Climate & Energy GENERATION Reinventing coal sites GENERATION Making blades recyclable CITIES New builds, old materials END USERS Data centres close the loop THE PATH TO CIRCULAR dkk 90,00 / € 12 BK returuge 48 23.05.2024—27.11.2024

FORESIGHT Climate & Energy SPRING/SUMMER 2024

PUBLISHER

FORESIGHT Media Group

EDITOR-IN-CHIEF

David Weston david@foresightmedia.com

CONTACT

CEO Kasper Thejll-Karstensen +45 3119 4000

kasper@foresightmedia.com

CCO

Kristian Lee Dahm Dickow kristian@foresightmedia.com

ART DIRECTORS

Julie Frölich & Sune Ehlers

COVER ILLUSTRATION

Bernardo França

ILLUSTRATIONS

Bernardo França

PHOTOS

Jason Pan

Joshua Fuller

Kevin Mueller

Michael Berger

Claudius Pflug

Benjamin Rasmussen

Leonid Sorokin

Allan van der Hoek

Christopher Halloran

Kas van Vliet

Justin Lim

Erik Karits

WRITERS

Sam Morgan

Eleonora Vasques

Sean Carroll

Carolina Kyllmann

Jason Deign

Ros Davidson

Sara Verbruggen

Catherine Early

Heather O'Brian

FORESIGHT ONLINE

CIRCULATION 6000

PRINT

Stibo Printing Solutions

FORESIGHT is made in Denmark

ADVERTISING

For advertising rates contact booking@foresightmedia.com or +45 3119 4000

SUBSCRIPTIONS

For our full range of subscription offers, including digital, print, and podcasts, visit foresightmedia.com or contact us at member@foresightmedia.com

FORESIGHT Climate & Energy is the essential read on the global transition to a decarbonised energy economy — objective reporting on what really matters by expert journalists and writers. Read more at foresightmedia.com/about

FORESIGHT is independent of outside economic and political interests and assumes no responsibility for advertising material. Content from the publication may not be reproduced, distributed or stored in any form without the publisher’s written permission. FORESIGHT is a trademark of FORESIGHT Media Group

FORESIGHT Climate & Energy ISSN 2446-094X

Website: foresightmedia.com / X: Foresight_CE

Instagram: FORESIGHT_CE / Facebook: ForesightCE Email: info@foresightmedia.com

ENVIRONMENTALLY AWARE MAGAZINE PRODUCTION

Using paper from sustainably managed forests. Postal deliveries of single copies in a 100% biodegradable wrapper

A HIGHER STANDARD

The clean energy sector has a secret. A dirty secret. For all the uproar and enthusiasm to force a move away from coal and gas, which requires pulling minerals from the earth the clean energy industry is just as reliant on naturally occurring materials from under our feet.

There is ambition to clean up these activities, and ultimately, mining and burning coal is much dirtier than using lithium in batteries, neodymium in wind turbines and silver in solar panels. But the sector is—and must be—held to a higher standard than its fossil-based predecessors.

Circularity—by which we mean reducing, recycling and reusing— is not a new concept. Indeed, you could argue that it has only been lost in the past few decades of excess and extravagance (driven, in part, by the profits of the fossil fuel industry).

“Make do and mend” was a familiar propaganda slogan across wartime Britain. Archaeologists, meanwhile, uncovering the ancient city of Pompeii, buried under a carpet of volcanic ash in 79 AD, believe that huge mounds of refuse seemingly just dumped outside the city walls were potentially “staging grounds for cycles of use and reuse”, the Guardian newspaper reported back in 2020.

The concept however has gained traction in the clean energy sector more recently as a result of bad press (page 40), supply chain concerns (page 32) and the desire by many to leave the world in a better place than we find it.

We won’t be able to do away with all mining—not in the foreseeable future and probably beyond—but work is being done to clean up the sector. But by embracing circularity a great deal more, we can maximise the materials already in the value chain, both in financial and use terms.

The impact of circularity will ripple out and affect businesses and sectors, beyond energy. Customer-facing firms will shift away from linear production models and provide refurbishment services, instead of simply replacing products. Meanwhile, the construction sector (page 24) can retain and source materials to give them second lives in new buildings. This limits dependence on raw materials and cuts waste—a double win.

It's still early days in the establishment of a fully circular economy. But this special print issue of FORESIGHT Climate & Energy, our 18th, wants to show the potential impact circularity can have on the energy sector and beyond. It highlights the value that can be derived by implementing circularity measures, which, once scaled up, could result in cheaper materials, helping to accelerate the energy transition even more.

David Weston EDITOR-IN-CHIEF

David Weston EDITOR-IN-CHIEF

NORDICSWAN ECOLABEL Printed matter 5041 0004 This printed matter is carbon compensated according to ClimateCalc. Offsets purchased from: South Pole Carbon www.climatecalc.eu Cert. no. CC-000001/DK

NEW BEGINNINGS

CONTENT

With coal plants retiring en-masse, can their infrastructure and locales be put to better use?

