Employee Benefits for Authentix

The Higginbotham Difference

Lead with Values and Value Leads.

Executive Summary 01

Executive Summary

Authentix operates in a highly specialized, global environment where precision, compliance, and cross-border execution are foundational to the business. As your organization continues to grow through international expansion and acquisition, your employee benefits strategy must support a distributed workforce, evolving regulatory considerations, and future-state workforce needs.

Higginbotham is well positioned to support Authentix through a unified, single-source model that brings U.S. and international benefits together under a coordinated framework. Our approach balances cost management, funding strategy, compliance, and employee experience while maintaining the flexibility required to support continued growth and global operations.

To support Authentix’s global footprint, Higginbotham leverages its partnership with Globex, a network of 300+ firms in 130+ countries that provides local regulatory expertise, in-market execution, and international benefits capabilities. This collaboration enables centralized strategy while honoring country-specific requirements and workforce nuances.

Domestically, we will work with Authentix to evaluate and optimize funding alternatives (ASO, self-funded, and level-funded solutions) supported by analytics, forecasting, and underwriting expertise. Our in-house specialists provide benchmarking, claims analysis, and strategic planning to support financial sustainability and long-term decision-making.

Through Day Two Services®—including our Employee Response Center (ERC) and Population Health Management (PHM) expertise—we deliver year-round guidance, advocacy, communication, and administration to reduce administrative burden and improve employee understanding and engagement across all benefits functions.

We welcome the opportunity to support Authentix’s global workforce and help align benefits strategy with your organization’s continued expansion and mission.

Nelson Parrott Strategic Account Executive

TJ Hutchings Managing Partner

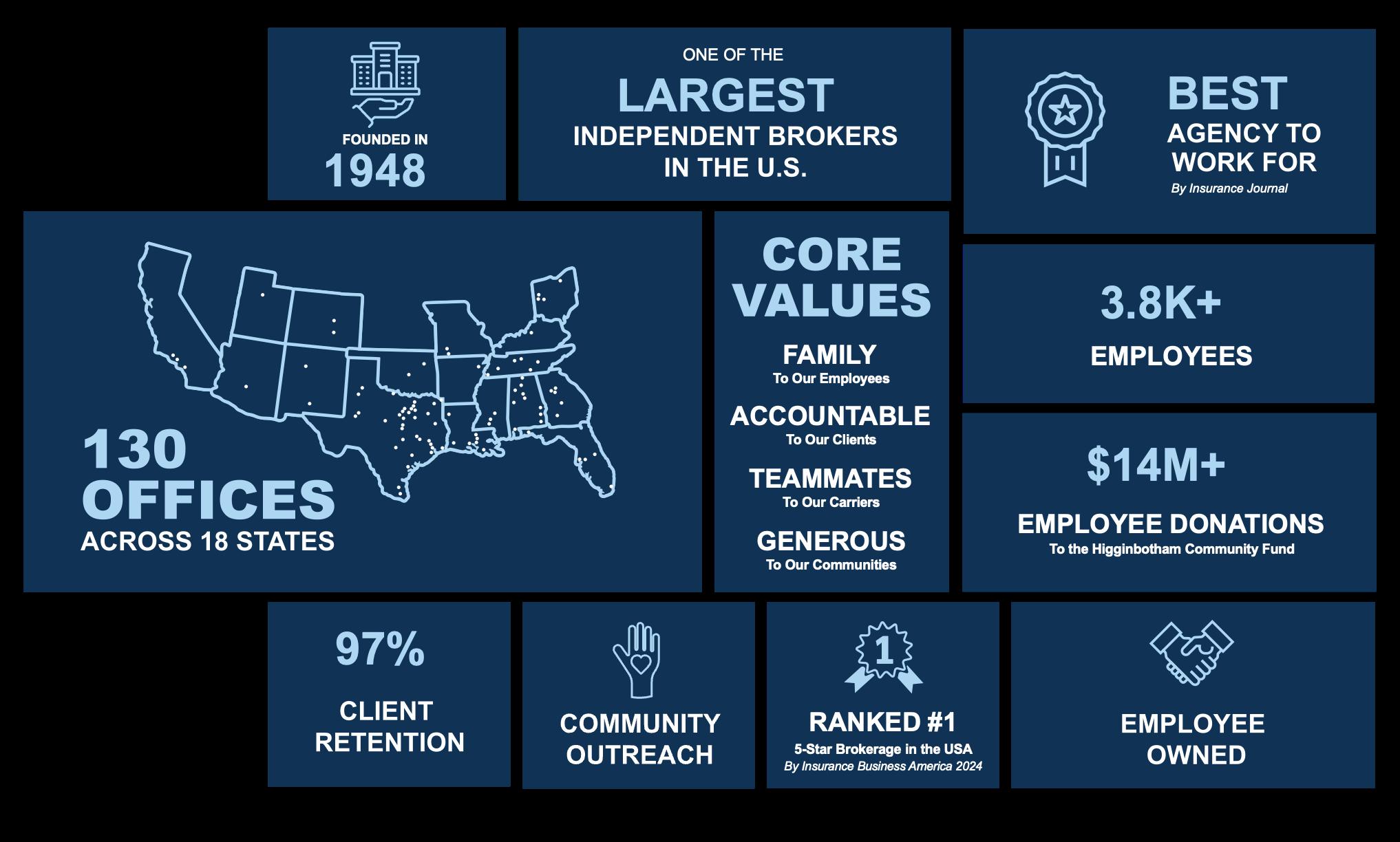

The Higginbotham Difference

Higginbotham At-a-Glance

The Higginbotham Difference

A single-source solution inspired by your needs.

You deserve solutions that are built for your business.

That's why Higginbotham starts with listening and ends with insurance, financial, and HR services. Designed to address your risk, budget, and operational goals, we are a multifaceted broker with a suite of services built around serving you.

Today, we are one of the leading independent brokerage firms in the nation, and largest in Texas. This long-standing commitment to excellence is reflective of our premier status across the U.S. Paired with market leverage and thought leadership, your business benefits from our highly sought-after and proprietary Day Two Services® .

A strong employee benefits plan is key to a healthy, happy, and productive workforce. Employers who stay informed on benefit trends are better equipped to meet employee needs and boost productivity. Higginbotham offers:

• Accessible year-round support from a team dedicated to your and your employees.

• Affordable tailor-made solutions, education, and processes to elevate your benefits.

• Customized cutting-edge technology to help control health care costs and save time.

Higginbotham is employee benefits made easy.

The Higginbotham Difference

Higginbotham's single-source service models provides you with a holistic client experience that goes beyond placement.

From traditional health insurance to everyday administration, our Day Two Services® are delivered by in-house specialists across benefits, compliance, wellness, technology, and more.

No outsourcing and committed to flat-fee, transparent pricing.

The Higginbotham Difference

Our Day Two Services® leadership team guides Higginbotham in innovative solutions, facilitating worldclass services for our clients. From communications to self-insured solutions, these industry experts contribute to your benefits program and remains available the entire duration of your policy term.

