The quarterly report explores the wholesale investment market, covering FUM and market share across platforms and managed accounts, investment vehicles, wholesale investment managers, super funds and investment consultants.

A quarterly report for exchange traded product and index providers, market makers and wealth groups who need to monitor FUM, net flows, fee revenue and market shares of the sector as a whole or across individual ETPs.

Assesses the net effect of all inflows and outflows among the Rainmaker universe of wholesale funds, reviewing net flow metrics for each investment manager, asset class and product.

03

News: BUSSQ, Elanor Investors, Vanguard 07

Opinion: Jenna Hayes, Income Asset Management

Matthew Wai

While our super system may be the envy of much of the world, the Superannuation Guarantee finally hitting 12% has seen some renew calls for the mandatory system to be scrapped as Australians continue to struggle with the cost of living.

A recent survey from Super Members Council found about 79% of Australians aged 50 and older see super as ‘very important’ to their retirement, while 70% said they would not have saved enough for retirement if it weren’t mandatory.

However, Fresh Thinking Economics chief economist Cameron Murray argues that people shouldn’t be “young and poor, and old and rich”, something he says the system enforces.

“[Super is] successful at amplifying wealth inequalities and making older people disproportionately richer than younger people historically – I don’t know if that’s success but that’s what it’s done,” Murray says.

“We’ve got this system that’s not quite mature but is already exposing that a typical person in their 60s and 70s with a lower rate of super is richer than the typical person aged 45 and below, and yet we’ve just changed the compulsory contribution from 11.5% to 12%.”

Murray says the younger generations need that money more right now than they will when they reach retirement.

“We’re making those families give up 12% of their income so they can be richer when they’re old, and still receive the Age Pension… We should have some coherent standard or expectation,” Murray continues.

“We pay $20 billion of Family Tax Benefit to young families because they’re too poor, and we make those young families contribute something in the order of $20 billion in super because they’re too rich – it’s ridiculous.”

A recent report from the Grattan Institute on the government’s super tax concessions claimed those exercising the concessions are already saving enough for retirement. In turn, super has slowly transformed into a “taxpayer subsidised inheritance scheme,” it said.

However, people struggle with many tradeoffs when it comes to voluntary savings models.

A recent review by Amundi Investment Institute found there are many behavioural factors that go into making savings decisions, particu-

larly in relation to retirement, like ‘present bias’ and procrastination.

Viola Private Wealth partner and adviser Peter Nevill says the pool of retirement savings in Australia is the “measure of success” and the envy of many other countries grappling with the surging costs of government benefits in retirement.

“There is no better vehicle of forced savings that has the dual benefit of funding lifestyles in retirement and easing the burden on the public purse,” Nevill says.

However, Murray says the hefty administration fees paid by super fund members are also eating into said savings. Despite falling drastically in recent years, Australians are still paying over $30 billion in super fees per year, according to Rainmaker Information’s Superannuation Benchmarking Report

But Arrow Private Wealth associate director, private clients Kreston Leggett points out the fees fund essential services such as customer support, digital infrastructure, and cybersecurity.

“While $30 billion in annual administration fees may seem excessive in isolation, it’s important to consider that this supports a superannuation system managing over $4 trillion in assets on behalf of 26 million Australians,” Leggett says.

“That said, it’s fair to scrutinise certain expenditures, such as aggressive marketing campaigns, particularly when industry funds heavily advertise on television.

“It’s also worth noting that significant consolidation across the superannuation sector in recent years should ideally lead to greater efficiency and put downward pressure on administration costs through economies of scale.”

As most Australians simply park their savings in a bank account, albeit possibly with a decent interest rate attached, those interest rates don’t compare to the returns achieved via super. The average annual return on super since the system’s creation is over 7%, and for FY25, the average MySuper return is predicted to be around 10%.

“Superannuation empowers individuals to take greater control of their retirement through a highly tax-effective structure for personal wealth creation,” Leggett adds.

“Beyond the personal benefits, superannuation plays a vital role in the broader economy by channelling billions of dollars into local investments, driving job creation, and ultimately improving the quality of life for all Australians.” fs

09

Executive appts: Cbus, Escala Partners, First Super 12

Feature: Platforms

Eliza Bavin

The Compensation Scheme of Last Resort (CSLR) has released a FY26 revised levy estimate, coming down slightly from the figure estimated in January.

The CSLR said the need for a revised estimate was triggered due to the initial levy estimate, issued in January 2025, exceeding the $20 million sub-sector cap for the personal financial advice sub-sector.

With the assistance of CSLR’s principal actuary, the revised estimate for the 2026 financial year has been calculated at $75.698 million, down from the initial estimate published in January of $77.975 million.

The key movements in comparison to the initial FY26 estimate are in the personal financial advice sub-sector, seeing a decrease of $2.821 million and the securities dealing sector, with an increase of $2.380 million.

“As the personal financial advice subsector estimate exceeds the sub-sector cap of $20

Continued on page 4

Jamie Williamson

Thirty-four percent of the entities regulated by APRA feel changes made to the prudential framework failed to adequately consider the increased costs imposed on the industry, while 33% say the compliance burden outweighs the benefits.

Those are some key findings from APRA’s latest stakeholder survey, which received more than 260 responses.

Respondents were asked whether changes to APRA’s prudential framework sufficiently considered the costs of regulation imposed on the industry. Some 40% said the consideration was inadequate; super funds rated their experience at just 21%, while the overall rating was just 24%.

Asked about the balance of regulatory burden and benefit, 33% said there is too little benefit to the industry for the level of burden.

Super trustees rated the balance at 71%, while life insurers put it at just 63%.

Continued on page 4

By Jamie Williamson jamie.williamson@ financialstandard.com.au

Hopes for a nice easing into the new financial year were dashed early this month when the Reserve Bank of Australia (RBA) opted against cutting the interest rate and keeping it at 3.85%.

It was a decision that shocked many, including the bulk of economists and other experts who were certain we’d see a reduction in July, followed by another in August. In fact, the market was so convinced that it had priced in a roughly 90% chance of a trim.

Factors such as the tight labour market, and continued uncertainty, including stemming from US tariffs, contributed to the call. The RBA also cited the lag in seeing the effects of monetary policy decisions, saying it was still too soon to confidently say inflation is sustainably tracking to where we want it.

Naturally, it took little time at all for RBA governor Michele Bullock to become a target, including copping questions around whether the RBA is really being as transparent and informative about its thinking and decision-making processes as it has endeavoured to be.

Director of Media & Publishing

Michelle Baltazar

Editorial

Jamie Williamson

Karren Vergara

Eliza Bavin

Andrew McKean

Matthew Wai

Research

John Dyall

Pooja Antil

Sanjesh Pinnapola

Advertising

Michael Grenenger

Client Services & Subscriptions

Matthew Martusewicz

Design & Production

Shauna Milani

Mary-Clare Perez

Doris Molina

CPD program

James Yin

Managing Director

Alison Mintzer

+61 2 8234 7530

+61 2 8234 7562

Stoic as ever, she rejected the assertion, saying there was no reason for the market to not know what the RBA is doing given how much more frequent the central bank’s monetary policy updates are.

But it’s not just updates on policy – the RBA has never been more communicative and open. Bullock gives press conferences for the public after every decision, explaining why they’ve chosen the road they have and, as of this month, even disclosed the actual vote tally. In this instance, the board was split 6:3, with three believing a cut was the way to go.

Despite this show of transparency, the focus was inevitably on the negative and many were quick to express their disappointment. While not disagreeing with the RBA’s call, even Treasurer Jim Chalmers responded swiftly, noting it was “not the result millions of Australians were hoping for.”