PAGE 6

CIRCULAR BUSINESS

Companies can maintain financial success while achieving a circular economy

PAGE 16

SCORCHED EARTH

Circularity measures alleviate societal and environmental impacts of mining

PAGE 22

REUSE AND RECYCLE

Applying circular economy principles to construction holds great promise but regulators need to play catchup and project developers must ditch old habits

PAGE 24

SOLAR SEARCHES FOR CIRCULARITY

Solar PV has a low environmental impact but the scale of the industry is forcing it to minimise its footprint further

PAGE 32

ON ROTATION

The wind turbine sector faces growing pressure to improve the circularity and avoid sending used components to landfills. But the complex machinery requires complex processes

PAGE 40

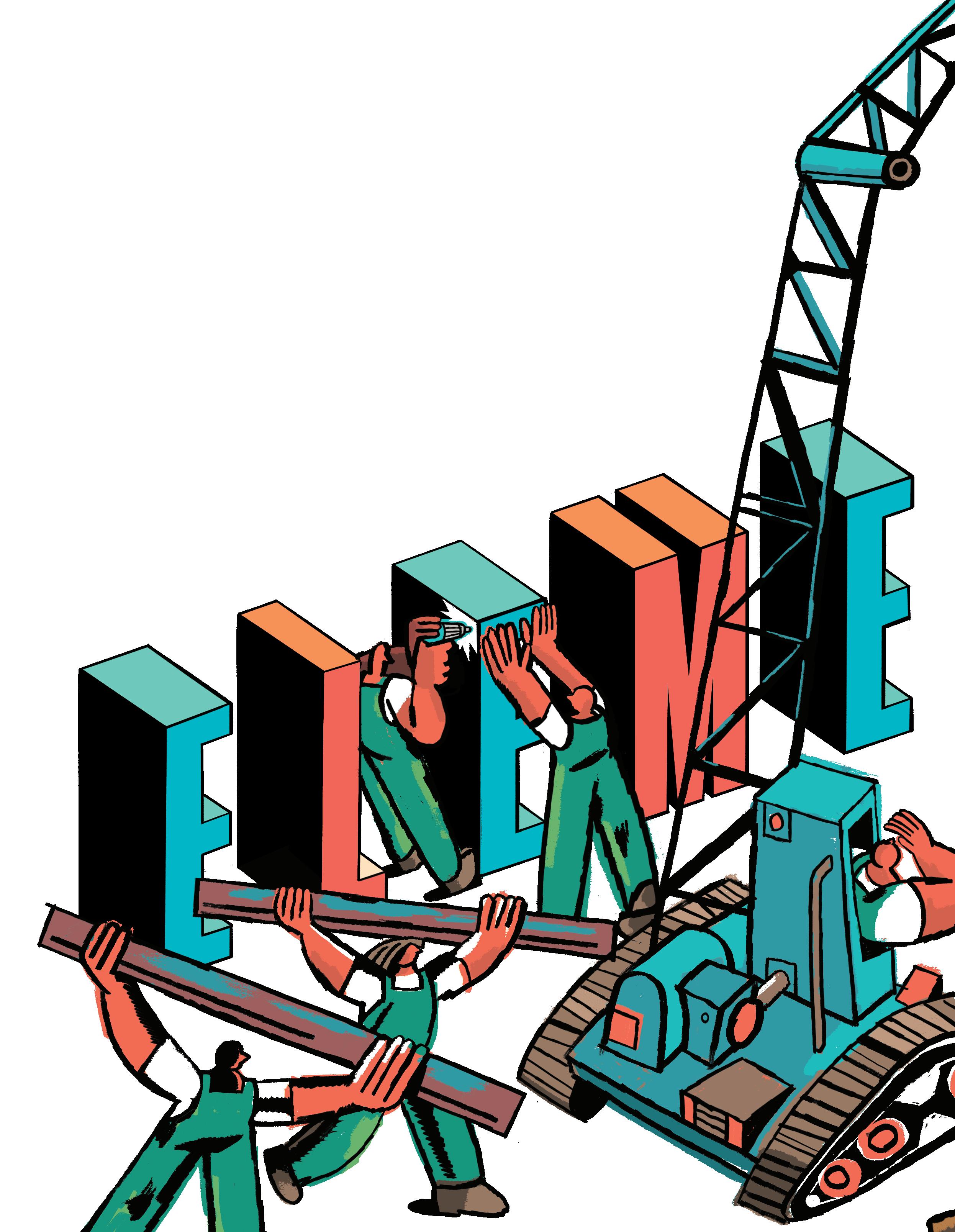

ELEMENTARY

Renewables infrastructure is also a drain on natural resources. Embracing circularity would optimise efficiency and extend equipment lifespans

PAGE 48

MISSION CRITICAL

Short-term bottlenecks and reputational risks from the source point to a growing need for circularity in

CIRCLING BACK

Power-hungry data centres can play a role in a circular economy by becoming providers of energy via the surplus heat they generate

PAGE 66

FORESIGHT

PHOTO JASON PAN ILLUSTRATION BERNARDO FRANÇA

NEW BEGINNINGS

THE DEMISE OF COAL POWER GENERATION is emblazoned on the walls with ever-increasing climate targets and rapidly worsening business cases. The physical assets left behind by coal projects still could play a role in the energy transition, if developers can decide which option is best for their needs

6 FORESIGHT TEXT SAM MORGAN · ILLUSTRATION BERNARDO FRANÇA GENERATION

PHOTO JOSHUA FULLER

King Coal’s reign is up in many advanced economies around the world, where the polluting power source is gradually being dethroned by ever-increasing amounts of renewable generation and fossil gas. There are an estimated 2500 coal power plants around the world. As demand for coal drops, renewables take over and governments phase out its use, those remaining plants will be made redundant.

It begs the question as to what is the best use for those sites once coal generation has ended. Having already been in place for decades, easing permitting pathways, and with high-capacity grid connections, coal sites may still have a role in the future clean energy system.

Several projects around the world plan to make use of the land and facilities once used by coal power plants to give them a second life as clean energy hubs and ease the pricey decommissioning costs. There is no shortage of ideas about what type of project should take over coal’s turf.

CAUSE OF DEATH

Nixing coal is an essential part of the energy transition. The International Energy Agency estimates that the fuel is responsible for 0.3°C of the 1°C warming that has already happened.

Ember, a UK-based think tank, estimates global carbon dioxide output from coal power was 7.85 billion tonnes between January and October 2023, a record total.

