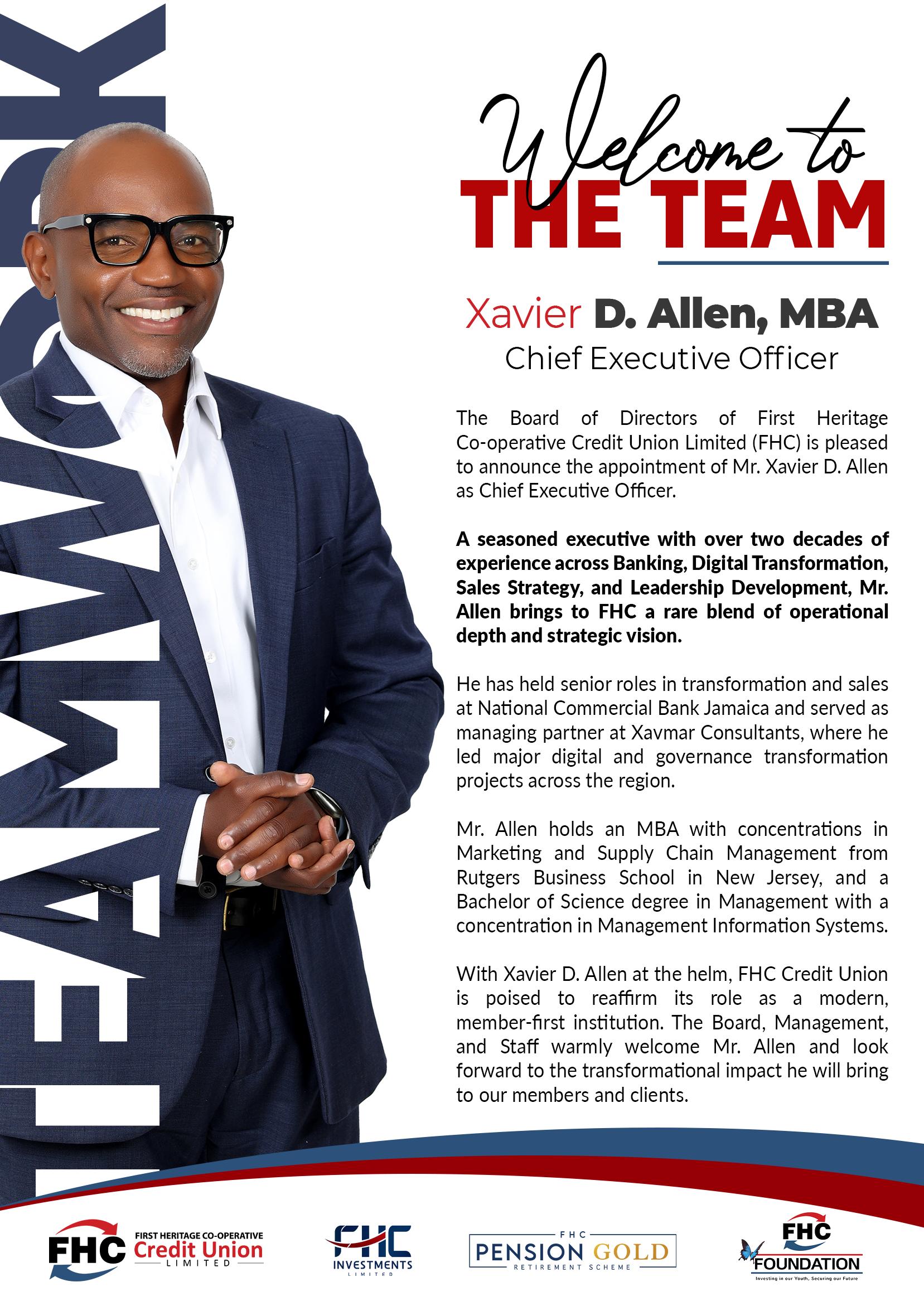

FHC Credit Union introduced its new Chief Executive Officer Xavier D. Allen to its members at the 2025 annual general meeting.

