By: Trina Y. Mallari

Vancouver, Canada. It was a bright and sunny day at Slocan Park, filled with hope and camaraderie that continuously built for many more hours, while the aroma of coffee percolated. The air smelled of new beginnings, like the smell of freshly cut grass. This was the backdrop of the BBM SARA 2022 Kapihan, as if it was held on cue after a long bout of cold spells, snow and flooding in the Lower Mainland. The warm, sunny day providing a much needed respite from old man winter. Even if it was only for a day, this was a good day for it. I took it as a sign of good things to come. The air was energized, the harmony of unity in full display. What a sight it was to behold.

Mr. Freddie Bagunu stood strong on the microphone as the moderator. A known activist during the martial law years in the Philippines, and

a graduate and instructor in the college of economics and finance at the Polytechnic University of the Philippines (PUP), he had a change of heart after witnessing the tragedy that befell the Philippines under the rule of the Liberal Party, better known as the yellow army, whose leadership was characterized by usurpers of power and greed. Their evil plan was no longer hidden. His is a sentiment common to many, including myself. We all thought the Philippines would improve, but it did not. In retrospect, it was actually so much better before. The Philippines was set up, and now it made sense why the late President Marcos had to enforce martial law and why he was exiled to Hawaii rather than Paoay in Ilocos Norte, a stronghold of the Marcos’ at the time.

Community leaders and notable Filipino - Canadians in the Lower Mainland attended the event. Well

represented were the officers who graduated from PMA, or KABALYERO as their group is called. Also in attendance were Virginia and Captain Mervin Espanero, who accompanied the Marcoses in exile in Hawaii and stood by their side until the very end. For 5 years, they continued to loyally serve the Marcos family without pay since all of Marcos’ personal assets were seized. To get by, they would work odd jobs for Hawaiian establishments. Their character and patriotism is beyond measure. Captain Mervin served with what is now known as the PSG (Presidential Security Group) while Virginia was with the Malacañang Press Corps and a contemporary of the infamous Rita Gadi, who made a documentary shedding light on the plight of the Marcoses, and which was collaborated by John Perkins in his book Confessions of an Economic Hitman.

14 13 11 MAKE YOUR MONEY WORK FOR YOU 7 6 FILIPINO NOW BBM-SARA FILIPINO - CANADIAN SUPPORTERS CALL FOR NATION BUILDING Miracle Life Church Canada Watch our Truth Thursday livestream on Facebook @ mlcvancouver 4306 Victoria Drive, Vancouver, BC V5N 4N5 Canada 778.995.1362 Pastor Ping Alba USEFUL AND RELEVANT NEWS ON BUSINESS, FINANCE, TECHNOLOGY, AND GEOPOLITICS FEBRUARY 15 - MARCH 15, 2022 VOL. 0101 CONTENTS 3 4 HOW TO LIVE AN EXTRAORDINARY LIFE PRINTER CERTIFIED 5,000 COPIES SHOW LOVE, NOT HATE... A GATHERING FOR UNITY! THE Vancouver Edition 2022

EVERGRANDE OF CHINA COLLAPSE TOP TEN RESONS TO INVEST IN SILVER FREEDOM TRUCKERS CONVOY MY TAKE: VACCINE DATA BANKS VS. CREDIT UNIONS

EMPOWERING FILIPINOS IN CANADA | EMAIL: HELLO@FILIPINONOW.CA | WWW.FILIPINONOW.CA BBM-SARA >> 13

2022 KAPIHAN 02.08.2022

BBM-SARA

Photo Credits: Remie Delos Reyes

A COFFEE TABLE MAGAZINE

CHRONICLING THE YEARS BETWEEN 1971 TO 2022

Ang Leksyon 1971 – 2022, ay coffee table magazine na kumpilasyon ng mga saluobin, panunuring political, suhestyon pang-ekonomiya, personal na salaysayin ng mga taong kasama ng pamilyang Marcos sa Hawaii at ang pag babago ng puso ng mga dating aktibista noong panahon ng Martial Law o kilala sa tawag na mga “anti-Marcos”. A clever play of the word “leksyon” which means “lesson”… This hopefully will brings forth learnings of the contentious and tumultuous years in the Philippines between 1971 to the present, and culminating on the 9th of May, 2022; the Philippine national elections, which incidentally in tagalog is called eleksyon…

Why 1971? We believe that this marks the insidious start of the systematic foreign infiltration and destabilization of the Philippines. On August 21, 1971 , the historic and tragic bombing of Plaza Miranda took place, claiming the lives of 9 innocent souls and injuring 95 other, including prominent politicians such as Senator Jovito Salonga. This significant event in Philippine history was conveniently alluded to be the work of the late president Marcos, along with the unsolved mysterious assassination of Sen. Benigno Aquino that led to the ousting of the Marcos regime and the first family being exiled to Hawaii. This was a turning point in Philippine politics. The once strong man of Asia was gone! A free-for-all grab for power and corruption then ensued. The power hungry and corrupted Filipino leaders and media outfits then conspired with the global elites to take advan tage of the power vacuum created as a result of the Marcos’ exile.

Mahigit kumulang limang dekada ng propaganda nang mga banyagang puppet masters kasabwat ang mangilan-ilan na mapagsamantalang politikong Pilipino ang nanamasa sa pagkakagulo, kahirapan at ang pag-papaksyon-paksyon ng mga Pilipno sa ngalan daw ng demokrasya at liberalismo.

“

Naniniwala kami na ang publikasyon ng Leksyon na ipama mahagi na libre sa mga Pilipino ay maging katalista ng pag babago! Ito ang lunas sa mga kasinungalingan, panlilinlang at pang- uuto sa mga kabataang Pilipino. Nawa’y pagpulutan din ng aral nating mga Pilipino ang Leksyon at tayo ay maka pagtatag ng malaya, progresibo at marangyang Pilipinas!

For $50 and $100 donations, receive a soft cover version of the Leksyon magazine with 1 & 2 line mentions. For $300 or more, receive a hard bound Leksyon magazine. Business card-size to Double Page mentions have dedicated ad space.

