State of the MARKET Quarter

2 2024

Prepared by Find Wellington AccountingThe following pages contain extensive data and reporting from our own systems and, where permitted, from our partners. This data is provided as a guide to the market, but does not guarantee or reflect the possible outcomes of job listings. Information enclosed may not be redistributed, amended or reproduced without express permission from Find Recruitment.

WELCOME HAERE MAI

WINTER IS COMING

It’s fair to say that with a change of government, coupled with the new coalition focusing on government cost cutting, the first quarter of Wellington’s accounting market was subdued!

January is typically a quiet month for recruitment in general, and it certainly was this year, February saw much more activity, and March was “back to normal” and busy, leading us to believe confidence was returning and the market was bottoming out somewhat.

However, April and May have remained lean months from a job volume perspective, backed up by SEEK data suggesting the number of advertised roles on SEEK is still low, and lower in fact than pre-Covid levels. Comparing this market to the post GFC market is probably a good way to gain some relativity though.

2009 – Unemployment in NZ rose to 6.5% and remained stubbornly high for 3 years before retreating slowly to reach 5% by 2016. Many of our experienced and qualified accountants were at home, looking for work. Contract recruitment was slow, and permanent recruitment volumes were extremely low. Wage inflation was close to zero, and confidence in changing roles was low.

2024 – Unemployment moved from 4% to 4.3%, still hugely better than the 2009 – 2013 period. We don’t have many professional accountants at home, even senior people are finding quality short to medium terms contracts and job seekers still have the confidence to move roles, something that is creating activity in Wellington’s smaller market. Wage inflation has topped 11% combining the last two years and is 4% as I write this in May 2024.

I suspect we are in a market that still has some consolidation to go, especially in government and service to government (including recruitment) and wouldn’t be surprised to see unemployment push towards 5% again. However, I believe we will see more of a balanced market post 30 June, one which hopefully provides a period of equilibrium between supply and demand as this will mean stable wage inflation, and the ability to attract good quality people to your teams and projects. It’s fair to say things were too one sided during 2021 and 2022 with unemployment dipping to 3.2% in the post-Covid boom.

On a final note, I believe that a robust recruitment process should involve a blend of non-active candidates, not just SEEK respondents to get a true quality of shortlisting, and our active referral scheme is invaluable for those candidates who are somewhat hidden away, but are the true high performers that every employer wants to reach.

Julian Greaves

We

partner with organisations

that reflect our values & help us discover exceptional people.

He aha te mea nui o te ao? He tangata, he tangata, he tangata What is the most important thing in the world? It is the people, it is the people, it is the people

Our commitment to helping our rainbow community be seen & heard in the workplace.

Working with Martin King at the Pride Pledge, we have conducted a full audit of our business to assess our rainbow progression, and are actively implementing steps to make our workplace, and our recruitment cycles, more accessible to those in the LGBTTQIA+ community.

The GenderPledge is our commitment to equity & developing robust, useful policies for our people. As leading experts on inclusivity, the team from the Genderat-Work Community help our organisation drive change from within that not only improves our workplace culture but has a positive impact on social change.

Opening recruitment gateways for people in the community with neurodiverse minds.

We are in the process of adjusting our business processes and recruitment methods to ensure that we cater to people from all walks of life. Accommodations to interview styles, and enabling people to declare their neurodiverse status allow us to serve the wider NZ community.

Our positive impact is regularly recognised and celebrated.

2023 Second Place/Runner Up | SEEK SARA’s for Outstanding Progress in Diversity, Equity & Inclusivity.

2021/2022 Winner | SEEK SARA’s for Recruitment Leader of the Year - Rob Woodward.

2023 Silver Award | Southern Cross Health Awards The New Horizons category for transformative & innovative healthcare policies.

2023 Bronze Award | Southern Cross Health Awards Small Business category for businesses that promote the wellbeing of their people.

2022 Finalist | RCSA Awards for Recruitment Leader of the Year - Mark Harper.

2021 Winner | RCSA Awards for CEO Outstanding Contribution - Rob Woodward.

2021 Finalist | RCSA Awards afor Outstanding Large Recruitment Agency of the Year. afor Excellence in Safety & Wellbeing.

We’re committed to keeping Aotearoa green & beautiful. We have actively worked with eco-friendly partners for many years now to offset our carbon emissions and to help keep our country beautiful for generations to come. We are in the process of exploring new carbon-neutral solutions to increase the positive impact we can have on New Zealand. We welcome questions about our carbon-neutral commitments at any time.