The 13th AGM, held at The Summit on Monday, June 16, 2025, gave the members in attendance in person and online the first engagement with the CEO who started on April 1. Allen in his address said that as CEO, he is not there just to lead, but to walk, build, and dream with the members.

“‘Member At The Centre’ is a clear sense of responsibility and a deep commitment to the mantra that has guided First Heritage for over a decade. I have spent my first few weeks actively listening, learning, and engaging with our teams, our members, and our directors. Within the development of our 2040 strategic vision it’s time to build on our strong foundation and reimagine what’s possible,” Allen explained.

He said that the Credit Union will continue to serve its members with integrity, innovation, and impact.

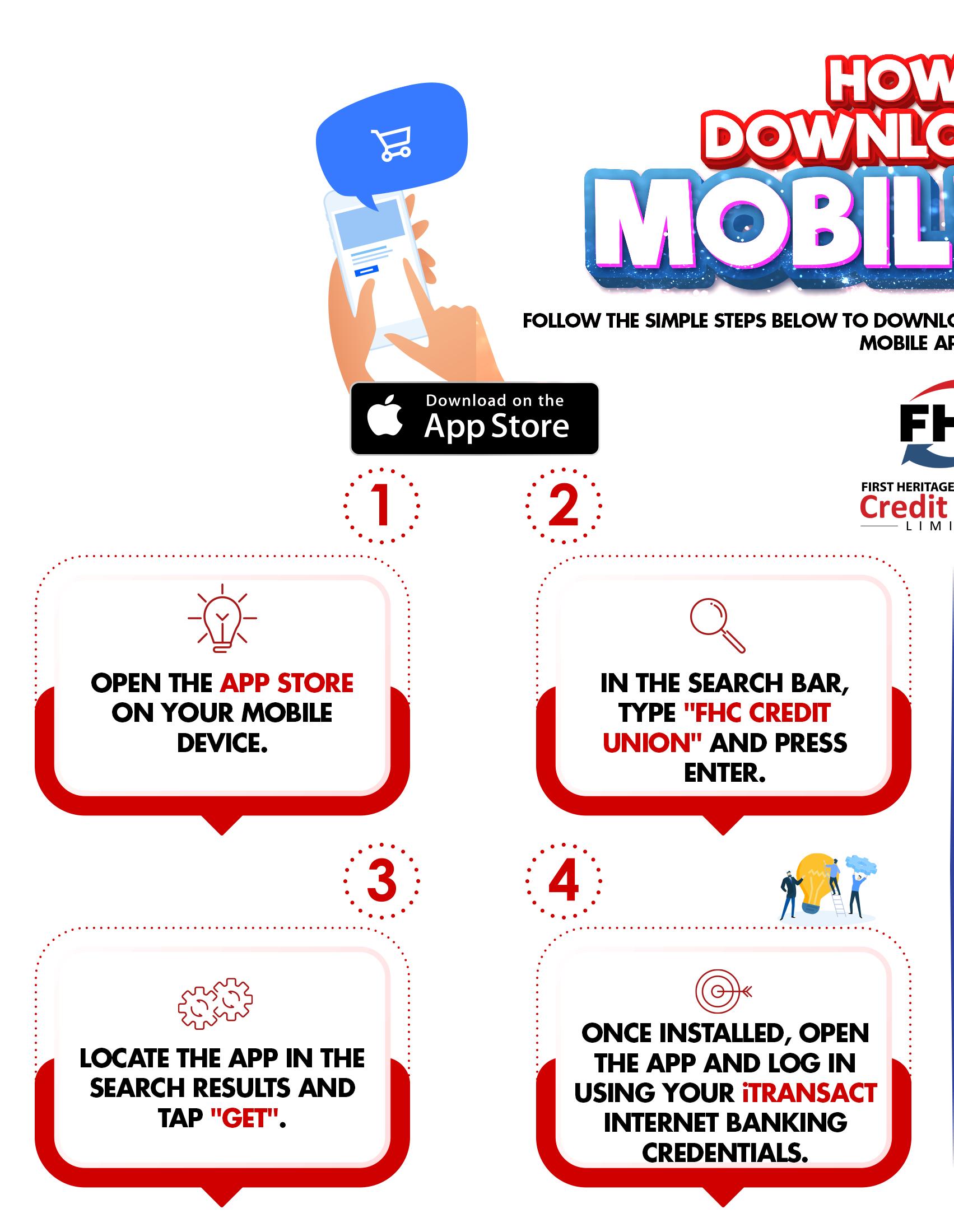

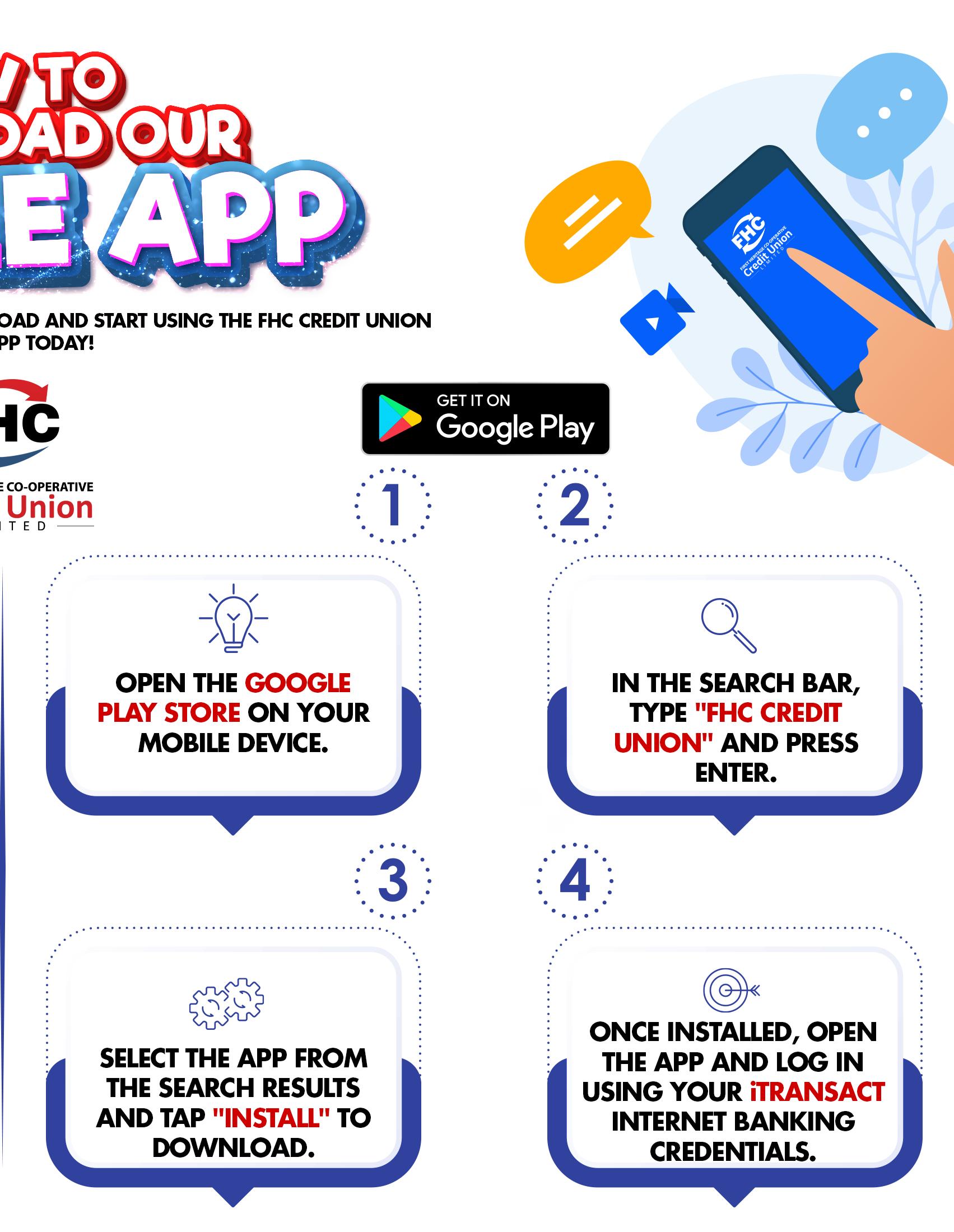

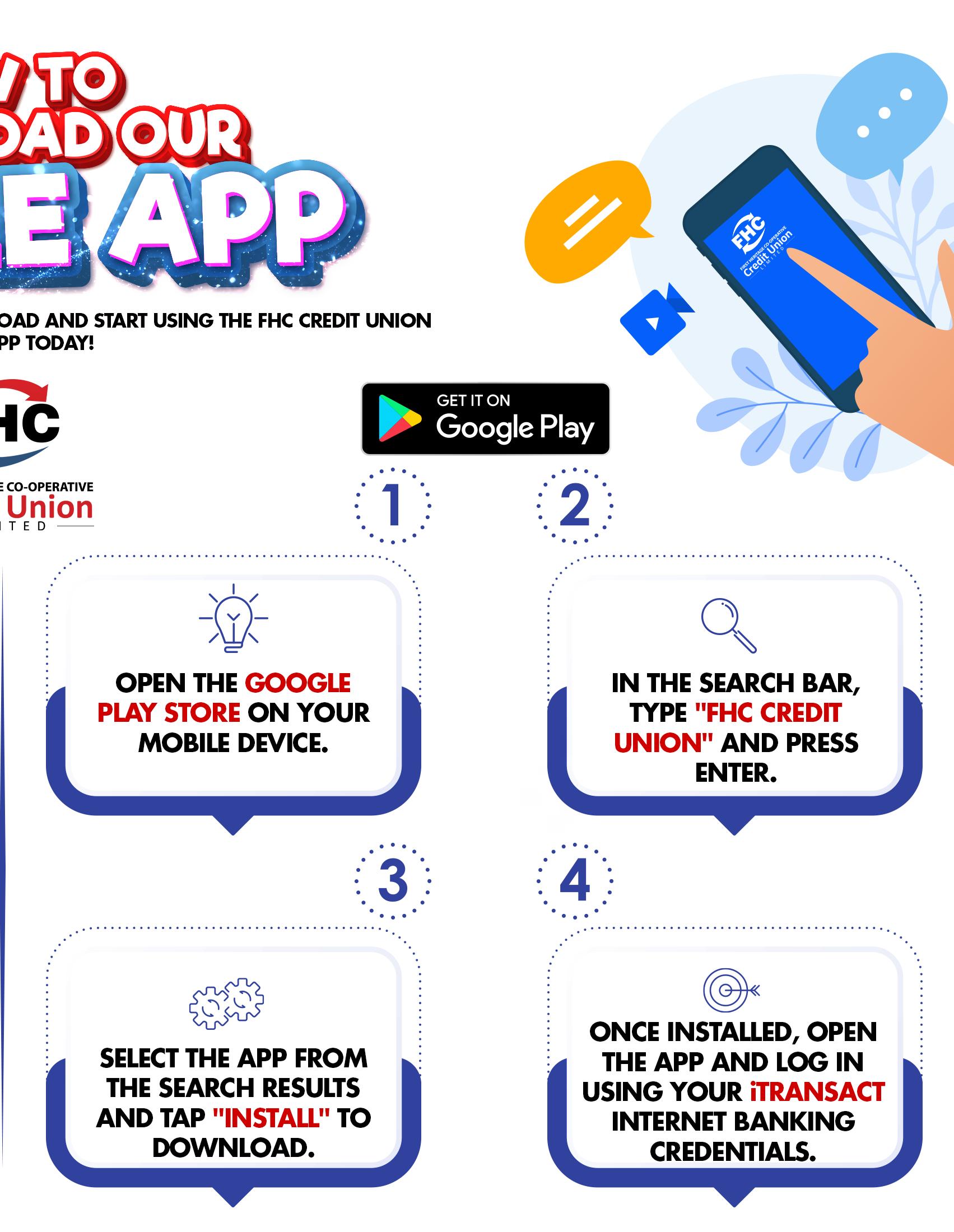

