Higginbotham Public Sector (800) 583-6908

www.mybenefitshub.com/sampleisd

Higginbotham (866) 419-3519 www.higginbotham.com

American Public Life Group #17588 (800) 256-8606

www.ampublic.com

MDlive (888) 365-1663 www.consultmdlive.com

Lincoln Financial Group (800) 423-2765 www.lincolnfinancial.com

UnitedHealthCare Group #905631 (800) 638-3120 www.myuhcvision.com EDUCATOR

New York Life Group #SLH-10019 (800) 362-4462 www.newyorklife.com/

Lincoln Financial Group (800) 423-2765 www.lincolnfinancial.com

American Public Life Group #17588 (800) 256-8606 www.ampublic.com

Texas Life (800) 283-9233 www.texaslife.com

The Hartford (866)-547-4205 www.thehartford.com/

UNUM Group #473143 Claims (800)635-5597 www.unum.com IDENTITY

IDWatchdog (866) 513-1518 www.idwatchdog.com

MASA (800) 423-3226 www.masamts.com

Higginbotham (800) 419-3519 https://flexservices.higginbotham.net/

1 www.mybenefitshub.com/sampleisd

Login

Click Login with Microsoft 3

4 Enter your work e-mail address.

5 Complete the verification steps as outlined by your employer. You can now complete your benefits enrollment!

3 Enter your Information

• Last Name

• Date of Birth

• Last Four (4) of Social Security Number

NOTE: THEbenefitsHUB uses this information to check behind the scenes to confirm your employment status.

4 Once confirmed, the Additional Security Verification page will list the contact options from your profile. Select either Text, Email, Call, or Ask Admin options to receive a code to complete the final verification step.

5 Enter the code that you receive and click Verify You can now complete your benefits enrollment!

During your annual enrollment period, you have the opportunity to review, change or continue benefit elections each year. Changes are not permitted during the plan year (outside of annual enrollment) unless a Section 125 qualifying event occurs.

• Changes, additions or drops may be made only during the annual enrollment period without a qualifying event.

• Employees must review their personal information and verify that dependents they wish to provide coverage for are included in the dependent profile. Additionally, you must notify your employer of any discrepancy in personal and/or benefit information.

• Employees must confirm on each benefit screen (medical, dental, vision, etc.) that each dependent to be covered is selected in order to be included in the coverage for that particular benefit.

All new hire enrollment elections must be completed in the online enrollment system within the first 30 days of benefit eligibility employment. Failure to complete elections during this timeframe will result in the forfeiture of coverage.

Who do I contact with Questions? For supplemental benefit questions, you can contact your Benefits/HR department or you can call Higginbotham Public Sector at 866-914-5202 for assistance.

Where can I find forms? For benefit summaries and claim forms, go to your benefit website: www.mybenefitshub. com/sampleisd.

How can I find a Network Provider? For benefit summaries and claim forms, go to the Sample ISD benefit website: www.mybenefitshub.com/sampleisd. Click on the benefit plan you need information on (i.e., Dental) and you can find provider search links under the Quick Links section.

When will I receive ID cards? If the insurance carrier provides ID cards, you can expect to receive those 3-4 weeks after your effective date. For most dental and vision plans, you can login to the carrier website and print a temporary ID card or simply give your provider the insurance company’s phone number and they can call and verify your coverage if you do not have an ID card at that time. If you do not receive your ID card, you can call the carrier’s customer service number to request another card. If the insurance carrier provides ID cards, but there are no changes to the plan, you typically will not receive a new ID card each year.

What is Guaranteed Coverage? The amount of coverage you can elect without answering any medical questions or taking a health exam. Guaranteed coverage is only available during initial eligibility period. Actively-at-work and/or preexisting condition exclusion provisions do apply, as applicable by carrier.

What is a Pre-Existing Conditions? Applies to any illness, injury or condition for which the participant has been under the care of a health care provider, taken prescriptions drugs or is under a health care provider’s orders to take drugs, or received medical care or services (including diagnostic and/ or consultation services).

