INTRODUCTION TO TITLE & ESCROW

WHAT TO EXPECT THROUGHOUT THE TRANSACTION

TIPS FOR A SMOOTH CLOSING

At Fidelity National Title, we are committed to the successful closing of your real estate transaction by guiding you through the title and escrow process. Your team at Fidelity National Title is proud to provide this resource to aid in understanding title insurance and the escrow process. We are committed to offering you the guidance and support you need every step of the way.

With over 150 years in the title industry, Fidelity National Title, through our family of companies, offers you the financial strength, experience and expertise needed to close your transactions with confidence and complete peace of mind.

This guide has been prepared to give you an overview of the process involved during the purchase or sale of a property and also to explain the various roles we will play in helping you as you move toward the successful close of your transaction

We hope you find this information helpful in the process of a smooth and successful transaction. Please feel free to contact us at any time with your questions or need for additional information.

_____________________________________________________________________________________

Escrow Number: ______________________________

Loan Number: ______________________________

Estimated Closing Date: ______________________________

Inspection Date: ______________________________

Other Notes: _____________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________

Wiring Instructions: _____________________________________________________________

ALWAYS CALL BEFORE YOU WIRE!

Wire fraud is on the rise, and Fidelity National Title urges our clients to CALL BEFORE THEY WIRE and NEVER rely solely upon email communication.

Always follow these two simple steps:

STEP 1: Ensure you have the phone number of your real estate broker and your Fidelity National Title escrow closer (as soon as an escrow is opened).

STEP 2: Call the phone number you wrote down from STEP 1 above to speak directly with your Fidelity National Title escrow closer to confirm wire instructions PRIOR to wiring. If you receive alternative wiring instructions appearing to be from Fidelity National Title, be suspicious as we NEVER change our wiring instructions. Wire instructions will never be sent, requested or accepted via email.

Real Estate Agent: Title & Escrow:

Name: ___________________________________ Name: ___________________________________

Company: ________________________________ Company: Fidelity National Title

Address: _________________________________ Address: _________________________________

City/ST/Zip: _______________________________ City/ST/Zip: ______________________________ Phone/Fax: _______________________________ Phone/Fax: Email: ___________________________________ Email ____________________________________

Lender: Home Warranty:

Name: ___________________________________ Name:

Company: ________________________________ Company: ________________________________

Address: _________________________________ Address: __________________________________

City/ST/Zip: _______________________________ City/ST/Zip: Phone/Fax: _______________________________ Phone/Fax: _______________________________

Email: ___________________________________ Email

Home Inspection: Insurance Company:

Name: ___________________________________ Name: ___________________________________ Company: ________________________________ Company: ________________________________ Address: _________________________________ Address: City/ST/Zip: _______________________________ City/ST/Zip: _______________________________ Phone/Fax: _______________________________ Phone/Fax:

Email: ____________________________________ Email ____________________________________

Like all insurance, title insurance exists to minimize the risk to an investment. More specifically, it provides the basic and essential protection for home ownership. Since a home purchase is usually the largest single financial investment most people make in their lifetime, the importance of fully protecting this investment cannot be overemphasized. Rely on Fidelity National Title for protection when purchasing real property.

Title insurance differs from conventional insurance in the following ways:

• It protects the insured from future losses arising from events of the past.

• The premium is a one time fee paid at issuance.

• The Owner’s policy remains in effect for as long as the owner and their heirs retain interest in the property. The Lender’s policy expires when the mortgage has been fully satisfied.

There are two main categories of risk that Title insurance covers:

• Hidden hazards (forgery, fraud, impersonator, incompetence of grantor or mortgagor, unknown heirs, etc.) which cannot be detected in the examination of title.

• Human Error - it’s a fact of life that people over time have made errors on documentation that affects title to a property, and title insurance protects from issues arising from these defects.

The role of the title company is to search for and examine public records. The facts uncovered will determine:

• Whether the person selling the property is or is not, in fact, the legal owner of the property.

• That the “estate” or degree of ownership being sold is currently and accurately vested with the seller.

• The presence of any unsatisfied liens which must be satisfied before “clear title” can be conveyed.

• Existing restrictions, easements, rights of way or other rights granted to others who are not owners which may limit the right of ownership.

• The status of property taxes and other public or private assessments.

Title insurance is actually a process...with the insurance policy being the end product.

This process starts with a comprehensive search of public records to determine if any liens or other encumbrances are attached to the title. During the search, detailed information from potentially hundreds of sources is gathered and reviewed, including tax records, court judgments, deeds and an evaluation of whether the property characteristics are accurately reflected by the information on the title. Not surprisingly, one in four title searches uncovers some problem that must be rectified prior to closing.

Protecting purchasers against loss is accomplished by the issuance of a title insurance policy, which states that if the status of the title to a parcel of real property is other than as represented, and if the insured suffers a loss as a result of title defect, the insurer will reimburse the insured for that loss and any related legal expenses, up to the face amount of the policy.

