THE 2024 MIDDLE EAST & AFRICA FINTECH REPORT

ECONOMIC DEVELOPMENT THROUGH FINTECH

WELCOME TO THE 2024 MIDDLE EAST & AFRICA FINTECH REPORT

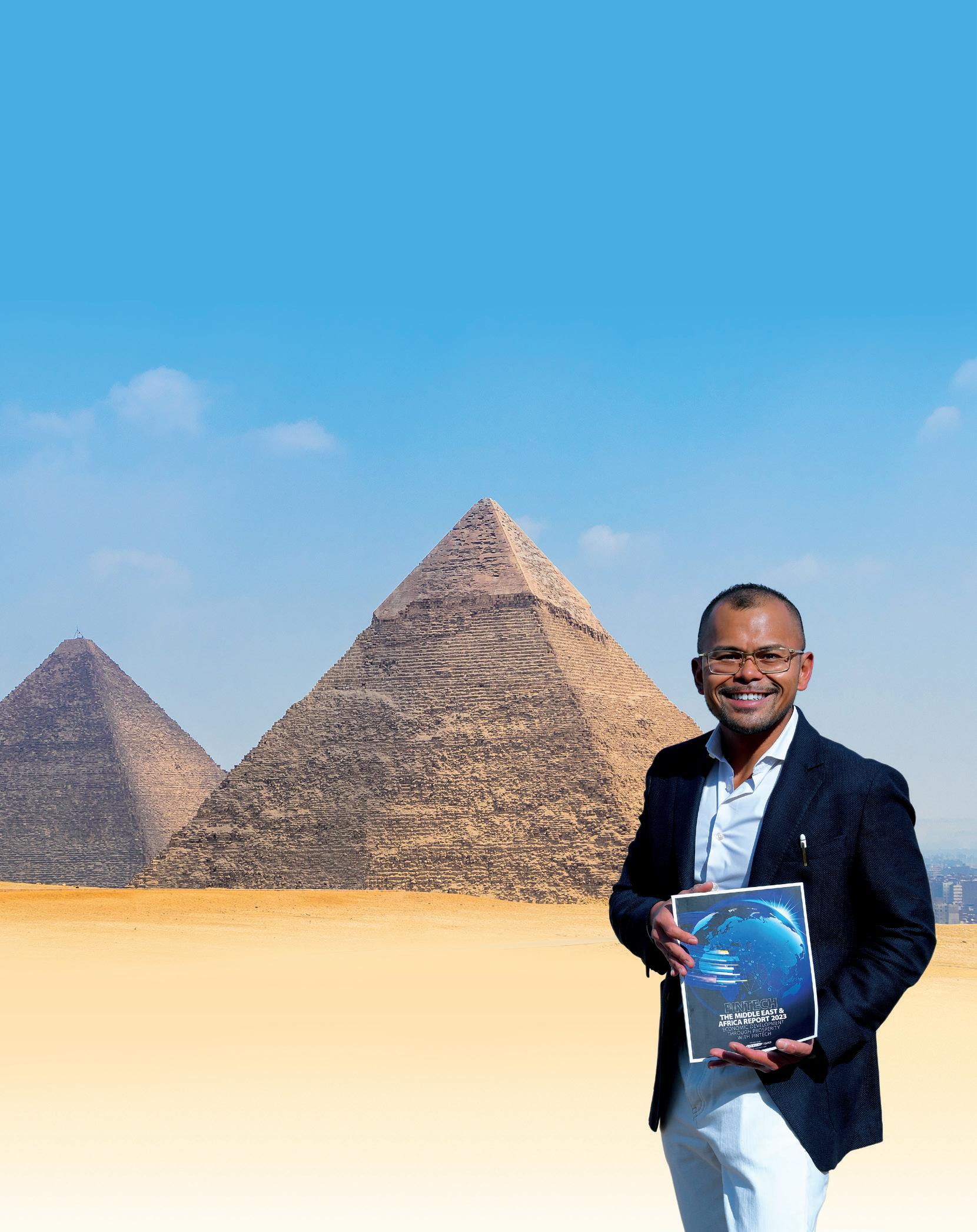

It's truly remarkable to reflect on the journey since 2020 when The Fintech Times, under my leadership, expanded its coverage to the Middle East and Africa (MEA) region. Back then, Mark Walker and I conceived the idea of creating the first-ever Middle East and Africa fintech report for 2021. Now, in its fourth edition, it’s no longer a novelty.

The first three editions of the MEA reports aimed to make an impact by providing valuable insights to both the fintech community and those less

familiar with the MEA region. While summarising such a vast region and dynamic sector like fintech is always a challenge, we’re pleased with the feedback suggesting that the previous editions succeeded in doing so.

This latest fourth edition builds upon the foundation laid by the previous MEA reports, delving deeper into the evolving fintech landscape of the region and its broader economic opportunities and challenges. Personally, I’m proud of the new content, including graphics and

timelines, which will aid in understanding the developments in MEA.

I extend my thanks to my family and friends for their unwavering support. I’m also grateful to The Fintech Times team, especially Claire, Chris and Mark, whose dedication made this edition possible. Special appreciation goes to our supporters and partners for their invaluable contributions.

I sincerely hope you find value in the latest Middle East and Africa report!

Author Richie Santosdiaz, economic development advisor – emerging economies, The Fintech Times

Editorial director Mark Walker Editor in chief Claire Woffenden Art director Chris Swales

Special thanks also to our supporters and partners for helping make this report possible.

Publishedby London | Dubai | New York

© The Fintech Times 2024. Reproduction of the contents in any manner is not permitted without the publisher’s prior content. ‘The Fintech Times ’ and ‘Fintech Times ’ are registered UK trademarks of Disrupts Media Limited. Disclaimer: This report was prepared by The Fintech Times and the main author to mainly educate the public on the growing trends of the fintech ecosystem in the Middle East and Africa region in the context of its relationship to economic development. Research findings of this report can be shared provided the report and their sources are acknowledged. Written: April 2024. Published: May 2024.

Seamless Evolution Unveiling tech advancements in MEA

Mark Dowdall Editor ofSeamless Xtra

Given the rapid advancement of technology across all facets of digital commerce, covering all things Seamless throughout the Middle East and Africa can be quite an eye-opener. With new innovations, greater products and a steady stream of partnerships and collaborations there is always something to report on, plenty to learn, and even experience first-hand while covering this beat.

To best describe the concept of being Seamless I am reminded by a quote from Hans Hofmann, a German-born American painter, renowned for his work as an artist in abstract expressionism around the mid1900s. Hofmann once said: “The ability to simplify means to eliminate the unnecessary so that the necessary may speak.”

While this could be seen as a nod to his craft of abstract painting it is equally something that can be applied today when we think about how technology is making once complicated processes quicker, more efficient and easier to execute than ever before. Increasingly, this is becoming evident, not only in banking and financial

services but also in other key areas of identity, retail, e-commerce, home delivery and even digital marketing. Carrying out essential everyday tasks has never been easier. With that in mind, here are some areas within the worlds of banking, fintech and e-commerce where ‘being seamless’, or not for that matter, can have a real impact.

Creating a Seamless digital ID system

From speaking to leaders in the banking industry, the evolution of digital identity systems is quite significant. Interestingly, this year marks two decades since the Federal Authority for Identity and Citizenship (ICA) was established in the UAE. In the time since, the Emirates ID has been modernised at various stages and is currently the only identity document aside from passports, accepted by all government agencies in the UAE. The thing to remember here is that in order to have a personal bank account in the country you are required to have a valid Emirates ID, which in turn, allows banks to better understand its customers and raise the standard of service.

While this may be seen as one of the more efficient systems in the region, elsewhere, in Egypt, digital KYC continues to be a barrier to significant progress in the financial services sector. Establishing an efficient, digital ID system has been earmarked by banking leaders as one of the key next steps

in improving financial services for its customers. In turn, ensuring it is seamlessly linked to the banking system provides its own set of challenges but, if executed, can be a key ingredient for future success.

The rise of real-time payment systems

One of the most exciting trends in Middle Eastern fintech right now is the rise of digital payments and mobile banking. The implementation of real-time payment systems, such as the Saudi SARIE Instant Payment has dramatically improved the speed and efficiency of financial transactions in the region.

Elsewhere, Qatar Central Bank launched a new instant payment system, earlier this year, that gets rid of the need for an IBAN during transactions. Governments are also starting to realise the benefits of fintech collaboration.

This is evident in Bahrain, for example, where government entities have recently started using digital wallet apps quite effectively to pay instantly for things like electricity, water and other utility bills. Delving further into digital wallets, instant wallet top-ups continue to be made more accessible through collaborations in the region.

