LIMITATION OF LIABILITY FOR INFORMATIONAL REPORTS

IMPORTANT -- PLEASE READ CAREFULLY:

This report is not an insured product or service or a representation of the condition of title to real property. It is not an abst ract, legal opinion, opinion of title, title insurance commitment or preliminary report, or any form of Title Insurance or Guaranty. This report is issued exclusively for the benefit of the Applicant therefor and may not be used or relied upon by any other person. This report may not be reproduced in any manner without First American or Title Security's prior written consent. First American or Title Security does not represent or warrant that the information herein is complete or free from error, and the information herein is provided without any warranties of any kind, as-is, and with all faults. As a material part of the consideration given in exchange for the issuance of this report, recipient agrees that First American or Title Security's sole liability for any loss or damage caused by an error or omission due to inaccurate information or negligence in preparing this report shall be limited to the fee charged for the report. Recipient accepts this report with this limitation and agrees that First American or Title Security would not have issued this report but for the limitation of liability described above. First American or Title Security makes no representation or warranty as to the legality or propriety of recipient's use of the information herein.

Disclaimer

This REiSource report is provided "as is" without warranty of any kind, either express or implied, including without limitations any warrantees of merchantability or fitness for a particular purpose. There is no representation of warranty that this information is complete or free from error, and the provider does not assume, and expressly disclaims, any liability to any person or entity for loss or damage caused by errors or omissions in this REiSource report without a title insurance policy.

The information contained in the REiSource report is delivered from your Title Company, who reminds you that you have the right as a consumer to compare fees and serviced levels for Title, Escrow, and all other services associated with property ownership, and to select providers accordingly. Your home is the largest investment you will make in your lifetime and you should demand the very best.

