Your Guide to 2025/2026

Your Guide to 2025/2026

We are pleased to offer you a comprehensive benefits package intended to protect your well-being and financial health. This guide is your opportunity to learn more about the benefits available to you and your eligible dependents beginning December 1, 2025.

To get the best value from your health care plan, please take the time to evaluate your coverage options and determine which plans best meet the health care and financial needs of you and your family. By being a wise consumer, you can support your health and maximize your health care dollars.

Each year during Open Enrollment (OE), you have the opportunity to make changes to your benefit plans. The enrollment decisions you make this year will remain in effect through November 30, 2026. After OE, you may make changes to your benefit elections only when you have a Qualifying Life Event (QLE). Depending on the qualifying event, you will have 30 or 60 days to make your benefit elections and submit supporting documentation to Human Resources. Changes will be effective on the day of the event and must be consistent with your QLE. If you do not make your changes during the 30- or 60-day period, your changes cannot be made until the next OE period.

Your benefits program offers three medical plan coverage options. To help you make an informed choice and compare your options, a Summary of Benefits and Coverage (SBC) document for each plan is available in BenefitsInHand.

you (and/or your dependents) have

You are eligible for benefits if you are a regular, full-time employee working 30 or more hours per week. Your coverage is effective the first of the month after you have completed 30 days of full-time employment. You may also enroll eligible dependents for benefits coverage. Your cost for dependent coverage will depend on the number of dependents you enroll and the particular plans you choose. When covering dependents, you must select the same plans for your dependents as you select for yourself.

Your legal spouse

Your domestic partner

Children or dependents under the age of 26 regardless of student, dependency, or marital status

Children or dependents over the age of 26 who are fully dependent on you for support due to a mental or physical disability and who are indicated as such on your federal tax return

Employee benefits can be complicated. The Higginbotham Employee Response Center (ERC) can assist with the following:

Enrollment guidance

Benefits plan information and details

Claims or billing questions

Eligibility issues

Call or text

866-419-3518 to speak with a bilingual representative Monday through Friday from 7:00 a.m. to 6:00 p.m. CT. If you leave a message after 3:00 p.m., your call or text will be returned the next business day. You can also email questions or requests to helpline@higginbotham.net

Once you elect your benefit options, they remain in effect for the entire plan year until the following OE. You may only change coverage during the plan year if you have a QLE, and you must do so within either 30 or 60 days.

30-day QLEs include:

Marriage, legal separation, or annulment

Birth, adoption, or placement for adoption of an eligible child

Change in your spouse’s employment that affects benefits eligibility

Change in residence that affects your eligibility for coverage

Significant change in coverage or cost in your, your spouse’s, or your child’s benefit plans

FMLA event, COBRA event, court judgment or decree

Receiving a Qualified Medical Child Support Order

60-day QLEs include:

Death of a spouse or child

Divorce

Change in your child’s eligibility for benefits (e.g., reaching the age limit)

Becoming eligible for Medicare, Medicaid or CHIP, or TRICARE

If you have a QLE and want to request a midyear change, you must notify Human Resources and complete your election changes within either 30 or 60 days following the event. Be prepared to provide documentation supporting the QLE.

Do you have questions about your benefits or need help enrolling? Call the ERC at 866-419-3518. Benefits experts are available to take your call Monday through Friday, 7:00 a.m. – 6:00 p.m. CT.

Go to www.benefitsinhand.com to begin the enrollment process . First-time users, follow steps 1-4. Returning users, log in and start at step 5.

1. If this is your first time to log in, click on the New User Registration link. Once you register, you will just use your username and password to log in.

2. Enter your personal information and company identifier of esogh and click Next

3. Create a username (work email address recommended) and password, then check the I agree to terms and conditions box before you click Finish

4. If you used an email address as your username, you will receive a validation email to that address. You may now log in to the system.

5. Click the Start Enrollment button to begin the enrollment process.

6. Confirm or update your personal information and click Save & Continue.

7. Edit or add dependents who need to be covered on your benefits. Once all dependents are listed, click Save & Continue

8. Follow the steps on the screen for each benefit to make your selection. Please notice there is an option to decline coverage. If you wish to decline, click the Don’t want this benefit? button and select the reason for declining.

9. Once you have elected or declined all benefits, you will see a summary of your selections. Click the Click to Sign button. Your enrollment will not be complete until you click the Click to Sign button.

Our medical plan options through Aetna are designed to protect you and your family from major financial hardship in the event of illness or injury. Easter Seals of Greater Houston offers three Preferred Provider Organization (PPO) plans: two traditional and one High Deductible Health Plan (HDHP).

TX25 2500 $2,500/Buy-Up

TX25 5000 $5,000/Base

A PPO allows you the freedom to see any provider when you need care. When you use in-network providers, you receive benefits at a discounted network cost. You may pay more for services if you use out-of-network providers. In-network preventive care is covered at 100%.

PPO/HDHP TX25 3500 HDHP $3,500/HSA Health Savings Account (HSA) eligible

In exchange for a lower per-paycheck cost, you must satisfy a deductible that applies to almost all health care expenses — including those for prescription drugs — with an HDHP. In-network preventive care is again covered at 100%. Once your in-network deductible has been met ($3,500 individual or $7,000 family), you will continue to pay your 20% coinsurance until you reach your in-network out-of-pocket maximum of $5,000 individual, or $10,000 family. The plan then pays 100% for all services.

