Hi, I'm Tim Totten, a 25-year industry veteran. I've worked at both corporate and family-owned firms before expanding my side business (making removal quilts out of the garage) into a full-time career. It's been my great pleasure to not only make great products for my favorite industry but now bring this magazine with aims to share other great products and ideas with you, funeral home owners and managers.

Timothy Totten Publisher

Even though this idea still feels so new to me, I can barely believe we're already on our 3rd calendar year publishing this magazine!

As we keep growing, we've added a skilled Ad Manager, Jim Rohrlack, to help us find companies that want to share their amazing products and services with you in the pages of this magazine.

If you'd like to feature your ads or learn more about how to market with us, you can reach him at jim@fbsmagazine.com.

We're looking forward to seeing you all in October at NFDA in Chicago! That's actually Jim's stomping grounds, so if you are coming to the convention, drop him a line for the best places to visit or, better yet, eat in the Chicagoland!

TIMOTHY TOTTEN Publisher

If you don't yet get our magazine in print form in your physical mailbox, click here to sign up for the print version that is free to all funeral professionals.

We can do this because of the generosity of our magazine advertisers!

You can also visit our website to request a digital email subscription in addition to your free print subscription.

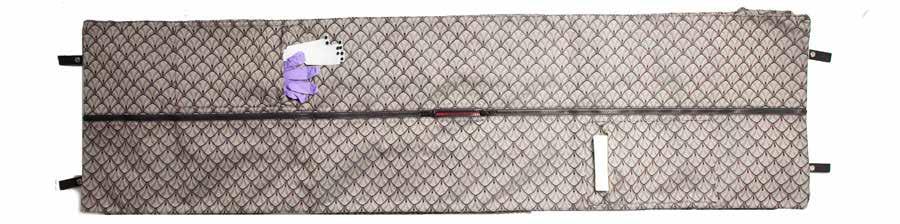

Easy to carry bag includes the integrated fabric cover.

The included aluminum table is lightweight but strong, able to support 100+ pounds with locking legs and full 30”x 60” surface.

Place the bag on top of the table and the cover unfolds in seconds. Flat pack design keeps fabric from wrinkling and stows quickly.

FAHERTY

Aurora brings together the tools that modern funeral professionals need to collect and manage case payments. From e-commerce website payments, in-person payments and convenient family payment links that are paid in 20 minutes average time, they also offer No Fee credit card processing and realtime business insights that simplify operations and offer families multiple payment options.

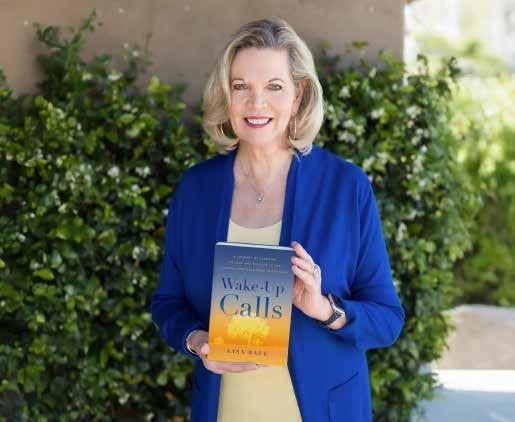

As an author, podcaster, and public speaker with over 45 years of experience as a funeral director, Lisa Baue's approach of next-era, heart-based development recognizes women are the future–and she's challenging the funeral profession to support them.

Erin Connolly started her communications career teaching anchors and reporters how to present the news. She found her niche working for Mortuary Lift Company writing articles and press releases. Erin received her B.A. from the University of Iowa and her M.A. from the S.I. Newhouse School of Communications at Syracuse University.

Gail Rubin, Certified Thanatologist and The Doyenne of Death®, is a pioneering death educator. She is the author of four books on end-of-life issues, was one of the first people to hold a Death Café in the United States and she has coordinated six Before I Die New Mexico Festivals. Learn more about Gail at her website, www.AGoodGoodbye.com.

Nikki Anne Schmutz, a Utah native, is a published author with a background in caretaking and as a Registered Behavior Technician (RBT) for special needs individuals. After being widowed in 2016, she became an Estate Specialist in 2019 at Full-Circle Aftercare. Promoted to Director of Operations in 2021, Nikki now guides funeral homes, hospice providers, and families through the complexities of non-legal estate settlements.

George Paul III is a volatile visionary using branding and design to help grieving families honor the legacy of their loved one. Cherished Creative delivers agency-level branding, marketing and design services to busy firm owners. He can be reached at gpaul@ cherishedkeepsakes.com.

Ronald H. Cooper, CPA is a funeral home accountant and consultant with Ronald Cooper, CPA, PLLC. He can be reached by phone at 603-671-8007, or you may email him at ron@funeralhomeaccounting.com.

Michael Faherty has been serving clients in the deathcare industry for more than seven years. He has more than 20 years in financial and investment experience. Michael holds a blended role with FSI and Argent Financial Group’s Funeral and Cemetery Trust division. You can reach Michael at mfaherty@argenttrust.com

Raymond L. Bald, CPA is a funeral home tax accountant and consultant with Cummings, Lamont & McNamee, PLLC. He can be reached by phone at 603-7723460, or you may email him at rbald@ clmcpa.com

FUNERAL BUSINESS SOLUTIONS MAGAZINE www.FBSMagazine.com

1801 South Bay Street Eustis, Florida 32726 Timothy Totten, Publisher TimTotten@FBSMagazine.com 352.242.8111

Robin Richter, Content Editor RobinRichter@FBSMagazine.com 813.500.2819

Funeral Business Solutions Magazine is published bi-monthly (6 Issues a year) by Radcliffe Media, Inc. 1801 South Bay Street, Eustis, Florida 32726. Subscriptions are free to qualified U.S. subscribers. Single copies and back issues are $8.99 each (United States) and $12.99 each (International). United States Subscriptions are $64.00 annually. International Subscriptions are $95.00 annually.

Visit www.FBSMagazine.com for content that is updated frequently and to access articles on a range of funeral industry topics. Radcliffe Media provides its contributing writers latitude in expressing opinions, advice, and solutions. The views expressed are not necessarily those of Radcliffe Media and by no means reflect any guarantees that material facts are accurate or true. Radcliffe Media accepts no liability in respect of the content of any third party material appearing in this magazine. Copyright 2025. All rights reserved. Funeral Business Solutions Magazine content may not be photocopied or reproduced or redistributed without the consent of publisher. For questions regarding magazine or for subscriptions, email info@FBSMagazine.com.

ARTICLE REPRINTS

For high quality reprints of articles, email us at content@FBSMagazine.com.

WAUNAKEE, WI — Tribute Technology is proud to announce the recipients of the 2025 Tech-Enabled Funeral Home Awards, which recognize funeral service professionals and organizations that are advancing the profession through thoughtful use of technology. These annual awards highlight leaders who are redefining the family experience, streamlining operations, and strengthening community connections through innovation.

“The 2025 award recipients continue to inspire the profession by embracing digital tools that create more meaningful, accessible, and compassionate experiences for the families they serve,” said Courtney Gould Miller, President of Commercial Markets at Tribute Technology. “Each honoree demonstrates how purposeful use of technology can transform funeral service while preserving the care and human touch that defines it.”

Innovation Impact: Water Cremation Technologies: Tom Tierney, Owner of The Green Cremation

Outstanding Organization-Wide Innovation: Lindsay Granson, Chief Operating Officer at Heritage Family Funeral Services

Unified Service Through Technology: Ryan Johnson, Funeral Director at Knapp-JohnsonHarris Funeral Home

Leader in All-in-One Technology: Anthem Partners

Leader in Personalized Memorial Experiences: Givnish Funeral Homes

The Connected Care Award: Brian Joseph, President of Verheyden Funeral Homes

Website Connected Video Displays: Paul St. Pierre, President of St. Pierre Family Funeral & Cremation Services

Marketing Thought Leader for ObitShare: Bob Arrington, President and Founder of Arrington Funeral Directors

Tribute Technology’s mission is to bring the best technology to all funeral homes, to help communities around the world celebrate life, and to pay tribute to loved ones. Over 9,000 end-of-life providers already use Tribute Technology’s software and product offerings, including websites, marketing services, management software, online planning, personalized memorial keepsakes, payment processing, and other solutions. Tribute Technology is focused on innovating to help funeral directors save time on tasks so they can focus more on connecting with the families who have lost a loved one. The company’s goal is to give funeral directors everything they need to run their business in one place, making their lives easier.

