Subsea Expo

Underwater expertise

Aquaculture’s health and safety record

Farming pike-perch at commercial scale

New standard unveiled

THE fearsome-looking creature on the cover of this month’s magazine is a pike-perch, also known as a zander. In Continental Europe, it is recognised as a high-quality fish for the table, but it has proved difficult to farm at any significant scale – up until now, at least.

As Mark Sallmann at Kaiserzander in Germany explains, pike-perch are now being raised in recirculating aquaculture systems on a commercial basis. Find out more about this premium freshwater fish, and how Kaiserzander found a formula for farming it, starting on page 38.

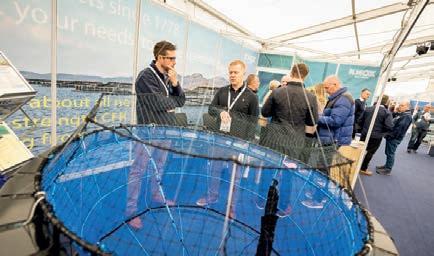

Also in this issue, we report on Subsea Expo 2024, the trade show for all things underwater. Fish Farmer was at the event in Aberdeen and discovered that an industry that cut its teeth on the lucrative oil and gas sector is now looking to apply its know-how to help customers in other industries – including aquaculture.

Our regional focus on the Faroe Islands includes a conversation with Jóhanna Lava Køtlum, Chief Executive of research organisation Firum, who explains why it has dropped its old name, Fiskaaling.

Nicki Holmyard reports from the Netherlands on the International Shellfish Conference, held at Deltapark Neeltje Jans and attended by shellfish farmers from all over the world.

Also on the shellfish front, CIEL’s Martin Sutcliffe writes about how innovation and collaboration could help the UK’s beleaguered industry overcome its challenges.

In his guest column, Jon Gibb, Fisheries Manager and Co-ordinator of the Salmon Scotland Wild Fisheries Fund, makes the argument that efforts to preserve endangered wild salmon populations would be undermined, not helped, if there was no salmon farming sector to help support conservation projects.

The rules on what constitutes “organic” farmed fish in the UK are changing, as Fiona Nicolson explains in her article on the Soil Association’s proposed new standard.

And finally Nick Joy, writing from Sicily this time, muses on the importance of export markets in allowing small producers to counter the power of the big supermarket chains.

Best wishes

Robert OutramEditorial advisory board:

Bracken, Hervé Migaud, Jim Treasurer, Chris Mitchell and Jason Cleaversmith

Editor: Robert Outram

Designer: Andrew Balahura

Commercial Manager: Janice Johnston

nston s ar er a a ine co Office Administrator

Fiona Robertson

robertson s ar er a a ine co

Publisher: ister enne

News

6-21 THE LATEST INDUSTRY NEWS

Processing news

22-23 PROCESSING UPDATE

Comment

24-25 BUILDING UP AN APPETITE

Martin Jaffa

Salmon Scotland

26-27 PART OF THE SOLUTION

Jon Gibb

Shellfish

28-30 FUTURE PROOF

Nicki Holmyard

Shellfish

32-33 EMERGING INNOVATIONS

Martin Sutcliffe

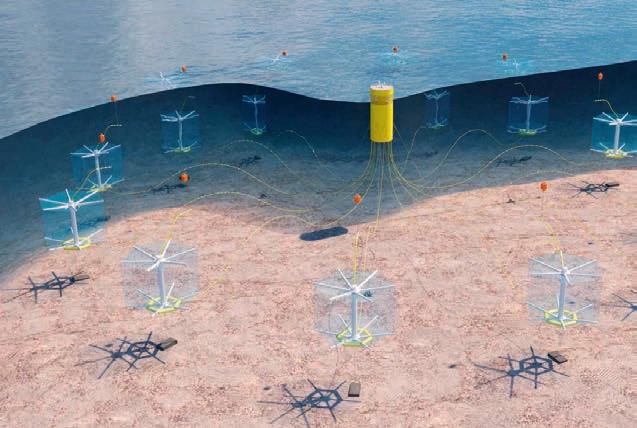

Sea farming

34-35 HEALTH AND SAFETY

Vince McDonagh

International trade

36-37 HURDLES GET HIGHER

Vince McDonagh

Pike-perch

38-41 PROFILE: KAISERZANDER

Robert Outram

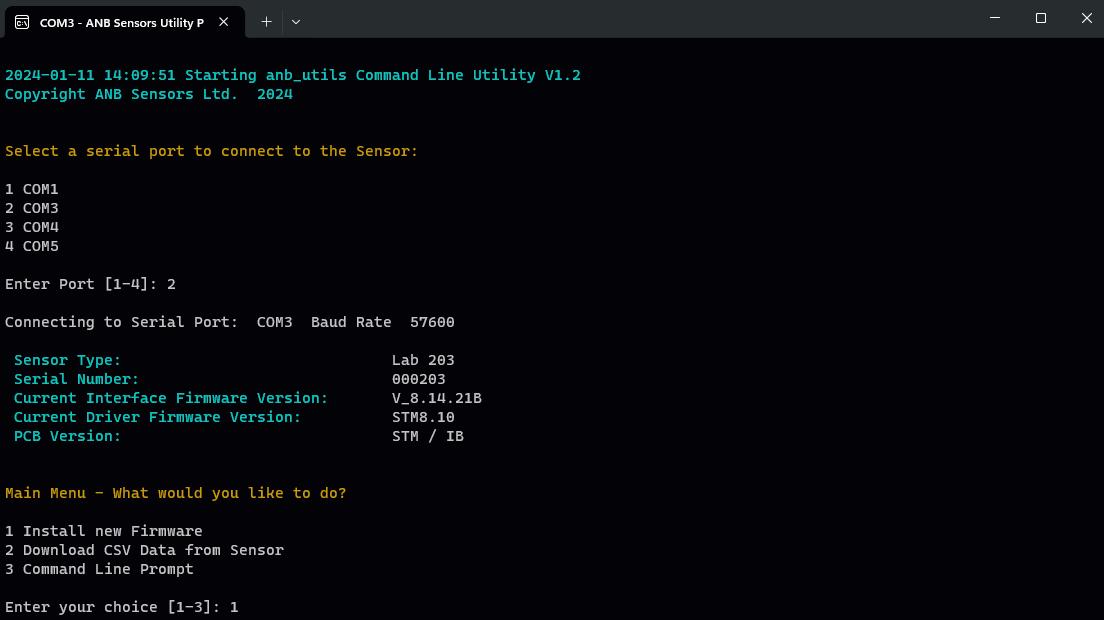

Subsea Expo 24

42-45 DEEP INSIGHTS

Robert Outram

Organic aquaculture

46-49 SEAL OF APPROVAL

Fiona Nicolson

Faroes focus

50-52 FJORDS AND FLYING FISH

Robert Outram

Boats and barges

54-58

Sandy Neil

AT SEA

www.fishfarmermagazine.com

WOMEN in Scottish Aquaculture (WiSA) marked International Women’s Day, and the fifth anniversary of the network’s launch, by announcing the winners of the annual iSA awards.

he awards, across five categories, were based on nominations from the network’s almost 400 members and judged by an independent panel.

Clémence Fraslin of the Roslin Institute was named Academic Champion for her work as leader of the aquaculture genetics group.

WiSA’s Rising Star of 4 was awarded to Alison Brough, fish veterinarian at Scottish Sea arms, for her contribution to sector wide advancements in fish health and welfare over the past year. She is the current Secretary of the ish eterinary Society as well as being involved in other groups such as the Young Aquaculture Society.

Kimberley McKinnell, Head of Health at Bakkafrost Scotland, was named Role odel of the ear and

The WiSA network – which was founded by the SAIC on International Women’s ay 19 represents all areas of the sector from producers and the supply chain to academia.

Daniel Carcajona, Business evelopment Manager at SAMS Enterprise, was WiSA’s Ally of the ear for his continued support for women in aquaculture. Also recognised for their outstanding contribution to diversity and inclusion in the sector were Sarah Riddle, Managing irector of Northern Light Consulting; Anne Anderson, Head of Sustainability and evelopment at Scottish Sea Farms; and Heather Jones, C of Sustainable Aquaculture Innovation Centre (SAIC).

Teresa Garzon, Chair of iSA, said he annual iSA awards provide us with a fantastic opportunity to celebrate the achievements of women in the sector who are helping to promote diversity and deliver impact in their respective fields.

hile great progress is being made in terms of inclusion, International Women’s Day is a reminder of the need for balance and support for women and girls in every workplace.

ver the past five years, we have seen WiSA making a real impact, bringing together women in the sector for professional collaboration, networking and career growth.”

AN Edinburgh-based start-up, Aquanzo, is developing a modular, land-based solution for aquafeed that could help to ease the pressure on marine resources for shrimp and fish farmers.

