WWW.TSHBP.ORG

Health Benefits Program 2024-2025 ENROLLMENT GUIDE

Texas Schools

Our purpose is to support the school children of Texas. We do this by providing health benefit solutions to our dedicated teachers, administrators, and support staff so they can concentrate on what they do best – teaching and supporting our kids.

Important Note

This summary is intended to be an easy-to-use reference for members and others interested in the TSHBP health benefits. The Summary Plan Description (SPD) and other materials specific to your plan supersede this general information with regard to individual participants’ eligibility and benefits.

2 | WWW.TSHBP.ORG

Table of Contents WWW.TSHBP.ORG | 3 TSHBP: Our Purpose 2 Table of Contents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Know the Terms . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 Choosing the Right Plan 5 Enrollment Checklist . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 MyTSHBP Digital Wallet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 Direct Care Plans Highlights 8 TSHBP High Deductible (HD) Plan Highlights 9 TSHBP Copay Plans Highlights . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 Care Coordinator . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 TSHBP Member Portal 13 Prescription Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 Your Diabetic Pharmacy Benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 Liviniti Member Portal 17 RxCompass Overview 20 How to Use Your Benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 Preventive Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 Provider Networks 24 Plan Comparison . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26 Deductibles and Maximum Out-of-Pockets: What to Know . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28 Cost Comparisons 30 Hinge Health: Digital Musculoskeletal Program 32 Virta: Type 2 Diabetes Reversal Program . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34 Unexpected Medical Bills . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35 Telehealth 36 Levels of Care . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38 TSHBeFit: Wellness Program . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40 Who is Eligible to enroll in TSHBP 43 TSHBP Contact Reference Guide 45

Terms to Know

Deductible

The annual amount for medical expenses you’re responsible to pay before your plan begins to pay its portion.

Copay

The set amount you pay for a covered service at the time you receive it. The amount can vary by the type of service.

Coinsurance

The portion you’re required to pay for services after you meet your deductible. It’s often a specified percentage of the costs.

Out-of-Pocket (OOP) Maximum

The maximum amount you pay each year for medical costs.

Emergency

A sudden or unexpected change in a person’s physical or mental condition that needs immediate medical care.

Generic Drug

A prescription drug that is the generic equivalent of a brand name drug.

Pre-Certification (or Prior Authorization)

When you need approval from your insurance carrier before certain services, procedures, treatments and/or medications can be carried out.

Primary Care Provider (PCP)

The provider you choose to be your first contact for medical care.

Referral

A written authorization from your PCP to receive care from a different in-network provider or specialist.

Specialist

A healthcare professional whose practice is limited to a certain branch of medical such as specific procedures, age categories, body systems or types of diseases.

Preventive Care

Routine healthcare like screenings, checkups, and patient counseling to prevent illnesses, diseases or other health problems.

Explanation of Benefits (EOB)

A written explanation of how an medical service was paid by your insurance and provides how much you’re responsible to pay.

Patient Assistance Program (PAP)

A program in which pharmaceutical manufacturers provide financial or medication assistance (pharmaceuticals) to low-income individuals.

Drug Deductible

The amount you must pay each year for your prescriptions before your medical plan pays it share.

Integrated with Medical

When your medical and prescription deductibles are combined. Any money paid towards a prescription goes towards your medical deductible.

In-Network

Refers to a healthcare provider that has a contract with your health plan network to provide healthcare services to its plan members at a pre-negotiated rate.

Out-of-Network

Refers to a healthcare provider who does not have a contract with your healthcare plan network.

4 | WWW.TSHBP.ORG

How to Choose the Right Plan

Choosing the right plan that will best suit you and your family can be overwhelming. We’re here to help make the decision process easier.

Following these simple steps can help you decide on which plan is the right fit for you and your family:

1

2

Reflecting on your healthcare needs for you and your family can give you insight on how you’ll use your plan:

• Are you and your family generally healthy and mostly need preventive care?

• Are you or a family member managing an ongoing health condition?

• Does an ongoing health condition require frequent doctor visits?

• Are you planning to start a family?

• Are your preferred doctors in the network?

Compare the features of each plan to determine which plan aligns most closely to you and your family needs:

Does this plan require a PCP?

3

4

Are referrals required to see a Specialist? Does this plan cover Specialty Medication? Does this plan have Out-of-Network coverage? Does this plan work with an Health Savings Account (HSA)?

Review the costs of each plan, including premiums, deductibles, copays and coinsurance:

None. You must meet deductible.

Yes. You must meet deductible, then copayments.

You must meet

Once deductible is met, plan pays 100%.

None. Once deductible is met, the copayments until maximum out-ofpocket is met.

(Provider and Ancillary Only)

(Provider and Ancillary Only) TSHBP

then

None. Once deductible is met, the copayments until maximum out-ofpocket is met.

(Provider and Ancillary Only)

Review each feature of each plan to ensure you understand their coverage and how the plans work.

WWW.TSHBP.ORG | 5

Premiums Deductibles Copays Coinsurance Network

HD Plan Lowest Highest

None.

National

Gold Plan Highest Lowest

TSHBP

TSHBP

Silver Plan Middle Middle Yes.

National

National

deductible,

copayments.

TSHBP HD Plan

No Yes Yes Yes TSHBP Gold Plan No No Yes Yes No TSHBP Silver Plan No No Yes Yes No

No

Enrollment Checklist

Open Enrollment is the best time to consider how you use your healthcare benefits and which of the offered TSHBP Medical Plans would be a good fit for you and your family. Are you getting married? Are you about to start a family? Do you have any upcoming surgeries that you are aware of? Keep all of this in mind when choosing a medical plan.

Comparing the TSHBP Plans features and costs can be a deciding factor in choosing a plan. Here is a checklist to keep in mind as you choose a TSHBP Medical Plan.

Understand the differences between each plan.

Understand what you’d pay for monthly premiums, copays, coinsurance, deductibles and out-of-pocket maximums.

Review each provider network to ensure your provider is in the network.

Understand that going out of the network will cost you more or the plan you choose may not cover you at all.

Know which preventive screenings and care the plan covers at no cost.

Consider any anticipated life changes, such as marriage or if you are thinking about starting a family.

Consider any upcoming surgeries or medical procedures and which plan would best suit your needs. Remember, for any non-emergency surgeries or procedures, you would be required to reach out to the Care Coordinator for precertification and scheduling.

6 | WWW.TSHBP.ORG

MyTSHBP Digital Wallet

Your TSHBP Medical Resources at your fingertips!

TSHBP Health Benefits Access

» Login to the Member Portal

» “What’s New” Plan Information

» Benefits Overview and Health Resources

Health Search Tools

» Provider Lookup

» Pharmacy Searches

» R(x) Cost Comparisons

TSHBP Support & Help Resources

» View Your Claims

» Call the Care Coordinator

» Request TSHBP Assistance

Use your phone to scan the QR code and access the MyTSHBP Digital Wallet!

Once accessed, save the webapp to your phone’s home screen for convenient use on-the-go.

WWW.TSHBP.ORG | 7

SCAN ME

A Deeper Dive into Directed Care

The TSHBP is proud to offer a Directed Care model for the 2024-25 Plan Year. With the Directed Care Plans, we utilize a National network for physicians, ancillary and office services. We contract directly with hospitals for provider reimbursements. To access hospitals, the Care Coordinators are utilized in order to direct members to high quality, fairly priced facilities for planned procedures.