A Cafeteria plan enables you to save money by using pretax dollars to pay for eligible group insurance premiums sponsored and offered by your employer. Enrollment is automatic unless you decline this benefit. Elections made during annual enrollment will become effective on the plan effective date and will remain in effect during the entire plan year.

Marital Status

Change in Number of Tax Dependents

Change in Status of Employment Affecting Coverage Eligibility

Gain/Loss of Dependents’ Eligibility Status

Judgment/ Decree/Order

Eligibility for Government Programs

Changes in benefit elections can occur only if you experience a qualifying event. You must present proof of a qualifying event to your Benefit Office within 30 days of your qualifying event and meet with your Benefit/HR Office to complete and sign the necessary paperwork in order to make a benefit election change. Benefit changes must be consistent with the qualifying event.

A change in marital status includes marriage, death of a spouse, divorce or annulment (legal separation is not recognized in all states).

A change in number of dependents includes the following: birth, adoption and placement for adoption. You can add existing dependents not previously enrolled whenever a dependent gains eligibility as a result of a valid change in status event.

Change in employment status of the employee, or a spouse or dependent of the employee, that affects the individual’s eligibility under an employer’s plan includes commencement or termination of employment.

An event that causes an employee’s dependent to satisfy or cease to satisfy coverage requirements under an employer’s plan may include change in age, student, marital, employment or tax dependent status.

If a judgment, decree, or order from a divorce, annulment or change in legal custody requires that you provide accident or health coverage for your dependent child (including a foster child who is your dependent), you may change your election to provide coverage for the dependent child. If the order requires that another individual (including your spouse and former spouse) covers the dependent child and provides coverage under that individual’s plan, you may change your election to revoke coverage only for that dependent child and only if the other individual actually provides the coverage.

Gain or loss of Medicare/Medicaid coverage may trigger a permitted election change.

Medical and Supplemental Benefits: Eligible employees must work 20 or more regularly scheduled hours each work week.

Eligible employees must be actively at work on the plan effective date for new benefits to be effective, meaning you are physically capable of performing the functions of your job on the first day of work concurrent with the plan effective date. For example, if your 20XX benefits become effective on September 1, you must be actively-at-work on September 1 to be eligible for your new benefits.

Dependent Eligibility: You can cover eligible dependent children under a benefit that offers dependent coverage, provided you participate in the same benefit, through the maximum age listed below. Dependents cannot be double covered by married spouses within the district as both employees and dependents.

You are performing your regular occupation for the employer on a full-time basis, either at one of the employer’s usual places of business or at some location to which the employer’s business requires you to travel If you will not be actively at work beginning 9/1 please notify your benefits administrator.

Please note, limits and exclusions may apply when obtaining coverage as a married couple or when obtaining coverage for dependents.

Potential Spouse Coverage Limitations: When enrolling in coverage, please keep in mind that some benefits may not allow you to cover your spouse as a dependent if your spouse is enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Higginbotham Public Sector, or contact the insurance carrier for additional information on spouse eligibility.

FSA/HSA Limitations: Please note, in general, per IRS regulations, married couples may not enroll in both a Flexible Spending Account (FSA) and a Health Savings Account (HSA). If your spouse is covered under an FSA that reimburses for medical expenses then you and your spouse are not HSA eligible, even if you would not use your spouse’s FSA to reimburse your expenses. However, there are some exceptions to the general limitation regarding specific types of FSAs. To obtain more information on whether you can enroll in a specific type of FSA or HSA as a married couple, please reach out to the FSA and/or HSA provider prior to enrolling or reach out to your tax advisor for further guidance.

Potential Dependent Coverage Limitations: When enrolling for dependent coverage, please keep in mind that some benefits may not allow you to cover your eligible dependents if they are enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Higginbotham Public Sector, or contact the insurance carrier for additional information on dependent eligibility.

Disclaimer: You acknowledge that you have read the limitations and exclusions that may apply to obtaining spouse and dependent coverage, including limitations and exclusions that may apply to enrollment in Flexible Spending Accounts and Health Savings Accounts as a married couple. You, the enrollee, shall hold harmless, defend, and indemnify Higginbotham Public Sector from any and all claims, actions, suits, charges, and judgments whatsoever that arise out of the enrollee’s enrollment in spouse and/or dependent coverage, including enrollment in Flexible Spending Accounts and Health Savings Accounts.