Aquanzo is working with CENSIS – Scotland’s innovation centre for sensing, imaging and Internet of Things technologies – to farm

artemia, a species of brine shrimp widely considered to be the best source of protein available for feeding fish and crustacea. The system will make use of food and drink by-products.

The project has received funding from Innovate UK and the Biotechnology and Biological Sciences Research Council, and is being supported by Boortmalt –one of the world’s largest malting companies.

Artemia are typically found in warm, salty water, occurring naturally in salt lakes in the USA, China and Eurasia. The specific conditions in which they grow means the supply of the shrimp is restricted – particularly for countries far away from their natural breeding grounds, which need to import them.

With increasing pressure on forage fish stocks, feed is increasingly plant-based. The current global

average for marine ingredients in fish feed is estimated at less than 10%, but research suggests that fish prefer marine ingredients.

Rémi Gratacap, Co-Founder and CEO of Aquanzo, said: “There is a crisis in fishmeal ingredients and we need to decouple aquaculture from maxed-out fisheries and find new ways of providing sustainable sources of protein to help the sector feed a growing world population. Farming, rather than harvesting, important components of feed like artemia is a better way of ensuring greater control and scale and is similar to what is already being done with insect farms, only with marine ingredients.”

The Aquanzo recirculating aquaculture system being developed at Heriot-Watt University is expected to reduce the amount of CO2 created in the production of fishmeal by 20% compared with harvesting fish. The artemia will be fed using co-products from the Scotch whisky industry.

THE Aquaculture Awards 2024 have attracted a record number of entries, up more than 20% on last year’s event. The awards, to be presented on 15 May at a gala dinner during the Aquaculture UK trade show and conference in Aviemore, Scotland, include 13 separate categories covering everything from innovation to community initiative, sustainability to animal welfare and the best of the suppliers and new start-ups.

a mo 100 om a o re ec the wide range of talent across the sector, e or a er ver fied ommu ca o a d e ud e ad a par cu ar d fficu task selecting winners this year. The shortlist in full is as follows.

RISING STAR

Rachel Brown, Aqua Pharma Group

David Lipcsey, Scottish Sea Farm a um co Bakkafrost Scotland

Silvia Viale, Mowi Scotland

Ace Aquatec and Tiny Fish

ofir and uafi r e eafood kva Group and Hampiðjan

Ridgeway Biologicals and Mowi Scotland

RS Aqua and Innovasea, Scottish Sea Farms and UKRI

ce ua ec ®

Bluegreen, Marine Donut a c ec o o omo a roup d (Live Plankton Analysis System)

r o a c e fic d e era e 3

Digital Twins of the Seabed e ec ca ood

Biochemistry of Salmonids

SUSTAINABILITY

Anpario, Natural Feed Ingredients d e ova o d e Regeneration Scheme

Rare Earth Global, Hemp Feed as a Sustainable Alternative o app re ea ro and Net Recycling Scheme

ooke uacu ure co a d Mowi Scotland

or er o u r a c ea arve and ar

Thomas Begg, Bakkafrost Scotland e o o Cooke Aquaculture Scotland

e a der ac o Mowi

o er e er o Cooke Aquaculture Scotland

Stewart Rendall, Cooke Aquaculture Scotland

ANIMAL WELFARE

Bakkafrost Scotland, Welfare Awareness c a r 48 r o ved e Forecasting Tool a and e

have up until 10 May to apply for a share of £1m in Welsh Government funding for the marine, fi er e a d a uacu ure industries.

The support comes from the Welsh Marine and Fisheries Scheme. Eligible projects include, but are not limited to, funding to increase the potential of aquaculture sites and equipment on vessels

aimed at reducing emissions and increasing energy effic e c a d profe o a advice for businesses ranging from marine environment sustainability to business and marketing strategies.

Applicants could also apply for funding for projects to carry out research on health safety and wellbeing needs.

e ma mum ra award is £100,000, with the minimum grant award being £500.The application window closes on 10 May and successful applicants will be o fied dur u .

Details can be found at www.gov.wales/marinefi er e ra

Inverlussa Marine Services RS Aqua Xelect Ltd

ucao ec

MiAlgae Ltd

cea arm erv ce d

Dr Ralph Bickerdike, Scottish Sea Farms o o m ard ffshore Shellfish

Emma Matheson, BioMar Ltd

Graham Milroy, Kames Fish Farming

Winner to be announced on the night.

Winner to be announced on the night.

Gilpin Bradley, Wester Ross Fisheries ep e amero Scottish Shellfish rof a o o Xelect Ltd

au ac re Lloyd’s Register

The winner will be chosen by the industry and announced on the night.Voting will open soon via the awards website.The Aquaculture Awards event takes place on 15 May at the Macdonald Resort in Aviemore, venue for Aquaculture UK, which runs from 14 and 15 May.

o

fi d ou more or for cke o e Aquaculture Awards, contact Aquaculture or a er ver fied ommu ca o by emailing aharrison@divcom.co.uk.

For further details, visit the website: www.aquacultureawards.com

Scottish salmon was the UK’s top food export by value in 2023, figures from HMRC show

EXPORT sales for the calendar year totalled £581m, up by 5% year-on-year and equivalent to £1.6m every day.

France – which is a key processor for on-sale to other countries as well as a major consumer of salmon – once again led global demand. The US and Asian markets saw sharp growth, however. Salmon exports by value to the US were up 7% to £139.8m and to China, up 27% to £47.5m.

Scottish salmon exports were far higher than the UK’s secondlargest food export, Cheddar cheese (£445.3m), as well as other popular British products such as lamb and beef.

Salmon is also by far the most popular fish among UK shoppers, with sales running at

around £1.25 billion a year.

Total volumes exported were down, however, in parallel with Norwegian salmon exports. The UK exported 64,000 tonnes, down 11% from the previous year’s 72,300 tonnes.

Tavish Scott, Chief Executive of industry body Salmon Scotland, said: “It’s testament to the hard work of salmon farmers in rural Scotland that our fish has been named the UK’s biggest export in 2023 in such challenging economic circumstances.”

e a mo e fi a d eaweed a uacu ure ec or a we a e fi du r were amo e rec p e of a fur er 14m of fi a c a uppor from ar e u d co a d 2023 24 fu d rou d a ou ced a e e d of a uar .

Fish Farmer ma a e poke o ome of e or a a o e a e rou d o ee ow e uppor w e u ed.

e co over me e up e ar e u d co a d fo ow re o rep ace fu d for e fi a d eafood ec or prev ou ava a e rou e uropea ar me a d er e u d.

e a e rou d of ra c uded ear 1.6m for du r od eafood co a d o promo e co eafood o dome c marke a d er a o a .

cea co o a o rece ved uppor for a pro ec u a a of e v ro me a e o a e w c pec e are pre e e oca eco o of area of e ea ed.

r c ae edford a ora or a a er a d e ave e up a e proce fac our a office o comp eme our e v ro me a erv ce o e a uacu ure ec or. e deve opme a m o uppor co a uacu ure dur re u a or c a e a d fo er a u a a e a a ca upp c a . ur e a w

prov de a fa er more fore c approac o mo or compared o rad o a a o om c approac e . e a uacu ure ec or e w predom a e u ed dur comp a ce mo or proce e a a ac er a e o fer fau a ua d ce . er app ca o c ude e mo or of ver e ra e a d pa o e e wa er co um a d ed me urrou d fi fi e . mo or approac a a um er of adva a e e amp a o va ve ec ue prov d a rap d co effec ve co ec o of da a. e a a of uc da a e ve compared o rad o a ec ue a d ca prov de accura e forma o o pec fic pec e pre e ce a d po e a a de ec o a d re po e o rea uc a pa o e . r edford a d e u e of e e v ro me a mo or o a ew ec ue e u e of e e a uacu ure ec or .

e producer co opera ve e fi co a d wa a oca ed 603 30 for a pro ec vo v ra o e re a packa forma for core added va ue produc e awa from ermoformed am a ed fi m o a preformed ra o u o .

e fu d a o a oca ed 112 00 for a ar ur u for e r a of a o re ource a uacu ure em de ed for fre wa er rou a d a mo mo pe .

a ar ur u rec or drew e e p a ed e o e ource em o ce a a a re ro fi e c o ure dep o ed o o e fre wa er ca e co ar u mp u a porou me a d com a o e a e of e e . e a e co e produced a a d ew o a a dard drum aped ope e of a commo u ed e from 0m o 120m re o . e co e mu ac eve a a e o e ce re of o e a 30 de ree o co ec a o wa e a d mor . ue cea ec o o w upp e o re ource co ec o a d rec c em. e r pa e pe d co ec o co e w epara e co ec mor a d o re ource for proce . ce de wa ered e o re ource p ro ed o a oc ar for a e a o mprover or fer er a d a o a a fue for ree e er a d ceme produc o a d eve ro ca for remov ammo a from a uacu ure wa er. a ar ur u ope w co r u e o a c rcu ar eco om c mode for co uacu ure. ue cea ec o o w a o e prov d e o re ource co ec o for our mo cree e c o ure o ore mar e ed farm . er ra a ou ceme c uded

• 3 8 000 for o er ordo ver for a ova ve pro ec o crea e ew fie d e for e fi o o

• 4 000 for a mo producer ow co a d a par of a 1 6 869 pro ec o e a ew aera o d c em a e compa eafor e o repe p op a k o a d m cro e fi

• 12 00 for co a cade for e crea o of e ra proce ream for eaweed farmer a d

• 9 000 for o co a d d o e a a e wa fac a eak av 300 e a ear from a dfi c era o ee Fish Farmer, e ruar 2024 . a e ecre ar for ura ffa r a d eform a d a d a r ou eo a d w e a ou c e ra e ucce fu or a a o a d d v dua

are helping to drive innovation in the marine sector and support coa a commu e a d am p ea ed o co firm uc a w de variety of recipients.

ow rd ear ar e u d co a d a e a ed a range of exciting and pioneering projects designed to support our marine ecosystem, improve economic prosperity and enhance social inclusion, all key pillars of our Blue Economy Vision.

