The Higginbotham Difference Lead with Values and Value Leads.

The Higginbotham Difference Lead with Values and Value Leads.

A single-source solution inspired by your needs.

You deserve solutions that are built for your business.

That's why Higginbotham starts with listening and ends with insurance, financial, and HR services. Designed to address your risk, budget, and operational goals, we are a multifaceted broker with a suite of services built around serving you.

Today, we are one of the leading independent brokerage firms in the nation, and largest in Texas. This long-standing commitment to excellence is reflective of our premier status across the U.S. Paired with market leverage and thought leadership, your business benefits from our highly sought-after and proprietary Day Two Services® .

A strong employee benefits plan is key to a healthy, happy, and productive workforce. Employers who stay informed on benefit trends are better equipped to meet employee needs and boost productivity. Higginbotham offers:

• Accessible year-round support from a team dedicated to your and your employees.

• Affordable tailor-made solutions, education, and processes to elevate your benefits.

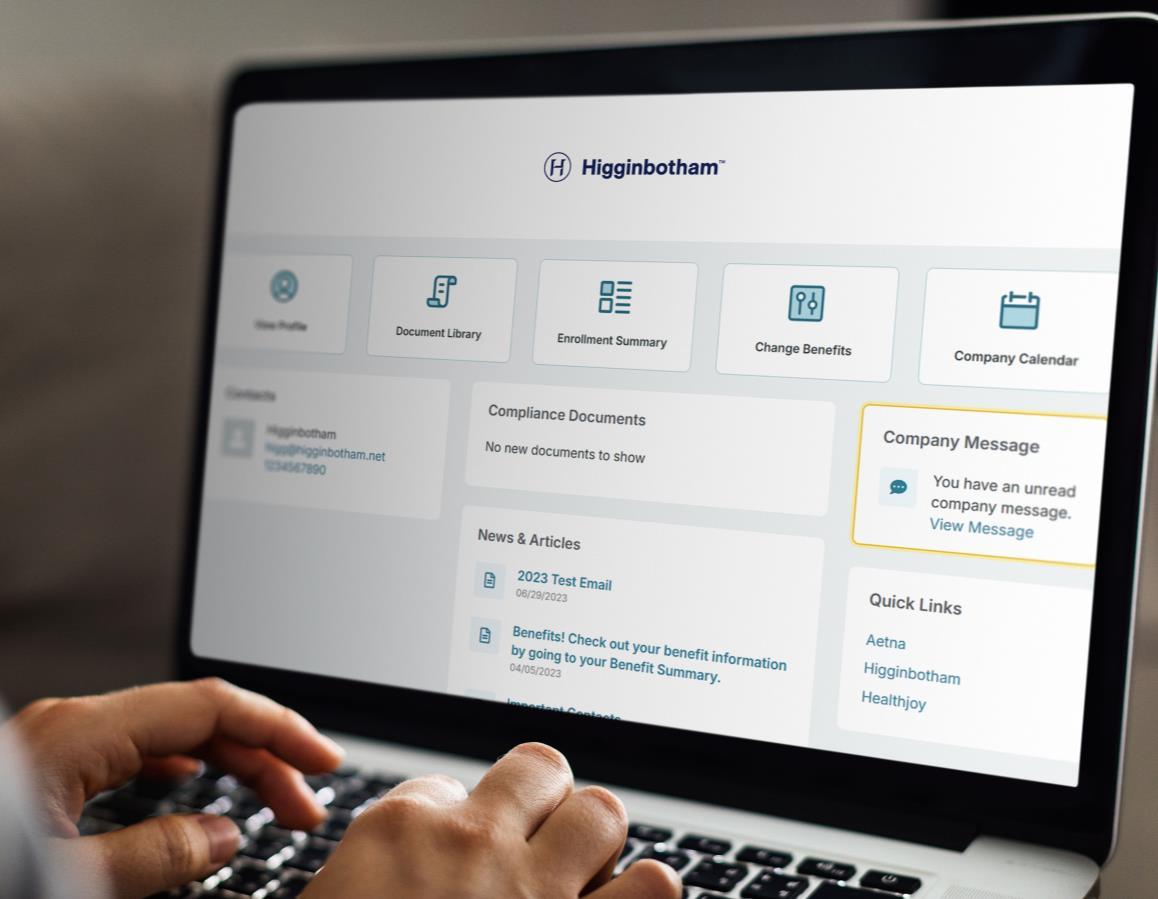

• Customized cutting-edge technology to help control health care costs and save time.