One such example was the recent partnership between Mastercard and Checkout.com who teamed up to enable instant wallet top-ups for Dubai-based super app Careem. The integration with the financial technology arm of Careem is seeking to

address time delays that can come with conventional bank transfers, in the process making the user experience more seamless. These funds can then be used for a range of the app’s daily services including getting around, delivery and money transfer, among others.

The rise of the super app

Indeed, it is worth mentioning the rise of the ‘super app’. There has been a growing number of apps downloaded on people’s smartphones in recent years, yet with the ‘super app’ several services are combined into one, from payments and banking to lifestyle and shopping, creating a more seamless experience for customers. Proponents of the technology argue that the integration not only provides more convenience for users but also increases engagement and loyalty.

Banks, in particular, are facing a crucial moment where they must decide how best to respond to the phenomenon. Right now, they can stay laser focused on what they are doing and ignore the whole thing, they can partner with a super app or thirdly, they can try to build their own Super App. In the UAE, for example, Invest Bank believes in the idea of a specialised Super App revolving around a theme and has been developing a lifestyle platform on the cloud, a strategy that it says will help it provide tailor-made financial offers based on customer preferences and habits.

More broadly, ride-hailing firms and telecommunications firms across the region continue to enter the fintech space by adding payments services to their existing portfolios. Most recently, du boosted its financial services offering with the launch of du Pay, enabling it to offer a range of digital financial services and payment options, from international money transfers and peer-topeer (P2P) transfers to mobile top-ups and bill payments. Globally, we are even seeing food delivery firms like Deliveroo tap into online retail by partnering with major supermarket brands. Its launch of in-app shopping is evidence of the variety of routes available to today’s businesses looking to become the much-coveted ‘all-in-one’ app.

Seamless connections in the

metaverse?

There has been so much buzz generated around the rise of a new virtual economy called the metaverse in the last 18 months that

it has been difficult for even the most casual observer to ignore. By 2026, it is expected that at least one in four people will spend a minimum of one hour every day in the Metaverse for different purposes like work, shopping, education, and even entertainment. Aside from just being the virtual world, using the actual infrastructure to do business and access financial services such as decentralised finance and tokenisation offers exciting possibilities. Recognising its potential, funding in this space has now started to come in from investors in the region. Earlier this year, Adaverse became the first venture capital fund in Saudi Arabia to specialise in Web3 and blockchain early-stage investing, supporting local fintech Takadao with an undisclosed sum as part of plans to invest $10million in local Web3 startups in 2024.

From speaking to experts in the field, however, there is a consensus that much of the potential of the metaverse lies in its ability to create more seamless connections,

With AI changing the business landscape so rapidly, there is a clear need to have a thorough framework in place and it will be fascinating to see how it all plays out

especially between brands and their customers. By offering more limitless, immersive experiences the metaverse is a place where brands can attract and enable the customer to access their world anytime, anywhere, and at whatever time they wish. As highlighted by a recent, Bain & Co. report, the metaverse offers real and growing economic opportunities for businesses and the ones that engage in the metaverse’s early stages of development over the next five to 10 years are more likely to become the market winners.

Key areas of regulation

There is no doubt that regulation plays a key role across all industries in creating an environment that encourages innovation while at the same time maintaining a level playing field. Regulation, of course, can vary from region to region, making life more or less seamless depending on who you are and what you are trying to achieve.

While there are certain challenges that come with having to develop tailored products or services to local regulations, the Middle East region does have the benefit of being able to innovate quite quickly compared to other parts of the world and it is fair to say that the UAE and Saudi Arabia are moving ahead at a much faster pace than probably some of the other regulators around the world. Around the region, however, some of the common challenges I have been made aware of from conversations with fintech startups includes both ambiguity of regulations and arbitrary regulations, especially where innovation is breaking new ground.

In terms of financial services, one of the big issues I foresee over the next 12 months will be the continued transition to delivering sustainable finance, something that is in particular focus off the back of COP28. The financial world is seen as a key driver of energy and the greater shift to a greener world and sustainable finance will be integral to the progress that is made on a broader scale. With that being said, it is promising to see that most central banks have now implemented the initial framework in terms of identifying climate risk and sustainability risk and more broadly, reporting regulation is starting to be standardised. In turn, now is the time to for financial services firms to move beyond awareness and start to implement the foundations of a more sustainable approach.

The last thing I want to touch on is AI. There has been a lot of concern mooted globally, and around the region, over how AI will seamlessly be implemented in the coming years. Undoubtedly, regulation will play a key role in that. According to a recent study, the vast majority of UAE business leaders believe that regulations and standards around AI usage should be developed within their sector as it transforms the business landscape. Nearly nine in 10 believe that such policies would help businesses implement AI responsibly, and half worry about the possibility of legal and ethical consequences from not having an ethical AI framework in place. With AI changing the business landscape so rapidly, there is a clear need to have a thorough framework in place and it will be fascinating to see how it all plays out.

A JOURNEY INTO THE MIDDLE EAST AND AFRICA FOR A FINTECH FUTURE

Purpose of the report

This report provides an extensive analysis of the fintech landscape in the Middle East and Africa (MEA). It begins with a broad overview and then delves into specific aspects of the industry, offering a comprehensive view of the fintech ecosystem in the region.

Intended as a reference for MEA fintech and broader economic development, this report aims to be useful for both those unfamiliar with MEA and fintech, as well as experts in either field.

Report overview – Key highlights unique to 2024

The report is divided into four chapters, mirroring the structure of the 2023 edition. Notably, this edition includes innovative visual aids, such as images and charts, to elucidate key aspects of fintech – a departure from previous reports. Key highlights include:

■ Industry images and summaries

This section provides insights into the fintech landscape of MEA, including summaries and images of key fintech sectors such as payments, digital banks, gametech, and more – unique features of this report.

■ Overviews of fintech across 25 different countries

The report profiles and ranks 25 MEA countries based on their fintech hub status, accompanied by visual fintech timelines showcasing key developments and growth since 2020. These include:

■ Middle East, North Africa and Türkiye: Bahrain, Israel, Jordan, Kuwait, Lebanon, Oman, Qatar, Saudi Arabia, Türkiye, United Arab Emirates (UAE)

■ Africa: Algeria (new to this 2024 report), Democratic Republic of the Congo (DRC) (new to this report), Egypt, Ethiopia, Ghana, Kenya, Mauritius, Morocco, Nigeria, Rwanda, Senegal, South Africa, Tanzania, Tunisia, Uganda

These visual timelines offer readers a quick understanding of key fintech developments spanning from pre-2020 to the present day, highlighting growth trajectories and comparative data from previous editions.

■ Wider economic development images

Unique visuals provide insights into the economic and population landscapes of the MEA region, complementing the fintech-focused content. These address:

■ The geography of MEA and its six key regions with overviews

■ An economic and population overview

■ The MEA consumer

Chapters overview

Chapter One: Overview of the Middle East and Africa

This chapter delves into the intricate fabric of the MEA region, beginning with a comprehensive analysis of its geography and economy. It navigates through the financial services and tech sectors, ultimately zooming in on the transformative potential of financial technologies (fintech).

Despite the region’s rich diversity, characterised by nearly two billion people and a spectrum of economic statuses, common threads emerge, including a reliance on natural resources and traditional financial frameworks.

The chapter highlights the region’s youthful, tech-savvy population juxtaposed with persistent challenges such as inadequate digital infrastructure and widespread financial exclusion, painting a dynamic landscape ripe for fintech innovation.

Chapter Two: Fintech landscape in the Middle East and Africa

This section unpacks the multifaceted fintech terrain across the MEA region, dissecting various sub-sectors and their evolution. While historically centred around payments, money transfer, and remittances, the fintech sphere has diversified to encompass insurtech, gametech, regtech, wealthtech, investing, digital currencies, lending, and open and embedded finance.

With an estimated two-thirds of fintech solutions focused on key areas such as payments and lending, the MEA region boasts over 3,700 fintech companies, signalling a vibrant ecosystem poised for further growth and innovation.

