POWERED BY INNOVATION POWERED DRIVEN BY SAFETY DRIVEN BY

• Low profile design for maximum operator safety. Full view of traffic during application. FEATURES:

• Industry’s fastest heat up time - less than one hour.

• fatigue.

Ergonomic counter-balanced hose boom. Dramatically reduces operator

• performance.

All diesel power (burner and engine) for maximum efficiency and

• rental,

Nationwide rental, sales and service.

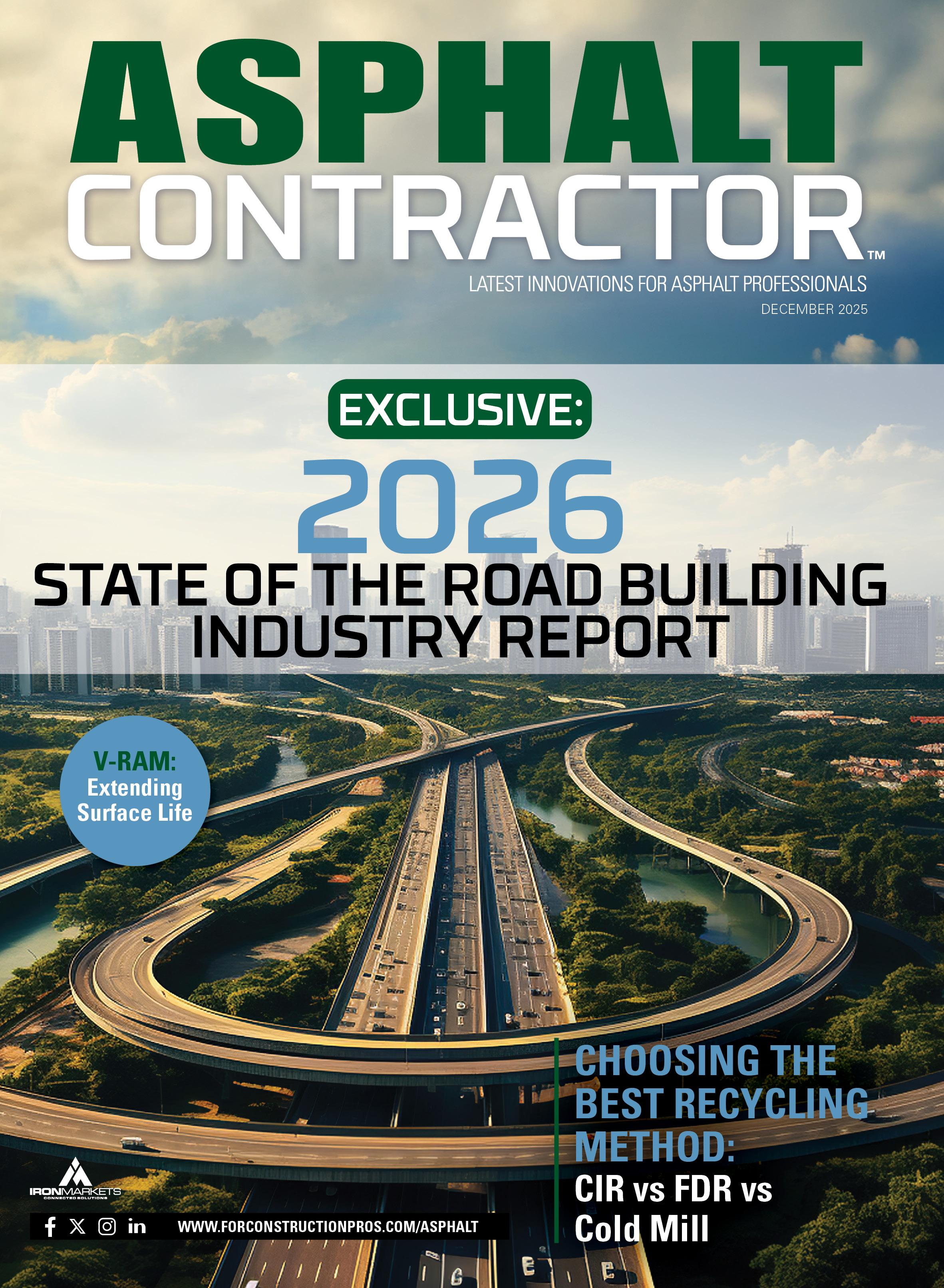

12 What ARTBA’s 2026 Reauthorization Blueprint Means For The Road Building Industry

From rising project delays to inflation-driven cost increases, workforce shortages, Buy America pressures, and work zone safety concerns, this report shows where federal policy must evolve to keep the industry building.

16 CIR vs. FDR vs. Cold Milling

Dennis Howard speaks with industry leaders and contractors adopting asphalt recycling to do more with less: resurfacing roads quicker, using fewer materials and burning less fuel.

28 A Technician’s Role

Tracy Richard shares her path from laborer to field technician, testing and paving quality in the asphalt industry.

INNOVATIONS

32 Why Training and Maintenance Are Critical for Roadside Crash Cushions and Safety Systems

Crash cushions protect motorists and workers, but only when properly installed and maintained. Training, evolving DOT standards and field-ready resources are key to ensuring roadway safety.

PRESERVATION & SUSTAINABILITY

36 How VRAM Extends Pavement Life: Void-Reducing Asphalt Membrane

Explore how VoidReducing Asphalt Membranes work, how they’re applied, and why more DOTs and contractors are adopting this proven method to extend pavement life.

Published and copyrighted 2025 by IRONMARKETS. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage or retrieval system, without written permission from the publisher.

Asphalt Contractor (ISSN 1055-9205, USPS 0020-688): is published ten times per year: January, February, March/April, May, June/July, August, September, October, November, December by IRONMARKETS, 201 N. Main St. Ste 350, Fort Atkinson, Wisconsin 53538. Periodicals postage paid at Fort Atkinson, Wisconsin and additional entry offices.

POSTMASTER: Please send change of address to ASPHALT CONTRACTOR, 201 N. Main St. Ste. 350, Fort Atkinson, WI 53538. Printed in the U.S.A.

SUBSCRIPTION POLICY: Individual subscriptions are available without charge only in the USA. The Publisher reserves the right to reject nonqualifying subscribers. One-year subscription to nonqualifying individuals: U.S. $45.00, Canada & Mexico

0 2 6

For over a half a decade Blaw-Knox has earned its reputation as the go to source of training and instruction on hot mix paving.

The Blaw-Knox University, is dedicated to training paver operators and foreman on proper Paver Operation and Maintenance and applied Best Paving Practices through classroom-style and handson application courses.

Blaw-Knox provides improved technical and problem-solving skills on a variety of paver operations and maintenance topics. Course instructors share decades of field and teaching experience with attendees, including training on the latest DOT requirements.

• January 12 - January 15

• January 19 - January 22

• January 26 - January 29

• February 2 - February 5 2026 DATES

All details can be found at www.blawknox.com/training or contact at (407) 290-6000 ext. 342 or training@blawknox.com

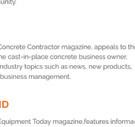

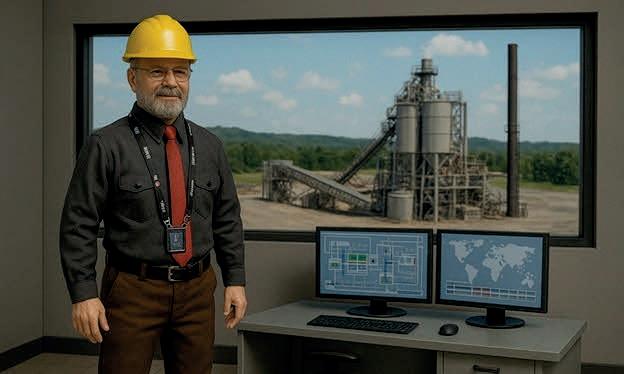

Open-pit operations move massive volumes of material, and they don’t leave much margin for error. Join industry experts to gain practical tips for running a smoother, safer, more productive pit.

Watch the video at: https://asph.link/mhzc0wwp

with Jim Rawson to Reintroduce Screening Plant for Microsurfacing Contractors

Bergkamp is partnering with industry veteran Jim Rawson to bring back a screening plant modeled after the discontinued Rawson design, responding to demand.

Read more at: https://asph.link/ odd69iu9

As OSHA advances its longawaited heat safety standard, ARTBA has provided detailed feedback representing the transportation construction industry.

Read more at: https://asph. link/g8myz49i

Trimble used its Dimensions 2025 user conference to unveil new AI tools, software updates, and data-sharing capabilities designed to improve jobsite visibility, financial management and cross-platform collaboration.

Read more at: https://asph. link/8e9sktoj

Construction Salary Report Shows Slower Wage Growth but Rising Optimism for 2026

Baker Tilly’s 2025 Construction Industry Salary Report shows wage growth slowing in 2024, with contractors expecting stronger increases and more incentives in 2026.

