Higginbotham Public Sector (800) 583-6908

www.mybenefitshub.com/cityofroma

UnitedHealthcare (866) 633-2446 www.uhc.com

UnitedHealthcare (866) 633-2446 www.uhc.com

FLEXIBLE SPENDING ACCOUNT (FSA) EMERGENCY TRANSPORTATION VISION

NBS (855) 399-3035

www.nbs.com

Lincoln Financial Group (800) 423-2765

www.lincolnfinancial.com

Lincoln Financial Group (800) 423-2765

www.lincolnfinancial.com

IDENTITY THEFT

Experian (855) 797-0052

www.experian.com

MASA (800) 423-3226

www.masamts.com

Texas Republic Life (572) 330-0099

www.texasrepubliclife.com

Lincoln Financial Group (800) 423-2765

www.lincolnfinancial.com

Eyetopia (800) 662-8264

www.eyetopia.org

Lincoln Financial Group (800) 423-2765 www.lincolnfinancial.com

Experian (855) 797-0052 www.experian.com

www.mybenefitshub.com/cityofroma

2

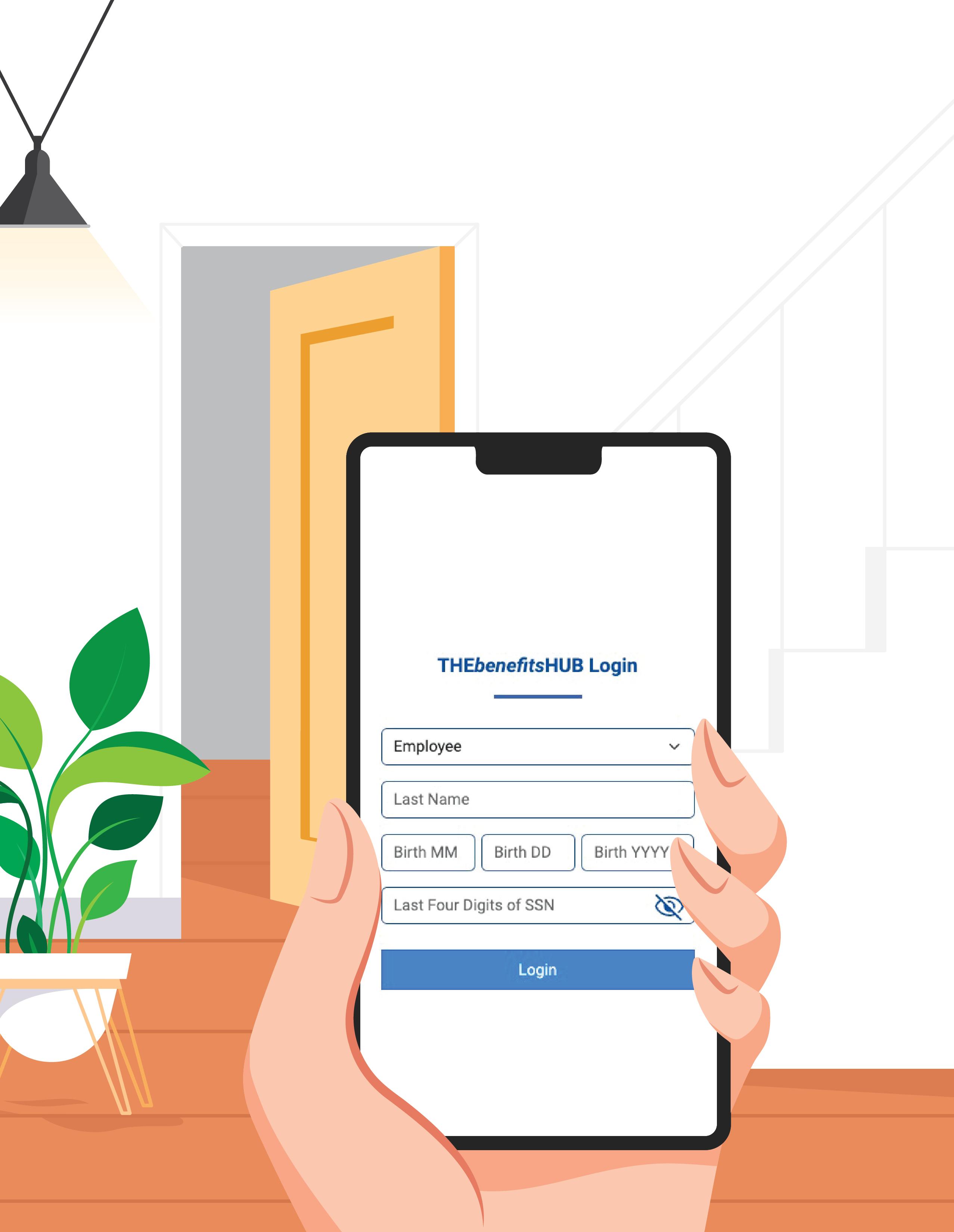

CLICK LOGIN

3

(Please have your cell phone ready for enrollment.)

• Enter your Last Name

• Enter your DOB

• Enter the last 4 digits of your SSN.

NOTE:

THEbenefitsHUB uses this information to check behind the scenes to confirm your employment status.

Once confirmed, the Additional Security Verification page will list the contact options from your profile. Select either Text, Email, Call, or Ask Admin options to receive a code to complete the final verification step.

Enter the code that you receive and click Verify. You can now complete your benefits enrollment!

During your annual enrollment period, you have the opportunity to review, change or continue benefit elections each year. Changes are not permitted during the plan year (outside of annual enrollment) unless a Section 125 qualifying event occurs.

• Changes, additions or drops may be made only during the annual enrollment period without a qualifying event.

• Employees must review their personal information and verify that dependents they wish to provide coverage for are included in the dependent profile. Additionally, you must notify your employer of any discrepancy in personal and/or benefit information.

• Employees must confirm on each benefit screen (medical, dental, vision, etc.) that each dependent to be covered is selected in order to be included in the coverage for that particular benefit.

All new hire enrollment elections must be completed in the online enrollment system within the first 90 days of benefit eligibility employment. Failure to complete elections during this timeframe will result in the forfeiture of coverage.

For supplemental benefit questions, you can contact your Benefits/HR department or you can call Higginbotham Public Sector at 866-914-5202 for assistance.

For benefit summaries and claim forms, go to your benefit website: www.mybenefitshub.com/cityofroma

Click the benefit plan you need information on (i.e., Dental) and you can find the forms you need under the Benefits and Forms section.

For benefit summaries and claim forms, go to the City of Roma benefit website: www.mybenefitshub.com/cityofroma. Click on the benefit plan you need information on (i.e., Dental) and you can find provider search links under the Quick Links section.

If the insurance carrier provides ID cards, you can expect to receive those 3-4 weeks after your effective date. For most dental and vision plans, you can log in to the carrier website and print a temporary ID card or simply give your provider the insurance company’s phone number, and they can call and verify your coverage if you do not have an ID card at that time. If you do not receive your ID card, you can call the carrier’s customer service number to request another card.

If the insurance carrier provides ID cards, but there are no changes to the plan, you typically will not receive a new ID card each year.

A Cafeteria plan enables you to save money by using pre-tax dollars to pay for eligible group insurance premiums sponsored and offered by your employer. Enrollment is automatic unless you decline this benefit. Elections made during annual enrollment will become effective on the plan effective date and will remain in effect during the entire plan year.

Marital Status

Change in Number of Tax Dependents

Change in Status of Employment Affecting Coverage Eligibility

Gain/Loss of Dependents’ Eligibility Status

Judgment/ Decree/Order

Eligibility for Government Programs

Changes in benefit elections can occur only if you experience a qualifying event. You must present proof of a qualifying event to your Benefit Office within 30 days of your qualifying event and meet with your Benefit/HR Office to complete and sign the necessary paperwork in order to make a benefit election change. Benefit changes must be consistent with the qualifying event.

A change in marital status includes marriage, death of a spouse, divorce or annulment (legal separation is not recognized in all states).

A change in number of dependents includes the following: birth, adoption and placement for adoption. You can add existing dependents not previously enrolled whenever a dependent gains eligibility as a result of a valid change in status event.

Change in employment status of the employee, or a spouse or dependent of the employee, that affects the individual’s eligibility under an employer’s plan includes commencement or termination of employment.

An event that causes an employee’s dependent to satisfy or cease to satisfy coverage requirements under an employer’s plan may include change in age, student, marital, employment or tax dependent status.

If a judgment, decree, or order from a divorce, annulment or change in legal custody requires that you provide accident or health coverage for your dependent child (including a foster child who is your dependent), you may change your election to provide coverage for the dependent child. If the order requires that another individual (including your spouse and former spouse) covers the dependent child and provides coverage under that individual’s plan, you may change your election to revoke coverage only for that dependent child and only if the other individual actually provides the coverage.

Gain or loss of Medicare/Medicaid coverage may trigger a permitted election change.