Despite this, coal use increased globally in 2023, as declines in countries like Australia, Canada, Korea, Japan and the United States, as well as the European Union, were offset by growth in China, India, Indonesia and other Southeast Asian nations.

However, according to research firm Rystad Energy, 2023 may have seen the peak of coal generation and 2024 will see new electricity supply from renewable sources outstrip overall power demand.

This will displace some coal from the global energy mix. Rystad estimates the fuel’s output will decrease by a modest 41 terawatt-hours but that this is “a sign of things to come”.

“Coal usage in the power sector is peaking. The drop in total coal generation in 2024 may be small

“Whichever way you look at it, there will be an increasing number of coal assets coming to the end of their lifetime very soon. Decisions on what to do with the plants, mines and other infrastructure need to be made now”

8 GENERATION FORESIGHT

Bygone days

The days of coal based electricity generation are numbered

on paper, but it signals the beginning of the renewable energy era in the power market,” says Rystad’s Carlos Torres Diaz.

Many countries have set phaseout deadlines and some—including Belgium, Portugal and Sweden—have already called time on burning coal as a power source. Big players like France, Spain and the UK aim to do the same by the end of the decade.

Whichever way you look at it, there will be an increasing number of coal assets coming to the end of their lifetime very soon. Decisions on what to do with the plants, mines and other infrastructure need to be made now.

THE CASE FOR REPURPOSING

Coal plants cannot simply be abandoned, as pricey decommissioning protocols often have to be followed. In some cases, asset owners also seek to recoup costs invested in infrastructure like the turbines or water purifiers.

Decommissioning costs vary greatly depending on the age of the plant and where it is located

in the world. According to a World Bank study produced in 2021, the financial burden averages around $60 million.

Costs include, among others, employee compensation, demolition, scrap removal, meeting environmental regulations and hazardous material abatement. The World Bank’s numbers were based on an Indian coal power plant, while in the United States, for example, the costs can be double that figure.

Given the significant financial outlay needed

GENERATION

PHOTO CURIOSO PHOTOGRAPHY

POLICY FORESIGHT

The challenges facing companies’ ability to combine profitability with circularity are more about their desire to move with the times, rather than the out-of-date dichotomy between sustainability and profits.

The European Union’s upcoming Ecodesign regulation and its existing Taxonomy do support companies’ moves towards circularity business models. However, global trends on circularity show that despite the matter being discussed more and more, globally it is in decline, according to the Circle Economy Foundation.

“The share of secondary materials consumed by the global economy has decreased from 9.1% in 2018 to 7.2% in 2023—a 21% drop over the course of five years,” the report authors explain.

In the meantime, “Consumption continues to accelerate: in the same

period, we have consumed over 500 gigatonnes. That is 28% of all the materials humanity has consumed since 1900,” the report authors highlight, pointing to the importance of more actions from companies to make the world more sustainable through circularity.

Circularity does not purely mean putting products into a circuit—it starts with the design, “goes through the recirculation of the products and components”, and minimises the impact of production on the environment and biodiversity, says Vanessa Miler-Fels at Schneider Electric.

“It can be, whether we can repack, manufacture, or refurbish our products, or whether ultimately we recycle the materials and give them another life. Circularity, for us, has to be end-to-end. Use better, use longer, use again,” she adds.

“It is a good business both financially and for the environment”, says Lars Knaack from Novenco Building and Industry, a Danish company which produces ventilation systems. Knaack emphasises that despite the higher upfront costs compared to materials used in traditional linear business models, in his experience, the return on investment is typically

18 FORESIGHT

between one to three years, attributable to the products' extended lifespan and reduced maintenance requirements.

there are costs associated with building processes, tools and talents to disclose circularity performance,” Hampel says.

Health check

Refurbishment of components is one way of alleviating raw material demand

Business plan

Circularity is impacting business models across Europe

Products and materials with a long lifetime are a key part of circularity. For instance, Novenco has products with 20-25 years of usable lifetime, a period that greatly contributes to business profitability, Knaack explains.

However, the availability of technologies and products in the market designed in a circular way might vary based on the market conditions and the locations where companies operate.

Astarting point is energy efficiency. It is a convenient and easy way to support circularity because cutting consumption cheapens production. “When we change an old fan in a factory, we save 30-60% of energy,” Knaack explains.

Schneider Electric, meanwhile, upped its energy efficiency by 50% since 2017 by saving energy and water.

Swiss engineer ABB took circularity a step further by sourcing recycled materials for the components it produces. “We partner with recycling companies to take back and recycle old equipment. In 2023, we [partnered] with Germany's Remondis, which recycles old inefficient motors and sends the retrieved metals to selected companies that ABB can [then] use as suppliers to manufacture new products,” says ABB’s Anke Hampel.

“The process saves on raw materials and energy plus it avoids emissions compared to sourcing new metals,” Hampel adds. According to ABB, investments are needed to find new supply chain solutions, such as “steel produced with lower CO2 emissions”.

“Investments in research and development to replace materials and redesign products are essential. Collecting data across the value chain is complex and

ABB is one of many collaborators with other recycling companies to reach their circularity goals. Novenco partners with Sweden-based company Stena Recycling, to take care of all its scrap and waste. “When the product is finalised and out of use, it goes in a container and is thrown in a shredder. Then it is split in a machine. The cleaner fragments, the higher their usability or recyclability,” Knaack explains.

Good results were reached with the reuse of different metals, Knaack says, but challenges remain with aluminium. “We need certain specifications for our products and there’s not so much reused aluminium available today. This is one of the things we are working on,” he adds.

EIT Climate-KIC, a European agency which implements projects to help institutions, industries and communities meet climate goals, is carrying out a three-year IKEA-funded project with partners, to establish an “ecosystem of circularity’” with a primary focus on waste.