» TSHBP High Deductible (HD) Plan

» TSHBP Silver Plan

» TSHBP Gold Plan

» Embedded Deductibles

» In and Out-of-Network Benefits

» HealthSmart National Network for Physician, Specialist and Ancillary services

» Care Coordinator is mandatory for hospital and planned procedures

» Specialty Drugs - Full Coverage, participation in the Patient Assistance Program (PAP) required

Individual Deductible & Maximum Out of Pocket for 2024-2025 In-Network Services

Individual Deductible Cost

Individual Max OOP Cost

$4,500 $4,500 TSHBP HD Plan TSHBP Gold Plan $6,000 TSHBP Silver Plan $2,500 $8,000 $1,500 8 | WWW.TSHBP.ORG

TSHBP High Deductible (HD) Plan Highlights

*The Care Coordinator program must be used to access facility services or no benefits will be available under the Plan

These services include routine colonoscopy and related services; hospital providers for MRIs, Cat Scans, and Pet Scans; hospital providers for outpatient Lab/Radiology Services; Inpatient Hospital Admissions; Outpatient Hospital/Ambulatory Surgical Facility Services; Maternity and Newborn Services; Rehabilitation/Therapy Services; Extended Care Services; and Other Services including durable medical equipment/supplies, orthotics/prosthetics, facilities for diabetic self-management training, and sleep disorder services. To review the complete plan document and services that require access through the Care Coordinator program, please call 888-803-0081.

Plan TSHBP HD Plan Coverage In-Network Out-of-Network Network HealthSmart N/A Plan Deductible Feature Deductible, then Plan pays 100% Deductible, then Plan pays 100% Individual/Family Deductible $4,500/$13,500 $7,000/$21,000 Coinsurance None - Plan Pays 100% after deductible None - Plan Pays 100% after deductible Individual/Family Maximum Out-of-Pocket $4,500/$13,500 $7,000/$21,000 Health Savings Account (HSA) Eligible Yes Yes Primary Care Provider (PCP) Required No No Primary Care Provider (PCP) Referral to Specialist Required No No Doctor Visits Preventive Care Yes - $0 copay Yes - $0 copay Virtual Health - Teladoc $30 per consultation $30 per consultation Primary Care Deductible, then Plan pays 100% Deductible, then Plan pays 100% Specialist Deductible, then Plan pays 100% Deductible, then Plan pays 100% Office Services Allergy Injections Deductible, then Plan pays 100% Deductible, then Plan pays 100% Allergy Serum Deductible, then Plan pays 100% Deductible, then Plan pays 100% Chiropractic Services Deductible, then Plan pays 100% Deductible, then Plan pays 100% Office Surgery Deductible, then Plan pays 100% Deductible, then Plan pays 100% MRI's, Cat Scans, and Pet Scans Deductible, then Plan pays 100% Deductible, then Plan pays 100% Care Facilities Urgent Care Facility Deductible, then Plan pays 100% Deductible, then Plan pays 100% Freestanding Emergency Room Deductible, then Plan pays 100% Deductible, then Plan pays 100% Hospital Emergency Room Deductible, then Plan pays 100% Deductible, then Plan pays 100% Ambulance Services Deductible, then Plan pays 100% Deductible, then Plan pays 100% Outpatient Surgery Deductible, then Plan pays 100% In-Network Only Hospital Services Deductible, then Plan pays 100% In-Network Only Surgeon Fees Deductible, then Plan pays 100% In-Network Only Maternity and Newborn Services Maternity Charges (Prenatal and Postnatal care) Deductible, then Plan pays 100% In-Network Only Routine Newborn Care Deductible, then Plan pays 100% In-Network Only Rehabilitation/Therapy Occupational/Speech/Physical Deductible, then Plan pays 100% Deductible, then Plan pays 100%* Cardiac Rehabilitation Deductible, then Plan pays 100% Deductible, then Plan pays 100%* Chemotherapy, Radiation, Dialysis Deductible, then Plan pays 100% Deductible, then Plan pays 100%* Home Health Care Deductible, then Plan pays 100% Deductible, then Plan pays 100%* Skilled Nursing Deductible, then Plan pays 100% In-Network Only Prescription Drug Benefits Drug Deductible Integrated into Medical Generic Deductible, then Plan pays 100%; $0 for certain generics Preferred Brand Deductible, then Plan pays 100% Non-Preferred Deductible, then Plan pays 100% Specialty Full Coverage - Participation in the PAP is required - Deductible, then Plan pays 100%

WWW.TSHBP.ORG | 9

TSHBP Copay Plans Highlights

*The Care Coordinator program must be used to access facility services or no benefits will be available under the Plan

These services include routine colonoscopy and related services; hospital providers for MRIs, Cat Scans, and Pet Scans; hospital providers for outpatient Lab/Radiology Services; Inpatient Hospital Admissions; Outpatient Hospital/Ambulatory Surgical Facility Services; Maternity and Newborn Services; Rehabilitation/Therapy Services; Extended Care Services; and Other Services including durable medical equipment/supplies, orthotics/prosthetics, facilities for diabetic self-management training, and sleep disorder services. To review the complete plan document and services that require access through the Care Coordinator program, please call 888-803-0081.

Plan TSHBP Gold Plan TSHBP Silver Plan Coverage In-Network Out-of-Network In-Network Out-of-Network Network HealthSmart N/A HealthSmart N/A Plan Deductible Feature Deductible then Copayments Deductible then Copayments Deductible then Copayments Deductible then Copayments Individual/Family Deductible $1,500/$4,500 $6,000/$18,000 $2,500/$9,000 $10,000/$20,000 Coinsurance Deductible then Copayments Deductible then Copayments Deductible then Copayments Deductible then Copayments Individual/Family Maximum Out-of-Pocket $6,000/$18,000 $18,000/$36,000 $8,000/$16,000 $20,000/$40,000 Health Savings Account (HSA) Eligible No No No No Primary Care Provider (PCP) Required No No No No Primary Care Provider (PCP) Referral to Specialist Required No No No No Doctor Visits Preventive Care Yes - $0 copay Yes - $0 copay Yes - $0 copay Yes - $0 copay Virtual Health - Teladoc $0 per consultation $0 per consultation $0 per consultation $0 per consultation Primary Care $45 copay $60 copay $45 copay $60 copay Specialist $70 copay $85 copay $70 copay $85 copay Office Services Allergy Injections $10 copay $15 copay $10 copay $15 copay Allergy Serum $45 copay $60 copay $45 copay $60 copay Chiropractic Services $45 copay $60 copay $45 copay $60 copay Office Surgery $125 copay $150 copay $125 copay $150 copay MRI's, Cat Scans, and Pet Scans $325 copay $375 copay $325 copay $375 copay Care Facilities Urgent Care Facility $75 copay $100 copay $75 copay $100 copay Freestanding Emergency Room $500 copay $500 copay $500 copay $500 copay Hospital Emergency Room $500 copay $500 copay $500 copay $500 copay Ambulance Services $275 copay $275 copay $275 copay $275 copay Outpatient Surgery $650 copay In-Network Only $750 copay In-Network Only Hospital Services $650 copay In-Network Only $750 copay In-Network Only Surgeon Fees $200 copay In-Network Only $250 copay In-Network Only Maternity and Newborn Services Maternity Charges (Prenatal and Postnatal care) $500 copay In-Network Only $650 copay In-Network Only Routine Newborn Care $250 copay In-Network Only $350 copay In-Network Only Rehabilitation/Therapy Occupational/Speech/Physical $55 copay $65 copay* $55 copay $65 copay* Cardiac Rehabilitation $110 copay $125 copay* $110 copay $125 copay* Chemotherapy, Radiation, Dialysis $110 copay $125 copay* $110 copay $125 copay* Home Health Care $55 copay $75 copay* $55 copay $75 copay* Skilled Nursing $500 copay In-Network Only $500 copay In-Network Only Prescription Drug Benefits Drug Deductible $200 Brand Deductible $350 Brand Deductible Generic $0 copay CVS/HEB/Walmart/Costco/Sam’s | $10 copay All other net Pharmacies $0 copay CVS/HEB/Walmart/Costco/Sam’s | $10 copay All other net Pharmacies Preferred Brand $35 copay or 50% copay / Max $100 $45 copay or 50% copay / Max $150 Non-Preferred $70 copay or 50% copay / Max $200 $90 copay or 50% copay / Max $250 Specialty Full Coverage - Participation in the PAP is required50% copay (Max $500) Full Coverage - Participation in the PAP is required50% copay (Max $750)

10 | WWW.TSHBP.ORG

Care Coordinator

Members enrolled in the Directed Care Plans will use the HealthSmart PPO Network for Physician and Ancillary services. However, all facility and hospital services must be accessed via the Care Connect Program. Under the Care Connect Program, a Care Coordinator becomes a personal concierge for our members.

