11TH SEPTEMBER 2025

Headline Sponsor

11TH SEPTEMBER 2025

We’re delighted that you have chosen to join us at the Smarter Payments Summit – a unique event, tailor-made to meet your individual requirements. We have carefully planned out your itinerary to ensure your time here is worthwhile: Connect with businesses relevant to your current and forthcoming projects in our matchmade one-to-one meetings.

And let’s not forget the networking – we’ve created a relaxed environment for you to form new partnerships, with ample opportunities to mix with peers during the buffet lunch and coffee breaks!

4

6

8

10 Seminars ‘Chargebacks Month: Building a proactive prevention strategy in 2025 ’

12 Delegates

14 Dates for your Diary

16 Itinerary

For more information about our event, contact:

Jennie Lane - Portfolio Sales Manager on 01992 374098 or J.Lane@forumevents.co.uk

Luke Jackman - Delegate Sales Executive on 01992 374101 or L. Jackman @forumevents.co.uk

Supplier Directory

08.45 - 09.30

Opening Panel

‘ The cVRP Potential: Redefining Recurring Payments’ Presented By: Farrel Levenson (GoCardless)

Joined by: Nick Davey (Open Banking Ltd) & Tom Burton (GoCardless)

Meeting Room 3/4/5

09.35 - 09.55

Panel

‘ The Future of the Payments Industry 2025-2028’ Eliot Heilpern

Pantheon Communications Meeting Room 3/4/5

10.00 - 12.55

Face to Face Meetings

Quayside Suite

12.55 - 13.35

Networking Buffet Lunch

Cinnamon Restaurant

13.35 - 14.15

Panel

‘Geographical Profiling in Payments: How We Boosted US Authorisation using bespoke fraud rules’.

Benjamin Clough

Heathrow Airport

Meeting Room 3/4/5

14.20 - 14.40

Seminar

‘Smarter Payments & Cash’

Paul Lewis

Freelance Financial Journalist Meeting Room 3/4/5

14.45 - 16.45

Face to Face Meetings

Quayside Suite

Access PaySuite offers a suite of payment channels under one roof, enabling you to capture every payment with ease.

features:

Omnichannel payments for all the ways your customers want to pay

Powerful reporting with AI insights

Robust security and compliance

Outstanding fraud protection and real-time transaction control

Scalable infrastructure for growth

Dedicated support based in the UK

Flexible API and white label options

Faster payments, better cashflow

Increased revenue with higher payment success and reduced fraud

Less admin, more efficiency

Elevated customer experience

Financial visibility, in real time

Peace of mind: keeping all your payments safe and compliant

A platform that grows with you backed by 20+ years’ experience

Join 6,000+ UK organisations simplifying payments

Discover a payment ecosystem designed to streamline collections, elevate your customer experience and improve cash flow, with expert support when you need it.

Chargebacks remain a significant threat to profitability in the UK’s e-commerce sector, with evolving fraud tactics, shifting customer expectations, and regulatory changes creating a complex landscape. Successful retailers, many of who are attending the eCommerce Forum, are moving beyond reactive dispute handling and instead embracing proactive, end-to-end strategies to prevent chargebacks before they happen…

At the heart of this approach is datadriven risk profiling. Retailers are increasingly using advanced analytics and AI to detect patterns in high-risk transactions, flagging anomalies in behaviour, location, and device usage in real-time. Machine learning models can help segment customers by risk profile and dynamically apply additional verification steps, such as step-up authentication or delivery confirmation.

Clear communication and transparent policies are another pillar of prevention. Ambiguous returns processes, unclear billing descriptors, and delayed shipping updates are all frequent triggers for chargebacks categorised as ‘fraud’ or ‘product not received’. By improving post-purchase communication, through realtime order tracking, chatbots,

and branded transactional emails, retailers can reduce the chance of misunderstandings that escalate into disputes.