You are performing your regular occupation for the employer on a full-time basis, either at one of the employer’s usual places of business or at some location to which the employer’s business requires you to travel. If you will not be actively at work beginning 6/1/2024 please notify your benefits administrator.

The period during which existing employees are given the opportunity to enroll in or change their current elections.

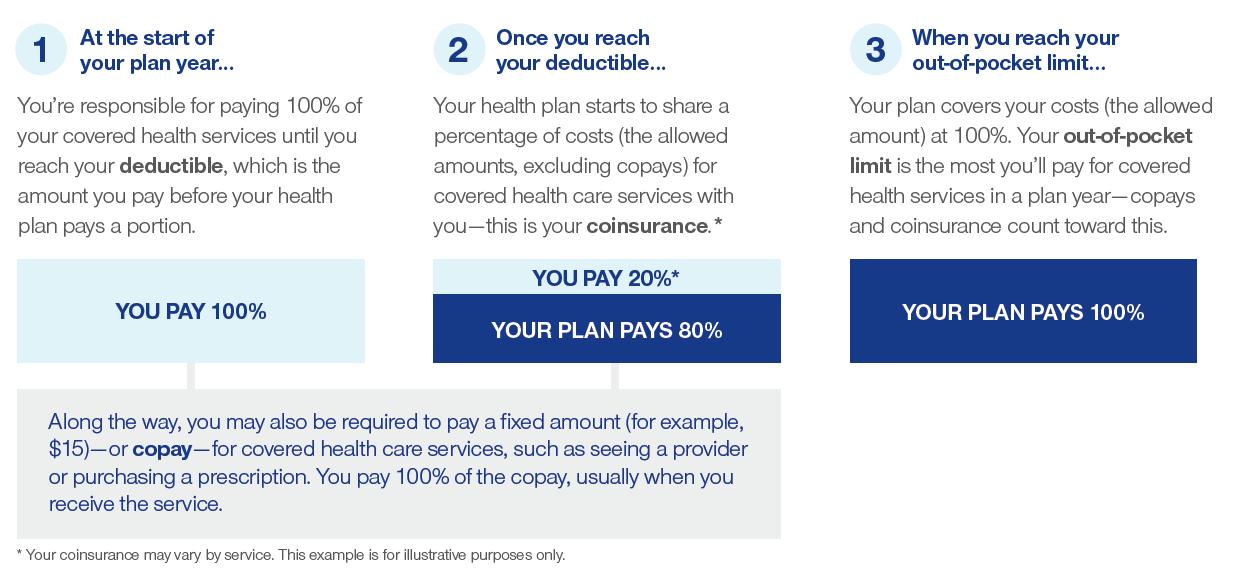

The amount you pay each plan year before the plan begins to pay covered expenses.

January 1st through December 31st

After any applicable deductible, your share of the cost of a covered health care service, calculated as a percentage (for example, 20%) of the allowed amount for the service.

The amount of coverage you can elect without answering any medical questions or taking a health exam. Guaranteed coverage is only available during initial eligibility period. Actively-at-work and/or preexisting condition exclusion provisions do apply, as applicable by carrier.

Doctors, hospitals, optometrists, dentists and other providers who have contracted with the plan as a network provider.

The most an eligible or insured person can pay in coinsurance for covered expenses.

June 1st through May 31st

Applies to any illness, injury or condition for which the participant has been under the care of a health care provider, taken prescriptions drugs or is under a health care provider’s orders to take drugs, or received medical care or services (including diagnostic and/or consultation services).

Medical and Supplemental Benefits: Eligible employees must work 32 or more regularly scheduled hours each work week.

Eligible employees must be actively at work on the plan effective date for new benefits to be effective, meaning you are physically capable of performing the functions of your job on the first day of work concurrent with the plan effective date. For example, if your 2024 benefits become effective on June 1, 2024, you must be actively-at-work on June 1, 2024 to be eligible for your new benefits.

Dependent Eligibility: You can cover eligible dependent children under a benefit that offers dependent coverage, provided you participate in the same benefit, through the maximum age listed below. Dependents cannot be double covered by married spouses within the district as both employees and dependents.

Please note, limits and exclusions may apply when obtaining coverage as a married couple or when obtaining coverage for dependents.

Potential Spouse Coverage Limitations: When enrolling in coverage, please keep in mind that some benefits may not allow you to cover your spouse as a dependent if your spouse is enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Higginbotham Public Sector, or contact the insurance carrier for additional information on spouse eligibility.

FSA/HSA Limitations: Please note, in general, per IRS regulations, married couples may not enroll in both a Flexible Spending Account (FSA) and a Health Savings Account (HSA). If your spouse is covered under an FSA that reimburses for medical expenses then you and your spouse are not HSA eligible, even if you would not use your spouse’s FSA to reimburse your expenses. However, there are some exceptions to the general limitation regarding specific types of FSAs. To obtain more information on whether you can enroll in a specific type of FSA or HSA as a married couple, please reach out to the FSA and/or HSA provider prior to enrolling or reach out to your tax advisor for further guidance.

Potential Dependent Coverage Limitations: When enrolling for dependent coverage, please keep in mind that some benefits may not allow you to cover your eligible dependents if they are enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Higginbotham Public Sector, or contact the insurance carrier for additional information on dependent eligibility.

Disclaimer: You acknowledge that you have read the limitations and exclusions that may apply to obtaining spouse and dependent coverage, including limitations and exclusions that may apply to enrollment in Flexible Spending Accounts and Health Savings Accounts as a married couple. You, the enrollee, shall hold harmless, defend, and indemnify Higginbotham Public Sector from any and all claims, actions, suits, charges, and judgments whatsoever that arise out of the enrollee’s enrollment in spouse and/or dependent coverage, including enrollment in Flexible Spending Accounts and Health Savings Accounts.

If your dependent is disabled, coverage may be able to continue past the maximum age under certain plans. If you have a disabled dependent who is reaching an ineligible age, you must provide a physician’s statement confirming your dependent’s disability. Contact your HR/Benefit Administrator to request a continuation of coverage.

Description

Allows employees to pay out-of-pocket expenses for copays, deductibles and certain services not covered by medical plan, tax-free. This also allows employees to pay for qualifying dependent care tax- free.

Employer Eligibility All employers

Contribution Source Employee and/or employer

Account Owner Employer

Underlying Insurance Requirement None

Minimum Deductible N/A

Maximum Contribution $1,200 (2024)

Permissible Use Of Funds

Reimbursement for qualified medical expenses (as defined in Sec. 213(d) of IRC).

Cash-Outs of Unused Amounts (if no medical expenses) Not permitted

Year-to-year rollover of account balance? No. Rollover Provision $610

Does the account earn interest? No

Portable? No

Use this benefit summary to learn more about this plan’s benefits, ways you can get help managing costs and how you may get more out of this health plan.

Check out what’s included in the plan Choice Plus

Network coverage only

You can usually save money when you receive care for covered health care services from network providers.

Network and out-of-network benefits

You may receive care and services from network and out-of-network providers and facilities — but staying in the network can help lower your costs.

Primary care physician (PCP) required

With this plan, you need to select a PCP — the doctor who plays a key role in helping manage your care. Each enrolled person on your plan will need to choose a PCP.

Referrals required

You’ll need referrals from your PCP before seeing a specialist or getting certain health care services.

Preventive care covered at 100%

There is no additional cost to you for seeing a network provider for preventive care.

Pharmacy benefits

With this plan, you have coverage that helps pay for prescription drugs and medications.

Tier 1 providers

Using Tier 1 providers may bring you the greatest value from your health care benefits. These PCPs and medical specialists meet national standard benchmarks for quality care and cost savings.

Freestanding centers

You may pay less when you use certain freestanding centers — health care facilities that do not bill for services as part of a hospital, such as MRI or surgery centers.

Health savings account (HSA)

With an HSA, you’ve got a personal bank account that lets you put money aside, tax-free. Use it to save and pay for qualified medical expenses.

This Benefit Summary is to highlight your Benefits. Don’t use this document to understand your exact coverage. If this Benefit Summary conflicts with the Certificate of Coverage (COC), Schedule of Benefits, Riders, and/or Amendments, those documents govern. Review your COC for an exact description of the services and supplies that are and are not c overed, those which are excluded or limited, and other terms an d conditions of coverage.

All individual deductible amounts will count toward the family deductible, but an individual will not have to pay more than the individual deductible amount.

*After the Annual Medical Deductible has been met.

You're responsible for paying 100% of your medical expenses until you reach your deductible. For certain covered services, you may be required to pay a fixed dollar amount - your copay.

All individual out-of-pocket maximum amounts will count toward the family out-of-pocket maximum, but an individual will not have to pay more than the individual out-of-pocket maximum amount.

Once you’ve met your deductible, you start sharing costs with your plan - coinsurance. You continue paying a portion of the expense until you reach your out-ofpocket limit. From there, your plan pays 100% of allowed amounts for the rest of the plan year.

