacation was a river cruise on the Rhine to see the Christmas Markets in December 2024.

Person you’d most like to have lunch with: Elon Musk—so much to tell. If he’s not available, Phil Mickelson.

MANAGEMENT

Business philosophy: Provide a great team member experience, and then your team will deliver a great customer experience.

Management method or style: Train, trust, and empower.

Greatest challenge: Creating an organization that can continue to set the standard for our industry in terms of team member pay, benefits, and client experience.

How do others describe you? Faith and family oriented, loves a challenge, results driven, detailed, and hardworking.

Have you ever been in a mentor-mentee relationship? What did you learn? I’m not sure that I have a lot of experience in a mentor/mentee relationship.

One thing you’re looking to do better: I can always improve on letting go of the day-to-day issues and spending my time focusing on the strategic aspects of the business.

How do you give your team room to innovate and experiment? Our leaders understand the nonnegotiables, and they know that outside of those items, we want to push the envelope. We’ve made changes to our pay and benefit structures based on feedback from our team. For example, we are among the first in our industry to have a matching 401(k) retirement plan available to all team members.

How close are you to operations? I’m still very close to operations. We have weekly meetings with our area leaders and discuss individual store performance. We have quarterly face-to-face, all-manager meetings in each of our markets.

What are the two most important things you rely on from your franchisor? Data is the number one thing I need. Having insights into client behaviors, marketing program performance, and store-by-store comparison data is very important. I also need solid technology, such as our app, online check-in system, and loyalty programs.

What you need from vendors: Quality and competitive pricing.

Have you changed your marketing strategy in response to the economy? How? For the past couple of years, after things settled from Covid, we have rededicated ourselves to marketing and bringing in new clients. Our strategy has been one of getting back to the basics that worked for us in the past. We’re using local store marketing and behind-the-chair marketing. We’re really trying to connect with our communities to drive new clients into our stores.

How is social media affecting your business? Obviously, social media continues to grow in importance. We focus very hard as an organization on our online reputation. We’re vigilant about resolving client concerns and responding to every online

review, positive or negative. Our teams know that we build our business one client at a time.

In what ways are you using technology (like AI) to manage your business? This is definitely an emerging area for us. We’re just starting to explore how it can help us in our back-office tasks and training programs. There is nothing solidly in place yet.

How do you hire and fire? We do both carefully. We’re probably a little slower than others when it comes to firing people. We care about our employees, and we want to make sure we’ve given them plenty of opportunities to right the ship if there are issues.

How do you train and retain? Sport Clips has a great training program for every new team member called “Core Camp.” It is a multi-day training course to ingrain Sport Clips’ culture and processes into our new hires. Our organization also has specific training for team members in haircutting, product sales, efficiency, and leadership. Sport Clips is among the best when it comes to providing quality training. Our team members often mention this as a reason they love working for us.

How do you deal with problem employees? We evaluate whether it is a training issue or a commitment issue. Training issues are fixable. If the person doesn’t understand what to do, we get them the education they need. On the other hand, if it’s a commitment issue, we simply ask them if they’re going to get on board or not. If the answer is no, we part ways. We’re also pretty diligent in the three strikes and you’re out approach. We make sure to document the process.

Fastest way into your doghouse: Not caring about the client. If you don’t care about our customers, this isn’t the place for you.

BOTTOM LINE

Annual revenue: $31 million.

Goals over the next year: Three percent yearover-year same-store customer count growth. Growth meter: Our top measurement is yearover-year same-store customer growth. The other is year-over-year same-store sales growth.

Vision meter: Where do you want to be in five years? 10 years? Within five years, I hope to have a strong footprint in the Phoenix area with five Woof Gang stores. We will continue to grow in our existing markets with Sport Clips. I expect we will be at 75-plus stores within five years. Within 10 years, I hope to be executing my exit plan and will probably shift to more of a consultant role. Do you have brands in different segments? Why/why not? We love the service segments. So, we’ve just opened our first Woof Gang, a dog grooming and bakery shop. It’s coming up pretty well, and we are very excited about this brand. Of course, Sport Clips is and has been our primary brand for 20 years. We have grown with this brand and love the Logan family and the brand that they’ve built.

How is the economy in your region(s) affecting you, your employees, your customers? The economies in Arizona and Utah are growing quickly. This is driving rent and wages higher, and we’re doing all we can to maintain our prices. In the Pacific Northwest, the minimum wage laws drive higher wages and even higher prices. Fortunately, the rent costs haven’t grown as much in the Northwest as they have in Utah and Arizona. Are you experiencing economic growth in your market? Yes. Our Utah market has really started to show some growth. Arizona and the Northwest are a bit slower.