Judi Archer

Financial Services Communications and Business Development Vice President

Jenn Wordell-Todd COBRA Administration Director

Jeff Wood Self-Funded Health Solutions Vice President

Francine Tebo Employee Engagement Director

Jill Sailors, PharmD

HiggRx Senior Clinical Specialist

Meet Your Team of Experts

Katie Callender

Population Health Management Director

Ross Carmichael, J.D., CEBS Compliance and Day Two Services® Managing Director

Tammy Decker HR Services Managing Director

Maggie Hadden Human Resources Technology Director

Stephanie Holbert TPA Services Director

Sam McMahan Financial Analytics Director

Day Two Services®

Day-to-Day Team

• Cross-functional account team with weekly touchpoints

• New partner onboarding

• Existing contract review

• Strategic plan design

• Industry benchmarking and gap analysis

• Financial planning and forecasting

CDHP Administration

• Assigned CDHP team

• Commuter plan, HDHP, FSA, HRA, LSA

• Daily claims processing

• Non-discrimination testing

• Plan document services

• Dedicated toll-free service number and email

COBRA Administration

• Direct bill services - FMLA, LOA, Retirees, etc.

• Texas state continuation administration

• Real-time compliance alerts and eligibility tracking

• Assigned COBRA client managers

• Toll-free service line; 8:30 a.m. to 5:00 p.m. CST Monday - Friday

• Customized, multilingual communications

• Employee engagement campaigns

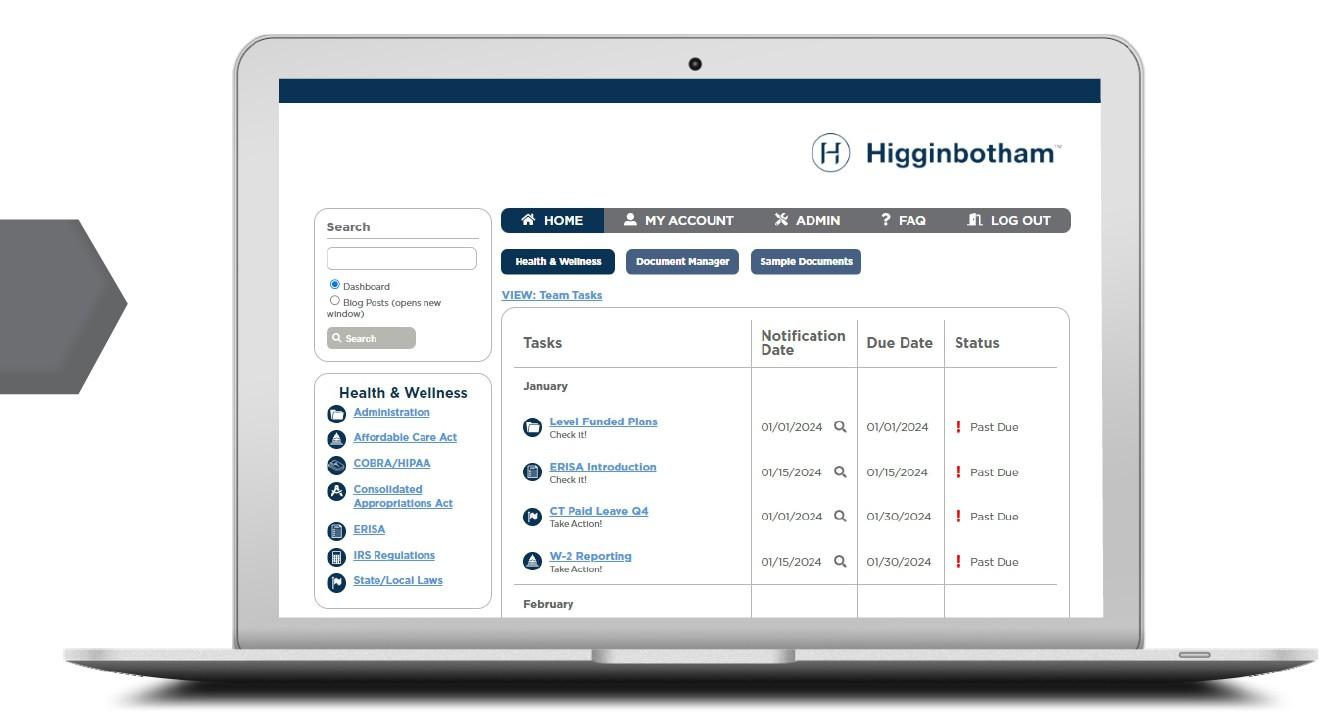

Compliance

• Compliance consulting

• Legislative, regulatory, political updates

• Audit support

• Customized compliance dashboard and calendar

• ERISA, HIPAA, COBRA, FMLA, ADA, and ACA guidance

HR Services

• HR care team and outsourcing

• Employee onboarding and consulting

• Payroll and benefits administration

• HR technology support and implementation

• FMLA/LOA administration

• State-specific & company leave policies

• Escalation of compliance concerns

HR Technology

• System vetting and implementation

• ACA reporting vendors

• Payroll platform integration

• HRIS/HCM consulting

• Managed buying process (RFP)

