FIDIC Future Leaders –Planning, procuring and delivering tomorrows infrastructure

A FIDIC Conference Booklet prepared by the FIDIC Future Leaders Advisory Council

September 2025

A FIDIC Conference Booklet prepared by the FIDIC Future Leaders Advisory Council

September 2025

I am pleased that the Future Leaders Advisory Council (FLAC) is represented strongly at the 2025 FIDIC Global Infrastructure Conference through a newly revamped session on the Sunday entitled “FIDIC Insight to the Future and FLMC 2025 Workshop Presentation,” previously the Future Leaders Symposium.

The aim of this rebrand will be to attract more people to attend the Sunday programme and further expand the reach of the Future Leaders’ session.

The FLAC and the conference provide the opportunity for the future leaders of our industry to participate actively in FIDIC with their peers and to develop as the next generation of leaders in the consulting engineering and wider infrastructure sector. This publication forms part of this remit. It is important that Future Leaders’ voices are heard if the industry is to move towards the UN sustainable development goals (SDGs), net zero and beyond whilst incorporating new technologies, challenges and uncertainties.

This year marks another important milestone and a first for us. Not only is it the ninth year of publishing our booklet, but we have continued the successful trend from 2024 where we published, not just one, but three booklets around different themes. What an achievement!

I would like to take this opportunity to thank those that lead the Future Leaders Advisory Council before me, the team around the FLAC and the secretariat at FIDIC, who have all supported the bold aim for this programme to go from an ambitious idea to the achievement it is today.

The three booklet themes this year, I believe, represent the breadth and importance of the challenges we are facing. They are:

• Planning, procuring and delivering tomorrows infrastructure.

• Advancing infrastructure and engineering sustainability

• Infrastructure in an increasingly diverse and digital society

We are now only five years away from the 2030 SDGs goals and net zero is also increasingly just over the horizon. The work we are doing today will form part of our net zero future and so it is important we are proactive in everything we design to meet such a goal.

Meeting global net zero targets will require a fundamental transformation of the infrastructure sector, both in the way assets are designed and in how they are delivered, maintained and operated.

Achieving these goals demands not only technological innovation but also systemic change across procurement, supply chains and regulatory frameworks. In this context, the role of young professionals and future leaders becomes increasingly significant, as they bring new perspectives, adaptability and a willingness to challenge traditional approaches.

Young professionals are entering the sector at a pivotal moment, with the opportunity to influence infrastructure planning, design and delivery in ways that lock in low-carbon outcomes for decades to come. Their familiarity with emerging digital tools, data analytics and sustainable materials provides an advantage in accelerating the adoption of greener solutions. Moreover, their active engagement in cross-disciplinary collaboration, working across engineering, environmental science, policy and finance will all play a key role in helping to bridge the gaps between sectors.

To fully realise this potential, the sector must invest in developing the skills, confidence and influence of its emerging workforce. This involves creating structured opportunities for young professionals to contribute to strategic decision-making, providing access to mentoring and leadership programmes and fostering workplace cultures that reward innovation and climate-conscious thinking.

Equally, industry leaders and policymakers must ensure that future leaders are empowered to take bold, evidence-based decisions, even when these challenge established norms. By equipping the next generation with the tools, authority and platform to lead, the infrastructure sector can better navigate the transition to net zero.

The conference theme, Smart Infrastructure: Equality, Resilience and Innovation for a Sustainable World, could therefore not be more apt or vital at such an important time. We hope that you enjoy reading the articles that FIDIC’s Future Leaders have prepared and find the content and context both interesting and valuable as we move towards a more sustainable, equitable and possibly technology-driven future.

Acknowledging the seriousness of the challenges we face in the sector, the FIDIC Future Leaders Advisory Council wanted to provide a platform for future leaders in the consulting engineering industry to share, reflect and come forward with new ideas or challenges.

We invited future leaders to reflect on the challenges and how we can not only approach the future but also consider that a different approach will also have additional or new benefits to economies, societies, and nature as a whole.

It is important that as a sector and as a society, individuals look forward to the opportunities in the V-U-C-A (volatility, uncertainty, complexity, and ambiguity) world despite how it impacts consulting engineering, infrastructure development, attraction, retention and development of Future Leaders.

We would like to highlight the contribution of those authors selected by the FLAC for inclusion in this booklet. They have provided us with opinions, experiences and innovative ideas on how to evolve and adapt to future challenges and opportunities.