Today, most health plans require members to navigate a complicated maze of in-network confirmation requirements, but the TSHBP is designed so the Care Coordinator steps in on behalf of the member and fully supports the member through the process. The Care Coordinator will explain benefits, verify eligibility, answer questions, research quality on every encounter, schedule procedures, and negotiate with facilities for best rates. Our goal is to simply and easily schedule the member with high quality, fair priced facilities in the easiest possible manner while supporting the member through all aspects of the health care continuum.

To allow for coordination and payment of hospitalizations and procedures, please contact the Care Coordinator as soon as you know. Care Coordinators require a minimum of 5 business days to complete their processing of your procedure.

For any emergency service, immediately go to the nearest facility to receive the care you need. Should you receive a balance bill from the facility, just contact your Care Coordinator and they will engage the TSHBP member advocates program to interact with the facility to settle any balance bill disputes.

Click the link to learn more about the Care Coordinator Process: https://tshbp.info/CCVideo

Navigating Care Coordination: Know When to Reach Out

HealthSmart Physician Network

» Office Visits (Primary Care Provider)

» Specialist Visit or Consultation (i.e. surgeon, cardiologist)

» Independent Labs

» Minor X-Rays

» Urgent Care

Care Coordinator

» All Inpatient and Outpatient stays

» PET/CAT Scans

» MRIs

» Colonoscopy

» Chemo

» Dialysis

» Physical, Speech and Occupational Therapies if scheduled with a procedure

WWW.TSHBP.ORG | 11

Our Care Coordinators are here for YOU!

When reaching out to a Care Coordinator, you may not know what to expect. At TSHBP, we are here to help you! Here’s what to expect when you call a Care Coordinator:

Researching Your Options

» Your Care Coordinator will research your options and locate a facility that meets the TSHBP Quality and Pricing standards.

» Your Care Coordinator will be in constant communication with you.

Discussing Your Choices

» Together with your Care Coordinator, they will walk you through your provider options, any out-of-pocket payments and help answer any questions you may have before scheduling your procedure.

Scheduling Your Appointment

» Your Care Coordinator will schedule your procedure with the provider and/or facility and will arrange the payment to the provider and/or facility.

» Payments are required to be submitted through PayPal.

» Your Care Coordinator will provide you detailed instructions on what to expect when you go into the facility.

The Day of Your Appointment

» You go to the facility and have your procedure as scheduled, knowing you have the support of your Care Coordinator team from start to finish.

12 | WWW.TSHBP.ORG

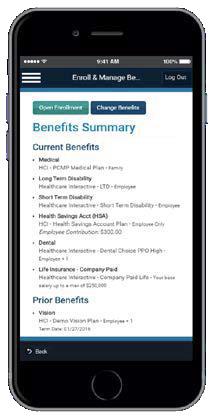

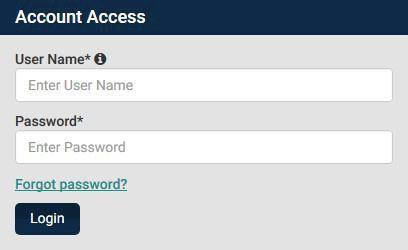

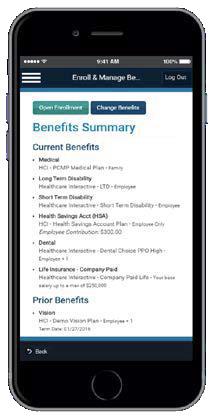

TSHBP Member Portal

Utilize your healthcare portal for seamless access to essential features such as your medical and prescription claims, downloading or ordering a new ID card, reviewing your benefit information and searching for in-network providers. Additionally, easily search for providers to ensure you’re accessing care within your network. The TSHBP Member Portal, powered by 90 Degree Benefits, is your one-stop-shop for all your needs.

Member Portal Instructions

Registration

Visit your TSHBP Member Portal at https://portal.90degreebenefits.com

In the upper right corner of the TSHBP Member Portal home screen, click the Register Now button

Fill out the Registration Form and click Submit. Use your Social Security Number or your Member ID Number printed on your TSHBP Member ID Card.

If you have any issues with the log in process, please contact 888-803-0081.

Logging In

Once you have registered for the Member Portal, you may use your user name and password to log in.

Log in to your Member Portal at https://portal.90degreebenefits.com

Take your TSHBP Benefits with You

View your claims history, search for a doctor or pharmacy and access a copy of your ID card on the go.

Look for the hciactive. my90db mobile app in the Apple App Store and Google PlayStore.

WWW.TSHBP.ORG | 13

1

4

2 3

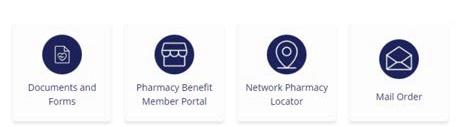

Prescription Drug Benefits

Prescription Drug Benefits are managed by Liviniti for all TSHBP Medical Plans. Liviniti uses a Performance Drug List to provide members with a managed selection of pharmacy choices. Liviniti has over 66,000 participating pharmacies nationwide with over 4,500 of those in Texas.

The pharmacy network is comprised of independent and chain pharmacies and the network is noted with the FirstChoice logo on the Pharmacy Locator page. First Choice pharmacies provide the greatest discounts on your prescriptions.

Full Coverage - Participation in the PAP is required - Deductible, then Plan pays 100% Full Coverage - Participation in the PAP is required - 50% copay (Max $500) Full Coverage - Participation in the PAP is required - 50% copay (Max $750)

Making Medications Make Sense

Switching to a new insurance can mean the processes for your prescriptions are different. Here is some guidance on what to do:

1

2 Understand where your prescriptions fall within the formulary

» To find out if your prescription is click here Liviniti Member App

» Some medications may need Prior Authorization (PA) or have Quantity Limits (QL), please contact Liviniti if you have any questions at (833) 439-9618.

Locate a Pharmacy

» You can locate a participating pharmacy by using the Pharmacy Locator here

» Remember, generics are a $0 cost at all CVS, HEB, Walmart, SAMS, and Costco locations.

14 | WWW.TSHBP.ORG

Prescription Drug Benefits TSHBP HD Plan TSHBP Gold Plan TSHBP Silver Plan Drug Deductible Integrated into Medical $200 Brand Deductible $350 Brand Deductible Generic

$0

$0

Preferred

$35

50% copay

Max $100 $45 copay

50% copay

Max $150 Non-Preferred

pay 0% after deductible $70 copay

50% copay

Max $200 $90 copay

50% copay

Max $250 Specialty

You pay 0% after deductible; $0 for certain generics

for certain generics / $10 copay

for certain generics / $10 copay

Brand You pay 0% after deductible

copay or

/

or

/

Brand You

or

/

or

/

Please Note:

Specialty Drug Benefits

Specialty Drug Program Assistance (PAP)

Specialty Drugs refer to a narrowly defined class of extremely high-cost, biologic drugs that often require special handling, administration, and careful adherence to treatment protocols. Specialty drugs that have a net cost of more than $670 per month, after discount, for a 30-day fill are not covered by the Plan and as such the Texas Schools Health Benefits Program has engaged RxCompass to assist members with securing drug coupons, manufacturer rebates, and governmental finance assistance as needed. Please refer to the following website for further information: Pharmaceutical Drug Look-up tool: Liviniti - Member Portal

It’s important to note: Participation in the RxCompass drug program is mandatory; however, for any drug for which assistance is not available, or for any other medication otherwise deemed ineligible for participation, coverage under an alternative funding prescription drug program may be available. Deductible and/or out-of-pocket amounts and/or Copays, are required for all medication coverage under any alternative funding prescription drug program.

» Specialty drugs administered in a facility setting will be covered as a component of a treatment plan when billed by the facility as a claim cost. Benefits will be provided following the payment parameters established in the plan document, based on the place of service and/or provider administering such medication.

