SUMMER 2023 | VOLUME 39, ISSUE 3

PROFILE It’s Key O’Keefe’s Time to Give Back PAGE 12

Meet Our 2023-24 Board of Directors Inside the SECURE 2.0 Act of 2022 Condo Reform Laws, Part II –SB 154 Update CHAIR

A Member Bene t of: ADMINISTERED BY: Products sold and serviced by Member Benefits, the administrator of the FICPA Insurance Marketplace. The FICPA is not a licensed insurance entity and does not sell insurance. With a group health solution through the FICPA Insurance Marketplace, you can customize your own employee benefits management portal and select from the most competitive group insurance plans on the market. Enjoy large provider networks, flexible plan designs, defined contribution capabilities, and concessions on ancillary products. Take control of your company’s healthcare expenses while providing personalized coverage options to your employees. Request a free quote at memberbenefits.com/ficpa Group Health & Employee Benefits

PRESIDENT & CEO

Shelly Weir

EDITORIAL COMMITTEE

Lynda M. Dennis, CPA, Chair

Joel M. DiCicco, CPA

David J. Hochsprung, CPA, Jonathan S. Ingber, CPA

Douglas B. Keith, CPA

Michael S. Kridel, CPA

Ryan A. Myers, CPA

Will Quilliam, CPA

FICPA STAFF

Nick Menta

Communications Manager and FCT Editor

Lindsay Cannizzaro

Graphic Designer

All articles submitted to Florida CPA Today are subject to technical review, Editorial Committee review, space availability, and editing requirements and restrictions.

Statements expressed herein are those of the identified authors and not necessarily those of the Florida Institute of Certified Public Accountants, Inc. (FICPA), nor should statements be considered endorsements of products, procedures or otherwise.

The FICPA reserves the right to reject any editorial material or paid advertising that does not meet Florida CPA Today criteria or detracts from its ethical and professional standards.

Florida CPA Today is published quarterly by the Florida Institute of Certified Public Accountants, Inc., 250 S. Orange Ave., Suite 300P, Orlando, Fla., 32801. Telephone: (850) 224-2727 or (800) 3423197. Visit our website at ficpa.org. This magazine is provided to members of the FICPA. No specific amount of your dues, either expressed or implied, is for this publication. This magazine is not available for purchase by either FICPA members or nonmembers.

For display advertising information , contact FICPA Strategic Partnership Manager Marjorie Stone at 850-521-5950 or MarjorieS@ficpa.org.

© 2023 by the Florida Institute of Certified Public Accountants, Inc. All rights reserved. Reproduction in whole or part is prohibited without the express written consent of the FICPA.

SUMMER 2023 | FLORIDA CPA TODAY 1

CONTENTS Visit issuu.com/ficpa to access and download the digital version of Florida CPA Today . FEATURES 12 Chair Profile: It’s Key O’Keefe’s Time to Give Back 16 Meet Our 2023-24 Board of Directors 21 Inside the SECURE 2.0 Act of 2022 24 Condo Reform Laws, Part II – SB 154 Update INSIDE THE ISSUE 2 CEO’s Message 4 News Briefs 10 MEGA 2023 Update 27 Department of Revenue Update 29 Strategic Partner Content 36 Scholarship Foundation Class of 2023 38 Foundation Chair and Trustees 41 Members on the Move 42 Welcome to the FICPA 45 Marketplace

12 FICPA.ORG

FICPA 2023-24 Chair Key O’Keefe

Photo and cover image by Brittany Echemendia / Two Stories Media

Experience, Learn and Earn offers an additional path to licensure

With our new membership year underway, I want to once again thank you for your support of the FICPA. It’s your membership that allows us to take a leading role in the profession, both here in Florida and across the country, as we continue to work closely with other state societies and our national partners.

With the talent pipeline always on our mind, I want to take this opportunity to focus on one promising path forward: ELE or Experience, Learn & Earn. I’ve been proud to serve on the AICPA and NASBA’s ELE Task Force, developing a post-graduate pilot program that will launch this fall in collaboration with the Tulane School of Professional Advancement.

What is Experience, Learn & Earn? In short, a significant number of prospective CPAs are having trouble meeting the cost of graduate-level education. At the same time, firms need promising young talent now more than ever. The ELE pilot program solves for both issues, helping accounting graduates access affordable online courses while they work as firstyear hires at public accounting firms.

Eligible candidates include accounting graduates who have completed at least 120 hours of coursework to date. These future CPAs are then hired by firms as full-time employees and allocated specific time to complete their coursework alongside their accounting work.

The ELE program is affordable: The projected cost for the full 30 credit hours is $4,500 or $150 per credit hour.

It’s additive: First-year hires are broadening their skill set as they

work for you, thus accelerating their development.

And it’s customizable: Firms can tailor the experience to meet their needs, structuring a work and study schedule that makes sense for everyone.

In the end, these new hires can work for you, earn a salary, and complete the 150 credit hours required for licensure – all at once.

You’ve heard me say before that there’s no single answer to the talent shortage, but ELE is one promising solution that both reduces the burden on students and upholds the high standards that set our profession apart.

I want to stress that ELE is not intended to replace any institution’s Master of Accountancy, as those who complete the program will not receive a degree. Instead, ELE offers an additional path to licensure for those students who lack the means to continue their education at the graduate level.

Thus far, more than 100 firms around the country have indicated interest in the pilot program.

I am honored to have played a role in this process alongside my colleagues at the AICPA and NASBA and eager to see the ELE program evolve and grow. To learn more on how your firm or university can get involved, head to ExperienceLearnEarn.org and scroll down to the FAQ section on the homepage.

While we may have disagreements in our shared effort to attract new talent to the profession, our unity is our greatest strength. Together, we can overcome our pipeline problem, and position the CPA profession for enduring success.

2 FLORIDA CPA TODAY | SUMMER 2023

CHIEF EXECUTIVE OFFICER’S MESSAGE

“In the end, these new hires can work for you, earn a salary, and complete the 150 credit hours required for licensure – all at once.”

SHELLY WEIR president & ceo

As FICPA’s largest South Florida event, the South Florida Accounting Conference includes Learning Labs, an optional Ethics course, a Solutions Center with exhibitors and resources from various fields, plus access to the most engaging and informative speakers.

This year’s program features a diverse set of topics to meet the needs of CPAs. Conference tracks include:

Honing Your Technical Acumen

Enhancing Your Role as Trusted Advisor

Innovation and Accounting Technology Not

SUMMER 2023 | FLORIDA CPA TODAY 3 REGISTER TODAY Scan now or visit ficpa.org/2023SFAC Special group rates are available. Call for details 850-342-3197. SOUTH FLORIDA ACCOUNTING CONFERENCE The Alan B. Levan | NSU Broward Center of Innovation Fort Lauderdale EMBRACING THE FUTURE OCT. 24-26, 2023

a Member?

now at ficpa.org/JoinNow

save!

Join

and

FICPA names Jason Harrell its new Chief External Affairs Officer

The Florida Institute of Certified Public Accountants (FICPA) is pleased to announce that Jason Harrell joined the FICPA as Chief External Affairs Officer, effective July 17, 2023.

Harrell will be stationed at the FICPA Governmental Affairs office in Tallahassee and will direct all aspects of the FICPA’s public policy, advocacy, governmental affairs and regulatory efforts. He will serve as the liaison to the Florida Department of Business and Professional Regulation and Florida Board of Accountancy and will be responsible for all advocacy-related external communications and campaigns aimed at increasing the value of the CPA license. Alongside FICPA’s longtime external public affairs agency, Liberty Partners of Tallahassee, Harrell will establish and implement the FICPA’s lobbying strategy.

“I’m extremely honored to join the FICPA as its new Chief External Affairs Officer,” Harrell said. “I understand the important role CPAs play in our economy, and I welcome this incredible opportunity

to represent the organization and the profession in Tallahassee. I look forward to working with the FICPA leadership team and accounting professionals across the state to promote the profession and further grow our legislative advocacy program.”

As a member of the executive team, Harrell will work alongside FICPA President & CEO Shelly Weir, Chief Growth & Innovation Officer Carrie Summerlin, and Chief Financial Officer Kristin High to lead and execute the strategic direction of the FICPA.

“Advocacy is at the core of what we do at FICPA. Jason’s rich experience in public policy and governmental affairs make him a perfect fit for the FICPA,” Weir said. “After our extensive search to fill this role, it was

Jason’s expertise, professionalism and enthusiasm that truly stood out. I am excited to work alongside him as we continue our efforts to protect and promote the CPA profession in Florida.”

Prior to joining the FIPCA, Harrell was the Director of Government Relations for the Florida Court Clerks & Comptrollers (FCCC) since 2018, leading five successful legislative sessions for the FCCC’s in-house advocacy program. He also previously served as budget and communications director of the Clerks of Court Operations Corporation (CCOC).

Harrell previously served in the Florida House of Representatives Majority Office as deputy staff director under former speakers Will Weatherford and Steve Crisafulli. He also served in the Governor’s Office of Policy and Budget and in the Office of the Chief Inspector General.

Harrell holds a master’s in public administration (MPA) and a bachelor’s degree in economics from Florida State University.

The FICPA engaged Korn Ferry, the world’s largest executive search firm, to conduct the search for its new Chief External Affairs Officer. A national search was conducted by the project team led by Audra Cross, Trenholm Boggs, and Jeremy Gold.

NEWS BRIEFS

CONFERENCE

10, 2023

UP TO 12 CPE *

you add a pre-conference workshop.