“We see a big potential in supporting and building this ecosystem clusters’ development in cities like Nairobi [Kenya] and Bengaluru [India] to tackle better the problem around waste, so often the first step in how circular economies are approached,” EIT Climate-KIC’s Emily Amann explains.

To do that, it is important to bring to the same table not only startups and companies but lawmakers and investors, Amann adds. “Often barriers are found on policies, especially in the circular economy, which is a new territory,” Amann says, adding that there are often cases in which policies are there but are not effectively implemented.

POLICY

REUSE AND

Applying circular economy principles to construction holds great promise for greening our buildings. But if this approach is to take off in earnest, regulators need to play catch-up and project developers must ditch old habits

24

CITIES

TEXT SEAN CARROLL & CAROLINA KYLLMANN · ILLUSTRATION BERNARDO FRANÇA

RECYCLE

25

Reuse and recycle" is a catchphrase most people associate with plastic bags or bottles.

But homes, schools and offices are also made with materials that are far too valuable and carbon-intensive for single use: they shouldn’t always be produced anew and then thrown away when buildings get demolished.

The CRCLR House in Berlin looks almost unfinished even though it was completed in 2022. There is no paint on the walls, which are a mix of timber, clay, hemp and what was left from the brewery that once stood there. Every joint is visible, as is the wiring running along the walls.

The idea behind the project? When, decades down the line, the time comes for the space to be changed to serve a different purpose, the building can be taken apart like a LEGO house, with the individual components retaining their original form and quality, ready to be used again.

As the name suggests, the co-working space was built following circularity principles. Around 70% of its materials were produced sustainably or were previously used elsewhere: from the bathroom sinks reclaimed from a camping site and timber from an art installation now converted into meeting booths to windows and fire safety doors.

“Form followed availability,” says Felix Hauerken from Impact Hub, an organisation providing co-working spaces. Construction started before the building plan was fully finalised and the design was adapted as materials from demolition sites or carpentry workshops became available.

Where reclaimed or “waste” materials were not available, the project developers used low-carbon ones. Above the shared offices, the architects added affordable flats. The new stories are made out of tim-

ber and insulated with straw—all materials screwed or wedged to make their eventual deconstruction as smooth as possible.

About half of the raw materials extracted in Europe every year end up in buildings and roads. Yet, these resources are finite: there are more materials now embedded in buildings and infrastructure than are easily accessible in the earth, Rebekka Steinlein from Concular, a circular construction business, told Bloomberg.

Construction and renovation sites alone also generate over a third of the waste that ends up in Europe’s landfills. Globally, 13% of materials delivered to construction sites are sent directly to landfill without being used at all, according to the World Green Building Council (WGBC).

“The current linear system does not work and

26

"

PHOTO MICHAEL BERGER

bal planning and design company.

Beyond finite resources and mountains of waste, there is the question of emissions. The EU estimates that greenhouse gas emissions from material extraction, manufacturing of construction products, and the construction and renovation of buildings account for 5-12% of total member states’ emissions.

As a result, the bloc’s building stock has emerged as a key obstacle to reaching the EU’s goal of climate neutrality by 2050, enshrined as a legal obligation in its Climate Law.

Acircular approach, which disconnects economic activity from the ever-increasing consumption of natural resources, has emerged as a key strategy to overcome this dilemma.

Circularity recognises the value of used materials by keeping them in supply chains, rather than discarding them into landfills.

Applying these principles to buildings means constructing houses with reclaimed, low or zero-carbon materials in such a way that they can be recovered and reused in future projects.

There is a hierarchy to circularity beyond the idea of keeping materials and components in “infinite” use cycles. It prioritises prolonging the value of buildings for as long as possible, followed by reusing their materials, rebuilding old ones to be as good as new—a process known as remanufacturing—and recycling or downcycling as a last resort, followed ultimately by incineration or disposal.

However, “designing efficiently often gets left out of the circularity discussion,” says Danielle Densley

Tingley at the University of Sheffield. Construction projects often use more materials than needed. For example, it is often possible to retain the same structural strength with only 50 to 60% of the cement used today. This alone has the potential to save one billion tonnes of CO2 per year by 2050, according to a 2023 report.

Indeed, shifting to a circular built environment could reduce global carbon emissions from building materials by 38% by 2050, thanks to reduced demand for new steel, aluminium, cement and plastic, a 2019 report by the Ellen MacArthur Foundation found.

Circularity first and foremost encourages extending the lifespan of existing buildings.

“The most sustainable building is the one you don’t build,” says Densley Tingley. “Changing our attitudes and massively increasing re-use of buildings within Europe is probably going to be the single most effective way of reducing carbon.”

Her views were echoed by her Sheffield University colleague Dr Charles Gillott, a construction expert. “We need to dramatically prioritise retention of existing buildings over demolitions and deconstruction,” he says. “There is huge circular potential within the existing building stock as it currently stands.”

“You could build the most circular or lowest carbon building possible, but if you demolished something that was in its place in order to be able to do so, that isn’t actually a good thing overall,” he adds.

Prolonging the lifetime of existing buildings has the potential to reduce emissions by an additional one billion tonnes of CO2 per year beyond 2050. Repurposing existing buildings—opening office canteens as restaurants in the evening, or converting unused office space (which has grown in the aftermath of the Covid-19 pandemic) is one way to achieve this, according to the European Environment Agency (EEA), an EU advisory body.

If the materials embedded in buildings are to be reused, we need to know what, and where, they are. This is a huge challenge for circularity today: with very few exceptions, we simply do not know what the walls around us and the floor we’re standing on are made from. Poor design and lack of information mean that, globally, only 20 to 30% of construction and demolition waste is recycled or reused.

