January 1 – December 31, 2026

We are pleased to offer a comprehensive array of valuable benefits to protect your health, family and way of life.This guide answers some of the basic questions you may have about your benefits. Please read it carefully, along with any supplemental materials you receive.

You are eligible for benefits if you work 30 or more hours per week.You may also enroll your eligible family members under certain plans you choose for yourself. Eligible family members include:

• Your legally married spouse

• Your biological children, stepchildren, adopted children or children for whom you have legal custody (age restrictions may apply). Disabled children age 26 or older who meet certain criteria may continue on your health coverage.

• New Hires: You must complete enrollment within 30 days of your date of hire. If you enroll on time, coverage is effective on the first of the month following 30 consecutive days of full-time employment. If you fail to enroll on time, you will NOT have benefits coverage (except for company-paid benefits) until you enroll during our next annual Open Enrollment period.

• Open Enrollment: Changes made during Open Enrollment are effective January 1, 2026December 31, 2026.

Due to IRS regulations, you cannot change your elections until the next annual Open Enrollment period, unless you have a qualifying life event during the year. Following are examples of the most common qualifying life events:

• Marriage or divorce

• Birth or adoption of a child

• Child reaching the maximum age limit

• Death of a spouse or child

• Lost coverage under your spouse’s plan

• You gain access to state coverage under Medicaid or The Children’s Health Insurance Program

To change your benefit elections, you must contact Human Resources within 30 days of the qualifying life event. Be prepared to show documentation of the event, such as a marriage license, birth certificate or a divorce decree. If changes are not submitted on time, you must wait until the next Open Enrollment period to change your elections.

Medical

Virtual Medical and Behavioral Health

In-Person Therapy

Dental

Vision

Flexible Spending

Accounts (FSAs) and (DCSA)

Retirement Plan

Life and AD&D

Disability

Employee Assistance Program (EAP)

Holidays

Paid Time Off

Valuable Extras

Wellbeing

Cost of Benefits

Contact information

Go to f-cs.okta.com. From the dashboard select UKG. Go to Myself>Open Enrollment.

Required Information You will be required to enter a

number (SSN) for all

dependents when you enroll. The Affordable Care Act (ACA) requires the company to report this information to the IRS each year to show that you and your dependents have coverage. This information will be securely submitted to the IRS and will remain confidential.

We are proud to offer you a choice of medical plans that provide comprehensive medical and prescription drug coverage. The plans also offer many resources and tools to help you maintain a healthy lifestyle. Following is a brief description of each plan.

FCS Pharmacy is included in our pharmacy network.There are a few advantages to using our pharmacy. 90-day prescription fills (mail order or pick up) at a convenient on-site location for employees. FCS pharmacy is 100% HIPAA compliant.

The Preferred Provider Organization (PPO) plan, provided through United Health Care Choice Plus, gives you the freedom to seek care from any provider of your choice. However, you will maximize your benefits and lower your out-of-pocket costs if you choose a provider who participates in the network.

A PPO plan relies on a network of health care clinics, hospitals, and professionals who have agreed to provide their services at discounted rates.These preferred providers are considered “in-network.” In general, you will pay less for in-network services than you would were you to seek care outside the network.

• You pay a flat dollar amount–or copay–for covered health care treatments and services, such as doctor’s office visits and prescription drugs.

• Family and Children’s Services covers the first 3 office visits at no cost to you $0 copay.

• Once you satisfy your annual deductible, you will pay a percentage–or coinsurance–of the cost of the visit, and the plan will cover the rest.

• Family and Children’s Services offers The ZERO Card as an alternative to Copays and Deductibles at $0 cost to you. If you are able to schedule the services, call your Personal Health Assistant to schedule through The Zero Card.

• Once you hit your annual out-of-pocket maximum, the plan will cover 100% of the cost of covered services for the rest of the year.

To find an in-network provider, see www.umr.com.

FCS Pharmacy at: Pharmacy@fcsok.org

F: 918-712-3408

Physicians: 918-991-6451

Employees: 918-712-3407, Press: 0

When you need a surgery, diagnostic test, lab service, or even a prescription refill, just give Zero Card a call.Their Personal Health Assistants take care of the details, and you pay $0.

Step 1- Your doctor recommends you get a specific service or procedure.

Step 2- Call (855)816-0001 or visit www.thezerocard.com to contact your Personal Health Assistant, who will help determine what is covered and where you can go.

Step 3- Zero Card takes care of all the details and you always pay $0.