FRISCO, TEXAS - Anthem Partners, a leading operator of funeral homes and cemeteries across North America, is proud to announce that its locations have become partners of the Life Celebration Inc. network. Through this partnership, Anthem locations will gradually introduce the Life Celebration program across the Anthem network, offering families distinctive services and fully customized products that honor their loved ones while supporting the grieving and healing process.

As part of the rollout, each location will receive training from one of Life Celebration’s Certified Experience Economy Experts. These in-depth, hands-on sessions will equip the Anthem team with the tools and knowledge to deliver Life Celebration’s unique offerings.

“It hasn’t taken long to see the impact of Life Celebration at our funeral homes,” said Chad Jackson, Executive VP of Operations at Anthem Partners. “Life Celebration not only brings healing to families but has also sparked new energy within our staff. We’re excited to give our funeral homes the tools to create truly memorable experiences for the families they serve.”

Brian Givnish, Director of Training and Development at Life Celebration, stated, “Our passion lies in the Life Celebration experience—it is about the products we create and the associated strategies we implement. Through customization, those products act as a vehicle to drive unique experiences for every family. With our team of more than 30 graphic designers, we strategically help our partners provide high-quality keepsakes that are branded on the hearts and minds of every guest who encounters their funeral homes.”

Jim Cummings, Vice President of Life Celebration, emphasized the deeper purpose behind the Life Celebration program: “We help create order out of chaos. Families leave Life Celebration services feeling informed, involved, and comforted—knowing they played a meaningful role in honoring their loved one’s life.”

As part of the Life Celebration network, every Anthem location will be better equipped to provide families with more personalized and meaningful memorial experiences. This association aligns with Anthem Partners’ mission to help funeral homes thrive through innovation, compassion, and exceptional service.

it’s what we do. We are committed to Preneed insurance...

For over 100 years, National Guardian Life Insurance Company (NGL) has focused on one thing: Insurance. We are dedicated to offering the best options for partnerships so you can build lasting relationships.

Anthem Partners is a privately held operator of funeral homes and cemeteries across North America. Founded by industry professionals and backed by long-term investors, Anthem is committed to honoring legacy, respecting community traditions, and supporting funeral professionals through sustainable growth. To learn more, visit www.anthempartners.com.

Founded by funeral directors for funeral directors, Life Celebration partners with firms to design personalized tribute products that support the healing process. All products are custom-designed and produced in-house by our graphic design team, leveraging advanced in-house print and digital equipment, and guided by Certified Experience Economy Experts to deliver truly one-of-a-kind memorial products. To learn more, visit www.lifecelebrationinc.com.

BOISE, Idaho — Gather, a leading provider of case management software and website design for funeral homes, announced the launch of Remember Books, a new memorialization product for funeral home and crematory customers to offer to the families they serve. Remember Books transform the memories, photos, and tributes shared online into beautifully designed hardcover keepsakes for families to hold, revisit, and cherish for generations.

Here is how Remember Books work:

• People contribute photos and memories to their loved one’s Remember Page.

• Gather automatically curates these contributions into a professionally designed book for funeral homes and crematories to offer to families.

• Families can order a hardcover keepsake that honors their loved one’s legacy.Funeral homes offering Remember Books can provide families with an elevated level of care and service at a very friendly price — helping them not only capture moments of remembrance but also create something they can be proud to share across generations.

Here are the full specifications for Remember Books:

• Friendly Pricing: $89 per Remember Book (plus tax), regardless of page count

• Best Quality: Premium hardcover with durable binding and elegant matte page finish

• Unique Orientation: Landscape orientation (8.5” tall and 12” wide)

• Handcrafted Content: Auto-optimized layout of photos, memories, and service details

• Customization: Families can customize artwork theme, photos, memories, and cover

• Printing: Full-color, high-resolution digital press

• Shipping and Delivery: Orders fulfilled within 2 weeks, confirmation email included

• QR Code: Includes a unique QR code that links directly back to the online obituary page

• Order Tracking: Order tracking report available to funeral homes in Gather, as well as notification emails when each new order is placed

• Commission: Funeral home customers earn 15% commission on each book order

With the launch of Remember Books, Gather's long-term vision is to help funeral and crematory businesses achieve more success with one centralized case management platform and website experience — both for their teams and the families they serve. To learn more about this feature, now available to Gather’s funeral home customers and the families they serve, watch this short

Gather is an innovative, all-in-one funeral home software company that helps hundreds of funeral homes with case management, live streaming, custom websites, and body tracking. To learn more about Gather or schedule your free demo, please visit www.gather.app or call (888) 492-2697.

www.crownevault.com

Lincoln, Rhode Island – Funeral professionals now have a powerful new way to stay informed, thanks to ICYMI from Kates-Boylston, a weekly podcast delivering essential funeral service news in just a few minutes every Friday. Hosted by Tony Russo, editor of Funeral Service Insider and the trusted voice behind FSI: The Podcast, ICYMI is your go-to source for fast, focused, and insightful updates.

With the funeral profession evolving faster than ever, ICYMI keeps listeners ahead of the curve by breaking down the week’s biggest stories with clarity and context – minus the fluff. From regulatory shifts and emerging technologies to leadership moves, and real-time business strategies, Russo delivers what matters most in a tight, digestible format.

“This industry doesn’t wait, and neither should you,” Russo said. "ICYMI is about giving funeral professionals a smart, efficient way to stay in the know, no matter how busy their week gets."

A new episode is available every Friday, providing a reliable end-of-week briefing to help professionals prepare for what’s next.

LISTEN NOW to ICYMI from Kates-Boylston available wherever you get your podcasts.

For media inquiries, interviews, or sponsorship opportunities, contact Publisher Sofia Goller at sgoller@ kbpublications.com. FBS

Kates-Boylston, an independent voice in coverage of the funeral service profession for nearly 150 years, is headquartered in Lincoln, Rhode Island. KatesBoylston’s independent journalistic portfolio includes American Funeral Director and American Cemetery & Cremation print and digital platforms, as well as Funeral Service Insider digital publication and associated podcast and media presence. For more information, visit www. kates-boylston.com.

Ogden, UT – Tukios, a leading provider of funeral home websites and technology solutions, is proud to announce that its websites are now fully optimized to rank in AI-driven search experiences. This cutting-edge enhancement equips all Tukios websites with Generative Engine Optimization (GEO), the modern evolution of traditional Search Engine Optimization (SEO). GEO helps funeral homes rise to the top of results when families ask questions through AI tools like ChatGPT, Claude, Perplexity, and Google’s Gemini.

As more families turn to AI assistants for quick, accurate answers, the way people find information online is shifting dramatically. Instead of typing search terms into a traditional search engine and sifting through blue links, users are increasingly relying on generative AI to give them a complete answer instantly. For funeral homes, this shift presents a unique challenge: if your website isn’t optimized for these AI tools, your business could include false information, or it may not be mentioned at all. With tools like Tukios’ built-in GEO functionality, funeral homes can be confident they’ll be seen and accurately represented in this new AI-first world.

So, what’s the difference between SEO and GEO? Traditional Search Engine Optimization (SEO) has long been the standard for helping websites rank higher on platforms like Google. It focuses on elements like keywords, metadata, internal links, mobile responsiveness, and content structure. These signals help search engine crawlers understand what your site is about so it can appear in relevant search results.

But GEO, short for Generative Engine Optimization, is a new and rapidly growing approach designed specifically for AI-powered tools. Rather than delivering a list of links like a typical search engine, generative AI delivers a fully formed answer, summarizing information from across the web in real time. If your funeral home’s information isn’t structured and fed to these models correctly, the AI may skip over your site entirely or provide inaccurate details.