To find an in-network provider, visit www.aetna.com/docfind or call 888-416-2277

Online

1. Under guest, enter your location

2. Scroll to Aetna Open Access Plans, and select Aetna Choice POS II (Open Access)

3. Enter a search detail or select a category

4. Make a selection

Log in at www.aetnanavigator.com and register for an account so you have convenient access to your health care information and to:

Check claim status and history

Print an Explanation of Benefits (EOB) statement

Confirm who in your family is covered under your plan

Find an in-network doctor or hospital

Request or print a member ID card

Compare medical and prescription costs

Review your personal health information

Complete a health risk assessment

Access health and wellness education information

The Aetna app can help you stay organized and in control of your health – anytime, anywhere. Log in and:

Find a doctor, dentist, or pharmacy

Check benefits and coverage information

Use the urgent care finder

Access your medical and/or dental ID card information

Search claims and track your health

Estimate prescription costs

Visit www.myaetnawebsite.com

Text Aetna to 90156

Download the Aetna Health app

Scan the QR code

1 The amount you pay after the deductible is met.

2

Through Aetna’s Over-the-Counter (OTC) Health Solution, you and your eligible family members will receive $100 per year to spend on health and wellness products through CVS pharmacies. You have three ways to use this benefit:

1. In-store – Shop OTC items at any CVS location – look for the blue “OTCH Eligible” label. Provide your name, date of birth, and Aetna ID card when you check out.

2. In-store with the app – Download the OTC Health Solutions app, scan the item’s label to confirm if it is included, and add it to your cart. The app will create a bar code for all your purchases to scan at the register.

3. Online – Order at https://www.cvs.com/otchs/ aetcommericalotc. Online orders must be submitted by 11:59 p.m. ET to be processed the same day.

4. By Phone – Call 888-628-2770 Monday through Friday from 9:00 a.m. to 8:00 p.m. local time. You will need your member ID to place your order.

You can purchase a variety of items including:

First-aid and medical supplies

Home diagnostics

Cough and cold support products

Allergy relief products

Pain relievers and sleep aids

Feminine care products

Antacids and laxatives

Eye and ear care products

With this program, you have peace of mind in deciding where to fill your prescriptions for the medications you take on a regular basis.

After two retail refills, you can get a 90-day supply of your maintenance drugs at a discounted rate from a participating mail service pharmacy, or at selected participating retail providers. Save time and enjoy the convenience of delivery options from participating mail service and retail providers. Get started so you have the medicines you need, when you need them.

You can opt out of Maintenance Choice for all your maintenance medications and continue to purchase your medicines at your local pharmacy. If you opt out, you will pay the regular retail copay for a 30-day supply. If you do not let Aetna know you want to opt out, you will pay the full cost of your medications on the third fill.

Call 888-792-3862 to opt out of the program and continue filling your 30-day supplies.

If you are filling your prescription at a local participating 90day provider pharmacy, your pharmacist can change your prescription to 90-day refills.

If you are not filling your prescription at a participating 90-day provider pharmacy, and you would like to switch to a mail service pharmacy, call Customer Care at 888-792-3862 or order online by visiting the website on your member ID card.

Become

Access to care via phone, online video, or mobile app whether you are home, work or traveling; medications can be

Usually lower out-of-pocket cost than urgent care; when you can’t see your doctor; located in stores and pharmacies Hours vary based on store hours

If you enroll in the HDHP, you may be eligible to open an HSA through HSA Bank

An HSA is more than a way to help you and your family cover health care costs — it is also a tax-exempt tool to supplement your retirement savings and cover health expenses during retirement. An HSA can provide the funds to help pay current health care expenses as well as future health care costs.

A type of personal savings account, an HSA is always yours even if you change health plans or jobs. The money in your HSA (including interest and investment earnings) grows tax-free and spends tax-free if used to pay for qualified medical expenses. There is no “use it or lose it” rule — you do not lose your money if you do not spend it in the calendar year — and there are no vesting requirements or forfeiture provisions. The account automatically rolls over year after year.

You are eligible to open and contribute to an HSA if you:

Are enrolled in an HSA-eligible HDHP

Are not covered by other non-HDHPs, such as your spouse’s health plan or a Health Care Flexible Spending Account (FSA)

Are not eligible to be claimed as a dependent on someone else’s tax return

Are not enrolled in Medicare, Medicaid, or TRICARE

Have not received Veterans Administration benefits

You can use the money in your HSA to pay for qualified medical expenses now or in the future. Your HSA can be used for your expenses and those of your spouse and dependents even if they are not covered by the HDHP.

A beneficiary is a person or entity you elect to receive the death benefits of your HSA with HSA Bank. You can name more than one beneficiary, and you can change beneficiaries at anytime. Visit www.hsabank.com and go to Settings>Profile>Edit to designate your beneficiaries.

Your HSA contributions may not exceed the annual maximum amount established by the IRS. The annual contribution maximums are based on the coverage option you elect.

You decide whether to use the money in your account to pay for qualified expenses or let it grow for the future. If you are age 55 or older, you may make a yearly catch-up contribution of up to $1,000 to your HSA. If you turn 55 at anytime during the plan year, you are eligible to make the catch-up contribution for the entire plan year.

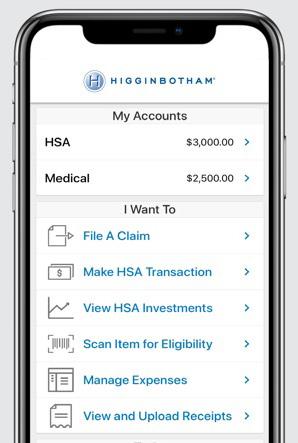

Once you enroll in the HDHP medical plan, you may be eligible to open an HSA administered by Bend Financial. You will then receive a debit card to manage your HSA reimbursements. Keep in mind, available funds are limited to the balance in your account. To view your HSA information, download the HSA Bank app to your smartphone or tablet to view your balance, find cost estimates, and call customer care.