» Specialty drug costs under $670 per month for a 30-day supply will be covered, subject to any deductible and copayment requirements.

» Participation in the RxCompass drug program is mandatory; however, for any drug for which assistance is not available, coverage under an alternative funding prescription drug program may be available. Deductible and/or out-of-pocket amounts and/or Copays, are required for all medication coverage under any alternative prescription drug program.

» Once prior authorization is approved up to 3 retail fills of 30 days are covered for specialty medications that require members to apply and wait to move through the Patient Assistant Program (PAP).

WWW.TSHBP.ORG | 15

Your Diabetic Pharmacy Benefits

You may fill your diabetes medications and testing supplies at any contracted pharmacy.

You can find a contracted pharmacy by accessing your company Pharmacy Benefits page by searching your group number 50000 at https://liviniti.com/members/ and selecting Network Pharmacy Locator under Member services at the bottom of the page.

Diabetic Supply

Glucose Monitor/Meter

» Contour, OneTouch products preferred

» PA is required for all other brands

Test Strips

» Contour, OneTouch products preferred

» PA is required for all other brands

Lancing Device

Lancet

Alcohol Swabs

Continuous Glucose Monitor—Dexcom

Continuous Glucose Monitor—Freestyle Libre

Insulin Pump—Omnipod

All Other Insulin Pumps

Insulin Pen Needles

Insulin Syringes

If you have concerns about your diabetic medication, the Liviniti Customer Service Team is available to help you.

Please call (800) 710-9341

Quantity Limits

1 meter per 365 days

10 strips per day

2 devices per 365 days

Covered—Max cost limit applies

Covered—Max cost limit applies

1 receiver per 365 days

1 transmitter per 90 days

1 sensor per 10 days

1 sensor per 14 days

1 reader per 365 days

15 pods per 30 days

Omnipod Kits: 1 kit per 365 days

Not covered under Pharmacy Benefit

Covered under Medical Benefit

Covered—Max cost limit applies

Covered

If you have type 2 diabetes, you may be eligible to enroll in a type 2 Diabetes Reversal Program, Virta, at no cost for you. More information is available on page 34 .

16 | WWW.TSHBP.ORG

Member Reference Guide

Your Pharmacy ID Card Includes Important Information

Group Number: Found on your Member ID Card

Member ID: Found on your Member ID Card

Bin Number: 015433

PCN: SSN (SSN is a network acronym –it does not refer to your social security number)

PBM: Liviniti

Contact Information

We’re here 24/7/365 to support plan members

» Call us: (800) 710-9341

» Send a fax: (318) 214-4190

» Send an email: support@liviniti.com

» Visit: liviniti.com

Find What You Need

1. Visit liviniti.com/members

2. Under Member Portal Login, select “Create Account”

» Refer to your ID card for your credentials

» Choose a password

» Click “Register”

3. You will receive an email to confirm your registration before you can login

The Liviniti Member Center is your one-stop hub for all the information you need to maximize your pharmacy benefits.

The Member Portal is loaded with information about your pharmacy benefits and prescriptions. After you create your account and confirm your registration, you can login to the Member Portal from the Member Center.

On the Member Portal you can:

» View benefit details, including out-of-pocket and deductible information for you and your family

» Review your prescription history and share it with your physician

» Search for a nearby pharmacy based on your zip code

» Find and compare drug prices to find the best price at any network pharmacy in a few easy steps

» Search for medications by name and view formulary tier, whether it is a specialty or over-the-counter (OTC) drug, and any special programs such as prior authorization or quantity limits that apply to the medication

» Check the history or status of any prior authorization

» Locate the mail order pharmacy used by your plan

» Download a digital ID card

WWW.TSHBP.ORG | 17

Activate your Member Portal:

Member Reference Guide

Find What You Need (continued)

Take your pharmacy benefits on the go with the Liviniti Mobile App.

The mobile app has the same features and information as the Member Portal. You can find a free copy of the Liviniti Mobile App wherever you download apps for your phone. Get started today!

What is the FirstChoiceTM Pharmacy Network?

What is Variable CopayTM?

Your Company Page also has helpful information. You do not need to create a personal account but will need your Group Number. On the Member Center, scroll down to Your Company Page, enter your Group Number and click “Visit Company Page.”

On your Company Page you can:

» Find your plan’s Formulary or Drug List and look-up a drug or learn more about your coverage

» Use your Group Number to access your Company Page

» Under Search For Medications, type the name of your medication and click Search

» Locate the best network pharmacy for your needs based on the zip code you enter

» Use your Group Number to access your Company Page

» Select Network Pharmacy Locator*

» Enter your ZIP code

» Enter the Liviniti Bin Number: 015433

» Choose your search radius and select “Search”

*These symbols are in the Network Pharmacy Locator

Pharmacy is contracted as a FirstChoice™ pharmacy

Pharmacy is contracted for specialty medications

Pharmacy is contracted for vaccines

FirstChoice is the preferred pharmacy network of Liviniti. You’ll find reduced prescription costs at network pharmacies that generally offer a lower cost on medications than a standard (non-preferred) pharmacy. The network consists of independent, community pharmacies as well as well-known regional or national chains. Participating pharmacies are approved to fill a 90-day supply of medications. Specialty medications are limited to a 30-day supply.

Unlock BIG SAVINGS On Brand and Specialty Drugs

Variable Copay utilizes manufacturer-provided coupons to significantly reduce the cost on eligible high-cost brand and specialty medications. With Variable Copay, your out-of-pocket costs for prescription drugs may be reduced or eliminated by a drug manufacturer’s coupon.

Your medications will arrive at your doorstep monthly via a shipping courier (UPS, FedEx, DHL) approximately 5-7 days before your current medications are completed. A Variable Copay Network Pharmacy will communicate with you each month on reminders of your shipment and verification of address.

Variable Copay requires enrollment. Enrollment in Variable Copay is quick and simple. Call (833) 439-9617 to speak with a dedicated Variable Copay Support Team. Enrollment is also available within the Liviniti mobile app.

18 | WWW.TSHBP.ORG

iPhone QR Code Android QR Code

Liviniti Mobile App

Quick access to your prescriptions

For fast, on-the-go questions about your pharmacy benefits, the answers can fit in the palm of your hand with the Liviniti mobile app. The mobile app has all the information and resources you would expect, in one convenient place. Use your smartphone to track and manage your prescriptions whenever you want. The free mobile app is a one-stop resource that keeps your pharmacy benefits always within your reach.

» Digital ID Card

» Prescription History

» Drug Price Check

Favorite Features

Drug

Formulary Search

» Drug Formulary Search

» Pharmacy Locator

» Variable Copay Enrollment

A formulary is a list of generic and brand name prescription drugs covered by your health plan. You can now quickly search for covered drugs inside the mobile app. Choose generics and preferred brands to save the most money.

Variable Copay Enrollment

The Variable Copay™ program significantly reduces the rising cost of eligible brand and specialty medications by utilizing manufacturer-provided coupons. Enrollment is necessary to receive these manufacturer provided coupons. You can enroll in Variable Copay directly from the mobile app, if applicable.

Prior Authorization Reviews

Prior authorization is a cost-savings initiative of your prescription plan and ensures the appropriate use of certain drugs. This program is designed to help prevent improper prescribing or use of certain drugs that may not be the best choice for a given health condition. You can view your prior authorization status within the mobile app.

Drug Price Check

Look up the cost of your prescriptions at various pharmacies to save additional money.

» Prior Authorization Reviews

» Plus More

mobile app

WWW.TSHBP.ORG | 19

Download the

In the app store, search for Liviniti or Southern Scripts. We’re here 24/7/365 to care for our members. Call us at 800-710-9341 or email us at support@liviniti.com. www.liviniti.com

RxCompass Program

RxCompass is a drug management program that provides significant savings on specialty and high-cost medications.

This comprehensive pharmacy benefit program guides members through various drug saving pathways to maximize savings.

Participation in RxCompass is required for members with high-cost brand or specialty medication. If your medication qualifies for a RxCompass pathway, a pharmacy Care Navigator will outreach to you to enroll you in the RxCompass program. This program could either eliminate or greatly reduce your out-of-pocket costs!