Chapter Three: Fintech hubs of MEA

This segment conducts a detailed analysis of 25 prominent fintech companies across the MEA region, evaluating their contributions to wider economic development and technological advancements. Each company is scrutinised based on various indicators, including their individual fintech timelines and specific fintech criteria. Results are categorised into three tiers:

■ Tier-one ‘premier global fintech hubs’: UAE, Israel, Saudi Arabia and Türkiye

■ Tier-two ‘emerging fintech hubs’: Bahrain, Egypt, Kuwait, Qatar, Nigeria, South Africa, Mauritius, Kenya, Oman, Jordan, Tunisia, Ghana, Lebanon and Morocco (new)

■ Tier-three ‘early-stage fintech hubs’: Rwanda, Algeria, Senegal, Uganda, Democratic Republic of the Congo (DRC), Ethiopia, Tanzania

Chapter Four: Reflection and summary on the future of fintech in the Middle East and Africa and beyond

In the final chapter, the report reflects on the outcomes of the year’s fintech hub analysis, evaluating the validity of past predictions for the MEA region. With a focus on fostering financial inclusion through fintech, the chapter concludes with a synthesis of key insights and future prospects, underscoring the pivotal role of fintech in driving economic growth and societal advancement across the MEA region and beyond.

Contents Middle East and Africa Report 2024

Chapter One 10-33

Overview of Middle East and Africa

a. MEA overview: Geography 12-13

b. MEA overview: 14 Population and economy

c. Breakdown overview by six regions 15-17

d. Financial services overview 18-25

e. Tech and startup overview 26-27

f. The MEA consumer 28-29

g. Economic diversification and 30-32 digitalisation economic development

h. Summary: Key takeaways 33

Chapter Two 34-64 Fintech landscape in the Middle East and Africa

a. Overview of fintech in MEA 38-39

b. Key subsectors of fintech 40-43

1. Payments, money transfers 40-41 and remittances

2. Digital, challenger and neobanks 42-43

3. Gametech 44-45

4. Wealthtech and investing 46-47

5. Regtech 50-51

6. Digital currencies 52-53

7. Open finance 54-55

8. Lending 56-57

9. Insurtech 58-59

c. The rise of superapps 60

d. Wider fintech ecosystem 61-63

e. Key takeaways 64

Chapter Three 66-120 Fintech Hubs of MEA

Chapter Four 108-115

Reflection and summary

a. Reflection on the findings of the 108-111 hubs of Middle East and Africa

b. Predictions from 2023 – 111-113 did they materialise or not?

c. Summary and future on fintech 114-115 in the Middle East and Africa

Chapter Five 116-122

Appendix and endnotes

Chapter One Overview of the Middle East and Africa

The Middle East and Africa region is a tapestry of diversity, encompassing a rich array of landscapes, cultures, and economies. From the opulence derived from natural resources to the burgeoning tech hubs, MEA represents a convergence of prosperity and potential. This chapter serves as a foundational exploration of the MEA landscape, offering insights into its geographical expanse, demographic composition, economic dynamics, and technological advancements.

■ a. MEA overview – Geography

■ b. MEA overview – Population and economic

■ c. Breakdown overview by six regions

■ d. Financial services overview

■ e. Tech and startup overview

■ f. The MEA consumer

■ g. Economic development overview and relation to financial technologies

■ h. Digital infrastructure pertaining to fintech

■ i. Summary: Key takeaways

Geographical overview of the Middle East and Africa

3 continents –Asia, Africa and Europe (plus parts of Türkiye)

54 members of the African Continental Free Trade Agreement (AfCFTA) – All of AU members minus Eritrea are signatories

69 countries

~30 million sq km land area

a.Geographical overview

This section provides an illustrative journey through the geographical contours of the Middle East and Africa region. Through maps and annotations, readers will gain a nuanced understanding of MEA's spatial distribution, accompanied by key terminologies and acronyms essential for navigating the region's diverse topography.

MIDDLE EAST Bahrain, Qatar, UAE, Oman, Yemen, Saudi Arabia, Lebanon, Türkiye, Jordan, Iran, Iraq, Syria, Israel and Palestine

NORTH Algeria, Egypt, Libya, Mauritania, Morocco, Tunisia and Western Sahara

SOUTH Angola, Botswana, Lesotho, Malawi, Mozambique, Namibia, South Africa, Zambia, Eswatini and Zimbabwe

CENTRAL Burundi, Cameroon, Central African Republic, Chad, Congo, Democratic Republic of Congo, Equatorial Guinea, Gabon and São Tomé and Príncipe

WEST Benin, Burkina Faso, Cape Verde, Côte d’Ivoire, Gambia, Ghana, Mali, Guinea-Bissau, Guinea, Liberia, Niger, Nigeria, Senegal, Sierra Leone and Togo

EAST Comoros, Djibouti, Ethiopia, Eritrea, Kenya, Madagascar, Mauritius, Rwanda, Seychelles, Somalia, South Sudan, Sudan, Tanzania and Uganda

The Middle East

■ THE GULF COOPERATION COUNCIL (GCC) – with members including Kingdom of Saudi Arabia, Kingdom of Bahrain, Sultanate of Oman, State of Qatar, State of Kuwait and the United Arab Emirates (UAE) – is a political and economic union in the Arabian Gulf region

■ THE LEVANT REGION –Jordan, Syria, Lebanon, Israel and the Palestinian Territories (the West Bank & Gaza)

■ GULF REGION NON-GCC – Yemen, Iran, Iraq

■ TÜRKIYE

■ NORTH AFRICA – Algeria, Egypt, Libya, Mauritania, Morocco, Tunisia, Sudan and Western Sahara

Sources: The Fintech Times, Africanews, African Union, GCC Image: Richie Santosdiaz and The Fintech Times

Africa

■ AFRICAN UNION (AU) – continental union consisting of 55 member states located on the continent of Africa

■ CENTRAL AFRICA – Burundi, Cameroon, Central African Republic, Chad, Congo, Democratic Republic of Congo, Equatorial Guinea, Gabon, São Tomé and Príncipe

■ EASTERN AFRICA – Comoros, Djibouti, Eritrea, Ethiopia, Kenya, Madagascar, Mauritius, Rwanda, Seychelles, Somalia, South Sudan, Sudan, Tanzania and Uganda

■ NORTHERN AFRICA – Algeria, Egypt, Libya, Mauritania, Morocco, Sahrawi Arab Democratic Republic and Tunisia

■ SOUTHERN AFRICA – Angola, Botswana, Eswatini, Lesotho, Malawi, Mozambique, Namibia, South Africa, Zambia and Zimbabwe

■ WESTERN AFRICA – Benin, Burkina Faso, Cabo Verde, Cote d’Ivoire, Gambia, Ghana, Guinea, Guinea-Bissau, Liberia, Mali, Niger, Nigeria, Senegal, Sierra Leone and Tongo

■ SUB-SAHARAN AFRICA

– all of Africa minus North Africa

*Burkina Faso, Mali, Guinea and Sudan, as of Feb 2023, are suspended from the African Union

b.Overview of population and economy

Urbanisation rate +70% in Middle East urbanised +59% in Sub Saharan Africa rural v

Main languages spoken

■ Arabic (Middle East and North Africa)

■ Swahili (Eastern Africa)

■ French (various parts of Africa)

■ Portuguese (mainly Mozambique, Angola, Cape Verde & Guinea Bissau

Top 5 largest countries (population)

1. Nigeria +213 million (below)

2. Ethiopia +120 million

3. Egypt +110 million

4. Dem. Rep. of Congo +96 million

5. Iran +89 million

■ English (various parts of Africa)

■ Hebrew (Israel)

■ Turkish (Türkiye)

■ Farsi (Iran)

Top five largest cities (population – metropolitan)

1. Cairo, Egypt (right) 22.6+million

2. Kinshasa, DR Congo 17+million

3. Istanbul, Türkiye ~16million

4. Tehran, Iran ~16million

5. Lagos, Nigeria ~15.4million

POPULATION OVERVIEW

+$3 trillion Nominal GDP of Africa (2024 estimates) +$5 trillion Nominal GDP of Middle East (2024 estimates) ~Two

19 out of 20 poorest countries in the world are in MEA (mostly in Africa)

Economic breakdown

in MEA

One in four of world’s population lives in MEA

3.4 billion people by 2050

30% MEA population between 15-29 years old

65% MEA population under 30 years old

ECONOMIC OVERVIEW

Services

MEA countries

12 of 13

Natural resources like oil & gas, gold play a strong part across much of MEA Poorest country in the world (GDP per capita) Burundi $270

OPEC members are MEA countries

G20 Three MEA countries (Saudi Arabia, Türkiye and South Africa) are part of the G20 International trade, past and present plays a strong role in MEA’s economy

12% total global trade passes through Suez Canal

Financial services and tech are playing a growing role in the wider MEA context

$7.9billion revenue generated directly for Egypt in 2021 Egypt’s Suez Canal

Only Israel and UAE were ranked in the top 50 for startup ecosystem

MEA city ranking

Highest in top 20 financial services hub – Dubai (20th)

Dubai

■ Busiest port (Jebal Ali) in MEA (only one in top 10 globally)

■ Busiest international airport in the world

Source: The Fintech Times Middle East and Africa Report 2023 and 2024 Image: Richie Santosdiaz and The Fintech Times

c.Breakdown overview by six regions

I. Middle East

(not including North Africa)

Countries: Bahrain, Qatar, UAE, Oman, Yemen, Lebanon, Saudi Arabia, Jordan, Iran, Iraq, Syria, Israel, Palestine and Türkiye

Overview: Shared characteristics

■ Language and culture diversity - Nearly all speak Arabic (except Türkiye; note Arabic is an official language in Israel). The majority in the region has been influenced by Arab and Islamic culture.