Always ask your health care provider to file your claims with your medical provider so network discounts can be applied. Then you can pay the provider with your HSA debit card based on the balance due after discount.

You, NOT your employer, are responsible for maintaining ALL records and receipts for HSA reimbursements in the event of an IRS audit.

You may open an HSA at any financial institution of your choice. However, payroll deductions are available only for HSAs opened through HSA Bank.

If you would like to make changes to your HSA contributions during the year, please reach out to Human Resources. Changes to deductions should not be made through HSA Bank.

CVS provides access to telemedicine services as part of your medical plan and can be a cost-effective alternative to visiting your primary care provider, urgent care center, or emergency room. Connect with a board-certified doctor via secure video chat or phone without leaving your home or office - for zero cost. Care is available 24 hours, seven days a week, 365 days a year, including holidays.

CVS services should only be used for minor, not lifethreatening conditions such as:

Sore throat

Headache

Stomachache

Cold and flu

Allergies

Fever

Urinary tract infections

You have access to CVS Health Virtual Care, CVS Health

Virtual Primary Care, and Teladoc Health.

Online – www.cvs.com/virtual-care

Phone – 866-211-5678

Download – Aetna Health app

Get trusted health information anytime you need it. With the 24-Hour Nurse Line, you and your covered family members can speak with a registered nurse — day or night — about symptoms, treatments, or general health concerns. The service is free, unlimited, and available by phone or online. Nurses can help you prepare for doctor visits, understand test results, or decide when to seek urgent care — saving you time, money, and unnecessary ER trips.

Call 800-556-1555 (TTY: 711)

Visit www.aetna.com

Get the care you need in person or virtually at MinuteClinic, located inside select CVS Pharmacy stores. With extended evening and weekend hours, you can be treated for common illnesses, minor injuries, allergies, infections, and more - often at no cost or a lower copay than urgent care or the ER.

Visit www.cvs.com/minuteclinic

Visit – www.teladoc.com/aetna

Call – 855-TELADOC (835-2362)

Less than an urgent care/ER visit, your cost is never more than a doctor visit!

Our dental plans help you maintain good oral health through affordable options for preventive care, including regular checkups and other dental work. Easter Seals of Greater Houston offers two dental options that help you pay for preventive, basic, and major care. BlueCare Dental coverage is provided through Aetna.

Two levels of benefits are available with the DPPO plans: in-network and out-of-network. You may see any dental provider for care, but you will pay less and get the highest level of benefits with in-network providers. You could pay more if you use an out-of-network provider.

Additional dental benefits are available if you have Aetna medical coverage and are pregnant or have cardiovascular disease, diabetes, or pre-diabetes. If you have one of these conditions, you may select one extra service:

Scaling and Root Planing

Periodontal Maintenance

Cleaning

Online – www.aetna.com

Phone – 877-238-6200

Download – Aetna Health app

The vision plan through Aetna, using the Aetna Vision Preferred network, is designed to provide basic eyewear needs and preserve your health and eyesight. In addition to identifying vision and eye problems, regular exams can detect certain medical issues such as diabetes or high cholesterol. You may seek care from any licensed optometrist, ophthalmologist, or optician, but plan benefits are better if you use an in-network provider.

One way to plan ahead and save money over the course of a year is to participate in our Dependent Care FSA program.

An FSA allows you to pay for certain dependent care expenses with pretax dollars that reduce your taxable income and save you money. When you enroll, you must decide how much money to set aside from your paycheck. Be sure to estimate your expenses conservatively as the IRS requires that you use the money in your account during the plan year and applicable grace period (the “use it or lose it” rule). Our FSA is administered by Higginbotham

The Dependent Care FSA helps pay for expenses associated with caring for elder or child dependents in order for you or your spouse to work or attend school full-time. The dependent child must be under age 13 and claimed as a dependent on your federal income tax return, or a disabled dependent of any age incapable of caring for themselves, and who spends at least eight hours a day in your home.

Reimbursement from your Dependent Care FSA is limited to the total amount that is deposited in your account at that time. In order to be reimbursed, you must provide the tax identification or Social Security number (SSN) of the party providing care, and that provider cannot be anyone considered your dependent for income tax purposes.

The maximum per plan year you can contribute to a Dependent Care FSA is $5,000 when filing jointly or head of household, and $2,500 when married filing separately.

You cannot change your election during the year unless you experience a QLE.

Expenses for services received during the 12-month period (or from the date you became covered) can be reimbursed from the money set aside from your pay during the 2025-2026 plan year. You can continue to file claims incurred during the plan year for another 90 days (up until March 31, 2027).

Overnight camps are not eligible for reimbursement (only day camps can be considered).

If your child turns 13 midyear, you may only request reimbursement for the part of the year when the child is under age 13.

You may request reimbursement for care of a spouse or dependent of any age who spends at least eight hours a day in your home, and is mentally or physically incapable of self-care.

Reminder: Your FSA is subject to the “use it or lose it” rule. You have until March 31, 2027 of the following year to submit claims.

