Omnia Outdoors is far more than just a pool builder. We truly cater to our customer’s comprehensive vision for their entire backyard experience. “Omnia” is the Latin word for ALL THINGS which is exactly what we provide – “ALL THINGS OUTDOORS”.

LANDSCAPES to schedule your free design consultation!

We are the ultimate design-build source for Swimming Pools and Spas to Landscaping and Irrigation, Outdoor Living, Cabanas and Pergolas, Outdoor Kitchens, Artificial Turf, Stone Masonry, Outdoor Lighting and even Patio Furniture and Accessories provided by Omnia Lifestyles.

Published by Fidelis Publishing Group, LLC

PUBLISHER

Cathy Payne

Like many of the best in her craft, Cathy has a specialized degree—in her case, hard science—and a gift for writing. She found her voice and fulfillment reporting and writing news and magazine features for a regional Central Texas audience. Along with serving as the publisher of the Liberty Hill Digest, Cathy oversees multiple magazines, marketing campaigns, and books.

SENIOR WRITERS / COPY EDITORS

Ann Marie Kennon

Charlotte Kovalchuk

CONTRIBUTING WRITERS

Linda A. Thornton

Rachel Strickland

GRAPHICS & DESIGN

Sandra Evans Zion Eaton

CONTRIBUTING PHOTOGRAPHERS

Patrick St. Cin

Christianna Bettis

BUSINESS DEVELOPMENT • Dawn Goodall

IT/WEBMASTER • Jesse Payne

CONSULTANT • W. Ben Daniel

ADVERTISING

Dawn Goodall • dawn@lhtxdigest.com Office: 512-598-6598 Cell: 512-677-3400

In an age where the rush of daily news often overshadows the deeper narratives that shape our community, the Liberty Hill Digest constantly strives to be an eager beacon of positivity and unity. Far more than just a lifestyle magazine, our publishers and staff are committed to creating a means of getting to know what makes our community thrive: its people and their impact.

Since its inception in 2020, the Liberty Hill Digest has not only reported on more than 550 of the great stories and people in our city, we have also taken pride in actively contributing to its enrichment by mailing more than 400,000 magazines for free in the last four years.

Moreover, we enjoy sharing our commitment to the animal companions of our community through regular features dedicated to the Williamson County Regional Animal Shelter, showcasing the importance of compassion. We are also pleased that our rotating nonprofit column further underscores this dedication by highlighting different support organizations each month like L4 Cares, creating a platform for advocacy and connection.

But we are also good at doing what we do — showcasing prominent community agencies and initiatives like Operation Liberty Hill, Liberty Hill ISD students, FFA, 4-H, and many more on our covers and in multi-page features. These not only celebrate their contributions but also inspire readers to engage personally and participate in the missions of these community pillars. As well, timely articles featuring local events like Whimsy & Wonder, the City of Liberty Hill, and the involvement of our local businesses in the community go beyond surface-level news, offering insights into the cultural and humanitarian assets of Liberty Hill.

In every story, from first responders and veterans to the latest city events and programs, our purpose is to foster a sense of pride and connection. In addition to these, each November, our Giving Thanks and Giving Back issue shines a spotlight on local nonprofits and philanthropic efforts, reminding us of the power of community support and the importance of gratitude.

Liberty Hill Digest isa FidelisPublishingGroup,LLCpublication andaproductof AdvocateNewsTXNewspaper. Copyright © 2024

All rights reserved. Liberty Hill Digest is published monthly and mailed USPS, free of charge, to homes and businesses in Liberty Hill, TX zip codes. Mail may be sent to Liberty Hill Digest, P.O. Box 213, Jarrell, TX 76537.

Email: info@lhtxdigest.com

In short, we believe the Liberty Hill Digest is more than a magazine; it is a vital part of the community’s fabric that spotlights advocacy, education, and celebration. We hope you will agree it stands as a testament to what we can all achieve when we choose to focus on the positive and the possible.

Meet

BLINDED BY THE LIGHT DEB LOHMAN

Expert in home décor finishing touches, including unique accessories, accent furniture, wall art, rugs, lamps, and gifts.

• 512-636-9653

GEORGETOWN FENCE & DECK

We complete hundreds of projects annually and are dedicated to creating exceptional outdoor living spaces that provide years of enjoyment and add value to your home.

GeorgetownFence AndDeck.com 512-948-7539

HANSON INSURANCE EMILY HANSON

Sixteen local brokers, specializing in Medicare, and ready to assist with all your health insurance needs.

HansonFirst.com 512-817-6906 NPN #18816155

ROYAL BLISS DAY SPA

Liberty Hill's hometown spa since 2019, specializing in skin care, beauty and massage, and offering an extensive line of natural skin care products so you can continue your routine at home.

RoyalBlissDaySpa.com 512-548-6733

MOORE LIBERTY BUILDINGS CHAD & AMANDA MOORE

Thousands of structures built since 2015.

MooreLiberty Buildings.com 512-548-6474

SCHULTZE AGENCY

JEFF & JAIME SCHULTZE

Family-owned and operated local insurance agency proudly serving this great community. We specialize in personalized consultations for home, auto, life, commercial and specialty insurance. Call, text or come by and see us.

SchultzeAgency.com 512-549-8700

For Matthew Lindemann, serving as Pct. 3 Constable has been one of the greatest honors of his life. This role has allowed him to ensure the safety of his community and uphold the law with dedication and integrity. However, Matthew believes he can do even more, which is why he is stepping up to run for sheriff, driven by a desire to serve all of Williamson County with the same commitment he has shown throughout his career.