Equally important is ensuring operational excellence. Delivery issues and poor fulfilment account for a significant percentage of chargebacks. By partnering with reliable logistics providers and leveraging shipment tracking APIs, brands can build trust and provide proof of delivery when needed. Some are also employing geolocation tools to validate delivery claims and challenge ‘item not received’ disputes with stronger evidence.

Multi-layered fraud prevention stacks are becoming the norm. Rather than relying on a single fraud tool, leading brands combine device fingerprinting, behavioural biometrics, CVV/AVS checks, and 3D Secure 2.0 for a robust, frictionbalanced approach. Additionally, flagging repeat offenders and analysing refund abuse trends helps identify serial first-party fraud cases.

Cross-functional collaboration between fraud, customer service, and marketing teams also plays a crucial role. Educating agents to spot refund scams, empowering them to resolve complaints pre-emptively, and aligning customer satisfaction metrics with fraud prevention KPIs

creates a more unified chargeback defence posture.

Finally, brands are increasingly investing in chargeback alerts and representment tools. Real-time alerts from networks like Ethoca and Verifi allow merchants to refund a transaction before it escalates into a chargeback, while automation tools streamline the representment process with templated responses, transaction evidence, and dispute tracking dashboards.

The brands that win in 2025/2026 will be those that treat chargeback mitigation as an integrated discipline, not an afterthought.

Scan or click here to subscribe to the eCommerce Briefing newsletter

THURSDAY 11TH SEPTEMBER

08.45 – 09.30

Presented

By:

Farrel Levenson Product Manager, GoCardless

Joined by:

Nick Davey Head of Strategy, Open Banking Ltd

Tom Burton Director of External Affairs & Public Policy, GoCardless

Adoption of open banking has been showing steady growth since its inception in 2018, often led by significant regulatory changes. The latest of these is the rollout of commercial Variable Recurring Payments. Variable Recurring Payments (VRPs) will enable recurring payments of differing amounts to be made via open banking.

At present they’re only available in very specific use cases with the commercial rollout coming later this year. But, what does this mean for your business and how you collect recurring payments? Join GoCardless’ panel discussion where we discuss why businesses are looking to implement VRPs. We will also be joined by policy specialists to find out more about current VRP developments and the future potential for the commercial rollout.

Farrel Levenson has nearly a decade of experience building customer-centric products and driving double digit growth across product leadership and strategy roles. Most recently, she has worked across consumer marketplaces and payments products to help established businesses expand beyond their core with new ventures and business lines.

Nick Davey joined Open Banking Limited in April 2024, having previously worked at the PSR and the Bank of England, with around half of his career at the Bank involved in payment policy and settlement. Notably, Nick managed the Bank’s Banknote Circulation Scheme, and managed the Payment and Settlement Analysis team where he worked with a number of the interbank payment systems and direct participants in those systems.

Tom Burton, Board member of the Open Finance Association, specialised in public affairs, regulatory policy, communications and business advisory professional specialising in the financial services and technology sectors. 09.35 – 09.55

“

CEO

The presentation will discuss these developments and illustrate crypto, regulation, greater customer demands, and risk awareness will alter the industry landscape in the next three years.

• Fraud, Financial Crime & Regulation

• Crypto Currencies & Open Banking

• Cross-Border Payments (Nostro Consolidation) & Smart Cites”

• Greater operational resilience & safeguarding

• Regulation v. Innovation…or Transformation for Innovation...?

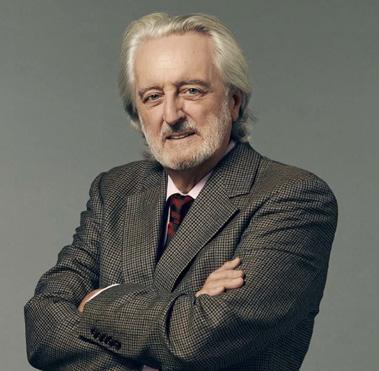

Eliot Heilpern is currently CEO and founder of the Banking and Payments Advisory Group entitled Parthenon Communications. The Company provides advice and solutions on International Payments to the Corporate, FI, and Fintech sectors.