GEO focuses on giving AI tools the structured, summarized data they need to understand and present your business accurately. In today’s environment, this means preparing your site not just for human readers and search engine crawlers but also for AI models trained to deliver answers directly to users.

This complex process is simplified by automating the creation of AI-optimized content behind the scenes. Every Tukios website now includes a built-in system that generates a specialized file formatted specifically for large language models (LLMs). This file acts as a clear guide for the AI, telling it exactly what the funeral home offers, what it values, and how it serves its community.

This includes accurate, up-to-date details such as service offerings, location and contact information, staff bios, blog posts, testimonials, and more. Crucially, the system skips over hidden or unfinished pages to avoid feeding AI tools incorrect or incomplete information. This reduces the risk of misinformation and boosts the visibility of trustworthy, client-approved content.

It all happens automatically. Every time a site is published or updated - whether you’re adding a new blog post, launching a pre-planning page, or changing business hours - the AI file is refreshed in the background. There’s no need for the funeral home to manually manage anything. Tukios handles it all, ensuring the information remains current and accessible to the most advanced AI systems in the world.

In the funeral profession, visibility and trust are everything. Families searching for a funeral home are often doing so during one of the most difficult times in their lives. They want quick, accurate, and caring answers, and more often, they’re turning to AI assistants to find them.

Many funeral home websites weren’t designed to work with AI, leading to outdated or incorrect information when families search for services. Tukios websites are optimized for AI, ensuring accurate and up-to-date details are provided to users.

Tukios has proactively addressed this by integrating GEO optimization into every website it powers. This feature is already live and automatically included for all Tukios customers, with no extra work required. Every time a site is published or updated, the system generates a clean, AIreadable guide that ensures each funeral home is accurately

represented in AI tools and platforms. Whether someone is asking an AI assistant for the best funeral provider in their area or trying to understand what services a specific funeral home offers, Tukios websites are built to give clear, direct answers link ing families to the right place, every time.

Unlike other website providers that may charge extra for AI readiness or offer GEO tools as separate plugins, Tukios includes this capability as a standard feature for all customers. There’s no additional fee, setup, or ongoing maintenance required. Every Tukios website comes GEO-ready right out of the box.

And it’s not just about AI search. GEO optimization enhances a funeral home’s digital presence over-all ensuring consistency across AI models, voice assistants, virtual agents, and even new tools like smart obituaries or AI-generated memorials. As the technology evolves, Tukios is staying one step ahead, continuously adapting its platform to meet the needs of modern funeral homes and the families they serve.

This innovation is part of a broader commitment by Tukios to simplify and enhance the lives of funeral directors through smart, intuitive technology. In addition to AIoptimized websites, Tukios offers a range of tools, including video tribute software, online arrangement forms, e-commerce integrations, and obituary enhancements. The company is leading the way in applying AI to make funeral service more efficient, personalized, and connected.

For more details about Tukios and its AI-ready websites, visit www.tukios.com or contact their support team at (801) 682-4391.

Tukios creates software to improve funerals. Their innovative platform powers thousands of funeral home websites, stunning video tributes, and streamlined e-commerce experiences. Tukios is known for leading the profession in AI technology, offering tools that simplify day-to-day tasks, elevate the online experience, and keep funeral homes visible and relevant in an ever-changing digital landscape. Whether it’s a family visiting a website or an AI assistant looking for answers, Tukios ensures your story is told clearly and beautifully every time.

BY ERIN CONNOLLY

Running a funeral home is not just about compassion, tradition, and creating meaningful services. It’s also about business — and business requires expertise in areas that most funeral professionals don’t necessarily sign up for when they enroll in mortuary school. Nobody sat in Embalming 101 thinking, “Boy, I can’t wait to reconcile my QuickBooks.”

Yet here you are.

To thrive, funeral directors need a team of trusted non-funeral professionals who keep the back end of the business running smoothly. Think of them as your off-site staff members: they don’t embalm, they don’t arrange flowers, and they don’t drive the hearse — but without them, you’d be driving yourself straight into a stress-induced ulcer.

The Accountant: Your Financial GPS

If you’ve ever looked at your books and thought, “I’ll just wing it this tax season,” please stop. Accountants are not optional — they are oxygen. A good accountant will not only keep you compliant with the IRS but also help you understand where your business is truly making money (and where it is not).

• Keeps you compliant with taxes and regulations

• Identifies where your funeral home is profitable — and where it’s not

• Helps prevent costly mistakes with payroll, deductions, and audits

Katie Hill, owner of Mortuary Lift Company in Cedar Rapids, Iowa, puts it simply, “You went into funeral service because you care about people. But unless you also enjoy spreadsheets and tax codes, find someone who does. Let them do their job so you can do yours.”

It’s the truth. Caring for families is your calling, but someone has to care for your profit-and-loss statement.

The Banker: Your Business Lifeline

From financing a new prep room to helping you expand to a second location, the right banker understands the unique cash flow quirks of the funeral industry.

• Understands the nuances of pre-need accounts and insurance assignments

• Provides lines of credit or loans for renovations, expansions, or vehicles

• Helps smooth over seasonal cash flow fluctuations

The wrong banker will look at your books and ask why you’re holding thousands in “other people’s money.” The right one will nod knowingly and get you the line of credit you need.

If you think a lawyer is expensive, try operating without one. Lawsuits, zoning issues, and contract disputes are a reality in all types of business. Lawyers protect you before things spiral.

• Drafts and reviews contracts to protect your funeral home

• Advises on zoning, compliance, and local regulations

• Defends you if disputes or lawsuits arise

And let’s face it: funeral service is deeply personal work, and deeply personal work sometimes leads to conflict. Having a lawyer on your side is like having an umbrella in a thunderstorm. You might not need it every day, but when the storm rolls in, you’ll thank yourself for keeping one handy.

Consultants & Specialists: Your Secret Weapons

Beyond accountants, bankers, and lawyers, you’ll also want to lean on specialists:

• HR consultants: Make sure you’re handling overtime, scheduling, and employee classifications legally and fairly.

• IT professionals: Rescue you when your livestream crashes mid-tribute or when ransomware threatens your records.

• Insurance brokers: Ensure you’re covered for everything from slip-and-falls to family feuds in the parking lot. These people aren’t luxuries — they’re survival gear. Cultivating relationships through networking events and getting involved in the community can help develop these connections.

Work Smarter, Not Harder

“In funeral service, you already work hard enough. If you can’t lift a body by yourself anymore, you get equipment to help you. Business is no different — find professionals who make the heavy lifting easier,” says Katie Hill.

Watch our 30-minute roundtable discussion of this article now!

She goes on to identify three ways you can work smarter.

• Outsourcing financial, legal, and technical tasks reduces stress

• Allows you to focus on the human side of funeral service

• Prevents burnout by taking unnecessary burdens off your plate

It’s a refreshing reminder that running a funeral home isn’t about proving you can do it all. It’s about doing it well.

The real benefit of having a strong network of non-funeral professionals? Time. Every hour you’re buried in bookkeeping or legal fine print is an hour you’re not spending with families, staff, or your own loved ones.

• Accountants save you from audits and costly mistakes

• Lawyers protect your business before problems escalate

• Bankers and specialists create growth opportunities

And while no accountant is ever going to send you a sympathy card, they will save you from audits. Your lawyer does not embalm, but they do create crucial legally-binding contracts. And your banker won’t arrange flowers, but they’ll set you up with the financing you need to grow.

So the next time you’re tempted to “just figure it out yourself,” remember success in funeral service isn’t only about compassion and care — it’s also about the team behind the scenes. The right accountant, banker, lawyer, and specialists aren’t overhead costs. They’re the reason you’ll still have overhead to cover in ten years.