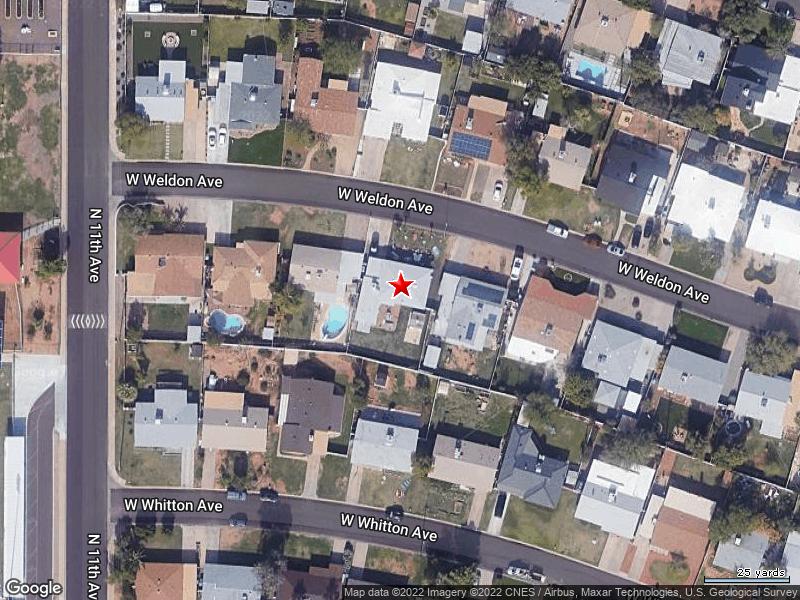

Subject Property : 1001 W Weldon Ave Phoenix AZ 85013

Owner Information

Owner Name : Gg2010 Holdings Corp

Mailing Address : 5340 E Flagstone St, Long Beach CA 90808-3544 C018

Vesting Codes : / / Corporation

Owner Occupied Indicator : A

Location Information

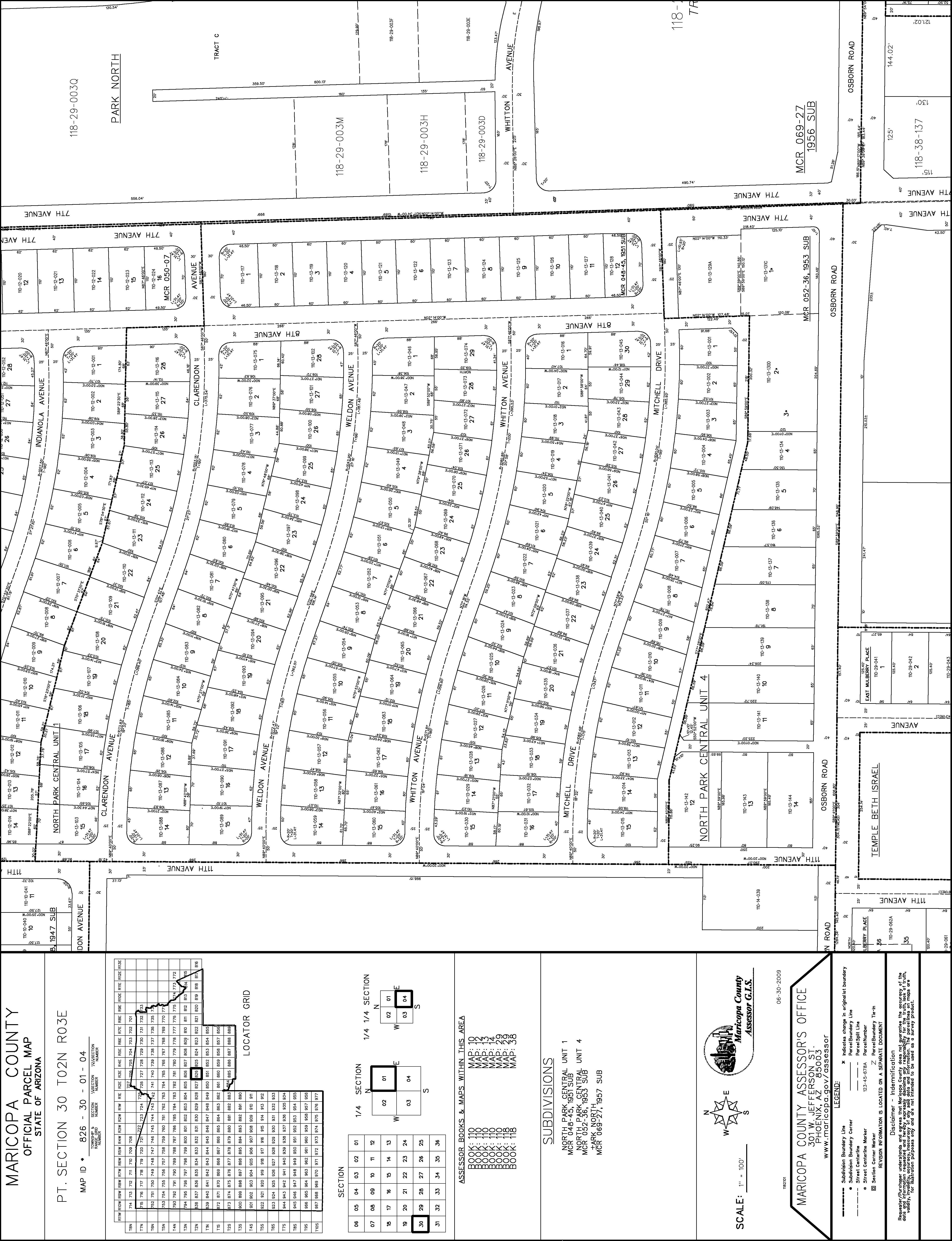

Legal Description : Lot 11 3 North Park Central 1

County : Maricopa, Az

Census Tract / Block : 1104.00 / 1

Township-Range- Sect : 02N-03E-30

Legal Lot : 11

Legal Block : 3

APN : 110-13-056

Last Market Sale Information

Subdivision : North Park Central Unit 1

Map Reference : 4845

School District : Osborn 8

Munic/Township : Phoenix

Neighbor Code : 17-008

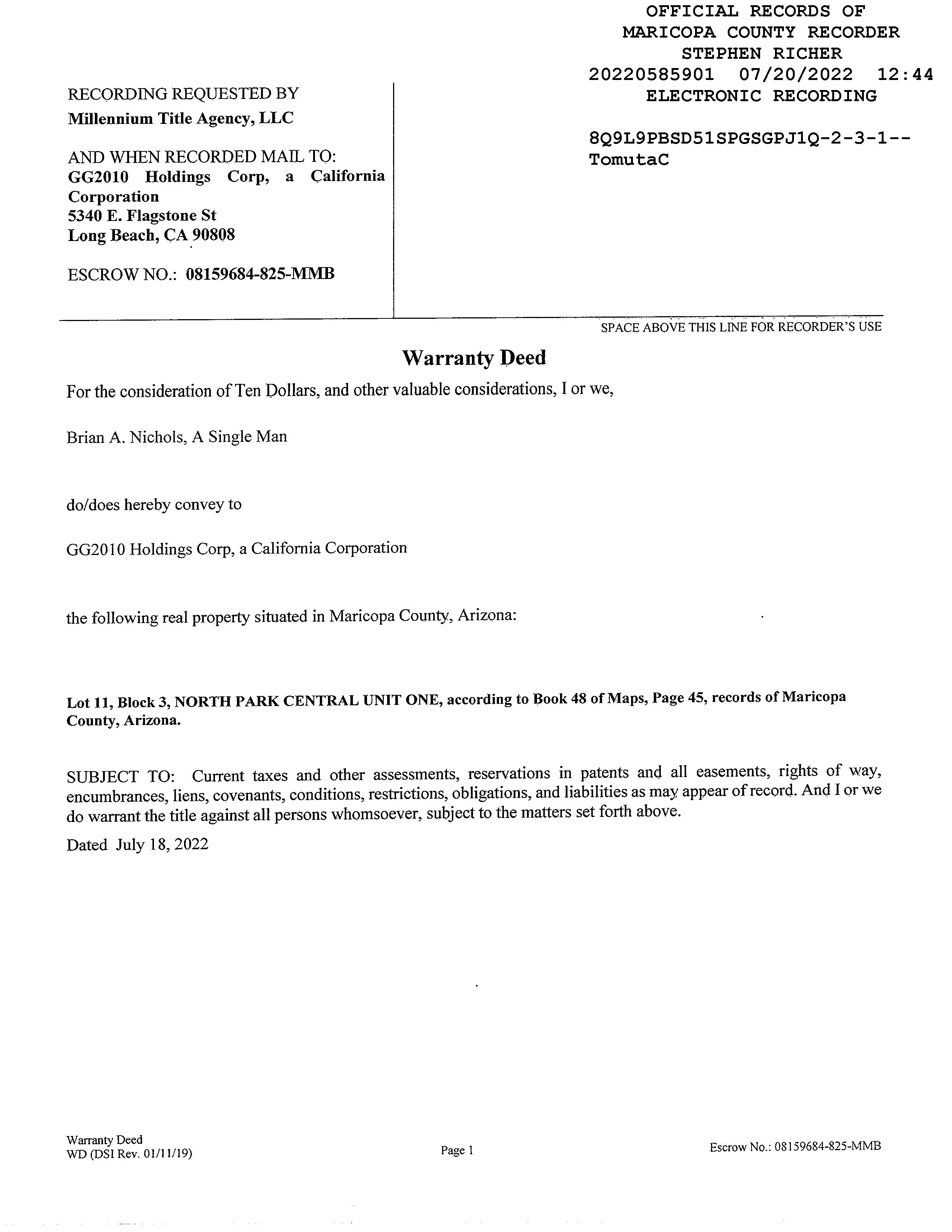

Recording/Sale Date : 07/20/2022 / 07/18/2022 1st Mtg Amount/Type : $353,000 / Cnv

Sale Price : $415,000 1st Mtg Document # : 585902

Document # : 585901

Deed Type : Warranty Deed

Title Company : Millennium Title Agcy

Seller Name : Nichols Brian A

Prior Sale Information

Prior Rec/Sale Date : 11/08/2004 / 10/25/2004

Prior Sale Price : $157,500

Prior Doc Number : 1308727

Prior Deed Type : Warranty Deed

Price Per SqFt : $294.54

Prior Lender : Rbc Mtg Co

Prior 1st Mtg Amt/Type : $171,700 / Va

Prior 1st Mtg Rate/Type : / Fixed Rate Loan

Customer Name : Jeremiah Stiffler

Customer Company Name : First American Prepared On : 12/02/2022

Property Characteristics

Gross Area : 1,409 Garage Capacity : 1

Patio Type : Covered Concrete Masonry Patio

Living Area : 1,409 Roof Material : Asphalt Shingle Air Cond : Refrigeration

Total Rooms : 6

Heat Type : Forced Air Quality : Average Year Built / Eff : 1951 Cooling Type : Forced Air Condition : Average

# of Stories : 1 Exterior wall : Paint Blk

Bath Fixtures : 6 Parking Type : Carport

Property Information

Land Use : Sfr Lot Acres : 0.15

State Use : Single Fam Resurban Subd ( 3 ) Zoning : R1-6 Lot Size : 6,429

Tax Information

Total Value : $274,700 Improve % : 80%

Current Assessed Year : 2023

Land Value : $54,900 Tax Year : 2022

Current Year Improvement Value :

$27,040

Current Year Total Value : $33,800 Improvement Value : $219,800 Property Tax : $879.12

Total Taxable Value : $11,369

Tax Rate Area : 081300

Assessed Year : 2022 Market Value : $274,700

Current Year Land Value : $6,760

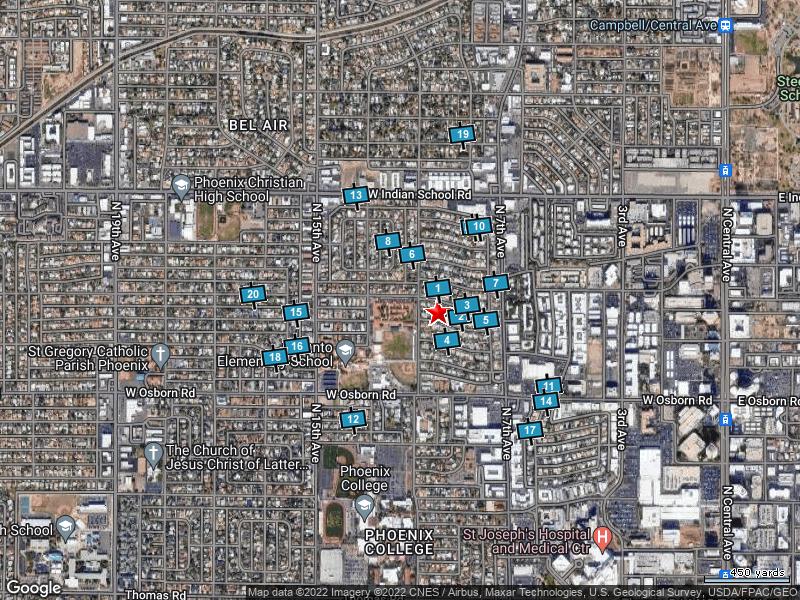

Customer Name : Jeremiah StifflerSale Price $415,000 $200,000 $1,695,000 $547,425 Bldg/Living Area 1409 1263 1593 1432 Price Per Square Foot $294.54 $144 $1,076 $377.76 Year Built 1951 1943 1955 1951 Lot Size 6,429 6,164 12,969 7,522 Bedrooms Bathrooms 2 1 3 2 Stories 1 1 1 1 Total Assessed Value $274,700 $236,500 $320,800 $283,575 Distance From Subject 0 0.05 0.46 0.26

S 1001 W Weldon Ave 415,000 274,700 07/20/2022 2 1,409 6,429 1951 R1-6 1 1001 W Clarendon Ave 640,000 286,600 03/04/2022 2 1,403 6,290 1950 0.05 R1-6 2 827 W Weldon Ave 449,000 265,300 05/03/2022 1 1,480 6,608 1951 0.06 R1-6 3 822 W Weldon Ave 205,000 276,300 03/07/2022 2 1,424 6,787 1950 0.07 R1-6 4 846 W Mitchell Dr 457,500 296,100 09/30/2022 3 1,467 6,233 1950 0.08 R1-6 5 3610 N 8th Ave 402,000 274,700 02/22/2022 2 1,475 6,778 1952 0.12 R1-6 6 3822 N 11th Ave 386,500 261,700 06/08/2022 2 1,501 7,662 1952 0.15 R1-6 7 3807 N 8th Ave 599,000 271,100 07/22/2022 2 1,462 6,891 1952 0.16 R1-6 8 3836 N 12th Ave 600,000 269,300 04/13/2022 2 1,455 7,388 1947 0.21 R1-6 9 812 W Piccadilly Rd 585,000 281,800 07/21/2022 2 1,434 6,443 1952 0.23 R1-6 10 808 W Piccadilly Rd 385,000 267,500 04/13/2022 2 1,276 6,286 1952 0.23 R1-6 11 3355 N 6th Ave 670,000 311,200 04/12/2022 3 1,528 8,364 1953 0.34 R1-6 Customer Name : Jeremiah Stiffler Customer Company Name : First American Prepared On : 12/02/2022

12 1318 W Flower St 340,000 296,000 05/10/2022 2 1,387 7,741 1948 0.34 R1-6

13 1312 W Amelia Ave 443,000 236,500 07/18/2022 1 1,263 8,154 1946 0.35 R1-6

14 3343 N 6th Ave 537,500 290,300 11/03/2022 2 1,402 6,530 1955 0.35 R1-6

15 3615 N 15th Dr 705,000 297,600 06/21/2022 2 1,593 10,795 1950 0.35 R1-6

16 1518 W Mitchell Dr 200,000 264,500 05/23/2022 2 1,383 6,164 1951 0.36 R1-6

17 3308 N 6th Ave 585,000 284,600 06/30/2022 2 1,414 7,157 1955 0.38 R1-6

18 3421 N 16th Ave 1,695,000 316,800 03/29/2022 2 1,576 12,969 1951 0.42 R1-6

19 903 W Mackenzie Dr 464,000 302,800 02/14/2022 2 1,393 7,109 1943 0.44 R1-6

20 1612 W Weldon Ave 599,999 320,800 07/15/2022 2 1,331 8,089 1951 0.46 R1-6

Distressed Sales =

Customer Name : Jeremiah Stiffler

Customer Company Name : First American Prepared On : 12/02/2022

Name : Jeremiah Stiffler

Company Name : First American Prepared On : 12/02/2022

Details of Comparables

Subject Property: 1001 W Weldon Ave Phoenix Az 85013

Owner Name: Gg2010 Holdings Corp / APN / Alternate APN: 110-13-056 / Deed Type: Warranty Deed

Land Use: Sfr Subdivision / Tract: North Park Central Unit 1 / Lot Size: 6,429 Year Built / Eff: 1951 /

Rec. Date / Price: 07/20/2022 / $415,000 Living Area: 1,409

# of units: Document #: 585901 Bedrooms: Pool: Total Tax Value: $274,700 Bath(F/H): /

#1 1001 W Clarendon Ave Phoenix Az 85013

Owner Name: Rivas Isela / APN / Alternate APN: 110-13-085 / Deed Type: Warranty Deed

Land Use: Sfr Subdivision / Tract: North Park Central Unit 1 / Lot Size: 6,290 Year Built / Eff: 1950 /

Rec. Date / Price: 03/04/2022 / $640,000 Living Area: 1,403

# of units: Document #: 200463 Bedrooms: Pool: Total Tax Value: $286,600 Bath(F/H): /

#2 827 W Weldon Ave Phoenix Az 85013

Owner Name: Guaranteed Home Buyers Llc / APN / Alternate APN: 110-13-051 / Deed Type: Warranty Deed

Land Use: Sfr Subdivision / Tract: North Park Central Unit 1 / Lot Size: 6,608 Year Built / Eff: 1951 /

