Rising Bitcoin Popularity Drives Cryptocurrency Market Growth

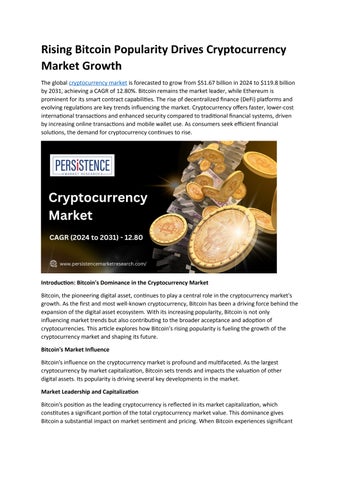

The global cryptocurrency market is forecasted to grow from $51.67 billion in 2024 to $119.8 billion by 2031, achieving a CAGR of 12.80%. Bitcoin remains the market leader, while Ethereum is prominent for its smart contract capabilities. The rise of decentralized finance (DeFi) platforms and evolving regulations are key trends influencing the market. Cryptocurrency offers faster, lower-cost international transactions and enhanced security compared to traditional financial systems, driven by increasing online transactions and mobile wallet use. As consumers seek efficient financial solutions, the demand for cryptocurrency continues to rise.

Introduction: Bitcoin's Dominance in the Cryptocurrency Market

Bitcoin, the pioneering digital asset, continues to play a central role in the cryptocurrency market's growth. As the first and most well-known cryptocurrency, Bitcoin has been a driving force behind the expansion of the digital asset ecosystem. With its increasing popularity, Bitcoin is not only influencing market trends but also contributing to the broader acceptance and adoption of cryptocurrencies. This article explores how Bitcoin's rising popularity is fueling the growth of the cryptocurrency market and shaping its future.

Bitcoin's Market Influence

Bitcoin's influence on the cryptocurrency market is profound and multifaceted. As the largest cryptocurrency by market capitalization, Bitcoin sets trends and impacts the valuation of other digital assets. Its popularity is driving several key developments in the market.

Market Leadership and Capitalization

Bitcoin's position as the leading cryptocurrency is reflected in its market capitalization, which constitutes a significant portion of the total cryptocurrency market value. This dominance gives Bitcoin a substantial impact on market sentiment and pricing. When Bitcoin experiences significant

price movements, it often triggers corresponding fluctuations in the prices of other cryptocurrencies, a phenomenon known as "market correlation."

Institutional Interest and Investment

The rising popularity of Bitcoin has attracted substantial interest from institutional investors and financial institutions. Major companies and investment firms are increasingly adding Bitcoin to their portfolios, recognizing it as a legitimate asset class. This institutional interest is boosting Bitcoin's credibility and contributing to the overall growth of the cryptocurrency market. Notable examples include Tesla's Bitcoin investment and the approval of Bitcoin exchange-traded funds (ETFs) by regulatory authorities.

Factors Driving Bitcoin's Popularity

Several factors contribute to Bitcoin's growing popularity and its influence on the cryptocurrency market. Understanding these drivers provides insight into the dynamics of Bitcoin's role in the broader digital asset ecosystem.

Digital Gold Narrative

Bitcoin is often referred to as "digital gold" due to its perceived store of value characteristics. Like gold, Bitcoin is seen as a hedge against inflation and economic instability. This narrative has gained traction as global economic uncertainties have increased, leading investors to view Bitcoin as a safe haven asset. The comparison to gold and its limited supply make Bitcoin an attractive investment option for those seeking long-term value preservation.

Mainstream Adoption and Recognition

Mainstream adoption and recognition of Bitcoin are key factors driving its popularity. As more businesses and institutions accept Bitcoin as a means of payment or investment, its legitimacy and appeal grow. High-profile endorsements from influential figures and companies have further elevated Bitcoin's status and contributed to its widespread acceptance.

Technological Advancements

Technological advancements in the Bitcoin network and ecosystem are enhancing its usability and appeal. Innovations such as the Lightning Network, which aims to improve transaction speed and reduce fees, are making Bitcoin more practical for everyday use. Additionally, developments in wallet technology and user interfaces are simplifying the process of buying, storing, and transacting with Bitcoin, making it more accessible to a broader audience.

