6 minute read

How To Fund Avatrade Account

by ForexMakets

How To Fund Avatrade Account

Funding your AvaTrade account is a crucial step in your trading journey. Whether you're a seasoned trader or just starting, understanding the deposit process ensures a smooth and efficient experience. This guide provides an in-depth look at how to fund your AvaTrade account, covering everything from account types to troubleshooting common issues.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

Understanding AvaTrade Account Types

Before depositing funds, it's essential to know the type of account you've opened with AvaTrade. The broker offers several account types to cater to different trading needs:

Retail Account: Suitable for most traders, offering access to a wide range of markets.

Islamic Account: Designed for traders who require a swap-free trading environment.

Professional Account: For experienced traders meeting specific criteria, offering higher leverage and access to more complex instruments.

Each account type may have different features and requirements, so it's important to choose the one that aligns with your trading goals.

Minimum Deposit Requirements

AvaTrade has a minimum deposit requirement to open a live trading account:

Standard Accounts: The minimum deposit is $100. This applies to Retail, Islamic, and AvaOptions accounts.

Professional Accounts: These accounts require a higher minimum deposit, typically around €500,000 in portfolio value, and are subject to specific criteria.

It's important to note that while AvaTrade does not charge internal deposit fees, third-party fees may apply depending on your chosen payment method.

Available Deposit Methods

AvaTrade offers a variety of deposit methods to accommodate traders worldwide. The availability of these methods may vary based on your country of residence.

Credit/Debit Cards

Accepted Cards: Visa, MasterCard, Maestro.

Processing Time: Instant for most deposits; however, the first deposit may take up to 24 hours due to security verification.

Fees: AvaTrade does not charge deposit fees; however, your card issuer may impose fees.

Bank Wire Transfers

Processing Time: Typically takes 1 to 7 business days.

Fees: AvaTrade does not charge deposit fees; however, your bank may impose fees.

Currency Options: USD, EUR, GBP, AUD.

Note: Ensure to include your trading account number in the transfer comments to facilitate faster processing.

E-wallets

E-wallets offer a convenient and fast way to fund your AvaTrade account. Available options include:

PayPal

Skrill

Neteller

WebMoney

Processing Time: Deposits are usually processed within 24 hours.

Fees: AvaTrade does not charge deposit fees; however, your e-wallet provider may impose fees.

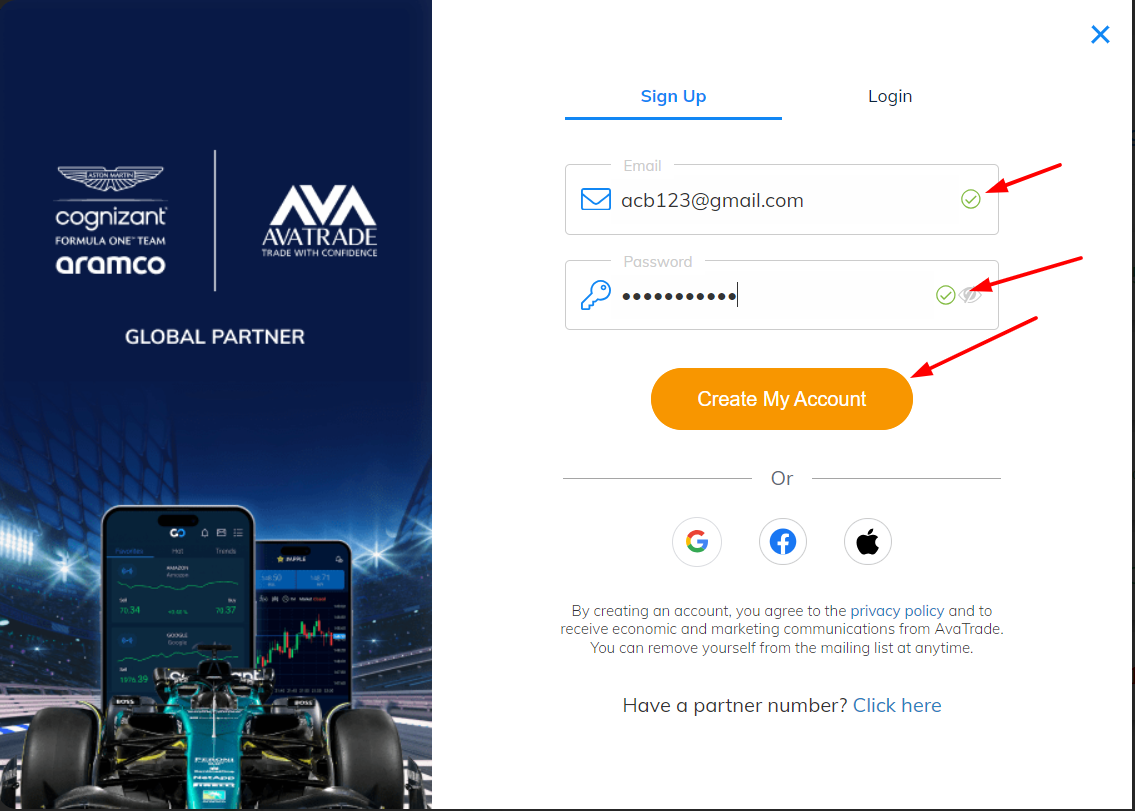

Step-by-Step Guide to Depositing Funds

Follow these steps to deposit funds into your AvaTrade account:

Log In: Access your AvaTrade account by logging into the client portal.