Rec. Date / Price: 05/03/2022 / $449,000 Living Area: 1,480

# of units: Document #: 388524 Bedrooms: Pool: Total Tax Value: $265,300 Bath(F/H): /

#3 822 W Weldon Ave Phoenix Az 85013

Owner Name: Avolan 1 Llc / APN / Alternate APN: 110-13-098 / Deed Type: Warranty Deed

Land Use: Sfr Subdivision / Tract: North Park Central Unit 1 / Lot Size: 6,787 Year Built / Eff: 1950 /

Rec. Date / Price: 03/07/2022 / $205,000 Living Area: 1,424

# of units: Document #: 207817 Bedrooms: Pool: Total Tax Value: $276,300 Bath(F/H): /

#4 846 W Mitchell Dr Phoenix Az 85013

Owner Name: Waters Warren M /Waters Karemmy N APN / Alternate APN: 110-13-036 / Deed Type: Warranty Deed

Land Use: Sfr Subdivision / Tract: North Park Central Unit 1 / Lot Size: 6,233 Year Built / Eff: 1950 /

Rec. Date / Price: 09/30/2022 / $457,500 Living Area: 1,467

# of units: Document #: 747375 Bedrooms: Pool: Total Tax Value: $296,100 Bath(F/H): /

Customer Name : Jeremiah Stiffler#5 3610 N 8th Ave Phoenix Az 85013

Owner Name: Good David Gregory /Bauman Jilliam Amanda APN / Alternate APN: 110-13-046 / Deed Type: Warranty Deed Land Use: Sfr Subdivision / Tract: North Park Central Unit 1 / Lot Size: 6,778 Year Built / Eff: 1952 /

Rec. Date / Price: 02/22/2022 / $402,000 Living Area: 1,475

# of units: Document #: 161143 Bedrooms: Pool: Pool Total Tax Value: $274,700 Bath(F/H): /

#6 3822 N 11th Ave Phoenix Az 85013

Owner Name: Dorian Explorations Llc / APN / Alternate APN: 110-10-044 / Deed Type: Trustee's Deed (foreclosure) Land Use: Sfr Subdivision / Tract: Woodlawn Park / Lot Size: 7,662 Year Built / Eff: 1952 / Rec. Date / Price: 06/08/2022 / $386,500 Living Area: 1,501 # of units: Document #: 485346 Bedrooms: Pool: Total Tax Value: $261,700 Bath(F/H): /

#7 3807 N 8th Ave Phoenix Az 85013

Owner Name: Dickens Dustin S / APN / Alternate APN: 110-12-023 / Deed Type: Warranty Deed Land Use: Sfr Subdivision / Tract: North Park Central Unit 2 / Lot Size: 6,891 Year Built / Eff: 1952 / Rec. Date / Price: 07/22/2022 / $599,000 Living Area: 1,462 # of units: Document #: 591227 Bedrooms: Pool: Total Tax Value: $271,100 Bath(F/H): /

#8 3836 N 12th Ave Phoenix Az 85013

Owner Name: Witenstein Matthew & Julie /Witenstein Daniel APN / Alternate APN: 110-10-156 / Deed Type: Warranty Deed Land Use: Sfr Subdivision / Tract: Woodlawn Park / Lot Size: 7,388 Year Built / Eff: 1947 / Rec. Date / Price: 04/13/2022 / $600,000 Living Area: 1,455 # of units: Document #: 326689 Bedrooms: Pool: Pool Total Tax Value: $269,300 Bath(F/H): /

#9 812 W Piccadilly Rd Phoenix Az 85013

Owner Name: Algarin Angel B / APN / Alternate APN: 110-11-045 / Deed Type: Warranty Deed Land Use: Sfr Subdivision / Tract: North Park Central Unit 3 / Lot Size: 6,443 Year Built / Eff: 1952 /

Rec. Date / Price: 07/21/2022 / $585,000 Living Area: 1,434

# of units: Document #: 587893 Bedrooms: Pool: Total Tax Value: $281,800 Bath(F/H): /

#10 808 W Piccadilly Rd Phoenix Az 85013

Owner Name: Traasco Llc & Moore Olga Edith / APN / Alternate APN: 110-11-046 / Deed Type: Warranty Deed Land Use: Sfr Subdivision / Tract: North Park Central Unit 3 / Lot Size: 6,286 Year Built / Eff: 1952 / Rec. Date / Price: 04/13/2022 / $385,000 Living Area: 1,276 # of units: Document #: 327309 Bedrooms: Pool: Total Tax Value: $267,500 Bath(F/H): /

#11

3355 N 6th Ave Phoenix Az 85013

Owner Name: Littleton Christopher /Littleton Heidi APN / Alternate APN: 118-38-018 / Deed Type: Warranty Deed Land Use: Sfr Subdivision / Tract: Park Central Unit 1 / Lot Size: 8,364 Year Built / Eff: 1953 / Rec. Date / Price: 04/12/2022 / $670,000 Living Area: 1,528 # of units: Document #: 323351 Bedrooms: Pool: Pool Total Tax Value: $311,200 Bath(F/H): /

#12 1318

W Flower St Phoenix Az 85013

Owner Name: Az Oz Property Solutions Llc / APN / Alternate APN: 110-28-041 / Deed Type: Warranty Deed Land Use: Sfr Subdivision / Tract: Mulberry Place / Lot Size: 7,741 Year Built / Eff: 1948 / Rec. Date / Price: 05/10/2022 / $340,000 Living Area: 1,387 # of units: Document #: 408435 Bedrooms: Pool: Total Tax Value: $296,000 Bath(F/H): /

#13 1312 W Amelia Ave Phoenix Az 85013

Owner Name: Newkirk Stacy / APN / Alternate APN: 110-10-118 / Deed Type: Warranty Deed Land Use: Sfr Subdivision / Tract: Woodlawn Park / Lot Size: 8,154 Year Built / Eff: 1946 / Rec. Date / Price: 07/18/2022 / $443,000 Living Area: 1,263 # of units: Document #: 580535 Bedrooms: Pool: Total Tax Value: $236,500 Bath(F/H): /

#14 3343 N 6th Ave Phoenix Az 85013

Owner Name: Alpha Tango Property Llc / APN / Alternate APN: 118-38-021 / Deed Type: Warranty Deed Land Use: Sfr Subdivision / Tract: Park Central Unit 1 / Lot Size: 6,530 Year Built / Eff: 1955 / Rec. Date / Price: 11/03/2022 / $537,500 Living Area: 1,402 # of units: Document #: 818524 Bedrooms: Pool: Total Tax Value: $290,300 Bath(F/H): /

Customer Name : Jeremiah Stiffler

Customer Company Name : First American Prepared On : 12/02/2022

#15 3615 N 15th Dr Phoenix Az 85015

Owner Name: Hales Greg B / APN / Alternate APN: 110-09-025 / Deed Type: Warranty Deed Land Use: Sfr Subdivision / Tract: Westwood Terrace / Lot Size: 10,795 Year Built / Eff: 1950 / Rec. Date / Price: 06/21/2022 / $705,000 Living Area: 1,593 # of units: Document #: 514602 Bedrooms: Pool: Pool Total Tax Value: $297,600 Bath(F/H): /

#16 1518 W Mitchell Dr Phoenix Az 85015

Owner Name: Mcginty Kathryn Marie /Kress Kevin Michael APN / Alternate APN: 110-15-106 / Deed Type: Warranty Deed Land Use: Sfr Subdivision / Tract: Westwood Terrace Amd / Lot Size: 6,164 Year Built / Eff: 1951 / Rec. Date / Price: 05/23/2022 / $200,000 Living Area: 1,383 # of units: Document #: 440390 Bedrooms: Pool: Total Tax Value: $264,500 Bath(F/H): /

#17

3308 N 6th Ave Phoenix Az 85013

Owner Name: Ballew Lindsay / APN / Alternate APN: 118-38-008 / Deed Type: Warranty Deed Land Use: Sfr Subdivision / Tract: Park Central Unit 1 / Lot Size: 7,157 Year Built / Eff: 1955 / Rec. Date / Price: 06/30/2022 / $585,000 Living Area: 1,414 # of units: Document #: 542127 Bedrooms: Pool: Total Tax Value: $284,600 Bath(F/H): /

#18 3421 N 16th Ave Phoenix Az 85015

Owner Name: Jackson Benjamin Thomas /Aker Sydney Brooke APN / Alternate APN: 110-15-059-A / Deed Type: Warranty Deed Land Use: Sfr Subdivision / Tract: Westwood Terrace / Lot Size: 12,969 Year Built / Eff: 1951 / Rec. Date / Price: 03/29/2022 / $1,695,000 Living Area: 1,576 # of units: Document #: 279477 Bedrooms: Pool: Pool Total Tax Value: $316,800 Bath(F/H): /

#19 903 W Mackenzie Dr Phoenix Az 85013

Owner Name: Young Craig /Brandice Nicole APN / Alternate APN: 155-39-074-B / Deed Type: Warranty Deed Land Use: Sfr Subdivision / Tract: Woodlea Blocks 3 Thru 6 11 12 / Lot Size: 7,109 Year Built / Eff: 1943 /

Rec. Date / Price: 02/14/2022 / $464,000 Living Area: 1,393

# of units: Document #: 135685 Bedrooms: Pool: Total Tax Value: $302,800 Bath(F/H): /

#20 1612 W Weldon Ave Phoenix Az 85015

Owner Name: Castillo Monica /Castillo Christopher APN / Alternate APN: 110-15-019 / Deed Type: Warranty Deed Land Use: Sfr Subdivision / Tract: Westwood Terrace / Lot Size: 8,089 Year Built / Eff: 1951 / Rec. Date / Price: 07/15/2022 / $599,999 Living Area: 1,331 # of units: Document #: 574718 Bedrooms: Pool: Total Tax Value: $320,800 Bath(F/H): /

Customer

Customer Name : Jeremiah Stiffler Customer Company Name : First American Prepared On : 12/02/2022