“We are entering a bold new chapter in our evolution, and it is one rooted in three pillars: digital transformation; inclusive innovation and; sustainable growth,” he added. “Our strategic vision with digitisation includes the phases to accelerate the rollout of intuitive, secure, and accessible digital platforms; create seamless, member-first experiences across mobile, online, and in-branch services; and to leverage data and digital tools to anticipate needs, personalise offerings, and deliver value in real-time.”

Strong Result

CEO Allen went on to report on the stellar performance of FHC, which earned a net surplus of $354.34 Million compared to the prior year’s surplus of $330.66 Million representing a 7.96% increase year over year. It also achieved loan disbursements of $6.12 Billion.

The Credit Union’s Total Assets have increased by 7.96% compared to the previous year, reaching a high of $20.49 Billion representing an increase of $1.51 Billion over the prior year’s $18.98 Billion, while the Group had Total Assets of $20.55 Billion as compared to $19.04 Billion (2023) or a 7.91% increase.

The performance of affiliated financial company FHC Investments Limited was commendable with its FHC Pension Gold Retirement Scheme realising a 10 per cent increase in net assets valued at $1.728 Billion at the end of the year.

For her part, in closing the Board of Directors’ Report, FHC Chairman, Mrs. Camelle RickettsMoore noted that “our Credit Union is well-positioned for sustained growth and transformation. Our perspective remains positive that we will achieve our key strategic obligations, and that the Management team will continue to drive operational excellence and enhance financial inclusion.” She shared that “we will continue to honour our promise of creating a secure future by delivering exceptional value and building a resilient, future-ready institution that is equipped to thrive in a fast-evolving financial landscape.”

The Credit Union’s performance in 2024 has been described as remarkable, with the institution successfully navigating economic challenges such as inflation, rising interest rates, and ongoing global supply chain disruptions. Notably, key prudential ratios, particularly capital adequacy and liquidity, remained strong and well above regulatory benchmarks. These indicators reflect the Credit Union’s financial resilience and continued ability to deliver on its strategic objectives while keeping members’ needs at the forefront.

The Credit Union attributes its continued success to the steadfast support of its members, the dedication of its team, and the commitment of its volunteers. As the organization looks ahead, it remains focused on strengthening member value, building institutional sustainability, and maintaining its position as a trusted financial partner in a dynamic economic landscape.