The Higginbotham Portal has everything you need to manage your Dependent Care FSA:

24/7 access to plan documents, letters and notices, forms, account balances, contributions, and other plan information

Update your personal information

Look up qualified expenses

Submit claims

Register On the Higginbotham Portal

Go to https://flexservices.higginbotham.net and click

Register. Follow the instructions and scroll down to enter your information.

Enter your Employee ID, which is your SSN with no dashes or spaces.

Follow the prompts to navigate the site.

Your Dependent Care FSA can be easily accessed on your smartphone or tablet with the Higginbotham mobile app. To locate and load the app, search for Higginbotham in your mobile device’s app store and download as you would any other app.

View Accounts – Includes detailed account and balance information

Card Activity – Account information

SnapClaim – File a claim and upload receipt photos directly from your smartphone

If you have any questions or concerns, contact Higginbotham:

Phone – 866-419-3519

Email – flexclaims@higginbotham.net

Fax – 866-419-3516

Life insurance is an important part of your financial security, especially if others depend on you for support. Even if you are single, your beneficiary can use your Life insurance to pay off your debts such as credit cards, mortgages, and other final expenses.

Accidental Death and Dismemberment (AD&D) coverage provides specified benefits for a covered accidental bodily injury that directly causes dismemberment (i.e., the loss of a hand, foot, or eye). In the event that death occurs from an accident, 100% of the AD&D benefit is payable to your beneficiary(ies).

Basic Life and AD&D insurance are provided by Easter Seals of Greater Houston at no cost to you through Guardian. You are automatically covered at one times your annual salary up to a maximum of $150,000.

A beneficiary is the person or entity you designate to receive the death benefits of your Life and AD&D insurance policies. You can name more than one beneficiary, and you can change beneficiaries at any time. If you name more than one beneficiary, you must identify the share for each.

You may purchase additional Life and AD&D insurance for you and your eligible dependents. If you decline Voluntary Life and AD&D insurance when first eligible, or if you elect coverage and wish to increase your benefit amount at a later date, Evidence of Insurability — proof of good health — may be required before coverage is approved.

You must elect Voluntary Life and AD&D coverage for yourself in order to elect coverage for your spouse or children. Coverage is provided through Guardian. If you leave Easter Seals of Greater Houston, you may be able to take the insurance with you.

Disability insurance provides partial income protection if you are unable to work due to a covered accident or illness while insured. Easter Seals of Greater Houston offers Voluntary Short Term Disability (STD) insurance for you to purchase and pays the full cost of your Long Term Disability (LTD) coverage. Both STD and LTD insurance are provided through Guardian

STD coverage pays a percentage of your salary for up to 13 weeks if you are temporarily disabled and unable to work due to an illness, non-work-related injury, or pregnancy. STD benefits are NOT payable if the disability is due to a job-related injury or illness.

LTD insurance pays a percentage of your salary for a covered disability or injury that prevents you from working for more than 90 days. Benefits begin at the end of a 90day elimination period and continue while you are disabled up to Social Security Normal Retirement Age (SSNRA).

*Easter Seals of Greater Houston will gross up your salary to cover the cost of this coverage and then deduct the cost from your paycheck. This makes the coverage employee paid and thus all benefits are tax-free.

**Benefits may not be paid for conditions for which you have been treated within the three months prior to your effective date until you have been covered under this plan for 12 months.

As a complement to our core benefits program, Easter Seals of Greater Houston offers the opportunity to enroll in additional coverage in case of serious illness or accident. These plans are provided by Guardian

Accident insurance pays a fixed benefit directly to you in the event of an accident on or off the job, regardless of any other coverage you may have. Benefits are paid according to a fixed schedule for accident-related expenses including hospitalizations, fractures and dislocations, emergency room visits, major diagnostic exams, and physical therapy. Refer to the SBC for benefit details.

*Percentage

These are fixed indemnity policies, not health insurance. These fixed indemnity policies may pay you a limited dollar amount if you are sick or hospitalized. You are still responsible for paying the cost of your care.

The payment you get is not based on the size of your medical bill.

There might be a limit on how much the policy will pay each year.

These policies are not a substitute for comprehensive health insurance.

Since these policies are not health insurance, they do not have to include most Federal consumer protections that apply to health insurance.

Looking for comprehensive health insurance?

Visit www.healthcare.gov or call 1-800-318-2596 (TTY: 1-855-889-4325) to find health coverage options.

To find out if you can get health insurance through your job, or a family member’s job, contact the employer.

Questions about these policies?

For questions or complaints about these policies, contact your State Department of Insurance. Find their number on the National Association of Insurance Commissioners’ website (www.naic.org) under Insurance Departments.

If you have one of these policies through your job, or a family member’s job, contact the employer.

Hospital Indemnity insurance provides financial assistance to enhance your current medical coverage. It helps you avoid using savings or borrowing money to pay outof-pocket costs that health insurance does not cover. Hospital Indemnity insurance can help with expenses related to meals and transportation for family members, childcare, or time away from work due to a medical issue that requires hospitalization. Refer to the SBC for complete benefit details.

Critical Illness and Cancer insurance helps pay the cost of non-medical expenses related to a covered critical illness or cancer. The plan provides a lump-sum benefit payment upon first and second diagnosis of any covered critical illness or cancer to help cover expenses such as lost income, out-of-town treatments, special diets, daily living, and household upkeep costs. Refer to the SBC for complete benefit details.