• Vendor assistance and escalation

Employee Response Center

Financial Analysis

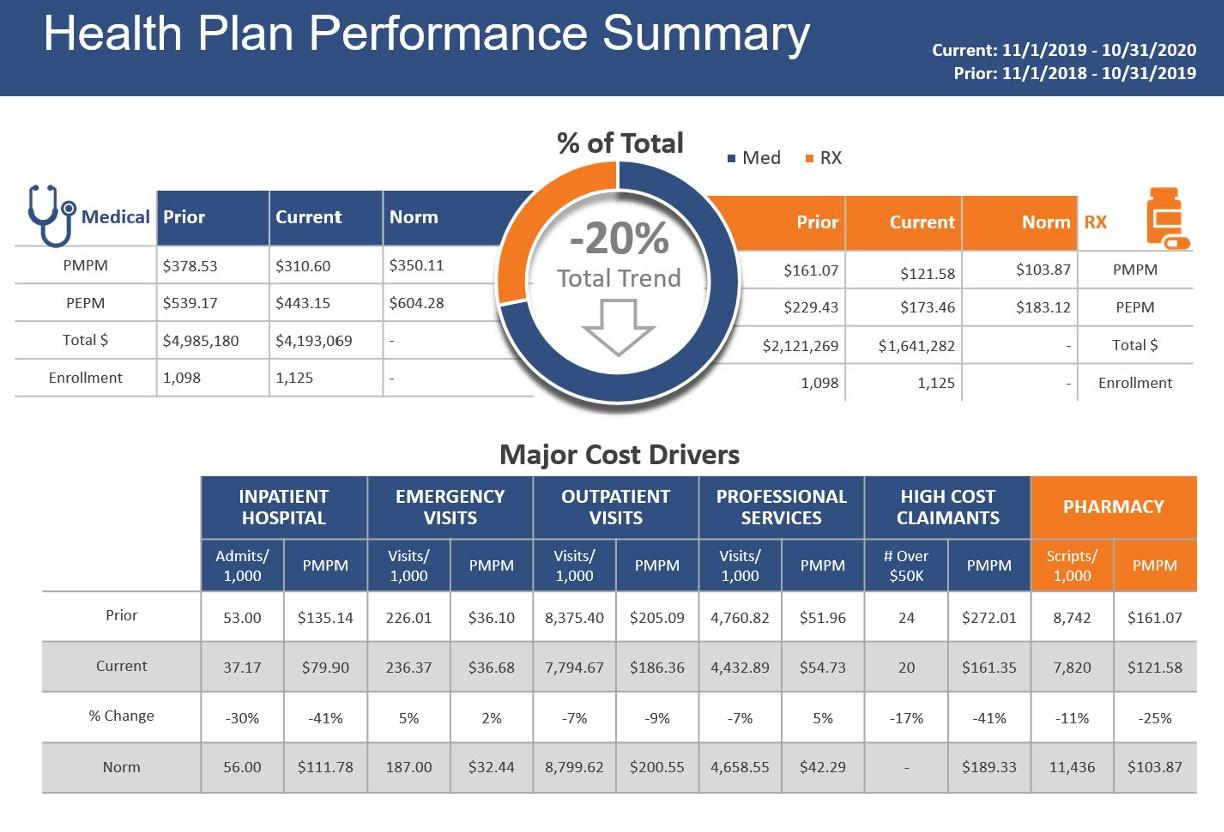

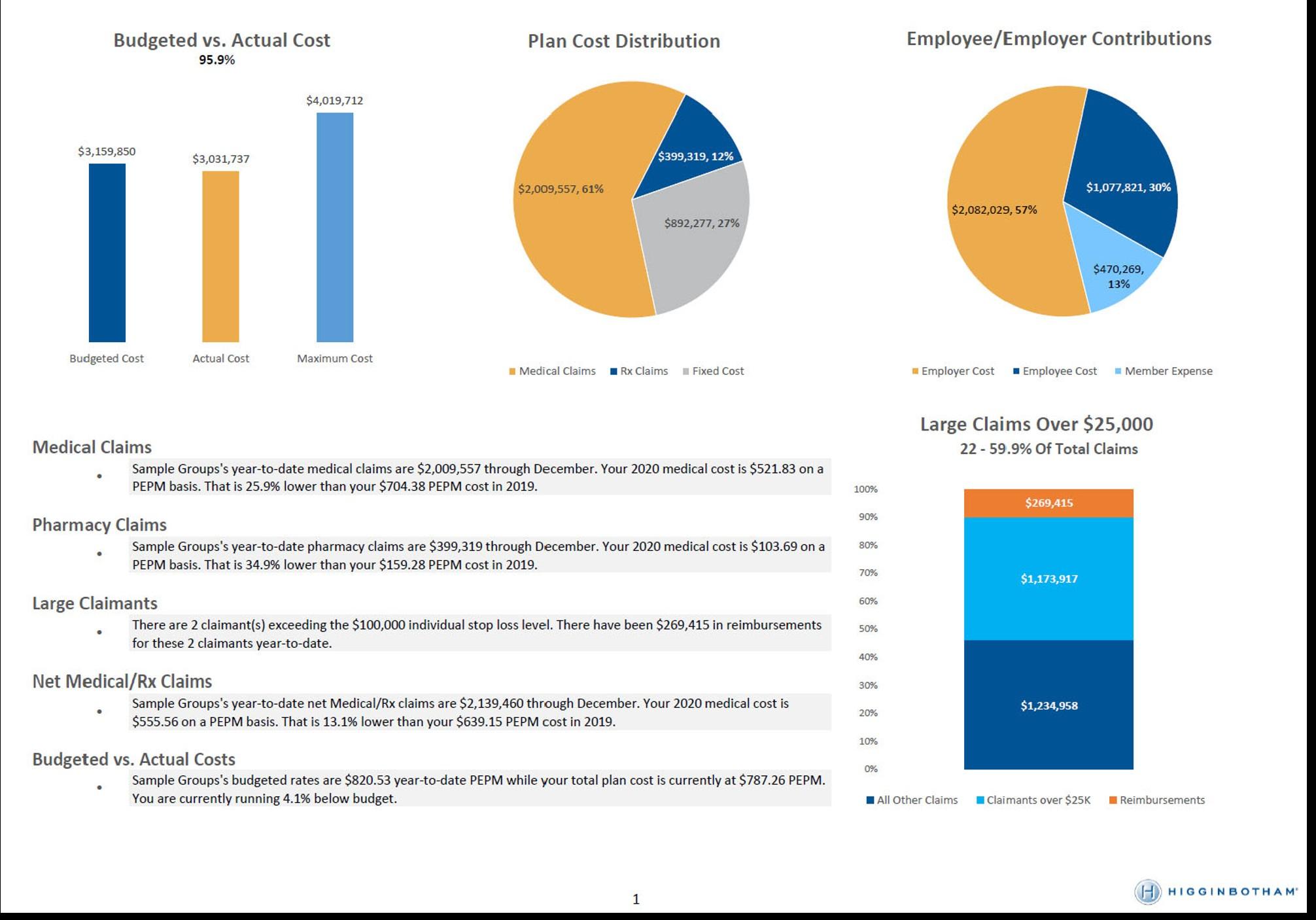

• Underwriting and renewal projections

• Monthly reporting

• Trend analysis and benchmarking

• Budget rate setting

• Plan design and contribution analysis

• Self-funded feasibility

Population Health Management

• Comprehensive program development

• Vendor coordination

• Health risk assessments and biometric screening

• Mental health initiatives

• Health and wellness education

• Incentive management

Additional Services

• In-house Medical Directors and Pharmacists

• Required plan documentation

• Section 125 administration

• 5500 reporting and filing

• Executive benefits

• Voluntary benefits

• Retirement plan services

• Telemedicine services

• Medicare education, navigation, and advocacy programs Communications

• Benefit guide and statements

• Open Enrollment materials

• Brand and logo development

• Crisis communications

• Custom landing pages, Flowcode, Brainsharks, and surveys

• Dedicated toll-free phone number and email address

• High-volume SMS and two-way chat

• Stewardship reports (bi-annually – more frequent if requested)

• 140 supported languages

• 7:00 a.m. to 6:00 p.m. CST | Monday - Friday

Strategic Planning 03

Strategic Planning

A successful employee benefits program starts with clear goals that align with your company's objectives.

Discovery Phase

• Deep dive into: culture, cost drivers, pain points

• Align channels with your HR and finance teams

• Detailed contract review: administration, stop-loss, pharmacy

Evaluate Alternate Strategies

• Request for Proposal (RFP)

• Independent Third-Party Administrators (TPA)

• Pharmacy Benefit Managers (PBM)

• Centers of Excellence (COE)

• Reference-Based Pricing (RBP)

