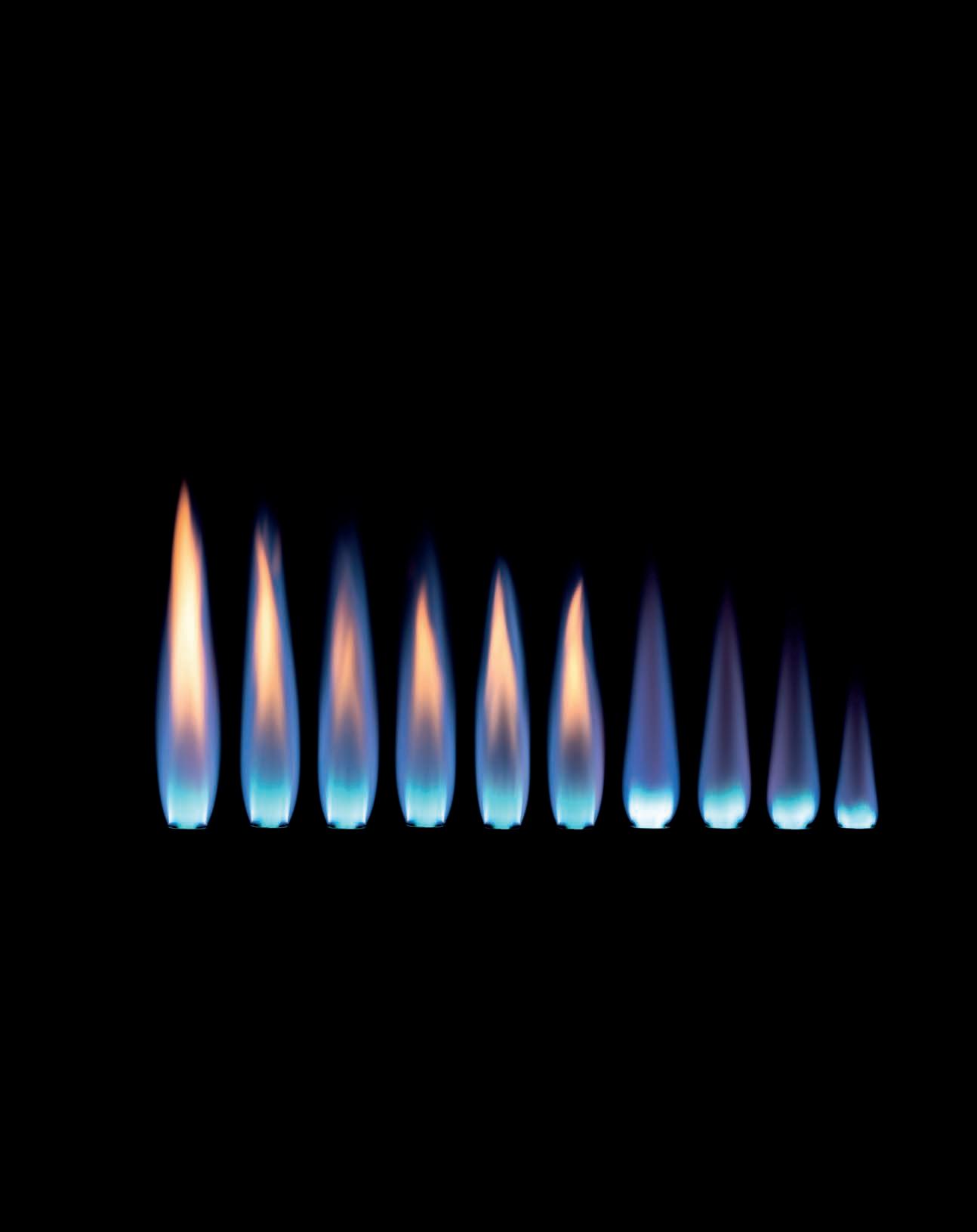

Under control

steps to keep your energy bills lower ENERGY COSTS | COST OF LIVING INTERNATIONAL TRADE OCTOBER-JANUARY 2023 DRIVING BUSINESS AMBITION FIRSTVOICE.FSB.ORG.UK | OCTOBER-JANUARY 2023 COST OF LIVING Helping staff when wage increases aren’t an option INTERNATIONAL TRADE How small firms are responding to Brexit MARKETING The importance of smart and efficient promotion

Practical

The first truly joined-up approach to employee health, safety, and wellbeing for SMEs BT201 •Flexible health, safety and wellbeing solutions tailored to your needs •Unique tools to benchmark your organisation •Access to industry leading HR, health, safety and wellbeing tools •Advice and support from industry experts to help you every step of the way. Helps you build a healthy, profitable, and sustainable future for your company. Sign up now: www.beingwelltogether.org support@beingwelltogether.org T. +44 (0)20 8600 1060

first steps

18 Under control

Penelope Rance reports on how hard-pressed small firms can help to mitigate the skyrocketing price of energy through smart costcontrolling measures and improved energy efficiency

24 Making ends meet

Staff will be struggling with the cost-of-living crisis, and yet many businesses are not in a position to raise wages; Peter Crush suggests other ways employers can help

28 Big picture

Adapting to post-Brexit trading

30 Fresh dawn

Brexit has made it more difficult for firms to trade with countries in the EU, says Alex Wright – but many are making a success of it, or even pivoting to alternative markets

34 Deep dive

Finding affordable and adequate insurance is proving to be yet another headache for small business owners

october-january 2023 | firstvoice | 3 heads up 6 Need to know Government package promises fixed energy costs for six months; public electric vehicle charging takes off; new legislation aims to boost local economies in Scotland 9 Data centre Rising costs and labour shortages bite small business 10 Regional voice Round-up of regional news 13 Opinionated Tina McKenzie on supporting skills, Perry Power on mental health and Marcus Herbert on employee wellbeing advice 36 How to ...Develop a wellbeing culture; Create effective video content 40 Legal With demand for staff greater than the available supply, what should employers be mindful of during the hiring process? inside firstvoice.fsb.org.uk

features

Marketing

straitened

importance

My journey

on his classic car firm with a difference

Ask the experts Challenging restrictive covenants and lockdown rents

news Photographer makes work out of a hobby, and a brewery whose beer leaves a better taste than most 52 Awards Enter the FSB Celebrating Small Business Awards 2023 54 Member services Making crucial connections through FSB events 56 My business Sharon McDermott’s legal firm specialises in wayleaves OCTOBER-JANUARY 2023 6 36 30

42

In

times, marketing retains its

46

Richard Morgan

48

member spotlight 49 Member

tech

Publisher: Aaron Nicholls

Editor: Nick Martindale

Email: firstvoice@redactive.co.uk

Lead designer: David Twardawa

Picture researcher: Claire Echavarry

Sub-editor: Kate Bennett

Production: Aysha Miah-Edwards

Email: aysha.miah@redactive.co.uk

Advertising Email: fsb@redactive.co.uk

Tel: 020 7324 2726

AS SMALL BUSINESS OWNERS, WE ALL know there are things that come along that can keep us awake at night. But the cost-of-doing-business crisis, which has come to a crescendo in recent months –energy costs, inflation, the highest tax burden for decades – is the most toxic combination in my 35 years of running businesses. And it comes off the back of the pandemic, when many small business owners’ reserves were wiped out.

Without support, the impact was starting to look bleak – small firms downsizing, mothballing, or even closing for good as the figures stopped stacking up and the scale of price rises needed to offset these soaring costs simply pie in the sky. Pizzerias which would need to charge £25 for a 9” thin crust pepperoni; pubs which would need to pump up prices to £10 a pint; manufacturers seeing exorbitant hikes in bills which couldn’t be passed on.

It’s times like this when standing together as small business owners to make our voice heard collectively is crucial. FSB has been shouting from the rooftops for months to succeed in getting this to the top of the media agenda, making clear that you can’t solve the cost-of-living crisis without tackling the cost-of-doing-business crisis. Behind the scenes, we’ve been making your voice heard loudly with political decisionmakers across the UK. As a result, we managed to secure help for small businesses on energy bills, plus other wins on reducing the tax burden – including a reversal of the hike in National Insurance.

It’s still going to be a tough winter, but these measures will be a lifeline for many, and FSB will continue to campaign to secure an environment in which entrepreneurship can flourish and drive economic recovery.

Follow Martin on Twitter @MMcTagueFSB

First Voice is available on subscription at £42 per annum. For details, contact publications@fsb.org.uk

First Voice has an audited net average circulation of 112,657 (July 2021 to June 2022).

