6 minute read

Does Avatrade Have Copy Trading

by ForexMakets

Does Avatrade Have Copy Trading

Unlock the Potential of Smart Trading with AvaTrade Copy Trading

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

1. Introduction to AvaTrade Copy Trading

AvaTrade Copy Trading is revolutionizing the way traders approach the market. By giving access to professional strategies through automation, it enables both beginners and experienced traders to maximize profits with minimal manual effort.

This feature is especially valuable in today’s volatile forex and CFD market, where timely decisions and consistent strategy make the difference between gain and loss.

💥 Read more: Avatrade Review

2. What Is Copy Trading?

Copy Trading is a form of social trading where you automatically replicate the trades of professional or experienced traders. Instead of analyzing charts for hours, you simply choose a trader to follow, and the system copies their moves in real-time.

This method is ideal for:

Traders who are new and want to learn by observing.

Busy individuals who want to trade passively.

Investors seeking portfolio diversification.

Avatrade Copy Trading enhances this process with a highly optimized platform ecosystem, ensuring both control and automation.

3. How AvaTrade Copy Trading Works

Here's how the Avatrade Copy Trading process typically functions:

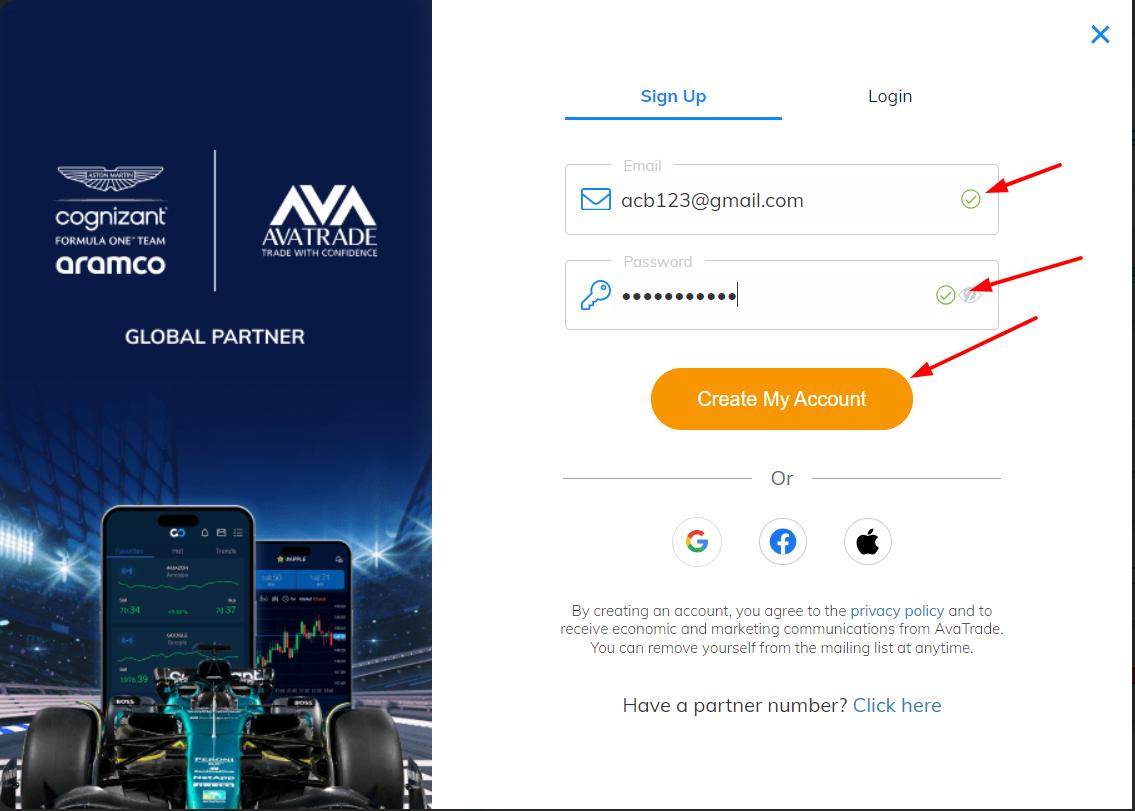

Step 1: You sign up and access the copy trading platforms provided by AvaTrade.

Step 2: Browse a list of verified professional traders with data on performance, risk level, and strategies.

Step 3: Select one or more traders that match your investment goals.

Step 4: Allocate a portion of your capital to automatically copy their trades.

Step 5: Monitor performance in real-time, adjust risk preferences, or stop copying anytime.

✅ Automation at its best, with your capital following expert logic and timing.

4. Platforms Offered by AvaTrade for Copy Trading

AvaTrade doesn’t limit you to one solution. It offers multiple professional-grade platforms to support your copy trading experience.

✅ AvaSocial

Fully mobile and interactive.

Engage with traders, chat, and ask questions in real-time.

Ideal for learning while earning.

✅ DupliTrade

Focused on strategy-based professional traders.

Offers data-backed portfolios and detailed strategy analysis.