Higginbotham is employee benefits made easy.

Higginbotham's single-source service models provides you with a holistic client experience that goes beyond placement.

From traditional health insurance to everyday administration, our Day Two Services® are delivered by in-house specialists across benefits, compliance, wellness, technology, and more.

No outsourcing and committed to flat-fee, transparent pricing.

Our Day Two Services® leadership team guides Higginbotham in innovative solutions, facilitating world-class services for our clients. From communications to self-insured solutions, these industry experts contribute to your benefits program and remains available the entire duration of your policy term.

Judi Archer

Financial Services Communications and Business Development VicePresident

Jenn Wordell-Todd COBRA Administration Director

Jeff Wood Self-Funded Health Solutions VicePresident

Francine Tebo Employee Engagement Director

Jill Sailors, PharmD

HiggRx Senior Clinical Specialist

Katie Callender

Population HealthManagement Director

Ross Carmichael, J.D., CEBS Compliance Managing Director

Tammy Decker HR Services Managing Director

Maggie Hadden Human Resources Technology Director

Sam McMahan Financial Analytics Director

Stephanie Holbert TPAServices Director

Day-to-Day Team

• Cross-functional account team with weekly touchpoints

• New partner onboarding

• Existing contract review

• Strategic plan design

• Industry benchmarking and gap analysis

• Financial planning and forecasting

• Assigned CDHP team

• Commuter plan, HDHP, FSA, HRA, LSA

• Daily claims processing

• Non-discrimination testing

• Plan document services

• Dedicated toll-free service number and email

COBRAAdministration

• Direct bill services - FMLA, LOA, Retirees, etc.

• Texas state continuation administration

• Real-time compliance alerts and eligibility tracking

• Assigned COBRA client managers

• Toll-free service line; 8:30 a.m. to 5:00 p.m. CST

Monday - Friday

• Customized, multilingual communications

• Employee engagement campaigns

• Compliance consulting

• Legislative, regulatory, political updates

• Audit support

• Customized compliance dashboard and calendar

• ERISA, HIPAA, COBRA, FMLA, ADA, and ACA guidance

HR Services

• HR care team and outsourcing

• Employee onboarding and consulting

• Payroll and benefits administration

• HR technology support and implementation

• FMLA/LOA administration

• State-specific & company leave policies

• Escalation of compliance concerns

• System vetting and implementation

• ACA reporting vendors

• Payroll platform integration

• HRIS/HCM consulting

• Managed buying process (RFP)