Eliot is a seasoned executive and multi-disciplinary business leader; well experienced at the intersection of payments, relationship banking, risk, partnerships, supporting technologies, and industry regulation.

His professional background is: Senior Banker with regards to Client Relationships and Revenue Generation. He maintains a strong understanding of the Financial Eco-System, having spent more than 25 years in the industry in the UK and overseas. His core areas of expertise are: Corporate and FI Banking, Correspondent Banking, Relationship Management, Global Transaction Services, and Cash Management; including supporting KYC and Due Diligence.

Eliot was former UK CEO of a UN/UNICEF affiliated international organisation, and has held various senior positions with several key international banks, and financial entities in the UK, and abroad overseeing; international retail, wholesale and corporate banking, and cards.

He is renowned for speaking engagements on the banking and payments industry, on social issues, and economic events of an international and geo-political concern. This includes ethical matters in the financial, commercial, and not-for-profit sectors.

Eliot’s mission is to: Review, Challenge, Improve and Inspire. He is passionate about developing relationships, delivering for clients, and exceeding expectations. Eliot enjoys connecting with like-minded industry participants, and leaders.

THURSDAY 11TH SEPTEMBER

13.35 - 14.15

Benjamin Clough Payment Manager Heathrow Airport

“Geographical Profiling in Payments: How We Boosted US Authorisation using bespoke fraud rules”

How a data-led fraud strategy used geographical insights to boost approval rates and reduce false declines in a challenging US market.

• The challenge: High false declines and low authorisation rates

• What is geographical profiling? Analysing fraud and approval patterns by region

• Mapping fraud and approval patterns geographically

• Tailoring fraud rules to local market behaviours

• The outcome: Higher approvals, lower fraud, better customer experience

Benjamin Clough is a payments and fraud specialist with a background spanning aviation, retail, and e-commerce. He currently lead payments at Heathrow Airport, overseeing end-to-end solutions for Marketplace, parking, rail, and premium services. Before this, he managed global fraud and payments at Dr. Martens, and prior to that, worked in revenue protection at easyJet. He brings a blend of commercial strategy and technical know-how, with a focus on secure, scalable, and customer-centric payment journeys.

Payment systems are wonderful for banks which make money from it, for retailers and other merchants who get more business and save costs, and of course for customers, but ultimately there will be a residual group who want and in many cases need cash. What should the payments industry be doing to ensure that technology facilitates their lives too?

Payment systems are wonderful for banks which make money from it, for retailers and other merchants who get more business and save costs, and of course for customers who can pay more easily and quickly 24/7 if (a) they have latest tech and (b) are happy and (c) able to use it for paying and moving money.

How will the payments industry convert them? Each presents different challenges which I would explore in this presentation. But ultimately there will be a residual group who want and in many cases need cash. What should the payments industry be doing to ensure that technology facilitates their lives too?

Paul Lewis has been a freelance financial journalist since 1987. He writes extensively on money issues and is a regular guest on BBC TV and Radio programmes. Paul became established in the public’s eye as a reporter on BBC’s Money Box in the 1990s and, following a three year stint on Radio 5 Live, returned as presenter on Money Box in September 2000. He also regularly appears on other BBC Television programmes such as BBC Breakfast, BBC News Channel, BBC Radio 4 topical shows such as You and Yours, Woman’s Hour and Analysis, as well as BBC Radio 4 news programmes like Today, The World at One and PM.