Copays ($) and Coinsurance (%) for Covered Health Care Services

Preventive Care Services

Certain preventive care services are provided as specified by the Patient Protection and Affordable Care Act (ACA), with no cost-sharing to you. These services are based on your age, gender and other health factors. UnitedHealthcare also covers other routine services that may require a copay, co-insurance or deductible.

Includes services such as Routine Wellness Checkups, Immunizations, Breast Pumps, Mammography and Colorectal Cancer Screenings.

Office Services - Sickness & Injury

Primary Care Physician

A deductible does not apply to necessary diagnostic follow-up care relating to the screening test for hearing loss of a Dependent child.

Additional copays, deductible, or co-insurance may apply when you receive other services at your physician’s office. For example, surgery.

Telehealth is covered at the same cost share as in the office.

*After the Annual Medical Deductible has been met.

¹Prior Authorization Required. Refer to COC/SBN.

A deductible does not apply to necessary diagnostic follow-up care relating to the screening test for hearing loss of a Dependent child.

Additional copays, deductible, or co-insurance may apply when you receive other services at your physician’s office. For example, surgery.

Telehealth is covered at the same cost share as in the office.

Network Benefits are available only when services are delivered through a Designated Virtual Network Provider. You can find a Designated Virtual Visit Network Provider by contacting us at myuhc.com® or the telephone number on your ID card. Access to Virtual Visits and prescription services may not be available in all states or for all groups.

Ambulance Services - Emergency Ambulance

Heart Disease (CHD) Surgeries¹

Habilitative Services - Inpatient¹ The amount you pay is based on where the covered health care service is provided.

Limit will be the same as, and combined with, those stated under Skilled Nursing Facility/Inpatient Rehabilitation Services.

Nursing Facility/Inpatient Rehabilitation Facility Services¹

Limited to 60 days per year.

*After the Annual Medical Deductible has been met. ¹Prior Authorization Required. Refer to COC/SBN.

Habilitative Services - Outpatient

Limits for physical, speech and occupational therapy do not apply when provided to a child for the treatment of Autism Spectrum Disorders or when provided in accordance with an individualized family service plan issued by the Texas Interagency Council on Early Childhood Intervention under Chapter 73 of the Texas Human Resource Code.

Limits will be the same as, and combined with those stated under Rehabilitation Services - Outpatient Therapy and Manipulative Treatment.

Visit limits do not apply if the primary diagnosis is for a Mental Illness.

Health Care¹

Limited to 60 visits per year.

One visit equals up to four hours of skilled care services. This visit limit does not include any service which is billed only for the administration of intravenous infusion.

Lab, X-Ray and Diagnostic - Outpatient - Lab Testing¹

Limited to 18 Definitive Drug Tests per year.

Limited to 18 Presumptive Drug Tests per year.

Lab, X-Ray and Diagnostic - Outpatient - X-Ray and other Diagnostic Testing¹

Diagnostic and Imaging - Outpatient¹

You may have to pay an extra copay, deductible or coinsurance for physician fees or pharmaceutical products.

Physician Fees for Surgical and Medical Services

*After the Annual Medical Deductible has been met. ¹Prior Authorization Required. Refer to COC/SBN.

Rehabilitation Services - Outpatient Therapy and Manipulative Treatment

Limited to 20 visits of cognitive rehabilitation therapy per year.

Limited to 20 visits of manipulative treatments per year.

Limited to 20 visits of occupational therapy per year.

Limited to 20 visits of physical therapy per year.

Limited to 20 visits of pulmonary rehabilitation therapy per year.

Limited to 20 visits of speech therapy per year.

Limited to 30 visits of post-cochlear implant aural therapy per year.

Limited to 36 visits of cardiac rehabilitation therapy per year.

Limits for physical, speech and occupational therapy do not apply when provided to a child for the treatment of Autism Spectrum Disorders or when provided in accordance with an individualized family service plan issued by the Texas Interagency Council on Early Childhood Intervention under Chapter 73 of the Texas Human Resource Code.

Scopic Procedures - Outpatient Diagnostic and Therapeutic

Diagnostic/therapeutic scopic procedures include, but are not limited to colonoscopy, sigmoidoscopy and endoscopy. Surgery - Outpatient¹

Therapeutic treatments include, but are not limited to dialysis, intravenous chemotherapy, intravenous infusion, medical education services and radiation oncology.

Diabetes Self-Management Items¹

Limited to 2 pairs of therapeutic footwear per year.

Limit refers to podiatric appliances applying to the prevention of complications associated with diabetes.

Diabetes Self-Management and Training/Diabetic Eye Exams/Foot Care¹

Durable Medical Equipment (DME), Orthotics and Supplies¹

Limited to a single purchase of a type of DME or orthotic every 3 years.

Repair and/or replacement of DME or orthotics would apply to this limit in the same manner as a purchase. This limit does not apply to wound vacuums.

Enteral Nutrition

*After the Annual Medical Deductible has been met.

¹Prior Authorization Required. Refer to COC/SBN.

The amount you pay is based on where the covered health care service is provided under Durable Medical Equipment (DME), Orthotics and Supplies or in the Prescription Drug Benefits Section.

The amount you pay is based on where the covered health care service is provided.

Aids

Limited to a single purchase per hearing impaired ear every 3 years.

Repair and/or replacement of a hearing aid would apply to this limit in the same manner as a purchase. Ostomy Supplies

Pharmaceutical Products - Outpatient

This includes medications given at a doctor's office, or in a covered person's home.

Prosthetic Devices¹

Limited to a single purchase of each type of prosthetic device every 3 years.

Repair and/or replacement of a prosthetic device would apply to this limit in the same manner as a purchase. Urinary Catheters

Pregnancy

Pregnancy - Maternity Services¹

Mental Health Care & Substance Related and Addictive Disorder Services

The amount you pay is based on where the covered health care service is provided except that an Annual Deductible will not apply for a newborn child whose length of stay in the Hospital is the same as the mother's length of stay.

Other Services

Acquired Brain Injury - Hospital - Inpatient Stay and Skilled Nursing Facility/Inpatient Rehabilitation Facility Services¹

Acquired Brain Injury - Outpatient Post-Acute Care, Transitional Services and Rehabilitation Services¹

Cellular and Gene Therapy¹

For Network Benefits, Cellular or Gene Therapy services must be received from a Network Transplant Provider. You may select a Network Transplant Provider most suitable to treat your condition.

Clinical Trials¹

Developmental Delay Services

Fertility Preservation for Iatrogenic Infertility¹

Gender Dysphoria¹

*After the Annual Medical Deductible has been met. ¹Prior Authorization Required. Refer to COC/SBN.

The amount you pay is based on where the covered health care service is provided.

copay

copay

The amount you pay is based on where the covered health care service is provided.

The amount you pay is based on where the covered health care service is provided.

The amount you pay is based on where the covered health care service is provided.

The amount you pay is based on where the covered health care service is provided or in the Prescription Drug Benefits Section.

Human Papillomavirus, Cervical Cancer and Ovarian Cancer Screenings

Osteoperosis Detection and Prevention

Preimplantation Genetic Testing (PGT) and Related Services¹

Reconstructive Procedures¹

Speech and Hearing Services

Benefits for the purchase or fitting of hearing aids are not provided under this Covered Health Service category, but are instead provided under the Hearing Aids category in this benefit summary.

The limit for Rehabilitation Services - Outpatient Therapy and Manipulative Treatment does not apply to speech and hearing services.

Telehealth and Telemedicine Services

Temporomandibular Joint (TMJ) Services¹

Transplantation Services¹

Network Benefits must be received from a Network Transplant Provider. You may select a Network Transplant Provider most suitable to treat your condition.

The amount you pay is based on where the covered health care service is provided.

The amount you pay is based on where the covered health care service is provided.

The amount you pay is based on where the covered health care service is provided.

The amount you pay is based on where the covered health care service is provided.

The amount you pay is based on where the covered health care service is provided.

The amount you pay is based on where the covered health care service is provided.

* After the Annual Pharmacy Deductible has been met. ** Only certain Prescription Drug Products are available through mail order; please visit myuhc.com® or call Customer Care at the telephone

retail Copayment and/or Coinsurance for 31 days or 2 times for 60 days based on the

your Physician to

Your Copayment and/or Coinsurance is determined by the tier to which the

Prescription Drug List are assigned to Tier 1, Tier 2 or Tier 3 If you are a member, you can find individualized information on your

More ways to help manage your health plan and stay in the loop.

Search the network to find doctors.

You can go to providers in and out of our network — but when you stay in network, you’ll likely pay less for care. To get started:

. Go to welcometouhc.com > Benefits > Find a Doctor or Facility.

. Choose Search for a health plan.

. Choose Choice Plus to view providers in the health plan’s network.

Manage your meds.

Look up your prescriptions using the Prescription Drug List (PDL). It places medications in tiers that represent what you’ll pay, which may make it easier for you and your doctor to find options to help you save money.

. Go to welcometouhc.com > Benefits > Pharmacy Benefits.

. Select Advantage to view the medications that are covered under your plan.

Access your plan online.