• Vendor assistance and escalation

Response Center

• Dedicated toll-free phone number and email address

• High-volume SMS and two-way chat

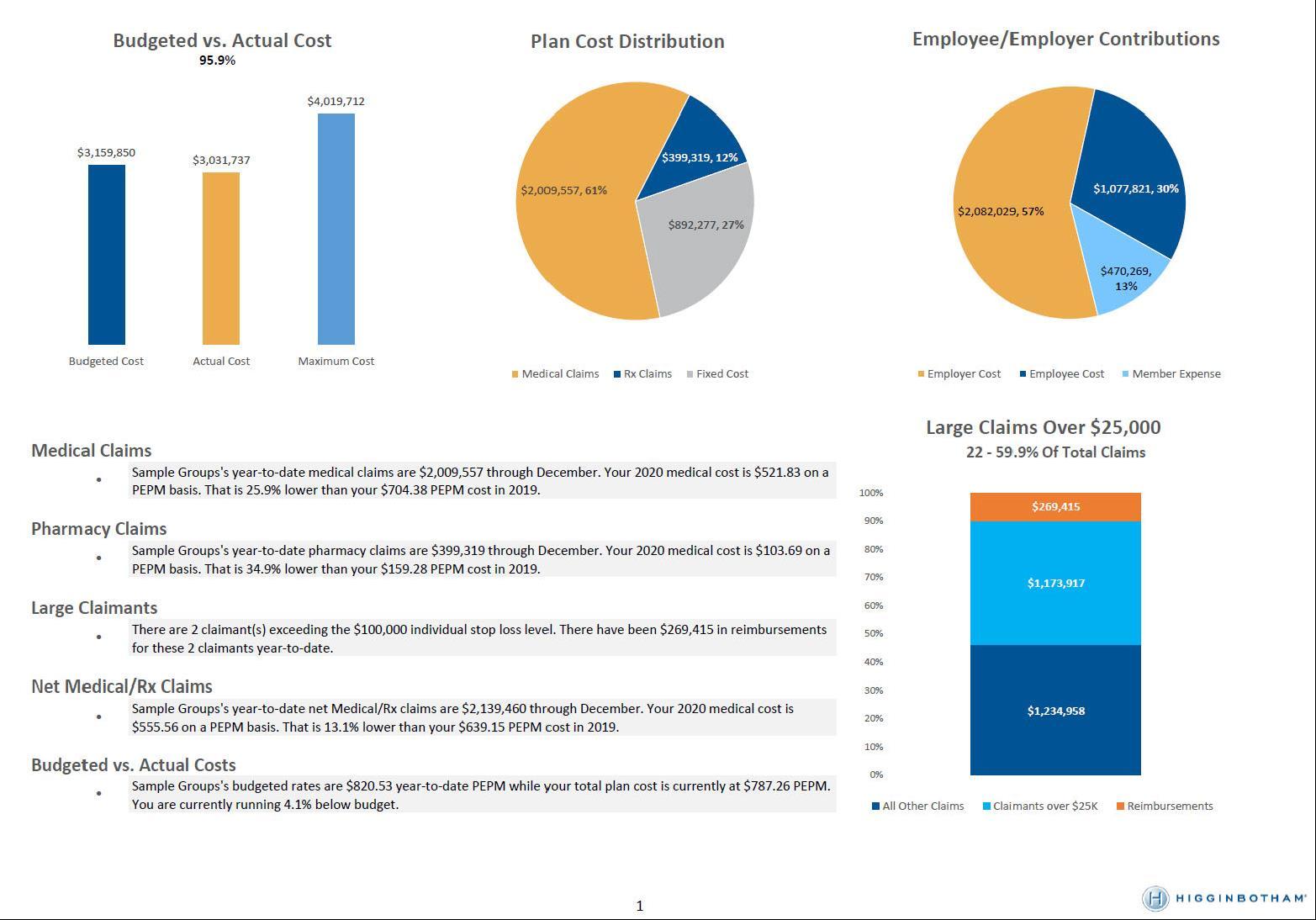

Financial Analysis

• Underwriting and renewal projections

• Monthly reporting

• Trend analysis and benchmarking

• Budget rate setting

• Plan design and contribution analysis

• Self-funded feasibility

Population Health Management

• Comprehensive program development

• Vendor coordination

• Health risk assessments and biometric screening

• Mental health initiatives

• Health and wellness education

• Incentive management

• In-house Medical Directors and Pharmacists

• Required plan documentation

• Section 125 administration

• 5500 reporting and filing

• Executive benefits

• Voluntary benefits

• Retirement plan services

• Telemedicine services

• Medicare education, navigation, and advocacy programs Communications

• Benefit guide and statements

• Open Enrollment materials

• Brand and logo development

• Crisis communications

• Custom landing pages, Flowcode, Brainsharks, and surveys

• Stewardship reports (bi-annually – more frequent if requested)

• 140 supported languages

• 7:00 a.m. to 6:00 p.m. CST | Monday - Friday

O E OF THE

EE

o u Emp o ees E E

o u Ca ie s E E

o u Communities CC LE

o u Cients E L EE E L EE

o t e i in ot am Communit und E

ta o e a e in t e

Single-Source Provider

– As of July 2025

Team Members

3.8K+ Offices across 17 states 130

Family to our employees

Retaining over half as employee-owners

Accountable to our clients

Supporting you after the sale from Day 2 to Day 365

Teammates to our carriers

Enjoying long-standing, deep-market relationships with industry leaders

Generous to our communities

Donating over $14 million to 1,800+ nonprofits and charities since 2014

“Being there day in and day out is what has led to our longevity and what has earned us the trust of our customers, our team, and our community partners.”

