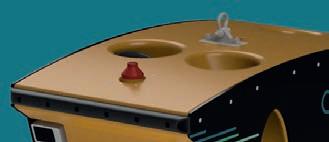

Bring confidence to your net cleaning job, with the most reliable pump on the market.

NLB’s high-pressure water jet pumps are proven reliable for offshore and onshore net cleaning. Engineered specifically for the aquaculture market, they withstand the harsh conditions of open seas, foul weather, and salt corrosion, all while delivering the same performance and durability NLB has been recognized for since 1971. Our units also offer a compatible interface with the industry’s leading head cleaning systems.

NLB will go the extra mile to make the switch easy for you. Contact us today to discuss your options!

AT least 10% of the waters around Scotland could be designated as Highly Protected Marine Areas – closed to fishing, aquaculture or offshore energy infrastructure –under proposals from the Scottish government.

The consultation on Highly Protected Marine Areas (HPMAs) sets out a policy framework, selection criteria for potential HPMAs and a process for balancing environmental considerations against economic needs and the interests of island and coastal communities.

The consultation defines HPMAs as “… designated areas of the sea that are strictly protected from damaging levels of human activities, allowing marine ecosystems to recover and thrive. These areas safeguard all of their marine life for the benefit of the planet and current and future generations; providing opportunities for carefully managed enjoyment and appreciation.”

Within designated HPMAs, all forms of fishing – whether commercial or recreational – would not be allowed, and these zones would also be off limits to aquaculture and any new infrastructure such as offshore wind turbines, ports and harbours.

Consultation on the proposals, which can be viewed online, will take place up to 20 March 2023. The consultation does not set out where any HPMAs are likely to be sited.

The restrictions in HPMAs go further than the existing framework of Marine Protected Areas (MPAs), which already cover just over one-third of the seas around Scotland.

For Scottish inshore waters (up to 12 nautical miles from the coast), there is full legislative competence within Scotland to introduce the necessary powers to designate HPMAs through primary legislation. For the Scottish offshore region (beyond 12 nautical miles out to the outer limits of the UK continental shelf), powers over the marine environment are currently reserved to the UK government,

with a small number of exceptions.

The Scottish government has said, however, that it would ask for powers to designate HPMA equivalents in offshore waters around Scotland.

Introducing the consultation, Scotland’s Environment Minister, Mairi McAllan, said: "Scotland has some of the most beautiful and diverse marine ecosystems on the planet, and we are committed to safeguarding them.

“As we develop this landmark HPMA network consultation, I would urge everyone with an interest in our precious marine environment, blue economy and coastal communities to take part.”

She also announced her intention to permanently designate the Red Rocks and Longay area – in the Inner Sound of Skye – as an MPA,to safeguard the future of the critically endangered flapper skate (Dipturus intermedius).

The pledge to introduce HPMAs was part of the Bute House Agreement between the Scottish National Party and the Scottish Green Party, which brought to Greens into coalition with the SNP.

The Scottish Green spokesperson for coastal communities, Ariane Burgess, said: “These bold plans represent a seismic shift for Scotland’s marine biodiversity. They will see key parts of our seas and coasts dedicated to the protection and restoration of nature, protecting them from exploitation and destruction.

"Highly Protected Marine Areas will be special places, protected for the good of current and future generations for their local, national and global importance. They will also play a critical role underpinning the restoration of healthy

This page from top: HMPAs have not been welcomed by the fishing industry; Mairi McAllan Opposite: Life on the seabed

fish populations and supporting the development of a sustainable fisheries sector.”

The Chief Executive of government agency NatureScot, Francesca Osowska, said: “We are a nation of coasts and seas, and it is vital that we safeguard these special places. The new HPMAs, which will complement and strengthen the existing MPAs network, will help to tackle both the climate change and nature emergencies, and meet our goal to achieve net zero in Scotland by 2045.”

She added: “Healthy seas also sustain the livelihoods of thousands of people in Scotland – without this resource, our food, energy and tourism industries would suffer.

“We know these proposals will be of interest to many people throughout Scotland, and we look forward to hearing a wide range of views on how we can best safeguard our marine life and habitats and the complex marine ecosystems they are part of, while at the same time securing a sustainable future for all those who use our seas.”

The announcement was not welcomed, however, by the Scottish Fishermen’s Federation, whose Chief Executive, Elspeth Macdonald, said: “HPMAs are an exercise in government greenwashing. There is no justifiable scientific rationale for their introduction or any evidence whatsoever that they will achieve their very vague aims.

“They will inevitably have a significant impact in further squeezing fishing vessels out of large areas of sea – 37% of Scottish waters are already protected under the existing MPA network.

“MPAs aim to strike a balance between conservation and sustainable harvesting, whereas HPMAs will exclude fishing altogether. HPMAs will also exclude most other types of activity, resulting in even greater pressure for marine space in other areas.”

She said the proposals were being brought in too fast for meaningful consultation, and added: “The speed at which the Scottish government intends to bring in these restrictions – first signalled out of the blue, without any consultation, in the Bute House Agreement – is totally unsuitable relative to the scale of the potential impact on fishing.

“The fishing industry has no objection to meaningful conservation, and indeed has been an active and supportive partner in developing the MPA network, but it is vitally important that we understand what we are conserving and why, and how we assess the contribution of restrictions to the objectives in question.

“The HPMA process is prioritising political objectives over good policymaking and decision-taking.”

MOWI Scotland’s appeal for permission to expand its salmon farm at Loch Hourn on Scotland’s

Last June, the Highland Council’s Northern Planning Committee, in Dingwall, voted by a narrow margin against the application to increase biomass at the site. Mowi was seeking a 10% increase to 2,750 tonnes.

The Reporter, Christopher Warren – the Scottish government’s legal official considering the planning appeal – issued a decision on 20 December, in which he dismissed objections to the Mowi application.

A campaign group, the Friends of Loch Hourn, had argued that fish farming in the loch is harming wild salmon.

Considering the appeal, Warren went through the objections in detail and noted that the Environmental Impact Assessment (EIA) had not found that the expansion of the site entailed an unacceptable risk of impact for the environment.

He stated: “I find no basis to conclude that finfish farming is inherently unsustainable… I conclude that this proposal does therefore represent a sustainable form of development.”

BAKKAFROST’S Scotland operation produced an unchanged harvest of 5,100 tonnes during the final quarter of 2022, the latest trading update from the company, out today, shows.

During last year, Bakkafrost secured land to build a large new hatchery in Scotland, in addition to its site at Applecross, which is being upgraded. CEO Regin Jacobsen said during the summer that building hatchery capacity in Scotland,was a top priority.

Bakkafrost’s latest update says ongoing expansion at Applecross is proceeding well and is scheduled to reach an important milestone during the final quarter.

Output from the company’s main Faroe Islands production operation fell by 1,400 tonnes to 19,300 tonnes during the October to December period.This was made up of 14,000 tonnes from Faroes Farming West, 5,300 tonnes from Farming North and no

production from Farming South, which produced 2,500 tonnes during Q4 last year.

Bakkafrost said the total harvest for 2022 in the Faroe Islands would be 66,700 tonnes. In Scotland, the total harvest in 2022 hit 23,900 tonnes.The total harvest from the entire group in 2022 was 90,600 tonnes, against 96,900 tonnes for 2021. All harvest volumes are provided as head-on gutted (HOG) equivalents.

Feed sales for Q4 2022 were 32,600 tonnes.The total for feed sales in 2022 was 127,800 tonnes and 297,800 tonnes of raw material were sourced.

A fund to support wild fish conservation projects in Scotland has been expanded, with angling organisations now among those being invited to apply for grants.

The Wild Salmonid Support Fund, set up by the salmon industry in 2021, has been renamed the Salmon Scotland Wild Fisheries Fund. With financial support from the industry, the fund aims to invest £145,000 through next year in habitat protection, removing barriers to migration, providing protection from predators and restocking.

Applications will be invited from fisheries organisations, including local angling clubs, fishery boards and other community associations.

Previously run by grant-making body Foundation Scotland, the Wild Fisheries Fund will be coordinated by Fishery Manager Jon Gibb, based in Fort William, in the north-west of the Highlands, who has championed a constructive relationship between the farm-raised salmon sector and fisheries and angling groups.

Gibb, an experienced fishery manager, said: “Wild salmon are under very serious threat from a

wide range of impacts both in the river and at sea, and any projects to further understand those impacts and mitigate against them are urgently required.

“Both the farmed and wild salmon sectors have a common interest to thrive in our shared space, and both rely on the rich heritage of the wild salmon and the angling that depends upon them.”

Salmon Scotland Chief Executive Tavish Scott said salmon farmers had a desire to save “one of Scotland’s most iconic species”.

The Wild Fisheries Fund is part of a total five-year investment of £1.5m from salmon farmers.

To date, grants have been used to save and restore a historic dam in the Western Isles that assists wild salmon to progress to their spawning grounds, as well as restoration projects to reduce riverbank erosion, and measures to provide tree canopy and in-stream cover for young salmon.

The revamped fund will prioritise applications of a practical nature that aim to protect and enhance wild salmon populations and local angling opportunities, recognising that salmon and trout fishing is at the cultural heart of many Highland communities and provides human health benefits.

The fund will be open for applications on 1 February and the closing date will be 31 March, with decisions on grants taken by Salmon Scotland in April.

SALMON producer Scottish Sea Farms has installed four 160m pens, its biggest to date, at Fishnish off the Isle of Mull, in a move aimed at improving fish health and welfare, employee safety and operational efficiency.

Where previously Fishnish had 10 100m pens, there are now just four 160m pens capable of supporting the same biomass and delivering several key benefits in the process, said Farm Manager Alastair Fraser. “The new £1.3m setup promises more room for the fish, better water flow and better oxygen, all of which will help the salmon thrive. Dealing with four pens instead of 10 also gives us more time as a farm team to focus on fish health and biological control. We can carry out any treatments faster, as it’s often the number of pens that takes time, as opposed to the number of fish.”

The advances in terms of employee health and safety look set to be every bit

as significant, the company believes.

Area Manager for Mull Andrew MacLeannan said: “Fishnish is one of the highest energy sites on the mainland in terms of weather and current speed, so when we were looking to upgrade the farm infrastructure, it made sense to go for the larger pens because they’re renowned for less movement in the weather.

“The bigger the pen, the heavier the mooring and the easier it’s going to be to make it safe, both for the team and the fish.

“All the lifting will be done by winches, with 10 fitted to each walkway that can be remotely controlled from a boat. Fishnish is first to switch to 160m pens “It’s an optional extra, but further adds to the safety of the staff and fish, as it gives us more control over the netting systems.”

To familiarise themselves with the new 160m pens – supplied by ScaleAQ

complete with moorings and HDPE

Midguard knotted nets designed to deter seals – MacLeannan and Fraser made two separate trips to Norway to observe operations at Lerøy and SalMar, which both use the larger pens.

“The farm team were a wee bit apprehensive at first, but excited too,” said Fraser. “It’s been a new challenge for us all, and a big learning curve, but with Scale AQ’s help, it’s actually been quite straightforward.”

Above:

SALES of salmon in UK stores are running at £1.2bn a year. The high-protein fish increased its share of the market ahead of the busy Christmas period, Salmon Scotland has revealed.

In the 12 months to October, new figures show that salmon made up 29.6% of total fish sales – an annual increase from 28.9%, despite lower volumes and overall food inflation.

In the year to October 8, 2022, £4.1 billion worth of fish was bought at UK retailers, down marginally by 4.2 per cent and back to similar values in 2020. Overall, fish purchases by volume were down 5.3% to below 400,000 for the period.

Salmon Scotland said: “International sales of Scottish salmon also remain strong, according to the latest data collated by Salmon Scotland, with more than £500m in fresh and smoked exports in the first nine months of 2022 [and] the most recent three months higher than pre-pandemic levels for fresh exports at £165m, and only down around 9% on the record-breaking 2021 figures.”

Despite the red tape from Brexit, European demand has seen the proportion of exports to the EU accounting for 76% of UK salmon exports in the most recent quarter.

Scottish salmon remains the UK’s biggest food export, followed by bread and pastries, chocolate, cereals, and cheese.

With reports of turkey shortages and the deepening costof-living crisis, Scottish salmon was expected to be in high demand over the Christmas season.

These latest figures, from trade body Salmon Scotland, using data from HMRC and NielsenIQ, came at the end of a highly successful year for the sector, which saw the Scottish government recognise the immense contribution of farmraised salmon to the blue economy.

Other highlights include Salmon Scotland being welcomed into the world’s leading body for chefs, and a university analysis that found that Scottish salmon is even more

nutritious than thought – providing more than 70% of daily vitamin D needs in a single portion.

Tavish Scott, Chief Executive of Salmon Scotland, said: “With food price rises, soaring energy bills and rampant inflation, the fact that salmon has increased its share of the UK market demonstrates the popularity of our fish."

He added: “A high level of domestic seafood consumption is not only healthy for the population, but it will also help the economy in some of the most rural areas of Scotland combat the challenges being faced by many at this time.

“Our sector is not without its own challenges,and we can’t hope to repeat the record-breaking performance of 2021, but international demand remains high – particularly in France, where Scottish salmon is recognised by chefs, restaurants and consumers as the best in the world.”

POLAND and D enmark, which both have large salmon processing sectors, continued to be the largest markets for N orwegian salmon last year, according to the annual figures published by the Norwegian Seafood Council.

But seafood sales to the UK, which traditionally buys a great deal of N orwegian cod and haddock, increased by 27% to NOK 7.8bn (£650m) in 2022.

Sales of Norwegian seafood to the US showed the most dramatic rise, at 46%, with much of it salmon, while sales to China rose by 45% despite some large cities facing Covid lockdowns.

Figures released yesterday by the Seafood Council showed that N orwegian seafood exports reached NO K 151.4bn (£12.6bn), a record value, in 2022.

Seafood Council analyst Eivind Hestvik Brækkan said: “We have also seen significant growth in the export value to Great Britain, driven by increased exports of frozen whole cod. We have to go all the way back to the year 2000 to find a higher export value of frozen cod to Great Britain.

The main 2022 export markets published by the Norwegian Seafood Council is (increases are on 2021 figures): 1. Poland: NOK 15.5bn (+24%) 2. Denmark: NOK 12.6bn (+22%)

US: NOK 11.7bn (+46%)

France: NOK 10.6bn (+29%)

The Netherlands: NOK 9.4bn (+34%)

Great Britain: NOK 7.8bn (+27%)

China: NOK 7.3bn (+45%)

Italy: NOK 6.6bn (+30%)

Portugal: NOK 4.9bn (+38%)

The main species exported in 2022 were:

1. Salmon: NOK 105.8bn (+30%)

2. Cod: NOK 12.2bn (+25%) 3. Mackerel: NOK 6.3bn (+7%) 4. Trout: NOK 5bn (+24%) 5. Herring: NOK 3.9bn (-9%)

6. Sei: NOK 3.6bn (+44%)

Last year, aquaculture accounted for 73% of Norway’s total seafood exports by value, while in volume it made up 45%.

In 2022, Norway exported 1.3m tonnes of seafood from aquaculture.The value was NOK 111.3bn, around 30%, up compared with 2021, while the volume fell by 2.5%.

The value of farmed salmon exports increased by NOK 24.6bn (£2bn), and the volume fell by 2%.

Seafood analyst Paul T. Aandahl said exports to the US saw the largest increase in value last year, with an increase in export value of NOK 3.2bn, or 57% compared with the previous year. The export volume to the US ended at around 66,000 tonnes, which is 22% higher than the previous year, he added.

The year also saw a record high price for fresh salmon fillets at NOK 117, or £9.75p per kilo.

There was also a record high price for fresh whole salmon at NOK 79 or £6.50 per kilo.

Aandahl said it was the price increase that contributed to most of the value increase for salmon last year: “The reopening of society after the coronavirus pandemic has had a positive effect on the demand for salmon.

“An increase in demand in combination with a slight decrease in produced volume, both globally and in Norway, is the most important reason for the price increase – in addition to increased further processing and a weakened Norwegian krone,” he maintained.

Last year, fishing accounted for 27% of Norway’s total seafood exports by value, while in volume it made up 55%.

U.S. Soy farmers are committed to advancing the United Nations Sustainable Development Goals. We are leading the way by producing more while using fewer resources, implementing farming practices that reduce carbon footprint, and helping to preserve forestland. Since 1980, U.S. Soy farmers have:

• Increased soy production, using roughly the same amount of land by 130%

• Improved water use efficiency per bushel by 60%

• Improved land use efficiency per bushel by 48%

• Improved energy use efficiency per bushel by 46%

• Improved GHG emissions efficiency per bushel by 43%

• Improved soil conservation per acre by 34%

From 1982–2017, the U.S. increased forest land by 2.1 million hectares and reduced crop land by 21.4 million hectares. But we won’t stop there. U.S. Soy farmers’ ongoing commitment to sustainability enables you to produce food, feed, energy and other products to support a healthy society, even as we preserve the planet for future generations.

See how we’re going further for you, your customers and the planet at USSOY.org/solutions.

U.S. Soy has the lowest carbon footprint when compared with soy of other origins.

THE Norwegian Seafood Council is planning to spend NOK 408m (£33.2m) on global marketing this year, with more than half that figure promoting farmed salmon and trout.

It is one of the largest national promotion budgets for seafood and will go to most corners of the world.

Børge Grønbech, Director of Global Operations at the Norwegian Seafood Council, said the 2023 marketing plans were ready at the start of October, which gave exporters a good planning horizon and time to get involved in the Council’s activities.

The money will be distributed across 25 markets and through 40 different marketing plans.

Grønbech said the overall goals would be to increase the value of and knowledge of Norwegian seafood, and strengthen the position of Norwegian seafood even in uncertain times.

The Council also aims to make Norwegian seafood more visible and more competitive in the battle for consumers, and place sustainable Norwegian seafood even higher on the agenda.

The investments are distributed as follows between the sectors:

• Salmon and trout: NOK 205m

• Whitefish: NOK 85m

• Conventional: NOK 55m

• Pelagic: NOK 40m

• Shellfish: NOK 23m

Grønbech said that as well as focusing on core markets, the Council would try to open up new areas including Israel, Saudi Arabia and Vietnam.

The US, where sales have been increasing recently, is one country that will receive special attention this year. The Council plans to spend NOK 44m (£3.5m) on the US in 2023, much of which will be spent promoting salmon.

IRELAND is to receive more than €142m (£122m) from the European Union to help develop its aquaculture and fisheries sectors.

The money, which spans the next five years, is from the European Maritime, Fisheries and Aquaculture Fund (EMFAF), which has placed a major emphasis on sustainability.

Around half of the programme’s allocation will be dedicated to sustainable fisheries and conservation of aquatic biological resources.

Including the EMFAF contribution, the total allocation for the Irish programme is €258.4m (£222m) over the period.

Virginijus Sinkevičius, the EU Commissioner for Environment, Oceans and Fisheries, said: “The [EMFAF] programme aims to boost the resilience of the entire seafood sector to accelerate its green transition, as well as to support the coastal communities. The programme will also enhance knowledge to deal with climate change and impacts on marine biodiversity.”

The main focus of the programme will be sustainable fisheries, including investment

BUSINESS tycoon Helge Gåsø has completely cut his ties with the NTS salmon and aquaculture services group, which he founded almost 30 years ago.

According to a recent stock exchange announcement, he has sold his and his family’s remaining 46-million-plus shares in the business, worth a total of NOK 3.5bn (£295m).

Gåsø’s business rival, SalMar founder Gustav Witzøe, has taken over as Chairman of the NTS board following SalMar’s successful takeover bid for the NTS group last year.

SalMar now controls almost all of the NTS shares, making it Norway’s second largest salmon farmer after Mowi. NTS formally delisted from the Oslo Stock Exchange this week.

It is thought Gåsø will now invest most of the proceeds from the sale in his new business venture, Frøy Kapital, which became operational in September and is widely believed to have a capital base of NOK 6bn (around £500m).

in improving energy efficiency to build the resilience of the fishery sector to current high costs and to reduce carbon emissions.

The funding will also focus on research and innovation to promote sustainable aquaculture, and the processing of fisheries and aquaculture products.

This includes investment in developing cultivation techniques that support biodiversity.

The programme also calls for action to increase the competitiveness of the processing sector, energy efficiency and decarbonisation in aquaculture.

“Sustainable sea” and “Ocean Blue economy” are now part of EMFAF’s remit, which will also include the development and economic diversification of coastal and island communities.

Helge Gåsø said last summer: “We have an ambition to be able to raise up to NOK 10bn in investment capital.The motivation is quite simply to help develop even more profitable companies and jobs along the coast and in the region.”

He has also more than hinted that he plans to return to salmon farming.

Gåsø and Witzøe are two intense salmon farming rivals, originally from the same island of Frøya near the port of Trondheim, and the SalMar-NTS battle dominated industry headlines through much of last year.

The main activities of NTS include salmon farming and wide-ranging aquaculture services such as the provision of wellboats and support craft.

SalMar was founded in 1991 following the acquisition of a licence for the production of farmed salmon and a whitefish production plant from a company that had gone into liquidation.

The growth of both businesses has been both impressive and rapid.

DB Schenker has just signed a contract with Avinor, the company that runs most of Norway’s airports.

Securing a site on this scale will, it is hoped, facilitate more profitable routes for the airlines, create a Nordic hub for freight to and from the Nordics, and strengthen import and export opportunities for Norwegian business.

Martin Langas, Freight Manager at Avinor, said it was clear that fully utilising aircraft freight capacity would ensure profitable intercontinental flight routes.

This in turn would give business increased access to markets in Asia, the US and other parts of the world.

Langas added: “So this is a win-win situation and will help to consolidate. By making it possible for large forwarders to consolidate their freight at Oslo Airport, we will be able to make better use of the available capacity by air and road.”

GERMAN

The 4,000sq m hub will not be exclusively for

nature of Norway’s

Knut Eriksmoen of DB Schenker Norway said: “Increased competition means that Oslo Airport will become more attractive to many. So we are looking forward to getting started and hope more players will follow suit.”

This is not the first such hub for Oslo. In March last year, it was announced that an advanced new export terminal for chilled seafood is to be built at Gardermoen Airport following the signing of a deal with the Oslo Seafood and Cargo Centre. That too will handle salmon and other fish.

CERMAQ has stocked fish in the third version of its artificial-intelligence-led iFarm in northern Norway. This time the emphasis is on machine learning.

Its iFarm project is designed to improve the health and welfare of fish in net pens with the focus this time on machine learning.

It has already been tested at Øksnes and Steigen in Nordland, but now the sea site in Steigen is being equipped with the iFarm setup in the net pens.

Cermaq said the operation was manned by the same crew that was responsible for stocking the very first iFarm in Martnesvika two years ago, adding that the team were excited to be able to experience operating an iFarm again.

Site Manager Tor Hansen at Hellarvika, said: “With the first version of iFarm, everything was new and we had an incredibly steep learning curve, but as we got started with operations, we think it worked out quite well.

“Now a number of adjustments have been made both to the setup and to operations based on experience gained in Øksnes, where we now have version 2 of iFarm, so it will be exciting to get started with operations and to follow how the fish thrive in the third version of iFarm.”.

The company explained that during the testing of version 1, the main focus was

on establishing an understanding of how iFarm affected fish behaviour and gaining basic learning about the iFarm construction.

In the testing of version 2, there was a lot of work on alternative versions of the sensor housing and operational adaptations, such as feeding the fish under a net roof, and achieving efficient handling operations in a sea site with a lot of extra equipment in the net pens.

But with version 3 up and running, the focus will be mostly on the sensors, on data collectionand machine learning, and on further development of the mechanism that sorts out fish.

Managing

Director of software expertBioSort Geir Stang Hauge said: “At Hellarvika, we will concentrate on the sensor arrangement to retrieve images with good quality and follow up the annotation of key parameters such as fish ID, lice, growth and fish welfare in the net pen, and on further developing sorters.”

He added: “After a successful test of the first-generation sorter in net pens where we saw that the mechanical sorting mechanism worked with fish swimming through the system, we are now testing the second generation, and we will try to lead the fish from the sorter into another volume through a pipe. The aim is to validate that it is possible to take out individual fish according to specific sorting criteria.”

The sorter will eventually become autonomous, so that together with the sensor system in iFarm it can make its own decisions based on defined criteria, such as the discovery of lice or wounds. The process requires the development of precise machine vision, rapid processing of large amounts of data and interaction with a mechanical sorting unit with its own control systems.

“It’s complicated work, and it’s work that hasn’t been done before, so it’s demanding, but also very exciting,” said Hauge.

Above: Catarina Martins

Above: Catarina Martins

GLOBAL salmon giant Mowi has been hailed as the most sustainable protein producer for the fourth year in succession.

The title was awarded by the Coller FAIRR Protein Producer Index after carrying out a detailed assessment of the largest meat, dairy and farmed fish producers in the world.

The rankings for each of the 60 companies assessed are determined by a risk and opportunity score across environmental, social and governance-related criteria, including greenhouse gas emissions, deforestation and food safety.

Mowi CEO Ivan Vindheim said: “This shows again that Mowi is at the forefront of sustainable food production. I am proud and humbled to lead an organisation that is a recognised leader in sustainable food production.”

Mowi has consistently scored at the top of the index since the award’s inception. The assessors have praised its robust policies on responsible sourcing, animal welfare, environmental sustainability and more.

Chief Sustainability and Technology Officer Catarina Martins added: “Our ultimate goal is to unlock the potential of the ocean to produce more food for a growing world population in a way that respects our planet, so we are extremely proud to be named the most sustainable protein producer and see our hard work recognised once again.”

The 2022 report found that aquaculture companies, primarily salmon companies, continue to perform better than land animal protein producers. In fact, Mowi is joined in the top four ranked companies by fellow aquaculture companies Grieg Seafood ASA and Lerøy Seafood Group ASA, both headquartered in Norway, who are ranked second and fourth respectively.

Catarina Martins continued: “FAIRR’s methodology continues to evolve, and companies are expected to report more and show progress on more metrics than when the rating started five years ago, so it is becoming increasingly harder to be on ranked on the top.

“Three Norwegian salmon companies are amongst the top four from all the 60 companies benchmarked. This reinforces the recognition of Norwegian salmon farming as frontrunners on sustainability.”

AQUACULTURE biotechnology company Benchmark Holdings has made its debut on the Oslo Stock Exchange’s Euronext Growth market to welcome and congratulations from the market.

Euronext Growth is a multilateral trading facility that mainly falls outside the scope of the Norwegian Securities Trading Act. At opening, the share price was set at NOK 4.5 per share, giving the company an estimated market capitalisation of NOK 3.3bn (£275m).

Euronext said Benchmark was the 13th listing on Euronext Growth this year and the 16th in total on Oslo Børs markets.

The move, said the company, is

the first step towards a listing on the main Oslo Børs and represents a strong foundation for its next growth phase. The company plans to eventually exit from the London Stock Exchange.

Benchmark CEO Trond Williksen said: “The listing on Oslo Børs is an important milestone for Benchmark that raises the company’s profile in the international aquaculture industry and strengthens the foundations for the company’s future development and growth.”

Benchmark says its mission is to drive sustainability in the aquaculture sector by delivering products and solutions in genetics, advanced nutrition and health.

The bank said RE:OCEAN was revolutionising the seafood industry,with land-based salmon farming of the future at a large-scale facility near the attractive woodland town of Säffle in the south of the country. It will be powered by fossil-free energy and almost all the water used will be in a closed environment.

With its new “ocean-on-land,” it will be able to produce 10,000 tonnes of sustainable and healthy salmon every year. Sweden currently imports most of its salmon, mainly from neighbouring Norway.

The project is supported by Sweden’s three leading wholesale companies – Axfood, Coop and ICA – which see great opportunities in being able to offer consumers healthy and sustainable Swedish salmon.

EIB Vice-President Thomas Östros, who is responsible for EIB operations in Sweden, said: “We are delighted to finance this groundbreaking, major project for sustainable food production.

THE European Investment Bank (EIB) is to provide 530m Swedish kroner (SEK) (£42m) to build a “super green” land-based salmon farm in Sweden.

The company behind the project is RE:OCEAN, which is planning to produce 10,000 tonnes of salmon a year by 2026.

RE:OCEAN has been given this generous support because of its commitment to innovative and sustainable food production.

“Not only will RE:OCEAN’s new facility provide the Swedish population with domestically and sustainably produced salmon, but it will also do so in an innovative and climate-friendly way, employing cutting-edge zerowater circulation technology.”

RE:OCEAN CEO Morten Malle said: “The EIB investment is a strong signal of trust and a cornerstone for other investors.”

THE Norwegian government has called a temporary halt to new land-based fish farming applications.

Fisheries and Oceans Minister Bjørnar Skjæran says he wants time to develop a clearer framework for the needs of aquaculture on land against those of sea-based aquaculture.

Compared with traditional sea or fjord salmon farming, land-based farming is a relatively young but fast-growing, sector and seen by many as being more environmentally acceptable.

Land farms are not subject to the government’s controversial

ground rent tax proposal –at the moment. Several applications for such farms are known to be in the pipeline.

The announcement has taken the industry by surprise, although it does feel the rules need to be clarified.

Skjæran stressed that the suspension would only apply until new regulations governing land farms are in place.

He said: “There have been significant technological

developments from those who seek permission for aquaculture production on land.

“This indicates that the industry is innovative and growing rapidly. However, we see that there is a need for clearer frameworks for what is to be considered aquaculture on land, as opposed to aquaculture in the sea.”

He explained the reason for the temporary halt is that there are a number of applications for plans close to the sea.

THE Norwegian authorities have launched a detailed investigation into the escape of at least 87,000 cod from a fish farm in Norway in September last year.

The fish, weighing an average of 600g, escaped from the Alida site in Volda Municipality, north of Bergen, which is operated by the Gadus group.

The circumstances of the escape are not yet clear, but the authorities are worried that the farmed fish are mixing with wild coastal cod.

Norway’s Directorate of Fisheries ordered Gadus to carry out a detailed count of the number of escaped fish with the results showing that approximately 87,000 cod swam loose from three cages.

As of last week, the company had only been able to recapture 408 fish, but the Directorate said it was receiving information from recreational fishermen that they have been catching farmed cod in a nearby fjord.

It added: “In order to increase the knowledge base related to the environmental consequences of cod escapes, the Directorate of Fisheries is collaborating with the Institute of Marine Research on data collection after the incident. We have

This presented a challenge to the differing regulations applicable to aquaculture in the sea and on land.

When permission is given for a land facility near the sea (usually by the local county council), it could in some circumstances fall within the confines of the government’s “traffic light” system, which regulates coastal growth in different zones.

It is important to avoid this, especially for the sake of the environment, said Skjæran.

also started a test fishery in the area and collected samples from the facility.”

It is only a few weeks ago that Gadus said it had achieved a record-breaking first harvest with fish exceeding expectations, reaching an average weight of 4.8kg.

The company, which is hoping to produce at least 30,000 tonnes of cod a year by 2025, operates from seven sites in Norway and employs 80 people.

decreased from last year. The cod quota has increased by 18.7% and is 53,374 tonnes, of which the Norwegian quota is 27,755 tonnes. The quota for North Sea herring was 396,556 tonnes and of this the Norwegian quota is 115,001 tonnes.

The cod quota was set at 21,652 tonnes, where the Norwegian quota is 3,681 tonnes before provisions. Cod quota is in accordance with the advice from ICES,and involves an increase from a record low level in 2022.

Catch limits for major fished species have all been increased with the exception of herring, which has had limits cut by 7.3%. Cod fishery limits have been increased by 63%.

The UK government said the trilateral deal has secured fishing catch limits worth £202m to the UK’s fishing industry, representing a £33m increase from last year.

NORWAY struck an important new fisheries agreement in December with the UK and the EU.

While the deal mainly involves the catching sectors of each of the participants, it is also important for Norway’s farmed salmon sector because it avoids the possibility of a wider dispute that might impact on trading for aquaculture.

Fisheries and Oceans Minister Bjørnar Skjæran said: “The tripartite agreement is the basis for the bilateral agreements and it is important that we agree on total quotas for the joint stocks in the North Sea. Total quotas and their distribution are crucial for sustainable management. I am happy that this is now in place.”

In addition to this agreement, Norway is negotiating quota swaps and zone access with the EU.

The quotas vary: some have increased, while others have

Two weeks earlier, Norway entered into a bilateral agreement with Britain that includes mutual access to fishing in each other’s zones, as well as the exchange of fishing quotas involving a number of species for 2023.

“I am very satisfied that the agreement with Great Britain is in place, as it gives Norwegian fishermen predictability,” Skjæran added.

He said: “The negotiations have taken place in a good tone, have been effective and show that our relationship with Great Britain is close and good.”

Fisheries Minister Mark Spencer said: “I’m pleased we have reached agreements with the EU and Norway, and wider coastal states, to secure important fish stocks worth over £450m for the UK fishing fleet in 2023.

“The deals will help support a sustainable, profitable fishing industry for years to come, while continuing to protect our marine environment and vital fishing grounds.”

THE Icelandic government has stalled on a demand by a group of 25 sports fishing and environmental organisations to ban opennet fish farming in the country.

They called on Reykjavik to take action following the escape into a fjord of 80,000 salmon from an Arnarlax farm pen last year.

In 2022, Arnarlax was fined ISK 120m (around £700,000), but it has appealed the penalty, saying it did all it could to prevent such an incident Svandís Svavarsdóttir, Iceland’s Minister of Food, has said she is not ready to take a position over the group’s demand, adding that managing an industry that is sustainable over the long term is proving to be a challenge.

However, the minister confirmed that she would take the group’s views into account when drawing up new policy making on aquaculture.

She said Iceland’s National Audit Office was also looking at regulations and

the legal implication of any new measures.

And when its views are known, it may be possible to take a position on what the group was demanding and on whether any further measures needed to be implemented. She also agreed that national veterinary organisation MAST was right to take such a serious view of the incident.

The fine is the largest yet imposed on a fish farming company for a large salmon escape.

Anti-salmon farming groups, including environmental NGOs and sports fishing organisations, present a constant challenge to Iceland’s mainly Norwegianowned salmon sector, which is watching developments closely.

Salmon farming in Iceland was worth ISK 20.5bn (£117m) last year and has been growing at an impressive rate, with Mowi becoming the latest participant. There are challenges, however, from possible higher taxes and the demands of campaigners who

are demanding an end to open-net farming to protect wild salmon stocks.

The Reykjavik government is said to be studying controversial measures to raise more tax from the industry, which have been proposed recently in Norway and the Faroe Islands.

Above:

Seafood Norway is appealing to the Norwegian government to look to the Faroe Islands as a possible model for introducing a new ground rent tax for fish farming.

Seafood Norway says the Faroese system is tried and tested and is also being used by Iceland.

The organisation’s Chairman, Paul Birger Torgnes, said: “It can easily be adapted to the government’s political wishes regarding tax levels, shielding of smaller companies and securing increased tax revenues for both communities and host municipalities.”

He pointed out that the Oslo government had asked his organisation to provide input on tax proposals for the industry and it had responded, putting a lot of work into the issue.

The scheme proposed for Norway, known as the “hydropower model” was not a suitable system for the aquaculture industry, he argued.

Torgnes maintained: “The proposed model is complicated, bureaucratic and administratively demanding for both society and companies.

“The tax proposal has a level and a design that could have major and harmful effects on the industry’s structure, investments, employment and value creation.”

He believes, like several

other consultation bodies, that the government’s proposal is not neutral either, which is a crucial premise for such a taxation to work.

“It is based on extracting oil or gas, or damming a waterfall. Aquaculture is a completely different industry with a complex value chain.

“It is industrial production of seafood where only part of the production is linked to the use of shared seawater.

“Sjømat Norge (Seafood Norway) recommends investigating the Faroese ground rent model instead.”

He added: “The government can collect the same amount of tax that [it] has proposed through a more suitable and proven tax model. The Faroe Islands tax aquaculture with a production tax that increases gradually with increasing price levels.”

The Chairman also pointed out that it has been a demanding process for the industry to produce a consultation response.

“Since the government announced the introduction of a new salmon tax at a press conference in September, the organisation has held 14 board meetings, a number of meetings in various industries and regional teams, and several member meetings.

“This has required large resources and much time to analyse the government’s proposals, various tax models and how these will affect a complex and diverse industry such as aquaculture.”

COOKE Aquaculture and the Jamestown S’Klallam Tribe have announced they will each be appealing over the decision to end net-pen fish farming in the US state of Washington.

Cooke is taking the Washington Department of Natural Resources (DNR) to the Superior Court of Washington in an effort to reverse the decision not to renew leases for its two remaining net-pen fish farms in the state.

Cooke’s two farms, producing native steelhead (rainbow) trout, were the last remaining marine net-pen farms in Washington, on the north-west Pacific coast of the US. On 14 November, Hilary Franz, the state’s Commissioner of Public Lands, announced that the leases for these sites would not be renewed,and a few days later followed that up with an announcement that net-pen fish farming would be banned altogether.

Franz said at the time: “There is no way to safely farm finfish in open sea net-pens without jeopardising our struggling native salmon… we, as a

state, are going to do better by our salmon, by our fishermen and by our tribes.”

The DNR had initially given Cooke just 30 days to harvest the fish at its two farms and remove the pens.

Cooke’s preliminary injunction, to secure an extension to 14 April to safely harvest the fish and remove equipment from the Rich Passage and Hope Island farm sites, was upheld by the Superior Court of the State of Washington. The company had argued that the initial harvest deadline of 14 January would jeopardise safety.

Cooke has pointed out that the

strain of sterile rainbow trout grown by the company is the same strain used by the state to stock lakes and rivers throughout Washington.

Cooke has also stressed the devastating effect that the closures would have on its employees, and – in a sign that the gloves are off – explicitly linked Commissioner Franz’s hard line on aquaculture to her re-election campaign, accusing her of launching a fundraising drive on the back of it.

The Jamestown S’Klallam Tribe, which is based on Washington’s Olympic Peninsula, is bringing a separate lawsuit to get the DNR’s state-wide ban overturned.

W. Ron Allen, CEO and Tribal Chairman of the tribe, said: “As a tribe, we have always been conscientious stewards of our natural environment and look seven generations ahead in all that we do. Modern, well-regulated aquaculture is the environmentally responsible solution for producing seafood and exercising our tribal treaty rights – now and into the future.”

THE salmon industry in Tasmania has hit back at its critics, with a robust defence of its track record and strong words for a protest culture that it says is funded by tax breaks.

Industry body Salmon Tasmania has launched a campaign using social and traditional media, with the theme “Tassie, we need to talk about salmon”.

Salmon Tasmania CEO Sue Grau said: “Activists have had a free run up until now. This clear air

has allowed them to mislead the community with what is at times absurd misinformation. The time has come to confront the misinformation head on and have an honest and open conversation with the people of Tasmania.”

Salmon Tasmania points out that previous protest movements have targeted Tasmania’s hydroelectric schemes and the forestry industry, before turning their attention to fish

farming. It claims that the protesters are well funded, with full-time staff and enjoying tax-free donation revenue.

Communications Director Stuart Harris commented: “We are really excited about taking a different approach to dealing with this issue. False stories and incorrect information have been seeded in the community over a long period of time, so we needed a fun and light-hearted way to engage in what is a very serious conversation. We hope that the way we are delivering it makes it something that the community will listen to and that our people will be proud of”.

The campaign addresses questions like “Do you dye the salmon’s flesh pink?”, “Why don’t you just move onto land?” and “Is there mountains of fish poo under the nets?”

The opening episodes of the campaign can be viewed at: www.facebook.com/SalmonTasmania www.youtube.com/watch?v=6pALPOrKPY&t=6s salmontasmania.au/savour

AQUACULTURE group Barramundi has entered into a strategic partnership with Wild Ocean Australia, which will enable it to develop its ambitious plans for expansion in Western Australia.

The Barramundi Group is based in Singapore, Australia and Brunei, farming the fish of the same name, also known as Asian sea bass. Last year, it had warned that its plans to develop up to 13 seawater sites in Western Australia might have to be shelved unless it could find a strategic partner. That partner, it has transpired, is Wild Ocean, which operates a seafood processing, value-adding and distribution business in Darwin, in the north of

Australia. Wild Ocean also owns and operates the Darwin Fish Market retail outlet, which supplies the full range of Australian-only seafood products to the Greater Darwin region.

Barramundi Group has entered into a Letter of Agreement for the sale of 75% of the company’s stake in its Australia business, held under Marine Produce Australia Pty Ltd (MPA), for a consideration of AUS $1.6m cash (£0.9m) with a further earn out payment of AUS $3.4m (£1.9m) to be disbursed upon the approval of at least four of the 13 additional seawater site leases in the Kimberley region of Western Australia.

The agreement also includes Barramundi Group obtaining ownership of 34% of WOA’s shares, which allows the company to retain effective equity majority interest in MPA and gain access to a variety of Australian seafood products for its other markets.

Barramundi CEO Andreas von Scholten said: “Having had a protracted search for investors and a strategic Australian partner for MPA, we are happy to now enter into this arrangement with Wild Ocean.

“The structure of our relationship allows us to retain a meaningful presence and interest in Australia, while at the same time benefit from having a strong local Australian partner who will provide expertise, network and funding for the next phase of MPA’s growth. With our lease applications well underway, the future of sustainable, ocean-grown barramundi in Australia just got much brighter.”

Frank Norton, Director of WOA, said: “At Wild Ocean, we are excited that through the acquisition into MPA, we can fully unlock the potential of Australia’s only oceangrown barramundi… the strategic nature of this partnership is compelling and formidable.”

THE Canadian Aquaculture Industry Association (CAIA) has published seven industry-wide National Salmon Farming Commitments, and all the major Canadian salmon producers have signed up to them.

Canada is one of the first countries in the world to establish national commitments for salmon farming.

The CAIA says the commitments, and their corresponding actions and targets, demonstrate the Canadian industry’s commitment to being the best producers of farm-raised salmon in the world. In summary, they are:

1. Fish health:We are committed to using best management practices and technologies that support the wellbeing of farmraised salmon.

2. Sustainable feed:We support innovation in aquaculture feeds and are committed to the sourcing of environmentally sustainable ingredients that provide high-quality nutrition for our fish.

3. Climate change:We are committed to continuing to reduce our carbon emissions and are equally committed to becoming more resilient in the midst of a changing environment.

4. Food security:We are committed to providing a reliable and healthy source of farm-raised salmon to Canadians to help navigate future uncertainty to communities and boosting food security throughout Canada.

5. Food traceability:We will work to ensure consumers can more easily access the information they want about their salmon meals.

6. Ocean health: We are committed to continuous improvements to farm practices that further protect the marine ecosystem, including the benthic ecosystem health beneath our farms, and to the prevention of plastic waste and debris from entering the oceans from our operations.

7. Public reporting: We are committed to continuous improvements to farm practices that further protect the marine

ecosystem, including the benthic ecosystem health beneath our farms, and to the prevention of plastic waste and debris from entering the oceans from our operations.

The full version can be found online at www.lovesalmon.ca/commitments

All major salmon producers in Canada, as members of the Canadian Aquaculture Industry Alliance (CAIA), have embraced the commitments. The CAIA said: “[We] will continue to work together to monitor and track progress. The goal is to achieve these commitments by 2032 and to transparently report progress each year.”

are patient, gentle and sustainable. We are delighted to bring this truly Scottish salmon product exclusively to Asda stores across the UK.”

When asked about the dedicated production process, Kenny Noble, who has been a master smoker for over 10 years, explained: “These kilns really are magic in lots of ways – the smoke adds flavour and helps preserve the salmon.”

Ashley Connolly, Local Buying Manager at Asda, said: ”We work alongside some wonderful local suppliers to create innovative, affordable, and delicious products for shoppers to enjoy.

YOUNG’S Seafood is the UK’s largest specialist seafood brand and the Extra Special Blackthorn Dry-Cured Smoked Salmon, it said, is one of its most decadent launches to date.

The Extra Special, superior grade salmon (pictured) is hand cured with Ayr-based Blackthorn sea salt flakes, and then undergoes a 30-hour smoking process. This is more than double the usual smoking time for a deeper, richer flavour.

Speaking at the launch in December, Paul Terris, Senior Development Manager at Young’s Seafood, said:

“We have enjoyed a long-standing partnership with Asda and are delighted to bring this exclusive Extra Special product to festive feasts across the UK this Christmas.

“We are very proud of our Scottish heritage and at our picturesque smokehouse in the far north-east of Scotland, our smoked salmon experts have spent many months perfecting the production process.”

He added: “Our salmon is hand cured with Blackthorn sea salt flakes made in the world’s only working graduation thorn tower in Ayr using methods that

“We are delighted to have such a strong relationship with Young’s and our customers always love the Extra Special Smoked Salmon products, especially at this time of the year. The Blackthorn Dry-Cured Smoked Salmon will be a fantastic addition to our Extra Special Christmas range in the lead-up to the festive season.”

RETAIL chain Lidl has had to recall two Scottish-produced smoked trout products from its UK Christmas range.

A warning was sent out by the UK Food Standards Agency, which said the products Deluxe Oak Smoked Scottish Loch Trout and Lighthouse Bay Smoked Trout Trimmings may be contaminated with listeria monocytogenes (LM).

The supermarket issued a “do not eat” warning due to the potential presence of listeria, which can cause severe health problems.

According to the recall notice issued by Lidl, the affected batch of products are marked with “use by” dates between and including 20 December 2022 and 6 January 2023.

This product recall specifically

affects 100g packs of Lidl Deluxe Oak Smoked Scottish Loch Trout, plus 120g packs of Lighthouse Bay Smoked Trout Trimmings. Only products with the use-by dates listed above are part of the recall.

The UK Food Standards Agency said symptoms caused by this organism can be similar to those of the flu and include high temperature, muscle ache or pain, chills, feeling or being sick, and diarrhoea.

However, in rare cases, the infection can be more severe, causing serious complications, such as meningitis.

Some people are more vulnerable to listeria infections, including those over 65 years of age, pregnant women and their unborn babies, along with babies less than one month old and people with weakened immune systems.

Lidl said that if anyone had bought these products, they should not eat them and should return them to the store for a full refund, with or without a receipt.

The scare follows recent listeria scares over smoked salmon in Norway, where the Food Safety Authority issued an alert, and France, where the retailer LeClerc had to withdraw products.

“We are delighted to bring this truly S cottish salmon product excusively to Asda stores across the UK ”

ICELAND Seafood International has found a potential new buyer for its Grimsby seafood factory, where more than 150 jobs are at stake, the company has announced.

A previous unnamed bidder pulled out of a deal in December, but Iceland Seafood said it had since signed a letter of intent with a new suitor, described as a “respected industry player” .

Both sides said they hoped to cement the transaction by 17 February. If successful this time, this could be a potential lifeline for many of the people who currently work there.

The statement added: “Further updates on the progress made in relation to the proposed transaction and its financial impact on Iceland Seafood will be provided as appropriate. The production site, built originally

for Five Star Fish, is modern and has undergone a number of upgrades since it first opened so it is no surprise that interest has been keen.

Iceland Seafood announced six weeks ago that, despite determined efforts, it had been unable to pull its UK business back into profit, adding that it was no longer a strategic fit for the company.

The business was eroding profitability and the board felt it was no longer justified in continuing with it.

It said that the time of uncertainty following Brexit, along with problems from the Covid pandemic, were mainly to blame.

Iceland Seafood International operates 12 businesses in seven different countries and has recently been growing its smoked salmon base, notably in Spain and Ireland.

THE European and North American operations of Samherji, Iceland’s largest integrated seafood group, have been acquired by a company run by the son of the group’s Chief Executive Officer.

south-west of the country.

THE oldest smoked salmon business in the Netherlands has been saved from closure by a competitor.

In December, the Zalmhuys Group, based in Urk, took over the activities of smokehouse H. van Wijnen at two locations in the Netherlands.

Two months ago H. van Wijnen B.V. was declared bankrupt, due mainly to the very high prices for salmon earlier in the spring.

Zalmhuys Group Director Harm ten Napel decided to act quickly and moved to rescue the business, describing it as an opportunity.

Most of the 130 workers were immediately offered a new jobs while its activities have been continued under the leadership of the existing management team.

Van Wijnen, based in Krimpen aan de Ijssel, is an established name in the salmon world. Founded as a company in 1864, the company grew into one of Europe’s oldest and most prestigious smokehouses, with an annual turnover of €40m (£34.5m).

It produces salmon under the van Wijnen brand, as well as Hendrick’s smoked salmon and John Orrin smoked Scottish salmon, and own-label products for retail customers. It managed to double its sales between 2010 and 2015.

A few years ago H. van Wijnen attracted support from investment firm Nimbus.

A Netherlands-based company owned by Baldvin Thorsteinsson (Þorsteinsson), son of Samherji’s CEO, Thorsteinn Már Baldvinsson) has reached an agreement to buy the assets of Álda Seafood, the foreign operations division of Samherji.

UK-based overseas businesses include Ice Fresh Seafood of Grimsby, which has a fish smoking operation supplying major retailers. They also include a major interest in the Hull-based trawler Kirkella, Britain’s last distant water fishing vessel.

The deal leaves Samherji in Iceland clear to concentrate on its large deep-sea fishing fleet and its ambitious fish farming plans, which include building a large, landbased salmon farm in the

A statement from Samherji Iceland said: “The domestic and foreign activities of Samherji hf. was separated into two independent companies, Samherji and Samherji Holding, in 2018. “Subsequently, the subsidiary of Samherja Holding, Álda Seafood, with headquarters in the Netherlands, was entrusted with the operation of the activities related to the fishing industry in Europe and North America. The ownership remained unchanged.

“An agreement has now been reached on the sale of the assets of Álda Seafood to another Dutch company under the

management and majority ownership of Baldvin Thorsteinsson.

“The new company will now hold Álda Seafood’s holdings in fishing companies in Europe and North America.”

The statement added: “Samherji started operations on foreign soil in 1994. We believed then, and in fact still believe, that the knowledge and experience that resides in the Icelandic fishing industry should be used more widely.

“We exported our knowledge of fishing and processing, on board ships and ashore, but in addition, Samherji Holding has directed its business to Icelandic companies to a large extent during these decades.”

How was your Christmas? I am reminded that the festive season is very much a time when people come together to share food, drink and the pleasure of a mutual experience. Whether fuelled by drink or not, the conversation flows, especially when it comes to putting the world to rights.

Now that the Christmas tree has gone, the decorations put away for another year and all those empties have gone to recycling, it is apparent in the hard light of a January day that the good will of the Christmas festivities has not extended to balanced discussion about salmon farming in Scotland.

If there is a wish for 2023, then it would be that those opposed to salmon farming, for whatever reason, be willing to discuss their concerns and explore how these can be addressed.

Unfortunately, it doesn’t matter whether it is those who only express their views on social media or those who are chief executives of a conservation charity – they all have one thing in common: their blanket refusal to discuss the issues with the most informed in the industry.

By comparison, they are always happy to expound their views to those who know less than themselves because their views are never challenged. This is why the salmon farming industry continues to be the target of a 40-year narrative. After repeating the same story for so long, they think it must be true.

The problem for the industry is that there are effectively three different campaigning groups sending out variations of the same narrative. These are: anglers, the NIMBYs (“not in my backyard”) and the environmental/vegan groups.

As I already highlighted, they all share one common feature and that is a refusal to discuss the issues. They all have a solution, which is removal of salmon farms from Scottish seas, and they are not interested in any other solution.

It no longer matters whether the concerns raised by these groups have either been addressed or are no longer valid – salmon farms must be removed regardless. There can be no other way.

The main theme of the anti-salmon farming narrative is that salmon farms are responsible for the disappearance of wild Atlantic Salmon from Scottish rivers. They reason that there were plenty of salmon in the rivers before salmon farming arrived on the west coast, but after salmon farming had become established, wild

salmon disappeared from many rivers. Clearly, they believe that the common factor is salmon farming and thus if there were numerous fish prior to the presence of salmon farming, the removal of salmon farms would allow wild fish numbers to return to their pre-1980s levels.

Sadly, this simplistic view of farmedwild salmon interactions is not supported by any hard evidence, but this doesn’t stop those propounding the narrative, especially in wild salmon circles. For us in the salmon industry, this narrative is difficult to counter, even when backed by proven science. This is because there is no avenue open to provide the opposing view. The angling press won’t publish anything written by the salmon industry, so readers only hear one side of the story.

Offers have been made to speak at the North Atlantic Salmon Conservation Organisation (NASCO), Atlantic Salmon Trust (AST) and Fisheries Management Scotland (FMS) conferences, all of which have been refused. And whilst the mainstream press seem to prefer articles that paint the salmon farming industry in a negative light, they are rarely willing to publish the industry’s view.

If a positive story does appear, the industry critics claim that it is in some way paid for by the Norwegian billionaires who spend millions greenwashing salmon farming to make it look acceptable.

Of course, it doesn’t need greenwashing because it is more than acceptable to those who eat and enjoy farmed salmon. Critics claim that salmon farming is like the tobacco industry in that it misled the damage it caused to

Opposite: All too often campaigners are not open to hearing opposing views

Left: Falling salmon numbers – who’s to blame?

Those who are dedicated to shutting down the aquaculture sector should take the time to hear the case for the industry’s defence. By Dr Martin Jaffa

Meanwhile, I would ask all the critics, regardless of their motives, that if they are so concerned about the fate of wild salmon, then what are they doing to help

stop the route to extinction other than moan about salmon farms.

Given all the noise about salmon farming, it is easy to forget that even before salmon farming arrived on the west coast, salmon catches from the west coast amounted to little more than 10% of the total Scottish catch. That means that 90% of the catch comes from rivers that are not associated with salmon farming in any way.

Yet as both the AST and Wild Fish state, wild salmon numbers have fallen by 70% over the last 20 years. It would take the most blinkered view to believe that catches from rivers such as the Tweed are impacted in anyway by salmon farming and thus the decline must be for other reasons.

Besides planting a few trees, I cannot see what the wild fish sector has done to protect wild fish except to ensure that salmon farming remains firmly at the top of the blame agenda. Given that anglers have caught and killed around 5.9 million wild fish from Scottish rivers since 1952, it is not surprising that there is a total unwillingness to learn about why salmon farming is not to blame. They might have to start blaming themselves.

I can live in hope that 2023 is the year that talking rather than just blaming takes precedence.

EMPOWERING

”

human health. However, I would argue that the damage to wild fish numbers is simply in the minds of the angling and wild fish sector, and that if they were open to listening to the facts, then they might see that the alleged damage is solely in their imagination.

It was at a recent get-together for one of the country’s oldest and most venerable angling clubs that I noticed it.

There was the usual narrowing of eyes and sharp intake of breath when I mentioned I worked in the salmon farming sector, but this time there was something different.