With myuhc.com®, you’ve got a personalized health hub to help you find a doctor, manage your claims, estimate costs and more.

When you’re out and about, the UnitedHealthcare® app puts your health plan at your fingertips. Download to find nearby care, video chat with a doctor 24/7, access your health plan ID card and more.

• Acupuncture

• Bariatric Surgery

• Cosmetic Surgery

• Dental Care (Adult/Child)

• Glasses

• Infertility Treatment

• Long-Term Care

• Non-emergency care when traveling outside the U.S.

• Private-Duty Nursing

• Routine Eye Care (Adult/Child)

• Routine Foot Care

• Weight Loss Programs

For Prescription Drug Products dispensed at an In-Network Retai l Pharmacy, you are responsible for paying the lowest of the fo llowing: 1) The applicable Copayment and/or Coinsurance; 2) The In- Network Retail Pharmacy Usual and Customary Charge for the Prescription Drug Product; and 3) The Prescription Drug Charge for that Prescription Drug Product. For Prescription Drug Products from an In-Network Mail Order Pharmacy, you are responsible for paying the lower of the following: 1) The applicable Copayment and/or Coinsurance; and 2) The Prescription Drug Charge for that Prescription Drug Product.

See the Copayment and/or Coinsurance stated in the Benefit Information table for amounts. We will not reimburse you for any non-covered drug product.

For a single Copayment and/or Coinsurance, you may receive a Prescription Drug Product up to the stated supply limit. Some products are subject to additional supply limits based on criteria that we have developed. Supply limits are subject, from time to time, to our review and change.

Specialty Prescription Drug Products supply limits are as written by the provider, up to a consecutive 31-day supply of the Specialty Prescription Drug Product, unless adjusted based on the drug manufacturer’s packaging size, or based on supply limits, or as allowed under the Smart Fill Program. Supply limits apply to Specialty Prescription Drug Products obtained at a Preferred Specialty Network Pharmacy, a Non-Preferred Specialty Network Pharmacy, an out-of-Network Pharmacy, a mail order Network Pharmacy or a Designated Pharmacy.

Certain Prescription Drug Products for which Benefits are described under the Prescription Drug Rider are subject to step therapy requirements. In order to receive Benefits for such Prescription Drug Products you must use a different Prescription Drug Product(s) first. You may find out whether a Prescription Drug Product is subject to step therapy requirements by contacting us at myuhc.com or the telephone number on your ID card.

Before certain Prescription Drug Products are dispensed to you, your Physician, your pharmacist or you are required to obtain prior authorization from us or our designee to determine whether the Prescription D rug Product is in accordance with our approved guidelines and i t meets the definition of a Covered Health Care Service and is not an Experimental or Investigational or Unproven Service. We may also require you to obtain prior authorization from us or our designee so we can determine whether the Prescription Drug Product, in accordance with our approved guidelines, was prescribed by a Specialist.

Certain Preventative Care Medications may be covered at zero co st share. You can get more information by contacting us at myuh c.com or the telephone number on your ID card.

Benefits are provided for certain Prescription Drug Products dispensed by an In-Network Mail Order Pharmacy or Preferred 90 Day Retail Network Pharmacy. The Outpatient Prescription Drug Schedule of Benefits will tell you how In-Network Mail Order Pharmacy and Preferred 90 Day Retail Network Pharmacy supply limits apply. Please contact us at myuh c.com or the telephone number on your ID card to find out if Be nefits are provided for your Prescription Drug Product and for information on how to obtain your Prescription Drug Product through an In-Network Mail Order Pharmacy or Preferred 90 Day Retail Network Pharmacy.

The following exclusions apply. In addition see your Pharmacy Rider and SBN for additional exclusions and limitations that may apply.

• A Pharmaceutical Product for which Benefits are provided in your Certificate.

• A Prescription Drug Product with either: an approved biosimilar, a biosimilar and Therapeutically Equivalent to another covered Prescription Drug Product.

• Any Prescription Drug Product to the extent payment or benefi ts are provided or available from the local, state or federal g overnment (for example, Medicare).

• Any product dispensed for the purpose of appetite suppression or weight loss.

• Any product for which the primary use is a source of nutritio n, nutritional supplements, or dietary management of disease, a nd prescription medical food products even when used for the treatment of Sickn ess or Injury. This exclusion does not apply to nutritional sup plements for the treatment of Autism Spectrum Disorders, as described in your Ce rtificate; amino acid-based elemental formulas as described und er Enteral Nutrition in your Certificate; formulas for phenylketonuria (PKU) or other heritable diseases and enteral formulas and other modified food products.

• Certain New Prescription Drug Products and/or new dosage forms until the date they are reviewed and placed on a tier by our PDL Management Committee.

• Certain Prescription Drug Products for tobacco cessation.

• Certain Prescription Drug Products for which there are Therapeutically Equivalent alternatives available.

• Certain Prescription Drug Products that are FDA approved as a package with a device or application, including smart package sensors and/or embedded drug sensors.

• Certain compounded drugs.

• Diagnostic kits and products, including associated services.

• Drugs available over-the-counter. This exclusion does not app ly to over-the-counter items for which Benefits are available a s described in the Certificate under Diabetes Services in Section 1: Covered Health Care Services.

• Drugs which are prescribed, dispensed or intended for use during an Inpatient Stay.

• Durable Medical Equipment, including certain insulin pumps an d related supplies for the management and treatment of diabetes , for which Benefits are provided in your Certificate. Prescribed and non-prescribed outpatient supplies. This does not apply to diabetic supplies and inhaler spacers specifically stated as covered.

• Experimental or Investigational or Unproven Services and medi cations. This exclusion will apply to any off-label drug that i s excluded from coverage under the Pharmacy Rider as well as any drug that the U.S. Food and Drug Administration (FDA) has determined to be contraindicated for the treatment of the disease or condition. This exclusion will not apply to drugs prescribed to treat a chronic, disabling, or life-threatening disease or condition if the drug meets certain conditions.

• General vitamins, except Prenatal vitamins, vitamins with fluoride, and single entity vitamins when accompanied by a Prescription Order or Refill.

• Growth hormone for children with familial short stature (short stature based upon heredity and not caused by a diagnosed medical condition).

• Medications used for cosmetic or convenience purposes.

• Prescription Drug Products dispensed outside the United States, except as required for Emergency treatment.

• Prescription Drug Products when prescribed to treat infertility. This exclusion does not apply to Prescription Drug Products prescribed to treat Iatrogenic Infertility and Preimplantation Genetic Testing (PGT) as described in the Certificate.

• Prescription Drug Products, including New Prescription Drug Products or new dosage forms, that we determine do not meet the definition of a Covered Health Care Service.

• Publicly available software applications and/or monitors that may be available with or without a Prescription Order or Refill.

UnitedHealthcare does not treat members differently because of sex, age, race, color, disability or national origin.

If you think you weren’t treated fairly because of your sex, age, race, color, disability or national origin, you can send a complaint to the Civil Rights Coordinator:

Online: UHC_Civil_Rights@uhc.com

Mail: Civil Rights Coordinator

UnitedHealthcare Civil Rights Grievance

P.O. Box 30608, Salt Lake City, UT 84130

You must send the complaint within 60 days of when you found out about it. A decision will be sent to you within 30 days. If you disagree with the decision, you have 15 days to ask us to look at it again.

If you need help with your complaint, please call the toll-free phone number listed on your ID card, TTY 711, Monday through Friday, 8 a.m. to 8 p.m. You can also file a complaint with the U.S. Dept. of Health and Human Services.

Online: https://ocrportal.hhs.gov/ocr/portal/lobby.jsf Complaint forms are available at: http://www.hhs.gov/ocr/office/file/index.html.

Phone: Toll-free 1-800-368-1019, 1-800-537-7697 (TDD)

Mail: U.S. Dept. of Health and Human Services, 200 Independence Avenue, SW Room 509F, HHH Building Washington, D.C. 20201

We provide free services to help you communicate with us such as letters in others languages or large print. You can also ask for an interpreter. To ask for help, please call the toll-free member phone number listed on your health plan ID card.

ATTENTION: If you speak English, language assistance services, free of charge, are available to you. Please call the toll-free phone number listed on your identification card.

ATENCIÓN: Si habla español (Spanish), hay servicios de asistencia de idiomas, sin cargo, a su disposición. Llame al número de teléfono gratuito que aparece en su tarjeta de identificación.

請注意:如果您說中文 (Chinese),我們免費為您提供語言協助 服務。請撥打會員卡所列的免付費會員電話號碼。

XIN LƯU Ý: Nếu quý vị nói tiếng Việt (Vietnamese), quý vị sẽ được cung cấp dịch vụ trợ giúp về ngôn ngữ miễn phí. Vui lòng gọi số điện thoại miễn phí ở mặt sau thẻ hội viên của quý vị. 알림: 한국어(Korean)를 사용하시는 경우 언어 지원 서비스를 무료로 이용하실 수 있습니다. 귀하의 신분증 카드에 기재된 무료 회원 전화번호로 문의하십시오.