Matthew’s journey into law enforcement began unexpectedly. As a young boy, he dreamed of becoming a firefighter, even chasing fire trucks on his bicycle and later volunteering for the Bartlett Fire Department. However, his path took a decisive turn after a personal experience. While working in his father’s store, he was a victim of a robbery, and the local police chief’s swift response left a lasting impression on him. This moment of courage and justice inspired Matthew to pursue a career where he could make a similar impact.

In 1984, a ride-along with a Bell County sheriff’s deputy further fueled his passion for law enforcement. “Within 10 minutes, we were involved in a sensational arrest,” Matthew recalls. “It was more excitement than I had experienced in several years with the fire department, and I never looked back.”

Today, with nearly 40 years of experience in law enforcement, Matthew Lindemann is ready to bring his expertise, dedication, and vision to the role of sheriff. “I’ve lived here all my

life, raised my kids here, and now my grandkids,” Matthew says. “I want to keep it safe for them and everyone who calls Williamson County home.”

As constable, Matthew’s responsibilities closely mirror those of a sheriff, including managing personnel, working with elected officials, and overseeing budgets and equipment. However, the role of sheriff presents new challenges and opportunities — ones he is eager to embrace. “The only significant difference is that a constable doesn’t manage a jail, but I’ve had that experience too,” Matthew explains. His first job in law enforcement was with the Williamson County Sheriff’s office, where he learned valuable lessons in managing difficult situations.

Matthew’s extensive experience in law enforcement is backed by impressive credentials. He is a Master Peace Officer, the highest certification in Texas law enforcement, and a graduate of the National Forensic Academy in Tennessee, with more than 6,637 hours of documented training. “The forensic academy was a great experience,” Matthew says. “I learned a lot about crime scene investigations. As sheriff, I would not conduct these investigations myself, but I have the experience to ensure my team’s work meets the highest standards.”

His distinguished career also includes two years on the Department of Public Safety (DPS)

by Ann Marie Kennon

Forty years of law enforcement has prepared me to be a good sheriff who is accessible — one who makes you feel safe living and working in Williamson County.

SWAT team, responding to highthreat situations across Texas.

As a Texas Ranger, Matthew was a firearms instructor and digital police photography instructor, training officers from all over the state. He has worked on major investigations, from cattle theft to capital murder, and helped supervise high-profile cases like the 2017 Sutherland Springs church shooting and the Austin bombings in 2018.

Matthew has seen Williamson County grow and evolve, and he is proud to have grown alongside it. “In the early days, it was normal to have just two deputies on patrol for

Matthew’s career has also been marked by his ability to collaborate effectively with agencies across the county, state, and nation. His time with the Texas Rangers provided invaluable experience and a vast network of professional contacts, allowing him to work seamlessly with other law enforcement entities. Whether investigating cartel-related kidnappings or working alongside Border Patrol and Texas Military Forces during reconnaissance missions along the southern border, Matthew has consistently demonstrated his capacity to lead and cooperate in complex, high-stakes situations. His deep understanding of inter-agency collaboration ensures that, as sheriff, he will be able to leverage these relationships to tackle cross-jurisdictional crime and bring additional resources to Williamson County whenever necessary.

"On a major investigation, you have to get everyone going in the same direction. There can be no egos and we all have one goal."

the entire county after 1am. Now, we have a minimum of nine deputies per shift, and I will work to provide greater coverage on the east side of IH-35,” Matthew notes.

Matthew's decision to run for sheriff was not made lightly. After the sudden passing of Constable Kevin Stofle in 2021, Kevin's wife Laura asked Matthew to consider taking over. “She agreed that in law enforcement, even when we are doing our very best, there are still those who will criticize. But she said, ‘We still need good people to step up and do the job.’ ” That conversation, combined with his dedication to the community, led him to take on the role, and Matthew is now ready to take the next step.

As sheriff, Matthew’s vision includes maintaining the programs and services that are already working well while building on them to address the county’s growing needs. He also intends to prioritize the training, equipment, and compensation of his deputies, aiming to retain top talent in the Sheriff’s Office. He is committed to working closely with the county and district attorney to ensure the cases he turns over result in successful prosecutions. “I developed a great understanding of those criteria when I worked at the district attorney’s office,” he adds.

Matthew recognizes that the biggest challenges for the county’s law enforcement are keeping pace with rapid growth and maintaining the high level of service that residents expect. He is particularly focused on improving safety

and services in the often-underserved east side of the county. He understands the delicate balance between providing adequate service and convincing commissioners that the Sheriff’s Office needs more resources. “Sometimes, there are only three deputies covering the entire east side,” he notes. “I assure the folks in Hutto and Taylor that I’ll do everything possible to enhance their safety.”

Constable Lindemann promises to be tough on crime while being fair to everyone. He is committed to protecting the most vulnerable members of the community, from seniors targeted by scams to children at risk of exploitation. He is also determined to combat the influx of fentanyl and other illegal activities in the county. “It’s unfortunate that many crimes are committed by people who aren’t even supposed to be here,” he says. With nearly 40 years of law enforcement experience, Matthew Lindemann is ready to bring his expertise, dedication, and vision to the role of county sheriff. He is committed to keeping Williamson County a safe and welcoming place for all its residents. “I want to keep Williamson County safe for my children, grandchildren, and everyone who calls it home.”

No matter where I worked or what job I had, I have always wanted what is best for the Sheriff's Office.

On the morning of February 28, 2008, business owner Paul Roland was abducted from his parking lot on his way to work. What unfolded was a chilling revelation: the man responsible for orchestrating the kidnapping was a contractor employed by Paul's brother. Matthew says, "To our knowledge, the man had found himself in deep debt to a Mexican cartel known as the Zetas. Despite the family's efforts to support him, the man hired accomplices to help carry out the abduction, snatching Paul as he left his apartment for a job in Houston."