AccessAbility help. If you require this document in an alternative format, please ring 01253 336036 or email: AccessAbility@fsb.org.uk

Printed by Warners First Voice is published on behalf of the Federation of Small Businesses (FSB) by Redactive Publishing Ltd (Tel: 020 7880 6200) firstvoice.co.uk | redactive.co.uk 4 | firstvoice | october-january 2023 firstvoice.fsb.org.uk

bits 58 New kit and apps

best new gadgets and apps for small businesses 60 Digital voice Our pick of First Voice’sonline and social media content out of office 62 I could try... ...Archery 64 Downtime Pottery, ski-free winter breaks and vintage cameras last word 66 Guy Browning Why self-knowledge is essential for the SME owner MARTIN McTAGUE, NATIONAL CHAIR 62 This edition of First Voice went to press on 30 September. All information is correct as of that point. inside october-january 2023 first word We hope you enjoy reading this edition of First Voice which you receive as part of your membership with FSB. We'd like to ask you to please consider the environment when you've finished reading it and pass it on to colleagues, friends, family or your business associates to have a read too before recycling it. FSB takes the privacy and protection of your data very seriously, and if you would like to find out more about this, please visit www.fsb.org.uk/privacy. If you would prefer not to receive the magazine at any time, please contact Customer Services on 0808 20 20 888 or by email to customerservices@fsb.org.uk Federation of Small Businesses Registered Office: Sir Frank Whittle Way, Blackpool, Lancashire, FY4 2FE. VAT No. 997 3427 63. The National Federation of Self-Employed and Small Businesses Ltd (FSB) is registered in England, number 1263 540. While every care has been taken in the compilation of this magazine, errors or omissions are not the responsibility of the publishers or of the editorial staff. Opinions expressed are not necessarily those of the publishers or editorial staff All rights reserved. Unless specifically stated, goods or services mentioned are not formally endorsed by FSB, which does not guarantee or endorse or accept any liability for any goods and/or services featured in this publication. ISSN 2399-5467 Copyright: FSB Publications Ltd This copy of First Voice magazine, and the paper envelope it was delivered in, are 100% recyclable FSB Publications: Email: publications@fsb.org.uk Tel: 0808 20 20 888 fsb.org.uk FSB Editorial Director: Alan Soady E ALL long But s he ers’ reserveswerewipedout. R

The

ORG ID REGISTERED ORGANISATION

heads up

Most valued work perks revealed

Being paid for overtime is the most valued employee benefit for UK staff, according to a study by Remote.

Energy price relief welcomed

FSB HAS WELCOMED THE move by the Government to provide greater clarity around the support that will be provided to help firms cope with energy costs, but warns that small firms must not fall through the cracks.

Under the package, gas and electricity prices will be fixed for six months from 1 October, and are expected to be around half the level that was previously predicted.

Tina McKenzie, Policy and Advocacy Chair, said: “This is a substantial move and will likely be of considerable help to small firms which have been crying out for months for measures to limit the pain caused by spiralling energy prices. The next stage will be for small businesses to learn what the changes mean for their current

1 d y

contracts and for any offers they have been looking at.”

Despite the move, FSB is warning that some businesses may still fall outside the current support and of the risk of a cliff-edge at the end of the six-month period.

“There will be hardship for some businesses which signed fixed contracts after prices rose but before April, who find themselves excluded from the scheme,” said Ms McKenzie. “FSB calls on energy suppliers to allow those customers to switch without charge to new fixed contracts, covered by the Energy Supported Price, if that makes the difference for small business to survive.”

See our feature on coping with energy costs on page 18

The research found 79 per cent of UK workers ranked overtime pay in their top fi ve work benefi ts. This was followed by fl exible work hours (77 per cent) and a company-sponsored retirement plan or pension (75 per cent).

Other popular measures include early finishes on Fridays (65 per cent) and a four-day working week (64 per cent), while private medical insurance came ninth on the list, with 58 per cent putting it in their top five.

TAX

NICs and tax reversal as Government hears FSB’s voice

In September, the incoming Government heard FSB’s campaign to reverse April’s National Insurance contribution and dividend tax hike, which the Chancellor said will be reversed in November. This tax made it more expensive for small business owners to pay both employees and themselves, as well as making it more expensive to start up as self-employed.

3 2 firstvoice.fsb.org.uk 6 | firstvoice | october-january 2023 9 THINGS YOU NEED TO KNOW

BENEFITS

ENERGY

Ten-year switch for new entrepreneurs

THE AVERAGE SMALLBUSINESS owner started up after working in a previous job for a decade, according to research by GoDaddy.

The study found that 70 per cent of entrepreneurs started their business in a different sector to that in which they had previously worked. The most common industries to move out of are retail (15 per cent), teaching and education (7 per cent) and accounting, banking or finance (7 per cent).

The most common reason for making the change was a desire for greater flexibility, cited by 41 per cent), becoming frustrated at working for someone else (36 per cent), fulfilling a lifelong dream (35 per cent) and a desire to earn more money (30 per cent).

The pandemic has also had an impact, the survey found, with 17 per cent saying Covid-19 had made them re-evaluate their life and a further 10 per cent launching a business after being made redundant.

EV charging spreads to retail and work premises

A trend towards charging electric vehicles (EVs) in public spaces or work environments is emerging, according to a survey by YouGov on behalf of vehicle charging firm CTEK.

With more people owning EVs, the survey suggests just 56 per cent of people now rely on their home charging point, down from 78 per cent in 2021.

People are also using shopping centres (20 per cent), work charging points (20 per cent), hotels (11 per cent) and restaurants (8 per cent).

The study also found that 25 per cent of EV users say lower running costs are the main benefit, with 21 per cent attracted by environmental benefits. But more than half (51 per cent) admit to having range anxiety.

BILLS

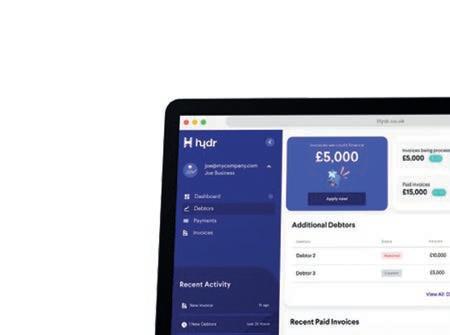

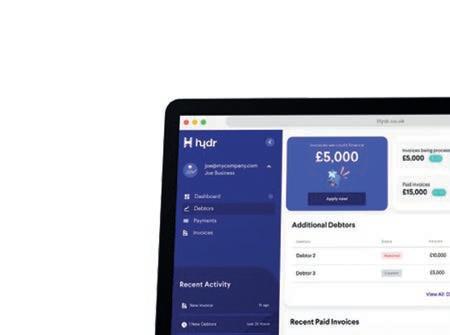

Late payment costs small firms dear

More than half of small business invoices are paid late, with the average bill being settled 5.8 days after it is due, according to research by Xero and Accenture.

The report found 49 per cent of small business invoices are paid late, with a delay of more than a month in 12 per cent of cases. Xero estimates this costs firms collectively £684 million a year.

The study also found that small business expenses rose by 18 per cent in 2021 due to supply chain disruptions, price shocks to commodities like oil, and

general inflation. This was a marked difference to 2020, when expenses actually declined by 1 per cent.

The report recommends that small firms consider adopting online invoice payment options for faster payment, and work with their accountant to stay on top of government programmes that offer payment plans to help smooth expenses.

“Late payments threaten owners’ ability to meet their own obligations such as rent or wages,” said Rachael Powell, Chief Customer Officer, Xero.

Cecilia Routledge, Global Director, Energy & Facilities, for CTEK, said: “It is extremely encouraging to see that the availability of public and destination charging facilities is starting to step up to meet the growing demand for out-of-home charging, as this is a vital factor in the overall acceptance and take up of electric motoring.

“However, reliability of out-of-home charging remains an issue, and this is an aspect that needs additional focus, along with steps to reduce the complexity of payment and industry-wide commitment to rolling out EV roaming.”

4 5 october-january 2023 | firstvoice | 7 heads up need to know

STARTING UP ENVIRONMENT 6

Local focus to help Scottish firms

EW LEGISLATION ONTHEWAY

Nin Scotland has the potential to boost communities and give local businesses a fairer crack of the whip when bidding for public contracts.

The Community Wealth Building Bill – which aims to fire up local economies by getting local institutions such as councils, universities and hospitals to work together to combine and unleash their economic power – could be an ideal vehicle to enact a number of long-standing FSB policies in areas such as procurement and local economic development.

Ahead of a consultation on the plans being launched, the Minister in charge of the Bill, Tom Arthur MSP, met FSB members to hear their first-hand

experiences of the procurement system and their suggestions for change.

Colin Borland, FSB’s director of devolved nations and also a member of the Bill’s steering group, said: “We need to extract the maximum local economic and community value from the £13.3 billion the Scottish public sector spends buying goods and services every year.

“This bill will be an ideal opportunity to do just that. But it won’t deliver unless it fully involves the microbusinesses who account for 70 per cent of our business population, yet win only about 5 per cent of public contracts by value. That means more place-based procurement strategies and local buyers who are empowered to adopt creative approaches in sourcing goods and services.”

Call for board directors

FSB is inviting expressions of interest to join its board of directors in 2023. This is an exciting opportunity for members to play a key role in FSB’s work to support small businesses, by leading and influencing overall strategy and the promotion of its long-term sustainable success for the benefit of the members.

There are also national volunteer opportunities, which may appeal to those

Report urges Wales tourism push

A report by FSB Wales has called for more to be done to help develop the distinctiveness of the Welsh brand and encourage UK and international tourists to visit.

As rising costs dampen business confidence across the country, FSB is calling for a post-peak Covid-19 ‘Welcome to Wales’ marketing campaign to help boost the economy and small businesses. Among the measures suggested is the need for an assessment to complement the debate about a proposed St David’s Day Bank Holiday, which has cross-party support in the Welsh Parliament. In the report, FSB calls for an analysis of the economic benefits and impact of a potential bank holiday.

Ben Francis, FSB Wales Policy Chair, said “Especially in rural communities in Wales, tourism underpins the economy, providing employment opportunities and enriching our landscape. In 2019, over a million international travellers visited Wales, adding an estimated £515 million to our economy.

with an interest in risk management and collaborative scrutiny of processes.

