Deal Team

Bryce Burns

From: Tiffin, OH Kelley School of Business| 2026

Majors: Finance

Jay Kadire

From: Moorestown, NJ Kelley School of Business| 2026

Majors: Finance

Shaun Gupta

From: Princeton, NJ Kelley School of Business| 2026 Majors: Finance

I. Executive Summary

Executive Summary

• Johnson & Johnson is a multinational healthcare company that operates in three main segments: pharmaceuticals, medical devices, and consumer health products

• Johnson & Johnson includes some 250 subsidiary companies that operate in 60 countries and sell products to over 175 countries

Scope

• This proposal will explain the strategic acquisition of Incyte Corporation, an acquisition that that would position Johnson and Johnson as one of stronger companies in the drug discovery market, specifically in the myelofibrosis and polycythemia vera market.

• Johnson & Johnson is positioned as a market leader in the biopharmaceutical, which allows for the acquisition of Incyte Corporation

Strategic

• Drive synergies and revenue growth by supporting the rapid expansion of Incyte's Opzelura in Europe and aiding the continued sales growth of Incyte's Jakafi, while leveraging the increased funding and market potential in oncology treatments

Prop o sal FIR

Given Incyte Corporation’s market placement, the FIR recommends the acquisition of Incyte Corporation at an offer price of $104.11 per share at an implied equity offer price of $22,704M.

II. Company Overview

Company Overview

•Incyte Corporation (NASDAQ: INCY) is a biopharmaceutical company focused on the discovery, development, and commercialization of novel medicines to meet unmet medical needs in oncology and other diseases.

•Founded in 1991, the company is headquartered in Wilmington, Delaware, and has operations in the United States, Europe, and Asia.

•Incyte's flagship product is Jakafi (ruxolitinib), a first-inclass JAK1/JAK2 inhibitor approved for the treatment of myelofibrosis, polycythemia vera, and acute graft-versushost disease. Jakafi has been a commercial success, generating $2.4 billion in net product revenue in 2022.

•The company invests heavily in research and development, with R&D expenses accounting for 48% of its total revenue in 2022. Incyte also has a robust intellectual property portfolio, with over 1,200 issued patents worldwide.