Economic development and progress

■ GCC and Israel highly developed and affluent – the six nations of the GCC and Israel are some of the world’s richest countries in the world (generally oil and gas transformed the Arabian Gulf whereas in Israel and parts of the GCC notably Dubai was mainly services).

■ Türkiye is a high middle income economy.

■ Rest of the Middle East not mentioned above is low middle income or a low income economy – the majority of the Middle East is the very most low-middle income economies.

■ Challenges remain – political and economic are ongoing challenges in parts of the region.

■ The Gulf Coorporate Council (GCC) is an economic and political union consisting of the six Gulf nations – Saudi Arabia, Bahrain, Kuwait, Qatar, Oman and the United Arab Emirates.

■ Largest country (by population) – Iran, almost 88 million people.

■ Three largest country (by economy per GDP) in order – Saudi Arabia ($1trillion), Türkiye ($819billion), Israel ($488.5billion).

■ Largest cities (by population) include Istanbul (around 16 million inhabitants), Tehran (around 16 million inhabitants) and Riyadh (+7.7million).

Riyadh is the capital and largest city in the Kingdom of Saudi Arabia

II.North Africa

(also considered part of the Middle East)

Countries: Algeria, Egypt, Libya, Mauritania, Morocco, Tunisia and Western Sahara

Overview: Shared characteristics

■ Language and culture diversity – North African nations share Arabic as the primary language, deeply intertwined with Arab and Islamic cultural influences. Additionally, local cultures, particularly Berber heritage, have left a significant imprint, notably in Morocco, Tunisia, and Algeria. French influence persists, especially in the Maghreb, where it remains a language of commerce and education among the educated class.

Economic development and progress

■ Economically, the region largely represents the highest spectrum of low-middle-income economies, measured by GDP per capita.

■ Largest country (by population) – Egypt leads the region with a population nearing 110 million.

■ Egypt boasts the largest economy in the region, with a GDP exceeding $404billion. Following closely are Algeria with $163billion and Morocco with over $142.9billion.

■ Largest cities (by population) include Cairo (+22.6million inhabitants), Algiers (+2.8million) and Casablanca (around six million).

■ Despite economic progress, political and economic challenges persist in various parts of the region, impacting development and stability.

III. South Africa (region)

Countries: Angola, Botswana, Lesotho, Malawi, Mozambique, Namibia, South Africa, Zambia, Eswatini and Zimbabwe

Overview: Shared characteristics

■ The Southern African region exhibits a rich tapestry of languages and cultures, shaped by a history of colonisation. British influence prevails, leading to widespread English proficiency. Portuguese legacies are evident in Angola and Mozambique, while Dutch (South Africa) and German (Namibia) influences are present to a lesser extent. Beyond colonial impacts, the region is home to hundreds of distinct tribes, each maintaining cultural distinctiveness within their current borders. Notable examples include the Zulu people.

Economic development and progress

■ South Africa, Botswana, and Namibia stand out as relatively affluent nations with higher GDP per capita compared to their neighbours.

■ The remainder of the region encompasses economies primarily classified as low-middle income, with countries like Lesotho, Malawi, Mozambique, and Zambia falling into the low-income category.

■ Largest country (by population) – South Africa emerges as the most populous country in the region, boasting a population of 59.39 million.

■ South Africa leads the region in terms of GDP ($419billion), followed by Angola ($67.4billion) and Zimbabwe ($28.37billion).

■ Examples of largest cities (by population): Johannesburg (around eight million inhabitants), Cape Town (around 4.9million inhabitants) and Luanda (over 8.9million inhabitants)

IV.Central Africa

Countries: Burundi, Cameroon, Central African Republic, Chad, Congo, Democratic Republic of the Congo (DRC), Equatorial Guinea, Gabon, and Sao Tome and Principe

Overview: Shared characteristics

■ Language and culture: From the helicopter view Central Africa is pretty diverse. The British (i.e. Congo), French (i.e. Cameroon and Gabon) , Portuguese (i.e. Sao Tome and Principe), Belgians (i.e. DRC) and Spanish have left their legacies in this part of Africa.

Economic development and progress

■ Low income and low-middle income – The majority in this region would be classified as low-income nations; some of the poorest countries in the world are located here, in particular Burundi which is the world’s poorest country by GDP per capita

■ Two high middle income nations – Notably, thanks in part due to petroleum, both Gabon (French-speaking) and Equatorial Guinea (the only Spanish speaking country in Africa) are rarities in the region and are both high middle income nations not just in the region but one of the highest in Africa as a whole (Gabon is at over $8,000 per capita and Equatorial Guinea at over $7,500).

■ Largest country (by population) – DRC 95.89 million people

■ Three largest country (by economy per GDP) in order – DRC ($55.35billion), Cameroon ($45.34bilion) and Gabon ($20.22billion)

■ Example of largest cities (by population): Kinshasa (DRC with over 17 million inhabitants) and Douala (Cameroon with around three million inhabitants)

Dakar is the capital and largest city of Senegal

Kinshasa is the capital and largest city of the Democratic Republic of Congo and also the world’s largest Francophone city

V. West Africa (Region)

Countries: Benin, Burkina Faso, Cape Verde, Côte d'Ivoire, Gambia, Ghana, Mali, Guinea-Bissau, Guinea, Liberia, Niger, Nigeria, Senegal, Sierra Leone and Togo

Overview: Shared characteristics

■ Language and culture – The region exhibits a rich tapestry of linguistic and cultural diversity, shaped by various colonial powers. French influence is prominent in countries like Cote d'Ivoire and Senegal, while British impact is evident in Nigeria and Ghana. Portuguese legacy is notable in Cape Verde and Guinea-Bissau. Additionally, Liberia has a unique history as a nation founded by freed American slaves.

Economic development and progress

■ Middle-income economies – South Africa, Botswana, and Namibia stand out as relatively affluent nations with higher GDP per capita.

■ Low-middle income economies – The remaining countries in the region fall into this category, reflecting varying levels of economic development.

■ The economic integration of these countries is influenced by their colonial past. The West African Economic and Monetary Union (WAEMU or UEMOA) comprises mainly French-speaking nations like Benin, Burkina Faso, Cote d'Ivoire, Guinea-Bissau, Mali, Niger and Togo

■ Largest country (by population) – Nigeria (over 213 million people)

■ Three largest country (by economy per GDP) in order – Nigeria ($440.8billion), Ghana ($77.59billion) and Cote D’Ivoire ($70.44billion)

■ Examples of largest cities (by population): Lagos (Nigeria over 15.4million inhabitants), Abidjan (Cote D’Ivoire with over 5.6 million inhabitants) Dakar (Senegal almost four million inhabitants)

VI.East Africa

(also considered part of the Middle East)

Countries: Comoros, Djibouti, Ethiopia, Eritrea, Kenya, Madagascar, Mauritius, Rwanda, Seychelles, Somalia, South Sudan, Sudan, Tanzania and Uganda

Overview

■ East Africa boasts a rich tapestry of linguistic and cultural heritage, making it one of the most diverse regions in Africa.

Shared characteristics

■ Language and culture: Various linguistic influences are evident, including:

■ Anglophone: English serves as an official language in countries like Uganda.

■ Francophone: Historical French influence is notable in nations such as Madagascar, Mauritius, and Rwanda. Mauritius uniquely embraces both French and English.

■ Others influences: – Italian heritage is seen in Eritrea, although Italian is no longer a major language. Several countries exhibit a mix of linguistic influences, for example: Comoros speaks Arabic, Comoran (related to Swahili) and French; Mauritius is a Francophone and Anglophone, Rwanda is Francophone but also becoming Anglophone).

■ Swahili influence – Swahili, serving as a lingua franca, holds significant influence in the region, particularly in countries like Kenya.

View of downtown Nairobi, the capital and largest city of Kenya

d.Financial services overview

The financial services landscape in the MEA region is multifaceted, encompassing a wide array of offerings such as payments and insurance. While sharing similarities with global trends, the MEA region also exhibits its own distinctive characteristics.

Overview

Globally, the financial services sector holds significant economic importance, with total assets exceeding $461trillion in 2022. Similarly, the MEA region showcases a diverse financial services industry, reflecting the varying economic landscapes across its territories.