If your dependent is disabled, coverage may be able to continue past the maximum age under certain plans. If you have a disabled dependent who is reaching an ineligible age, you must provide a physician’s statement confirming your dependent’s disability. Contact your HR/Benefit Administrator to request a continuation of coverage.

Description

Health

(IRC Sec. 223)

Approved by Congress in 2003, HSAs are actual bank accounts in employee’s names that allow employees to save and pay for unreimbursed qualified medical expenses tax-free.

(IRC Sec. 125)

Allows employees to pay out-of-pocket expenses for copays, deductibles and certain services not covered by medical plan, taxfree. This also allows employees to pay for qualifying dependent care tax- free.

Employer Eligibility A qualified high deductible health plan. All employers

Contribution Source Employee and/or employer

Account Owner Individual

Underlying Insurance

Requirement High deductible health plan

Minimum Deductible

Maximum Contribution

Permissible Use Of Funds

Cash-Outs of Unused Amounts (if no medical expenses)

Year-to-year rollover of account balance?

Does the account earn interest?

Portable?

$1,500 single (20XX)

$3,000 family (20XX)

$3,850 single (20XX)

$7,750 family (20XX)

55+ catch up +$1,000

Employees may use funds any way they wish. If used for non-qualified medical expenses, subject to current tax rate plus 20% penalty.

Employee and/or employer

Employer

None

N/A

$3,050 (20XX)

Reimbursement for qualified medical expenses (as defined in Sec. 213(d) of IRC).

Permitted, but subject to current tax rate plus 20% penalty (penalty waived after age 65). Not permitted

Yes, will roll over to use for subsequent year’s health coverage.

Yes

Yes, portable year-to-year and between jobs.

No. Access to some funds may be extended if your employer’s plan contains a 2 1/2 –month grace period or $550 rollover provision.

No

No

This Hospital Indemnity plan by Metlife is available at ZERO COST to employees who decline the district medical plan offering. Dependents are not eligible. Benefits are payable for confinement to a hospital.

For full plan details, please visit your benefit website: www.mybenefitshub.com/sampleisd

1 If the Admission Benefit is payable for a Confinement, the Confinement Benefit will begin to be payable the day after Admission.

2 The period of newborn confinement, immediately following the child’s birth.

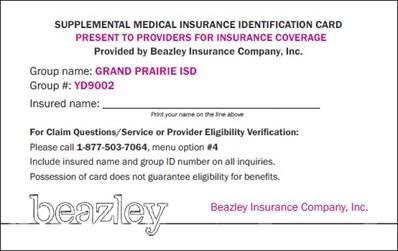

Beazley Insurance Company, Inc.’s Supplemental Medical Expense (Gap) insurance is designed to help cover part of your out-of-pocket costs incurred under your major medical plan (the copay, coinsurance, or deductible) in the event of inpatient hospitalization or eligible outpatient services.

For full plan details, please visit your benefit website: www.mybenefitshub.com/sampleisd

$2,500 benefit amount: Reimburses eligible out-of-pocket expenses, up to the annual benefit maximum, that are incurred during inpatient hospitalization for hospital room and board and other inpatient hospital expenses.

$1,500 benefit amount: Reimburses eligible out of pocket expenses, up to the annual benefit maximum, that are incurred in these select outpatient settings:

• Treatment in a hospital ER (but not admitted to inpatient)

• Surgery in an Outpatient Hospital facility or Freestanding Surgery Center, or Physician’s Office/Urgent Care facility

• Radiological diagnostic testing in an Outpatient Hospital facility, or MRI facility, or Physician’s Office/Urgent Care facility

• Chemotherapy or radiation therapy in a licensed facility

You are eligible for this coverage (regardless of your health status), and you do not have to answer any medical questions to qualify for coverage.

Dependent Coverage

You may also opt for coverage for your spouse or child(ren), as long as they participate in your employer’s underlying major medical plan. Your family maximum will be two times the individual benefit amounts above.

