Welcome to Fort Street, where clients’ financial success is our utmost priority. As the founders, we are thrilled to introduce ourselves and present our investment strategies tailored to the unique needs of investors in Hawaii and abroad.

With a team of seasoned professionals, we bring a wealth of experience and a track record of success. Our unwavering commitment to putting clients first drives our client-centered approach, fostering trust, transparency, and mutual respect in our long-term partnerships.

Explore our website to gain insights into our innovative investment strategies and discover how we can provide you with the peace of mind and financial security you deserve. Don’t hesitate to reach out to us for any inquiries or to schedule a consultation.

RICHARD WERTHEIMER & CLINT DODSONAt Fort Street, our mission is to safeguard and grow client assets with unwavering vigilance across all market conditions. Our purpose is to empower individuals and organizations to unlock their financial potential through personalized investment strategies, rigorous research, and a client-centric approach.

Founded in 2019 by Richard Wertheimer and Clint Dodson, Fort Street Asset Management is an investment firm based in Honolulu, Hawaii. With a shared background at Morgan Stanley’s Wealth Management office in Hawaii, Richard and Clint brought their expertise together to establish a firm dedicated to protecting and compounding client assets. Supported by a highly experienced team of investment and business professionals, Fort Street has a proven track record in managing the core portfolio since 2016. In 2022, the firm expanded its investment scope and operational efficiency with the launch of the Fort Street AM LP Fund.

At Fort Street, our culture is defined by collaboration, integrity, and a passion for excellence. We foster an environment where teamwork thrives, encouraging open communication and the sharing of diverse perspectives. We value the highest ethical standards, ensuring transparency and trust in all our interactions. Our team is driven to continuously push boundaries to deliver exceptional results for our clients. We embrace a culture of learning and professional development, staying ahead of industry trends and evolving market dynamics. At Fort Street, we empower our team members to unleash their full potential, fostering innovation and a client-centric mindset.

We understand that choosing an investment management firm is a significant decision that can greatly impact your financial future. Here’s why we believe Fort Street stands out from the rest:

A Seasoned Team: Our team comprises experienced professionals with deep industry knowledge and expertise across various asset classes.

Proven Track Record: Fort Street has a demonstrated history of delivering strong investment performance and successfully navigating market cycles.

Market Insights: We stay at the forefront of industry trends and provide timely, data-driven insights to guide and explain investment decisions.

Tailored Solutions: We recognize that each client has unique financial goals and risk tolerances. Our customized investment strategies are designed to meet specific needs.

Transparent Communication: We believe in open and honest communication, providing regular monthly and quarterly updates, performance reports, and opportunities for dialogue, in-person meetings, and events to ensure clients are always informed.

Uncovering Opportunities: Our research goes beyond traditional market analysis to identify hidden investment gems and emerging trends.

Risk Management Focus: We prioritize capital preservation and employ sophisticated risk management techniques to mitigate potential downsides.

Long-Term Relationships: At Fort Street, we strive to build enduring partnerships with our clients, guiding them through various life stages and financial milestones.

Fiduciary Responsibility: We place clients best interests first. Our commitment to acting as a protector of client capital drives every decision we make at the firm..

Holistic Approach: Fort Street offers a range of investment management services, including portfolio construction, asset allocation, manager selection, and ongoing monitoring.

Multi-Asset Expertise: With our diverse capabilities, we can navigate different asset classes, from equities and fixed income to alternative investments, to help diversify and optimize your portfolio.