Employee Up to $20,000 Guaranteed Issue – $10,000 (under age 70)

Spouse

50% of Employee Benefit Guaranteed Issue – $5,000 (under age 70)

Child 25% of employee benefit rounded to next higher multiple of $1,000 Guaranteed Issue – $10,000

Invasive cancer; heart attack; stroke; heart, kidney or organ failure

Carcinoma in situ, benign brain tumor, coronary arteriosclerosis, Addison’s disease, Huntington’s disease, multiple sclerosis

in Employee coverage

In October 1998, Congress enacted the Women’s Health and Cancer Rights Act of 1998. This notice explains some important provisions of the Act. Please review this information carefully.

As specified in the Women’s Health and Cancer Rights Act, a plan participant or beneficiary who elects breast reconstruction in connection with a mastectomy is also entitled to the following benefits:

• All stages of reconstruction of the breast on which the mastectomy was performed;

• Surgery and reconstruction of the other breast to produce a symmetrical appearance; and

• Prostheses and treatment of physical complications of the mastectomy, including lymphedema.

Health plans must determine the manner of coverage in consultation with the attending physician and the patient. Coverage for breast reconstruction and related services may be subject to deductibles and coinsurance amounts that are consistent with those that apply to other benefits under the plan.

This notice is being provided to ensure that you understand your right to apply for group health insurance coverage. You should read this notice even if you plan to waive coverage at this time.

Loss of Other Coverage or Becoming Eligible for Medicaid or a state Children’s Health Insurance Program (CHIP)

If you are declining coverage for yourself or your dependents because of other health insurance or group health plan coverage, you may be able to later enroll yourself and your dependents in this plan if you or your dependents lose eligibility for that other coverage (or if the employer stops contributing toward your or your dependents’ other coverage). However, you must enroll within 31 days after your or your dependents’ other coverage ends (or after the employer that sponsors that coverage stops contributing toward the other coverage).

If you or your dependents lose eligibility under a Medicaid plan or CHIP, or if you or your dependents become eligible for a subsidy under Medicaid or CHIP, you may be able to enroll yourself and your dependents in this plan. You must provide notification within 60 days after you or your dependent is terminated from, or determined to be eligible for, such assistance.

If you have a new dependent as a result of a marriage, birth, adoption, or placement for adoption, you may be able to enroll yourself and your dependents. However, you must enroll within 31 days after the marriage, birth, or placement for adoption.

To request special enrollment or obtain more information, contact:

of Greater Houston Human Resources

4888 Loop Central Drive Suite 200 Houston, TX 77081

713-838-9050

Please read this notice carefully and keep it where you can find it. This notice has information about your current prescription drug coverage with Easter Seals of Greater Houston and about your options under Medicare’s prescription drug coverage. This information can help you decide whether or not you want to enroll in a Medicare drug plan. Information about where you can get help to make decisions about your prescription drug coverage is at the end of this notice.

If neither you nor any of your covered dependents are eligible for or have Medicare, this notice does not apply to you or the dependents, as the case may be. However, you should still keep a copy of this notice in the event you or a dependent should qualify for coverage under Medicare in the future. Please note, however, that later notices might supersede this notice.

1. Medicare prescription drug coverage became available in 2006 to everyone with Medicare. You can get this coverage through a Medicare Prescription Drug Plan or a Medicare Advantage Plan that offers prescription drug coverage. All Medicare prescription drug plans provide at least a standard level of coverage set by Medicare. Some plans may also offer more coverage for a higher monthly premium.

2. Easter Seals of Greater Houston has determined that the prescription drug coverage offered by the Easter Seals of Greater Houston medical plan is, on average for all plan participants, expected to pay out as much as the standard Medicare prescription drug coverage pays and is considered Creditable Coverage.

Because your existing coverage is, on average, at least as good as standard Medicare prescription drug coverage, you can keep this coverage and not pay a higher premium (a penalty) if you later decide to enroll in a Medicare prescription drug plan, as long as you later enroll within specific time periods.

You can enroll in a Medicare prescription drug plan when you first become eligible for Medicare. If you decide to wait to enroll in a Medicare prescription drug plan, you may enroll later, during Medicare Part D’s annual enrollment period, which runs each year from October 15 through December 7 but as a general rule, if you delay your enrollment in Medicare Part D after first becoming eligible to enroll, you may have to pay a higher premium (a penalty).

You should compare your current coverage, including which drugs are covered at what cost, with the coverage and cost of the plans offering Medicare prescription drug coverage in your area. See the Plan’s summary plan description for a summary of the Plan’s prescription drug coverage. If you don’t have a copy, you can get one by contacting Easter Seals of Greater Houston at the phone number or address listed at the end of this section.

If you choose to enroll in a Medicare prescription drug plan and cancel your current Easter Seals of Greater Houston prescription drug coverage, be aware that you and your dependents may not be able to get this coverage back. To regain coverage, you would have to re-enroll in the Plan, pursuant to the Plan’s eligibility and enrollment rules. You should review the Plan’s summary plan description to determine if and when you are allowed to add coverage.

If you cancel or lose your current coverage and do not have prescription drug coverage for 63 days or longer prior to enrolling in the Medicare prescription drug coverage, your monthly premium will be at least 1% per month greater for every month that you did not have coverage for as long as you have Medicare prescription drug coverage. For example, if nineteen months lapse without coverage, your premium will always be at least 19% higher than it would have been without the lapse in coverage.

For more information about this notice or your current prescription drug coverage:

Contact the Human Resources Department at 713-838-9050.

NOTE: You will receive this notice annually and at other times in the future, such as before the next period you can enroll in Medicare prescription drug coverage and if this coverage changes. You may also request a copy.