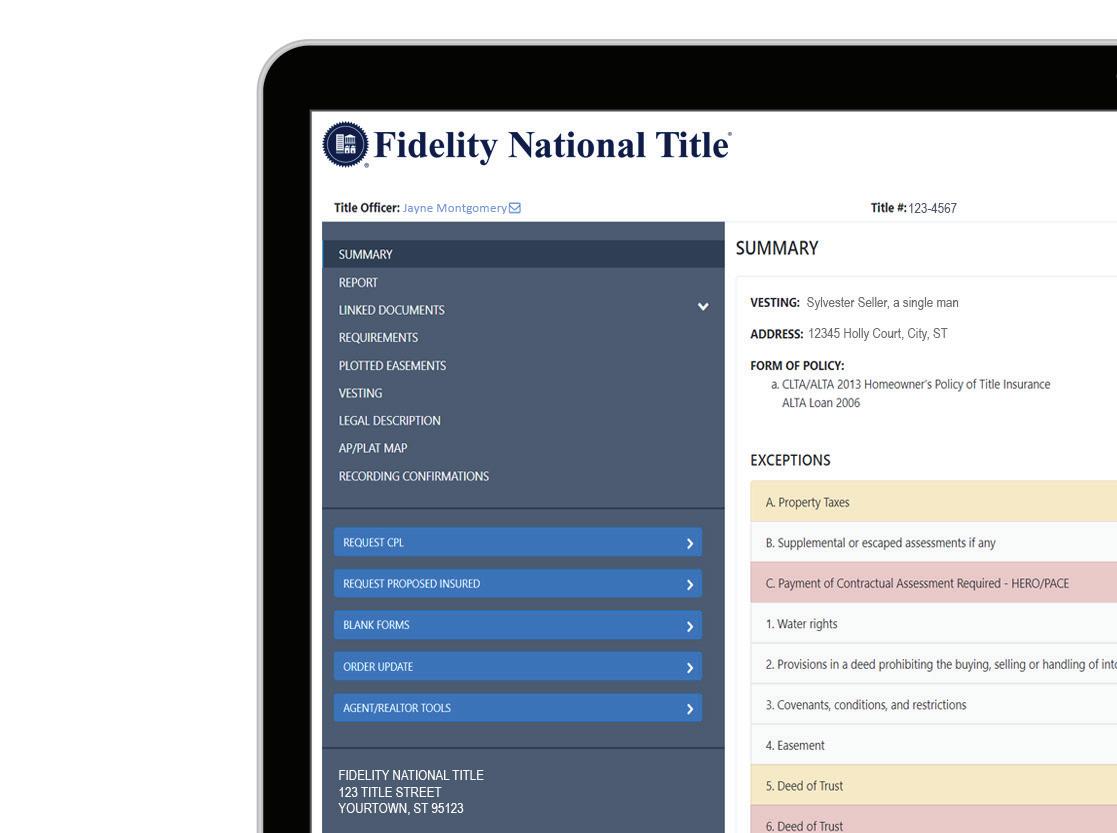

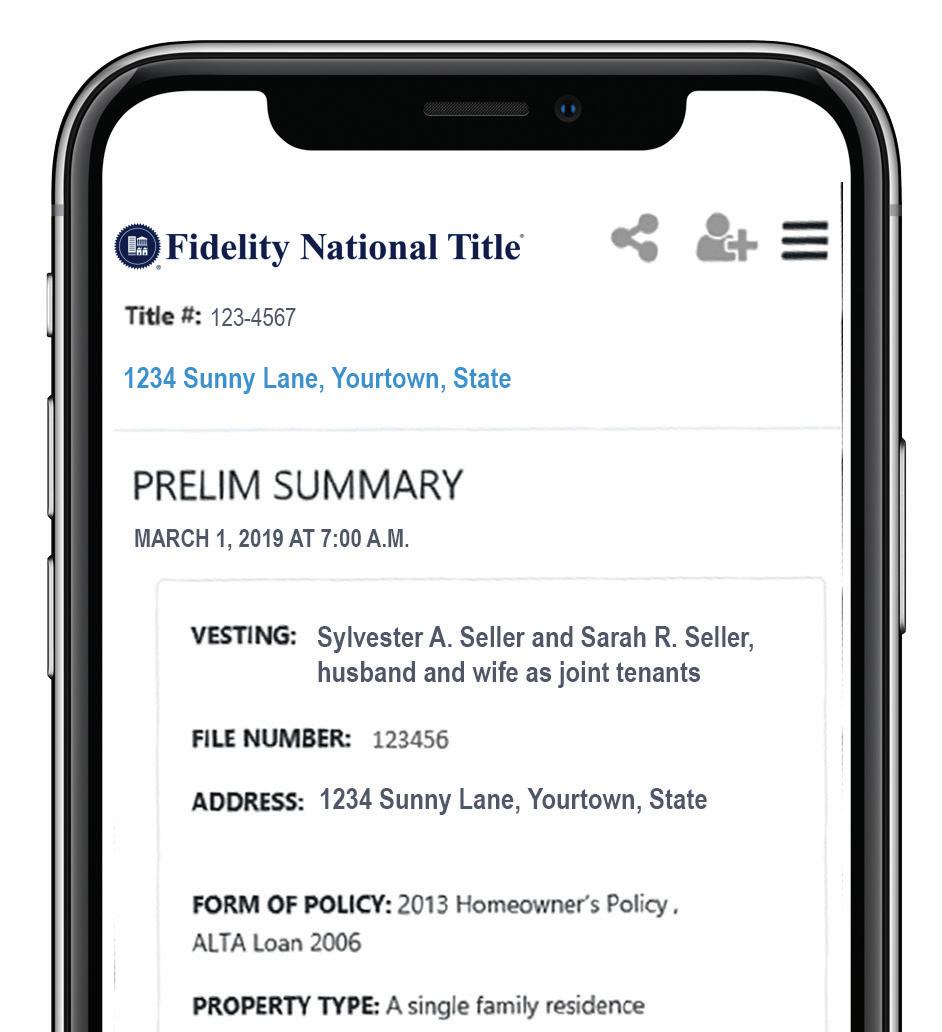

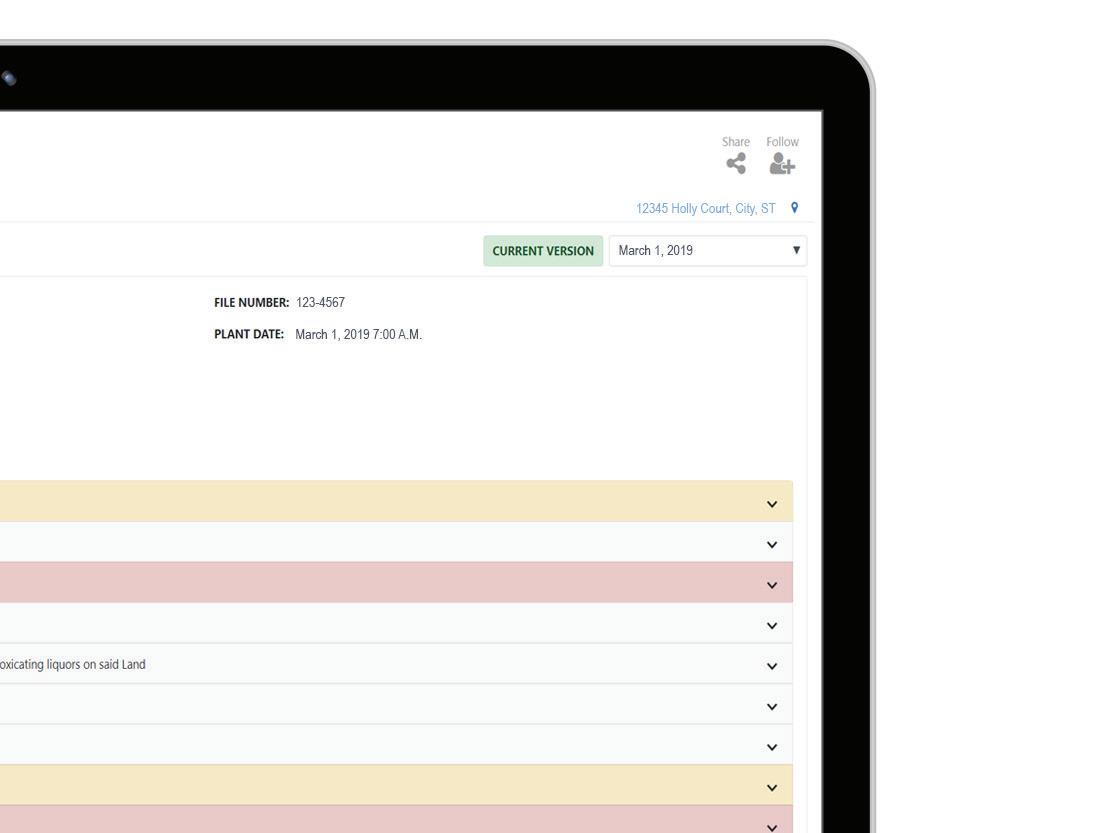

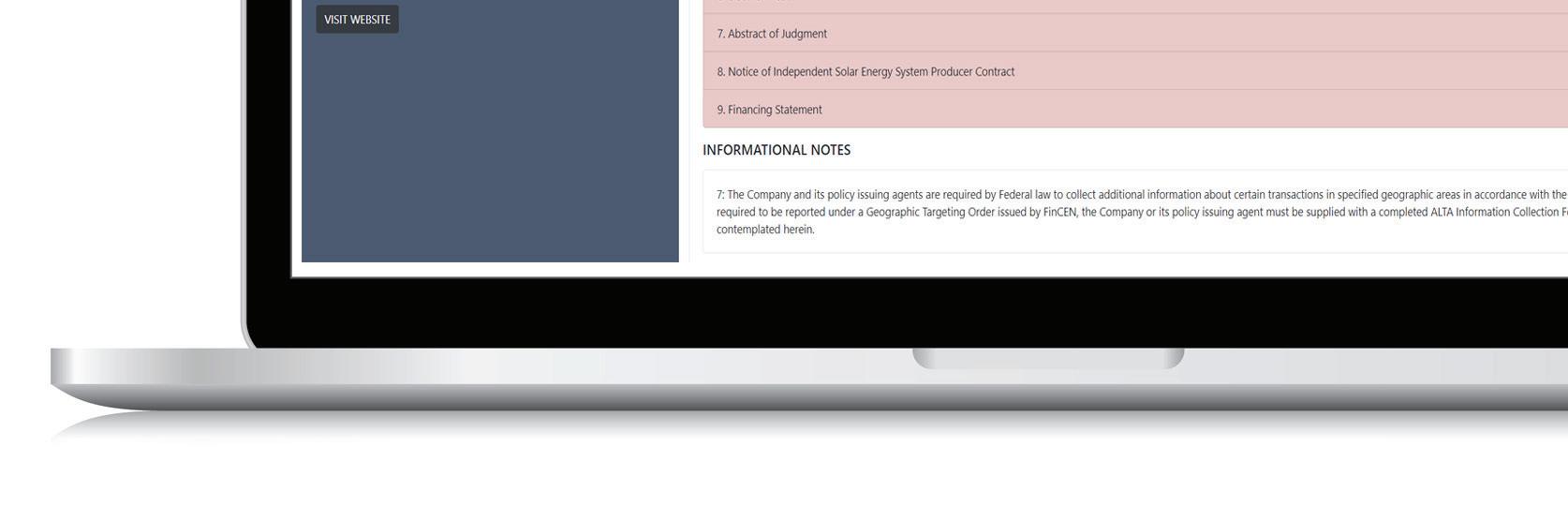

The title search meticulously seeks out and evaluates any known indication of the primary hazards that can cloud title and result in risk for a prospective home buyer. When the commitment to title insurance report is received, there will be an option to review the standard PDF file or the new interactive version via our supercharged, title document delivery system...LiveLOOK.