Read more at: https://asph.link/ c8x3n270

Signup for the Roadbuilding Update, a free bi-monthly newsletter for the most up-to-date DOT, FHWA, asphalt, and other industry news

Astec paves the way for sustainable, innovative asphalt plants. The new IntelliPac Moisture System is a revolutionary solution that integrates seamlessly with Astec control systems. This provides unparalleled, real-time visibility into virgin aggregate moisture content. IntelliPac empowers operators to optimize mix design, minimize energy consumption, and reduce environmental impact. With Astec, you get superior asphalt production – better for the environment, better for your business.

Brandon Noel, Editor-n-Chief

bNoel@iron.markets 234-600-8983

There’s a cliché everyone knows but still repeats this time of year: everything just keeps getting faster. I feel it. You feel it. The industry feels it.

The year 2025 was nobody’s favorite. I’m confident in saying that. As I put together this year’s State of the Industry report, I started to sense that everyone understands what’s happening—but no one really wants to say it out loud. I tried to frame my questions so people could be honest without sounding negative. Negativity isn’t constructive, but avoiding the truth isn’t helpful either.

Since the IIJA passed, which covers the entirety of my time in this industry, things have been on a high. There’s been steady funding, strong project pipelines, and optimism. That may not last.

I’ve repeatedly heard another familiar phrase over the last few years: “The asphalt industry is recession-proof.” I don’t doubt that belief comes from real experience, but I think it’s worth pausing on. I’m not sure any industry is immune to everything.

From my side of the business, as someone in the media covering it, I hear things contractors might not. I see indicators they might not see. I’m not an alarmist, but I am concerned. There are a lot of things that need to go right in 2026. And if 2025 has taught us anything, it’s that t here’s a lot of room for things to go wrong.

It only takes one of those things to falter, a single domino could send a ripple down the whole chain. And the odds of every single thing going perfectly? That makes me uneasy, not panicked, but uneasy.

I still consider myself new here. Heading into my fourth year as your editor, and I know many of you have weathered tougher times than this before. Maybe that’s why you’re not as uneasy as I am and that’s good. I’m always willing to be wrong. I’m always willing to admit when I don’t have the full picture.

But what I won’t do is sugarcoat reality. Spending is down. Investment is down. And while nobody I’ve spoken with says they aren’t busy, it’s not quite the same kind of busy. I can feel the whole industry seemingly holding its breath, as everyone looks to the first quarter of 2026 to try and gauge their reactions.

If that Q1 is rough, if it doesn’t look like things are going right, the flow of capital will tighten further. The industry may very well go into a hibernation, in an effort to insulate itself from economic downturn. My hopes, however, are that this scenario doesn’t happen, and this editorial column can just go to the bottom of the bin!

So as we close out the year, I’d like to end on something simple. Take the time to focus on your families, your friends, and the good things right in front of you.

I’ll see you on the road!

EDITORIAL

Editor-In-Chief Brandon Noel bnoel@iron.markets

Content Director, Marketing Services Jessica Lombardo jlombardo@iron.markets

Managing Editor Allyson Sherrier asherrier@iron.markets

AUDIENCE

Audience Development Director Angela Franks

PRODUCTION

Senior Production Manager Cindy Rusch crusch@iron.markets

Art Director April Van Etten

ADVERTISING/SALES

Brand Director Amy Schwandt aschwandt@iron.markets

Brand Manager Megan Perleberg mperleberg@iron.markets

Sales Representative Sean Dunphy sdunphy@iron.markets

Sales Representative Kris Flitcroft kflitcroft@iron.markets

IRONMARKETS

Chief Executive Officer Ron Spink

Chief Revenue Officer Amy Schwandt VP, Finance Greta Teter VP, Operations & IT Nick Raether VP, Demand Generation & Education Jim Bagan Brand Director, Construction, OEM & IRONPROS .....................................................Sean Dunphy

Content Director Marina Mayer Director, Event Content & Programming Jess Lombardo

CIRCULATION & SUBSCRIPTIONS

201 N. Main St. Ste. 350, Fort Atkinson, WI 53538 afranks@iron.markets

LIST RENTAL

Sr. Account Manager Bart Piccirillo | Data Axle (518) 339 4511 | bart.piccirillo@infogroup.com

REPRINT SERVICES

Brand Manager Megan Perleberg mperleberg@iron.markets | (800) 538-5544 Published and copyrighted 2025 by IRONMARKETS. All rights reserved. No part of

@ASPHALTCONTRACTOR

@ASPHALTCONTRACTOR

Epiroc has partnered with Luck Stone to deploy the first fully autonomous SmartROC D65 drill rig in the United States, and the first fully autonomous surface drill for the global quarry market. The SmartROC D65 MKII can execute entire drill patterns without an operator in the cab. The rig meets Global Mining Guidelines Group Level 4 standards for full autonomy and is supervised remotely through Epiroc’s Common Automation Panel and Link Open Autonomy platform. Luck Stone, an early adopter of autonomous technologies, views the project as a step toward improving safety.

DPL Telematics has released the ClearView Smart Dashcam, a new device that integrates real-time video monitoring, GPS tracking, and artificial intelligence to support fleet safety and management.

The dashcam records highdefinition video while providing AI-powered driver assistance and real-time alerts for harsh braking, speeding, and collision risks. It also monitors distractions, drowsiness, and seatbelt use. Designed to help fleets combat staged accidents and fraudulent insurance claims, the system offers both live-streaming access and dual data storage.

Caterpillar has introduced a new generation of articulated trucks, adding built-in automation, safety features and operator-focused upgrades to the Cat 725, 730, 730 EJ and 735 models. The trucks feature push-to-start ignition with operator ID, a redesigned cab with touchscreen controls and a Cat C13 engine that meets global emissions standards. Automatic traction control, engine overspeed protection and retarder control are now integrated to improve handling and reduce wheel slippage on difficult terrain.

Updated dump bodies provide easier loading and reduce carryback, while payload technology gives operators real-time weight data and external indicator lights. Safety enhancements include Dynamic Roll Protection, Stability Assist and Auto Wait Brake, all designed to minimize rollovers and reduce operator fatigue.

The Skokie features a KEEN.ReGEN midsole that provides up to 50% more energy return than standard EVA foam and a leather and mesh upper with a KEEN.DRY waterproof, breathable membrane. The boot also includes a 90-degree heel for stability on the job.

Additional safety features include a carbon-fiber toe, an EH-rated outsole that resists oil and slips, and a lightweight design aimed at all-day performance. The Skokie is available in men’s and women’s sizes, in several color options, and in both carbon toe and soft toe versions.

Kubota Tractor Corporation has expanded its compact equipment lineup with the addition of the SVL75-3 compact track loader and a new series of snow blowers.

The SVL75-3 is powered by a 74.3-horsepower Kubota engine and includes an Advanced Multifunction Valve designed to allow smooth, simultaneous hydraulic operation. A redesigned cab features a one-piece sealed frame, while a 7-inch color LCD monitor with jog dial provides operators with easy access to machine settings and information. Kubota also introduced the SBL30.

HD Hyundai Construction Equipment North America has debuted its new HT38 compact track loader at The Utility Expo.

The large-frame HT38 features a 115-horsepower Hyundai engine, a rated operating capacity of 3,807 pounds, and a standard bucket lift height of 10 feet 9 inches. The 12,785-pound machine is designed for demanding applications in utility, paving, landscaping and concrete work. Standard features include high-flow hydraulics at 4,000 psi and 40 gpm, ride control, return-to-dig, lift-arm float and auto self-leveling.

From rising project delays to inflationdriven cost increases, workforce shortages, Buy America pressures, and work zone safety concerns, this report shows where federal policy must evolve to keep the industry building.

As the industry turns its attention toward the sunset of the Infrastructure Investment and Jobs Act (IIJA) in 2026, a central question hangs over every contractor,

producer, and DOT office in America: What comes next?

The American Road& Transportation Builders Association (ARTBA) released a policy blueprint for the next federal highway and public transit bill. Representing 27 leaders from across the transportation construction ecosystem. The document acts as a valuable roadmap, meant to offer important insight to legislators as they face the daunting task of following up and building upon the IIJA’s investments into America’s infrastructure. As good as it was for the industry, it wasn’t perfect, and there are things to learn and takeaway from it.

The report’s core argument is clear: historic levels of investment over the last few years are not enough on their own.

“Funding alone is not enough,” ARTBA writes. The industry needs a

AdobeStock/ stockphotomania

smarter, more efficient, less tangled federal process if America is going to build and maintain the infrastructure required to support a modern economy.

From funding mechanisms to NEPA reform, digital construction technology, Buy America policies, and workforce safety, the blueprint hits every issue this industry has been wrestling with. Below is a full breakdown of the key takeaways, how they intersect with contractor realities, and what they signal about the next several years of federal transportation policy.