PAALALA: Kung nagsasalita ka ng Tagalog (Tagalog), may makukuha kang mga libreng serbisyo ng tulong sa wika. Pakitawagan ang toll-free na numero ng telepono na nasa iyong identification card.

ВНИМАНИЕ: бесплатные услуги перевода доступны для

людей, чей родной язык является русский (Russian). Позвоните по бесплатному номеру телефона, указанному

ATANSYON: Si w pale Kreyòl ayisyen (Haitian Creole), ou kapab benefisye sèvis ki gratis pou ede w nan lang pa w. Tanpri rele nimewo gratis ki sou kat idantifikasyon w.

ATTENTION : Si vous parlez français (French), des services d’aide linguistique vous sont proposés gratuitement. Veuillez appeler le numéro de téléphone gratuit figurant sur votre carte d’identification.

UWAGA: Jeżeli mówisz po polsku (Polish), udostępniliśmy darmowe usługi tłumacza. Prosimy zadzwonić pod bezpłatny numer telefonu podany na karcie identyfikacyjnej.

ATENÇÃO: Se você fala português (Portuguese), contate o serviço de assistência de idiomas gratuito. Ligue gratuitamente para o número encontrado no seu cartão de identificação.

ATTENZIONE: in caso la lingua parlata sia l’italiano (Italian), sono disponibili servizi di assistenza linguistica gratuiti. Per favore chiamate il numero di telefono verde indicato sulla vostra tessera identificativa.

ACHTUNG: Falls Sie Deutsch (German) sprechen, stehen Ihnen kostenlos sprachliche Hilfsdienstleistungen zur Verfügung. Bitte rufen Sie die gebührenfreie Rufnummer auf der Rückseite Ihres Mitgliedsausweises an.

注意事項:日本語 (Japanese) を話される場合、無料の言語支援 サービスをご利用いただけます。健康保険証に記載されている フリーダイヤルにお電話ください。

CEEB TOOM: Yog koj hais Lus Hmoob (Hmong), muaj kev pab txhais lus pub dawb rau koj. Thov hu rau tus xov tooj hu deb dawb uas teev muaj nyob rau ntawm koj daim yuaj cim qhia tus kheej.

PAKDAAR: Nu saritaem ti Ilocano (Ilocano), ti serbisyo para ti baddang ti lengguahe nga awanan bayadna, ket sidadaan para kenyam. Maidawat nga awagan iti toll-free a numero ti telepono nga nakalista ayan iti identification card mo.

DÍÍ BAA’ÁKONÍNÍZIN: Diné (Navajo) bizaad bee yániłti’go, saad bee áka’anída’awo’ígíí, t’áá jíík’eh, bee ná’ahóót’i’. T’áá shǫǫdí ninaaltsoos nitł’izí bee nééhozinígíí bine’dęę’ t’áá jíík’ehgo béésh bee hane’í biká’ígíí bee hodíilnih.

OGOW: Haddii aad ku hadasho Soomaali (Somali), adeegyada taageerada luqadda, oo bilaash ah, ayaad heli kartaa. Fadlan wac lambarka telefonka khadka bilaashka ee ku yaalla kaarkaaga aqoonsiga.

(Gujarati):

Radiographs

Lab and Other Diagnostic Tests

Prophylaxis (Cleaning)

Fluoride Treatment (Preventive) Sealants

Space Maintainers

Restorations (Amalgams or Composite) BASIC

Emergency Treatment/General Services Simple Extractions

Oral Surgery (incl. surgical extractions)

Inlays/Onlays/Crowns

Dentures and Removable Prosthetics

Fixed Partial Dentures (Bridges) Implants

* Your dental plan provides that where two or more professionally acceptable dental treatments for a dental condition exist, your plan bases reimbursement on the least costly treatment alternative. If you and your dentist agreed on a treatment which is more costly than the treatment on which the plan benefit is based, you will be responsible for the difference between the fee for service rendered and the fee covered by the plan. In addition, a pre-treatment estimate is recommended for any service estimated to cost over $500; please consult your dentist.

**The network percentage of benefits is based on the discounted fees negotiated with the provider.

***The non-network percentage of benefits is based on the usual and customary fees in the geographic areas in which the expenses are incurred.

Veneers are only covered when a filling cannot restore a tooth. For a complete description and coverage levels for Veneers, please refer to your Certificate of Coverage. Cone Beams are limited to combined captured and interpretation treatment codes only. For a complete description and coverage levels for Cone Beams, please refer to your Certificate of Coverage.

In accordance with the Illinois state requirement, a partner in a Civil Union is included in the definition of Dependent. For a complete description of Dependent Coverage, please refer to your Certificate of Coverage.

The Prenatal Dental Care (not available in WA) and Oral Cancer Screening programs are covered under this plan.

The material contained in the above table is for informational purposes only and is not an offer of coverage. Please note that the above table provides only a brief, general description of coverage and does not constitute a contract. For a complete listing of your coverage, including exclusions and limitations relating to your coverage, please refer to your Certificate of Coverage or contact your benefits administrator. If differences exist between this Summary of Benefits and your Certificate of Coverage/benefits administrator, the certificate/benefits administrator will govern. All terms and conditions of coverage are subject to applicable state and federal laws. State mandates regarding benefit levels and age limitations may supersede plan design features.

UnitedHealthcare Dental Options PPO Plan is either underwritten or provided by: United HealthCare Insurance Company, Hartford, Connecticut; United HealthCare Insurance Company of New York, Hauppauge, New York; Unimerica Insurance Company, Milwaukee, Wisconsin; Unimerica Life Insurance Company of New York, New York, New York or United HealthCare Services, Inc.

03/13 ©2013-2014 United HealthCare Services, Inc

UnitedHealthcare/Dental Exclusions and Limitations

Dental Services described in this section are covered when such services are:

A. Necessary;

B. Provided by or under the direction of a Dentist or other appropriate provider as specifically described;

C. The least costly, clinically accepted treatment, and

D. Not excluded as described in the Section entitled. General Exclusions.

PERIODIC ORAL EVALUATION Limited to 2 times per consecutive 12 months.

COMPLETE SERIES OR PANOREX RADIOGRAPHS Limited to 1 time per consecutive 36 months.

BITEWING RADIOGRAPHS Limited to 1 series of films per calendar year.

EXTRAORAL RADIOGRAPHS Limited to 2 films per calendar year.

DENTAL PROPHYLAXIS Limited to 2 times per consecutive 12 months.

FLUORIDE TREATMENTS Limited to covered persons under the age of 16 years, and limited to 2 times per consecutive 12 months.

SPACE MAINTAINERS Limited to covered persons under the age of 16 years, limited to 1 per consecutive 60 months. Benefit includes all adjustments within 6 months of installation.

SEALANTS Limited to covered persons under the age of 16 years, and once per first or second permanent molar every consecutive 36 months.

RESTORATIONS (Amalgam or Composite) Multiple restorations on one surface will be treated as a single filling.

PIN RETENTION Limited to 2 pins per tooth; not covered in addition to cast restoration.

INLAYS, ONLAYS, AND VENEERS Limited to 1 time per tooth per consecutive 60 months. Covered only when a filling cannot restore the tooth.

CROWNS Limited to 1 time per tooth per consecutive 60 months. Covered only when a filling cannot restore the tooth.

POST AND CORES Covered only for teeth that have had root canal therapy.

SEDATIVE FILLINGS Covered as a separate benefit only if no other service, other than x-rays and exam, were performed on the same tooth during the visit.

SCALING AND ROOT PLANING Limited to 1 time per quadrant per consecutive 24 months.

ROOT CANAL THERAPY Limited to 1 time per tooth per lifetime.

PERIODONTAL MAINTENANCE Limited to 2 times per consecutive 12 months following active or adjunctive periodontal therapy, exclusive of gross debridement.

FULL DENTURES Limited to 1 time every consecutive 60 months. No additional allowances for precision or semi-precision attachments.

PARTIAL DENTURES Limited to 1 time every consecutive 60 months. No additional allowances for precision or semi-precision attachments.

RELINING AND REBASING DENTURES Limited to relining/rebasing performed more than 6 months after the initial insertion. Limited to 1 time per consecutive 12 months.

REPAIRS TO FULL DENTURES, PARTIAL DENTURES, BRIDGES Limited to repairs or adjustments performed more than 12 months after the initial insertion.

Limited to 1 per consecutive 6 months.

PALLIATIVE TREATMENT Covered as a separate benefit only if no other service, other than the exam and radiographs, were performed on the same tooth during the visit.

OCCLUSAL GUARDS Limited to 1 guard every consecutive 36 months and only covered if prescribed to control habitual grinding.

FULL MOUTH DEBRIDEMENT Limited to 1 time every consecutive 36 months.

GENERAL ANESTHESIA Covered only when clinically necessary.

OSSEOUS GRAFTS Limited to 1 per quadrant or site per consecutive 36 months.