A “title commitment” is a dated formal report that sets out, in detail, the conditions under which a policy of title insurance would be issued on a particular parcel of land. Its sole purpose is to facilitate the issuance of the policy.

1. Everything needed in relation to the title insurance transaction is available in a well-organized, easy-to-access, centralized location online.

• Is the buyer’s name reflected on the commitment appropriately and exactly as they would like to take title?

• Ensure the purchase price and/or loan amount are reflected accurately on the commitment.

2. The summary page lists any red flag (hazards) warnings that may impede the closing.

3. The title report is web-based and accessible from any device at any time.

4. Clients can easily access linked documents, vesting, maps, etc.

5. LiveLOOK is easy to navigate from a smartphone.

• Are there easements, covenants or other restrictions on the commitment that can impact the way the buyer intends to use the property?

• Is the title commitment up to date? If the report is more than a few weeks old, contact us to see if there are any changes or supplemental reports that have been issued.

For questions on how to access the LiveLOOK title report or learn more about what to look for, please contact one of our experienced title o��icers at 800-776-3021.

A “Value Proposition” is the unique value a product or service provides to a customer. It describes the benefits the product delivers. In this instance, the value proposition will answer the question: Why is this worth the money?

1. Title insurance protects the interests of property owners and lenders against legitimate or false title claims by owners of lien holders. It insures the title to the investment, unlocking its potential as a financial asset for the owner.

2. At Fidelity National Title we access, assemble, analyze and distribute title information, in addition to handling escrow and closing.

3. Potential title problems are discovered in more than one-third of residential real estate transactions. These “defects” must be resolved prior to closing. The most common problems are existing liens, unpaid mortgages and recording errors of names, addresses or legal descriptions.

4. A homeowner’s title insurance policy protects the owner for as long as they have an interest in the property, and the premium is paid only once at closing.

5. Title insurance is different from other forms of insurance because it insures against events that occurred before the policy is issued, as opposed to insuring against events in the future, such as health, property or life insurance. Title insurance is loss prevention insurance.

6. Fidelity National Title performs a thorough search of existing records to identify all possible defects in order to resolve them prior to issuing a policy. We perform intensive and extensive work up-front to minimize claims. The better we do this research, the lower our rate of claims, and the more secure the level of protection.

7. Researching titles is extremely labor-intensive since only a small percentage of public records are computerized. The industry invests a substantial amount of time and expense to collect and evaluate title records. As a result, there are relatively fewer claims compared to other lines of insurance.

With origins that can be traced back 150 years, Fidelity National Title Insurance Company, through its underwriting subsidiaries, is one of the nation’s premier real estate service companies, providing title insurance and other real estate-related products and services.

8. Fidelity National Title’s impressive claim reserves provides unquestionable security and peace of mind knowing the policy is backed by a leader in the industry.

9. Dollar for dollar, title insurance is the best investment a buyer can make to protect their interest in one of the most valuable assets they own: Their Home.

10. To get the best value, choose Fidelity National Title for ALL your Title and Escrow needs. Write us in on your next transaction, and see why we are trusted everywhere, every day.

In Washington State, we have 5 common ways title can be held to real property. The descriptions on this page are for general reference purposes only to provide assistance in understanding the differences. For additional information, please contact our experienced Title Officers with questions.

A person who is not married or a registered domestic partner.

A person who is married or a registered domestic partner who holds title without a spouse or registered domestic partner. Fidelity National Title typically requires the non-participating spouse or registered domestic partner to execute a Quit Claim Deed in order to relinquish their possible interest in the property.

The Revised Code of Washington (RCQ 26.16.030) defines community property as property “acquired after marriage or after registration of a state registered domestic partnership by either domestic partner by either domestic partner; or either husband or wife; or both”, unless acquired by gift, bequest, devise, descent, or inheritance, or with the rents, issues and profits thereof.

Two or more people have interests (not as community property or joint tenants) in the property. The individual interests do not need to be equal, but the sum total of the interests must equal 100% (i.e. Fred Smith, an unmarried man, as to an undivided (73% interest, and Anne Jones, an unmarried woman, as to an undivided 27% interest). The interests of each tenant-in-common passes to his or her heir(s) at law upon death.

Two or more people have equal interests in the property and the deed by which they take title must specify that the property is “held as joint tenants, with rights of survivorship”. Unlike tenancies-in-common, when a coowner dies, his or her ownership interest automatically passes on to the other co-owners. Evidence of intent, signed by the grantees, is generally necessary.

Fidelity National Title has a rich history of serving its customers with accuracy, e��iciency and unequaled �inancial strength to back their title insurance policies.

Please visit FidelityWA.com for a complete chart showing a deeper comparison of the three forms of coverage below.