Submit an Explanation of Benefits (EOB) from your major medical plan showing the expenses (deductibles, coinsurance, and/or co-pays) you are responsible for paying out of pocket.

If the EOB does not show the services and diagnosis, then also submit the itemized bill from the provider. No claim form is necessary.

Send by mail, fax, or email to: By Email: beazleyclaimshealthplan.com

By Mail: Beazley c/o Health Plan Services P.O. Box 3889 Seattle, WA 98124-9998

-289-7937 Attn: CLAIMS

After an accident you may have expenses you’ve never thought about. Can your finances handle them? It’s reassuring to know that an accident insurance plan can be there for you in your time of need to help cover expenses such as:

For full plan details, please visit your benefit website: www.mybenefitshub.com/sampleisd

Plan Highlights:

• Benefits are paid directly to you unless

• otherwise assigned

• Coverage is guaranteed-issue regardless of health

• Benefits are paid regardless of any other medical insurance

• $50 Wellness benefit paid each year per covered person

• 24 Hour coverage

Critical illness insurance can be used towards medical or other expenses. It provides a lump sum benefit payable directly to the insured upon diagnosis of a covered condition or event, like a heart attack or stroke. The money can also be used for non-medical costs related to the illness, including transportation, child care, etc.

For full plan details, please visit your benefit website: www.mybenefitshub.com/sampleisd

• Pays a lump sum percentage benefit for a covered critical illness

• Coverage is guaranteed-issue regardless of health

• No pre-existing condition limitations

• Spouse eligible for 100% of what employee chooses

• Children are covered at no additional cost

• Additional and Re-occurrence benefits with only 1 month separation

• Wellness benefit paid each year

Please speak with a benefits counselor for personalized rates.

An HSA is like a 401(k) for healthcare. It’s yours for life, regardless of your employment or health plan. And unlike a flexible spending account (FSA), there’s no “use it or lose it” rule.

With more tax advantages than any other savings vehicle, an HSA is one of the most efficient ways to manage healthcare costs. You can choose to put your money to work, or build a healthcare safety net. And after age 65, you can even use it for non-medical expenses just like a regular 401(k).

For full plan details, please visit your benefit website: www.mybenefitshub.com/sampleisd

Pre-tax or tax-deductible contributions

Tax-free interest and investment earnings

Tax-free distributions when used for qualified expenses

“Am I eligible for an HSA?” You may be eligible for an HSA if your health plan meets the IRS criteria for a high-deductible health plan (HDHP). In 2021, this means your minimum deductible is $1,400 for individuals or $2,800 for families. And your maximum out-of-pocket is $7,000 for individuals or $14,000 for families.

“How much can I contribute to an HSA?” The IRS sets annual contribution limits for HSAs. In 2021, individuals may contribute up to $3,600, and families may contribute up to $7,200. If you are 55 or older, you may add another $1,000 on top of that. These limits are subject to change year to year.

“What can I spend HSA funds on?” You can use your HSA for a wide range of qualified expenses, such as doctor’s visits, prescription drugs, imaging, lab work, medical equipment, contacts lenses, dental work, physical therapy… the list goes on! Refer to IRS Publication 502 for comprehensive guidelines.

A Flexible Spending Account allows you to pay for eligible healthcare expenses with a pre-loaded debit card. You choose the amount to set aside from your paycheck every plan year, based on your employer’s annual plan limit. This money is use it or lose it within the plan year (unless your plan contains a $500 rollover or grace period provision).

For full plan details, please visit your benefit website: www.mybenefitshub.com/sampleisd

An FSA is a great way to pay for expenses with pre-tax dollars.

Because an FSA is a planning tool with great tax benefits, you must use the account balance in its entirety before the end of the plan year or it will be forfeited. This is known as the “use-it-or-lose-it” rule.

Your employer may offer a grace period or a $500 rollover to help if you miss the mark a little bit. Just make sure to plan carefully when you enroll.