Arizona Schools

Public Schools : Elementary Schools

Clarendon School Distance 0.12 Miles 1225 W Clarendon Ave Phoenix AZ 85013

Telephone : (602) 707-2000

School District : Osborn Elementary District (4262)

Lowest Grade : Pre-K Highest Grade : 8th Kindergarten : Yes School Enrollment : Enrollment : 442 Total Expenditure/Student : 165

Encanto School Distance 0.25 Miles 1426 W Osborn Rd Phoenix AZ 85013

Telephone : (602) 707-2300

School District : Osborn Elementary District (4262)

Lowest Grade : Pre-K Highest Grade : 8th Kindergarten : Yes School Enrollment : Enrollment : 681 Total Expenditure/Student : 165

Basis Phoenix Central Primary Distance 0.86 Miles 201 E Indianola Ave Phoenix AZ 85012

Telephone : (602) 559-5399

School District : Basis Charter Schools Inc. (92349)

Lowest Grade : K Highest Grade : 5th Kindergarten : Yes School Enrollment : Enrollment : 579 Total Expenditure/Student :

Customer Name : Jeremiah Stiffler

Customer Company Name : First American Prepared On : 12/02/2022

Phoenix Modern Distance 0.95 Miles

200 E Mitchell Dr Phoenix AZ 85012

Telephone : (602) 740-9271

School District : New Learning Ventures Inc. (320470)

Lowest Grade : K Highest Grade : 6th Kindergarten : Yes School Enrollment : Enrollment : 69 Total Expenditure/Student :

Middle Schools

Osborn Middle School Distance 1.2 Miles 1102 W Highland Ave Phoenix AZ 85013

Telephone : (602) 707-2400

School District : Osborn Elementary District (4262)

Lowest Grade : 7th Highest Grade : 8th Kindergarten : No School Enrollment : Enrollment : 595 Total Expenditure/Student : 165

Imagine Camelback Middle Distance 1.64 Miles

5050 N. 19th Ave. Phoenix AZ 85015

Telephone : (602) 344-4620

School District : Imagine Camelback Middle Inc. (89561)

Lowest Grade : 6th Highest Grade : 8th Kindergarten : No School Enrollment : Enrollment : 218 Total Expenditure/Student :

Madison Park School Distance 2.22 Miles 1431 E. Campbell Phoenix AZ 85014

Telephone : (602) 664-7500

School District : Madison Elementary District (4270)

Lowest Grade : 5th Highest Grade : 8th Kindergarten : No School Enrollment : Enrollment : 407 Total Expenditure/Student : 173

Customer Name : Jeremiah Stiffler

Customer Company Name : First American Prepared On : 12/02/2022

Choice Learning Academy Distance 2.22 Miles

5330 N 23rd Ave Phoenix AZ 85015

Telephone : (602) 246-0699

School District : Alhambra Elementary District (4280)

Lowest Grade : 6th Highest Grade : 8th Kindergarten : No School Enrollment : Enrollment : 493

High Schools

Total Expenditure/Student : 66

Phoenix College Preparatory Academy Distance 0.27 Miles

3310 N 10th Ave Phoenix AZ 85013

Telephone : (602) 285-7998

School District : Mcccd On Behalf Of Phoenix College Preparatory Academy (811

Highest Grade : 12th School Enrollment : Enrollment : 192

Lowest Grade : 9th

Total Expenditure/Student : Advanced Placement : No

Linda Abril Educational Academy Distance 0.96 Miles 3000 N 19th Ave Phoenix AZ 85015

Telephone : (602) 764-0050

School District : Phoenix Union High School District (4286)

Lowest Grade : 10th Highest Grade : 12th School Enrollment : Enrollment : 327

Total Expenditure/Student : 176 Advanced Placement : No

Metro Technical High School Distance 1.04 Miles 1900 W Thomas Rd Phoenix AZ 85015

Telephone : (602) 764-8000

School District : Phoenix Union High School District (4286)

Lowest Grade : 9th Highest Grade : 12th School Enrollment : Enrollment : 1794

Total Expenditure/Student : 176 Advanced Placement : No

Customer Company Name : First American Prepared On : 12/02/2022

Customer Name : Jeremiah StifflerPhoenix Coding Academy

4445 N Central Ave Phoenix AZ 85012

Telephone : (602) 764-5700

Distance 1.06 Miles

School District : Phoenix Union High School District (4286)

Highest Grade : 12th School Enrollment : Enrollment : 317

Lowest Grade : 9th

Total Expenditure/Student : 176 Advanced Placement : No

Customer Name : Jeremiah Stiffler

Customer Company Name : First American Prepared On : 12/02/2022

Attractions / Recreation

Name Address

Telephone Distance (Miles)

True Self Yoga 841 W Clarendon Ave Phoenix Az (602) 206-7628 0.07

Equilibrium Studio Phx Llc 802 W Osborn Rd Phoenix Az (602) 577-7409 0.19

Samba Performers 4113 N 7th Ave Phoenix Az (480) 510-4741 0.38

Az Irish Ball Club 1544 W Whitton Ave Phoenix Az (480) 748-9005 0.39

Banks / Financial

Name Address Telephone Distance (Miles)

Arizona Wholesale Mortgage Inc. 4019 N 15th Ave Phoenix Az (480) 650-4230 0.39

1st Metropolitan Mortgage 4019 N 15th Ave Phoenix Az (602) 277-4545 0.39

The Equitable Real Estate Comp 3620 N 3rd Ave Phoenix Az (602) 224-3962 0.45

Am Mechanical, Inc. 300 W Clarendon Ave # 230 Phoenix Az (423) 559-9377 0.46

Eating / Drinking

Name Address Telephone Distance (Miles)

Fair Trade Cafe 847 W Weldon Ave Phoenix Az (623) 703-1902 0.05

Eribertos Mexican Food 3437 N 7th Ave Phoenix Az (602) 264-8517 0.23

Pho Noodles Llc 3417 N 7th Ave Phoenix Az (623) 399-2463 0.23

Marina Subs Inc 3413 N 7th Ave Phoenix Az (602) 274-5074 0.23

Health Care Services

Name Address Telephone Distance (Miles)

Karen A Epley

1226 W Osborn Rd Phoenix Az (602) 707-2319 0.21

Lynn A Krivda 1226 W Osborn Rd Phoenix Az (602) 707-2511 0.21

Stephen A Caswell

1226 W Osborn Rd Phoenix Az (602) 707-2230 0.21

Fmc Central Dialysis 3421 N 7th Ave Phoenix Az (602) 274-2293 0.23

Customer Name : Jeremiah Stiffler Customer Company Name : First American Prepared On : 12/02/2022

CoreLogic.

Hospitality

Name Address Telephone Distance (Miles)

Clarendon Hotel Group, Llc 401 W Clarendon Ave Phoenix Az (602) 252-7363 0.38

The Clarendon Hotels & Suites 401 W Clarendon Ave Phoenix Az (602) 252-7363 0.38

Budget Suites Of America, Az-306 611 W Indian School Rd Phoenix Az (602) 277-3400 0.41

Holiday Inn Phoenix Downtown North 212 W Osborn Rd Phoenix Az (602) 595-4444 0.55

Organizations / Associations

Name Address

Telephone Distance (Miles)

The Ebenezer Group Llc 1008 W Weldon Ave Phoenix Az (602) 368-3529 0.02

Christian Manton Llc 917 W Flower St Phoenix Az (602) 374-2860 0.3

Arizona Conference Of Seventh-day Adventists 821 W Flower St Phoenix Az (602) 246-0403 0.31

Resurrection Community Church Of Hope 4121 N 7th Ave Phoenix Az (602) 234-2180 0.39

Personal Services

Name Address Telephone Distance (Miles)

Orangetheory Fitness 3350 N 7th Ave Ste 160 Phoenix Az (602) 663-9047 0.27

John H Vogel & E E Matesi Dds Pc 1544 W Osborn Rd Phoenix Az (602) 279-2386 0.41

Fitness Solutions Inc 4145 N 6th Ave Phoenix Az (602) 631-9698 0.46

Mira Fitness And Health Solutions, Llc 1730 W Mackenzie Dr Phoenix Az (602) 790-4013 0.78

Shopping

Name Address

Telephone Distance (Miles)

Phx Street Food Coalition 1005 W Amelia Ave Phoenix Az (602) 466-2007 0.26

Sprouts Farmers Market, Inc. 3320 N 7th Ave Phoenix Az (602) 384-2650 0.28

10net Managed Solutions Inc. 3614 N 15th Ave Ste A Phoenix Az (888) 880-9694 0.3

Safeway Stores, Incorporated 520 W Osborn Rd Phoenix Az (602) 285-0661 0.3

Customer Name : Jeremiah Stiffler

Customer Company Name : First American Prepared On : 12/02/2022

3605 N 7TH AVE

Owner Name : 7th Avenue Advisory Llc

Sale Date : 01/17/2019

Distance 0.19 Miles

Recording Date : 01/22/2019

Sale Price : $2,040,000

Total Value : $1,514,800 Property Tax : $19,434.98

Land Use : Office Building Lot Acres : 0.65

Stories : 1 Living Area : 25,166

Yr Blt / Eff Yr Blt : 1972 / 1997

Subdivision : Park North

APN : 118-29-003-M

3603 N 7TH AVE Distance 0.19 Miles

Owner Name : Forest Park Lee Lane Llc

Recording Date : 01/02/2018

Sale Date : 12/27/2017 Sale Price : $786,462

Total Value : $927,700 Property Tax : $11,204.86

Land Use : Office Building Lot Acres : 0.55 Stories : 1 Living Area : 8,806

Yr Blt / Eff Yr Blt : 1974 / 1978

Subdivision : Park North

APN : 118-29-003-H

3601 N 7TH AVE Distance 0.2 Miles

Owner Name : Forest Park Lee Lane Llc

Recording Date : 01/02/2018

Sale Date : 12/27/2017 Sale Price : $323,250

Total Value : $338,400 Property Tax : $5,013.32

Land Use : Office Building Lot Acres : 0.23 Stories : 1 Living Area : 4,005

Yr Blt / Eff Yr Blt : 1962 / 1962

Subdivision : Park North

3801 N 7TH AVE

Owner Name : Forest Park Llc

Total Value : $29,666,200

APN : 118-29-003-D

Distance 0.21 Miles

Subdivision : Park North

Property Tax : $126,276.06

Land Use : Apartment Lot Acres : 5.52

Stories : 3 Living Area : 168,228

Yr Blt / Eff Yr Blt : 1975 / 1975

APN : 118-29-003-Q

Customer Name : Jeremiah Stiffler Customer Company Name : First American Prepared On : 12/02/2022