How do changes in the economy affect the way you do business? We try to deliver a great service at a great value regardless of the economy. Wages primarily and rents secondarily are the main determinants of our pricing. We’ve generally found that haircuts are somewhat insulated from swings in the economy. For example, during slight downturns in the economy, we’ll see a little bit of a slump driven by clients going a little longer between haircuts.

How do you forecast for your business? We are pretty simple. We rely on our past years, take into account any new stores that have opened nearby, and then apply an expected growth rate.

What are the best sources for capital expansion? We’ve had the most success with smaller local or regional banks. The big banks are generally asset-based lenders and don’t typically work well with salons. The local/regional banks look more at cash flow, and we’ve had success there. We also have had seller financing for some of our deals, and that has worked out well. For the past several years, we’ve been building our new stores using cash from operations.

Experience with private equity, local banks, national banks, other institutions? Why/ why not? We haven’t had experience with private equity. We’ve been able to grow through the other methods mentioned.

What are you doing to take care of your employees? I’m proud to say that we set the bar for our industry in terms of pay and benefits. We have store managers making six-figure incomes. We have a matching 401(k) retirement plan available for all team members. We have company-subsidized health insurance and paid time off for all team members. Through Sport Clips’ SupportLinc, our team members have access to counseling services, legal services, and financial services. It’s all free of charge.

How are you handling rising employee costs (payroll, minimum wage, healthcare, etc.)? We’ve put some effort into improving our operational efficiency. This includes eliminating wasted labor, consolidating some of our back-office work, and bringing some things in-house. And, of course, we’ve had to pass some of these rising costs on to our customers.

What laws and regulations are affecting your business, and how are you dealing with them? We’ve been happy with many of the changes with the current administration. Of course, we’re thrilled with no tax on tips. That’s a huge win for our team members. The extension to the beauty industry of the 45B FICA tax tip credit was a big win for us as well. It is interesting to see the differences when you have a multi-state operation. Fortunately, most of our stores are in Arizona, which is a business-friendly, low-bureaucracy state.

How do you reward/recognize top-performing employees? Every year, we have a big awards banquet where we give away great raffle prizes, including a seven-night cruise. We also recognize our top-performing team members in all our key metrics, and we recognize the Most Improved, Heart of a Champion, and Stylist of the Year. Additionally, we celebrate our team milestones with dinners and outings. One of the most important things we do is always promote from within. Our top performers have the opportunity to become assistant managers, store managers, area coaches, and area managers. What kind of exit strategy do you have in place? My business partner and I are both thinking about working a bit less. We enjoy the business, so we’re not in a hurry to fully exit. My two sons are working in the business. They are doing a great job of managing different parts of our organization and learning how to lead it. One of my sons has been with us for more than six years and is leading our Utah and Northwest markets. Another son has been with us for a year and a half, and he’s handling all the back-office responsibilities. My plan is to make sure both are well rounded and can lead the organization into the future.

“There are so many fierce, fabulous women in franchising, and I am honored to celebrate their work with them.”

Lifting Others

Taco John’s franchisee elevates the next generation of leaders

Written by KEVIN BEHAN

TAMRA KENNEDY

Franchise Operator

Company: Twin City T.J.’s

No. of units: 6 Taco John’s

Age: 62

Family: 1 son, Jesse, 40

Years in franchising: 41

Years in current position: 27

From slinging pizzas as a teenage waitress at Pizza Hut to running a thriving portfolio of six Taco John’s restaurants across the Minneapolis–St. Paul metro, Tamra Kennedy’s journey is a masterclass in franchising success. With more than 40 years in the restaurant industry, she’s a seasoned operator and a passionate champion for the franchise model and the doors it can open for entrepreneurs from all walks of life.

Kennedy started her career in 1984 as a secretary for a company that owned Taco John’s and Burger King franchises. Early on, she was tasked with creating a spreadsheet that tracked food supply, cost management, and employee training across each location. She later became the office manager and handled administrative duties such as accounting, human resources, and payroll.

She spent more than a decade learning the restaurant business. When her boss was looking to retire and sell the stores, Kennedy asked about buying them. She knew she had mastered the administrative side, but he told her she needed to spend the next year learning about restaurant operations to prepare herself for franchise ownership. She put in the extra hours on nights and weekends in addition to her regular daily responsibilities. She was also assigned to turn around the lowest-performing store in the franchise group.