Rusty Reid, Chairman and CEO

We are committed to investing in the communities we serve. Upholding our core value of generosity, we believe in enriching the communities that grow our and our clients businesses.

Encouraging employees to donate their time and leadership, we coordinate volunteer initiatives with community partners and through internal outreach.

• In-house legal

• Audit support services

• Compliance reviews

• HR/legislative updates

• Compliance and interpretation for ERISA, ACA, HIPAA, COBRA, FMLA, etc.

• Quarterly compliance scorecards and action plans

AND SERVICES

• Section 105(h) and Section 125 nondiscrimination testing

• Section 414 controlled group analysis

• ERISAdocumentation

• 5500 preparation and reporting

• COBRA administration

Higginbotham's Compliance Dashboard and Calendar provides an at-a-glance view of annual compliance tasks, with automatic reminders (federal and state).

The Dashboard is customized with your plan details and serves as a repository for all compliance tasks and required plan documents.

Additional capabilities: retirement plan tracking/401(k) support,ACA reporting logs, and HIPAA policy attestations.

• Full service, turnkey administration

• Custom-branded cards

• Employer/employee portal

• Customer service center

• QSEHRAs

• ICHRAs

• Integrated eligibility validation and substantiation reporting

Prescription and specialty drugs are a significant cost of your medical plan.

Improper usage, drug intolerance, and brand drug purchases over generics create excess costs.

We contain overall Rx spend and provide real-time oversight through:

• Ingredient cost transparency

• Dispensing fees and AWP discounts

• Aggressive rebate negotiations

• Guaranteed minimum rebates

Based on group needs, we implement:

• Clinical programs

• International sourcing programs

• Patient assistance programs

• Manufacturer copay optimization

Higginbotham's Rx consulting division allows us to be agnostic and objective. This team works to evaluate your current pharmacy solution against potential cost saving alternatives.

Our methodology includes:

• Intent to Bid from vendors with 20+ contract terms

• Executable contracts requested with every RFP

• PBM matching aligned with member needs and risk

• Preferred modeling: pass-through pricing to determine "lowest net cost"

• Carve-in vs. carve-out evaluated case by case

• Cost containment programs like international Rx sourcing, patient assistance programs, copay solutions, manufacturing coupon programs

Beyond cost control measures, proactive tracking measures and exploration of alternative solutions keeps your pharmacy and Rx program effective.

• Pharmalucent program runs daily against all client claims to identify outliers in real time and address clinical programs to be implemented.

• ADC® reporting contains over 200 proprietary clinical programs, including those to address adherence, compliance, and savings.

• RxSurge Alert reviews 100% ofAWP cost increases based on Medi-Span.Any significant increases are discussed with clients.

A successful employee benefits program starts with clear goals that align with your company's objectives.

• Deep dive into: culture, cost drivers, pain points

• Align channels with your HR and finance teams

• Detailed contract review: administration, stop-loss, pharmacy

Evaluate Alternate Strategies

• Request for Proposal (RFP)

• Independent Third-Party Administrators (TPA)

• Pharmacy Benefit Managers (PBM)

• Centers of Excellence (COE)

• Reference-Based Pricing (RBP)

How far down the spectrum have you evaluated? What carriers were evaluated? What has been evaluated in the past?

Proprietary data analysis risk engine that offers:

• Side-by-side views to other companies and similar industries at individual or group levels

• Comparison of care delivery, costs, and quality

• Predictive modeling with evidence-based intervention

• Population segmentation and cost driver mapping

Offerings Included

• Self-insured financial plan support

• Pricing and reserve strategy

• Employee contribution strategy

• Long-term disability reserve and IBNR valuations

• Renewal validation

• Projecting renewal and calculating ASO reserves

• Trend modeling and break-even analysis

Simplified solutions and customized resources help you mitigate risks associated with today's complex self-funded market.