3605 N 7TH AVE

Owner Name : Forest Park Llc

Sale Date : 07/15/2008

Distance 0.23 Miles

Recording Date : 07/31/2008

Sale Price : $1,595,000

Total Value : $3,097,000 Property Tax : $12,862.10

Land Use : Apartment Lot Acres : 0.49

Stories : 3 Living Area : 18,198

Yr Blt / Eff Yr Blt : 1970 / 1970

Subdivision : Park North

APN : 118-29-003-F

3602 N 6TH AVE Distance 0.23 Miles

Owner Name : Forest Park Llc

Recording Date : 08/29/2008

Sale Date : 08/09/2008 Sale Price : $1,400,000

Total Value : $3,228,700 Property Tax : $12,597.12

Land Use : Apartment Lot Acres : 0.48 Stories : 2 Living Area : 19,160

Yr Blt / Eff Yr Blt : 1960 / 1960 APN : 118-29-003-E

Subdivision : Park North

3653 N 6TH AVE Distance 0.27 Miles

Owner Name : Phoenix Sixth Avenue Llc

Recording Date : 03/21/2003

Sale Date : 03/17/2003 Sale Price : $4,758,000

Total Value : $16,111,300 Property Tax : $63,947.12

Land Use : Apartment Lot Acres : 3.56

Stories : 2 Living Area : 101,145

Yr Blt / Eff Yr Blt : 1960 / 1960

Subdivision : Park North

APN : 118-29-009-A

Customer Name : Jeremiah Stiffler

Customer Company Name : First American Prepared On : 12/02/2022

3600 N 5TH AVE # 200

Owner Name : Rees Katherina & Steven

Sale Date : 07/12/2018

Distance 0.3 Miles

Subdivision : Pierre On 5th Ave Condo Amd

Recording Date : 07/31/2018

Total Value : $205,100 Sale Price : $224,500

Bed / Bath : / 2 Property Tax : $1,803.28

Land Use : Condominium

Lot Acres : 0.03

Stories : 1 Living Area : 1,344

Yr Blt / Eff Yr Blt : 1961 / APN : 118-30-323

3600 N 5TH AVE # 301

Owner Name : Gold Ingrid M

Sale Date : 04/01/2016

Distance 0.3 Miles

Subdivision : Pierre On 5th Ave Condo Amd

Recording Date : 05/06/2016

Total Value : $205,100 Sale Price : $195,000

Bed / Bath : / 2 Property Tax : $1,803.28

Land Use : Condominium Lot Acres : 0.03

Stories : 1 Living Area : 1,344

Yr Blt / Eff Yr Blt : 1961 / APN : 118-30-332

3600 N 5TH AVE # 101 Distance

Owner Name : Donlan Thomas A

Sale Date : 05/18/2016

0.3 Miles

Subdivision : Pierre On 5th Ave Condo Amd

Recording Date : 05/31/2016

Total Value : $208,300 Sale Price : $204,500

Bed / Bath : / 2 Property Tax : $1,844.96

Land Use : Condominium Lot Acres : 0.03

Stories : 1 Living Area : 1,376

Yr Blt / Eff Yr Blt : 1961 / APN : 118-30-315

Customer Name : Jeremiah Stiffler

Customer Company Name : First American Prepared On : 12/02/2022

Census Tract / block: 1104.00 / 1 Year: 2018

Household

Population Population by Age

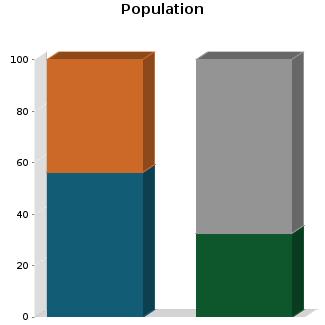

Count: 5,054 0 - 11

Estimate Current Year: 4,770 12 - 17

Estimate in 5 Years: 3,785 18 - 24 4.21%

Growth Last 5 Years: 1.01% 25 - 64 68.72%

Growth Last 10 Years: -155.14% 65 - 74 6.67% 75+

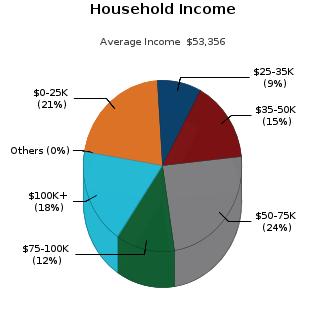

Household Size Household Income

Current Year: 2,200 0 - $25,000 21.18%

Average Current Year: 2.26 $25,000 - $35,000 8.95%

Estimate in 5 Years: 2,112 $35,000 - $50,000 15.36%

Growth Last 5 Years: 0.64% $50,000 - $75,000 24.32%

Growth Last 10 Years: -11.06% $75,000 - $100,000 11.91%

Male Population: 56.11% Above $100,000 18.27%

Female Population: 43.89% Average Household Income: $53,356

Married People: 32.47%

Unmarried People: 67.53%

Housing

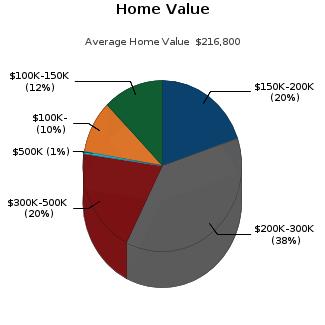

Median Mortgage Payments Home Values

Under $300: 11.72% Below $100,000: 9.89%

$300 - $799: 17.85% $100,000 - $150,000: 12.34%

$800 - $1,999: 60.37% $150,000 - $200,000: 19.69%

Over $2,000: 10.06% $200,000 - $300,000: 37.71%

Median Home Value: $216,800 $300,000 - $500,000: 19.86%

Unit Occupied Owner: 51.95% Above $500,000: 0.52%

Median Mortgage: $1,009

Customer Name : Jeremiah Stiffler

Customer Company Name : First American Prepared On : 12/02/2022

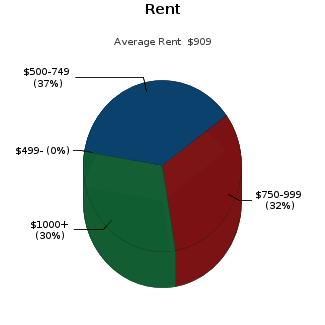

Rent Payments Year Built

Unit Occupied Renter: 48.05% 1999 - 2000

Median Gross Rent: $909 1995 - 1998

Less Than $499 0% 1990 - 1994

$500 - $749 37.18% 1980 - 1989 3%

$750 - $999 32.37% 1970 - 1979 15.57%

$1000 and Over 30.45% 1900 - 1969 76.34%

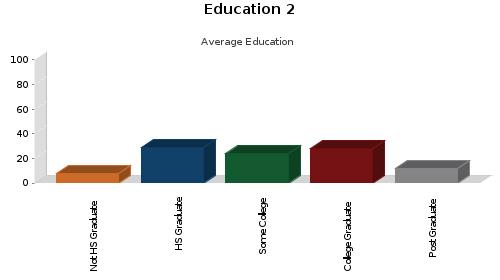

Education

Enrollment

Public Pre-Primary School: 0.47% Not Enrolled in School: 82.1%

Private Pre-Primary School: 0.98% Not A High School Graduate: 7.68%

Public School: 14.18% Graduate Of High School: 28.72%

Private School: 3.72% Attended Some College: 23.61%

Public College: 4.37% College Graduate: 27.91%

Private College: 0.63% Graduate Degree: 12.08%

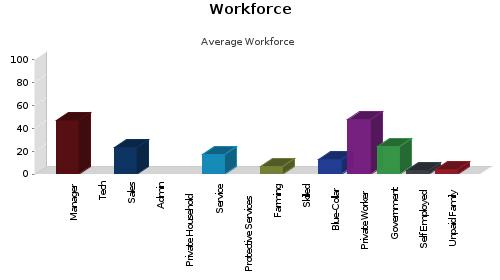

Workforce

Occupation:

Manager/Prof: 47.05% Private Worker: 47.47% Technical: Government Worker: 23.9% Sales: 23.28% Self Employed Worker: 3.02%

Administrative: Unpaid Family Worker: 3.91%

Private House Hold: Farming: 6.7%

Service: 17.04% Skilled:

Protective Services: Blue-Collar: 12.64%

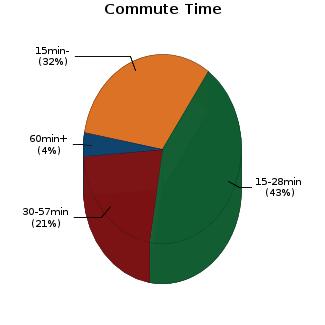

Commute Time

Less Than 15 Min: 31.97%

15 min - 28 min: 42.79%

30 min - 57 min: 21.18%

Over 60 min: 4.06%

Customer Name : Jeremiah Stiffler

Customer Company Name : First American Prepared On : 12/02/2022

Customer Name : Jeremiah Stiffler

Customer Company Name : First American Prepared On : 12/02/2022

Customer Name : Jeremiah Stiffler Customer Company Name : First American Prepared On : 12/02/2022

Customer Name : Jeremiah Stiffler Customer Company Name : First American Prepared On : 12/02/2022

Southwest Gas 1.877.860.6020 www.swgas.com Cox 602.277.1000 www.cox.com

Direct TV 1.888.777.2454 www.directv.com

Dish Network 1.800.823.4929 www.dishnetwork.com CenturyLink 800.366.8201 www.centurylink.com AT&T 1.800.222.0300 www.att.com

Verizon 1.877.300.4498 www.connecttoverizon.com

Salt River Project 602.236.8888 www.srpnet.com APS 602.371.7171 www.aps.com

Count on First American Title

Welcome to the home-selling process. Throughout this process, you can count on First American Title to guide you smoothly through your transaction and provide expert answers to your questions. We are happy to serve you.