Bitcoin's Impact on Cryptocurrency Market Growth

Bitcoin's popularity is driving growth in the cryptocurrency market in several ways, contributing to the overall expansion of the digital asset ecosystem.

Market Expansion and New Investments

The increasing interest in Bitcoin is driving new investments and expanding the cryptocurrency market. As Bitcoin gains traction, investors are exploring other cryptocurrencies and blockchain projects, leading to a broader range of digital assets and financial products. The growth of the market is attracting new participants and encouraging innovation within the cryptocurrency space.

Increased Regulatory Focus

Bitcoin's prominence is drawing increased regulatory attention, which is both a challenge and an opportunity for the cryptocurrency market. While regulatory scrutiny can create hurdles, it also provides clarity and legitimacy to the market. The development of regulatory frameworks for Bitcoin and other digital assets can help establish a more stable and secure environment for investors and businesses.

Enhanced Market Infrastructure

The popularity of Bitcoin is driving the development of market infrastructure, including exchanges, trading platforms, and financial services. As Bitcoin becomes more integrated into mainstream finance, the infrastructure supporting it is expanding and improving. This enhanced infrastructure contributes to the overall growth of the cryptocurrency market and facilitates greater participation from both retail and institutional investors.

Challenges and Considerations

Despite its popularity, Bitcoin faces challenges that could impact its influence on the cryptocurrency market. Addressing these challenges is essential for sustaining its growth and ensuring its continued role as a market leader.

Volatility and Price Fluctuations

Bitcoin's price volatility is a significant challenge for investors and businesses. While volatility can create opportunities for profit, it also introduces risks that require careful management. Market participants must navigate price fluctuations and implement strategies to mitigate potential losses. Addressing volatility is crucial for maintaining investor confidence and supporting the long-term growth of the cryptocurrency market.

Environmental Concerns

The environmental impact of Bitcoin mining is a growing concern. Bitcoin's proof-of-work consensus mechanism requires substantial computational power, leading to high energy consumption. As sustainability becomes an increasingly important issue, addressing the environmental impact of Bitcoin mining and exploring more energy-efficient alternatives are essential for the cryptocurrency's future.

Regulatory and Legal Challenges

Regulatory and legal challenges continue to pose risks to Bitcoin's market influence. Governments and regulatory bodies are working to develop frameworks for digital assets, and the regulatory landscape is evolving. Navigating regulatory requirements and ensuring compliance will be crucial for Bitcoin's continued growth and integration into mainstream finance.

The Future of Bitcoin and the Cryptocurrency Market

The future of Bitcoin and its impact on the cryptocurrency market is likely to be shaped by several factors, including technological advancements, regulatory developments, and market trends.

Continued Innovation and Integration

The ongoing development of Bitcoin technology and its integration with traditional financial systems will drive its future growth. Innovations such as scalability improvements, enhanced privacy features, and integration with financial services will contribute to Bitcoin's adoption and influence. Continued innovation will be key to maintaining Bitcoin's position as a leading cryptocurrency.

Evolving Regulatory Landscape

The regulatory landscape for Bitcoin and other cryptocurrencies will continue to evolve. Clear and supportive regulations will play a crucial role in fostering market growth and ensuring investor protection. As regulatory frameworks become more defined, Bitcoin's role in the cryptocurrency market will likely become more established and integrated into mainstream finance.

Growing Institutional and Retail Adoption

The increasing adoption of Bitcoin by institutional investors and retail users will drive the continued growth of the cryptocurrency market. As more individuals and businesses recognize the value and potential of Bitcoin, its influence on the market will strengthen. Growing adoption will contribute to the overall expansion of the cryptocurrency ecosystem and the development of new financial products and services.

Conclusion: Bitcoin's Role in Shaping the Cryptocurrency Market

Bitcoin's rising popularity is a significant driver of the cryptocurrency market's growth. As the leading digital asset, Bitcoin influences market trends, attracts investment, and contributes to the overall expansion of the cryptocurrency ecosystem. While challenges such as volatility, environmental concerns, and regulatory issues exist, Bitcoin's continued innovation and adoption will play a key role in shaping the future of the cryptocurrency market. By addressing these challenges and leveraging its strengths, Bitcoin will remain a central force in the evolution of digital assets and the broader financial landscape.