// THEMA (ALTERNATIVE) FIXED INCOME

IS THERE STILL VALUE IN SUB-INVESTMENT GRADE CREDIT? By Mikkel Sckerl

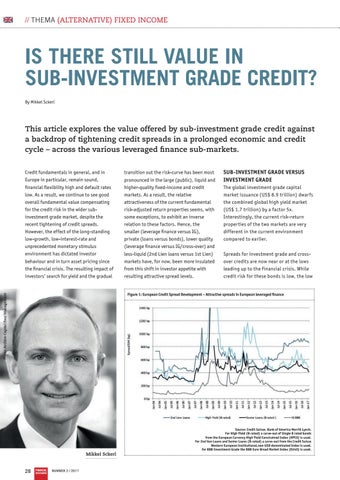

This article explores the value offered by sub-investment grade credit against a backdrop of tightening credit spreads in a prolonged economic and credit cycle – across the various leveraged finance sub-markets. Credit fundamentals in general, and in Europe in particular, remain sound, financial flexibility high and default rates low. As a result, we continue to see good overall fundamental value compensating for the credit risk in the wider subinvestment grade market, despite the recent tightening of credit spreads. However, the effect of the long-standing low-growth, low-interest-rate and unprecedented monetary stimulus environment has dictated investor behaviour and in turn asset pricing since the financial crisis. The resulting impact of investors’ search for yield and the gradual

transition out the risk-curve has been most pronounced in the large (public), liquid and higher-quality fixed-income and credit markets. As a result, the relative attractiveness of the current fundamental risk-adjusted return properties seems, with some exceptions, to exhibit an inverse relation to these factors. Hence, the smaller (leverage finance versus IG), private (loans versus bonds), lower quality (leverage finance versus IG/cross-over) and less-liquid (2nd Lien loans versus 1st Lien) markets have, for now, been more insulated from this shift in investor appetite with resulting attractive spread levels.

SUB-INVESTMENT GRADE VERSUS INVESTMENT GRADE The global investment grade capital market issuance (US$ 8.9 trillion) dwarfs the combined global high yield market (US$ 1.7 trillion) by a factor 5x. Interestingly, the current risk-return properties of the two markets are very different in the current environment compared to earlier. Spreads for investment grade and crossover credits are now near or at the lows leading up to the financial crisis. While credit risk for these bonds is low, the low

Photo: Archive Capital Four Management

Figure 1: European Credit Spread Development – Attractive spreads in European leveraged finance

Mikkel Sckerl

28

FINANCIAL INVESTIGATOR

NUMMER 2 / 2017

Source: Credit Suisse, Bank of America Merrill Lynch. For High Yield (B-rated) a carve-out of Single B rated bonds from the European Currency High Yield Constrained Index (HPC0) is used. For 2nd lien Loans and Senior Loans (B-rated) a carve-out from the Credit Suisse Western European Institutional,non-USD denominated Index is used. For BBB Investment Grade the BBB Euro Broad Market Index (EU40) is used.