The development of the financial services sector in MEA mirrors the progress of individual economies and their respective financial ecosystems. Notably, advanced banking sectors thrive in regions like the GCC in the Middle East, as well as in countries such as South Africa and Mauritius in Africa. Conversely, other parts of MEA feature less developed banking sectors, often characterised by dominance of public sector banks with government intervention in credit allocation and liquidity issues.

Reforms in the African banking sector, driven partly by structural adjustment policies (SAP) from international institutions like the World Bank and IMF, aimed to restructure and privatise statecontrolled banks. These reforms also targeted easing entry and exit restrictions, interest and capital controls, and enhancing supervisory and regulatory frameworks within the banking sector.

MEA, particularly the Middle East, exhibits an abundance of banks, leading to oversaturation in certain markets. For example, in 2019, the GCC (excluding Qatar) boasted approximately 120 private

and public banks catering to a population exceeding 50 million. This saturation has prompted banks in the GCC to explore expansion opportunities in emerging markets like Türkiye.

What are key financial centres in MEA?

Several financial centres in MEA play pivotal roles not only in their own economies but also regionally. These include:

■ Beirut: Historically renowned as the ‘Paris of the East’, Beirut served as a major financial centre in the Middle East, characterised by its embrace of Western culture and sophisticated banking regulations. However, the Lebanese Civil War in 1975 significantly altered its financial landscape.

■ Bahrain and Kuwait: Emerging as financial hubs following the challenges of the Lebanese Civil War, Bahrain and Kuwait have seen substantial growth in their financial sectors. In Bahrain, the financial industry represents over 27 per cent of GDP and is a significant employer in the country.

■ Mauritius: With the financial services sector contributing 13 per cent to the total GDP, Mauritius has established itself as a key financial centre. The ICT/ business process outsourcing (BPO) industry also plays a crucial role in driving economic growth, with a significant contribution to GDP and employment (7.4 per cent for last year and employing around 30,000 people with over 850 companies in the sector).

MEA boasts a diverse range of robust financial centres, including Casablanca, Johannesburg, Cape Town, Istanbul, Kigali, Nairobi,

Doha, Tel Aviv and Abu Dhabi, further enhancing the region's economic vibrancy and connectivity. However, when considering various metrics, Dubai emerges as the undisputed leader in the region. Over the past two years, Dubai has consistently ranked among the world’s top 20 vibrant financial centres, securing the 20th position in the Global Financial Centres Index (GFCI). Remarkably, it stands as the sole representative from the Middle East, Africa, and South Asia, alongside global financial powerhouses like London, New York City, Singapore, and Hong Kong. Notably, Dubai, along with Tel

Aviv (ranked 48th) and Abu Dhabi (the UAE's capital, placed 37th), is among the only MEA cities to feature in the top 50 rankings. At the heart of Dubai’s financial prominence lies the Dubai International Financial Centre (DIFC), established as a specialised economic zone. Hosting regional offices of two-thirds of Fortune 500 companies with MEA operations, Dubai has become a preferred destination for international banks such as HSBC and Standard Chartered, as well as payment giants Visa and Mastercard, and tech titans like Microsoft and Oracle. At its zenith, Dubai served as the regional base for two-thirds of Fortune 500 companies operating in MEA. It's estimated that DIFC alone contributes at least 12 per cent to Dubai’s GDP, underscoring its pivotal role in the Emirate’s economic landscape.

Besides Dubai, Abu Dhabi and Tel Aviv, other MEA cities in the top 100 included Casablanca (56th place), Mauritius (61st), Kigali (67th), Bahrain (76th), Johannesburg (82nd), Cape Town (83rd), Riyadh (84th), Doha (88th), Nairobi (95th) and Lagos (100th). Beyond the top 100, Istanbul (110th) and Tehran (112th) finalised the MEA representation.

The MEA region boasts a diverse array of financial institutions, including both native-born banks and regional branches of non-MEA banks. This rich tapestry of financial institutions reflects the region's vast population and the myriad opportunities it offers.

While multinational giants like HSBC, JPMorgan Chase, and the Bank of China are widely recognised, it's equally important to highlight the native-born MEA banks that contribute significantly to the region's financial landscape.

In this report, we present the top 20 largest banks in the entire MEA region, all of which are native to the region. These rankings are based on total assets in US dollars, using updated figures from 2023 sourced from the banks' individual investor relations reports. This list provides readers with insights into the prominent MEA banks and their standing in the global financial arena.

regional offices are often based in countries such as Dubai, Abu Dhabi (UAE), South Africa, Israel, Türkiye, Egypt, and Saudi Arabia, aligning with the geographic concentration of leading MEA banks.

Spotlight: Insurance industry in MEA

Delving into the realm of financial services, this report sheds light on the insurance industry as a representative example. By examining the insurance sector within the broader financial services landscape, one can discern similar patterns observed across the entire spectrum of financial services.

Focusing on the top 15 largest insurance companies in the MEA region, we find a parallel with the earlier analysis of the top 20 banks: the concentration of major players in specific countries. These top insurance institutions are primarily located in Israel, South Africa, Saudi Arabia, Morocco, Qatar, and Kuwait. While some significant players, such as Daman Health in the UAE and Misr Insurance in Egypt, are not among the top 15, they remain prominent within their respective countries or regions.

The list is predominantly composed of banks from large and developed, or relatively developed, economies in the MEA region, including South Africa, Israel, Saudi Arabia, UAE, Türkiye, and Egypt. Qatar, ranking first on the list, and Kuwait, ranking 11th, also have representation. Other countries such as Nigeria and Bahrain, while not featured in the top 20, boast a considerable number of local banks, alongside smaller financial institutions ranked by assets. It's worth noting that many leading financial institutions, whether included in the top 20 or not, tend to be clustered in specific countries within the region.

Additionally, it's essential to recognise that multinational banks like HSBC and Standard Chartered, while not headquartered in the MEA region, have significant operations within the region. Their

Furthermore, the top 15 insurers often feature other key players that did not make it onto the list, reinforcing the concentration of insurance industry leaders in select parts of the MEA region, mirroring the banking sector's dynamics.

In addition to regional players, the MEA region hosts several large global insurance brands, including MetLife, Zurich, AXA, Cigna, Munich RE, Aetna, and Bupa. However, similar to the overall financial services landscape, these global insurers also tend to operate primarily in the same countries mentioned earlier, with many establishing a presence in cities such as Dubai, Istanbul, Johannesburg, or Tel Aviv. This concentration reflects the strategic importance of these key locations within the MEA insurance market.

What distinguishes the financial services sector in the MEA region?

While it shares similarities with global financial markets in terms of the services provided to individuals and businesses, such as investment houses, lenders, finance companies, real estate brokers and insurance companies, there are notable differences that set it apart:

1 Government ownership of financial institutions

In the MEA region, it's common for financial institutions to be owned or partially owned by the government. Unlike the Western perception where government ownership might signal instability, in MEA, this is not necessarily associated with financial crises. For example, Angola has numerous state-owned companies, including financial institutions. Similarly, in the affluent GCC countries, such as Saudi Arabia and Qatar, government entities, including sovereign wealth funds and state pensions, have significant stakes in major banks like First Abu Dhabi Bank (FAB) and Qatar National Bank (QNB). These government interests extend to around 80 per cent of the region's largest lenders, as reported by The Financial Times.

2

Conservative lending practices

Banks in the MEA region tend to adopt a more conservative approach to lending. This conservatism was evident during the 2008 Global Financial Crisis when the MEA financial sector weathered the storm better than its Western counterparts. Despite experiencing the impact of the global recession, MEA banks, particularly those in the GCC (Gulf Cooperation Council) countries, maintained high levels of capital. They typically exceed the minimum capital requirements outlined in the Basel III agreements, which were established by the Basel Committee on Banking Supervision in response to the 2007-2009 financial crisis. This prudent approach to capital management contributes to the stability of the MEA financial sector, distinguishing it from other regions.

3

Growth of Islamic finance

Islamic finance is experiencing significant growth and plays an increasingly prominent role in the broader financial services landscape of the MEA region. Originating from the birthplace of Islam and serving much of the world's two billion Muslims, Islamic finance has its roots dating back to the seventh century but began formalising in the 1960s. It operates in accordance with Sharia, or Islamic law, guiding how businesses and individuals raise capital and determining permissible investment types. This system is often viewed as a unique form of socially responsible investment.

