THE FINTECHTIMES.COM EDITION 50 THE WORLD'S FINTECH NEWSPAPER Read online at thefintechtimes.com IN THIS ISSUE FEATURE STORY What’s next for embedded finance and BaaS? Page 8 ESG Taranis Capital on ethical fintech-focused investments Page 17 Streamlining e-commerce payments in Latin America PayRetailers on accepting payments from anywhere in the world page 15 Empowering a sustainable world ekko on why green fintech is postively blooming page 11 Democratising payments How APMs drive financial inclusion, by IXOPAY page 16 The potential of embedded finance Weavr offers banks advice page 10 Spotlight on The industry’s smartest visionaries and innovators come together to create the future of money page 12 Revolutionising workplace pensions Cushon’s Steve Watson on unleashing the power of tech to deliver value page 18 BOOK REVIEW Redecentralisation by Ruth Wandhöfer and Hazem Nakib Page 22 CULTURE Revolutionising embedded finance by Philipp Buschmann, AAZZUR Page 21 FINTECH FOR GOOD HIGHLIGHTING THE INDUSTRY’S COMMITMENT TO LEVERAGING TECHNOLOGY TO DRIVE POSITIVE SOCIAL IMPACT Measuring what matters Kimberley Abbott of Vested Impact, on reshaping the evaluation of investments page 8 SUBSCRIBE HERE

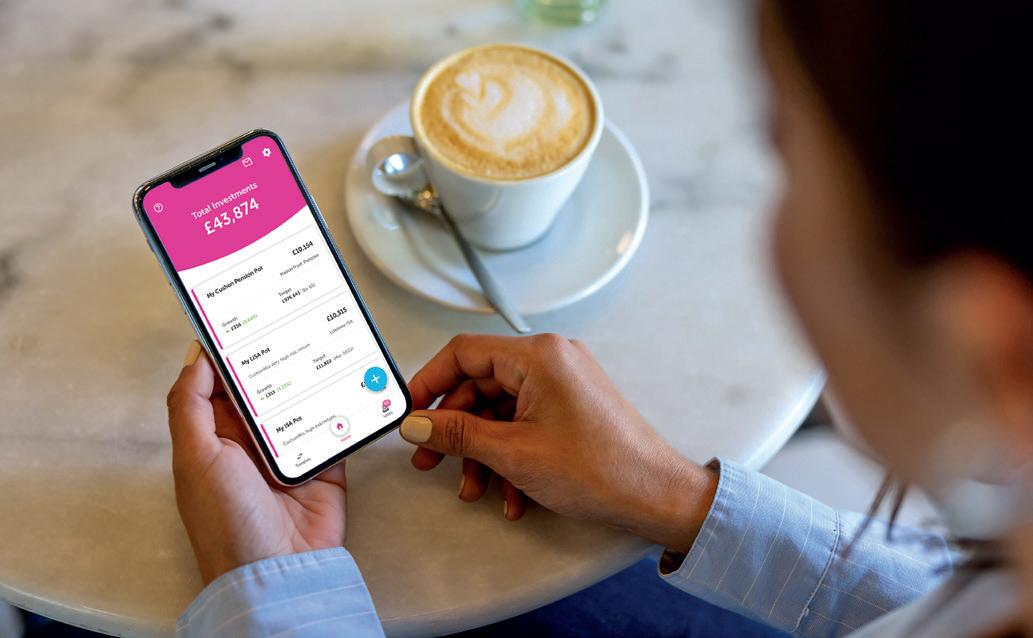

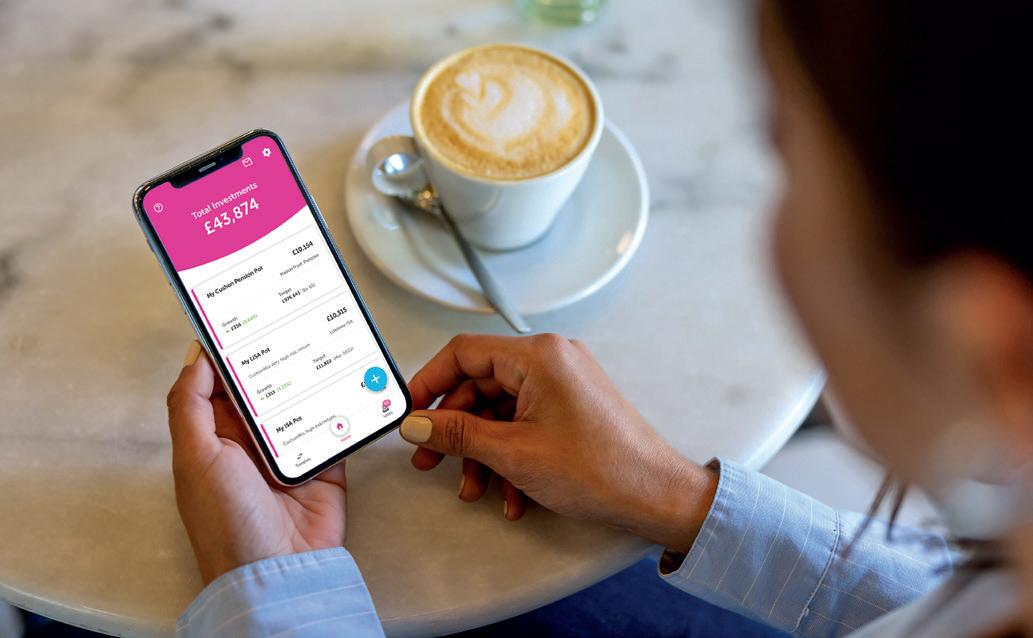

Workplace pensions, reimagined Cushon delivers the climate-friendly, app-based pension that your employees deserve Learn more about Cushon’s innovative workplace solutions: hello@cushon.co.uk While Cushon can give you plenty of information about the options available to you, we’re not able to give financial advice. It’s also important to recognise that no form of investment is ever guaranteed. The value of investments can go down as well as up. Cushon is authorised and regulated by the Financial Conduct Authority.

Halfway through the year, we find ourselves reflecting on the journey of the fintech landscape so far. According to CB Insights data, global fintech funding grew 55 per cent quarter on quarter in Q1, while early-stage deal share reached 72 per cent, a new high, suggesting a renewed focus on nurturing promising ventures in an era of cautious valuations, market uncertainties and recessionary headwinds.

Separate research from FIS also indicates that embedded finance and positive societal impact are drivers of growth. Its findings suggest that early adoption in these innovative spaces is critical to success over the next few years. Embedded finance, the seamless integration of financial services into existing platforms, is certainly changing how we access and engage with banking, lending and investment opportunities. It has democratised finance, breaking down barriers and making financial services more accessible than ever before.

The concept of fintech for good has also gained momentum, highlighting the industry’s commitment to leveraging technology to drive positive

social impact. From promoting financial inclusion and empowering underserved communities to bridging the gap between traditional banking systems and the digital world, fintech for good initiatives are paving the way for a more equitable and inclusive financial landscape.

In the pages ahead, we delve into these two themes, exploring the innovative solutions, success stories, and emerging trends that exemplify the convergence of embedded finance and fintech for good.

Of course, the phrase ‘fintech for good’ gets bandied around a lot in the industry. You can always count on it appearing at a conference or whenever a group of fintech leaders are standing in a room. In our cover feature on page four, features editor Polly Jean Harrison, delves into whether it is a realistic concept or just a finance fantasy!

We hear from Kimberley Abbott, founder and CEO of Vested Impact, on reshaping the evaluation of investments to drive positive change and solve global challenges (page eight). While on page 11, Oli Cook,

Fintech's Impact: Driving Positive Change

CEO and co-founder of climatefocused fintech startup ekko, explains why he thinks the fintech sector comprises enough talent and knowledge to make collective and impactful changes on the world.

With embedded finance projected to reach $7trillion in transaction value by 2026, Tom Bleach investigates what it takes to stay ahead of the game on page six. While Alex Mifsud, founder and CEO of Weavr, discusses why embedded finance can quickly help to unlock significant new revenue streams even among established financial institutions, such as banks.