"We are committed to maintaining the full allocation for ar e u d co a d u a depe de co a d w e rece v pre re eve of fu d cou d muc e er support our seafood and marine industries.

me a e over me prov ded e ec or w e r e u a e a d r fu are of fu d o a pro ec ke e e ca co ue o o e fu ure. e w co ue o press them to do so.”

e over me a ow c eme e 100m eafood u d w c c ude uppor for co a ed u e e .

e a e rou d of ar e u d co a d a o c ude var ou ar our from ck o emou . ra er ur ar our ome o e ora a ff ore dfarm ar e a e rece ved ear 1.2m for ar our wa mproveme a d a mar e litter project.

Opposite from top: Ocean Ecology hovercraft; Ocean Ecology lab; Andrew Bett, Salar Pursuits; Mairi Gougeon

This page from top: Salmon smolts; mussels; Fraserburgh Harbour

STAFF from Mowi Scotland worked over three days to clear more than 300 tyres, which had been dumped on the shores of Loch Ness by persons unknown. They were helping the local Ness District Salmon Fishery Board, which asked for assistance with the clear-up. Mowi was able to reuse 100 of the tyres and

approximately 200 were given to Highland Council to dispose of. Graham Mackenzie, Chairman of Highland Council’s Communities and Place Committee, said: “The Council is extremely grateful for the support which ensured this horrendous incidence of y tipping was dealt with quickly.”

FORMERLY Area Manager of the Western Isles for Mowi, Connie Pattillo has been

MORE than 350 ocean and blue food pioneers in production, technology, retail, innovation and investment will be gathering in London on 21 and 22 May to share solutions for a biodiverse, stronger and more resilient blue economy.

at Wester Ross Fisheries Ltd, which was acquired by Mowi in . wo senior figures, Managing Director Gilpin Bradley and Fisheries Director David Robinson, had retired last year.

Pattillo is a marine biologist who has worked in a number of roles with Mowi, including Health Manager and Farm Manager, having started at the company’s wrasse hatchery in Machrihanish.

A NEW version of the RSPCA Assured standards for farmed Atlantic salmon welfare comes into effect from 19 May this year, with more than 300 new standards and amendments.

The standards will apply to the vast majority of salmon production in Scotland.

The standards include a new set of rules covering non-medicinal treatments for problems such as sea lice and gill disease, as well as 80 new standards to ensure the welfare of cleaner fish.

Delousing treatments must now be carried out only on the advice of a veterinarian and following a risk assessment. Such treatments may only be carried out where it is in the best welfare interests of the fish, as determined by the risk assessment.

of antibiotics on-farm must now be reviewed annually or at the end of a production cycle and that a written action plan, aimed at reducing the use of antibiotics, must be developed and implemented where required;

• improved oversight and protocols for the transfer and unloading of smolts to minimise stress and escape risks; and

• implementation of over 80 new standards aimed at enhancing cleaner fish welfare, including new rules on catching and transporting wild cleaner fish and a requirement that cleaner fish mortalities and cause of death are recorded.

The Blue Food Innovation Summit features must-see speakers from aquaculture, finance and technology among other sectors. See the two-day programme and full delegate registration at: www.bluefoodinnovation.com

The standards set out a range of new rules for carrying out non-medicinal treatments, such as maximum limits for fasting ahead of a treatment, maximum temperatures for thermal delousing and a rule that only one treatment can be carried out in a 28-day period, unless authorised by a veterinarian.

The new standards also include:

• mandatory regular welfare outcomes assessments at both freshwater and seawater sites;

• improvements to the stunning and slaughter processes, including introducing the requirement for CCTV coverage for the entire slaughter process;

• clarifying the requirement to undertake daily checks for sick or dying fish in all tanks and enclosures, with immediate action required for any issues identified

• formal written production plans to prevent unnecessary culling of freshwater parr;

• a requirement that the use

As of 1 ay 5, cleaner fish must be removed from the crowd in a pen before the salmon are removed for treatment.

Sean Black, Senior Scientific fficer and aquaculture specialist at the RSPCA, said: “The new farmed Atlantic salmon standards will be a huge step forward for fish welfare and among other changes, include pioneering new standards for nonmedicinal treatments for sea lice and gill disease.

“Further, we are pleased to introduce over 80 new standards to improve cleaner fish welfare. hese include the need to risk assess the impact of treatments on their welfare, the requirement to record, categorise and monitor all mortality causes, and reduce transport stocking density.”

RSPCA Assured said its welfare standards have been a catalyst for change throughout the entire salmon industry for more than 20 years, with most farms in Scotland now adopting these standards. They are also internationally recognised as being world leading, the organisation added.

TEAM Scotland’s presence last year at Aqua Nor, the international aquaculture trade show, has been hailed as a resounding success.

In a poll, three-quarters of the Scottish businesses represented there said they expect to see an increase in turnover after attending the biennial exhibition and conference held at Trondheim, Norway, in August last year.

The Scottish Pavilion at Aqua Nor was organised through a partnership involving Highlands and Islands Enterprise, the Sustainable Aquaculture Innovation Centre and the Scottish Government (Marine Directorate).

A delegation of 18 of Scotland’s aquaculture supply chain businesses – including Fish Farmer magazine – travelled to

A NORWEGIAN salmon company is hoping to build a 9 , tonne land based fish farm in a remote part of ewis, in the uter Hebrides. ocal paper the Stornoway Gazette broke the story.

he company concerned, Norwegian ountain Salmon (N S), already has plans underway for a ow through site on the Norwegian island of Utsira (pictured, below) and it is believed that the ewis farm would use the same technology.

N S Chief xecutive B rd H elmen has said the pro ect is at a very early stage , adding that tight cooperation with local inhabitants will be essential for both sites.

he ewis site is at ealista, an uninhabited estate on the west coast of the island. he proposed farm is believed to involve 4 fish tanks, using filtered water pumped from deep levels of the ocean to minimise the risk of pathogens. he Gazette

Trondheim, joining an estimated 25,000 people from 76 countries at the three-day event. Feedback gathered so far by points towards its success with three-quarters (76%) of exhibitors saying they expect to see an increase in turnover over the next three years as a result of attending Aqua Nor. Almost all (94%) of the exhibitors said the event met or exceeded expectations and the delegation was left feeling optimistic about opportunities for new business contacts or leads (59%), opportunities with existing contacts (59%), potential new customers (59%), and potential new markets (55%).

BAKKAFROST’S Scottish business began to turn the corner during the final three months of 2023, the company has reported.

As forecast last year, Bakkafrost Scotland produced reduced revenue of DKK 84m (£9.6m) against DKK 298m (£34m) during the quarter, along with an operational loss of minus DKK 104m (-£12m). This was an improvement on Q4 2022, when the loss was -DKK 149m (-£17m).

The group’s combined operational EBIT, including its Faroes activities, was DKK 356m (£41m) during the period, against DKK 376m (£43m) 12 months earlier.

Bakkafrost said that “...after a troublesome third quarter in Scotland with biological challenges, the fourth quarter gave opportunities with good biological development to grow the fish.”

APPLICATIONS are now being invited for seafood sector projects as part of the UK Government’s Fisheries and Seafood Scheme (FaSS). Around £6m in matched funding is set to be allocated.

FaSS is open for applications until 31 March 2025 or until all funding has been allocated, whichever happens first, and is available on a first-come, first-served basis. Funding is available for both new projects and existing projects that are already benefiting from the scheme.

The scheme, administered by the Marine Management Organisation (MMO) on behalf of Department for Environment, Food and Rural Affairs, has already committed more than £27m for around 1,300 projects. Its scope includes projects aimed at developing the catching, processing and aquaculture sectors, or enhancing the marine environment. Successful projects are expected to address areas such as health and safety, processing and partnerships.