The Islamic finance industry has emerged as one of the fastest-growing sectors, although it still represents a relatively small share of global finance. By 2022, the global Islamic finance industry's asset size had increased by 11 per cent to $4.5trillion, with Islamic banking holding 72 per cent of the total industry's assets. Over the decade leading up to 2022, the industry experienced remarkable growth, expanding by 163 per cent, and is projected to reach $6.7trillion by 2027.

The top 10 Islamic Financial Institutions, ranked by Sharia-compliant assets, are predominantly from the Gulf Cooperation Council (GCC) countries. These include Saudi Arabia's AL Rajhi Bank, Saudi National Bank, Saudi British Bank, and Alinma Bank, as well as Kuwait Finance House, UAE's Dubai Islamic Bank, and Abu Dhabi Islamic Bank, along with Qatar's Qatar Islamic Bank and Masraf Al Rayan.

In terms of insurance, the lack of Sharia-compliant offerings may contribute to low penetration in the market. However, Takaful, a form of Islamic insurance where members contribute to a pool to guarantee each other, has the potential to enhance the uninsured rate in the Arab world. This Sharia-compliant insurance model, according to Investopedia, could address the needs of individuals seeking insurance coverage while adhering to Islamic principles.

4

Underdeveloped infrastructure

Much of the MEA region suffers from inadequate infrastructure to support the financial services ecosystem. These infrastructural deficiencies pose significant challenges for lenders who rely on data and information to offer services to end-users.

Direct infrastructure for financial services

One example is the lack of credit bureaus, which are vital for assessing creditworthiness. As of 2007, only four African countries had effective credit bureaus. In the MENA region, private credit bureau coverage for adults is estimated to be just over 20 per cent, with notable disparities among countries. While Israel boasts full coverage, most GCC countries exceed 50 per cent, whereas Iran surpasses 60 per cent. However, this still indicates significant room for improvement. Furthermore, basic financial services infrastructure such as ATMs is lacking, particularly in rural Africa, exacerbating financial exclusion. Despite the recognition of the importance of digital technology by many banks in Africa and the Middle East, a substantial portion have yet to develop comprehensive digital strategies, with fewer than a third of surveyed banks investing over $3million annually in digital transformation efforts.

Indirect infrastructure for financial services

Beyond the direct infrastructure, there's a significant gap in digital infrastructure that indirectly supports financial services. For instance, there's a relative scarcity of data centres across the region, leading to data being stored abroad. However, there has been a notable growth in the construction of data centres, even in affluent regions like the GCC. For instance, Saudi Arabia launched an $18billion plan in 2021 to build a network of large-scale data centres as part of its economic development strategy, Saudi Vision 2030. Additionally, the lack of registered IDs poses a challenge, particularly in Sub-Saharan Africa, where over half of the estimated one billion people globally without registered IDs reside. This absence of identification makes digital transformation and fintech advancements difficult to implement, hindering processes like know your customer (KYC). Despite the emphasis on digital experiences, infrastructure improvements remain essential to facilitate these advancements.

5

Financial exclusion for individuals

Despite advancements in some parts of the MEA region, many areas remain underserved or entirely excluded from the financial sector. Countries like South Africa, Mauritius, and Kenya have made progress in banking penetration and financial infrastructure, boasting high penetration rates of 85 per cent, 90 per cent, and 84 per cent, respectively. For instance, South Africa and Mauritius have a significantly higher number of bank branches per 100,000 adults compared to the Sub-Saharan African average. However, despite these improvements, a substantial portion of Africans, accounting for 52 percent, lack any form of bank account, including mobile money accounts. In certain African countries like the Democratic Republic of the Congo, Angola, and Ethiopia,

this rate is even lower, with figures ranging from 26 per cent to 35 per cent. Sub-Saharan Africa also grapples with low credit and debit card penetration rates, standing at three per cent and 18 per cent, respectively.

One of the primary challenges contributing to financial exclusion in Africa is the inadequate urbanisation, with many financial institutions primarily catering to urban areas, thereby neglecting rural populations. Moreover, poverty levels exacerbate the problem of financial exclusion, further widening the gap between urban and rural access to financial services.

Similarly, in the Arab world, there is a pressing need for greater financial inclusion, with almost 92 per cent of the population requiring adequate access to financial services. In this region, 60 per cent of the population remains unbanked, highlighting the urgency to address issues of financial exclusion and enhance access and resilience within the financial system.

6 Financial exclusion is a challenge for small and medium enterprises (SMEs) SMEs and micro small and medium-sized enterprises (MSMEs) play a crucial role in economies worldwide, contributing significantly to job creation and GDP. In the MEA region, these enterprises are equally essential across various income levels, serving as key drivers of economic growth. Here are some examples of their significance in specific MEA countries:

1 Saudi Arabia – SMEs constitute up to 99 per cent of all private businesses, employing 64 per cent of the workforce and contributing around 20 per cent of the country's GDP

2 Kenya – MSMEs contribute 98 per cent to the country’s total licenced entities, although only 20 per cent are officially licenced MSMEs, reflecting a substantial informal sector.

3 Egypt – SMEs make up more than 95 per cent of all non-agricultural private companies and employ about three-fourths of recent workers.

4

South Africa – SMEs account for 91 per cent of businesses, 60 per cent of employment, and contribute over half (52 per cent) of total GDP

5 Kuwait – SMEs make up 90 per cent of private labour, including labour and imports, an additional 45 per cent of labour, jobs, and domestic rates of less than one per cent, producing about 90 per cent of employment in Lebanon, and more than 95 per cent of total firm

6

UAE - SMEs comprise around 94.3 per cent for the country's commercial ventures, employ nearly 62 per cent of the population and produce about 75 per cent of the state’s GDP.

7 Algeria - MSMEs in represent a large part of the economic fabric (i.e. 99 per cent of around 1,200,000 companies in 2019 were SMEs); 97 per cent are micro-businesses as they employ less than 10 employees

8 Middle East and Central Asia - SMEs are the majority (96 per cent) of all registered companies in the region.

For the MEA region, access to finance for small and medium-sized enterprises (SMEs) and micro businesses remains a challenge. Nevertheless, the region has the lowest SME access to finance via the banking system. The average share of SMEs in total bank lending in Middle East, North Africa and Pakistan (MENAP) is around seven per cent (it is even lower in parts of the GCC at two per cent). This is also reflected in a survey from the World Bank Enterprise Survey where 32 per cent of firms in the MENAP region cite access to credit as a major constraint (higher than the global average of 26 per cent). It is estimated that SMEs in the Middle East have the highest rate of lack of financial access in the world.

Other sources show that MENA has a financing gap of 80 per cent and that SSA has one of 72 per cent. For more fragile nations and for female entrepreneurs the gap unfortunately widens.

With SSA, It is estimated annually SMEs there have a finance gap of $330billion. SMEs across the continent struggle to secure loans due to various factors, including their inability to provide the necessary information about their businesses to lenders (as highlighted earlier with the infrastructure bullet point). In Africa, 75 per cent of enterprises are financed by internal funds, and another 10 per cent use traditional banking loans. For instance, 79 per cent of informal businesses have never obtained a loan, and only 21 per cent have utilised a bank loan in South Africa. Moreover, only under 20 per cent of formal businesses have used a bank loan to start their business.

offered in the MEA region is underserved, both from a socioeconomic perspective and in terms of cultural context and financial literacy. Taking insurance as an example, many in the MEA region lack coverage, reflecting the broader theme of financial exclusion discussed earlier. According to data from Atlas, the insurance premiums market in MENA in 2018 was valued at $57billion.

In the affluent GCC region, research from management consulting firm Kearney indicates that it is one of the world’s fastest-growing insurance markets, with registered growth of nearly seven percent annually in gross written premiums over recent years. Despite this growth, the GCC countries collectively accounted for less than half (44.3 per cent) of the region’s premium market share. Much of the Middle East remains uninsured, particularly in less affluent regions beyond the GCC. Historically, certain types of insurance, such as life insurance, were not widely practiced in the affluent GCC. However, there is a noticeable shift in this trend. For example, in Dubai, health or medical insurance has been mandatory by law since 2014.

Presently, the UAE and Saudi Arabia are the two largest insurance markets in the GCC. According to the latest S&P Global Ratings GCC Insurers 2023 Report, Saudi Arabia surpassed the UAE as the largest market in the previous year, driven by a significant increase in gross written premiums (GWP). Projections from a ‘GCC Insurance Industry’ report by Alpen Capital suggest that Saudi Arabia will continue to lead the GCC insurance market, reaching a market share of 42.6 per cent by 2028.

Even with the rise of insurance technologies, or insurtech, there remains significant room for growth in the insurance sector across the MEA region

When examining the hurdles encountered by micro-enterprises in South Africa, access to both debt and equity markets emerges as a significant challenge. Furthermore, the absence of adequate business infrastructure, equipment, and limited awareness of government support programmes are impeding the capacity of MSMEs to expand and thrive in the country.