ARTBA wastes no time laying out the stakes. Despite record levels of

investment since IIJA passed in 2021, the devastating effects of inflation have eroded the buying power of those dollars. The report calls for a substantial upward correction in the next reauthorization. Specifically, ARTBA states:

• The next bill should “offset the impact of historic inflation over the past four years by increasing highway investment to $84.6 billion and transit investment to $26.3 billion in Fiscal Year (FY) 2027.”

• These increases must “adjust upward in subsequent years over the life of the bill.”

This is a significant departure from the narrative Washington has relied on in the past, and one that emphasized historic spending commitments without acknowledging what inflation does to project budgets and schedules. Contractors are all too familiar with that reality, and it’s good to see that it’s being included as a major factor.

The report backs this position with concrete results from IIJA’s early years, but it also warns that progress will stall if Congress fails to act. To maintain the momentum, the next bill cannot simply extend IIJA levels. According to ARTBA it should look to increase them.

This is a subject that I’ve written about several times over the last few years, as its continued solvency has risen to the highest levels of importance. From congressional hearings, committee meetings, and bandaid bills passed by congress, it’s clear to see that everyone understands there is a problem that must be solved. However, the Highway Trust Fund (HTF) remains structurally unstable, and ARTBA makes it clear that Congress cannot afford to delay addressing it. The organization supports revenue mechanisms that demonstrate a reliable method of funding the federal share of investment, writing:

“ARTBA supports any revenue mechanism that delivers resources to the Highway Trust Fund (HTF) at a pace that sustains the federal-share of investment necessary to maintain and

improve the nation’s highway and public transportation systems.”

Potential tools on the table include:

• EV fees

• Federal motor fuels tax increases and inflation indexing

• Mileage-based user fees

• Freight fees

• National registration fees

Importantly, ARTBA insists that revenue solutions must be grounded in system use and dedicated entirely to transportation. This is a firm stance, especially at a time when some policymakers float environmental or social revenue structures that pull transportation dollars into unrelated policy agendas.

One of the strongest themes throughout the document is ARTBA’s critique of regulatory redundancy.

The message is blunt: “The impact of federal highway and public transit investment depends not only on investment levels, but on eliminating the inefficiencies that delay projects and dilute outcomes.”

For contractors, this may be the most resonant argument in the entire report. Ask any road builder what slows projects down, and permitting, environmental reviews, and multi-agency approvals will be at the top of the list.

In line with this stance, ARTBA is adamant that the National Environmental Policy Act (NEPA) must be modernized to reflect the fact that “most transportation projects occur in existing rights-of-way.”

Concrete proposals include:

• Making NEPA assignment permanent for participating states

• “Simplifying and standardizing the application process”

• Expanding categorical exclusions for all federal-aid highway and transit projects under $10 million

• Limiting lawsuits to a 120-day window after agency action

What stands out is the organization’s willingness to call out the structure itself as a problem, not just its

execution. States that have implemented NEPA assignment are already demonstrating results. According to the report:

• Florida estimates $22 million in annual savings

• Ohio reports $32 million in avoided construction delays and inflation costs

• Utah saves between nine and 11 months by handling NEPA responsibilities

These are not abstract efficiency gains. They are months of saved labor time, avoided idle equipment, and real money kept in contractor pockets.

As a sort of companion argument from ARTBA, they express concerns about the role of discretionary grants. The group calls for a return to a, “90-10 ratio of formula funds to discretionary and allocated grant funds,” and warns that federal agencies must, “refrain from dictating project delivery decisions such as procurement methods and product and material choices.”

This is a direct critique of the way some federal programs overstep into state-level decision-making.

For contractors, this matters because states tend to build more predictably. When federal agencies dictate procurement structures or product types, contractors sometimes enter bidding processes with greater risk and uncertainty. Of course, this sentiment runs into one of the Biden era’s key policy pushes during their time in office: Buy American.

This section is particularly relevant to material producers, asphalt plant operators, and contractors who have been navigating domestic sourcing rules since 2022. ARTBA articulated a balanced but unambiguous position: the industry supports the intent of Buy America, but rigid implementation is causing supply chain problems, or, at the very least, it’s bumping into those problems.

To harmonize the two goals, both domestic economic growth and project deliverability, the report makes several proposals:

• Make the waiver review process work

• Refocus the White House Made in America Office (MIAO)

• Preserve existing exclusions

• Establish meaningful ‘de minimis’ thresholds

• Allow contractors a 15 percent surcharge option when domestic products are unavailable That last point is noteworthy. It gives contractors a pressure valve, a way to keep schedules moving instead of stopping a project over a missing bolt or component that has no domestic supplier. It’s a practical solution to a problem many contractors have dealt with since the IIJA rollout.

ARTBA strongly supports expanded federal investment in digital delivery, writing, “Technology can help transform project delivery by enhancing productivity, collaboration, and cost-effectiveness.”

The report calls for:

• Increased funding for Advanced Digital Construction Management Systems (ADCMS)

• A parallel program focused on work zone safety

• Federal support for lifecycle digital workflows

• Digital integration within NEPA processes

Contractors who have already adopted 3D modeling, machine control, digital twins, or model-as-the-legal-document workflows know how dramatically these tools improve project outcomes. ARTBA is arguing for greater support to institutionalize those gains at scale.

One case study in the report highlights PennDOT’s Gardner Creek Bridge, which was, “finished ahead of schedule thanks to paperless, digital workflows and 3D modeling.”

The industry continues to lose more than 800 workers and motorists each year in work zone incidents, and ARTBA calls this exactly what it is: unacceptable.

In blunt terms: “Motorist and worker fatalities in road construction zones, which exceed 800 annually, are unacceptably high.”

ARTBA’s recommendations include:

• Updated FHWA research into “positive separation” strategies

• Speed camera enforcement and active law enforcement presence

• Expanding the Highway Safety Contingency Fund

• Faster roadside safety hardware testing and approval

• Treating workers as “vulnerable road users” within state safety plans

The group connects technology, funding access, and regulatory reform into a single narrative: better tools and clearer rules save lives.

Workforce shortages were a top concern across nearly every stakeholder we surveyed for our 2026 State of the Industry report. This has been a pain point going back to even before things like COVID and major deportations became factors. ARTBA adds its voice to that chorus but goes further by connecting workforce development to federal policy execution.

The blueprint urges Congress to:

• Expand the Highway Construction Training Program

• Increase funding for University Transportation Centers

• Require U.S. DOT to report how states use workforce-related formula funds

• Integrate AI evaluation into state Human Capital Plans

Their closing statement on this topic sets the tone: “Developing the next generation of roadway construction workers is critical to ensuring the modernization of the nation’s transportation system.”

As we move toward 2026, ARTBA’s reauthorization framework gives the industry a much more detailed, and some might say practical picture of what will shape the next decade of road building.

The federal program we have today is not built for the speed, complexity, or the technological sophistication of the modern transportation system. It’s not built for the labor realities, the inflationary landscape, or the sourcing constraints we are dealing with. And it’s certainly not built for the literal slidingscale of investment required.

What I found interesting is that ARTBA’s blueprint doesn’t ask Congress to simply spend more money. That is, in some ways, the easier path. It asks Congress to spend smarter, build faster, and center policy around data driven outcomes: safety, mobility, reliability, and the physical condition of the system itself.

As the organization writes in its call to action: “The next highway and public transit law must be more than a funding bill—it must be a strategic reinvestment in America’s future.”

Whether Congress is ready to think that way remains to be seen. But for road builders, producers, and public agencies preparing for the next chapter, this blueprint is the clearest signal yet of where the policy conversation is headed, and why the stakes are so high.

Your first stop in the FAYAT GROUP road lifecycle, ADM makes the plants that make the hot mix. When it comes to North American roadbuilding, FAYAT Group brands including ADM, BOMAG, Dynapac, LeeBoy, and Mecalac have you covered.

See a totally new EX Series asphalt plant at CONEXPO-CON/AGG March 3-March 7 in Las Vegas.

JOIN US AT BOOTH SV2067

Dennis Howard speaks with industry leaders and contractors adopting asphalt recycling to do more with less: resurfacing roads quicker, using fewer materials and burning less fuel.

Grit is more than just a trait of most people in the roadbuilding industry, it’s also the texture of one of the most recycled materials in the world: asphalt. In a year when “doing more with less” has become the rule rather than the exception, contractors are watching building costs more closely than ever. I spoke with emerging leaders in the asphalt industry to learn how today’s machines are reclaiming and renewing old roads — transforming yesterday’s infrastructure into tomorrow’s foundation.