2 THE FILIPINO NOW • FEBRUARY 15 - MARCH 15, 2022

FreeShipping

Ang nalakap na pondo para sa Leksyon coffee table magazine ay siyang gugugulin para sa paglikha at pagpapaimprenta. nito. Ipamamahagi ito ng libre para sa mga mamamayang Pilipino upang maitama at nawa’y maging lunas sa sa propagandang antiMarcos na nagdulot ng pagkakawatak-watak ng mga Pilipino, kaguluhan at kahirapan. LET’S MAKE THIS HAPPEN. PLACE YOUR CONTRIBUTION ORDER @ WWW.E-LEKSYON2022.COM

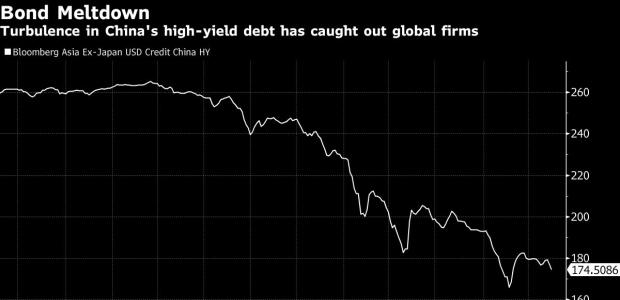

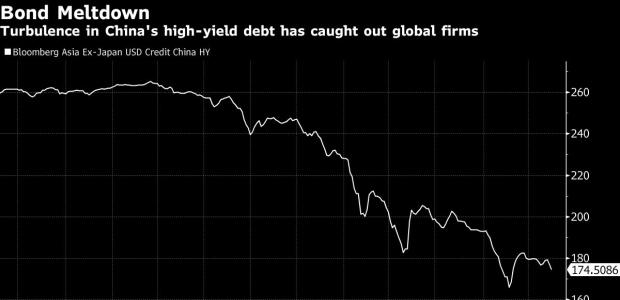

Evergrande of ChinaThe Domino Effect on Canada

By: Eula Stein

U p to now, like many people, you probably had no idea who or what Evergrande was. But after the past few months, it would be almost comical if you still asked, “What is an Evergrande?”

For the past two months, the global financial ecosystem has been turned on its head, with one of China’s foremost real estate companies declaring an eyepopping USD $305 Billion debt owed to investors, homebuyers, and suppliers. The news sent shockwaves throughout the world and crippled stock markets across North America, Europe, and Asia. Financial professionals and economists everywhere are waiting with bated breath to witness the inevitable global domino effect the catastrophe will have.

month low of 1.5 per cent. The value of the company has already plummeted by almost 90% and shares in China Evergrande Group have been suspended from trading in Hong Kong.

However, research conducted shows that Canadian banks have no direct borrowing products to Evergrande or China’s real estate sector, and the Big Five banks have less than 1 per cent of their equity capital — an estimated $1.4 billion combined, in legal entities in China. Some pension funds such as the Canadian Pension Plan Investment Board and the Cais de Depot et Placement du Québec have minute equity stakes in Evergrande and a few other Chinese real estate companies such as China Vanque Company Limited. BlueBay Asset Management, a British-based subsidiary of Royal Bank of Canada, holds a minimal number

Canada is no exception. The maple maven has a few significant business connections with the real estate mogul now in jeopardy, and everyone is waiting with bated breath to see the outcome. What is most anticipated is to see Evergrande will opt to sell its lone Canadian holding, the Fairmont Le Château Montebello.

The now in debt multinational corporation added the vast historical log cabin to its portfolio in 2014. Located just 2 hours west of Montreal, this property marked the developer’s initial foray into Canada, joining many other Chinese real estate organizations that have rushed to Canada, recreating, and reshaping the country’s largest cities into contemporary metropolitans.

The Evergrande ripple was most felt in the Toronto Stock Exchange (TSX), which grounded to a halt with futures sinking to a two-

of tens of millions of dollars’ worth of bonds issued by Evergrande. The institution, however, sold some of those bonds earlier this year and some more in July.

What must be noted is that Evergrande’s crumbling debt is an effect of outrageous borrowing to construct ambitious buildings. There seemed to be no borrowing too much, just as long as they could turn a profit to cover the borrowing costs. It kept diversifying its portfolio and borrowing more, hoping to stay ahead of its building debt. A few have likened this wayward strategy to that of the Canadian economy, which is now one trillion dollars in debt as it funds social services. Evergrande Canada is wishing on a star that reinvestment of the borrowed funds will yield a turnover the costs of its lofty ideals. However, like Evergrande, Canada must remember that things don’t always work out the way you expect them to.

3 THE FILIPINO NOW • FEBRUARY 15 - MARCH 15, 2022 T ah o … . T ah o k a yo d ya n . . . S a O Taho! Hours of operation Mon-Sat 12-6:30 Sun 12-6 604.720.9604 O Taho . 4223 Fraser Street Vanancouver

Source: BNN Bloomberg

Create Your Own Reality

How to Live an Extraordinary Life

By: Arianne Pioquinto

By: Arianne Pioquinto

Living out the best life in this pandemic may mean a lot of things to each of us. Just breathing the air outside our homes can make us feel that we are already blessed, and this gratitude towards life is something that a lot of us relate to nowadays.

lin-starred chef with a famous restaurant café, or a businessman earning 6 digits while at home with the wife and kids. We continue to trudge through life as if there’s no tomorrow, pushing ourselves to the brink of exhaustion only to be paid a month’s salary and still be unhappy about life in general.

So, what did we miss? Did our parents and teachers not tell us everything we must do to be successful individuals?

According to Bashar, an extraterrestrial in telepathic communication with channel Darryl Anka, these are the things we must do to live out our best life: 1

Be aware of what your potential is and be aware of the opportunities life offers each day. 2

Follow and act on your passion, then stay passionate about being passionate. Do not ever give up on your passion, no matter how tough things might get. 3

Trust the timing of your life and how it unfolds. 4

Do not let fear stop your momentum. You might as well be afraid of doing what you love instead of doing nothing. Do whatever it takes to achieve your goals.

Filipino Now The

Useful and relevant news on business, finance, technology and geopolitics.

Editor

Arianne Pioquinto

Writers and Contributors

Arianne Pioquinto

Trina Y Mallari

Eula Stein

Freddie Bagunu Shaylan Stein

Lou Tang

Layout and Design

Albion Marketing

Publisher

Kaplaza Cooperative

Advertise With Us

There are now over 1,000,000 Filipinos in Canada, making this, already the 3rd largest visible minority group in the country, also the fastest growing community. Reach out and grow your market. We can help you.

But how do we actually get to live our best life? We’ve been told since childhood about the things we must do to reach our full potential: study well, finish school, get a good job, marry, and have kids. It’s all so basic, so standard, so ordinary that we just go through all those steps and forge a life that we think is OK.

Through all that hustle of getting the best life, we forget to be passionate. We just go through the motions because we are doing what we think is the way to get the best life. We forget that we used to dream about being a Miche

5

Be true to your authentic self and let go of the things or people that are not of the same vibrations as you.