X-Rays, CT scans and MRIs at over 1,500 locations. Chat with or call your Personal Health Assistant to get started.

You have access to lab services through your ZERO benefit at over 3,000 Quest Diagnostics locations.

Present your ZERO Member ID Card at any QuestSelect facility; no appointment needed.To obtain member ID Card register at my.zero.health and download your card today.

Download your Member ID at my.zero.health

Rx N Go Free Generic Maintenance Medications, Insulins and Diabetic Supplies.

To check if your prescriptions are covered at $0 Log on to www.rxngo.com Select Medications

1. Search & Select your Employer – Family and Children

2. Select your Plan – PPO

3. Search Medication – by generic or brand name

Or you can scroll down and search by Therapeutic class.

To sign up and get started, select members and complete the registration. From there you can request to have RxNGo reach out to your provider to transfer your prescription to Mail Order utilizing the Transition Pharmacy Mail Order Service or, Provide the following to your doctor to send prescriptions to Transition Pharmacy.

Phone: 888.697.9646 (must come from physician's office) Fax: 888.697.0646 (must come from physician's office)

Use QR code here to register

Choose your plan carefully: By utilizing the $0 No Cost, Low-Cost options members have saved money on their maximum out-of-pocket expenses that could have been incurred with deductible and coinsurance costs.

Following is a high-level overview of your medical plan options. For complete coverage details, please refer to the Summary Plan Description (SPD). Note: The deductibles and out-of-pocket maximums are per calendar year.

Coinsurance percentages and copay amounts shown in the above chart represent what the member is responsible for paying.

*Benefits with an asterisk ( * ) require that the deductible be met before the Plan begins to pay.

1. If you use an out-of-network provider, you will be responsible for any charges above the maximum allowed amount.

Regular preventive care can help you stay well, catch problems early on, and may be potentially lifesaving. The ACA requires that certain preventive care services are provided for no cost, copayment or coinsurance.All medical plans cover preventive care services like screenings, immunizations, and exams. When you visit in-network providers, you don’t have to worry about any out-of-pocket costs for preventive care services. If you use an out-of-network provider, a deductible and out-of-network expenses may apply.

Preventive care is generally precautionary. For example, if your doctor recommends having a colonoscopy because of your age or family history, this would be considered preventive care. But if your doctor recommends a colonoscopy to investigate symptoms you’re having, this would be considered diagnostic care, and your plan cost share will apply.

Our telehealth program is a convenient and cost-effective way to get quick medical advice by phone, online, or on your mobile device about many Urgent Care, Prevention & Wellness, Mental Healthcare, Health Management, and referrals for testing and more. It’s just one more way our organization invests in you and your family.

It’s Affordable

A trip to the ER, urgent care center or doctor’s office can easily set you back hundreds of dollars in out-of-pocket costs. A call to our telehealth program will cost you $0, no copay, deductibles or coinsurance, regardless of your condition.

It’s Convenient

Long wait times at the ER, urgent care center or doctor’s office are an unfortunate reality for many.Whether you are at home or work or on the road, a medical professional is available 24/7/365 so you can get the care you need when and where it’s convenient for you in just minutes. Even better: There is no time limit to the consult, giving you plenty of time to ask questions and resolve your issue.

It’s Easy to Use

A telehealth medical professional is never more than a phone call, click or tap away! Call 888-691-7867 or visit firststophealth.com

Get Care in Minutes

It takes just a few minutes to set up your medical history online. Once you submit a request, it often takes less than 10 minutes for a doctor to call you back.

Common Reasons to Call

• Allergies

• Anxiety issues

• Back problems

• Bronchitis

• Cold and flu symptoms

• Ear infections

• Diarrhea or constipation

• Headaches and migraines

• Rash and skin problems

• Sore throat and stuffy nose

• Sprains and strains

• Urinary tract infections

Wellbeing is “a sense of peace and contentment that endures through the trials and triumphs that life can bring”.The therapists at Synergy Wellbeing are honored to serve our colleagues at Family and Children’s Services as you care for your wellbeing.

When you call Synergy Wellbeing, you will be at the top of our list for an in-person or virtual appointment (the choice is yours).We understand that the sooner you begin or continue your well-being journey, the sooner you can begin to LiveYour Life Better and, in turn, be at your best for those in your care.

We want to connect you with a therapist who truly gets you... A therapist who gives you:

◆ A close, supportive, and compassionate relationship.