In this issue, we also put a focus on Money 20/20 Europe – one of Europe’s biggest fintech events – where the industry’s finest will delve into the challenges of right now and shape together what comes next for the money ecosystem in Europe and beyond. As the year progresses, we eagerly await the developments and opportunities that lie ahead. Happy reading!

Claire Woffenden, Editor, The Fintech Times

THE FINTECH TIMES EDITOR’S WELCOME BRINGING FINTECH TO THE WORLD Editorial Enquiries editor@thefintechtimes.com Chief Executive Officer Jason Williams Editorial Director Mark Walker Editor Claire Woffenden Art Director Chris Swales Features Editor Polly Jean Harrison Operations Emily Spence Marketing Karen Phiri Business Development Callum Blackwell Deepakk Chandiramani Stephen McMaugh Ania del Rosario Journalists Francis Bignell Tom Bleach Published by Rise London, 41 Luke Street, London EC2A 4DP, UK CONNECT WITH US /fintech-times /thefintechtimes /thefintechtimes thefintechtimes.com This Newspaper was printed by Park Communications Limited, London using its environmental print technology, on 100% recycled paper. Copyright: The Fintech Times 2023. Reproduction of the contents in any manner is not permitted without the publisher’s prior consent. ‘The Fintech Times’ and ‘Fintech Times’ are registered UK trademarks of Disrupts Media Limited.

The words ‘fintech for good’ get thrown around a lot in the industry. They’re the buzzwords you can always count on appearing at a conference or whenever a group of fintech leaders are standing in a room. But does the phrase have any legs – or is it just a collective industry pipe dream? Polly Jean Harrison, features editor at The Fintech Times, learns more.

Though pretty self-explanatory, the idea of fintech for good is using financial technology and its innovations to create a more inclusive and accessible world for all. Whether that's addressing financial issues such as poverty or financial exclusion, or other global issues like climate change, diversity or other factors of ESG.

Greg Ott, CEO of small business financial health platform Nav, suggests that fintech for good means “finding

historically underserved audiences – like small business owners – and putting them at the centre of every decision we make. We believe embedding the idea of ‘good’ in products, instead of bolting it on as a way to drive engagement or making a one-time donation to a cause and marketing it as a commitment – is the only way to drive ‘good’ that’s impactful instead of performative.”

GREAT EXPECTATIONS

Fintech always has a lot of potential to do a lot of great things – by its very nature it exists to solve problems. It takes the issues that have been troubling the industry and flips them on their head, presenting exciting and innovative solutions that have us all thinking ‘Now that's clever!’.

With these exciting solutions, the out-of-the-box thinking and the general can-do attitude that everyone in fintech

has by the bucket load – it makes sense that the industry puts their collective power into doing some good. But is it realistic? The words fintech for good get thrown around so much at this point, have we become desensitised to them? It's easy to get cynical about the world, especially with the current state of affairs. Is doing good just a pipe dream? Something we can all dream about to make ourselves feel better?

Or is it all just a marketing ploy? Is merely declaring your pursuit to ‘do good’ enough without having to follow through? Merely plant a couple of trees or donate to a few charities and your good box is ticked for another year.

CYNICISM IS NATURAL

Like I said, it's easy to be cynical, but many in the industry are passionate about fintech's ability to do a bit of good in the world and change things for the better.

Ashley Aydin, principal with VC firm

VamosVentures, is one such individual. He believes that “fintech companies have the potential to be real businesses and do good at the same time”.

He continued: “Companies can streamline inefficient status quo financial experiences and democratise financial knowledge for those who would not have access to it otherwise. With financial technology, we can, in new ways, help individuals grow their wealth, make payments more seamlessly, have the right infrastructure to grow their businesses, and more."

WINDOW OF OPPORTUNITY

Providing financial opportunities to those traditionally left behind is probably the easiest way fintech can do good – in fact it’s pretty much the raison d'etre of most of the industry. However, it's not always as simple as just doing. James Galassi, digital, product and marketing director at Acuity Knowledge, a provider

COVER STORY THE FINTECH TIMES 4 | Edition 50

of research and analytics to the finance sector, believes that companies must be driven by a higher purpose than just the desire to do good.

“From providing people with easy access to their credit scores so they can make more informed financial decisions, to using new payment rails to slash the cost of cross border payments, fintech has a history of being a force for good and putting more power into the hands of customers. This, however, is not a given,” he said.

“Companies must be driven by a higher purpose. One that seeks to create a positive and lasting change with both customers and the wider world. Fintechs can only do this if they act with humility and a genuine desire to

payments. The result is wider access and greater choice for people who can often find these choices narrowing as result of change.”

Of course, ESG standards are always high on the list, if anything they dominate the conversation whenever you're talking about doing good, as sustainability and ethical issues are prime candidates for doing some good.

so will the ability of all business verticals – fintechs included – to contribute towards the concept of ‘for good’.”

ACTUALLY DONE GOOD

It should be said that fintech is already doing a lot of good. Credit should be given where it's due, and fintech really is making a difference when it comes to the lives of those who are unbanked or financially excluded. It would be remiss to downplay the actual effects fintech has had in this space already, proving the aspiration to do good is more than just a pipe dream.

As Elizabeth Lyons, chief operating officer at SaaS platform T-REX, said: “The opportunity for fintech to create positive outcomes has never been greater. There are so many incredible stories for consumers, from free access to financial services to enhanced decision-making thanks to digital products. What doesn’t always make headline news is the impact fintech, particularly enterprise fintechs, are having on the institutional side.

“Innovation and collaboration are the very fabric of fintech DNA; this partnership mindset for established fintechs and new entrants alike is propelling sustainable growth forward at a pace we've never seen before.”

For a specific example, CEO and co-founder of IT charity TechAid, Lacey Hunter proposes Indian mobile-based cash transfer app PayTM as proof of the positive impact possible via fintech.

employees to continue to purchase goods and services as they went about their lives.

“The additional benefits were and continue to be far-reaching, resulting in the inclusion of the underserved into the mainstream economy, as well previously unattainable transparency and traceability both from both a taxation and a fair payment of wages standpoint. These are the types of benefits one should expect to see from a fintech solution that truly enables ‘good’ in society – simply digitising an existing financial vehicle isn’t enough."

TEACHING THE MASSES

Of course, you can’t forget about education, and fintech is making leaps and bounds when it comes to actually teaching people about money and how to use it – another clear way that good is being done. Stuart C. Harvey Jr, chairman of the board of advisors at Rego Payments believes fintech can absolutely be a force for good – but it's all about “education and experience”.

“Studies show that a lack of financial education can cost 15 per cent of adults at least $10,000 in 2022. Fintech services are closing the gap, giving parents resources to teach their kids personal finance at home before they reach adulthood.

“Doing good has to start with our children. As a parent, I hope my kids are not just smart with their money, but also generous. At an early age, kids want to help. That's why I believe that fintech companies, like REGO, can make ‘fintech for good’ a reality if we give parents tools to reward their kids for making financial decisions that benefit their community”.

understand the motivations of their customers. This will enable them to see the world through their customers’ eyes and create products and services that authentically connect with them.”

PURPOSE AND PLANNING

Philip Hart, chief internal auditor and executive co-sponsor for ESG at ClearBank echoes these thoughts: “Fintech for good is not just a marketing exercise – it is a real force for positive change. For it to be effective you have to seek out the issues and situations where there’s an opportunity for fintech to help people. As an example of societal impact, there have always been people without bank accounts, and the shift to digital payments risks leaving them even further behind. As of 2020, 1.2 million UK adults had no current or e-money account of any sort. There’s also a great deal of overlap between those who are unbanked and those in receipt of benefit

Gabby Kusz, CEO of the Global Digital Asset & Cryptocurrency Association, said: “Just as there are good and bad applications of any type of business vertical, the same holds true for fintech. The most important measure and pathway for any business vertical to achieve its own ‘for good’ will be its ability to align with, embody and action on ESG or environmental, social and governance. ESG standards, measurements and communication continues to grow and develop. As it does

"Users can transact in the absence of paper currency, the importance of which I witnessed while working in India in Q4 2016 after 500 and 1,000 rupee bills were devalued overnight without warning as an effort to combat corruption, smuggling and the avoidance of tax payments within the country.