For more information about your options under Medicare prescription drug coverage:

More detailed information about Medicare plans that offer prescription drug coverage is in the “Medicare & You” handbook. You will get a copy of the handbook in the mail every year from Medicare. You may also be contacted directly by Medicare prescription drug plans. For more information about Medicare prescription drug coverage:

• Visit www.medicare.gov

• Call your State Health Insurance Assistance Program (see the inside back cover of your copy of the “Medicare & You” handbook for their telephone number) for personalized help.

• Call 1-800-MEDICARE (1-800-633-4227). TTY users should call 877-486-2048

If you have limited income and resources, extra help paying for Medicare prescription drug coverage is available. Information about this extra help is available from the Social Security Administration (SSA) online at www.socialsecurity. gov, or you can call them at 800-772-1213 . TTY users should call 800-325-0778 .

Remember: Keep this Creditable Coverage notice. If you enroll in one of the new plans approved by Medicare which offer prescription drug coverage, you may be required to provide a copy of this notice when you join to show whether or not you have maintained creditable coverage and whether or not you are required to pay a higher premium (a penalty).

December 1, 2025

Easter Seals of Greater Houston Human Resources 4888 Loop Central Drive Suite 200 Houston, TX 77081 713-838-9050

This notice describes how medical information about you may be used and disclosed and how you can access this information. Please review it carefully.

The Health Insurance Portability and Accountability Act of 1996 (HIPAA) imposes numerous requirements on employer health plans concerning the use and disclosure of individual health information. This information known as protected health information (PHI), includes virtually all individually identifiable health information held by a health plan – whether received in writing, in an electronic medium or as oral communication. This notice describes the privacy practices of the Employee Benefits Plan (referred to in this notice as the Plan), sponsored by Easter Seals of Greater Houston, hereinafter referred to as the plan sponsor. The Plan is required by law to maintain the privacy of your health information and to provide you with this notice of the Plan’s legal duties and privacy practices with respect to your health information. It is important to note that these rules apply to the Plan, not the plan sponsor as an employer.

You have the right to inspect and copy protected health information which is maintained by and for the Plan for enrollment, payment, claims and case management. If you feel that protected health information about you is incorrect or incomplete, you may ask the Human Resources Department to amend the information. For a full copy of the Notice of Privacy Practices describing how protected health information about you may be used and disclosed and how you can get access to the information, contact the Human Resources Department.

Complaints: If you believe your privacy rights have been violated, you may complain to the Plan and to the Secretary of Health and Human Services. You will not be retaliated against for filing a complaint. To file a complaint, please contact the Privacy Officer.

Easter Seals of Greater Houston Human Resources

4888 Loop Central Drive Suite 200 Houston, TX 77081

713-838-9050

Conclusion

PHI use and disclosure by the Plan is regulated by a federal law known as HIPAA (the Health Insurance Portability and Accountability Act). You may find these rules at 45 Code of Federal Regulations Parts 160 and 164. The Plan intends to comply with these regulations. This Notice attempts to summarize the regulations. The regulations will supersede any discrepancy between the information in this Notice and the regulations.

If you or your children are eligible for Medicaid or CHIP and you’re eligible for health coverage from your employer, your state may have a premium assistance program that can help pay for coverage, using funds from their Medicaid or CHIP programs. If you or your children aren’t eligible for Medicaid or CHIP, you won’t be eligible for these premium assistance programs but you may be able to buy individual insurance coverage through the Health Insurance Marketplace. For more information, visit www. healthcare.gov

If you or your dependents are already enrolled in Medicaid or CHIP and you live in a State listed below, contact your State Medicaid or CHIP office to find out if premium assistance is available.

If you or your dependents are NOT currently enrolled in Medicaid or CHIP, and you think you or any of your dependents might be eligible for either of these programs, contact your State Medicaid or CHIP office or dial 1-877-KIDS NOW or www. insurekidsnow.gov to find out how to apply. If you qualify, ask your state if it has a program that might help you pay the premiums for an employer-sponsored plan.

If you or your dependents are eligible for premium assistance under Medicaid or CHIP, as well as eligible under your employer plan, your employer must allow you to enroll in your employer plan if you aren’t already enrolled. This is called a “special enrollment” opportunity, and you must request coverage within 60 days of being determined eligible for premium assistance. If you have questions about enrolling in your employer plan, contact the Department of Labor at www. askebsa.dol.gov or call 1-866-444-EBSA (3272)

If you live in one of the following States, you may be eligible for assistance paying your employer health plan premiums. The following list of States is current as of July 31, 2025. Contact your State for more information on eligibility.

Website: http://www.myalhipp.com/ Phone: 1-855-692-5447

myakhipp.com/ Phone: 1-866-251-4861 Email: CustomerService@MyAKHIPP.com Medicaid Eligibility: https://health.alaska.gov/dpa/Pages/default.aspx

Arkansas – Medicaid

Website: http://myarhipp.com/

Phone: 1-855-MyARHIPP (855-692-7447)

California– Medicaid

Health Insurance Premium Payment (HIPP) Program Website: http:// dhcs.ca.gov/hipp

Phone: 916-445-8322

Fax: 916-440-5676

Email: hipp@dhcs.ca.gov

Colorado – Health First Colorado (Colorado’s Medicaid Program) and Child Health Plan Plus ( +)

Health First Colorado website: https://www.healthfirstcolorado.com/

Health First Colorado Member Contact Center: 1-800-221-3943/State Relay 711

CHP+: https://hcpf.colorado.gov/child-health-plan-plus

CHP+ Customer Service: 1-800-359-1991/State Relay 711

Health Insurance Buy-In Program (HIBI): https://www.mycohibi.com/ HIBI Customer Service: 1-855-692-6442