FSB is particularly keen to hear from members from minority and under-represented groups as it strives to be a truly inclusive organisation that recognises and celebrates diversity. Members who would like more information can email fsb.governance@fsb.org.uk

“There is much more we can do to grow the sector, its contribution to the economy and its role in profiling Wales to the world. It’s time to get the ‘Welcome to Wales’ message out there, to protect and redefine what it means to visit Wales.”

FSB Wales is asking people to share their favourite spaces and places in Wales, including their favourite small business in the tourism space, using the hashtag #MyHiddenGemFSB on social media.

9 heads up need to know

LEGISLATION firstvoice.fsb.org.uk 8 | firstvoice | october-january 2023

7

TOURISM

8

VOLUNTEER

heads up in-depth

data centre

Rising costs and labour shortages start to bite

Cost concerns have led to falling confidence, according to FSB’s Small Business Index.

The combined 53.4 per cent of small firms that predict they will stay the same size (38.7 per cent) or downsize or close their business (14.7 per cent) in the coming 12 months outweighs the 46.6 per cent who predict they will grow.

There was a better outlook for businesses in information and communication, where 63 per cent of businesses expected to grow, compared with 35 per cent of hospitality businesses and 34 per cent of wholesale and retail firms.

Nearly nine in 10 firms say their costs are higher now than 12 months ago – the highest proportion on record. The most common causes were fuel and utilities, both cited by 64 per cent.

The second quarter of 2022 also saw the number of small firms taking on more employees (11 per cent) outnumbered by those that shrank (14 per cent). However, 7 per cent believe their employee base will grow in the third quarter.

Confidence fell from 15.3 in the first quarter of 2022, to -24.7.

SMALL BUSINESS CONFIDENCE BY SECTOR

SMALL BUSINESS INDEX SNAPSHOT

34%

The proportion of small firms that have resorted to reducing operating hours to save money on electricity, according to a study from Disruptive Technologies

76%

The amount of small firms that have changed their business plan in the last two years in response to changing circumstances, research by Oracle Netsuite finds

40,000

The number of small firms that have sought finance to cope with rising costs, equating to around one in seven, a Nucleus Commercial Finance survey finds

october-january 2023 | firstvoice | 9 firstvoice.fsb.org.uk

CONFIDENCE

Most confident Least confident SMALL BUSINESS CONFIDENCE BY REGION -5 -6 -34 -39 -65 -70 -60 -50 -40 -30 -20 -10 0 QUICK FIRE STATS Q3 2021Q4 2021Q1 2022Q2 2022 -8.5 +15.3 -24.7 25 20 15 10 5 0 -5 -10 -15 -20 -25 -30 +16.4 69Information and communication Accommodation and food service activities Construction Manufacturing Wholesale and retail Professional, scientific and technical -32 -39 -32 -16 -27 -10 -43 -17 -24 -14 -29

regional voice

ROUND-UP OF REGIONAL NEWS

MIDLANDS

New project to focus on skills needs

NORTHERN IRELAND

FSB NI meets Small Business Commissioner over late payments

FSB NI has welcomed the Small Business Commissioner’s commitment to do all she can to deal with late payments and help firms in Northern Ireland whose financial wellbeing is suffering as a result. Sixty per cent of small businesses have problems with late payments, and the pandemic has made it worse.

During its first meeting with Commissioner Liz Barclay, FSB NI outlined the need to change the payment culture that harms businesses in Northern Ireland. It also shared a series of proposals that aim to address problems with the prompt payment system and incentivise customers to pay early in Northern Ireland.

FSB is calling for the creation of a Prompt Payment Champion in Northern Ireland, who would report on the payment performance of the public sector and large businesses and make recommendations for improvement.

Small Business Commissioner Ms Barclay said: “Meeting with FSB Northern Ireland underlined to me the big impact that late and poor payment practices have across the UK. As the cost of doing business rises and skills are in shorter supply, it’s more important than ever that small suppliers are paid quickly and fairly.”

FSB NI is developing a report that will outline how the private sector and every level of government can take the right steps to ensure that small businesses get paid much faster.

FSB is to lead a new project looking at future skills needs of businesses and technical education provision in three areas of England, including a large part of the East Midlands. By working with local employers and key education providers, this project will seek to set out the key priorities and changes needed to make post-16 technical education or training in the area more closely aligned with the skills needs of local employers and local economies.

The Local Skills Improvement Plans (LSIPs) are an initiative funded by the Department for Education, which has selected FSB as the lead employer

SCOTLAND

representative body to head up the LSIPs in Lincolnshire, Derbyshire & Nottinghamshire, and Cornwall.

FSB will be holding a series of events during the autumn in conjunction with employers and education and training providers in these areas. This will influence the recommendations of a report for each area to be completed by mid-2023.

FSB National Chair Martin McTague said: “We look forward to working alongside employers, key education providers and local stakeholders to help shape the future skills and local provision in these areas of England.”

Single use plastics banned in Scotland

Businesses in Scotland are now banned from supplying single-use plastics such as plastic forks and polystyrene boxes. The new rules – in force from August – were delayed following a dispute between the UK and Scottish governments. While FSB research shows that many small businesses have taken action to reduce waste, FSB is arguing for understanding as the rules bed down.

A spokesman for FSB said: “Given the confusion associated with the implementation of these new rules, we’d urge councils enforcing the new regulations to initially take a lenient approach.

“Between recovering from the Covid crisis and dealing with spiralling overheads, a huge number of small businesses already have a lot on their plates.”

More information can be found at zerowastescotland.org.uk/single-useplastics/regulations

10 firstvoice.fsb.org.uk 10 | firstvoice | october-january 2023 heads up area update

Night school offers business learning

A small business night school has been launched by FSB’s south-west England team, offering expertise and skills on a variety of aspects of business.

FSB pushes back against proposed ULEZ extension

FSB London has urged the Mayor of London to rethink the proposed expansion of the Ultra-Low Emission Zone (ULEZ), warning it will negatively affect too many small and vulnerable businesses.

It follows a survey conducted by FSB which found that 84 per cent of businesses oppose the proposal to expand the ULEZ in 2023, and 19 per cent were unaware of it.

FSB London is calling for:

Time to comply by having a similar lead-in period to previous zone extensions, including a ‘no charge’ period until at least 29 August 2024

An all-encompassing vehicle scrappage scheme for small businesses that can be supported by Government, Mayor of London and financial institutions providing low-cost finance

A project bank account for any small business paying the charge from August 2023 to August 2025, with funds protected in a TfL ULEZ bank account. Businesses would be able to use the funds towards purchasing a new or second-hand vehicle, subject to an upper limit.

Rowena Howie, FSB London Policy Chair, said: “FSB recognises the climate emergency and the commitment to move to net zero – but the Mayor must support the small business community through a ‘carrot’ and education approach to make greener decisions.”

SOUTH-EAST

FSB contributes to levelling up report

FSB in Kent has contributed to a new report on levelling up and its implications for the south-east of England’s small businesses.

The report, titled Financing the future –What does levelling up mean for South East England?, was published in July by the All-Party Parliamentary Group for the South East, and focused on small business and local government.

As an area hit hard by the economic impacts of Covid-19, levelling up the south-east is critical to ensure the long-term success of communities and small businesses across the region, and the UK more widely.

Tim Aker, FSB’s Development Manager for Kent, said: “A levelling up agenda must

include a strong focus on left-behind communities in the south-east.

“Making sure places in the south-east have much-needed care and attention is not only incredibly important to the region but to the UK economy as a whole.”

The modernisation of outdated infrastructure is a significant cause for concern in the region, with many towns and coastal areas ranked as some of the most deprived in the UK.

The report recommended that an effective policy of levelling up must focus on bolstering skills and businesses in the area in order to ignite long-term economic success.

Sessions will include topics such as marketing and public relations; social media; understanding your accounts and cash flow; creating a strategy for your business; finding and converting leads; making your business greener; time management; and costing your products.

The virtual events are being held between 6.30pm and 8.30pm on a number of dates in October and November.

It follows the success of previous evening programmes that were run in partnership with the University of the West of England and Plymouth University, with some small business owners finding evenings easier than daytimes to fit them into their diaries.

Each session will have a maximum of 25 attendees, so that there is plenty of scope for discussion of individual issues.

FSB members attending the workshops benefit from a 50 per cent discount on the cost of taking part, with each session available for £15 to FSB members and £30 to non-members.

Further details can be found in the Events section of FSB’s website

SOUTH-WEST

heads up area update

LONDON

october-january 2023 | firstvoice | 11 firstvoice.fsb.org.uk

Photography: Alamy

CertCheck

Total confidence in accredited certification at the touch of a button.

Free-to-use online database for verification that organisations hold accredited certification to ISO standards, such as:

ISO 9001 (Quality Management)

ISO 14001 (Environmental Management)

ISO 45001 (Health and Safety Management)

Plus over 15 other international standards/schemes

Streamline your supply chain management and procurement processes now by visiting UKAS CertCheck today!

CertCheck.UKAS.com

UKAS is the National Accreditation Body for the United Kingdom. We are appointed by government, to assess and accredit organisations that provide services including certification, testing, inspection, and calibration.

FINDING TALENT IS NOT EASY for small firms, which must compete with big corporates. Finding the right talent is even harder.

