FENGATE PRIVATE EQUITY

Transformative Capital.

ABOUT FENGATE

Fengate is a leading alternative investment manager focused on private equity, infrastructure and real estate strategies.

With offices in Canada and the United States, Fengate is one of the most active real asset and growth capital investors in North America.

FENGATE PRIVATE EQUITY

Established in 2016, Fengate Private Equity is a Toronto-based investment platform focused on partnering with growth-oriented businesses in the business services, consumer products and services, and healthcare sectors.

Our Transformative Capital approach has helped create value across our investments portfolio by helping our entrepreneurial partners accelerate the evolution of their businesses.

3.2X+ MOIC on realized investments to date

$3.8B

Realized value created 18+ Professionals

$ 700M AUM (assets under management)

TRANSFORMATIVE CAPITAL

With a 50-year entrepreneurial history, we understand the challenges presented with scaling a business. Our Transformative Capital approach was designed to create long and lasting positive change in the businesses we invest in.

STRONG PARTNERSHIPS

Building partnerships is at the centre of what we do. Rooted in our core values of Alignment, Transparency and Trust, our active partnership approach sets the foundation required to adapt to the evolving demands of scaling a business.

CUSTOMIZED SOLUTIONS

Our approach combines bespoke financial solutions suited to the needs of our partners while leveraging our experience and resources to anticipate and navigate the obstacles presented through growth.

INSTITUTIONAL SCALE

With more than $10B AUM and 250+ employees, the Fengate platform provides extensive network, corporate resources, and capabilities delivering institutional scale and differentiated success for our partners beyond traditional private equity firms.

HOW WE ADD VALUE

We create value through our 3 step value creation process.

1. STRENGTHEN THE FOUNDATION

All great businesses need a strong foundation. Through joint planning and collaboration, our process ensures the appropriate investment is made in the systems, processes and people required for the future.

2. BUILD TO SCALE

With a strong foundation set, our focus shifts to building scale. However, not all growth is created equal. Through our strategic guidance and leveraging the Fengate network, we help our partners to identify and execute on accretive growth opportunities.

3. CONTINUOUSLY IMPROVE

Continuous improvement is at the heart of Fengate’s culture. We seek to combine our talents with those of our partners to create a powerful engine, driving continuous improvement by evaluating and experimenting with new ways to create value and opportunities for the business, its employees and communities.

PARTNERSHIP CRITERIA

We seek to identify scalable platforms led by high-quality entrepreneurs and management teams in the expansionary stage of their business.

Financial Criteria

Investment: $25M to $50M

EBITDA: up to $30M

Sector Focus

Business Services, Consumer Products & Services, Healthcare

Ownership

Influential Equity Positions (30% to 80% ownership)

Geography

Canada and the U.S.

Capital Structure

Common Equity

Preferred Equity

Structured Equity

Capital Uses

Primary Capital (Growth Opportunities)

Secondary Capital (Liquidity Solutions)

OUR COMMITMENT TO ESG

SOURCING

Leverage relationships to identify and source investment opportunities.

Fengate performs initial risk assessment, including the identification of material ESG factors.

DILIGENCE AND INVESTMENT APPROVAL

Evaluate investment risk and develop risk mitigation strategies, including value creation strategies and assessment of material ESG factors. Complete asset-specific environmental and technical diligence, and leverage independent third-party experts to identify and assess ESG factors.

VALUE CREATION AND ASSET MANAGEMENT

Ongoing review and monitoring of ESG factors, summarized in our annual ESG Monitoring Report.

Leverage governance rights on projects to influence positive ESG outcomes.

At Fengate, we understand that growing our communities is fundamental to our work. Our commitment to environmental sustainability, social responsibility and corporate governance defines great stewardship across our firm, our stakeholders, and the communities we work in, creating the foundation for better informed decisions for the long-term horizon.

As a signatory of PRI, a United Nations-supported international network of financial institutions, Fengate has committed to integrating their principles throughout the firm’s activities and full investment life cycle.

OUR PEOPLE

Maxim Tcherner Managing Director, Investments

Raul Dumitras Senior Associate, Investments

Mohit Kansal Managing Director

David Luder Principal

Deian Kutev Managing Director

Jennifer Pereira Managing Director, Group Head of Private Equity

Julia Maltby Principal, Venture Capital

Alexander Chang Principal

Emilie Granger Vice President

Kristen Floro Senior Associate, Origination

Richard Armstrong Senior Associate, Origination

Prashant Shangari Associate Vice President, Finance

We are a dedicated team of professionals with significant multi-asset experience and a successful track record.

