5 minute read

Does Avatrade Have ZAR Account

by ForexMakets

Does Avatrade Have ZAR Account

In the dynamic world of forex trading, choosing the right broker is crucial. For South African traders, one of the key considerations is whether a broker offers trading accounts denominated in South African Rand (ZAR). This article delves into AvaTrade's offerings, examining whether they provide ZAR accounts and what that means for traders in South Africa.

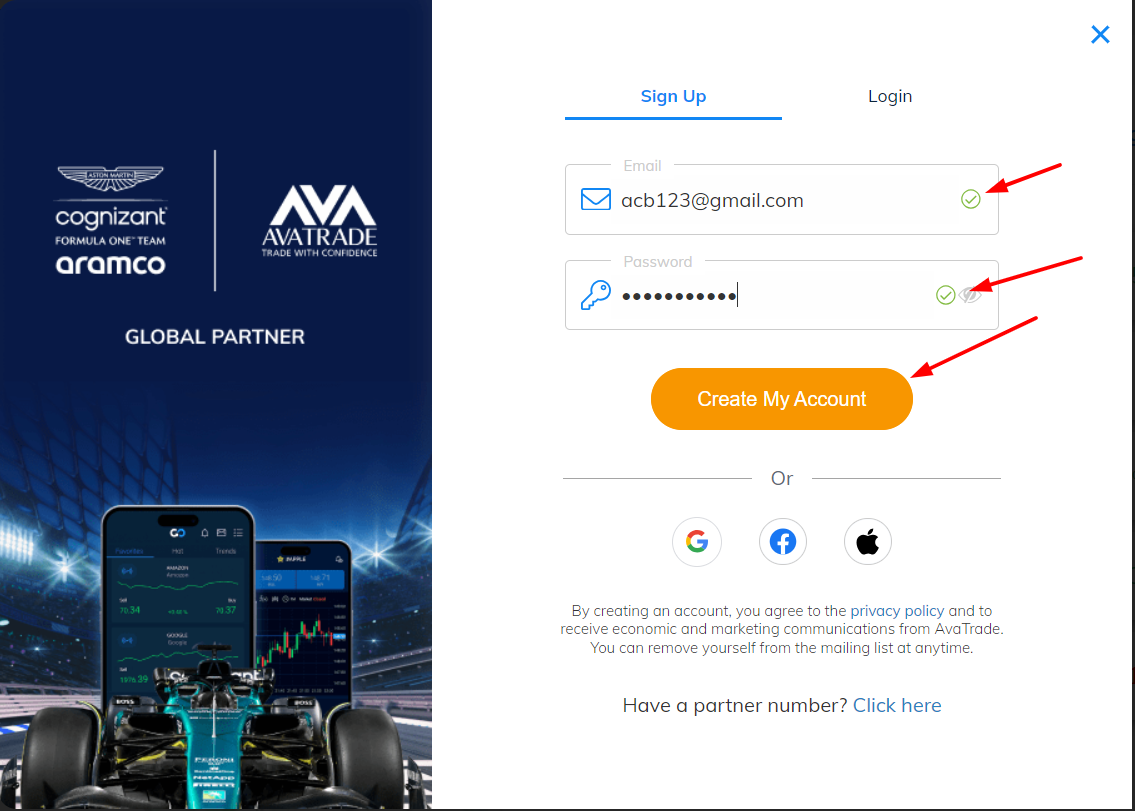

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

1. Overview of AvaTrade

AvaTrade is a global forex and CFD broker established in 2006, with a presence in South Africa under the Financial Sector Conduct Authority (FSCA) license number 45984. The broker offers a wide range of trading instruments, including forex, commodities, indices, stocks, and cryptocurrencies, catering to both beginner and experienced traders.

2. AvaTrade's Regulatory Standing

AvaTrade operates under multiple regulatory authorities, ensuring a secure trading environment for its clients. In South Africa, it is regulated by the FSCA, providing local traders with a sense of security and trust in the platform.