Kennedy taught herself all aspects of store operations and purchased the group of restaurants in 1999. The operations experience gave her an appreciation for frontline teams.

“Restaurants are the single best business for young people to learn skills they will need later in their careers,” she says. “It teaches them how to manage people, money, and inventory. It provides an opportunity for those who didn’t go to college to receive on-the-job training. If and when they move on from us, they can take what they learned and the skills they acquired to another job. My guarantee is that when people come and work for us, they will be able to grow and shine.”

Kennedy has seen considerable changes in the restaurant industry during her career, including changing laws and regulations. In addition, customer payment shifted from cash to credit cards, which tack on processing fees.

She says speed of service is as important today as it was when she started. Customers should enjoy connecting over shared meals at her restaurants, and it’s her team’s job to deliver a superior guest experience. The company’s motto is “Our family feeds friends.”

Kennedy has served as a trusted voice and mentor to other female business owners. In 2023, she was honored by the International Franchise Association (IFA) with the Bonny LeVine Award, which recognizes women for their business and professional accomplishments within franchising.

“Some women may not have the opportunity or know-how to work their way up the ladder, so I want to share all I can about my experience and help them get through any problems or obstacles,” Kennedy says. “There are so many fierce, fabulous women in franchising, and I am honored to celebrate their work with them.”

Kennedy serves on several IFA boards and has testified before Congress about the joint-employer issue to help define entrepreneurism through franchise ownership. Her mission is to help protect the business model that has been instrumental to her and her team’s success.

“I will always contribute to supporting franchising and advocate for its effectiveness in creating jobs as it is the greatest generator of wealth creation there has ever been,” Kennedy says. “I would like to think my career has stood for giving young people the opportunity to achieve amazing results. I have been able to positively educate elected officials that franchisees are business leaders in their local communities. It is an honor to serve, and it is the least I can do to give back to something I have been a part of my whole career.”

PERSONAL

First job: A waitress at Pizza Hut when I was 20 years old.

Formative influences/events: My father was an independent truck driver. I grew up in the cab of a semi, traveling the country and learning about the food supply chain from the fields to the port terminals as we hauled produce coast to coast. I learned about food cost management while at Pizza Hut. Exact ingredient portions were key to guest experience and, thus, the tips I earned.

Key accomplishments: Working my way from secretary for the owner of the business to becoming the franchisee when I bought his business. I have been engaged for several years at the IFA as a board member and past chair of the Franchisee Forum. I testified before Congress on the joint-employer issue, and I was deeply honored to receive the Bonny LeVine Award from the IFA in 2024.

Biggest current challenge: Staying on top of all the current technology and how to maximize those assets in our daily operations.

Next big goal: Finish remodeling our units and turn our focus more clearly to local market engagement.

First turning point in your career: Stepping out from the administrative role and learning daily operations at one of our locations before I was able to buy the stores. It was a life-changing experience to learn the hard and important work from the night crew.

Best business decision: Focusing on retaining and rewarding our store managers. They are the reason for any success we have, and they build incredible teams.

Hardest lesson learned: I built four franchised units with a different brand in 2004 and then closed them during the recession in 2008. It was the wrong brand and the wrong approach to growth.

Work week: Unless I am on vacation, I work seven days a week, and I usually get more done at night.

Exercise/workout: I swim on a near-daily basis.

Best advice you ever got: My former boss, whom I later purchased the franchise restaurants from, said, “Hope for the best, plan for the worst,” and “Surround yourself with experts in fields that you are not.” It was helpful to have good accountants and attorneys who know the ins and outs of the business. What’s your passion in business? Providing a great workplace for employees on their first job and

setting them up with skills to take with them to any career they pursue.

How do you balance life and work? I tend to schedule all my work from small tasks to large projects and don’t move work to the next day. I work the daily list, but I also schedule personal time and tasks so that I can give respect to both pieces of any day.

Guilty pleasure: Watching “Project Runway” and “American Idol.”

Favorite book: The Deming Management Method by Mary Walton.

Favorite movie: “The Wizard of Oz.”

What do most people not know about you? I can drive almost anything: semi-trailer trucks, farm tractors, and motorcycles.

Pet peeve: People who chew with their mouths open.

What did you want to be when you grew up? An attorney.

Last vacation: St. John with my son and his family in the summer of 2025.

Person you’d most like to have lunch with: President Donald Trump.

MANAGEMENT

Business philosophy: Results through spirited competition and benchmarking against the best of the best. We strive to be number one in all results and cheer each other on through every obstacle and win.