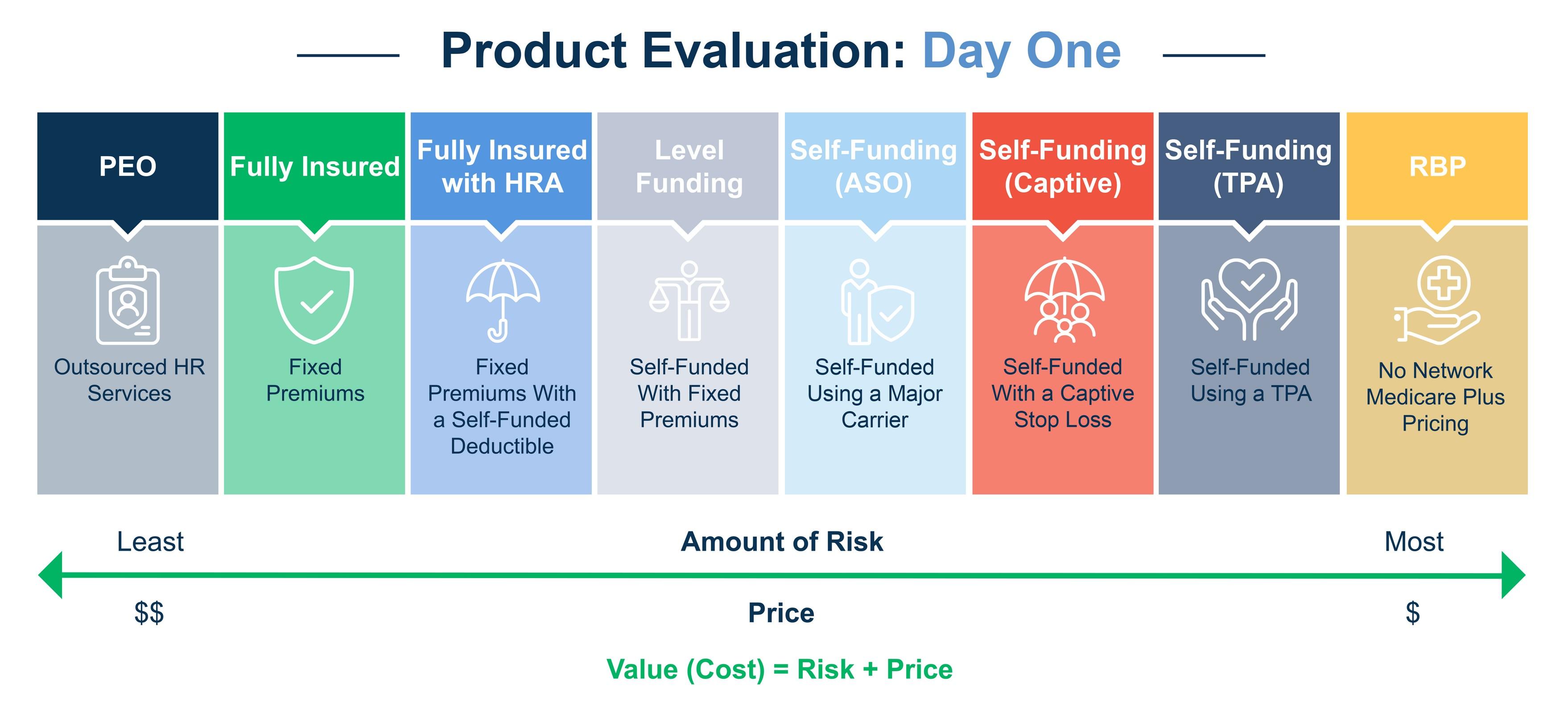

Product Evaluation: Day One

How far down the spectrum have you evaluated? What carriers were evaluated? What has been evaluated in the past?

Clinical Analysis

Proprietary data analysis risk engine that offers:

• Side-by-side views to other companies and similar industries at individual or group levels

• Comparison of care delivery, costs, and quality

• Predictive modeling with evidence-based intervention

• Population segmentation and cost driver mapping

Financial Analysis

Offerings Included

• Self-insured financial plan support

• Pricing and reserve strategy

• Employee contribution strategy

• Long-term disability reserve and IBNR valuations

• Renewal validation

• Projecting renewal and calculating ASO reserves

• Trend modeling and break-even analysis

Higginbotham’s Globex Partnership

• Benefits team dedicated to delivering custom solutions with a collaborative, consultative approach

• Higginbotham’s international department

• 300+ brokers and correspondents in 160 countries

Higginbotham’s Globex Partnership: Service Model

Information + Education

• Country Profiles

• Newsletters / Updates Consulting Services

• Benefits Assessments

• M&A Due Diligence

Key Features

• Enables client to centrally control and manage local benefits activities.

• Benefits renewal support around the world.

• Partner Desks Brokerage Services

• Plan Design, Marketing, Implementation

• Plan Servicing (Centrally Managed, Locally Implemented)

Partner Desk Services

Flexible, renewable, retainer-based arrangement

Strategic Initiative Opportunities

• Multinational Pooling

• Compliant International Pensions

• Global Wellness / EAP / Gym Memberships, etc.

• Expatriate and Business Traveler Benefits

• Access to ongoing advice and assistance with other benefits or HR needs (planned or unexpected).

• Flexibility to work with existing local broker relationships.

• Global Communication Branding / Deliverables

• Evacuation / Repatriation / Crisis Management (i.e., Bird Flu, Ebola)

• International HR (i.e., employee handbooks, international compensation, etc.)

APPENDIX

HR Services

HR Services

Support for you existing HR team with a la carte HR services. We are more than your employee benefits broker—we are an extension of your HR team.

Outsourcing

• Syndicate risk via HR professionals

• Custom training and coaching

• Overall guidance on performance management

• Employee issue advice and counseling

• Tech stack advisory for scalability

• Integration with ERP/HRIS systems

• Hiring alternatives

• Easily scaling staff

• Dedicated team support

• Qualified and non-qualified plans

• 401k, 403b, and DB plans

• Key person and buy-sell agreements

• Estate planning

• Wealth preservation and paradigm plan

• Payroll and HRIS automated processing

• HR and Payroll resources, internally and through third-party vendors

• Payroll integration with benefits platforms

• Employee lifecycle documentation support

Administration

• Source, screen, and interview all levels of talent (includes C-suite)

• Personality and skills assessment administration

• Compensation and benefits negotiation

• Background checks and credentialing

• Automated onboarding workflows

Technology

• Audit of current HR technologies

• Tech stack advisory for scalability

• Integration with ERP/HRIS systems

Real Answers from Real Experts

There's simply no substitute for human experience and knowledge. Enjoy unlimited, immediate access to certified, experienced advisors to help navigate your people risk management issues.

Content You Can Rely On

Fully integrated content combined with expert analysis or employment laws and regulations and best practice information to help you handle current issues and to better understand how to prepare for future issues.

Train Your Staff (and Yourself!)

Whether you train because you have to or because it's just a really good idea, we've got you covered with a full-featured learning management system with the industry's most comprehensive unlimited training catalog.

A Living Handbook

The industry's only wizard-based handbook tool covering all 50 states, complete with policy change alerts to ensure your handbook is always up-to-date, accurate, and protecting your business as effectively as possible.

Stay Ahead of the Curve

You have enough on your plate just dealing with today's issues! Our team of attorneys and experts monitor and anticipate future challenges and prepare you through email and CE-accredited webinars.

Tools, Forms, and Templates

Thousands of templates, tools, checklists, and policies to make your job easier. Resources include FLSA classification, performance management, salary benchmarking, interactive audits, job description builder, and more.