“Asphalt recycling is like rebuilding a road with its original grit and DNA,” said Jessie Boone, WIRTGEN GROUP’s market development manager of recycling products. “Some machines and processes, like cold in-place recycling (CIR) or full depth reclamation, or paver-laid recycling, can reuse existing materials, reinforce the surface, and put it to work without hauling in new resources.” Bonne and Casey Bovkoon, General Manager of Allstates Pavement Recycling and Stabilization, both agree that asphalt recycling can significantly increase efficiency without increasing

overall project costs while reducing impacts to traffic.

“With a single W 380 CRi (cold recycler) our team has been able to increase efficiency and quickly re-use asphalt in the urban area projects in Minnesota,” Bovkoon said. “We’ve focused on partnering with equipment providers like RDO Equipment Co. to ensure that we have the right equipment and training to create new base materials to be paved on.”

Bovkoon explained that the Allstates team works on projects from Minnesota n to Texas and relies on support from RDO from the Midwest to southern Texas to Utah. as to Utah.

“When we partner with agencies like a state or county’s DOT and work together to provide the best solution for each individual project,” he said “Weather its CIR, asphalt milling, soil stabilization or Full Depth Reclamation (FDR), Allstates has a solution to solve any base issue.”

Bovkoon explains that different states may specify what they’d prefer in the bidding process. He further

Allstates Pavement Recycling & Stabilization on a cold recycling project in Hennepin County, Minnesota.

defines some of the work his team specializes in:

• Asphalt Milling: Removes the top layer of asphalt to smooth imperfections or recycle it for new pavement

• Full Depth Reclamation (FDR): Pulverizes the existing road surface to create a new base layer.

• Soil stabilization: Mixes in additves to alter soil to enhance its physical strength.

Contractors like Allstates understand that asphalt usually still retains its resilient fighting spirit. And with the many ways to grind it up and mix materials before laying it back down, we in industry can build stronger roads ready to handle the weight of busy traffic. Let’s take a closer look at each cold milling, CIR and FDR application process.

The 8680 Asphalt Paver delivers high production capacity while maintaining a compact and maneuverable footprint meeting the needs of heavy commercial and main-line contractors alike.

210 hp (157 kW) Kubota Tier 4 Final Diesel Engine

Weight: 33,600 lbs. with LB5 Screed; 36,000 lbs. with LB7 Screed

Paving Widths Variable Up To 15’ 6”

High Speed Smooth Rubber Tracks

Actuator Driven Hood Lift to Aid in Maintenance

an underlying issue like a subgrade failure isn’t addressed.”

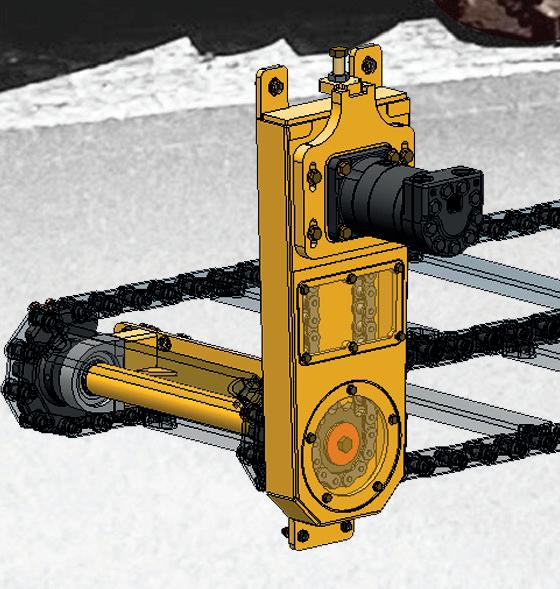

CIR, or Cold in Place Recycling, involves milling the existing asphalt layer up to six inches and then reusing all that material on site. DOT engineers and contractors may opt for CIR when the top asphalt layer has reached the end of its life but its underlying base remains intact. Ideal for roads with surface cracking that does not extend to its subgrade layer, CIR mills the existing asphalt layer, then mixes it with stabilizers like applies in emulsion or foamed format before laying it back down.

Cold In-Place Recyclings Key

Characteristics:

• Depth: 2-6 inches (asphalt layer only)

• Stabilizers: Asphalt emulsion or foamed asphalt· Equipment: Reclaimer/stabilizer (e.g., Wirtgen 380CR), high-density paver

• Best For: Roads with surface cracking that hasn’t penetrated the base

Cold milling and cold recycling serve very different purposes but are sometimes referred to interchangeably. Cold milling, also known as asphalt milling, is a surface-level process that removes the top layer of asphalt using a milling machine. As a “mill and fill operation,” where the milled surface is overlaid with new asphalt, cold milling is ideal when the underlying base is still structurally sound.

• Depth: 1-4 inches

• Purpose: Prepares surface for overlays, corrects profile and drainage

• Output: Reclaimed Asphalt Pavement (RAP), which can be reused

• Best For: Roads with surface distress but stable subgrade

“Cold milling can be great option to quickly resurface roads,” Boone said. “Although, it can act as a ‘Band Aid’ if

Boone said CIR is gaining popularity among DOTs due to its reduced hauling costs and potential environmental benefits. For rural roads, when asphalt plants and aggregate sources are far apart, CIR can be especially effective. Some states’ DOTs like California or Viriginia could be especially interested in CIR to reduce RAP stockpiles. FDR revitalizes a road’s structural base and can be used when the subgrade layer has failed. FDR pulverizes the entire pavement structure and blends it with stabilizers to create a new, stronger base.

FDR Key Characteristics:

• Depth: Up to 20 inches

• Stabilizers: Cement, lime or asphalt emulsion

• Variants: Traditional FDR or PaverLaid FDR using high-density pavers

• Best For: Roads with deep structural issues

“FDR allows contractors to address the ‘mashed potatoes’ under a road’s asphalt,” Boone said. “FDR can create a longer-lasting solution by addressing pavement’s root causes of deterioration.”

FDR can extend the life of the road

significantly and reduce the need for repeated mill-and-fill cycles. Boone shared that some are opting for Paver Laid FDR, a recently developed method that uses a high-density paver instead of grader to create a single-pass operation, eliminating the need for more compaction passes.

DOT engineers and contractors always begin with a thorough analysis of pavement conditions, including core sampling and deflectometer testing. When the asphalt layer’s damage is minimal, CIR might be best, but when structural issues exist, FDR may be necessary.

CIR and FDR’s Core Differences

Feature Cold In-Place Recycling (CIR) Full-Depth Reclamation (FDR)

Depth Targets only the asphalt layer (3-6”) Can go up to 20”, addressing subgrade

Use Case Asphalt is aged but subgrade is intact Subgrade or base is failing

Process Recycles asphalt in place, repaves over it Pulverizes and stabilizes entire pavement structure

Equipment Standard paver or CIR machine Reclaimer or paver-laid FDR with HD paver

Cost Lower initial cost, good for surface issues Higher cost but addresses root causes

Longevity May require rework in 5-7 years Longer-lasting solution

Bonne explained mill and fill operations are used more often than CIR or FDR. Although she expects CIR, FDR or Paver Laid FDR, to grow in popularity in the coming years.

“When we all can understand the differences among cold milling, CIR and FDR, we can work together to make smarter decisions,” Boone said. “DOT engineers, county planners or contractors know that they will get better results when a failing road’s root cause is treated and not just the symptoms.”

Dennis Howard is senior vice president of Roadbuilding and Minerals at RDO Equipment Co.

Contractors say the work is there, but some cracks in the system are starting to show. How will funding, labor, sustainability, and other pressures shape the year ahead for the asphalt industry?

The only pure certainty in life is that the future is uncertain, and that is something which has been painfully apparent to me over the last several months as I try to get a grasp on what 2026 is going to look like for our industry. Some messaging has remained consistent, but what they indicate isn’t exactly positive either. The factors that have been nagging at asphalt contractors for the past few years, like: Finding and retaining skilled workers, rising costs and the availability of materials, and shifting federal expectations continue to be concerns as they have for a long time.

This year’s report features our regular annual feedback from multiple associations who partner with the road building and asphalt industry as well as a represenative from Superior Construction to provide a voice from contractors, as well as, the National Asphalt Pavement Association (NAPA), and the

American Road and Transportation Builders Association (ARTBA).

How confident are you that the Highway Trust Fund will remain a sustainable source of highway and road funding over the next decade?

Nick Largura, Superior Construction: I’m cautiously optimistic in the short term, but concerned about the long-term sustainability of the Highway Trust Fund as it currently operates. The fundamental challenge is clear: the HTF relies primarily on fuel taxes, and those revenues are eroding as vehicles become more fuel-efficient and electric vehicles gain market share. We’re essentially watching the funding mechanism slowly become obsolete.

What concerns me is the political difficulty of addressing this. The federal fuel tax hasn’t been increased since 1993, and significant political hurdles would have to be overcome before it would be raised. Meanwhile, construction costs have increased significantly — we saw annual cost increases of 10% in 2021 and 12% in 2022, though they moderated to about 2-3% in 2024. The gap between available funding and actual infrastructure needs continues to grow.