Navigate to Deposit Section: Click on the 'Deposit' tab.

Select Deposit Method: Choose your preferred payment method (e.g., Credit Card, Bank Wire, E-wallet).

Enter Deposit Details: Provide the required information, including deposit amount and currency.

Confirm Deposit: Review your details and confirm the deposit.

Wait for Confirmation: You will receive a confirmation once your deposit has been processed.

Processing Times and Fees

Understanding the processing times and potential fees associated with each deposit method is crucial:

Credit/Debit Cards: Instant processing; however, the first deposit may take up to 24 hours due to security checks.

Bank Wire Transfers: Processing time ranges from 1 to 7 business days.

E-wallets: Deposits are typically processed within 24 hours.

AvaTrade does not charge internal deposit fees; however, third-party fees may apply depending on your chosen payment method.

Currency Considerations

AvaTrade supports multiple base currencies for your trading account, including:

USD: Available worldwide.

EUR: Available for UK, Australian, and South African traders.

GBP: Available for UK and EU traders.

AUD: Available for Australian traders.

ZAR: Available for South African traders.

JPY: Available for Japanese traders.

To avoid currency conversion fees, it's advisable to deposit funds in the same currency as your trading account's base currency.

Tips for Efficient Fund Management

Regular Monitoring: Keep track of your account balance and margin levels to avoid margin calls.

Diversify Funding Sources: Use a combination of deposit methods to ensure flexibility and quick access to funds.

Set Deposit Alerts: Enable notifications to stay informed about your deposit status.

Maintain Sufficient Funds: Ensure your account has enough funds to cover potential losses and margin requirements.

Common Issues and Troubleshooting

While depositing funds into your AvaTrade account is generally straightforward, you may encounter some common issues:

Deposit Delays: If your deposit is delayed, check with your payment provider to ensure there are no issues on their end.

Verification Issues: Ensure that all required documents are submitted and verified to avoid delays.

Currency Conversion Fees: Be aware of potential fees if depositing in a currency different from your account's base currency.

If you encounter any issues, contact AvaTrade's customer support for assistance.

Conclusion

Funding your AvaTrade account is a simple process with multiple payment options to suit your needs. By understanding the available deposit methods, processing times, and potential fees, you can ensure a smooth and efficient funding experience. Remember to choose the deposit method that best aligns with your trading goals and preferences.

FAQs

What is the minimum deposit required to open an AvaTrade account?

The minimum deposit is $100 for standard accounts.

Are there any deposit fees?

AvaTrade does not charge internal deposit fees; however, third-party fees may apply.

How long does it take to process a deposit?

Processing times vary: Credit/Debit Cards are typically instant, Bank Wire Transfers can take 1 to 7 business days, and E-wallets usually process within 24 hours.

Can I deposit in a currency different from my account’s base currency?✅ Yes, you can deposit in a different currency, but currency conversion fees may apply depending on the method you use and the provider.

What happens if my deposit doesn’t appear in my AvaTrade account?❌ Don’t panic. First, verify the transaction status with your bank or e-wallet provider. If everything seems fine on their end, contact AvaTrade support with your transaction reference ID for faster resolution.

Is it safe to deposit money into AvaTrade?✅ Absolutely. AvaTrade is regulated in multiple jurisdictions (including Ireland, Australia, South Africa, Japan), uses SSL encryption, and adheres to strict financial security standards.

Can I use someone else’s payment method to fund my AvaTrade account?❌ No. For security and compliance reasons, third-party deposits are strictly prohibited. The deposit method must be in your name and match your account information.

Are there deposit bonuses for new users?AvaTrade occasionally offers promotional bonuses, especially for new users. However, such offers depend on your region and current promotions, which you’ll find after signing up.

What documents do I need to verify my account before funding?You’ll typically need:

A valid government-issued ID or passport

Proof of address (like a utility bill or bank statement)

In some cases, a copy of the card or payment method used

Why should I choose AvaTrade over other forex brokers?✅ AvaTrade offers:

Regulation in multiple jurisdictions

Negative balance protection

A wide range of deposit options

Powerful trading platforms like MT4, MT5, AvaTradeGO

Competitive spreads & no deposit fees

Award-winning customer support

💥 Read more:

Avatrade Signals Review 2025: Pros & Cons A Comprehensive Review

Avatrade Copy Trading Review 2025: Pros & Cons A Comprehensive Review

Avatrade Spreads Review 2025: Pros & Cons A Comprehensive Review

Avatrade App Review 2025: Pros & Cons A Comprehensive Review

Avatrade Demo Account Review 2025: Pros & Cons A Comprehensive Review