Management method or style: Teaching and always providing the why with the how.

Greatest challenge: Convincing our team that the brand’s decisions and protocols are what we follow even when we disagree.

How do others describe you? Focused, helpful, caring, and collaborative.

Have you ever been in a mentor-mentee relationship? What did you learn? Yes, as a mentor. I learned that not every experience or piece of advice can be directly translated. There must be a commitment to listening to learn for both parties.

One thing you’re looking to do better: Celebrate more of our team members’ accomplishments. They truly bring the magic.

How do you give your team room to innovate and experiment? We are always searching for solutions to issues. Anyone can bring their ideas and freely share them, and we often ask for volunteers to try something new that could benefit everyone. How close are you to operations? Not as close as I could be. I visit stores monthly and also have district managers who are on top of the day-to-day operations in the stores.

What are the two most important things you rely on from your franchisor? Menu and marketing. The more of each, the better. We want to be able to offer food that is relevant to today’s consumer while being profitable for the operator. From a

Restaurants are the single best business for young people to learn skills they will need later in their careers. It teaches them how to manage people, money, and inventory. It provides an opportunity for those who didn’t go to college to receive on-the-job training. If and when they move on from us, they can take what they learned and the skills they acquired to another job. My guarantee is that when people come and work for us, they will be able to grow and shine.

marketing perspective, it is important for the franchisor to establish our brand’s DNA through things like our creative, colors, and font. We need to tell customers who we are.

What you need from vendors: The timely, accurate deliveries of goods and services.

Have you changed your marketing strategy in response to the economy? How? Yes. We have leaned into some discounting through the loyalty app as well as menu offerings at lower prices to promote on a trial basis.

How is social media affecting your business? It has broadened our appeal to those who don’t know us and opened our brand up to a younger guest. Sadly, when there is a negative event, our opportunity to make it right for one guest manifests as an open issue to the masses, so we have less control over mistake resolution.

In what ways are you using technology (like AI) to manage your business? As a brand, Taco

John’s has recently introduced automated drivethru guest interaction, and we are beginning to roll it out as an option for each restaurant. Within our stores, we are using AI to analyze data to collect results, and we use that to create data points for training and operations.

How do you hire and fire? We use interview questions designed to find alignment with our core values, which are more important to us than skills in our evaluation. We are slow to fire, believing that counseling and impactful conversations often solve issues before they become a last-chance scenario.

How do you train and retain? Training is an everyday event. There is always something to teach. New employees go through our “First Day Our Way” training to fully understand their role as a member of the team they are joining. Again, skills come second to behaviors for us.

How do you deal with problem employees? Every chance is given to them to improve. We document, we coach, and we wish them well if we have to part ways.

Fastest way into your doghouse: Lying, cheating, or stealing. Everything else is given grace.

BOTTOM LINE

Annual revenue: $6 million.

Goals over the next year: To move third-party delivery to 15% of our overall revenue and grow the loyalty app base across all our stores.

Growth meter: How do you measure your growth? Guest count, revenue, average ticket, and speed of service.

Vision meter: Where do you want to be in five years? 10 years? I’ll likely have less to do with the day-to-day operations in five years. I will hand over the torch to some great leaders who are already clearing the path for me.

Do you have brands in different segments? Why/why not? One iconic brand to focus on has been my mission from the beginning.

How is the economy in your region(s) affecting you, your employees, your customers? Our guests have less to spend, which means we must overdeliver when they choose us for a meal. As a company, we have thrown our profits into remodels, which cost more to complete than even two years ago. It’s a tough time for everyone, but we are

committed to focusing on controlling those costs we can and not skimping in areas where it makes a difference.

Are you experiencing economic growth in your market? 2024 and 2025 to date are flat or slightly lower. Growth has been elusive, but we are seeing some uptick in the start of the second half of the year.

How do changes in the economy affect the way you do business? The labor market certainly has been a challenge post-Covid. Our team brilliantly does more with fewer on the floor, and they have adapted to some time-saving processes our brand has brought to operations.

How do you forecast for your business? I read tirelessly, focusing on global economic issues and even politics that can affect our future. Commodities play a huge role in our cost modeling. We also look closely at our competitors and track QSR trends.

What are the best sources for capital expansion? Profit. I don’t like to borrow.

Experience with private equity, local banks, national banks, other institutions? Why/ why not? Banks act as our cash depositories only.

What are you doing to take care of your employees? We offer a competitive pay and benefits package to everyone. We find ways to reward excellence and focus on flexibility with scheduling where we can. Our managers focus on a team environment so that everyone thrives, no matter their tenure, their background, or their position on the floor.