Authors:

• Jacqueline Sampah-Adjei, Ghana

• Wojciech Szewczak, United Kingdom

• Sajeela Ghaffar, United Arab Emirates

• Makafui Senyo Ahianyo, Ghana

• Lorena Oliveira, Brazil

• Thiago Melo, Brazil

• Francisco Diniz, Brazil

Jacqueline Sampah-Adjei is an environment and sanitary engineering specialist and the manager for partnership and business development at Constromart. She holds an MSc in water sanitation and health engineering from the University of Leeds and a BSc in environmental science from KNUST. Jacqueline is a FIDIC Certified Consulting Professional and a member of the International Water Association and the American Society of Civil Engineers. She is also an alumna of the FIDIC Future Leaders Management Course. With a focus on water and sanitation solutions in developing countries, Jacqueline has worked on various multilateral development bank projects, including landfill design, e-waste management solutions, and organic waste management technology.

In addition to her professional work, she is actively involved in industry development initiatives, such as serving on the FIDIC Africa committee for integrity, quality, risk and standards and being vice president of the Ghana Consulting Engineers Future Leaders group. She is also a member of the IWA young water professionals steering committee.

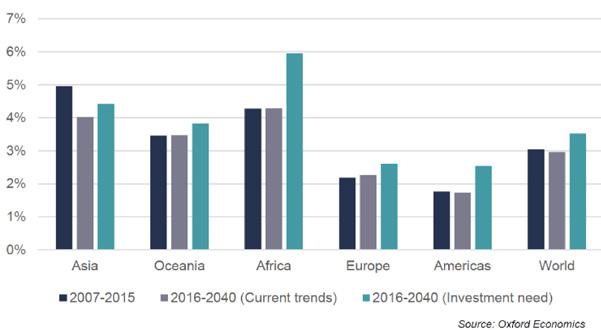

Infrastructure development has become a necessity for economic development and social uplifting1, yet unfortunately it is also frequently associated with corruption, environmental degradation and community displacement. Globally, the need for infrastructure investmentis forecasted to reach $94 trillion by 2040. In Africa alone, the magnitude of its infrastructure financing gap, estimated at $68–$108bn annually2, has intensified pressure to mobilise both public and private capital to meet this growing demand.

The current financing environment, however, often prioritises speed and scale over sustainability and inclusivity. The global shift toward ESG-aware investing offers an opportunity to redefine the role of infrastructure finance3. By embedding ESG principles in upstream project preparation, midstream procurement and downstream delivery, countries, especially in Africa, can ensure that infrastructure not only meets immediate development needs but does so in a way that is transparent, equitable and environmentally sound. This paper therefore explores how ESG can be integrated meaningfully into infrastructure financing systems in developing economies. This study adopts a qualitative research approach, combining documentary analysis, case study evaluation as well as expert commentary to excplore how ESG principles can be effectively integrated into infrastructure financing.

1. The World Bank. 2019. Understanding Poverty. Infrastructure Finance (worldbank.org)

2. Oxford Economics. 2017. Infrastructure Investment needs 50 countries, 7 sectors to 2040. Global Infrastructure Outlook.

3. Brickstone. (2025). Implementing ESG in infrastructure projects in Africa. Brickstone Africa, Webinar

Contextualising ESG in infrastructure landscape for developing countries

Integrating ESG principles in developing economies cannot simply mimic global north models. These contexts are shaped by institutional fragility, overlapping mandates, contested land rights and political entanglements in infrastructure delivery. Furthermore, ESG relevance is rising, driven by global investor pressure, multilateral development banks and emerging precedents like AfDB’s green bonds and performance-based oversight in Nigeria and Ghana.

While frameworks such as the World Bank’s Environmental and Social Framework and IFC Performance Standards guide this shift, organisations like FIDIC help translate ESG from theory into actionable project management. Ultimately, ESG in infrastructure is not just about compliance, it represents governance innovation. It serves as a risk management tool, a sustainability-based procurement filter and a performance accountability framework4.

The transformative potential of environmental, social and governance (ESG) integration in Africa’s infrastructure landscape is most clearly demonstrated through the case studies outlined below. While ESG frameworks can appear abstract, often necessitating adaptation to local contexts, the practical experience of projects such as the Lake Turkana wind power project in Kenya and InfraCredit in Nigeria offer tangible examples of how ESG principles, when rigorously applied, can unlock capital, de-risk projects and enhance developmental impact.

These projects often align with global best practices articulated by bodies like the World Bank's sustainable infrastructure series and the African Development Bank's own environmental and social safeguards policies.

Lake Turkana wind power project: Social license and environmental stewardship5

The $700m Lake Turkana wind power project initially faced local scepticism due to historical marginalisation and environmental concerns. Through transparent stakeholder engagement, robust social and environmental assessments and benefit-sharing initiatives the project-built community trust and established legitimacy. Governance-wise, the project aligned with international ESG standards, managed land rights proactively and maintained open stakeholder communication. This approach attracted major international financing from institutions like AfDB and the European Investment Bank and positioned the project as a leading example of ESG-aligned renewable infrastructure in Africa, now providing nearly 17% of Kenya’s electricity.