CONSTRUCTION INDUSTRY

November

Signia by Hilton Orlando Bonnet Creek

*When

2023 Women to Watch: Marie Rosier and Elizabeth Jackson

As part of our Women’s Leadership Summit at MEGA 2023, the FICPA presented its annual Women to Watch Awards to Experienced Leader Marie Rosier and Emerging Leader Elizabeth Jackson.

“These outstanding women are not only shaping the future of the FICPA, but also our profession,” said Key O’Keefe, presenting the awards. “I hope that this ceremony and their example will inspire all of us to focus on how we each make a lasting impact on the profession.”

Rosier is the owner of MMR CPA and an expert in the areas of financial operations, financial reporting, and tax reduction strategies. She has dedicated her career to helping businesses develop the knowledge, processes, systems, and tools for success.

A former adjunct professor, Marie is passionate about introducing young people to the accounting profession, currently serving as a trustee for the FICPA Scholarship Foundation and as a member of the AICPA’s Student Recruitment Committee.

Marie is a graduate of the third class of the FICPA Emerging Leaders Program and was a recipient of “40 Under 40” CPAs, awarded by the inaugural Black Centennial Celebration Project, honoring Black CPAs who are influencing positive change in the CPA profession and their communities.

Jackson is a Transfer Pricing Manager at RSM US LLP. She currently serves as co-leader of RSM’s South Florida STAR (‘Stewardship and Teamwork for the Advancement and

Retention of RSM’s Women’) employee network group and engages in RSM’s recruitment activities to identify future leaders within the accounting, finance, and economics industries.

Jackson is a past FICPA Leadership Academy graduate and an FICPA Horizon Award recipient. During the FICPA’s annual MEGA Conference, she was presented the 2023 Women to Watch - Emerging Leader Award for her contributions to the accounting profession during the first decade of her career.

As the current Chair of the FICPA’s Young CPAs Committee for members 35 and under, she will serve a one-year term as a non-voting participant on the FICPA Board.

The Experienced Leader Award is reserved for women who have risen to leadership positions after more than 10 years in the profession. The Emerging Leader Award recognizes women who have made significant contributions to the profession in the early stages of their careers.

Nominations for the 2024 awards will be open from Dec. 1, 2024, through Jan. 15, 2024, with winners to be announced at MEGA 2024.

SUMMER 2023 | FLORIDA CPA TODAY 5

Experienced Leader Marie Rosier, MMR Certified Public Accounting

Emerging Leader Elizabeth Jackson, RSM US LLP

Volunteer recognition: Honoring Howard, Gardi for their leadership

From yacht clubs and boat cruises to CPE, tailgating to taxes, baseball games to beach breweries, Young CPA to YOLO events, and symphonies to socials, one thing is clear: FICPA Chapters are back in business.

Florida is a large and diverse state, and our FICPA Chapters play a vital role in member engagement, contributing to CPA camaraderie, professional development and cross-industry networking.

As we’ve emerged from the pandemic and reimagined the Chapter model, we’d like to recognize two outstanding Chapter officers and volunteer leaders for leading successful revitalization efforts in their areas.

Anchored by their deep knowledge of member preferences, the Gulf Coast Chapter’s Debi Gardi, CPA (Gardi & Gardi), and the Palm Beach Chapter’s Sharon Howard, CPA, CMA, MST (Divine, Blalock, Martin & Sellari) have brought fresh ideas –uniquely contextualized to their Chapter’s business and social culture – and offered a range of educational and “member-able” experiences.

FICPA Chapter membership is included with your annual dues. Let’s keep the positive momentum going for an even more dynamic 23-24 membership year! Participate in your profession by getting involved with your local chapter. You get out of it what you put into it and your involvement will pay dividends, both personally and professionally. For more information, visit ficpa.org/chapters.

IVEY ROSE SMITH Vice President of Membership and Corporate Relations

6 FLORIDA CPA TODAY | SUMMER 2023 NEWS BRIEFS

Debi Gardi, CPA Gulf Coast Chapter

Sharon Howard, CPA, CMA, MST Palm Beach Chapter

FICPA members at the Palm Beach Symphony.

The Gulf Coast Chapter at the Sarasota Yacht Club.

THE FULL LIST OF ADVISORY GROUP MEMBERS

Jeannine Birmingham, Alabama Society of CPAs

Ken Bouyer, EY Americas

Susan Coffey, AICPA & CIMA

Daniel J. Dustin, NASBA

Joe Falbo, Szymkowiak & Associates

Jonathan Hauser, KPMG

Angela Ho, OceanFirst Bank

Kathy Johnson, JS Held

Lori Kaiser, Kaiser Consulting

Lexy Kessler, Mid-Atlantic Regional

Elizabeth (Betsy) Krisher, Maher Duessel

Allen Lloyd, Montana Society of CPAs

Tom Neill, CPA (retired)

Michelle F. Randall, Schoolcraft College

Jodi Ann Ray, Texas Society of CPAs

Marcus Rayner, PwC

Rick Reisig, Pinion

Kimberly Scott, Washington Society of CPAs

Lindsay Stevenson, BPM

Mark Taylor, University of South Florida’s

Lynn Pippenger School of Accountancy

Emily Walker, Virginia Society of CPAs

Shelly Weir, Florida Institute of CPAs

President & CEO Shelly Weir named

to AICPA’s National Pipeline Advisory

Group

The AICPA on July 31 announced the formation of a new National Pipeline Advisory Group aimed at combating the CPA profession’s ongoing talent shortage.

FICPA President & CEO Shelly Weir is among the 22 members of the group, which comprises a range of perspectives from across the profession.

“The slowdown in young adults choosing accounting as a career is a collective problem for the CPA profession and requires a collective and inclusive solution,” Sue Coffey, CPA, CGMA, CEO of Public Accounting for AICPA & CIMA and a member of the Advisory Group, said in a statement. “We want to make sure we have a broad range of viewpoints and perspectives to help define the profession’s pipeline strategy moving forward. This deep, capable and experienced group will play a critical role in

guiding that conversation and subsequent call to action.”

Per the AICPA: The National Pipeline Advisory Group’s work is part of a multi-pronged approach that includes an intensive effort to use technology, surveys and in-person forums to solicit insights and input from a diverse array of groups around the country.

The group, which began meeting in July, is expected to report on its progress at the AICPA Fall Council meeting in October.

In addition to her new role on the Advisory Group, Weir also serves as a member of the AICPA’s Experience, Learn and Earn Task Force, which seeks to create a bridge between accounting students on the path to licensure and accounting firms.

“Since I arrived at the FICPA two years ago, I’ve been focused on the biggest challenge facing the profession – the state of the pipeline,” Weir said. “I am honored to be a member of this vital group and excited to work alongside this renowned and respected collection of leaders. Together, we can pave the way for the next generation of CPAs and secure the future of our profession.”

SUMMER 2023 | FLORIDA CPA TODAY 7

FICPA

Beneficial ownership information reporting under the Corporate Transparency Act

AICPA

The Corporate Transparency Act (CTA) was enacted as part of the National Defense Act for Fiscal Year 2021. The CTA mandates that millions of entities report their beneficial ownership information (BOI) to the Financial Crimes Enforcement Network (FinCEN). This resource is meant to provide a preliminary overview of the provisions in the CTA and answer questions that clients could raise when informing them of compliance requirements.

WHO IS REQUIRED TO REPORT UNDER THE CTA’S BOI REPORTING REQUIREMENT?

All domestic and foreign entities that have filed formation or registration documents with a U.S. state (or Indian tribe), unless they meet one of 23 enumerated exceptions (see question No. 8 of FinCEN FAQs for a full list of exemptionsi), including:

EXEMPT: large operating entities that meet all the following criteria:

Employ more than 20 people in the U.S.

Had gross revenue (or sales) over $5 million on the prior year’s tax return

Has a physical office in the U.S.

EXEMPT: publicly traded companies that have registered under Section 102 of SOX

WHEN MUST COMPANIES FILE?

New entities (created/registered after Dec. 31, 2023) — must file within 30 days

Existing entities (created/registered before Jan. 1, 2024) — must file by Jan. 1, 2025

Reporting companies that have changes to previously reported information or discover inaccuracies in previously filed reports – must file within 30 days.

WHAT INFORMATION DO COMPANIES NEED TO REPORT?

Each company must report the information below ii

Full legal name of the reporting company and any trade or DBA names

Business address

State or Tribal jurisdiction of formation or registration

IRS TIN

In addition, each reporting company must report the following details on its beneficial owners and, for newly created entities, its company applicant(s):

Name

Birthdate

Address

Unique identifying number and issuing jurisdiction from an acceptable identification document (and image of such document)

WHO IS A BENEFICIAL OWNER?

Any individual who, directly or indirectly, either:

Exercises substantial control over a reporting company, or

Owns or controls at least 25% of the ownership interests of a reporting company

WHO IS A COMPANY APPLICANT?

The individual who files the document that creates the entity or who first registers the company to do business in the U.S., and

The individual primarily responsible for directing or controlling the filing of such a document

WHAT ARE THE PENALTIES FOR NONCOMPLIANCE WITH THE STATUE?

Civil penalties are up to $500 per day that a violation continues.

Criminal penalties include a $10,000 fine and/or up to two years of imprisonment.

WHAT DO I NEED TO BE AWARE OF?

There has been some debate about whether non-attorney practitioners advising clients on the requirements of the CTA or the BOI reporting form could be considered unauthorized practice of law.

Practitioners may wish to contact their state regulators, insurance carriers and/or legal counsel to further discuss this issue.

WHAT OTHER CONSIDERATIONS ARE THERE BEFORE I ENGAGE WITH A CLIENT?

Consider updating engagement letters, organizers and checklists to clearly state whether services relating to the CTA are included.

FOR MORE INFORMATION

Tax, PFP and FVS section members can access an expanded FAQ guide.iii

AICPA’s beneficial ownership information reporting guidance and resources page. iv

(i) www.fincen.gov/boi-faqs

(ii) www.aicpa-cima.com/resources/download/beneficial-ownership-information-boi-report-summary-of-data-fields

(iii) www.aicpa-cima.com/resources/download/beneficial-ownership-information-boi-faq-expanded

(iv) www.aicpa-cima.com/resources/landing/beneficial-ownership-information-boi-reporting

Burns Wealth Management Group

SUMMER 2023 | FLORIDA CPA TODAY 9 Is there a better way to plan and invest? ©2023 JPMorgan Chase & Co. All rights reserved. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. Chartered Financial Consultant® (“ChFC®”) are registered trademarks owned by The American College of Financial Services. Investments & Wealth Institute™ (The Institute) is the owner of the certification marks “CPWA,” and “Certified Private Wealth Advisor.” CPWA, and/or Certified Private Wealth Advisor signifies that the user has successfully complete The Institute’s initial and ongoing credentialing requirements for investment management professionals and/or wealth advisors. J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (JPMCB). JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Robert Burns CFP®, ChFC®, CPWA ® Managing Director Wealth Partner Portfolio Manager 3825 PGA Blvd, Floor 9, Palm Beach Gardens, Florida 33410 561.694.5666

INVESTMENT AND INSURANCE PRODUCTS: •NOT A DEPOSIT • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY •NO B ANK GUARANTEE • MAY LOSE VALUE

robert.m.burns@jpmorgan.com jpmorgan.com/burnswm

AND BETTER THAN EVER BIGGER

A

look back at MEGA 2023

In June, the FICPA welcomed more than 500 members, speakers, sponsors and special guests to the JW Marriott Orlando Bonnet Creek for our premier annual event: MEGA.

This year’s reimagined conference invited everyone on site and streaming from home to “Explore the Possibilities”

across four full days of continuing professional education, networking and socializing.

In addition to the main conference slate, MEGA 2023 was also home to our Accounting Scholars Leadership Symposium, Bridge the Gap Conference, Personal Financial Planning Boot Camp, and Women’s Leadership

10 FLORIDA CPA TODAY | SUMMER 2023

You can enjoy a look back at this year’s conference by visiting ficpa.org/MEGA or scanning the QR code below to watch our recap video.

Summit, where we were proud to recognize our two 2023 Women to Watch Award Winners, Marie Rosier and Elizabeth Jackson (see Page 5).

The highlight of the week, MEGA Thursday featured an address from the Director of the Florida Division of Emergency Management, the return of our

Newly Certified Ceremony –with visits from CPA Lawmaker Sen. Joe Gruters and the Florida Department of Business and Professional Regulation Secretary Melanie Griffin –and our annual dinner and celebration: the FICPA Chair’s Reception.

We can’t wait for even more of you to join us next June for MEGA 2024, June 11-13, at the Loews Sapphire Falls Resort at Universal Orlando.

SUMMER 2023 | FLORIDA CPA TODAY 11

NICK MENTA FICPA Communications Manager

Key O’Keefe has spent the bulk of her career on the move.

Her husband of 45 years, Brian, served for three decades in the United States Coast Guard, rising to the rank of Captain. First on her own, then with Brian, and later with their now-grown children, Daniel and Aime, O’Keefe has taken the scenic route to her current station: 96th Chair of the Florida Institute of Certified Public Accountants.

A native of Alabama, O’Keefe first attended LSU in Baton Rouge, Louisiana, before graduating from Ole Miss in Oxford, Mississippi, and moving back to Mobile. She met and married Brian and started on the following journey:

From St. Petersburg, Florida, to West Lafeyette, Indiana, to Miami, to Cape Canaveral, to Northern Virginia, back to Miami, back to Northern Virginia, back to Miami, to San Francisco, and back to Virginia.

It was in Norfolk that Brian completed his 30 years of service, setting up the family to finally settle in one spot – Melbourne, Florida – in 2007.

“I never sought spotlight. That’s not something that comes naturally to me,” O’Keefe says. “I want to get the work done, and someone else can get the attention. For 30 years, I was a military wife. It took me a long time to realize that it was OK for me to take my turn.

“The profession has given me so much over the course of my career. Once we settled in Melbourne, finally, it was time for me to give back.”

A member of the FICPA since 1984, her volunteer service began nearly 25 years later with officer roles in the Brevard Chapter. She progressed from Treasurer to President to Chapter Director before moving on to Chair the FICPA’s Chapter Operations Committee. From

Chapter member to FICPA Chair, her commitment to individual members – “to working for those who do the work” –has never waned.

“No one cares more about our Chapters and members at the grassroots level than Key,” FICPA President & CEO Shelly Weir says. “She’s poured her heart and soul into this organization, and it all started with Chapter service.”

It was as a representative and voice for those at the local level that she began to make an impression on her fellow volunteer leaders. Past Chair Gary Fracassi (2018-19) has admired O’Keefe’s passion and courage from one of their earliest interactions, when she spoke up during a leadership meeting in Tallahassee.

“She had no shyness about stepping in front of 100 people and speaking her mind, telling them what she thought was right, and

what was wrong – like a leader is supposed to do,” Fracassi says. “She’s only become more comfortable in that role. As she took on each additional responsibility, she kept growing.”

But even when she joined the Council in 2017 and the Board of Directors in 2019, she wasn’t pining to take the next step. In fact, Fracassi distinctly remembers asking her: “Do you want to be Chair?”

“Not really,” she answered, “unless you need me.”

That’s a sentiment all too familiar to those who know her best, like John Somerville, O’Keefe’s partner at O’Keefe, Somerville & Associates.

“When there’s help needed –whether it’s for 15 minutes or five hours – she’s the person who will jump in with both feet,” he says. “She’s an outstanding person to work with.

Continued on page 14

SUMMER 2023 | FLORIDA CPA TODAY 13

Key O’Keefe and FICPA President & CEO Shelly Weir

All images by Brittany Echemendia / Two Stories Media

More than that, she’s someone who will take the time to mentor you and help you along. She genuinely enjoys seeing other people succeed.”

That’s coming from a friend of 30 years, but you’ll hear almost the exact same description from Alex Welsh, last year’s Chair of the FICPA Young CPAs Committee. O’Keefe and Welsh first met during a strategy session in August 2021. In a situation where Welsh could have felt unsure or out of place, it was O’Keefe who made her feel welcome. Later, it was O’Keefe again who encouraged her to apply for both the FICPA and AICPA Leadership Academies.

“She talks to everyone in a room,” Welsh says, “and she makes you want to get more involved. She directs you, and she encourages you. She makes you feel like your contribution matters. This year at MEGA, she made a point to have dinner with the Young CPAs. She’s creating a bridge, and she’s making

us much more confident about approaching other volunteer leaders and getting involved.”

O’Keefe’s efforts to mold the next generation pre-date her service to the FICPA. She’s spent the last 20 years working with Junior Achievement, a nonprofit focused on providing financial literacy, career education and entrepreneurship education. Each year, she leads multi-session courses with as many as 20 classes of elementary and high school students, introducing them to accounting and the CPA profession. She has been named JA’s Volunteer of the Year in three different locations: the San Francisco Bay Area, Greater Hampton Roads/ Tidewater, and Melbourne.

As much as she’s been able to teach, she’s also eager to tell you what she’s learned. To any accountant or auditor reading this piece, 2 + 2 = 4. But when O’Keefe enters a classroom, she asks a slightly different question.

“What’s

2 and 2?”

She’ll never forget the day she learned the answer, when a fourth-grader explained that if you turn one of the numbers around, believe it or not, 2 and 2 actually equals … a fish.

HOW DOES 2+2 = FISH?

14 FLORIDA CPA TODAY | SUMMER 2023

“It’s up to us to tell our story as CPAs, and we need to be creative about how we do that. We need to think outside our own box. We need to nurture and guide and help these kids grow. Without the future, what do we have?”

- Key O’Keefe FICPA Chair

Continued from page 13

Gary Fracassi, Key O’Keefe and Kristin Bivona

=

“The point of the exercise is to think outside the box,” O’Keefe says. “It’s up to us to tell our story as CPAs, and we need to be creative about how we do that. We need to think outside our own box. We need to nurture and guide and help these kids grow. Without the future, what do we have?

“I’m never going to leave a monetary mark in this world. But I might make a difference in the life of a young person. If I’ve made a positive impact on someone, that’s what’s important to me. I think we should all be striving to leave things better than we found them.”

Which brings us back to her conversation with Fracassi. What changed over the course of a few years, moving O’Keefe from a “not really” to a Chair? What made her, like Somerville would say, jump in with both feet?

“I would still tell you, I didn’t do this so I could say ‘I was Chair,’” O’Keefe explains. “I applied because I realized I have something unique to offer. I’ve worked at every level of public accounting, from a Big 4 firm to sole proprietorship. I’ve worked in industry. I’ve worked in academia. Not many people have jumped around as much I have. I understand the importance of connection.”

That’s a quality Chair-Elect Ed Duarte has seen firsthand over the last year, her ability to relate.

“She has a very calm way of identifying the issues and thoughtfully responding,” Duarte says, “both on behalf of the profession and through the eyes of individual members. She’s thoughtful about how to navigate those murky waters. It’s the right mentality to build consensus.

“She’s always been a strong voice for our Chapters, but as I’ve spent more time with her, I’ve noticed the commitment to Young CPAs and students. The passion she has for them – it’s genuine.”

It’s an encouragement O’Keefe did not receive herself as an aspiring accountant at Ole Miss. Quite the opposite. During her senior year, she was one of 11 female students in the room when her professor announced: “Every woman in this room is taking a job away from a man who needs it. My job is to make sure you don’t graduate.”

Only two of those 11 did go on to graduate. One of them is now Chair of the FICPA.

“That’s why it’s so cool that she’s Chair now,” Welsh says. “It makes me feel like I can accomplish something when someone tells me I can’t.

“I know what I can achieve, because I watched Key do it.”

SUMMER 2023 | FLORIDA CPA TODAY 15

Key O’Keefe and FICPA President & CEO Shelly Weir

FICPA Leadership consists of the Board of Directors, Council, and Chapter leaders.

The Board of Directors includes the FICPA Chair, Chair-Elect, nine directors, the Chair of the FICPA’s Young CPAs Committee (non-voting) and the FICPA’s President & CEO, who serves as the Secretary-Treasurer (also, non-voting).

Together, the Board implements the Council’s policies and oversees the Institute’s activities.

Eduardo “Ed” Duarte, CPA, CGMA | Chair-elect CFO | Foreign Parts Distributors, Inc.

Ed has served the FICPA in various volunteer leadership roles since 2006 and will be the Institute’s 2024-25 Chair. He currently serves on the AICPA Council. Additionally, under the Florida Department of Business and Professional Regulation, Ed serves as a member of the Clay Ford Scholarship Committee. He was previously the President of the Cuban American CPA Association and Foundation. He is also a founding member of the executive board of directors with the Live Like Bella™ Foundation, which works to help find a cure for pediatric cancer.

Kristin Bivona, CPA Managing Partner | GellerRagans

Kristin is the Managing Partner for GellerRagans, Central Florida’s oldest accounting firm, and for nearly 20 years, she has been working with closely held businesses in the Central Florida area providing accounting, advisory and taxation services. Kristin is the Vice President of the Florida CPA PAC, Central Florida Region and she serves on the Council of the AICPA as well as the AICPA UAA Committee. A proud Knight, Kristin received both her bachelor’s degree in accounting and her Master of Business Administration from the University of Central Florida.

Kathryn Horton, CPA, CMA, CIDA, CFE President | Kathryn K. Horton, CPA PA

Kathryn is a four-time National 40 Under 40 honoree by CPA Practice Advisor and has served on the FICPA Board of Directors since 2020. Kathryn was recipient of the 2023 AICPA Outstanding Young CPA Award and serves on the AICPA Governing Council. She is the past chair of the Young CPA Committee and a graduate of the FICPA Emerging Leaders Program, the Florida TaxWatch Citizenship Institute and the AICPA Leadership Academy. She is also a past recipient of the FICPA’s Women to Watch – Emerging Leader Award and a frequent speaker at FICPA conferences.

BOARD

2023-24

OF DIRECTORS

Jennifer Keller, CPA Senior Manager | Crowe LLP

Working in Crowe’s National Retail Dealer services group, Jennifer is a graduate of the FICPA Emerging Leaders Program, a past member of Women in Leadership committee and a past chair of the West Coast Chapter and the Young CPA Committee. In addition to her role on the Board of Directors, she is also a member of the FICPA Scholarship Foundation’s Board of Trustees. A past FICPA Horizon Award nominee, Jennifer has a passion for giving back and helping young accountants become CPAs and future leaders in the profession.

Kistka, CPA Jacksonville Managing Director | Deloitte & Touche LLP

In addition to serving as a national audit facilitator for Deloitte, Amy also leads the learning initiatives and strategy for all the firm’s Florida practices. As a member of the FICPA, she has previously served as a member of the State Legislative Policy Committee and the Women in Leadership Committee. She was named by the Jacksonville Business Journal as one of its 2018 Women of Influence.

Karen Lake, CPA Director of Tax Services | Berkowitz Pollack Brant Advisors + CPAs

Karen leads the firm’s SALT (State and Local Tax) practice and previously served on the FICPA Board of Directors from 2018-19 and has chaired the Institute’s State Tax, Corporate Finance and South Florida Accounting Conference Committees. In 2020, she was presented the FICPA’s Women to Watch – Experienced Leader Award for her contributions to the CPA profession. Outside the FICPA, Lake was previously Chair of Florida TaxWatch’s COVID-19 Task Force and its Tax Advisory Council.

Chris Oatis, CPA Partner-State & Local Tax | Grant Thornton, LLP

As a Partner at Grant Thornton Chris focuses on state and local tax. He joined the FICPA Council in 2021 and was previously Chair and Vice Chair of the Institute’s State Tax Committee and a member of its State Legislative Policy Committee. Oatis also served on the Florida Board of Pilot Commissioners, as Vice Chair of its Pilotage Rate Review and Legislative committees. He is a member of the AICPA and received both his bachelor’s in finance and his master’s in accounting from the University of Florida.

SUMMER 2023 | FLORIDA CPA TODAY 17

Amy

2023-24 FICPA COUNCIL

JESSICA BORMEY, CPA, MACC

Exec. Dir. Foundation Finance & Operations, Nicklaus Children’s Health System

ADAM DANIELS, CPA

Sr. Audit Manager, Spoor Bunch Franz

ASHLEY MAHER FAGAN, CPA Managing Director, Business Tax Services, KPMG, LLP

ANDREW GAY, CPA

President/Owner, Grimsley and Company CPAs

PETER GOLOTKO, CPA

President/CEO, CPS Investment Advisors

CARLOS GROSMANN, CPA, MACC Manager Tax Services, Kaufman, Rossin & Co.

ANNE MARIE HICKS, CPA

Sr. Manager, Capital Edge Consulting, Inc

TARSHA JACOBS, CPA

President/CEO, Jacobs and Associates, CPA, PLLC

ROBBIE MAYA, CPA

Manager, Kaufman, Rossin & Co, PA

GRAEME MELLET, CPA

Audit Partner, RSM US, LLP

HEBER ROJAS, CPA Partner, Tapia, Rojas & Associates, PA

CHRISTOPHER STEMLEY, CPA

Senior Manager – Financial Accounting, Disney Financial Services Co., LLC

CHERI SWAIN, CPA

Partner, Carr, Riggs & Ingram, LLC

ALEX WELSH, CPA, CISA, CITP Senior Manager, A-lign

DR. AHARON YOKI, DBA, CPA

Asst. Professor of Instruction, University of South Florida

DANA ZUKIERSKI, CPA

Assurance Partner, Ernst & Young, LLP

Mindy Rankin, CPA, CCD Member | Warren Averett, LLC

Mindy was appointed by Gov. Rick Scott to the Florida Board of Accountancy (2016-2020) and has served on the FICPA Board of Directors, Council, Young CPA Committee and Membership Committee. She has also been an officer for the Miracle Strip Chapter having served as President, President-Elect, and Treasurer. She previously served on the Board of Directors of Girls, Inc. of Bay County for six years and is currently Treasurer of the Panama City Chapter of Troy Alumni and a member of the Board of Directors of Tyndall Federal Credit Union.

Brion Sharpe, CPA Trust Solutions Director | PricewaterhouseCoopers LLP

Brion is a past chair and vice chair and currently an active member of the FICPA’s Accounting Principles & Auditing Standards Committee. He has been the lead and co-lead on multiple FICPA exposure draft responses. He is also an active member of the State Legislative Policy Committee and has previously contributed to an award-winning Florida CPA Today article. He is a previous member of the Young CPA Committee and was recognized as one of the FICPA’s 26 Under 36 honorees. He is serving his second term as a member of the FICPA Board of Directors.

Jesus Socorro, CPA Managing Partner-Management Consulting, South FL BDO USA LLP

Jesus has extensive prior board experience, having served public companies, regulatory bodies and nonprofits. He was first named to the Florida Board of Accountancy in 2016 and later served as the BOA’s Vice Chair and Chair. He is the former President of the FICPA’s Miami Chapter, a member of the AICPA and the Board Treasurer of the Florida Chapter of the National Association of Corporate Directors.

Elizabeth “EJ” Jackson, CPA | YCPA Rep Manager | RSM US LLP

Elizabeth serves as co-leader of RSM’s South Florida STAR (‘Stewardship and Teamwork for the Advancement and Retention of RSM’s Women’) employee network group and is an FICPA Leadership Academy graduate and FICPA Horizon Award recipient. In June, she was presented the 2023 Women to Watch - Emerging Leader Award for her contributions to the accounting profession during the first decade of her career. As the current Chair of the FICPA’s Young CPA Committee for members 35 and under, she will serve a one-year term as a non-voting participant on the FICPA Board.

SUMMER 2023 | FLORIDA CPA TODAY 19 Let CPAlliance™ help you turn your tax practice into a full-service Investment Advisory and Financial Planning firm. Our Turnkey Asset Management Platform is designed to allow members to provide clients with conflict-free and holistic financial planning that steadily builds wealth for long-term prosperity and peace of mind. CONTACT US | 863-688-1725 | CPALLIANCE.COM 205 East Orange Street, Suite 310 Lakeland, Florida 33801- 4611 Shawn J. McCabe MSA, MBA, CFP® CPALLIANCE TM DIRECTOR | PARTNER smccabe@cpalliance.com

CPA Financial Planner DESIGNED BY CPA s FOR CPA s CPAlliance™ is a turnkey asset management platform designed by CPAs for CPAs and is a division of CPS Investment Advisors.

Become a

Are your clients overwhelmed by HR?

Are your clients overwhelmed by HR?

Clients look to you for guidance on running their business, which includes supporting their workforce. Paychex HR can enhance your client advisory service offering with a scalable suite of solutions, designed to tackle their HR challenges.