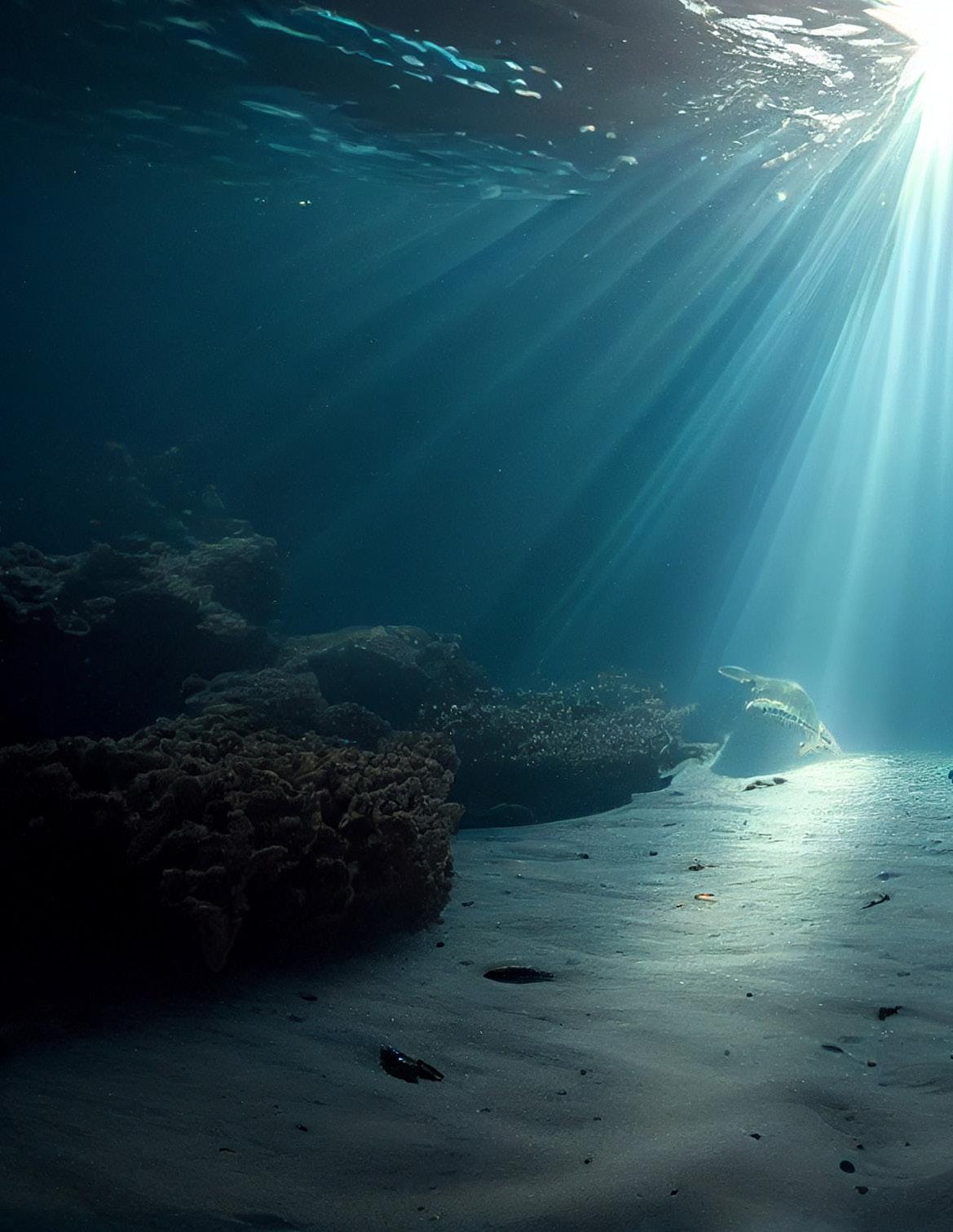

Investment management is the cornerstone of our expertise, providing clients with a strategic and disciplined investment team that aims to maximize the performance ofinvestments. By diving well beyond the surface of speculation, we rely on meticulous analysis, research, and expertise to make informed decisions.

At Fort Street, investment management is both an art and a science. Our experienced team combines artistic insights with scientific methodologies to identify opportunities, recognize patterns, and make insightful decisions that generate favorable returns. Through quantitative analysis, rigorous research, and data-driven strategies, we optimize portfolio performance and help clients achieve desired financial outcomes.

Preserving capital and minimizing risks is a fundamental objective of our investment management approach. We employ a range of strategies to mitigate potential downsides, including diversification, careful asset allocation, and risk management techniques. By striking a balance between generating returns and preserving capital, we aim to create resilient portfolios that can withstand market fluctuations and deliver consistent results over the long term.