When Paul failed to show up at work, his family quickly alerted the Williamson County Sheriff's Office. Acting swiftly, deputies located Paul's vehicle and cell phone abandoned in a field near San Marcos. The situation escalated by 7pm when the Texas Rangers were called in, and Lt. Matthew Lindemann shared the lead on the case, working tirelessly through the night. At 5am, the kidnappers made first contact, demanding a $500,000 ransom—a sign that Paul was still alive, which reinvigorated the search efforts.

recalls, "We were coordinating with the Sheriff’s Office, the Rangers, San Antonio police, the FBI, and every other agency we could think of." The trail led south, and Paul's credit card was flagged as the kidnappers moved closer to the Mexican border. Law enforcement teams arrived at each location to review footage but, each time, found themselves about an hour behind.

Federal Marshals used advanced technology to track the kidnappers to a rundown motel in San Antonio.

Surveillance was set up, and around 2am, a van pulled up and a group moved from the motel to the vehicle. Officers surveilled the van — which later crashed — and found Paul inside. Reflecting on the moment, Matthew said, "I've never been happier to see someone alive in my life."

The operation was a testament to collaboration and the determination of law enforcement. More than 100 officers were involved, pooling resources like the gym bag full of $250,000 "flash cash" arranged between DPS and Sheriff James Wilson to fake a

ransom drop. Rangers then arranged to track Paul's brother’s vehicle as he followed the kidnappers’ ever-changing instructions. But as the situation grew increasingly dangerous, with the brother nearing a remote and more perilous area, Matthew and his team had continued to do everything they could to get him back but were forced to make a critical decision: they halted the pursuit at 9pm, suspecting the kidnappers intended to rob and possibly kill Paul's brother and potentially leave Paul unrecovered.

At 2am, the van was recovered, bringing a tense day to a dramatic close. The emotional toll on the Roland family was immense—a trauma that took years to heal. The ordeal was so profound that the couple authored a book, Walking Between the Raindrops, to process their lingering fears and document the extraordinary efforts of the Rangers and other law enforcement agencies. Their story is both a testament to resilience and a stark warning: such a nightmare could happen to anyone.

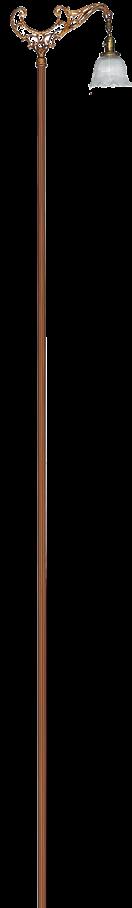

Whether you’re looking to restore a vintage lamp, re pair a beloved piece of decor, or create something en tirely new, Gary McNabb's new shop, Austin Lampworks, is Central Texas' premier destination for custom lighting solutions. This family-owned and operated showroom is dedicated to serving the lighting needs of everyone in the Austin metro area. With a focus on craftsmanship and customer satisfaction, Austin Lampworks offers a unique blend of artistry and technical expertise, making it a trust ed name in the world of lighting.

Gary brings a wealth of experience and a deep passion for his craft to Williamson County. Originally a low-volt age electrician, Gary found himself unfulfilled in his ca reer. But, after taking a chandelier to a repair shop in Aus tin, his wife got the idea that the environment would be a perfect fit for Gary and her intuition was spot on—Gary began working in the field the very next day and discov ered a new calling.

After many years honing his skills in Austin, Gary decid ed to open his own shop in Georgetown, a community he has called home for over a decade. He started with basic repairs, ensuring electrical components were in perfect working order. But it wasn’t long before his work evolved into something more. “People come to you with an idea

3010 Williams Dr. Suite 180

Georgetown

Tuesday Noon to 7 pm

Wed - Sat 10 am to 5 pm

of how they want something to work,” Gary explains. This led him to focus not only on repairs but also on restoring beloved, sentimental pieces and creating custom lamps from cherished objects.

Austin Lampworks offers a range of services, from simple repairs to full-scale restorations. Gary’s shop also boasts a carefully curated selection of premium lamp shades, specialty light bulbs, decorative chains, chandelier crystals, and other hard-to-find lighting accessories. Gary notes, “Lighting is an important part of your overall interior design. We do not provide in-home consults like a designer might do, but I make sure whatever lighting you need is functional, beautiful, and exactly what you want.”

a pair of deer antlers — into a one-of-a-kind lamp. “The only limit is your imagination,” he says. Each project, no matter how big or small, receives the same level of care and attention, ensuring your sentimental treasures remain functional and cherished for years to come.

Gary and his son invite you to "get lit" in their showroom, where your lighting dreams can become a reality.

One of the standout features of Austin Lampworks is its custom lighting service. Gary can transform almost any object — an old typewriter, a wine bottle, or even

Find them on Facebook and Instagram by searching LAMP REPAIR IN GEORGETOWN.

Gary’s commitment to quality and customer service is evident in every aspect of Austin Lampworks. “I would rather people be happy with what they get than just take something off the shelf,” he emphasizes. This dedication has earned him a loyal following, with many customers coming from referrals by local antique dealers and lighting stores all over the region.

HANSON INSURANCE

Sixteen local brokers, specializing in Medicare, and ready to assist with all your health insurance needs. HansonFirst.com • 512-817-6906 • NPN #18816155

The Medicare Annual Enrollment Period (AEP) is a crucial time for Medicare beneficiaries to review their health care options and make necessary changes to their coverage. This period gives eligible individuals the opportunity to evaluate their needs and adjust their Medicare plans accordingly.

