5 minute read

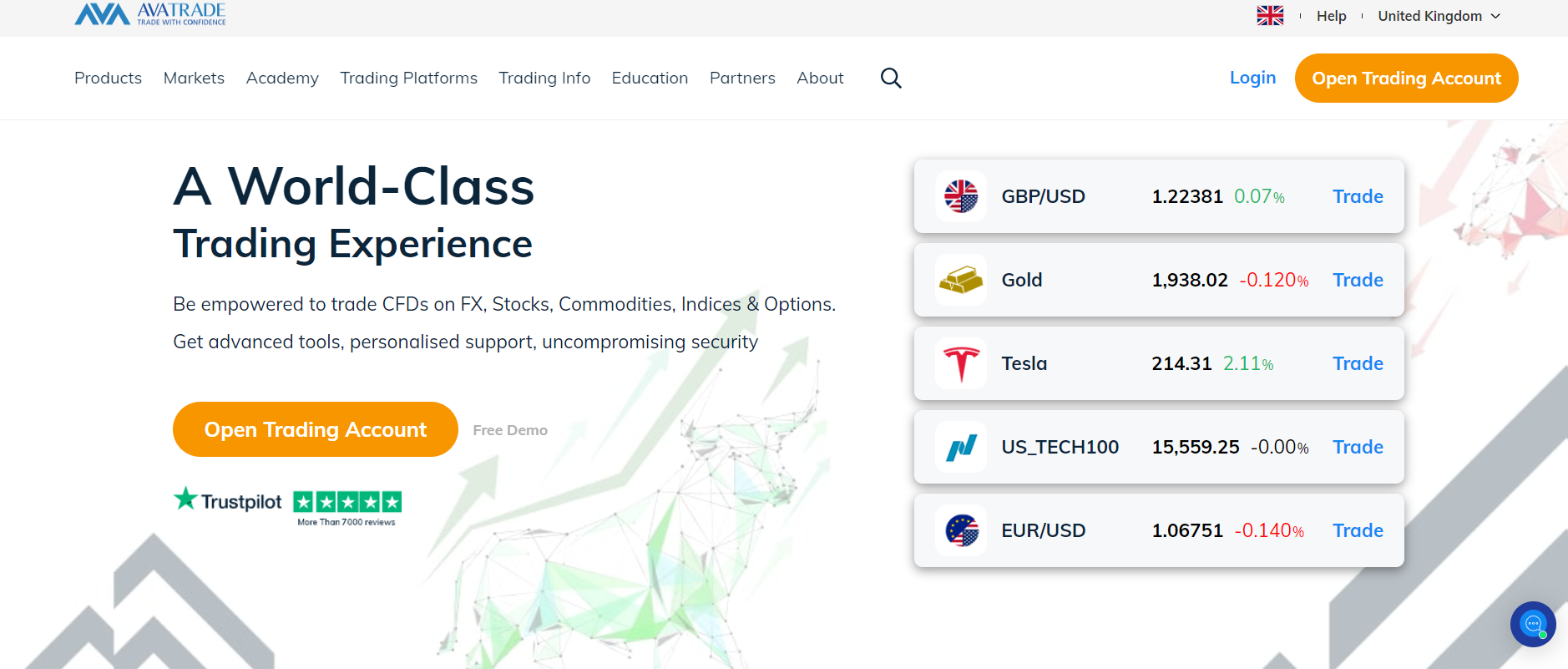

Avatrade Spreads Review 2025: Pros & Cons A Comprehensive Review

from Avatrade Review

by ForexMakets

Avatrade Spreads Review 2025: Pros & Cons A Comprehensive Review

The Forex trading landscape is fast evolving, and as we step into 2025, traders are becoming more vigilant than ever when choosing the right broker. One of the key factors that determine profitability in trading is spread cost. In this comprehensive review, we deep dive into Avatrade spreads, exploring their advantages, limitations, and how they stack up in the competitive Forex broker arena.

If you're looking to minimize costs, optimize entry and exit points, and maximize trading efficiency, this detailed article is tailored for you.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

1. What Are Spreads in Forex Trading?

Before evaluating Avatrade specifically, it's essential to understand what spreads are. In Forex, the spread is the difference between the bid and ask price of a currency pair. This gap is essentially the cost of executing a trade and serves as a primary source of income for brokers.

Lower spreads generally benefit traders, especially scalpers and high-frequency traders. Wider spreads, on the other hand, might eat into profits, especially during volatile sessions.

2. Who Is Avatrade?

Avatrade is a globally regulated Forex and CFD broker founded in 2006. With licenses in jurisdictions like Ireland, Australia, South Africa, Japan, and the UAE, it's recognized as a trusted broker offering:

Forex

Stocks

Indices

Commodities

Cryptocurrencies

What makes Avatrade stand out is its user-centric approach, strong educational resources, and intuitive trading platforms such as MetaTrader 4, MetaTrader 5, AvaTradeGO, and WebTrader.

3. Avatrade Spread Types Explained

Avatrade offers fixed spreads across most instruments. This means the spread amount remains consistent regardless of market volatility. This is highly beneficial for traders who value predictability and cost transparency.