3. Account Types and Currency Options

AvaTrade offers various account types, including standard retail accounts, professional accounts, and Islamic (swap-free) accounts. While the broker provides a selection of base currencies such as USD, EUR, and GBP, it does not offer accounts denominated in ZAR. South African traders will need to choose one of the available base currencies for their accounts.

4. Deposits and Withdrawals in ZAR

Although AvaTrade does not offer ZAR as a base currency, South African traders can still deposit and withdraw funds in ZAR. The broker facilitates ZAR deposits and withdrawals through local payment methods like Ozow and bank transfers. However, it's important to note that currency conversion fees may apply when depositing or withdrawing funds in ZAR.

5. Trading Platforms and Tools

AvaTrade provides access to several trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary AvaTradeGO mobile app. These platforms offer a range of tools and features to assist traders in executing their strategies effectively.

6. Customer Support for South African Traders

AvaTrade offers customer support to South African traders through various channels, including email and live chat. While phone support is available during business hours, it's advisable for traders to utilize the available online support options for assistance.

7. Educational Resources and Trading Tools

AvaTrade provides a comprehensive suite of educational resources, including webinars, video tutorials, and articles, to help traders enhance their skills and knowledge. Additionally, the broker offers trading tools such as AvaProtect, which allows traders to protect their trades against short-term losses.

8. Fees and Charges

AvaTrade maintains a transparent fee structure, with competitive spreads and no commission charges on standard retail accounts. However, traders should be aware of potential inactivity fees and currency conversion charges when dealing with ZAR.

9. Pros and Cons of Trading with AvaTrade

Pros

Regulated Broker: AvaTrade is regulated by multiple authorities, including the FSCA in South Africa, providing a secure trading environment.

Variety of Trading Instruments: Traders have access to a wide range of instruments, including forex, commodities, indices, stocks, and cryptocurrencies.

User-Friendly Platforms: AvaTrade offers intuitive trading platforms suitable for both beginners and experienced traders.

Educational Resources: The broker provides comprehensive educational materials to help traders improve their skills.

Cons

No ZAR Accounts: AvaTrade does not offer accounts denominated in ZAR, which may result in currency conversion fees for South African traders.

Currency Conversion Fees: Deposits and withdrawals in ZAR may incur additional charges due to currency conversion.

Limited Local Support: While customer support is available, it may not be as extensive as some traders might desire.

💥💥💥 If you do not have an Avatrade account, please: 👉 Open An Account or 👉 Go to broker

10. Conclusion

While AvaTrade does not offer ZAR-denominated accounts, South African traders can still trade effectively by selecting an appropriate base currency and utilizing the available deposit and withdrawal methods. The broker's robust regulatory standing, diverse range of trading instruments, and comprehensive educational resources make it a viable option for traders in South Africa.

11. Frequently Asked Questions

1. Does AvaTrade offer ZAR-denominated accounts?

No, AvaTrade does not offer accounts denominated in ZAR. Traders will need to choose from available base currencies.

2. Can I deposit and withdraw funds in ZAR?

Yes, AvaTrade facilitates ZAR deposits and withdrawals through local payment methods like Ozow and bank transfers.

3. Are there any fees associated with currency conversion?

Yes, currency conversion fees may apply when depositing or withdrawing funds in ZAR.

4. What trading platforms does AvaTrade offer?

AvaTrade offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary AvaTradeGO mobile app.

5. Is AvaTrade regulated in South Africa?

Yes, AvaTrade is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa.

6. What is the minimum deposit requirement for South African traders?

The minimum deposit requirement is $100 or approximately R1,800.

7. Does AvaTrade offer educational resources for traders?

Yes, AvaTrade provides a range of educational materials, including webinars, video tutorials, and articles.

8. Are there any inactivity fees?

Yes, AvaTrade charges an inactivity fee after a period of non-use.

9. Can I use ZuluTrade or DupliTrade with AvaTrade?

Yes, AvaTrade supports social trading platforms like ZuluTrade and DupliTrade.

10. Is AvaTrade suitable for beginner traders?

Yes, AvaTrade offers user-friendly platforms and educational resources suitable for beginners.

💥 Read more:

Avatrade South Africa Review 2025: Pros & Cons A Comprehensive Review