InfraCredit Nigeria: Institutionalising ESG in financial guarantees6

InfraCredit Nigeria plays a pivotal role in closing the infrastructure financing gap through a credit enhancement model that enables access to long-term local currency debt. Its robust ESG framework is integral to risk assessment and project selection, focusing on long-term value and minimal externalities rather than mere compliance. This has earned InfraCredit the trust of ESG-conscious investors and DFIs aligned with global standards like the IFC Performance Standards. Projects it supports benefit from reduced financing costs, stronger stakeholder trust and greater operational resilience.

4. Impact Africa Consulting. (2025). ESG and its importance in the infrastructure sector

5. Bhebhe, B. D. (2024). Banking on renewables: Kenya Turkana Wind Power Project and its challenges for community development. Power Shift Africa & Recourse.

6. Oyugi, E. C. A. (2021). Integration of ESG—Environmental, Social and Governance—Policies in Africa. In Sustainable Infrastructure for Cities and Societies (pp. 123–140)

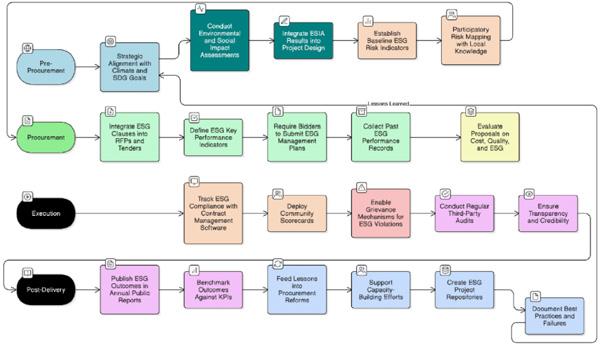

To adequately integrate ESG principles in infrastructure already developed, this study proposes a phased framework adapted for infrastructure ecosystems. This proposed ESG-integrated procurement framework is grouped into four phases.

• Pre-procurement focuses on aligning infrastructure projects with national climate strategies and SDGs.

• Conducting early environmental and social impact assessments and establishing ESG risk baselines through local and participatory methods.

• Procurement embeds ESG by including relevant clauses and KPIs in tender documents, requiring bidders to submit ESG management plans and past performance.

• Evaluating bids using a triple-bottom-line approach.

During execution, ESG compliance is monitored using contract management software, community scorecards, grievance mechanisms and third-party audits. In the post-delivery phase, ESG outcomes are published, lessons inform procurement reforms and capacity-building and project repositories capture best practices and failures as illustrated above in figure 2.

Drawing from the case studies and literature, the application of this ESG framework should include:

• Align national procurement and infrastructure policies with global ESG standards to reduce regulatory fragmentation.

• Ministries and infrastructure agencies should create dedicated ESG units with cross-sector mandates.

• Governments and contractors should be required to report ESG metrics using standards such as the GRI or SASB.

• MDBs and national development banks should prioritise concessional funding for projects that meet ESG benchmarks.

• Establish platforms for governments, investors, academia and civil society to co-create ESG tools and share knowledge.

The integration of ESG principles into Africa’s infrastructure financing is no longer a peripheral consideration - it is a strategic necessity. As this paper has demonstrated, ESG-aligned infrastructure projects are more resilient, socially inclusive and financially attractive, yet the path to integration is fraught with institutional, financial and technical challenges.

Through the lens of stakeholder theory, institutional dynamics and sustainable development imperatives, we have shown that a phased, context-sensitive ESG strategy can unlock transformative potential. Africa’s infrastructure future hinges on its ability to attract long-term capital while safeguarding environmental and social interests. ESG is the bridge between these imperatives.

Wojciech Szewczak is an associate director at KEO International Consultants, driven by a passion for building sustainable futures through impactful ESG strategy and advisory. With over a decade of experience, he has helped organisations embed ESG into core business decisions, transforming sustainability challenges into long-term value and competitive advantage. Currently, he leads ESG advisory services across the UK, Europe and the Middle East, with a focus on the real estate and infrastructure sectors. His approach combines in-depth regulatory expertise with commercially grounded, actionable solutions tailored to diverse markets. He is an active member of the FIDIC Future Leaders Advisory Council and in 2024, he was recognised in the ‘35 Under 35 in Sustainability’ list and received the Outstanding Achievement Award at the FIDIC Future Leaders Awards 2023 in Singapore for his leadership in influencing the UK infrastructure sector.