While it may seem callous, I think if you were to ask just about any financial adviser, they’d tell you that if you feel a single rate cut is going to make a difference to your finances

michelle.baltazar@financialstandard.com.au

jamie.williamson@financialstandard.com.au

+61 2 8234 7500 karren.vergara@financialstandard.com.au

+61 2 8234 7500 eliza.bavin@financialstandard.com.au

+61 2 8234 7500 andrew.mckean@financialstandard.com.au

+61 2 8234 7500 matthew.wai@financialstandard.com.au

+61 2 8234 7551 john dyall@financialstandard.com.au

+61 2 8234 7500 pooja.antil@financiatstandard.com.au

+61 2 8234 7500 sanjesh.pinnapola@financialstandard.com.au

+61 2 8234 7500

+61 2 8234 7524

+61 2 8234 7542

rm_mediasales_@issgovernance.com

clientservices@financialstandard.com.au

shauna.milani@financialstandard.com.au

+61 2 8234 7500 mary-clare.perez@financialstandard.com.au

+61 2 8234 7500 doris.molina@financialstandard.com.au

+61 2 8234 7527

+61 2 8234 7500

then you probably can’t afford your mortgage anyway.

That said, there is good reason Aussie borrowers are struggling and it isn’t their fault. Coinciding with the July meeting, Mozo released its 10-Year Mortgage Snapshot which showed that since 2015 repayments have surged an average of 98% and loan sizes are up 69%. Breaking those figures down, Australian mortgage holders are paying $71 more per day than they were 10 years ago.

What this means is that even if the RBA had cut this month, it is highly unlikely there would have been much relief at all. It also demonstrates that those prospective homebuyers banking on a lower interest rate before jumping into the market are all but wasting their time – the interest rate means very little; property prices are the real issue. So now we wait. It’s widely predicted we’ll see a cut in August and at least one other thereafter. My hope is that those who do feel they need it get it – I just also hope they realise it’s not a silver bullet and that Michele Bullock isn’t the problem. fs

james.yin@financialstandard.com.au

alison.mintzer@issgovernance.com

Jamie

Williamson

Elanor Investors is currently considering several offers, including potential takeovers, saying it has so far engaged with more than 15 interested parties as part of its strategic review.

In a business update, the real estate fund manager said it is continuing to “examine a range of options to maximise value for all securityholders.”

This includes having received non-binding indicative offers (NBIOs) from a number of parties, as well as working with other entities for a potential recapitalisation of the business including a refinancing of the balance sheet debt.

“There is no certainty that any of these NBIOs or other options to maximise value for all securityholders will result in a transaction,” the group said.

As part of the strategic review, Elanor has undertaken an asset realisation program which has so far resulted in divestments worth more than $300 million in value.

Elanor Investors said it also continues to refine and enhance its corporate governance, saying it has decided to establish a separate independent trustee and responsible entity board for its managed funds.

Doing so would see the replacement of many directors on the board of Elanor Funds Management Limited, with a majority independent board to be appointed.

A new responsible entity would be appointed for the Elanor Investment Fund, with the same board of directors as Elanor Investors Limited.

Finally, Elanor said it still plans to commence a search for a chief executive, following the departure of Glenn Willis in September 2024. It said it will do this once the balance sheet is appropriately stabilised. fs

Insignia Financial has finalised the outsourcing of about 1300 staff who worked in the master trust business to SS&C Technologies after striking a deal in February.

At the end of June those working in administration, technology and digital teams that support Insignia’s master trust business officially moved to SS&C. Insignia said members, employers and advisers will continue to engage with their existing contacts without any disruption, ensuring continuity of service, operations and product knowledge.

Meanwhile, Insignia will retain functions such as claims, complaints, product development, relationship management, marketing, member education and advice and guidance.

The move follows Insignia severing ties with NAB last November, which meant ceasing the use of the bank’s systems and technologies.

This involved Insignia transferring 700,000 MasterKey and Plum accounts, 55 systems and applications and more than 100 terabytes of data.

MLC Super chief executive Dave Woodall said: “We’re delivering on our commitment to simplify and transform our superannuation business to convert our size into meaningful scale benefits, through lower cost-to-serve, competitive fees and industry leading service outcomes, under our go-forward brand, MLC.” fs

01: Chris Taylor chair BUSSQ

Andrew McKean

Queensland-based industry super fund

BUSSQ, which has ties to the scandalplagued Construction, Forestry, Maritime, Mining, and Energy Union (CFMEU) through its board, emerged largely unscathed from an independent report by KPMG.

The quote

We welcome the report’s positive findings into the board’s overall compliance in these areas, which come as no surprise.

BUSSQ was hit with additional licence conditions by APRA last year over concerns about its governance and expenditure practices, particularly its relationship with the CFMEU, and was therefore required to commission a review assessing the fitness and propriety of its board members and financial dealings.

KPMG’s report concluded that BUSSQ’s current directors and officers were fit and proper, and that, apart from one area where recommendations have been made, CFMEU connected expenditure decisions are consistent with sound and prudent management.

KPMG also determined that the current directors remain fit and proper under SPS 520, which requires trustees of APRA-regulated super funds to assess whether individuals in responsible person positions demonstrate the competence, character, honesty, integrity, and judgement necessary to perform their roles, and to evaluate any conflicts of interest or affiliations that could compromise their objectivity.

Notably, BUSSQ overhauled its internal fit and proper processes in 2023, revamping sev-

eral policies and procedures to be more aligned with SPG 520 – the accompanying guidance to SPS 520.

Meanwhile, BUSSQ’s annual sponsorship deal with the CFMEU, which covers events and promotional services for a flat fee, was found to have achieved its stated purpose, delivered on the objectives outlined in the business case metrics, and included mechanisms to monitor outcomes.

KPMG, however, recommended that the fund further clarifies how it demonstrates fair value, including by outlining costs of similar arrangements, which it said would in turn provide further evidence that the arrangement is conducted on an arm’s length basis.

As for arrears collection, annual compliance agreements entered with the CFMEU for the sole purpose of recovering outstanding superannuation contributions from employers – aside from recommendations to enhance board-level reporting on these expenses – were otherwise found to be above board.

“We welcome the report’s positive findings into the board’s overall compliance in these areas, which come as no surprise. Strong governance practices have been a focus for this Board since I became chair three years ago. We will continue to make improvements, as we’ve always done, to ensure our governance practices meet the high expectations of our members and the regulators,” BUSSQ chair Chris Taylor01 said. fs

Karren Vergara

The two retail superannuation funds delivered strong returns for members, but it was the low-cost, indexed-based strategy that outmuscled the other.

Vanguard Super returned 13.5% p.a. for 2025 financial year for members aged 47 and under

Since its inception nearly three years ago, Vanguard Super’s default MySuper Lifecycle product has achieved 13.6% p.a.

Those in the 48- to 54-year-old bucket achieved between 12% p.a. and 13.2 p.a. Members aged between 55 and 62 earned between 10.2% p.a. and 11.8% p.a.

At the option level, High Growth Diversified delivered 13.5% p.a. for the year, while the Growth and Ethically Conscious Growth Diversified made 11.8% p.a. and 12.6% p.a. respectively.

The International Shares option turned in 16.7% p.a. while Australian Shares returned 13% p.a.

Vanguard Asia-Pacific chief investment officer Duncan Burns said the low-cost, index-based approach to superannuation is continuing to deliver strong outcomes for members.

“The 2024-25 financial year was a tale of two halves. The year began on a relatively stable note, while the second half saw periods of market volatility, which is a normal part of long-term investing,” he said.

“Superannuation is a long-term investment, and it’s important for Australians to maintain a long-term perspective.”

Meanwhile, Colonial First State (CFS) confirmed that only two of its MySuper Lifestage options delivered above 10% p.a. at the time of writing.

The FirstChoice Employer Super growth fund (MySuper Lifestage 1975-79) delivered 12.8% p.a. while the FirstChoice Employer Super balanced fund (MySuper Lifestage 1965-69) made 11.4% p.a.

While the returns for Lifestage options for younger members who were born after 1980 are not yet finalised, based on May 2025 results they are on track to achieve about 13% p.a.

CFS chief investment officer Jonathan Armitage said global and domestic equities were a key driver of returns over the year.

“We have also benefited from the recent additions of emerging market equities and increasing the hedging ratio of global equities,” he said.

“Pleasingly, following three consecutive years of doubledigit returns we have been able to significantly improve performance over both three and five-year periods. This achievement underscores our commitment to delivering consistent value to our members.