Because let’s be honest: the only thing harder than lifting a 250-pound body up a narrow staircase… is trying to run your funeral business without professional help. FBS

Erin Connolly started her communications career teaching anchors and reporters how to present the news. Her clients vary range from Good Morning America anchors to attorneys looking to improve their courtroom performance. She found her niche working for Mortuary Lift Company writing articles and press releases. Erin received her B.A. from the University of Iowa and her M.A. from the S.I. Newhouse School of Communications at Syracuse University.

BY RAYMOND L. BALD, CPA, & RONALD H. COOPER, CPA

On July 4, 2025, the One Big Beautiful Bill Act (Public Law 119-21) became law. It makes permanent many tax cuts from 2017, adds new deductions, and trims back some recent credits.

For funeral home directors, these changes affect both business and personal taxes. Below is a summary of the most important points.

The law makes bonus depreciation and higher Section 179 expensing permanent. That means you can keep deducting the full cost of equipment and property in the year you buy it, instead of spreading deductions over many years.

Why it matters: Funeral homes often purchase expensive vehicles, crematory equipment, and building improvements. These rules lower your taxable income right away.

The 20% pass-through deduction for businesses like S-corporations, LLCs, and partnerships is now permanent.

Why it matters: Many family-owned funeral homes qualify. This reduces the income subject to tax.

The lower tax brackets introduced in 2017 are now permanent, along with the larger standard deduction.

Why it matters: Most people will continue to see lower income taxes and simpler filing.

The cap on state and local tax deductions rises from $10,000 to $40,000 (or $20,000 for married filing separately). It phases out for higher-income households.

Why it matters: Residents of states with high income or property taxes may benefit.

• Tips: Up to $25,000 in tip income can be deducted from federal taxes (through 2028).

• Overtime: A new deduction allows up to $12,500 (or $25,000 if married filing jointly) of overtime pay.

Why it matters: This mostly helps employees, but directors who still work shifts may qualify if they are paid overtime.

You can deduct up to $10,000 per year of car loan interest for vehicles built in the U.S., purchased between 2025–2028.

Why it matters: If you buy U.S.-made vehicle for personal use, this deduction may apply.

Taxpayers age 65 and older get an extra $6,000 standard deduction (through 2028), with income limits.

Why it matters: Older funeral directors or retirees may see lower tax bills.

The Child Tax Credit rises to $2,200 per child and will now grow with inflation.

Why it matters: Families get a little more help each year.

Credits for solar, electric vehicles, and other clean energy projects are being cut back.

Why it matters: Funeral home directors investing in solar panels or electric hearses may see smaller tax benefits.

The One Big Beautiful Bill Act locks in many tax breaks that funeral home directors rely on, including immediate write-offs for equipment and lower personal tax rates. It also adds new opportunities, like deductions for vehicle loan interest and extra relief for seniors.

Some of these changes expire in 2028 or 2029, so planning ahead is important. Funeral home directors should review their business spending, ownership structure, and personal tax situation with a trusted advisor to make the most of these updates.

This article is meant to provide general information and should not be construed as legal or tax advice or opinion and is not a substitute advice of counsel, CPAs or other professionals.

Raymond L. Bald, CPA is a funeral home tax accountant and consultant with Cummings, Lamont & McNamee, PLLC. He can be reached by phone at 603-772-3460, or you may email him at rbald@clmcpa.com

Ronald H. Cooper, CPA is a funeral home accountant and consultant with Ronald Cooper, CPA, PLLC. He can be reached by phone at 603-671-8007, or you may email him at ron@funeralhomeaccounting.com.

Please share the history of your funeral homes.

At just eight years old, Geraldine was told she was too young to attend her grandmother’s funeral. That moment left a lasting impression—and sparked a deep curiosity about funeral service that ultimately led to her life’s calling.

After completing her internship at Belkoff Jewish Memorial

Chapel, Geraldine earned her funeral director license. In 1987, she opened the doors to Oliverie Funeral Home in Lakehurst, a modest location serving about 50 families a year. As her reputation for compassionate care grew, she expanded in 2001 with a second location in Manchester. The new facility quickly became the preferred location, prompting Geraldine to sell the original Lakehurst site, which is now home to a church.

Geraldine and her husband, Mike— also a licensed funeral director—live above the Manchester funeral home, where they raised their three children: Marissa, Bridget, and Michael. Their on-site presence means phones are personally answered, and help is available 24/7.

In 2021, Oliverie Funeral Home expanded once again, opening a state-of-the-art facility in Jackson. This location was thoughtfully designed from the ground up to meet the evolving needs of today’s families, with flexible spaces to accommodate all sizes, customs and requests.

“I had a vision to create a funeral home unlike any other in New Jersey,” Geraldine shares. “We were the first to design and build a facility that includes an on-site banquet hall, a peaceful atrium café, and a memorial store—all under one roof. It’s a onestop service center to help families honor their loved ones in the most personal way.”

Oliverie Funeral Home remains proudly family-owned and is predominantly led by women, continuing a tradition of heartfelt, attentive care that began with a young girl’s quiet wish to say goodbye.

What makes your funeral home unique?

What sets us apart is that we are the only Life Celebration funeral home in the county. This distinction allows us to offer families truly personalized services and meaningful keepsakes that reflect the life and legacy of their loved one.

As a completely family-owned and operated business, our first-generation owner and manager remains hands-on—personally directing services and answering calls to ensure compassionate care at every step.

Both of our locations offer on-site catering, and our Jackson facility features The Wisteria banquet hall. While often used for repasts, the space also hosts a wide variety of community events, including bridal

and baby showers, wedding receptions, birthday celebrations, and more. It’s a warm and welcoming venue that brings people together in all of life’s moments.

Our Jackson location is also equipped with Blink charging stations for electric vehicles, available for use by anyone in the community.

Additionally, we have three certified celebrants on staff who are skilled in creating personalized services— whether religious, non-religious, or a blend of both— ensuring every ceremony reflects the unique life it honors.

What does excellent customer service mean to you?

Excellent customer service means being available to families at all times and serving this deeply human need with the highest level of care, respect, and attention. We are genuinely passionate about supporting families through one of life’s most difficult moments—and we

always go the extra mile to meet their needs.

Our commitment doesn’t end when the service is over. We continue to stay in touch with the families we’ve served for up to a year, offering aftercare support and acknowledging the importance of the first anniversary of death and all first holidays that they will experience without their loved one, as part of our ongoing care.

What do you feel has been the biggest factor in your success?

I believe our success is rooted in our strong ties to the community and the fact that we’ve raised our family here. Our local involvement, paired with a compassionate team of dedicated employees who truly represent our values, has been essential to building trust and meaningful relationships over the years.

Over the years, we’ve introduced a variety of complimentary programs at our funeral home to support the families and

communities we serve. These include free grief counseling, educational pre-planning seminars, and dedicated sessions for veterans that explain the benefits they are entitled to—along with assistance in pre-registering for the veterans' cemetery. We also offer notary services and are continually expanding the range of services available.

How are you involved in your community?

In addition to these ongoing offerings, we host a number of meaningful community events throughout the year. These include:

• Holiday Remembrance Dinners, providing comfort and connection during the holiday season

• Clergy & Staff Day on the River Lady, to honor and thank those who also serve our community

• Veterans Remembrance Services in collaboration with the local town hall

• Annual Blood Drives in partnership with the American Red Cross

• Annual Tax Shred Day, promoting security and sustainability

• Senior Health Fairs, co-hosted with local medical and long-term care providers

Each event is part of our commitment to serve not just during times of loss, but throughout the many seasons of life.

What excites you about the future?

What excites me most is seeing new generations enter the funeral profession—bringing fresh perspectives while honoring the values and traditions that have shaped our industry. I'm inspired by the opportunity to blend timehonored practices with innovative ideas to better meet the evolving needs of today’s families. It’s exciting to imagine what the “traditional funeral” of the future will look like.

Do you have any advice for other funeral homes?

My advice to other funeral homes

is to remain open and adaptable to the ongoing changes within our industry—whether they are new methods of disposition or the evolving ways families choose to memorialize and celebrate their loved ones.