For example:

EUR/USD: Fixed at 0.9 to 1.3 pips

GBP/USD: Fixed at 1.6 to 2.0 pips

USD/JPY: Fixed at 1.0 to 1.5 pips

✅ Fixed spreads provide stability during high-volatility periods like news releases.

4. Avatrade Fixed vs Variable Spreads

While most brokers offer variable spreads that fluctuate with liquidity and volatility, Avatrade’s fixed spread model gives traders the advantage of:

Cost predictability

Avoidance of slippage

Better risk management

❌ However, fixed spreads might be slightly wider than the tightest variable spreads offered by ECN brokers during calm market conditions.

5. Avatrade Spreads on Major Currency Pairs

Let’s break down typical spreads for some major pairs:

EUR/USD: 0.9 – 1.3 pips (fixed)

GBP/USD: 1.6 – 2.0 pips (fixed)

USD/JPY: 1.0 – 1.5 pips (fixed)

AUD/USD: 1.2 – 1.6 pips (fixed)

USD/CHF: 1.8 – 2.2 pips (fixed)

✅ These spreads are competitive considering they are fixed and come with no commissions.

6. Avatrade Spreads on Commodities, Indices & Crypto

Commodities:

Gold (XAU/USD): ~0.34 pips

Crude Oil: ~0.03 pips

Indices:

S&P 500: ~0.25 points

DAX 30: ~2.0 points

Cryptocurrencies:

Bitcoin/USD: ~0.75%

Ethereum/USD: ~0.80%

Crypto spreads are relatively high, which is common across most brokers due to volatility.

❌ Not ideal for low-cap crypto scalping.

7. Avatrade Account Types and Spread Conditions

Avatrade offers the following account types:

Retail Account (Standard)

Professional Account (EU clients with criteria)

Islamic Account (Swap-free)

All accounts benefit from fixed spreads and zero commissions on trades.

✅ No hidden fees or commissions make budgeting easy.

8. Pros of Trading With Avatrade ✅

Fixed spreads provide stability during volatile markets

No commissions on trades

Multiple global regulations ensure security

Excellent educational support for beginners

Variety of platforms: MT4, MT5, AvaTradeGO

Fast account opening process

Negative balance protection

9. Cons of Trading With Avatrade ❌

Fixed spreads can be slightly wider in calm markets

No ECN pricing

Limited variety of account types

High spreads on cryptocurrencies

No MetaTrader 4 for MacOS (without emulators)

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

10. Avatrade vs Other Brokers: Spread Comparison

Let’s evaluate how Avatrade compares to common brokers (no tables used):

IC Markets: Offers variable spreads as low as 0.1 pips but charges commission

XM: Offers variable spreads with standard accounts (around 1.6 pips)

Exness: Offers raw spreads + commission model

Pepperstone: ECN-like spreads with commission

✅ Avatrade wins on transparency and simplicity, ❌ but loses when it comes to raw spread value.

11. Are Avatrade Spreads Suitable for Scalpers?

Scalpers thrive on tight spreads and fast execution. While Avatrade offers predictable fixed spreads, some scalpers might prefer raw spreads + commission models offered by ECN brokers.

✅ Great for beginners or intermediate scalpers seeking cost consistency.

❌ May not suit ultra-aggressive scalping styles needing sub-0.5 pip spreads.

12. How to Open an Account With Avatrade

Getting started with Avatrade is quick and seamless:

Click "Register Now"

Fill in basic personal info

Verify identity and address

Fund your account using cards, e-wallets, or bank transfer

Start trading on MT4/MT5/AvaTradeGO

✅ Minimum deposit: $100 ✅ Fast approval within 24 hours

13. Marketing Verdict: Is Avatrade Right For You?

Avatrade is ideal if you value fixed costs, simplicity, and global trustworthiness. It's especially good for:

New traders seeking consistency

Swing traders who hold positions through news events

Traders from regulated regions who want safety

✅ With zero commissions and a clean trading environment, it’s a solid choice.

If you’re ready to experience predictable spreads and a reliable platform, now’s the time to open your Avatrade account and start trading with confidence.

14. Frequently Asked Questions (FAQs)

Q1. Are Avatrade spreads competitive?Yes, for fixed spread brokers. They're stable and cost-effective in volatile conditions.

Q2. Does Avatrade charge commissions?No, all trading costs are built into the spread.

Q3. Are fixed spreads better than variable?It depends. Fixed spreads offer predictability, while variable ones can be lower but fluctuate.

Q4. Is Avatrade good for beginners?Absolutely. The intuitive platforms and educational tools make it ideal for newcomers.

Q5. What’s the minimum deposit?$100, which is accessible for most retail traders.

Q6. Can I trade crypto with Avatrade?Yes, but spreads on crypto are wider due to high volatility.

Q7. How fast can I open an account?Usually within 24 hours after ID verification.

Q8. Is Avatrade regulated?Yes, by multiple bodies including ASIC, FSCA, and the Central Bank of Ireland.

Q9. Does Avatrade offer demo accounts?Yes. Traders can practice with virtual funds risk-free.

Q10. Can I use MT4 or MT5 with Avatrade?Yes. Both platforms are available for all accounts.

Ready to trade with stable spreads and no commissions?

✅ Open your live account with Avatrade today and trade smarter in 2025!

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker