Navigating Change:

• Sizing up tariffs, spending cuts and other policy changes

• What it means to the construction industry, the economy, and the American people

Advertise with Us

On

Hudson

and union leaders to

policy

and business owners, if they’re involved in construction they’re reading On the Level

To advertise with us or to learn more about our services and membership benefits, contact:

Robin Seidman, Editor: rseidman@ccahv.com

Millie Rodriquez, Advertising: mrodriguez@ccahv.com

Board of Directors

Construction Contractors Association

James McGowan — Board President

Joseph Perez — First Vice President

Josh Ingber — Second Vice President

Joseph Barone — Secretary/Treasurer

Mike Adams — Immediate Past President

Scott Dianis

Dan Depew

Louis Doro

Joe Jerkowski

Kurt Kaehler

Anthony Perrello, Jr.

Mark Stier

Alfred Torreggiani

Charlotte VanHorn

Fabricators, Erectors & Reinforcing Contractors Association

Justin E. Darrow — Chairman

Jake Bidosky — Vice Chairman

Bernie Hillman — Secretary

Daniel Teutul — Treasurer

Ron Olori — Trustee

SMACNA of Southeastern NY

Steve Mulholland — President

Dominick DiViesti — Vice President

William Haskel — Treasurer

Mark DiPasquale — Secretary

James D’Annibale — Immediate Past President

Louis J. Doro — Trustee and Chapter Representative

Walter “Chip” Greenwood — Trustee and Chair of SMACNA North East

Richard K. Berg — Trustee

Dan Harden — Trustee

Dennis LaVopa, Jr. — Trustee

Association Staff:

Alan Seidman — Executive Director

Robin Seidman — Marketing Consultant

Millie Rodriguez — Office Administrator

Director’s Message

Executive Director’s Ramblings

There’s lots of thoughts on transitions and gratitude going through my head right now.

To start with, Lisa Ramirez, our former magazine editor, left us for another position and I am very appreciative of her time and professionalism with us. I wish her well at her new job.

Secondly, I thank my wife, Robin, who I was able to coax out of retirement to fill in for Lisa. While many of you know that Robin had a long career in banking, her degree (and first job) was actually in journalism, so she will be putting together our On the Levels for the rest of the year. Robin has contributed articles in the past and also has done the magazine proofreading with Lisa.

Finally, myself! I’m the guy who thought I’d be here until I was carried out in a pine box. I’ve been at CCA for 16 years, originally taking the position and thinking I’d work 5 years and retire. Well, I’ve loved the opportunity and challenges so much, the clock just hasn’t ticked. Robin has finally convinced me that it is indeed time to move on to the next chapter of our lives.

As of December 31, I intend to step down as Executive Director of CCA. It has truly been an honor and privilege to work with so many Board Members through the years and I have enjoyed working with our members and union partners to advance union construction throughout our region. My career here has been such a rewarding experience due to all of you, our union leadership and my fellow association executives.

I am deeply grateful for the opportunities given to me throughout the years and certainly that gratitude extends to CIC’s Rose Pepe whose guidance (and patience) helped me when I started at CCA. There are so many to thank and I’m pretty sure it will fill up my columns for the rest of the year. But for now, John Cooney, CIC; John Delollis, NYC Walls and Ceilings; Don Fella, SMACNA Rochester, Earl Hall in Syracuse, Todd Helfrich, ECA and Aaron Hilger, formerly in Rochester, now CEO of SMACNA National, have been great resources on so many issues and have become personal friends as well.

As the Board begins a search for my successor, I look forward to working with that person to make sure CCA continues to be strong and supportive resource for our members, our elected officials and developers looking for quality projects!

With heartfelt appreciation,

Alan Seidman

Alan Seidman

Welcome to Our New Members

We are pleased to welcome the newest members to the Construction Contractors Association of the Hudson Valley:

Fisch Solutions provides high quality web and IT services. Based in New Windsor and with a staff of 20, Fisch services clients nationwide. In business for 15 years, Fisch Solutions maintains relationships with over 30 IT suppliers and vendors in order to give their clients efficient and professional solutions to their IT needs. With over 50 5-star reviews, Fisch has earned 3 national awards and 4 local awards – a testament to its commitment to providing outstanding customer service.

To learn more, visit Fisch Solutions at www.fischsolutions.com or call 845.237.0000 3188 Route 9W, Suite 1

New Windsor, NY 12553

EP George is a bonds-only agency focused on servicing the construction industry. The business model is based on experience, reliability and trust. By gaining the trust of both clients and the underwriters they work with, EP George establishes long-term relationships that enable construction clients to grow their business by obtaining the bonding program that fulfills their company’s needs.

To learn more, email info@epgeorge.com or call 914-829-8345

150 White Plains Road, Suite 106 Tarrytown, NY 10591

A good roof lasts

Theoretically, the Smoot-Hawley would have given American farmers an edge in the competition against their European rivals after World War I. However, in practice, the tariff had tremendous adverse effects on the global economy.

Smoot-Hawley had two significant impacts on the global economy. First, the bill added to the already deteriorating stock market as it progressed through Congress. Second,

and most notably, the law initiated a global trade war between the United States and its international trade partners. Countries immediately responded to Smoot-Hawley with their own retaliatory tariffs on American exports. In the end, American exports shrank by nearly 30 percent.

The ever-changing landscape of Trump’s tariff policy has left businesses and consumers scrambling to understand and prepare for its broader implications for the domestic and global economies. The Smoot-Hawley Act teaches the United States that tariffs are not the one-size-fits-all solution to restoring competitiveness with foreign businesses. Although the tariffs did not inherently cause the Great Depression, they added to the economic burden held on the world’s shoulders. This is an essential lesson for President Trump and Congress, considering the global economy recently suffered severe inflation and even, in some cases, a recession.

Trump’s Second-Term Tariffs — A Tentative Timeline

Before taking office for a second term, the President promised an additional 10 percent tariff on China and an additional 25 percent tariff on the United States’ neighbors, Canada and Mexico, on day one of his presidency. Jump to Trump’s Inauguration Day, however, and the 47th President postponed these tariffs to February 1st.

Immediately after Trump signed the executive order to implement these tariffs, Canada announced its retaliatory 25% tariffs on the United States. Although the China tariff went into effect on February 4th, President Trump did not levy tariffs against Mexico and Canada until March 4th. Then, two days later, the President reprieved the tariffs on Canada and Mexico again, following additional retaliatory tariffs from Canada, stock market losses, and criticism from major industry players. To top it off, the President levied a further 25 percent tariff on all steel and aluminum products — with copper’s inclusion in talks.

Although no one has a crystal ball to determine the economic impacts of these tariffs, historical evidence, including statistics from Trump’s first term, can assist in predicting the next four years of doing business in the United States.

continued...

“Who

Pays the Cost?”

Following the announcement of any central economic policy, especially tariffs, the typical question is who will inevitably pay the price. In their most straightforward terms, tariffs are taxes imposed on imported goods paid by the buyer at the time of customs clearance. So, while the importer pays for the tariff, it is more complex to determine who ultimately pays more.

If you ask President Trump, foreign exporters will pay the bill. Tariffs are integral to his America First economic playbook, which protects American jobs and grows the nation’s economy. Trump argues that tariffs pressure foreign exporters to make concessions with importers to remain involved in the American market.

Additionally, according to Trump, forcing foreign companies out will help restore manufacturing jobs to the workforce. The U.S. Bureau of Labor Statistics’s 2024 data shows that American manufacturing jobs fell from 22 percent to roughly 7 percent since 1965. By eliminating the low costs of foreign goods from the domestic market, American manufacturers will have a more substantial presence, raising demand and job growth. However, economists generally agree that American consumers will pay most of the cost of tariffs. Although the importer pays the bill at the border and absorbs some of the cost, higher consumer prices often offset the rest.

President Trump risks heightening the prices of groceries, automobiles, and housing by targeting Mexico and Canada. Similarly, increased tariffs on China will impact the cost of items from toys, clothes, and electronics. The Yale Budget Lab estimates that Trump’s 20 percent tariffs on China and 25 percent on Canada and Mexico will cost the average American family up to $2,000 annually.

The Cost to Construction

Tariffs pose a significant risk to the cost of construction projects from planning to implementation. Most notably, they will skyrocket raw material costs. As mentioned, President Trump specifically targeted foreign lumber, steel, and aluminum in his second-term tariff policy. Canada is one of the United States’s top providers of all three raw materials. As a result, the industry will be forced to pay higher prices or develop strategies to use domestic materials.

The construction industry saw this cause-and-effect scenario following Trump’s 2018 tariffs on steel and aluminum. Although the country saw a 6 million metric ton increase in steel and a 350 thousand metric ton increase in aluminum in 2019, prices did not see a decline. American steel and aluminum prices rose 5 and 10 percent, respectively, within the first month of the 2018 tariffs. After a few months, prices began to decrease, but at a slower rate than their increase. Still, American steel and aluminum never fell below the average global prices.

The exact costs of Trump’s tariffs are as unclear as the President’s tariff policy. However, the National Association of Home Builders estimates that tariffs on lumber, aluminum, and steel could increase home construction costs by $9,200 per home. In February, input costs were recorded to have increased by 0.5%, including an 11.7% increase in softwood lumber prices. How these price hikes might exacerbate construction costs and the already expensive housing market is unknown.

The Cost of Uncertainty

Whether you are a Republican or Democrat, we can all agree that uncertainty is the only certainty about President Trump’s tariff policy. While this may benefit Trump’s negotiating power with foreign countries, it can limit long-term planning for businesses of all sizes. Trade policy uncertainty may directly undo any progress President Trump attempts to make on the American manufacturing industry.

Oxford Economics studied the sharp rise in global trade uncertainty for its March 18th global report. In the briefing, Oxford dissects the endless implications of elevated uncertainty, including deferred investment, hiring, and significant spending until the dust has settled. The most notable finding from Oxford’s study was that Trump’s volatile tariff policy would decrease US business investment by 4% in 2025. If Trump’s uncertainty extends beyond the year, disinvestment will grow exponentially globally.

Trade policy uncertainty directly limits a company’s long-term decision-making ability, especially in the manufacturing sector, where stability and predictability are paramount. Manufacturing companies depend on global supply chains for raw materials, unfinished products, and critical components. When trade policy remains uncertain, these companies are disincentivized to ramp up production schedules, determine pricing strategies, and invest in raw

materials like lumber, steel, and aluminum. In short, the industry is forced to take business planning on a day-to-day basis, halting major long-term decisions.

While Trump argues that tariff policy will incentivize businesses to bring back American manufacturing jobs, uncertainty is destined to stagger his aspirations to rework the American economy. Companies cannot design a large-scale plant relocation strategy without a clear regulatory roadmap to guide them. Why rework a manufacturing regime if these tariffs will be temporary or may not even happen in the first place?

Second, fluid tariff policy obscures educated decision-making about training and recruiting the growing demand for workers. There is no question about it: new manufacturing plants equal new manufacturing jobs. What remains unanswered is whether the American workforce can meet this labor demand alongside Trump’s sharp pivot back to a manufacturing economy.

The manufacturing industry depends on welders, fabricators, electricians, and many other workers trained explicitly in specialized skills. However, ongoing uncertainty discourages investment in workforce development programs and apprenticeships. Additionally, many skilled trades require apprenticeship programs lasting three to five years. Like business owners, prospective apprentices may lack conviction in pursuing a trade if the demand for that skill set depends solely on turbulent economic conditions.

Overall, neither employers nor workers can make long-term investments in the domestic manufacturing industry without confidence in the economic landscape. These decisions, such as relocating a business and planning a career path, take time and security. Reigniting the United States’ manufacturing prowess begins with a clear, consistent tariff policy.

A former NYS Senator, David Carlucci is the founder of Carlucci Consulting that assists companies in effectively navigating government while developing business. He is a frequent guest on Fox News and other television stations.

Join CCA

Since 1956, the CCA has had a hand in almost every significant construction project in the region. With a commitment to providing quality management together with outstanding local labor, CCA members get the job done right, on time and within budget.

The

The power and leverage of strong relationships with state, local and federal officials Project leads

• Exclusive networking and informational opportunities

• Inclusion in the CCA’s directory of contractors, suppliers and service providers The support of the CCA’s expert staff

• Money saving support of the CCA’s labor expertise regarding compliance, wage and fringe issues, and grievances

Competitive health insurance plans with premium rates not available on the open market

• Access to exclusive networking events Retirement planning

Central Hudson is More than a Utility Company Member Spotlight

By Robin Seidman

There are some things we just take for granted. Walking into a dark room and hitting the light switch. Voila! Lights come on. Entering a cool house during the dog days of August thanks to air conditioning. When outside wintery temperatures make the hardiest of us shiver, it is toasty warm inside with just a turn of the thermostat. Yes, we are spoiled.

If it’s magic then the magician is longtime CCA member, Central Hudson, who supplies us with electricity and gas to keep our lives humming along.

A member since 1985, Central Hudson is celebrating its 125th anniversary with the same unwavering dedication to providing safe and reliable service to the community. It’s a big community too with a service area that extends from the suburbs of New York City north to the capital district of Albany.

The story began in 1900 when three men, Thaddeus Beal and his father, William, along with John Wilkie purchased two power companies to provide electricity and gas to 5,000 Newburgh customers. Over the next 25 years, the men widened their vision and consolidated more than 80 electric and gas companies into the Central Hudson Gas & Electric Corporation.

Fast forward to 2000 when The CH Energy Group, Inc. was formed as the parent company to Central Hudson Gas & Electric and ultimately, in 2013, both entities joined Fortis Inc.’s federation of utility companies. That fortuitous move provided Central Hudson with the capital needed to make infrastructure improvements that passed nearly $50 million in financial benefits to its customers.

With an eye on the environment, Central Hudson is committed to reducing its carbon emissions and providing cleaner energy by upgrading electric and transmission lines, integrating natural gas benefits and using smarter technology to ensure our energy system is sustainable and reliable.

“Central Hudson benefits immensely from the collaborative spirit and shared expertise that comes from being a member of the CCA of the Hudson Valley. The association's commitment to excellence and innovation in construction fosters a strong network of

Central Hudson is More than a Utility Company

professionals dedicated to the growth and development of the region,” Steph Raymond, President and CEO of Central Hudson said. “Together, we are building a brighter, more sustainable future for our community."

Because Central Hudson supports more than 5,000 jobs in the region, its employees and partners are part of your community. They live, work and shop where you do. Their children go to local schools, the families worship in local churches. The company and its employees support non-profit organizations both with money and sweat equity. To stress that commitment, Central Hudson is celebrating its 125th anniversary with the community by performing 125 acts of service and donating up to $1 million to organizations that provide support for those in need. That’s the sure sign of a good neighbor.

In addition, Central Hudson provides a number of other programs to benefit its customers:

• Ambassador Programs

• Economic Development Programs

• Matching Gift Programs

• Non-profit Partnership Programs

• Services for Seniors

The company has also assisted outside of our local community by sending help to areas that have been devastated by natural disasters. Central Hudson recently received the Edison Electric Institute’s Emergency Assistance Award after sending crews to Georgia to help restore electric service to customers after the area was devastated by Hurricane Helene.

CCA Executive Director Alan Seidman has this to say about 40-year member Central Hudson: “Central Hudson has been not only an energy provider for our region but is a premier investor in economic development. The investment and commitment Central Hudson has made to our regional growth has helped to create jobs as well as decades of building projects which have provided opportunities for our members.

We are proud to have Central Hudson as a 40- year member and are truly appreciative to their commitment to economic opportunities for businesses to locate, build and grow here.”

3. I am contracting with the federal government and am now subject to tariffs and rising material costs, what can I do?

There are three clauses in Federal Acquisition Regulation (“FAR”) contracts that may be used to recoup the rising costs of materials that has resulted from tariffs. Whether acting as a contractor or subcontractor, SMACNA members should look to the language in their existing contracts to determine whether they contain provisions that permit price adjustment. If helpful provisions do not exist, they should be added to future contracts.

New Tax Provision Adjustment

FAR 52.229-3 provides that “the contract price shall be increased by the amount of any after-imposed Federal tax, provided the Contractor warrants in writing that no amount for such newly imposed Federal excise tax or duty or rate increase was included in the contract price, as a contingency reserve or otherwise.”

For a tariff to be considered a newly imposed tax, the tariff must be implemented after the date set for bid opening or, for a negotiated contract or modification, after the effective date of the contract or modification. It is important to pay careful attention to this timeline when submitting bids because tariffs imposed after bid submission, but before contract award, will not be considered newly imposed. Further, contractors should also keep in mind that FAR 52.229-3 requires prompt notification of “the Contracting Officer of all matters relating to any Federal excise tax or duty that reasonably may be expected to result in either an increase or decrease in the contract price” and that the contractor “take appropriate action as the Contracting Officer directs.”

Overall, this means that if FAR 52.229-3 is in the contract (or is a mandatory clause under federal regulations) and the contractor provides prompt notice to the Contracting Officer that the new tariffs “reasonably may” affect pricing, the contractor may be entitled to an adjustment to account for the increased costs. More specifically, pursuant to this clause, increased costs resulting from Executive Order No. 14193 titled “Imposing Duties to Address the Flow of Illicit Drugs Across Our Northern Border” are likely recoverable to the extent the effective date of the contract or modi-

fication is before February 1, 2025, and the contractor provides prompt notification. However, it should be noted that FAR 52.229-3 only protects contractors against tariffs that they pay directly, meaning that it does not protect against tariff-driven cost increases that contractors incur on domestically produced goods.

Economic Price Adjustment Provision

An economic price adjustment clause, including FAR 52.216-4, may be another option if it is included in the contract. FAR 52.216-4 provides that contractors may, at any time during contract performance, notify the Contracting Officer if the unit prices for material shown in the schedule either increase or decrease. Increased prices that are the result of a tariff arguably fall within the scope of this economic price adjustment provision. Notification must be provided within 60 days after the increase, or within any additional period that the Contracting Officer may approve in writing, but not later than the date of final payment under the contract. The notice must include the contractor’s proposal for an adjustment in the contract unit prices to be negotiated as well as supporting data explaining the cause, effective date, and the amount of the increase and the amount of the contractor’s adjustment proposal.

Promptly after the Contracting Officer receives the relevant notice and data, the Contracting Officer and the contractor shall negotiate a price adjustment in the contract unit prices and its effective date. However, it should be noted that the aggregate of increases is usually limited to 10% of the original unit price. Additionally, the contractor shall continue performance pending agreement on, or determination of, any adjustment and its effective date.

However, even if a construction contract contains a price escalation provision, there is no guarantee a contractor will recoup all additional costs incurred resulting from material cost increases. The precise wording of the provision and any requirements placed on the contractor must be examined closely for the contractor to take full advantage of the provision. For example, many escalation provisions require the contractor to give the owner notice of a price increase in order to receive an adjustment of the contract price. Other escalation provisions may impose other duties on the contractor or may only offer adjustment of the contract price for increases to specific, predetermined construction materials. As always, careful reading of the controlling contract language is crucial.

Force Majeure Clause

Force majeure clauses may offer another route for addressing the increase in material costs. A force majeure clause is defined by Black’s Law Dictionary as a clause “allocating the risk of loss if performance becomes impossible or impracticable, especially as a result of an event or effect that the parties could not have anticipated or controlled.” Similar clauses are also described as “Act of God” clauses. The goal of these two clauses is essentially the same – to protect a party when events occur outside of that party’s control.

Generally, simply because a product is more expensive does not make it “unavailable,” for purposes of force majeure. As such, courts generally will not enforce force majeure provisions where government action, such as the imposition of tariffs, has resulted in the increased cost of performance. Contractors often bear the risk of loss for additional costs due to force majeure events unless the contract specifically shifts the risk to the owner. Thus, while owners may be required to grant time extensions, contractors are often not entitled to additional compensation for the increased costs unless the contract explicitly states otherwise.

Because increased material costs are generally not considered force majeure events, parties look to other methods of capturing increased costs, like cost plus

contracts or price escalation provisions. Moreover, in this situation, increased tariff costs have been discussed for years, and, thus, it is not likely to be considered an “unanticipated” event triggering a force majeure clause.

Contractors should consider explicitly including governmental imposition of tariffs in the clause’s list of force majeure events in order to shift the risk associated with the future imposition of tariffs to the owner. The clause should clearly and specifically allocate the risk by referring explicitly to tariff-based “unprofitability,” “economic hardship,” or “market fluctuations” as an excuse for nonperformance.

Impracticability/Impossibility Defenses

Although not a contract clause, the common law recognizes “impracticability” and “impossibility” as defenses to nonperformance under a contract resulting from substantial material cost increases. While “impossibility” and “impracticability” are technically separate legal defenses, their definitions are quite similar, and the application of both defenses often overlaps in case law.

The impossibility doctrine operates to discharge a promisor’s performance when an event arises, after formation of the contract, making it no longer possible for the promisor to perform their obligations under the contract. Similarly, performance under a contract may be excused if performance “becomes impracticable in the sense that performance would cast upon the promisor an excessive or unreasonably burdensome hardship, loss, expense, or injury.” As such, contractors may attempt to use these defenses to argue that the dramatic rise in material costs has created impossibility of performance.

However, if the circumstance giving rise to nonperformance under the contract was foreseeable by the promisor at the time of entering into the contract, impossibility will not excuse the promisor’s performance. Owners may argue that contractors have long been alerted to the possibility of tariffs that could significantly increase the cost of their materials. Furthermore, the fact that performance under the contract is less profitable than a party expected typically does not by itself relieve a party of performance.

However, if a party can show that material costs have risen to the point where the party’s performance under the

5. Strategies for Managing Supplies?

Traditionally, contractors try to limit the amount of materials they are holding in inventory. The potential significant increases in prices as a result of tariffs could cause contractors to consider holding materials beyond traditional levels. Obviously, this represents both a business risk and opportunity which contractors need to carefully balance and consider.

Additionally, one of the goals of imposing tariffs is to encourage purchasers to buy products from U.S. suppliers. The challenge is establishing new relationships and obtaining timely shipping with domestic suppliers who are experiencing increased demand as a result of the tariffs.

If timing is crucial on purchases, contractors should consider including liquidated damages clauses to compel domestic suppliers to meet delivery timing requirements.

contract is “excessive and unreasonable,” impracticability may allow the contractor to be excused from performance. Courts have not established a clear threshold for an increase in financial burden, or accompanying decrease in profit, that would qualify as impracticability/impossibility and excuse a party from performing under a contract. However, as a general rule of thumb, courts will typically not recognize an impossibility unless the cost exceeds 100% of the contract price. The determination of whether a material cost increase constitutes impracticability or impossibility is a fact-specific determination that will vary by jurisdiction.

6. What are the tax consequences of tariffs?

Contractors who invest in equipment can use IRS Section 179 deductions to immediately write off qualifying expenses rather than depreciating them over time. This helps offset higher costs caused by tariffs on imported machinery. However, expenses that may be deducted are capped by statute. For 2025, businesses can deduct up to $1,250,000 in qualifying purchases immediately. The equipment must be (1) placed in service during the 2025 tax year, (2) used for business purposes more than 50% of the time, and (3) qualify under IRS guidelines. The Section 179 deduction begins to phase out when the equipment purchases exceed $3,130,000. A Section 179 deduction cannot exceed a business’s net taxable income. However, if the Section 179 election exceeds taxable business income, a partial Section 179 election may be utilized. Any unused portion of the deduction carries forward to subsequent tax years, meaning it applies once there is sufficient income.

7. I am a contractor performing work in Canada, what can I do in response to rising costs from tariffs?

Tariffs mandated by both the United States and Canada will likely have a significant impact on the Canadian construction industry, including increasing prices, potential delays to projects, and uncertainty in budgeting and pricing projects. The following are important considerations for contractors involved in the Canadian construction industry.

Current Projects

Contractors should first review their agreements to determine which provisions may already respond to increased tariffs. Standardized contract documents developed by the Canadian Construction Documents Committee (“CCDC”) often include provisions that provide for an increase or decrease to the contract price if duties change after bidding closes.

The CCDC 2 and CCDC 14 are fixed price contracts and contain provisions relating to the handling of changes such as tariffs. Under these provisions, any increase or decrease in costs to the contractor due to changes in taxes and duties after the time of the bid closing shall increase or decrease the contract price accordingly. However, some uncertainty remains as to whether tariffs meet the definition of a tax or duty. If tariffs fall under the definition of a tax or duty, then this provision directs that the risk of price increases be borne by the owner, not the contractor.

Additionally, the CCDC 2 includes a provision which states that if, subsequent to the time of bid closing, changes are made to applicable laws, ordinances, rules, regulations or codes of authorities having jurisdiction which affect the cost of the work either party may submit a claim. Unfortunately, this

provision does not clearly state who will bear the burden of increased costs associated with tariffs. Instead, it refers the parties to follow a procedure which ultimately fails to clarify under which circumstances contractors ought to reasonably request a change in contract price under this provision and how this change in price ought to be calculated.

The CCDC 14 contract also has a provision stating that the contract price shall include all taxes and customs duties in effect at the time of the proposal or bid closing. Further, the provision provides that any increase or decrease in costs to the design-builder due to changes in such included taxes and duties after the time of the proposal or bid closing, as the case may be, shall increase or decrease the contract price accordingly. As such, any additional customs or duties that are not in effect at the time of the bid would be paid by the owner.

The CCDC also publishes cost-plus contracts such as CCDC 3 and CCDC 5B. Under these contracts, the construction manager is required to pay all customs, taxes, and duties during the performance of the work. As such, the contractor is entitled to pass along all customs, taxes, and duties to the owner, including price increases due to new or increased tariffs.

More generally, contracts may include change-in-law provisions which are designed to address cost increases due to tariffs or other similar legislative impacts. The wording of these clauses can vary significantly from contract to contract. However, they generally entitle the contractor to relief where there is a change in the applicable laws of Canada after the effective date of the contract. Unfortunately, because the threat of tariffs by the United States and Canada has been looming for some time, it may be difficult to support a change-in-law claim if the contractor knew or should have reasonably anticipated the tariffs prior to signing the contract.

Future Projects

For parties negotiating a contract with knowledge of actual or potential tariffs, it will be especially important to specifically address the potential cost increases and

other impacts. Contractors should consider expressly addressing the allocation of the risk of tariffs and price increases by including contractual provisions stating how any increase or decrease in tariffs applied after bid closing will impact the contract price, cost of the work, or other compensation. Alternatively, contractors may also consider including contractual provisions that outline a process for the parties to consider and pursue alternative options should tariffs cause an increase to the project costs. Such provisions should include notice requirements, a process for considering options, and timing for the application of any changes in pricing. Ultimately, proper allocation of risk through careful contract drafting will help manage expectations and ensure that performance proceeds even in the face of unforeseen circumstances.

Felhaber Larson is outside general counsel for SMACNA. If you have questions about this article, please contact its authors Stephen Yoch (syoch@felhaber.com) or Alexandra (Ally) Diwik (adiwik@felhaber.com).

Here to help with what matters most to you

The Chrys Group

Michael Chrys, CIMA®, CPFA™ Managing Director Wealth Management Advisor

518.782.4094

michael_chrys@ml.com

Merrill Lynch Wealth Management 26 Century Hill Drive Latham, NY 12110

Merrill Lynch, Pierce, Fenner & Smith Incorporated (MLPF&S) is a registered brokerdealer, registered investment adviser, and Member SIPC. Bank of America, N.A., Member FDIC and MLPF&S are wholly owned subsidiaries of Bank of America Corporation.

The Bull Symbol and Merrill are registered trademarks of Bank of America Corporation. CIMA® is a registered certification mark of the Investments & Wealth Institute®. For more information about the Institute and the CIMA certification, please visit investmentsandwealth.org.

© 2025 Bank of America Corporation. All rights reserved.

MAP6209646 | AD-01-25-2223 | 470944PM-0124 | 01/2025

PROVIDING EXPERT VERTICAL ACCESS SOLUTIONS

Service Scaffold Company Inc is one of the fastest-growing independent scaffolding companies in the Tri-State Area offering innovative and cost-effective scaffold access and protection solutions to major residential, commercial, civil and industrial customers.

With over 60 years of experience, our talented team has the strength and resources to deliver competitive custom scaffold solutions for any size project. Whether it’s designing and installing scaffold equipment for a large urban building or coming to the aid of a client to erect an emergency sidewalk canopy, we can deliver access and protection.

• Mast Climbing Work platforms

• Construction hoists and transport platforms

• Supported Scaffold

• Temporary Stair Access

• Sidewalk shed and overhead protection

• Shoring

• Wall bracing • Trash chutes

• Horizontal netting

• Temporary weather enclosures

Resorts World Hudson Valley

Simon Property Group Woodbury Common Premium Outlets

How Will Tariffs Impact the Construction Industry?

By Thomas Zupan, CPA, Partner, RBT CPAs, LLP

The United States economic landscape has seen a great deal of change over the last few months since the arrival of the new administration. One of the most widely discussed and debated acts by the White House has been the enactment of significant tariffs on imported goods. The impact of the new trade policies can already be seen in the construction industry, taking the form of rising material costs and supply chain disruptions. The construction industry may be hit hard by the new tariff policies, but there are ways for contractors to prepare for the changing trade situation and remain resilient despite logistical challenges.

Since January, the U.S. has announced tariffs on goods imported from Canada, Mexico, and China. The U.S. has also reinstated a 25 percent tariff on steel imports and increased the tariff on aluminum imports to 25 percent. Several countries have responded to these measures with retaliatory tariffs on U.S. goods. The newly imposed tariffs will likely impact the construction industry in significant ways, with some effects already taking hold.

The most obvious impact of the tariffs is the likelihood of increased material costs. According to the National Association of Home Builders (NAHB), “approximately 7% of all goods used in new residential construction originate from a foreign nation.” Costs of certain materials began rising even before the new tariffs took effect, due to widespread anticipation of the new trade policies. Materials impacted by the recent tariffs include lumber, gypsum, steel, iron, aluminum, and cement.

Increased material costs could force contractors to either absorb the additional costs or pass them on to their customers. Contractors with fixed or maximum price contracts may be unable to pass on increased costs onto customers, forced instead to take the financial hit themselves. Cost increases and escalating tensions with trading partners may also impact supply chains, leading to potential disruptions, delays, and/or shortages. These disruptions could in turn lead to delays in project deadlines,

and uncertainty surrounding future material costs may lead to difficulty estimating project costs.

The current uncertainty surrounding the tariffs and retaliatory measures by other countries makes it hard to predict the full effect of these policy changes. However, there are ways contractors can prepare for the impact of tariffs. Business owners should identify which of their sources and materials will be affected and assess the potential cost impact of the new tariff rates. To offset higher material costs, contractors may consider raising prices strategically while maintaining transparency with clients.

To avoid the new tariffs altogether, businesses may consider alternative sourcing, domestic suppliers, and the use of alternate building materials. Diversifying suppliers helps to strengthen the resilience of supply chains against unpredictable events and circumstances. Contractors should also meet with their legal counsel to review their contracts and contract language. Fixed-price contracts present financial risk for contractors, especially during uncertain economic times. Business owners, under the guidance of their attorneys, might consider adjusting contract language to include protective clauses such as price escalation clauses and change-in-law clauses. These clauses help to protect businesses from factors outside of their control such as unexpected changes in material costs and law changes.

Lastly, contractors should stay informed of the latest tariff developments, as the situation is developing rapidly. The new tariffs may present significant challenges to the construction industry in the coming years, but U.S. businesses can weather the storm of changing trade policies by rethinking their sourcing, improving supply chain resilience, and innovating their business strategies. Planning ahead with financial and legal advisors—and adjusting your business strategies accordingly—will help to minimize the risk of disruption to your operations in the face of the new tariffs.

An Economy in Unrest: Understanding the Impact

of Tariffs on Business

By Gus Scacco CEO & Chief Investment Officer

Valley Investment Advisors, Inc.

We are in a period where the economy seeks clarity from tariff risk. The economy's direction is clouded as the tariff threat limits company investment plans and impacts potential costs. Competitive positioning of industries and companies around the world may change. As we write this, the situation is very fluid; the Trump

Administration is now indicating that a more targeted approach will be implemented on tariffs. Equity and bond markets, inflation, and GDP are all influenced by the back-and-forth situation in the short term. Longer term we would expect an adjustment period for markets until a normalization under the new cost structure is in place.

Hudson

Tariffs — Unsettled Times

Fixed Income Markets

• First, as markets are uncertain, they often are more volatile. This can prompt a flight to safety and often provides an increase in demand for government bonds in places like the United States, which is stable.

• Spreads (higher yields relative to Treasuries), with an increase in perceived risk, would widen and higher risk companies would get hurt by the change.

• Interest rates and prices - If inflation were to increase, you could see the Federal Reserve raise rates to limit the impact, or if the economy was slowing, the Fed could cut rates to increase demand.

Inflation

• Tariffs tend to be inflationary, though the magnitude depends on how they are put in place and the current economic environment.

• Increasing the cost of imported goods via tariffs can directly raise prices for consumers. As an example, if tariffs are added to Chinese electronics, the impact would be an increase in the cost of smartphones and laptops. This potentially would decrease demand.

• Additionally, if domestic producers see an increase in demand, they may increase prices, pushing up inflation in domestic markets.

GDP

• With domestic substitution, local production can gain demand, and it may take time to meet this new level of need. Other goods can potentially fill the requirement, limiting the impact of a reduction in direct supply.

• Retaliation risk can occur if trading partners impose or raise current tariff levels and can reduce GDP levels. This is prevalent with agricultural products.

• Short-term trade quantities are often impacted by higher prices resulting in reduced volumes and a reduction in GDP on a worldwide basis.

• Overall, most international groups that attempt to forecast the global economy (WTO, IMF) will see a reduction in GDP growth. Both the aggressor and receiving countries would see a hit to their economies.

Finance

• Financial institutions may slow lending, waiting until a better understanding of pricing and economic impact is in place.

• Rates and inflationary levels would take into account the higher costs that companies would have to adjust to.

Big Picture

• Will tariffs be targeted and have a limited impact?

• Reaction from Central banks may include an increase in money supply to offset some of the drag from tariffs.

• A major economy that implements tariffs may see an impact that hits a major industry, causes offset implications elsewhere.

• Tariffs can impact equity markets (both positively and negatively) with pressure on rates, risk, inflation, and GDP growth.

Impact on trades

• Higher costs will raise inflation on a one-time basis unless there is back and forth retaliation.

• There could be a significant impact on estimating, pricing, and the number of jobs put out to bid, potentially at higher cost.

• Those higher costs can lead to fewer jobs.

• The substitution for things like fixtures, structural wood, drywall could have a major impact on pricing a new job.

• Greater use of technology may be implemented to bring down costs.

• Capitalization rates on projects would decline, possibly impacting funding from lenders.

Overall, we are in a period where we are waiting for direction from our political leadership. Keep in mind that U.S. is very entrepreneurial and flexible. We would expect a combination of efforts to limit costs and adjust to the new realities of trade and the impact on industry.

Gus Scacco has been the Chief Executive Officer and Chief Investment Officer of Hudson Valley Investment Advisors (HVIA) since 2015 and Portfolio Manager on HVIA’s mutual fund (HVEIX) since its inception. He has over 30 years of experience as a portfolio manager and analyst in both the institutional and high-net-worth markets. Gus is a regular guest on Fox Business talking about the markets. When he’s not looking after portfolios, Gus is active as a board member for both public and not-for-profit organizations.

You Did What???

By Robin Seidman

Making mistakes is never fun. Sometimes it can be downright humiliating. Yet, mistakes are a part of life which we explain by saying “stuff happens.” Although “stuff” is usually replaced by more colorful language.

In the business world, mistakes can be costly. A transposition on an invoice, a wrong order, a forgotten phone call, the list is endless and the cost can be monetary, reputational or both.

So we try to mitigate errors by implementing policies, writing procedures, sending emails and literally bombarding our staff with information that in the end, doesn’t account for plain old human error. Whether the mistake is caused by lack of attention, lack of training or lack of common sense, the end result is the same and damage control begins.

The first step is to rectify the business end of the mistake. Whether it is a customer, client, vendor, provider or colleague, admitting an error has been made and having a solution in mind goes a long way in patching relationships. Dancing around the mistake, placing blame where it doesn’t belong or throwing an employee/colleague under the bus really doesn’t help and may make the situation even worse. Just like your grandmother told you, honesty is the best policy and prevents you from digging the hole a little deeper.

Once that is under control, the internal investigation begins. How did the mistake happen and how do we prevent it in the future? Coaching and training may be needed, a revision of procedure or a team meeting. Unless the error is egregious, suspension, demotion or termination of an employee might not be the best way to go; it’s almost like throwing away the baby with the bath water. Think of recruiting a new hire, training, and the learning curve, and it might make sense to take a deep breath and instead keep a watchful eye on the team.

Motivational speaker and author, Glenn Shepard, in his weekly newsletter, talks about an employee who made a mistake that cost a small business company $600k and when asked if the owner was going to fire the employee, the owner replied, “I just spent $600k training him. Why would I fire him now?” That small business is now known as IBM!

Glenn has promoted the idea that there is a way to make mistakes the right way and has developed his 10 Commandments that both bosses and subordinates should follow.

Glenn’s Ten Commandments for Making Mistakes the Right Way

1. They’re reasonable mistakes; not carelessness.

2. No one gets physically hurt by them.

3. You catch your own mistakes.

4. You correct your own mistakes.

5. You accept responsibility and don’t blame others.

6. You don’t make excuses.

7. You don’t hide your mistakes from your boss.

8. You learn from them.

9. You don’t keep repeating the same mistake.

10. You apologize when it’s appropriate.

Make sure your team knows you have an open-door policy so they feel empowered to come to you. Nip the mistakes in the bud before they become overwhelming issues.

By the way, Glenn Shepard’s weekly email Work is Not for Sissies is a great tool for improving the dynamics of the workplace. Take a look at www.glennshepard.com.

After 24 Years, Maureen Halahan to Retire In the News

With Halahan at the helm, the Orange County Partnership has become a pivotal part of economic development in the region.

The Orange County Partnership, a premier economic development organization, has announced that Maureen Halahan, its President and CEO, will retire in June of this year after 24 years of exceptional leadership. Throughout her tenure, Halahan has played a pivotal role in positioning Orange County, NY, as a key destination for national and international business, driving job creation, significant tax revenue, and billions of dollars in capital investment.

Under Halahan’s stewardship, the Partnership has experienced remarkable growth, attracting major development projects such as Legoland New York, CPV Valley Energy Center, Amazon, Tesla, Pratt & Whitney, Medline Industries, and President Container Group, among others. These high-impact projects have resulted in the creation of thousands of jobs, the development of critical infrastructure, and billions of dollars in private investment. Additionally, local school districts and municipalities have benefited from hundreds of millions of dollars in tax revenue generated by these transformative developments.

Halahan’s leadership has been a cornerstone of the economic revitalization not only in Orange County but across the entire Hudson Valley. Her vision and strategic guidance have helped shape a thriving, resilient regional economy.

In addition to her work at the Orange County Partnership, Halahan has served for over 13 years on the Mid-Hudson Regional Economic Development Council, offering invaluable insights and fostering regional collaboration to support business growth.

"I have been privileged to lead the Orange County Partnership for 24 years," Halahan remarked. "I take immense pride in what we’ve accomplished.”

Halahan is also known for her talent in identifying and nurturing leadership. Many of those who have worked with her at the Partnership have gone on to hold influential positions in the private, nonprofit, and government sectors. She recruited Conor Eckert only 3 years ago with the intention of working closely with him as her successor. His experience and vision will continue to elevate the Partnership to even greater heights.

Throughout her career, Halahan has emphasized the importance of collaboration. As she often says, the work of the Partnership is a true team effort, bringing together local labor, consultants, municipal leaders, government officials, financial institutions, suppliers, utility companies, and everyone involved in strengthening the local economy.

Reflecting on her work, Halahan said, "Working in the region where I was born and raised, with people I admire and respect, has been one of the greatest privileges of my life. I’ve received far more than I’ve given along the way. The Partnership’s reputation for having a strong and influential board of directors has been the cornerstone of the overall success of the organization for nearly 40 years.”

Maureen proudly serves as a Board Trustee for Ulster Savings Bank, a community-focused institution that reflects her strong commitment to giving back to the communities it serves. Her role as a Trustee allows her to contribute to the bank’s mission of fostering local growth and supporting financial well-being. In addition to her position at the bank, Maureen will also be providing consulting services, offering her expertise to organizations seeking guidance and strategic insight.

NYS Paid Emergency Leave Expires

The law requiring New York State Paid Emergency Leave for COVID-19 expires effective July 31, 2025. Thereafter, employees will need to use their existing paid leave including, but not limited to, New York State’s Paid Sick Leave (for private sector employees), for COVID-19 -related absences.

Voters Approve Major Improvements for the Pine Bush School District

Votes in the Pine Bush School district approved a two-part capital improvement proposition on March 4, 2025. The propositions totaling over $70 million cover sweeping infrastructure upgrades as well as a multi-purpose athletic facility at the Circleville Middle School and new technology equipment in all schools.

Some of the upgrades are heating and cooling improvements that include air conditioning in the

cafeterias and gyms. New elevators, repairs and upgrades to the building roofs, fire alarms and floor and window replacements where needed.

A large part of the improvements will be paid through state aid, the district’s capital reserve and retiring debt.

A start date for the work to begin has not yet been determined.

Don’t be Held Captive by Zoning

Be Creative. Solve the

problem.

By Dan Depew Director of Business Development Holt Construction

A key leader in economic development recently asked me why, in the Town of Wallkill, warehouses require Town Board approval for a floating zone in a district which is called Office/Research?

I get these kinds of questions every now and then because, as Wallkill’s former Town Supervisor, people think I might have the answer. This time I did, and the answer was simple.

About 10 years back, Wallkill was experiencing the beginning of the “office exodus.” The vacancy rate in our Office/Research Zone was significant and the amount of undeveloped land in that zone was even greater.

Don’t be a Held Captive by Zoning: Be Creative. Solve the problem.

Their guidance is important but challenge them to help find creative solutions. The best municipal attorneys can find a legal way to deliver a result versus those who will simply tell you it’s impossible or you could get sued. Truth is you can get sued for almost anything you do or don’t do - the real question is who will win.

Lastly, if your zoning board often grants variances, it may be time to assess your zoning and see if you should be allowing what they’ve been approving. Why make an applicant go to the ZBA - wasting time and money - when the zoning is outdated, and simple tweaks can relieve the inconveniences.

Each year, the town or village board should ask the zoning board for recommendations based on their experiences then consider making the necessary amendments to stop the madness.

Create a Floating Zone

A floating zone - which creates the criteria in which a town board may consider a project in a defined zone without blanketly putting the use in the zone - is a great way to give an elected board some say in key projects.

Remember, once you make a zone change and allow a use, the planning board is almost bound to approve that use. Floating zones, though, allow for political discretion - a good thing for both the public and applicants. If the project has merit it will get the floating zone overlay approved.

There are many scenarios in which a floating zone may resolve problems, including blighted areas and

areas where there are a lot non-conforming or failing buildings. Getting creative with how to use a floating zone to capture market development opportunities and redevelop stagnant sections of communities should be a tool in every municipality's pocket.

If your zoning doesn’t permit the type of development that the market is searching for, opportunities will pass right by without even stopping to kick your tires. An established floating zone designed for flexibility can help. There are great legal firms here in the Hudson Valley that can help create one. You can keep your attorney but just hire the other firm to help you with this concept (it’s called special council).

Towns, villages and cities hold the key to their own future; their vision for their community is expressed in their zoning and in the infrastructure they create to support it. At the CCA and the building trades, we are all too often asked to support controversial projects. But what if we helped communities identify ways to capture opportunities ahead of time?

The CCA is a construction-based organization; nimble zoning practices lead to more jobs for our members and create vibrant communities we can be proud of. But we can’t do this without the support of great municipal leaders who work with legal and engineering professionals to free up process and zoning.

If you are interested in getting a reference to some of the best in the business or want to talk about solving problems with zoning, please reach out. I am always willing to give ideas and guide you to great firms.

Dan Depew has a degree in Political Science and International Relations and has been a municipal leader in several levels of local government in the Hudson valley for over 20 years. He has been a leader in the community serving on several boards and as a keynote speaker on various topics affecting the Hudson Valley, national issues and leadership development. He is currently the National Business Development Director with Holt Construction.

And it’s incredible in here.

Our teams are dedicated to providing cutting-edge, compassionate care, from primary care to intensive care and everything in between. With our broad expertise and commitment to innovation, Montefiore St. Luke’s Cornwall has been recognized as one of the top 2% of hospitals in the nation. Much like Newburgh and our surrounding communities are changing, so too are we.

MontefioreSLC.org | (845) 561-4400

Building trades unions are dedicated to protecting the rights of their members, ensuring fair wages, benefits, and safe working conditions. A good relationship with the local District Attorney enables unions to effectively advocate for these rights, addressing issues such as unfair labor practices, wage theft, workplace safety violations, and other possible criminal activity that affects our communities. When DAs are aware of the concerns and challenges faced by union members, they can take proactive steps to address these issues, leading to improved safety standards, higher wages, and better working conditions across the industry.

The construction industry is subject to a complex set of regulations, labor laws, and criminal laws, most notably wage theft. By maintaining open communication with the local District Attorney, building trades unions, contractors, and management, can stay informed about legal requirements and changes that may impact their operations. This collaboration helps everyone in the construction business educate their members on compliance matters, minimizing the risk of legal disputes, and ensuring that all projects adhere to local, state, and federal regulations. Most importantly, this relationship helps everyone know the local District Attorney is dedicated to a level playing field where everyone is treated fairly and knows they must follow the law.

Disputes between workers and employers can arise in any industry, particularly in construction, where pressures and timelines can be intense. A strong relationship with the District Attorney can facilitate effective conflict resolution, allowing unions to address construction fraud and wage issues before they escalate into major legal battles. By having a trusted ally in the District Attorney’s Office, unions and management can seek the

District Attorney’s advice and support, in helping to resolve issues swiftly and maintain reasonable workflow on job sites.

There is no doubt that building trades unions play a vital role in the local economy, providing skilled labor and contributing to community development. When unions and district attorneys collaborate, it also fosters a sense of shared purpose and community engagement. This partnership can enhance the public’s perception of both unions, contractors, management, and local government, garnering community support for construction projects and initiatives that benefit everyone. A unified approach can lead to greater investment in local infrastructure and development, ultimately enriching the community.

A healthy relationship with the District Attorney also helps ensure fair competition within the construction industry. When unions are in dialogue with local authorities, they can advocate for policies that prevent unfair practices, such as wage theft or misclassification of workers. This creates a level playing field for all contractors and protects the interests of skilled labor, contributing to a more robust and ethical construction environment.

In conclusion, the relationship between local building trades unions, contractors, and management, and District Attorneys, is vital for promoting workers’ rights, ensuring legal compliance, resolving conflicts, engaging with the community, and fostering fair competition. By working together, all entities can create a safer, more equitable, and prosperous construction industry that benefits workers and the communities they serve.

In short, get to know your local District Attorney!

David Hoovler is the Orange County District Attorney elected in 2013. He has received numerous honors including the FBI Award of Merit – Newburgh-based BBK Gang Prosecution and the Federal Executive Board Teamwork Award for Narcotics and Gang Prosecution.

JEFF LOUGHLIN

JAMES SASSO

MIKE MILLER

JOHN BELARDI

DAVE RYAN

JAMES ARNAU

SEAN MEANEY

BUSINESS MANAGER

PRESIDENT/BUS. AGENT

VICE PRESIDENT/BUS. AGENT

RECORDING CORR. SECRETARY

TREASURER/TRAINING DIRECTOR

FINANCIAL SECRETARY

ASSISTANT TRAINING DIRECTOR

Executive Board

Ronald Burgess – Rocco Miceli – Dan Calandro – Trevor Rodney Pete Sampogna – Evan Vona

Workers’ Comp Rates Continue to Decrease

But are Employers Seeing the Savings in Their Bottom Line?

By Steven Bell

Workers’ Compensation Rates Continue to Defy Inflationary Pressures

Despite the ongoing inflationary environment, workers' compensation costs are set to decrease for the eighth consecutive year on October 1, 2024. Overall, loss costs and resulting rates will drop by an average of 9% across all class codes. However, this

Source: NYCIRB State of the System 2023

change may vary depending on specific class codes, with some seeing increases and others decreases, but the overall net decrease averages 9%.

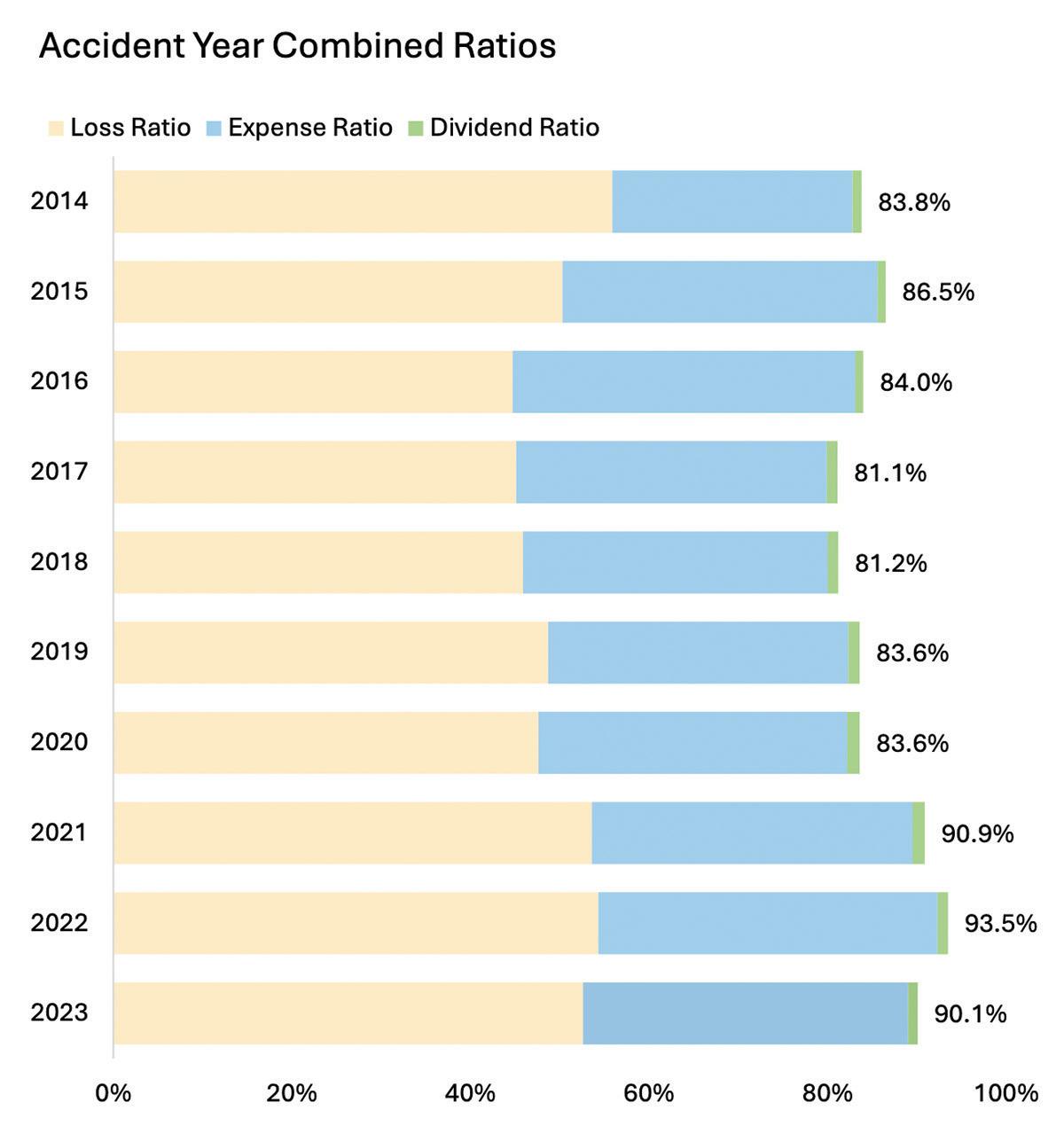

During this same period, workers' compensation insurance carriers have enjoyed several profitable years. Their profitability is typically measured by the combined ratio, which compares total expenses, including losses and operational costs, against premiums earned. The chart below highlights the accident-year combined ratio performance in the New York State (NYS) workers' compensation market, consistently showing combined ratios below 100%.

Understanding the Combined Ratio

So, what does this mean? For every $100 of premium earned in 2023, carriers paid out $90.10 in expenses and losses, leaving the remaining 9.9% as underwriting profit. It's worth noting that the combined ratio does not account for investment

income, which can be significant for workers' compensation due to the long-tail nature of claims. Workers' compensation has been a reliable profit center for many carriers, thanks to factors such as reduced claim frequency and severity. Moreover, wage growth during this period has increased premiums for carriers, further contributing to their profitability.

Declining Rates Amid Carrier Profitability

While insurance carrier profitability has remained stable, workers’ compensation rates have steadily declined. Since 2017, rates have cumulatively decreased by an average of 53.9% across all class codes. In the same time frame, wages have increased by approximately 34.5%. Although rising wages have offset some of the rate decreases, employers who haven’t seen corresponding wage growth should have experienced a reduction in their workers' compensation costs. The ongoing profitability of the market, paired with decreasing rates, may seem counterintuitive, but the key question for many employers is whether these benefits have translated into lower overall costs for them.

Safety Groups: A Path to Profit-Sharing for Employers

For employers looking to capture the benefits of underwriting profits, there are alternatives in the fully insured market that offer low-cost, low-risk options. One such program is the workers' compensation safety group. A safety group is a collection of businesses who are in the same trade or industry. The members of the safety group are homogeneous or have similar work conditions, safety hazards, and job risks.

Employers with similar operational hazards are grouped together to reduce their workers’

compensation costs, spreading the risk from the individual policyholder to the entire group. The premiums of the group are pooled together, then the costs of claims and administrative expenses and charges are deducted. Any money left over after accounting for these expenses is available for payment of a dividend.

The Benefits of Safety Group Programs

For businesses in New York State, joining a safety group program is a proven strategy for reducing insurance costs and ensuring excess premiums are returned as dividends. These programs incentivize employers to maintain safe working environments, fostering a culture of prevention that benefits both employees and the bottom line. The potential savings in a safety group depend on how the group is managed and its combined ratio. For members of Lovell Safety Management’s 13 industry-specific safety groups, over $1.24 billion has been returned to participants in the form of dividends to date.

A Proven Path Forward

The workers' compensation rate decreases on October 1, 2024, marks yet another chapter in an eight-year success story for the industry. Workers' compensation safety groups, in particular, stand out as a model for how businesses can thrive under a well-managed insurance program. While insurance carriers have benefited from lower rates and improved profitability, participants in workers' compensation safety groups have shared directly in the financial rewards, enjoying both reduced rates and higher dividends. As safety groups continue to prioritize safety and financial transparency, their members can look forward to sustained savings and ongoing financial returns for years to come.

Steven Bell serves as the Vice President of Underwriting & Sales at Lovell Safety Management Co., LLC. Prior to joining Lovell, Steve served as Director of Underwriting for a major carrier, overseeing one of the largest WC underwriting operations in the country. He has over 32 years of expertise in WC underwriting, pricing, business & system development, operations & strategic business planning with proven success in the design, development & deployment of complex business & technology solutions. Steve@LovellSafety.com 212-709-8832

Partnerships Made Stronger

By Robin Seidman

The common perception is that labor and management must always have adversarial relations because they approach issues and projects from different sides of the coin. That perception doesn’t hold true in the Hudson Valley where contractors and unions not only work together but learn, plan and implement ideas to attract quality projects to the area – a truly win-win methodology.

In February, the Hudson Valley Construction Industry Partnership (HVCIP) held a 2-day meeting that featured speakers and programs to bring all up to date on current and future projects, legislation affecting the industry and economic outlooks that clear the way for more effective planning.

The HVCIP strategic partners are those folks in the industry that make work happen:

• John T. Cooney, Jr. - Executive Director of the Construction Industry Council (CIC) representing Westchester and Rockland counties.

• L. Todd Diorio – Business Manager of the Eastern New York Laborers District Council, International Representative with the Laborers International Union of North America, and President of the Hudson Valley Building and Construction Trades Council.

• Jeff Loughlin – President of the Building & Construction Trades Council of Westchester & Putnam Counties.

• Matthew Pepe – Executive Director of the Building Contractors Association of Westchester & the Mid-Hudson Region, Inc. (BCA).

• Steve Reich – Business Manager of the Heavy Construction Laborers Local 754.

• Alan Seidman – Executive Director of the Construction Contractors Association of the Hudson Valley (CCA) including the Fabricators, Erectors & Reinforcing Contractors Association and the Sheet Metal Air Conditioning Contractors’ National Association (SMACNA).

The agenda was packed with presentations from industry, government, and economic experts that addressed not only existing conditions but trends that will affect future projects.

The value of the meeting was not just the information provided by the distinguished speakers but in the questions and answers that uncovered the very real concerns of the attendees. The after-hours networking built new relationships and strengthened existing partnerships.

Ultimately, the HVCIP goal of tackling the pressing legal, legislative and labor/management issues as a team was achieved and solidarity cemented.

Sharing Their Expertise

Bill Banfield, Assistant Executive SecretaryTreasurer of the North Atlantic States Regional Council of Carpenters.

Dan A. Bianco, Jr., LIUNA Vice President and New England Regional Manager of the Laborers’ International Union of North America (LIUNA).

David Carlucci, former NYS Senator and recognized leader in public policy, government affairs and business development.

Taryn Duffy, President of Tarsam Public Affairs.

David Hoovler, Orange County District Attorney.

Steve Neuhaus, Orange County Executive.

Marina O’Donnell, Political Director of the Northeast Region of the International Union of Operating Engineers.

Daniel Ortega, Community Outreach at ELEC 825.

Michael Sabitoni, General Secretary-Treasurer of the Laborers’ International Union of North America (LIUNA).

Gus Scacco, CEO and Chief Investment Officer of Hudson Valley Investment Advisors (HVIA).

Because of the many digital options available, the use of paper checks has declined significantly in the last 20 years. Unfortunately, fraud related to paper checks has taken the opposite path and has skyrocketed. According to the Association of Fraud Professionals, checks account for less than 9 % of payments but 66% of payment fraud. And the Financial Crimes Enforcement Network (FINCEN) has received reports of fraudulent check activity that has pushed its numbers over 700% in the last ten years. An alert issued by the FBI and the Postal Service in January reports that check fraud has nearly doubled from 2021 to 2023.

The sad but true story is that it’s not difficult to commit check fraud. First of all, the check itself gives a wealth of information: the account owner’s name and address, the bank, the routing number and the account number. Secondly, mailboxes present the perfect vehicle for a criminal to get their hands on a check – whether it is a check going out or a new box of checks being delivered. USPS Blue Collection boxes are a target after the last pickup.

With check in hand, the fraudster uses a technique called check washing that allows a criminal to erase what the check writer has filled in and replace it with their own information. There’s also check cooking that allows the fraudster to use photo editing software and high-tech printers to digitally change the stolen check image and then print multiple checks on the stolen account. In other words, it’s not rocket science and no special skills are needed to pull off check fraud.

Luckily, there are digital payment solutions that can mitigate the need for checks.

The most popular options are ACH payments. E-checks, mobile payments, and online payments through a vendor’s website. For large amounts, wire transfers are an alternative although they tend to be pricey. There are also vendors that offer payment solutions for a fee.

In the event that check writing is a necessity for your business, there are steps you can take to protect your business. There are gel pens and heat sensitive ink pens available that make it difficult for a criminal to wash your check and this should be a priority purchase. Keep the writing tight on the check – don’t leave spaces in the payee, written amount and number amount areas. There are also other security features for checks that can be obtained through your check printing company, i.e. special paper, watermarks, holograms, etc.

Review your bank activity daily to see what checks have cleared and if something looks funky, take a look at the check image online. If there appears to be a problem, contact your bank right away. In addition, if you think your checks have been compromised through mail theft, contact the United States Postal Inspection Service at uspis. gov/report or call at 1-877-876-2455.

SOME COMMON SENSE STEPS:

• Take mail containing checks directly to the post office and deposit the envelopes inside.

• For large checks, consider using return receipt and signature options for tracking purposes.

• If ordering checks through a bank, have them delivered to the bank and pick them up there. If using an independent check printer, ask them for a secure method of delivery.

• Don’t rely on a bookkeeper or office staff to monitor your bank accounts for fraud. Make it part of your daily routine. Being aware of the pitfalls of writing checks, taking appropriate precautions and careful monitoring of your accounts will give you a leg up on preventing check fraud and protecting your business.

Hat Tips!

The CCA congratulates our friends and colleagues on their achievements and recognitions.

Fisch Solutions Receives Prestigious Recognition

Named to Top 500 MSP Award List by CRN Magazine

Congratulations to new CCA member Fisch Solutions which earned a spot on the Top 500 Managed Service Provider list for 2025 by CRN Magazine.

The award recognizes the top providers in the industry who deliver innovative and cutting-edge IT solutions to their customers. This is a significant milestone for Fisch and it underscores its commitment to delivering top-notch value and service to its customers.

Jason Fisch, president and founder of Fisch Solutions, has this to say of the award: “Being included among such prestigious company is no small feat. It reflects hard work, dedication, and a focus on delivering exceptional value to clients. The team at Fisch Solutions has consistently pushed boundaries to provide cutting-edge technology solutions.” Fisch Solutions is located in New Windsor, NY.

Community Foundation Celebrates Giving Hearts

Donors and Volunteers Honored at Reception

It was a night to remember when the Community Foundation of Orange and Sullivan honored volunteers and donors at its reception on February 13th at the Resorts World Catskills.

Two longtime volunteers and supporters, Ron and Anita Feller, and Judy Siegel, were the recipients of the Karen Minogue Award for Distinguished Service

The Fellers have distributed over $85,000 to Valley Central graduates through the Corinne Feller Memorial

Scholarship fund which they established in memory of their daughter, Corinne. In addition, they are active volunteers in their church and community with a track record of more than 50 years of giving.

Judy Siegel is president of the Livingston Manor Temple and a Rotarian. She is also on the Town of Liberty Planning Board and co-founder of the STEAM fund. She is instrumental in bringing new relations to the Foundation.

In addition, Michael Bonura and David Apps were recognized for their many years of service.

Save the date for the Foundation’s 26th Annual Reception on October 22, 2025 at the West Hills Country Club.

Congratulations to Olori Crane

Celebrating 75-years of business in the Hudson Valley

Olori Crane has been servicing the Hudson Valley business community since its inception in 1950. Through 4 generations, the Nanuet-based company took the principles handed down by founder Lou Olori, Sr. as its cornerstone:

• Work hard

• Understand the customer’s needs

• Provide quality equipment

• Hire the best in the field

Today, those principles still drive the business and its 75 years of success is proof of the family’s commitment to being the best in class. Olori Crane has received the 2024 & 2025 Crane & Rigging Safety Award from the Specialized Carriers and Riggers Association as well as the honor of providing the crane that hoisted the American Flag at the Bowline Haverstraw site for Rockland County Vietnam Veterans Watchfires.