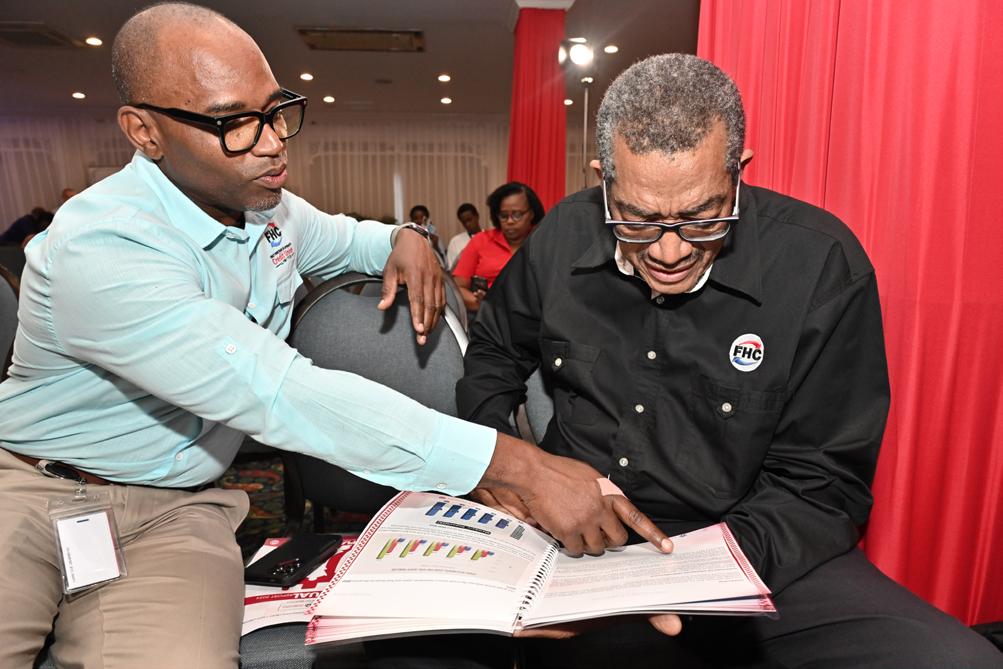

FHC Credit Union Chief Executive Officer Xavier D. Allen sits with General Manager of Credit Administration and Loan Risk Quilston Harrison for a quick discussion before the start of the 13th Annual General Meeting of the Credit Union held on Monday, June 16, 2025.

FHC team member Nzinga Campbell (left) hands an annual report to a member upon registration and entry to the Annual General Meeting held at The Summit on June 16, 2025.

FHC Credit Union Chief Executive Officer

Xavier D. Allen and Board Chairman Mrs. Camelle Ricketts-Moore greet members prior to the commencement of the 13th Annual General Meeting of the Credit Union held on Monday, June 16, 2025.

FHC Credit Union Chairman Camelle RickettsMoore engages Credit Union members as she gives welcoming remarks at the 13th Annual General Meeting of the Credit Union held on Monday, June 16, 2025.

FHC Credit Union Chief Executive Officer Xavier D. Allen delivers the Management Report at the 13th Annual General Meeting of the Credit Union held on Monday, June 16, 2025

FHC member (left) receives a gift basket after winning a prize during the giveaway segment at the 13th Annual General Meeting. The prize was courtesy of CUNA Caribbean Insurance and presented by CUNA representative Abigale Scott (right), who was in attendance at the event.

(from left) FHC Credit Union Chief Executive Officer Xavier D. Allen; Board Chairman Camelle Ricketts-Moore; FHC Credit Union Member and FHC Investments Limited General Manager Omoi Green at the 13th Annual General Meeting of the Credit Union held at The Summit on Monday, June 16, 2025.

FHC Credit Union members actively participating in the 13th Annual General Meeting, held at The Summit on June 16, 2025.

Protect what Matters

with the Family Indemnity Plan (FIP) with

Optional Critical Illness Rider

Why Choose the FIP

Benefits of Choosing the FIP

Enjoy up to two million dollars coverage benefit

The Family Indemnity Plan with Optional Critical Illness Rider provides your loved ones with the funds needed to help them cover funeral expenses, There is a possibility of finding the right option for you and your loved ones

Who is covered

The plan you select can cover you and up to 5 eligible family members Your eligible family members can be any combination of the following persons:

Your spouse

Two parents (yours or your spouse’s or one of each).

Two children (aged 1 through 25 and who are not yet married)

**Children who are permanently disabled are covered for the duration of their lives once they are enrolled before age 26

No medical examination required to sign up. You are eligible to receive the full benefit (per person) where valid claims are made

You get lifetime insurance coverage once you enrol before age 76

Take advantage of the Critical Illness rider

The Critical Illness Rider is an optional add-on to the Family Indemnity Plan providing the policyholder with a lump-sum payment upon diagnosis of specified critical illnesses. This payment is received while the policyholder is alive and can be used at their discretion for expenses such as medical bills.