Suitable for traders who want more data-driven replication.

✅ ZuluTrade

Global leader in social trading.

Offers thousands of verified traders from around the world.

Includes advanced filters and performance dashboards.

All platforms integrate seamlessly with your AvaTrade account. No coding, no hassle — just smart automation.

5. Benefits of Using AvaTrade Copy Trading ✅

Choosing AvaTrade means choosing a regulated, professional, and user-first broker. Let’s break down why this matters:

✅ Time-Saving and Passive

No need to monitor the charts 24/7. Once set, trades happen in real-time without user intervention.

✅ No Prior Experience Required

New to forex or CFD trading? Start copying seasoned traders immediately.

✅ Regulated and Secure

AvaTrade is regulated in multiple jurisdictions, offering high transparency and safety for your capital.

✅ Risk Control Features

Set your own:

Stop-loss per trader.

Maximum capital allocation.

Risk score filter.

✅ Diverse Strategies

You can follow scalpers, swing traders, trend followers, or volatility experts — all from one dashboard.

✅ Learning Opportunities

Especially with AvaSocial, you learn the logic behind trades, not just copy them blindly.

6. Who Should Use AvaTrade Copy Trading?

Avatrade Copy Trading is ideal for a wide range of user profiles:

Beginner traders looking to avoid costly rookie mistakes.

Busy professionals who can’t actively trade.

Investors seeking passive income.

Aspiring analysts wanting to learn from real trades.

Retirees looking for safe, guided exposure to forex.

Whether you’re looking for learning, profit, or time efficiency — copy trading fits your lifestyle.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

7. How to Start Using AvaTrade Copy Trading

Create a trading account.

Choose your copy trading platform (AvaSocial, DupliTrade, or ZuluTrade).

Explore verified traders based on performance metrics.

Allocate capital to your chosen trader(s).

Set your own risk parameters.

Monitor, adjust, and grow.

This setup typically takes under 15 minutes and doesn't require advanced trading skills.

8. Common Mistakes to Avoid ❌

Even with the best tools, mistakes happen. Avoid these:

❌ Copying traders with only short-term success.❌ Over-allocating capital to one trader.❌ Ignoring risk management settings.❌ Blindly following hype or popularity.❌ Failing to reassess your portfolio monthly.

Smart copy traders are strategic, diversified, and risk-aware.

9. Psychology of Copy Trading

Copy trading reduces effort, but the psychological traps remain:

Overconfidence after a few good trades can lead to bigger risks.

Fear of missing out (FOMO) may cause poor choices in trader selection.

Impatience pushes users to change traders too quickly without giving enough time for a strategy to work.

Master your emotions and stick to your strategy.

10. Tips for Maximizing Profits with Copy Trading

To elevate your results with Avatrade Copy Trading, apply these tips:

Diversify your traders – Don’t depend on a single strategy.

Start small – Test with modest capital. Scale up as you gain trust.

Track performance monthly – Use built-in analytics for decision-making.

Use stop-loss & exposure settings – They are your best defense.

Don’t panic during drawdowns – Even pros have losing periods.

Follow traders with consistent, not flashy, returns.

The key is to treat copy trading like portfolio management, not gambling.

💥💥💥 If you do not have an Avatrade account, please: 👉 Open An Account or 👉 Go to broker

11. Frequently Asked Questions (FAQs)

1. Does AvaTrade offer real copy trading?

✅ Yes, through AvaSocial, DupliTrade, and ZuluTrade.

2. Is it beginner-friendly?

✅ Absolutely. No trading experience required.

3. Do I control my funds?

✅ Yes, you retain full control over capital allocation and risk.

4. Can I copy multiple traders?

✅ Yes, and it's encouraged for diversification.

5. Are there extra fees for copy trading?

✅ No management fees. Standard spreads and commissions apply.

6. What’s the minimum deposit required?

💵 Varies by platform, but you can start as low as $100.

7. Can I stop copying anytime?

✅ Yes, you can disconnect instantly without penalty.

8. Is mobile trading supported?

✅ Fully supported across Android and iOS.

9. Is copy trading safe?

🔐 AvaTrade is regulated and offers advanced risk tools, but all trading involves risk.

10. Do I earn passive income from this?

📈 Yes, but profits depend on market conditions and the trader's strategy.

12. Conclusion

AvaTrade Copy Trading is not just a feature — it’s a complete trading ecosystem designed to make smart trading accessible to all. Whether you're a full-time trader or a casual investor, the ability to copy professional trades while maintaining control over your capital is a game changer.

✅ It's regulated.✅ It's easy to use.✅ It brings together automation, education, and opportunity.

Ready to take control of your financial future with less stress and more strategy?Don’t just trade. Trade smarter. Trade with AvaTrade Copy Trading.

💥 Read more:

Avatrade UK Review 2025: Pros & Cons A Comprehensive Review

Avatrade South Africa Review 2025: Pros & Cons A Comprehensive Review

Avatrade Review Singapore 2025: Pros & Cons A Comprehensive Review