Count On Us For Service

First American Title’s professionals are proud to provide the title insurance that assures people’s home ownership. Backed by First American Title Insurance Company, your transaction will be expertly completed in accordance with state-specific underwriting standards and state and federal regulatory requirements.

Count On Us For Stability

First American Title is the principal subsidiary of First American Financial Corporation, and one of the largest suppliers of title insurance services in the nation. With roots dating back to 1889, we’ve served families for generations.

Count On Us For Convenience

First American Title has a direct office or agent near you, offering convenient locations throughout Arizona. We also have an extensive network of offices and agents throughout the United States, and internationally.

Count On Us To Meet Your Needs

First American Financial Corporation offers more than title insurance and escrow services through its subsidiaries. Our subsidiaries also provide property data, title plant records and images, home warranties, property and casualty insurance, and banking, trust and advisory services.

Benefits of using a Professional REALTOR ®

Before you make the decision to try to sell your home alone, consider the benefits a REALTOR ® can provide that you may not be aware of.

A REALTOR ® :

› Understands market conditions and has access to information not available to the average homeowner.

› Can advertise effectively for the best results.

› Knows how to price your home realistically, to give you the highest price possible within your time frame.

› Is experienced in creating demand for homes and how to show them to advantage.

› Knows how to screen potential buyers and eliminate those who can’t qualify or are looking for bargain-basement prices.

› Knows how to go toe-to-toe in negotiations.

› Is always “on-call,” answering the phone at all hours, and showing homes evenings and weekends.

› Can remain objective when presenting offers and counter-offers on your behalf.

› Maintains errors-and-omissions insurance.

› Will listen to your needs, respect your opinions and allow you to make your own decisions.

› Can help protect your rights, particularly important with the increasingly complicated real estate laws and regulations.

› Is experienced with resolving problems to facilitate a successful closing on your home.

Only you can determine whether you should attempt to sell your home—probably your largest investment—all alone. Talk with a REALTOR® before you decide. You may find working with a professional is a lot less expensive and much more beneficial than you ever imagined!

FOR SALE BY OWNER

Many people believe they can save a considerable amount of money by selling their homes themselves. It may seem like a good idea at the time, but while you may be willing to take on the task, are you qualified? The following are some questions to help you realistically assess what’s involved.

Do you...

- have the knowledge, patience, and sales skills needed to sell your home?

- know how to determine your home’s current market value?

- know how to determine whether or not a buyer can qualify for a loan?

- understand the steps of an escrow and what’s required of you and the buyer?

- need to hire a real estate attorney? If so, do you know what the cost will be and how much liability they will assume in the transaction?

- know how to advertise effectively and what the costs will be?

- understand the various types of loans buyers may choose and the advantages and disadvantages for the seller?

- have arrangements with an escrow and title company, home warranty company, pest-control service and lender to assist you with the transaction?

Are you...

- aware of conditions in the marketplace today that affect value and length of time to sell?

- concerned about having strangers walking through your home?

- familiar enough with real estate regulations to prepare a binding sales contract? Counter-offers?

- aware that every time you leave your home, you are taking it off the market until you return?

- aware that prospective buyers and bargain hunters will expect you to lower your cost because there’s no REALTOR® involved?

- prepared to give up your evenings and weekends to show your home to potential buyers and “just-looking” time wasters?

Key Professionals Involved in Your Transaction

REALTOR ®

A REALTOR ® is a licensed real estate agent and a member of the National Association of REALTORS,® a real estate trade association. REALTORS ® also belong to their state and local Association of REALTORS.®

REAL ESTATE AGENT

A real estate agent is licensed by the state to represent parties in the transfer of property. Every REALTOR ® is a real estate agent, but not every real estate agent has the professional designation of a REALTOR.®

LISTING AGENT

A key role of the listing agent or broker is to form a legal relationship with the homeowner to sell the property and place the property in the Multiple Listing Service.

BUYER'S AGENT

A key role of the buyer’s agent or broker is to work with the buyer to locate a suitable property and negotiate a successful home purchase.

MULTIPLE LISTING SERVICE (MLS)

The MLS is a database of properties listed for sale by REALTORS ® who are members of the local Association of REALTORS.® Information on an MLS property is available to thousands of REALTORS ®

TITLE COMPANY

These are the people who carry out the title search and examination, work with you to eliminate the title exceptions you are not willing to take subject to, and provide the policy of title insurance regarding title to the real property.

ESCROW OFFICER

An escrow officer leads the facilitation of your escrow, including escrow instructions preparation, document preparation, funds disbursement, and more.

PREPARING FOR SALE YOUR HOME

Mow and edge the lawn regularly, and trim the shrubs.

Make your entry inviting: Paint your front door and buy a new front door mat.

Paint or replace the mailbox, if needed.

If screens or windows are damaged, replace or repair them.

Repair or replace worn shutters and other exterior trim.

Make sure the front steps are clear and hazard-free. Make sure the doorbell works properly and has a pleasant sound.

Ensure that all exterior lights are working.

Check stucco walls for cracks and discoloration.

Remove any oil and rust stains from the driveway and garage.

Clean and organize the garage, and ensure the door is in good working order.

Shampoo carpeting or replace if worn. Clean tile floors, particularly the caulking.

Brighten the appearance inside by painting walls, cleaning windows and window coverings, and removing sunscreens.

Repair leaky faucets and caulking in bathtubs and showers.

Repair or replace loose knobs on doors and cabinets. If doors stick or squeak, fix them.

Make sure toilet seats look new and are firmly attached.

First impressions have a major impact on potential buyers. Try to imagine what potential buyers will see when they approach your house for the first time and walk through each room. Ask your REALTOR ® for advice; they know the marketplace and what helps a home sell. Here are some tips to present your home in a positive manner:

Repair or replace loud ventilating fans.

Replace worn shower curtains.

Rearrange furniture to make rooms appear larger. If possible, remove and/or store excess furniture, and avoid extension cords in plain view.

Remove clutter throughout the house. Organize and clean out closets.

Clean household appliances and make sure they work properly.

Air conditioners/heaters, evaporative coolers, hot water heater should be clean, working and inspected if necessary. Replace filters.

Check the pool and/or spa equipment and pumps. Make sure all are working properly and that the pool and/or spa are kept clean.

Inspect fences, gates and latches. Repair or replace as needed.

Staging your home for Show

To make the best impression, keep your home clean, neat, uncluttered and in good repair. Please review this list prior to each showing:

Keep everything clean. A messy or dirty home will cause prospective buyers to notice every flaw.

Clear all clutter from counter tops.

Let the light in. Raise shades, open blinds, pull back the curtains and turn on the lights.

Get rid of odors such as tobacco, pets, cooking, etc., but don’t overdo air fresheners or potpourri. Fresh baked bread and cinnamon can make a positive impact.

Send pets away or secure them away from the house, and be sure to clean up after them.

Close the windows to eliminate street noise.

If possible you, your pets, and your children should be gone while your home is being shown.

Clean trash cans and put them out of sight.

If you must be present while your home is shown, keep noise down. Turn off the TV and radio. Soft, instrumental music is fine, but avoid vocals.

Keep the garage door closed and the driveway clear. Park autos and campers away from your home during showings

Hang clean attractive guest towels in the bathrooms.

Check that sink and tub are scrubbed and unstained.

Make beds with attractive spreads.

Stash or throw out newspapers, magazines, junk mail.

Terms You Should Know

Appraisal

An estimate of value of property resulting from analysis of facts about the property; an opinion of value.

Annual Percentage Rate (APR)

The borrower’s costs of the loan term expressed as a rate. This is not their interest rate.

Beneficiary

The recipient of benefits, often from a deed of trust; usually the lender.

Closing Disclosure (CD)

Closing Disclosure form designed to provide disclosures that will be helpful to borrowers in understanding all of the costs of the transaction. This form will be given to the consumer three (3) business days before closing.

Close of Escrow

Generally the date the buyer becomes the legal owner and title insurance becomes effective.

Comparable Sales

Sales that have similar characteristics as the subject real property, used for analysis in the appraisal. Commonly called “comps.”

Consummation

Occurs when the borrower becomes contractually obligated to the creditor on the loan, not, for example, when the borrower becomes contractually obligated to a seller on a real estate transaction. The point in time when a borrower becomes contractually obligated to the creditor on the loan depends on applicable State law. Consummation is not the same as close of escrow or settlement.

Deed of Trust

An instrument used in many states in place of a mortgage.

Deed Restrictions

Limitations in the deed to a parcel of real property that dictate certain uses that may or may not be made of the real property.

Disbursement Date

The date the amounts are to be disbursed to a buyer and seller in a purchase transaction or the date funds are to be paid to the borrower or a third party in a transaction that is not a purchase transaction.

Earnest Money Deposit

Down payment made by a purchaser of real property as evidence of good faith; a deposit or partial payment.

Easement

A right, privilege or interest limited to a specific purpose that one party has in the land of another.

Endorsement

As to a title insurance policy, a rider or attachment forming a part of the insurance policy expanding or limiting coverage.

Hazard Insurance

Real estate insurance protecting against fire, some natural causes, vandalism, etc., depending upon the policy. Buyer often adds liability insurance and extended coverage for personal property.

Impounds

A trust type of account established by lenders for the accumulation of borrower’s funds to meet periodic payments of taxes, mortgage insurance premiums and/or future insurance policy premiums, required to protect their security.