Please contact RxCompass to see if your medication qualifies at (833) 439-9618.

RxCompass Pathways

20 | WWW.TSHBP.ORG

RxCompass Program

Patient Assistance Programs (PAP)

» The Patient Assistance program guidelines are reviewed for your medication

» The application forms are sent to you for completion with support from your Care Navigator

» The Care Navigator forwards completed forms to your prescribing physician for finalization

» The finalized application is sent to the manufacturer

» If you are approved for Patient Assistance, your Care Navigator will initiate follow-up shipments

» If you are denied for Patient Assistance, your Care Navigator will navigate you through an alternate pathway to source your medication

INTL Mail

If International Mail is determined to be the best source of your medication:

» Our INTL mail vendor will contact you. If you have a question regarding the vendor, please contact your RxCompass Care Navigator, who will assist.

» The International Mail team will contact you directly to enroll. A copy of your passport or government ID may be required.

» The International Mail team will obtain the prescription from your physician and contact you to set up delivery of your medication.

Variable Copay

» If Variable Copay program is determined the best source of your medication, you will be referred to an Intake Specialist

» If you are not already enrolled in a copay savings program, the Intake Specialist will register you

» Upon enrollment, you will be transitioned to a Variable Copay Network Pharmacy to fill your medication

TeleSaverRx

» If TeleSaverRx is determined to be the best source of your medication, you are navigated through the intake process which includes an annual Telehealth visit

» TeleSaverRx will obtain the prescription from your physician and contact you to set up delivery of your medication

WWW.TSHBP.ORG | 21

How to Use Your Benefits

Selecting a Medical Plan can leave you wondering about the next steps. Questions like, “What information do I provide to my doctor?” or “Which network am I a part of?” might come up. It’s completely normal to feel a bit unsure. Here’s a friendly headsup on what to expect and what you should do after choosing your TSHBP Medical Plan.

» Verify that your physician is in network by looking up your provider on the provider search. This would be the HealthSmart Network.

» When visiting the doctor’s office, provide your Medical ID card.

» If a provider asks what network you are on, you would say the ’HealthSmart’ network.

» The doctor’s office will contact 90 Degree Benefits at 888-803-0081 or visit the provider portal at https://portal.90degreebenefits.com/ providerportal/

If you need additional services requiring use of a medical facility or hospital, you are required to contact a Care Coordinator at 888-003-0081. The Care Coordinator team will work with you and your doctors to locate a quality medical facility, schedule your procedure, collect your copay/responsibility, and will pay the facility for your procedure.

What is the difference between TSHBP, 90 Degree Benefits and HealthSmart?

» TSHBP, otherwise known as the Texas Schools Health Benefits Program, is your Medical Plan Administrator.

» 90 Degree Benefits administers the TSHB Program much like BCBSTX administers the TRSActiveCare program. 90DB provides customer service for your TSHBP benefits, process claims, and provides concierge service through Care Coordinators.

» HealthSmart Physician & Ancillary is the provider network for the Directed Care Plans.

22 | WWW.TSHBP.ORG

Preventive Services

Preventive Services are designed to comply with terms of the Patient Protection and Affordable Care Act (PPACA), current recommendations of the United States Preventive Services Task Force, the Health Resources and Services Administration, and the Centers for Disease Control and Prevention.

Examples of preventive health care services include, but are not limited to—

» Well-baby/Well-child care

» Preventive, routine physicals

» Well-Woman visits

» Preventive Mammograms

» Immunizations

» Preventive colonoscopy

» Prostate cancer screening

» Preventive and screening tests and services must be ordered by a treating healthcare provider

» Preventive care does not include diagnostic treatment, lab, x-ray, follow-up care, or maintenance care of existing conditions or chronic disease

Any plan deductible or copay amounts stated in the Benefit Summary are waived when preventive care services are provided by an in-network provider. When preventive services and diagnostic or therapeutic services occur during the same visit, the member pays applicable deductible or copays for diagnostic or therapeutic services but not for preventive services.

WWW.TSHBP.ORG | 23

Provider Networks

Did you know… it is common practice for providers to be contracted with a network but opt to not appear in the network yet choose not the shown in the network provider portal?

If you’re unable to locate your provider within the network, it doesn’t necessarily mean that they are not part of the network. Call the Care Coordinator at 888-803-0081 and we can help you in confirming if your provider is part of the network.

The TSHBP Directed Care Plans utilizes a national network to provide physician and ancillary services access to all members. TSHBP members will have access to the HealthSmart Network Solutions’ Physician and Ancillary Only Primary PPO which contains approximately 502,309 contracted providers in over 1,421,981 unique locations across the country.

Please Note: hospitals are excluded from the PPO networks. All hospital and other medical facility-based services are accessed via an assigned Care Coordinator.

TSHBP members will experience the lowest outof-pocket costs for physician and ancillary medical services when utilizing network providers. It is easy to look up providers in your area by clicking on the link below. Your searches can be saved to your computer or sent to your email.

Visit https://tshbp.info/HSNetwork for a provider near you.

24 | WWW.TSHBP.ORG

HealthSmart Network

We understand that it can be frustrating to not find your provider in the network. If you’ve already searched through provider network and contacted Care Coordinators without success, you have the opportunity to nominate your provider. You can provide the below links to your provider to fill out.

HealthSmart Network Nomination: https://www.healthsmart.com/Service-Centers/Member-Center/Nominate-a-Provider/Nominate-a-Provider

It could take up to 30-90 days for a provider to be added into the network if they choose. Please be aware of the TSHBP Medical Plan you are enrolled in and if that plan has out-of-network coverage. Out-of-Network providers tend to be more expensive than in-network providers.

WWW.TSHBP.ORG | 25

network—

My provider isn’t in the

what can I do?

TSHBP Plan Comparison Chart

(Including, but not limited to, MRI, PET, CT, Nuclear Medicine, Myelogram, Cardiac Stress Test, and Bone Scans, facility/professional expenses, all Outpatient, and office places of service.)

Plans TSHBP HD Plan Plan Features In-Network Coverage Out-of-Network Coverage In-Network Network HealthSmart N/A HealthSmart Individual/Family Deductible $4,500/$13,500 $7,000/$21,000 $1,500/$4,500 Coinsurance None - Plan Pays 100% after deductible None - Plan Pays 100% after deductible Deductible Primary Care Provider (PCP) Required No No Primary Care Provider

to Specialist Required No No Doctor Visits Preventive Care Yes - $0 copay Yes - $0 copay Yes Virtual Health $30 per consultation (Includes Behavioral/Mental Health) $30 per consultation (Includes Behavioral/Mental Health) $0 per (Includes Behavioral/Mental Primary Care Deductible, then Plan pays 100% Deductible, then Plan pays 100% $45 Specialist Deductible, then Plan pays 100% Deductible, then Plan pays 100% $70 Care Facilities Urgent Care Facility Deductible, then Plan pays 100% Deductible, then Plan pays 100% $75 Freestanding Emergency Room Deductible, then Plan pays 100% Deductible, then Plan pays 100% $500 Hospital Emergency Room Deductible, then Plan pays 100% Deductible, then Plan pays 100% $500 Outpatient Surgery Deductible, then Plan pays 100% In-Network Only $650 Prescription Drug Benefits Drug Deductible Integrated into Medical Days Supply 30-Day Supply/90-Day Supply Generic Deductible, then Plan pays 100%; $0 for certain generics $0 Preferred Brand Deductible, then Plan pays 100% Non-Preferred Brand Deductible, then Plan pays 100% Specialty Full Coverage - Participation in the PAP is requiredDeductible, then Plan pays 100% Full Coverage Other Services Diagnostic Labs (does not include Major Diagnostic Procedures) Deductible, then Plan pays 100% $55 Major Diagnostic Labs

(PCP) Referral

Deductible, then Plan pays 100% $325 Bariatric Surgery No Coverage Weight Loss Medications No Coverage 26 | WWW.TSHBP.ORG