Paychex HR can help your clients:

Clients look to you for guidance on running their business, which includes supporting their workforce. Paychex HR can enhance your client advisory service offering with a scalable suite of solutions, designed to tackle their HR challenges.

Paychex HR can help your clients:

• At tract and retain talent — We provide innovative solutions to help businesses attract the right people, streamline the hiring process, and efficiently onboard employees.

• At tract and retain talent — We provide innovative solutions to help businesses attract the right people, streamline the hiring process, and efficiently onboard employees.

• Offer world-class benefits — Through our buying power, clients may have access to more affordable insurance rates, so they can offer more robust health and retirement plan benefits.

• Re duce risk — HR professionals can help clients navigate complex laws and regulations.

• Offer world-class benefits — Through our buying power, clients may have access to more affordable insurance rates, so they can offer more robust health and retirement plan benefits.

• Re duce risk — HR professionals can help clients navigate complex laws and regulations.

• Improve employee engagement — We can assist your clients with integrated performance development and learning management technologies.

• Improve employee engagement — We can assist your clients with integrated performance development and learning management technologies.

With Paychex HR, clients can access a dedicated HR professional to address common HR concerns, like compliance support and sensitive workplace issues.

With Paychex HR, clients can access a dedicated HR professional to address common HR concerns, like compliance support and sensitive workplace issues.

Learn more at: go.paychex.com/ficpa_jun23

(877) 534-4198 | FICPA@paychex.com

Learn more at: go.paychex.com/ficpa_jun23

(877) 534-4198 | FICPA@paychex.com

Paychex is proud to be the preferred provider of HR, payroll, and retirement services for the FICPA’s members.

Paychex is proud to be the preferred provider of HR, payroll, and retirement services for the FICPA’s members.

© 2023 Paychex, Inc. All Rights Reserved. | 05/03/23

© 2023 Paychex, Inc. All Rights Reserved. | 05/03/23

20 FLORIDA CPA TODAY | SUMMER 2023

SECURE 2.0 Act of 2022: A prod and a poke to protect your retirement savings

CAROL A. VANCE Esq., CPA MELINDA LIKENS CPA

As old tax law theory decreed, tax legislation incentivizes desired economic behavior. The SECURE 2.0 Act of 2022 (H.R. 2617), signed into law on Dec. 29, 2022, may support that end by inducing more workers to save for retirement and incentivizing more employers to offer participating plans while providing flexibility to participants and retirees to spend more freely.

PROD FOR EMPLOYEES AND EMPLOYERS

The prod appears in newly created 401(k) and 403(b) plans, effective after Dec. 31, 2024, requiring employers to automatically enroll eligible employees, who may opt out. Participants may unwind an automatic contribution within 90 days of contributions (as defined in Section 414(w) (2)). The minimum employee contribution is 3% (and no more than 10%) and must be increased 1% annually until it reaches 10%, not to exceed 15%. There are exceptions for churches, governmental plans, SIMPLE plans, small businesses with 10 or fewer employees and businesses not more than three years old. (i)

Beginning in 2023, a small business with fewer than 50

employees may receive a 100% (an increase of 50%) plan administration cost credit up to $5,000 annually for the first three years of its employer pension plan. Defined contribution plans are not included in this credit. An additional credit, capped at $1,000 per employee, is available for IRC 414(j) eligible businesses with up to 100 employees for employer contributions. The number of employees, the plan year and wage and phase-out limitations will be factors in calculating this credit. Both of these employer credits are a deduction-for-credit swap. (ii)

Part-time employees, meeting the minimum age requirements and with 500 hours of service over two years or 1,000 hours in one year, may qualify for the non-union employer’s 401(k) or 403(b) plan effective after Dec. 31, 2024. (iii)

Starting in 2024, employers may match an employee’s qualified IRC 212(d)(1) student loan payments with a contribution to the employee’s 401(k), 403(b), 457(b) or SIMPLE IRA account for the benefit of the employee. The provision for employer student loan matching must be consistent with the plan document for elective deferral matching. Non-discrimination testing allows student loan participants to be tested separately. (iv)

For lower-income taxpayers, the Treasury Department

will now match 50%, up to $2,000 per person, for qualified employee contributions. In the past, a credit was issued to the taxpayer. Effective in 2027, the credit will be converted to a matching government contribution and subject to annually indexed income thresholds and phaseouts.(v)

Sole proprietors and single member LLCs received a 2022 tax deadline savings lifeline. They may establish a new plan and make elective deferrals up to the un-extended due date of their tax return.(vi)

In 2024, SIMPLE IRA employer matches have been increased from 2%-3% up to the lesser of 10% of compensation or $5,000 (indexed annually).(vii)

All employer-provided plans: 401(k), 403(b), 457(b), and in addition, effective in 2023, SIMPLE IRA and SEP plans,

may allow Roth designation for employee contributions.(viii)

Employer-sponsored Roth plans get even better. Now matching employer contributions to a Roth 401(k), 403(b) and 457(b) may also be designated Roth contributions. Employees electing this option will be taxed immediately on these contributions.(ix)

The catch-up contributions shall receive Roth treatment starting in 2024 unless the employee earns $145,000 or less. This wage limit will be indexed for inflation.(x)

Employers may automatically enroll non-highly compensated employees in a “pension-linked emergency savings account” in 2024. Employee contributions are Roth-like contributions, up to 3% of wages, and capped at $2,500. Employers may match

Continued on page 22

SUMMER 2023 | FLORIDA CPA TODAY 21

the savings up to the maximum account balance. Employees may make monthly withdrawals at their discretion. When employees separate from service, the account may be rolled into the employee’s Roth IRA or Roth Defined Contribution Plan or may be cashed out.(xi)

POKE FOR SAVERS

The poke in this new act may provide some relief to the savers. The Required Minimum Distribution (RMD) age is increased to age 73 beginning in 2023 and to age 75 in 2033. (xii)

The IRA catch-up provision available to taxpayers over age 50 is currently $1,000 and shall be subject to a cost-of-living adjustment (COLA) effective 2024.(xii)

Catch-up retirement plan contributions for 401(k), 403(b) and 457(b) plans will increase to $10,000 for employees closer

to retirement age. In 2023, the over-age-50 catch-up contribution is $7,500 for all plans, but only $3,000 for a SIMPLE IRA. The act increased the limits, for employees ages 60-63, to the greater of $10,000 ($5,000 for SIMPLE IRAs) or 150% of the regular catch-up amount beginning in 2025 and shall be subject to COLAs during those age 60-63 catch-up limit tax years.(xiv)

For those clients who have lost their retirement plans, the Department of Labor (DOL) has been directed to create a database to assist citizens in locating their lost savings through the current plan administrator. The database shall be available no later than 2025.(xv)

Perhaps before relying on the lost-and-found DOL database, employees who have been separated from service could opt for an employer rollover of a workplace retirement fund, not exceeding $7,000, up from

$5,000, into the employee’s personal IRA.(xvi)

The philanthropists are getting a break. The $100,000 IRA distribution election to qualified charities is now being indexed for inflation and a one-time $50,000 IRA distribution to a split-interest entity like a Charitable Remainder Unitrust, Gift Annuity or Charitable Remainder Annuity Trust is also permitted.(xvii)

Retirement plans are portable so long as the former employer deposits the employee’s funds into a default IRA account and then the new employer transfers those funds into its plan. (xviii)

Taxpayers with unused Section 529 account balances may have a safety net Roth IRA rollover option for those long-term qualified tuition programs (QTP) that are older than 15 years starting in 2024. This special tax-free Roth IRA rollover is subject to annual

contribution limits and a lifetime $35,000 aggregation limit for all QTPs Roth rollover distributions. It must be a trustee-to-trustee transfer and have the same 529 plan beneficiary named on the new Roth IRA rollover account to qualify.(xix)

Starting Dec. 29, 2025, employees will have the ability to fund a high-quality long-term care insurance plan for themselves, a spouse or other family members, for up to $2,500 (subject to limitations and indexed annually), via penalty-free distributions from a qualified retirement plan. The employee and spouse must file a joint tax return to qualify for the 10% penalty tax exemption.(xx)

PENALTY PROTECTION

In 2024, both Roth IRAs and employer plan accounts are no longer subject to pre- death required minimum distributions, and surviving spouses may elect to be treated as employees for purposes of the RMD.(xxi)

22 FLORIDA CPA TODAY | SUMMER 2023

Continued from page 21 For your FREE analysis, contact: Michael Dringus 609-709-6985 mdringus@merchantadvocate.com www.merchantadvocate.com/FICPA Merchant Advocate has helped save businesses $250 MILLION+ in excess credit card fees Imagine what we can do for your clients!

Penalties for failing to take the RMD timely have been reduced to 25%, from 50%, and further reduced to 10% if the RMD is corrected in a timely fashion. The correction window is the earlier of the initial audit date or the last day of the second taxable year after the end of the tax year in which the tax is imposed.(xxii)

Self-certified domestic abuse victims may withdraw the lesser of $10,000 or 50% of the non-forfeitable accrued employee benefit under their employer plan. The 10% penalty tax will not apply, and the distribution may be repaid to the plan during the three years following the date of distribution.(xxiii)

Effective 2024, hardship withdrawal rules will apply to the eligible withdrawal balances in both 401(k) and 403(b) plans. The current law only permits employee contributions excluding any earnings to be withdrawn from 403(b) plans for hardship.(xxiv) Emergency withdrawals up to $1,000 annually are permitted allowing three years to reimburse the plan. The reimbursement must occur before a future annual emergency withdrawal is permitted.(xxv)

Additional hardship withdrawals are permitted to participants experiencing terminal illness. A physician must certify that death is likely imminent within 84 months to avoid the 10% early withdrawal penalty.(xxvi) Participants impacted by a Federally Declared Disaster, occurring on or after Jan. 26, 2021, may withdraw up to $22,000 avoiding the 10% penalty tax and may repay the plan over three years the withdrawal itself may be taxed over three years.(xxvii)

The Act has several different effective dates and indexed amounts that will require annual reminders or review. While the contribution limits are still far too low for those

late to the retirement savings game, the new SECURE 2.0 Act provisions boast some planning opportunities that will keep CPAs on their toes and may offer taxpayers some relief as they reach for the final touchdown goal towards retirement.