Successful applicants will be able to invest in a range of activities such as health and safety equipment to continue to keep fishing crews safe, processing equipment to increase the value of seafood products, vessel modification to improve energy efficiency, innovation partnerships and support to diversify and create new forms of income.

Fisheries Minister Mark Spencer said:

“Our world-class fishing industry leads the way in making sure we offer the highest quality of seafood, support a multitude of highly skilled jobs and play a valuable role in ensuring our coastal communities thrive.

“This funding will help other projects and businesses to be more sustainable and resilient, enter new markets and improve our efforts to enhance and protect our precious marine environment.”

The Scottish Government runs its own grant scheme, Marine Fund Scotland, which announced recipients of the 2023/24 funding round in January (see report on page eight).

For more information about FaSS and how to contact MMO’s grants team, visit: gov.uk/guidance/fisheries-and-seafoodscheme

PRICE fixing by Norway’s biggest salmon producers cost the U retailers now suing them £6 5m. hat’s the claim made by the seven supermarket chains that have filed a claim with the U ’s Competition Appeals ribunal (CA ).

It emerged last week, thanks to a trading update from er y Seafood, that a number of U retailers are taking legal action against the Norwegian companies over alleged anti competitive practices, following a preliminary assessment last month from the uropean Commission.

A document lodged with the CA now shows that the seven chains bringing the latest legal action are

Asda, Iceland, orrisons, arks and Spencer, Aldi, cado and the Co operative roup. istributor International Seafoods, part of the m orrison group, is also oining in the claim.

he claimants and their subsidiaries comprise seven of the largest supermarkets in the U , together representing over 44% of the U grocery market with total estimated combined purchases of farmed Atlantic salmon of around £1. bn during the period in question.

he claim, under Section 4 a of the Competition Act 1998, is for damages arising from alleged unlawful cartel arrangements entered into

and or implemented by at least the defendants in relation to the supply of farmed Atlantic salmon.

he named businesses alleged to have colluded in fixing market prices are Bremnes Seashore, Cermaq, rieg, er y, Sal ar, owi and their respective U subsidiaries. All have previously denied the cartel allegations set out by the uropean Commission.

he latest claim document says he effects of the cartel extended downstream through the supply chain, affecting secondary processed products made from farmed Atlantic Salmon, such as smoked or fro en salmon and ready to eat salmon products.

he documents says that it is likely that the unlawful collusion continued from 11 through to ebruary 19, but the run off effect on long standing contracts is likely to have gone on for much longer than that.

It also anticipates that the uropean Commission will find the defendants liable for one or more infringements of competition law.

ast year, five of the companies ( owi, er y Cermaq, Sal ar and rieg) settled broadly similar claims in the United States and Canada, choosing to end the legal action by paying out several million dollars. hey continued to deny any liability.

ICELANDIC salmon company Ice Fish Farm saw its biomass more than triple last year from 5,233 tonnes to 16,132 tonnes.

It is expecting an even better performance this year, with a harvest guidance of 20,5009 tonnes.

The company said it had seen low mortality and good biological status during the final three months of 2023, except at one site where winter wounds had been a problem. In the first quarter of 2023, the company was forced to suspend all harvesting due to lower winter temperatures and high mortality.

Sales, including 20% sold under contracts, achieved a price of just NOK 79.60 per kilo (£5.96) due to smaller fish and winter wounds.

Total Q4 sales were NOK 367m (around £27m).

For the final quarter of 2023,

Above: Roy ore Rikardsen

operating EBIT before fair value adjustment of biomass amounted to NOK 51.7m (£3.85m).

Investment is continuing at pace, the update said, with capital expenditure in Q4 totalling NOK 99m (£7m).

Total investment last year came to NOK 234m (£17m) and is likely to be around NOK 290m (£21m) this year.

February also saw Roy Tore Rikardsen, who has considerable

experience in cold water fish farming in Norway and Canada, appointed as Chief Executive Officer, replacing Guðmundur Gíslason, who announced in September that he would be stepping down. He has outlined his priorities, which include developing the company through entrepreneurial growth and Iceland salmon farming in general. He said he will be focusing on excellence in operations, environmental safety and fish welfare.

Ice Fish Farm is one of the leading salmon farmers in Iceland and is the only salmon farmer in the world with AquaGAP environmental certification, which is assessed by sustainable agriculture body Ecocert.

The Norwegian fish farming group Måsøval Eiendom is a main shareholder in Ice Fish Farm, in partnership with the Icelandic fishing company Ísfélag Vestmannaeyja.

group SalMar has launched an ambitious innovation and research initiative, aimed at bringing different players in the salmon industry together for collaboration.

SalMar is calling on industry leaders and others involved with salmon to come together in what it calls the Salmon Living Lab to share and learn. Cargill, the global food corporation, is the fir par er o up.

In addition to bringing partners across the salmon supply chain together, the initiative will also lead to the building of an innovation and R&D centre, which will house various activities and function as a focal point for knowledge.

Gustav Witzøe, founder and Chairman of SalMar said: “Our aquaculture industry is at a crossroads.

e ave ce e ra ed fica ac eveme e pa . e have succeeded in bringing large quantity of much sought-after salmon to customers and consumers worldwide. Now, we must acknowledge that we face greater challenges than we have done before.”

a ar a d a offic a a c ow a ke performa ce d ca or are re d e wro d rec o fi mor a crea fi we fare more c a e a d e feed conversion ratio is going up.

“We must realise that there are simply too many gaps in our knowledge. We need to know more about the salmon, which is the most important part of our value chain,” Witzøe said.

In addition to its expertise, SalMar will be supporting the a ve w a ro fi a c a comm me .

SalMar’s investment is estimated at about NOK 500m (£37m) to ensure that the project gets off on a good start. In future, it expects that the costs will be shared among the parties who join the project.

The partners will be asked to contribute, but details are yet to e co firmed. e a d w ere e ce re w e u a o not yet decided.

SalMar is the second largest farmer of Atlantic salmon in the world and it is deeply involved in the entire value chain. It is involved in genetics, egg, fry, smolt, ongrowing, harvesting and processing.

Cargill, a trusted partner for farmers and food and agriculture companies worldwide, has been a key supplier and partner of SalMar for decades.

Cargill said the Salmon Living Lab is a continuation of this close collaboration with SalMar and potentially with other key players in the salmon industry.

Helene Ziv-Douki, Cargill Aqua Nutrition President, said: “We believe that bringing together the holistic capabilities of SalMar and Cargill will drive greater impact in improving animal welfare and sustainability, ultimately protecting and aiding further sustainable growth of this critical industry.

“There is a need for more collaboration to tackle the challenges we are currently facing.”

HIGH Liner Foods, one of North America’s leading seafood companies, has bought a stake in the Norwegian cod farmer, Norcod.

The move is an interesting one, because the big Canadian company has not previously been directly involved with aquaculture.

High Liner is mainly a marketer and a processor of value-added frozen seafood, with several retail brands sold throughout the United States and Canada.

Norcod has just expanded its previously announced share issue through private placement by NOK 170m (just over £12m).

The subscription price was set at NOK 12 and on Thursday evening

there was confirmation that almost 14.2 million new shares will be issued for gross proceeds of NOK 170m.

The funds are being raised to cover the company’s need for working capital in connection with its ambitions to increase production and slaughter volumes.

Norcod said High Liner was being welcomed to the company as a new shareholder with over 4.4 million shares. High Liner had earlier announced that it was planning to buy into Norcod to the tune of US $5m.

In exchange for the investment, High Liner Foods will receive an approximately 10% share ownership in Norcod and nomination rights for a director, currently CEO and President Paul Jewer, to serve on Norcod’s board.

Jewer said: “Today’s investment is a small but important step forward in our strategy to position High Liner Foods for the next chapter of leadership and growth.”

ARCargo, which started ights this month, was set up as an associated company by aroese salmon farmer Bakkafrost to ensure a more direct route for its exports, especially to the

United States. The outbound route will go from Billund in Denmark, then onto the aroe Islands before landing in Newark in the US. There will be a refuelling stop in Iceland. he Boeing 5 aircraft will bring fresh salmon from Bakkafrost in the aroe Islands to the US.

• For more, turn to the Faroes regional focus on page 50.

NORWAY’S seafood export boom continues but there are signs things could be slowing down, according to the latest figures. he export value total last month was N 13.3bn ( ust short of £1bn), a rise of 3% on a year ago. he Norwegian Seafood Council said that thanks to large value growth for salmon, trout, cod and snow crab, the export value in ebruary was raised to a historically high level. he proportion of fillets and other processed salmon in the overall export total reached its highest recorded level 3 % by value.

health business STIM has been acquired by Swedish investment firm Summa quity.

S I is the aquaculture industry’s largest quality supplier of fish health products and services, operating in Norway, Chile, UK, and Canada. The gross revenue of the company was over 15 m (£1 8m) in 3. he price paid

for the acquisition has not been disclosed, but Summa has taken a 5% controlling interest.