Risk Financing

Stop-loss, captives, group purchasing

Financial Analytics

Actuarial analysis and modeling, quarterly reporting

Population Health

Address macro cost trends within health plans

Data Analytics

Data warehouse provides actionable insights

Self- Funded

Specialty Practice

From risk financing and pharmacy, to clinical oversight and analytics, we are bring deep subject matter expertise to better manage costs, improve health care outcomes, and make confident, data-driven decisions.

Strategic Account Management

Strategic total life-cycle for self-funded clients

Level-Funded Solutions

Expanded access to alternate funding through scalable solution for small groups

Point Solution Tool Kit

Center of truth for evaluating, validating, and advising on the wide array of point solutions for self-funded employers

Clinical Cost Containment

Dedicated resources to reduce impact of larger, complex claims

PBM Consulting

Transparent pharmacy benefits with independent reviews, negotiations, and audits

We deliver a fully integrated model that combines insight, financial protection, and execution support for:

• Data Intelligence Powers every lever of the plan

• Medical/Network Optimization Driven by provider cost and utilization benchmarks

• Pharmacy Strategy

Informed by actual claims data

• Risk Financing Smarter stop-loss, captives, and budgeting strategy

• Population Health & Clinical Oversight Targeted programs and claim-specific containment

Benchmark provider pricing, utilization patterns, and in-network leakage

Your medical plan structure is optimized by aligning benefit design and network access with real world cost and provider data.

Identify inefficient or high-cost care settings

(e.g., hospital-based infusions, imaging)

Evaluate tiered, narrow, high-performance, or direct-contracting models

Recommend steerage and incentive strategies via plan design

Support carve-outs for targeted services (e.g., surgery, imaging, dialysis)

Every recommendation is backed by claims intelligence

—not trend reports.

Risk Financing Strategy

Financial performance of your plan is protected by aligning stop-loss structures and alternative funding strategies with actual exposure and performance.

• Tailor specific and aggregate levels to the group’s risk profile

• Evaluate contract terms, lasers, aggregating factors, and corridor options

• Consider captives, level-funded, and group purchasing strategies where appropriate

• Model renewals using underwriting, actuarial, and claims trend insights

W d ’t j t p v g —we design protection.

We evaluate and integrate emerging cost-containment solutions through a data-led outcome-focused lens-ensuring innovation drives measurable value.

• Continuously monitor the evolving vendor landscape-point solutions, tech platforms, care models

• Use claims and performance data to validate efficacy before recommending or deploying

• Design pilot programs with clear success metrics and ROI tracking

• Apply data to validate vendor performance and match actual plan needs using condition prevalence, utilization trends, and cost drivers

• Streamline and rationalize vendor footprint-only adopt what moves the needle

Population Health & Clinical Strategy

Strategic data mining and diagnostic reports help pinpoint macro and micro solutions that define a clear path to cost savings. This process informs plan design and tactical solutions to achieve favored outcomes.

Macro: Population Health Strategy

• Identify chronic condition trends (e.g., MSK, diabetes, BH, oncology, etc.)

• Recommend targeted wellness, DM, navigation, or advocacy programs

• Align vendor deployment with actual population needs and performance benchmarks

• Focus on impact, not vendor count

Micro: Clinical Cost Containment

Bringing clinical intelligence to the financial side of healthcare

• Identification & Monitoring

• Continuous tracking of high-dollar and emerging claims

• Clinical review of unusual billing patterns, escalations, and inappropriate care settings

• Benchmarking Cost & Quality

• Compare provider pricing, site-of-care decisions, and billed vs. allowed charges to market norms

• Strategic Cost Containment Review

• Site-of-care redirection

• Medical necessity validation

• Fraud, waste & abuse flagging

• Pharmacy utilization and sourcing review

• In-network leakage and contract alignment opportunities

Macro supports trend. Micro protects margin.

Clinical Navigation

Imaging/Surgical Bundles

Virtual/Direct Primary Care

Alternative Payors

Cancer/Infusions

Alternate Rx Sourcing

Programs

Rx Solutions

Sourcing Claim and ContractAudits

Aim to track utilization and ROI of each solution, via data analytics. Using that data to make active plan decisions for future solutions that increase value and lower spend.