Lastly, you are the one that creates peace with in yourself. No one else can determine that. You must decide that you will live your best life regardless of anything that is going on around you.

Always remember: You are capable of living an extraordinary life, and you can inspire and move other people to live their best life as well.

For advertising inquires, contact: Freddie Bagunu at 604-355-1987 or send an email to info@filipinonow.ca

Be an Area Publisher

If you would like to become an area publisher of The Filipino Now in your city, please feel free to reach out to us be sending an email to info@filipinonow.ca

4 THE FILIPINO NOW • FEBRUARY 15 - MARCH 15, 2022

ATTRACTION

LAW OF

SERIES

5 THE FILIPINO NOW • FEBRUARY 15 - MARCH 15, 2022 Make money online. Free to sign up with international business coach Gina Enjoy more time with your family. GEDE MARKETING www.ginadimitrov.com Be your own boss!

TOP TEN REASONS TO INVEST IN SILVER

By: Trina Y. Mallari

R eferred to as the poor man’s gold, silver has always stood in the shadow of its more prominent cousin, gold. And while gold is usually the go-to metal of choice for an alternative tangible investment, silver is no slouch. People have used silver as a form of exchange of value for more than 4,000 years, and it has garnered a reputation as one of the safest assets.

junk silver bags, or bars. However, you can opt to buy silver stocks from companies involved in the mining or processing of silver, mutual funds that hold silver portfolios, or exchangetraded commodities– these publicly traded securities invest in silver bullion as if it were a fund, where silver serves as the collateral.

3. Silver Is Actual Money. Dollars is Just Currency

Silver has a long history of being utilized as legal tender. Even though that may not be the case now, it is still real money and still greatly valued. In concurrence with gold, silver is the ultimate form of currency and not quickly depreciated.

Silver is well known to be an inflation hedge. Since inflation signals a decrease in the value of paper money, when it rears its ugly head, investors turn to assets like silver. Silver has garnered a reputation for being one of the only assets that positively correlates with inflation.

8. Inventories Are Falling

The bulk of the world’s silver comes from nations marked with labor unrest and underdeveloped economies. Poor infrastructure and political instability in countries such as Peru and Mexico mean less silver, giving way to a dramatic value increase to meet the demand.

What we are recommending is buying actual physical silver in the form of 1-ounce coins, 10-ounce bars or even 100-ounce bars. 1oz. coins are around just $30 each. There are many networking market schemes out there who claim to be selling collectible silver coins, with some schemes charging unsuspecting investors as much as $200 monthly in exchange for a 1 oz. silver coin. Please be wary of these. It’s better if you buy the coins yourself and store them in a secure location or a safety deposit box at your bank. What’s important is you hold your assets.

Here’s what makes silver a great investment choice:

1. Silver Is Economical

Silver is by far more affordable than gold. Investors in silver can purchase more silver than gold, dollar for dollar. It is much more cost-effective for the average investor, yet it will help maintain your standard of living just as much as gold.

2. Silver Can Be Bought Physically and Digitally

There exists a myriad of options to invest in silver. The most pragmatic way to invest in silver is by purchasing actual silver bullions,

4. Silver Outperforms Gold in Bull Markets

In an unstable market, silver will consistently outperform gold. Because the silver industry is so small, it is more volatile. The slightest shift in the sector dramatically impacts the price, and in the bull market, it will continue to reign supreme.

5. Hard Asset

Even though you can choose to buy silver electronically, still the best mode of purchase is physical. You can carry silver around hasslefree, and it is immune to biohacking and all cybercrime.

6. Rising Industrial Use

Silver is a powerful conductor, making it ideal for technological applications in the electric automotive industry and solar energy. As these industries grow, so will the value of silver. An investment in silver also supports green energy.

7. Hedge Against Inflation

9. Demand Is Growing

The demand for silver globally is growing. Between governments and industrial juggernauts, China and India silver are at an all-time high.

10.Practicality

Silver is more practical when you need to sell. Since it comes in smaller denominations than gold, you can sell only what you need at the drop of a hat for small purchases. Due to its high industrial value, and growing demand, silver represents a great addition to any investment portfolio.

In Vancouver, I would recommend buying physical silver from the Vancouver Bullion & Currency Exchange (VBCE) in downtown Vancouver, on the corner of Pender and Howe Street. Their prices are more competitive that what your bank can offer, and they have an ample supply. You can buy 1 ounce coins, or 10 ounce and 100 ounce bars.

For those purchasing more $10,000 or more worth of silver, you will need to first call to make an appointment. The form of payment they accept is a bank draft drawn from your personal account, not a business account or an account in someone else’s name.

6 THE FILIPINO NOW • FEBRUARY 15 - MARCH 15, 2022

People have used silver as a form of exchange of value for more than 4,000 years.

IN FOCUS

UNDERSTANDING BASIC INSURANCE PRODUCTS

PARTICIPATING LIFE INSURANCE

This is the most cost effective insurance product in our opinion. Insurance policies cost significantly less while you are young and healthy so it’s best to start early. This is most popular among the Jewish and Chinese communities and is unheard of in the Filipino community. This is the same type of insurance Walt Disney was alluded to have leveraged to build his theme parks. With this insurance product, you can live wealthy and retire early.

Aside from the basic insurance coverage, which is tax free for your beneficiaries, the policy builds up cash value quickly which the policy owner can borrow against and use to invest in products such as exchange traded funds (ETFs) within your TFSA allocation. Any income earned in a Tax-Free Savings Account (TFSA) is not taxed, unlike RRSPs which just defers your tax payments and cannot be touched until you are retired.

As an example, a 40 year old female with a coverage of $1.5M will be paying $30K annually in premiums or $2,800 monthly. By the 10th year, the policy will have a cash value of over $300K, meaning should the policy owner pass away by year 10, then the beneficiary will be receiving approximately $1.8M.

After just 1 year, the cash value will already be approximately $15K. If this amount were to be invested in self directed ETFs it could have the potential to increase by 100%-200% a year. Most people are only aware of RRSP products offered by their banks, which in many cases you barely notice going up in value. What many people also do not realize is when they need this money after retirement, they will be taxed on it, unlike with TFSAs.

The reason why participating life insurance products are very popular with high income earners, business owners and entrepreneurs is it gives them the ability to have good insurance coverage while, at the same time, borrow the cash value to invest in other high yield financial products such as ETFs. The application to borrow only takes 2 weeks to process and the policy owner can start borrowing as soon as the premiums for the first year are paid. Live wealthy and retire early!