“Although progress towards these aims was eventually achieved, in the short run, the sudden cash shortage rippling throughout the economy left workers, mostly in the informal sector, who earned their daily wages in cash, with no source of income. New types of informal work popped up, some of which included standing in line at the bank for hours in hopes of making a cash withdrawal on behalf of an employer – a poor use of time and resources that often as not ended fruitlessly if the bank ran out of hard currency before a withdrawal could be made. The existence of PayTM, which grew rapidly during the aftermath of the devaluation, made it possible for employers to pay employees and

Of course, there's still a long way to go in all of these areas, the world isn’t completely financially inclusive, and not everyone knows how investing works. But it's something, and something is always infinitely better than nothing, right?

THE FUTURE IS BRIGHT?

The debate of whether fintech can really be a force for social good rages on and will likely remain a constant aim of the industry – and definitely isn’t going anywhere as a buzzword any time soon. Whether it is a realistic end goal or just a finance fantasy will remain to be seen – but I’m confident, as with many others in the industry, that fintech for good really is the future of finance.

The demand for sustainable, accessible and inclusive services is only getting bigger and bigger as time goes on, and fintech will always be there to help fill the gaps, doing what it does best and innovating until the problem is solved. But that innovation can go hand in hand with purpose – and that is where the future lies.

www.thefintechtimes.com | 5 THE FINTECH TIMES COVER STORY

The debate of whether fintech can really be a force for social good rages on and will likely remain a constant aim of the industry

What’s next for embedded finance and BaaS?

Banking-as-a-service (BaaS) and embedded finance have both taken the financial industry by storm. With embedded finance projected to reach $7trillion in transaction value by 2026 and BaaS estimated to become a $25billion opportunity by the same time, both spaces appear to have become crowded and competitive. Industry experts reveal to The Fintech Times’ Tom Bleach their thoughts on how to stay ahead.

ANABEL PEREZ CEO and co-founder at Miami-based BaaS provider NovoPayment

“It’s important to clarify who’s who in this space. Many emerging firms identify as BaaS or embedded finance, but in reality, they’re playing the role of API marketplaces. Others, on the other hand – like NovoPayment, are in full control of the depth of technology and breadth of solutions they offer. API technology exists to create new value and connect organisations across industries – that is the real purpose and core of embedded finance. True value in this space is defined by enabling any organisation to incorporate financial and payment services into their product catalogue and/ or consume financial and payment APIs to improve their cash and treasury management. As such, the key to staying ahead is anticipating the next wave of sectors to be connected beyond merchant marketplaces, and ensuring that real problems are being solved. In other words, bringing operational and financial efficiencies to all parties involved will define the true winners.”

JOHN GOODALE executive director of operations, UK and EMEA at Ubiquity

“Although there is considerable opportunity in embedded finance, customer experience could prove to be make or break. Just as you need integration across customer engagement channels, there’s also the challenge of continuity for the customer between financial and non-financial services. You can solve it, but the CX solution must have more flexibility and technical capability than a standard (non-embedded) finance product. Embedded finance providers and their partners need to put equal (if not greater) emphasis on the CX part of their offer as they do on the financial product itself. Agile, available, skilled, and resourced CX is critical to making the complex happen seamlessly for customers and to help drive adoption and loyalty in a cost-effective way.”

JOSH WILLIAMS executive vice president, chief banking officer and head of partnerships at Seattle Bank.

“I’d say that it’s not so much that the BaaS and embedded finance marketplace is becoming crowded, but it’s more about the business line becoming more generally accepted. A few years back, the ‘BaaS banks’ were considered a little exotic and there was a lot of intrigue around the technology, the strategy and the financial prospects in the space. As the field has grown and partnerships have become more commonplace, BaaS has been somewhat demystified and we’re now seeing more banks of all sizes enter the market. Having the right tech stack with a configurable and modular back-end has been the primary barrier of entry up to this point.

Banks with this technology have an advantage in not only how they serve their own clients, but also in how they can step forward and seize the growing opportunities BaaS presents. That said, the reality is that it remains a vast and largely unexplored landscape. I don’t think it’s a winner takes all space.

To be successful, it’s going to be about finding a niche that enables you to solve a real problem for customers and demonstrating your durability by consistently solving for the technology, regulatory and economic challenges.”

BARRY O’SULLIVAN head of payments infrastructure at OpenPayd

“The BaaS sector is changing fast amid economic uncertainty and new competitors entering the sector. The BaaS providers that stay ahead of the competition will be innovative, agile, and customercentric. They’ll be forging strong partnerships with their banking partners, providing flexible and customised solutions, proactively managing their compliance and regulatory requirements, and constantly expanding their products and services.

Success and failure in BaaS will hinge on the underlying technology infrastructure. Simply having an API isn’t enough; BaaS providers are being judged on the ease of integration, the quality of their API documentation, and the level of service up-time they can deliver. This infrastructure also needs the ability to continually scale up as their customer base grows.

Ultimately, businesses in this space that will win will be constantly expanding their offerings. They will have rapid product development to help them respond to client needs and have a clear product vision with a strong underlying business model.”

6 | Edition 50 FEATURE STORY THE FINTECH TIMES

CHRISTINE ROBERTS executive vice president and head of Citizens Pay at Citizens Bank

“The key to staying ahead in a competitive market is by continuing to innovate and differentiate based on partner and customer feedback. This is one of the best strategic investments you can make, as well as building better, long-term relationships with customers and enhancing loyalty to drive repeat purchases. If you deliver on expectations, provide value, and listen to and incorporate feedback, you’ll be better positioned to succeed. Businesses can remain competitive and accelerate growth by diversifying revenue streams and expanding into new markets and verticals.

For instance, at Citizens Pay, we are continuously expanding into new sectors, such as jewelry, fitness and recreation, while maintaining and growing partnerships with companies in legacy sectors such as retail, consumer technology, and home improvement. We leverage technology and innovative thinking to create tailored solutions to meet the needs of consumers and merchants, whether it’s improving existing products and services or developing new ones.

Merchants and service providers are increasingly looking to offer consumers convenient and flexible financing options, especially for larger purchases, which means that embedded finance is no longer just the future, it’s already here. As the embedded finance industry continues to evolve and advance, with more players entering the ecosystem, staying ahead means a constant focus on innovation to deliver bespoke solutions and experiences, as embedded finance shouldn’t be a one-size fits all solution.”

Aditya Raikar chief growth officer at Checkbook

“In a crowded space like banking as a service (BaaS), companies are going to struggle to maintain a competitive edge if they don’t focus on the customer’s overall experience. At the end of the day, many of the products are similar. To differentiate themselves, businesses need to understand the real challenges customers are facing and address those head-on through product innovation and partnerships. For example, many BaaS platforms don’t offer their clients the ability to send digital and paper checks. With many consumers and businesses still relying on checks as a form of payment, this is a key pain point not being addressed. Having a complete suite of services will allow companies to stand out and be a one-stop fintech shop for the customers they serve.”

FEATURE STORY THE FINTECH TIMES www.thefintechtimes.com | 7

MEASURING WHAT MATTERS

The Fintech Times chats to Kimberley Abbott , founder and CEO of Vested Impact , on reshaping the evaluation of investments to drive positive change and solve global challenges

In a rapidly evolving world that demands purposeful action, the need to measure the impact of financial investments has never been more pressing. As investors increasingly seek to align their values with their portfolios, a new challenge arises: how can we accurately assess the social and environmental consequences of capital allocation?

This is where Kimberley Abbott steps in. With a mission to revolutionise the way we evaluate and understand the true impact of investments, her company Vested Impact pioneers automated and data-driven solutions that empower asset managers, investors, and capital allocators to make informed decisions that drive true positive change.

The Fintech Times’ editor in chief, Claire Woffenden recently caught up with Kimberley at the Innovate Finance Global Summit in London to find out more.

THE FINTECH TIMES: Tell me a little about how your career has evolved

KIMBERLEY ABBOTT: I’m originally from Australia and started my career as a mechanical engineer. I became an engineer because I believed that working in engineering would allow me to make a real difference; engineers literally design and build the world around us, and I originally had my heart set on becoming a biomedical engineer. During my time at university, I volunteered in India, and it was there that I decided to establish an award-winning social enterprise in India focused on economic empowerment of women. I realised that business had a more sustainable model for creating change, as it sustains itself through its own revenue, and that doing good business is not an oxymoron.