Support for you existing HR team with a la carte HR services. We are more than your employee benefits broker—we are an extension of your HR team.

• Syndicate risk via HR professionals

• Custom training and coaching

• Overall guidance on performance management

• Employee issue advice and counseling

• Tech stack advisory for scalability

• Integration with ERP/HRIS systems

• Hiring alternatives

• Easily scaling staff

• Dedicated team support

• Qualified and non-qualified plans

• 401k, 403b, and DB plans

• Key person and buy-sell agreements

• Estate planning

• Wealth preservation and paradigm plan

• Payroll and HRIS automated processing

• HR and Payroll resources, internally and through third-party vendors

• Payroll integration with benefits platforms

• Employee lifecycle documentation support

• Source, screen, and interview all levels of talent (includes C-suite)

• Personality and skills assessment administration

• Compensation and benefits negotiation

• Background checks and credentialing

• Automated onboarding workflows

• Audit of current HR technologies

• Tech stack advisory for scalability

• Integration with ERP/HRIS systems

There's simply no substitute for human experience and knowledge. Enjoy unlimited, immediate access to certified, experienced advisors to help navigate your people risk management issues.

Whether you train because you have to or because it's just a really good idea, we've got you covered with a full-featured learning management system with the industry's most comprehensive unlimited training catalog.

The industry's only wizard-based handbook tool covering all 50 states, complete with policy change alerts to ensure your handbook is always up-to-date, accurate, and protecting your business as effectively as possible.

Fully integrated content combined with expert analysis or employment laws and regulations and best practice information to help you handle current issues and to better understand how to prepare for future issues.

You have enough on your plate just dealing with today's issues! Our team of attorneys and experts monitor and anticipate future challenges and prepare you through email and CE-accredited webinars.

Thousands of templates, tools, checklists, and policies to make your job easier. Resources include FLSA classification, performance management, salary benchmarking, interactive audits, job description builder, and more.

Employee Navigator is our in-house benefit admin solution

• Create detailedACA Reporting guide annually to support 1094/1095 requirements

• Custom configured onboarding, qualifying life event, and dependent verification workflows

• Provide detailed reports at Open Enrollment close

• In-house experts support:

• Payroll integrations

• Data exchange setups

• 834 carrier feeds

• API-based connectivity with carriers and payroll vendors

• Self-bill and consolidated billing capabilities

• SSO and multi-system login options for clients

As a specialty practice of Higginbotham, Higginbotham Public Sector (HPS) provides comprehensive insurance and employee benefits solutions specifically tailored to education and government institutions.

Through innovative proprietary enrollment systems, education, engagement, and administration solutions, we help businesses attract and retain valuable public sector employees.

Public Sector Expertise

• Service 600+ public and governmental entities

• Pioneered the development of employee benefit cooperatives

• Created the RISE Savings Program to address the unique needs of public sector employees

• Consultant for the majority of Texas Education Service Centers

Single-Source Benefits Solution

• Expert consultants and marketing resources

• Full insurance product suite, including property and casualty (P&C)

• Customized employee benefits offerings

• First-of-its-kind, proprietary online enrollment system

• In-house Day Two Services® for year-round, turnkey support

Day Two Services®

• Consolidated Billing and Reconciliation

• Section 125, COBRA, HSA/HRA,ACA Compliance

• HR Services and FMLAAdministration

• Population Health Management

Katie Callender, MPH, ACSM-CEP Director

Population Health Management

Lindsay Ewart, MA, CWWPM

Managing Consultant

Specialty: Key Accounts

Kelly Aguilar, CEAS, 500 ERYT, YACEP, PMA Consultant

Specialty: Ergonomics & Body Mechanics

Khai Huynh, CWP Consultant

Specialty: Non-Profits & Technology

Andrea Miller, MSW, LMSW

Senior Consultant

Specialty: Mental Health

Kelley Melcher Consultant

Specialty: Worksite Strategy & Engagement

Wellness programs are tailored to your goals, population, and budget. Our team works with you to design and implement initiatives.