How are you handling rising employee costs (payroll, minimum wage, healthcare, etc.)? It’s a challenge—no doubt. We see these costs as necessary, but they do chew away at profit, so we have less to reinvest in the stores for other things.

What laws and regulations are affecting your business, and how are you dealing with them? While we comply with all regulations, we don’t enjoy those that have been imposed as a blanket panacea for perceived workplace issues, like sick time and mandatory PTO. These programs serve as entitlements that chip away at our foundational belief that you earn benefits through performance and not because the state declares us all as equally deserving because we are employees.

How do you reward/recognize top-performing employees? We have a program focused on controlling costs, delivering guest experience scores, and reaching sales goals. Employees are recognized and rewarded when those goals are met. Our individual restaurants recognize their employees during birthdays and anniversaries and have funds for store parties and gift cards.

What kind of exit strategy do you have in place? Well, that’s a work in progress for sure! It is a family-run business. My son oversees the daily operations, and my sister is the office manager. We will look at our options and plan our future together.

“There was a fork in the road at that moment, and I pursued what I knew.”

A Friendly Acquisition

Multi-unit franchisee steps up to lead the brand

Written by KEVIN BEHAN

AMOL R. KOHLI

Managing Partner, Legacy

Brands International

Franchisor title: Chairman of the Board, Brix Holdings

No. of units as a franchisee: 31 Friendly’s

No. of units as a franchisor: 61 Friendly’s, 63 Orange Leaf, 60 Clean Juice, 36 Red Mango, 9 Smoothie Factory + Kitchen, 6 Humble Donut Co., 3 Souper Salad

Age: 37

Family: Wife, who is a doctor, and 2 children

Years in franchising: 16

Years in current position: Since July

At 15, Amol Kohli’s first job as a breakfast server at Friendly’s sparked a journey that few could have predicted. Two decades later, he was no longer serving breakfast; he was a multi-unit franchisee who owned 31 Friendly’s restaurants. Now, his path has led him to an even bigger role: operating the entire franchise company that owns Friendly’s and six other brands.

Kohli made headlines this summer when his investment group, Legacy Brands International, acquired Brix Holdings, a multi-brand franchising company with seven food service chains, including Friendly’s, and more than 250 locations. Following the acquisition, he continues to manage his Friendly’s franchise locations while also overseeing Brix’s restaurant operations as its chairman of the board. He plans to grow the company and is looking for additional brands to acquire.

As a teenager, Kohli dove into restaurant work, learning nearly every aspect of operations before becoming a store manager at 18. He left to study business at Drexel University but soon got a call from his former Friendly’s general manager, Jeffrey Blum, who was acquiring several locations and needed help running the back office. Kohli jumped at the chance, spending his last two years of college immersed in the business side of restaurant ownership. By the time graduation rolled around, he faced a pivotal decision.

“I graduated with high honors in finance and marketing and was going to look for a job on Wall Street,” Kohli says. “I also had three to four years of experience on the restaurant administrative side with Friendly’s. There was a fork in the road at that moment, and I pursued what I knew.”

After several years, Kohli successfully petitioned the Friendly’s board to acquire four underperforming units that were set to close. He became a firsttime franchisee when he was 23 and later added five more restaurants. While many locations became successful, Kohli says the ones that failed motivated him the most.

“If not for those failures, there is no way I would be here today,” he says. “I just would have been satisfied and complacent and would have decided not to keep pushing the envelope. Early in my career, I was doing $15,000 a week in business, but I saw other operators doing $40,000 a week. I wanted to be like them. I felt I had to prove to myself that I could do more than operate stores poised for closure. It fueled me for several years to find the right time and location to add and develop new stores and explore various brands in the industry.”

The son of Indian immigrants, Kohli learned the value of hard work early in life. The same motivation that pushed him up the store ladder at Friendly’s at the outset of his career drove his desire to scale the business as a multi-unit owner. He grew his portfolio to more than 30 Friendly’s restaurants before setting his sights on Brix Holdings and its diversified pool of restaurant concepts.

Kohli believes that being able to work with many of the Brix team members before acquiring the company has helped in the transition and established a collaborative relationship. He plans on taking a strategic approach to expand the Friendly’s brand by targeting Georgia, the Carolinas, Florida, Arizona, and Texas while opening other Brix brands in growing markets nationwide.

“We plan on being a unique and world-class group that provides a potentially rewarding and comfortable lifestyle for anyone who wants to partner with us,” Kohli says. “I will lead with a franchisee-

Have you ever been in a mentor-mentee relationship? What did you learn?