The policyholder could receive the additional benefit of up to $1,000,000 should he/she be diagnosed with any of the following covered critical illnesses: cancer, heart attack, stroke, paralysis, or major burns

FHC Credit Union was proud to be an exhibitor at Expo Jamaica 2025, one of the island’s largest and most exciting trade events. Held from April 3–6, 2025, the Expo brought together businesses, entrepreneurs, and thousands of attendees and we were thrilled to be right at the heart of the action.

Our booth was buzzing with energy and excitement as we connected with both members and new prospects, showcasing the many ways FHC continues to empower financial success. We also designed a special offer for patrons of the event dubbed the Red Hot Red Tag Sale a limited-time offer available exclusively during the Expo dates. It was developed to give attendees a chance to experience unbeatable deals.

In true FHC style, we also made it fun! Visitors to our booth had the chance to win exciting prizes and giveaways, making every interaction a memorable one.

In celebration of Financial Literacy Month 2025, FHC Credit Union conducted school visits across the island to engage and empower youth with essential money management skills. Through interactive presentations and ageappropriate discussions, students were introduced to topics like budgeting, saving, and financial responsibility. These visits reflect our commitment to planting the seeds of financial confidence early and supporting the next generation of financially savvy Jamaicans.

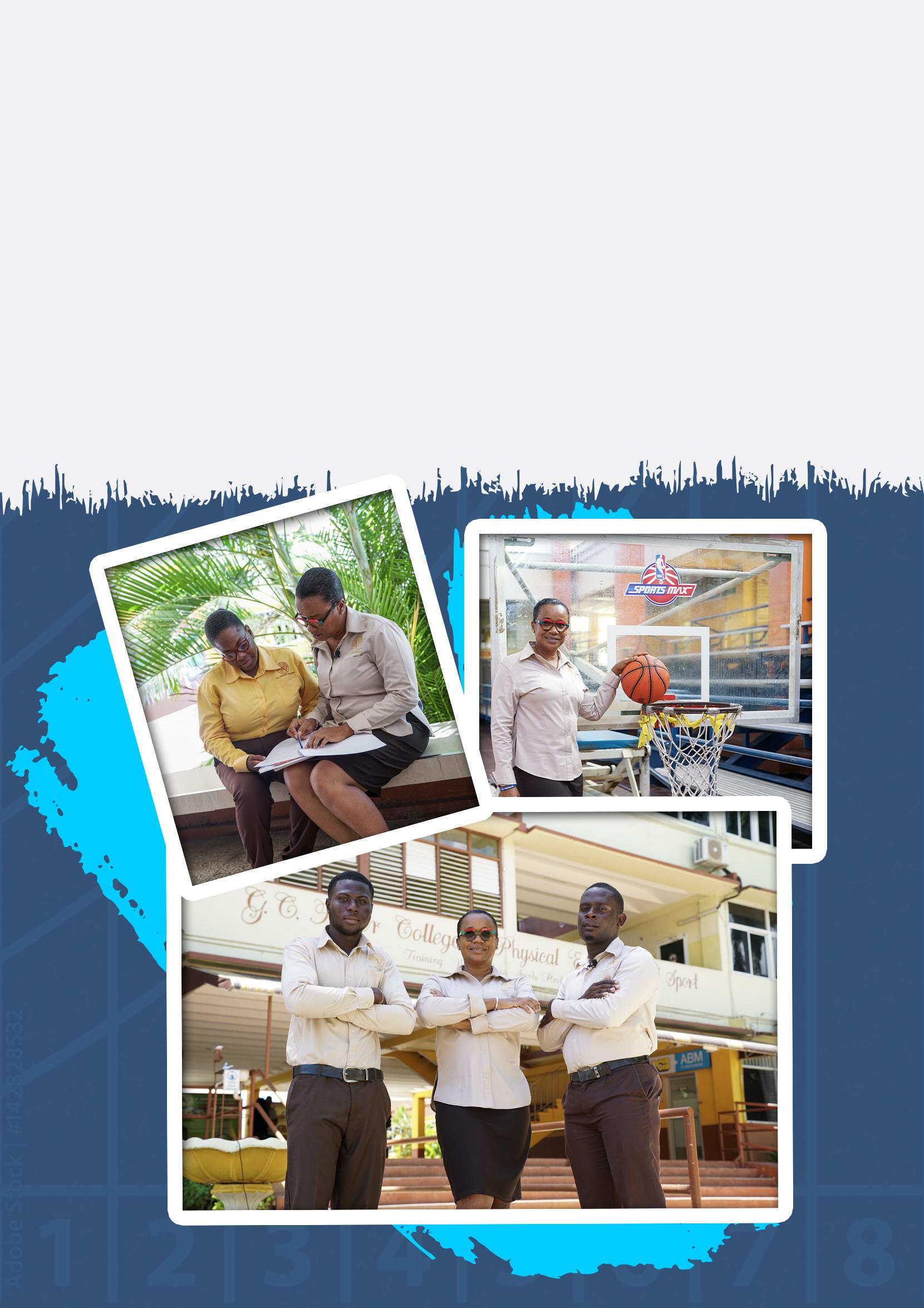

At 47, Lavana Shorter is rewriting her story — one marked by resilience, faith, and a fierce determination to finish what she started. Once a teenage mother who had to put her education on hold, Shorter returned to G.C. Foster College of Physical Education and Sport in 2023, fuelled by the hope of a second chance. With no certainty of how she’d fund her studies, she pressed forward — and today stands proud as a recipient of the FHC Sports Education Scholarship from First Heritage Co-operative Credit Union Limited.

Now at the close of her second year, Shorter has earned her Associate’s Degree and is continuing toward a Bachelor’s in Coaching and Sports Administration, with a minor in Sports Management. She is one of three recipients of the scholarship, introduced in 2023 under FHC’s Youth, Education & Sports (YES) pillars, which supports students who maintain strong academics, demonstrate financial need, and give back to their communities.