“Despite the rebound, uncertainty remains elevated. This highlights the volatile nature of the current market environment. As we anticipated, investment returns are now starting to come back down to more normalised levels but remain higher than long running averages.” fs

Continued from page 1

million, the scheme has notified the minister for financial services of the need for a special levy of $47.289 million,” the CSLR said.

Meanwhile, the revised estimate for the securities dealing sub-sector is $4.7 million. The $2.4 million increase will be funded by CSLR’s cash reserves and recovered in the FY27 annual levy for securities dealing.

CSLR chief executive David Berry said the harm caused by those in the finance sector doing the wrong thing disproportionately impacts and detracts from those acting correctly.

Berry noted that the rate and number of firm failures show little sign of abating.

“Whilst we are disappointed at the need for a special levy, we recognise these funds provide a measure of compensation for those who have experienced lengthy and stressful financial loss,” Berry said.

“The CSLR continues to operate in alignment with the legislative framework in a manner that is effective, efficient and economical as we strive to increase consumer trust across the financial services sector.” fs

Continued from page 1

More positively, 93% of respondents said APRA’s supervision enhanced the financial and operational strength of their organisation, while 96% said the regulator’s supervision had been a positive for their risk management practices.

Eighty-two percent said the prudential requirements had positively influenced financial management, and 74% believe APRA provides sufficient support when changes are proposed.

“At a time of great international volatility and economic uncertainty, it’s important the Australians can rely on the financial and operational resilience of our banking, insurance and superannuation sectors. It’s clear the entities we supervise also see the value in what we do to protect financial stability and to improve risk management in their organisations. We welcome their continued endorsement,” APRA chair John Lonsdale said.

“We are also aware of the need for us to strike the right balance between financial safety and not unnecessarily burdening industry in a way that lessens competition and productivity – a message that once again our regulated entities want to remind us about.

“These reflections, alongside feedback we receive from our stakeholders across industry, government and regulatory sector, are contributing to our thinking as we develop our priorities for next financial year in an environment of heightened risk.”

Meanwhile, the review also highlighted financial institutions’ feelings about certain emerging trends. It revealed that the threat of cyber security was listed as a critical or high risk among 91% of respondents.

Following that, geopolitical risks and their potential to magnify liquid, market, credit, investment, and insurance risks, was flagged as critical or high by 70% of respondents, while 48% said the same for operational risk. fs

01: Jeff Peters chief executive Platinum Asset Management

The quote

In many ways, it represents the culmination of the work that started 18 months ago to return Platinum to where it was.

THREE LINE HEAD

Jamie Williamson

The two parties have entered a merger implementation deed, with the Platinum name to be retired from the entity and the newly created ‘MergeCo’ to be listed under a new ticker code.

As previously disclosed, under the deal Platinum will acquire 100% of L1 Capital, while L1 Capital shareholders will own about 74% of the merged entity. The balance will be owned by existing Platinum shareholders.

The merged business will be led by current Platinum chief executive Jeff Peters 01, while current chief financial officer Andrew Stannard and chief operating officer Joel Arber will remain in their roles.

While the group will be rebranded, the Platinum and L1 Capital brands will be retained at the product level.

The Platinum board, which has unanimously endorsed the deal, said it believes the merger will deliver several benefits. These include exposure to alternative strategies which will diversify assets under management; complementary client relationships and potential for combined distribution capabilities; and pro-forma for $20 million of annual pre-tax synergies due to overlaps in the businesses, among other things.

Platinum said it is targeting a 25-30% reduction in operating costs. It also confirmed there will be no further special dividends paid ahead of the merger.

“For us, this is a very exciting day… In many ways, it represents the culmination of the work that started 18 months ago to return Platinum to where it was,” Peters said.

As for whether the investment teams will also be merged, Peters said: “I think it is safe to assume

we will leverage the best capabilities of both firms, there will be opportunities for the L1 team to add value in relation to the Platinum products.”

Meantime, L1 Capital co-chief investment officer Mark Landau said: “I think the way people should think about it is that, from an L1 point of view, we only launch funds that are best in class… to the extent we think there’s more people required, we’re open to anything to ensure it’s an A+ product. We have some announcements to make in the coming weeks… we’re viewing this as a major, positive inflection point for the L1 funds.”

According to Peters, the prevailing sentiment of discussions the group has had with existing shareholders on the merger has been one of optimism, saying they are looking forward to “where we come out post-completion.”

However, Landau said L1’s discussions with clients have stemmed largely from curiosity around why L1 is doing the deal. He said investors have raised concerns that he and L1 Capital co-founder Raphael Lamm would be distracted by the merger but reinforced that they “just want to focus on stocks.”

Landau and Lamm, who are currently joint managing directors of L1, will be stepping back from management responsibilities to focus on portfolio management. They will also not take up a board position.

“… We love investing, that’s the best thing for clients and for us in terms of personal satisfaction,” he said.

Finally, when compared to other multi-boutiques in the market like Pinnacle and Fidante, Lamm said L1 Capital has never had an objective to be the biggest by distribution footprint, but to be the best. fs

Karren Vergara

The financial advice sector can expect to contribute $46.2 million to ASIC’s industry funding levy for the 2025 financial year, new estimates show.

ASIC’s Cost Recovery Implementation Statement (CRIS) report shows that advisers who provide personal advice to retail clients on relevant financial products, which comprises most of the sector, will pay $39.3 million.

This is based on 2680 AFSLs with 15,233 advisers. In essence, an AFSL will pay the minimum levy of $1500 plus $2314 for every adviser on their books.

Those that provide general advice only will pay $5.2 million. There are 1122 of these entities and they can expect to pay a flat levy of $4665. The 565 licensees that provide personal advice to retail clients on products but are not relevant financial products will pay $44,000.

Licensees that provide personal advice to wholesale clients only, in which there are 1991, will pay $16 million and pay a flat levy of $825.

In budgeting the $39.3 billion FY25 levy, ASIC expects to allocate $17.2 million on enforcement activity and $5.6 million on supervision and surveillance.

ASIC flagged it has prioritised its policing of cold-calling superannuation switching business models, saying it is an issue that has reached an “industrial scale.”

ASIC has also made this issue prominent in the CRIS report along with investigating SMSF establishment advice, which includes an assessment of related AFSL policies and procedures.

The levy will also spend money reviewing on how AFSLs rely on offshore service providers and how they manage the risks.

“In particular, we will look at how they manage risks related to technology, data sharing and privacy. We will also publish resources that will help licensees improve the security of client data when sending it offshore,” ASIC said.

The total levy estimates budgeted for advisers for 2025 is slightly lower than the amount ASIC estimated for the prior year of $48.4 million. fs

The 50 most influential financial advisers in Australia.

The FS Power50 is back again in 2025, celebrating the 50 most influential financial advisers the country has to offer.

We are on the hunt for advisers that are proudly advocating for both the industry and their clients, powering and shaping the future of financial advice in Australia.

Nominations close 27 July

or

Matthew Wai

Former Crown Wealth Group director and head of compliance Andrew Moore has been banned for three years for failing to recognise the seriousness of fees for no service conduct, committed by one of its representatives at Lighthouse Partners.

Kiriley Roper was recently banned for 10 years by ASIC for charging fees for no service to the tune of more than $80,000. Roper was authorised by Crown Wealth Group when Moore was head of compliance and responsible manager.

ASIC believes Moore is not adequately trained or competent as he failed to notify ASIC despite becoming aware of the fees for no service, and delayed reporting the conduct to ASIC until at least six months after it was first identified.

It is alleged that the misconduct occurred between January 2022 and October 2023, affecting 14 Lighthouse Partners clients.

As a result, the conduct was not investigated, and Lighthouse Partners failed to refund fees totalling $81,653 plus interest to those affected.

Moore has been banned from performing any function and controlling an entity that carries on a financial services business for three years, ASIC said.

The banning took effect from July 3 and has been recorded on ASIC’s banned and disqualified register. fs

Corporate governance and advisory services firm Acclime has acquired Boutique Capital, a North Sydney-based specialist in fund incubation and wholesale fund services.

Acclime said the move significantly expands its capabilities in fund establishment and administration, strengthening its position as a partner to both domestic and international fund managers operating in Australia and New Zealand.