I ran that social enterprise for four years, but it wasn’t a great success. Scaling the enterprise was a significant challenge. However, we did manage to help nine women and fund the education of 152 children. Despite these achievements, I realised that there are billions of women in India, and I swore I wanted to have a broader impact. So, I handed over the social enterprise to another organisation and decided to get some experience working in the corporate world, which led me to the UK.

After a few years as head of engineering innovation at Thales UK, I decided I wanted to go back to solving social problems, so I took a leap and resigned

from my job. By a stroke of fortuitous timing, that brought me to the United Nations (UN). While the UN is traditionally known as a policy and governance institute staffed by policyoriented individuals, they faced a significant challenge: how to leverage data to evidence their impact. I received a call from them, expressing their urgent need to find a better way to track and evaluate the performance and impact of peacekeeping operations on a global scale.

The situation at hand revealed a striking similarity between the UN and what I’d been exploring with what companies face: much like the financial sector, the UN focused on reporting what they delivered and did, rather than monitoring and assessing the actual impact they made. So, I spent four years gallivanting around the world’s conflict zones, building a data platform capable of assessing and monitoring the impact of the $8billion invested in peacekeeping operations. The platform needed to adapt to the unique circumstances and of each conflict and country, considering the diverse needs of people on the ground, and deal with often sparse or poor data.

impacts millions of lives. While it may seem naive, the idea was inspired by the simple notion of being able to see impact as easily as we see risk and return in our investment accounts. However, measuring impact is complex, and isn’t just dependent on what companies do, but also where they do it and what is happening in the world. Traditionally, ESG focuses on a company’s internal behaviour and risk assessment, whereas Vested Impact strives to assess the external impact of a company’s products and services.

To address this, Vested Impact leverages over 200 million academic articles, and analyses more than 100 million impact data points sourced from the development world. Combining this with company activity data, this allows us to establish the link between a company’s actions and their real-world impact, such as how a phone affects access to mobile banking and affordable internet.

TFT: Are companies getting on board?

KA: What I’ve overwhelmingly found, which is encouraging, is that people do care. The current emphasis on this topic stems from everyday individuals

that could drive real change. However, we soon realised that to truly transform the world, we must engage with the levers of power, as the target amount we seek to redirect is around $5trillion. That significant sum resides within large institutions. Currently, Vested operates as an automated data platform for asset managers, catering to a range of clients, from small venture capitalists with five companies to major financial institutions and even includes the United Nations, where we facilitate the reporting of 26 governments and hundreds of private signatories. We work with decision-makers responsible for allocating and monitoring funds, as well as those whose money is being invested or who seek accountability. While we primarily focus on these areas now, we’ve also seen interest from development banks and central finance bodies that understand the importance of impact and are held to higher standards. Governments also express interest in linking our data with policy decisions, recognising the potential for comprehensive collaboration across sectors. Impact investment and its broad-reaching applications are crucial, as mobilising private sector finances might be our best and perhaps only chance to tackle the world’s greatest challenges. Society has always cared, but now people are realising they can align their values and principles with their investments, serving both their needs and the greater good.

Through doing this, I realised that while transforming the UN was undeniably impactful, the world faced a significant shortfall of £3 to £5trillion annually to solve the world’s greatest challenges and It became evident that the greatest potential for financing change lay within the private markets. This led me to contemplate that if we could leverage the data and knowledge of social and world needs from the development sector, and use it as an evidence-base of trusted metrics against which to understand the true impact private companies have, we could facilitate improved financing decisions that genuinely address the world’s most pressing challenges. This led to the start of Vested Impact.

TFT: Tell us more about Vested Impact

KA: Vested Impact began with a mission to redefine ‘millionaire’ to be a person who

questioning the impact of their money rather than focusing solely on ticking the right boxes. While it has been challenging to bring large incumbent banks on board, it’s not because they lack concern. In fact, they genuinely care and strive to get it right. Their hesitation may stem from a fear of moving outside their traditional comfort zone, and working with nonfinancial factors they have never dealt with. That’s where companies like Vested Impact, and our friends Cogo, come in – to help bridge the understanding gap and provide the necessary methods, frameworks and data that can offer evidence-backed assurance.

TFT: Who are the people you work with?

KA: When we initially built Vested Impact, our aim was to serve retailers and everyday individuals, because I believed it was the groundswell of everyday people

TFT: So, what’s next?

KA: Our goal, as I mentioned, is to redefine what it means to be a millionaire. In practical terms, this means redirecting the substantial amount of money that falls short annually, estimated at £3 to £5trillion, to address the UN Sustainable Development Goals encompassing various critical issues such as poverty, inequalities and food security. Our objective is to effectively mobilise this substantial funding, recognising that it represents just a small percentage of global capital markets. While achieving this goal, our broader vision is to democratise access to impact data. It

CEO INTERVIEW THE FINTECH TIMES 8 | Edition 50

“THE IMPACT SECTOR IS NOT A COMPETITION; IT’S ABOUT AMPLIFYING THE COLLECTIVE GOOD. THERE ARE NO LIMITS TO THE SCALE OF POSITIVE CHANGE WE CAN CREATE, IT’S NOT PIE, THERE’S ENOUGH TO GO AROUND”

shouldn’t be exclusive to large banks; everyday individuals should be able to log into their accounts and see the impact of their investments. Governments and central and multilateral bodies like the UN and the World Bank should also have access to this data. Our aim is for impact considerations to be an integral part of every investment decision and for this type of data to inform decisionmaking across various sectors.

TFT: What has been your biggest lesson learned in your career so far?

KA: I learned a great deal from my experience in India as I got so many things wrong! I think most people do when starting their first startup. You need to be humble about it and recognise that you need to listen more and truly understand the needs of the people we aim to serve. In my second time round with Vested Impact, I have focused more on collaboration and active listening. We recognise our strengths and acknowledge that we may not excel in certain areas and that’s where collaboration becomes crucial. The impact sector is not a competition; it’s about amplifying the collective good. There are no limits to the scale of positive change we can create, it’s not pie, there’s enough to go around! And that’s the beauty of this sector.

TFT: What is your leadership style and culture?

KA: I am a problem solver and driven by the desire to create change and I didn’t really set out to start a company, I simply wanted to solve problems and make an impact. While I feel most comfortable working behind a computer and analysing data, stepping outside my comfort zone for tasks like pitching to investors or sales has been a learning experience. However, I’ve been fortunate to have mentors, advisors, and supportive friends who have guided and pushed me, even when I doubted myself.

As a woman in fintech, I face unique challenges, pitching to people who may not look like me or selling to financial institutions where I may not fit the typical mould. But I am grateful for the incredible support network I have, with whom I can share my concerns and seek advice. They encourage me to step outside my comfort zone, acknowledging that mistakes are part of the process. If I stumble, they help me regain my footing and get back out there. While leading internally comes naturally to me, being the public face and CEO is a different beast, especially in the age of social media. It requires

vulnerability and a willingness to embrace the role, which can be challenging for those in the tech field who often prefer to remain behind the scenes. Although growing up as one of the few women in my engineering class never bothered me because I had a very capable and independent mother, as well as a supportive and encouraging father who instilled in me the belief that his daughters could achieve anything.

TFT: Share an insight into life beyond Vested Impact

KA: Being Australian, it’s no surprise that I’m a mad sports person! I love sports, particularly hockey and cricket, and sport has always been a significant part of my life. When I was about 10 years old, I wanted to play cricket so badly and my dad took me to sign up, but I found myself in a boys’ team for years where I didn’t receive fair opportunities. So, my dad talked to his friends with daughters, and he started the only all girls’ team to play in the boys competition, he became the coach, and we even made the finals! Through sports, I learned the most about leadership, going on to captain county-level women’s cricket. I have a great love for running and enjoy staying active, but I also have a passion and secret talent for art, so if I’m not working you either find me running, watching sport, or tucked away drawing.

AT A GLANCE

ABOUT VESTED IMPACT: Founded in 2019, Vested Impact is a platform that automatically assesses, and quantifies, the impact of companies’ products and services on their contribution to helping (or hindering) the world’s greatest challenges, leveraging over 300 million academic articles and impact data points to quantify real impact and manage risks and opportunities, aligned with global standards and leaders in impact assessment.