Climate change is no longer a distant risk, it is a present and accelerating reality. Infrastructure worldwide is facing growing exposure to extreme weather conditions, rising temperatures and unpredictable rainfall patterns. Events such as floods, heatwaves and droughts are becoming more intense and frequent posing serious challenges to the durability, safety and performance of infrastructure assets. Many Infrastructure networks are still not adequately prepared to handle these climate-related disruptions.

The concept of resilience, referring to the capacity to foresee, withstand and recover from adverse events, has emerged as a key focus area. Integrating climate risk assessments can support more informed planning and investment decisions, helping infrastructure stay operational and relevant in the face of increasing climate uncertainties.

Climate risk assessments as a resilience tool

Climate risk assessments are essential tools that help identify, quantify and manage the threats posed by a changing climate. These threats fall into two broad categories - physical risks (e.g. extreme weather, sea level rise, temperature shifts) and transition risks (e.g. regulatory changes, carbon pricing, market shifts). Both can impact infrastructure performance, costs, and lifecycle outcomes.

Through climate risk and vulnerability assessments, engineers and planners can pinpoint asset-specific vulnerabilities and prioritise targeted interventions. These assessments inform climate-adapted designs, robust maintenance strategies and resilient investment decisions, ensuring that infrastructure delivers value over the long term.

Innovation is transforming how these assessments are conducted. Digital tools, including GIS mapping, remote sensing, AI-based risk modelling and digital twins, now enable real-time scenario analysis and long-range forecasting. By integrating these tools early in the project lifecycle, stakeholders can simulate climate scenarios and develop data-driven responses that reduce risk and enhance adaptive capacity.

The resilience agenda: A cross-cutting framework

Resilience is not just an engineering challenge, it is a systems-level imperative. Effective climate-resilience demands collaboration across disciplines and sectors.

• Finance Investors and insurers increasingly require climate risk data to assess asset value and manage liabilities. Resilient infrastructure is viewed as a lower-risk, long-term investment.

• Nature Nature-based solutions like wetlands, permeable surfaces, and green roofs, not only mitigate climate risks but also provide co-benefits such as biodiversity enhancement and urban cooling.

• Digitalisation Smart infrastructure integrates sensors and data analytics for early warning, remote monitoring and performance adjustments. This agility is central to adaptive resilience.

• Policy and Regulation Governments are embedding climate resilience into policy frameworks, mandating disclosure, adaptation planning and risk accountability.

Together, these elements form a cross-cutting resilience agenda. It is no longer sufficient to focus solely on strengthening physical components, resilience must be embedded in how infrastructure is financed, designed and operated.

The role of disclosure frameworks

Climate risk has traditionally been seen as a technical or environmental issue. Still, frameworks like the Financial Stability Board’s task force on climate-related financial disclosures (TCFD) have elevated it to the strategic and financial level. TCFD requires organisations to assess climate risks through scenario analysis, disclose those risks publicly and ensure board-level oversight of climate-related governance and strategy.

By integrating climate risk into mainstream reporting, TCFD helps bridge the gap between engineers and financiers. It translates technical climate risks into material financial impacts, making it easier for decision-makers to justify investment in resilience. TCFD’s global adoption is accelerating as it underpins disclosure requirements and is increasingly being adopted across the European Union (EU). Aligning with the TCFD means understanding how physical risks impact asset performance, as well as how to effectively communicate those risks to funders, regulators and communities.

In the EU, climate resilience has evolved from an aspiration to an obligation. A wave of new regulations now mandates that infrastructure projects assess and disclose climate risks as a condition of market access, funding and classification under ‘green’ standards.

Key among these is the Corporate Sustainability Reporting Directive, which requires companies to report on both physical and transition risks, as well as their adaptation strategies. The EU taxonomy for sustainable activities similarly defines climate risk assessment and resilience planning as prerequisites for projects to be deemed environmentally sustainable.

Under the Sustainable Finance Disclosure Regulation, investors are required to evaluate and disclose the climate resilience of their portfolios, thereby creating indirect pressure on infrastructure developers and operators. The EU Adaptation Strategy sets the direction for the coming decades, with a goal of fully climate-resilient infrastructure by 2050.

Sajeela Ghaffar is an ESG specialist at KEO International Consultants, supporting the clients in the Middle East and Europe to progress in their sustainability journey within the real estate and infrastructure sectors. Currently contributing to internal ESG reporting, strategy and business development within the KEO ESG team, she brings extensive experience across multiple sectors and continents.

Her experience spans working in academic research, private sector, public entities and donor agencies on sustainability, environmental and social impact assessments and monitoring, and evaluation for infrastructure and urban planning projects. Sajeela holds multiple credentials in ESG and sustainability which she continuously builds upon to supplement hands-on learning and keeps pace with the dynamic ESG landscape.