As we emerge from the pandemic, small businesses are experiencing both labour and skills shortages. There are simply not enough people, and enough suitably skilled people, to meet business demand.

Our research finds small firms in England are held back by poor vocational skills provision in schools, challenges in accessing apprenticeships, and inadequate incentives to retrain and upskill.

Seventy-eight per cent of small firms are struggling to recruit the right people, with eight in 10 of those flagging a lack of qualifications, skills and experience. Sixty per cent say a lack of applicants is an issue.

Five in six small employers provided training for themselves and/or their staff in the previous 12 months. Only 26 per cent undertook leadership and management training in the same period.

Self-employed people, meanwhile, are held back from realising their business’s potential by a lack of encouragement to learn skills that are outside their core operations but are vital for growth. Four in five sole traders have no training plan, budget or relationship with a training provider. Two in five have not completed

Scaling up skills

Small firms are being held back by a lack of suitable talent, made worse by poor vocational provision in schools. The new Education Secretary must act now to develop the skills we need

any training or professional development in the past year. The skills of business owners and are central to running and growing a business. Aside from learning new skills, such as the development of new products or technologies, training improves competitiveness, efficiency and longer-term effectiveness. Keeping our skills up to date and learning new ones is indispensable in growing a business.

A forward-looking, cross-departmental labour market strategy is a pre-requisite to solving skills mismatches in the labour market. To address the challenges, we suggest a package of measures including:

and university or college leavers, with the winner receiving start-up funding; providing grant funding so all schools can offer programmes to encourage enterprise, such as Young Enterprise’s Company Programme; and ensuring young people have encounters with employers that reflect their local labour market by amending statutory careers guidance.

Maintaining the Apprenticeship Levy and government funding for apprenticeship training in small firms; revamping financial incentives to take on apprentices and host T Level placements; and providing apprentices with free bus passes.

Increasing the corporation tax relief for employers training low or mediumskilled employees, and introducing 50+ Skills Bootcamps to provide the skills older people require to remain in or re-enter the labour market.

Extending tax relief for sole traders who upskill or reskill to include training aimed at securing business growth, and widening rollout of the EnterprisingYou programme.

Establishing a legislative target that, by 2035, no young person in England should complete compulsory education without at least Level 2 qualifications. Threequarters of the working age population in England should have at least Level 3 qualifications, with at least two-thirds of working-age people in every English region qualified to this level.

Launching a nationwide young enterprise competition for school leavers

If the Government is serious about rebuilding the economy, our recommendations need to be on the new Education Secretary’s slate.

Skills and labour shortages are not limited to England: devolved nations are facing similar challenges. Only concerted, co-ordinated efforts between all relevant Whitehall departments and devolved governments can spur changes.

october-january 2023 | firstvoice | 13 firstvoice.fsb.org.uk heads up talent shortage

The skills of business owners and staff are central to running and growing a business

Sm su p m any a dev d staff a s sttaff groow w new skil new s new pro new p

TINA MCKENZIE is UK Policy and Advocacy Chair, FSB

Illustrations: Sam Kerr

TINA MCKENZIE

heads up mental health

THE SUCCESS OR FAILURE OF small businesses often comes down to the owner’s decisions. That can be a massive strain. Business can be lonely, especially in hard times. Add in the pressures of trauma, and it’s a wonder some people can even function.

I’ve been there. There was a time when my house had no furniture, I slept on the floor, and I halved my dinners with my dog… a tough time in entrepreneurship.

I had been trying to build businesses for five years. Wherever I turned there was another obstacle: debt collectors at my door, a clamp on my car, business expenses bouncing, thinking my business idea wasn’t needed within the market. I struggled to cope. However, no matter how pressured I felt, no matter how much I didn’t see a way out, I didn’t quit.

My mum walked out when I was four, leaving my dad to raise me. Growing up, I saw him work his ass off for little pay. My dad controlled me, in contrast to the parenting he experienced – his mum and step-dad were alcoholics who didn’t spare a moment’s thought for where their son was. The controlling, fearful relationship I had with my father caused me to develop a strong dislike for being ordered around.

When I took a job at a call centre in London, I found I needed permission to go to the toilet. I left. I decided to start my own business so I could manage my time and become a millionaire within a year. How young and naive I was!

I became a fitness coach, then ran a Facebook ads agency, then stepped into the world of personal branding before burning out. If you’ve ever experienced burnout, you’ll know it’s not great.

ter w much four, ng up, I pay. My he e um and n’t spare eir son onship around. tre in ssion to o start nage my within a as! n ran a ped into before erienced reat. couldn’t 10, I was randad for

Looking back, it’s because I couldn’t handle my ‘shit’. When I was 10, I was sexually abused by my step-grandad for over a year. Once he was caught, my dad stopped me from going round to his mum’s house and told me to keep quiet.

I lived in silence for 12 years. I wore mental masks and changed who I was because I was scared to be the man who was abused. Then, in 2017, my dad, who had become an alcoholic, had a heart

attack and died at 48. A year later I broke my silence to the world – my girlfriend, business networking meeting, Tik Tok – and found out he was a victim, too. Since then, I have worked more than ever before. I run two charities, have written a bestselling book, run a business, am working on a film, and haven’t burnt out once – not even close. Do I get a lot of pressure? Of course. But there are two differences. The first is knowing that I’m doing what I’m meant to be doing. I believe in my message and I believe in what I’m selling. Second, I removed my masks, began my healing journey, and started handling my ‘shit’. Have you been through a traumatic event that you’ve kept to yourself? You can nd help. Reach out to

me or to FSB Care, which can support your mental or physical wellbeing. If someone is showing signs of stress, ask them, “How are you?” – and don’t always take their first answer at face value.

event that you ve to your t help yourself, and find help. Reach out to help y am confiden some type o and don’t d your menta

I’m not saying you have to have gone through child sexual abuse to relate, but I dent that you have lived with some type of trauma. If you live in silence and don’t deal with it, it will spill over into your mental health and business.

We can’t outrun our demons. We can’t change the past. We must take ownership of our story. We need to confront the darkness inside our minds to live the life we want to live outside of our minds.

Break your silence, take off the masks, confront your demons and stop running. The business and life you want to build will only happen once you become the person who is meant to build it.

nd out more about FSB Care, visit fsb.org.uk/join-us/membership/ fsb-member-benefits.html

We of our stor i we want to Brea e k y confront y The busin will only person w To find visit fsb. fsb-mem

PERRY POWER is a motivational speaker, actor and author known for the #breakthesilence hashtag. Views expressed are those of the author and not necessarily those of FSB

Break the silence

Running a business puts people under a huge amount of pressure. For some, like me, this will involve confronting traumatic events from the past

firstvoice.fsb.org.uk 14 | firstvoice | october-january 2023

My house had no furniture, I slept on the floor, and I halved my dinners with my dog

PERRY POWER

BizSwitch: making energy switching simple

BizSwitch takes a different approach to how you can switch your energy contracts, making it simple and easy to understand. That approach is shared by our team of energy experts, who provide information and insight that allows clients to make sense of the energy market.

For example, did you know that part of the reason our energy prices are so high at the moment is because of the increase in liquid natural gas imports? And that these imports are being traded time and time again while halfway across the Atlantic Ocean on enormous ships?

Just look at Figure 1. This shows the route of the BW Pavilion Leeara on its way to Europe. Every turn it makes is because somebody else, somewhere else, has bidded a higher price for its cargo. With Russia reducing the amount of gas it supplies to Europe, these cargos are becoming more and more valuable, driving the price of gas higher and higher.

But this is gas, so why are electricity prices high? The BizSwitch team makes it simple again: more than 70% of the UK’s electricity comes from combined cycle gas turbines – gas creates electricity. If the gas price is high, so is electricity.

That is not the only thing costing you more; if you have used an energy broker to arrange your supply contract, you could be paying 10%–50% higher than the actual market rate due to commission payments you may not know you are making.

It is widely accepted that UK businesses are not getting the best deal

they can from the current outbound telesales model. Ofgem has identified numerous ‘sharp practices’ that expose business consumers to risk, yet little is being done to protect them. BizSwitch offers a viable alternative by removing exposure to those ‘sharp practices’: No hidden fees: the low service cost is transparent and clear for you to see. No ‘pressure selling’: No need to talk to a salesperson – the choice is yours, with no supplier favouritism.

No unsolicited calls: the switch is online, removing the need to speak to anybody. Access to the whole available market: BizSwitch works with 15 suppliers and you will see prices from all of them (if available). This removes the risk associated with brokers where they may only show you the suppliers that pay them the best terms – meaning the cheapest ones may not be presented. BizSwitch customers see all available suppliers, with the cheapest listed first (Figure 2).

BizSwitch.co.uk is the only website that allows for a fully automated dual fuel switch. It can be done at any time, anywhere, and only takes three minutes to retrieve prices and switch.

It is important to us that consumers understand that the new Business Energy Bill Relief scheme, supporting businesses with rising energy costs and running until March 2023, is not creating a new fixed tariff for all businesses – it is offering a discount to the wholesale element of the bill. Suppliers need to add in distribution and transmission costs, taxes, levies, risk and standing charges, so will still be competing for business; it will still pay to shop around. BizSwitch will give you visibility of these new market rates so you can find the right contract for you

At BizSwitch we want to drive better outcomes for businesses and put decision making in your hands, with the power to choose what you want, when you want it. Learn more at bizswitch.co.uk/firstvoice

firstvoice.fsb.org.uk october-january 2023 | firstvoice | 15

advertorial BizSwitch

BizSwitch.co.uk is a brand new entrant to the business energy switching market, providing the first end-to-end price comparison website that facilitates the full utility switch (gas and electricity) online, with no need to speak to anybody

Figure 1: BW Pavilion Leeara’s route alterations due to competing bids for its cargo. Provided by Independent Commodity.