Florida – Medicaid

Website: https://www.flmedicaidtplrecovery.com/flmedicaidtplrecovery. com/hipp/index.html

Phone: 1-877-357-3268

Georgia – Medicaid

GA HIPP Website: https://medicaid.georgia.gov/health-insurancepremium-payment-program-hipp

Phone: 678-564-1162, Press 1

GA CHIPRA Website: https://medicaid.georgia.gov/programs/thirdparty-liability/childrens-health-insurance-program-reauthorization-act2009-chipra

Phone: 678-564-1162, Press 2

All other Medicaid

Website: https://www.in.gov/medicaid/ http://www.in.gov/fssa/dfr/ Family and Social Services Administration

Phone: 1-800-403-0864

Member Services Phone: 1-800-457-4584

Iowa – Medicaid and CHIP (Hawki)

Medicaid Website: https://hhs.iowa.gov/programs/welcome-iowamedicaid

Medicaid Phone: 1-800-338-8366

Hawki Website: https://hhs.iowa.gov/programs/welcome-iowamedicaid/iowa-health-link/hawki

Hawki Phone: 1-800-257-8563

HIPP Website: https://hhs.iowa.gov/programs/welcome-iowa-medicaid/ fee-service/hipp

HIPP Phone: 1-888-346-9562

Kansas – Medicaid

Website: https://www.kancare.ks.gov/

Phone: 1-800-792-4884

HIPP Phone: 1-800-967-4660

Kentucky – Medicaid

Kentucky Integrated Health Insurance Premium Payment Program (KI-HIPP) Website: https://chfs.ky.gov/agencies/dms/member/Pages/ kihipp.aspx

Phone: 1-855-459-6328

Email: KIHIPP.PROGRAM@ky.gov

KCHIP Website: https://kynect.ky.gov

Phone: 1-877-524-4718

Kentucky Medicaid Website: https://chfs.ky.gov/agencies/dms Louisiana – Medicaid

Website: www.medicaid.la.gov or www.ldh.la.gov/lahipp Phone: 1-888-342-6207 (Medicaid hotline) or 1-855-618-5488 (LaHIPP)

Enrollment Website: https://www.mymaineconnection.gov/benefits/ s/?language=en_US Phone: 1-800-442-6003

TTY: Maine relay 711

Private Health Insurance Premium Webpage: https://www.maine.gov/ dhhs/ofi/applications-forms Phone: 1-800-977-6740

TTY: Maine Relay 711

Website: https://www.mass.gov/masshealth/pa Phone: 1-800-862-4840

TTY: 711

Email: masspremassistance@accenture.com

Website: https://mn.gov/dhs/health-care-coverage/ Phone: 1-800-657-3672

Website: http://www.dss.mo.gov/mhd/participants/pages/hipp.htm Phone: 573-751-2005

Website: https://dphhs.mt.gov/MontanaHealthcarePrograms/HIPP Phone: 1-800-694-3084

Email: HHSHIPPProgram@mt.gov

Website: http://www.ACCESSNebraska.ne.gov

Phone: 1-855-632-7633

Lincoln: 402-473-7000

Omaha: 402-595-1178

Medicaid Website: http://dhcfp.nv.gov

Medicaid Phone: 1-800-992-0900

Website: https://www.dhhs.nh.gov/programs-services/medicaid/healthinsurance-premium-program

Phone: 603-271-5218

Toll free number for the HIPP program: 1-800-852-3345, ext. 15218

Email: DHHS.ThirdPartyLiabi@dhhs.nh.gov

New Jersey – Medicaid and CHIP

Medicaid Website: http://www.state.nj.us/humanservices/dmahs/ clients/medicaid/

Phone: 1-800-356-1561

CHIP Premium Assistance Phone: 609-631-2392

CHIP Website: http://www.njfamilycare.org/index.html

CHIP Phone: 1-800-701-0710 (TTY: 711)

Website: https://www.health.ny.gov/health_care/medicaid/

Phone: 1-800-541-2831

Website: https://medicaid.ncdhhs.gov

Phone: 919-855-4100

Website: https://www.hhs.nd.gov/healthcare

Phone: 1-844-854-4825 Oklahoma – Medicaid and CHIP

Website: http://www.insureoklahoma.org

Phone: 1-888-365-3742

Website: https://healthcare.oregon.gov/Pages/index.aspx

Phone: 1-800-699-9075

Pennsylvania – Medicaid and CHIP

Website: https://www.pa.gov/en/services/dhs/apply-for-medicaidhealth-insurance-premium-payment-program-hipp.html

Phone: 1-800-692-7462

CHIP Website: https://www.dhs.pa.gov/chip/pages/chip.aspx

CHIP Phone: 1-800-986-KIDS (5437)

Rhode Island – Medicaid and CHIP

Website: http://www.eohhs.ri.gov/

Phone: 1-855-697-4347 or 401-462-0311 (Direct RIte Share Line)

South Carolina – Medicaid

Website: https://www.scdhhs.gov

Phone: 1-888-549-0820

South Dakota - Medicaid

Website: https://dss.sd.gov

Phone: 1-888-828-0059

Texas – Medicaid

Website: https://www.hhs.texas.gov/services/financial/healthinsurance-premium-payment-hipp-program

Phone: 1-800-440-0493

Utah – Medicaid and CHIP

Utah’s Premium Partnership for Health Insurance (UPP) Website: https://medicaid.utah.gov/upp/ Email: upp@utah.gov