While the concept of urban mining has picked up—the notion of finding, extracting, reusing or recycling materials already built into urban areas—there is still no requirement to either assess the re-usability potential of materials inside of buildings being

27 FORESIGHT CITIES

Laid bare

CRCLR House in Berlin uses reclaimed materials left for all to see

32

ON ROTATION

The wind turbine sector is facing growing pressure from its customers and the wider public to improve the circularity in its value chain and avoid sending used components to landfill. But complex machinery requires complex processes to help sort and manage the various materials

41

GENERATION

PHOTO BENJAMIN RASMUSSEN/GETTY IMAGES

TEXT ROS DAVIDSON

In 2019, the wind industry suffered a public relations problem.

A photo was widely shared on social media platform Twitter, now named X, of a blade “graveyard” in Casper, Wyoming. The picture showed 1100 blades piling up in a ten-metre-deep dry tomb.

“Turbines tossed into dump stirs debate on wind’s dirty downside,” read a Bloomberg news headline.

The blades were as long as a Boeing 747’s wingspan and had been transported hundreds of kilometres from the Midwest. At the dump, the landfill operator tried to reduce the footprint of the blades by crushing them, but the blades were too tough and the machinery kept sliding off their smooth surfaces.

Sharif Khalifa, of the US National Renewable Energy Laboratory (NREL), stresses that blade waste is not as bad as people think, though it can be visually dramatic.

It’s nowhere near as toxic as photovoltaic panel waste, he says, which contains lead and cadmium. “Wind components tend to be on the cleaner side of electricity waste,” he says. Yet the problem remains as the world moves towards greater circularity and as the installed base of wind capacity grows.

CRITICAL MASS

While a little cleaner than other technologies, the volume of wind plant waste is relatively high. Wanliang Liang at the Global Wind Energy Council (GWEC), a trade group, cites an expert who said between 100 to 240 tonnes of steel, copper, aluminium and glass fibre can be recovered from each megawatt of retired wind capacity, compared with 60 to 80

tonnes of copper, aluminium and plastics from each megawatt of solar capacity.

Wind projects can last around 20-35 years and blades have lifespans of about 20 years. An entire wind turbine rated at 3-6 megawatts (MW) might weigh a massive 600-800 tonnes, with steel making up 90% of the total.

The Chinese government is encouraging the replacement of 15-year-old turbines that are often less than 1.5 MW. This could result in a market of 100 GW by 2030 in China alone.

The wind recycling industry remains in its infancy; most wind farms are not quite old enough to be decommissioned. New installations in the wind sector were about 110 gigawatts (GW) globally in 2023, while the decommissioned capacity in the last four to five years averages almost 2-3 GW per year, says Shashi Barla of the Brinckmann Group, a consultancy.

REUSE OR RECYCLE

Wind industry circularity works best when entire turbines— or their major components—are re-used. The end destination might be Eastern Europe or the distributed turbine market, experts suggest. Alexander Vandenberghe of WindEurope, a trade group, cites the example of a reused turbine now powering a cookie factory in Belgium with a guaranteed new life of 20 years.

Generators are typically reclaimed by original equipment manufacturers (OEMs), says NREL’s Khalifa, lead author of a March 2024 report on wind industry recycling. Components can then be refurbished or used as spare parts, says Aaron Barr of market analyst Wood Mackenzie (WoodMac).

If reuse is not possible, up to 95% of the mass of a wind turbine can be recycled, says Vandenberghe—though that proportion is more like 85%, according to Brinckmann’s Barla. The steel, aluminium, copper and electronics are all recyclable.

US LEADS

Due to the vibrant US partial repowering market, encouraged by federal tax credits, recycling has become more of an issue in America than Europe. By 2025, NREL estimates there will be up to five million tonnes of wind turbine waste in the US, including the balance of plant components. By 2050, there will be 140 million tonnes.

There are already established industries that recycle metals, but challenges remain. The scrap steel industry, for instance, has to deal with different grades that need to be separated.

The capacity of recycling for metals is an issue too. “As the waste stream grows significantly in the 2030s, the US aluminium and copper industries could likely be constrained, depending on how fast other sectors that use both materials produce waste too,” says NREL’s Khalifa.

42 FORESIGHT

BLADE HANDLING

The blades—made using fibreglass or carbon fibre—are the least green part of a wind turbine, along with the rare earth elements found in magnets. The composite technology of blades that allows them to be buffeted by the wind means it is hard to break down the resin and fibres for recycling.

In the next ten years, 4.3 million tonnes of blades—roughly half a million blades—could be ripe for decommissioning, says Barla. After the US tax credits were extended in 2016 to repowering, 3000 blades were decommissioned and ended up in landfill, he says.

Blade recycling is a nascent area. Project developer Ørsted has warehoused 13 blades until a recycling solution can be found, according to its 2023 sustainability report.

The most established recycling method to date is to mechanically grind down blades into pellets to be made into items such as kitchen cabinets or solar panel frames. It’s currently the lowest cost and lowest impact way of recycling blades, says WindEurope’s Vandenberghe.

CEMENT SUPPORT

Growing problem

In the next ten years, 4.3 million tonnes of blades could be ripe for decommissioning

Blades can also be recycled in cement co-processing, which involves mechanically shredding the blade. In a cement kiln, the blade’s resin and core components provide energy for the chemical reaction, reducing the use of coal. The fibreglass ash (or silica) acts as a setting agent in Portland cement.

In the US, ecological waste company Veolia North America has a plant in Missouri that uses an optical sorter to separate the wood, metal and silica in blades for cement co-processing. The company’s Bob Cappadona says cement manufacturers can reduce their CO2 emissions significantly using this process.

“28% of the windmill blade is made of materials that can be consumed in the cement manufacturing process and provide btu [energy] to the chemical reaction in the cement kiln. The end result is a reduction by 27% of the potential CO2 emissions,” says Cappadona.