Several. Most of my mentors are still mentoring me today. It is the most valuable resource you could ever have. Personal and professional mentorship is critical to having a proper life balance and longterm success. Good mentors who have had the experience and longevity can be instrumental to your business success. It is important to have them from an unbiased perspective. I speak with multiple mentors weekly.

first mindset and a long-term view that focuses on people, operations, and the guest experience. I am excited to see what the years ahead hold for us.”

PERSONAL

First job: As a breakfast table waiter at a Friendly’s restaurant when I was 15.

Formative influences/events: Growing up in a family that valued hard work and entrepreneurship. In addition, starting in an entry-level restaurant role taught me the value of every position in the business. Earning Drexel University’s Top 40 Under 40 recognition reinforced that with focus, persistence, and metered risk-taking, big goals are achievable.

Key accomplishments: Building a multi-unit, multi-brand franchise portfolio that is focused on being an industry leader; successfully acquiring Brix Holdings and its seven national brands through Legacy Brands International; developing

top-performing Friendly’s locations and expanding into new markets; and negotiating more than $50 million in landlord contributions and tenant improvement allowances and more than $100 million in leasehold monetization over the years.

Biggest current challenge: Scaling Brix’s portfolio while preserving the unique culture and guest connection that make each brand special.

Next big goal: Expand the Brix platform both organically and through complementary acquisitions with a focus on better-for-you and family-friendly brands and bring Friendly’s into the Southeast, Midwest, and Texas.

First turning point in your career: Transitioning from a single Friendly’s operator to a multi-brand developer and realizing I could apply operational discipline and growth strategy across diverse concepts.

Best business decision: Taking the leap to go into business and purchasing my first Friendly’s restaurant and then focusing on finding great mentors and role models as I scaled my business.

Hardest lesson learned: Rapid growth without sufficient infrastructure. Growth and control are key.

Work week: Often six to seven days with a mix of on-site visits, strategy sessions, and deal negotiations as well as significant admin time.

Exercise/workout: Regular weight training and cardio. Staying active is key to managing the demands of the role.

Best advice you ever got: “Never ask your team to do something you wouldn’t do yourself.” That came from James Yanucil, the owner of the first Friendly’s I worked at as a teen. Today, he is one of my strongest mentors and supporters in business and friendship.

What’s your passion in business? Transforming underperforming businesses into healthy, growing ones while mentoring future leaders.

How do you balance life and work? Protecting family time and integrating my children into my work life when possible so that they can see firsthand what it means to build something.

Guilty pleasure: Obviously, ice cream at Friendly’s even after 16 years.

Favorite book: Tap Dancing to Work: Warren Buffett on Practically Everything by Carol Loomis.

Favorite movie: “The Pursuit of Happyness.”

What do most people not know about you? I used to be an event DJ. I started while I was in high school.

Pet peeve: People who struggle with being up front with what they need and people who do not respect others’ time.

What did you want to be when you grew up? A businessman. I grew up in a middle-class family, and we always had more than sufficient means for what we needed. But I saw others who were in

business and had more money, and I was drawn to that possibility.

Person you’d most like to have lunch with: President Abraham Lincoln.

MANAGEMENT

Business philosophy: People and culture first, supported by strong systems, routines, and processes. Management method or style: Hands-on to an extent while also providing room for managers to grow and develop. Being highly collaborative, I’m in the field often, but I empower leaders to own their results.

Greatest challenge: Balancing strategic growth with operational excellence and consistency across multiple brands.

How do others describe you? Driven, disciplined, fair, and relentless in pursuing growth.

Have you ever been in a mentor-mentee relationship? What did you learn? Several. Most of my mentors are still mentoring me today. It is the most valuable resource you could ever have.

Personal and professional mentorship is critical to having a proper life balance and long-term success. Good mentors who have had the experience and longevity can be instrumental to your business success. It is important to have them from an unbiased perspective. I speak with multiple mentors weekly. One thing you’re looking to do better: Worklife balance and delegating more to create space for long-term strategic work.

How you give your team room to innovate and experiment: Encourage pilot programs at the store level and measure success before rolling out system wide. I also want to encourage team members to come up with genuine out-of-the-box solutions and developments.

How close are you to operations? Operations are the heartbeat of any business, and I try to remain close to that side. I began in operations and still believe the guest experience starts with how the restaurant runs every day while ensuring all the direct and indirect support systems are functioning. What are the two most important things you rely on from your franchisor? Efficient and profitable systems and innovation.