As we embrace these changes, it’s equally important to stay informed and educate the families we serve. Providing compassionate, knowledgeable guidance ensures that families can make well-informed decisions about endof-life care with clarity and confidence. FBS

When funeral directors talk about challenges in the profession, few issues loom larger than the complexities of insurance claims. Families often arrive at a funeral home with life insurance policies in hand, believing that the paperwork alone will cover the cost of services. But funeral directors know all too well that what looks simple on the surface often turns into weeks—or months—of delays, denials, and red tape.

With more than 55 years experience, Dick Abrams leads a team that helps funeral homes across the country navigate the tricky world of insurance assignments.

For more than fifty years, Dick Abrams, CPA, has dedicated his career to solving this problem. As the founder and Executive Chairman of Surety Capital Corporation, Abrams pioneered the insurance assignment funding industry and built the company into one of the most trusted partners for funeral homes nationwide. Today, under his continued leadership alongside his daughter Jodi Abrams Engfer and son-inlaw Mike Engfer, Surety remains not only a fixture but also a standard-bearer for integrity and client service.

And now, through his newest venture, Assigned Claims LLC, Abrams is once again changing the industry—this time by tackling the claims that other companies won’t touch.

The story of Surety Capital begins not in a boardroom, but with an unusual request from a funeral director in Chicago.

In the early 1970s, Abrams was working as a CPA in the tax department of Arthur Young (now Ernst & Young). At the same time, he owned a commercial building in Chicago. One of his tenants was a funeral home.

“One day, the funeral director asked me if I’d be willing to take an insurance assignment in lieu of rent,” Abrams recalls. “I said yes, not knowing that decision would set me on a path to create an entire industry.”

That first assignment revealed a simple but powerful truth: families needed flexibility, funeral homes needed cash flow, and insurance companies operated on their own timelines. Abrams recognized that there was a business opportunity in bridging the gap.

Soon after, he left his position at Arthur Young and dedicated himself to building a company that specialized in financing insurance assignments. That company became Surety Capital Corporation, and with it, Abrams effectively launched the funeral funding industry.

“Our clients never have to worry about whether a claim will be paid,” says Chief Legal Officer Mike Engfer, Esq. “If there’s a problem with an insurer, we take responsibility for resolving it. Once we verify and fund a claim, it’s our issue—not the funeral director’s.”

This guarantee is more than just words. Unlike

financial surprises after services have already been rendered, it represents peace of mind.

While Surety has always prided itself on personal service, the company has also invested heavily in technology.

Through a secure online portal, clients can track the real-time status of claims, see which assignments are being paid, and review payment histories. At the same time, forms can be completed online, by email, or even fax, ensuring flexibility for funeral homes of all sizes and technological capabilities.

This combination of high-touch and high-tech has kept Surety relevant across generations of funeral directors.

“Some of our clients are second- and third-generation

funeral home owners,” notes Abrams. “Just as they’ve modernized their businesses, we’ve modernized ours— without losing the personal touch that matters most.”

For funeral professionals, insurance assignment funding isn’t just about numbers; it’s about helping families at their most vulnerable moments. Abrams has never lost sight of this.

“When a family comes in with a policy, they’re expecting it to take care of things,” he explains. “Our job is to make that happen quickly, so the funeral director can focus on service, not financial logistics.”

By ensuring that funds are available promptly—often within one business day—Surety allows funeral directors to extend care without delay or uncertainty. That reliability can make a profound difference for both the business and the families they serve.

Though Abrams remains actively involved as Executive Chairman, the leadership of Surety is now shared with family.

His daughter, Jodi Abrams Engfer, serves as Chief Operating Officer, overseeing day-to-day operations and driving the company’s strategic plan.

Her husband, Mike Engfer, Esq., serves as Chief Legal Officer, leveraging his background in insurance and consumer protection law to provide guidance to clients and ensure airtight claim resolution.

Together, the team represents a blend of continuity and innovation—a balance between Abrams’ pioneering spirit and the modern demands of the industry.

Even after five decades, Abrams is still finding ways to innovate. His latest project, Assigned Claims LLC, was launched to handle the kinds of life insurance claims that other funding companies avoid.

(See full sidebar for more details)

As Surety Capital celebrates over fifty years in business, Abrams is reflective but not finished.

“I never set out to create an industry,” he says with a smile. “I just wanted to solve a problem for a funeral director. Everything else grew from there.”

Today, that problem-solving spirit continues to guide both Surety and Assigned Claims. For funeral directors, the benefit is clear: a partner who not only understands the business but is willing to stand shoulder-toshoulder through its toughest challenges. FBS

Abrams most recent innovation is a new company designed to handle the kinds of insurance-policy assignments that other funeral funding firms won’t touch—or worse, accept and then try to “charge back” to the funeral home later.

With Assigned Claims, LLC, Abrams and his team are solving some of the worst problems in the insurance assignment world.

Assigned Claims categorizes cases into three groups:

Good Claims – straightforward policies where funds are available quickly.

Bad Claims – delayed cases tied up by coroners’ investigations, homicide reviews, or insurer red tape.

Ugly Claims – policies denied outright or assignments that another company has funded, then tried to claw back.

The Legal Advantage

What makes Assigned Claims different is its legal muscle. With attorneys built into the process, the company can pursue delayed or denied claims aggressively. That means:

• Families can still receive benefits on difficult cases.

• Funeral homes are shielded from chargebacks.

• Insurers are less able to avoid responsibility through delay or denial.

As Abrams explains, “Some claims are abandoned or reversed simply because they’re difficult. We believe those cases deserve the same fight as the easy ones.”

For funeral directors, Assigned Claims is a safety net— ensuring that when a policy exists, there’s always a path to funding, no matter how complicated the circumstances.

BY GAIL RUBIN, CT

Mortality Movie Nights at funeral homes are educational and engaging community events that use classic films to spark conversations about end-of-life issues. Your funeral home setting enables attendees to embrace mortality with open arms—and a little popcorn. These gatherings make death less taboo and planning more approachable by blending entertainment with reflection.

As a pioneering death educator, I’ve always used films and film clips in my presentations. Studies show people will remember information in a film or TV scene 30% better and longer than information simply conveyed by a speaker. In 2024, I started a television series, Mortality Movies, to blend videos with expert commentary on issues such as death, grief, funeral planning, and end-of-life issues.

In 2025, I started Mortality Movie Nights in the living room at my home. I invited people to come to watch a classic film related to death and discuss it. After three sessions, the event quickly outgrew the space at home.

Here in Albuquerque, New Mexico, French Funerals and Cremations has been a long-time supporter of my death education activities. We originally did a few “Movie Night at the Funeral Home” events in 2013, with the films Get Low and Bernie, both funeral-related films based on true stories. We had a good turnout and received some nice press coverage for those events.

I contacted French CEO Tom Antram to ask about holding Mortality Movie Nights at French locations, and he agreed.

Give your clients amazing programs in less time. With same day turnarounds built on 15 years of reliability, we’ve got your memorial keepsakes covered.

doing 100 service calls / year ?

We want to help you spend less time on programs orders and more time serving families. Try us out. Call 980-231-1476 to place an order.

We hold these events every other Tuesday night. There’s a regular group of 10-20 fans who come out, plus new attendees at each event. It’s a great way to get the public to come to your funeral home without having to experience a death in the family and build up positive personal preneed connections.

Here are valuable tips on how you can hold a Mortality Movie Night at your funeral home.

One way to connect with local audiences is through the people who host Death Cafés (www.DeathCafe.com) or Death over Drafts events (www.DeathOverDrafts.com). Both movements draw attendees who are open and interested in discussing mortality issues. Depending on the content of the planned film, you might connect with professionals in related fields who can bring in viewers: estate attorneys (Grand Budapest Hotel, The Ghost and Mrs. Muir), hospice social workers (Two Weeks), or grief counselors (A Man Called Otto, Big Hero Six).

Mortality Movie Night is a great event to promote in your social media feeds and to local news media. You can use online platforms such as Meetup or EventBrite to promote the event and collect contacts from RSVPs. Preneed sales staff can send emails to prospects and past customers to encourage additional attendees and reinforce relationships. Precoa’s Proactive Preneed® program can handle everything to generate leads and promote your event, including targeted direct mail postcards and/or Facebook ads.