TSHBP Gold Plan TSHBP Silver Plan In-Network Coverage Out-of-Network Coverage In-Network Coverage Out-of-Network Coverage HealthSmart N/A HealthSmart N/A $1,500/$4,500 $6,000/$18,000 $2,500/$9,000 $10,000/$20,000 Deductible then Copayments Deductible then Copayments Deductible then Copayments Deductible then Copayments No No No No No No No No Yes - $0 copay Yes - $0 copay Yes - $0 copay Yes - $0 copay per consultation Behavioral/Mental Health) $0 per consultation (Includes Behavioral/Mental Health) $0 per consultation (Includes Behavioral/Mental Health) $0 per consultation (Includes Behavioral/Mental Health) $45 copay $60 copay $45 copay $60 copay $70 copay $85 copay $70 copay $85 copay $75 copay $100 copay $75 copay $100 copay $500 copay $500 copay $500 copay $500 copay $500 copay $500 copay $500 copay $500 copay $650 copay* In-Network Only $750 copay* In-Network Only $200 Brand Deductible $350 Brand Deductible 30-Day Supply/90-Day Supply 30-Day Supply/90-Day Supply copay at certain pharmacies; others $10/$20 copay $0 copay at certain pharmacies; others $10/$20 copay $35 copay or 50% copay / Max $100 $45 copay or 50% copay / Max $150 $70 copay or 50% copay / Max $200 $90 copay or 50% copay / Max $250 Coverage - Participation in the PAP is required - 50% copay (Max $500) Full Coverage - Participation in the PAP is required - 50% copay (Max $750) $55 copay $75 copay $55 copay $75 copay $325 copay* $375 copay* $325 copay* $375 copay* No Coverage No Coverage No Coverage No Coverage

program must be used to access facility services or no benefits will be available under the Plan WWW.TSHBP.ORG | 27

*The Care Coordinator

Deductibles and Maximum Out-of-Pockets—What to Know

Understanding how deductibles and maximum out-of-pocket amounts work can help you understand how your medical plan works. The deductible is the amount you pay yearly for covered healthcare services before your medical plan starts to pay.

Every covered family member has a deductible and a maximum out of pocket. In addition, the whole family also has a deductible and a maximum out of pocket. Depending on the TSHBP Plan you intend to elect, individuals would need to meet their deductibles before the plan begins to pay coinsurance. They don’t have to meet the family deductible for coverage to start.

How deductibles work:

» Claims that count towards an individual’s deductible also count towards the family’s deductible. Once a person meets their deductible, they pay coinsurance and/ or copays, which don’t count toward the family deductible.

» After any combination of family members meets the family deductible, the entire family pays only coinsurance and/or copays for medical care and prescriptions for the rest of the plan year.

Maximum out-of-pockets work similarly to deductibles:

» An individual’s deductible, copay and/or coinsurance count towards both individual and family maximum out of pockets. Once a person meets their maximum out of pocket, the plan covers allowable expenses at 100% for the rest of the plan year.

» After any combination of family members meets the family’s maximum out of pocket, the plan covers the family’s medical care and prescriptions at 100% for the rest of the plan year.

Please remember, depending on the TSHBP Medical Plan you intend to elect, out-of-network provider costs are higher than in-network providers or the plan may not cover out-of-network costs.

28 | WWW.TSHBP.ORG

WWW.TSHBP.ORG | 29

Cost Comparison

At TSHBP, we are committed to ensuring that you choose the best plan for you and your family. We understand that navigating costs with Medical Plans, how your coverage works, and how much to expect to pay for services can be difficult at first. We will take two different scenarios and break down what each member would pay for services according to each TSHBP Medical Plan.

Please remember, these costs are for example use only. The cost of procedures and/or surgeries will vary depending on many factors such as provider, hospital, and region you are located.

Let’s look at Sue. Sue is having a baby and let’s say the total cost of having a baby is $19,000. We will break down the costs Sue would expect to pay on each plan.

Using the above costs and each plan’s copays/co-insurance, this is what Sue would expect to pay on each plan for having a baby. Remember, Sue is required to call the Care Coordinator to set up a plan for her delivery.

30 | WWW.TSHBP.ORG

TSHBP HD Plan TSHBP Gold Plan TSHBP Silver Plan Deductible $4,500 $1,500 $2,500 Primary Care Visit $150 $150 $150 Prenatal Costs $1,850 $1,850 (Remaining deductible + Copay) $1,850 Delivery Costs $2,500 $650 copay $1,300 (Remaining deductible + Copay) Routine Newborn Care $0 $250 copay $350 copay Total Paid $4,500 $2,900 $3,650

Sue Example Costs of Services Initial Primary Care Visit $150 Prenatal Costs $1,850 Delivery Costs $14,000 Routine Newborn Care $3,000 Total Costs of Services $19,000

Cost Comparison

Now, let’s look at Tom.

Tom is experiencing knee pain and after a visit with his PCP and a Specialist, he is told he needs to have knee surgery. Let’s say the total cost of having a knee surgery is $17,750. We will break down the costs Tom would expect to pay on each plan.

Please remember, these costs are for example use only. The cost of procedures and/or surgeries will vary depending on many factors such as provider, hospital, and region you are located.

Costs of Services

Using the above costs and each plans copays/co-insurance, this is what Tom would expect to pay on each plan for knee surgery. Remember, Tom is required to call the Care Coordinator to set up his surgery.

WWW.TSHBP.ORG | 31 Example

Primary Care Visit $150 Specialist Visit $350 Hospital Stay (3 days) $12,000 Surgeon fee $2,500 Physical Therapy (Twice a week for 6 weeks) $2,400 Total Costs of Services $350 Total Cost of Services $17,750

TSHBP HD Plan TSHBP Gold Plan TSHBP Silver Plan Deductible $4,500 $1,500 $2,500 Primary Care Visit $150 $150 $150 Specialist Visit $350 $350 $350 Hospital Stay (3 days) $4,000 $1,650 (Remaining deductible + copay) $2,750 (Remaining deductible + copay) Surgeon Fee $0 $200 copay $250 copay Physical Therapy (Twice a week for 6 weeks) $0 $660 copay $660 copay Final Checkup with Specialist $0 $70 copay $70 copay Total Paid $4,500 $3,080 $4,230 Tom

Hinge Health

Ready, set, enroll!

Open enrollment is here, so this is a great time to learn more about Hinge Health: a benefit provided by TSHBP at no additional cost to you.

Whether your goal is to hike more, spend more time in your garden, or take the stairs (or all three), you can get pain relief with exercises that can be done in as little as 15 minutes — anytime, anywhere you’re comfortable. Take advantage of your Hinge Health benefit today! Eligible family members can also join at no cost to them. Join today!

If you’re struggling with joint or muscle pain, Hinge Health can help. Our virtual programs combine gentle exercise with 1-on-1 support to improve your condition, reduce your pain, and help you move with confidence.

Questions? Call (855) 902-2777 or email hello@hingehealth.com Participants must be 18+ and enrolled in a TSHBP Medical Plan.

32 | WWW.TSHBP.ORG

What is Hinge Health?

How do the programs work?

Hinge Health provides personalized care plans to help people accomplish their health goals related to musculoskeletal (back, muscle, and joint ) health.

What could be included in my treatment plan?

1 2 3 Access to the Hinge Health app with guided exercise therapy

Virtual visits with members of your care team

Kit with a tablet and tools to assist in guiding exercise therapy

Who is eligible?

Participants must be 18+ and enrolled in a TSHBP medical plan.

What types of programs are available?

» Chronic Pain Management: get daily support from a health coach and physical therapist to reduce hard to treat pain from the comfort of home- -without drugs or surgery.

» Injury Recovery: a physical therapist will help you reduce pain, restore range of motion, and increase strength after a recent injury.

» Women’s Pelvic Health: get 1-on-1 care from a pelvic floor physical therapist and support from a women’s health coach to treat pelvic floor disorders through all stages of life.

» Preventive Care: get support to help you take care of your body today and keep it healthy for tomorrow.