COMPANY: Vested Impact

FOUNDED: 2019

CATEGORY: Financial services provider

KEY PERSONNEL:

Kimberley Abbott, founder and CEO

HEAD OFFICE: London, UK

ACTIVE IN: UK, Europe and USA

WEBSITE: www.vestedimpact.co.uk

LINKEDIN: linkedin.com/ company/vestedimpact

CEO INTERVIEW THE FINTECH TIMES www.thefintechtimes.com | 9

BANKS CAN’T AFFORD TO GET STUCK IN AN EMBEDDED FINANCE GROUNDHOG DAY

Is embedded finance the next big financial innovation? It certainly seems so. According to some estimates, the market capitalisation of embedded finance firms is expected to exceed $7trillion in the next few years alone. To put that figure into perspective, it’s around double the combined value of the world’s top-30 banks today. However, rather than replacing banks in the financial ecosystem, embedded finance providers have the potential to help them unlock new revenue streams. There is some apprehension among banks about how best to approach embedded finance. While understandable, the opportunity cost of missing out on this new distribution model for financial services is too great to be ignored. Just as banks that were late to online and mobile channels lost market share, so it may turn out with embedded finance. If banks want to maintain their position at the top of the financial ecosystem, it’s essential that they grab this opportunity with both hands and leverage as much value from the framework as possible.

EARLY SUCCESS, LASTING LESSONS

Up until this point, banks have primarily engaged with embedded finance in one of two ways. The first has been with open banking. Since its introduction, open banking-based solutions have been used by over four million users in the UK alone. Despite being increasingly popular, the framework doesn’t deliver the ROI that banks really crave, and only provides limited open access into the internal digital banking layer, which has hampered its perceived value for banks, partners and customers alike.

By contrast, banking as a service (BaaS) has been a game-changer for some financial institutions but carries

Alex Mifsud , founder and CEO, Weavr

significant risk from a compliance and regulation point of view. We’re already beginning to see regulators sanction institutions that promoted BaaS solutions which didn’t comply with sufficient rigour to the financial regulations and standards. This risk is unpalatable for most banks and far outweighs the potential benefits that come with adopting systems of this nature.

APPETITE FOR CHANGE

Banks appear to understand the commercial potential of embedded finance but seem less certain about how to integrate solutions of this nature in a profitable and scalable manner. Similarly, to the early days of mobile banking, there’s also a clear push from banks to assert as much control as possible over the technology. While that’s a totally rational perspective, it’s a mindset that’s holding the banking sector back from getting the most from embedded finance.

embedded finance systems at great financial and time cost.

STUCK IN GROUNDHOG DAY

Having to undertake this time-consuming and costly process time and time again will leave banks feeling like the cast of groundhog day. Worse still, despite all this effort, banks will end up with siloed embedded finance solutions, which are very difficult to scale. As such, this approach to embedded finance appears to be largely unviable and, more broadly, seems to miss the opportunity to create products that are embeddable by design.

To this end, banks need to explore embedded finance opportunities that can be unified in one comprehensive offering. In doing so, banks can create embeddable solutions that can be tailored to specific use cases much more efficiently. This approach also helps to improve the scalability of embedded finance solutions as the products used can be easily and seamlessly onboarded by companies within different market ecosystems.

PLAN C EMERGES

middleware vendors like Weavr are providing comprehensive solutions delivered as a platform-as-a-service.

With this approach to embedded finance, banks retain control over customer consent and customer data, while still supporting a seamless user experience through the third-party software. In addition, rather than outsourcing compliance, as in the BaaS model, the bank can operate controls that are appropriate for the context in which the financial service is being delivered. By adopting a platform approach, the bank will be able to deploy and support deployment of its embeddable financial products at scale, allowing it to realise the full potential of embedded finance as a powerful and highly cost-effective distribution channel.

TIME FOR CHANGE

We’re currently seeing that banks only feel comfortable developing bespoke embedded-finance partnerships with a select few commercial partners, each operating as standalone one-off integrations. This is short-term thinking and will inevitably lead to a situation where banks are required to constantly build and maintain small-scale, disparate

As banks eschew BaaS in favour of embeddable financial products, they need a platform that runs on top of their digital banking layer, and provides the means to create, publish and support embeddable financial products at scale. Creating and running embeddable financial products needs capabilities such as orchestration, contextual risk and compliance management as well as data security tools that keep them in control as their financial products are integrated into third-party software applications.

To support multiple such integrations, they need tools to support the embedder lifecycle, from sandbox to go-live, on to effective oversight and change management. These solutions can be assembled from a diverse range of vendors, but new embedded finance

Banks recognise the potential of embedded finance but have so far struggled to decipher how to leverage the most value from this transformative technology. As explained in this article, when handled incorrectly, embedded finance can look unscalable and insecure. However, with the right approach, the technology can quickly help to unlock significant new revenue streams even among established financial institutions, such as banks.

The question for banks is not whether to adopt embedded finance, but how to. Ultimately, this is an opportunity that must not be ignored, but equally, one that must be approached in the right manner. Working with an innovator like Weavr is clearly a great first step in that process and will give banks the chance to create fully embeddable financial solutions in a totally compliant and cost-effective manner.

Website: www.weavr.io

Twitter: @WeavrPayments

10 | Edition 50 EMBEDDED FINANCE THE FINTECH TIMES

Banks recognise the potential of embedded finance but have so far struggled to decipher how to leverage the most value from this transformative technology

GREEN FINTECH BLOOMS EMPOWERING A SUSTAINABLE AND EQUITABLE WORLD THROUGH INNOVATION

Despite a few recent bumps in the road, the fintech sector continues to sustain its incredible momentum. In the past few years, solutions emerging from the sector have revolutionised how we send, spend and receive money, providing individuals and businesses with new tools to manage their finances more effectively. However, despite all this progress, there are still some areas of everyday life that are only now beginning to feel the transformative impact of the industry. For me, the key example would be the climate. Up until recently, with the emergence of companies like ekko, it’s often felt that we’ve been waiting for a company to come along and truly make this issue their own.

THE WINDS OF CHANGE

That is now changing, with more brands positively engaging with the issue. Better still, there’s growing recognition that businesses should work together to ensure that new, climate-friendly solutions reach as many people as possible. That’s very important, especially as we enter a critical phase for the environment.

To this end, the science tells us that to have an inhabitable planet, we need to limit global warming to 1.5°C and to do that we must achieve net zero emissions by 2050 at the latest. To have a chance at not exceeding this limit, we must halve emissions every decade and that means acting at speed and scale today.

TIME FOR ACTION

The point cannot be overstated that our planet now sits on the precipice of disaster. While we cannot fix this problem

Oli Cook, CEO and founder of ekko

overnight, we can begin to slow its effects by changing behaviours and habits. Ultimately, by making small but meaningful changes to our everyday lives, we can contribute to the solution instead of being part of the problem.

It’s here where fintech could really help. Over its history, the sector has fostered multiple companies that have demonstrated an ability to engender behavioural change among a wide cohort. Whether it’s the shift to digital payments or the rise of neobanks, the fintech sector regularly provides evidence to support the notion that people can change.

RECIPE FOR CHANGE

For those of us working in the sector, the question is how can we use the lessons of transformative fintech businesses and apply them to the issues affecting the climate? A common throughline underpinning many of these solutions is how they leverage data and combine it with an empowering digital experience to engender meaningful change.

Now, it feels like the world of green fintech is finally ready to bloom into life

Another thing in common is their ability to facilitate cross-industry collaborations between different industries. Frameworks like open banking have highlighted fintech’s potential to bridge sectors together, so now it’s time for companies in the green fintech space to follow suit and

demonstrate the sector’s potential to be a ‘gateway to green’.

FINDING THE MISSING LINK

However, up until the arrival of companies like ekko, the sector had spent a long time failing to produce a fintech that met these criteria. In the past, this may have been affected by a lack of demand from investors regarding solutions of this ilk, but that has subsequently changed. Now, it feels like the world of green fintech is finally ready to bloom into life. Thankfully, we’re beginning to see fintech platforms come to market that help individuals and businesses to enact climate-related changes across their daily lives. What’s more, many of these solutions are suitable for use by businesses across multiple industries, which could be very important to ensuring cross-industry collaborations between different sectors.