When you watch a film on DVD, you’ll often see a screen that says, “The unauthorized reproduction or distribution of this copyrighted work is illegal. Criminal copyright infringement, including infringement without monetary gain, is investigated by the FBI and is punishable by up to 5 years in federal prison and a fine of $250,000.”

While I’ve never seen any movie police in all my years presenting films, you don’t want to tangle with Hollywood lawyers. The Umbrella License from the Motion Picture Licensing Corporation (www.MPLC.org) provides the legal coverage to publicly show films without fear of copyright infringement. There are certain rules to follow, including not charging for the event and avoiding promoting the specific film title and stars – hence the Mortality Movie Night name. I renew my Umbrella License every year.

Plan on having two staffers there to set up and stay for the event. You might recruit younger employees, preneed sales folks, and movie fan employees. Someone needs to be the emcee to introduce the film and its themes and facilitate the conversation afterward. Have discussion points prepared for the film you plan to show. You can email me at Gail@ agoodgoodbye.com to get a list of discussion points for just about any Mortality Movie you might show.

Whether you show movies using a streaming service or playing DVDs, make sure the technology works before the audience arrives. This includes audio – we had an issue with the sound the first night we set up at the funeral home. Avoid committing a faux pas!

Nothing says Movie Night like the smell of freshly popped popcorn, and it’s an inexpensive snack. An air popper is easier to use than a traditional oil popper machine, but either can work well. Chocolate is also a popular treat. Offer coffee, water, and lemonade for beverages. You can liven the “Concession Stand” with Movie Night paper goods from a party supply store.

If you’d like ideas for Mortality Movie Night films and TV show options, I’m happy to share a comprehensive list of comedies and dramas, organized by subject matter: funerals and funeral directors; medical treatment/end-oflife issues; death fantasy/after-life visions; grief; animated films; estate planning; mortality and living life fully; and documentaries. FBS

Gail Rubin, CT, is a pioneering death educator, author, and speaker who uses humor, film, and outside-the-box activities to get people talking about mortality and endof-life planning. Known as “The Doyenne of Death®,” she hosts Mortality Movie Nights that blend Hollywood storytelling with meaningful conversations about grief, legacy, and preneed planning. Gail is a Certified Thanatologist, a TEDx speaker, and the author of multiple books, including the forthcoming title, 98.6 Mortality Movies to Watch Before You Die. Visit her website, www. AGoodGoodbye.com, and subscribe to her Substack column, Mortality Movies with The Doyenne of Death, at gailrubin.substack.com.

Who is Auora Payments and what product and/or service do you provide?

Aurora brings together the tools that modern funeral professionals need to collect and manage case payments. From e-commerce website payments, in-person payments and convenient family payment links that are paid in 20 minutes average time, we also offer No Fee credit card processing and real-time business insights that simplify operations and offer families multiple payment options.

How did Aurora get involved in the funeral industry?

In 2016 we were looking for a new vertical market. Our Funeral Association Relationship Manager, Jim Luff, had 25-years of experience working as a Supplier in the industry. We attended our first industry convention in California that year along with the NFDA and ICCFA Shows. We knew the industry was a good fit for us.

What makes Aurora Payments unique?

Our proprietary ARISE platform is a cloud-based solution built for small to midsize funeral homes. It was designed with the funeral industry in mind to combine payment processing, easy online invoicing and more ways to pay beyond traditional credit cards.

What are the benefits to funeral homes using Aurora?

Aurora is an endorsed partner of the National Funeral Directors Association as well as having partnerships with funeral associations in California, Florida, New York, Washington, Michigan and Missouri. We are also partnered with Order of the Golden Rule. We are the most trusted and respected credit card processor in the industry.

How does Aurora help funeral homes get paid faster?

Using our ARISE platform, a convenient payment link can be sent to family members allowing fast and easy payment

collection. ARISE can create a simple invoice and our automated recurring billing collects funds from a credit card or bank account and applies the payment to the invoice.

How would a funeral home contact Aurora Payments for more information on your products?

You can reach Aurora by visiting our website at www. risewithaurora.com, email jim.luff@risewithaurora.com or call Jim at 661-706-7955.

BY MICHAEL FAHERTY

As fall approaches and the calendar quickly moves through the third quarter of the year, it's natural for deathcare professionals to shift their focus inward: to catch up on administrative tasks, prepare for the year-end, or brace for a seasonal slowdown. Yet, this time offers a valuable, often underappreciated opportunity.

Rather than letting momentum stall, the second half of the year can offer a time of growth, deeper community engagement, and a stronger finish to the year for firms that know how to keep their foot on the gas.

The first half of the year presented its fair share of challenges: persistent inflation, evolving consumer preferences, and operational pressures. While it’s tempting to view this season as a time to slow down, the risk is clear. Slowing down in Q3 can mean missed opportunities and a weaker foundation for Q4.

As we’ve shared before, today’s consumers expect convenience, transparency, and the ability to make

important decisions on their own time, and these expectations don’t pause for the second half of the year, and neither should our industry’s efforts to meet them. By employing a few targeted strategies, firms can keep up the momentum and finish the year strong.

One of the most effective ways to keep momentum alive is by maintaining robust preneed outreach. This is one of the greatest sources of revenue potential that many firms leave underleveraged. There are several strategies that can help boost this critical area:

1.Increase education efforts: Help consumers make informed, confident decisions. Your firm should position preneed as a caring, proactive choice rather than a transaction to help families see the value of planning ahead.

Try hosting educational events, either in person or as a webinar, to help break down the preneed planning process and answer questions in a relaxed, no-pressure environment.

Make sure your website has multiple resources to help families understand the preneed process, know their options to create customized celebrations of life, and view transparent pricing.

2.Bundle preneed offerings: Create a good/better/best preneed package to make choices easier for families. Bundled options reduce decision fatigue and encourage higher-value selections, which can generate larger sales.

These bundles should include non-traditional celebration of life options that reflect the preferences of today’s consumers. Think happy hour services at the individual's favorite restaurant, a beachfront celebration at sunset, or a catered backyard gathering.

The convenience and flexibility of packages such as these can help consumers confidently make decisions.

3.Emphasize the financial benefits of preplanning: Preneed planning helps families lock in today’s prices. The peace of mind that this can bring, particularly given the consistently upward trend of inflation, can reduce the financial burden on loved ones. Planning can protect against unexpected costs and help families avoid debt.

Consistency in these efforts can support a healthy preneed pipeline all year long and position your firm to serve families better, regardless of the season.

Fixed-income securities have significantly higher yield, compared to several years ago, so reviewing your preneed trust investment performance is crucial. In a conservative allocation of 60% equities and 40% fixedincome securities, the fixed-income assets now have the potential to generate substantially more income during the next several years.

The investment performance of your trust portfolio is a key driver in the profitability of your preneed program, so firms should have a solid understanding of the asset allocation of trust investments.

One of the best ways to evaluate the performance of your investment manager is by benchmarking the trust portfolio to appropriate indexes, such as the Bloomberg Barclays US Aggregate Bond Index for fixed-income securities and the S&P 500 for equities.

Taking the time to review your preneed trust investment performance mid-year can help identify areas for improvement or spot whether major changes are needed.

A strong digital footprint is no longer optional – it's essential. Encourage families to use online preplanning resources and eCommerce platforms, which offer transparency, accessibility, and allow families to explore and purchase at their convenience. eCommerce tools can also help capture leads, so your firm can support families that have not yet committed to a preneed purchase.

These tools not only help facilitate the preneed sale but also meet the expectations of today’s consumers who value the ability to make decisions on their own schedules, without having to call or visit a funeral home in person.

Positioning technology as a year-round resource and priority ensures your firm remains competitive and relevant, particularly as we settle into the second half of the year.

Now, while we’re still in Q3, is the perfect time to get ahead of the year-end curve.