Amazon Business

BBC Studios

Bede Gaming

Booking.com

BP Plc

CV Villas

Durham County Cricket Club

EG Group

Entain

Eurotunnel

Footasylum

Harrods

Honor TECHNOLOGIES

HX Expeditions

International Airlines Group (IAG)

JD Sports

Lancaster Court Hotel

Liberty London

Redbridge Council

Resident Hotels

Sky

The Automobile Association

The Perkbox Vivup Group

The Savoy

Tombola

Travel Republic / Netflights

VinFast Europe

Virgin Media O2

VSO International

White Stores

Senior Program Manager, GTM

Head of Finance

Product Lead

Senior Product Manager

Payments Project Manager

Lead Product Manager, Digital Payments

Assistant Accountant

Finance Manager

Finance Director

Retail Solutions Manager

Project Coordinator

Product Manager

Payments Cosultant

Commercial Accountant

Transaction Service Manager

Lead Transaction Service Manager

Finance Manager

Treasury Manager

Transformation Lead

Omni-Channel Profit & Asset Protection Operations Manager

Head of Data & Fraud Ecom

Director

Digital Product Manager

Business Manager

Business Support Manager

Head of Finance

Head of Billing Operations

Payment Product Manager

Product Manager

Digital Transformation Analyst

ARIA Leader

Product Manager - Payments

Product Manger

Chief Financial Officer

Payments Specialist

Payments Specialist

Supporter Care Manager

Financial Controller

10th November 2025

Hilton London Canary Wharf

Scan or click here for our website:

5th February 2026

Hilton London Canary Wharf

9th July 2026

Hilton London Canary Wharf

Scan or click here for our website:

11th November 2025

Hilton London Canary Wharf

Scan or click here for our website:

4th March 2026

Hilton London Canary Wharf

10th September 2026

Hilton London Canary Wharf

Scan or click here for our website:

01509 972 380 / Gerard.Evans@theaccessgroup.com / accesspaysuite.com

Access PaySuite helps organisations of all sizes take control of their payments with simple, secure, and scalable solutions. Whether you’re collecting regular payments, one-off transactions or managing complex multi-channel payment journeys, Access PaySuite makes it easier to get paid—accurately and on time. As part of The Access Group, one of the UK’s leading providers of business software, Access PaySuite combines deep sector expertise with powerful technology to streamline how organisations manage income. From Direct Debit and card payments to open banking and real-time reporting, we help reduce admin, improve visibility, and enhance the experience for your customers. With FCA authorisation, Bacs approval and over 20 years of experience, we support thousands of organisations in managing millions of transactions every year. Whether you’re looking to simplify operations or scale your income, Access PaySuite gives you the confidence to grow with a smarter payments strategy.

07950 473 720 / adilla.khan@adyen.com / adyen.com

Adyen (AMS: ADYEN) is the financial technology platform of choice for leading companies. By providing end-to-end payments capabilities, data-driven insights, and financial products in a single global solution, Adyen helps businesses achieve their ambitions faster. With offices around the world, Adyen works with the likes of Facebook, Uber, H&M, eBay, and Microsoft.

Airwallex is a leading global financial platform for modern businesses, offering trusted solutions to manage everything from payments, treasury, and spend management to embedded finance. With our proprietary infrastructure, Airwallex takes the friction out of global payments and financial operations, empowering businesses of all sizes to unlock new opportunities and grow beyond borders. Proudly founded in Melbourne, Airwallex supports over 100,000 businesses globally and is trusted by brands such as Bolt, Rippling, Navan, Qantas, SHEIN and many more.

Established in 1994, allpay has consistently been at the forefront of payment aggregation, processing over £9.4 billion annually for over 900 public and private sector entities. With over three decades of experience, we now process in excess of 66.4 million transactions annually, offering a comprehensive bill payment solution that encompasses all major payment methods. Our commitment to innovation has led us to pioneer the introduction of Prepaid Cards within the Public Sector. From card design to printing and fulfilment, all aspects are handled by our dedicated team. What sets us apart is our unwavering commitment to security and compliance. We adhere to the highest standards of PCI DSS compliance, hold various ISO certifications, maintain Bacs-approved Bureau status, and boast accreditations from Mastercard and Visa. In essence, allpay is the preferred payment supplier for the public sector, offering reliability, security, and efficiency in every transaction.