The UAE is acutely vulnerable to climate-related risks including rising sea levels, increasing temperatures and humidity, intensifying dust storms and unusual thunderstorms that pose a direct risk to its coastal infrastructure and economic stability. With over 85% of the population and more than 90% of the infrastructure situated within several meters of current sea level along coastlines7, the country faces significant physical and transition risks that could impact asset valuations, financial markets and regional economic dynamics8

The UAE has established itself as a regional climate leader, becoming the first MENA country to commit to net zero by 2050. Building on various policy, legislative and institutional instruments, including the UAE Green Agenda 2015-2030 and National Climate Change Plan 2050, the government passed two landmark pieces of legislation in 2024 that transform climate governance from voluntary commitments to mandatory compliance, cementing the path for a structured climate transition.

Federal decree-law No. 11: A regulatory framework for climate action

Federal decree-law No. 11 on the reduction of climate change effects, that came into force in May 2025, applies to all public and private entities including free zones. The law mandates all entities climate action through emissions measurement and reduction (MRV), climate adaptation planning and research and innovation.

The Climate decree-law (11) is supplemented by cabinet resolution No. 67 which establishes a national carbon credit registry for domestic and international carbon trading. The latter mandates registration for entities emitting above 0.5 MtCO2e in Scope 1 and 2 annually, while entities falling below this threshold (“participating entities”) may register voluntarily creating market-driven decarbonisation mechanisms. The requirement to measure emissions, develop adaptation plans aligned with national targets and report their progress annually, signifies a shift on national level from aspirational sustainability goals to concreate legal obligations. The Decree-Law (11) also sets out to incentivise innovation in technologies for reducing emissions using mechanisms such as carbon offsetting, emissions trading and adopting shadow prices of carbon.

Implementation challenges: Non-compliance carries significant financial penalties ranging from AED 50,000 to AED 2 million, alongside reputational risks that can trigger investor pressure, drop in market share, and falling behind industry peers. Beyond regulatory penalties, companies face technical expertise gaps, cost implications from upfront costs to set up compliance systems and transitional learning curve to integrate climate considerations into project delivery methods.

Strategic opportunities: Early adopters can gain first-mover advantages in a rapidly evolving market by positioning themselves as regional innovation leaders and set international benchmark. Also, enhanced brand positioning opens access to green finance, sustainable investments and premium project opportunities as clients are increasingly prioritising proactive partners in climate and ESG. On the other hand, non-compliant companies may face exclusion from major projects as clients are conducting stricter ESG due diligence to protect their own regulatory standing and reputation.

Compliance and implementation: To meet compliance requirements by May 2026, infrastructure developers and construction firms need to swiftly conduct baseline emissions assessments to determine threshold status and establish comprehensive MRV systems. Real estate developers and contractors that are already proactive in their ESG reporting or green certifications can leverage existing systems to that end. Project teams should consider integrating climate risk assessments into all project planning phases and implementing digital monitoring infrastructure for accurate emissions tracking.

Revision and updating of contract templates can be undertaken to include climate compliance clauses and clear MRV responsibility allocation between developers, contractors and consultants, while procurement strategies should prioritise sustainable materials and circular waste management practices to meet mandated reduction targets.

Long-term value: Further to compliance, proactive developers and construction leaders can leverage the regulatory framework to generate revenue and competitive advantages. They can actively participate in:

• Carbon credit trading to create new income streams for large-scale infrastructure projects.

• Invest in carbon management platforms (SaaS tools).

• Build staff technical capacity to enhance project value propositions for environmentally conscious investors and end-users.

This will potentially result in increased long-term asset values as green buildings command higher rents and sale prices.

Developers can further maximise their compliance investments by aligning MRV systems with evolving green building certifications such as LEED v5 and benchmarking frameworks such as GRESB, which increasingly prioritise emissions reporting in their scoring methodologies, hence effectively streamlining operations to meet multiple certification requirements across project portfolios simultaneously.

Looking ahead: The UAE's climate legislation represents a fundamental shift from voluntary sustainability to mandatory climate accountability in infrastructure development. Companies already engaged in ESG reporting, commitments, pledges, sustainability certifications or benchmarking (e.g. LEED and GRESB), will be well-positioned to meet these requirements, while SMEs will likely need additional technical support and capacity building.

As the industry prepares for the May 2026 deadline, further guidance from the UAE Ministry of Climate Change and Environment is expected to clarify implementation specifics, with the legislation's true impact becoming evident as companies begin their reporting cycles and demonstrate whether this framework can successfully transform the regional construction sector and where gaps arise in terms of both policy and implementation level.

As the UAE sets a regional precedent in climate legislation, neighbouring GCC countries are likely to follow suit, creating a unified regulatory landscape that rewards early preparation. Infrastructure developers and construction firms that view this transition as a catalyst for innovation rather than a compliance exercise, will establish themselves as leaders in the region's sustainability pathway. Also, the compliance strategies, as well as market shift by UAE companies, will serve as case studies to learn from for other regional industry peers and regulators.