Carol Vance is a past Chair and member of the Federal Tax Committee at the FICPA, a USF MUMA LPSA faculty member and a practicing CPA and lawyer representing high-net-worth entrepreneurs from cradle to grave.

Melinda Likens CPA is a partner with Vance & Likens, CPAs, PA and is also Chair of the FICPA Federal Tax Committee.

(i) IRC 414A(b)(3) and IRC 414A(4)(c)

(ii) IRC 45E(e)(4)

(iii) Section 202 ERISA of 1974 (29 U.S.C. 1052(c))

(iv) IRC 401(m)(4)(A)

(v) IRC 6433 and IRC 25(B)(a)

(vi) IRC 401(b)(2)

(vii) IRC 408(p)(2)

(viii) IRC 402(h)

(ix) IRC 402(A)(a)

(x) IRC 414(v)(1)

(xi) Section 3 ERISA of 1974 (29 U.S.C. 1002); (29 U.S.C. 1021 et seq.)

(xii) IRC 401(a)(9)

(xiii) IRC 219 (b)(5)(C)

(xiv) IRC 414(v)(2)(B)(i) and 414(v)(2) (B)(ii)

(xv) Part 5 of Title 1, ERISA of 1974 (29 U.S.C. 1341)

(xvi) IRC 401(a)(31)(B)(ii) and 411(a)(11)(A)

(xvii) IRC 408(d)(8)(F)

(xviii) IRC 4975(d)(24)

(xix) IRC 529(c)(3)(E)

(xx) IRC 401(a)(39) and IRC 72(t)(2)(N)

(xxi) IRC 401(a)(9)(B)(iv) and IRC 402A(d)(5)

(xxii) IRC 4974(e)

(xxiii) IRC 72(t)(2)(K)

(xxiv) IRC 403(b)

(xxv) IRC 72(t)(2)(I) and IRC 72(t)(2)(H) (v)(I)

(xxvi) IRC 72(t)(2)(L)

(xxvii) IRC 72(t)(2)(M)

SUMMER 2023 | FLORIDA CPA TODAY 23

COMMON INTEREST REALTY ASSOCIATIONS CONFERENCE NOVEMBER 9-10, 2023 SIGNIA BY HILTON ORLANDO BONNET CREEK Up to 16 HOURS of CPE REGISTER TODAY Scan the QR code or visit ficpa.org/2023CIRA Special rates for groups. Call 850-342-3197 for more information.

Condo Reform Laws, Part II – SB 154 update and unanswered questions

DAVE HOCHSPRUNG CPA

GUY STRUM CPA

In May 2022, the Florida Legislature convened for a Special Session and brought about sweeping changes to condominium and cooperative associations’ approach to the long-term repair and replacement of common properties with the passage of Senate Bill 4-D (SB 4D). You can find our first article on this subject in the Summer 2022 issue of Florida CPA Today.

Since then, several interested parties – including the FICPA’s CIRA Committee – have raised concerns about certain provisions of SB 4D, resulting in the introduction of Senate Bill 154 (SB 154) during the 2023 Legislative Session. SB 154 was signed into law by Gov. Ron DeSantis on June 9, 2023. Practitioners who serve affected community associations need to be aware of the new law to help their clients navigate the requirements.

SB 154 addressed many of the concerns raised about SB 4D, but some issues remain unresolved. Major provisions of the new law and some of the unanswered questions are discussed below.

MILESTONE INSPECTIONS

Several changes were made to the requirements of the milestone inspection. SB 154 limited the requirement for a milestone inspection to only residential associations. SB 4D required these inspections to be performed by a licensed engineer or architect; SB 154 relaxes that requirement and allows the inspection to be performed by a “team of professionals,” with the final sign-off by an architect or engineer. SB 154 removed a tighter

timeline for coastal communities but allows “local enforcement agencies” to modify the timing of the required inspections, speeding up if needed and allowing extensions for the completion of the inspections for cause.

STRUCTURAL INTEGRITY RESERVE STUDY

SB 4D introduced the requirement for associations with buildings three stories or higher to have a Structural Integrity Reserve Study (SIRS) performed. Like the milestone inspection, SB 154 limited the requirement to include only residential associations. SB 154 also modified the required elements to be considered in the study. It removed floors and foundations but added exterior doors. (See table below.)

Another modification to the required elements in a SIRS concerns items that have a remaining useful life greater than 25 years. Associations don’t have to directly reserve for

the replacement cost of these items. Instead, they have to reserve amounts for deferred maintenance for these items. In addition, the definition of three stories would be determined by the Florida Building Code.

One of the more confusing changes made was to the definition of the SIRS and responsible parties. There are several elements involved in the development of any reserve study: a visual inspection of the property, a determination of estimated costs for repair and replacement, an assessment of remaining useful lives of each item, a determination of existing funds restricted for reserves, and a calculation of required reserve funding. SB 154 first states that a SIRS may be performed by “any person qualified to perform such study.” Later, it states that the visual inspection must be performed by a licensed engineer or architect or a person certified as a reserve specialist or professional reserve analyst by the

Reserve Items: What changed from SB 4D to SB 154

a. Roof.

b. Structure, including load-bearing walls and or other primary structural members and primary structural systems as those terms are defined in 2. 627.706.

c. Floor.

d. Foundation.

e. Fireproofing and fire protection systems.

d. f. Plumbing.

e. g. Electrical systems.

f. h. Waterproofing and exterior painting.

g. i. Windows and exterior doors.

h. j. Any other item that has a deferred maintenance expense or replacement cost that exceeds $10,000 and the failure to replace or maintain such item negatively affects the items listed in sub-subparagraphs a.-g. subsubparagraphs 1.-j., as determined by the licensed engineer or architect performing the visual inspection portion of the structural integrity reserve study.

CODING: Words stricken are deletions; words underlined are additions.

24 FLORIDA CPA TODAY | SUMMER 2023

Community Associations Institute. While qualifications to perform the visual inspection are clear, the qualifications for performing the rest of the study are not.

RESERVE FUNDING AND ALTERNATE USE

SB 4D introduced a new requirement for associations to maintain and fund the reserves called for in the SIRS. As noted above and in the insert, those reserves are quite specific, and funding of these reserves cannot be waived for budgets adopted on or after Dec. 31, 2024. Of course, most associations will have other types of reserves that need to be maintained. The old laws and rules still apply to these reserves. SB 154 raised the bar for associations to waive or reduce full funding of these reserves or to use these reserves for an alternate purpose. SB 154 did not change the prohibition of waiving the funding or alternate use of SIRS reserves. That said, those options are still available for these other reserves. The previous law allowed waiver, less-than funding or alternate use of reserves with a majority vote of members at a duly called meeting. SB 154 requires the majority of all members – not just those in attendance – for these actions. As a result of the different treatment of SIRS and non-SIRS reserves, it may appear that associations will have two sets of reserves included in their reserve studies.

ALTERNATE RESERVE FUNDING

SB 154 allows an “alternate funding method” for reserves for multicondominium associations operating at least 25 condominiums. This funding method must be approved by the Florida Department of Business and Professional Regulation’s Division of Florida Condominiums, Timeshares, and Mobile Homes (the Division).

ADMINISTRATIVE RULEMAKING

One of the more important provisions of SB 154 is the directive from the Legislature to the Division to promulgate rules to implement SB 154. State agencies are often given rulemaking authority with respect to certain areas of the law they regulate, but SB 4D did not provide for this agency rulemaking authority.

The FICPA has a long-standing relationship with the Division, and the CIRA Committee regularly meets with representatives of the Division on issues of interest such as rulemaking. We anticipate FICPA’s continued communication with the Division as this rulemaking process moves forward.

WHAT’S NEXT?

With the Division’s ability to promulgate rules to implement SB 154, we see great opportunity to clarify any ambiguities. We are likewise seeking clarification on the topics below, originally identified in our discussion of SB 4D last summer:

1. Separating required reserves that exist in current pooled funds: Many associations maintain some of the required SIRS reserves in existing pooled accounts. These associations need guidance on a specific mathematical approach to separate those reserves from the pool.

2. Frequency of SIRS and other types of reserve studies: SIRS are required at least every 10 years. Associations need clarification in determining what type of reserve studies can be prepared and used in their funding plans between those dates.

3. Inconsistency in Full Impact of Effective Date of SIRS: There seems to be inconsistent language as to the effective date of implementing SIRS.

Dave Hochsprung and Guy Strum are members of the FICPA’s CIRA Committee; Strum is the Chair of the FICPA’s CIRA Legislative Subcommittee and the State Legislative Policy Committee.

The CIRA Committee assists the Governmental Affairs team with technical support and feedback on pending legislation. It will continue to monitor activities related to SB 154 or legislation proposed during the 2024 Legislative Session and work with the Division to clarify some of the issues noted here.