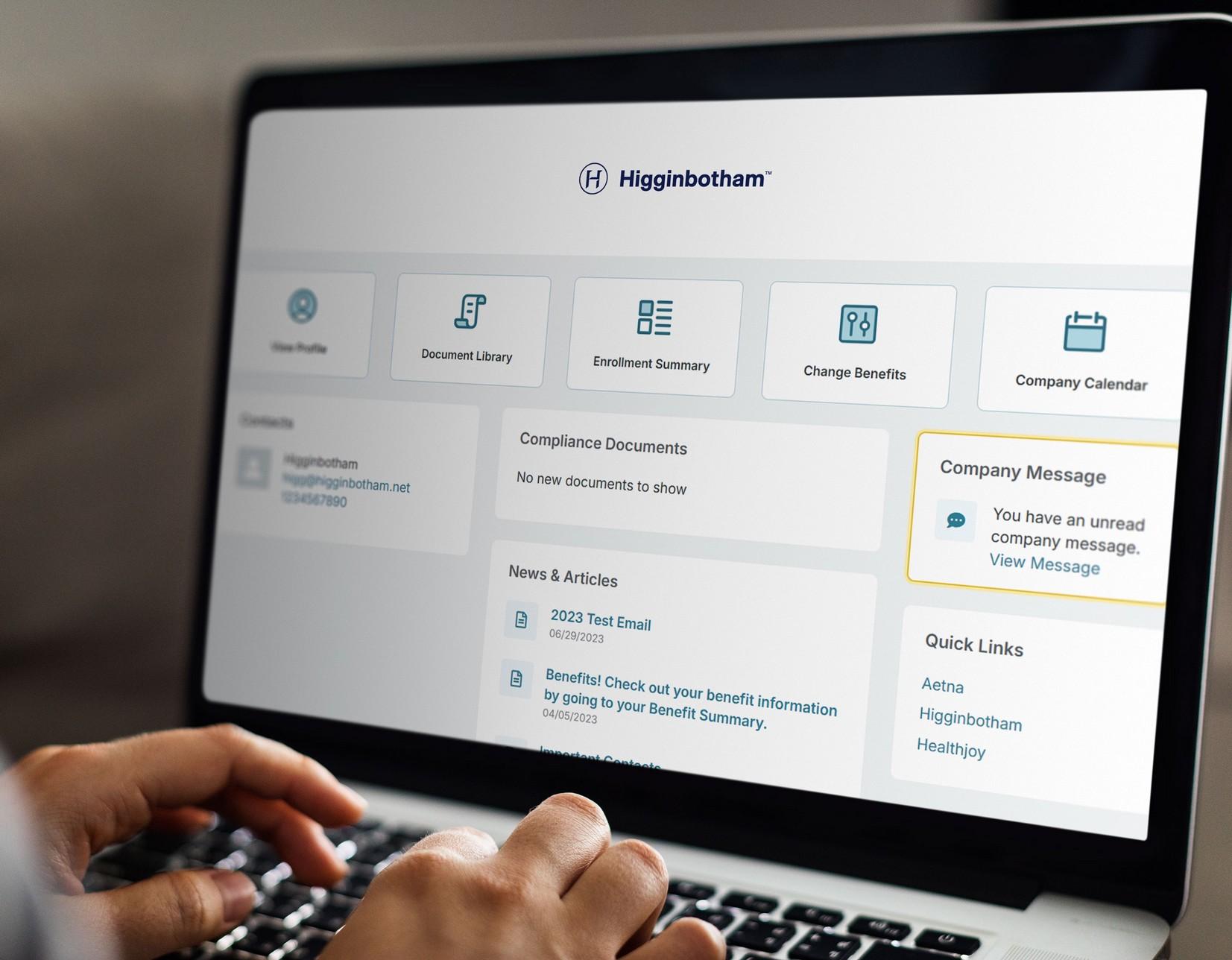

Employee Navigator

Employee Navigator is our in-house benefit admin solution

• Create detailed ACA Reporting guide annually to support 1094/1095 requirements

• Custom configured onboarding, qualifying life event, and dependent verification workflows

• Provide detailed reports at Open Enrollment close

• In-house experts support:

• Payroll integrations

• Data exchange setups

• 834 carrier feeds

• API-based connectivity with carriers and payroll vendors

• Self-bill and consolidated billing capabilities

• SSO and multi-system login options for clients

Self-Funded Center of Excellence

Self-Funded COE

Simplified solutions and customized resources help you mitigate risks associated with today's complex self-funded market.

Risk Financing

Stop-loss, captives, group purchasing

From risk financing and pharmacy, to clinical oversight and analytics, we are bring deep subject matter expertise to better manage costs, improve health care outcomes, and make confident, data-driven decisions.

Strategic Account Management

Strategic total life-cycle for self-funded clients

Financial Analytics

Actuarial analysis and modeling, quarterly reporting

Population Health

Address macro cost trends within health plans

Data Analytics

Data warehouse provides actionable insights

Specialty Practice

Level-Funded Solutions

Expanded access to alternate funding through scalable solution for small groups

Center of truth for evaluating, validating, and advising on the wide array of point solutions for self-funded employers Self- Funded

Clinical Cost Containment

Dedicated resources to reduce impact of larger, complex claims

Point Solution Tool Kit

PBM Consulting

Transparent pharmacy benefits with independent reviews, negotiations, and audits

Self-Funded COE

We deliver a fully integrated model that combines insight, financial protection, and execution support for:

Our Self-Funded Strategy at-a-Glance

• Data Intelligence Powers every lever of the plan

• Medical/Network Optimization Driven by provider cost and utilization benchmarks

• Pharmacy Strategy

Informed by actual claims data

• Risk Financing Smarter stop-loss, captives, and budgeting strategy

• Population Health & Clinical Oversight Targeted programs and claim-specific containment

This isn’t just TPA management—it’s active plan stewardship.

Self-Funded COE

Medical & Network Strategy

Benchmark provider pricing, utilization patterns, and in-network leakage

Your medical plan structure is optimized by aligning benefit design and network access with real world cost and provider data.

Identify inefficient or high-cost care settings

(e.g., hospital-based infusions, imaging)

Evaluate tiered, narrow, high-performance, or direct-contracting models

Recommend steerage and incentive strategies via plan design

Support carve-outs for targeted services

(e.g., surgery, imaging, dialysis)

Every recommendation is backed by claims intelligence —not trend reports.

Self-Funded COE

Risk Financing Strategy

Financial performance of your plan is protected by aligning stop-loss structures and alternative funding strategies with actual exposure and performance.

Captive Stop-Loss Layer

• Tailor specific and aggregate levels to the group’s risk profile

• Evaluate contract terms, lasers, aggregating factors, and corridor options

• Consider captives, level-funded, and group purchasing strategies where appropriate

• Model renewals using underwriting, actuarial, and claims trend insights

We don’t just place coverage—we design protection.

Self-Funded COE

We evaluate and integrate emerging cost-containment solutions through a data-led outcome-focused lens-ensuring innovation drives measurable value.

Innovation & Emerging Solutions Strategy

• Continuously monitor the evolving vendor landscape-point solutions, tech platforms, care models

• Use claims and performance data to validate efficacy before recommending or deploying

• Design pilot programs with clear success metrics and ROI tracking

• Apply data to validate vendor performance and match actual plan needs using condition prevalence, utilization trends, and cost drivers

• Streamline and rationalize vendor footprint-only adopt what moves the needle

We don’t chase trends-we apply innovation with intention

Self-Funded COE

Population Health & Clinical Strategy

Strategic data mining and diagnostic reports help pinpoint macro and micro solutions that define a clear path to cost savings. This process informs plan design and tactical solutions to achieve favored outcomes.

Macro: Population Health Strategy

• Identify chronic condition trends (e.g., MSK, diabetes, BH, oncology, etc.)