Boutique Capital offers a bespoke approach to fund incubation, offering end-to-end services including licensing, trustee, legal, compliance, registry, investor support, AML/KYC compliance, FATCA/CRS reporting, tax compliance and fund accounting.

This acquisition follows Acclime’s ongoing strategic expansion in Australia and New Zealand, including recent integrations of Bedford in Australia, and The Advisory Group and Rockburgh Fund Services in New Zealand.

“This acquisition represents another transformative step for Acclime in Australia,” Acclime group chief executive Izzy Silva said.

“By bringing exceptional specialist firms into our fold, we’re expanding our capabilities and empowering our clients to thrive both locally and throughout the region.”

Acclime regional managing director for Australia and New Zealand Randolph van der Burgh said Boutique Capital brings specialist fund knowledge and a strong client-centric culture.

“They are a great fit for Acclime, and we are delighted to welcome the team into our Asia Pacific fund services group,” van der Burgh said. fs

01: Judith Fox chief executive Stockbrokers and Investment Advisers Association

Eliza Bavin

Stockbrokers and Investment Advisers Association (SIAA) chief executive Judith Fox 01 will retire at the end of 2025 once a replacement has been appointed.

SIAA chair Hamish Dee said Fox has advised that she has decided to retire after six years in the role.

The quote

Leading the team at SIAA and serving our members through a tumultuous period has been a privilege and a joy.

Dee said Fox had provided outstanding leadership and has ensured that SIAA has played a pivotal role in addressing the policy and regulatory changes that have occurred during her tenure.

“Judith has been a passionate advocate for the stockbroking and wealth management sector, leading vital industry discussions and representing the interests of our members with professionalism and dedication. She is held in the highest esteem by the SIAA board of directors, the members, staff and the many stakeholders with whom she engages,” Dee said.

“On behalf of the membership and board of SIAA, I would like to thank Judith for her tireless dedication to our industry and profession and recognise the significant impact she has had.”

Dee said Fox has been instrumental in lifting the profile and increasing the influence of SIAA.

“She has driven capability uplift across the sector through sector-wide collaboration, innovation, thought leadership and professional development,” he said.

Speaking on her decision to step down, Fox said the role had been enormously professionally and personally satisfying.

“Leading the team at SIAA and serving our members through a tumultuous period has been a privilege and a joy,” Fox said.

“With an outstanding team I am proud to have strengthened the voice of our members as well as peer engagement, improved financial sustainability, and delivered key advocacy outcomes. There is more to be done, and my decision was not taken lightly. Ultimately my view is there is a point where organisations need renewed chief executive leadership, and this should occur when performance is strong.

“I want to acknowledge and thank my chair Hamish Dee and former chair Brian Sheahan as well as our expert board members and team for their support and counsel over the years.”

SIAA said the board will initiate a comprehensive search for a new chief executive, ensuring a seamless transition of leadership. fs

Karren Vergara

AustralianSuper’s MySuper option delivered 9.5% p.a. for members in the 2025 financial year, slightly trailing behind its peers.

The MySuper Balanced option, in which the majority of its nearly 3.7 million members are invested, has about 25% invested in Australian equities and 34% in global equities.

Some 15% is invested in infrastructure, 10% is in fixed interest and 5% is in private equity.

“Equities in Australia and overseas were significant drivers of returns this year, as AI and technology investments continued a three-year trend of boosting equity markets,”

AustralianSuper chief investment officer Mark Delaney said.

“We maintained our diversified portfolio while also capitalising on good growth in share markets.”

Delaney pointed to a “challenging 12 months for active investors” as one of the detractors of performance.

Nevertheless, he said that delivering “this strong result for members is pleasing”.

For their default options, Australian

Retirement Trust (ART) made 11.2% p.a. while HESTA returned 10.2% p.a.

Aware Super delivered a return of 11.9% p.a. and Vanguard Super’s default MySuper Lifecycle product made 13.5% p.a.

During the period, the nation’s largest superannuation fund wrote off a whopping $1.1 billion investment in online education firm Pluralsight following the company’s restructuring.

AustralianSuper head of international equities and private equity Mark Hargraves said last August that the fund remains strongly committed to private equity, as it’s been the topperforming asset class over five and 10 years for the fund, delivering returns of 10% p.a. and 12% p.a. respectively.

AustralianSuper’s default option achieved an average return of 8.7% p.a. over three years, 8.5% p.a. over five years and 7.9% p.a. for 10 years.

Meanwhile, in the last financial year

AustralianSuper’s High Growth option returned 10.6% p.a. while the Choice Income Retirement Balanced option earned 10.4% p.a. fs

01: Jenna Hayes executive director of capital markets Income Asset Management

For investors, the challenge is clear: cash earns little, but rushing into deals risks overpaying for weaker assets. One option is senior secured syndicated loans—a high-yield, defensive investment for wholesale high-net-worth investors seeking both yield and resilience in a latecycle market.

Fund managers confront a difficult balancing act. With capital to deploy and performance pressures mounting, many feel compelled to hunt for deals even as valuations reach stretched levels.

The pendulum has swung dramatically from the post-GFC era when asset prices were depressed, and lenders could demand rich covenants. The current landscape finds sponsors and borrowers with strong bargaining power. In a scramble for volume, managers may accept thinner margins or loosen covenant protections — risks that only become apparent when credit conditions sour. This ‘reach for yield’ in a supply-constrained market leaves portfolios vulnerable when credit conditions inevitably tighten.

The problem is compounded by the structure of many private credit funds. When investors need liquidity, they face a choice - either wait indefinitely or sell their positions in distressed secondary markets at steep discounts. In addition, stale net asset value calculations mask growing credit problems until it’s too late to react.

One remedy to the cycle-timing problem is to bypass pooled vehicles altogether and invest directly in individual loans. This approach allows investors to hold off deploying capital until they find the right opportunity. By underwriting each loan on its merits, investors gain control over timing, credit quality, collateral coverage and covenants. They can steer clear of so-called “cov-lite” structures—loans with minimal maintenance tests—and focus on senior secured exposures that sit at the top of the borrower’s capital structure.

Direct investing also offers transparency. Unlike pooled funds, where investors depend on quarterly snapshots, direct investing provides continuous insight into asset performance and covenant adherence. Investors know exactly which assets they own, how they perform and whether triggers have been tested. As a result, they avoid the potential mismatch between a fund’s reported value and the true market price for a distressed loan emerging under stress.

Historically, syndicated bank term loans were exclusively the province of large institutions. Major banks would arrange financings for blue-chip corporate borrowers—companies with substantial assets and reliable cash flows—and syndicate slices of the facility to other banks and institutional investors. While trading was limited, the asset class earned its reputation through meticulous due diligence, strict maintenance covenants and senior secured status. Loss rates on these loans have historically been very low, a reflection of both the credit quality of borrowers and the collateral packages underpinning the loans.

Today, wholesale high-net-worth investors can join this market directly, accessing largeticket, senior secured loans at yields that often exceed 9% per annum. This represents a notable pick-up over investment-grade bond yields. What makes syndicated loans uniquely attractive becomes clear when examining their mechanics. Borrowers agree to ongoing maintenance covenants—tests of leverage, interest coverage and other financial metrics—that, if breached, can trigger margin ratchets under a predefined leverage grid. In other words, lenders receive higher margins the weaker the borrower’s financial health becomes. Scheduled amortisation and cash-sweep provisions further lighten credit duration, returning principal to investors before a final maturity date.

Real world transactions illustrate the wide array and diversity of sectors that can access bank-led loans is wide, from infrastructure and real estate to financial services and utilities. While each deal is unique, the common thread is a combination of large asset bases, strong cash flows and the security of first-ranking collateral. For investors accustomed to the domestic bond market’s lending dynamics, the structural advantages are clear. New investors often question the liquidity profile- or the lack thereof. Unlike corporate bonds that trade electronically in seconds and trade daily on an active secondary market, syndicated loans typically change hands less frequently and require dealer support or brokered transactions for off-market trades. Trade settlement times can vary based on market conditions. Still, investors should consider syndicated loans an illiquid component of a diversified fixed income portfolio, allocating capital they do not expect to need at short notice.