(i) www.ficpa.org/cira-fct-summer-22

SUMMER 2023 | FLORIDA CPA TODAY 25

26 FLORIDA CPA TODAY | SUMMER 2023

2023 Legislation reduces commercial rent tax and adds sales tax exemptions and tax holidays

HEATHER MILLER Florida Department of Revenue

The 2023 legislative session produced one of the largest taxation bills (HB 7063) in recent memory. On May 25, 2023, Governor DeSantis signed the bill into law, which included revisions to all the major taxes the Department of Revenue administers. Among these changes, chapter 2023-157, Laws of Florida, establishes several reductions in sales and use tax.

COMMERCIAL RENT TAX

Continuing steps taken in recent years to reduce the sales tax on commercial rentals, the law reduces the state sales tax on commercial rentals from 5.5% to 4.5% beginning Dec. 1, 2023.

SALES TAX EXEMPTIONS

Several new permanent exemptions to sales and use tax were added, effective July 1, 2023.

Baby and toddler products, including diapers and wipes

Oral hygiene products

Adult incontinence products

Materials used to construct or repair permanent or temporary agricultural fencing for cattle

Renewable natural gas machinery and equipment

Firearm safety devices

Certain private investigative services

TAX HOLIDAYS

This year’s legislation also saw the continuation, and expansion, of several popular sales tax holidays.

Disaster Preparedness Sales Tax Holidays (May 27 - June 9 and Aug. 26 - Sept. 8, 2023): This year, in addition to the traditional disaster preparedness items such as batteries and tarpaulins, additional pet supplies and certain household items will be tax-free, too.

Freedom Summer Sales Tax Holiday (May 29 - Sept. 4, 2023): During this sales tax holiday, no tax is due on the retail sale of admissions to music events, sporting events, cultural events, specified performances, movies, museums, state parks, and fitness facilities plus, new to this year’s holiday are children’s athletic equipment and toys.

ENERGY STAR® Sales Tax Holiday (July 1, 2023 - June 30, 2024): During this year-long exemption period, certain energyefficient household appliances will be exempt from tax.

Gas Ranges and Cooktops Sales Tax Holiday (July 1, 2023 - June 30, 2024): New for 2023, this holiday allows consumers to purchase gas ranges and cooktops exempt from sales tax.

Back-to-School Sales Tax Holidays (July 24 – Aug. 6, 2023, and Jan. 1-14, 2024): Families can save on clothing, school supplies,

and personal computers and accessories during two separate sales tax holiday periods.

Tool Time Sales Tax Holiday (Sept. 2-8, 2023): Florida’s labor force plays an important role in Florida’s economic success. During this tax exemption period, consumers can save on tools and related gear.

The Department of Revenue’s website features information on what is included in each sales tax holiday, including Tax Information Publications, frequently asked questions for both businesses and consumers, and digital downloads for individuals and businesses wishing to share information about the sales tax holidays.

For specific sales tax holiday information, visit floridarevenue. com/SalesTaxHolidays to find more details.

The Department of Revenue is also issuing Tax Information Publications to provide the public information on these and many other recent tax law changes. For more information, visit floridarevenue.com/taxes/tips.

SUMMER 2023 | FLORIDA CPA TODAY 27 DOR UPDATE

Heather Miller is the Sales and Use Tax Coordinator in the Florida Department of Revenue’s General Tax Administration

Managed Hosting for Major Financial Software

• Private Hosted Environment Customized for Sole Proprietor CPAs

• Affordable Solution: $249 Per Month (includes 1 up to 2 Users)

• Solution Includes: a File Server and Application Server, 250GB Storage, Backup, Multi-Factor Authentication, Anti-Virus, Anti-Malware/Anti-Ransomware, 10 Hours Monthly Application Support (Phone/Email), and more

• Solution Requirements: Functional Workstation Running Windows 10 or MAC latest IOS, Twain Compliant Printer/Scanner, Microsoft Office365 (E3 or ProPlus with Email), High Speed Internet Connection

• Financial Software Hosting Expertise: Thomson Reuters, Wolters Kluwer, Drake Software, Intuit®, and Others

• Compliant with GLBA, HIPPA, and CJIS

• SOC 2 Type 2 Unqualified Audit Opinion

Endorsed by

SOLE PROPRIETOR DEDICATED SERVER

bizdev@coaxiscloud.com 850.391.1022 CoaxisCPA.com

The FTC’s safeguards rule just got stronger – Are you ready?

A member case study in cybersecurity preparedness

COAXIS

Let’s take a quick trip down memory lane. The year was 1999; the euro was introduced and quickly became the world’s second-most-traded currency behind the U.S. dollar, and the Gramm Leach Bliley Act (GLBA) was signed into law by President Bill Clinton.

THE BACKSTORY

Colloquially known at the time as the Financial Services Modernization Act, GLBA was meant to repeal large parts of a 1933 law that regulated the financial industry by separating commercial and investment banking. The law also impacted consumer privacy by requiring financial companies to explain to consumers how they share personal financial information and to safeguard that sensitive data.

An important component of the GLBA is the Federal Trade Commission’s (FTC) Standards for Safeguarding Customer Information – the Safeguards Rule, for short. It is meant to ensure that covered entities maintain safeguards to protect the security of customer information.

WHAT’S NEW

The FTC recently amended the Safeguards Rule to keep pace with current technology and the growing number of large-scale data breaches that are regularly compromising customers’ personal financial information. In fact, supporting data from the Association of International Certified Professional Accountants (AICPA) cites an 80% increase in data breaches

reported by CPA firms between 2014 and 2020.

The stronger regulations – most of which took effect on June 9, 2023 – require covered financial institutions to develop, implement and maintain an information security program with administrative, technical and physical safeguards designed to protect customer information.

It defines a “financial institution” as any business that engages in an activity that is financial in nature, meaning accounting firms must comply with the new laws.

“Information security program” refers to the safeguards used to access, collect, distribute, process, protect, store, use, transmit, dispose of or otherwise handle customer information. The amended Safeguards Rule further identifies nine elements that an information security program must include.i

“Customer information” is defined as any record containing nonpublic personal information about a customer of a financial institution, whether in paper, electronic or other form.

To better comply with the new guidance, CPAs need to understand the different types of protections and testing that are required to regularly monitor and assess the effectiveness of their information security safeguards.

LOCAL AREA NETWORK (LAN) VS. DATA CENTER PROTECTIONS

A local area network (LAN) is a computer network that interconnects computers in a limited area

such as a home, school, computer laboratory or office building. Conversely, a data center is a facility used to house server equipment and provide a physical space for data to be stored and distributed. Industry standards exist from organizations like the Telecommunications Industry Association (TIA) to certify the design, construction and maintenance of these data center facilities. For instance, Coaxis is a Rated 3 TIA-942 site meaning its data center has redundant capacity components and distribution paths that serve the computer equipment and protect against most physical events.

VULNERABILITY ASSESSMENTS VS. PENETRATION TESTING

The newly amended Safeguards Rule requires CPA firms to regularly monitor and test the effectiveness of their information security safeguards. There was a time when vulnerability testing was the standard protocol used by managed service providers to identify and shore up weaknesses in an organization’s IT infrastructure. But today’s fast-evolving cyber landscape has made that practice a thing of the past.

Penetration testing – commonly known as ethical hacking – is now the gold standard. It involves skilled, authorized “white hat hackers” who attempt to circumvent or defeat the security features of an information system to determine if an organization’s IT infrastructure can withstand a similar attack in real life. This is where the rubber meets the road.

Continued on page 30

SUMMER 2023 | FLORIDA CPA TODAY 29

Continued from page 29

It’s one thing to assume that software updates and staff training work. It’s quite another to know whether or not the infrastructure protections are doing their job. Cybercriminals are becoming more sophisticated by the day, and CPA firms need to know their IT safeguards are up to the challenge.

FICPA MEMBER CASE STUDY

Tallahassee-based Carroll and Company, CPAs, was already in business for nearly a decade when GLBA was enacted. The firm, headed by Managing Partner and former FICPA Chair Abby Dupree, is located in an older building that has seen its share of natural disasters, including a couple of floods. Through all of that, the IT infrastructure and data was never severely compromised due to the safety precautions in place. Then it happened.

On a bright, sunny day, Oct. 15, 2015, to be exact, the whole IT infrastructure failed. The main file server as well as the two backup servers failed, with no warning whatsoever. “It was a very stressful event,” Dupree recalls. Restoring

the cloud backup took months. Some data was corrupted, and other data was never fully restored. It took even longer to get all the firm’s programs back online. That’s when the firm decided it was time to begin investigating its options with respect to moving its on-site IT infrastructure from a managed LAN service provider to a more comprehensive solution. FICPA-endorsed Coaxis now provides Carroll and Company with secure cloud storage and a Rated 3 TIA942 data center, safeguarding the firm’s network and client data with proactive monitoring and routine updates supported by a certified network support team.

Recently, Carroll and Company worked with Coaxis to add penetration testing to its information security program. Not only does it help the firm comply with the amended FTC Safeguards Rule, but it also meets the AICPA’s new tax standards scheduled to take effect on Jan. 1, 2024, that require members to customize their data protection efforts based on their particular facts and circumstances.

The initial three-month penetration test, performed during tax season no less, uncovered

vulnerabilities that required fixing and would have gone undetected had it not been for the testing. Going forward, Coaxis’ partner company SXIPHER will perform ongoing penetration testing and will provide Carroll and Company with quarterly reports centered on what the firm needs to know in order to keep its data protected. More importantly, SXIPHER will communicate the results of the testing to the Coaxis managed services team who will then resolve any potential vulnerabilities. All of this is done without disruption to the daily routine of Carroll and Company.

More information about the Safeguards Rule and what your business needs to know can be found in this resource provided by the FTC.ii To learn how Coaxis can help ease the burden of complying with both the new FTC Safeguards Rule and AICPA tax standards, contact Lisa Bryant, executive vice president of corporate development, at (850) 391-1022 or lisa.bryant@coaxissolutions.com.