PERIODONTAL SURGERY Hard tissue and soft tissue periodontal surgery are limited to 1 quadrant or site per consecutive 36 months per surgical area.

REPLACEMENT OF COMPLETE DENTURES, FIXED OR REMOVABLE PARTIAL DENTURES, CROWNS, INLAYS OR ONLAYS Replacement of complete dentures, fixed or removable partial dentures, crowns, inlays or onlays previously submitted for payment under the plan is limited to 1 time per consecutive 60 months from initial or supplemental placement. This includes retainers, habit appliances, and any fixed or removable interceptive orthodontic appliances.

CONE BEAM Limited to 1 time per consecutive 60 months.

Dental Services that are not Necessary.

Hospitalization or other facility charges.

Any Dental Procedure performed solely for cosmetic/aesthetic reasons. (Cosmetic procedures are those procedures that improve physical appearance.)

Reconstructive surgery, regardless of whether or not the surgery is incidental to a dental disease, injury, or Congenital Anomaly, when the primary purpose is to improve physiological functioning of the involved part of the body.

Any Dental Procedure not directly associated with dental disease.

Any Dental Procedure not performed in a dental setting.

Procedures that are considered to be Experimental, Investigational or Unproven. This includes pharmacological regimens not accepted by the American Dental Association (ADA) Council on Dental Therapeutics. The fact that an Experimental, Investigational or Unproven Service, treatment, device or pharmacological regimen is the only available treatment for a particular condition will not result in Coverage if the procedure is considered to be Experimental, Investigational or Unproven in the treatment of that particular condition.

Drugs/medications, obtainable with or without a prescription, unless they are dispensed and utilized in the dental office during the patient visit.

Setting of facial bony fractures and any treatment associated with the dislocation of facial skeletal hard tissue.

Treatment of benign neoplasms, cysts, or other pathology involving benign lesions, except excisional removal. Treatment of malignant neoplasms or Congenital

Anomalies of hard or soft tissue, including excision.

Replacement of complete dentures, fixed and removable partial dentures or crowns if damage or breakage was directly related to provider error. This type of replacement is the responsibility of the Dentist. If replacement is Necessary because of patient non-compliance, the patient is liable for the cost of replacement.

Services related to the temporomandibular joint (TMJ), either bilateral or unilateral. Upper and lower jaw bone surgery (including that related to the temporomandibular joint). No Coverage is provided for orthognathic surgery, jaw alignment, or treatment for the temporomandibular joint.

Charges for failure to keep a scheduled appointment without giving the dental office 24 hours notice.

Expenses for Dental Procedures begun prior to the Covered Person becoming enrolled under the Policy.

Fixed or removable prosthodontic restoration procedures for complete oral rehabilitation or reconstruction.

Attachments to conventional removable prostheses or fixed bridgework. This includes semi-precision or precision attachments associated with partial dentures, crown or bridge abutments, full or partial overdentures, any internal attachment associated with an implant prosthesis, and any elective endodontic procedure related to a tooth or root involved in the construction of a prosthesis of this nature.

Procedures related to the reconstruction of a patient's correct vertical dimension of occlusion (VDO).

Occlusal guards used as safety items or to affect performance primarily in sports-related activities.

Placement of fixed partial dentures solely for the purpose of achieving periodontal stability.

Services rendered by a provider with the same legal residence as a Covered Person or who is a member of a Covered Person's family, including spouse, brother, sister, parent or child. This exclusion does not apply for groups sitused in the state of Arizona, in order to comply with state regulations.

Dental Services otherwise Covered under the Policy, but rendered after the date individual Coverage under the Policy terminates, including Dental Services for dental conditions arising prior to the date individual Coverage under the Policy terminates.

Acupuncture; acupressure and other forms of alternative treatment, whether or not used as anesthesia. Orthodontic Services.

Foreign Services are not Covered unless required as an Emergency.

Dental Services received as a result of war or any act of war, whether declared or undeclared or caused during service in the armed forces of any country.

Policies other than company sponsored policies (i.e. spouse’s or dependents’ individual policies) may not be paid through What

• Acupuncture

• Addiction programs

• Adoption (medical expenses for baby birth)

• Alternative healer fees

• Ambulance

• Body scans

• Breast pumps

• Care for mentally handicapped

• Chiropractor

• Copayments

• Crutches

• Diabetes (insulin, glucose monitor)

• Eye patches

• Artificial teeth

• Copayments

• Deductible

• Dental work

• Dentures

• Fertility treatment

• First aid (e.g., bandages, gauze)

• Hearing aids & batteries

• Hypnosis (for treatment of illness)

• Incontinence products (e.g., Depends, Serene)

• Joint support bandages and hosiery

• Lab fees

• Menstrual Products*

• Monitoring device (blood pressure, cholesterol)

• Non-prescription medicines or drugs (vitamins/supplements without a prescription are not eligible)*

• Orthodontia expenses

• Preventative care at dentist office

• Bridges, crown, etc.

• Physical exams

• Pregnancy tests

• Prescription medicines or drugs

• Psychiatrist/psychologist (for mental illness)

• Physical therapy

• Speech therapy

• Vaccinations

• Vaporizers or humidifiers

• Weight loss program fees (if prescribed by physician)

• Wheelchair

• Braille - books & magazines

• Contact lenses

• Contact lens solutions

• Eye exams

• Personal hygiene (e.g., deodorant, soap, body powder, sanitary products. Does not include menstrual products)

• Addiction products**

• Cosmetic surgery**

• Cosmetics (e.g., makeup, lipstick, cotton swabs, cotton balls, baby oil)

• Counseling (e.g., marriage/family)

• Dental care - routine (e.g., toothpaste, toothbrushes, dental floss, antibacterial mouthwashes, fluoride rinses, teeth whitening/bleaching)**

• Exercise equipment**

• Haircare

(e.g., hair color, shampoo, conditioner, brushes, hair loss products)

• Health club or fitness program fees**

• Homeopathic supplement or herbs**

• Household or domestic help

• Laser hair removal

• Massage therapy**

• Eyeglasses

*After January 1, 2020

• Laser surgery

• Office fees

• Guide dog and upkeep/ other animal aid

• Nutritional and dietary supplements (e.g., bars, milkshakes, power drinks, Pedialyte)**

• Skin care

(e.g., moisturizing lotion, lip balm)

• Sleep aids (e.g., snoring strips)**

• Vitamins**

• Weight reduction aids (e.g., Slimfast, appetite suppressant)**

**Portions of these expenses may be eligible for reimbursement if they are recommended by a licensed medical professional as medically necessary for treatment of a specific medical condition.

$14/month

Comprehensive coverage and care for emergency transport.

Our Emergent Plus membership plan includes:

Emergency Ground Ambulance Coverage1

Your out-of-pocket expenses for your emergency ground transportation to a medical facility are covered with MASA.

Your out-of-pocket expenses for your emergency air transportation to a medical facility are covered with MASA.

When specialized care is required but not available at the initial emergency facility, your out-of-pocket expenses for the ground or air ambulance transfer to the nearest appropriate medical facility are covered with MASA.

Should you need continued care and your care provider has approved moving you to a hospital nearer to your home, MASA coordinates and covers the expense for ambulance transportation to the approved medical facility.

Did you know?

51.3 million emergency responses occur each year

MASA protects families against uncovered costs for emergency transportation and provides connections with care services.

Source: NEMSIS, National EMS Data Report, 2023

MASA is coverage and care you can count on to protect you from the unexpected. With us, there is no “out-of-network” ambulance. Just send us the bill when it arrives and we’ll work to ensure charges are covered. Plus, we’ll be there for you beyond your initial ride, with expert coordination services on call to manage complex transport needs during or after your emergency — such as transferring you and your loved ones home safely.

Protect yourself, your family, and your family’s financial future with MASA.

$19/month

Comprehensive coverage and care for emergency transport.

Our Emergent Premier membership plan includes:

Emergency Ground Ambulance Coverage2

Your out-of-pocket expenses for your emergency ground transportation to a medical facility are covered with MASA.

Emergency Air Ambulance Coverage2

Your out-of-pocket expenses for your emergency air transportation to a medical facility are covered with MASA.

Hospital to Hospital Ambulance Coverage2

When specialized care is required but not available at the initial emergency facility, your out-of-pocket expenses for the ground or air ambulance transfer to the nearest appropriate medical facility are covered with MASA.

Should you need continued care and your care provider has approved moving you to a hospital nearer to your home, MASA coordinates and covers the expense for ambulance transportation to the approved medical facility.

In the event your minor child traveling with you is left unattended due to your emergency transport, MASA coordinates services and covers expenses to return your child safely home.

Did you know?

51.3 million emergency responses occur each year

MASA protects families against uncovered costs for emergency transportation and provides connections with care services.

Source: NEMSIS, National EMS Data Report, 2023

MASA is coverage and care you can count on to protect you from the unexpected. With us, there is no “out-of-network” ambulance. Just send us the bill when it arrives and we’ll work to ensure charges are covered. Plus, we’ll be there for you beyond your initial ride, with expert coordination services on call to manage complex transport needs during or after your emergency — such as transferring you and your loved ones home safely. Protect yourself, your family, and your family’s financial future with MASA.