It's important to highlight that even basic necessities are often inaccessible to many MSMEs. For instance, the same survey revealed that only 16 per cent and 28 per cent of MSMEs had access to electricity from the national grid and water from public or municipal sources, respectively. These deficiencies underscore the pressing need for comprehensive support mechanisms to bolster the growth and sustainability of micro-enterprises in South Africa.

7 Underserved financial service products

As mentioned earlier in the discussion on financial inclusion for both individuals and businesses, the range of financial services

A report by Zurich highlights that the potential of the insurance market in MENA remains largely untapped. Insurance penetration, which measures the ratio of insurance premiums written to GDP, is among the lowest in the world for MENA countries. While some countries like Jordan, Lebanon, and Morocco have insurance penetration ratios above 1.5 per cent, others, including Algeria, Egypt, Yemen, and several GCC countries, have very low ratios.

In contrast, the uninsured rate in Africa is even higher. Despite having nearly 20 per cent of the world’s total population, the insurance industry in Africa represents less than three percent of insured catastrophe losses worldwide. Nigeria, with a population exceeding 200 million, has an insurance penetration rate of only 0.5 per cent. However, South Africa stands out with one of the world’s highest insurance penetration rates, reaching an estimated 80 per cent of the continent’s total gross premiums at its peak. Overall, only about three per cent of Africa's population is insured, the lowest rate globally.

Even with the rise of insurance technologies, or insurtech, there remains significant room for growth in the insurance sector across the MEA region. Digital transformation can streamline operations and enhance accessibility, contributing to wider financial inclusion.

e.Tech and startup overview

Overview

Global venture capital (VC) investment declined from $531.4 billion in 2022 to $344 billion in 2023, marking the lowest level since 2019. This downward trend was also observed in the MEA region, reflecting general declines across the board. The decrease can be attributed to the prevailing economic climate, ongoing political challenges, and other factors affecting the global tech and VC space.

Despite the decline in VC investment, the global tech industry remains robust, estimated to be worth at least $5.2trillion. The majority of this value is concentrated in North America (35 per cent), Asia (32 per cent), and Europe (22 per cent), leaving only 10 per cent for the rest of the world, including the MEA region. This percentage seems small considering that the MEA region is home to a quarter of the world's population. However, technology is increasingly playing a stronger role in the region and has significant potential to grow further, particularly in sectors like financial technology (fintech).

In previous versions of this report, the nascent stage of the region’s tech space was highlighted, evident in the lack of unicorns. Excluding Israel, often referred to as the ‘Startup Nation’, the MEA region has few unicorns. However, in recent years, there has been notable progress in both the tech and fintech sectors, with emerging unicorns in countries such as Nigeria, Egypt, Saudi Arabia, the UAE, Senegal and Türkiye.

While such figures may suggest limited potential for the MEA region, the day-to-day changes and opportunities in fintech paint a different picture. Similar to the financial services industry, the region's broader tech ecosystem exhibits varying levels of development and disparity, indicating opportunities for growth and innovation.

Tech hub

Where are the known tech hubs? As with other regions, tech activity and innovation in the MEA region are concentrated in specific areas. In the Middle East, the UAE stands out with the highest levels of activity across various metrics, including the number of tech companies and VC deals.

Dubai, in particular, has positioned itself as a regional and global tech hub, attracting multinational corporations like Google to establish their regional offices there. Notably, Dubai has been the birthplace of some of the first unicorns in the region, such as car-hailing app Careem and Souq.com, the online e-commerce portal that was acquired by Amazon.

While the UAE leads the way, other countries in the Middle East are catching up and developing their own robust tech ecosystems. Saudi Arabia, for instance, launched the LEAP tech trade show and conference two years ago and has made significant investments in AI, allocating $20billion for further advancement in this field. In Africa, tech activity and innovation are concentrated in certain countries, with Egypt, Nigeria, Kenya, and South Africa leading the pack. These countries also dominate the fintech space and the wider tech and startup scene on the continent.

Türkiye has experienced a remarkable surge in startup investments, with annual investments skyrocketing from $50million to $100million between 2010 and 2020 to over $1.5billion in 2021. This surge has led to the emergence of several unicorns, including gametech company Dream Games and fintech Papaya.

Israel, often referred to as the Startup Nation, boasts the most advanced tech hub in the MEA region and is considered one of the world's leading tech ecosystems. The country has the highest number of startups per capita globally and has produced numerous tech unicorns, such as , including eToro, Rapyd, TripActions, Moon Active, Compass, Next Insurance, and Melio. At least 77 Israeli-founded startups have achieved this status, many of which are fintechs. Much of the activity is centred around Tel Aviv, the largest city and commercial hub in the country.

Israel's innovative tech ecosystem is supported by government initiatives and has a highly skilled workforce. The country ranks second in the world in research and development (R&D) expenditure per capita, which amounts to around 4.1 per cent of its GDP. Israel also has the highest percentage of engineers and scientists per capita in the world, and boasts one of the highest ratios of university degrees and academic publications per capita.

Despite Israel's thriving tech industry, other parts of the region still have relatively underdeveloped tech ecosystems.

VC funding

MEA received over $9.3billion in VC funding last year, marking a decline similar to the global trend. However, this funding is not evenly distributed, with Israel alone accounting for $4.3billion, followed by the Middle East (excluding North Africa, Israel, and Türkiye) with $2.2billion, Africa with $1.9billion, and Türkiye with around $1billion.

Israel experienced a notable decrease in funding compared to previous years, dropping from $8.9billion across 677 deals to $4.3billion across 369 deals. The Gulf countries, excluding Saudi Arabia, reported a 47 percent year-on-year decline in funding, with the UAE down by 45 percent. Similarly, the Big 4 African countries –Kenya, South Africa, Nigeria, and Egypt – also witnessed declines in VC funding.

Spotlight: Sovereign wealth funds (SWFs)

The rise of sovereign wealth funds in the MENA region has garnered more attention recently, driven in part by the growing significance of technology and startups as catalysts for future economic development and diversification. These funds are increasingly focused on fostering entrepreneurship both presently and in the future.

Globally, there are estimated to be 176 sovereign wealth funds managing over $11.36trillion in assets. The Middle East, particularly the wealthy GCC countries, is home to 20 of these funds, collectively managing assets of around $4trillion. The top five largest sovereign wealth funds in the Middle East alone deployed over $73billion, with their investments in Western countries, such as Europe and the US, doubling in 2022 to $51.6billion.

Despite these challenges, there were significant achievements in 2023. Saudi Arabia saw a 33 per cent increase in funding, surpassing the UAE to become the largest value recipient for the first time, with $1.383billion. Saudi Arabia also produced a unicorn with buy now pay later (BNPL) platform Tamara, which secured the largest deal in MENA at $340million. However, the UAE still led in the number of deals and exits with 158 (Saudi had 125).

Fintech remained a vital sector in MENA, receiving $1.279billion out of the $1.9billion total funding, with 101 deals. In Africa, Kenya emerged as the leading VC investment destination, securing $800 million, followed by Egypt with $640million, South Africa with $600million, and Nigeria with $400million.

Notably, Francophone-speaking Africa, including countries like the DRC and Morocco, experienced growth. Besides the Big 4, other top African investment destinations included : Morocco ($88million), Benin Republic ($71 million), the Democratic Republic of Congo ($62 million), Ghana ($57 million), Senegal, and Rwanda at $44 million each; 11th was Tanzania ($25 million).

While some countries like Tunisia and Algeria appeared quieter in 2023, they had successful years in 2022. For example, Algeria's Yassir raised $150million in November 2022, one of the largest rounds raised in Africa that year, with investments from Silicon Valley-based Bond and accelerator Y Combinator.

A Financial Times article titled ‘The New Gulf Sovereign Wealth Fund Boom’ underscored the substantial growth in investment witnessed by these funds. Sovereign wealth funds have shown particular interest in specific sectors such as fintech, with Qatar’s fund among those actively seeking opportunities globally. Notably, the GCC countries play a significant role in this sector, representing a substantial portion of the global top ten both in terms of representation and assets controlled. Notable GCC funds that missed the top ten include the Investment Corporation of Dubai (12th place), Abu Dhabi Development Holding Company (14th), Mubadala Investment Company (18th place), and National Development Fund of Iran (16th).

f.The MEA consumer

Considering the diversity among the regions of the Middle East and Africa discussed earlier in this chapter, one might question how such a region, with its multitude of nations and diverse ethnicities, tribes, and socio-economic backgrounds, can exhibit similarities.