SHIFTING FORWARD

Here at ekko, our award-winning technology can provide real-time carbon tracking and offsetting across everyday transactions, encouraging those using it to be more mindful when making purchases, which in turn helps to promote more sustainable buying choices. As a business, we want to help companies to engage with the climate in a more honest, accountable way.

It’s our ardent belief that the fintech sector comprises enough talent and knowledge to fight this battle and is perfectly positioned to foster exciting new cross-industry collaborations with other sectors centred around the problem at hand. Ultimately, it will end up being these collaborations that will make a difference.

However, in this pursuit, it’s essential that companies and individuals alike prioritise progression over perfection. Issues affecting the climate can’t be fixed overnight, but with small, collective and impactful changes we can begin to get a better grip on our carbon impact and work towards reducing it over time.

SMALL CHANGES MAKE A BIG DIFFERENCE

We know that one person can’t change the world alone, but when people work together, great things can happen. That’s the platform that ekko provides its users. Our technology is enabling people to be better informed and make small, incremental changes to their everyday lives, which, when combined, end up making a big difference.

At ekko, we want to help people and companies from a myriad of sectors to work together, enabling more individuals and businesses to start making an impact and giving them the tools to see that impact in a more comprehensible manner. Fintech has the potential to make a huge difference in this pursuit. By working together, our industry can contribute to a more sustainable and equitable world where everyone has the chance to thrive, while also providing a platform for other sectors and individuals to build upon. Here at ekko, we plan to help drive that change at speed and scale.

Website: https://ekko.earth

Twitter: @joinekko_earth

www.thefintechtimes.com | 11 THE FINTECH TIMES SUSTAINABLE FINANCE

Top executives from global fintech companies will share their insights and expertise on the industry's most pressing topics.

Founded in 2011, Money20/20 has attracted 20,000 attendees from over 5,000 companies across both its shows in Europe and USA. Fintech’s finest gather to discuss innovation in everything from payments, to banking and crypto to financial services.

Companies in attendance will include HSBC, Barclays, Deutsche Bank, NatWest, Citi, GoCardless and Stripe along with Plum, Bunq and Zilch.

Money20/20 Europe is also welcoming the CEO of the London Stock Exchange, the Tel Aviv Stock Exchange, the Regtech Association, the European Banking Authority, and the Israel and German Ministries of Finance to their stages.

EUROPE’S GOT ACCESS

Money20/20 Europe this year brings a new pitch battle, Europe’s Got Access, which will showcase the most innovative and eco-conscious climate fintech startups across Europe. Startups will demonstrate their greenest and most groundbreaking products and services live on the Encore stage with a $100,000 prize from Commerce Ventures up for grabs.

Scarlett Sieber, (left) chief strategy and growth officer at Money20/20, said: “Europe’s Got Access has been designed to give climate champions and fintech innovators a platform to unite and create a greener financial

future. This is very much at the core of what Money20/20 stands for, as the place where the industry’s boldest and brightest voices delve into the challenges we’re facing now and shape together what comes next for the money ecosystem in Europe and beyond.”

Pitching live on stage at Money20/20 Europe will be the following climate champions:

■ Samantha Duncan, founder and CEO of Net Purpose

■ Klas Klaas, co-founder at Clima Cash

■ Fredrik Billing, CEO of at Eljun

■ Beltran Berrocal, co-founder and CEO of ZeroLabs

■ Gustaf Anselmsson, co-founder and CEO of Gokind

M20/20 FOCUS THE FINTECH TIMES 12 | Edition 50

is taking place at RAI Amsterdam

on 6 to 8 June –billed as the space where the industry’s smartest visionaries and innovators come together to create the future of money

EUROPE’S CHAMPIONS OF CHANGE

Money20/20 Europe’s Champions of Change sees seven influential fintech leaders presenting or moderating sessions.

“The Champions of Change is a team of influential, passionate thinkers with impact and purpose beyond the norm leading and disrupting everything from green finance, financial inclusion and explainable AI. We are so excited for our speakers to take their stages in Amsterdam and share their stories and leadership with the world,“ said Tracey Davis, (right) global president at Money20/20.

The champions are:

■ Dr. Ruth Wandhofer, executive director and VC partner at Gauss Ventures

■ Maria Prados, head of vertical growth at Worldpay

■ Mary Agebsanwa, fintech growth lead at investment technology provider Seccl

■ Maarten Stolk, co-founder and CEO of Deeploy

■ Joanne Dewar, ambassador at the Payments Association

■ Aydan Al-Saad, creator at the startup European Inco

■ Gerrit Sindermann, deputy executive director at Green Digital Finance Alliance

M20/20 FOCUS THE FINTECH TIMES www.thefintechtimes.com | 13

the disruptive deeptech in software proudly presents The pioneering payment tech for banks, businesses, service providers & software vendors: Meet us at Money 20/20 Europe, D160 Download our brochure contact@streammind.com • intelligent payments • SEPA Request-to-Pay • e-Invoicing & more CM CMJ

Considered one of the most dynamic sectors in Latin America, e-commerce is currently thriving. This trend has been mainly driven by the change in consumer habits that the pandemic brought about, with LatAm becoming the second fastest-growing digital commerce region in the world, reaching $125billion in 2022.

This figure is projected to reach $243billion by 2027, marking the highest number recorded. Coupled with the fact that the region has a 74 per cent internet penetration rate, it’s clear that the environment has presented all the conditions for the region to become a powerful global market.

To take advantage of this growth, e-commerce companies are working with payment platforms that offer a complete range of local payment methods, such as PayRetailers, a Spanish company that allows businesses to accept payments from anywhere in the world. This helps overcome barriers such as distrust in online payments and lack of access to traditional financial solutions, enabling businesses to leverage the full potential of the Latin American market.

LATAM ON A WINNING STREAK: GOOD RESULTS CONTINUE

Whether it’s the 42 per cent of digital sales that Brazil currently represents, the $21billion that Mexico brought to the market last year, or how Argentina, Colombia, and Chile have raised over $30billion between their three digital economies, online retail in Latin America is unstoppable and could grow by 84 per cent within the next four years.

To achieve this growth, having the right local payments in the region is key. Having a partner that offers these along with a wide range of solutions in an increasing number of countries saves time and pressure for merchants seeking the best all-in-one solution in LatAm, within that system.

Currently, the most popular payment methods in e-commerce in Latin America

STREAMLINING E-COMMERCE PAYMENTS IN LATIN AMERICA: THE ALL-IN-ONE ADVANTAGE

are credit cards, bank transfers, and digital wallets. In addition to offering traditional methods, it is vital to consider the emergence and strength of alternative payments in each country, taking into account the preferred methods, to have greater reach in each digital market and understand the facilities that come with offering each method, such as OXXO in Mexico, Nequi in Colombia, Pix in Brazil, or Khipu in Chile.

PayRetailers operates in more than 12 countries in Latin America and, in the face of the constant evolution in the region’s businesses, is constantly seeking to expand to new markets, anticipating industry trends that demand more innovation and more payment methods.

E-commerce companies are working with payment platforms that offer a complete range of local payment methods, such as PayRetailers

That’s why countries such as Uruguay, Paraguay, and the Caribbean are some areas of interest that they are currently investigating.

EUROPEAN KNOW-HOW MEETS LATAM OPPORTUNITY

Latin America and Europe are opposite poles when it comes to business environment, with the former being a space where each country has a different currency, financial laws, and unique frameworks for each territory. Unlike Europe, establishing a business in one country does not necessarily mean being able to sell in the rest, adding a difficulty that European countries do not face.

In this scenario, technology plays a unifying role, and that’s where the great value of PayRetailers comes in. The knowledge and technological advancement that Europe has make it an ideal combination to integrate digital

payments, making it more convenient for those looking to expand their businesses in the Latin American region. Focusing on the user experience and making the purchasing process as fast, convenient, and intuitive as possible, and making financial technology more accessible. This is always supported by a local team that knows the market, regulations, and is attentive to new trends, changes, and developments, to always stay one step ahead in Latin America.