» Surgery Care: having a back or joint pain procedure? Get pre and post surgery support to build strength and improve your recovery.

» Expert Medical Review: our experienced care team can help you make an informed decision on how to treat your joint or muscle pain.

Treatment from your care team

Exercise therapy made easy

Follow along in the app for simple, 10-minute exercise therapy sessions.

Scan the QR code to learn more or apply at hinge.health/texasschoolshealthbenefits-oe or call (855) 902-2777

WWW.TSHBP.ORG | 33

Get help overcoming pain, recovering from an injury, preparing for surgery, and more!

Virta

Reverse type 2 diabetes with Virta!

Virta is a medically supervised, research-backed treatment that reverses type 2 diabetes, meaning that patients can lower their blood sugar and A1c, all while reducing diabetes medications and losing weight.

90 Degree Benefits fully covers the cost of Virta, valued at over $3,000, for all eligible members with type 2 diabetes.

How does Virta work?

Virta uses nutritional ketosis to naturally lower blood sugar and turn the body into a fat-burning machine. There is NO surgery, required exercise, or calorie counting on Virta.

With Virta’s personalized treatment plan, each patient gets medical supervision from a physician-led care team, a one-on-one health coach, diabetes testing supplies, educational tools like videos and recipes, and a private online support community.

Virta provides around-the-clock monitoring and care—there are no waiting rooms and no lines. With an easy-to-use mobile and desktop app, Virta can be done from anywhere.

Additional Eligibility Information

Virta is available to TSHBP members between the ages of 18 and 79 who are enrolled in an eligible TSHBP health plan. This benefit is currently being offered to those with type 2 diabetes. There are some serious medical conditions that would exclude patients from the Virta treatment. Start the application process now to find out if you qualify.

34 | WWW.TSHBP.ORG

Get started on

life free from diabetes: www.virtahealth.com/join Questions? Email support@virtahealth.com

a

Balance Bill

With TSHBP, our goal is to prevent any surprise medical bills for our Directed Care Members. If you let our team assist, we’ll work so you don’t have to pay more than your out of pocket responsibility. Let us take care of you!

Here are the steps to take if you receive a balance bill from a medical provider:

STEP 1

Start the Process and call the Care Coordinator

» Call your Care Coordinator at (888) 803-0081.

» Send all relevant documentation to the Care Coordinator and they will send you a packet of letters and authorization forms to sign and return.

STEP 2

Sign and Return the Initial Letters

» All copies will be retained and forwarded to the provider and credit bureaus, stopping credit report issues before they start.

STEP 3

STEP 4

STEP 5

Staying Engaged

» The Care Coordinator will follow up with you on a regular basis.

Continued Communication

» If or when a second bill or notice is received, you should contact your Care Coordinator.

» If you are being repeatedly billed, there is the option to send additional dispute letters.

Legal Support and Professional Bill Negotiation Services

» The Care Coordinator can initiate settlement discussions with approval from the plan sponsor.

» Our partner Patient Advocate Attorney support will assist you in taking the appropriate actions.

» If a decision is made to pay the balance bill, the TSHBP will cover it at no cost to you.

Our specially trained Care Coordinators are here to aid you in finding the care you need and help protect your wallet. Please contact us at 888-803-0081 if you have additional questions or if you have received a balance bill.

WWW.TSHBP.ORG | 35

TELADOC— Your Care. Your Way.

Access your Teladoc Health and Mental Health Benefits at any time, any place, on your schedule.

General Health

Talk to a Board-Certified doctor or pediatrician 24/7 for nonemergency conditions such as:

» Sinus infections

» Allergies

» Cold

Schedule a visit at any time!

Visit Teladoc.com

Call 1-800-TELADOC (835-2362)

Download the app |

Mental Health

» Nausea

» Asthma

» Rashes or minor burns

Talk to a therapist or psychiatrist of your choice 7 days of the week from anywhere for mental health conditions such as:

» Stress

» Anxiety

» Depression

» Trauma

» Grief

» Burnout

» TSHBP Gold and Silver Plan Members— $0 Consult Fee

» TSHBP HD Plan Members—$30 Consult Fee

36 | WWW.TSHBP.ORG

Set up your Teladoc account in 4 easy steps

Download the app to talk to a doctor anytime, anywhere by phone or video.

1

Download the app Search for “Teladoc” in the App Store or on Google Play.

2

Set up your account

Once you’ve downloaded the app, select “Set up your account.”

3

4

Enter basic contact information

Provide some information about yourself to confirm your eligibility. We’ll confirm we found your benefits and you’ll continue creating your account.

Create your account

Enter your address and phone number, create a username and password, pick security questions, and agree to terms and conditions.

Download the app to schedule a visit today!

Download the app | Visit Teladoc.com

Call 1-800-TELADOC (835-2362)

© 2020 Teladoc Health, Inc. All rights reserved. Teladoc and the Teladoc logo are registered trademarks of Teladoc Health, Inc. and may not be used without written permission. Teladoc does not replace the primary care physician. Teladoc does not guarantee that a prescription will be written. Teladoc operates subject to state regulation and may not be available in certain states. Teladoc does not prescribe DEA controlled substances, non therapeutic drugs and certain other drugs which may be harmful because of their potential for abuse. Teladoc physicians reserve the right to deny care for potential misuse of services. 10E-207B_415798056_11112019

WWW.TSHBP.ORG | 37

Levels of Care

Where you go for health matters!

You have choices for receiving in-network care that will work with your schedule and also give you access to the kind of care you need. Use this chart to help you figure out where to go when you need care.

Your Options:

Use it for:

Example of Issues or Services:

Virtual care from a doctor, including Rx 24/7

» Allergies

» Cold

» Nausea

» Sinus infections

» Asthma

» Pinkeye

» Rashes, minor burns

Sick visits, exams, nonemergency care and health screenings

» Fever, cold and flu

» Sore throat

» Minor burns

» Stomachache

» Ear or sinus pain

» Physicals

» Vaccinations

» Minor allergic reactions

» Back pain

Sick visits, exams, screenings, non-urgent care when doctor is not available

» Cold and flu

» Sore throat

» Infections

» Minor injuries or pain

» Vaccinations

» Allergies

» Sprains or strains

» Ear or sinus pain

Cost: $ $ $

Search for in-network providers in your area:

TSHBP Directed Care Plans: https://tshbp.info/HSNetwork

38 | WWW.TSHBP.ORG

Teladoc Doctor's Office Retail Health Clinic

Clinic Urgent Care

screenings, when your available

Urgent, but not lifethreatening care

» Migraines

» Stitches

» Stomachache

pain

» Sprains or strains

» Urinary tract Infection

» Animal bites

» Back pain

» X-Rays

Serious or life-threatening care

» Chest pain, stroke

» Seizures

» Head or neck injuries

» Sudden or severe pain

» Fainting, dizziness, weakness

» Uncontrolled bleeding

» Breathing problems

» Broken bones

If you are in a medical emergency, please go to the nearest hospital/facility, or dial 911.