There was, for the first time, a recognition among some of the most long-standing and traditional anglers that sea lice from salmon farms were probably not responsible for the decline in Scotland’s wild salmon populations.

The question I pose – and which I have been posing to fellow anglers for years – seems to be getting through: “If salmon farms are responsible for the decline in wild salmon and there are only farms on the west coast, why are wild salmon numbers going down on the east coast?”

It is an unanswerable question for those who blame sea lice and fish farms for the decline in their sport and, at last, it seems to be gaining traction.

At this particular gathering, anglers who would have defaulted to blame salmon farms at the drop of a tweed cap were now taking a different approach. There was an acknowledgement (grudging,

certainly, but it was there) that salmon farms could not be held responsible for the big declines in wild salmon populations in Scotland’s dominant east coast rivers. They did insist, however – almost certainly as a last, fall-back position – that there was still a big question mark over the effect of farms on west coast sea trout.

That sea trout issue is a battle we are going to have to win over time, but, leaving that to one side, the shift in attitudes over wild salmon is a very significant one.

I have been mixing with, debating with and fishing with these anglers for years and, up to now, the reaction to salmon farms has been a knee-jerk kick of outright opposition, as if the evidence on damage to wild salmon populations is so incontrovertible there is no need to debate it.

However, like a wide east coast river after days of rain, the waters have become muddied. There is now a recognition that just blaming salmon farms is no longer good enough, that the crisis in wild salmon numbers has reached such a point that hitting out at the only visible potential culprit is not the answer.

There are obviously those on the fringes of the angling world, blinkered obsessives who refuse to look at the evidence, who will never change, but for the thoughtful angler, who actually thinks about the issue, there does appear to be movement.

Part of this is down to that big nagging question about the east coast rivers, but there is more.

Last month, the Scottish government

Anglers are beginning to realise that salmon farmers are not responsible for all their problems.

By Hamish MacdonellAbove: Wild Atlantic salmon Left: Private Fishing notice

released a report into the escape of farmed salmon from the Carradale North farm during Storm Ellen in 2020.

Almost 50,000 fish escaped, yet, after extensive research in rivers in Scotland and down into England, the Scottish government found no significant effect on local wild salmon populations.

The report stated: “There is no indication that this escape event resulted in significant interbreeding of escaped farm fish with wild stocks.”

This is also hugely significant. Many of us will know from experience that escapes is the second major argument that anglers (and others) use to claim that fish farms are damaging wild salmon stocks.

Yet we now have an independent, Scottish government report that makes it clear that, at best, there was absolutely no effect on wild salmon from a sizeable escape of farmed fish and, at worst case, the effect was minimal.

This gives us powerful ammunition to use every time escapes are brought up as a reason to stop new farms being built or to restrict the ones already in place.

The third major pillar of the arguments used against fish farms is one of pollution and impact on the environment.

We know that farms do not have a long-term effect on the sea bed once they have been fallowed. What we cannot do right at the moment is prove it. However, that remains our aim and, hopefully, we will be able to do that before too long.

For years, a narrative has been established that blames fish farms for the decline in wild salmon numbers, a narrative that for too long went largely unchallenged. But the ground is beginning to shift, which is happening because that particular narrative was not based on science, evidence or data.

What I have detected may only be the first whispers of doubt from previously defiant anti-fish farming anglers, but I do believe it is significant. If we can push back, reasonably and with evidence, then I believe this is an argument we can win, and win comprehensively.

It is probably difficult for non-anglers to appreciate, but the sense of gloom and despondency that has settled on the angling community has become pervasive.

At that angling club dinner, there was an end-of-an-era feel to it, at least as far as salmon fishing was concerned. It was not just that the best days were long gone, but that they will never return.

For a community like that, it is easy – and understandable – to hit out at the new, the visible and the challenging, which is what fish farms appeared to be for many years.

What is harder to accept is a complicated and multi-faceted picture, one that is constantly evolving and involves factors, many of which are invisible and, as yet, undetectable.

But what I have seen and heard does suggest that these more complex arguments are starting to gain ground at the expense of the knee-jerk opposition to salmon farms. That can only be good, not just for Scotland’s fish farmers, but for the country’s vulnerable wild salmon populations too.

The shift in attitudes over wild salmon is a very significant one

”

and is the largest consumer of molluscs. The vast majority of production (97%) is concentrated in the north-west of the country in Galicia, which uses suspended rope culture from rafts.

France, the second largest producer and consumer, grows both blue mussels (Mytilus edulis) and Mediterranean mussels. In 2020, bouchot production (mussels grown on poles driven into the seabed) accounted for 83% of French output and a large proportion is marketed under various quality schemes such as Label Rouge, Traditional Speciality Guaranteed (TSG) and the “Moules de Bouchot” brand.

The latest figures from the Food and Agriculture Organisation (FAO) show that in 2020, around 2.2 million tonnes of mussels entered the global food chain, primarily from aquaculture. This figure rose by 7% between 2011 and 2020.

In 2020, China produced 43% of the world’s mussels, followed by the EU 27 (20%) and Chile (19%). Chinese production has increased by 24% in the past 10 years to 943,000 tonnes and Chilean production by 38% to 409,000 tonnes.

With a couple of exceptions, EUROSTAT data shows that overall EU 27 production has experienced a downward trend of 13% over the past 10 years, particularly in Italy (-36%), Ireland (-36%) and Germany (-35%). Bucking the trend was Greece, with an 11% increase.

The November 2022 European Market Observatory for Fisheries and Aquaculture Products (EUMOFA) report on mussels in the EU shows that EU 27 total production in 2020 was 430,748 tonnes, with Spain accounting for 47% of the total at 204,492 tonnes, followed by France at 61.378 tonnes (14%), Italy 50,913 tonnes (12%), the Netherlands 32,420 tonnes (8%), Denmark 28,548 tonnes (7%), Greece 19,155 tonnes (4%) and Ireland 14,729 tonnes (3%).

The UK no longer features in EU 27 data, but official figures put total production in England, Ireland and Wales at 12,000 tonnes in 2020, down -68% from 2011 and down 75% on the production high of 47,000 tonnes in 2013.

The EUMOFA report points out that Spain, as well as being the largest producer in the EU of the Mediterranean mussel (Mytilus galloprovincialis), has a significant mussel processing industry

Italy, which takes third place in terms of production and consumption of Mediterranean mussels, relies on three distinct growing methods and the majority of production takes place on the Adriatic coastline. Bottom culture is favoured in the lagoon areas of the Po delta, fixed poles in the sheltered lagoon and coastal areas in the south, and suspended longlines in the open sea.

Imports of mussels from third countries into the EU are considerably higher than exports and in 2021, the trade deficit in these molluscs was €104.4m (£62m). Mussel imports are predominantly (91%) processed products and in 2021, amounted to 43,000 tonnes with a value of more than €104114m (£100.3m). The majority are imported from Chile as a cooked product.

France and Italy are the main exporters of fresh mussels from the EU, while Spain and Belgium export prepared or processed mussels. Switzerland and the United Kingdom are the main importers of EU mussel production.

Belgium, with no production of its own, is highly dependent on imports from other EU countries, particularly the Netherlands, and was the largest importer in 2021.

Interestingly, apparent mussel

Above:

Right:

World mussel production continues to grow, but in the UK and Europe the industry is not doing so well. By Nicki Holmyard

How do we encourage people to eat moreTop left: Mussel farming in Jiangxi, China Mussels Mussel farming in France

consumption (production plus imports, minus exports) in the EU was estimated at 537,212 tonnes live weight equivalent (LWE) in 2020, giving an annual per capita consumption of 1.20kg. Apparent consumption in Spain was 167,403 tonnes LWE and 3.54kg per capita, followed by France at 127,337 tonnes LWE and 1.89kg per capita, then Italy with 103,328 tonnes LWE and 1.73kg per capita.

Ireland in contrast has a per capita consumption of just 0.38kg, with the UK slightly higher at 0.40kg per person per year.