During this period, beneficiaries can:

CHANGE MEDICARE ADVANTAGE

PLANS: Switch from one Medicare Advantage plan to another, or revert to Original Medicare (Parts A & B).

ENROLL IN A NEW PART D PLAN: Sign up for a new prescription drug plan or make changes to existing coverage.

SWITCH FROM ORIGINAL MEDICARE TO A MEDICARE

ADVANTAGE PLAN: Transition to a Medicare Advantage plan if you currently have Original Medicare. Changes made during this period will take effect January 1 of the following year.

Medicare Supplement (Medigap) plans can be applied for at any time of year and do not need to be addressed during the Annual Enrollment Period unless you are concerned about a rate increase.

Every year we see small changes to Medicare plans, however this year we expect changes that will greatly impact part D (prescription) AND part C (Medicare Advantage) plans. These changes stem from the Inflation Reduction Act and the elimination of the Coverage Gap Phase (Donut hole) of Medicare drug coverage.

The GREAT news is that the individual maximum out of pocket responsibility for drug coverage will be $2,000, instead of the current $8,000. We will see repercussions for this though, and they are expected in the form of one or all of the following.

For part D plans:

Increased plan premiums (primarily expected on part D plans)

Slimmer formularies (the list of covered drugs); some medications may no longer be covered

Higher copays (a set dollar amount) and higher coinsurances (a percentage of the medication retail price)

Medicare Advantage plans will likely see slimmer benefits and increased copays.

The changes do not need to be stressful! Tips for a calm enrollment period:

Watch out for and READ your Annual Notice of Changes (ANOC) letter that will come from your current insurance company in late September.

Notice the 2025 updates and decide if they are acceptable or if a plan change would benefit you.

Contact a local broker to guide you through the upcoming changes and help you find and enroll in the best plan for you.

AEP: October 15 to December 7

The Medicare Annual Enrollment Period is a vital opportunity for beneficiaries to reassess their health care plans and ensure they are getting the best coverage for their needs at the most affordable price.

By being proactive and using the resources available, Medicare beneficiaries can make informed decisions that support their health and financial well-being in the coming year.

Christian Kurtz Takes Helm as Economic Development Director

Christian Kurtz has taken the helm as Liberty Hill’s newly minted economic development director following the retirement of the city’s former steward of business and growth, Mary Poché.

As a member of the Texas Economic Development Council and the International Economic Development, Christian came across what he calls an intriguing opportunity to lead Liberty Hill’s economic development department.

“Liberty Hill is a beautiful city full of potential to shape its own destiny. That opportunity was what really pulled me in. I see cities in our region that grew without intention or measures in place to guide the best use of their resources. I wanted to be part of helping this city avoid those mistakes.”

Both his 25-plus years of business management experience and previous 12-year role as economic development director for Pflugerville, which he says has grown — much like Liberty Hill— at an explosive rate, helped prepare him for that mission. While he only just started July 8, Christian is excited about the opportunity to foster job growth and attract new businesses to Liberty Hill.

Looking ahead, one of Christian and the Economic Development Corporation Board’s main goals is to help the city implement the Downtown Master Plan. The plan aims to draw more people to the downtown with added signage in highly trafficked areas like Highway 29 as well as other efforts like more downtown event spaces and transportation improvements. He also plans to recruit businesses from sectors such as advanced manufacturing, AI, life sciences, and campus headquarters to help keep citizens in town during the day instead of having to commute to other cities. “In

cities where rooftops outnumber the commercial and business growth, the burden for the cost weighs too heavily on the residents. One of the greatest missions of economic development is to help diversify the economy by bringing in jobs and capital investment.”

The biggest obstacle Christian faces is one he says needs to be addressed by more than just him and his team. “Infrastructure like water, electricity, and roadways – the costs for the city and its partners to provide these have grown exponentially and to keep doing so will require help from all of the partners. It’s not just an economic development-related challenge, it is one all of us share.”

• 512-636-9653

Design pros are often asked about the popular trends in window fashions. Following are some popular soft shades and features.

There are many window covering choices available. For starters, consider how you live in a room. Do you need privacy, protection from the sun glare, light filtering, or room darkening? Room darkening shades are usually reserved for bedrooms and media rooms. Light filtering allows some natural light to filter through and is usually used in the main living areas, however, it can be put in any room where you want to have natural light filtering through. The best approach is to go with what you love and what best fits your lifestyle and personal taste.

WOVEN WOOD SHADES: Thanks to HGTV, woven wood shades have made a huge comeback. Once popular in the 1970s, they are now back in full force and going strong. These shades bring an organic style to your home, having been handcrafted from natural wood, reeds, bamboo, and grasses. Today’s fresh woven wood fabrics are created with lighter weight materials to combine natural fibers and materials into designs rich in texture and personality. If you are looking for shades to fit your casual lifestyle, boho style, or create a beachy vibe, woven woods will accomplish that.

PRIVACY SHEERS: These shades offer an elevated style of luxury and elegance to any room. Fabric vanes between sheer fabrics rotate for privacy while controlling the light in a room. When the vanes are open, the sheer fabric allows you to enjoy your view while protecting your furnishings from harmful UV rays. Turn harsh rays into soft, ambient light without the glare. Closing the vanes will give you complete privacy. There are various options available for large windows and sliding glass doors too.

SHADES: This shade is very popular due to its high level of energy efficiency. These pleated shades have insulating pockets that reduce heat loss and unwanted solar heat gain.