Review compliance, trust records, and contracts now to avoid a year-end crunch. Test new marketing campaigns and community outreach initiatives while there’s time to adjust and refine. And proactively address staffing or scheduling challenges before the holiday season begins.

These steps will help ensure a seamless, successful transition into Q4.

The most successful deathcare firms are defined by their empathy, adaptability, and consistency. The second half of the year should be viewed as the growth opportunity that it is, not a time to slow down.

By keeping your foot on the gas: investing in your preneed pipeline, reviewing your trust performance, leveraging technology, and reviewing your records, you’ll be well positioned to serve with confidence and momentum all year long. FBS

Michael Faherty has been serving clients in the deathcare industry for more than seven years. He has more than 20 years in financial and investment experience. Michael holds a blended role with FSI and Argent Financial Group’s Funeral and Cemetery Trust division.

You can reach Michael Faherty at mfaherty@ argenttrust.com

Like a Glove.

Secures to the bumpers on the church truck with large metal grommets.

Bottom edge features 100% impervious FluidBlocker fabric to protect against damaging effects of rain, snow, dirt, etc.

Classic Design.

Eight graceful box pleats dress up the drape and lend a formal look to bare metal church trucks.

Drape top is lined with 100% impervious FluidBlocker, designed to protect the beautiful fabric top from being snagged, cut, or damaged by the scissor mechanism. FluidBlocker.

Identify The Model.

Because of the variety of church truck models sold in the industry over the years, there is no single ONE SIZE FITS ALL design possible.

Identifying your church truck model may require photo verification. Please do not order a church truck drape without first contacting your rep to correctly identify your church truck model.

Various Models.

Ferno 88 Compact Small Grommets

Ferno 88 Compact Large Grommets

churchVerifyyour truck modelorderingbefore Restocking Fees Apply to All Unverified Orders.

Ferno 87 Small Grommets

Ferno 87 Large Grommets

Junkin CH-300 Old Style

Junkin CH-300 New Style

Elliot DURA-BUILT

Mobi / Import Truck

Premier A1

Spencer and others...

Situatedatoneend,thedrawstring adjuststosecurethecovertothecot andkeeptheendabovethewheels.

BY GEORGE PAUL, III

The funeral industry is at a crossroads. While we've long enjoyed the security of an "insulated industry," that protection is rapidly eroding. Families increasingly view funeral homes as interchangeable commodities, making decisions based on price rather than value. This dangerous shift threatens the very foundation of what we've built—but it doesn't have to be your reality.

After two decades in branding and design, working with hundreds of funeral homes nationwide through Cherished Keepsakes, I've identified five critical characteristics that separate million-dollar funeral brands from struggling firms trapped in the race to the bottom. These aren't just nice-tohaves—they're survival essentials for the modern funeral home.

The Commodity Crisis

Here's the uncomfortable truth: when families can't distinguish between funeral homes, they default to price comparison. This commoditization divides our industry, forces us to compete on cost rather than value, and ultimately leads to burnout, market share loss, and business closure. The firms that thrive understand that branding isn't about pretty logos—it's about creating an emotional connection that transcends price.

Think of it this way: a person's gut feeling about your funeral home determines whether they choose you or your competitor. That feeling is your brand, and it's either working for you or against you. There's no neutral ground.

Characteristic #5: Your Facility Speaks Before You Do

Your facility is the visible foundation of your brand. It sets and reinforces the experience families expect, reduces their hesitation, and reflects how they'll be perceived by attendees. A well-maintained, thoughtfully designed facility doesn't just look good—it generates additional revenue.

Consider this: an updated facility can help you break through the 150-200 service call ceiling that traps many firms, potentially bringing in an additional $400,000-$600,000 annually. The curb appeal alone levels the playing field with larger competitors.

Don't have renovation money? Start with what you can control. Hire out maintenance, establish a renovation account using 10% of gross revenue, and think like your families when evaluating your space. Sometimes the smallest improvements yield the biggest impact on family perception.

Your staff represents your brand in every interaction. A strong culture doesn't just happen—it's intentionally built to attract and retain the best people who will give you more time and freedom while serving families at the highest level.

People want to be part of something bigger than themselves. They crave fulfillment and growth in their work. Build a culture they're excited to join by paying living wages, creating operational systems, providing direction with accountability, and giving them the freedom to make decisions and even fail. Remember: your team's passion for your mission directly impacts how families experience your care. Invest in culture, and it will pay dividends in both staff retention and family satisfaction.

"We don't need marketing—families find us when they need us." This thinking will kill your business. Marketing ensures you're easily found, keeps you top-of-mind in an unpredictable field, and communicates your positioning and values to ideal families.

Families go on a journey when selecting a funeral home, moving through stages of pain awareness, comparison, validation, service experience, and sharing. Your brand must be positioned at each point as the best choice, or they'll select your competitor.

Experience bold ideas in real spaces. Hear from game-changing leaders. Make connections that stick. Leave inspired.

Don’t just hear about the future. Be there.

October 21 - 23,

Start simple: gather email addresses from families you serve, create a content marketing plan, and launch where families engage with your brand most. Focus on inbound marketing—content that attracts rather than interrupts. Blog posts, social media presence, and video marketing build trust and demonstrate expertise.

Consistency matters more than perfection. A regular newsletter, active social media presence, or helpful blog content positions you as the caring expert families want during their most vulnerable moments.

True brand recognition happens when families immediately identify your funeral home's unique approach and value. This occurs through three key elements: specialization (niching down), knowing your ideal family intimately, and developing a well-defined brand identity.

Think like a family making funeral decisions. They're driven by emotions, seeking transformation, status, and healing while navigating death's inherent stigma. Your brand should minimize these challenges while maximizing their confidence in choosing you.

Here's a brand hack: leverage keepsakes as extensions of your loved one's brand. Provide memorial programs, prayer cards,

or other keepsakes that families can't get elsewhere. This makes them feel uniquely cared for while serving as lasting testaments to your exceptional service.

You don't truly know your business unless you know your numbers. Operating costs, profit margins, client acquisition costs, conversion ratios, and lifetime client value—these metrics provide the competitive advantage that separates successful firms from struggling ones.

Knowing your numbers allows you to price competitively while maintaining profitability, builds confidence in business decisions, creates doubt in competitors' minds, and enables strategic scaling. Most importantly, it buys back your time by providing clarity for every business decision.

Track your P&L, balance sheet, and key performance indicators religiously. This knowledge transforms you from a reactive business owner into a strategic leader who can navigate any market condition.

The insulated industry we once knew no longer guarantees business security. Families group us into the same category, making decisions based on price rather than the value we provide. But branding breaks this cycle, allowing you to stand

out and command premium pricing for premium service.

These five characteristics aren't just theoretical concepts— they're practical steps toward building a million-dollar funeral brand. Start with knowing your numbers, then systematically address each characteristic. Your families, your staff, and your future self will thank you.

The choice is yours: remain trapped in the commodity race to the bottom, or build a brand that honors legacies while securing your business's future. The funeral homes that thrive in the coming decade will be those that embrace branding as their competitive advantage.

Until next time, I wish you success in honoring the legacies in your care. FBS

George Paul III, known as The Legacy Leader™, is a Funeral Experience Specialist and founder of Cherished Keepsakes. For over 15 years, he has helped families and select funeral homes create healing, high-impact memorial keepsakes that honor legacies, illuminate memories, support grief, and transform pain. Through personalized keepsakes and an endto-end family journey, George ensures every tribute reflects the life it celebrates — while helping firms stand out without the stress. He can be reached at gpaul@cherishedkeepsakes. com or at www.cherishedkeepsakes.com

Author, Podcaster, Speaker and Founder of

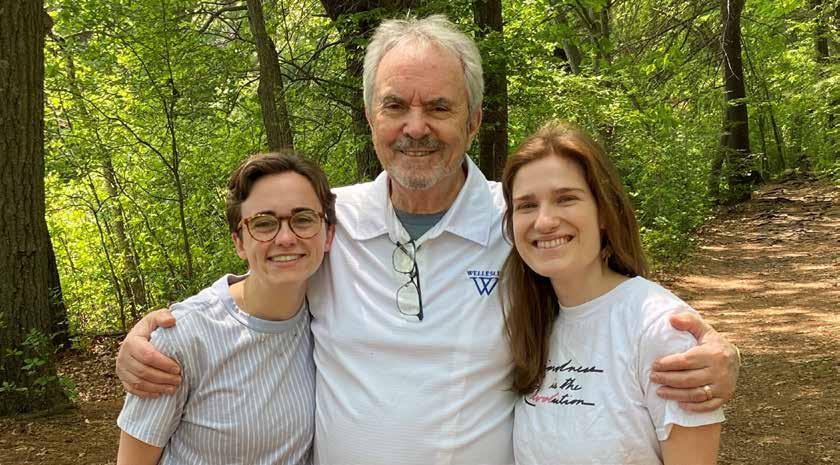

Can you start out by sharing a brief history of the company or organization you currently work with?