TERM LIFE INSURANCE

This is usually the cheapest in terms of monthly payments but is very limited in terms of protection and insurance. Most term insurance policies have a term of 20-30 years. Should the policy owner live until the end of the term, the policy will just end. All premiums already paid remains with the insurance company. At this stage, it will be very expensive for the policy owner to get another term policy, largely due to their age. Most health issues manifest in the later years which is why the older you get, the more expensive any insurance becomes.

Term life insurance is usually used by most home owners to insure their mortgages, instead of getting just a mortgage insurance. There is a very slight difference in price, but term life insurance is more encompassing than a mortgage insurance.

UNIVERSAL LIFE INSURANCE

This policy is popular with many Filipino clients and financial advisors alike. True to popular belief, this can very expensive if you look into the details. For a coverage of only $1.5 million, typical payments for a late 40’s male would be 40,000 a year/ $3300 a month; at year 10, the cash value will only be around $140,000, meaning the $400,000 you paid will only be worth $140,000. If one dies on the 11th year, the beneficiary will be getting $1.64 million tax free. Universal Life Insurance can only benefit the beneficiary which in a way eerily reminds us of the popular Filipino saying “Aanhin pa ang damo kung patay na ang kabayo”!

Not all universal life policies have cash values that can be borrowed against, which is another disadvantage.

Universal Life Insurance is best for older couples or elderly individuals with multiple properties whose heirs will be dealing with substantial capitals gains tax upon death. With a joint last-to-die policy, the proceeds upon death can cover the capital gains taxes due form the estate of the deceased. Universal Life Insurance used to cover the capital gains tax makes the monthly payment more cost effective. An even better strategy in this case will be to assign a registered charity to be the beneficiary of the policy. At the time of death, the charity will receive the policy coverage in full, tax free, and will issue a tax donation receipt to the estate of the deceased which will also offset any capital gains taxes due. This is what we mean when we say you can leave a meaningful legacy for a good cause!

Participating life insurance is not your ordinary life insurance policy. Not only is your family protected, but you are also given access to capital which can be used in invest in self directed platforms such as Wealth Simple under a Tax Free Savings Account (TFSA). Simply link your existing bank account to your TFSA in the Wealth Simple app.

Your earnings in your TFSA is tax free and can be withdrawn at anytime with no penalty.

If you have never contributed to a TFSA and have been eligible since its introduction in 2009, your cumulative contribution room will be $81,500 as of 2022. All Canadian residents 18 and over with a valid SIN are eligible to open a TFSA. Your contribution room increases every year. For 2022, the additional room is $6,000.

7 THE FILIPINO NOW • FEBRUARY 15 - MARCH 15, 2022

Let your MONEY work for you

Contrary to popular belief, real estate may not the best investment nowadays! Especially since cities in Canada are now among the most expensive in the world .

A million dollar mortgage will require a combined gross income of over $200K a year, which means you’re paying close to $100K in income taxes yearly.

But before you get a mortgage, be prepared to make a 20% down payment ($200K). For the rst year, that’s a total initial capital outlay of $300K for a $1M property.

8 THE FILIPINO NOW • FEBRUARY 15 - MARCH 15, 2022 FINANCIAL FREEDOM FREE CONSULTATION C O N T A C T U S Is Real Estate the Best Investment? f r ee d o m@ au bi tx. c a EXPERIENCE FREEDOM BUILD A BLISSFUL LIFE! 604.355.1987 CALL OR TEXT TO BOOK AN APPOINTMENT #A113, 2099 Lougheed Hwy. Port Coquitlam, BC

9 THE FILIPINO NOW • FEBRUARY 15 - MARCH 15, 2022 AUBITX HOLDINGS NOT YOU WORKING HARD FOR MONEY Expand your understanding with simple financial strategies to make your hard earned money work for you. MAKE YOUR MONEY WORK FOR YOU! FREEDOM AT 45 AND LIFE! Ask about our Freedom 45 strategy!

SETTING YOU UP FOR SUCCESS

My nancial advisor is the most knowledgeable one I know. He specializes in nancial products for high income individuals, business owners and family members. I borrowed against my cash value in 2020 and reinvested it. e value has increased by more than 200% since. My family is protected for several millions while I can make my money continually work hard for me.

- Jun C.

A S S E S S ME N T

Aubitx Holdings will begin by sitting down with you to go over your current financial situation, your goals, interests, busineses, assets that can potentially be leveraged, and your risk appetite. Everyone’s situation is different, so we’d like to find out more about you which will help us formulate what we think is best for you and what will help you succeed.

LET ’S GET STARTED

BEST MATCH

Aubitx Holdings works with accountants, lawyers, insurance agents, and investors. We can match you with the right professionals or companies to give you the best products and financial advice.

We don’t view your finances with just one perspective, we take a holistic approach to take into account your financial needs now, in the future, and beyond.

LEGAL

We are financial compliance experts. We make sure our thorough assessment and recommendations for you will bring you the desired results, and in compliance with the CRA, bank regulations, Corporations Canada and the Canadian Securities Administrators. We have your covered from a legal standpoint.

