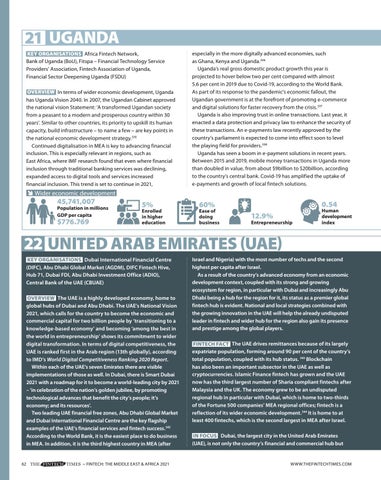

21 UGANDA KEY ORGANISATIONS Africa Fintech Network, Bank of Uganda (BoU), Fitspa – Financial Technology Service Providers’ Association, Fintech Association of Uganda, Financial Sector Deepening Uganda (FSDU) OVERVIEW In terms of wider economic development, Uganda has Uganda Vision 2040. In 2007, the Ugandan Cabinet approved the national vision Statement: ‘A transformed Ugandan society from a peasant to a modern and prosperous country within 30 years’. Similar to other countries, its priority to upskill its human capacity, build infrastructure – to name a few – are key points in the national economic development strategy. 335 Continued digitalisation in MEA is key to advancing financial inclusion. This is especially relevant in regions, such as East Africa, where IMF research found that even where financial inclusion through traditional banking services was declining, expanded access to digital tools and services increased financial inclusion. This trend is set to continue in 2021,

especially in the more digitally advanced economies, such as Ghana, Kenya and Uganda. 336 Uganda’s real gross domestic product growth this year is projected to hover below two per cent compared with almost 5.6 per cent in 2019 due to Covid-19, according to the World Bank. As part of its response to the pandemic’s economic fallout, the Ugandan government is at the forefront of promoting e-commerce and digital solutions for faster recovery from the crisis. 337 Uganda is also improving trust in online transactions. Last year, it enacted a data protection and privacy law to enhance the security of these transactions. An e-payments law recently approved by the country’s parliament is expected to come into effect soon to level the playing field for providers. 338 Uganda has seen a boom in e-payment solutions in recent years. Between 2015 and 2019, mobile money transactions in Uganda more than doubled in value, from about $9billion to $20billion, according to the country’s central bank. Covid-19 has amplified the uptake of e-payments and growth of local fintech solutions.

Wider economic development

45,741,007

Population in millions GDP per capita

$776.769

5%

Enrolled in higher education

0.54

60%

Ease of doing business

12.9%

Entrepreneurship

Human development index

z ARAB EMIRATES (UAE) 22 UNITED INFOCUS

KEY ORGANISATIONS Dubai International Financial Centre (DIFC), Abu Dhabi Global Market (AGDM), DIFC Fintech Hive, Hub 71, Dubai FDI, Abu Dhabi Investment Office (ADIO), Central Bank of the UAE (CBUAE) OVERVIEW The UAE is a highly developed economy, home to global hubs of Dubai and Abu Dhabi. The UAE’s National Vision 2021, which calls for the country to become the economic and commercial capital for two billion people by ‘transitioning to a knowledge-based economy’ and becoming ‘among the best in the world in entrepreneurship’ shows its commitment to wider digital transformation. In terms of digital competitiveness, the UAE is ranked first in the Arab region (13th globally), according to IMD’s World Digital Competitiveness Ranking 2020 Report. Within each of the UAE’s seven Emirates there are visible implementations of those as well. In Dubai, there is Smart Dubai 2021 with a roadmap for it to become a world-leading city by 2021 – ‘in celebration of the nation’s golden jubilee, by promoting technological advances that benefit the city’s people; it’s economy; and its resources’. Two leading UAE financial free zones, Abu Dhabi Global Market and Dubai International Financial Centre are the key flagship examples of the UAE’s financial services and fintech success.342 According to the World Bank, it is the easiest place to do business in MEA. In addition, it is the third highest country in MEA (after

62

~ FINTECH: THE MIDDLE EAST & AFRICA 2021

Israel and Nigeria) with the most number of techs and the second highest per capita after Israel. As a result of the country’s advanced economy from an economic development context, coupled with its strong and growing ecosystem for region, in particular with Dubai and increasingly Abu Dhabi being a hub for the region for it, its status as a premier global fintech hub is evident. National and local strategies combined with the growing innovation in the UAE will help the already undisputed leader in fintech and wider hub for the region also gain its presence and prestige among the global players. FINTECH FACT The UAE drives remittances because of its largely expatriate population, forming around 90 per cent of the country’s total population, coupled with its hub status. 343 Blockchain has also been an important subsector in the UAE as well as cryptocurrencies. Islamic Finance fintech has grown and the UAE now has the third largest number of Sharia compliant fintechs after Malaysia and the UK. The economy grew to be an undisputed regional hub in particular with Dubai, which is home to two-thirds of the Fortune 500 companies’ MEA regional offices; fintech is a reflection of its wider economic development. 344 It is home to at least 400 fintechs, which is the second largest in MEA after Israel. IN FOCUS Dubai, the largest city in the United Arab Emirates (UAE), is not only the country’s financial and commercial hub but

WWW.THEFINTECHTIMES.COM