Rely on Our In-House Professionals

• Health Education

• Corporate Wellness

• Exercise and Sports Physiology

• Nutritional Sciences

• Psychology and Mental Health

• Social Work

• Public Health

• Ergonomics and Musculoskeletal Health

i in ot am’s popu ation ea t mana ement consultants focus on five proven principles:

A population health management (PHM) program goes from good to great when it takes into account the overall well-being of your employees, their current risks, and their work environment. A strategic and cultural analysis paired with a claims review helps identify workforce issues and needs that can be targeted with the right solutions. This assessment provides a solid foundation for program development, implementation, facilitation, and evaluation.

2. Engage Management

Senior leadership support is crucial to the success of a program. Employers who serve as a role model and integrate well-being into the business strategy create a culture where healthy lifestyles are valued, promoted, and incentivized.

A holistic approach to population health considers your employees’ work-life balance, existing resources, potential solutions, and focuses on the specific health risk factors affecting them to create awareness. A comprehensive program may focus on many pillars of well-being, including social, mental, physical, spiritual, occupational, intellectual, environmental, and financial wellness.

4. Provide Education

A careful evaluation of health improvement solutions is important to keep employees informed and engaged. Resources may be provided through our PHM department, the community, a medical carrier or a vendor partner to encourage employees to make more informed health care decisions, take steps toward sustainable lifestyle changes, and take ownership of their individual well-being.

5. Measure Success

Setting tangible goals and analyzing aggregated data gives us powerful information to see what initiatives are working and what needs attention. Integrate outcomes into renewal strategy through baseline measurements that include medical and pharmacy utilization, medical claims costs, employee engagement and participation, and overall employee satisfaction.

The best employee benefits programs are those that ensure employees know of and understand how to use their benefits.

Companies with best practice plans report that their participants receive consistent, uniform, and branded communications.

Our internal Employee Benefits Communications team is available to create strategic communications that address your specific benefit needs and inform employees before, during, and after Open Enrollment.

Quick and convenient texts send a clear, concise, and cost-effective message when you want to instantly communicate with a select audience.

High-quality video creation increases engagement and connection with your target audience and showcases your knowledge and know-how on a given topic.

These virtual seminars allow participants to hear what you have to say in a compelling, interactive real-time event that feels more like a conversation.

Get your message across with a one-time digital audio program or a series of episodes that you can download and stream –anywhere, anytime.

Executes digital technology, interactive PDFs, landing pages, websites, analytic microsites, photography, and videos.

Develops engaging print and digital tool kits, annual planning calendars, drip campaigns, SMS text messaging, landing pages, videos, Brainsharks, newsletters, onboarding booklet, and custom products for our clients' employees.

Creates custom employee benefits collateral, engagement platforms, presentations, and informational multimedia for our public sector clients.

Employees who feel cared for are....

• 1.6x more likely to feel valued

• 1.5x more likely to say they are happy

• 1.5x more likely to feel a sense of belonging at work

• 1.3x more likely to feel successful

When employees understand how their benefits work, they are

• 50% more likely to be loyal to their employer

• 6% more likely to be engaged at work

And yet, nearly two-thirds of employees (62%) are not completely confident they know about all their employer's benefits.

• Almost half of employees (45%) do not fully understand their benefits package

*Source: 2024 MetLife EB Survey

Our internal full-service call and communications center is committed to supporting your employees from Open Enrollment and throughout the year. This team of experts handles a range of inquiries and responsibilities—from lost ID cards to complex claims—allowing your HR team to focus on other pressing priorities.

• Average call time exceeds 13 minutes

• Benefit eligibility administration and verification

• U.S.-based team located in Texas and Florida

• Certified ERC professionals

• Roles and responsibilities grid between HR and ERC

• Benefit claims assistance and resolution

• Quarterly customized call reports

• Dedicated toll-free number (group size dependent)

• 140+ languages available with multilingual enrollment support

• System enrollments based on access

When it comes to creating best-in-class resources, we’ e a t usted pa tne fo ou c ients and t ei employees. They rely on us to create clear, concise, and accurate materials.

SCANHERE TO LEARN MORE ABOUT WHAT WE CANDO FOR YOU.