DESIGNER ROLLER SHADES: Another shade style that has made a big comeback for the minimalist who is looking for clean lines and a simple aesthetic. Gone are the days of the old-fashioned spring-loaded shades that would spin around the roller if you let go too quickly. Today they are offered in many sophisticated fabrics, beautiful textures, and timeless colors. Depending on your needs, these shades are available in semi-sheer fabrics, light filtering, or room darkening for privacy and light control.

MOTORIZED SHADES: Once considered a luxury in window fashions, motorization is now a much sought after product. Smart technology is so advanced that your shades can be scheduled to adjust to various positions throughout the day to create the perfect balance of light and privacy. Motorized shades can also be easily integrated with smart home technology and voice assistance. Keep in mind, motorization is an available option on any shade.

with Keller’s multi-award-winning design team. From stunning landscape transformations to meticulous tree care, we ensure your property remainsimmaculate year-round. Experience custom patio installations, elegant pergolas, captivating water features, and expert irrigation services. Let us craft your dream outdoor sanctuary today.

Dan Wiley’s passion for cars dates back to a childhood obsessed with Hot Wheels® toys and car shows that has since evolved into a lifelong career in the automotive industry, particularly focused on customizing vehicles. “I’ve never had a normal vehicle,” he says with a laugh. “I’ve been customizing vehicles my entire life.”

After 25 years in the industry, working everywhere from dealerships to service shops, Dan decided it was time to build something of his own. That dream became a reality with Relentless Rides – a family-owned and -operated business he launched in Liberty Hill in May this year. While Dan has lived in the Hill Country area most of his life, he has always wanted to live and work in Liberty Hill, which he calls “absolutely beautiful. The people are awesome, and it feels close enough to a big city but still with small-town vibes.”

With a deeply rooted love for custom cars and a relentless drive, Dan set out to create a place where vehicles could be transformed into something truly unique. “We’re taking somebody’s everyday vehicle and turning it into something totally unique that stands out. We wanted to start something different that nobody does around here and take cars to the next level.”

Since opening its doors, Relentless Rides has become the go-to spot for automotive customization in the area, offering everything from suspension modifications and wheel packages to exterior wraps, spray-on bed liners, and LED lighting. Relentless Rides also strives to be a onestop shop for automotive needs and offers basic maintenance services. Some of his recent work has included a camouflage wrap on a Toyota 4Runner, custom interior lighting on a BMW, and multiple suspension modifications on various trucks.

For Dan, the best part of the job is seeing customers’ reactions when they pick up their vehicles. “I never send pictures during the process,” he says. “I love pulling the vehicle out, all cleaned up and ready to go, and watching them dancing and screaming and saying, ‘This is my dream. You made it come true.’ ”

Scan the QR code to learn more about Relentless Rides.

THERE ARE MYRIAD GREAT REASONS TO ADD A SHED TO YOUR PROPERTY!

Before you order and put down money you need to make sure the new building is allowed on your property.

If you are within city limits, all cities in Williamson and Burnet counties require permits depending on the size of your shed. Liberty Hill requires a permit for any size shed. Other cities have size thresholds from 120-200 sq ft that trigger the need for a permit.

If you need a permit, you will need your property survey to verify any easements and building setback lines (how far the shed must be from your property line).

You must mark the location of the shed on your survey and submit as part of your application.

If your residence is outside city limits and you do not have an HOA, no permits or permissions are required. You may have deed restrictions or easements that could restrict your shed placement, so it is best to check those.

Impervious cover: This is a technical term for surfaces on your property that water cannot penetrate. This includes your house, driveways, sidewalks, patios, garage, pools (50 percent of the surface area) and any other hard surfaces. You will have to add up all the square footage of your current impervious cover (including your new shed) and compare that to the total square footage of your property. Most cities require your impervious cover to be no more than 40 percent of your total property size.

Adding electrical to the shed, you will need a separate permit.

If you live in an historic district, the city will typically have mandates for the design and aesthetic features of your building.

If so, you will need to obtain permission from your governing committee.

You will need to provide your property survey and mark the location of the shed.

The HOA will be concerned with how the exterior looks. Paint, shingle color and, sometimes, the building materials are usually pre-determined and typically must match your house. HOAs usually require a mockup of what your shed will look like as well.

HOAs will often have strict size and height restrictions. Sometimes they also require the shed to be built on a slab.

If you are in an HOA and within city limits, you will need both a city permit and HOA approval. Approval from one entity does not guarantee approval from the other.

Once you are armed with the requirements for your shed, you are ready to go shed shopping! Make sure your shed provider can meet the requirements to keep you in compliance. Some shed builders will take care of the city permitting for you for an additional fee. HOAs typically require the homeowner to apply for approval.

Taking the time to understand what’s allowed will save you time, money, and the headaches of unforeseen regulations.

It was an honor to serve as an American Soldier for 32 years and now seven years as state representative in the Texas Legislature. The 88th Texas Legislature set a record for the most days in session within a single year, as legislators tackled complex and highly detailed issues facing Texans like border security, fighting human trafficking, protecting our children, and promoting economic development.

Over the last four years one set of issues received more consistent focus from the people of House District 20 than any other: the quality and transparency of public education and the ever-increasing property tax bills Texans are being asked to pay to provide it. As the biennium draws to a close, you deserve a review of what your legislators have done to address these issues, hear what your legislators believe to be the best path forward to substantive property tax relief, and to have an opportunity to give feedback on these and other issues important to you and your family.

Previously, as chair for the House Appropriations Subcommittee on Article III of the state budget for the 87th session overseeing the process of funding both public and higher education in Texas, I worked with Senator Larry Taylor of Galveston to put $180 million toward building up vocational programs in schools as early as seventh grade.