Figure 2: Price comparison page.

up

Positive action

IF YOU HAVE EVER BEEN responsible for putting together a company wellbeing programme, you will likely have experienced the challenge of where to begin.

To know where to start, it is important to understand what wellbeing is. A quick internet search will offer a multitude of definitions that ultimately point back to the way British Safety Council defines wellbeing – as “an individual’s ongoing state which enables a person to thrive”.

This means that anything a person experiences may have an impact on their wellbeing. So, if it is so far-reaching, how can companies support the wellbeing of their employees?

In the last five years, the number of organisations that have put in place a standalone wellbeing strategy has increased, but it is still only around 51 per cent. And, while having a standalone wellbeing strategy results in lower sickness absence, reduced work-related stress and better staff retention, many companies are still getting it wrong.

We often see companies provide benefits that don’t get used. This might be because staff don’t know about the benefits, don’t want to be seen to use these benefits, or don’t think the benefits will help them. Whatever the

reason, understanding what employees need (and maybe want) is the foundation of a wellbeing programme. Companies should ideally follow a ‘Plan, Do, Check, Act’ approach. The ‘Plan’ phase is all about determining what exactly it is you want to achieve with your wellbeing programme. This will allow you to take a snapshot of, or use data to benchmark, where you are now. This is crucial to determine if your wellbeing programme supports what you are trying to achieve in the future. This phase should allow you to formulate your strategy, determine

reason, reaasson need (a neeed d ( foundat found Comp Com ‘Plan, D ‘Pllaan, ‘Plan’ p ‘Pllaann’ what e with y will al a use da us d

priorities, define metrics to monitor improvement, and set timescales for implementation and review.

This phase should also clearly define how you plan to communicate with your employees, based on the type of communication they can most relate to. For example, one workforce may be very in-tune with the nuances of social media and using smartphones daily, so this may be the best way to connect with them. Another may be more receptive to face-to-face discussion to help absorb

information. It is important to do what suits your workforce.

The ‘Do’ phase involves implementing the strategy. This can, and should, take time. Simply telling a workforce about a wellbeing programme as a one-off won’t support its success. ‘Do’ is about reinforcing what you are trying to achieve and how you are supporting your workforce’s wellbeing.

The ‘Check’ phase may start during the ‘Do’ phase, as it is about using data and information to assess whether the programme is moving in the right direction. This could be done by reviewing raw data, such as absence or staff retention, or through focus group sessions and management feedback. You shouldn’t wait until the end of the programme to assess whether you have achieved what you set out to.

‘Act’ is about reviewing what has been achieved in line with the mission statement, the metrics of improvement, and the timelines defined in the strategy. This fourth phase should not be the end of the programme – it should be the point at which it is adapted based on the findings from the ‘Do’ and ‘Check’ phases.

Embedding a wellbeing programme is no mean feat. Keeping it simple, listening to employee needs and following a ‘Plan, Do, Check, Act’ approach are the ingredients to future success.

MARCUS HERBERT is Head of Wellbeing at British Safety Council. Views expressed are those of the author and not necessarily those of FSB

firstvoice.fsb.org.uk 16 | firstvoice | october-january 2023

Knowing what your employees need, and taking a Plan, Do, Check and Act approach, can help small firms develop wellbeing plans that will help staff to thrive

Assess whether the programme is moving in the right direction

F for a Kn ta ca

heads

employee wellbeing MARCUS HERBERT

pl

MAR C

We want to hear from you!

Do you want to play a vital role in our long-term success so we can support more small businesses and the self-employed?

Do you want to develop your existing skills?

Volunteer with FSB

Volunteering with our member-led governance groups at a national level is a rewarding opportunity to influence FSB’s strategy. We’re looking for committed FSB members who can contribute valuable experience and knowledge to our Board of Directors and Scrutiny Body. Everything we do is in the best interests of our members, so we’re proud of the important work

Are you passionate about the work we do at FSB?

Do you have experience to help guide us through this challenging time?

our volunteers do to ensure FSB is as effective as possible and that our culture aligns with FSB’s purpose.

At FSB, we strive to be inclusive and celebrate diversity. We encourage FSB members from minority and under-represented groups to apply.

Visit www.fsb.org.uk/elections2023 to learn more and register your interest by Monday 14 November 2022 at 4pm

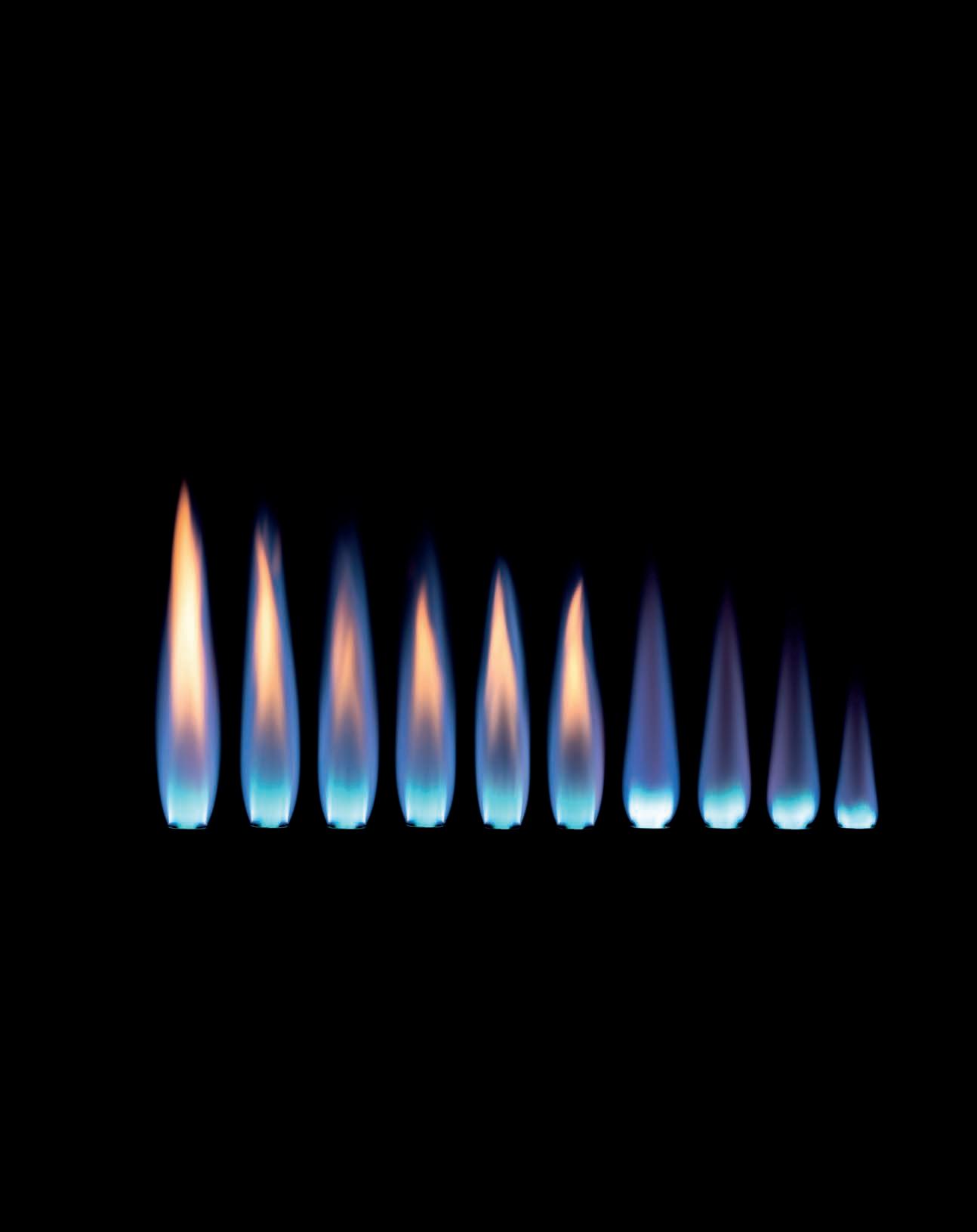

DESPITE GOVERNMENT INTERVENTION, THE MAJORITY OF SMALL BUSINESSES ARE NOW PAYING SIGNIFICANTLY MORE FOR THEIR ENERGY THAN EVER BEFORE. BUT THERE ARE WAYS IN WHICH SMALL FIRMS CAN KEEP PRICE RISES UNDER CONTROL, SAYS PENELOPE RANCE

firstvoice.fsb.org.uk

18 | firstvoice | october-january 2023 feature energy costs

Y JULY 2022, WHOLESALE energy prices stood at 450 per cent versus the same time in 2021. For a while, businesses were largely protected from the increases, as many had bought supplies 12 to 24 months in advance. But many energy contracts have now come to an end and, despite the recent government announcement to cap wholesale rates for six months, small businesses are facing significantly higher bills than they were paying just a few months ago.