For wholesale high-net-worth investors, syndicated loans deliver a powerful trifecta of benefits that

In a scramble for volume, managers may accept thinner margins or loosen covenant protections — risks that only become apparent when credit conditions sour.

address today’s market challenges: yield enhancement, credit quality and diversification. Yields above 9% can materially boost portfolio income compared with sub-5% IG bond coupons. At the same time, the senior secured status and active covenant structure of bank loans provide cover in a downturn that unsecured or subordinated securities cannot match. Finally, syndicated loans broaden sector exposure beyond the traditional bond markets—opening opportunities in healthcare, energy, infrastructure and more.

In December 2024, the Australian Prudential Regulation Authority (APRA) announced that, following extensive industry consultation, it will phase out the use of Additional Tier 1 (AT1) capital instruments (hybrid bonds) by 2032. In the months since, a wave of funds and ETFs has emerged, positioning themselves as natural reinvestment options for displaced hybrid capital. But in my view, this misses the point. A major reason many investors were drawn to hybrids was the appeal of direct ownership—holding the security outright rather than a unit in a pooled vehicle. These new alternatives aren’t a like-forlike replacement. In fact, they’re not even close.

With the proposed Division 296 tax set to apply an additional 15% tax on superannuation earnings above $3 million—including both realised and unrealised gains—income-focused investments are becoming increasingly attractive. Unlike equities or property, where gains are capital in nature and often volatile, fixed income (as the name suggests) can offer predictable income without triggering capital gains, especially when bought around par. With RBA rate cuts likely to compress term deposit yields, SMSFs and large super funds are now actively reallocating to income-generating assets that offer both yield stability and tax efficiency.

Navigating private credit in a late-cycle environment demands a careful balance between chasing yield and preserving capital. While pooled funds may tempt with diversification and ease of access, the timing risks and liquidity mismatches they entail can erode returns when markets turn. By contrast, direct ownership of senior secured syndicated term loans can appeal to wholesale investors seeking both higher income and defensive characteristics.

As regulators bring greater scrutiny to private markets, these qualities become even more valuable. fs

Karren Vergara

Two former MWL Financial Services financial advisers who invested clients’ superannuation in the Shield Master Fund have copped bans from the regulator.

Matthew Simon Bradley has ceased working in financial services for eight years after ASIC found he advised certain clients to invest most of their superannuation into Shield Master Fund’s High Growth class or the Growth class, which were high-risk investments. Some also went into the Balanced class, which was deemed a mediumhigh risk investment.

Bradley was an authorised representative of MWL Financial Services from 11 October 2017 to 27 December 2021, and from 28 March 2022.

ASIC found that Bradley’s Statements of Advice (SoA) to certain clients included false and misleading statements that implied clients would enjoy better returns if their superannuation were invested in Shield.

This included projection tables and statements for client’s superannuation that did not have reasonable grounds and representations that Shield had a higher performing track record against other super funds when it had only been in existence for a short period.

MWL Financial Services is part of MWL Financial Group, which is headquartered in Melbourne. Bradley was based in the Chatswood office in Sydney. His banning order took effect from July 3.

For his part, ASIC banned Isaac Jacob McQueen from providing financial services for four years.

The bad advice Queensland-based McQueen provided was similar to the inappropriate advice Bradley gave, moving client savings into the High Growth class or the Growth class of the Shield Master Fund.

Between 31 October 2022 and 9 June 2023, he was an adviser at MWL Financial Services.

He then jumped to CWS Finance, which is under Interprac Financial Planning, between July 2023 and January 2024. fs

Alternatives fund manager Blue Owl Capital has launched a private credit fund to local investors in partnership with Koda Capital.

The Blue Owl Credit Income Fund AUT is a feeder fund targeting financial advisers and their wholesale clients.

The unlisted unit trust invests in Blue Owl Credit Income Corp (OCIC), a private credit strategy that invests in a diversified portfolio of predominantly senior secured, directly originated floating rate loans to US middle and upper middle-market companies.

Koda Capital has seeded the fund for an undisclosed amount. Channel Investment Management is the responsible entity for the fund.

The underlying fund focuses on tailored debt investments, according to the PDS, including firstlien debt, second-lien debt, mezzanine debt and broadly syndicated loans.

The Australian unit trust charges management costs of 1.86% p.a. based on the net asset value. fs

01: Sonya SawtellRickson chief investment officer HESTA

Eliza Bavin

HESTA’s MySuper Balanced Growth option has delivered 10.18% for the 2024/25 financial year, with the fund crediting the performance of listed equities and prudent management of market volatility for the result.

The outcome represents the third consecutive year of annual returns above 9% for the MySuper Balanced Growth option.

The quote

We started the year with a cautious stance, and our robust liquidity management and stress testing allowed us to take advantage of long-term buying opportunities...

Over 10 years to 30 June 2025, the fund’s default investment option – where most members are invested – has averaged an annual return of 7.64% and ranked in the top quartile over five, seven and 10 years.

Among other super investment options, Indexed Balanced Growth, High Growth and Sustainable Growth achieved very strong annual returns of 12.01%, 12%, and 11.06%, respectively.

HESTA’s Retirement Income Stream Balanced Growth achieved a return of 11.81% and Retirement Income Stream Conservative yielding 8.45%.

HESTA chief investment officer Sonya Sawtell-Rickson 01 said the fund’s investment team was on the lookout for opportunities to continue to drive performance and build the retirement savings for members over the long-term.

“We started the year with a cautious stance, and our robust liquidity management and stress testing allowed us to take advantage of longterm buying opportunities during the periods of market volatility,” Sawtell-Rickson said.

Sawtell-Rickson added policy announcements in the US and conflict in the Middle East had impacted markets in recent months, with management of these risks remaining a focus.

“While volatility has eased after a surge in March and April, geopolitical events remain an important consideration as we head into the new financial year,” she said.

“Our expectation is that global economic growth will likely be slower, though the response of several central banks has helped temper recession fears. Further rate reductions are expected over the year ahead, including here in Australia, which should provide additional support to the economy and households.”

HESTA chief executive Debby Blakey said the financial results were great news for the fund’s members.

“We are very pleased to report another strong performance for our members, particularly given the more volatile and uncertain period in global markets over the past six months,” Blakey said.

“The consistency of our returns over the long run can make a significant difference to our members, helping improve their retirement readiness.

“It was also great to see our income stream options perform well for the financial year, with the positive returns helping retired members maintain their savings as they draw an income stream and enjoy the retirement they deserve.” fs

AMP has been served two separate legal proceedings; one a fresh class action and the other from Dexus Funds Management.

The class action – which has been lodged in the Federal Court of Victoria – has been filed against N.M. Superannuation Proprietary Limited (N.M. Super) and has also been commenced against AMP Superannuation and Resolution Life.

“The proceedings relates to allegations of higher premium payments by certain members of AMP’s superannuation funds for life insurance (death only cover, total and permanent disablement cover and income protection cover) during the period 2019 to 2024,” AMP said.

AMP confirmed it intends to defend the proceedings.

Separately, a further proceeding has been filed against AMP in the Supreme Court of NSW by Dexus Funds Management, in its capacity as the responsible entity of Dexus Property Trust and Dexus Operations Trust.

Dexus has launched the case against AMP

and Collimate Capital.

AMP said the filing has arisen out of a dispute between Dexus and Macquarie Retail regarding the disposal of the Macquarie Shopping Centre, following the sale of the former AMP Capital business, and relates to the sale value of that property.

This comes after the Supreme Court of NSW ruled that Cbus and UniSuper, the co-owners of Macquarie Centre, could force Dexus to sell its stake, valued at around $830 million.

Dexus flagged back in December 2024 that it would seek to appeal the court’s decision to force the sale of the asset.

Following the forced sale, which was one of the Dexus Wholesale Shopping Centre Fund’s major assets, Dexus underwent a strategic review and terminated several funds, including the Dexus Core Property Fund and the Regional Property Fund.