But Shorter’s journey goes far beyond academics. She is a mother of two, a mental health advocate, a certified Autism Spectrum Disorder (ASD) specialist, and CEO of her own foundation. Her experiences coaching children with special needs inspired her to pursue online certification through Walden University and create sport-based programs that support the mental and physical development of children. Through her foundation, Firstclass Enterprise, she designs inclusive, movement-based interventions that bridge sports and special education.

Shorter’s life has not been without personal trials. Her return to school was marked by tragedy — the loss of her brother to suicide during her first-year exams. Rather than give up, she leaned on faith, support from the G.C. Foster community, and her own inner strength to continue. “God is my comforter, and I’ve had supported every step of the way,” she shared.

Receiving the FHC scholarship lifted a significant weight. “It gave me room to focus on school, participate in extracurriculars, and serve others without constantly worrying about tuition,” she said. Encouraged by her mentor to apply, she nearly dismissed the opportunity, believing she wouldn’t qualify. “But God showed me I am favoured,” she reflected.

From officiating at Champs to roles with the Jamaica Anti-Doping Commission and the Jamaica Athletics Administrative Association, Shorter has long contributed to the advancement of sports, especially for women. She has also lobbied for increased female representation in officiating roles and continues to advocate for greater recognition and investment in sports education.

Her children remain her greatest motivation. “There were many times I wanted to give up,” she admitted, “but my daughter would say, ‘Mommy, you never gave up on us. We’re not giving up on you.’”

Shorter’s remarkable journey is a testament to the power of perseverance and the importance of institutional support. The FHC Sports Education Scholarship did more than relieve financial pressure — it reignited a lifelong dream and created space for healing, growth, and service.

Through its unwavering commitment to youth, education, and sports, the FHC Foundation — backed by First Heritage Co-operative Credit Union — continues to invest in stories like Lavana Shorter’s. Stories of courage. Stories of second chances. Stories that remind us all: it’s never too late to begin again.

In celebration of Mother’s and Father’s Day 2025, FHC Credit Union proudly honoured the remarkable parents across our branches with a special token of appreciation. These gestures were our way of saying thank you to the incredible mothers and fathers who continue to shape lives with love, strength, and unwavering dedication.