DATA & ANALYTICS

Marketing Insights

Below we've highlighted some of our analytical data for you to give you insight into the New Zealand employment market as it stands. We've also highlighted data from polls we've conducted of our audience, to showcase what people are talking about and what's important to candidates in 2024.

Website Activity | APRIL 1 2024 TO PRESENT

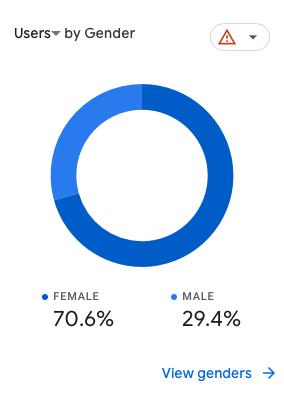

Our website visitor gender spread stands steady at 70.6% female and 29.4% male. This distribution reflects a balanced and diverse representation of job seekers actively participating in the job market. This contributes to an equitable and diverse recruitment landscape, highlighting the market's appeal to a wide range of candidates and employers. This data is based on freely expressed gender demographic information that is collated by Google, and currently only defined by male and female.

5. Add recruitment costs into your 24/25 budget! Here's why.

These articles have remained consistently high with, often, thousands of views each month. This is not unexpected given the current nature of the market. We’re seeing candidates looking for advice around how to navigate employment contracts, and businesses looking to recruitment agencies for potential costeffective methods for managing their hiring needs. These are closely followed by ‘The Must Have Skills of any Candidate in 2024’ and various ‘fun’ articles we have.

DATA & ANALYTICS

Placement Insights

We’re seeing continued momentum across both our offices with new job listings coming in frequently. Applications remain exceptionally high with the April to June period seeing some roles receive 100’s of applications. Whilst most businesses are keeping their cards close to their chest, we’re still seeing hiring across the board, and have received a larger volume of hiring requests from outside of Auckland and Wellington.

Job Listing Location

Applications by Source

Placement Location

* Sitting at 0% as no Fixed-Term or Part-Time roles were listed through Find Recruitment between April and June 2024, or they are still active in the market.

DATA & ANALYTICS

Audience Insights

In partnership with our friends at the Gender-at-Work Community and The Pride Pledge, we are proudly taking steps to understand our candidates on a deeper level. All of this data is being collected freely, of the candidates' volition and is anonymous so can not be matched to specific candidates, to ensure we continue to combat bias in hiring processes.

We can collect demographical data for your specific roles going forward, so if you would like this done, please let your consultant know and once the job is filled we will survey all applicants to give you insight into who saw your role, and who applied! Please note below that the arrows used indicate a change in total dispersal of percentage from previous report and not a reduction in people or identities.

Candidate Ethnic Identity

Based on the willing responses of candidates across roles recruited through Find Recruitment.

Category

Respondees

Māori, Samoan or Tongan

Candidate Gender Identity

Based on the willing responses of candidates across roles recruited through Find Recruitment.

Identifying Gender

Cisgender Male (my sex assigned at birth and gender identity are the same)

Cisgender Female (my sex assigned at birth and gender identity are the same)

Prefer not to say

Respondees

Gender Queer, Intersex, Trans Woman & Takatāpui*

* Gender Queer, Intersex, Trans Woman & Takatāpui are all listed individually in our survey however are grouped here to accommodate space in this report.

Candidate Location

Based

Location

Candidate Industry Based

of Respondees

Candidate Age Groups

Based on the willing responses of candidates across roles recruited through Find Recruitment.

Age Group

Sexual Identity

Based on the willing responses of candidates across roles recruited through Find Recruitment.

Candidate Sexual Identity

of Respondees

Candidate Preferred Pronouns

Based on the willing responses of candidates across roles recruited through Find Recruitment.

Pronouns

he/him/his (masculine pronouns)

of Respondees

My pronouns are not listed

ia (Māori gender neutral pronouns)

they/them/theirs (neutral pronouns)

ze/zir/zirs (neutral pronouns)

Neurodiverse Status

Based on the willing responses of candidates across roles recruited through Find Recruitment.

Identifying Neurodiversity

of Respondees

DATA FROM SEEK

Top industries by job ad volume

A review of industry data as provided to us from industry leaders.

Job Listings 2024

Job ad change by region