At Fort Street, we go above and beyond traditional market analysis to provide you with unparalleled insights. Our approach extends beyond surface-level information, delving deep into market dynamics, and employing advanced research methodologies. By going the extra mile, we uncover valuable investment opportunities that may be overlooked by conventional analysis. Our commitment to comprehensive research allows us to provide clients with a unique advantage in the ever-evolving investment landscape.

Our team tirelessly sifts through vast amounts of data, aiming to uncover hidden investment gems. We believe that true investment excellence lies in identifying promising opportunities before they reach the mainstream. With our meticulous research process and keen eye for potential, we unearth undervalued assets, emerging industries, and overlooked trends.

Staying ahead of the curve is essential for successful investment decision-making. At Fort Street, we pride ourselves on our ability to identify emerging trends that can shape the future investment landscape. By closely monitoring industry shifts, technological advancements, and global economic developments, we gain valuable foresight. Our goal is to equip ourselves and clients with the knowledge needed to make advantageous investment decisions and position ourselves at the forefront of evolving market opportunities.

We recognize that strategic asset allocation is crucial for preserving capital and optimizing investment performance. Our experienced team understands that different asset classes have varying risk profiles and return potentials. By strategically allocating funds across a diversified range of assets, including stocks, bonds, outside managers, and more, we aim to create a portfolio that aligns with your risk tolerance and financial objectives. Through thoughtful asset allocation, we strive to enhance returns while managing risk in a disciplined and strategic manner.

Diversification is a cornerstone of our asset allocation strategy. By spreading investments across various asset classes, we reduce exposure to any single investment and mitigate the impact of market volatility. Fort Street emphasizes the importance of building well-diversified portfolios that are not overly reliant on a single sector or asset class. This diversification approach helps to enhance stability, minimize the impact of individual investment fluctuations, and provide a more consistent return profile over time.

Volatility is an inherent aspect of financial markets, and managing it is crucial for long-term success. At Fort Street, we employ sophisticated risk management techniques to minimize volatility and provide stable growth opportunities. By closely monitoring market conditions, actively managing portfolios, and employing risk-mitigation strategies, we strive to smooth out the ups and downs of investment performance. Our goal is to deliver consistent and reliable growth while minimizing the impact of market fluctuations, ultimately providing you with a smoother investment journey.

At Fort Street, our purpose is clear: to empower our clients to achieve their financial aspirations and secure their long-term success. We are driven by a commitment to deliver exceptional investment management services that go beyond the ordinary. Our purpose is rooted in the following core principles:

Protecting and preserving clients’ capital is a fundamental priority for us. We understand the significance of managing risks effectively to safeguard investments. With a focus on strategic asset allocation, diversification, and risk management techniques, we aim to minimize volatility and ensure stable growth.

We are dedicated to unlocking the full potential of active investment management and consistently strive for excellence. Through meticulous research, advanced analysis, and comprehensive due diligence, we identify promising investment opportunities and navigate market complexities.

Trust forms the foundation of our relationships with clients. We aim to earn and maintain clients’ trust by acting as fiduciaries, putting their best interests first. Transparency, open communication, and integrity guide our interactions. We are committed to building long-term partnerships, accompanying clients on their financial journey, and adapting our strategies as needs evolve.

We place our clients at the center of everything we do. Their financial goals, risk tolerance, and unique circumstances guide our decisionmaking process. We strive to understand client needs deeply and provide personalized solutions that align with their objectives. Client success is our ultimate purpose.

We differentiate ourselves from traditional financial advisors by actively engaging in research, strategic allocation decisions, trade execution and continuous portfolio monitoring. Unlike financial advisors who often rely on external sources, we have the expertise and resources to conduct our own trading, research and analysis, and asset allocation. By taking a holistic approach to investment management, we provide our clients with a higher level of service and expertise that financial advisors themselves often seek.

We harness the art and science of investment management to optimize returns while minimizing risks. Through strategic allocation across diverse asset classes, including stocks, bonds, and alternative investments we pave the way for achieving clients’ unique financial objectives.