Energy prices will compound the growing cost of doing business for SMEs. FSB’s quarterly Small Business Index revealed that 89 per cent of small business operating costs are up compared to 2021, with 64 per cent seeing rises in utilities. “For some businesses, energy price rises have either doubled or tripled, and this has had a significant impact on the cost of doing business,” says FSB Policy Adviser Friederike Andres. “It’s impacting the majority of small businesses because it has become a big outgoing cost, and they can’t do anything about it.”

feature energy costs

A survey of small businesses by Smart Energy GB revealed that two of their top three price pressures were increases in the price of fuel (47 per cent) and gas and electricity bills (41 per cent). A worrying 28 per cent didn’t know how high their next energy bill would be.

Despite the introduction of a six-month business price cap – and a pledge to support “vulnerable” industries, sectors or businesses afterwards – many have concerns, which FSB has drawn attention to. “Our work on vulnerability of small businesses to energy costs has revealed

october-january 2023 | firstvoice | 19 firstvoice.fsb.org.uk

huge bills causing damage in virtually any sector that uses energy in any meaningful way, just like most households,” says Martin McTague, FSB National Chair. “Any future definition of ‘vulnerable industries’ will need to be broad, realistic and fair.

“The Government should also make good on its commitment for comprehensive help for all small businesses affected,” he adds. “If any have energy circumstances such that, in practice, they turn out not be covered by the measures announced, the Government must keep an open mind and ensure policy decisions do not create another group of disenfranchised or excluded small businesses without support, just like it did on income support during Covid.”

The degree of pain felt will depend on the proportion of direct costs that include energy, and whether businesses can pass these on. The impact is greater for those in industries such as manufacturing, travel, care and hospitality.

“The increase an individual business sees depends on when their energy contracts are due for renewal; when they placed their last contract; their consumption and usage pattern; location and meter type; and the market status on the date they purchased,” outlines

Steve Silverwood, Managing Director of ECA Business Energy.

The best way to ease the impact of price rises is to manage usage, but this is easier said than done. “Many SMEs are not in a strong position to adapt to these increases because their energy requirements are relatively static, either because they do not own their premises, or because their ability to access upfront capital for energy efficiency improvements is limited,” says Jack Wilkinson-Dix, Policy Officer at the Energy Saving Trust.

Small firms need to keep energy consumption down, reduce demand and prevent wastage. “There is no magic bullet or single strategy,” says Mr Silverwood. “Instead, initial action followed up by a long-term energy strategy will help manage costs increases.” The following tips are some of the main ways in which you can mitigate rising energy prices:

AIM FOR EFFICIENCY

Energy efficiency isn’t just about LED lightbulbs and automatic off-switches – SMEs need to look at the bigger picture. A good starting point is to have an energy audit undertaken, says Mr Wilkinson-Dix. “This involves an energy expert assessing where your business uses energy and where savings might be possible. Audits can be relatively inexpensive, and many local authorities offer subsidised or free audits.” You could set targets for employees to reduce their energy usage, being transparent about why it’s important to the business. “Communicate with staff to ask for their cost-saving ideas, to ensure they are on board with any new processes you are trying to implement,” advises Fflur Lawton, Head of Policy and Public Affairs at Smart Energy GB.

feature energy costs

GET TECHNICAL

Analysing your consumption data will highlight where you can make efficiencies, and the impact of any changes. Smart meters track how much energy you use and when, helping you plan your usage. “Smart meters send meter readings directly, and securely, to energy suppliers, putting an end to manual meter readings, meaning less admin for small business owners,” says Ms Lawton. “They also provide accurate billing, so owners know exactly how much their energy is costing, and only pay for the energy they use. This helps when budgeting and managing cash flow.”

Smart technology can also save power. “Have thermostats fitted that can be controlled remotely so that temperatures aren’t set too high, and heating and lighting isn’t left on when it’s not required, overnight or when the business is closed,” recommends Chris Bowden, founder and Managing Director of clean energy marketplace Squeaky.

OPEN COMMUNICATION CHANNELS

Contact your supplier to make sure you’re on the right tariff and understand when prices are likely to fall. “Suppliers have a range of different products to suit individual usage and demand,” says Mr Silverwood.

october-january 2023 | firstvoice | 21 firstvoice.fsb.org.uk

The percentage of small firms reporting a rise in utility bills in 2022

feature energy costs

“Larger-consuming clients may be able to purchase energy on a flexible contract rather than a traditional fixed price contract.”

Flexible products have a framework agreement in place with one supplier for a set term; the power is then purchased at various points throughout the contract period in line with an agreed strategy.

Microbusinesses should negotiate contracts that suit their needs and agree competitive prices when they switch suppliers or agree a new contract. “Microbusinesses can also obtain valuable market insight and contracting services from reputable brokers,” says Louise Van Rensburg, Head of Non-Domestic Retail Policy at Ofgem. Following Ofgem’s Microbusiness Strategic Review, from 1 December, suppliers will only be permitted to work with brokers signed up to a qualifying alternative dispute resolution scheme.

TIME YOUR TARIFF

If you don’t need to run all of your high-energy machines and appliances during peak business hours, switch to a time-of-use or smart tariff, which reduces costs by spreading supply and demand. “This financially rewards customers who use energy when demand is low, or when excess energy is available,” explains Ms Lawton.

POWER YOUR OWN PREMISES

Self-generation from renewable technologies such as solar panels or wind turbines is now a viable option, with payback on investment possible within three or four years. Local initiatives including grants and funding for installing renewables are often available.

Considerations for self-generation include who owns the premises and future plans for the buildings. “Also check your current energy

Support for reducing energy costs

FSB’s advice on improving energy efficiency: fsb.org.uk/resourcespage/energy-management-planshow-to-improve-energy-efficiencyin-your-business.html

FSB’s sustainability hub offers advice on how small firms can move towards net zero: fsb.org.uk/ knowledge/fsb-infohub/smallbusiness-sustainability-hub.html

Ofgem’s energy efficiency tips and links to grants and schemes: ofgem.gov.uk/informationconsumers/energy-advicebusinesses/find-business-energyefficiency-grants-and-schemes

The Zero Carbon Business Portal overview of energy efficiency measures: zerocarbonbusiness.uk/ reduce-the-impact-of-risingenergy-costs/

Energy efficiency advice from the Energy Saving Trust: energysavingtrust.org.uk/business/ Citizen’s Advice Bureau support for those struggling to pay their energy bills: citizensadvice.org.uk/consumer/ energy/energy-supply/yoursmall-businesss-energy-supply/ your-small-business-cant-affordits-energy-bills/

HAVE A LONG-TERM PLAN

An energy strategy can mitigate price increases. It will work best when incorporated into a business plan with board sign-off, says Mr Silverwood. A four-part plan would include:

A procurement strategy covering when contracts are up and reviewing the market so you can buy during favourable conditions

supply contract, as some suppliers have tolerances built in, so if you reduce your contracted consumption by installing these technologies you may be penalised,” says Mr Silverwood. Ofgem is attempting to reduce such restrictions, to make energy access more flexible. “We are working to make it easier for users to be rewarded for being more flexible in when they use or generate energy,” says Ms Van Rensburg. “This will help lower the cost of balancing the system, while, together with energy efficiency actions, helping businesses manage energy costs.”

Invoice management, which should include using smart meters to send monthly reads direct to the supplier and checking bills against unit rates, standing charges, consumption, meter readings and taxes before signing off invoices

Consumption reduction, which means understanding your usage data, looking for wastage points, and ensuring equipment is well maintained and working efficiently, plus a carbon reduction plan

Finally, future proofing: protecting against long-term price volatility by investing in self-generation, energyefficient technology, a green supply chain, and a route to net-zero.

PENELOPE RANCE is a freelance business journalist

firstvoice.fsb.org.uk 22 | firstvoice | october-january 2023

The percentage by which wholesale energy costs rose in the 12 months to July 2022

DIRECT

CAN YOU AFFORD NOT TO REDUCE YOUR LIGHTING COSTS?

Small and independent retailers depend on their signage to promote their business, but spiralling energy prices are putting them under huge pressure. Fraser Burns, Managing Director of Cygnia, explains whether retailers can reduce their signage energy usage

Q How should retailers respond to increases in their energy bills?

FB The obvious first step, of course, is to stop wasting energy – computers left on overnight, lights in back offices and so on. The next step is to look at reducing essential energy usage, including signage illumination.

Q Can signs use less energy?

FB Absolutely. Most signage lighting uses fluorescent tubes, and they’re expensive. Switching to LED lighting reduces energy usage by up to 90% compared to fluorescent tubes. That’s a huge drop in your electricity bills.

Q That means a retailer needs to spend money on upgrading their signs?

FB It does, but you get that money back in three ways. First is the lower bills. Second, LED lighting lasts up to five times longer than fluorescent tubes, so you save money not changing them. And third, via Enhanced Capital Allowance, you may get corporation tax benefits when you upgrade to LED lighting – and you may be able to claim Corporate Tax Relief, too. Those are excellent reasons for switching to LED lighting in your signage. The tax savings, lower bills and less maintenance pay you back.

Q How should retailers switch to LED lighting?

FB First, it must be done properly. Legislation states your signage must be cared for by someone with the experience and correct training to do the work. For small businesses this used to mean entering a complex maintenance contract – but now they can switch to LED via our Cygnia Direct service.

Q What is Cygnia Direct?