If you are traveling with your pets and an emergency occurs requiring your medical transport, MASA coordinates services and covers expenses for returning up to two pets to your home

Should you need care in a rehabilitation facility, skilled nursing facility, long-term care facility, hospice, or at home after an emergency, your out-of-pocket expenses for transport are eased with MASA.

Should you contract a communicable disease while traveling away from home, your out-of-pocket expenses are eased with MASA.

$39/month

Comprehensive coverage and care for emergency transport.

Our Platinum membership plan includes:

Emergency Ground Ambulance Coverage2

Your out-of-pocket expenses for your emergency ground transportation to a medical facility are covered with MASA.

Emergency Air Ambulance Coverage2

Your out-of-pocket expenses for your emergency air transportation to a medical facility are covered with MASA.

to Hospital Ambulance Coverage2

When specialized care is required but not available at the initial emergency facility, your out-of-pocket expenses for the ground or air ambulance transfer to the nearest appropriate medical facility are covered with MASA.

Should you need continued care and your care provider has approved moving you to a hospital nearer to your home, MASA coordinates and covers the expense for ambulance transportation to the approved medical facility.

Return Transportation Coverage4

Once you’re discharged from medical care and able to travel without medical transport, MASA coordinates and covers the costs associated with your commercial airline transport home.

Did you know?

51.3 million emergency responses occur each year

MASA protects families against uncovered costs for emergency transportation and provides connections with care services.

Source: NEMSIS, National EMS Data Report, 2023

MASA is coverage and care you can count on to protect you from the unexpected. With us, there is no “out-of-network” ambulance. Just send us the bill when it arrives and we’ll work to ensure charges are covered. Plus, we’ll be there for you beyond your initial ride, with expert coordination services on call to manage complex transport needs during or after your emergency — such as transferring you and your loved ones home safely. Protect yourself, your family, and your family’s financial future with MASA.

MASA coordinates services and covers the cost for a companion to accompany you during your emergency air ambulance transport.

Should you be hospitalized more than 100 miles from home, MASA coordinates and covers the cost of roundtrip air transportation for a companion to join you.

In the event your minor child traveling with you is left unattended due to your emergency transport, MASA coordinates services and covers expenses to return your child safely home.

If you are traveling with your pets and an emergency occurs requiring your medical transport, MASA coordinates services and covers expenses for returning up to two pets to your home.

In the event that you pass away more than 100 miles from home, MASA coordinates services and covers the cost of air transport for your remains to be returned home.

Should a travel emergency occur requiring you to leave your vehicle or RV by ambulance, MASA provides services and covers expenses associated with returning your vehicle or RV to your home.

Should you need an organ transplant, MASA coordinates and covers the cost of getting you or the organ to the transplant location.

With a MASA plan, you’ll have an additional layer of financial protection from the out-of-pocket costs of medical transportation. Explore the options below to compare the benefits offered in each plan.

Gain peace of mind and shield your finances knowing there’s a MASA plan best suited for your needs.

Coverage territories

1: United States only.

2: United States, Canada.

3: United States, Canada, Mexico, the Caribbean (excluding Cuba), the Bahamas and Bermuda.

4: Worldwide coverage to include any region with the exclusion of Antarctica and not prohibited by U.S. law or under certain U.S. travel advisories as long as the member has provided ten (10) day notice. Disclaimers

This material is for informational purposes only and does not provide any coverage. The benefits listed, and the descriptions thereof, do not represent the full terms and conditions applicable for usage and may only be offered in some memberships or policies. Premiums and benefits vary depending on the plan selected. For a complete list of benefits, premiums, terms, conditions, and restrictions, please refer to the applicable member services agreement or policy for your state. For additional information and disclosures about MASA MTS plans, visit: https://info.masamts.com/masa-mts-disclaimers

FL residents: MASA MTS provides insurance coverage whereby Medical Air Services Association of Florida, Inc. is a prepaid limited health service organization licensed under Chapter 636, Florida Statutes, license number: 65-0265219 and is doing business as MASA MTS with its principal place of business at 1250 S. Pine Island Road, Suite 500, Plantation, FL 33324.

Eyetopia provides two vision benefits each eligibility period. You may have the opportunity to maximize your Eyetopia benefits by coordinating benefits with your Health Insurance coverage.

BENEFIT ONE 2 (choose either one of the following 2 options every 12 months):

1. Refractive Exam. One routine Vision Exam.

2. Coverage towards a medical eye exam copay or other services or materials. 2

BENEFIT TWO (choose only one of the following Vision Correction Options): Eyetopia provides you with 3 options for correcting your vision every 12 months.3

1. Prescription Lenses 4 CR-39 plastic single vision, bifocal, trifocal lenses

CR-39 plastic Progressive (no-line multi-focal) lenses that retail for up to $199.

CR-39 plastic Progressive (no-line multi-focal) lenses that retail for more than $199.

Polycarbonate material upgrade for child dependents (under age 26)

Basic Coating (Ultraviolet Protection & Scratch Resistant Coating)

Mid-Level Anti-Reflective Coatings that retail up to $99.

Premium Anti-Reflective Coatings that retail for $100 or more copay not to exceed:

Photochromatic or Polarized Lenses

spectacles for Aniseikonia or Amblyopia.5

♦ Frame: The member may select any frame on display and is responsible for any amount exceeding the allowance.

2. Contact Lens Option: In lieu of spectacles. Allowance to be applied toward prescription contact lenses.

♦ This allowance can be applied toward the contact lens fitting fee and all other charges including follow-up visits and contact lenses.6

♦ Medically necessary

3. Refractive Surgery Option 8 In lieu of spectacles or contact lenses. A $350.00 per eye allowance with contracted surgeons or a $75.00 per eye allowance with non-contracted surgeons toward the fees for refractive surgery care for the following procedures: LASIK, PRK, ICL or RLE. The member pays any amount exceeding the per eye allowance

1 The co-pay must be paid to the Participating Provider at the time of service.

2 When Health Insurance Carriers offer a comprehensive medical eye exam it creates an overlap in benefits for Eyetopia Members. If this occurs, the Member may choose another option under Benefit One as described, no co-pay is required to exercise these other options.

3 If your prescription has changed at least ½ diopter or your eye doctor recommends a change of lenses, you may select one of three vision correction options every 12 months.

4 Special Lens Materials and Non-covered Items: Ultra-light, premium PALs, rush service, service agreements, other special lens materials, oversize, other extras and any items not specifically mentioned above may be substituted provided the Member pays any amount exceeding the price of the covered benefit and the Participating Provider’s usual and customary fees for the upgrade at the time of service.

5 The Shaw Lens coverage includes a premium anti-reflective coating and an upgraded lens material. .

6 If the contact lens evaluation, fitting or dispensing service is performed and the Member decides to use their benefit toward an alternative vision correction option, the Member must pay the cost of the contact lens evaluation, fitting or dispensing service before another vision correction benefit option can be used.

7 Total maximum benefit allowance is $550.00 the Participating Provider must pre-authorize medical necessity.

8 Non-covered Items and Exclusions – Facility fees, surgical procedures, medications and enhancements or treatments related to medical procedures.

Included Services and/or Eye Wear. Only those professional vision care services and/or vision correction options specifically referenced herein are included in the Eyetopia.

In-Network coverage is available through Participating Providers. Out of network services are not covered.

Additional Professional Services and/or Vision Corrections. The member may select professional services and/or vision correction items not specifically referenced as included in Eyetopia. However, these services and/or items are the member’s responsibility at the Participating Provider’s (U&C) charge, payable at the time of service or of ordering.

Effective: May 1, 2023

All services require preauthorization. Providers seeking authorization or members with questions who are seeking Participating Providers in their area should call AudioNet America at (586) 250-2731 or click www.audionetamerica.com

Obtained at a Participating Provider

Participating Provider means a physician, audiologist, hearing instrument specialist or dispenser who participates in the AudioNet America Hearing Aid Program.

Essential-Level standard digital hearing devices will be covered with a $350 monaural /$1,400 binaural member co-payment.

Mid-Level standard digital hearing devices will be covered with a $630 monaural /$1,960 binaural member co-payment.

Hearing Aids

Advanced Level standard digital hearing devices will be covered with a $910 monaural /$2,520 binaural member co-payment

Flagship Level standard digital hearing devices will be covered with a $1,180 monaural /$3,060 binaural member co-payment

Premium Level standard digital hearing devices will be covered with a $1,530 monaural /$3,760 binaural member co-payment

Conformity Evaluation Covered in Full per ear

Replacement Ear Molds (For children up to age 7)

Ear Molds

(Enrollees over age 7)

Up to four (4) replacement ear molds annually are covered in full for children up to age 3. Up to two (2) replacement ear molds annually are covered in full for children ages 3-7. Additional molds are charged to member.