S I founder im Roger Nordly said: “I am convinced that Summa is the right strategic and long term partner for us. hey recognise that our employees’ expertise and efforts is the bedrock of this company.”

www.fishfarmermagazine.com

GRIEG Seafood is the latest Norwegian salmon farmer to report biological and ellyfish issues during the final quarter of 2023.

The company, which was big in Scotland until three years ago but now concentrates on Norway and Canada, recorded an operational (EBIT) loss of NOK 67m (around £5m) against an operational profit of N 156m (£11.5m) 1 months earlier.

This represents an operational EBIT loss per kilogram of NOK 3.1 (£ . 3) against a profit per kg of NOK 7.4 (£0.56) in Q4 2022.

Grieg CEO Andreas Kvame said that the parasite spiro (Spironucleus salmonicida), winter sores and ellyfish have affected survival rates and operational efficiency in innmark and led to reduced volume, increased handling costs and lower price achievement.

He added I am not satisfied with the results and we have taken measures to tackle the challenges both in the short and medium term.

The operational EBIT per kg in Rogaland ended at NOK 1 .4, equivalent to £ . 9 (Q4 N 13.8). Contributing to the loss was a decline in the proportion of salmon rated superior to 86% compared to 91% in the corresponding period last year, as well as a somewhat unfavourable timing of harvest.

The underlying production was good, however, with a strong 1 months survival rate at 94%.

In innmark, harvest volume

for the quarter ended at 1 ,38 tonnes, 1,8 tonnes below guidance. The lower volume is mainly related to impact from the spiro parasite, winter ulcers and string ellyfish.

The operational EBIT/kg in British Colombia was negative at minus N .9 (£ .6 ), but this compared favourable to the loss of N .9 in Q4 (£1. 3).

arming cost was impacted by historical biological issues and write downs. However, the seawater performance was good during the quarter, with a 1 month survival rate of 91%.

In Newfoundland, an important milestone was reached this quarter when the company started harvesting the first generation of fish in the province.

The total harvest volume during the quarter was 3,184 tonnes.

his is some 1,8 tonnes below guidance, postponed to 2024 due to weather conditions and positive market expectations.

Kvame said spiro alone is estimated to cause a total loss of N 9 m (£66m) since it was detected in 2022 at the company’s freshwater facility in innmark, most of which has previously been realised.

He added: “We have implemented measures to prevent spiro from entering our facility again with good results. All fish transferred to the ocean farms in 3 were spiro free and we expect impact from spiro to cease after we have harvested out the last fish groups from the generation during Q2.”

TWO major Icelandic salmon farming companies have been granted licences to produce an extra 18, tonnes of fish.

MAST, Iceland’s veterinary authority, has given Arnarlax the goahead to farm an additional 10,000 tonnes of sterile salmon in the Isaf ord area, in the northwest.

It has also awarded Arctic Sea Farm a new operating licence for up to 8,000 tonnes of salmon and rainbow trout, also in Isaf ord.

Arnarlax is part of the SalMarowned Icelandic Salmon company. CEO Bjørn Hembre said: “This announcement marks another significant milestone for us. It has been a long process and we are glad to see our application now moving forward towards the finishing line.

“We are excited about the future and ready to utilise this opportunity for further sustainable growth.

With this new 10,000-tonne licence, Arnarlax will have a total license capacity of 33,700 tonnes, divided into 23,700 tonnes of fertile salmon in Arnarfjörður, Patreks and

Tálknafjörður, and 10,000 tonnes of sterile salmon in saf r ur.

Arnarlax said it will provide further updates once the consultation period is ended and after a final decision on the licence.

Arctic Fish is owned by Norway’s owi. he announcement allows for 5,200 tonnes of Atlantic salmon and ,8 tonnes of trout.

The company now has a maximum allowable biomass of 27,000 tonnes of salmon and 2,800 tonnes of trout in Isafjord, Iceland’s leading openpen salmon farming area.

The Icelandic government appears committed to the aquaculture industry despite opposition.

AQUAFEED group BioMar achieved record revenue and profits on slightly reduced volumes for 2023, the company’s update for Q4 shows.

BioMar saw revenue for the full year 2023 up by just under 1% to DKK 17.9bn (£2.05bn) but recorded EBITDA or operating profit of DKK 1.25bn (£143m) up 23% from the full year 2022.

EBITDA was DKK 397m for Q4 last year (£45.6m) compared with DKK 294m (£33.8m) for Q4 the previous year.

The volume of sales for 2023 was 1,437,000 tonnes, a fall from 1,456,000 tonnes in 2022.

Non-consolidated joint ventures, not reflected in the group figures, recorded EBITDA for 2023 of DKK 179m(£20.6m) on revenue of DKK 1.8bn (£207m), also representing a significant increase on 2022’s figures.

Carlos Diaz, CEO of BioMar Group, said: “I am extremely

satisfied with our business performance for 2023. We have continued to optimise our product portfolio and product concepts, being proactive to the development in the markets. At the same time, we have improved our commercial performance both up- and downstream. Looking at the totality of our business, including our joint ventures in Turkey and China, the year summed up to a volume of 1.6 million tons, a turnover of DKK 20bn and an EBITDA of DKK 1.4bn.”

He said that BioMar had prioritised building long-term product collaborations with core customers, rather than chasing volumes.

Diaz added: “To us, it is becoming increasingly important to create partnerships with suppliers of novel raw materials as well as forward-looking customers.”

SALMAR, the world’s second-largest Atlantic salmon farmer, produced “solid results” during the final quarter of last year.

The company plans to pay NOK 4.6bn (around £345m) in dividends for the whole year.

SalMar announced a Q4 group operational EBIT or operational profit of NOK 2.16bn (£162m), up nearly 115% from the same period in 2022. This was the first year in which SalMar’s accounts include the former NTS operations, which the group acquired.

The harvest volume was 83,100 tonnes and an operational EBIT per kg of NOK 26 (almost £2).

SalMar said the company passed several strategic milestones, strengthened its financial position and demonstrated strong operational performance throughout the year.

However, jellyfish (“pearl normanets”, also known as string jellyfish) attacks during the autumn continued to present challenges for the business.

Operational EBIT for the group ended at NOK 2,158m (£162m) in the fourth quarter.

The slaughter volume was 83,100 tonnes and operational EBIT per kg was NOK 26 (£1.96).

Norway slaughtered 73,600 tonnes with an operational EBIT per kg of NOK 28.8 (£2.17).

As a result of the successful integration of NTS, NRS and SalmoNor, strong performance by employees and good operations, 2023 was a new record year for SalMar.

Consolidated slaughter volume increased by 31% to 254,100 tonnes and operational EBIT ended at NOK 8.09bn (£610m), which resulted in an operational EBIT per kg of NOK 31.8 (£2.34).

Based on good results in 2023 and the strong financial position, the board recommends a dividend of NOK 35.00 per share (£2.64) for the financial year 2023.

SalMar CEO Frode Arntsen said: “The SalMar team has once again performed well and delivered impressive results, both in terms of operational operations, realisation of synergies and execution of strategic processes.

“I am proud of our dedicated and skilled employees and the strength that the SalMar organisation has shown throughout 2023.

“We see significant potential for continued improvement and growth in all parts of our business going forward.

“Despite unresolved regulatory matters, we are confident that we will be able to increase production and grow further with our current operational structure.”

ICELAND’S Arctic Fish produced an operational profit or BI of 3. m (£ . m) in 3, the first full year under owi ownership.

his was in spite of serious escape issues during the summer, which led to a backlash in Iceland against open pen salmon farming.

he company said the financial biological performance improved somewhat after a challenging third quarter when the escapes took place.

he fourth quarter harvest volume was ,5 9 tonnes gutted weight in the fourth quarter. he positive deviation versus guided volumes was mainly due to good production.

Harvest volumes for the full year of 11,8 8 tonnes were at an all time high.

he company said during the fourth quarter, price achievement was negatively impacted by temporary logistics issues.

It is not ust Scotland and parts of Norway with biological problems. Iceland too is being affected and Arctic ish said its operational performance in the final quarter, and the year as a whole, bears the mark of a challenging autumn with lice problems.

But it adds Biology is now however good with low mortality and reasonably good growth given the prevailing seawater temperatures. Costs in the quarter were positively impacted by insurance income.

rimary processing cost for Arctic ish has

been significantly higher than in owi’s other farming operations.

Its new primary processing facility in Bolungarv k is now fully operational and all of the company’s volumes were harvested at the plant in the final quarter.

Consequently, Arctic ish is no longer dependent on external harvesting capacity and the Bolungarv k processing plant is expected to improve operational efficiency and the cost level over time, said the report.

ur clear goal is to develop Arctic ish into a streamlined and cost effective operation. his includes improved lice strategy and treatment capacity, which is a priority for the company. In addition, the bureaucracy around treatment approvals by the authorities must be streamlined.