This accessibility opens up a wide range of possibilities for a population that has been more marginalised from the financial system, where, with low banking, at 40 per cent before Covid, and with the presence of these types of solutions and the change in habits brought by the pandemic, it currently reaches 73 per cent.

THE ALL-IN-ONE PROMISE

PayRetailers’ solution is cutting-edge and innovative, with top-class technology, a single API integration to ensure a frictionless, user-friendly, and intuitive payment experience with local currency and a variety of more than 250 payment methods in the countries where it operates.

Thus, it guarantees a global payment offering that allows online stores to receive payments anywhere in the world through 25 currencies, with local and international payouts, intelligent transaction routing, real-time actionable reports, and scalable and reliable technology. In addition to offering simplified integration through plugins on platforms such as WooCommerce and PrestaShop, which are the most popular within e-commerce.

In addition to its global reach, advantages include an intuitive and easy-to-use graphical interface, assistance throughout the integration process, with personalised customer service available 24/7, and it is recognised as a platform that offers secure payments, with a risk prevention system based on AI, monitoring of transactions, and PCI DSS certification.

JOINING MONEY’S BIGGEST CONVERSATION

PayRetailers is taking the opportunity to attend Money2020 in Amsterdam from 6 to 8 June this year to enhance its portfolio of solutions and stay up-to-date on the latest trends in the e-commerce world. The company understands the importance of keeping up with the innovations and knowledge of the global financial market, and this event is a great opportunity to do so. By connecting with leaders and innovators from various industries, PayRetailers will be able to strengthen its value proposition and continue to provide innovative solutions to its customers.

To connect with the PayRetailers team, learn more about the company, and its all-in-one payment solution revolutionising the payments industry, don’t miss the event and visit their booth C112.

About PayRetailers

Founded in 2017, PayRetailers is a leading global provider of online payment services with Latin DNA. We offer e-commerce payment solutions for end-to-end cross-border transaction flow without the need of a local entity.

Through one direct API, one technology platform and one contract, we offer global merchants more than 250 local Latin American payment options. With a flexible and highly scalable advanced proprietary technology architecture, we innovate rapidly in response to market demand for online businesses of all sizes.

PayRetailers is headquartered in Spain with regional offices in Argentina, Brazil, Chile, Colombia, Mexico, Costa Rica, Paraguay, and Peru.

Website: www.payretailers.com

THE FINTECH TIMES M20/20 FOCUS www.thefintechtimes.com | 15

DEMOCRATISING PAYMENTS

HOW APMs DRIVE FINANCIAL INCLUSION

Financial inequality is not just related to global wealth distribution. A large number of people around the world are unbanked, having no access to a bank account. This is particularly true of markets in Africa, Latin America and parts of Asia, although it also applies to major economies to a lesser extent (5.4 per cent of US households were unbanked in 2019). This lack of access to bank accounts and other financial services poses a significant barrier to economic growth, excluding large portions of the global population from participating in the global economy and online commerce. Conversely, providing access to financial services and facilitating payments can open up new economic opportunities and drive regional development.

Lacking access to a bank account brings a whole host of challenges. It can make paying rent and utility bills more complicated, restrict access to other financial services such as loans or insurance, and restricts the types of payments businesses can accept. However, the rise of alternative payment methods (APMs) has resulted in a slew of payment solutions that cater to the needs of this unbanked population. These include prepaid cards, voucher systems, digital wallets and mobile payments. Adoption and preferences differ widely by region. In Africa, where over 40 per cent of the population is unbanked, mobile money dominates. Mobile phone adoption is relatively high, and most popular solutions like M-PESA and MTN Mobile Money rely on phone-based payments. In some regions – particularly East Africa – adoption is high.

Transactions via mobile wallets were equivalent to 87 per cent of Kenya’s GDP, with around 84 per cent of internet users in Kenya using mobile phones to make payments in 2021. These figures dwarf those of more traditional payment methods like credit cards, where access is limited.

These mobile money solutions allow payments from one user to another via a mobile phone. As well as allowing consumers to make digital payments, including for online goods and services. mobile money solutions also allow

small businesses to accept digital payments without requiring a bank account and other infrastructure like POS devices. This gives entrepreneurs a convenient means to accept payments from customers and pay suppliers. The reduced friction empowers small businesses, who can keep their earnings secure without relying on a bank to hold their money. Some challenges still remain however – converting mobile money into actual cash can be a challenge, as this often requires an ID – something that a large number of Africans do not have.

Brazil. Payment typically takes one working day to process, although there are express options available for payment within 15 minutes.

Boletos can be used to pay regular expenses such as rent or utilities, as well as for e-commerce purchases – customers simply choose the Boleto option at checkout and then complete payment at one of the many physical locations using the voucher.

Latin America has also seen a concerted push towards expanding coverage of open banking services such as Pix and digital payment methods, particularly in the wake of Covid-19. This has seen the unbanked population reduced significantly in some countries like Brazil. By integrating the unbanked population into the local and global economies, countries can improve wealth generation locally, open up new business opportunities and make an important contribution to raising living standards. Solutions like Pix democratise access to e-commerce, giving people without credit cards or small entrepreneurs with no way to accept them a simple means of making and receiving payments.

NEW PAYMENT CHOICES

The advantages to society extend beyond the ability to more easily conduct business. Mobile money services play a key role in allowing utility providers to serve low-income populations. Pay as you go solar power services are spreading rapidly in off-grid areas, providing increased access to affordable electricity and providing additional economic opportunities.

In Latin America, by contrast, voucher-based systems are far more popular. These have been in place for quite some time and include systems like OXXO in Mexico and Boleto (the word for ‘ticket’) in Brazil. For example, the boleto is a printed or virtual voucher that includes a barcode and other payment information. These boletos can be paid at locations such as post offices and convenience stores across

Many of these alternative payment methods go beyond just offering payment options. Users can also apply for loans or other lines of credit and sign up for insurance policies. For small business owners and farmers, this can make a significant difference. Loans provide a means to invest in more expensive equipment that raises efficiency and output without needing to cover the full cost of purchase up-front.

While IXOPAY does not directly provide these services – these are delivered by our partners such as dLocal, EBANX, PPRO and DPO – IXOPAY plays a significant role in lowering the barrier to entry for global corporations. The cost of integrating a new payment method can be very high, and potentially discourage companies from supporting alternative payment methods if the perceived financial benefit is too low.

By offering a single API for all payment integrations, IXOPAY customers can integrate new payment methods quickly and easily for a mere fraction of the

cost. Merchants simply configure the desired payment methods in our payment orchestration platform and embed the payment option on their checkout page; there are no overheads associated with integrating a new API, handling settlement and reconciliation processes and transferring data to third party systems, as this effort has already been undertaken by IXOPAY. This means that merchants can immediately offer their goods and services to unbanked customers and tap into new markets worldwide. For consumers, these payment methods bring closer integration with the wider world and a means to participate directly in the global economy. For merchants – both local and international – they result in a larger potential customer base and a means of growing revenue. For the wider region, reduced friction and increased opportunities drive economic growth, benefiting the quality of life in local communities and furthering their inclusion into the modern global economy.

About IXOPAY

IXOPAY is a payments orchestration platform enabling independent, flexible and global payment processing. As a highly scalable and PCI-DSS certified ‘fintech enabler’, IXOPAY fulfils the needs of large merchants as well as those of ‘white label’ clients: payment service providers (PSPs), acquirers and independent sales organisations (ISOs). IXOPAY is part of the IXOLIT Group, founded in Vienna, Austria in 2001. With local entities in Austria and the USA, IXOLIT supports national and international customers across various industry verticals. The owner-led and -financed company has grown from two to more than 80+ employees and is focused on building innovative solutions for e-commerce.

Web: www.ixopay.com

LinkedIn: linkedin.com/company/ixopay

Twitter:@ixopay

FINANCIAL INCLUSION THE FINTECH TIMES 16 | Edition 50

Thomas Beinhart, partner and relationship manager at Ixopay

This lack of access to bank accounts and other financial services poses a significant barrier to economic growth, excluding large portions of the global population from participating in the global economy and online commerce

TRANSFORMATIVETARANIS

Pioneering ethical investments and personalised support for fintech success

Taranis Capital, a visionary global ethical fintech-focused fund, has unveiled plans to shake up the industry by prioritising ethical governance, providing comprehensive advisory support, and tapping into the expertise of its newly formed advisory board.