While it's challenging to make generalisations, it's evident that many aspects of the MEA region share common traits, particularly in the realm of financial services and, as highlighted in this report, fintech.

Spotlight: Remittances in MEA

Because of significant migration, the MEA region stands out as one of the busiest corridors globally for remittances – reflecting the flow of money sent and received.

Firstly, wealthy regions, notably the Gulf Cooperation Council (GCC), have attracted people from worldwide, including other MEA countries and beyond. For example, the UAE, with an expatriate population comprising nearly 90 per cent of its total population, hosts representatives from around 200 nationalities, with Egyptians constituting one of the largest groups, estimated at around five per cent of the total population. Remarkably, five of the six GCC nations rank among the world’s top 20 remittance outflows. Notably absent from this list are Israel (21st) and Bahrain (32nd).

Secondly, less affluent MEA nations benefit from remittances sent by their citizens working abroad, which significantly contribute to their economies. This is evident both in the top five global remittance volumes (with Egypt ranking fifth) and in terms of the percentage contribution to GDP (with Lebanon ranking fourth).

Recap – rise of digital behaviours in MEA during and post-pandemic

73%

MEA consumers shopped more online since Covid-19

30% in Africa will visit a bank branch less post-pandemic

82% of surveyed banking customers in the Middle East willing to start using fintech solutions in 2020

Africa

Middle East

93% reported an increase in their use of e-wallet and mobile banking in 2021. Covid-19 was one of the main factors for that

64% only started using online payments services during the pandemic

~40%

Increase usage of online banking in Africa

~40%

Increase usage of digital channels post-pandemic in Africa

69%

Cashless payments in the Middle East (2023)

64% in Middle East only started using online payments during pandemic

53% in Middle East are shopping more post-covid on their smartphones than pre-Covid

1

Many in MEA work in the informal economy

In much of MEA many, according to the International Labour Organization (ILO), are found on the edge of high vulnerability to poverty, low earnings, irregular incomes, and bad working conditions. Africa – 83% employment informal economy

SSA – 85% employment informal economy

And in the Middle East and North Africa….Nearly 2 out of 3 people hold a job in the informal economy

2 The population is young and growing fast in comparison to the rest of the world

MEA is a young and growing region.

In MENA nearly 50% of the population is 24 and under...

In SSA .70% of the population is under 30 years old

The Middle East and Africa consumer overview

3

Many in MEA work in the informal economy

Especially in the poorer parts of MEA youth unemployment is higher than the rest of the globe. This results in many of the poorer MEA residents having to immigrate and find work, especially in more affluent parts of MEA (notably the Arabian Gulf GCC) and beyond.

In MENA 25% is the youth unemployment rate.

In SSA over 30% of youth are not in employment, education nor training (world’s highest) – 2/3 of them are women

4 Many in MEA work in the informal economy

MEA has one of the world’s busiest corridors when it comes to migration of people, both immigrating and/or working as expatriates, as well being a recipient of those expatriates and/or immigrants. This is noted in particular with remittances

Top 5 MEA countries remittances outflow (value):

1. United Arab Emirates (2nd globally)

2. Saudi Arabia (3rd globally)

3. Kuwait (6th globally)

4. Qatar (11th globally)

5. Oman (19th globally)

Top MEA country – remittances inflow (value)

Egypt – (5th globally)

Top MEA country – remittances inflow (contribution to GDP % ) Lebanon – (4th globally)

5 Varied internet penetration and relatively high mobile usage

In terms of mobile adoption, in particular smartphones….. SSA – 51% of the population is now estimated to own a smartphone.

However, it still has the highest usage gap globally with 59% of the total population unconnected.

Also, only 25% of the population are connected to its mobile broadband service.

Generally, with internet, only around 40% of Africans had access to the internet.

MENA – are over 415million unique mobile subscribers

There are over 330 million mobile internet users

There is a 70% smartphone adoption rate

Generally, with internet, only around 61% of the MENA population had access to the internet

FACT Three-fourth of African internet traffic goes via mobile phone.

g.Economic diversification and digitalisation economic development

Overview

Examining the diverse economies, cultures, and socio-economic statuses across the MEA region, one might question how they share common ground. However, despite this diversity, economic development priorities emerge as a unifying factor. Such priorities are not unique to the MEA but are instead a global imperative, driving public sector agendas worldwide in pursuit of citizen well-being through economic growth and job creation.

The MEA region, encompassing a spectrum of nations and demographic compositions, experiences visible transformations and unmistakable economic development and diversification efforts. These changes present an exciting era for observers like myself, yet they may not be apparent to all, particularly those unfamiliar with economic development and diversification concepts. However, whether visiting the MEA or residing there, one cannot overlook these shifts. This report aims to shed light on such transformations, spurred by the growth of fintech, both directly and indirectly. Understanding economic development strategies is fundamental. Essentially, they represent a national or municipal outlook aimed at enhancing existing sectors while nurturing new ones. Their overarching goal is to stimulate economic growth, foster job creation, and enhance the lives of residents.

Why are these strategies vital in the MEA? Many MEA countries rely heavily on commodities and natural resources, such as oil in the GCC and parts of Africa like Nigeria. Given the volatility of oil prices

and the finite nature of natural resources, these nations require clear visions and strategic roadmaps to diversify their economies.

Each of the six GCC countries has crafted its own economic development strategies, such as Bahrain Economic Vision 2030, Kuwait Vision 2035, Qatar National Vision 2030, Oman Vision 2040, and Saudi Vision 2030. The UAE, for instance, has other national initiatives such as UAE Centennial 2071 and UAE Vision 2021, as well as regional initiatives like Abu Dhabi Vision 2030. These strategies focus on diversifying sectors, including technology, financial services, and tourism, to sustain growth and uphold living standards.

Moreover, various low- to high-income countries across the MEA region are leveraging economic development strategies to elevate living standards. By capitalising on their strengths and expanding into sectors like technology and financial services, these nations aspire to spur economic growth. Examples of these strategies include Egypt Vision 2030, Mauritius Vision, Rwanda Vision 2050, Jordan 2025, Uganda Vision 2040, Kenya Vision 2030, and Ghana Vision 2020. By diversifying their economies, these countries hope to uplift their nation's income and standard of living in the long term.

Governments in the region are also fostering entrepreneurship and nurturing homegrown startups. This involves incentivising entrepreneurship, promoting priority sectors like fintech, and supporting accelerator and incubation programmes. Initiatives to

IN GENERAL – DIGITAL ECONOMIC DEVELOPMENT

Government support generally across wider economic development transformations via national strategies

Digital economic development plays a strong part of this generally

22% of sub-Saharan businesses

said that they’d either started to use or increased their use of digital tech during 2020

The

potential for MEA remains huge and opportunities remain

$712 billion projected size of Africa’s digital economy by 2050 40% GDP per capita in MENA could rise by more than 40%

Source: Various including The Fintech Times, Mastercard, World Bank MENA Fintech Association, Kaspersky, Economist, McKinsey, World Economic Forum, World Population Review, Accenture Image: Richie Santosdiaz and The Fintech Times

encourage local hiring in the private sector and provide education and sector-specific training are also underway. Additionally, education and sector-specific training receive prioritisation, accompanied by incentives for aspiring entrepreneurs. For instance, the UAE recently introduced a unique initiative allowing locals to take a year off from their government jobs to launch their businesses. Furthermore, there are digital-specific initiatives, including those targeting sub-sectors such as fintech. These strategies often complement broader national or city-wide plans. Sub-digital initiatives focus on areas like artificial intelligence (AI), blockchain, and big data. While each initiative is tailored to meet the specific needs of its respective nation, they all share overarching economic objectives, including:

■ Diversification of economic sectors These initiatives aim to mitigate the risk associated with economies reliant on a single sector by fostering diverse economies with multiple sectors such as tourism, transportation, technology and fintech.

■ Drive innovation and entrepreneurship These initiatives promote innovation within the future economy, encouraging the development of local talent and ideas, and fostering entrepreneurship to propel these ideas forward.

■ Digital transformation Digital technology drives sectors like technology and fintech, and it's crucial for broader technology adoption to prepare for a digital future. The Covid-19 pandemic has underscored the importance of robust technology infrastructure globally.

■ Job creation and economic growth Job creation and economic growth serve as fundamental pillars of economic development. Therefore, these initiatives aim to formulate an overall economic development strategy to enhance the wellbeing of citizens.

In the context of fintech, a combination of market demand and government support has driven many countries to develop fintech and broader digital ecosystems. Regulatory sandboxes have also emerged across the region, and legislative changes have been prioritised in fintech to ensure consumer protection and foster a positive business environment in the MEA region.