◆ A confidential, trustworthy, and safe place to share your thoughts and feelings.

◆ Help in identifying your goals, overcoming barriers, and creating opportunities.

◆ Tools to help you move beyond situations getting in the way of your happiness.

Call 918-940-4321 to speak with our care navigator who will help connect you with the therapist that is the right fit for you. Or you can get started by completing the survey on our website at synergytulsa.com.

Most of the therapists at Synergy Wellbeing have been providing mental health care for our community for many years in a variety of settings. Many worked at FCS at some point in their career. We understand firsthand how important it is to care for yourself when you care for others.

We are here for you… to help you rediscover your happiness, regain peace of mind, alleviate anxiety and depression, and revitalize your most treasured relationships.

The dental Preferred Provider Organization (PPO) plan, provided through Standard, offers you the freedom and flexibility to use the dentist of your choice. However, you will maximize your benefits and lower your out-of-pocket costs if you choose a dentist who participates in the Standard network.

To find an in-network provider, see contacts in this benefit guide.

Following is a high-level overview of your dental plan options. For complete coverage details, please refer to the Summary Plan Description (SPD). Note: The deductible and annual benefit maximum are per calendar year.

Coinsurance percentages and copay amounts shown in the above chart represent what the member is responsible for paying.

*Benefits with an asterisk ( * ) require that the deductible be met before the Plan begins to pay.

1. If you use an out-of-network provider, you will be responsible for any charges above the maximum allowed amount.

Your eyesight is an integral part of your overall health and a key component of safety.This plan, provided through Standard, gives you the freedom to seek care from the provider of your choice. However, you will maximize your benefits and lower your out-of-pocket costs if you choose a provider who participates in the Standard network. If you decide to use an out-of-network provider, you will pay the provider in full at the time of your appointment and submit a claim form for reimbursement up to the amount allowed by the plan.

Receiving benefits from a network provider is as easy as making an appointment with the provider of your choice from the list of providers.The provider will coordinate all necessary authorizations you supply in your membership information.

Special discounts are offered on non-covered services, such as an additional pair of glasses, special lens options and LASIK.

To find an in-network provider, see contacts in this benefit guide.

Following is a high-level overview of your vision plan options. For complete coverage details, please refer to the Summary Plan Description (SPD).

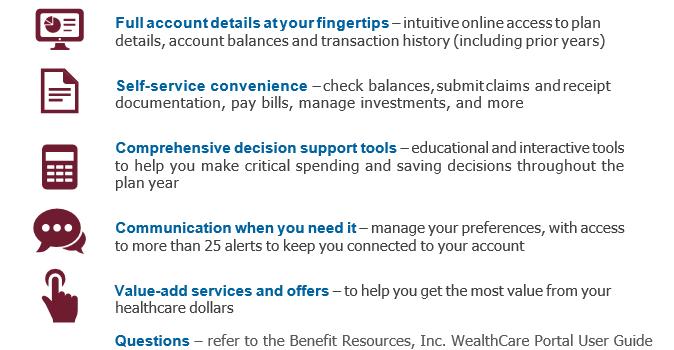

The flexible spending accounts (FSAs), provided through Benefit Resources, Inc. (BRI) are tax-advantaged accounts that can help you cover certain qualified out-of-pocket expenses. Each account works in much the same way but has different eligibility requirements, list of qualified expenses and contribution limits.You may choose to enroll in the following accounts.

Examples of Qualified Expenses

• Coinsurance

• Copayments

• Deductibles

• Dental treatment

• Eye exams/eyeglasses

• LASIK eye surgery

• Orthodontia

• Prescriptions

• Care of a dependent child under the age of 13 by licensed childcare provider, nursery schools, pre-school or daycare centers

• Care of household members who are physically or mentally incapable of caring for themselves and who qualify as your federal tax dependent

Because FSAs can give you a significant tax advantage, they must be administered according to specific IRS rules:

• You must enroll each year to participate.

• FSA and DCFSA: Unused funds will NOT be returned to you or carried over to the following year.

According to experts, you should aim to have 70–80% of your pre-retirement income saved by the time you retire.With help from the 403(b) provided through Bank of Oklahoma, you can help secure your financial future.Whether retirement is decades away or just around the corner, the time to save for retirement is today.

• The 403(b) is a tax-advantaged savings account that lets you save money for retirement.

• You can contribute either pre-tax or after-tax tax funds through automatic payroll deductions.

• You can then invest your funds through a mix of stocks, bonds and cash to help your account grow faster.