These funds, which have remained in place for the 2024-2025 budget, will help schools purchase the necessary equipment and facilities for students to train for in-demand, marketable, and lifelong careers they can start after graduation. Finding a child’s spark is essential to proper education and giving every child the opportunity to discover the trades and skill sets that make them show up every day hungry for knowledge is what Texas public schools were designed for.

Paying for quality education is never easy, and the property tax system in Texas makes a tough situation much worse by trying to force a square peg in a round hole. Rising property taxes force people out of their homes, and businesses out of existence altogether.

As the new school year begins and property tax bills have hit kitchen tables across the state, I wanted to provide an overview of how our property tax system works, how it got this way, and some of the proposals on the table for fixing it in the upcoming 89th session.

To gain an understanding of the taxes Texans pay to support public education, it is important to begin at the beginning. The Republic of Texas laid out its Declaration of Independence in 1836 and itemized all the things Mexico had done wrong to compel the territory to break away. They listed their grievances in order of importance and first on the list, even before the forcible military dissolution of the State Legislature, was the lack of support and maintenance of a system of free and public schools. Our State Constitution reflects this history by placing two main requirements on the State Legislature regarding public education:

Article 7 Section 1 of the Texas Constitution provides for “knowledge essential to preserving the knowledge and liberty of the people.” In simple terms, public education in Texas is required to be sufficient such that every Texas student is either educated enough to have a

job in a productive industry or area immediately after high school, or at the conclusion of their public education program, or is sufficiently prepared to go on to post-secondary, military, vocational, or other training. This is the job of the legislature, before anyone else, to provide a funding for public education and ensure Texans receive a quality education.

While the Constitution makes clear that the State of Texas is responsible for funding education, the courts have ruled the responsibility could be fulfilled by providing a means for local districts to raise funds themselves, rather than all funding coming directly from state revenues. With the establishment of the ISDs, the burden of paying for education shifted gradually from state support to local property taxes, as they provide consistent revenue with minimal fluctuations during recessions.

“On average, about half the property taxes you owe are paid to the local ISD. You may also pay property taxes to your city, county, and special purpose districts, such as emergency services districts, hospitals, community colleges, and municipal utilities (MUD).

For example, in Georgetown ISD (GISD), the Maintenance & Operations (M&O) tax is $0.6992 per $100 of home value. Based on the number of homes and home values, the ISD receives $166 million (after recapture) in revenue to pay for actual expenses required by the legislature: building maintenance, salaries, and materials. For FY2024, GISD property taxes will bring in 82 percent of what is needed to meet its full budget.

In Buckholts ISD, the M&O tax rate is close, at $0.6692, but there is not as much land value, so their tax revenue is $360,385; just 17.71 percent of their budget. If the taxpayers in Buckholts were required to fully fund their ISD entirely, they would have to pay $3.77 per $100 to meet their full M&O burden.

To bridge the gap between the costs of educating students and disparity in property values, ISDs with a surplus of property tax revenue must purchase “recapture” credits from the state. Those credits, along with billions in state revenue, help fund districts whose rates are already at the statewide ceiling and still need additional funds to operate their schools.

While taxpayers statewide do pay about the same rate under this system, property values and costs have continued to rise, pressuring local property owners but measures passed in the last legislative session have provided considerable relief. The school district property tax rate for GISD was reduced by 18.5 cents. Additionally, a $60,000 increase in the state mandated homestead exemption provided significant tax relief for homeowners.

Texas is one of nine states that does not collect a personal income tax. Instead, local governments charge property taxes to provide local services and pay down debts. Texas does not have a state property tax and instead relies on other taxes, like sales and use tax, to generate state revenue. Each taxing entity determines your property tax bill by applying their adopted property tax rate to the taxable value of your home. Most Liberty Hill property tax is paid to Williamson County, City of Liberty Hill, and LHISD.

Rates are set, individually, by a governing body or executive committee of those taxing entities, e.g., City Council or MUD Board. Before setting a property tax rate, cities, counties, and school districts must propose a budget, make it available for public inspection, and hold a public hearing. Once they have their budget in place, they set

their rate based on the revenue necessary to cover the spending listed in their budget.

Budgets determine revenues, revenues determine rates, and rates determine your tax bill, so the best thing you can do to lower your property tax bill is get involved in the budgeting process for your local government. Attend their hearings, ask “why” each item is necessary, and get detailed answers. These hearings are often sparsely attended, and your participation is integral to ensuring local budgets match local priorities.

Property tax rates are charged as a dollar amount owed per $100 in value of a property. The taxable value is found by looking at the property’s market value, assessed value, and any applicable exemptions.

The chief appraiser in each County Appraisal District determines the market value of each property within the county based on its value on January 1 of that year using generally accepted appraisal practices, such as reviewing recent comps. They report those values to the Appraisal District Board of Directors who are selected by taxing districts, with each district’s voting strength determined by their share of the total property tax collected within the county.

If your house qualifies for a homestead exemption, then the value of your home on the January 1 after you moved in becomes your initial assessed value. While the market value of the property increases or decreases year to year based on changes in the local housing market, the assessed value acts as a buffer against drastic changes, limiting year to year increases to 10% until the assessed value and the market value are equal.

If your house was worth $200,000 when you moved in, its year one assessed value is $200,000. If your year two market value increased to $300,000, your assessed value would only increase 10% to $220,000. In year three, if the market value stayed at $300,000, your assessed value would still increase by 10% to $242,000, since the assessed value had not yet caught up to the market value.

The final taxable value is found by taking the assessed value and subtracting exemptions you may have available. Homesteads are eligible for a $100,000 exemption on their taxable value, so our $200,000 house would only have a taxable value of $100,000 as a homestead. This is the value used by the tax assessor/collector to determine your tax liability once the rates have been set.