The Homeowner’s Policy is only available on single family homes to fourplexes. It must be owned by a “natural person” and not an entity, such as a corporation or an LLC. In addition to the protections offered in the Standard Policy, the Homeowner’s Policy extends coverage beyond the issue date.

Policy coverage examples include:

• The land can’t be used because use as a single family residence violates an existing zoning law or regulation.

• The owner is forced to remove an existing structures which encroach onto an easement or over a building set-back line even if the easement or building set-back line is excepted in the title policy.

• A neighbor builds any structure after the policy date, other than boundary walls or fences, which encroach onto the covered property.

• Both actual vehicular and pedestrian access to and from the land based upon a legal right is not available.

Fidelity National Title provides homeowners peace of mind by protecting their interest in the property and their investment.

The Owner’s Standard Policy will cover the buyer against issues that could be discovered by an examination of Public Record.

Policy coverage examples include:

• A document upon which the title is based was not properly filed, recorded or indexed in the Public Records.

• Someone else has a right to limit use of the land.

• Someone else claims to have rights affecting title arising out of forgery or impersonation.

• Someone else owns an interest in the title.

The Extended Owner’s Policy offers the most extensive title insurance as it covers not only matters of Public Record but also insures issues that are revealed as a result of a physical inspection or survey of the property. This is commonly issued for high value residential properties, large parcels of vacant land and commercial properties.

Policy coverage examples include:

• The owner is forced to remove an existing structure(s) because they encroach onto a neighbor’s land.

• Someone else has a legal right to, and does, refuse to perform a contract to purchase the land, lease it or make a mortgage loan on it because a neighbor’s existing structure(s) encroach onto the land.

Why is Homeowner’s Title Insurance Policy the default option for buyers on a Purchase & Sale Agreement? Below are 7 True Stories to explain the benefits.

1. The Parents buy a new house and then go on a month long cruise. Son decides to forge his parents’ signature quit claiming their house to him. Son then takes out a second loan on their house and never makes any payments. The second loan goes into foreclosure. The Parent’s standard owner’s title coverage doesn’t cover forgeries after the date of their policy. Fidelity’s Homeowner’s Policy does.

2. The Buyers purchase a new house. After they move in they notice the neighbor building a driveway and carport for his RV. They also notice that the driveway and carport are partially on their property. The Buyers standard owner’s title coverage doesn’t cover encroachments after the date of their policy. Fidelity’s Homeowner’s Policy does.

3. The Buyers purchase a new house because they like the big detached four-car garage. After their purchase, a neighbor informs them the CC&R’s allow only a two car detached garage, and the homeowners association intends to sue them. The Buyers standard owner’s title coverage excepted the CC&R’s in Schedule B so they have no coverage for the violation. Fidelity’s Homeowner’s policy also shows the CC&R’s in Schedule B, but specifically does cover for the violation. Fidelity’s Homeowner’s Policy protects the owner for as long as they have an interest in the property, and the premium is paid only once at closing.

standard owner’s title coverage specifically excludes from coverage all governmental regulation, including building permits. Fidelity’s Homeowner’s Policy specifically covers for subdivision, zoning and building permit violations.

4. The Buyers purchase a new house. After they move in, the neighbor informs them that their fence encroaches onto his property two feet and demands that they move it. The Buyers standard owner’s title coverage, even with the homeowner’s protection endorsement, does not cover the encroachment of a fence. Fidelity’s Homeowner’s Policy does.

5. The Buyers purchase a new house with a recreation room addition. The Buyers want to remodel their new house. The County informs them that they can’t get a permit to remodel and that they will have to tear down the recreation room or get a building permit for it and bring it up to code. The Buyers

6. The Buyers purchase a second home. They thought they had access via an easement, but they are informed their legal right of access is off of the main highway. Although their property abuts the highway, the highway lies at the bottom of a 200-foot shear cliff. The Buyers standard owner’s title coverage insures the legal right of access, but not actual access. Fidelity’s Homeowner’s Policy does.

7. The Buyers purchase a new house and, on the advice of their financial planner, quit claim deed the house into their living trust. A month later mechanic’s liens are recorded against their house. The Buyers standard owner’s title coverage does not cover the trustee of their living trust. Fidelity’s Homeowner’s Policy does.

Escrow is an arrangement in which a neutral third party, the escrow closer, assembles and processes all of the components of a real estate transaction (including legal documents), records the transaction, and ultimately, disburses funds according to the buyer’s and seller’s instructions (purchase & sale agreement). The typical responsibilities in the escrow process are listed below.

The Seller & Their Agent:

• Delivers a fully executed Purchase and Sale Agreement (PSA) to the escrow agent.

• Provides evidence to meet the buyer’s conditions of sale, such as proof of repair work and inspections.

• Submits other documents such as tax receipts, mortgage information, insurance policies, and warranties.

The Buyer & Their Agent:

• Deposits funds required to close with the escrow agent.

• Approves any inspection reports, commitment for title insurance, or other items as called for by the PSA.

• Fulfills any other conditions specified in the escrow instructions.

The Lender (when applicable):

• Prepares the Closing Disclosure for the buyers.

• Deposits proceeds of the loan.

• Directs the escrow agent of the conditions under which the loan funds may be used.

The Title Company (Fidelity National Title):

• Receives a request for title service.

• Examines the title to the real property and issues a title report (commitment to title insurance).

• Determines the requirements and documents needed to complete the transaction and advises the escrow closer and/or real estate agents.

• Reviews and approves the releases, signed documents and order for title insurance prior to the closing date.