Without a fundamental reform to how we fund highways, whether that’s indexing the fuel tax to inflation,

implementing new revenue sources, or some combination, the HTF will struggle to meet the nation’s infrastructure needs over the next decade.

Audrey Copeland, NAPA: After decades of teetering on collapse, HTF solvency needs to be addressed now. There’s likely no single solution to address its $250 billion shortfall, but we can chip away at this large deficit by implementing tried-and-true solutions. One approach is to identify new user fees in the short term and deploy them in the market to analyze revenue impact. Importantly, HTF is a dedicated fund; we cannot sacrifice its autonomy and we cannot afford to let it languish, because it allows the roadbuilding community to operate with clear market predictors on what the government spends and what the government will capture as it relates to user fees.

Which alternative or supplemental revenue sources do you think are most promising to sustain highway funding in the future?

Dr. Alison Black, ARTBA: ARTBA supports any revenue mechanism that will provide resources to the Highway Trust Fund and sustain federal investment levels. Some options that Congress could consider include an electric vehicle fee, increasing and indexing the federal motor fuel tax, a road usage charge, a freight fee, or a national registration fee. These are sources of revenue that are derived from the system,

generate recurring revenue, and support additional investment.

Copeland:

• Increase in federal fuel tax (with index for inflation)

• Mileage-Based User Fees (charging drivers per mile driven)

• Tolling expansion on highways/bridges

• Dedicated sales taxes (e.g., on vehicles or auto parts)

• General fund transfers or other public funding (beyond user fees)

• Public-private partnerships or private financing mechanisms

For the first time in decades, we were close to seeing HTF revenues increased by capturing EV and hybrid drivetrains, which contribute little to nothing into the HTF. Although unsuccessful this time, the mere possibility demonstrated that we can find additional revenues if we are willing to take action. And, frankly, that includes raising and indexing the fuel tax for the first time since the 1990s. Still, we know that any perceived new gas taxes or increases are unpalatable to most legislators, regardless of the need. EV and hybrid fees may be the lowest hanging fruit given they passed the House just a few months ago – it’s time for the Senate to get on board and support new revenues for the HTF.

Largura: The reality is that maintaining and expanding our highway infrastructure requires substantial, stable funding, and no single revenue source will meet this need. We need a combination of approaches that generates sufficient resources and provides the predictability needed for long-term planning.

Long-term, Mileage-Based User Fees (VMT fees) make the most sense. Instead of paying a gas tax, drivers would be charged based on the number of miles they actually drive. This is sustainable regardless of vehicle fuel type — whether you’re driving a gas car, hybrid or electric vehicle — and it aligns costs directly with road usage and wear. The transition will be complex and needs careful phasing to address privacy concerns and ensure fairness, but several states are already piloting VMT programs successfully.

In the near term, indexing the federal fuel tax to inflation would provide stability while longer-term solutions are developed. Other approaches like public-private partnerships for major projects and dedicated sales taxes can play complementary roles.

The key is implementing a funding framework that’s adequate, sustainable, and provides the certainty needed for long-term infrastructure investment.

What are some other technologies, besides Electrification, that are shaping up to have a greater impact on the future of the industry?

Black: In terms of funding, flexible financing tools that foster innovation and accelerate project delivery could have an impact on the future of the industry. Some of these tools include eliminating the cap on Private Activity Bonds, enhancing the Transportation Infrastructure Finance& Innovation Act (TIFIA) program, and lifting the federal ban on Interstate tolling.

Largura: The broader shift toward data-driven decision-making is having perhaps the most significant impact. Better data on asset conditions, project performance and cost factors allows agencies and contractors to make more informed decisions about where to invest and how to deliver projects most effectively.

Several specific technologies are making this happen. Digital project management and preconstruction planning tools, like drone mapping, 3D modeling and digital risk assessment, allow us to identify potential issues before breaking ground, reducing the need for costly changes during construction.

Automated and connected work zone systems, including smart traffic management, real-time data communication, and advanced warning systems are improving both safety and traffic flow while minimizing disruption to the traveling public.

Advanced materials and construction methods are also making a difference, from longer-lasting pavement materials to accelerated bridge construction techniques that shorten project timelines.

As the fourth-generation owner and operator, Nick’s vision and commitment are at the core of our continued growth and success. Nick grew up with a deep interest in construction and the business and spent every opportunity available working within the company and alongside those who built it. He fostered his love of construction in his hometown in Northwest Indiana before relocating to Florida. As he leads us into the future with the Largura legacy pushing us forward, his strategic growth plan is backed by his commitment to provide opportunities for employees and the communities we build. Nick graduated from the College of Charleston with a bachelor’s degree in business administration and management.

What are the primary factors causing project delays in road/highway construction today?

Copeland: There are many variables that impact highway project delivery, all of which are policy arenas NAPA aims to improve. The most significant is the permitting process, which is layered between local, state, and federal jurisdictions. On Capitol Hill, NAPA focuses on permitting reform and streamlining to ensure roadway projects are executed on time and on budget – specifically modernizing the National Environmental Policy Act (NEPA) to improve timing and eliminate duplicative reviews across agencies and jurisdictions, similar to what NAPA supported via One Federal Decision under IIJA. Another improvement is expanding categorical exclusions

for projects like road maintenance to avoid costly reviews for infrastructure work within existing footprints.

Largura: Funding is the primary factor. Projects are at the mercy of funding cycles and budget decisions that are often beyond our control. Right now, we’re tracking five projects, and two of them just got pushed back two months due to funding issues. You have to go with the flow, but it creates real challenges for planning and resource allocation.

also understand that these changes take time, so the reforms we are seeing today likely will not be fully realized for at least a couple of years.

Workforce availability is another challenge we’re managing, though it hasn’t directly caused project delays for us. Getting craft workers is difficult everywhere, but we’ve been able to work around those constraints so far. We’re even building a two-story training center to help address workforce development long-term.

Are recent permitting reforms having any impact on project delivery times for road projects?

Black: There have been cost and time savings for the eight states that have taken over the environmental review and permitting process for federal aid highway projects. The NEPA assignment has allowed California to shave years off its environmental reviews. Florida estimates $22 million in annual savings, and Ohio reported $32 million in avoided construction delays and inflation costs. Utah has saved between nine and 11 months by handing the NEPA process.

Largura: We haven’t seen much impact from the permitting reforms yet. Obtaining permits from the Army Corps of Engineers is a six- to ten-month process, and that hasn’t changed. In design-build projects, obtaining those permits falls on us as the contractor, which adds complexity. With NEPA permits and environmental reviews, if we want to change something in the design after permits are approved, we have to go through the permitting process again. That means we have to carefully assess whether the potential delay is worth it. Sometimes you’re locked into the original plan even if there’s a better way.

The bigger issue is that private owners and even some county agencies don’t fully understand the permitting process and its timelines. They’re under pressure to move quickly or risk losing funding, but the regulatory requirements don’t speed up just because there’s urgency on the funding side.

Copeland: Permitting reform –such as how NEPA is interpreted and executed, or whether certain duplicative federal and state agency reviews are consolidated – is a welcome change to how we build surface transportation projects in this country. Permitting challenges and delays stalled a lot of projects within IIJA (outside of formula funding dollars for roads, bridges, and highways). Permitting reform used to be more of a political wedge between the power brokers in DC; it has become more apolitical as elected officials have developed a better understanding that industry can evolve with permitting reform and environmental stewardship –they are not mutually exclusive. But we

What changes would most help speed up project delivery for road infrastructure?

Copeland: Allowing states more NEPA authorities can have immediate effect and help certain markets speed up projects. This summer, FHWA granted TxDOT the ability to conduct its own environmental review within the NEPA authorities. This is a great incentive for states to take more ownership of the federal dollars they receive for projects in their backyard, driving momentum to fulfill projects quicker when possible. Granted, certain state politics may be different if given the ability to utilize their own NEPA reviews, but ultimately if state agencies control the local process for their projects, more states may be inclined to find efficiencies within their permitting review.

Black: Eliminating inefficiencies would help speed up the delivery of highway and bridge infrastructure projects. Some measures to improve federal investments include streamlining the discretionary grant application and

ALISON PREMO BLACK PHD, SENIOR VP& CHIEF ECONOMIST, ARTBA

In addition to serving as senior vice president and chief economist for ARTBA, she is managing director of the Transportation Investment Advocacy Center program. Dr. Black manages ARTBA’s economics staff and is responsible for over 100 studies examining national and state transportation funding and investment patterns, including the association’s landmark economic profile of the transportation construction industry, state bridge condition profiles and annual modal forecast.

She has been interviewed numerous times as an industry expert for national and local print, television and radio, including the NBC TODAY show, the Washington Post, NPR, USA Today, the Wall Street Journal, The Economist and industry publications. She has testified before state legislative committees in Illinois, Tennessee, Kansas, North Carolina and Pennsylvania.

agreement process, reallocating stalled project funds, accelerating project delivery through NEPA reforms and harnessing innovative practices learned form emergency responses.