Our convenient NBS Benefits Card allows you to avoid out-of-pocket expenses, cumbersome claim forms and reimbursement delays. Or you may also utilize the “pay a provider” option on our web portal. Account access is easy

Get account information from our easy-to-use online portal and mobile app. See your account balance, contributions and account history in real time.

Dental insurance is a coverage that helps defray the costs of dental care. It insures against the expense of routine care, dental treatment and disease. For full plan details, please visit your benefit website: www.mybenefitshub.com/sampleisd

Vision insurance provides coverage for routine eye examinations and can help with covering some of the costs for eyeglass frames, lenses or contact lenses.

For full plan details, please visit your benefit website: www.mybenefitshub.com/sampleisd

Healthy eyes and clear vision are an important part of your overall health and quality of life. With Avesis vision, you have access to a national network of providers to help care for your eyes. Eye exams, eyeglasses, and contacts are available to you at the cost of applicable co-pays.

The Buy-up plan includes the following lens options and more covered in full: Polycarbonate, Standard scratch resistant coating, Standard Anti-reflective coating

Click or Scan for additional plan details

Group term life is the most inexpensive way to purchase life insurance. You have the freedom to select an amount of life insurance coverage you need to help protect the well-being of your family.

Accidental Death & Dismemberment is life insurance coverage that pays a death benefit to the beneficiary, should death occur due to a covered accident. Dismemberment benefits are paid to you, according to the benefit level you select, if accidentally dismembered.

For full plan details, please visit your benefit website: www.mybenefitshub.com/sampleisd

GPISD provides $20,000 of Basic life insurance and Accidental Death and Dismemberment (AD&D) to eligible employees at no cost to you while you’re employed. Be sure to designate a beneficiary.

Grand Prairie ISD gives you the opportunity to elect additional life insurance on a guaranteed issue (G.I.) basis, meaning no heath questions up to the G.I. Amount.

Employees may elect up to 5 times annual earnings (not to exceed $500,000)

Spouse coverage may be elected up to 100% of the employee elected amount (not to exceed $100,000)

Child coverage may be elected in increments of $1,000 up to a maximum benefit of $10,000 (Not to exceed 100% of employees election)

Amounts of coverage elected above the Guarantee Issue amount are subject to medical underwriting approval. To submit a medical history statement online, please visit www.standard.com/mhs

To submit a medical history statement online, visit: standard.com/mhs

Please enroll online or call your benefitsservice center for personalized rates.

Universal life insurance also known as permanent life insurance1 can help protect your family’s quality of life after you’re gone. But that’s just one of sever- al benefits when you enroll in TransElite®universal life insurance from Transamerica Life Insurance Company.

For full plan details, please visit your benefit website: www.mybenefitshub.com/sampleisd

Universal life insurance offers greater flexibility than basic life insurance. In addition to the death benefit, universal life insurance allows you to build cash value plus interest over time. This cash value lets you to:

Borrow against the cash value2 if you need money in a pinch and/or Use the cash value to cover the cost of your premiums down the road* Plus, if you’re diagnosed with a debilitating condition that is expected to be permanent, TransElite universal life insurance can help. It includes a feature that allows you to accelerate your death benefit to provide financial relief. The benefit can be used to pay for any expenses you may have, such as household or credit card bills, costs for an assisted living facility, or even for family members taking care of you benefits can be paid even if care is being provided by a loved one such as a spouse or child. In short, there are no restrictions on how you use the benefit.

* Using cash value to pay the monthly premium will decrease how long the policy will last.

AT A GLANCE: UNIVERSAL LIFE INSURANCE WITH ACCELERATED DEATH BENEFIT FOR CHRONIC CONDITION RIDER AND EXTENSION OF BENEFITS(EXT) RIDER:

• Guaranteed issue no medical or blood tests required

• Fully portable you can take your policy with you if you retire or change employers, so long as you maintain the premiums

• Group rates for this benefit are lower than if purchased individually

• Can be used as traditional life insurance to provide money to your loved ones after you pass away

• Premiums never increase due to your age

• Borrow from the policy amount in advance, if needed2

• Build cash value with guaranteed 3% interest annually

Benefit Amounts:

• Employee - Up to $150,000 not to exceed 5x salary

• Spouse - $25,000

• Child Term Rider - $20,000

MORE ABOUT THE CHRONIC CONDITION RIDER AND EXTENSION OF BENEFIT RIDER3

• Help cover unexpected costs, helping to reduce the physical, emotional, and financial burden associated with a chronic condition

• Access 4% of the policy value each month for up to 50 months

• Receive up to twice the policy’s face amount, plus 25% as a paid-up policy

• No restrictions on how you use the money

Please see plan documents located on the GPISD benefits hub for reference 1 2

3 This is a brief summary of TransElite® Universal Life Insurance underwritten by Transamerica Life Insurance Company, Cedar Rapids, Iowa. Policy Form Series CPGUL300 and CCGUL300. Forms and form numbers may vary. This insurance may not be available in all jurisdictions. Limitations and exclusions apply. Refer to the policy, certificate and riders for complete details.

1720107 07/21

Long-Term Disability Insurance provides income replacement benefits for you and your family in the unfortunate event you are unable to work due to injury or illness.

For full plan details, please visit your benefit website: www.mybenefitshub.com/sampleisd

Long-Term Disability Insurance provides income replacement benefits for you and your family in the unfortunate event you are unable to work due to injury or illness.

Employee Benefit: You may purchase a monthly benefit in $100 units, starting at a minimum of $200, up to 66-2/3% of your monthly earnings rounded to the nearest $100, but not to exceed a monthly maximum benefit of $8,000. Please see your Plan Administrator for the definition of monthly earnings.

Definition of Disability: You are disabled when The Standard determines that: you are limited from performing the material and substantial duties of your regular occupation due to your sickness or injury; you have a 20% or more loss in your indexed monthly earnings due to the same sickness or injury; and during the elimination period, you are unable to perform any of the material and substantial duties of your regular occupation.

Elimination Period: The Elimination Period is the length of time of continuous disability, due to sickness or injury, which must be satisfied before you are eligible to receive benefits.

You may choose an Elimination Period (injury days/ sickness days) of 0/7, 14/14, 30/30, 60/60, 90/90, or 180/180 days.

Pre-existing Condition Exclusion1: Benefits will not be paid for disabilities caused by, contributed to by, or resulting from a preexisting condition. You have a pre -existing condition if: you received medical treatment,

consultation, care or services including diagnostic mea- sures*, or took prescribed drugs or medicines in the 3 months just prior to your effective date of coverage; and the disability begins in the first 12 months after your effective date of coverage.

Benefit Integration: Your disability benefit will be reduced by deductible sources of income and any earnings you have while disabled.

*Preexisting Exclusion will not apply for the first 90 days of disability . 1Waived for those previously enrolled.

*If because of your disability you are hospital confined as an inpatient, benefits begin on the first day of inpatient confinement.

An Employee Assistance Program (EAP) is a program that assists you in resolving problems such as finding child or elder care, relationship challenges, financial or legal problems, etc. This program is provided by your employer at no cost to you.

For full plan details, please visit your benefit website: www.mybenefitshub.com/sampleisd

There are times in life when you might need a little help cop- ing or figuring out what to do. Take advantage of the Employee Assistance Program1 (EAP) which includes Work Life Services and is available to you and your family in connection with your group insurance from Standard Insurance Company (The Stan- dard). It’s confidential information will be released only with your permission or as required by law.

888.293.6948

TDD: 800.327.1833

24 hours a day, seven days a week

workhealthlife.com/Standard3

NOTE: It’s a violation of your company’s contract to share this information with individuals who are not eligible for this service.

Identity theft protection monitors and alerts you to identity threats. Resolution services are included should your identity ever be compromised while you are covered.

For full plan details, please visit your benefit website: www.mybenefitshub.com/sampleisd

SafetyNets plus provides 4 Benefits for you and Your Immediate Family All For $16.96 Per Month + A Free Student Loan Analysis Powered by GotZoom

Identity Fraud cost Americans a total about $56 Billion last year, with approximately 49 Million Consumers falling victim in 2020.1

• Studies show individuals who receive a data breach notification are over 4 times more likely to become victims of Identity Fraud

• Credit monitoring only shows changes to credit AFTER they are reported to the credit bureaus, and damage has been done

• LifeLock Identity Alert System with Privacy MonitorTM Tool provides reduced public exposure of your personal information by using advanced technology to constantly monitor over a trillion data points.