Sarah Peccia Associate, Originations

Michael Lising Senior Associate, Investments

Martin Yiu Senior Associate, Investments

Liam Rodrigues Senior Associate, Investments

Rebecca Rudisch Operating Advisor

Anthony Sobel Operating Advisor

Lindsay Sparks Operating Advisor

Michael Watt Operating Advisor

Alexander Aversa Associate, Investments

Nikita Naik Associate, Investments

Jamar Norick Associate, Originations

SACO FOODS

CURRENT INVESTMENT

Founded in 1973 by the Sanna family, Saco has grown into a diversified and rapidly expanding portfolio of leading shelf-stable food brands: Dolci Frutta, the #1 brand in confectionary chocolate coatings; California Sun Dry, the #1 brand in sun-dried tomato food products; Saco Pantry, a leader in instant dry milk products and complementary baking ingredients; Solo Foods, a century-old staple in toppings, pastes and fillings; and Hoosier Hill Farm, a pioneer in online and direct-to-consumer food offerings. Fengate acquired Saco in partnership with Weathervane Investment Corp. in 2024.

Sector: Consumer Products & Services

Headquarters: Middleton, Wisconsin

Website: www.sacofoods.com

INFLECTOR ENVIRONMENTAL SERVICES

CURRENT INVESTMENT

Founded in 1994, Inflector is one of Canada’s leading environmental services providers, specializing in hazardous material abatement, remediation, and related services.

With more than 500 employees in five offices across Canada, Inflector provides mission-critical services to clients in the commercial, residential, institutional, and industrial sectors. Fengate

Private Equity made its initial investment in Inflector in 2022.

Sector: Business Services

Headquarters: Ottawa, ON

Website: www.inflector.ca

GRACEMED CURRENT INVESTMENT

Founded in 2002, GraceMed is a provider of plastic surgery, dermatology, and medical spa services across its network of clinics.

As a physician-led platform, the company has grown both organically and through acquisitions, developing a reputation as a partner-of-choice for operators and aesthetic service providers across Canada’s fragmented cosmetic surgery and medical spa industry. Fengate Private Equity made its initial investment in GraceMed in 2021.

Sector: Healthcare

Headquarters: Oakville, ON

Website: www.gracemed.com

YORK1 CURRENT INVESTMENT

York1 is a leading, vertically integrated provider of environmental and infrastructure services with a 70 year track record.

With over 800 employees, York1 provides comprehensive waste and soil management and remediation along with a variety of value-added infrastructure services to a diversified base of infrastructure, commercial, and residential customers in Ontario. Fengate Private Equity made its initial investment in York1 in 2021.

Sector: Business Services

Headquarters: Mississauga, ON

Website: www.york1.com

e STRUXTURE DATA CENTERS

REALIZED INVESTMENT

Founded in 2017, eStruxture has become the largest Canadian-owned data center provider with 15 carrier and cloud-neutral facilities in Montreal, Toronto, Vancouver, and Calgary.

eStruxture offers colocation, bandwidth, and security and support services to more than 1,200 customers across Canada. Fengate Private Equity made its initial investment in eStruxture in 2017.

Sector: Business Services

Headquarters: Montreal, QC

Website: www.estruxture.com

SCORE MEDIA AND GAMING REALIZED

INVESTMENT

Score Media and Gaming’s flagship mobile app, theScore, is one of the most popular multi-sport news and data apps in North America, serving millions of fans monthly.

The company was the first media company to launch a mobile sportsbook in North America with its roll out of ‘theScore Bet’ in the United States. Fengate Private Equity made its initial investment in Score Media and Gaming in 2019. The company was subsequently acquired by Penn National Gaming in October 2021.