Arctic Fish said costs are expected to increase in the first quarter on seasonally lower volumes.

N R IAN land based fish farming company igante Salmon has announced that it is reducing its production by around 3 , fish almost half of the stock released into its tanks in anuary.

his is the second batch for the company at its newly completed site at R d y in northern Norway. igante revealed at the end of anuary that it was experiencing significant mortality issues related to this release of smolt.

he 3 , reduction corresponds to the volume of the second smolt delivery.

igante Salmon said it has collaborated with its fish health services partner to investigate the cause of the mortality and to implement mitigating measures.

igante said no single factor has been identified, but rather it is down to a combination of several causes.

he smolt in the second delivery was of lower quality for several reasons among them, delayed delivery due to a late start up of the facility. ther identified causes include recorded mortality during loading onto the

wellboat, which may have resulted in lower water quality during transportation. his, combined with bad weather, meant that the second delivery spent longer in the boat than planned.

he slo Stock xchange announcement states here was also a low sea temperature (3.8 degrees centigrade) at the time of release.

he facility itself is functioning well and as intended. Seawater is being pumped in as planned and the water chemistry is good. he fish are doing well in the longitudinal tanks, which are now operating with a water velocity of about cm per second.

ur employees are doing everything they can to address the fish’s health challenges. It is of little consolation to us that this is not due to the design of the facility.

THE large Norwegian salmon business Nova Sea has entered into a long-term collaboration with another salmon company, Torghatten Aqua, with the aim of strengthening both companies.

They say that the plan will contribute to continued sustainable growth and development in the Helgeland region. Torghatten Aqua AS, formerly known as Torgnes AS, is an investment and development company with roots on the Helgeland coast. Its portfolio includes fish farming operations including Bue Salmon AS, Eco Fjord Farming AS and Codfarm AS, and also training organisation Campus Blue and the Norwegian Aquaculture Centre, which was set up to carry out research and to raise awareness of the industry.

Nova Sea comes in as a new major shareholder with a 33.4% stake in Torghatten Aqua, which will happen through a capital expansion in the company and the purchase of shares. It thus becomes the second-largest shareholder in the group, with Trøndelag Helgeland Invest, which owns 39% of the shares, still the largest owner.

The farming operations of the Torghatten Aqua companies will eventually be operated in collaboration with Nova Sea.

A joint statement said the boards of Torghatten Aqua and Nova Sea have approved

MOWI achieved all-time high revenues of €1.43bn (£1.28bn) in the fourth quarter of 2023 – against €1.36bn (£1.16bn) in the corresponding quarter of 2022.

The Q4 report said the period concluded another recordbreaking year for Mowi.

Mowi shareholders will receive a total dividend payout of NOK 983m (around £73.4m) – or NOK 1.90 per share.

eve ue of . 4.68 produced a opera o a profi of €1.028bn (£876m). Harvest volumes of 475,000 tonnes in 2023 were at a record high.

the agreements, and Torghatten Aqua is calling an extraordinary general meeting of the company on 23 February for a final decision.

The chairman of Torghatten Aqua, Frode Blakstad, said the company was happy to have Nova Sea on the ownership side. He said: “We get increased access to capital and expertise, which means a lot for the further development of our companies.”

Blakstad, who has been central to the negotiations, believes that the common value base in the two companies is important for the ambitious plans going forward.

In recent years, Nova Sea has invested aggressively with billion-dollar investments in a new slaughterhouse, a new hatchery and the purchase of farming volume on Helgeland.

The investment and collaboration with Torghatten Aqua fits in well with Nova Sea’s investment, the company said.

In addition, Aino Olaisen, the Chairman of Nova Sea, said: “This is a big and happy day for us! The main shareholders in Nova Sea and Torghatten Aqua have worked together for several decades. They have a common ambition for growth and development, both in the companies, the industry and the region. We are therefore pleased that we will be able to actively take part in this in the future.”

CEO Ivan Vindheim said: “I am extremely grateful for the hard work and dedication of my 11,500 colleagues around the world that has led to record results and stellar performance in Mowi’s three business areas – farming, consumer products and feed –in 2023.”

Volume growth across the value chain is one of Mowi’s strategic pillars. Growth within Mowi Farming has been strong in recent years and 2023 marked another good year with all-time high harvest volumes of 475,000 tonnes, equivalent to growth of 2.4% vs global supply contraction of 2.5%.

Mowi harvested 129,234 tonnes of salmon in the quarter. Fullyear harvest volume guidance for 2024 is maintained at 500,000 tonnes.

Vindheim continued: “As recently as 2018, harvest volumes were 375,000 tonnes, hence we will have grown our farming volumes by as much as 125,000 tonnes by 2024.

“This is equivalent to annual growth of 4.9% versus a projected growth rate for the industry of 2.9%.

“This is mainly organic growth and Mowi still has further organic growth initiatives that are expected to contribute to additional volume growth, of which the most important one is perhaps the post-smolt programme we launched at our Capital Markets Day in 2021.”

By the end of 2024, Mowi’s post-smolt capacity will be almost 40 million post-smolt, equivalent to approximately 25% of the group’s total smolt. In Norway, Mowi’s post-smolt share will be approximately 50% when the naturally more resilient Region North is excluded from the equation.This is expected to drive licence utilisation higher and improve Mowi’s sustainability credentials yet further through shorter production time in sea and improved survival rate.

Consumer Products also had another solid quarter and an ou a d 2023 e a a e opera o a a d fi a c a record o ro co umer dema d. pera o a profi of €152m (£130m) and volumes of 232,000 tonnes product weight in 2023 were both new records for the group.

“These are impressive results and I think it is fair to say that Consumer Products’ relentless focus on operational excellence over the past few years has really started to pay off,” Vindheim said.

Mowi Feed delivered a good fourth quarter result and can also celebrate its best year so far with an operational EBITDA of €52m (£44m).

“Volumes produced in Norway reached the impressive milestone of 405,000 tonnes for the full year following strong growth in sea and consequently good feed demand,” Vindheim concluded.

The total amount of feed sold reached 523,000 tonnes in 2023.

A TOOL aimed at helping stakeholders to identify and understand environmental, social and governance (ESG) risks in the aquafeed supply chain has been launched jointly by industry body the Global Salmon Initiative (GSI) and the World Wildlife Fund (WWF).

The Aquaculture Stewardship Council (ASC) has reviewed the tool and intends to incorporate it as one of its due diligence mechanisms to be part of the ASC Feed Standard certification process.

The GSI and WWF said the tool will improve visibility into supply chains, allowing stakeholders to better identify and address possible ESG risks.

These risks could include biodiversity loss, climate change, resource use, environmental footprint, health and

welfare, nutrition, human rights, and governance, among others. It can also help companies assess the scalability of future novel ingredients.With this knowledge, the authors say, companies can make more informed sourcing decisions aligned with their strategic priorities and values.The tool, developed over a three-year period in consultation with the GSI members, WWF and industry feed companies, is the first time a common methodology has been made available to support greater alignment in feed data collection.

GSI and WWF designed the tool to support the salmon farming sector, but the wider animal protein production sectors, including livestock, may also benefit from its use, the two organisations say.

Daniel Miller, Aquaculture Lead Specialistat WWF, said: “Feed ingredient sourcing remains one of the main sustainability challenges in salmon farming and food production more broadly.

“The surprising amount of unknown information in feed-ingredient supply chains leaves the sector open to unintentional risks and vulnerabilities – even for companies prioritising sustainable, ethical production.With this tool, GSI members are taking a proactive approach to address these risks and identify opportunities to improve the supply chain. Looking at supply chains broadly and holistically doesn’t just mitigate risk; it also facilitates more informed and strategic decisions.”

Tor Eirik Homme, Director of Feed and Nutrition, Grieg Seafood, commented: “By developing a common tool… producers can all ask the same questions of the supply chain, which will streamline requests and improve the level of traceability, ultimately supporting accelerated improvements in the sustainability of the ingredients being used for feed.”

In addition to the tool,WWF in collaboration with GSI and Grieg Seafood, have released a business case, Feed of the Future:Transparent and Traceable.The paper outlines the challenges inherent in feed production, the development of the tool and Grieg Seafood’s experience applying it to their supply chain.

FLORIDA-based land salmon company Atlantic Sapphire raised around NOK 369m (£27.5m) in a new share issue in Oslo, where the company is listed.

The issue at NOK 1.20 per share was fully subscribed with its largest shareholder Nordlaks Holdings of Norway buying shares worth NOK 52m (£3.8m).

The extra money will be used to ensure sufficient leeway for the company’s phase one plans across the Atlantic. The share price dropped by around 17% in Oslo this morning on the news that Atlantic Sapphire had gone back its shareholders to raise more money.