FB Cygnia Direct is a new signage maintenance service for small retailers. It works on a pay as you go model, rather like a mobile phone, so a shop owner can have experts looking after their signs without committing to a long-term contract.

Q So it is a more flexible option for a retailer?

FB It is, especially in such a fluid economic situation. Being tied to a long-term contract just won’t work for a small retailer. They might move premises, change their signage and then have to go through sorting out the details again. Cygnia Direct keeps you legally compliant with the flexibility they need for the future.

Q Is it a restricted service?

FB Not at all, no. All the usual services from Cygnia can be requested, so there’s annual safety inspection, repairs, LED upgrades, cleaning, pest protection and so on. With Cygnia Direct you just call us when you want work done.

Q So Cygnia Direct is more cost-effective for a small retailer?

FB Yes, and until the end of January, Cygnia Direct is available at 10% discount to small retailers. Retailers must still meet legal requirements covering their signage. With this offer, shopkeepers can reduce their bills and keep their signs looking great.

To find out more visit www.cygniamaintenance.com/cygnia-direct

Employees as well as employers are feeling the inflationary pinch, and that could spell trouble for small businesses unable to offer them hefty salary rises. But there are ways in which firms can help make a difference for staff, as Peter Crush discovers

MAKING ENDS MEET W

ITH INFLATION

hitting a 40year high – and forecast by the Bank of England to carry on rising to 13 per cent by the end of the year –the oft-cited ‘cost-of-living crisis’ for employees isn’t just real, it’s a catastrophe. Some 2.1 million people are already using food banks, according to the Trussell Trust, while in-work poverty is at 17.4 per cent, the IPPR thinktank suggests.

The problem for small firms is that, with their own costs also rising, pay rises just aren’t on the cards. A recent NerdWallet poll of 402 SMEs backs this up, finding

feature cost of living firstvoice.fsb.org.uk

24 | firstvoice | october-january 2023ovember 2023

that 46 per cent have been unable to grow pay in line with inflation. So what can cash-strapped SMEs do to help staff deal with the cost-of-living crisis without resorting to inflation-busting pay rises? The following tips offer a few ideas:

1 Offer a one-off bonus

A one-off cost-of-living payment is a cheaper alternative to a permanent pay rise, but still shows employees they’re cared for. Larger firms that have already done this include TSB, Shoosmiths and Virgin Money (all giving staff £1,000). According to Mark Joyne, Director, Research and Development Specialists Ltd, it’s not off-limits to smaller firms, and diligent SMEs can actually pay for it using an existing government R&D tax credit claim scheme. He says: “People think the grant has to be used for R&D, but that not the case,” he says. “It’s a government scheme to help businesses in the UK to grow and stay competitive, and recently we’ve seen clients – including a small dental company – inject the money to their staff in the form of bonuses to help them navigate the difficult economic times.”

2 Make salaries go further

When the value of money is falling, it needs to work harder. A plethora of benefits platforms now give SME employees access to vouchers and thousands of money-off discounts to help do just this. Perkbox, for instance, claims staff can save up to £1,000 per year on everything from the cost of gym memberships to cinema tickets.

But it’s making everyday spend go further that Stella Smith, founder of Pirkx, argues is most effective. “We call this creating ‘found money’,” she says, “where staff get discounts on their ordinary spending – like groceries and clothes.” At a cost to SMEs of £4.50 per employee per month, Smith says the average staffer saves £2,000 per year just doing their usual spend. “There are also options to take cash-back, and pay it directly into people’s bank accounts,” she adds.

FSB members can access affordable wellbeing benefits for their staff through Pirkx; see fsb.org.uk/join-us/ membership/fsb-member-benefits for more information.

3 Offer reward cards/ e-vouchers

“As an immediate way to minimise employees’ outgoings, employers can provide e-vouchers and cashback cards to maximise employees’ spending power,” argues Jamie Mackenzie, Director at Sodexo Engage. “Cashback cards can reward employees for anything from a promotion to winning a new client and can go a long way in trimming everyday expenses.”

More niche providers include the likes of eatoutroundabout.co.uk, where employers reward staff with money-off vouchers for eating out. CEO Ali Gordon says: “SMEs are able to offer money off to staff without paying tax or National Insurance on the benefit, while staff can claim money off at local restaurants.”

But sometimes it’s the small gains that can add up. Britons spend more than £4 billion getting their morning caffeine fix from coffee shops, according to data from Mintel. Through provider Ello Group though, users of its Coffee Club scheme could save £3.45 a week – £179 per year.

4 Let staff take a second job

It’s often frowned upon, but with a third of workers planning to take additional temporary work to top up their incomes, according to data by Indeed Flex, SME bosses should perhaps consider bowing to the inevitable and being flexible with their schedules to enable staff to take on second jobs.

5 Holiday trading

“This allows employees to sell back unused annual leave,” says Nadene Evans, people operations and employment expert at Zenefits. Normally, it is limited to five days per year, with each day ‘worth’ 1/260th of that person’s annual salary [a full-time employee

october-january 2023 | firstvoice | 25 firstvoice.fsb.org.uk feature cost

living

of

feature cost of living

works 260 days per year]. It’s important to remember that employees cannot go below the statutory minimum amount.

6

Give access to alreadyearned income

For the ‘just about managing’, it’s often a sudden, unexpected bill that can tip people over. To alleviate this, a growing number of SMEs are offering staff early access to their alreadyearned income if they need it. Through providers such as Wagestream, staff can get access to up to 50 per cent of their earned wages early, rather than wait until the standard end-of-month payday. SMEs can set how much staff can access. Camden Town Brewery is one SME that recently introduced it, and staff have already used it to pay deposits for flats or to meet unexpected costs.

7

Rework commission policies

“In recognition that the cost of living has increased, we’ve launched a ‘team commission pot’,” says Matt de la Hey, CEO at technology company inploi. “A proportion of every sale and renewal goes to a kitty shared by everyone – not just the sales team.”

8

Offer salary sacrifice schemes

At a time of increased financial pressure, the idea of sacrificing salary might not sound logical, but official salary sacrifice schemes are a way of giving staff non-cash benefits (such as a bicycle), at a much-reduced rate. In return for giving up part of their pre-tax salary, staff can typically save 26-40 per cent on the cost of a bicycle and/or accessories.

Since a portion of their salary is foregone, employees also pay less tax and National Insurance contributions on the amount sacrificed. Once they have their bike, users can save again on commuting costs. Salary sacrifice can also be used by staff to buy IT equipment, e-bikes and even electric cars – where savings of up

to 40 per cent on the cost of an electric vehicle can be achieved.

9 Employer loans

Employers can offer employees a tax-free interest-free loan of up to the value of £10,000 per year. Not only is it interest-free to employees but, because it is not salary, SMEs will not have to pay secondary Class 1 NICs on the amount borrowed. Increasingly, these have been used to help pay for season tickets.

10

Offer support

Employers have a valuable role to play as signposters to other services such as budgeting tools (for example, MoneyHelper) and Citizens Advice, which can help identify which benefits or grants staff may be eligible for (such as the one-off payment of £650 to low-income households on means-tested benefits such as Universal Credit, as well as the £400 energy bills discount).

A number of debt consolidation providers – such as Salary Finance – offer employee debt consolidation services, which combine all of an employee’s existing debts into a single lump sum, and offer better-than-credit-card repayment rates that can be paid direct via payroll. It means staff can save money while also meeting repayment commitments. SMEs can also point staff to debt charities such as StepChange and National Debtline.

11

Long service awards

At trade body The Institute of Export and International Trade, it’s recently introduced long-service awards worth £500 for five years’ service and £800 for 10 years’. “One member of staff has already used their 10-year award to buy a new cooker that they urgently needed,” said its HR manager, Amy Finck. This not only helps loyal staff make ends meet, but can also ensure those coming up to milestones have an incentive to stick around rather than looking elsewhere.

PETER CRUSH is a freelance business journalist

Taking action

At award-winning tech and digital recruitment company Maxwell Bond, founder Steven Jagger says he tries to do anything he can to put a bit more money into people’s pockets. “We do random, crazy stuff like having office paper plane competitions (winner gets £20), offering monthly paid-for lunches and giving out ad-hoc cash incentives,” he says.

The biggest focus, though, is on educating staff around how to manage money. “We recruit mostly second or third-jobbers, but I’m staggered to find many don’t know how to budget or do basic financial planning,” he says. “So I’ll sit down with my team and run sessions on this, which can dramatically improve people’s finances.”

Training, he says, is then the next biggest way staff can get more money. “We promise to move people up in their careers as quickly as possible, and it’s training that gets people to this level.

“One employee who started last year on £21,000, rising to £27,000 after her probation, is now earning £50,000 because she’s been given the tools to meet her targets.”