Sector: Consumer Products & Services

Headquarters: Toronto, ON Website: www.scoremediaandgaming.com

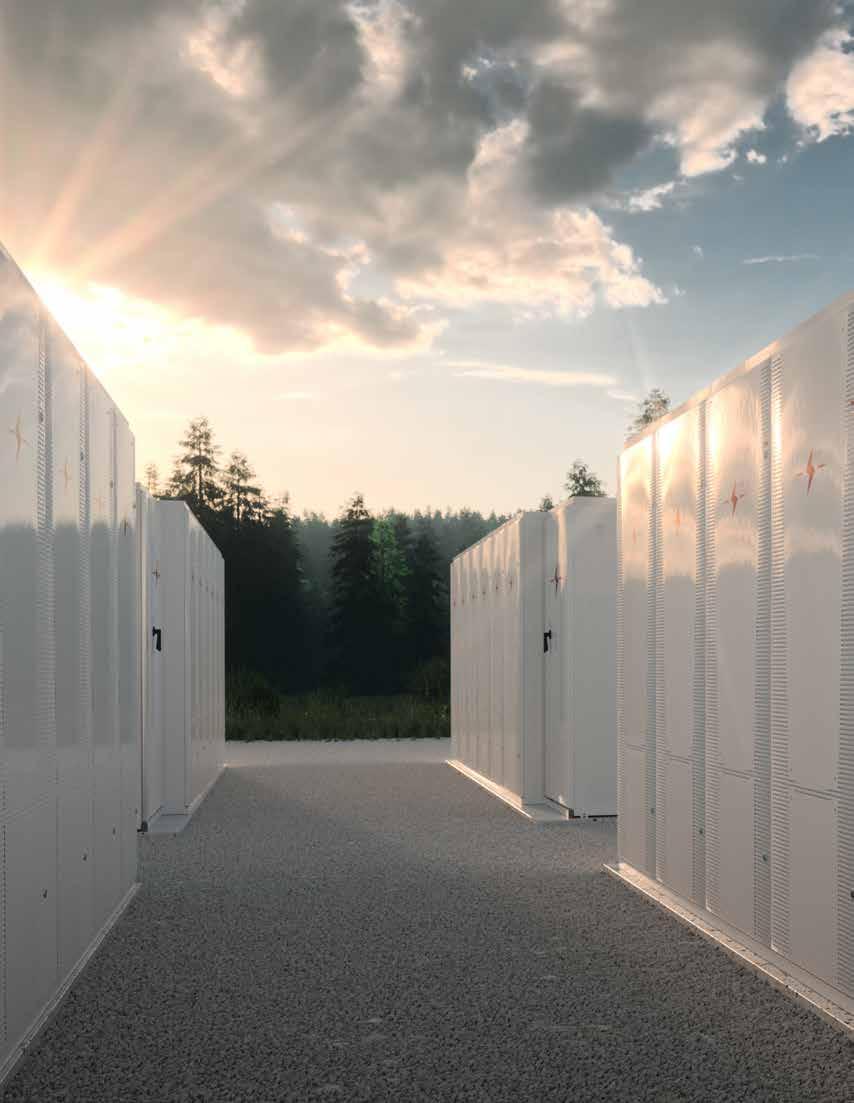

NRStor C&I

REALIZED INVESTMENT

Established in 2016, NRStor C&I is a turn-key, energy-as-a-service provider to commercial, industrial, institutional, and utility customers across North America.

With energy storage being a focal point of its offering, the company provides its services under a turn-key build, own, and operate business model. The company was acquired by Blackstone Energy Partners in March 2020 and subsequently rebranded as Aypa Power.

Sector: Business Services

Headquarters: Toronto, ON Website: www.aypa.com

CRICKET ENERGY

REALIZED INVESTMENT

Cricket Energy is a leading provider of home comfort services and smart energy solutions for the residential and commercial real estate sectors in Ontario.

The company provides water heater and other home comfort rentals, multi-residential insuite metering, and energy focused consulting services. Fengate Private Equity made its initial investment in Cricket Energy in 2017. The company was subsequently acquired in December 2020. Sector: Business Services

Headquarters: Concord, ON Website: www.cricketenergy.com

*All values presented in this brochure are in Canadian dollars.

“Fengate” refers to the Fengate group of companies which is comprised of Fengate Capital Management Ltd., its affiliated entities and the funds or other investment vehicles that they manage. Fengate has produced this information brochure (the “brochure”) for informational purposes only. The information contained in the brochure (the “Information”) is believed to be accurate at the time of publication of the brochure; however, Fengate does not guarantee or warrant or make any representations concerning the quality, suitability, accuracy completeness or timeliness of the information contained in the brochure.

This brochure and the information contained within it does not constitute an offer or solicitation by anyone in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation. In no event will Fengate be liable to any party for any claim or any direct, indirect, exemplary, incidental, punitive, special or other consequential damages arising out of information available in the brochure. Fengate is a trade name of Fengate Corporation. All other trade names, trademarks, service marks or logos found in this brochure are owned by their respective owners.

© 2025 Serafini Holdings Corporation. All rights reserved. Designed and produced by Fengate. 2025.08.08

Canada | Toronto and Oakville United States | Miami and Houston info@fengate.com