10 THE FILIPINO NOW • FEBRUARY 15 - MARCH 15, 2022

AUBITX HOLDINGS

Freedom Truckers Convoy 2022

By: Thina Abando

By: Thina Abando

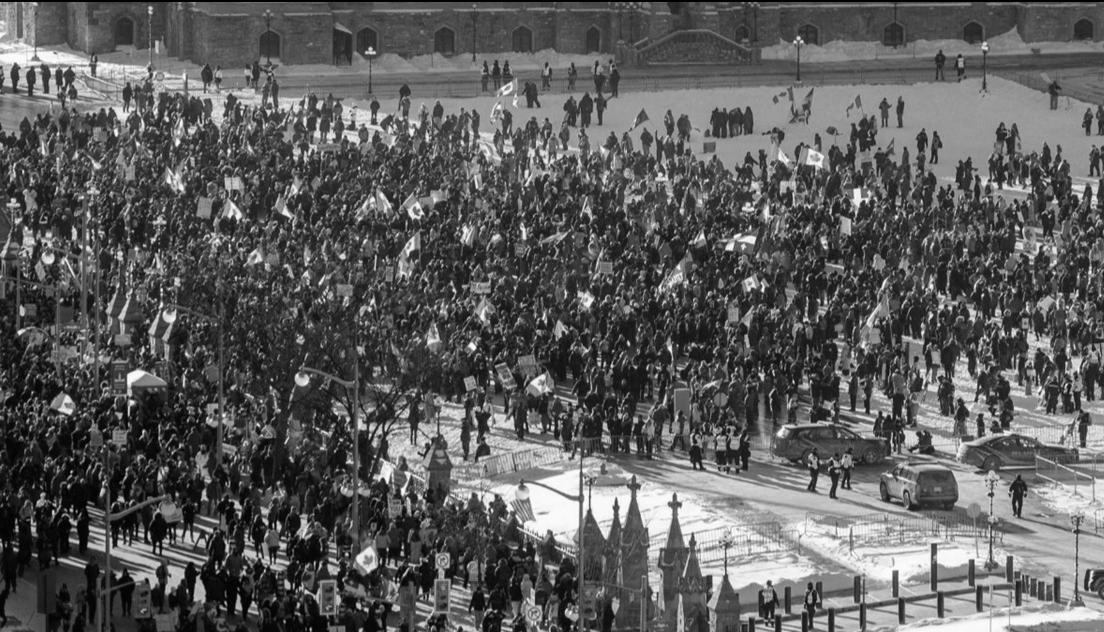

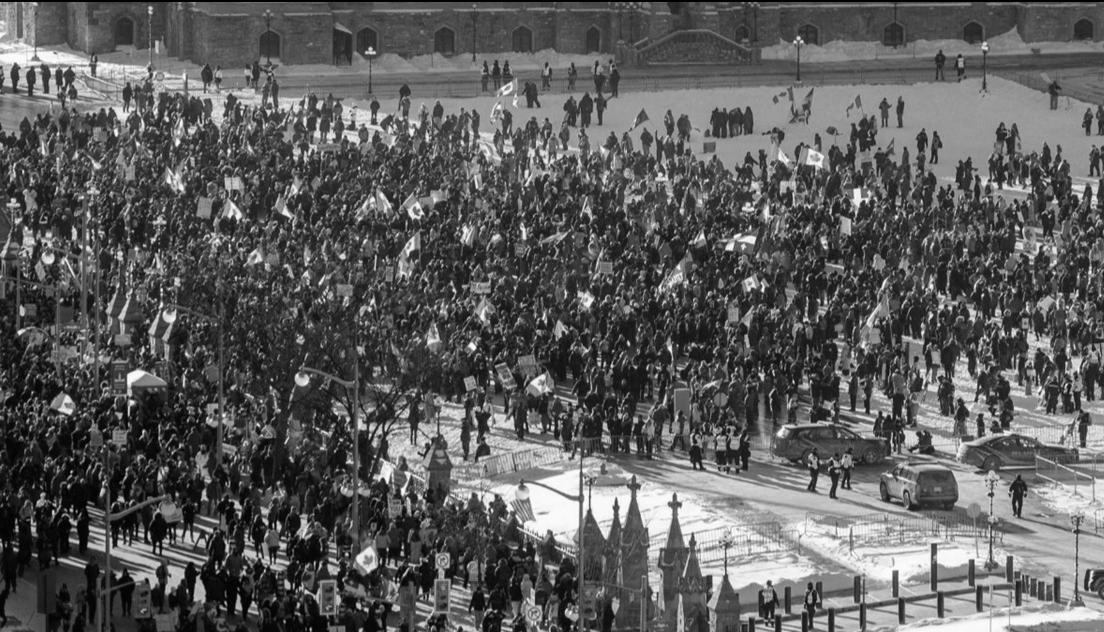

The seemingly endless Covid pandemic has taken a toll on everybody. Nobody knows how or when these absurd and deranged happenings will end or if there is an end in sight. The recent outcry of the logistics pros, our Canadian truckers, speak on behalf of those who are tired of it. These individuals have been voicing out their sentiments as their lives

with a frightening amount of power. With the new extreme measures introduced by the government, Canada now has the authority to freeze bank accounts of anyone or any activity that is associated with the convoy. As of now, banks across the nation have already frozen dozens of personal bank accounts, as well as e-wallets containing cryptocurrencies. GoFundMe has also permanently shut down Truckers Convoy donations and

have to go through with forced vaccinations. With no truckers allowed to travel between Canada and the US, the entire world becomes faced with the consequences of crippling supply chain issues.

This outcry has left the Canadian government in a bind. They want to suppress the rallies and cover up the fact that hundreds of thousands of people have already joined this fight for freedom of choice. It is clear that the democracy in Canada is at stake, giving from what we have seen already with the extreme measures introduced by the government. Citizens cannot take it any longer and especially do not want it to get worse. Despite all the challenges, friendly Canadians continue to stand for their democracy. These people are full of hope, they only want to fight for their rights. They just want peace, love, unity, and freedom.

have been drastically affected by the vaccine mandates set by the government, specifically from the mandatory vaccination requirements for truckers crossing the United States border providing essential goods for Canadians. The truckers’ outcry has gone beyond just mandates, however. This show of force by both unvaccinated and vaccinated truckers and supporters has put into light the effects of government restrictions and mandates on the nation and its citizens. The Canadians truckers are showing the world how to stand up against tyranny. They are standing up for freedom.

As mainstream media outlets suppress this developing news and in fact try to paint a picture of extremists and right-wing terrorists holding the city of Ottawa hostage, the masses have brought it out on the streets, gaining a lot of sentiment and even raising millions of dollars in donations from all over Canada and the US. Several issues have snowballed already, and now the GoFundMe donations, amounting to over $10M, has already gone viral, with the clamor for freedom catching the attention of people globally. Support has poured in from all directions with this movement gaining traction in countries such as Australia, New Zealand, France and many more – all fighting for the same cause, all fighting for freedom.

For the first time in Canadian history, the government introduced the Emergency Act, stripping the fundamental freedoms and rights of Canadians, granting the government

any subsequent pages raising funds for the cause. Furthermore, police are now able to arrest any citizen on the spot if they take part in the convoy.

What started as a peaceful protest to support the hardworking truckers, has turned into a political debate, resulting in an even larger divide within our country. The purpose of this peaceful protest was to raise awareness on the barrier’s truckers

11 THE FILIPINO NOW • FEBRUARY 15 - MARCH 15, 2022

NATIONAL

THE FILIPINO NOW • SPECIAL REPORT

Photo credits: Melissa Tait, The Globe and Mail 2022

Photo credits: Lars Hagberg / AFP

Photo credits: Adrian Wyld, The Canadian Press / Associated Press 2022

12 THE FILIPINO NOW • FEBRUARY 15 - MARCH 15, 2022

Dominica Bagunu, a well respected Filipino elder and an active community representative for the B.C. NDP for more than 30 years, was also present. Eula Stein, publisher of the Filipino Star Magazine, made sure the elderly attendees had their fill of warm coffee and were comfortably seated. Boni Barcia, the former vice president of the Hospitals Employees’ Union, also attended the event, along with his other volunteers, continuing his socio-civic endeavors.