I stepped into leadership as a third-generation funeral director at Baue Funeral Home, Crematory and Cemetery (https://www.baue.com/), taking over my father’s modest funeral business after his death in 1987 when I was 30 years old. Over 32 years—I transformed it into a thriving enterprise: multiple funeral home locations, an 80-acre cemetery, a centralized care and cremation center, and even pet cremation services. In 2019, I decided to sell that business to focus fully on coaching and empowering others, specifically women in the funeral and deathcare profession.

In 2021, I launched Your Funeral Coach, a platform dedicated to coaching, mentoring, speaking, and advocacy around that mission of the profession. I love coaching, but wanted to have more of an impact on the women’s development and leadership. So, in 2025 I founded Funeral Women Lead, an organization extending my commitment to elevate women in deathcare. And most recently, I published my first book, Wake-Up Calls, in September 2025. Part memoir and part professional guidebook, which I am very proud of. One hundred percent of the book proceeds will be given to nonprofits supporting women’s education in the profession.

How did you personally become involved in this industry?

I have spent my entire professional life in it. I took over our family business after my father’s death, transitioning from grieving daughter and funeral director to President/CEO of a thriving funeral and deathcare business. My life long personal connection and deep interest in the future of this profession –especially for women – have shaped my lifelong commitment to the profession.

What is your favorite thing about what you do?

Without hesitation: empowering women. I love mentoring, speaking, and coaching—helping women to see their worth, claim their leadership, and thrive using their heads, their hearts, and their grit, as future leaders in our profession.

What is something that you know now that you wish you knew when you first started?

Early on, I didn’t fully grasp how systemic biases could block women’s professional growth paths—even in fields where women are very present and active. I wish I had understood sooner how to navigate these barriers and had access to more learning in areas of ownership, people management, and leadership principles, to guide my journey.

What is the most challenging aspect of your career?

Breaking through entrenched, male-dominated leadership structures was very tough for me personally, especially as one of the first women stepping into top roles in funeral service. The emotional toll of balancing grief, leadership, being a mother and wife, active volunteer in the community, and at the same time trying to learn to become an owner of a growing business, added another layer of complexity.

How do you set personal goals for yourself? What is the process like?

I am a visionary, so setting long term goals for me both personally and professionally is second nature! Once I see the vision clearly in my mind, I start moving toward it, bringing in others' ideas, working together and setting smaller goals with actions to help us get to the big goal: talking to potential supporters and partners, and pushing myself and others to help support that vision.

What keeps you in this industry?

Purpose. Being part of helping resilient women rise, gain confidence and ownership in a space that’s historically overlooked them—this is what fuels me. This drive to break barriers and rewrite norms keeps me passionately engaged and dedicated to the funeral industry.

What do you feel has been the most important factor in your success?

Resilience, combined with empathy. My commitment to survive and thrive, powered by grit and paired with a heartled leadership style has been what I feel is a key factor in learning to thrive through hard times and overcome

Lisa Baue published her first book, Wake-Up Calls, in September 2025, debuting as an Amazon Best Seller.

failures in my success over decades.

This industry has changed dramatically in the past few years. How has that affected you and your efforts?

It’s made what we are doing with Funeral Women Lead and what I share in Wake-Up Calls even more important. Women are telling us that they seek mentorship, coaching, and support, along with more training in areas of leadership and wellness. This profession will not survive if we do not nurture, support, and develop the women who are choosing it as a professional career. The time to unleash the greatness of women in this profession is now.

What are you most proud of so far in your career?

I’m proud to have stayed true to myself and my mission. Between building a thriving funeral care organization, and then pivoting to my personal mission of championing women across the profession, it all has come together to help others. I’m so proud of my soon-to-become nonprofit and especially my recent book launch - all in the name of my overall mission.

Looking forward to the future, what are you most excited about? What are you most concerned about?

I’m most excited about the growing wave of women

entering our profession at over a 75% ratio of the graduates in mortuary school today. I am proud to see more women are growing in their involvement in management in supplier partner companies and in the growing corporate world that is in our profession. I am excited but also concerned to see that they want to grow themselves and are using their own personal time to do so. That means they are dedicated professionals who are life learners and that they want to be supported by resources like coaching, mentorship, and scholarships. I’m also thrilled to see a shift toward more empathetic, inclusive, leadership models.

I continue to be concerned about persistent burnout, emotional strain, and the slow pace of systemic change. While progress is happening, sustaining momentum in a high-stress, emotionally demanding environment remains challenging.

Do you have any advice for others in this industry that might be struggling?

Lean into your head, heart, and grit. Use resilience and empathy as dual strengths. Seek community. You’re not alone, and shared experiences are powerful. We are here to help – reach out to us, attend our programs and become a Charter supporter of Funeral Women Lead to be part of a movement to support yourself and other women. FBS

Learn more about Lisa at https://lisabaue.com

BY NIKKI ANNE SCHMUTZ

The holiday season is often described as a time of joy, family, and togetherness. But for those who are grieving, the holidays can also be a deeply painful reminder of the absence of a loved one. In response, many funeral homes and cemeteries across the country have begun offering holiday remembrance programs— heartfelt gatherings designed to support families through the emotional weight of the season while honoring the lives of those who have passed.

Holiday programs hosted by funeral homes or cemeteries often feature candlelight memorials, tree-lighting ceremonies, ornament decorating, music, and readings. These events provide a comforting space where families can come together in remembrance, finding solace in a shared experience of love and loss.

For many attendees, these programs serve as a rare opportunity to say their loved one’s name out loud, to cry openly, and to feel seen and supported by others walking a similar path. It’s a moment to pause amid the chaos of the season and simply acknowledge: “They are still with us in memory.”

Funeral professionals understand that grief does not end after the service, and that the holidays can intensify emotions families thought they had already processed. By hosting holiday events, funeral homes fulfill a critical role in long-term bereavement support, offering more than just a one-time service and becoming a lasting presence in the lives of those they serve.

These events also serve to build deeper relationships with the community, showing that the funeral home is not just a business,

but a partner in healing. For some families, this is their first interaction with the funeral home after a loss. For others, it’s an annual tradition—a sacred time to reflect and reconnect.

While programs vary, some common features include:

• Tree of Remembrance: Families are invited to hang ornaments with their loved one’s name.

• Candlelight Vigils: A symbolic way to “light the way” through grief.

• Personalized Keepsakes: From photo ornaments to written tributes.

• Live Music or Choirs: Offering a healing atmosphere with seasonal and reflective music.

• Support Resources: Grief counselors may be present to offer guidance.

Some funeral homes even offer virtual participation options, allowing distant family members to join in remembrance from wherever they are.

As funeral homes continue to evolve, embracing a more holistic approach to aftercare, holiday remembrance programs represent

a compassionate bridge between tradition and healing. They are a reminder that love endures and that no one needs to face the holidays alone.

Support resources offered at holiday remembrance events—or in conjunction with them—can be a vital lifeline for grieving families. The holidays are often a time when grief resurfaces with intensity, and the right resources can provide emotional tools, validation, and practical guidance. Here’s a deeper look at the types of support that funeral homes and cemeteries can offer during these events, and why they matter.