• How much you can contribute depends on the annual limits set by the IRS. Catch-up contributions are also allowed if you are age 50 or older. See the chart below for details.

To help the account grow, we match your contributions up to 6% as outlined in the following chart:

Your contributions are fully vested, meaning you own them outright. Employer contributions are 50% vested after two continuous years of service and fully vested 100% after three continuous years of service.

Life insurance, provided through The Standard, provides your named beneficiaries with a benefit following your death, while accidental death and dismemberment (AD&D) insurance provides a benefit to you following a covered accident that leads to dismemberment (such as the loss of a hand, foot or eye). Should your death occur due to a covered accident, both the life benefit and the AD&D benefit would be payable.

Imputed income is the value of non-monetary compensation or benefits provided to you by the company, such as health insurance premiums and life insurance coverage. Even though these benefits are not received in cash form, they are considered part of your overall compensation package and are subject to taxation.

If you determine you need more than the basic coverage, you may purchase additional insurance for yourself and your eligible family members.

Under federal tax law, if the total coverage of your company-paid basic life insurance is more than $50,000, the premium paid for the coverage above $50,000 is considered imputed income and will be added to your W-2 earnings. You must pay federal, state and Social Security taxes on this amount.

Note: During your initial eligibility period, you can secure coverage up to the Guaranteed Issue limits without the need for Evidence of Insurability (EOI, or information about your health). Please note that coverage amounts requiring EOI will only go into effect once the insurance carrier approves them.

Disability insurance, provided through The Standard, provides benefits that replace part of your lost income when you cannot work due to a covered illness or injury.