• Recommend targeted wellness, DM, navigation, or advocacy programs

• Align vendor deployment with actual population needs and performance benchmarks

• Focus on impact, not vendor count

Micro: Clinical Cost Containment

Bringing clinical intelligence to the financial side of healthcare

• Identification & Monitoring

• Continuous tracking of high-dollar and emerging claims

• Clinical review of unusual billing patterns, escalations, and inappropriate care settings

• Benchmarking Cost & Quality

• Compare provider pricing, site-of-care decisions, and billed vs. allowed charges to market norms

• Strategic Cost Containment Review

• Site-of-care redirection

• Medical necessity validation

• Fraud, waste & abuse flagging

• Pharmacy utilization and sourcing review

• In-network leakage and contract alignment opportunities

Macro supports trend. Micro protects margin.

Year 1 Solutions: Custom Built

Clinical Navigation

Imaging/Surgical Bundles

Virtual/Direct Primary Care

Alternative Payors

Cancer/Infusions

Alternate Rx Sourcing 340B Programs Specialty Rx Solutions

Strategy

Sourcing Claim and Contract Audits

Aim to track utilization and ROI of each solution, via data analytics. Using that data to make active plan decisions for future solutions that increase

and lower spend.

Self-Funded COE

Crawl

Compliance

Guidance

• In-house legal

• Audit support services

• Compliance reviews

• HR/legislative updates

• Compliance and interpretation for ERISA, ACA, HIPAA, COBRA, FMLA, etc.

• Quarterly compliance scorecards and action plans

Tools and Services

• Section 105(h) and Section 125 nondiscrimination testing

• Section 414 controlled group analysis

• ERISA documentation

• 5500 preparation and reporting

• COBRA administration

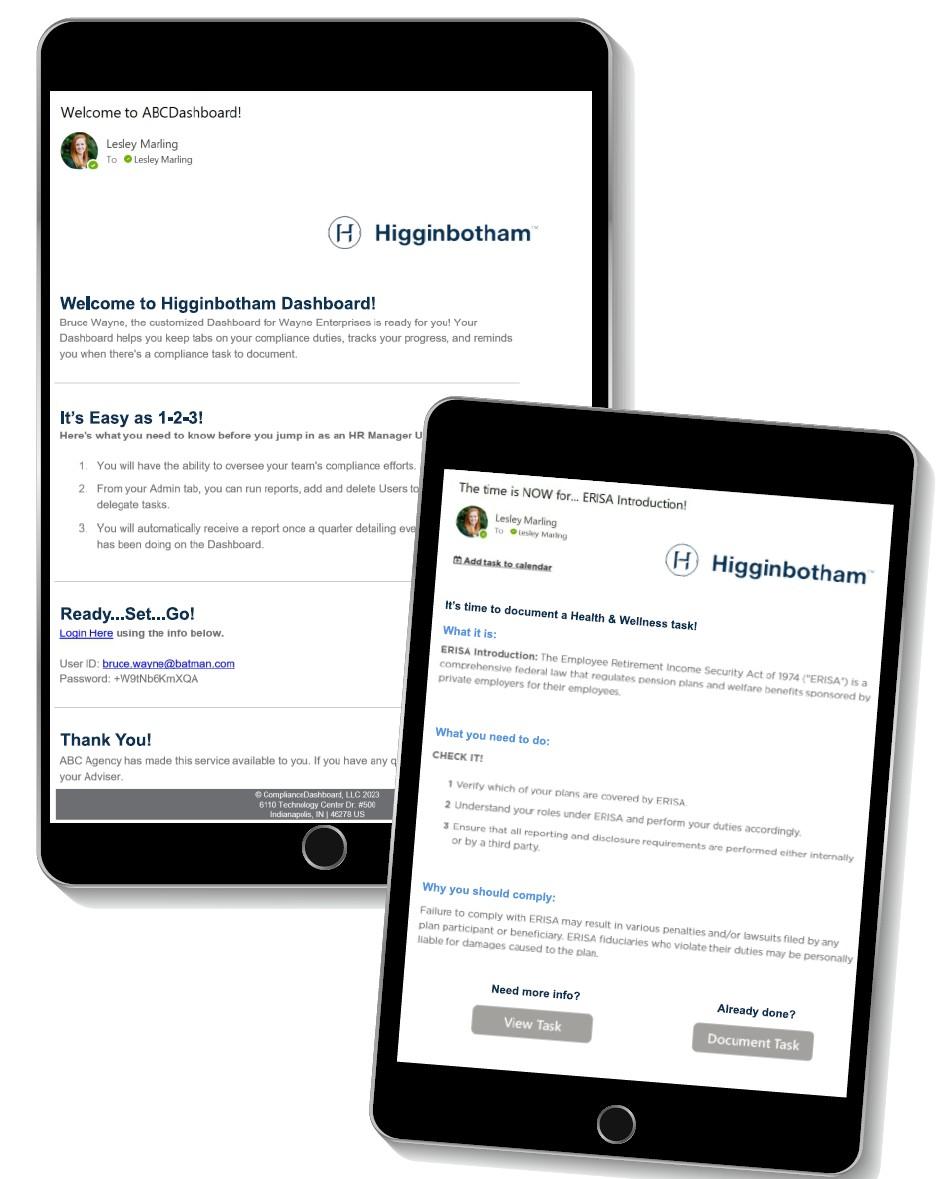

Compliance - Automated

Higginbotham's Compliance Dashboard and Calendar provides an at-a-glance view of annual compliance tasks, with automatic reminders (federal and state).

The Dashboard is customized with your plan details and serves as a repository for all compliance tasks and required plan documents.

Additional capabilities: retirement plan tracking/401(k) support, ACA reporting logs, and HIPAA policy attestations.

CDHP Administration

Section 125 Health FSA/Dependent Care Accounts

• Full service, turnkey administration

• Custom-branded cards

• Employer/employee portal

• Customer service center

HRA Plans

• QSEHRAs

• ICHRAs

• Integrated eligibility validation and substantiation reporting

LSA HRA FSA

Rx Solutions

Rx Solutions

Prescription and specialty drugs are a significant cost of your medical plan.

Improper usage, drug intolerance, and brand drug purchases over generics create excess costs.

We contain overall Rx spend and provide real-time oversight through:

• Ingredient cost transparency

• Dispensing fees and AWP discounts

• Aggressive rebate negotiations

• Guaranteed minimum rebates

Based on group needs, we implement:

• Clinical programs

• International sourcing programs

• Patient assistance programs

• Manufacturer copay optimization

Pharmacy Predictive Modeling Tools

Higginbotham's Rx consulting division allows us to be agnostic and objective. This team works to evaluate your current pharmacy solution against potential cost saving alternatives.

Our methodology includes:

Pharmacy Benefit

• Intent to Bid from vendors with 20+ contract terms

• Executable contracts requested with every RFP

• PBM matching aligned with member needs and risk

• Preferred modeling: pass-through pricing to determine "lowest net cost"

• Carve-in vs. carve-out evaluated case by case

• Cost containment programs like international Rx sourcing, patient assistance programs, copay solutions, manufacturing coupon programs

Pharmacy Reporting Capabilities

Beyond cost control measures, proactive tracking measures and exploration of alternative solutions keeps your pharmacy and Rx program effective.

• Pharmalucent program runs daily against all client claims to identify outliers in real time and address clinical programs to be implemented.

• ADC® reporting contains over 200 proprietary clinical programs, including those to address adherence, compliance, and savings.

• RxSurge Alert reviews 100% of AWP cost increases based on Medi-Span. Any significant increases are discussed with clients.