• Logo and brand development

• Memos, letters, and instructions

• Payroll stuffers and postcards

• Benefits and recruiting summaries

• Company announcements and newsletters

• Enrollment guides

• Wallet cards and envelopes

• Wellness campaigns

• Special mailings and fulfillment

• Promotional materials (magnets, key fobs, etc.)

• Translations

• Electronic–interactive PDFs and benefit portal branding

• Social Media–LinkedIn, X, Facebook, and blogs

• Total compensation statements

You face a variety of concerns with regards to your retirement plan. We work with you to align corporate goals with the retirement and financial needs of your employees.

• Regulatory compliance and fiduciary risk mitigation

• Fee benchmarking

• Competitive investment menus

• Participant education and readiness

p an’s named fiducia is accounta e fo a aspects of an o anization’s eti ement p an.

We assist with the formal delegation of daily administrative and investment responsibilities to a retirement plan committee.

• Plan governance

• Fiduciary compliance

• Investment due diligence

• Target date fund selection

• Benchmarking record keeping fees

• Benchmarking advisor feeds

• Plan design optimization

Plan sponsors are notified of their fiduciary duty and assisted in developing procedures and accountability standard that help mitigate fiduciary liability.

• Vendor market analysis

• Plan benchmarking

• Vendor management

• Merger & acquisition assistance

• Participant communications strategy

• Cybersecurity protocols

• Fiduciary insurance guidance

Top executive talent demands creative, tax-efficient compensation structures. Providing offers inclusive of supplemental executive benefits helps retain, motivate, and recruit top talent.

Our Solutions

• Supplemental retirement income strategies

• Executive disability and life insurance

• Key person insurance

• Split-dollar arrangements

• Deferred compensation plans (SERPs, 409A)

• Non-qualified savings plans for highly compensated employees

• Golden handcuffs and retention strategies

With performance-based benefits, you can reward the driving force behind your business while meeting long-term retention and financial goals. of highly compensated employes say they are very concerned about the financial effects of a loss of income in the event of a disability and/or premature death.

*Data collected in connection with MetLife's 11th Annual Study of Employee Benefits Trends 42%

Executive Life Higher incomes need larger death benefits. Supplemental life insurance provides an added layer of protection that suits employee's lifestyles.

We help you enhance your core benefits with executive life and disability, salary continuation plans, deferred compensation plans, and more.

Executive Disability Group long-term disability plans have coverage limits, leaving highly compensated executives with inadequate income protection. Supplemental disability coverage can enhance monthly benefits, as well as safeguard bonus and commission income, while also offering portability.

To further enhance your executive offerings, these additional benefits will continue to motivate your team and provide an additional sense of security.

While buy-sell contracts specify how the business will transfer if an owner dies or becomes disabled, many are not funded, leaving the surviving shareholders in a financial bind. This calls for life and disability policies designed specifically for this purpose and an experienced advisor to implement them.

Essential protection for high-net-worth individuals to protect inheritances, address estate taxes, and allocate assets as intended.

efe ed Compensation an ( C )

401k plans limit what highly paid executives can contribute. A DCP provides greatly increased deferral limits to select employees. These tax-advantaged savings can increase key employee’s retirement benefits without creating yearend testing problems.

e e son

Key person life insurance protects the company if an employee with specific skills, knowledge, or relationships passes. The policy proceeds can supplement lost income and cover expenses while a replacement is hired.

Executive onus an (E )

An effective, simple approach to enhance key employee benefits.A life insurance policy is purchased for the executive, treating the premium as a compensation bonus. The employee owns the policy and can use the cash value for retirement and protection for their family.

Bank- wned Life nsu ance ( L )

BOLI is used by banks to manage employee benefit costs and enhance overall financial performance. Purchased on select executives, it provides a tax-efficient way for banks to fund future employee benefits, such as retirement plans, while also generating a reliable return on investment.

upp ementa Executive eti ement an ( E )

Qualified plans (401k and pensions) limit company contributions for highly paid executives. But the company can still provide an enhanced retirement benefit to select employees. The SERP provides additional employer-provided retirement income as outlined in the agreement.