Company Overview

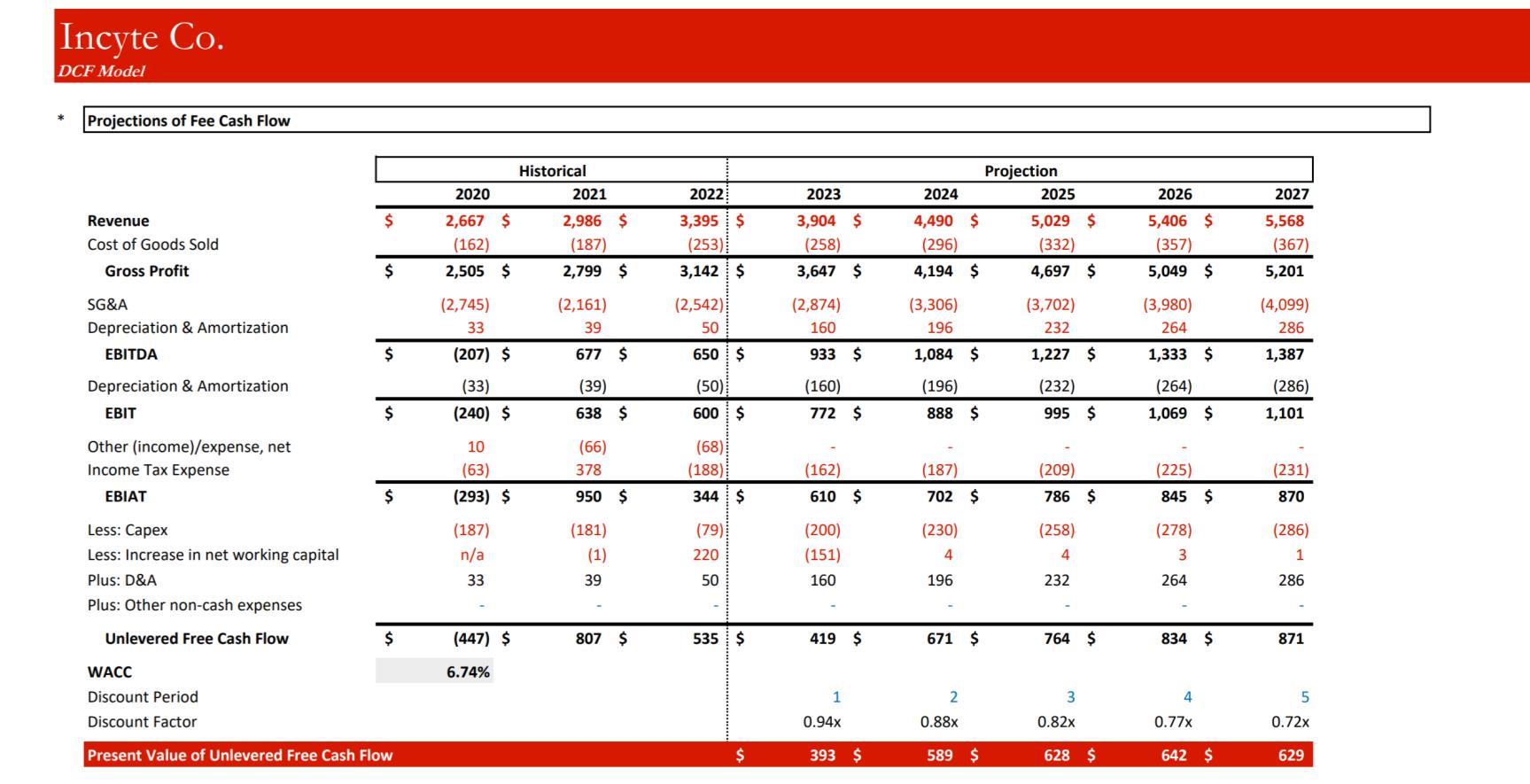

Financial Summary (USD, in mm)

Total Revenue: 3394.6

EBITDA: 665.3

EBIT: 594.3

Net Income: 340.7

Capital Expenditures: (77.8)

Market Cap: 16,631.0

Total Enterprise Value: 13,448

Cash and ST Investments: 3239.0

Total Debt: 55.6

Total Assets: 5841.0

Stock Performance (NASDAQ: INCY)

Nov 1993: INCY files for an IPO

Mar 2002: Incyte Genomics and Incyte Pharmaceuticals merge to form Incyte Corporation

Oct 2022: INCY buys an asset-centric biopharamaceutical company, Villaris Therapeutics to expand in theraputics for vitiligo

Mar 2023: FDA Approval of Zunyzm drug for merkel cell carcinoma

III. Industry Outlook

Industry Analysis

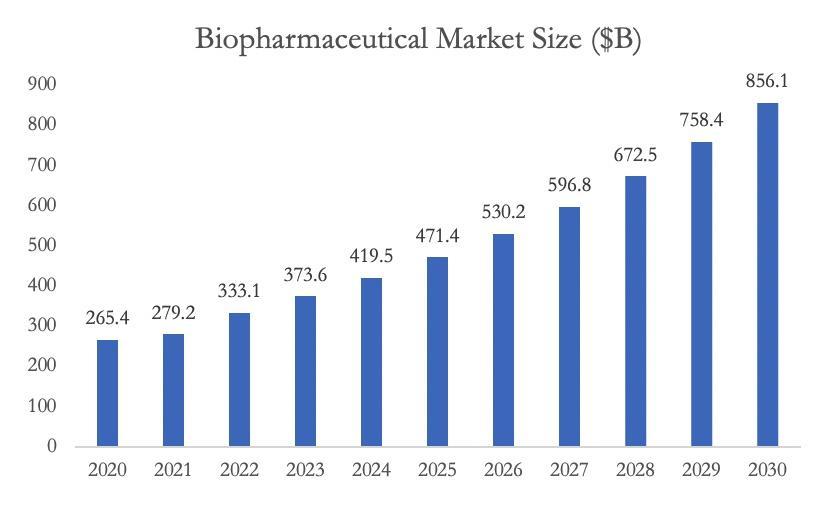

Biopharmaceuticals Market Size, Share, and Revenue

The biopharmaceuticals market size was$333.09 billion in 2022, increasing by 12% from 2021

There are 5 major companies that dominate this industry Johnson & Johnson has 21.9% of the market share in pharmaceutical preparation industry

Biopharmaceutical Market Outlook

Trends: Oncology Innovation

Biotechnologies have begun changing the approach to oncology treatment in order to battle the disease •

• Personalized medicine has becomepopularinthe oncology researchsectors. Building anmRNA medicine that canidentify the problem withina patient and fix it.