Once every 12 months

Three-year repair warranty and three-year loss and damage warranty (one-time replacement)

First is Covered in Full. Additional molds are charged to member.

Batteries Covered in Full per ear. First 48 batteries, one-time supply

Accessories Not Covered

Once every 12 months

No more than four (4) replacement ear molds annually for children up to age 3. No more than two (2) replacement ear molds annually for children ages 3-7. Any additional molds are not covered.

First is included with initial hearing aid. Any additional molds are not covered.

First year only

Maintenance / Fittings / Follow-Up Visits Covered in Full within first 6 months, $45 copay thereafter for the remaining 30 months.

Effective: May 1, 2023

All services require preauthorization. Providers seeking authorization or members with questions who are seeking Participating Providers in their area should call AudioNet America at (586) 250-2731 or click www.audionetamerica.com

Obtained at a Participating Provider

Participating Provider means a physician, audiologist, hearing instrument specialist or dispenser who participates in the AudioNet America Hearing Aid Program.

Essential-Level standard digital hearing devices will be covered with a $0 monaural /$550 binaural member co-payment.

Mid-Level standard digital hearing devices will be covered with a $0 monaural /$1,110 binaural member co-payment.

Digital Hearing Aids

Advanced Level standard digital hearing devices will be covered with a $60 monaural /$1,670 binaural member co-payment

Flagship Level standard digital hearing devices will be covered with a $330 monaural /$2,210 binaural member co-payment

Premium Level standard digital hearing devices will be covered with a $680 monaural /$2,910 binaural member co-payment

Conformity Evaluation Covered in Full per ear

Replacement Ear Molds (For children up to age 7)

Ear Molds

(Enrollees over age 7)

Up to four (4) replacement ear molds annually are covered in full for children up to age 3. Up to two (2) replacement ear molds annually are covered in full for children ages 3-7. Additional molds are charged to member.

Once every 24 months

Three-year repair warranty and three-year loss and damage warranty (one-time replacement)

First is Covered in Full. Additional molds are charged to member.

Batteries Covered in Full per ear. First 48 batteries, one-time supply

Accessories Not Covered

Once every 24 months

No more than four (4) replacement ear molds annually for children up to age 3. No more than two (2) replacement ear molds annually for children ages 3-7. Any additional molds are not covered.

First is included with initial hearing aid. Any additional molds are not covered.

First year only

Maintenance / Fittings / Follow-Up Visits Covered in Full within first 6 months, $45 copay thereafter for the remaining 30 months.

Effective: May 1, 2023

All services require preauthorization. Providers seeking authorization or members with questions who are seeking Participating Providers in their area should call AudioNet America at (586) 250-2731 or click www.audionetamerica.com

Obtained at a Participating Provider

Participating Provider means a physician, audiologist, hearing instrument specialist or dispenser who participates in the AudioNet America Hearing Aid Program.

Hearing Aids

Essential-Level standard digital hearing devices will be covered in Full.

Mid-Level standard digital hearing devices will be covered with a $0 monaural /$160 binaural member co-payment.

Advanced Level standard digital hearing devices will be covered with a $0 monaural /$720 binaural member co-payment

Flagship Level standard digital hearing devices will be covered with a $0 monaural /$1,260 binaural member co-payment

Premium Level standard digital hearing devices will be covered with a $0 monaural /$1,960 binaural member co-payment

Conformity Evaluation Covered in Full per ear

Replacement Ear Molds (For children up to age 7)

Ear Molds

(Enrollees over age 7)

Up to four (4) replacement ear molds annually are covered in full for children up to age 3. Up to two (2) replacement ear molds annually are covered in full for children ages 3-7. Additional molds are charged to member.

Three-year repair warranty and three-year loss and damage warranty (one-time replacement)

First is Covered in Full. Additional molds are charged to member.

Batteries Covered in Full per ear. First 48 batteries, one-time supply

Accessories Not Covered

Maintenance / Fittings / Follow-Up Visits

Once every 36 months

No more than four (4) replacement ear molds annually for children up to age 3. No more than two (2) replacement ear molds annually for children ages 3-7. Any additional molds are not covered.

First is included with initial hearing aid. Any additional molds are not covered.

First year only

Covered in Full within first 6 months, $45 copay thereafter for the remaining 30 months.

City of Roma provides this valuable benefit at no cost to you.

All Full-Time Employees

Consider what your loved ones may face after you’re gone. Term life insurance can help them in so many ways, like helping to cover everyday expenses, pay off debt, and protect savings. Accidental death and dismemberment (AD&D) insurance provides additional benefits if you die or suffer a covered loss in an accident, such as losing a limb or your eyesight

At a glance:

• A cash benefit of $10,000 to your loved ones in the event of your death, plus an additional cash benefit if you die in an accident.

• AD&D Plus: If you suffer an AD&D-covered loss in an accident, you may also receive benefits for the following in addition to your core AD&D benefits: coma, plegia, education, childcare, spouse training. Additional conditions are outlined in your policy.

• Includes LifeKeys® services, which provide access to counseling, financial, and legal support services.

• TravelConnect® services, which give you and your family access to emergency medical assistance when you’re on a trip 100+ miles from home

You also have the option to increase your cash benefit by securing additional coverage at affordable group rates. See the enclosed voluntary life insurance information for details. Additional details

Continuation of coverage for ceasing active work: You may be able to continue your coverage if you leave your job for reasons including and not limited to Family and Medical Leave, lay-off, leave of absence, or leave of absence due to disability.

Waiver of premium: This provision relieves you from paying premiums during a period of disability that has lasted for a specified length of time.

Accelerated death benefit: Enables you to receive a portion of your policy death benefit while you are living. To qualify, a medical professional must diagnose you with a terminal illness with a life expectancy of fewer than 12 months.

Conversion: You may be able to convert your group term life coverage to an individual life insurance policy if your coverage decreases or you lose coverage due to leaving your job or for other reasons outlined in the plan contract.

Benefit reduction: Your employee Life/AD&D coverage amount will reduce by 50% when you reach age 70. Benefits end when you retire.

This is an incomplete list of benefit exclusions. A complete list is included in the policy. State variations apply.

REMINDER: Please review your beneficiary(ies) to ensure they are up to date. It’s good practice to review, and if necessary update, your beneficiary(ies) annually.

This is not intended as a complete description of the insurance coverage offered. Controlling provisions are provided in the policy, and this summary does not modify those provisions or the insurance in any way. This is not a binding contract. A certificate of coverage will be made available to you that describes the benefits in greater detail. Refer to your certificate for your maximum benefit amounts. Should there be a difference between this summary and the policy, the policy will govern.

LifeKeys® services are provided by ComPsych® Corporation, Chicago, IL. ComPsych® is not a Lincoln Financial Group® company. Coverage is subject to actual contract language. Each independent company is solely responsible for its own obligations. EstateGuidance® and GuidanceResources® Online are trademarks of ComPsych® Corporation.

State limitations apply. Beneficiary Grief counseling is the only benefit available to a beneficiary(ies) of policies issued in the state of New York. Online will prep is the only benefit available to insured employee and dependents of policies issued in the state of Washington.

Travel Connect® services are provided by On Call International, Salem, NH. On Call International is not a Lincoln Financial Group® company and Lincoln Financial Group does not administer these services. Each independent company is solely responsible for its own obligations. On Call International must coordinate and provide all arrangements in order for eligible services to be covered. Coverage is subject to contract language that contains specific terms, conditions, and limitations, which can be found in the program description.

The TravelConnect® program is not available to insured employees and dependents of policies issued in the state of New York and Washington. Access only program available to insured employees and dependents of policies issued in the state of Missouri and Texas. Benefits provided under the Access Only program exclude payment for paid services. Not for use in New York or Washington.

Group insurance products and services described herein are issued by The Lincoln National Life Insurance Company (Fort Wayne, IN), which does not solicit business in New York, nor is it licensed to do so. In New York, insurance products are issued by Lincoln Life & Annuity Company of New York (Syracuse, NY). Both are Lincoln Financial Group® companies. Product availability and/or features may vary by state. Limitations and exclusions apply. Lincoln Financial Group is the marketing name for Lincoln National Corporation and its affiliates. Affiliates are separately responsible for their own financial and contractual obligations.

Voluntary Life and AD&D

AD&D

Insurance Plan:

• Provides a cash benefit to your loved ones in the event of your death or if you die in an accident

• Provides a cash benefit to you if you suffer a covered loss in an accident, such as losing a limb or your eyesight

• Features group rates for employees

• Includes LifeKeys® services, which provide access to counseling, financial, and legal support services

• Also includes TravelConnect® services, which give you and your family access to emergency medical assistance when you’re on a trip 100+ miles from home

All Full-Time Employees

Employee Life and AD&D

Coverage Options

Maximum coverage amount

Minimum coverage amount

Guaranteed Life coverage amount

Optional/Voluntary AD&D coverage amount

Increments of $10,000

This amount may not exceed the lesser of seven times Annual Earnings (rounded up to the nearest $10,000) or $500,000

$10,000

$150,000