Makafui Senyo Ahianyo is a civil and transportation engineer who is passionate about delivering sustainable and efficient infrastructure solutions in Ghana. He holds a BSc in civil engineering from Kwame Nkrumah University of Science and Technology. Makafui currently works at DELIN Consult as a graduate engineer, where he specialises in traffic modelling, feasibility studies and site supervision for diverse infrastructure projects.

He has experience using advanced tools such as SIDRA Intersection, PTV Vissim and AutoCAD for traffic analysis and design optimisation. His previous roles at the Department of Urban Roads involved road inventory, traffic safety assessments, and supervision of speed calming measures across Greater Accra.

Makafui is committed to integrating innovative, people-centred solutions to enhance urban mobility and safety. He has attended conferences on urban sustainability and circular economy and is known for his diligence, teamwork and adaptability in complex engineering environments.

Cities across West Africa, including Accra, are experiencing growing traffic congestion that affects productivity and quality of life. Existing traffic management approaches, which rely on fixed signal timings and manual interventions, are reactive and unable to meet today’s mobility demands.

This paper outlines a framework that combines Artificial Intelligence (AI) forecasting with the simulation capabilities of SIDRA Intersection software to enable proactive traffic control. AI processes real-time traffic data to anticipate conditions and detect incidents, while SIDRA evaluates alternative management strategies before implementation. This integrated approach can reduce delays, lower emissions and strengthen resilience, demonstrating that AI-based traffic management is an achievable step towards sustainable mobility in Accra and similar urban contexts.

Accra’s rapid growth has increased congestion, especially on arterial and collector roads. Fixed-time traffic signals fail to adapt to changing conditions and manual police interventions offer only a temporary relief, highlighting the systems limitation. Addressing these challenges requires smarter, data-driven solutions. Advancements in digital technologies provide opportunities to modernise traffic systems. The integration of internet of things (IoT) devices, Big Data analytics, and AI can transform static networks into adaptive systems that improve traffic flow, safety, and environmental performance. Adopting these tools is crucial for developing transport systems capable of responding to current needs while remaining adaptable for future challenges.

Case study context: Traffic management challenges in Accra

Accra, Ghana’s capital city, experiences congestion at intersections like Mallam Junction, Kaneshie First Light, Legon Okponglo Junction and Madina Zongo Junction. This is driven by rising vehicle ownership, inadequate traffic signal optimisation, limited public transport efficiency and encroachment of informal activities along roadsides. Fixed-time traffic signals often fail to respond to the demand and manual traffic control remains a common reactive measure, highlighting the urgent need for predictive and data-driven management.

The proposed traffic management framework integrates three main components data collection, AI-based prediction and simulation using SIDRA Intersection.

Data collection forms the foundation of the system. Modern traffic data collection has evolved from manual counting methods to diverse technologies providing a real-time view of conditions. AI-powered cameras count and classify vehicles, detect pedestrians and estimate queues. Connected vehicle data and anonymised GPS information provide continuous updates on speeds, travel times and congestion hotspots. IoT and environmental sensors add context, capturing air quality, noise and weather conditions essential for safe and sustainable management.

AI models form the analytical core, transforming data into actionable insights. Time-series forecasting models, such as long short-term memory (LSTM) neural networks, use historical and real-time data to predict traffic volumes and speeds 15–60 minutes ahead9, enabling early adjustments to traffic signals and produces interventions before congestion builds. Anomaly detection models establish baselines for normal traffic and monitor deviations, identifying incidents like accidents or stalled vehicles faster than manual observation. Automating detection and forecasting improves situational awareness and speeds up decision-making.

SIDRA Intersection acts as the virtual testing environment. AI predictions, such as anticipated congestion or detected lane blockages, are converted into simulation inputs within SIDRA. The software tests various control strategies, evaluating them based on level of service (LOS), delays, queues, stops and environmental impacts like fuel consumption and emissions, ensuring chosen strategies align with sustainability goals.10

The workflow operates in sequence. Real-time data is collected continuously and analysed by AI models to generate forecasts and detect incidents. These predictions are translated into SIDRA simulation inputs, testing alternative management strategies such as signal optimisation or diversion of routes. Outputs are evaluated against objectives, including reducing delays or emissions, before the optimal strategy is deployed to traffic signals. This proactive approach manages conditions before severe congestion occurs, enhancing efficiency and resilience.

Adopting this framework has several benefits. Sustainability goals are supported through reduced fuel consumption and emissions, contributing to climate commitments and promoting green infrastructure.11 Faster incident response improves network resilience, while smoother traffic flow enhances public transport reliability, encourages shifts away from private vehicle use and reduces exposure to air pollution for pedestrians and cyclists.