Largura: One key change would be using design products that don’t rely on materials with long lead times. Structural steel, for example, can have very long lead times. If you can use precast concrete instead, that can significantly reduce delays. Sometimes it’s worth choosing a slightly more expensive material if you know you can get it faster and save money by keeping the project on schedule.

How would you rate the impact of IIJA on the road building industry during its time?

Black: The increased investment in the federal-aid highway program through the IIJA has had a significant market impact on highway and bridge construction. Federal investment has helped support significant increases and record levels of major indicators, including contract awards, highway and bridge contractor employment, and construction activity.

Largura: The Infrastructure Investment and Jobs Act has had a significant positive impact on our industry and on the broader economy. Since fiscal year 2022, federal funding has supported the construction of more than 85,000 new highways and bridges across all 50 states. Public highway and pavement construction is expected to reach $124.8 billion in 2025, an increase of 4.79% compared to 2024. That growth is directly tied to IIJA funding flowing through to projects.

Two other challenges have tempered IIJA’s impact. First, the bill coincided with significant inflation in construction costs — 10% in 2021 and 12% in 2022. While the increased funding was welcome, cost escalations eroded some of the benefit, particularly for contractors on fixed-price contracts. Second, permitting processes and project development take time, so some IIJA funding is still working its way through the pipeline.

roadbuilding sector. Even taking this into account, the record levels established in IIJA, like the formula funding program, were used effectively. Congress and the White House must acknowledge that IIJA established the baseline for funding vital road, highway, and bridge projects. To serve the nation now and into the future, the 2026 reauthorization must increase, allowing states and their roadbuilding partners to execute projects more efficiently. That’s why NAPA is advocating for permitting reform, increased HTF revenues, and common-sense regulations.

With IIJA funding expiring in 2026, how concerned are you about a potential funding gap or slowdown in projects if a new bill is not passed in time?

Largura: A funding gap would be significantly disruptive for the industry. At Superior, we’ve adjusted operations and investment decisions based on IIJA funding levels, and contractors across the country have built their workforce to meet the increased demand.

Copeland: No doubt, there is a lot to celebrate in IIJA and what it achieved: record levels of investment into infrastructure (both traditional and non-traditional) with a clear mandate from Congress and the White House that America’s infrastructure requires critical resources to expand and remain efficient. IIJA’s record funding levels, unfortunately, were essentially eaten away by the effects of the pandemic and inflation – rendering those record amounts, effectively, status quo. If it weren’t for those funds, infrastructure work would be even further behind, because those external variables were so unpredictably impactful on the

We’re seeing stark regional variations in how states are planning for the post-IIJA period. In Florida, FDOT has several large work programs scheduled, which provides confidence and visibility for planning. In other markets, the absence of scheduled major work programs raises questions about maintaining stable operations after a decade of increased funding.

The industry needs consistent project volume to maintain trained crews, specialized equipment, and operational efficiency. When work slows significantly, contractors face difficult decisions, and then when funding returns, there’s inefficiency ramping back up. This creates waste in the system that benefits no one.

Appointed National Asphalt Pavement Association (NAPA) President & CEO in 2019. Previously, she served as NAPA’s Vice President of Engineering, Research, and Technology beginning in 2012. She began her career as a highway engineer at the Federal Highway Administration (FHWA) and then went on to be a highway materials research engineer at FHWA’s Turner Fairbank Highway Research Center where she managed asphalt-related research laboratories and projects.

Audrey earned a PhD in Civil Engineering from Vanderbilt University in 2007 and Master and Bachelor of Science degrees in Civil& Environmental Engineering from Tennessee Technological University. She is a registered engineer in the Commonwealth of Virginia and the State of Maryland. Audrey lives in Kensington, Maryland, with her husband, Jose Albertini, and their two children.

federal match that is currently available – creating delays in project development for those currently in design and likely resulting in stop-work orders for projects are under construction.

That’s why active industry involvement in advocating for timely federal reauthorization is so important. A smooth transition from IIJA to the next bill isn’t just good for contractors — it’s essential for maintaining the workforce and capacity needed to deliver America’s infrastructure projects efficiently.

Copeland: Without a clean extension of reauthorization, state DOTs would be forced to delay projects without the

What priorities or features would you most like to see in the next federal surface transportation bill?

Black: The next federal surface transportation bill should increase investment levels to continue the progress being made to improve the nation’s infrastructure. At a minimum, investment levels should be increased to offset the impact of historic inflation over the last four years. Additional investments would allow states to continue to repair and replace bridges, address freight bottlenecks, increase mobility and

Our UL asphalt tanks have properly sized normal and emergency venting as standard.

All structural attachments are OSHA approved and are af xed to our tanks per code.

All tanks are tested to UL142 Section 42.2.1a 10th Edition.

All weld joints are per UL142 standards.

Your asphalt tanks will be properly labeled and registered with UL142.

improve safety. These investments could be supported by a combination of new and existing user fees, or if necessary, General Funds. All of these should be policy options.

produces better-performing pavements and reduces costs to taxpayers.

Largura: A longer-term bill with stable funding: Five years is the minimum for meaningful planning, but six or even ten years would be better. States need to program projects with confidence that funding will be available to complete them, and contractors need visibility to make appropriate capacity investments.

A Highway Trust Fund fix: Whether through indexing the fuel tax to inflation, implementing VMT fees, or using another mechanism, we need to address the long-term sustainability of the funding source. A short-term funding boost without addressing the underlying revenue problem just kicks the can down the road.

Workforce development support: The labor shortage is real and industry-wide. At Superior, we’ve made substantial investments in workforce development, from formalized apprenticeship programs and equipment operator training to partnerships with educational institutions and dedicated training facilities. We’re even transitioning experienced workers into leadership and mentorship roles. But these investments require significant resources that not every contractor can afford. Federal support would level the playing field and help the entire industry develop the workforce we need.

Copeland: NAPA’s priorities are enumerated below:

• Work zone safety: Keeping construction workers safe while they pave our nation’s critical road network.

• Buy America construction material exemption: Preserving the critical construction materials supply chain by maintaining the Buy America exemption that has been in place for raw construction materials (such as asphalt binder and aggregate) for more than 40 years.

• Permitting reform: Addressing challenges associated with permitting road and bridge projects via programs like NEPA and other federal regulatory processes.

• Limit arbitrary PFAS liabilities on passive receivers: Ensuring critical construction materials suppliers are not held liable for passively receiving recycled materials potentially containing PFAS.

• Limit overreliance on discretionary grants: IIJA substantially expanded discretionary grant programs delivering great projects but not without unforeseen challenges. While certain discretionary grants work well, like AID-PT, an overabundance of discretionary programs creates problems and rising costs.

• HTF solvency: Solving issues with HTF financial solvency and ensuring all road users contribute to the system.

• RAP: Incentivizing the use of recycled materials that save on road construction costs, efficiently use existing materials and advance road construction sustainability.

• Accelerated Implementation and Deployment of Pavement Technologies (AID-PT): Reauthorizing this important pavement deployment program that

demonstrate to women of all ages and capabilities that road construction offers opportunities for them too. NAPA, through our Research& Education Foundation (NAPAREF) has also worked with SAPAs and others like the National Center for Asphalt Technology (NCAT) at Auburn University to elevate opportunities for undergraduate and graduate students to gain early industry experience and open their eyes to the opportunities among member companies. Just this year, the NAPAREF Road Scholars program granted its first round of scholarships to NCAT graduate students.

Black: A highly-trained and safe workforce is key to delivering infrastructure projects The number of workers employed by highway, street, and bridge contractors reached record levels over the summer construction season –with 411,100 employees, up by over 35,600 jobs, or 9 percent, compared to 2021. But while the industry has been adding jobs, it is likely that contractors would be hiring more workers in some areas.

• Workforce opportunities: Supporting workforce challenges facing the industry, including finding and training the workforce necessary to complete the thousands of roadway projects across the country each year.

• Material neutrality: Ensuring there is no material bias within any federal highway bill regarding pavement materials and mixtures.

How challenging is it currently to recruit and retain qualified workers?

Copeland: Like most other industries, we are constantly seeking talent. The good news is that many of our State Asphalt Pavement Association (SAPA) partners are leading on workforce development with training initiatives, community college and technical school partnerships, and seeking opportunities with groups that connect candidates with jobs. Further, Women of Asphalt and its local branches

Largura: I’d say it’s one of the most critical issues facing our industry right now. We’re dealing with a perfect storm: Baby Boomers are retiring and taking decades of knowledge with them. Roughly 40% of the construction workforce is expected to retire in the next decade or so, and we don’t have nearly enough new workers entering the field to replace them. Plus, many Millennials got the message that a four-year college degree was the only path forward. When I’m on jobsites today, I see younger workers and experienced veterans, but there’s a real gap in that middle tier — the people who should be stepping into leadership roles.