American Express is driving innovation in payments and Pay with Bank transfer (PwBt) reflects our commitment to delivering choice for UK consumers and businesses through new ways to pay. Leveraging Open Banking, PwBt is another way American Express offers digital-first solutions to customers. PwBt is a secure debit (non-card) payment method that lets consumers pay via a direct transfer from their bank account, whether they are an American Express Cardmember, or not.

ClearBank is a purpose-built, technology-enabled clearing bank. We enable financial institutions and corporates to offer secure accounts, clear payments in real-time and enhance their banking propositions for their customers.

07583 292 050 / egrunewald@ecommpay.com / ecommpay.com

At Ecommpay, we’re all about making online payments smooth and seamless for businesses ready to grow. We’re not just a provider – we’re your trusted partner, here to keep your payments flowing effortlessly and help you get the most out of every transaction. Our payment gateway brings together direct acquiring capabilities, 100+ alternative payment methods, open banking, and Direct Debits, all through a single integration. Plus, our team of experts is always here to support you and help your business thrive.

02045 797 398 / rbramley@gocardless.com

GoCardless is a global bank payment company. Over 100,000 businesses, from start-ups to household names, use GoCardless to collect and send payments through direct debit, real-time payments and open banking. GoCardless processes US$130bn+ of payments annually, across 30+ countries; helping customers collect and send both recurring and one-off payments, without the chasing, stress or expensive fees. We use AI-powered solutions to improve payment success and reduce fraud. And, with open banking connectivity to over 2,500 banks, we help our customers make faster, more informed decisions. We are headquartered in the UK, with additional offices in Australia, France, Ireland, Latvia and the United States. For more information, please visit www.gocardless.com and follow us on LinkedIn @GoCardless.

+35 387 2524 821 / adam.kissane@juspay.io / juspay.io/europe

Juspay is a leading multinational payments technology company, redefining payments for 500+ top global enterprises and banks. Founded in 2012, the company processes over 200 million daily transactions, exceeding an annualized total payment volume (TPV) of $900 billion with 99.999% reliability. Headquartered in Bangalore, India, Juspay is powered by a global network of 1200+ payment experts operating across San Francisco, Dublin, São Paulo, and Singapore. Juspay offers a comprehensive product suite for merchants that includes open-source payment orchestration, global payouts, seamless authentication, payment tokenization, fraud & risk management, end-to-end reconciliation, unified payment analytics & more. The company’s offerings also include end-to-end white label payment gateway solutions & real-time payments infrastructure for banks.These products help businesses achieve superior conversion rates, reduce fraud, optimize costs, and deliver seamless customer experiences at scale.

07881 544 772 / dfernandez@marqeta.com / marqeta.com

Marqeta’s modern card issuing platform empowers its customers to create customized and innovative payment cards. Marqeta’s modern architecture gives its customers the ability to build more configurable and flexible payment experiences, accelerating time-to-market and democratizing access to card issuing technology. Marqeta’s open APIs provide instant access to highly scalable, cloud-based payment infrastructure that enables customers to launch and manage their own card programs, issue cards, and authorize and settle payment transactions. Marqeta is headquartered in Oakland, California and is certified to operate in more than 40 countries globally.

+35 3873 480 875 / kguzek@paypal.com

PayPal has been revolutionizing commerce globally for more than 25 years. Creating innovative experiences that make moving money, selling, and shopping simple, personalized, and secure, PayPal empowers consumers and businesses in approximately 200 markets to join and thrive in the global economy. For more information, visit https://www.paypal.com/uk/home. LinkedIn: https://www.linkedin.com/showcase/paypal-open/ Instagram: https://www.instagram.com/paypalopen/