Population Health Management

Population Health Management

Katie Callender MPH, ACSM-CEP Director

Kelley Melcher ACSM-CEP Consultant

Specialty: Health Strategy & Carrier Solutions

Lindsay Ewart MA, CWWPM

Managing Consultant

Specialty: Key Accounts

Rachel Ellman MS, RD, LD Consultant

Specialty: Nutrition & Dietetics

Andrea Miller MSW, LMSW

Senior Consultant

Specialty: Mental Health

Kelly Aguilar CEAS, 500ERYT, PMA Consultant

Specialty: Ergonomics & Body Mechanics

Population Health Management

Wellness programs are tailored to your goals, population, and budget. Our team works with you to design and implement initiatives.

Rely on Our In-House Professionals

• Health Education

• Corporate Wellness

• Exercise and Sports Physiology

• Nutritional Sciences

• Psychology and Mental Health

• Social Work

• Public Health

• Ergonomics and Musculoskeletal Health

Population Health Management

Steps Toward Success

Higginbotham’s population health management consultants focus on five proven principles:

1. Analyze Culture & Claims

A population health management (PHM) program goes from good to great when it takes into account the overall well-being of your employees, their current risks, and their work environment. A strategic and cultural analysis paired with a claims review helps identify workforce issues and needs that can be targeted with the right solutions. This assessment provides a solid foundation for program development, implementation, facilitation, and evaluation.

2. Engage Management

Senior leadership support is crucial to the success of a program. Employers who serve as a role model and integrate well-being into the business strategy create a culture where healthy lifestyles are valued, promoted, and incentivized.

3. Create Awareness

A holistic approach to population health considers your employees’ work-life balance, existing resources, potential solutions, and focuses on the specific health risk factors affecting them to create awareness. A comprehensive program may focus on many pillars of well-being, including social, mental, physical, spiritual, occupational, intellectual, environmental, and financial wellness.

4. Provide Education

A careful evaluation of health improvement solutions is important to keep employees informed and engaged. Resources may be provided through our PHM department, the community, a medical carrier or a vendor partner to encourage employees to make more informed health care decisions, take steps toward sustainable lifestyle changes, and take ownership of their individual well-being.

5. Measure Success

Setting tangible goals and analyzing aggregated data gives us powerful information to see what initiatives are working and what needs attention. Integrate outcomes into renewal strategy through baseline measurements that include medical and pharmacy utilization, medical claims costs, employee engagement and participation, and overall employee satisfaction.

Communications

Communications

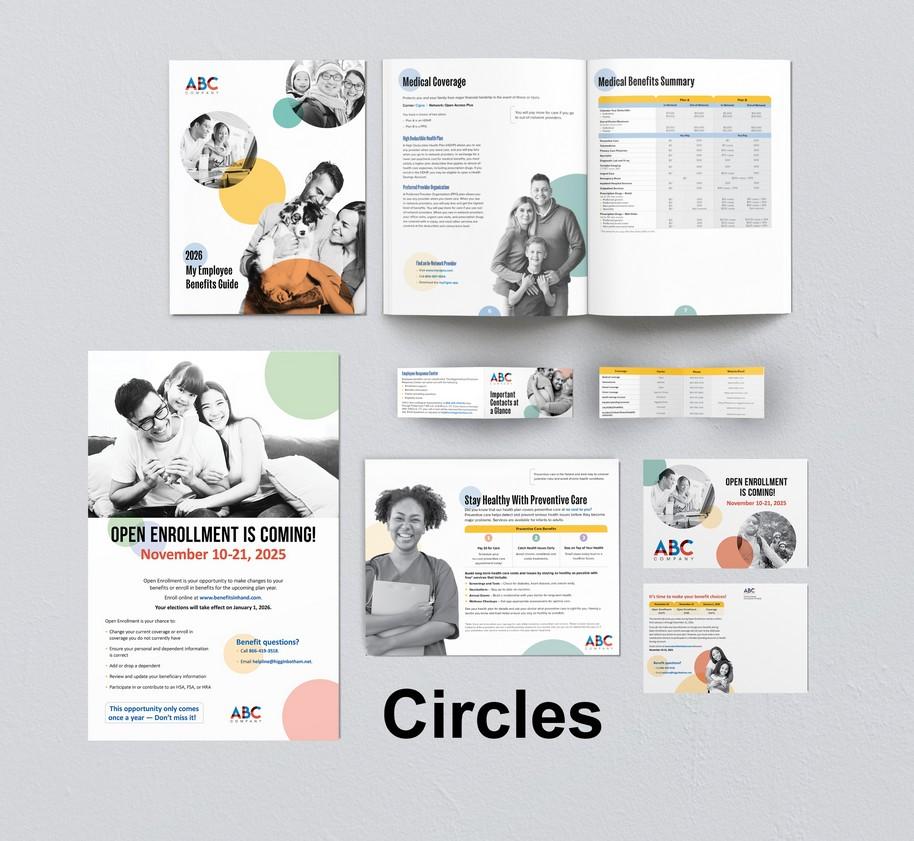

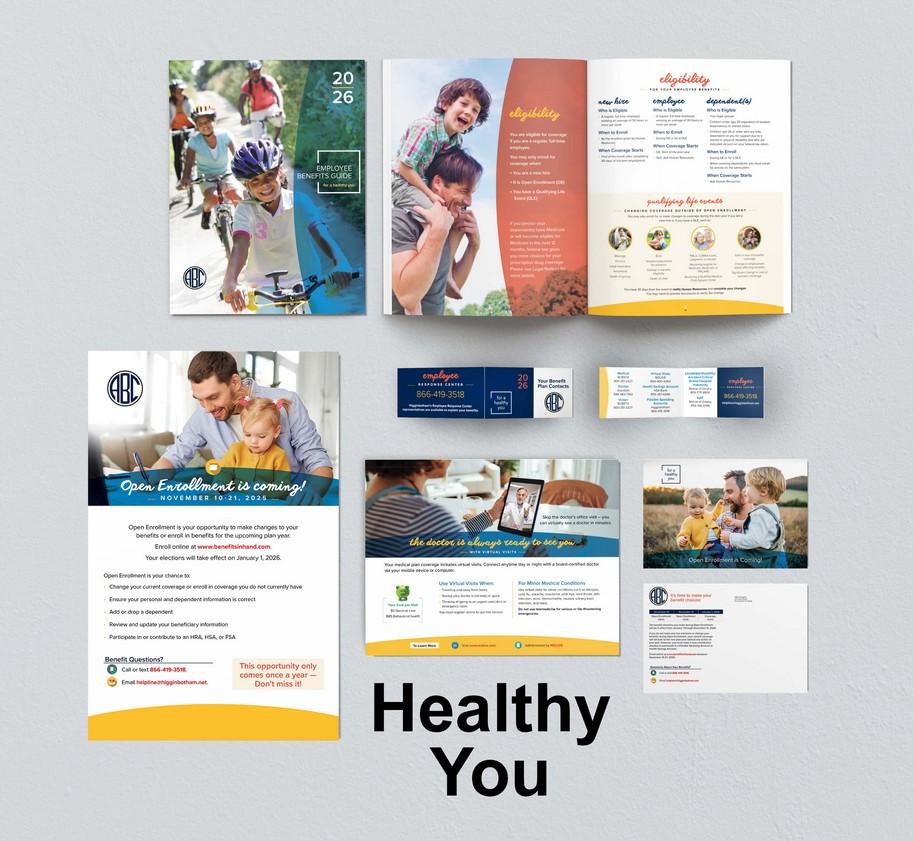

The best employee benefits programs are those that ensure employees know of and understand how to use their benefits.