• When authorized by the escrow closer, records the signed documents with the county recorder’s office and prepares to issue the final title insurance policies.

The Escrow Closer:

• Obtains/Orders title insurance.

• Obtains approvals from the buyer(s) on the commitment for title insurance and any inspections that are called for in the Purchase & Sale Agreement.

• Keeps all parties informed of progress to the escrow.

• Obtains any required payoffs/release documents to clear title.

• Receives funds from the buyer and/or lender.

• In most cases, prepares vesting document and excise tax affidavit on seller’s behalf.

• Prorates insurance, taxes, rents, etc.

• Prepares a final statement for each party, indicating amounts paid in conjunction with the closing of the transaction.

• Responds to lenders requirements.

• Oversees the signing of the loan documents.

• Forwards deed to the county for recording.

• Once the proper documents have been recorded, the escrow agent will disburse and distribute funds to the proper parties.

• Prepare a final statement outlining funds received and disbursed in conjunction with the transaction.

For questions about the escrow process, please contact us at 800-776-3021.

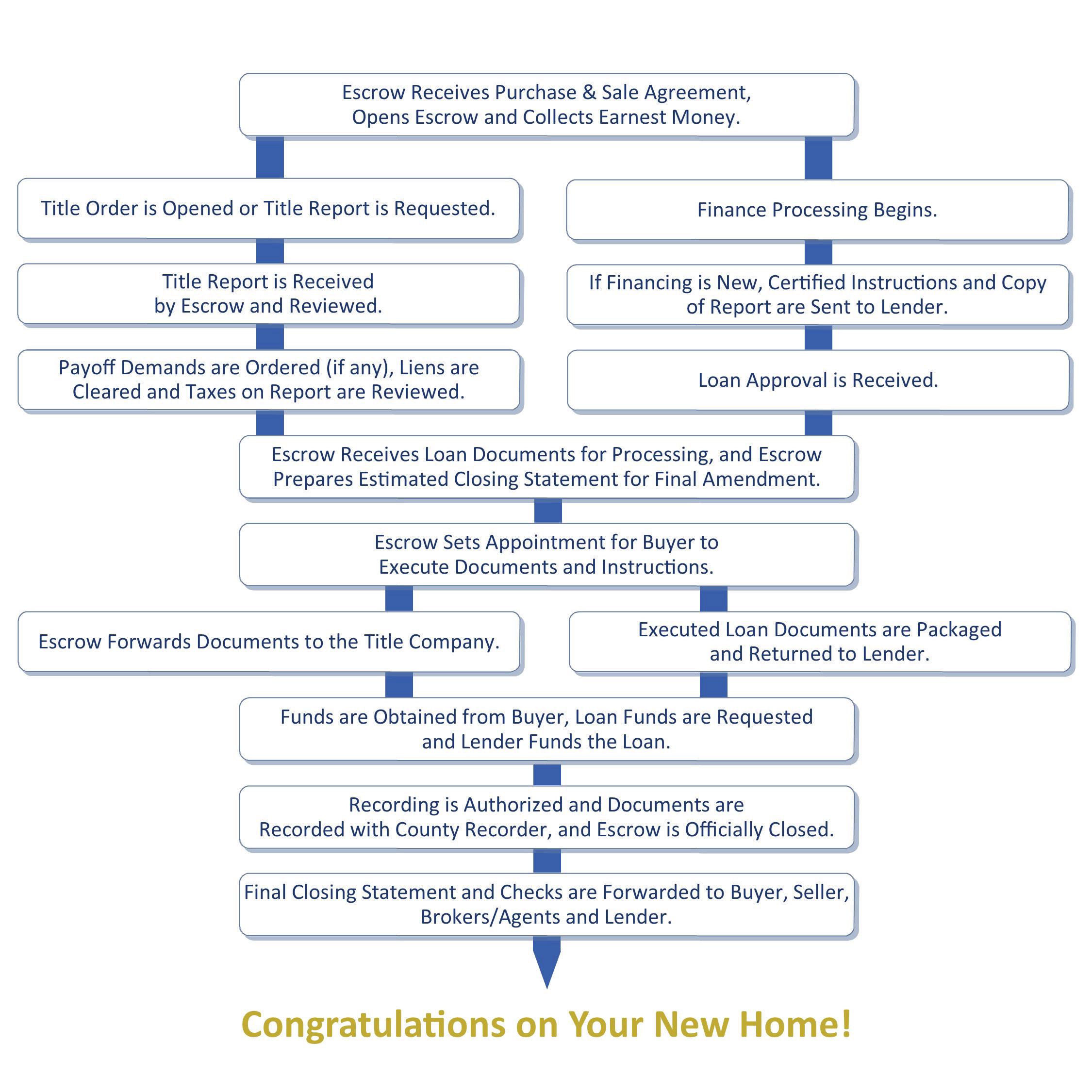

Below is a step-by-step description of the escrow closing process.

Start inHere® is a secure, digital workspace for home buyers and sellers to engage with Fidelity National Title as they begin their real estate transaction. It provides a more secure and intuitive digital consumer experience, while also allowing them to deliver earnest money in seconds.

When the escrow transaction is opened with Fidelity National Title, we will email both the buyer and seller a secure link to our Digital Opening Package (DOP), which includes the Mobile Earnest Money Deposit (EMD). Start inHere® uses advanced security protocols and multifactor authentication to initiate a secure digital opening experience with our customers.

The DOP is an intuitive, question-based information collection process that guides consumers through providing and confirming necessary information. Wire safety information and specific wiring instructions are also delivered securely for consumers to review and then acknowledge with an electronic signature.