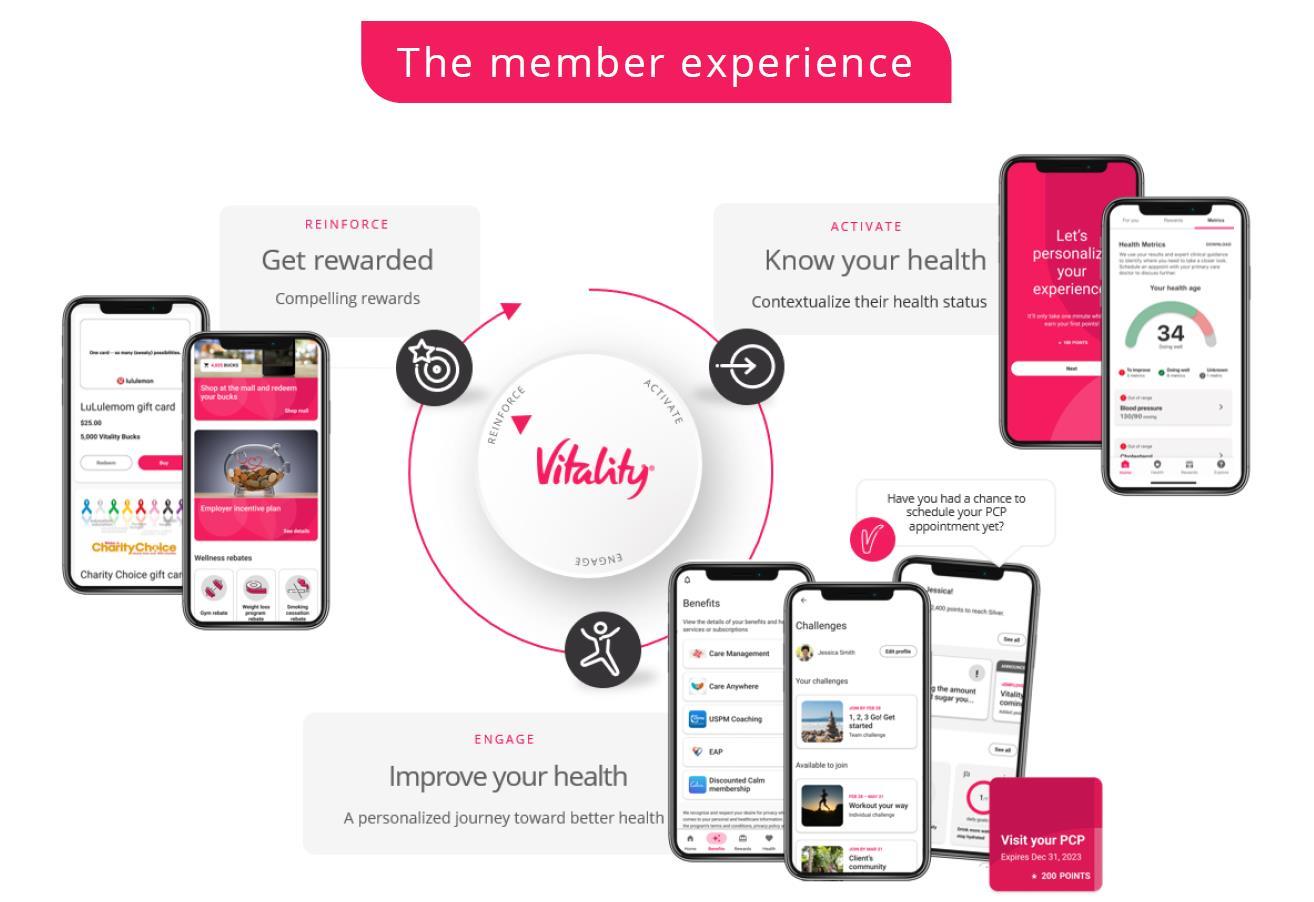

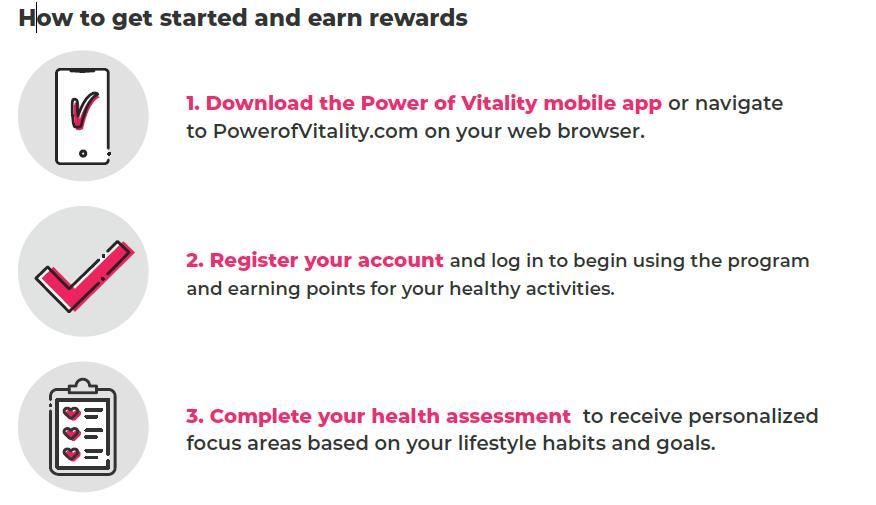

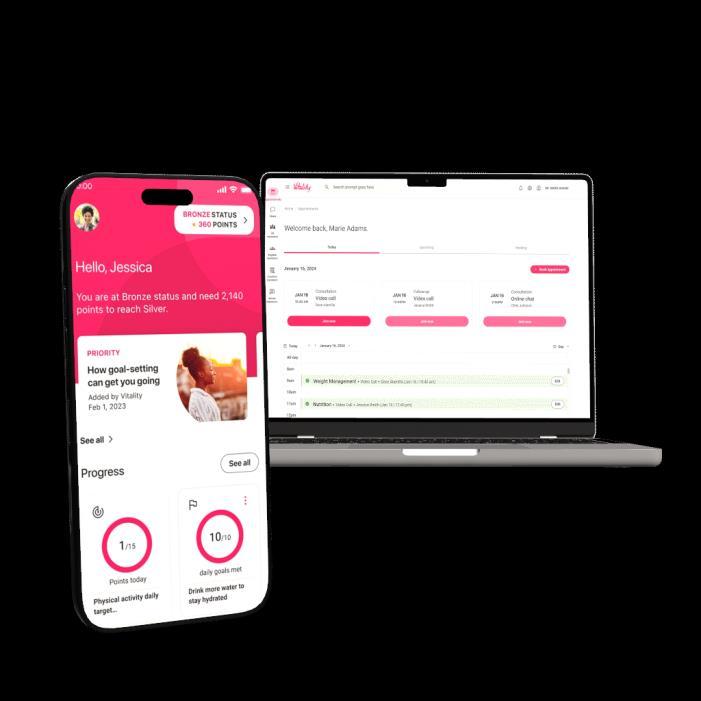

Privacy is a top priority at Vitality, and we are committed to maintaining the highest level of confidentiality with all the information we receive from our members.