AMP said it also plans to defend these proceedings. fs

Sentier chief steps down

First Sentier Investors has confirmed its chief executive is leaving at the end of the year.

After seven years with First Sentier Investors, Mark Steinberg 01 has announced he plans to step down.

Confirming the news, a First Sentier spokesperson said: “To ensure a seamless transition, a comprehensive search for his successor has commenced.”

“The selection process will include both internal and external candidates, as we aim to find the most suitable individual to lead the business into its next phase of growth and success.”

Steinberg first took over as chief executive in an interim capacity in 2018 when Mark Lazberger departed after 10 years in the role.

The business was still known as Colonial First State Global Asset Management (CFSGAM) then but was later rebranded to First Sentier Investors following its acquisition by Mitsubishi UFJ Trust and Banking Corporation in 2019. At that time, Steinberg was permanently named in the lead role.

Metrics managing partner departs

Metrics Credit Partners managing partner Graham McNamara has advised the board of his intention to retire, effective 31 March 2026.

Metrics said McNamara’s retirement forms part of a “carefully managed” leadership transition plan.

“He will remain fully engaged in the business until his retirement date and will continue in an advisory role thereafter to ensure continuity for investors and clients,” Metrics said.

The board congratulated McNamara on an “exceptional career spanning more than 45 years across banking, funds management and financial markets”.

“As a founding shareholder and managing partner, McNamara has played an important role in Metrics’ success, contributing to the firm’s strategy, growth and reputation since its inception in 2011,” Metrics said.

“His experience and leadership have helped build Metrics into one of Australia’s leading private markets asset management firms with more than $30 billion in assets under management.”

Escala unveils new leadership team

Private wealth group Escala Partners has made changes to its leadership structure as it officially integrated into global financial services firm Focus Financial Partners.

Although Escala joined Focus’ network of independent wealth management firms in 2019, this marks its full integration into the group.

As part of the integration, Escala’s founding partner and former head of advisory Ben James has been appointed chief executive.

Torty Howard, meanwhile, was named chief operating officer, while Simon Dawkins will continue as head of capital markets and fixed income.

It’s also expected that Focus’ chief corporate development officer Travis Danysh will be appointed executive chair of Focus’ Australian businesses.

Grok Ventures sees two executives exit

Grok Ventures - the climate technology investor backed by Atlassian founder Mike CannonBrookes - has seen chief executive Tan Kueh and chief investment officer Jeremy Kwong-Law exit the business.

“Both have played a huge role in Grok’s journey and our mission to decarbonise the planet,” Grok said.

The company thanked Kueh for amplifying Grok’s presence and accelerating the progress of the SunCable project across Asia Pacific.

Kwong-Law was credited for his impact over his nine-year tenure, from unearthing some of the company’s earliest seed deals through to reshaping AGL.

“Investments like these (and many more) show that with the right amount of guts, ambition and capability, we can make real change. Grok remains committed to making bold investments that push us towards a better tomorrow,” Grok added.

Casey Taylor02 , who was appointed chief executive of Cannon-Brookes’ private office earlier this year, will now oversee climate investments at Grok Ventures, climate philanthropy alongside Boundless Earth chief executive Eytan Lenko, and other things under Cannon-Brookes’ umbrella of companies.

After four years with the industry fund that serves people in the furniture and joinery, pulp and paper and timber industries, deputy chief executive Michelle Boucher03 has taken a role at REI Super.

REI Super chief executive Jarrod Coysh confirmed Boucher has been appointed group executive of transition and transformation at the superannuation fund for Australia’s real estate industry.

“We are delighted to have an executive of Michelle’s capability and experience joining us to oversee our transition to a new administrator, SS&C and also to accelerate our digital transformation,” he said.

“I’m personally happy to be working with Michelle again and know she will be a great addition to the executive team.”

Boucher has spent nearly two decades in the superannuation sector, holding leadership roles at Cbus and ESSSuper where she focused on marketing, member experience, digital transformation and operational performance.

Bombora Advice is welcoming a new chair and a managing director following the departure of founder Kevin Martin.

Wayne Handley will take on the role of executive chair and Niall McConville 04 will become managing director, effective July 1.

Martin served as chair since January 2016 and McConville has been a member of the Bombora board since April 2024.

Prior to joining Bombora in 2023, McConville held roles at the Pro Bono Financial Advice Network, Fidelity Life and TAL Australia.

In welcoming McConville into the role of managing director, Handley said he is a seasoned financial services executive with a proven track record that has spanned two decades in advice, insurance, distribution, and strategy.

McConville said he was delighted to take on the new role.

“My focus will be the next phase of Bombora’s strategic journey that will include enhancing operational efficiency, capitalising on growth opportunities in the life insurance sector and improving both adviser and client experiences,” he said.

High-profile sustainable finance specialist Camille Wynter has taken on the role of ESG integration lead at Cbus.

She will be part of the responsible investment team and report to Ros McKay.

With over 10 years of experience in sustainable finance, Wynter joins the industry fund serving building and construction workers after a ninemonth break.

Previously, she was the head of ESG research for Australia and New Zealand at UBS, where she led the strategy for these markets. Wynter also previously served as the director of sustainable finance in Commonwealth Bank’s institutional division.

Wynter also spent seven years at AMP Capital as a senior sustainable investment analyst. There, she helped manage the Australian Sustainable Share Fund, led engagements with company executives and board members, and managed proxy voting on behalf of all global equity teams.

“Strong leadership and a shared sense of purpose create the best conditions for impact. I’m grateful to be joining a team and company where those foundations are lived every day,” she stated. fs

CareSuper has mandated Macquarie Cloud Services to migrate and recalibrate its cloud environment into a Managed Edge Azure Local offering.

It will consolidate the super fund’s technology estate into a single, scalable platform and will see databases modernised and platform-as-a-service offerings implemented to create efficiencies.

CareSuper said it is about more than cost savings for its 573,000 members.

“Our goal is to optimise every part of our operation so we can deliver long-term value to our members,” CareSuper chief technology officer Simon Reiter said.

“Cloud decisions must serve that mission – not just today, but five years from now. Macquarie Cloud Services stood out as a partner who could deliver both the technical transformation and the ongoing managed service maturity required.”

Macquarie Cloud Services head of Azure Naran McClung said the group is “seeing a wave of repatriation from AWS.”

“For many organisations, rising costs, and architectural limitations have made them re-evaluate. But it’s not just about moving away –it’s about moving forward. That’s where our team adds value,” McClung said. fs

A former company director has received a prison sentence after he was found to have continued to run a financial services business despite having been banned from doing so.

In 2018, Joshua Fuoco was found to have engaged in misleading and deceptive conduct and unconscionable conduct, and to have broken financial services laws. His business was offering cash to vulnerable clients in exchange for sizeable commissions from insurance policies the clients did not want or need but that he forced them to take out in order to access the cash. Those policies were funded via their superannuation accounts, significantly eroding their balances.

He was banned for 10 years from being involved in the running of a financial services business. However, in 2020 he was found to be continuing to run one firm, Financial Circle.

At the time, he was charged with four offences, but in October 2022 pleaded guilty to one rolled-up count of managing a corporation while disqualified. He was convicted in 2023 and fined $6000. He was permanently banned the following year, and ASIC then filed a contempt application in the Federal Court.

Now, Fuoco has been convicted on 18 charges of contempt and sentenced to 12 months’ imprisonment, with Justice Horan saying it was “the most serious incident of contempt of court in recent years.” His sentence is to be suspended for two years, with the judge saying he wanted to give Fuoco “one last chance.”

Between March 2019 and April 2023, he was found to have been involved in five companies: State Advice, Ansa Finance, AFSL Group, About Advice, and Advice Now. All the companies were operating a similar model to that of the business Fuoco was running when banned. fs

01: Damian Graham chief investment officer Aware Super

Eliza Bavin

Aware Super has delivered a return of 11.9% for its Future Saver High Growth optionits default MySuper option for under 55s – for the 2025 financial year.

Retirees invested in Aware’s Conservative Balanced option also enjoyed strong performance with the pension option achieving a 9.8% return.