Legal Description

A description of land recognized by law, based on government surveys, spelling out the exact boundaries of the entire parcel of land. It should so thoroughly identify a parcel of land that it cannot be confused with any other.

Lien

A form of encumbrance that usually makes a specific parcel of real property the security for the payment of a debt or discharge of an obligation. For example, judgments, taxes, mortgages, deeds of trust.

Loan Estimate (LE)

Form designed to provide disclosures that will be helpful to borrowers in understanding the key features, costs and risks of the mortgage loan for which they are applying. Initial disclosure to be given to the borrower three (3) business days after application.

Mortgage

The instrument by which real property is pledged as security for repayment of a loan.

PITI

A payment that includes Principal, Interest, Taxes, and Insurance.

Power of Attorney

A written instrument whereby a principal gives authority to an agent. The agent acting under such a grant is sometimes called an “Attorney-in-Fact.”

Recording

Filing documents affecting real property with the appropriate government agency as a matter of public record.

Settlement statement

Provides a complete breakdown of costs involved in a real estate transaction.

TRID

TILA-RESPA Integrated Disclosures

The Life Of An Escrow

THE BUYER

Chooses a Real Estate Agent

Gets pre-approval letter from Lender and provides to Real Estate Agent.

Makes offer to purchase. Upon acceptance, opens escrow and deposits earnest money.

Finalizes loan application with Lender. Receives a Loan Estimate from Lender.

Completes and returns opening package from First American Title.

Schedules inspections and evaluates findings. Reviews title commitment/ preliminary report.

Provides all requested paperwork to Lender (bank statements, tax returns, etc.) All invoices and final approvals should be to the lender no later than 10 days prior to loan consummation.

Lender (or Escrow Officer) prepares CD and delivers to Buyer at least 3 days prior to loan consummation.

Escrow officer or real estate agent contacts the buyer to schedule signing appointment.

Buyer consummates loan, executes settlement documents, & deposits funds via wire transfer.

Documents are recorded and the keys are delivered!

THE SELLER

Chooses a Real Estate Agent

Accepts Buyer’s offer to purchase.

Completes and returns opening package from First American Title, including information such as forwarding address, payoff lender contact information and loan numbers.

Orders any work for inspections and/or repairs to be done as required by the purchase agreement.

Escrow officer or real estate agent contacts the seller to schedule signing appointment.

Documents are recorded and all proceeds from sale are received.

THE ESCROW OFFICER

Upon receipt of order and earnest money deposit, orders title examination.

Requests necessary information from buyers and sellers via opening packages.

Reviews title commitment / preliminary report.

Upon receipt of opening packages, orders demands for payoffs. Contacts buyer or seller when additional information is required for the title commitment/ preliminary report.

All demands, invoices, and fees must be collected and sent to lender at least 10 days prior to loan consummation.

Coordinates with lender on the preparation of the CD.

Reviews all documents, demands, and instructions and prepares settlement statements and any other required documents.

Schedules signing appointment and informs buyer of funds due at settlement.

Once loan is consummated, sends funding package to lender for review.

Prepares recording instructions and submits docs for recording.

Documents are recorded and funds are disbursed. Issues final settlement statement.

THE LENDER

Accepts Buyer’s application and begins the qualification process. Provides Buyer with Loan Estimate.

Orders and reviews title commitment / preliminary report, property appraisal, credit report, employment and funds verification.

Collects information such as title commitment / preliminary report, appraisal, credit report, employment and funds verification. Reviews and requests additional information for final loan approval.

Underwriting reviews loan package for approval.

Coordinates with Escrow Officer on the preparation of the Closing Disclosure, which is delivered to Buyer at least 3 days prior to loan consummation.

Delivers loan documents to escrow.

Upon review of signed loan documents, authorizes loan funding.

Closing

The Escrow Process

WHAT IS AN ESCROW?

The escrow is the process of having a neutral party manage the exchange of money for real property. The escrow holder is known as an escrow or settlement officer or agent. The buyer deposits funds and the seller deposits a deed with the escrow holder along with all of the other documents required to remove all "contingencies" (conditions and approvals) in the purchase agreement prior to closing.

HOW IS AN ESCROW OPENED?

Once a purchase agreement is signed by all necessary parties, the agent representing the party who will pay the fee selects an escrow holder and the buyer's earnest money deposit and contract are submitted to the escrow holder. From this point, the escrow holder will follow the mutual written instructions of the buyer and seller, maintaining a neutral stance to ensure that neither party has an unfair advantage over the other. The escrow holder also follows the instructions of the Buyer's new lender, the seller's existing lender, and both parties' agents. The escrow holder ensures the transparency of the transaction, while carefully maintaining the privacy of the consumers.

Your Escrow Professional May:

Open escrow and deposit good faith funds into an escrow account

Conduct a title search to determine the ownership and title status of the real property

Review the title commitment and begin the process of working with you and the title officer to eliminate the title exceptions the buyer and the buyer’s new lender are not willing to take subject to. This includes ordering a payoff demand from your existing lender.

Coordinate with the buyer’s lender on the preparation of the Closing Disclosure (CD)

Prorate fees, such as real property taxes, per the contract and prepare the settlement statement

Set separate appointments allowing the buyer and seller to sign documents and deposit funds

Review documents and ensure all conditions are fulfilled and certain legal requirements are met

Request funds from buyer and buyer’s new lender

When all funds are deposited and conditions met, record documents with the County Recorder to transfer the real property to the buyer

After recording is confirmed, close escrow and disburse funds, including proceeds, loan payoffs, tax payments, and more

Prepare and send final documents to all parties

Understanding Title Insurance

Prior to the development of the title industry in the late 1800s, a home-buyer received a grantor’s warranty, attorney’s title opinion, or abstractor’s certificate as assurance of home ownership. The buyer relied on the financial integrity of the grantor, attorney, or abstractor for protection. Today, home-buyers look primarily to title insurance to provide this protection. Title insurance companies are regulated by state statute. They are required to post financial guarantees to ensure that any claims will be paid in a timely fashion. They also must maintain their own “title plants” which house duplicates of recorded deeds, mortgages, plats, and other pertinent county property records.

The Title Industry & Title Insurance in Brief

WHAT IS TITLE INSURANCE?

Title insurance provides coverage for certain losses due to defects in the title that, for the most part, occurred prior to your ownership. Title insurance protects against defects such as prior fraud or forgery that might go undetected until after closing and possibly jeopardize your ownership and investment.

WHY IS TITLE INSURANCE NEEDED?

Title insurance insures buyers against the risk that they did not acquire marketable title from the seller. It is primarily designed to reduce risk or loss caused by defects in title from the past. A loan policy of title insurance protects the interest of the mortgage lender, while an owner’s policy protects the equity of you, the buyer, for as long as you or your heirs (in certain policies) own the real property.

WHEN IS THE PREMIUM DUE?

You pay for your owner’s title insurance policy only once, at the close of escrow. Who pays for the owner’s policy and loan policy varies depending on local customs.

Compare First American’s Eagle Policy® for Owners

Protection from: 1 Someone else owns an interest in your title 2 A document is not properly signed

Forgery, fraud, duress in the chain of title

Defective recording of any document 5 There are restrictive covenants 6 There is a lien on your title because there is: a) a deed of trust b) a judgement, tax, or special assessment c) a charge by a homeowner’s association 7 Title is unmarketable 8 Mechanics lien 9 Forced removal of a structure because it: a) extends on another property and/or easement b) violates a restriction in Schedule B c) violates an existing zoning law* 10 Cannot use the land for a Single-Family Residence because the use violates a restriction in Schedule B or a zoning ordinance

Unrecorded lien by a homeowners association

Unrecorded easements

Building permit violations*

Restrictive covenant violations

Post-policy forgery

Post-policy encroachment

Post-policy damage from extraction of minerals or water

Lack of vehicular and pedestrian access 19 Map not consistent with legal description

Post-policy adverse possession

EAGLE ALTA Standard or CLTA

Compare First American’s Eagle Policy® for Owners

Post-policy prescriptive easement

Covenant violation resulting in your title reverting to a previous owner

Violation of building setback regulations

Discriminatory covenants

Other benefits:

Pays rent for substitute land or facilities

Rights under unrecorded leases

Plain language statements of policy coverage and restrictions

Compliance with Subdivision Map Act

Coverage for boundary wall or fence encroachment*

Added ownership coverage leads to enhanced marketability

EAGLE ALTA Standard or CLTA

Insurance coverage for a lifetime 32 Post-policy inflation coverage with automatic increase in value up to 150% over five years 33 Post-policy Living Trust coverage * Deductible and maximum limits apply. Not available to investors on 1- to 4-unit residential properties. Coverage may vary based on an individual policy.

As with any insurance contract, the insuring provisions express the coverage afforded by the title insurance policy and there are exceptions, exclusions and conditions to coverage that limit or narrow the coverage afforded by the policy. Also, some cov erage may not be available in a particular area or transaction due to legal, regulatory, or underwriting considerations. Please contact a First American representative for further information. The services described above are typical basic services. The services provided to you may be different due to the specifics of your transaction or the location of the real property involved.

Consider This

One escrow transaction could involve more than 20 individuals, including real estate agents, buyers, sellers, attorneys, escrow officer, escrow technician, title officer, loan officer, loan processor, loan underwriter, home inspector, termite inspector, insurance agent, home warranty representative, contractor, roofer, plumber, pool service, and so on. And often, one transaction depends on another.

When you consider the number of people involved, you can imagine the opportunities for delays and mishaps. Your experienced escrow team can’t prevent unforeseen problems from arising; however, they can help smooth out the process.

Closing Your Escrow

THE CLOSING DISCLOSURE

Once the loan is approved and all invoices and paperwork have been provided, the lender and escrow officer will collaborate on the preparation of the Closing Disclosure (CD). In order to close on time, all paperwork and invoices should be submitted at least 10 days prior to the expected close of escrow date. The borrower must receive the CD at least three days* prior to consummation of the loan (typically the signing date). The escrow officer will also prepare an estimated settlement statement and inform the buyer of the balance of the down payment and closing costs needed to close escrow.

