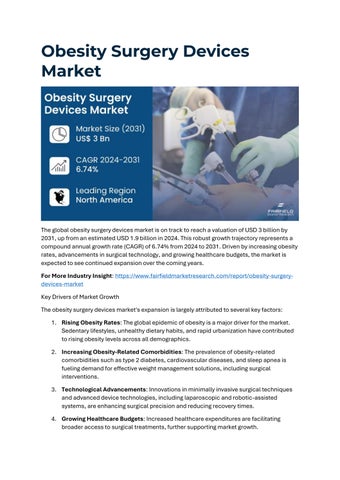

Obesity Surgery Devices Market

The global obesity surgery devices market is on track to reach a valuation of USD 3 billion by 2031, up from an estimated USD 1.9 billion in 2024. This robust growth trajectory represents a compound annual growth rate (CAGR) of 6.74% from 2024 to 2031. Driven by increasing obesity rates, advancements in surgical technology, and growing healthcare budgets, the market is expected to see continued expansion over the coming years.

For More Industry Insight: https://www.fairfieldmarketresearch.com/report/obesity-surgerydevices-market

Key Drivers of Market Growth

The obesity surgery devices market's expansion is largely attributed to several key factors:

1. Rising Obesity Rates: The global epidemic of obesity is a major driver for the market. Sedentary lifestyles, unhealthy dietary habits, and rapid urbanization have contributed to rising obesity levels across all demographics.

2. Increasing Obesity-Related Comorbidities: The prevalence of obesity-related comorbidities such as type 2 diabetes, cardiovascular diseases, and sleep apnea is fueling demand for effective weight management solutions, including surgical interventions.

3. Technological Advancements: Innovations in minimally invasive surgical techniques and advanced device technologies, including laparoscopic and robotic-assisted systems, are enhancing surgical precision and reducing recovery times.

4. Growing Healthcare Budgets: Increased healthcare expenditures are facilitating broader access to surgical treatments, further supporting market growth.

Challenges Facing the Market

Despite its growth potential, the obesity surgery devices market faces several challenges:

1. High Costs and Reimbursement Issues: The high costs associated with obesity surgery and the varying reimbursement policies across different healthcare systems can limit patient access and market growth.

2. Post-Operative Complications: Potential complications such as infections and nutrient deficiencies, along with the need for long-term management, can influence patient decisions and affect market dynamics.

Emerging Trends and Opportunities

The obesity surgery devices market is witnessing several notable trends and opportunities:

1. Focus on Patient Outcomes: There is an increasing emphasis on patient-centered care and long-term outcomes. Manufacturers are investing in developing devices that improve patient outcomes and offer value-based solutions.

2. Acceptance of Obesity Surgery: The normalization of obesity surgery and greater societal acceptance are driving more individuals to consider surgical options, expanding market opportunities.

3. Expansion into Developing Markets: Regions such as Latin America, the Middle East, and Africa are becoming significant growth areas due to rising obesity rates and increasing healthcare infrastructure.

4. Rise of Medical Tourism: Countries offering cost-effective and high-quality bariatric surgeries are attracting international patients, impacting the demand for obesity surgery devices.

Regulatory Impact on the Market

The regulatory landscape plays a crucial role in shaping the obesity surgery devices market. Stringent regulatory approvals from bodies like the FDA and EMA are essential for ensuring device safety and efficacy. While these regulations ensure high standards, the complex and evolving regulatory environment can pose challenges, including extended approval times and increased operational costs. However, clear regulatory frameworks can also foster innovation and enhance investor confidence.

Market Segmentation and Key Players

The market is segmented into various categories:

1. Minimally Invasive Surgical Devices: This segment dominates the market due to the preference for less invasive procedures. Devices such as laparoscopic instruments and staplers are essential for bariatric surgeries, offering reduced patient discomfort and shorter recovery times.

2. Gastric Balloons and Gastric Bands: Gastric balloons, used for temporary weight management, are gaining popularity for their minimally invasive nature. Gastric bands, though experiencing a decline, still cater to specific patient populations.

3. Stapling Devices: These devices are crucial for creating precise tissue folds and incisions during surgeries, driving their significant presence in the market.

4. End-User Segmentation: Hospitals remain the primary end users, owing to their comprehensive infrastructure and expertise. Specialty clinics and ambulatory surgical centers are also emerging as key players due to their focused approach to weight management and cost-effective solutions.

Regional Insights

1. North America: The region, particularly the United States, holds a dominant market share due to its high obesity rates, advanced healthcare infrastructure, and robust reimbursement policies.

2. Asia Pacific: This region is emerging as a high-growth market, with increasing obesity rates, rising healthcare expenditure, and growing medical tourism driving market expansion. Countries like India, China, and South Korea are significant contributors.

Competitive Landscape

The obesity surgery devices market is characterized by a mix of established medical device companies and innovative startups. Key players include:

• Johnson & Johnson

• Medtronic, Plc.

• Apollo Endosurgery Inc.

• Aspire Bariatrics Inc.

• Spatz FGIA Inc.

• MetaCure

• IntraPace Inc.

• TransEnterix Inc

• Allergan, Inc

• ReShape Medical, Inc

• Entero Medica, Inc