Phone: 1-888-222-2542

Adult Expansion Website: https://medicaid.utah.gov/expansion/ Utah Medicaid Buyout Program Website: https://medicaid.utah.gov/ buyout-program/

CHIP Website: https://chip.utah.gov/

Vermont– Medicaid

Website: https://dvha.vermont.gov/members/medicaid/hipp-program Phone: 1-800-250-8427

Virginia – Medicaid and CHIP

Website: https://coverva.dmas.virginia.gov/learn/premium-assistance/ famis-select

https://coverva.dmas.virginia.gov/learn/premium-assistance/healthinsurance-premium-payment-hipp-programs

Medicaid/CHIP Phone: 1-800-432-5924

Washington – Medicaid

Website: https://www.hca.wa.gov/ Phone: 1-800-562-3022

West Virginia – Medicaid and CHIP

Website: https://dhhr.wv.gov/bms/ http://mywvhipp.com/

Medicaid Phone: 304-558-1700

CHIP Toll-free phone: 1-855-MyWVHIPP (1-855-699- 8447)

Wisconsin – Medicaid and CHIP

Website: https://www.dhs.wisconsin.gov/badgercareplus/p-10095.htm Phone: 1-800-362-3002

Website: https://health.wyo.gov/healthcarefin/medicaid/programs-andeligibility/ Phone: 1-800-251-1269

To see if any other States have added a premium assistance program since July 31, 2025, or for more information on special enrollment rights, can contact either:

U.S. Department of Labor Employee Benefits Security Administration www.dol.gov/agencies/ebsa 1-866-444-EBSA (3272)

U.S. Department of Health and Human Services

Centers for Medicare & Medicaid Services www.cms.hhs.gov

1-877-267-2323 , Menu Option 4, Ext. 61565

Under the Federal Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA), if you are covered under the Easter Seals of Greater Houston group health plan you and your eligible dependents may be entitled to continue your group health benefits coverage under the Easter Seals of Greater Houston plan after you have left employment with the company. If you wish to elect COBRA coverage, contact your Human Resources Department for the applicable deadlines to elect coverage and pay the initial premium.

Plan Contact Information

Easter Seals of Greater Houston Human Resources

4888 Loop Central Drive Suite 200 Houston, TX 77081

713-838-9050

When you get emergency care or get treated by an out-ofnetwork provider at an in-network hospital or ambulatory surgical center, you are protected from surprise billing or balance billing.

What is “balance billing” (sometimes called “surprise billing”)?

When you see a doctor or other health care provider, you may owe certain out-of-pocket costs, such as a copayment, coinsurance, and/or a deductible. You may have other costs or have to pay the entire bill if you see a provider or visit a health care facility that isn’t in your health plan’s network.

“Out-of-network” describes providers and facilities that have not signed a contract with your health plan. Out-of-network providers may be permitted to bill you for the difference between what your plan agreed to pay and the full amount charged for a service. This is called “balance billing.” This amount is likely more than in-network costs for the same service and might not count toward your annual out-of-pocket limit.

“Surprise billing” is an unexpected balance bill. This can happen when you can’t control who is involved in your care—like when you have an emergency or when you schedule a visit at an in-network facility but are unexpectedly treated by an out-ofnetwork provider.

You are protected from balance billing for:

• Emergency services – If you have an emergency medical condition and get emergency services from an out-of-network provider or facility, the most the provider or facility may bill you is your plan’s in-network cost-sharing amount (such as copayments and coinsurance). You cannot be balance billed for these emergency services. This includes services you may get after you are in stable condition, unless you give written consent and give up your protections not to be balanced billed for these post-stabilization services.

• Certain services at an in-network hospital or ambulatory surgical center – When you get services from an in-network hospital or ambulatory surgical center, certain providers there may be out-of-network. In these cases, the most those providers may bill you is your plan’s in-network cost-sharing amount. This applies to emergency medicine, anesthesia, pathology, radiology, laboratory, neonatology, assistant surgeon, hospitalist, or intensivist services. These providers cannot balance bill you and may not ask you to give up your protections not to be balance billed.

If you get other services at these in-network facilities, out-ofnetwork providers cannot balance bill you, unless you give written consent and give up your protections.

You are never required to give up your protections from balance billing. You also are not required to get care out-of-network. You can choose a provider or facility in your plan’s network.

When balance billing is not allowed, you also have the following protections:

• You are only responsible for paying your share of the cost (like the copayments, coinsurance, and deductibles that you would pay if the provider or facility was in-network). Your health plan will pay out-of-network providers and facilities directly.

• Your health plan generally must:

• Cover emergency services without requiring you to get approval for services in advance (prior authorization).

• Cover emergency services by out-of-network providers.

• Base what you owe the provider or facility (cost-sharing) on what it would pay an in-network provider or facility and show that amount in your explanation of benefits.

• Count any amount you pay for emergency services or out-of-network services toward your deductible and out-of-pocket limit.

If you believe you have been wrongly billed, you may contact your insurance provider. Visit www.cms.gov/nosurprises for more information about your rights under federal law.

This brochure highlights the main features of the Easter Seals of Greater Houston employee benefits program. It does not include all plan rules, details, limitations, and exclusions. The terms of your benefit plans are governed by legal documents, including insurance contracts. Should there be an inconsistency between this brochure and the legal plan documents, the plan documents are the final authority. Easter Seals of Greater Houston reserves the right to change or discontinue its employee benefit plans at anytime.