Implementation challenges include initial investments in sensors and AI infrastructure, developing local expertise, ensuring data privacy and cybersecurity and building political commitment for long-term strategies.1 These challenges can be addressed through coordinated planning, capacity-building programmes and cross-sector partnerships.

Traditional reactive traffic management methods are no longer sufficient for the complexities of modern cities. Combining AI’s predictive analytics with the detailed simulations of SIDRA Intersection provides a practical path toward proactive traffic control in Accra and similar urban areas.

This approach shifts traffic management from reactive to preventive, creating transport systems that are efficient, sustainable, resilient and equitable. It is now up to engineers, planners and policymakers to drive this transformation. The future of urban mobility in West Africa is within reach and it must be built with intention and the right tools.

9. IEEE Access, Artificial intelligence applications in transportation systems: A review, 2022

10. Australasian Transport Research Forum, SIDRA Intersection and SIDRA TRIP: Overview of traffic, environmental and fuel consumption models, 2011

11. Renewable and Sustainable Energy Reviews, Big data driven smart energy management: From big data to big insights, 2016, https://doi.org/10.1016/j.rser.2015.11.050

Lorena Oliveira is the quality and innovation director and a unit director at TPF Engineering, with nearly ten years of experience at the company. She holds a PhD in production engineering and a master’s degree in civil engineering from the Federal University of Pernambuco. She also completed postgraduate studies in project management at the Getúlio Vargas Foundation and in advanced topics in business management at Pearson College London.

Lorena is certified in PMP, ACP and Scrum Fundamentals, with expertise in project management, quality and BIM. In addition to her role at TPF Engineering, she serves as an educator at the Project Management Institute, coordinates the Innovation Committee at ABCE and mentors at Porto Social.

Thiago Melo is a civil engineer graduated from UFPE and the Technical University of Berlin, with a master’s degree in energy efficiency and a specialisation in sustainability and decarbonisation strategies. With over ten years of experience, his career spans various fields within consulting engineering, from project development to contract management.

Currently at TPF Engenharia, he works as a sustainability consultant, supporting clients in achieving their sustainability goals by reducing costs, optimising processes and mitigating climate and ESG-related risks, transforming challenges into opportunities.

A passionate advocate for innovative solutions that merge technology and sustainability, he believes that a focused and technical approach can ensure fair and sustainable development for all.

Francisco Diniz is a civil engineer graduated from the Catholic University of Pernambuco, he has built a career marked by dedication and excellence in project management. He joined TPF Engenharia in 2015, where he has established a solid and distinguished professional path. He currently holds the position of product manager, leading strategic solutions in the company’s major contracts.

One of the key milestones in his career is his role in managing Proexmaes II, a comprehensive programme aimed at strengthening the public healthcare network in the State of Ceará. Within this contract, he was recognised for his innovative approach by developing the “Automated Construction Logbook,” a tool that modernised and optimised the technical monitoring of works, earning him an internal award. His work reflects a strong commitment to efficiency and digital transformation in public engineering.

The rapid urbanisation process in Brazil has led to a significant housing deficit, primarily concentrated in areas of high social vulnerability. Addressing this demand requires more than just building housing, it requires the development of territories that promote quality of life, inclusion and resilience. The ProMorar programme, led by the Ministry of Cities and implemented by the Recife City Hall, aims to upgrade Social Interest Communities.

This paper presents the methodology applied to the housing project of the Coque Areinha community, comprising 120 units on a 5,770 m² plot in the southern zone of Recife. The proposal sought to balance the pillars of environmental, social, and economic sustainability by using climate simulations and geospatial data to analyse implantation alternatives. The final decision was guided by a multicriteria analysis aligned with the territory and the community’s needs.

The methodology was structured to comparatively assess three alternative layouts for the housing blocks. Proposals 1 and 2 were developed to enhance the efficiency of natural ventilation by orienting the buildings according to the prevailing wind direction. Proposal 3 was designed to optimise land use by expanding the open spaces on the plot.

The orientation and layout of the housing blocks were evaluated using indicators derived from the sustainability methodology of the Inter-American Development Bank’s Investment Monitor (IDB, 2022). The attributes were adapted to the scope of the study, enabling a more targeted and concise analysis of the results. This approach allowed optimisation of critical parameters such as cross-ventilation, solar exposure and natural lighting use.

Additionally, the local climate of Recife, the plot’s geographic position and the surrounding urban characteristics were considered to understand their impact on the performance of the proposed alternatives. The simulations were conducted using the Autodesk Forma platform, which enables quantification of previously qualitative variables like ventilation and solar radiation, based on specific climatic and spatial data.