07776 115 332 / dsingh@telesign.com / telesign.com

Proximus Global, combining the strengths of Telesign, BICS, and Route Mobile, is transforming the future of communications and digital identity. Together, our solutions fuel innovation across the world’s largest companies and emerging brands. Our unrivaled global reach empowers businesses to create engaging experiences with built-in fraud protection across the entire customer lifecycle. Our comprehensive suite of solutions – from our super network for voice, messaging, and data, to 5G and IoT; and from verification and intelligence to CPaaS for personalized omnichannel engagement – enables businesses and communities to thrive. Reaching over 5 billion subscribers, securing more than 180 billion transactions annually, and connecting 1,000+ destinations, we honor our commitment to connect, protect and engage everyone, everywhere.

07480 110 489 / dan@simpler.so / simpler.so

At Simpler, we understand the challenges merchants face when managing fragmented solutions for checkout flow, payment processing, shipping, and loyalty programmes. Having to integrate and maintain multiple systems can be a headache, leading to higher costs, inefficiencies, and, ultimately, lower conversion rates. That’s why our mission is simple: to eliminate these complexities and give merchants everything they need in one, easy-to-use platform.

+35 3862 365 918 / alex.donohoe@solidgate.com / solidgate.com

Solidgate is a payment orchestration platform. One integration enables instant connections to a global network of PSPs and Alternative Payment Methods. Advanced payment routing allows you maximise ROI across PSPs based on parameters such as cost, acceptance rate, card type, geography and more. Stay ahead of fraud with our comprehensive Chargeback Management suite and built-in risk management tools. Manage and optimise subscriptions through our PSP-agnostic subscription management system. Accept more payments through Solidgate’s own acquiring network. Our team of payment experts works 24/7 to optimise your setup, maximise revenue, and help you cut costs. You run your business. We handle the payments.

Stripe is a technology company that builds economic infrastructure for the internet. Businesses of all sizes—from startups to large enterprises—use our software to accept payments and manage their businesses online. Founded in 2010, Stripe’s mission is to increase the GDP of the internet by making it easy for companies everywhere to start, run, and scale their business. We combine a payments platform with applications that put revenue data at the heart of business operations. Our products power payments for online and in-person retailers, subscriptions businesses, software platforms, marketplaces, and everything in between. We process hundreds of billions of pounds annually for millions of businesses around the world. afshin@stripe.com / stripe.com

Tink was founded in 2012, and a decade later became part of Visa in 2022. Tink was created with the aim of changing the banking industry for the better. We have built Europe’s most robust open banking platform – with the broadest, deepest connectivity and powerful services that create value out of the financial data. We offer the tools that allow anyone – from big banks and fintechs to startups – to build the future of financial services across Europe.

VGS is the world’s leader in payment tokenization and trusted credential management platform depended on by Fortune 500 companies, merchants, fintechs, and banks. Our mission is to revolutionize the way sensitive data is stored and secured, enabling organizations to manage information across cards, bank accounts, and digital wallets with ease. VGS stores sensitive data and addresses critical payment acceptance challenges, including multi-PSP management, card issuance, payment orchestration enablement, PCI compliance, and the protection of personally identifiable information (PII). We provide our clients with complete ownership, control, and insights into their payment data, driving growth and enhancing user experiences across industries. VGS offers a comprehensive suite of solutions, including a Card Management Platform, a PCI Vault, and value-added services such as Network Tokens, Account Updater, and Card Attributes. Our technologies empower businesses to boost revenue through higher authorization rates, reduce fraud, and streamline operations, while seamlessly integrating with existing tech stacks.

10th November 2025

Hilton London Canary Wharf

The Fraud Prevention Summit offers an opportunity to meet with like-minded specialists, attend educational seminars and meet with some of the most innovative suppliers in the market. This event will assist buyers with their fraud projects in this constantly changing and evolving landscape.

From Fraud Management Software, AI, Multifactor Authentication, Risk Prevention Solutions to Chargeback Protection – the Summit covers all areas for you to successfully manage and combat challenges within the fraud sector.