Atlantic Sapphire had gender maturation problems last year, which led to lower income. The company therefore needed to raise extra capital. It has also been struggling with high water temperatures at its Florida site.

In a production update, Atlantic Sapphire said that the temperatures in the growth systems had stabilised at around 14°C after the delivery of new coolers in September 2023.

It also said that all cooling systems had performed according to expectations in the five months since installation. The batches transferred to growth tanks after the new cooling installations show strong growth, the company added, with performance in line with expectations or better.

General farming conditions were “stable and support good biomass growth”, the statement said.

Atlantic Sapphire says its phase one facility is in operation, which provides the capacity to harvest approximately 10,000 tonnes (HOG) of salmon annually. The company is currently constructing its phase two expansion, which will bring total annual production capacity to 25,000 tonnes and it has a long-term targeted harvest volume of 220,000 tonnes.

In November the company, when it announced that its water temperatures were back under control, said that the Hong Kong-based venture capital fund VLTCM had bought a 10% stake in the business through the purchase of 79.6 million shares.

THE Barramundi Group has raised the equivalent of £8.8m to expand its fish farming operations in Brunei.

The company has announced that it had secured the credit facility of BND $15m from a Bruneian financial institution.

The Singapore-based Barramundi Group farms the fish of the same name, also known as Asian sea bass. It has operations in Singapore and, at a small scale, in Brunei, but last year its Australian farms were placed into administration and subsequently sold to Australian salmon producer Tassal, which itself is part of the global Cooke Group.

The latest funding for the Barramundi Group, subject to finalisation and completion, will be used to fund the first phase of the Brunei expansion and pivot to what the company calls BG 2.0.

The first steps will be, the company said:

• the construction of a recirculating aquaculture system (RAS) broodstock and hatchery centre, complementing the existing RAS nursery operations; and

• immediate deployment of sea cages at Barramundi’s existing sea lease, Pelong Rocks, planned for mid-2024.

Barramundi said: “With the new broodstock and hatchery facility, the Brunei operations will be able to capitalise on the genetic nucleus from our Singapore broodstock – naturally bred and selected over 20 years – to spawn and culture fry and fingerling within Brunei. The capacity of this facility will allow Brunei to be sufficient not only for the phase one Pelong Rocks grow-out cages, with an annual capacity of 1,000 tonnes, but also for phase two requirements of the planned 3,000 tonne land-based RAS facility.

Above: Barramundi farm

Above: Barramundi farm

“The immediate deployment of Pelong Rocks will help to smoothen the gap in production and revenues, but also provide the Group with an opportunity to re-enter the China market.”

MEDELLÍN, Colombia will be the headquarters of the Congress on Aquaculture in Latin America “Innovation and Sustainability for Global Aquaculture”.

The combined event will include Lacqua 2024, the eighth Latin American conference on native fish culture, and the 11th Colombian Aquaculture Congress from 24 to 27 September 2024 at the Plaza Mayor Convention Center.

Medellín, known as the City of Eternal Spring, combines modernity and traditional charm framed by majestic mountains. With a warm climate all year round, the city offers innovative architecture, vibrant cultural scene and unique hospitality. This event is the result of collaboration between a number of organisations, including WAS-LACC,

GIFFORD Cooke, the Canadian marine mechanic who created one of the world’s largest seafood businesses, has died at the age of 85.

He was co-founder of the Cooke Seafood group, which turned a local New Brunswick company into a global operation and ra formed a e a ad a fi farm o a a uacu ure operation employing thousands of people.

The Cooke empire stretches across the world from North America to Australia and over to Scotland and Continental Europe.

A company statement said: “The Cooke family is deeply saddened to announce the death on 3 March 2024 of Gifford Cooke, co-founder with his sons Glenn and Michael Cooke in 198 of ooke uacu ure c.

Joel Richardson, Vice President of Public Relations, added: “On behalf of the Cooke family and our employees, I would like to express our gratitude for the immense contributions Gifford has made to rural coastal communities in Eastern Charlotte, New Brunswick, and throughout Atlantic Canada and the globe.

“Over the decades, Gifford and his children, Glenn, Michael and Debbie, built a local family company into a global seafood leader with fully integrated facilities, product lines and distribution networks. Cooke provides careers to nearly 13,000 employees in 15 countries and is passionate about supporting commu a d co erva o pro ec .

Gifford Cooke was a marine mechanic for much of his career in Blacks Harbour, New Brunswick. With his sons, he e a ed e ove a mo a fi farm compa w

the Latin American Association on Native Fish Farming, the Colombian Academic Association of Aquaculture, the CES University, the University of Antioquia and Fedeacua.

The congress will bring together experts on topics of global relevance, addressing the development, sustainability and growth of aquaculture in Latin America and the Caribbean

Participants will have the opportunity to send summaries of their most recent research and work to present orally or in poster format throughout the three days of the event and the pre- and postcongress courses.

The organisers are now calling for abstracts for presentation at the conference. The deadline for reception of abstracts is 31 March 2024.

In addition, the event will stand out with the presence of the largest aquaculture trade fair in Colombia, for which stands are still available.

The registration form can be found on the WAS website: www.was.org/Meeting/Registration/ Submit/LACQUA24

o e e 198 a d we o o fou d e compa fir hatchery in 1989. The family set up True North Salmon in 1994 to manage marketing, processing and distribution. ooke uacu ure e worked a o de e emp o ee to modernise the company’s freshwater salmon hatcheries a d ve e ee a d ed cou e co ruc o pro ec . e compa a o e pa ded o ca c fi er e a d rew rou ac u o arou d e wor d from co a d a d pa o Australia and Chile.

The company added: “Gifford’s outgoing personality, robust work ethic, friendly sense of humour and steadfast faith will eave a vo d o ea fi ed. e o a ooke fam w miss him greatly. Our thoughts and prayers are with his wife ar or e fam a d ma fr e d .

A POTENTIAL dispute is looming between the aquaculture giant Cooke Seafood and the leader of the Nova Scotia regional government in Canada.

Nova Scotia prime minister Tim Houston has come out against Cooke’s proposal to expand its salmon farm in Liverpool Bay through its Canadian aquaculture operation, trading as Kelly Cove Salmon Ltd.

There has also been a swell of opposition from some sections of the community against the proposal.

Cooke is seeking approval of an existing site boundary amendment at Coffin Island and to create two new marine finfish aquaculture licenses and leases for the cultivation of Atlantic salmon in Liverpool Bay at Brooklyn and Mersey.

opposing the plan because the project would triple the number of salmon in the area and add two more fish farm sites.

Above: Tim Houston

Above: Tim Houston

It said last year that if successful, the Kelly Cove application would enable a modest Nova Scotia production increase to be phased in over a number of years.

It added that according to Statistics Canada, in 2021 Atlantic Canadian salmon aquaculture production in Nova Scotia was 8,592 tonnes, while Newfoundland harvested 15,904 tonnes and New Brunswick harvested 27,423 tonnes.

Now, the national broadcaster CBC reports that Premier Houston is

“There’s certainly a lot of people in Liverpool who are concerned about this. I respect their concerns and have heard their concerns,” Houston told the press in Halifax.

He added: “While I think there are incredible opportunities for aquaculture in this province, it’s my personal opinion that Liverpool Bay is not an appropriate place for that.”

However, the final decision on whether the expansion should go ahead will be made not by politicians but by an independent commission.

Cooke told CBC that it has been working on the project with provincial and federal regulators for several years.

Although expanding and creating jobs and a great deal prosperity in several areas, Canada’s aquaculture industry frequently has a strained relationship with both federal and regional governments, most notably in British Columbia.

Opposition is generally less intense on the eastern seaboard, but it is there all the same.

Growth plans are frequently met with opposition from local residents, sport fishing groups and those opposed to fish farming in any form.

NORTH American land-based salmon farmer AquaBounty Technologies is putting its Indiana site on the market in an effort to raise funds and strengthen its balance sheet.

In a stock market announcement on 14 February, CEO Sylvia Wulf said: “We have been focused on securing funding for our near- and long-term needs, so we can continue to pursue our growth strategy. Making the decision to sell our Indiana farm was a difficult one for us. We have built a strong operation there with a passionate and experienced team. I want to take this opportunity to express my gratitude to our team members in Indiana for the job they have done over the last eight years to transform the facility and create a well-run operation. Our focus will be on harvesting the remaining GE Atlantic salmon for sale over the coming months to ready the farm for a new owner.

“We are proceeding to pursue additional funding across multiple financing alternatives with the goal of securing our cash requirements in the coming months.”

AquaBounty is the first salmon farmer to produce GMO (genetically modified organism) fish at commercial scale. Its Atlantic salmon also have genes from two other salmonid species to achieve faster growth in recirculating aquaculture system (RAS) conditions.

The company’s main project is a 10,000-tonne RAS farm in Pioneer, Ohio, but last year this ran into problems with rising construction costs. AquaBounty has been looking for ways to raise more funding and strengthen its balance sheet.