Life is full of challenges and sometimes balancing them all can be difficult.We are proud to provide a confidential program dedicated to supporting the emotional health and well-being of our employees and their families.The Employee Assistance Program (EAP) is provided at NO COST to you through Health Advocate.

The EAP can help with the following issues, among many others:

• Mental health

• Relationships

• Substance use

• Child and eldercare

• Grief and loss

• Legal or financial issues

• Assistance for you and your household members

• Up to 6 in-person or virtual sessions with a counselor per event, per year, per individual

• Unlimited toll-free phone access and online resources

To learn more, visit healthadvocate.com/standard6.

For questions, contact Health Advocate at 877-851-1631 or TTY Services: 711 24 hours a day.

FCS provides eleven paid Holidays. Paid Holiday time is prorated for regular employees scheduled to work between 30 and 39 hours per week.

Employees will begin accruing PTO after the completion of one full pay period. Accruals will be posted in UKG the following pay period and each pay period thereafter.Accruals are suspended for any absences in excess of 30 calendar days. Benefit stated below is based upon continuous years of full-time employment. PTO is available after three (3) months of employment. PTO accruals are prorated for Regular employees scheduled to work between 30 and 39 hours per week.

Prorated for

We also offer the following additional benefits:

Other available Leaves are described in the Employee Handbook and include Military, Jury, and Funeral.

FCS encourages your professional development.You may increase your competency for your job by attending conferences, required and voluntary inservice workshops, and seminars or by reading publications provided by FCS’s libraries and other resources.

FCS is a member of the Oklahoma Central Credit Union and employees are eligible for membership.

Direct deposit is required.Your biweekly pay may be deposited directly to any five (5) financial institutions of your choice (bank, savings & loan, credit union) anywhere in the USA for your convenience at no cost to you.

*Summary Plan Document supersedes information contained above.

BenefitHub

BenefitHub is an exclusive employee discount program that can help you save big on thousands of items daily such as travel, apparel, tickets, auto, electronics, insurance, education, restaurants and so much more! To get started:

• Go to https://familyandchildrenservices.benefithub.com

• Click on “Any Offer”

• Complete the Sign-Up Form

Questions? Call 866-664-4621 or email customercare@benefithub.com

Your contributions toward the cost of benefits are automatically deducted from your paycheck.The amount will depend on the plan you select and if you choose to cover eligible family members.

taken from your paycheck after taxes. Rates are available during enrollment.

This is the amount agreed upon between the provider and the insurance company for the service provided. It is almost always less than the billed amount, which is why enrollees see different amounts on their Explanation of Benefit statements (EOBs). For example, a provider may charge $120 per hour of psychotherapy, but the insurance company pays them $95 the allowed amount for that service.

When an out-of-network provider bills you for the difference between the provider’s charge and the allowed amount. For example, if the provider’s charge is $100 and the allowed amount is $70, the provider may bill you for the remaining $30.An innetwork provider cannot balance bill you for the covered services.

A person who is designated as the recipient of proceeds from an insurance policy.

Your share of the costs of a covered medical service calculated as a percent of the allowed amount for the service.You pay coinsurance plus any deductibles you owe. Consider an example in which the medical plan’s allowed amount for a medical service is $100 and you’ve met your deductible. If your plan pays 70%, then you are responsible for the remaining 30%, which is $30.

Often referred to as a “copay,” this is the amount you are responsible for paying when seeing a doctor, picking up a prescription, or visiting an urgent care facility or emergency room.

The amount you must pay for eligible expenses before the plan begins to pay benefits.A deductible may be per service, per visit, per supply or per coverage year. For example, if your individual deductible is $1,500, your plan will not pay anything for certain medical services until you have paid $1,500.The deductible may not apply to all services, such as services that are covered by a copay.

Medical tests designed to establish the presence (or absence) of disease as a basis for treatment decisions in symptomatic or screen positive individuals. Note that diagnostic tests are different than screening tests. Screenings are primarily designed to detect early disease or risk factors for disease in apparently healthy individuals.

The most you pay during a policy period (a calendar year) before your plan begins to pay 100% of the allowed amount.This limit does not include your premium or balance-billed charges.

A medically necessary determination by a health insurance carrier for a medical service, treatment plan, prescription drug, medical or prosthetic device or certain types of durable medical equipment. Sometimes called preauthorization, prior authorization or prior approval, many plans require preauthorization for certain services before you can receive them, except in cases of emergency. Preauthorization isn’t a promise your medical plan will cover the cost.