• Immunotherapy and targeted therapy have also grownand are based ondeep understandingof functional genomics, pharmacodynamics,and bioinformatics. They help identify therapeutic interventionpoints that drive tumorgrowth.

•

• • billion

The biopharmaceutical industry is expected to grow at a compound annual growth rate of12.5% from 2022 to2030

Projected revenues for 2030 are estimated to reach $856.1

Trends: Increased Acquisitions

With increasing profit and competition amongst big pharmaceutical companies, smaller biotechnology companies have been bought out at a muchhigher volume

• Companies with breakthroughresearch and development related to drugs and treatments will continue to be promising targets foracquisitions

• Combining technology with chemistry and biology to create new drugs has become widespread and allows for diverse areas of study

VI. Strategic Recommendation

Strategic Recommendation

Rapid Growth

1. FY'22 revenues grew 14% to $3.4 billion

2. FY'22 net product revenues grew 18% to $2.75 billion

3. EPS has grown 28% per year over last 3 years

Drugs:

1. Jakafi(ruxolitinib) is Incyte Corporation's best-selling drug, it is used to treat myelofibrosis and polycythemia vera. This accounts for around 71% of their revenue.

2. Opzelura isone-of-a-kind tropical JAK inhibitor cream that targets mild to moderate eczema at a key source. Opzelura saw a growth of 61% in the 4th quarter of 2022.

In total Incyte Corporation has 8 approved products and 25 clinical candidates.

Strategic Recommendation

Jakafi Growth: Jakafi will continue to grow in sales because of its affordability and effectiveness; it directly competes with the new drug Carvykti, which it is outperforming

Performance Catalysts

Opzelura Expansion: The rapid expansion of Opzelura, a dermatology product for adults with vitiligo, will continue to grow Incyte’s revenues through expansion in Europe.

Increased Cancer Treatment : Oncology treatments are receiving far more funding than ever before due to the newer technologies being used during development

Synergies

Revenue Synergies: JnJ acquiring Incyte will allow JnJ to fill a gap in their pipeline, and also support their growth into certain areas. JnJ has already developed a multiple myeloma drug, however it’s price drives consumers away. Jakafi’s growth will allow JnJ to absorb those revenues, which have already exponentially grown to above $3B, until the patent’s expiration. JnJ is also known for its strong dermatology brands; acquiring Opzelura, which doubled its sales between Q3 and Q4, allows for even greater growth. Incyte’s other drugs complement JnJ’s pipeline as well.

Cost Synergies: Johnson & Johnson and Incyte are both biopharmaceutical companies so this acquisition will lead to economies of scale. As resources are shared marketing, labor and operational costs will decrease. Research and development costs will also decrease as information is exchanged.

Risks and Mitigations

• Incyte Corporationrelies too much on its best-selling drug Jakafi

• Jakafi is currently one of-a kind and the market is only expected to continue growing.

• Failure to establish new drugs or customers may diminish future revenues

• Incyte Corporation currently has 20 molecular targets and 25 clinical candidates. On top of this they just won approval for their Opzelura drug in Europe

•

VII. Valuation

Comparable Companies Analysis

Precedent Transaction Analysis

VIII. Strategic Alternatives

Strategic Alternatives FIR

Strategic Alternatives

• Focused on developing kinase inhibitors for the treatment of cancer and rare diseases

• Pipeline of noveltherapies targeting specific genetic mutations; Strong patient and sales growth

• Risks:

• History of massive losses with possible inability to attain profitability in the future

• High amount of liabilities; FDA issued holds on drugs due to safety concerns; Small portfolio of drugs and potentialfor sustained losses if future approvals are denied

• • •

Flagship drug, Cabometyx, is the top prescription for renal cell carcinoma; consistent label expansion A growing portfolio of drugs for thyroid, kidney, and liver cancer through Cabozantinib technology

Risks:

•

• Early state pipeline outside of cabozantinib (Phase I and Phase II); multiple drugs recently failed for FDA approval Low adoption from consumers; stagnant/low sales growth; patent expiration in 2026

• • Rapid sales growth, Brukinsa drug treating chronic lymphocytic leukemia, an increase of 159% YoY Focused on developing targeted therapies for various types of cancer, including solid tumors and hematologicalmalignancies.

• Risks:

• Operating in China's entails navigating complex regulatory frameworks and legal risks

• Only 1 FDA-approved drug on the market driving revenue; lacking diversification