Francisco and Zeala Cortes of Pintech Solutions also graced the event. They donated an ID unifying app to the BBM SARA campaign, which can issue IDs to supporters, scan IDs, send SMS text blasts and hold data of up to 20 million supporters. Montanya Anonuevo, the architect of the relationship database for the app could not make it to the event but was there in spirit nonetheless.

Stella Daza, the sister of Sandy Daza, was in charge

of distributing the BBM SARA campaign apparel. The red BBM SARA sweatshirt is a must-have for attending events like this.

Also present were community donors Mr. and Mrs. Nicanor, the Vancouver Tiktok TR headed by Rudy Garbiel, and Remie Delos Reyes behind the camera lens.

There were other BBM SARA events that took place in the last two months organized by other supporter groups and all well attended. From small, private indoor get togethers, all within the Provincial guidelines, to large park gatherings, the common theme was camaraderie.

As the sun began to set, the wind got colder, signifying the conclusion of the event, and the end of the beautiful sunny day. If it weren’t for the chilly weather, we probably would have stayed to chat for several more hours. There were meet ups that followed the Kapihan event. The hope and camaraderie we fostered carrying all of us together until the next event in March.

My Take: Covid Vaccines - Side Effects Include Death

By: Freddie Bagunu

The Covid plandemic has now been with us for over 2 years, ruining the world economy, and forcing hardships onto many. 70% of small and medium sized businesses have experienced either declining revenues or have had to permanently close shop, meanwhile billionaires are 54% richer. Close to half a billion people “tested positive” and 6 million deaths were reported as Covid related. After a closer look, one can see that early on in the pandemic, the statistics failed to mention and capture hospital reporting behavior. Insurance companies and WHO-funded government hospitals were financially incentivized to report deaths as Covid-related. If, for example, a person who died in a vehicular accident also tested positive for Covid, then they would be counted as a Covid death. There has always been questions on the accuracy of Covid testing. There’s the infamous story of the president of Tanzania, John Magufuli, secretly sending specimens from papaya, quail and goat to a lab testing for Covid and all results came back positive.

The statistics now show that there does not seem to be any letting up for both deaths and cases, despite the fact that 4.35 billion people (56% of the world’s population) are already fully vaccinated. Since May 2021, there have been at least 50,000 deaths weekly. The numbers have actually spiked to over 70,000 weekly since the end of January. Could it be that the deaths are coming from the experimental vaccine? Written on their published product inserts in very fine print are horrible side effects such as Thrombosis with thrombocytopenia syndrome (TTS),

Guillain-Barré Syndrome (GBS), Anaphylaxis, Myocarditis and pericarditis, and death. Coincidentally, my Facebook feed has an alarming amounts of RIPs, especially among males 20 to 75 years old, many dying from myocardial infarction (heart attack).

Dr. Bonnie Henry, British Columbia’s Provincial Health Officer, in a recent press conference expressed her usual doom-andgloom narrative and that other new variants can still come up. During Christmas, why did so many people test positive for the Omicron variant yet did not have any symptoms? Both vaccinated and un-vaccinated. Some reported symptoms of a mild cold. Are we to expect more experimental vaccine$ to be forced onto us once again that alter our bodies’ natural immune response through bio-engineering? In the guise of public safety? As I have reiterated in the past, this faulty strategy of forcing the use of this experimental jab is not making the situation better. Why aren’t we even looking into alternative treatments for the virus? Why are governments and the public succumbing to the scare tactics of vaccine$ advocates and big pharma? Why does the liberal media continue to downplay and condemn treatments using Ivermectin, Hydroxychloroquine, Colchicine, Fluvoxamine, Budesonide, among others. They even go as far as to label the doctors who have found these treatments to be more effective, as witch doctors and heretics. And label those who do try these alternative treatments and get better as illiterate and ignorant.

Is the general public even aware that in the USA, there have already been 16,310 deaths

and 778,685 reported cases of adverse side effects from the vaccine$ through October 1, 2021? And in Europe, the numbers are even worse. 38,983 deaths from Covid vaccine$ and 3,530,362 adverse side effects, through January 29, 2022. Do people also know that pharmaceutical companies are not liable for any deaths caused by these experimental vaccine$? That’s right, if you die as a result of any Covid vaccine, the manufacturer is not liable and cannot be sued.

In the name of “science” and “doing what’s right”, we have been coerced into become fearful and to just blindly obey medical and political authorities. Failure to comply has resulted in people losing their jobs, being prevented to freely move about, and being ridiculed in public and on social media. We are losing our rights to chose and decide for ourselves and are reduced to being lab rats. Hopefully before the end of 2022, Nuremberglike trials commence. Stand your ground. Look after yours and your families’ own health and well being. Enhance the immune system. Do not appropriate or squander your own power to some arbitrary institution to decide what’s best for you. Our leaders were elected to serve the people, not decree tyrannical mandates that only serve their own interests and that of the billionaire elites.

Sources: US CDC – Vaccine Adverse Event Reporting System (VAERS)

Eudra Vigilance – European database of suspected drug reaction reports Health Impact News

13 THE FILIPINO NOW • FEBRUARY 15 - MARCH 15, 2022

BBM-SARA >> From Page 1

02.08.2022

BBM-SARA 2022 KAPIHAN

Photo Credit: Remy Delos Reyes

ALIGNMENT MEETING 02.14. 2022

Photo Credit: Rudy Gabriel

BANKS VS. CREDIT UNIONS

By: Shaylan Stein

I

n Canada, the next best alternative to banks is the community Credit Union. Credit Unions have, over the years, stayed abreast with the ever-changing tides of the economy and the needs of their clients. They have proven to be not only a worthy opponent but also a top choice for current clients and prospects alike.

For those who don’t know the difference, below is a detailed comparison between Banks and Credit Unions in Canada.

Banks

Banking is a financial system in which institutions are regulated to accept deposits, lend money, and transfer funds. The Canadian central banking system classifies financial institutions into the following five categories; Chartered banks, The Cooperative Credit Movement, Insurance Companies, Trust and Loan Companies, and Securities Dealers. There are 5 major banks in Canada:

● Royal Bank of Canada (RBC)

● Bank of Nova Scotia (Scotiabank)

● Canadian Imperial Bank of Commerce (CIBC)

● Toronto-Dominion Bank (TD)

● Bank of Montreal (BMO)

The Chinese and Korean communities, because of their wealth and economic strength, no longer go through the Credit Union route. They have established several commercial banks here in Canada, to name a few: Bank of China, CTBC Bank, Industrial and Commercial Bank of China (ICBC), KEB Hana Bank of Canada and Shinhan Bank.