What you need from vendors: Commitment with a partnership mentality. Advisors and vendors should bring solutions, not just products, and be excellent at logistics and execution.

Have you changed your marketing strategy in response to the economy? How? Yes. We lean into value, digital, loyalty, and localized campaigns that can flex by market conditions.

How is social media affecting your business? Social media is a significant part of our business. It is another way for customers to learn about your business and also interact with your brand. It requires constant monitoring and dynamic

engagement. A business with an online presence must be aware of reputation management, which is an important part of making sure your business is properly represented online. For advertising, social media allows you to reach customers in a targeted method. Digital-only marketing campaigns are effective if done properly, but generally, retailers who use digital marketing will coordinate messaging with other marketing channels to be fully effective. The drawback is that with limited dollars to invest in marketing the businesses, a brand’s voice can be splintered due to the need/desire to communicate with customers through multiple channels.

In what ways are you using technology (like AI) to manage your business? We are leveraging AI and analytics to optimize site selection, staffing, innovation, and marketing targeting. How do you hire and fire? Hire slowly, focusing on character and capability. Part ways quickly but respectfully when alignment isn’t there.

How do you train and retain? Invest in onboarding, mentorship, and recognition programs. How do you deal with problem employees? Address issues early with direct, constructive feedback.

Fastest way into your doghouse: By overpromising and underdelivering.

BOTTOM LINE

Goals over the next year: Open multiple new units across Brix brands, execute at least one strategic acquisition, and expand Friendly’s into two or three new states.

Growth meter: How do you measure your growth? Unit count, same-store sales comps, profitability, and team retention.

Vision meter: Where do you want to be in five years? 10 years? A national and international portfolio of high-performing brands that are recognized for operational excellence and strong franchisee relationships.

Do you have brands in different segments? Why/why not? Yes. Diversification mitigates risk and allows us to capture different guest occasions. But we do our best to focus on kids and family brands in the better-for-you sector.

How is the economy in your region(s) affecting you, your employees, your customers? Inflation pressures margins, but strategic pricing and value engineering help maintain competitiveness. Are you experiencing economic growth in your market? In many markets, we are seeing economic growth. Many of our restaurants are in growing areas, and we are looking at areas to continue to grow through strategic planning and marketing.

How do changes in the economy affect the way you do business? Changes are good and bad, but unexpectedly, they generally lead to an expense for the business. The economy is very important. You have to be able to detect the change in the

economy before it moves and create a plan to attempt to benefit your business during that economy or, at least, protect your business if a benefit cannot be realized during that period of time.

How do you forecast for your business? Datadriven modeling based on historical trends, market analysis, and competitive insights.

What are the best sources for capital expansion? A combination of private equity, family office, REITs, and traditional banking partners.

Experience with private equity, local banks, national banks, other institutions? Why/ why not? I have worked with all the above. The experience varies greatly and generally depends on your need for the capital and the outcome of your investment to understand the varieties.

What are you doing to take care of your employees? With competitive pay and growth opportunities. We also foster a culture of respect.

How are you handling rising employee costs (payroll, minimum wage, healthcare, etc.)? Through design efficiencies, training, innovation, and technology. Innovation is critical. Being in the restaurant industry, we focus on the human experience. Great employees and culture are the apex of what we will always be. We need to incorporate technology into our operations to make the job easier, more efficient, and less stressful. We always want to put people first, putting them in the right position while eliminating waste.

What laws and regulations are affecting your business, and how are you dealing with them? Every state has different rules and regulations, such as hourly rates, and they are constantly changing. We work tirelessly to remain compliant by tracking them closely, quickly adopting SOPs, and advocating through industry groups.

How do you reward/recognize top-performing employees? With bonuses, public recognition, and growth opportunities.

What kind of exit strategy do you have in place? Build a sustainable, profitable portfolio with strategic options for transition or generational handoff.

(All stores... not just the top quartile) 8-hour

“You can’t grow properly without having your infrastructure in place first.”

Baked Into the Business

Papa Murphy’s largest operator prepares for the future

Written by KEVIN BEHAN

TOM LOVELACE

Owner/President

Company: Tom Lovelace Group No. of units: 96 Papa Murphy’s Age: 63

Family: Wife Lisa, 2 children, Jeremy, 42, and Jenn, 40, and 6 grandchildren

Years in franchising: 35

Years in current position: 35

Tom Lovelace’s nearly 50-year career in the restaurant industry will likely conclude within the next year. Before he turns over the reins of his 96 Papa Murphy’s units to his children, however, he has some things left to accomplish. Ever the restaurant lifer, Lovelace wants to optimize profitability and communication across each of his stores to ensure his business is in good hands for the next generation of his family.