Our younger members have had the benefit of being in the highgrowth phase for longer, enhancing their retirement outcomes.

Aware Super chief investment officer Damian Graham 01 said the performance was testament to the strength of the $195 billion fund’s diversified portfolio and actively managed investment strategy.

“Aware Super members have enjoyed another year of strong returns with our diversified, actively managed portfolio again performing well despite challenging market conditions at the beginning of 2025,” Graham said.

The super fund said global shares were a strong performing asset class, with private equity and infrastructure also delivering solid returns.

Graham also highlighted the fund’s globally diversified portfolio as being pivotal in delivering consistently strong results for members, noting the High Growth option achieved a positive return for April despite big falls on share markets that month.

“Our investments span a vast range of listed and unlisted assets, from technology companies and data centre operators to energy transition

investments and build-to-rent housing projects across global markets,” Graham said.

“We search the world for investments exposed to promising long-term growth trends, including the digital economy, technology innovation, the energy transition, and the ageing population and its need for retirement housing and health services.”

Graham said the fund has been working to create new approaches and options to preserve retirement savings for members as they progress through different life stages.

“Aware Super was one of the first funds to make High Growth the default option for younger members as part of our MySuper Lifecycle approach. Our younger members have had the benefit of being in the high-growth phase for longer, enhancing their retirement outcomes,” Graham said.

“The Conservative Balanced pension is our default and most popular option for retirees. It still invests in growth assets to help their savings keep up with the rising cost of living but balances this with more defensive assets.”

Graham said Aware Super has aimed to cushion the impact markets can have on retiree balances.

“If they lose less when markets fall, their income won’t be as affected, so they can have more confidence that their money will last for longer in retirement,” he said. fs

Jamie Williamson

Pendal has updated the exclusions for three sustainable funds, evolving its stance on controversial weapons.

The Pendal Sustainable International Share Fund, Pendal Sustainable Conservative Fund, and the Regnan Global Equity Impact Solutions Fund now exclude companies directly involved in the supply of goods or services specifically related to controversial weapons.

For the Sustainable Conservative Fund, the exclusion applies to International shares, Australian fixed interest and part of its Alternative investments allocations.

The funds already exclude companies involved in the manufacturing of controversial weapons, and companies that derive 10% or more of revenues from manufacturing non-controversial weapons or armaments.

“In our view, this change ensures that the fund remains true to label and is more closely aligned with investor expectations in relation to responsible investment funds,” Pendal said.

The change was effective June 30 and adds to the

list of exclusions already in place, including tobacco production and extraction or exploration for fossil fuels. The funds also don’t invest in companies that derive 10% or more of revenues from things like the production of alcoholic beverages, pornography, or uranium mining in support of nuclear power. However, companies with a climate transition plan may be exempted from some of the screens. Further, Pendal clarified that in the case of the Regnan fund, it does consider white phosphorous weapons to be controversial weapons.

White phosphorous is used in smoke, illumination, and incendiary munitions, with the white phosphorous ignited by contact with air; according to the World Health Organisation, it is harmful to humans by all means of exposure and can burn all the way through to the skin.

Human Rights Watch and Amnesty International have both claimed Israeli forces have used white phosphorous weapons in Gaza and along Lebanon’s southern border. It’s also previously been used by US forces in Iraq and in Afghanistan, and was used to varying degrees by several armed forces in the First World War. fs

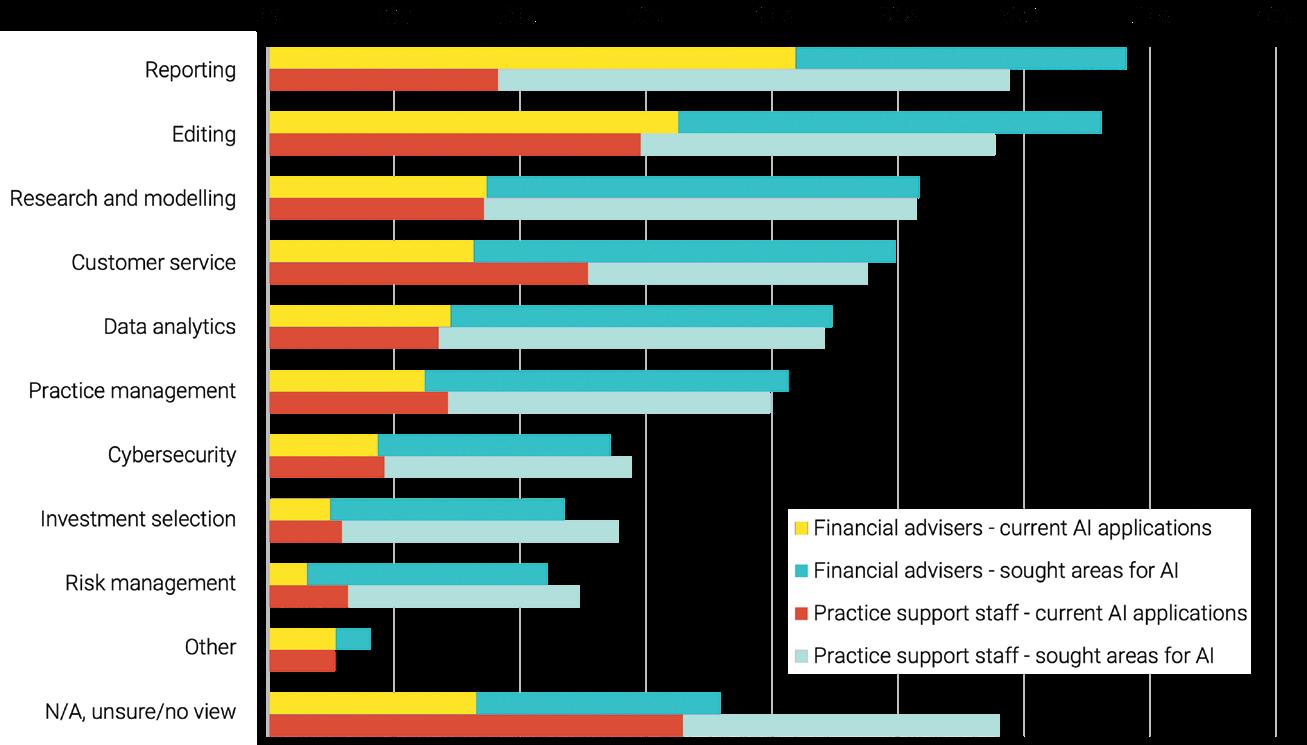

With the advancement of artificial intelligence, it isn’t exactly surprising platforms have quickly adopted solutions. But what can we really expect from the technology – and what are the risks? Matthew Wai explores.

rtificial intelligence (AI) brings clear advantages across various channels, predominantly on platforms. Examples are seen throughout Investment Trends’ 2024 Annual Platform Benchmarking Report, showing that platforms are adopting AI to strengthen cybersecurity and fraud detection initiatives, machine learning capabilities, and portfolio review for better access insights.

Investment Trends finance and research director Paul McGivern 01 highlights that technology can also streamline the documentation of client interviews, educate and train advisers on certain aspects, as well as create client report content and information retrievals, assist with software development, and more.

“In the 2024 report, we did include some AI-linked functionality, and the participating platforms gained additional points where they have implemented that functionality,” McGivern says (see Figure 1).

“Whilst the impact of AI functionality to their scores in 2024 was very limited, we do expect its importance to grow over the coming years.”

Although limited data may not demonstrate the true level of AI infiltration in the sector, DASH head of product – adviser solutions Terri Ho 02 says history has shown clear indications that those who are slow to adapt to the latest innovations will become the losers.

“History is pretty clear: in every wave of innovationfrom electricity to the internet - businesses that moved either too slowly or too recklessly got left behind. The winners were those who made deliberate, strategic moves grounded in real use cases,” Ho says.

“With financial advice being highly regulated in the way information and advice is delivered to clients, basic use cases like using AI-powered tools for notetaking, meeting documentation, and client communications report saving over 10 hours per week on average. This equates to more than 500 hours per year.”