Finally, after the DOP is sent, one of our customer care or escrow team calls both the buyer and the seller to verify they have received the email, understand the information needed, help the buyer with the EMD if needed, review the wire fraud warning & wire instructions, and answer any questions they may have.

Start inHere® Mobile Deposit allows buyers to enjoy the safety and simplicity of depositing their earnest money from the convenience of their smartphone.

With just a few clicks, Start inHere® mobile deposit makes delivering earnest money as easy as taking a picture of the front and back of a check. Deposits can be made as the buyer completes the Start inHere® questionnaire process or as a separate initial step.

Start inHere® Mobile Deposit is a contact-free and safe way to deliver earnest money.

INQUIRE BEFORE YOU WIRE! All parties, especially realtors, buyers and sellers, may be targets of wire fraud due to email compromise. Simply relying on the wire instructions that were received via e-mail has caused the loss of hundreds of thousands of dollars in some transactions. Be Safe...Call First!

We urge everyone to “inquire before you wire” and never rely solely on e-mail communication when transferring money. Always follow these simple steps:

Verbally verify the phone number of the escrow closer on the transaction as soon as escrow is open.

Step 2:

Prior to wiring funds, call the escrow closer at the trusted phone number to confirm the wire instructions that were sent.

One tactic of a fraudster will be to hack into a participant’s e-mail account to obtain information about upcoming real estate transactions. After monitoring the account to determine the likely timing of a closing, the fraudster will send an email to the buyer purporting to be the escrow closer or another party to the transaction. The fraudulent email will contain new wiring instructions and will request that the buyer send funds to a fraudulent account.

BE SUSPICIOUS of any changes in wiring instructions received at any time during the transaction, as Fidelity National Title NEVER changes our wiring instructions.

74% of home buyers believed their title company or bank could recover funds that are wired to the wrong account (Retrieved from Alta.org, May 2020)

52% of home buyers are completely unaware of wire fraud in real estate (Retrieved from Notarize.com, May 2020)

$3.5B was attempted to be diverted and wired to “criminally controlled” accounts in 2019 (Retrieved from fbi.gov, May 2020)

Many of these fees and forms for the purchase of a home are misunderstood, especially by first time home buyers and sellers. It’s important to have a basic understanding before signing the closing documents to ensure a smooth signing appointment. So, below is a brief description of documents and fees that may be seen when preparing to close on a new home.

When financing from an institutional lender is involved, the buyer(s) will receive a closing disclosure from their lender a minimum of 3 days prior to consummation of the loan (signing of the loan documents) as required by the Consumer Financial Protection Bureau (CFPB). The seller will receive their copy from the escrow closer. The Closing Disclosure includes all the terms of the loan, what is being paid and what the Buyer and Seller will need to pay at closing. This is one of the most important pieces of paperwork, so be sure to take time to review the details.

This form is only used when there are transactions with specific types of loans such as reverse mortgages, home equity lines of credit, mobile home only, etc.

Based on the terms of the Purchase and Sale Agreement and instructions from the lender (when financing), the escrow closer balances the debits and credits for both the buyer and seller for the transaction. Both parties will receive a settlement statement, provided by the escrow closer, which outlines the final costs of the sale, to review and acknowledge all of the debits & credits for their perspective sides of the transaction. This format makes it easier to understand the Title Insurance Fees as compared to the Closing Disclosure (due to CFPB’s nationally required calculations).

Closing costs are the expenses, over and above the price of the property that buyers and sellers incur to complete a real estate transaction. These costs can include, but are not limited to, any expenses related to obtaining a loan, governmental charges such as property taxes and real estate excise tax, homeowners insurance, title & escrow charges, commissions and Homeowners Association (HOA) charges, to name a few.

Net proceeds refers to the amount received by the seller arising from the sale of a property. This is different from the homeowner’s equity, or gross proceeds in the home, because it takes into account all costs and expenses that are due from the seller as part of the sale.

Closing costs may be confusing. Let’s break it down by buyer and seller. Keep in mind, all costs are subject to negotiation. The list below reflects what is generally considered acceptable in most areas.

THE SELLER PAYS FOR:

• Real estate commission

• Real estate excise tax (if any)

• Payoff of all loans in seller’s name

• Interest accrued to lender being paid off

• Statement fees, reconveyance fees and any prepayment penalties

• Any judgments, tax liens, etc. against the seller

• Health Inspection Fee (county examination of water systems, septic, etc. if applicable)

• Prorated taxes

• Tax registration (FHA and VA Loans)

• Any unpaid homeowner’s dues

• Recording charges to clear all documents of record against seller

• Any bonds or assessments

• Any and all delinquent taxes

• Homeowner’s transfer fees

• Mobile notary fees (if any)

• Courier fees (if any)

• Title insurance premium for owner’s policy

• Escrow fee

THE BUYER PAYS FOR:

• Potential for real estate commission as negotiated per individual contract/agreement

• Credit report

• Appraisal fee

• Inspection fees (roofing, property inspection, geological study, etc.)

• Miscellaneous lender fees (document preparation, underwriting, processing, etc. if applicable)

• Recording charges for all documents in buyer’s name

• Prorated taxes

• Tax Registration (conventional loans)

• All new loan charges (except those required by lender for seller to pay)

• Prorated interest on new loan (estimated 2/3 of monthly payment)

• Reserve account for 6 months of property taxes (estimated) and homeowner’s insurance

• Mortgage Insurance

• Funding Fee (on VA loans)

• Fire or flood insurance premium (if applicable)

• Mobile notary fees (if any)

• Courier fees (if any)

• Title insurance premium for the lender’s policy

Closing Day is Here! Understanding the signing process can really help ensure a smooth closing. We’ve included some important information below to help both the buyer and the seller be fully prepared for their signing appointment.