Serious or life-threatening care, except for trauma

» Most major injuries except for trauma

» May also provide imaging and lab services but do not offer trauma or cardiac services requiring catheterization

» Do not always accept ambulances

WWW.TSHBP.ORG | 39

Hospital ER Freestanding ER

$$ $$$ $$$$

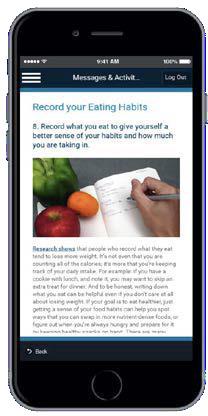

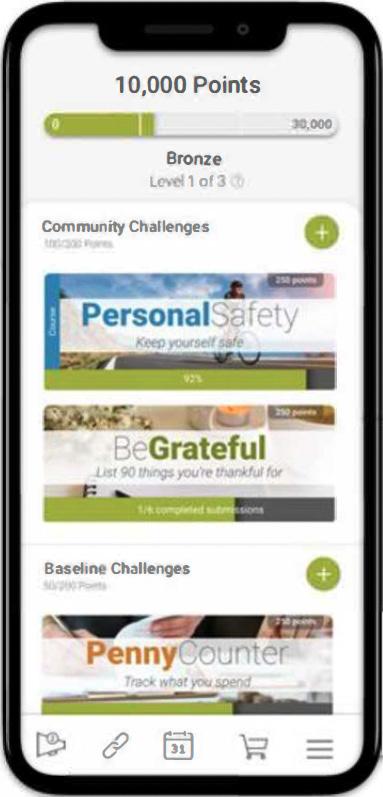

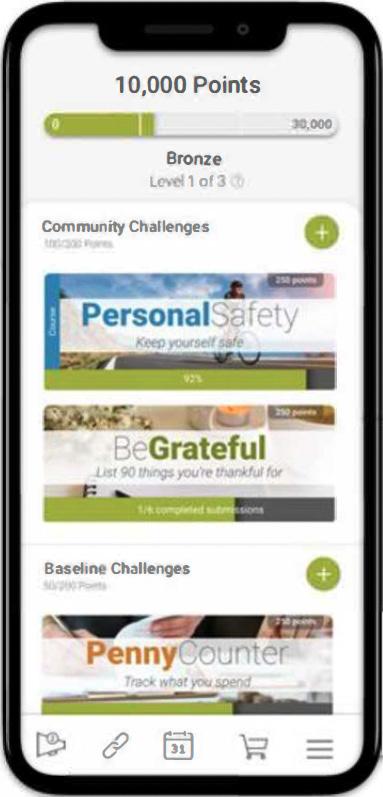

Incentive Program

We at TSHBP want to support you in living your healthiest life. Our wellness program, TSHBeFit, is designed to offer opportunities to improve your health through various activities, challenges, and education with a holistic approach that focuses on your overall well-being.

For the 2024-2025 Plan Year, we are rewarding our participants monthly for taking an active role in your health! Completing the AgeGage can jump start your journey this year and help you understand where opportunities may lie and earn you some hefty points! Keeping up with Preventive Care visits throughout the year keeps you on the path to better health and wellness while earning more points.

Most importantly, be sure to HAVE FUN and incorporate this into your daily life. Did you volunteer for the school dance this year? Make sure you do the JustDance Challenge that month! Is your class loving Morning Minutes time? Join the 5 Questions Challenge! Thinking about World Kindness Week? Challenge yourself and your coworkers to the GoodDeed Challenge! Challenges range from emotional, physical, social, environmental, and more.

Two Ways to Win!

Each month TSHBP will host a drawing to give away two $75 gift cards.

Anyone who earns 75 points during the month is entered into the drawing. This can be as simple as going to a preventative care visit, doing our monthly challenges, completing an educational course challenge, or picking your own personal challenges. Teaming up with coworkers can make this more fun and you can all encourage each other!

We are also excited to share that we will do an annual drawing for two $575 gift cards!

For our annual drawing you will be entered for each 1,000 points you earn over the plan year. By just completing the base program you earn 1,100 points, but if you want to get your name in the drawing twice, complete more challenges and focus on your personal well-being!

40 | WWW.TSHBP.ORG

Wellright Mobile App

WWW.TSHBP.ORG | 41 Your wellness journey, your way. Even when you’re on-the-go. Download the Mobile App Access all of the platform features no matter where you are. 9 Complete the health assessment 9 Join a challenge 9 Set up text tracking 9 Sync a fitness device 9 Track your progress 9 Complete a University Course 9 Add a personal challenge 9 Review your Summary Report Search for the WellRight App in the iOS App Store or Google Play Store.

1 2 Log in with the same email and password you use on the web.

42 | WWW.TSHBP.ORG

Eligibility

Who is eligible to enroll in the TSHBP Medical Plans?

Employee Eligibility

To be eligible for the Texas Schools Health Benefits Program (TSHBP), an individual:

» Must be either (i) a participating member who is currently employed by a participating district in a position that is eligible for membership in the TRS pension, or (ii) an individual who is currently employed by a participating district for 10 or more regularly scheduled hours each week in a position that is not eligible for membership;

And

» Is not receiving health care coverage as an employee or retiree under (i) the Texas State College and University Employees Uniform Insurance Benefits Act (e.g., coverage offered by The University of Texas System or the Texas A&M University System), (ii) the Texas Employees Uniform Group Insurance Benefits Act (e.g., coverage offered by ERS); or (iii) TRS-Care.

Please Note:

Medicare-eligible retirees ARE eligible to enroll in TSHBP.

WWW.TSHBP.ORG | 43

Eligibility

Dependent Eligibility

An employee may also cover eligible dependents at the same time he or she enrolls in coverage. No person may be covered under TSHBP as both an employee and as a dependent, or as a dependent of more than one employee.

Eligible dependents include:

» A spouse, including a common law spouse (A common law spouse is not considered eligible unless there is a Declaration of Informal Marriage filed with an authorized government agency.)

» A child under 26, who is one of the following:

» A natural child

» An adopted child or a child who is lawfully placed for legal adoption

» A stepchild

» A foster child

» A child under the legal guardianship of the employee

» A grandchild* under 26 whose primary residence is the household of the employee and who is a dependent of the employee for federal income tax purposes for the reporting year in which coverage of the grandchild is in effect. An employee must have legal guardianship of the grandchild for the dependent to be considered eligible for coverage. *For purposes of dependent eligibility under TSHBP, a grandchild that does not fit into the above definition and is not considered a “child”.

» “Any other dependent” (other than those listed above) under 26 in a regular parent-child relationship with the employee, meeting all four of the following requirements:

» The child’s primary residence is the household of the employee;

» The employee provides at least 50% of the child’s support;

» Neither of the child’s natural parents resides in that household; and

» The employee has the legal right to make decisions regarding the child’s medical care (This requirement does not apply to dependents 18 and over.)

A child, 26 or over, of a covered employee may be eligible for dependent coverage, provided that the child is either mentally or physically incapacitated to such an extent that they are dependent on the employee on a regular basis as determined by TSHBP, and meet other requirements as determined by TSHBP.

A dependent does not include a brother or a sister of an employee, unless the brother or sister is an individual under 26 who is either:

(1) under the legal guardianship of an employee, or (2) in a regular parent-child relationship with an employee, as defined in the “any other dependent” category above. Parents and grandparents of the covered employee do not meet the definition of an eligible dependent.

44 | WWW.TSHBP.ORG

TSHBP Contact Reference Guide

Care Connect Program

Care Coordinators

Toll Free: 888-803-0081

Mon-Fri: 8 AM—6 PM CST

Email: careconnect@90degreebenefits.com

Employee Benefits Portal Link: https://tshbp.info/90Degree

Liviniti

Pharmacy Benefits Program—All Plans

Toll Free: 833-439-9618

Mon-Fri: 6 AM—8 PM CST

Sat: 8 AM—6 PM CST

Sun: 8 AM—5 PM CST

Medication Directory Tool: https://tshbp.info/DrugPham

TSHBeFit

Wellness Program with WellRight

TSHbeFit Website: TSHBeFit.wellright.com Learn More!

Tshbp.org/tshbefit-wellness/ Email: support@wellright.com

Hinge

Digital Musculoskeletal Management Program

Hinge Website: www.hingehealth.com/for/texasschoolhealthbenefits/

HealthSmart Provider Network

Toll Free: 855-830-9234

HealthSmart Physician Directory Tool: https://tshbp.info/HSNetwork

Rx Compass

Specialty and Brand Drug Patient Assistance

Toll Free: 833-652-8379

Rx Compass Website: https://myrxcompass.com

Virta Type 2 Diabetes Reversal Program

Virta Website: www.virtahealth.com/join/tshbp Learn More! tshbp.org/virta-health/

Teladoc Virtual Telehealth

Toll Free: 1-800-835-2362

TelaDoc Website: www.teladoc.com

WWW.TSHBP.ORG | 45

(888)803-0081|WWW.TSHBP.ORG Educator Healthcare For Texas Schools Questions? Call: (888) 803-0081 Visit: www.TSHBP.org