“It’s a good circular economy use for what most people, candidly, do not realise is a problem,” he adds. Cappadona says the resultant cement has the same chemical

“28% of the windmill blade is made of materials that can be consumed in the cement manufacturing process and provide btu to the chemical reaction in the cement kiln.”

43 FORESIGHT

PHOTO RECYCLABLEBLADES, LEONID SOROKIN

The growing desire for renewable energy generation is placing unsustainable demand on critical minerals. This goes beyond wind turbines and solar panels, with the rest of the project infrastructure also a drain on natural resources. The renewables industry is embracing circularity frameworks to optimise efficiency, extend equipment lifespans and navigate an evolving terrain

GENERATION

TEXT SARA VERBRUGGEN · ILLUSTRATION BERNARDO FRANÇA

49

Take apart a renewable energy plant and virtually all components are made from something that has been mined originally. As well as silicon, aluminium, copper and steel, growth in energy storage and green hydrogen are now putting more of the periodic table under more pressure by increasing demand for sources of lithium, cobalt, vanadium, graphite, gallium and more besides.

Factor in the balance of plant (BoP) equipment these plants use—inverters, switchgear, cables and so on—it is no wonder then that the energy transition is contributing to unprecedented demand for critical minerals. So much so, the World Economic Forum recently concluded that our current way of life depletes 60% more resources than the Earth can sustainably provide.

An industry survey by ABB, an engineering firm, highlights that embracing circularity not only improves resource efficiency and saves money but also enhances business resilience in the face of global challenges.

The survey findings demonstrate that businesses, including those in the renewable energy industries and utilities sector, view circularity through a broader lens beyond recycling to encompass waste reduction, sustainable design and the development of resource-efficient processes.

In the short term, these practices enable greater energy efficiency and reduce pressure on resources, like energy and water in manufacturing, as well as the consumption of raw materials. In the long term, circularity can lead to enhanced process efficiency and improved cost control

NEW CONSIDERATIONS

Circularity is an issue that RES’ Jamie Scurlock thinks about more and more. The company has established a global business over the past few decades designing, building, operating, owning and managing renewable energy assets, including wind and solar farms, battery energy storage systems (BESS) and more recently green hydrogen.

During the solar “gold rush” of the past few years, it is fair to say that little consideration was given to circularity, particularly along the renewable energy supply chain. “Inverter suppliers and solar module

manufacturers suddenly saw an opportunity and so there was a rush to supply equipment into the UK that could be installed rapidly so that projects could make use of the Feed-in Tariff (FiT) incentives,” says Scurlock.

“This was followed by several inverter manufacturers exiting [the market] because they didn’t have a business that was sustainable once the subsidies stopped,” he adds.

One result of this was that some inverters could no longer be supported by their original equipment manufacturer (OEM). “A lot of BoP suppliers with legacy products in the field were concerned with developing new, more efficient products and so they wouldn’t have thought about obsolescence seven or eight years ago. Now they are thinking about it and they will be making these products backwards compatible,” says Scurlock.

Embracing circularity not only improves resource efficiency and saves money but also enhances business resilience in the face of global challenges.

Value chain

All parts of renewables projects can benefit from higher levels of circularity

50 FORESIGHT

GENERATION

REPAIR SHOP

RES identified a small number of partners able to do third-party repair of boards and control elements of inverters. “We have found some outlets that will take them, test them and understand the programming behind them to be able to replace a capacitor or a resistor on a board that has failed,” Scurlock explains.

“With such partners, there is a finite amount of product that we can put through their doors and get it back out on site. With this approach, we need to ensure the refurbished board meets the required standard. This requires a lot of thorough testing to make sure it works as the original board did. Safety is our priority and if we can’t prove it safe, we won’t use it,” Scurlock says.While such an approach has limitations and RES will only do it if the OEM that supplied it no longer stocks parts, Scurlock is emphatic it is better than the alternative. “Otherwise we end up throwing away a whole inverter and have to repower with a new one. If we can’t avoid it, then it will have to be recycled but if we can avoid it then we’re increasing

the life of the original components. If there was more of this happening it would be great,” he says.

In addition, some OEMs are seeing the opportunity to refurbish legacy control boards. In the case of Spanish firm Power Electronics, the company thinks there is enough legacy equipment installed—comprising an older inverter that is no longer manufactured and will accept control boards in batches to their headquarters in Valencia for repair before shipping them back to the site.

That this approach is more exception than rule can be understood when some of the oldest renewable energy plants are now only reaching decommissioning phases. These are typically those wind farms which have gone through a lifetime extension when they reached 20 years and are now approaching 30 years. RES has decommissioned three wind farms in the US reusing 95-99% of the equipment including BoP.

Despite a brief turbulent period in recent years, the renewables industry is forecast to enter unprecedented growth in demand which the supply chain

51 FORESIGHT

There have been many attempts to estimate the scale of demand for minerals and metals needed for the energy transition. One of the most recent examples, last year’s report from the Energy Transitions Commission (ETC), estimates that by 2050, cumulative demand for cobalt will reach 7-11 million tonnes, while 12-21.5 million tonnes of lithium and 7-11.4 million tonnes of copper will be required.

Though these numbers seem overwhelming, they are

Need for speed

There are roadblocks to meeting mineral demand driven by the energy transition

achievable, the ETC concluded, noting that geological resources exceed the total project cumulative demand from 2022-50 for all key materials, whether arising from the energy transition or other sectors. Analyses by the International Energy Agency (IEA), International Renewable Energy Agency (Irena) and Rocky Mountain Institute all reached similar conclusions.

However, the ETC report pointed to significant bottlenecks for lithium, nickel, graphite, cobalt, neodymium and copper in the shorter term as supply scales up to meet demand by 2030. It flagged innovation and recycling as one strategy to reduce pressure on primary supply. The lower numbers in its estimates reflect the resulting demand.