*For purposes of the Closing Disclosure“business day” is defined as every day except Sundays and Federal legal holidays.

THE CLOSING OR SIGNING APPOINTMENT

The escrow holder will contact you or your agent to schedule a closing or signing appointment. In some states, this is the "close of escrow." In some others, the close of escrow is either the day the documents record or that funds are disbursed. Ask your escrow holder if you would like clarification about your state's laws.

You will have a chance to review the settlement statement and supporting documentation. This is your opportunity to ask questions and clarify terms. You should review the settlement statement carefully and report discrepancies to the escrow officer. This includes any payments that may have been missed. You are responsible for all charges incurred even if overlooked by the escrow holder, so it's better to bring these to their attention before closing.

The escrow holder is obligated by law to have the designated amount of money before releasing any funds. If you have questions or foresee a problem, let your escrow holder know immediately.

DON'T FORGET YOUR IDENTIFICATION

You will need valid identification with your photo I.D. on it when you sign documents that need to be notarized (such as a deed). A driver's license is preferred. You will also be asked to provide your social security number for tax reporting purposes, and a forwarding address.

WHAT HAPPENS NEXT?

If the buyer is obtaining a new loan, the buyer’s signed loan documents will be returned to the lender for review. The escrow holder will ensure that all contract conditions have been met and will ask the lender to "fund the loan."

If the loan documents are satisfactory, the lender will send funds directly to the escrow holder. When the loan funds are received, the escrow holder will verify that all necessary funds are in. Escrow funds will be disbursed to the seller and other appropriate payees. Then, the REALTOR® will present the keys to the property to the buyer.

Planning your move

SIX WEEKS BEFORE:

Create an inventory sheet of items to move.

Research moving options You’ll need to decide if yours is a do-it-yourself move or if you’ll be using a moving company.

Request moving quotes Solicit moving quotes from as many moving companies and movers as possible. There can be a large difference between rates and services within moving companies.

Discard unnecessary items Moving is a great time for ridding yourself of unnecessary items. Have a yard sale or donate unnecessary items to charity.

Packing materials. Gather moving boxes and packing materials for your move.

Contact insurance companies. (Life, Health, Fire, Auto) You’ll need to contact your insurance agent to cancel/transfer your insurance policy. Do not cancel your insurance policy until you have and closed escrow on the sale.

Seek employer benefits. If your move is work-related, your employer may provide funding for moving expenses. Your human resources rep should have information on this policy.

Changing Schools. If changing schools, contact new school for registration process.

FOUR WEEKS BEFORE:

Contact utility companies Set utility turnoff date, seek refunds and deposits and notify them of your new address.

Obtain your medical records. Contact your doctors, physicians, dentists and other medical specialists who may currently be retaining any of your family’s medical records. obtain these records or make plans for them to be delivered to your new medical facilities.

Note food inventory levels Check your cupboards, refrigerator and freezer to use up as much of your perishable food as possible.

Service small engines for your move by extracting gas and oil from the machines. This will reduce the chance to catch fire during your move.

Protect jewelry and valuables. Transfer jewelry and valuables to safety deposit box so they can not be lost or stolen during your move.

Borrowed and rented items. Return items which you may have borrowed or rented. Collect items borrowed to others.

ONE WEEK BEFORE:

Plan your itinerary. Make plans to spend the entire day at the house or at least until the movers are on their way. Someone will need to be around to make decisions. Make plans for kids and pets to be at the sitters for the day.

Change of address. Visit USPS for change of address form.

Bank accounts Notify bank of address change. Make sure to have a money order for paying the moving company if you are transferring or closing accounts.

Service automobiles If automobiles will be driven long distances, you’ll want to have them serviced for a trouble-free drive.

Cancel services. Notify any remaining service providers (newspapers, lawn services, etc) of your move.

Start packing. Begin packing for your new location.

Travel items. Set aside items you’ll need while traveling and those needed until your new home is established. Make sure these are not packed in the moving truck!

Scan your furniture. Check furniture for scratches and dents before so you can compare notes with your mover on moving day.

Prepare Floor Plan. Prepare floor plan for your new home. This will help avoid confusion for you and your movers.

MOVING DAY:

Review the house. Once the house is empty, check the entire house (closets, the attic, basement, etc) to ensure no items are left or no home issues exist.

Sign the bill of lading. Once your satisfied with the mover’s packing your items into the truck, sign the bill of lading. If possible, accompany your mover while the moving truck is being weighed.

Double check with your mover. Make sure your mover has the new address and your contact information should they have any questions during your move.

Vacate your home. Make sure utilities are off, doors and windows are locked and notify your real estate agent you’ve left the property.

1 SUN CITY WES T 623.299.3644 13940 W. Meeker Blvd., #119 Sun City West, AZ 85375 N of Meeker Blvd W of R.H. Johnson

2 GOODYEAR 623.936.8001 1626 N. Litchfield Rd. Ste. #170 Goodyear, AZ 85395 NW corner of McDowell & Litchfield

3 ARROWHEAD

623.487.0404 16165 N. 83rd Ave , #100 Peoria, AZ 85382

S of Bell/E side of 83rd Ave

4 THE LEGENDS 623.537.1608 20241 N. 67th Ave , #A-2 Glendale, AZ 85308 E side 67th Ave/N of 101

5 ANTHEM 623.551.3265 39508 N. Daisy Mountain Dr., #128 Anthem, AZ 85086 NE corner Daisy Mtn Dr/ Gavilan Peak Pkwy

6 BILTMORE 602.954.3644 3200 E Camelback Rd., #123 Phoenix, AZ 85018 NE Corner of Camelback/32nd Street

7 DESERT RIDGE 480.515 4369 20860 N. Tatum Blvd , #100 Phoenix, AZ 85050 NW corner of Tatum/Loop 101

8 CAREFREE 480.575.6609 7202 E. Carefree Dr , Bldg 1, #1 Carefree, AZ 85377 NE corner of Tom Darlington/ Carefree Dr.

9 KIERLAND COMMONS

480.948.6488 14648 N Scottsdale Rd., Ste. #100 Scottsdale, AZ 85254 W of Scottsdale Road, S side of Greenway

10 SCOTTSDALE FORUM

480.551.0480 6263 N. Scottsdale Rd., #110 Scottsdale, AZ 85250 E Side Scottsdale/S of Lincoln

11 DC CROSSING 480.563.9034 18291 N. Pima Rd , #145 Scottsdale, AZ 85255 SE corner of Pima/Legacy

12 AHWATUKEE 480.753.4424 4435 E. Chandler Blvd , #100 Phoenix, AZ 85048 SW corner Chandler/45th St.

13 CHANDLER PORTICO 480.777.0051 2121 W. Chandler Blvd., #215 Chandler, AZ 85224 SW Corner Chandler Blvd./ Dobson Rd.

14 GILBERT SAN TAN 480.777.0614 1528 E. Williams Field Rd., #101 Gilbert, AZ 85295 NW corner of Williams Field Rd./ Val Vista Rd.

15 MESA 480.401.3738 1630 S. Stapley Dr., #123 Mesa, AZ 85204 N of Baseline / W of Stapley

16 RED MOUNTAIN 480.534.3599 1135 N. Recker Rd , #103 Mesa, AZ 85205 SE corner of Recker & Brown

17 GOLD CANYON 480.288.0883 6877 South Kings Ranch Rd., #5 Gold Canyon, AZ 85118 E of 60/ South Side Kings Ranch Rd.

1 MAIN OFFICE

520.885.1600 | Fax 520.885.2309 6390 E. Tanque Verde Rd. Tucson, AZ 85715

2 BROADWAY 520.747.1644 | Fax 520.747.1403 3777 E. Broadway Blvd., Ste. 220 Tucson, AZ 85716

3 CAMBRIC 520.577.8707 | Fax 520.529.5034 1840 E. River Rd., Ste. 200 Tucson, AZ 85718

4 CASA GRANDE 520.426.4600 | Fax 520.426.4699 421 E. Cottonwood Ln Casa Grande, AZ 85122

5 CASAS ADOBES

520.575.1900 | Fax 520.432.0168 6760 N. Oracle Rd., Ste. 100B Tucson, AZ 85704

6 CENTRAL 520.319.9207 | Fax 520.319.1468 3777 E. Broadway Blvd., Ste. 102 Tucson, AZ 85716

7 DOWNTOWN 520.740.0424 | Fax 520.740.0436 1 S. Church Ave., Ste. 1610 Tucson, AZ 85701

8 FOOTHILLS 520.299.4606 | Fax 520.577.6993 4051 E Sunrise Dr., Ste. 155 Tucson, AZ 85718

SSantaRitaRd

9 GREEN VALLEY

520.625.1095 | Fax 520.958.9663 190 W. Continental Rd., Ste. 226 Green Valley, AZ 85622

10 ORO VALLEY/LA CANADA 520.877.9200 | Fax 520.202.6348 11165 N. La Canada Dr., Ste. 143 Oro Valley, AZ 85737

11 ORO VALLEY/ORACLE 520.229.9194 | 520.297.2576 Fax 520.229.9210 | 520.742.5866 8500 N. Oracle Rd., Ste 100 Oro Valley, AZ 85704

12 RITA ROAD 520.618.7790 | Fax 520.901.1720 10222 East Rita Rd., Ste. 190 Tucson, AZ 85747

13 RIVER 520.529.1944 | Fax 520.615.2945 1650 E. River Rd., Ste. 105 Tucson, AZ 85718

14 SKYLINE 520.529.0506 | Fax 520.529.8998 2890 E. Skyline Dr., Ste. 200 Tucson, AZ 85718

15 TANQUE VERDE 520.202.2626 | Fax 520.495.6151 7479 E. Tanque Verde Tucson, AZ 85715