The challenge isn’t just finding bodies to fill positions. It’s finding people with the right skills and mindset who want to build a career. And frankly, we’re competing against a public perception that construction is dangerous or just a fallback option, when the reality is we’re offering stable, well-paying careers with real growth potential.

For more information visit https://asph.link/2026SOTI

By Allyson Sherrier, Managing Editor

Quality Control

Inspector Tracy Richard shares her path from laborer to field technician, overseeing mix designs, testing and paving quality in the asphalt industry.

In an industry where precision determines pavement performance, few roles carry more day-to-day responsibility than field quality control. It’s the kind of work that demands technical confidence, physical stamina and the ability to make confident decisions in unpredictable conditions. That challenge is exactly what drives Tracy Richard, a Quality Control Inspector for Amrize Building Materials.

Richard specializes in the realworld application of mix designs and job-specific specialty designs. While she participates in winter design-team work, she is quick to note that the lab supervisor is “truly the genius behind design.” Her job begins once the designs leave the lab. With the designs in hand, she’s then responsible for sampling, coring, density testing and keeping close oversight on best practices during paving to ensure those designs perform exactly as intended.

Born and raised in New Bedford, Massachusetts, and the youngest of four siblings, Richard credits her family’s perseverance with shaping her own. The granddaughter of Portuguese immigrants, she grew up with a clear understanding of hard work and resilience — qualities that would one day become a calling card throughout her career in the aggregate and construction materials industry.

Richard’s journey started when she learned of an apprentice laborer position through a personal connection and found herself intrigued by the opportunity despite having “little experience in quality control or construction.” What she lacked in exposure, she made up for in enthusiasm.

She spent her first six years at the company gaining hands-on experience, working her way from apprentice to journeyman and building a strong understanding of what it takes to construct and maintain infrastructure. When she was asked to take on milling inspection work, she found both a challenge and a passion, eventually developing the milling inspection program still used today and training others in the process. By 2015, Richard transitioned full time into Quality Control, where new expectations and a steep learning curve pushed her further. Observing, testing, asking questions and applying new skills onsite shaped her understanding of both the science and the craft behind asphalt quality.

In this role, she’s found a passion for the technical side of mix designs. Working with her team to develop mixes that meet stringent project demands and bringing innovation into practical field use led to further growth. A standout project involved a specialized waterproofing mix for bridge decks, an effort that later informed similar infrastructure applications. That experience helped her master the mix and eventually create a best-practices manual, which she later presented to the Department of Transportation.

Richard’s early years in laborer roles gave her a perspective many technicians may not experience. She understands firsthand how each position on a paving crew connects to the next and how each task influences the final product.

“I have a solid understanding of how each role on a crew connects and supports the next,” she said. That understanding informs her

Since its introduction, the Weiler P385 has set the standard for commercial pavers. The P385C raises that standard.

Variable speed and reversible conveyors and augers and a 25% increase in tunnel height provide optimal material output.

Increase to 120 hp with the Cat® C3.6 Tier 4F/Stage V engine.

Modular conveyor drive and sealed chain case increase feeder system reliability and life.

Enhanced heat system performance with direct-drive hydraulic generator and elimination of GFCI breakers.

approach to leadership. She focuses on collaboration, communication and safety as the foundation for highquality work. “We work and succeed as a team,” Richard said.

She has made it a priority to reinforce safety, appreciate hard work and check in on her colleagues while also taking every dent or setback as an opportunity to uphold standards of workmanship and strengthen relationships.

Over the course of her career, Richard has seen safety culture evolve in meaningful ways. “Safety remains the core,” she said, noting that the entire industry has become more intentional about integrating safety into every operational step rather than treating it as a separate checklist. She sees this shift as a positive sign of maturity across construction and an important foundation for long-term workforce development. That’s not the only change she’s noticed – and hopes to see more of.

More women are getting into construction roles, but it’s still a low number. To get more women into the trades, Richard believes the best and easiest solution is to simply raise awareness. These careers aren’t as widely marketed towards women, so students may not realize this work is accessible right out of high school, nor do they understand the range of opportunities beyond those on a traditional jobsite. She wants more women to see the pride and potential in this career.

As a longtime participant in the Women of Asphalt mentorship program, she uses her voice to advocate for women

and underrepresented groups navigating a field that remains predominantly male. Mentorship played a pivotal role in her growth, and she encourages new workers to seek it out. “You only need curiosity, a willingness to learn and faith in yourself.”

Richard emphasizes the importance of mentorship, particularly for young professionals entering the field. The construction industry is seeing more apprentices and new workers, and she wants them to feel supported. She offers guidance, answers questions and works to create an environment where curiosity is welcomed.

“When my career ultimately reaches its finish line, I hope someone coming up behind me knows there was someone who believed in them and helped carry the baton forward.”

As far as a career in quality control is concerned, Richard’s advice is simple: take the first step. “You have nothing to lose by trying.”

Crash cushions protect motorists and workers, but only when properly installed and maintained. Training, evolving DOT standards and field-ready resources are key to ensuring roadway safety.

In highway work zones and along high-speed corridors, impact attenuators and crash cushions often serve as the last line of defense between a vehicle and catastrophe. These safety systems are engineered to absorb impact, redirect vehicles that veer off course, and protect both motorists and workers. Even the most rigorously tested device can fail if it is not installed by someone with sufficient training or maintained properly. Too often, the conversation around crash cushions and other end treatments stops at product selection. Yet, to deliver the performance these products are designed for, these devices must also be maintained in line with manufacturer specifications and evolving Department of Transportation (DOT) standards.

Maintenance contractors, the professionals responsible for installing and servicing end treatments, often work under tight timelines. They may receive contracts from state DOTs, juggle products from multiple manufacturers, and deploy systems that look deceptively similar but are not interchangeable. Many devices are engineered for very specific roadway environments, such as low speed arterials or high speed interstates, and some designs are only suited to particular roadway widths or configurations. State DOT specifications may go even further, requiring that an end treatment be reusable, repaired on site, or replaced entirely after a single impact. These requirements

vary from state to state and are often tied to reducing the time that crews spend exposed to live traffic.

With workers out on live roadways, time is not just money; it is exposure and risk.

In this environment, there is very little margin for error. A bracket that “seems” to fit but does not belong, a component swapped between systems, or a misunderstanding about repairability could render a safety device ineffective in a crash. From low speed arterials to high speed interstates, as crash cushions become more complex and tailored to specific applications, it becomes critical that those installing and maintaining them know exactly what they are working with.

This knowledge includes the ability to distinguish between general wear and damage that compromises structural integrity. Subtle deformations, unseen cracks, or weakened fasteners may look harmless but can drastically affect

performance if not addressed. Training plays a pivotal role in closing that knowledge gap, helping contractors avoid “Frankenstein” repairs that might hold a system in place but compromise its performance. Additionally, it saves both time and money by ensuring installations are done right the first time.

Crash cushion technology and roadway applications continue to evolve, shaped in large part by changing state and federal regulations. For example, the transition from NCHRP Report 350 to the MASH (Manual for Assessing Safety Hardware) standards raised the bar for product testing and compliance. As a result, older devices that were once acceptable may now fall out of compliance, yet many remain in use due to cost constraints or lagging awareness. In some areas, legacy units remain installed well past the point of compliance, often

for years. While they may still appear functional, these systems can provide reduced protection levels in real‑world impacts.

At the same time, DOTs are increasingly mandating formalized training for contractors working with critical safety systems. These mandates are driven not only by performance concerns but by a broader public safety goal: reducing deaths on roadways by mini mizing failure points and streamlining repair timelines. The faster a damaged system can be inspected and repaired, particularly if it is designed to be reusable, the less time road crews need to spend in active traffic zones, significantly reducing their exposure to passing vehicles and overall safety risk. Shortening this window restores full protection more quickly and reduces road‑crew exposure to passing traffic; one of the most effective ways to lower on‑site injury risk.

Staying compliant requires more than updating devices; it requires updating knowledge. Training materials must evolve as quickly as regulations, helping contractors understand which transitions or applications are newly approved and which are not. The ability to access the most current information, particularly in the field, has become a necessity.

Leading manufacturers and training providers continually update their programs based on feedback from DOTs, contractors, and industry groups such as ATSSA and TRB. Insights drawn from real‑world installations and performance in the field help refine maintenance guidelines, transition designs, and instructional mate rials so that training remains closely aligned with evolving roadway conditions and safety standards. This ensures the content stays directly relevant to field personnel and regulatory demands.