Rachel Lock, who looks at supply chain management at DNV, agreed the issue was not whether there are sufficient metals and minerals to support the transition, but rather the speed at which they are needed.

“It comes down to how much should we be investing in expanding mining operations versus investing in circular models and looking at the recycling and reuse, and moving away from the linear model currently used by industry,” she says.

RECOVERY RATE

Recovering minerals and metals from renewable energy and battery technologies at the end of their original life and reusing them in new or refurbished equipment could cut the need for virgin materials.

“Circular economy principles can contribute significantly to future materials needs for

PHOTO

PHOTO

CHRISTOPHER HALLORAN

solar panel manufacturing, particularly for aluminium, copper, glass, silicon, and silver, if systematically implemented,” says Ute Collier at Irena.

This would bring economic value to companies and mitigate adverse environmental impacts associated with mining activities. Renewable energy and battery manufacturers are under the same pressure from investors and consumers as other industries to disclose the impacts of their raw material sourcing on carbon emissions, biodiversity and local communities, and to reduce them.

DEAD END

On the whole, renewable energy companies have yet to extend circular economy principles to metals and minerals. Even just looking at simple recycling—the most basic level of circularity—in the US, fewer than 10% of solar photovoltaic panels are recycled. When they are, only the aluminium and copper are recycled, not the silver and silicon, according to a report by the Green Purposes Company, a non-profit. This pointed out that though the masses of silver and silicon in a PV panel are tiny (0.08% and 4% respectively), these materials represent 9-23% and 35-45% of a panel’s value.

University College London, says circularity has made “very, very little progress” in Europe, despite being discussed for over a decade.

Many critical minerals are relatively new and recycling them is “anything but straightforward”, he says. “You may need a new smelter in order to recycle some of these minerals and metals. Smelters are expensive and they’re not something that most people want in their backyard—most of those in Europe have shut down,” Ekins adds.

In contrast, China has recognised metals and minerals as a strategic issue in terms of batteries and renewable energy technologies and has invested in extraction and reprocessing, says Eskins. “It’s been doing this for at least two and a half decades, which is why it is such a dominant position,” he explains.

Meanwhile, the report notes that the collection of lithium-ion batteries remains low at less than 5% in the US. Even where they are recycled, these facilities recover cobalt, nickel and copper, but not lithium and aluminium, which are burned. The renewable energy sector is facing a “tsunami of waste”, it concludes.

According to Collier, the potential opportunities of circular economy models in the renewable energy sector are held back by persistent challenges including unclear economic viability for recyclers particularly the costs of collection and transportation. Insufficient information on components and how and where to recycle them are also factors, she says.

SLOW PROGRESS

Paul Ekins, of the Green Purposes Company and professor of resources and environmental policy at

Another issue is the fast-moving nature of the technologies. Lithium-ion is the current choice for electric vehicle batteries, but Chinese electric vehicles—a large number of which are expected to enter the European market—are switching to calcium-ion batteries. In the future, sodium-ion batteries could prove to be the technology of choice, Ekins says. Each would require a different recycling technology, he points out.

“It’s a brave investor who will put forward several billion Euros in a lithium-ion recycling facility in Europe when it will be ten years before we have enough batteries to recycle. And there’s uncertainty as to whether the batteries will even be made from lithium-ion,” he says.

NEW TECHNIQUES

Much research and development is underway on battery recycling. The Faraday Institution, a UK-based battery research group, is developing a delamination method under which high-powered, focussed ultrasonic waves are used to separate materials from electrodes. The aim is to obtain lithium, cobalt, nickel, manganese, copper and aluminium for reuse.

Researchers estimate that the method is 100 times faster than current methods for separating these

Over demand

58 SUPPLY CHAIN FORESIGHT

Minerals supply will struggle to meet demand

materials and can lead to a higher proportion and purity of recovered materials. Ultrasonic delamination uses water or dilute acids as a solvent, making it more sustainable and cheaper than current methods. Lithium-ion battery recycling, for example, involves shredding batteries and a complex set of physical and chemical separation processes.

SAVING SILVER

In the solar industry, the biggest concern of minerals and metals supply is silver, according to Marius

Untapped reserves

Recycling rates of key transition materials show more room for improvement

Mordal Bakke at Rystad Energy, a market observer. Circular strategies are being driven both by a desire to keep costs down and by a need to reduce supply risks for the huge number of PV panels that need to be deployed, he says.

Silver paste is used in solar cells to complete circuits, Bakke explains. P-type modules, which were the mainstream solar modules, used around eight milligrams of silver per watt.

Three factors affect effective battery recycling: battery chemistry, recycling method and location. The sector's objective should be close to 100% re-use or recycling given the high cost of the primary minerals—creating economic incentive—the potential for supply bottlenecks to constrain demand growth and the environmental impact of mining. For NMC batteries, extensive recycling could occur without regulation; by contrast, LFP batteries, where only the lithium is valuable, might not be entirely recycled without regulation. Strong public policy should therefore require that EV batteries are either re-used in stationary storage applications or almost entirely recycled.

Direct battery recycling involves shredding a battery to separate components

SUPPLY CHAIN NCA = Nickel-Cobalt-Aluminium; NMC = Nickel-Manganese-Cobalt; LFP = Lithium-Iron-Phosphate; LMO = Lithium-Manganese-Oxide.