This also supplements a sector that is currently facing a critical shortage, with only 15,600 financial advisers

and research director Investment Trends

active in Australia. AI can help in many ways, including playing a big part in digital advice for personalised advice as well as customer support.

However, with the abundance of merit comes the underlying threats AI also presents.

“AI is both the biggest threat and the biggest opportunity facing business today. The critical point: this isn’t a passing phase. The tension AI creates isn’t cyclical – it’s structural,” Ho continues.

“The real challenge is learning to operate within that tension and drawing crystal clear lines between where AI replaces us, where it augments human capability – and where we want to preserve and double down on the human elements of our business.

“Whether you’re excited by AI or wary about it, one truth cuts through: economics always wins. The moment a competitor uses AI to lower costs, boost efficiency, or elevate client experience, the conversation shifts. It’s no longer about belief – it’s about economics.”

Many, if not most platforms currently used by Australia’s advisers are equipping themselves with the latest AI features.

Still, Mason Stevens chief platform officer Vien Luong03 says there are components of AI that remain insufficient.

Although the firm does leverage AI technologies to some extent, Mason Stevens prides itself on the fact that human interaction still edges over innovation, refusing to use any form of AI in the front office.

“When it comes to more principle-based or a grey area like regulation, Australia is very good at adopting principle-based regulation. AI technology today just isn’t able to provide holistic solutions for that segment, not yet,” Luong says.

“That’s one area I’d love to see advancements in because Mason Stevens’ philosophy here is ‘AI is not going to replace us’ – it is just going to enable and supercharge what we do.”

Mason Stevens operates as an investment platform and a deposit-taking institution that has a superannuation fund, meaning it is regu-

AI is both the biggest threat and the biggest opportunity facing business today. The critical point: this isn’t a passing phase. The tension AI creates isn’t cyclical – it’s structural.

Terri Ho

lated by both ASIC and APRA – and that any use of AI must be stringently monitored.

“We are positioned in the market not only as a platform, but also as a provider of sophisticated investment services – not too dissimilar to an asset management business,” Luong explains.

“Hence, we use a lot of portfolio management and analytics tools internally, and the partners that we’ve used for that technology have rolled out certain AI features to help optimise those processes.”

Although Luong remains unsure about what AI regulation will look like in the future, he believes the firm’s “compliance-by-design” approach puts it in good stead.

“I don’t think anyone is sure where that’s [the regulation of AI across platforms] going to go for now. For us, it’s principle based. We as an organisation have a compliance-by-design mentality; everything we design, every solution we put in place, has a compliance lens – it is not just about ticking a box but to think through what regulations might be coming,” Luong explains.

“If we’re designing a solution, how do we future proof that, regardless of whether AI is involved or not.”

While Mason Stevens is looking to take a more considered approach, others are more gung-ho about capitalising on AI’s capabilities.

For example, Netwealth has overhauled several aspects of its business, following the adoption of AI tools in its platforms business.

“We’ve seen sound adoption and outcomes from AI already within the business and our

contact and service area; we’ve implemented several significant AI projects, which have led to improved customer service, reductions in call waiting times, as well as broader efficiencies within the team,” Netwealth chief executive and managing director Matt Heine 04 says.

“One [aspect] is around that back-office efficiency, and the other half is client-facing technology, where we can create new and different ways of interacting with the platform.

“Ultimately, the more that we can drive efficiency, increase accuracy, and also deliver better services to our customers, it’s a ‘win-win’ for everyone.”

This includes a chatbot that Netwealth is planning to introduce, which has been in development over the past 12 to 18 months.

Netwealth has conducted rigorous testing and Heine says the chatbot, once introduced, will be able to handle well over half of all incoming enquiries before matters need to be shifted to a staff member. This would lift a considerable burden for employees whose time is spent answering and resolving simple issues.

“That’s really important from a chatbot perspective; we’ll be adopting a multi-layered approach, whereby we believe that moving forward, in the next two or three years the chatbot will be able to answer 60% to 70% of all inquiries,” Heine says.

“It’ll be able to answer a wide range of enquiries in real time with high levels of accuracy. However, we also recognise the importance of having the ability for customers to be triaged and directed to a human when help is needed. To make sure that we don’t end up frustrating our customers, we’ll be running AI sentiment analysis over the top of the chatbot interactions.”

Equally, Heine recognises that ethical overlays are critical, and notes that most of his employees are encouraged to learn how to use AI in some form.

“It can be difficult [to measure], because it is being adopted and used broadly across the whole business,” Heine adds.

“Some areas are getting much greater benefits earlier given the technologies that we’re working with however, we have a number of medium to longer-term projects and plans which I think will deliver very significant benefits.

“Whilst AI definitely isn’t the solution for everything… it’s supporting more and more automation as well as better customer experiences.”

It’s prudent to consider that not every platform is suited to ride the AI wave; sometimes, they may already be too heavily equipped to properly integrate new capabilities in a timely manner.

Avoiding this issue, Elemnta chief executive Shaun Green 05 explains that younger companies are typically on the front foot, compared to their older counterparts, because they often have the right systems in place from the get-go.

“Our work with many financial services institutions highlights how legacy data systems, or stacks, are not ready for the full benefits of AI,” Green says.

“… due to legacy, some more mature institutions don’t have the data foundations in place to allow them to truly leverage the power of AI. They often need help to create clean, better organised, standardised data to deploy AI benefits, and it’s the core foundational integrations work that we are assisting them with.

“I can’t emphasise enough that the back-end data infrastructure inside a platform or institution should be the priority focal point when seeking to unravel historic technology systems built over previous time horizons and at different levels of cognisance regarding the power of properly integrated data.”

This also applies to consumer-focused platforms like Pearler, as it was able to incorporate the latest technologies during establishment.

“We’ve built on the most modern tech stacks available. So, AI has enabled our engineering team to increase our efficiency,” Pearler cofounder Nick Nicolaides 06 says.

“As a modern company, I wouldn’t say that AI has had a material impact yet on back office, because everything in our back office is fairly automated and digital to begin with.

“Within our business, at every level, AI is already driving decision making and it’s not [about] us tearing everything down to insert AI; it’s involved in every decision, whether it’s resourcing, recruiting… and particularly how we are investing marketing budgets.”

As a trading platform, Nicolaides reiterates AI isn’t a “magical black box” for the best investment decisions but a catalyst in searching the most suitable content to learn.

“Rather than focusing on how someone can use AI to pick investments or manage money, we’re [understanding and testing] how it can cut down the decision-making process around how to utilise features like automation, optimising for saving rates, investment frequency, and more,” Nicolaides says.

The trading platform is orientated towards

04:

Matt Heine chief executive and managing director Netwealth

Shaun Green chief executive Elemnta

… due to legacy, some more mature institutions don’t have the data foundations in place to allow them to truly leverage the power of AI.

Shaun Green

younger Australians that tend to be more self-directed.

“AI is putting itself in between that person and the endless world of general content such as blogs, videos, how-to guides, courses, forums, and more,” Nicolaides explains.

“AI is dramatically simplifying and speeding up a person’s ability to find the content… we don’t see AI as creating a new type of content, because people are already happy and used to existing content.

“AI is enabling people to find the content that’s most relevant for them… a young, selfdirected person that wants to learn, wants to be in control and isn’t looking for this magic black box to tell them what to do.”

AI also assists Pearler in search engine optimisation (SEO) and organic forms of distribution, but for material impact he believes the industry needs to wait-and-see how the true benefits are going to play out as business continues to grow.

As with any other software rollout, it is imperative to understand the strengths, weaknesses and risk factors of implementing AI tools.

Ho says some key risks can include the lack of transparency, security concerns and misinformation and manipulation.

“The rapid growth of AI does mean that laws and policies have not yet quite caught up with providing proper legal frameworks,” Ho warns.

“As such when implementing AI, part of the strategic solution would be to incorporate strict policies around the use of AI, including developing guidelines for responsible use such as vetting AI tools and outlining which tools can be used, how they are used, and steps to protect confidential data.

“Ensuring the risks are well understood is also key, with one of the main risks being trusting AI too much and over-relying on its outputs, hence overlaying its use with a review framework would help manage risks.”

Cybersecurity is also paramount.