Other measures include offering a cycle-to-work and tech scheme through salary sacrifice, while healthcare provision through Westfield Health means people can get up to £300 off the cost of eye tests and prescription glasses, he adds.

firstvoice.fsb.org.uk 26 | firstvoice | october-january 2023

Illustrations: Getty

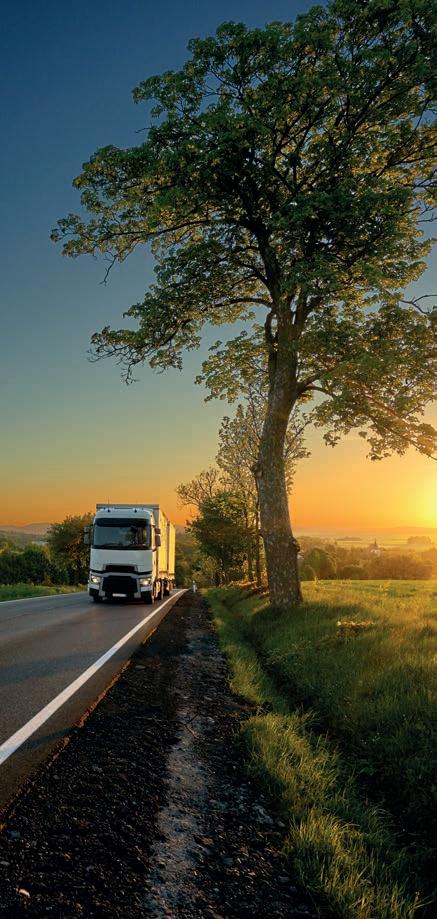

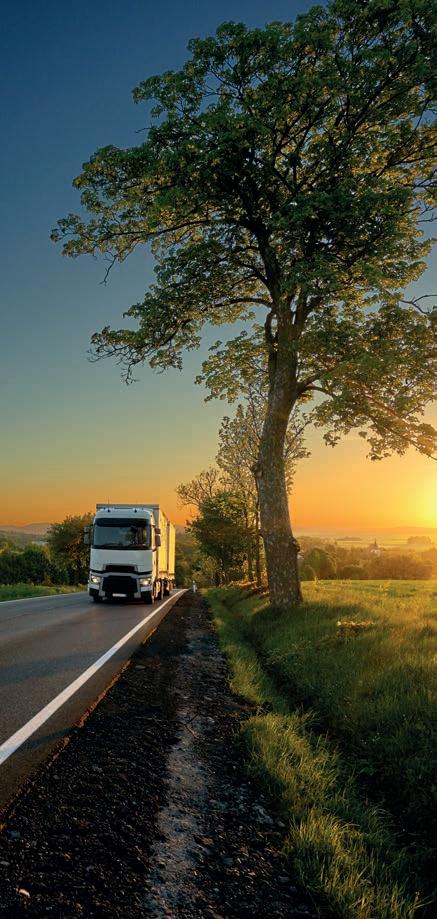

Road to nowhere

Freight lorries and heavy goods vehicles queue on the A20 towards the Port of Dover in April 2022. New customs controls in the wake of the UK’s departure from the EU have made it significantly more difficult to transport goods in and out of the UK, with many small firms now choosing not to export as a result. A new Customs Declaration Service due to come into force in 2023 is expected to add to the bureaucracy.

Yet some sectors and small businesses are adapting to the new realities, and developing targeted strategies to ensure they can continue trading with the EU and further afield.

big picture international trade 28 | firstvoice | october-january 2023

BIG PICTURE

firstvoice.fsb.org.uk

Photography: Getty

october-january 2023 | firstvoice | 29 big picture international trade firstvoice.fsb.org.uk

Brexit has thrown conventional exporting and international trade norms up in the air. But amid the challenges and frustrations are opportunities, and the potential to target entirely new markets. Alex Wright reports on how small firms are responding

firstvoice.fsb.org.uk

30 | firstvoice | october-january 2023 feature international trade

£16.9bn

rexit has undoubtedly made it harder for UK small businesses to trade with the EU. Under the new trading relationship, many firms have reported increased costs, rules, paperwork, delays and disruption. Compounding this are the ongoing difficulties many continue to encounter with the movement of goods across the Northern Ireland border. This is evidenced by the fact that one in eight small exporters have temporarily or permanently stopped selling to the EU and a further nine per cent are thinking about it, according to the FSB’s Small Business Index. A study by the Department for International Trade suggests that 33 per cent of firms considering exporting to one of the four key markets face customs procedures barriers, while another 18 per cent are encumbered by technical requirements imposed on end products.

Small businesses have also been disproportionately disadvantaged by the disruption that the Covid-19 pandemic caused to the global supply chain. In addition, because of their size, they don’t necessarily have the resources needed to meet the rising upfront costs of exporting.

The war in Ukraine, inflation and the energy crisis have all added to the burden. Cumulatively, they have resulted in a loss of customers and a shortage of key commodities such as wheat, driven up costs and made it harder to find suppliers and secure trade routes.

Despite these initial shocks, trade is starting to improve, with UK exports to the EU up 2.6 per cent at £16.9 billion in May 2022 from April 2022, according to the Office for National Statistics – their highest level since current records began in 1997, although part of this is down to the impact of higher prices. The bigger picture looks more promising, too, with total global exports rising 7.4 per cent over the same period.

So what are the main challenges for small and medium size enterprises (SMEs) looking to trade overseas? What fresh

october-january 2023 | firstvoice | 31 firstvoice.fsb.org.uk feature international

trade

The level of exports to the EU in May 2022 – a record figure

opportunities should they be seeking to capitalise on? And how can they find new suppliers and customers, and secure trade routes? “The original challenges of Brexit are still with us,” says Arne Mielken, founder of Customs Manager. “These include red tape, bureaucracy, additional costs and delays.”

Customs minefield

Then there are the familiar minefields of customs and tariffs to be navigated. Firms need to use the right commodity code on customs declarations to ensure they are paying the right tariff and, if necessary, register for VAT in overseas countries.

“There are still so many hoops for small businesses to jump through,” says Paul Samrah, partner at Moore Kingston Smith. “The consequences of getting them wrong can be disastrous, too, with incorrect paperwork or the wrong code resulting in even greater delays.”

One of the most significant customs changes arising from Brexit came into force on 1 January 2022, when firms importing goods into the UK were no longer able to delay making import customs declarations under the Staged Customs Controls rules that have applied during 2021. Importers that bring in certain products such as live animals and animal by-products now also have to use the import of products, animals, food and feed system to notify the authorities before they arrive.

Meanwhile, UK exporters have been subject to full EU customs controls since 1 January 2021, when the Trade and Cooperation Agreement became effective. There’s more to come. A new Customs Declaration Service will be brought in for import declarations on 1 October 2022 and for exports on 1 April 2023.

FSB has welcomed the Government’s decision to delay full EU import checks from this summer, which would have put an added strain on small firms struggling with the new trade rules and spiralling operating costs. Instead, it gives them more time to prepare for future changes and reassess their supply chains.

Branching into new markets

When Brexit came in, Julianne Ponan, owner of allergen-free food producer Creative Nature, decided to stop selling to the EU because of the amount of paperwork involved. Instead, she decided to move into markets further afield, such as Australia and the Middle East.

As a result, the company has increased its product sales in the UAE, Qatar and Kuwait. It has also made its first larger shipment into Australia and the US.

However, trading in this new post-Brexit world has not been without its challenges. Ms Ponan says that the amount of smaller online orders being returned or

lost has risen, as have the shipping costs.

The prices of dried fruit – an essential ingredient in Creative Nature’s recipes – have also gone up, with some suppliers changing their prices every few hours. In addition, sunflower oil – another staple – has become more difficult to source.

“The other issue is lead times, as small suppliers are getting pushed to the back of the queue and large suppliers, who can pay upfront, are getting the available stock,” she adds. “Packaging costs keep rising, too. We had five increases in the space of a year, yet we are still needing to absorb these without passing them on.”

firstvoice.fsb.org.uk 32 | firstvoice | october-january 2023

feature international trade

The secret to our success has been in understanding which countries are the best fit for our brand

Getting into international trade

1 Do as much research upfront as possible about international trade and the markets you want to go into. FSB’s Trade Advisory Hub is a good place to start – visit fsb.org.uk/knowledge/ fsb-infohub/fsb-tradeadvisory-hub.html

2 Seek the Government’s help. The Department for International Trade’s Export Academy can provide advice on international trade, while UK Export Finance, the Government’s credit

agency, gives help on funding, payment and performance bonds. Scottish firms can access advice from Scottish Development International (sdi.co.uk)

3 Engage an international trade adviser who knows the different markets and customs rules and regulations to design an international trade strategy. Trade associations such as the Society of Independent International Trade and

best practice and resources, and flexible funding for firms, including the formation of an SME Trade Support Fund.

New opportunities

Despite all these challenges, opportunities abound for small businesses to move into new markets. The Government has already signed several trade deals with new markets including Australia and New Zealand, and is pursuing free trade agreements (FTAs) with Canada and India, as well as a new deal with Mexico.

“We want the Government to work with small business organisations such as FSB to help firms understand and realise the new opportunities provided by these FTAs,” says Lucy Monks, FSB’s Head of International Affairs. “This will open them up to markets that they hadn’t previously considered or didn’t have access to.”

Additionally, FSB has called on the Government to use the new Trade Act 2021 to gain a better understanding of small businesses’ requirements, enabling it to target relevant support initiatives. It also wants a central hub for expertise,

Scotland, for one, has benefited from an increased demand for its goods and services. For example, the desire for low-carbon and high-tech products is enabling Scottish manufacturers to drive growth and innovation. “While it has undoubtedly been a difficult past couple of years for Scottish exporters due to Covid-19, new trading rules following the UK’s departure from the EU and global uncertainty caused by the conflict in Ukraine, ample opportunities continue to exist for companies in Scotland to trade overseas,” says Jan Robertson, interim Director of Global Trade at Scottish Development International.

Targeted approach