Credit Unions

A credit union is a type of financial cooperative that is member-owned. When you join a Credit Union, you buy shares in the organization. Credit Unions vary in size and provide most traditional banking services.

They are formed by organizations, large corporations, and other entities for their employees and members. Credit Unions are created, owned, and operated by their participants.

Alphonse Desjardins opened the first caisses populaires (people’s bank) in Quebec in the early 1900s. Desjardins is now an international financial institution based in Quebec, now worth $282 billion. To this day, Quebec is home to the most Credit Union members in Canada, followed by western Canadian Provinces and more than 700 credit unions across Canada.

Similarities

Credit Unions and Banks share many similarities. They are guided by similar regulations that govern mortgages, loans, and security. When it comes to financial products, they are almost identical. Credit unions, over the years, have done a fantastic job of evolving to meet the exact needs of customers just as banks. Both entities seamlessly execute Checking accounts, Savings Accounts, Loans, Credit Cards, Mobile Banking and ATM facilities.

Differences

Banks are privately held, usually by investors, and shares can be sold to another party. Credit unions are member-owned. The profit in credit unions are passed on to members while surplus in banks serves as a return on investment for shareholders. Credit unions are memberfocused, and banks are focused on profits.

Another major difference is clientele. Banks are very accommodating. Anyone with proper identification can open a bank account. On the other hand, Credit Unions are traditionally comprised of members bound by a common bond, such as working in the same industry or living in the same community, or are a member of a specific community. Some credit unions in past years have been less restrictive, extending their services to outside persons through membership fees. Others have chosen to remain exclusive to the point that new members require a formal referral from an existing member.

Banks have more customer service options but credit unions offer a more personalized customer experience.

Credit Unions have more customer-centric interest rates, lower for borrowing and higher for deposits. Banks have the opposite. Credit unions have lower banking fees than their traditional banking counterparts; however, they also have fewer product offerings.

Top 5 Credit Unions In Canada

● Desjardins Financial

Group

● Vancity

● Coast Capital Savings Credit Union.

● Meridian Credit Union.

● First West Credit Union (Includes Envision Financial)

A COMPREHENSIVE REVIEW PUBLIC ANNOUNCMENT

Ethnic based (as a common bond) credit unions have been established all over Canada. Even smaller communities such as the Estonians, Lithuanians and Ukrainians have their own credit unions. The deposits of the Ukrainian credit union is over $1Billion. The South Asian communities even have credit unions by denomination, as is the case with Khalsa Credit Union, whose common bond is the Sikh community, and whose assets top $600M and generate a net income of close to $5M annually.

The Filipino community, which is the 3rd largest visible minority group in Canada, unfortunately has never had its own credit union, despite having thousands of Filipinobased societies, associations and associations of associations throughout Canada. It is high time the Filipino community stepped up with its own credit union to support Filipino businesses, trade between Canada and the Philippines and bank the unbanked in the community.