The Ohio plant is now 30% complete, AquaBounty said, and to support this priority project the smaller RAS site in Albany, Indiana (pictured right) is being put on the market.

Investment bank Berenson & Co will be advising on the sale.

AquaBounty’s financial update for Q3, published in November, showed that the company saw revenue up 12% year-on-year to US$733,000 (£584m) but losses also up by almost 13% to US$6.1m (£4.9m).

NORWEGIAN company Nordic Aqua Partners, which is developing a landbased facility in China, has reported a good operational performance in the fourth quarter of last year with construction works for stage one completed on time and on budget.

The biological performance was good for all batches – with strong growth, a mortality rate below 1.6% and no signs of early maturation, says the company.

Nordic Aqua said it is on schedule for the first harvest late next month and is now fully focused on launching its Atlantic Salmon into the Chinese market.

A recent test harvest showed 5kg live weight fish with supreme quality along with good fish health and welfare.

CEO Ragnar Joensen said: “The fourth quarter of 2023 was another eventful quarter for Nordic Aqua.

“Biological performance was good during the quarter with good fish health and strong growth.

“We continued the important work of increasing

management capacity and expertise as we continue to grow. During the quarter, we also conducted a successful private placement, strengthening our liquidity and securing necessary equity funding for the next phase.”

Joensen said the overall status at the end of the period is that the Nordic Aqua team, with strong support from local authorities and in collaboration with leading industrial partners, is all set for the first harvest at the end of next quarter and ready to execute on the next steps in developing the company towards 20,000 tonnes.

“Competence and organisational capacity are critical in the successful development of land-based salmon farming. Nordic Aqua continues to grow the organisation and the company made several new hires during the fourth quarter, adding vital competence across the organisation,” he added.

Nordic Aqua said equity funding for stage two is secured and the company is currently in the process of evaluating sources of debt funding of this second phase, which will double capacity to 8,000 tonnes.

SALMON producer Mowi and food processing systems business Marel are putting the final touches on Mowi Scotland’s Fort William processing plant upgrade. The project includes the installation of state-of-the-art food processing and packaging systems. When complete, the upgrade will enable the facility to process and pack 200 fish per minute and increase plant capacity to more than 80,000 tonnes annually.

Scott Nolan, Mowi’s Sales and Operations Director (UK, Ireland, Faroes and Iceland), said: “With salmon being the UK’s largest agricultural export and 40% of this production

going through our plant in Fort William, it was time to ensure our facility maximises throughput whilst maintaining the high quality that customers expect of Scottish salmon. The last major upgrade to this facility came in 2006 and with the fast pace of the aquaculture sector, there are many new and innovative food processing solutions available to us today.”

Olafur Karl Sigurðarson, EVP Marel Fish, commented: “The main challenge with a large project like this is to ensure a stable production from the existing plant while changing the building and installing new equipment. I’m super-proud of the

HIGH-TECH aquaculture and processing business Optimar International has been acquired by Icelandic investment company Kaldbakur ehf.

Kaldbakur has completed the purchase of all shares in the company from the previous owner, German investment firm Franz Haniel & Cie. GmbH, for an undisclosed sum.

Based in Ålesund, Norway and with offices in Norway, Spain, Romania and the United States, Optimar serves customers in more than 30 countries. It serves the aquaculture and seafood processing sectors with products including humane stunners for finfish and shrimp, and the Optilicer delousing solution.

It is stated that there are no planned changes to Optimar’s current operations.

Kaldbakur is an investment company owned by the two founders of the Icelandic seafood company Samherji: Þorstein Más Baldvinsson and Kristján Vilhelmsson, and their families.

Two years ago the company, also known as Kaldbaks, took over assets that Samherji had acquired over the years but were not part of the company’s core business.

collaboration and teamwork between Mowi and Marel being able to plan this complex installation to the smallest details in such a successful way. This close partnership has proven itself during first testing of the new Marel equipment and we are looking forward to further cooperation with Mowi.”

The two companies say the collaboration “…showcases a commitment to deliver high-quality, sustainable seafood to fulfil the needs of a growing global population.”

The upgraded facility is equipped with two automatic packing graders and five efficient box lines that deliver a consistent and substantial throughput.

Mowi received a £2m grant for infrastructure upgrades in 2022 from the UK Government’s Seafood Fund.

As Nolan explained: “The upgrade to our salmon processing plant in Fort William is vital to ensure the UK remains competitive in a global seafood market. The UK Seafood Fund Infrastructure Scheme comes at a key time, helping to safeguard and grow our domestic food supply, securing local jobs in rural communities, improving staff recruitment and retention, and reducing our carbon footprint.”

“I’m super-proud of the collaboration and teamwork ”

Eiríkur S Jóhannsson, Kaldbakur’s Managing Director said: “Optimar is a trusted service provider to the maritime industry worldwide. The company has a lot of experience, knowledge and business relationships. We are excited about the opportunities that this investment will create, both for Optimar and for other companies we own.”

The announcement said: “There are no planned changes to the operation of Optimar, which will continue to serve its customers as an independent company in the Kaldbaks ehf group.” Optimar describes itself as a trusted service provider to the maritime industry worldwide.

SEAFOOD processing and logistics software business Maritech has been snapped up by US high-tech group CAI Software.

Maritech is a leading cloud-based enterprise resource planning (ERP) provider for the seafood and logistics industries across the European and North American markets. Founded in Norway, Maritech has an expansive, blue-chip customer bases in the seafood industry, offering solutions such as an Internet of Things application, production line monitoring and Maritech Eye, an automated quality control system for salmon and white fish.

The company is now part of the CAI Software portfolio. Broodstock Capital, a major investor in Maritech, will continue to have equity in the new, merged business. In a joint statement, CAI Software and Maritech said: “Together, CAI Software and Maritech will build a leading, global seafood ERP platform to serve companies of all sizes.”

Brian Rigney, CEO of CAI Software, said: “Combining CAI Software and Maritech brings key granular information for seafood manufacturers of all sizes to make more informed and timely business decisions in this ever-changing business environment.

“As we bring the companies together, we will continue to collaborate with our customers to develop solutions purpose-built to serve the unique requirements of this industry. In our next chapter of growth, I look forward to working with the Maritech team and Broodstock, who will continue to be an investor in the combined company.”

CAI Software is part of a portfolio of companies owned by private equity investor STG.

Maritech CEO Odd Arne Kristengård added: “This is a great milestone for us and a natural next step towards global growth for Maritech. Together with CAI, we will continue to have a laser focus on our Norwegian home market and customers while increasing the international traction that we have built over the last several years.”

A LARGE salmon processing plant in southern Chile has been severely damaged by fire.

The site, near the city of Punta Arenas, employs several hundred people and belongs to Entrevientos, which is owned in turn by the aquaculture companies Blumar and Mul�export Foods, also known as Mul� X.

On 12 February, large flames followed by a huge pall of smoke were seen coming from the building.

The blaze broke out around 10am and was brought under control about five hours later. A

large number of the city’s firefigh�ng vehicles were in ac�on throughout.

Reports suggest that it was started by sparks in one of the warehouses.

The staff had been evacuated and there are no reports of any injuries, but it will be some �me before the site is back in ac�on – if at all.

The company said the damage had been extensive and produc�on had been halted un�l further no�ce. The one posi�ve note is that the flames did not reach some parts of the site, such as the refrigera�on area.

The 9,000m2 factory is fairly new, completed just over three years ago at a cost of around £45 million.

Blumar is a major global name in aquaculture and fishing with more than 60 years’ experience.

In the case of salmon, this product is sold both fresh and frozen, with its main market in the United States, where it has a commercial office.

NORWEGIAN cod farmer Ode has taken over a harvesting facility formerly owned by the salmon group Måsøval.

Ode confirmed at the weekend that it had acquired the Western Seaproducts facility in Vartdal near Ålesund on the west coast of Norway.

The plant will become a fully owned subsidiary and will be operated as a specialised facility for harvesting and processing cod.

Last year, Måsøval announced a major restructuring of its

business. The harvest for 2023 showed an improvement on the previous period.

The move also secures employment for the people who work at the site. Ode CEO Ola Kvalheim added: “At Ode, we have a clear strategy of being fully integrated to

control quality, traceability and efficiency across the entire value chain.

“By acquiring the processing plant in Vartdal, we are now involved all the way from the egg to the customer, a process that takes three years, caring for our fish to end up with the best products for our consumers.”

Ode delivered just under four million kilos of fresh cod in 2023 and plans to triple the company’s production volume to 12 million kilos this year.

NORWEGIAN salmon farmer Nova Sea has signed a NOK 673m (£50m) contract to build a new slaughterhouse in Nordland.

The deal with the construction company Consto will see an ultra-modern facility on the small island of Lovund.

It is in the area where Nova Sea began its fish farming operations in the 1970s. The new plant will cover more than 17,000m2, spread over four floors.