Lovelace got his start in the industry as a busboy when he was 14 and worked in several restaurants as a teenager before heading to the University of Oregon on a football scholarship. After one year on campus, he decided he needed to take another direction in life by getting married and starting his career. At age 19, he married his girlfriend Lisa and enrolled in the McDonald’s management program.

“Forty-four years later, those proved to be the right decisions,” he says.

After spending 11 years as a manager in the McDonald’s system and learning all aspects of restaurant operations, Lovelace decided it was time to become an owner. He was attracted to Papa Aldo’s (later Papa Murphy’s), a burgeoning takeand-bake pizza franchise based in his native Pacific Northwest. Although he considered becoming a McDonald’s franchisee, Lovelace preferred Papa Aldo’s operational advantages of fewer hours and employees and a smaller store footprint than the burger chain. He and his brother Jim, who also worked at McDonald’s, purchased two stores from a local owner, but the acquisition came with stress.

“I was scared to death,” Lovelace says. “I went from having a secure paycheck every two weeks to mortgaging our house and putting everything on the line for something we believed we could do. Coming from McDonald’s, it was all about systems. So, it was the same experience for us, and it was an easy transition.”

For the first decade of his ownership, Lovelace only operated in Washington state. As the brand grew, he became its first franchisee in Canada in 2006 and operated 16 stores over three years north of the border. Today, he is the largest franchisee in the Papa Murphy’s system with 96 locations across 12 states.

Lovelace credits the franchise model with his ability to scale the business. He said having effective systems in place, including training programs and supply chain management, helped the most during his early years. He now relies upon strong marketing programs and assistance with real estate for new restaurants.

Over the next year, Lovelace will turn over ownership of the company to his two children, who have worked for him for two decades and have been brought along with a succession plan for the past five to six years. His son Jeremy is VP of operations, and his daughter Jenn is an accountant, and both will continue in similar roles after the transition. Although he will oversee legal matters in a chairman role, Lovelace looks forward to traveling more with his wife in the coming years, knowing the company is in good hands with his children at the helm.

PERSONAL

First job: As a busboy at a restaurant in Vancouver, Washington, when I was 14.

Formative influences/events: Growing up, we didn’t have much, but I excelled in football. I saw

my hard work pay off when I was awarded a scholarship to play Division 1 football. That mentality that you need to work hard to achieve your goals has stuck with me throughout my career.

Key accomplishments: In a joint venture with Papa Murphy’s International, we opened the first 16 stores in Canada. Our group was also the first Papa Murphy’s to operate branded locations within a professional sports stadium. For three years, we were the exclusive pizza provider for every event at Quest Field (now Lumin Field) in Seattle. At its peak, we grew our portfolio to 107 stores.

Biggest current challenge: There are a few. The quality and cost of labor in our restaurants. Another is the increasing costs of goods and real estate. All expenses continue to go up.

Next big goal: Completing my exit strategy by handing the business over to the kids.

First turning point in your career: Buying my first two Papa Murphy’s locations. Once we purchased the first two, it wasn’t long before we acquired our third and fourth, and we have grown exponentially since then.

Best business decision: To invest in great people and pour into them. I knew that if we were going to successfully expand, we needed to have good people to do it. We emphasized hiring the right people and developing them, so we had a strong bench of people in place for when we expanded.

Hardest lesson learned: You can’t grow properly without having your infrastructure in place first. When we first expanded out of Washington state and into California, we tried to do it on the cheap. We purchased three stores and ran them through Washington. It didn’t work, and it was a painful experience.

Work week: Six to seven days a week. I usually spend Monday through Friday in the office or traveling. I use the weekends to catch up or prepare for the upcoming week.

Exercise/workout: Not as much as I should, but I do get out and golf every now and then.

Best advice you ever got: Work really hard and then work harder to achieve your goals. It came from a coach during my football-playing days. Being big isn’t good enough. You have to work harder than the person across the line from you.

What’s your passion in business? I love to grow. I’ve had the privilege to help grow the overall Papa Murphy’s brand, along with my own organization, for the past 35 years. We went from around 70 stores to more than 1,500 at its peak.

How do you balance life and work? Being a family business, those lines have always been pretty blurred, but we’ve made it work. Business issues constantly come up during family time, but we only discuss them if we need to. We try to protect family time by discussing business later.