In the 2019 session, the legislature established a new formula to put a cap on how much local governments could increase their annual property tax revenue collections without first having to ask the voters for approval.

The no-new-revenue rate would provide the taxing entity with approximately the same amount of revenue it received in the previous year on properties it has taxed before. Essentially this is the tax rate that would completely cancel out all increases in property value. If the values have gone up, the “no-new-revenue” rate will go down. If new property has been added, like a home being built on a once empty lot, the additional revenue that home would bring in is not considered in calculating the “no-new-revenue” rate, as it has not been taxed before. Once the taxing entities have charged property tax to a new property, that revenue will be considered in calculating the next year’s “no-new-revenue” rate.

The voter-approval tax rate is a level that allows the taxing jurisdiction to collect more taxes than the previous year, allowing local governments to adjust for inflation and increases in population. For cities, counties, and special purpose districts, it is calculated by taking the revenue generat-

ed by the “no-new-revenue” tax rate and finding the tax rate that would increase that revenue by 3.5 percent from the previous year. For ISDs the increased collection cannot exceed 2.5 percent.

If the taxing entity sets a budget that would require setting a tax rate higher than the voter-approval rate to cover the spending, then they must hold an election for the voters to approve or deny the new budget along with the increased taxes. If the voters do not approve the budget, then the tax rate is automatically set to the “no-new-revenue” rate, and the taxing entity must go back and rebuild a budget using only the revenues allowed when charging that rate.

These changes only apply to the taxes charged for funding the local government’s budget, not to the repayment of bonds and other debt, as those already require voter approval before the debt could be issued.

Under this new process, when the state provides additional funding to schools, ISDs must reduce their property tax rate to keep their overall revenue the same without having to collect as much in property taxes.

2019’s reforms set very stringent requirements on local government revenue growth, so it was only proper we should also set similarly stringent requirements on the state government. Starting with the 88th Legislative Session in 2023, the State of Texas is now bound by law to spend no more than it did in the previous two-year cycle, with adjustments for population growth and inflation. The government should provide the services required by the people and spend no more than necessary to do so. If more revenue is collected, those funds should be returned to the taxpayers.

While the Homestead Exemption and taxable value caps help keep the taxable value of your home from increasing too quickly, that limitation forced many school districts to raise the amount of taxes collected from small businesses and other commercial properties. Constitutional requirements for all school M&O tax rates to be within a certain range of one another meant that simply collecting less revenue was not an option for school districts.

The 88th Legislature passed, and voters ratified, a constitutional amendment placing a 20 percent cap on the year-to-year increase in the appraised value for commercial property, including small businesses. The Homestead Exemption was also increased from $40,000 to $100,000, and $12.8B in state revenue was dedicated to buying down school M&O rates across the state, above and beyond the $5B previously dedicated in 2021 for the 2023-2025 biennium.

Since providing an education for every Texan is a state responsibility, rather than a local one, it is essential that Texas decouple the funding mechanism for schools from local property taxes. In the 3rd Special Session of the 2021 legislature, I supported HB 122. This bill builds on the work from the 2019 session, which reduced property tax rates by between $0.08 and $0.13 per $100 of value across the state from where they would have been otherwise.

When sales tax revenue exceeds the state’s spending cap, HB122 would have required the state to spend 90 percent of that surplus to buy down the M&O rate for public schools, which would require an amendment to the Texas Constitution. Most property taxpayers pay close to 50 percent of their taxes to schools, so, as the state buys down costs, property tax decreases, with the goal of completely replacing M&O property taxes with state revenue over time. This would take about 20 years using only surplus state revenue.

For decades, the legislature balanced its books by pushing the cost of providing quality public education onto property taxpayers by way of local school districts. As property tax receipts rose, state lawmakers were able to use sales tax revenues to pay for other priorities, allowing local property owners to pay the bill, and school districts to take the blame. The question at hand, then, is what should the state do with additional revenue if it cannot spend it? The way I see it, we will not truly have a surplus until the local share of school district M&O is zero.

This option builds on the legislation in Option 1 but includes removing sales tax exemptions to achieve the elimination of M&O property taxes at a faster pace.

We currently exempt many categories from sales taxes. Some, like essential groceries and raw materials, make complete sense, while others, like boats, do not. If we pass a bill similar to 87(3) HB 122, removing exemptions would produce additional revenue that would help reduce property taxes in less time rather than giving exemptions to special interest groups.

With the state spending limits and a bill like HB 122 in place, we could trust that the revenue generated by removing sales tax exemptions would go to the intended purpose. It would not require removing all exemptions, but each one we do eliminate gets us close to zero M&O taxes that much faster.

Eliminating school district M&O property taxes will not only help homeowners, it will also make Texas an even more attractive state for business, industry, and commerce. Instead of having to give sweetheart deals, such as a 10 year exemption from school district property taxes to entice companies to relocate, we can offer every business, new or existing, the benefits once offered only to large corporations like Facebook or Amazon.

Your input will be essential to making sure we are being fair when considering the impact of these options.

I'm going to borrow a phrase from comedian John Heffron, who described being in your 50s as being "the youngest of the old people." He is 100 percent correct. My parents were in their 50s when I was in my 20s thinking I was already a grown up. Now that I am — essentially — them (except without the emotional distance or narcissism), I feel like people in their 20s simply don't appreciate that they are little more than recycled teenagers. They don't appreciate being able to stay out late, buy their own toys, and subscribe to the deluxe cable TV package while still enjoying physical activity with ligaments that stay in place.