Founded by Nicholas S. Bingham, a seasoned professional with over 25 years of financial market experience, and Mark Walker, an experienced technologist and fintech specialist, the fund aims to champion companies that uphold environmental, social, and governance (ESG) principles, driving positive change and promoting long-term sustainability within the fintech sector.

Ethical considerations have become increasingly prevalent across industries worldwide, and the fintech sector is no exception. The emergence of economic challenges, climate concerns, and social issues has placed ethical governance at the forefront of responsible business practices. This ambitious venture aims to reshape the landscape of fintech investments, elevating ethical standards and offering personalised guidance to foster the growth and success of fintech companies worldwide.

Bingham said: “One of the major aspects of this fund is visiting companies personally. We don’t want to outsource that to anyone else. We would like to gain a full understanding of them as a company.

“Ethical governance, how staff are treated, the staff’s social wellbeing and the projects companies work on are all very important. Even if a company looks attractive to an investor; if their

ethical standing is not good then this fund would not want to get involved.

“We don’t only want to put money in to get money back out again. If a company is not of good standing and good governance, then we wouldn’t see it as the right fit for the fund.”

MAKING CONNECTIONS

The formation of a new advisory board marks a significant milestone for Taranis Capital, bringing together internationally recognised leaders from diverse professional backgrounds and specialities, including banking, financial services, capital markets, and technology.

With this distinguished board in place, Taranis Capital gains access to a wealth of industry knowledge and experience, enabling them to offer strategic guidance and support to fintech companies within their portfolio. The board members will work closely with Taranis Capital’s leadership team, providing invaluable insights and helping shape the fund’s investment strategy.

David Parker, a fintech specialist with extensive experience in the industry, expressed his enthusiasm for Taranis Capital’s unique approach, emphasising the fund’s ethical focus and commitment to driving growth for fintech companies.

“Taranis Capital represents the best of a new breed of funds; ethical, working with owners to drive growth. Having worked in fintech and MENA for the last 20 years this was simply too good an opportunity not to get involved with,” said Parker. This sentiment was echoed by other board members, who include:

■ Andrea Dunlop, angel investor, M&A expert, regulatory professional, cross border financial services

■ Amjad Shacker, an innovative leader, government advisor, management professional, strategist.

■ Daniel Roubeni, international trade, financial management, early-stage VC investment

■ David Birch, digital financial services, one of the top 100 global fintech influencers, Forbes contributor

■ David Parker, global all-round fintech specialist, Ex Saatchi, keynote presenter and chair in fintech

■ Derek Stewart, founder of Paysme, fintech super app, Ex BNY Mellon Fund $2billion AUM, financial services for 39 years

■ Jack Hollander, capital markets New York, Master of Law, raised over $3billion in alternative investment

■ John W ‘Jack’ Crook , regulatory compliance, NED, government compliance

■ Mike Chambers, chairman of answer pay, pioneered the UK’s Faster Payments scheme, ex-CEO for BACS, experienced NED/Advisor

Bingham hailed the formation of the advisory board as another significant step forward in Taranis Capital’s launch journey.

“I’m delighted that we have been able to attract such a diverse and inspirational group of business leaders. I look forward to drawing on their decades of collective expertise, which will be invaluable as Taranis continues to expand our operations on a global scale,” he said.

WORKING WITH THE FINTECH TIMES

Taranis Capital has also forged an exclusive partnership with The Fintech Times, giving Taranis Capital access to a wealth of industry knowledge and insights. The collaboration provides the fund with valuable research and analysis from The Fintech Times, empowering it to make informed investment decisions and identify promising fintech companies that align with their ethical investment criteria. In return, Taranis Capital opens up its portfolio companies to The Fintech Times, allowing the platform to showcase innovative fintech solutions and share inspiring success stories with its readers.

Walker said: “The venture capital industry has seen a radical shake up in the last few months, with many VCs seeing their high-profile portfolio companies devalued. This is leading to a well needed correction in valuations and assessments of sustainable business models.

“The research, insights and industry connections we have direct access to via The Fintech Times, put us in an excellent position to better asses the long-term future of fintech companies and their business models.” www.taraniscapital.com

INVESTMENT THE FINTECH TIMES www.thefintechtimes.com | 17

Revolutionising workplace pensions

Fintech unleashes the power of tech to deliver real value

One of the biggest challenges facing UK workplace pensions at the moment is defining and assessing value for money to savers. In an attempt to deal with this issue, the Government is proposing the introduction of a framework that will help employers understand the value their current pension scheme delivers to employees.

To anyone outside of the industry, it must seem a bit strange that pension providers who control and manage nearly £3trillion of savers’ money need a ‘steer’ as to what value they’re actually delivering? But in all fairness, pensions are very different to most other consumer products.

With most purchases, the assessment of value is pretty easy and is mostly at the point of sale. It basically boils down to the consumer deciding if the product they’re thinking of buying is worth the price.

And usually, the person buying and using the product is the same, the consumer.

And then of course, if after buying the product, the consumer is unhappy, they might have the option to return it or at the very least they can buy an alternative product the next time.

IN WORKPLACE PENSIONS, IT’S A VERY DIFFERENT KETTLE OF FISH!

Firstly, the decision-maker and the consumer are not the same. The employer decides on the pension provider and the employee (the consumer) is automatically delivered the product with no say whatsoever. It’s up to the employer to determine if value is being delivered and this is often not aligned with the views of all employees.

Cushon research shows that for employers, in determining value massively focus on costs which on their own reveal nothing about value. Whereas for employees, value is more about what the product delivers and how it delivers it. Costs have to be considered but are not as important.

The ‘what’ ultimately is a good pension at retirement. But between now and then, which for younger members can be decades away, there has to be other deliverables. And the ‘how’ is about technology not paper!

From our research, it’s clear that employees in general understand the basic mechanics of a pension – the size of anyone’s pension pot at retirement is mostly determined by how much is paid in

and so conversely, how much the employer contributes is primary to the delivery of ultimate value.

Thereafter, it’s down to the chosen pension provider and tech is seen as massively important. It not only delivers value in its own right, but it also enables value. But unbelievably when you think about the size of the industry – again £3trillion in assets under management – pension providers in general have not been quick to embrace technology.

Not only is this archaic and hardly environmentally friendly, it’s a real barrier to the delivery of value. Employees want better education, more regular communications, contribution flexibility, investments aligned with their own values and to see their pension savings having a positive environmental and social impact. All these things can only be effectively delivered through tech.

TECH IS THE VALUE ENABLER

For example, let’s take the issue of valueled investments and environmental and social impact. Employees want their pension savings to not only be doing good

difference in the fight against climate change. Imagine being able to track the building of a new solar power farm from planning until it’s fully commissioned – knowing that this is the good that your pension savings are doing?

Imagine being able to give your view on how companies your pension is invested in should be dealing with global issues such as animal welfare, gender equality and climate change, so that you can help make sure that your money is being invested in a way that aligns with your personal views.

Well imagine no more! This is what we at Cushon are delivering for our customers and it’s all through the power of tech. Digitalising pensions is how you bring real value to consumers.

About Cushon

Cushon is a fintech using its worldleading financial technology to bring innovation to workplace pensions and savings to help people build better financial futures. Its products are delivered via employers to reach as many savers as possible. It is digitally transforming pensions through a highly engaging and intuitive app. Its ultimate goal is to help employers deliver value to their workforce by increasing pension engagement and empowering employees to have control of their finances. The Cushon app has a 65 per cent download rate and 55 per cent engagement level, the highest among top pension providers. Cushon’s app-first approach, sustainable investment strategy, automated nudge technology, shareholder voting feature on ESG issues and jargon-free financial education are the key features driving this high engagement.

Unfortunately, for a lot of pension members, dealing with their pension is synonymous with wading through reams and reams of paper. When all they want, is to be able to access and manage their pension in the same way that they access and manage most other things in their lives, through a mobile app. It just seems bizarre that in 2023, some pensions are still very much paper based!