END-OF-LIFE RECYCLING RATE GLOBAL AVERAGE, % 70 75 60 60 60 Large potential to increase recycling rates at end-of-life 40 30 10 1 1 1 SOURCE: ENERGY TRANSITIONS COMMISSION NET BATTERY RECYCLING PROFIT1 $/KWH NCA NMC-622 NMC-811 LFP LMO NCA NMC-622 NMC-811 LFP LMO NCA NMC-622 NMC-811 LFP LMO NCA NMC-622 NMC-811 LFP LMO NCA NMC-622 NMC-811 LFP LMO -25 -20 -15 -10 -5 0 5 10 15 20 25 UK BELGIUM USA S. KOREA CHINA Pyrometallurgy Hydrometallurgy Steel Aluminium Copper Nickel Silver Cobalt Silicon Graphite Lithium Platinum and palladium Rare Earth Elements

CIRCLING

END USERS

BACK

DATA CENTRE S ARE BIG AND GROWING CONSUMERS OF ELECTRICITY BUT ARE ALSO POTENTIALLY PROVIDERS OF ENERGY THROUGH THE MASSIVE SURPLUS HEAT THEY GENERATE

TEXT HEATHER O'BRIAN · ILLUSTRATION BERNARDO FRANÇA

orwegian data centre operator Green Mountain supplies heated water, warmed by the residual heat from its DC2-Telemark data centre in Rjukan to a nearby trout farm via a pipe that links the two sites. Heat exchanger technology allows the farm’s owner, Hima Seafood, to use the energy in the water to obtain the temperature ideal for raising its fish. The water is subsequently returned to the data centre but now at a lower temperature so it can be used to help cool the facility.

Meanwhile, in Odense, Denmark, waste heat from a hyper-scale data centre owned by Facebook-owner Meta, is routed to the Fjernvarme Fyn district heating station, where the low-temperature water is upgraded with the use of heat pumps. The data centre pro-

vides 100,000 megawatt-hours (MWh) a year of waste heat, enough to warm up some 7000 homes. Heat extraction occurs through hot air circulation in copper coils inside the data centre’s cooling unit, which are filled with water.

Fellow hyper-scaler Microsoft intends to provide waste heat from data centres it is building in Finland through a collaboration with Finnish energy company Fortum. The aim is to supply about 40% of the needs of the 250,000 district heating customers in the municipalities of Espoo, Kauniainen and Kirkkonummi later this decade.

“The decision to invest in a data centre region that also provides surplus heat to our cities and homes is a win-win,” commented then-Finnish prime minister Sanna Marin when the investment was announced in 2022. “It will accelerate Finland’s digital growth while making our energy system greener,” she said.

An increasing number of data centres are looking into reusing their waste heat, as pressure grows to prove they can be sustainable. Surging demand for digital services, including the expected expansion of power-hungry artificial intelligence (AI) applications, contributes significantly to growing electricity consumption. Some data centre buyers of renewable energy have also been charged with crowding out other purchasers and

Beat the heat

Data centre operators are being urged to capture the heat that would otherwise be wasted

68 END USERS FORESIGHT

Power hungry

Power demand from data centres, AI and cryptocurrencies could rise to as much as 1050 TWh by 2026, the IEA predicts

potentially slowing the energy transition.

The International Energy Agency (IEA) highlighted the growing power consumption of data centres in its Electricity 2024 analysis. The IEA estimates that power demand from data centres, artificial intelligence and cryptocurrencies could rise from an estimated 460 terawatt-hours (TWh) in 2022 to as much as 1050 TWh by 2026, or a level roughly the consumption of Japan.

The situation is particularly critical in those cities and regions that are already data centre hubs. In Ireland, with generous corporate tax policies, data centres already consumed about 17% of electricity in 2022 and the IEA anticipates nearly one-third of the country’s electricity could go to data centres as early as 2026.

On the bright side, almost 100% of the electricity supplied to the information technology in data centres is transformed into heat. Much of this heat could be reused, helping to elbow out fossil fuels in the heating mix and reducing emissions.

Danfoss, a Danish engineering company, highlighted the potential of using this heat along with that from other sources including factories, supermarkets, wastewater facilities, metro stations and commercial buildings. It argues, “Using gas or electricity for heating is like using a chainsaw to cut butter, as heating can easily be covered by low-value heating sources such as excess heat.”

Danfoss points to data showing excess heat in the European Union alone amounts to 2860 terawatt hours (TWh) a year, almost matching the bloc’s total energy demand for heat and hot water in residential and service buildings like schools, hospitals, hotels, restaurants, offices and shopping centres.

An increasing number of data centres are looking into reusing their waste heat, as pressure grows to prove they can be sustainable

This heat from data centres has traditionally been dissipated in the environment and overlooked by policymakers as an energy source. The wisdom of capturing the heat instead was underscored when natural gas prices spiked following Russia’s invasion of Ukraine and governments scrambled to find alternative gas supplies. “When you have high energy prices and need heat, it’s not wise that you throw away the heat you have,” says David Gyulnazaryan, a heat reuse consultant.

In the European Union, the recently revised Energy Efficiency Directive (EED) mandates that data centres over one-megawatt use waste heat recovery applications, unless their owners can show this is not technically or economically feasible. Member states must audit the feasibility studies of data centre operators that reach an unfavourable conclusion. European cities and regions, where a large number of data centres have already been opened, are at the forefront when it comes to establishing policies to promote the use of waste heat.

This consists of removing the roadblocks to using waste heat. In Denmark, a tax on surplus heat was removed in 2021 for those industries like data centres

69 END USERS

PHOTO KAS VAN VLIET PHOTO DIGITAL REALTY

Proudly independent, informing the energy transition

FORESIGHT — Climate & Energy

To join the FORESIGHT Climate & Energy partner network contact us at partner@foresightmedia.com Our independent in-depth journalism is financially strengthened with the support of our network of partners: SECTION PARTNERS MAIN PARTNERS

David Weston EDITOR-IN-CHIEF

David Weston EDITOR-IN-CHIEF

PHOTO

PHOTO