• LifeLock SSN & Credit Alerts use propriety technology scans millions of transactions* every second for threats to your identity. If potential misuse of your information is found, they will alert** you via text, phone or email.

• LifeLock Alerts for potential misuse on applications for many forms of retail credit cards, mortgage loans, tax refund anticipation loans and auto loans, as well as for other non-credit related transactions including wireless services, utilities and payday loans.

• Lost Wallet Protection helps you quickly cancel or replace credit. Debit cards, license, Social Security card, insurance cards and more from a lost or stolen wallet, to help stop fraudulent charges before they can occur.

• Black Market surveillance LifeLock patrols over 10,000 criminal websites for the illegal selling or trading of your personal information and notifies you if they find your data.

1 2021 Identity Fraud Study, Javelin Strategy & Research

* LifeLock does not monitor all transactions at all businesses.

** Fastest alerts require member’s current email address. Phone alerts made during normal business hours.

LifeLock membership Includes 3 adult memberships available to member, spouse, domestic partner, adult children elder parents, & membership for up to 5 dependent children under the age of 18.

Telehealth provides 24/7/365 access to board-certified doctors via telephone or video consultations that can diagnose, recommend treatment and prescribe medication. Telehealth makes care more convenient and accessible for non-emergency care when your primary care physician is not available.

For full plan details, please visit your benefit website: www.mybenefitshub.com/sampleisd

✓ 24/7 access to a doctor is only a call or click away anytime, anywhere with a $0 visit fee

✓ Talk to a doctor by phone, online video or mobile app

✓ Get a diagnosis, treatment options and prescription if medically necessary.

✓ Save time and money simply use your phone, computer, smartphone or tablet to request a visit with a U.S. physician licensed in your state.

✓ Teladoc doctors respond on average within10 minutes to treat non-emergency medical issues such as the following:

cold & Flu Symptoms Constipation

Urinary Tract Infection

Sinus problems Allergies Diarrhea

Gastroenteritis Respiratory Infection Rash & Other Skin Eruptions

Pink Eye Pharyngitis Bronchitis And many more_

Disclaimers:

©2021 Teladoc, Inc. All rights reserved. Teladoc and the Teladoc logo are registered trademarks of Teladoc, Inc and may not be used without written permission. Teladoc does not replace the primary care physician. Teladoc does not guarantee that a prescription will be written. Teladoc operates subject to state regulation and may not be available in certain states. Teladoc does not prescribe DEA Controlled substances, non-therapeutic drugs and certain other drugs which may be harmful because of their potential for abuse. Teladoc physicians reserve the right to deny care for potential misuse.

Disclosures: This plan is NOT insurance. This discount card program contains a 30-day cancellation period. This plan is not insurance coverage and does not meet the minimum creditable coverage requirements under the Affordable Care Act.

Enrollment Guide General Disclaimer: This summary of benefits for employees is meant only as a brief description of some of the programs for which employees may be eligible. This summary does not include specific plan details. You must refer to the specific plan documentation for specific plan details such as coverage expenses, limitations, exclusions, and other plan terms, which can be found at the Sample ISD Benefits Website. This summary does not replace or amend the underlying plan documentation. In the event of a discrepancy between this summary and the plan documentation the plan documentation governs. All plans and benefits described in this summary may be discontinued, increased, decreased, or altered at any time with or without notice.

Rate Sheet General Disclaimer: The rate information provided in this guide is subject to change at any time by your employer and/or the plan provider. The rate information included herein, does not guarantee coverage or change or otherwise interpret the terms of the specific plan documentation, available at the Sample ISD Benefits Website, which may include additional exclusions and limitations and may require an application for coverage to determine eligibility for the health benefit plan. To the extent the information provided in this summary is inconsistent with the specific plan documentation, the provisions of the specific plan documentation will govern in all cases.