Coaxis Hosting is an endorsed program for the FICPA that provides CPA firms with a fully hosted and managed network solution designed to remove the complexities of federal and industry compliances, curb the demands of maintaining an IT infrastructure, and greatly minimize the threat of cybercrime. It owns and operates a private single-tenant data center built, operated and maintained to strict ANSI/TIA-942 Site - Rated 3 standards. In addition, the company’s services are compliant with GLBA, HIPAA HITECH, CJIS, and an Industry Audit SOC 2 Type 2- Unqualified Audit Opinion. Coaxis also partners with SXIPHER, a leading ethical hacking company that supports clients in shifting from a defensive to an offensive posture by providing in-house penetration tests.

(i) www.ecfr.gov/current/title-16/chapter-I/subchapter-C/part-314/section-314.4

(ii) www.ftc.gov/business-guidance/resources/ ftc-safeguards-rule-what-your-business-needsknow

STRATEGIC PARTNER CONTENT WITH

30 FLORIDA CPA TODAY | SUMMER 2023

– Cantor Forensic Accounting, PLLC

Trusted by accounting industry professionals nationwide, CPACharge is a simple, web-based solution that allows you to securely accept client credit and eCheck payments from anywhere.

22%

65% of consumers prefer to pay electronically

62% of bills sent online are paid in 24 hours

Get started with CPACharge today PAY CPA

payments

increase in cash flow with online

CPACharge is a registered agent of Synovus Bank, Columbus, GA., and Fifth Third Bank, N.A., Cincinnati, OH. AffiniPay customers experienced 22% increase on average in revenue per firm using online billing solutions

+

CPACharge has made it easy and inexpensive to accept payments via credit card. I’m getting paid faster, and clients are able to pay their bills with no hassles.

Member Benefit Provider

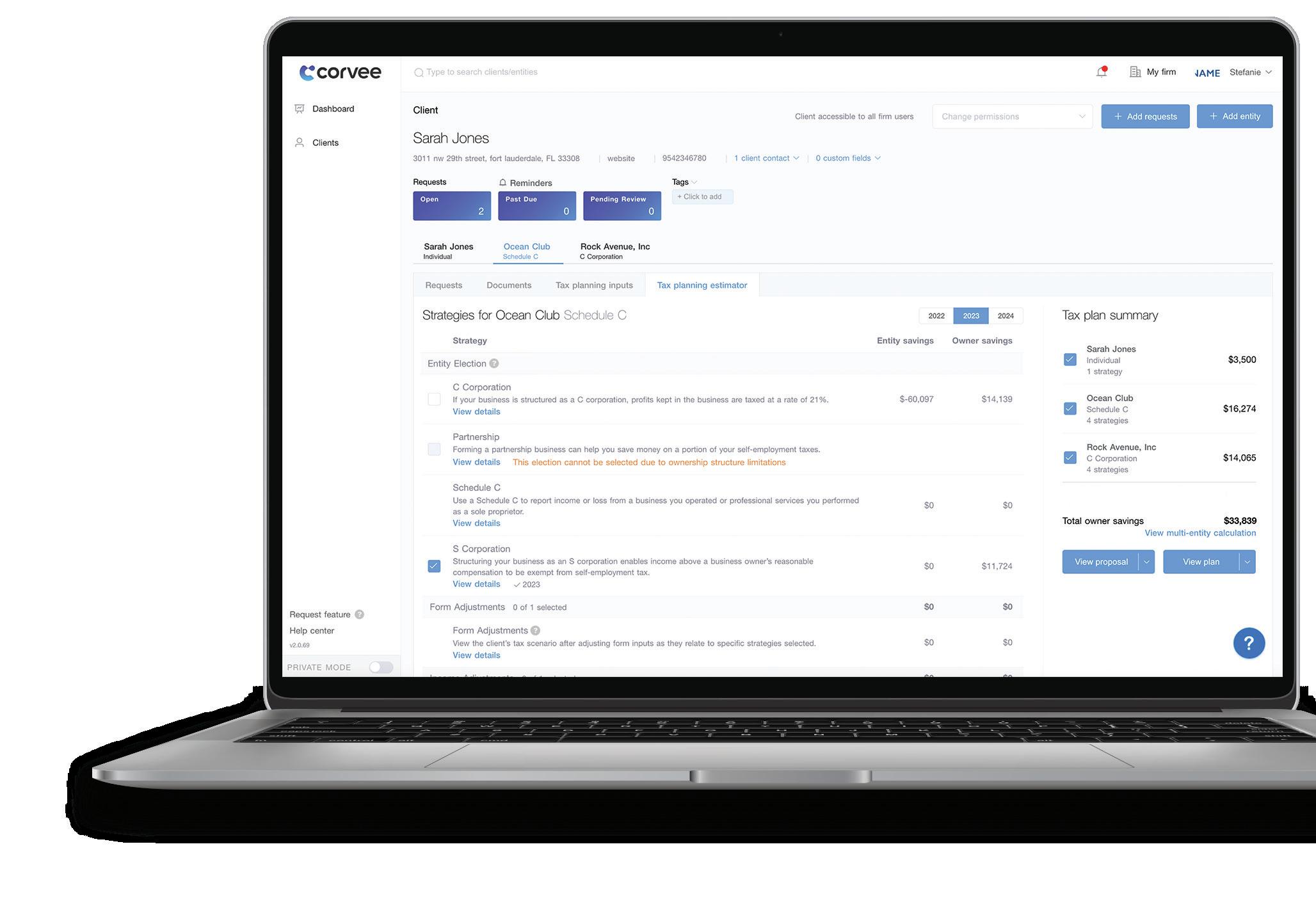

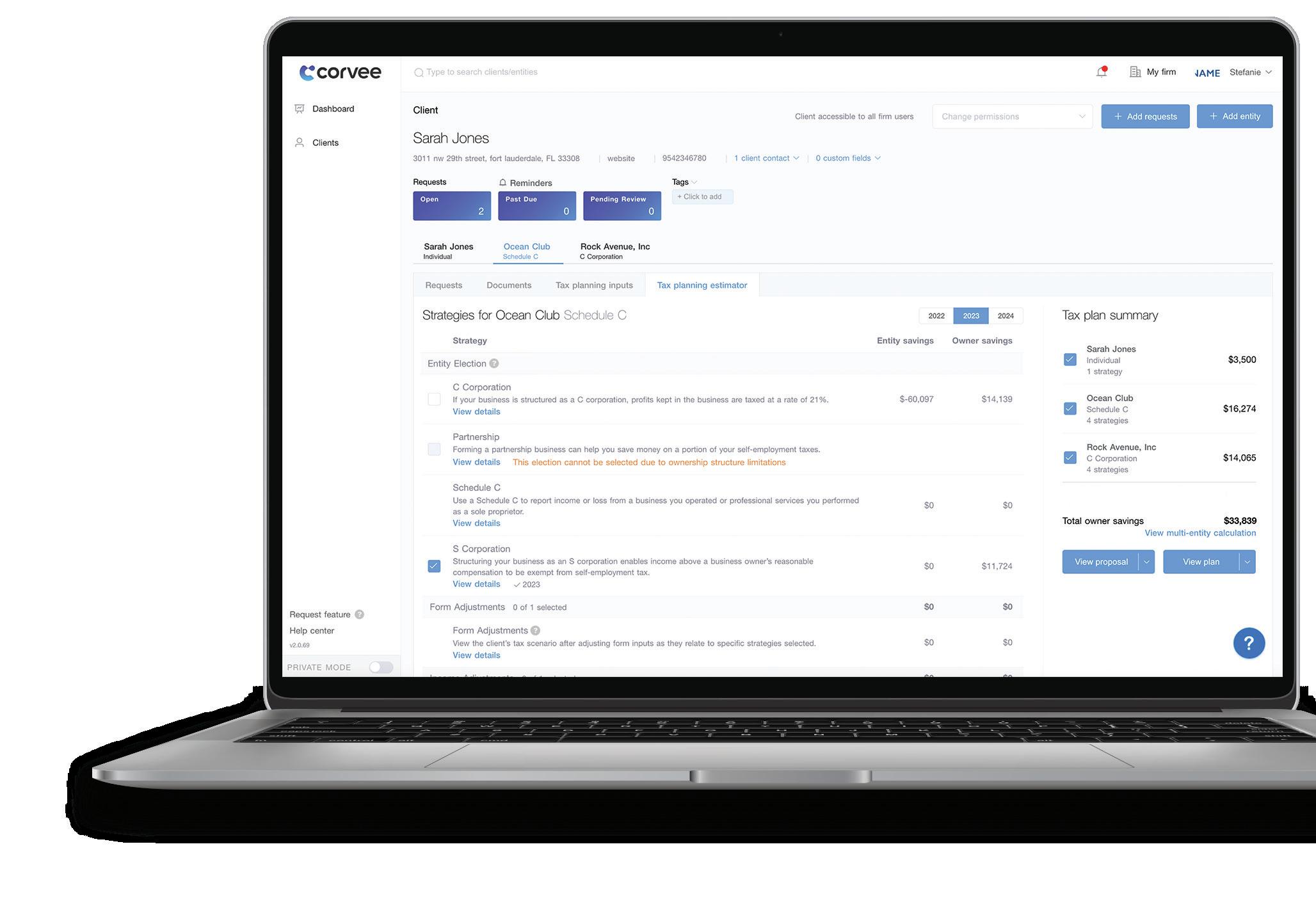

Future-proofing an accounting practice: Three effective strategies for year-round cash flow

CPACHARGE