Based on these data, the proposals were assessed and scored from 0 to 5 across five criteria - natural ventilation, solar exposure, natural lighting, acoustic comfort and potential for renewable energy generation. This method enabled an objective comparison between the alternatives, supporting the selection of the configuration with the best integrated environmental performance.

The three proposals demonstrated distinct performances across the evaluated criteria. Proposal 1 achieved the best overall performance, with 25 points, receiving maximum scores in natural ventilation, solar exposure, natural lighting, acoustic comfort and photovoltaic potential.

Proposal 3, with 18 points, performed moderately, standing out in natural lighting, whereas proposal 2, with 10 points, showed significant limitations, especially in ventilation, thermal performance, and natural lighting.

TABLE 1: SUMMARY OF INDICATORS AND RESULTS BY PROPOSAL

NATURAL VENTILATION

SOLAR EXPOSURE (THERMAL)

NATURAL LIGHTING (DAYLIGHT)

URBAN NOISE (ACOUSTIC COMFORT)

PHOTOVOLTAIC ENERGY POTENTIAL

Assessment of the presence of cross-ventilation in the units, considering the number of buildings benefitted. This indicator is related to thermal comfort and the reduction of reliance on mechanical cooling systems.

Analysis of solar incidence simulations on facades during representative days of the year. Areas exposed to the afternoon sun were considered unfavourable due to increased nighttime discomfort and energy consumption. Therefore, morning sun exposure was prioritized.

Estimation of natural light utilization based on the Vertical Sky Component (VSC); values above 27% indicate adequate levels, reducing the need for artificial lighting and promoting energy efficiency and visual comfort.

Simulation of road noise propagation based on the Average Daily Traffic (ADT) of surrounding roads, assessing the acoustic adequacy of the units according to sound intensity, as per ABNT NBR 10151:2019.

Calculation of the potential solar generation on rooftops, considering 60% of the roof area for energy generation, to estimate the energy self-sufficiency level of the development.

The results show that Proposal 1 stood out for adopting efficient passive strategies, such as cross-ventilation and favourable solar orientation, ensuring comfort with minimal reliance on artificial systems. All proposals demonstrated the potential to generate up to 296,000 kWh/year in solar energy, contributing to energy efficiency and operational cost reduction which is an essential factor in socially vulnerable areas.

The ProMorar Coque Areinha study confirms the effectiveness of using climate simulations and multicriteria analysis in urban planning for social interest communities. Proposal 1 achieved the best overall performance, showing that passive strategies combined with digital tools such as Autodesk Forma allow for integrated evaluation of climate and contextual impacts on the project.

Beyond environmental gains, the adopted model generates tangible social benefits. It reduces energy and cooling costs, enhances residents’ wellbeing and promotes equity in vulnerable contexts. Thus, housing becomes a tool for inclusion, resilience and social justice.

This approach allowed for the optimisation of thermal and acoustic comfort from the design phase, resulting in solutions better aligned with the population’s socioeconomic conditions. The adopted model is replicable, feasible and socially just, offering a concrete pathway to sustainable urbanisation. Aligned with FIDIC principles and the sustainable development goals, the project contributes to more inclusive, resilient and energy-efficient cities.

FIDIC, the International Federation of Consulting Engineers, is the global representative body for national associations of consulting engineers and represents over one million engineering professionals and 40,000 firms in around 100 countries worldwide.

Founded in 1913, FIDIC is charged with promoting and implementing the consulting engineering industry’s strategic goals on behalf of its member associations and to disseminate information and resources of interest to its members.

FIDIC member associations operate in around 100 countries with a combined population in excess of 6.5 billion people and a combined GDP in excess of $30tn. The global industry, including construction, is estimated to be worth over $22tn. This means that FIDIC member associations across the various countries are worth over $8.5tn.

This document was produced by FIDIC and is provided for informative purposes only. The contents of this document are general in nature and therefore should not be applied to the specific circumstances of individuals. Whilst we undertake every effort to ensure that the information within this document is complete and up to date, it should not be relied upon as the basis for investment, commercial, professional or legal decisions.

The views expressed in any contributions and/or articles made by third parties and/or individuals are those of the author and do not necessarily reflect the views or positions of FIDIC.

FIDIC accepts no liability in respect to any direct, implied, statutory and/or consequential loss arising from the use of this document or its contents. No part of this report may be copied either in whole or in part without the express permission of the authors in writing.

Copyright FIDIC © 2025

Published by

International Federation of Consulting Engineers (FIDIC) World Trade Center II P.O. Box 311 1215 Geneva 15, Switzerland

Phone: +41 22 568 0500

E-mail: fidic@fidic.org

Web: www.fidic.org