14 THE FILIPINO NOW • FEBRUARY 15 - MARCH 15, 2022

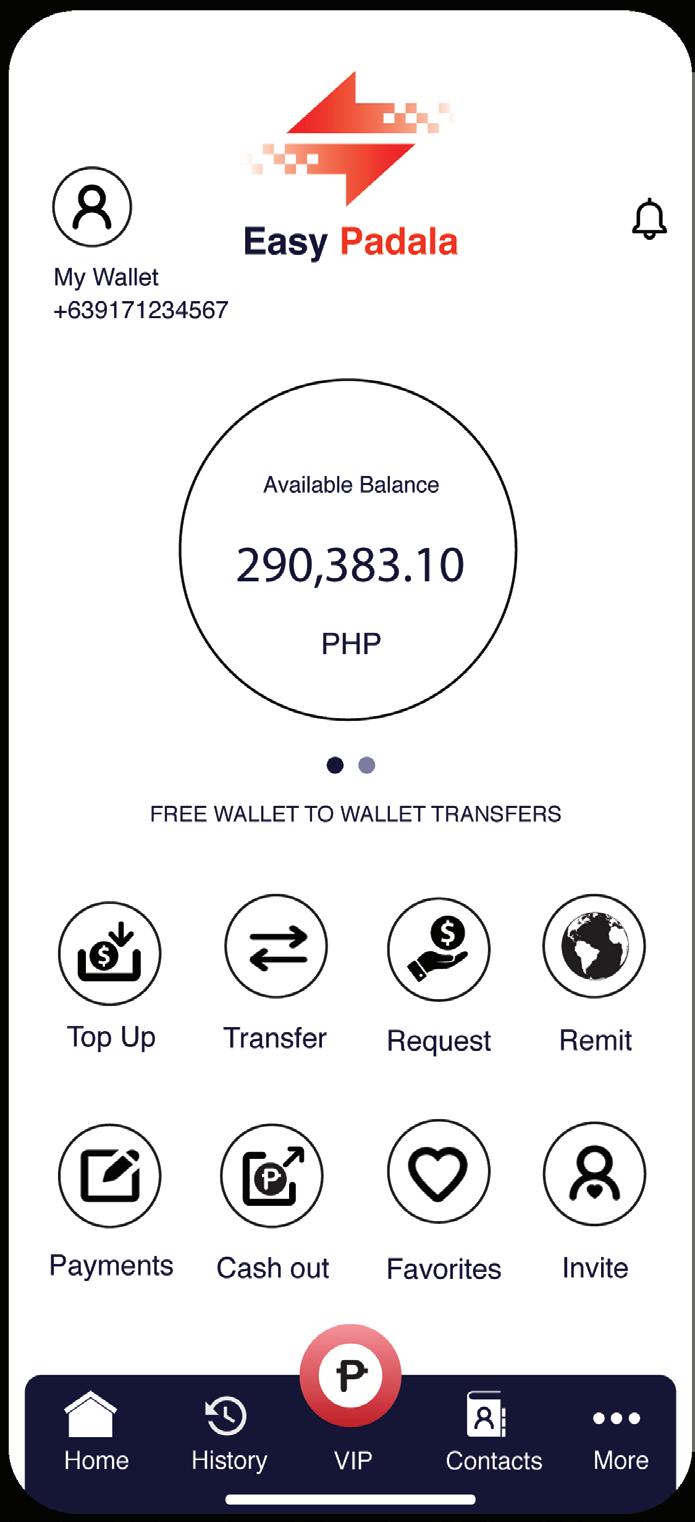

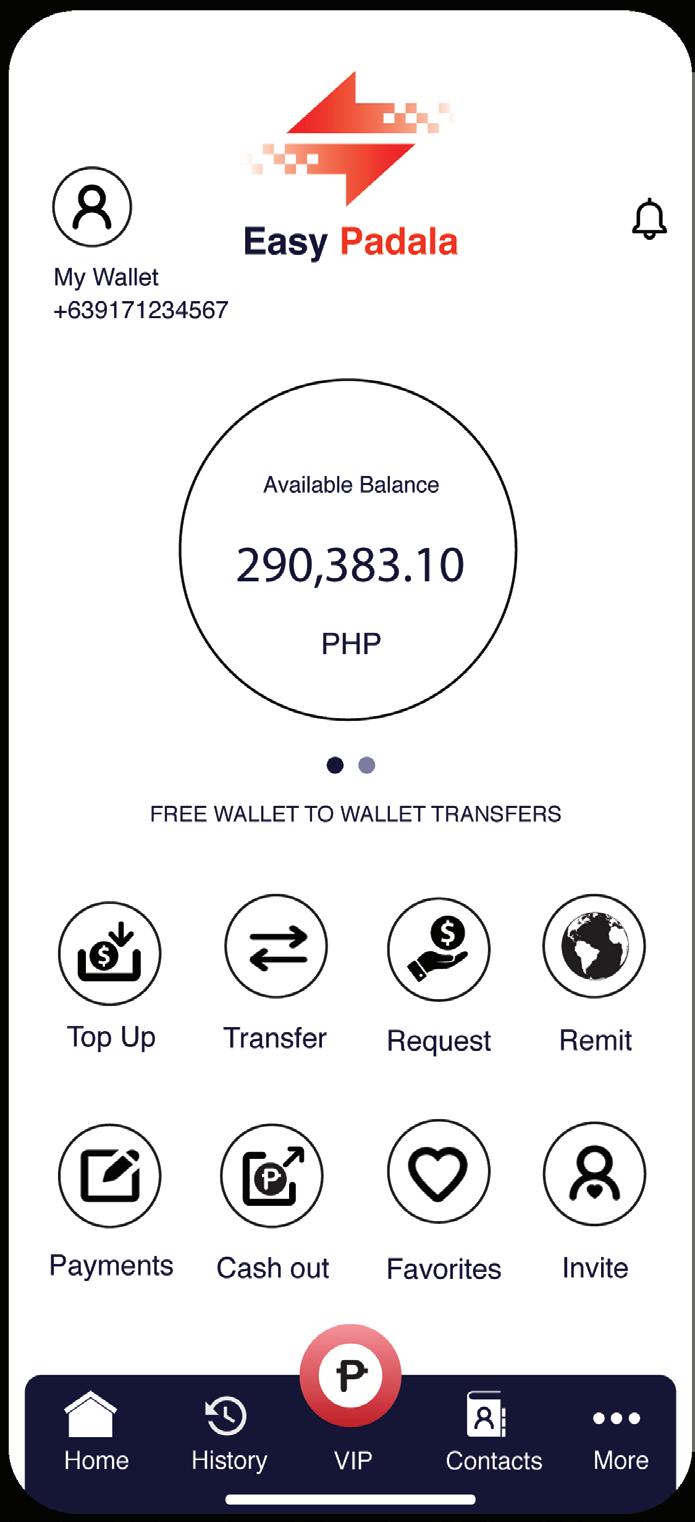

15 Easy Padala App Papindot-pindot, paupo-upo na lang, pwede nang mag-remit sa Pilipinas! Now made Easy ang pagpa Padala... eLoad your wallet using your favorite remittance agent eLoad your wallet via e-transfer to eload@easypadala.com FREE Peso transfers to other Easy Padala users Pay your bills like Meralco, SSS, Smart, Globe With a 1-time balance of P1M, you are instantly upgraded to the Maharlika VIP Business Account. Earn from your Peso balance by providing remittance & instant eLoad services. Earn half of the transaction fee and forex spread. STAY TUNED 04.01.2022

Polytechnic University of the Philippines (PUP) and was conceptualized by Mr. Bong de Guzman, a corporate accountant in Chicago, Illinois USA, and Mrs. Eula Buan -Stein, the publisher of Filipino Star Magazine Canada. They have selflessly donated their time, money and effort for this cause to unite Filipinos.

They have also reached out to their networks, friends and families to put together an organizing platform for BBM SARA supporters to pursue the course of unity through Filipino big tech innovation. The software, mobile app, text messaging (SMS) broadcasting system, website, hosting and social media cam paigns were all sponsored by Pintech Solutions.

We humbly ask anyone and everyone to be a part of this movement, “Sama sama tayong babangon muli!” All information gathered

ID Photo with White Background ID Photo Passport Photo Maker ID Photo Type in the search tab Install... Facebook Messenger Send via Now you can take an ID photo for the BBM-SARA 2022 ID for you and your friends... 1 2 Maaring magkaroon ng BBM-SARA 2022 ID nasaan ka man! Ipadala lamang ang ID photo, personal information at sagot sa 4 question survey sa Team Darud or BBM International Facebook page! 3 4 VOLUNTEER TEAM DARUD 1. Ano sa palagay n'yo ang pinakakailangan ng inyong lugar sa Pilipinas? 4. Ano po ang masasabi ninyo sa consular office sa inyong lugar? Needs improvement Good Poor performance Very good Agriculture Fisheries Transportation Health care Drinking water Livelihood projects Power & electricity Telecommunications Public infrastructure All of the above Weekly Monthly Occasionally 3. Anu-anong proyekto ang sa palagay ninyo makakatulong guminhawa ang inyong pamumuhay sa Pilipinas? 2. Nagpapadala po ba kayo ng remittance? Gaano kadalas? e.g. Cebu Trabaho Sagutan ang nasa ibaba... International BBM BBM International is an informal group of Filipinos residing abroad who want to give back and be a part of building a better Philippines. The group is spearheaded by graduates of Ramon Magsaysay High School and

are private and confidential. All data are encrypted and will not be shared with any third party. Ipadala lamang ang personal na impormasyon at kasagutan sa survey. www.e-leksyon2022.com

By: Arianne Pioquinto

By: Arianne Pioquinto

By: Thina Abando

By: Thina Abando