• Buyers will need to deposit their down payment and closing costs in the form of a bank wire 24-hours prior to closing. Wire instructions will be provided through Fidelity National Title’s Start inHere® secure portal when the transaction is opened with us. We will never send or accept wire instructions via email. ALWAYS be sure to confirm wire instructions directly with the escrow closer before completing any transfer.

• Each buyer and seller must bring 2 forms of identification:

1. A government-issued form of identification that includes a photograph

2. A second piece of identification such as library card, AAA membership card or warehouse card

• Buyers should bring any materials needed to fulfill conditions from the Lenders. If the buyers have lender conditions to fulfill, they will be notified of the missing documentation prior to closing. Items on the list of conditions may include:

1. Most recent pay stubs

2. Copies of tax forms

3. Copies of credit card invoices that are being paid at closing

• Buyers and Sellers will sign their documents prior to* their actual closing date. After documents are signed, they are returned to the lender for review and final approval (see difference and key steps on next page). *On FHA purchases the seller’s documents also have to be reviewed by the lender which prohibits a seller from signing early.

• The way in which sellers decide to receive funds will determine when they receive their proceeds. They may choose to:

1. Pick up a check after recording numbers have been received

2. Have their check mailed or sent via overnight delivery

3. Have funds wired into their account, to be received the next business day after closing

When it comes to real estate transactions and escrow, the terms “signing” and “closing” are often used interchangeably which creates some confusion. They are very different steps in the process, and there are a few key steps in between. The descriptions below should clarify.

Before the signing appointment, the escrow team will work with the lender as they prepare the “Closing Disclosure”. The buyer(s) will then review and sign for acceptance, which initiates the required waiting period of 3 days. During the waiting period, the escrow team will prepare the necessary escrow and title transfer documents. After the required waiting period, the lender will send to escrow all documents required for the “signing”.

At the signing appointment, all final documents requiring signatures will be presented to the buyer and seller (separately). They will need to have any required funds to close as well as acceptable forms of identification for notarization (listed on the prior page).

Once the loan documents have been signed, the escrow closer delivers them to the lender for review. Upon completion of all requirements and receipt of signatures, the lender will notify the escrow closer that it is time to “release funds”, i.e. “funding”. The review is typically completed within 24 to 48 hours.

Once the lender confirms authorization for recording and all funds are received by escrow, the documents are either electronically recorded or hand-carried to the county recorder’s office by the title insurance company. Recording numbers are unique and specific numbers given by the county recorder’s office to a properly executed legal document thereby making it part of the public record. Once a recording number is issued, the buyer is considered “on record” as the new party holding title to the property.

When the transaction is “on record” with the county, the ownership of the property has been officially transferred to the buyer and funds are disbursed to the seller. Depending on the specified possession date agreed to within the purchase and sale agreement, the buyer may then receive the keys to their new property and take possession.

As you close on your property, you may be thinking ... “Now What?”

Your team at Fidelity National Title is here to ensure you have an exceptional experience throughout all stages of your ownership, so we have included the following list of considerations at the close of your successful escrow.

An important consideration at closing is the transfer of your utilities. Be sure to contact your local service providers for transfer of service for items such as electricity, gas, phone, water, cable/satellite, internet and garbage services. The various service providers have different timelines and requirements. Be sure to have your closing statement available, as needed, and feel free to contact us for a copy.

Contact your local post office for your change of address forms to ensure proper delivery of mail to your new home. You may also wish to proactively alert those that regularly send you mail, such as current service providers and personal contacts, to ensure that you are receiving your mail promptly.

Contact your local Department of Motor Vehicles to update your address. If you have moved to a new state, you may be required by law to obtain a new driver’s license issued by your state of residency.

Upon receipt of the keys to your property, be sure to schedule to have your locks changed. This would also be a great opportunity to pursue the purchase of a new locking system such as a SmartHome lock that will integrate with your SmartHome system for remote management of your door locks.

In your closing documentation, you will find written instructions containing your new payment information and deadline for your first loan payment. Make a note of the date so that you may be sure to submit your payment on time in the event that you don’t receive further information from your current lender. Please contact your lender directly with any questions about your payment, deadline, taxes or insurance.

You may also find that your loan is sold to another company shortly after your closing. For your protection, be sure to contact your lender from the time of closing to confirm the transfer of the loan before making the payment to the new lender.

UTILITIES & SERVICES

☐ Electric ☐ Cellphone

Internet

Cable

Gas

Water

Sewer

Garbage

Recycling

Home Security

FAMILY / PERSONAL

☐ Employer / benefits / 401k

☐ Schools & alumni associations ☐ Children’s organizations

☐ Clubs (athletic / misc)

☐ Relatives, friends, business

☐ Child care provider

GOVERNMENT

☐ Dept. of Licensing (www.dol.wa.gov)

☐ Post Office (www.usps.com) ☐ Voter Registration

IRS

Veterans Affairs

FINANCIAL INSTITUTIONS

Banks / credit unions

Finance company

Credit cards

Charities

Financial advisor / investments

INSURANCE AGENCIES

Life

Home

Auto

Health