One of the most persistent barriers to proper maintenance is not just the availability of training, but the willingness to invest in it. Many highway contractors operate with lean teams and tight margins, and when every hour in the field counts toward revenue, pulling crews off the road for training can seem like a luxury. For many contractors, hesitation stems from focusing on immediate billable hours, yet the savings from fewer reworks, faster installations, and reduced compliance risk often outweigh the short term cost of taking crews off the road. But when training is overlooked, the costs multiply quickly: misinstalled systems, repair delays, noncompliance fines, and worst of all, safety failures.

That is why high impact training needs to be both accessible and flexible. In many cases, contractors should attend formal, classroom style sessions, particularly when rolling out new systems or updates. These structured settings allow for hands on instruction and deeper engagement with evolving specifications. In addition, the availability of mobile friendly, digital modules is critical for fieldwork. Whether it is confirming which component to use or reviewing a recent update, crews need to access reliable guidance in real time, without leaving the job site.

Beyond convenience, this accessibility is a key driver of effi ciency. A crew that can install or repair a crash cushion correctly the first time avoids costly delays and minimizes the risk of repeat labor. In contrast, a team working without the latest training

may take two or three times longer to complete a job, burning through labor hours, reducing project margins, and leaving safety systems out of spec. Field experience shows that fully trained crews may complete six to eight system installations in a single day, versus one or two for untrained teams. That productivity difference saves money and shortens road closures.

Beyond the training itself, asset management is another crucial layer. Agencies need systems to track what equipment has been deployed, when it was last maintained, and whether it has been impacted. Best-practice programs record installation dates, the number and severity of impacts, replaced parts, and environmental wear factors like corrosion or UV damage. Without a structured log, degraded or out-of-compliance devices can remain in service long after their safe operational lifespan has ended, undermining safety and potentially

exposing the agency or contractor to legal and financial liability.

Investing in training may pull workers off the road temporarily, but failing to invest can lead to even longer delays, higher costs, and increased risk. In an industry where time is money and safety is paramount, doing it right the first time is more than good practice. It is good business.

Many roadway-safety equipment providers actively assist transportation agencies as they write or revise specifications. This collaboration helps ensure state and local requirements reflect current safety standards, that each project uses the most appropriate device for its environment, and that long-term maintenance considerations are built into the planning process from the start.

Roadway safety is more than compliance; it is grounded in integrity.

End treatments and crash cushions are designed to absorb impact and protect lives, but their effectiveness hinges on something less tangible, the labor behind them. From DOT and contractors to manufacturers, every player has a role in making sure safety systems are installed correctly, maintained properly, and deployed with precision.

Proper training and ongoing maintenance are not simply procedural requirements. They are proactive investments that support long term safety, reduce unnecessary equipment turnover, minimize worker exposure, and prevent costly rework. By educating the people responsible for these systems and giving them access to current, field-ready resources, agencies and contractors build a foundation of trust, efficiency, and reliability.

Steel Diverter to control direction of material flow

Steel Diverter to control direction of material flow

Positive

12 Cu. Yd Aggregate 800 Gal Emulsion/800 Gal Water Smart Ops Monitoring System Twin ergonomic Joystick Operation

Our combi-versions feature four rear rubber tires in place of a traditional drum. Each pair is independently powered by separate drive motors, significantly reducing the risk of surface damage —especially during tight turns on freshly laid asphalt. The rubber tires also help achieve a denser, smoother finish, meeting the demands of high-spec paving jobs.

By Brandon Noel, Editor-In-Chief

Explore how Void-Reducing Asphalt Membranes work, how they’re applied, and why more DOTs and contractors are adopting this proven method to extend pavement life.

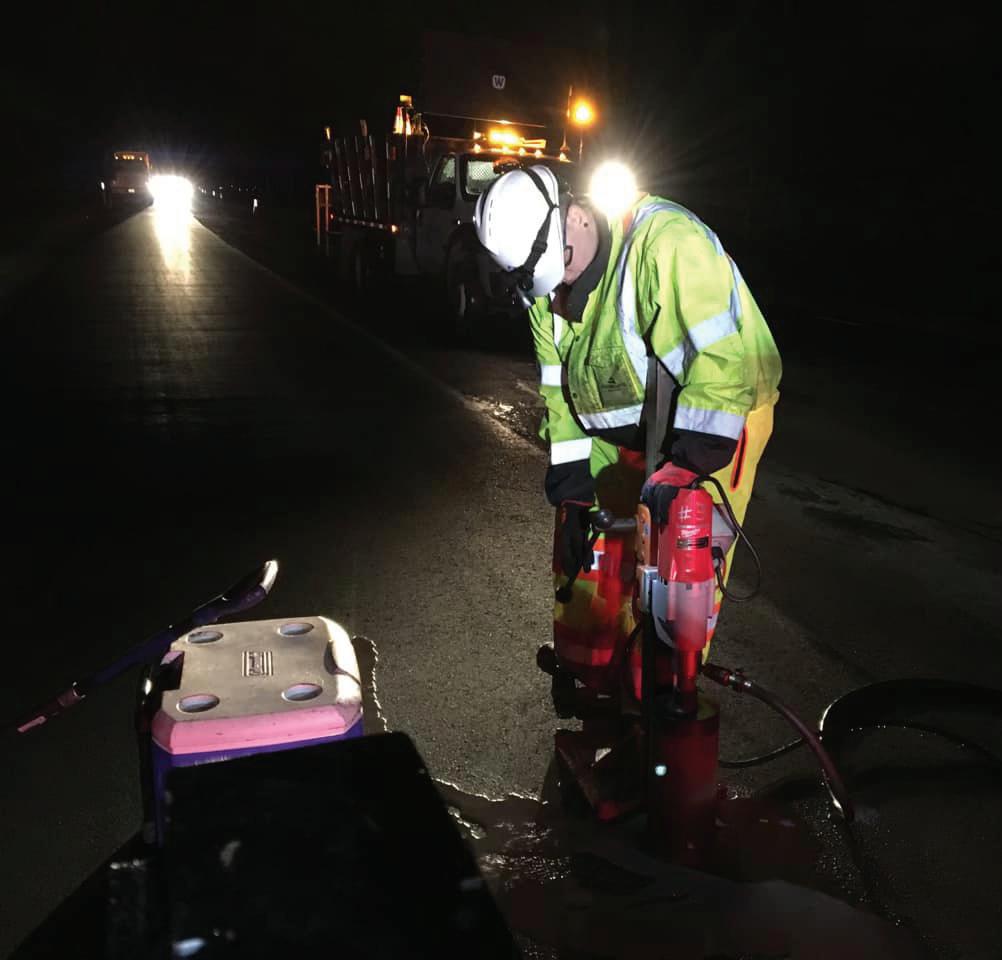

In the past three years I’ve visited a fair number of jobsites to see how blacktop crews do a lot of what they do on a day-to-day basis. However, I haven’t undergone a lot of what I think of as “formal” training. Thankfully, last year I connected with Shelly & Sands, a large road work contractor near where I live in Ohio, and spent a day at their safety and training facility in Zanesville, OH. There I was introduced to Void Reducing Asphalt Membranes and trained how to safely apply it.

It is essentially a thick band of polymermodified asphalt sealer applied before paving, at the location of the future joint, to seal voids and create a moisture barrier within the asphalt layer. As the hot mix is paved over this strip of material, the VRAM softens and “wicks” upward, filling the air voids in the lower part of the mat from the bottom up. This bottom-up approach dramatically reduces permeability at the joint, preventing water infiltration and air intrusion that would otherwise weaken the seam.

Importantly, VRAM is known by different terms. In most states, the generic specification is VRAM, while Illinois refers to the practice as Longitudinal Joint Sealant (LJS). A leading proprietary VRAM product is J-Band, developed by Asphalt Materials, Inc. (AMI).

In fact, “J-Band and VRAM are identical to each other, with one exception: VRAM is sold in a cold block form… and J-Band is sold and

distributed in a hot liquid form,” explained Bill Ganger of Cimline, who travels state-to-state providing on-site training in application for contractors.

Both forms create a void-reducing membrane at the joint, but the choice often depends on project logistics and available equipment.

VRAM cools and solidifies quickly on the pavement surface, so it can be in place hours ahead of paving. When the hot top layer is paved over the treated joint area, the heat causes the VRAM to melt and wick upward into the new asphalt mix, infiltrating about 50–75% of the layer’s thickness.

In effect, the VRAM becomes an integral part of the joint, filling the voids that remained due to slightly lower compaction at the edge. By occupying those void spaces, VRAM keeps out water and air.

“What we’re doing is filling those void spaces up on the edge where you can’t get that full compaction,” said Bill Ganger, describing how VRAM addresses the natural density drop-off at unconfined edges.

The result is a dramatically more water-resistant joint. Even if a crack eventually forms on the seam, the penetrated VRAM resin prevents water from permeating downward through the joint as it normally would. The effectiveness of this approach cannot be overstated. Attacking the joint problem from within rather than sealing a joint after paving.