Companies with best practice plans report that their participants receive consistent, uniform, and branded communications.

Our internal Employee Benefits Communications team is available to create strategic communications that address your specific benefit needs and inform employees before, during, and after Open Enrollment.

How We Work For You

SMS Text Messaging

Quick and convenient texts send a clear, concise, and cost-effective message when you want to instantly communicate with a select audience.

Topic-Specific Videos

High-quality video creation increases engagement and connection with your target audience and showcases your knowledge and know-how on a given topic.

Webinars

These virtual seminars allow participants to hear what you have to say in a compelling, interactive real-time event that feels more like a conversation.

Podcasts

Get your message across with a one-time digital audio program or a series of episodes that you can download and stream –anywhere, anytime.

Digital Media Team

Executes digital technology, interactive PDFs, landing pages, websites, analytic microsites, photography, and videos.

Employee Benefits Team

Develops engaging print and digital tool kits, annual planning calendars, drip campaigns, SMS text messaging, landing pages, videos, Brainsharks, newsletters, onboarding booklet, and custom products for our clients' employees.

Public Sector Division

Creates custom employee benefits collateral, engagement platforms, presentations, and informational multimedia for our public sector clients.

Employee Engagement

Employees who feel cared for are....

• 1.6x more likely to feel valued

• 1.5x more likely to say they are happy

• 1.5x more likely to feel a sense of belonging at work

• 1.3x more likely to feel successful

When employees understand how their benefits work, they are…

• 50% more likely to be loyal to their employer

• 6% more likely to be engaged at work

And yet, nearly two-thirds of employees (62%) are not completely confident they know about all their employer's benefits.

• Almost half of employees (45%) do not fully understand their benefits package

*Source: 2024 MetLife EB Survey

Employee Response Center (ERC)

Our internal full-service call and communications center is committed to supporting your employees from Open Enrollment and throughout the year. This team of experts handles a range of inquiries and responsibilities—from lost ID cards to complex claims —allowing your HR team to focus on other pressing priorities.

• Average call time exceeds 13 minutes

• Benefit eligibility administration and verification

• U.S.-based team located in Texas and Florida

• Certified ERC professionals

• Roles and responsibilities grid between HR and ERC

• Benefit claims assistance and resolution

• Quarterly customized call reports

• Dedicated toll-free number (group size dependent)

• 140+ languages available with multilingual enrollment support

• System enrollments based on access

What We Can Do For You

Robust Open Enrollment Toolkits

When it comes to creating best-in-class resources, we’re a trusted partner for our clients and their employees. They rely on us to create clear, concise, and accurate materials.

SCAN HERE TO LEARN MORE ABOUT WHAT WE CAN DO FOR YOU.

Communications

Full Creative Suite

• Logo and brand development

• Memos, letters, and instructions

• Payroll stuffers and postcards

• Benefits and recruiting summaries

• Company announcements and newsletters

• Enrollment guides

• Wallet cards and envelopes

• Wellness campaigns

• Special mailings and fulfillment

• Promotional materials (magnets, key fobs, etc.)

• Translations

• Electronic–interactive PDFs and benefit portal branding

• Social Media–LinkedIn, X, Facebook, and blogs

• Total compensation statements

Retirement Plan Services

Retirement Plan Services

You face a variety of concerns with regards to your retirement plan. We work with you to align corporate goals with the retirement and financial needs of your employees.

• Regulatory compliance and fiduciary risk mitigation

• Fee benchmarking

• Competitive investment menus

• Participant education and readiness

Fiduciary Steps

A plan’s named fiduciary is accountable for all aspects of an organization’s retirement plan. We assist with the formal delegation of daily administrative and investment responsibilities to a retirement plan committee.

• Plan governance

• Fiduciary compliance

• Investment due diligence

• Target date fund selection

• Benchmarking record keeping fees

• Benchmarking advisor feeds

• Plan design optimization

Plan Governance

Plan sponsors are notified of their fiduciary duty and assisted in developing procedures and accountability standard that help mitigate fiduciary liability.

• Vendor market analysis

• Plan benchmarking

• Vendor management

• Merger & acquisition assistance

• Participant communications strategy

• Cybersecurity protocols

• Fiduciary insurance guidance

Executive Life and Compensation

Executive Life and Compensation

Top executive talent demands creative, tax-efficient compensation structures. Providing offers inclusive of supplemental executive benefits helps retain, motivate, and recruit top talent.

Our Solutions

• Supplemental retirement income strategies

• Executive disability and life insurance

• Key person insurance

• Split-dollar arrangements

• Deferred compensation plans (SERPs, 409A)

• Non-qualified savings plans for highly compensated employees

• Golden handcuffs and retention strategies

*Data collected in connection with MetLife's 11th Annual Study of Employee Benefits Trends 42%

With performance-based benefits, you can reward the driving force behind your business while meeting long-term retention and financial goals. of highly compensated employes say they are very concerned about the financial effects of a loss of income in the event of a disability and/or premature death.

Executive Life and Compensation

We help you enhance your core benefits with executive life and disability, salary continuation plans, deferred compensation plans, and more.

Executive Life Higher incomes need larger death benefits. Supplemental life insurance provides an added layer of protection that suits employee's lifestyles.

Executive Disability Group long-term disability plans have coverage limits, leaving highly compensated executives with inadequate income protection. Supplemental disability coverage can enhance monthly benefits, as well as safeguard bonus and commission income, while also offering portability.

Executive Offerings

To further enhance your executive offerings, these additional benefits will continue to motivate your team and provide an additional sense of security.

Buy-Sell Funding

While buy-sell contracts specify how the business will transfer if an owner dies or becomes disabled, many are not funded, leaving the surviving shareholders in a financial bind. This calls for life and disability policies designed specifically for this purpose and an experienced advisor to implement them.

Estate Planning

Essential protection for high-net-worth individuals to protect inheritances, address estate taxes, and allocate assets as intended.

Deferred Compensation Plan (DCP)

401k plans limit what highly paid executives can contribute. A DCP provides greatly increased deferral limits to select employees. These tax-advantaged savings can increase key employee’s retirement benefits without creating year-end testing problems.

Key Person

Key person life insurance protects the company if an employee with specific skills, knowledge, or relationships passes. The policy proceeds can supplement lost income and cover expenses while a replacement is hired.

Executive Offerings

Executive Bonus Plan (EBP)

An effective, simple approach to enhance key employee benefits. A life insurance policy is purchased for the executive, treating the premium as a compensation bonus. The employee owns the policy and can use the cash value for retirement and protection for their family.

Bank-Owned Life Insurance (BOLI)

BOLI is used by banks to manage employee benefit costs and enhance overall financial performance. Purchased on select executives, it provides a tax-efficient way for banks to fund future employee benefits, such as retirement plans, while also generating a reliable return on investment.

Supplemental Executive Retirement Plan (SERP)

Qualified plans (401k and pensions) limit company contributions for highly paid executives. But the company can still provide an enhanced retirement benefit to select employees. The SERP provides additional employer-provided retirement income as outlined in the agreement.