Personally, that starts with everyone in the house waking to the rifle cracks of my toes and knees when I am trying to tiptoe around in the dark.

John says people in their 50s are the "freshmen" of the old people set, and I would agree with him. I still often felt like I wanted my mommy until I turned 30, and I was in my 40s before I finally felt like I was in the senior class of young people.

Now that I'm a noob again, it would have been nice to have had some "sophomore" mentors in their 60s provide me with appropriate warnings for this new life stage. For instance, the freshman-15 is back again, only this time it's not something I can blame on awesome weekend party activities. Without changing, literally,

anything about my lifestyle, I packed on the pounds courtesy of my hormones and lazy thyroid. So where was the Be sure to eat 45 percent less food space on my "Surviving Middle Age" bingo card?

If, like me, you're new to the club, you can stop worrying about going to pop music concerts because you're going to hate pretty much everything you hear on the radio from now on. It starts to creep up on you when you're in your 30s and 40s — I'm pretty sure I haven't downloaded anything new since Bruno Mars sang at the Super Bowl. If you think I'm wrong, consider Britney Spears is 42 and Toni Basil is 81... now try to name any of the last 10 hosts or musical guests on "Saturday Night Live." I can't, but that's mostly because I go to bed at 10.

Another tip: It's important to purchase a shredder as a new old person because once you show up for orientation, you will start receiving daily postcards and applications from AARP and people trying to sell you walk-in tubs and Medicare plans. Seriously, there is an entire industry making money off of trying to help you figure out how to keep and/or avoid all the "perks" real seniors get.

On the plus side, you go to movies in the daytime and pay matinee prices. Plus, there is almost no one younger and noisier at the theater. However, you will be required to download the IMDB app so you don't aggravate your children with, "Oh, I

like him! Wasn't he in that show with the other girl with the hair and the pretty eyes? Aren't any of the actors I still know making movies any more? Is Clint Eastwood still alive?"

On the plus side, you can now leave parties at 9pm and no one calls you a wuss for not staying for just one more...anything. Most of the time you just get that patronizing, smiling head-tilt and a cloying, "Yeah, well, we're just so glad you could make it out of the house tonight."

You get to enjoy memberships at stores and clubs you used to walk by and think, How are they still in business? These include shops that provide items and supplies to feed wild animals in your backyard or crocheting and quilting, and can-your-ownfood learning annexes.

You also might want to start practicing the speech you will inevitably have to give your parents about assisted living, taking their car keys away, and/or why they should have stopped watching CNN in 2015.

Fortunately, my son is in high school now so I have someone to keep up with my technology and I won't have to feel like I'm running a marathon in flip-flops as I graduate to my 60s and 70s. In the 1980s that race was me telling my mother how to use the microwave. Tomorrow it will be me asking my son how to reboot my refrigerator because I am locked out of the grocery app and can't remember what I wanted to eat.

Locally, we need only go as far as Schwertner, to Capitol Land and Livestock — one of the nation’s largest cattle dealers, to learn more. President/CEO Jim Schwertner grew up in the business alongside his father, Eugene, who founded the company in 1946 and Jim is proud to employ the most cowboys in Central Texas. His 14 full-time and 14 contract cowboys work more than 21,000 acres in northern Williamson County in much the same way Old West cowboys did.

The cowboy culture is unique, Jim says, explaining that one of the unwritten cowboy codes, Ride for the Brand, originated in the Old West, but is still well understood today. The brand — the trademark used for livestock identification — represents a cow-

by Linda A. Thornton

boy’s pride and dedication to the ranch owner to protect the brand as if it were his own. Jim says, “You do not micromanage cowboys, you assign them jobs, then leave them alone to accomplish them. Loyalty and honesty are a big part of the cowboy credo.”

Tom Madden, Jim's general manager, had the pleasure of hiring the company’s first full-time cowgirl. Watching Merideth Scroggs rope one afternoon, he said to himself, “She’s the real deal!” and quickly promoted her from contract to full-time cowgirl.

Merideth’s father, himself a horse trainer and bull rider, took her under his professional wing and dedicated himself to her training. By age 4, she was competing in rodeos and training mean ponies — the kind that throw and bite you. She began roping at age 10 and by 13, she and her father were making extra cash catching loose cattle for ranchers.

Choosing a career of unrelenting hard work, cowboys and cowgirls are athletes in their own right. They work outdoors in all types of weather, confront the harsh realities of livestock deaths and injuries, and face constant dangers working with large animals. Despite these challenges, Merideth says the pros far outweigh the cons. She relishes the outdoors, the independence, and the fact that no two days are alike. The work is physically demanding but honest, leaving her with a profound sense of accomplishment.

While practically an extension of herself, horses are Merideth’s pride and joy. Her deep love for them has instilled in her a fierce determination to quietly observe and learn all she can. Even after 10-hour days, six days a

week, Merideth still finds joy in spending her spare time with her horses. On nights and weekends, she gives riding lessons, enjoying the balance between personal interaction and the solitude of her regular workweek.

Being a cowgirl does have its benefits. Merideth has participated in parades and starred in a photo shoot for a boot company. One of her most exciting moments was when she was asked to attend the San Antonio rodeo to help country music's Tanya Tucker wrangle her horses. The plan for Tanya to ride out onstage was scrapped at the last minute when her manager deemed it too dangerous. “Tanya was madder than a wet hen,” Merideth recalls.

So, while times have changed, both Lucille Mulhall and Merideth Scroggs embody the same core values and adventurous spirit that celebrate the cowgirl ethos—a treasured part of our history that remains alive and well today.

Visit the National Cowgirl Museum and Hall of Fame online at Cowgirl. net.