At Fort Street, we go beyond traditional market analysis to uncover hidden investment gems and reveal emerging trends. Our team is dedicated to staying ahead of the curve, constantly monitoring market shifts and identifying trends before they become widely recognized.

We prioritize capital preservation and minimize volatility through strategic asset allocation. Our expert team constructs diversified portfolios to balance risk and reward, providing stability in changing markets. With our focus on capital preservation and volatility management, you can confidently navigate market fluctuations while working towards your financial goals.

We have a large network of top-tier managers that we sometimes invest alongside. Our rigorous manager selection process evaluates track records, investment philosophies, risk management approaches, and alignment with client objectives.

We are adaptable to evolving markets and not limited by style boxes. We are similar to a multistrategy fund but don’t do everything in-house. We outsource certain strategies that allow us to focus on what we are good at while taking advantage of experts in other areas.

Did you know that working with financial advisors often involves additional fees and intermediaries, with clients typically placed in model portfolios? By choosing Fort Street as your investment manager, you can bypass the middlemen and enjoy a more efficient investment experience. With our direct approach, you gain access to active portfolio management without paying embedded fees.

Find more info about why model portfolios are bad here.

From inception, Fort Street has been committed to crafting an investment portfolio that prioritizes capital preservation, outperforms the market, and adapts to changing circumstances. Throughout our journey, we have consistently met these objectives, particularly during times of market turbulence. Fort Street employs two robust investment strategies to safeguard and grow client assets: our proprietary enhanced equity portfolio and a newly introduced fixed-income portfolio in collaboration with BlackRock. This dynamic duo empowers clients to toggle between minimal risk with stable cash flows and moderate risk with higher compounded returns.

Our proprietary enhanced equity portfolio is designed to deliver superior returns by harnessing the potential of the equity market. With a focus on rigorous research, disciplined analysis, and active management, we seek to identify undervalued stocks and capitalize on market opportunities. By employing our expertise and a blend of quantitative and qualitative analysis, we aim to outperform traditional benchmarks to drive investment success.

We have partnered with industry leader BlackRock to offer a fixed-income portfolio that emphasizes stability and reliable cash flows. This collaboration allows us to tap into BlackRock’s extensive expertise and resources in fixed-income investments. By strategically allocating funds across a diversified range of fixed-income securities, we aim to help clients generate consistent income while managing risk. This portfolio option provides a balance between stability and potential returns.

To open an account or learn more about our customized solutions, simply contact us using the information provided below. Our team is ready to assist you in exploring the possibilities and answering any questions you may have.

At Fort Street, we believe in building strong relationships with our clients, based on trust, transparency, and exceptional service. We are committed to guiding you through the process, providing the support and expertise you need to make informed investment decisions.

Mahalo!

Phone: [Phone number]

Email: ir@fortstreetam.com

Website: www.forstreetam.com

Fort Street Asset Management, LLC (“FSAM”) is a Registered Investment Advisor (“RIA”) registered with the State of Hawaii. Registration as an investment adviser does not imply a certain level of skill or training, and the content of this communication has not been approved or verified by the United States Securities and Exchange Commission or by any state securities authority. FSAM renders individualized responses to persons in a particular state only after complying with the state’s regulatory requirements, or pursuant to an applicable state exemption or exclusion. The information contained in this brochure is intended to provide general information about FSAM and its services. It is not intended to offer investment advice. Investment advice will only be given after a client engages our services by executing the appropriate investment services agreement and shall be subject to the terms and conditions therein.

Information regarding investment products and services are provided solely to read about our investment philosophy, our strategies and to be able to contact us for further information. You should not rely on any information provided on our web site in making investment decisions. Market data, articles and other content in this brochure are based on generally available information and are believed to be reliable. FSAM does not guarantee the accuracy of the information contained in this brochure. The information is of a general nature and should not be construed as investment advice and relied upon in making investment decisions. FSAM will provide all prospective clients with a copy of our current Form ADV, Part 2A (Disclosure Brochure) prior to commencing an advisory relationship. However, at any time, you can view our current Form ADV, Part 2A on our web site. In addition, you can contact us to request a hardcopy.